Exhibit 13

Guaranty Federal Bancshares, Inc.

2010 Annual Report

|

Investor Information

|

||

|

Contents

1 Investor Information

2 Common Stock Prices & Dividends

4 Selected Consolidated Financial and Other Data

5 Management’s Discussion and Analysis of Financial Condition and Results of Operations

17 Consolidated Financial Statements

51 Report of Independent Registered Public Accounting Firm

52 Directors and Officers

|

ANNUAL MEETING OF STOCKHOLDERS:

The Annual Meeting of Stockholders of the Company will be held Wednesday, May 25, 2011 at 6:00 p.m., local time, at the Guaranty Bank Operations Center, 1414 W. Elfindale, Springfield, Missouri.

ANNUAL REPORT ON FORM 10-K:

Copies of the Company’s Annual Report on Form 10-K, including the financial statements, filed with the Securities and Exchange Commission are available without charge upon written request to:

Lorene Thomas, Secretary

Guaranty Federal Bancshares, Inc.,

1341 W. Battlefield St., Springfield, MO 65807-4181

TRANSFER AGENT:

Registrar and Transfer Company

10 Commerce Drive

Cranford, NJ 07016

STOCK TRADING INFORMATION:

Symbol: GFED

SPECIAL LEGAL COUNSEL:

Husch Blackwell LLP

901 St. Louis St., Suite 1900

Springfield, MO 65806

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM:

BKD, LLP

910 St. Louis St.

PO Box 1190

Springfield, MO 65801-1190

STOCKHOLDER AND FINANCIAL INFORMATION:

Carter Peters,

Executive Vice President, Chief Financial Officer

417-520-4333

|

1

Guaranty Federal Bancshares, Inc.

2010 Annual Report

|

Common Stock Prices & Dividends

|

|

|

The common stock of Guaranty Federal Bancshares, Inc. (the “Company”) is listed for trading on the NASDAQ Global Market under the symbol “GFED”. As of March 7, 2011, there were approximately 1,054 holders of shares of the Company’s common stock. At that date the Company had 6,779,800 shares of common stock issued and 2,660,087 shares of common stock outstanding.

During the years ended December 31, 2010 and 2009, the Company did not declare a cash dividend. Any future dividends will be at the discretion of the Company’s Board of Directors and will depend on, among other things, the Company’s results of operations, cash requirements and surplus, financial condition, regulatory limitations and other factors that the Company’s Board of Directors may consider relevant.

The table below reflects the range of common stock high and low closing prices per the NASDAQ Global Market by quarter for the years ended December 31, 2010 and 2009.

|

|

Year ended

|

Year ended

|

|||||||||||||||

|

December 31, 2010

|

December 31, 2009

|

|||||||||||||||

|

High

|

Low

|

High

|

Low

|

|||||||||||||

|

Quarter ended:

|

||||||||||||||||

|

March 31

|

$ | 5.85 | 5.08 | $ | 5.95 | 3.85 | ||||||||||

|

June 30

|

6.50 | 5.30 | 7.50 | 4.61 | ||||||||||||

|

September 30

|

6.31 | 5.15 | 7.00 | 5.05 | ||||||||||||

|

December 31

|

5.18 | 4.30 | 6.74 | 5.04 | ||||||||||||

2

Guaranty Federal Bancshares, Inc.

2010 Annual Report

|

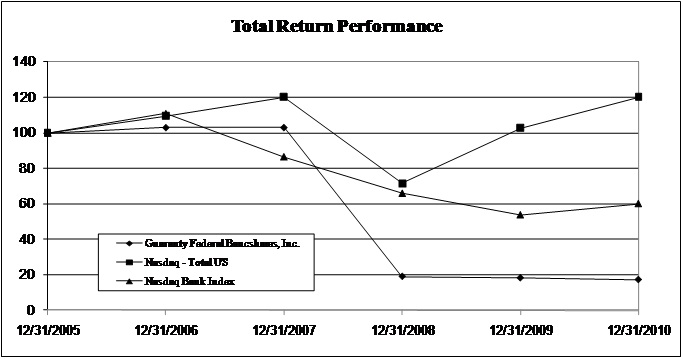

Set forth below is a stock performance graph comparing the cumulative total shareholder return on the Common Stock with (a) the cumulative total stockholder return on stocks included in The Nasdaq – Total U.S. Index and (b) the cumulative total stockholder return on stocks included in The Nasdaq Bank Index. All three investment comparisons assume the investment of $100 as of the close of business on December 31, 2005 and the hypothetical value of that investment as of the Company’s fiscal years ended December 31, 2006, 2007, 2008, 2009, and 2010, assuming that all dividends were reinvested. The graph reflects the historical performance of the Common Stock, and, as a result, may not be indicative of possible future performance of the Common Stock. The data used to compile this graph was obtained from NASDAQ.

|

|

Period Ending

|

||||||||||||||||||||||||

|

Index

|

12/31/2005

|

12/31/2006

|

12/31/2007

|

12/31/2008

|

12/31/2009

|

12/31/2010

|

||||||||||||||||||

|

Guaranty Federal Bancshares, Inc.

|

100 | 102.9 | 102.94 | 19.03 | 18.21 | 17.22 | ||||||||||||||||||

|

NASDAQ - Total US

|

100 | 109.52 | 120.27 | 71.51 | 102.89 | 120.29 | ||||||||||||||||||

|

NASDAQ Bank Index

|

100 | 111.01 | 86.51 | 65.81 | 53.63 | 60.01 | ||||||||||||||||||

3

Guaranty Federal Bancshares, Inc.

Selected Consolidated Financial and Other Data

The following tables include certain information concerning the financial position and results of operations of Guaranty Federal Bancshares, Inc. (including consolidated data from operations of Guaranty Bank) as of the dates indicated. Dollar amounts are expressed in thousands except per share data.

|

Summary Balance Sheets

|

As of December 31,

|

|||||||||||||||||||

|

2010

|

2009

|

2008

|

2007

|

2006

|

||||||||||||||||

|

ASSETS

|

||||||||||||||||||||

|

Cash and cash equivalents

|

$ | 14,145 | $ | 33,017 | $ | 15,097 | $ | 12,046 | $ | 14,881 | ||||||||||

|

Investments and interest-bearing deposits

|

109,891 | 119,693 | 66,062 | 15,385 | 8,669 | |||||||||||||||

|

Loans receivable, net

|

504,665 | 528,503 | 558,327 | 516,242 | 480,269 | |||||||||||||||

|

Accrued interest receivable

|

2,670 | 2,671 | 2,632 | 3,323 | 2,910 | |||||||||||||||

|

Prepaids and other assets

|

18,982 | 25,249 | 16,573 | 8,613 | 10,075 | |||||||||||||||

|

Foreclosed assets

|

10,540 | 6,760 | 5,655 | 727 | 173 | |||||||||||||||

|

Premises and equipment

|

11,325 | 11,818 | 11,324 | 9,442 | 7,868 | |||||||||||||||

|

Bank owned life insurance

|

10,450 | 10,069 | - | - | - | |||||||||||||||

| $ | 682,668 | $ | 737,780 | $ | 675,670 | $ | 565,778 | $ | 524,845 | |||||||||||

|

LIABILITIES

|

||||||||||||||||||||

|

Deposits

|

$ | 480,694 | $ | 513,051 | $ | 447,079 | $ | 418,191 | $ | 352,230 | ||||||||||

|

Federal Home Loan Bank advances

|

93,050 | 116,050 | 132,436 | 76,086 | 108,000 | |||||||||||||||

|

Securities sold under agreements to repurchase

|

39,750 | 39,750 | 39,750 | 9,849 | 1,703 | |||||||||||||||

|

Subordinated debentures

|

15,465 | 15,465 | 15,465 | 15,465 | 15,465 | |||||||||||||||

|

Other liabilities

|

1,668 | 2,053 | 3,627 | 3,500 | 2,548 | |||||||||||||||

| 630,627 | 686,369 | 638,357 | 523,091 | 479,946 | ||||||||||||||||

|

STOCKHOLDERS' EQUITY

|

52,041 | 51,411 | 37,313 | 42,687 | 44,899 | |||||||||||||||

| $ | 682,668 | $ | 737,780 | $ | 675,670 | $ | 565,778 | $ | 524,845 | |||||||||||

|

Summary Statements of Operations

|

Years ended December 31,

|

|||||||||||||||||||

|

2010

|

2009

|

2008

|

2007

|

2006

|

||||||||||||||||

|

Interest income

|

$ | 32,331 | $ | 33,873 | $ | 36,363 | $ | 37,972 | $ | 35,204 | ||||||||||

|

Interest expense

|

14,807 | 20,527 | 19,524 | 20,519 | 17,386 | |||||||||||||||

|

Net interest income

|

17,524 | 13,346 | 16,839 | 17,453 | 17,818 | |||||||||||||||

|

Provision for loan losses

|

5,200 | 6,900 | 14,744 | 840 | 750 | |||||||||||||||

|

Net interest income after provision for loan losses

|

12,324 | 6,446 | 2,095 | 16,613 | 17,068 | |||||||||||||||

|

Noninterest income

|

4,350 | 4,288 | 2,316 | 4,729 | 3,660 | |||||||||||||||

|

Noninterest expense

|

15,049 | 14,710 | 12,760 | 11,842 | 10,177 | |||||||||||||||

|

Income (loss) before income taxes

|

1,625 | (3,976 | ) | (8,349 | ) | 9,500 | 10,551 | |||||||||||||

|

Provision (credit) for income taxes

|

494 | (1,635 | ) | (2,989 | ) | 3,400 | 4,042 | |||||||||||||

|

Net income (loss)

|

$ | 1,131 | $ | (2,341 | ) | $ | (5,360 | ) | $ | 6,100 | $ | 6,509 | ||||||||

|

Preferred stock dividends and discount accretion

|

1,126 | 1,032 | - | - | - | |||||||||||||||

|

Net income (loss) available to common shareholders

|

$ | 5 | $ | (3,373 | ) | $ | (5,360 | ) | $ | 6,100 | $ | 6,509 | ||||||||

|

Basic income (loss) per common share

|

$ | - | $ | (1.29 | ) | $ | (2.06 | ) | $ | 2.25 | $ | 2.34 | ||||||||

|

Diluted income (loss) per common share

|

$ | - | $ | (1.29 | ) | $ | (2.06 | ) | $ | 2.19 | $ | 2.25 | ||||||||

4

Guaranty Federal Bancshares, Inc.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

GENERAL

Guaranty Federal Bancshares, Inc. (the “Company”) is a Delaware corporation organized on December 30, 1997 that operates as a one-bank holding company. Guaranty Bank (the “Bank”) is a wholly-owned subsidiary of the Company.

The primary activity of the Company is to oversee its investment in the Bank. The Company engages in few other activities, and the Company has no significant assets other than its investment in the Bank. For this reason, unless otherwise specified, references to the Company include the operations of the Bank. The Company’s principal business consists of attracting deposits from the general public and using such deposits to originate multi-family, construction and commercial real estate loans, mortgage loans secured by one- to four-family residences, and consumer and business loans. The Company also uses these funds to purchase government sponsored mortgage-backed securities, US government and agency obligations, and other permissible securities. When cash outflows exceed inflows, the Company uses borrowings and brokered deposits as additional financing sources.

The Company derives revenues principally from interest earned on loans and investments and, to a lesser extent, from fees charged for services. General economic conditions and policies of the financial institution regulatory agencies, including the Missouri Division of Finance and the Federal Deposit Insurance Corporation (“FDIC”) significantly influence the Company’s operations. Interest rates on competing investments and general market interest rates influence the Company’s cost of funds. Lending activities are affected by the interest rates at which such financing may be offered. The Company intends to focus on commercial, one- to four-family residential and consumer lending throughout southwestern Missouri.

The Company has two wholly-owned subsidiaries other than the Bank, its principal subsidiary: (i) Guaranty Statutory Trust I, a Delaware statutory trust; and (ii) Guaranty Statutory Trust II, a Delaware statutory trust. These Trusts were formed in December 2005 for the exclusive purpose of issuing trust preferred securities to acquire junior subordinated debentures issued by the Company. The Company’s banking operation conducted through the Bank is the Company’s only reportable segment. See also the discussion contained in the section captioned “Segment Information” in Note 1 of the Notes to Consolidated Financial Statements in this report.

The discussion set forth below, and in any other portion of this report, may contain forward-looking statements. Such statements are based upon the information currently available to management of the Company and management’s perception thereof as of the date of this report. When used in this document, words such as “anticipates,” “estimates,” “believes,” “expects,” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Such statements are subject to risks and uncertainties. Actual results of the Company’s operations could materially differ from those forward-looking comments. The differences could be caused by a number of factors or combination of factors including, but not limited to: changes in demand for banking services; changes in portfolio composition; changes in management strategy; increased competition from both bank and non-bank companies; changes in the general level of interest rates; and other factors set forth in reports and other documents filed by the Company with the Securities and Exchange Commission from time to time including the risk factors of the Company set forth in Item 1A. of the Company’s Form 10-K.

FINANCIAL CONDITION

From December 31, 2009 to December 31, 2010, the Company’s total assets decreased $55,111,732 (7%) to $682,668,120, liabilities decreased $55,741,865 (8%) to $630,627,354, and stockholders' equity increased $630,133 (1%) to $52,040,766. The ratio of stockholders’ equity to total assets increased to 7.6% during this period, compared to 7.0% as of December 31, 2009.

From December 31, 2009 to December 31, 2010, cash and cash equivalents decreased $18,871,368 (57%) to $14,145,329 and interest-bearing deposits decreased $3,775,802 (23%) to $12,785,000.

From December 31, 2009 to December 31, 2010, available-for-sale securities decreased $5,814,598 (6%). The decrease is primarily due to maturities and principal payments exceeding purchases for 2010. Gains on sales of investment securities decreased $414,644 (60%) to $275,125 for the year ended December 31, 2010.

From December 31, 2009 to December 31, 2010, held-to-maturity securities decreased $211,827 (45%) to $260,956 due to principal repayments received during the year. Stock of the Federal Home Loan Bank of Des Moines (“FHLB”) was decreased by $951,400 (16%) to $5,025,200 due to lower stock requirements necessary from the reduction in FHLB advances.

5

Guaranty Federal Bancshares, Inc.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

From December 31, 2009 to December 31, 2010, net loans receivable decreased by $23,057,668 (4%) to $501,980,385. During this period, permanent loans secured by both owner and non-owner occupied one to four unit residential real estate decreased $5,069,537 (5%), multi-family permanent loans increased $8,233,793 (23%), construction loans decreased $12,082,642 (16%), permanent loans secured by commercial real estate decreased $837,639 (1%), commercial loans decreased $7,106,355 (8%), and installment loans decreased $7,142,154 (23%).

As of December 31, 2010, management identified loans totaling $27,211,000 as impaired with a related allowance for loan losses of $6,026,000. Impaired loans decreased by $12,484,123 during 2010, compared to the balance of $40,009,123 at December 31, 2009.

From December 31, 2009 to December 31, 2010, the allowance for loan losses decreased $993,420 to $13,082,703. In addition to the provision for loan loss of $5,200,000 recorded by the Company during the year ended December 31, 2010, loan charge-offs of specific loans (classified as nonperforming at December 31, 2009) exceeded recoveries by $6,193,420 for the twelve months ended December 31, 2010. Also, the Company experienced a significant decline in loan balances during fiscal year 2010 that has reduced allowance for loan loss reserve requirements. The allowance for loan losses as of December 31, 2010 and December 31, 2009 was 2.54% and 2.61% of gross loans outstanding (excluding mortgage loans held for sale), respectively. As of December 31, 2010, the allowance for loan losses was 48% of impaired loans versus 35% as of December 31, 2009. Management believes the allowance for loan losses is at a level to be sufficient in providing for potential loan losses in the Bank’s existing loan portfolio.

From December 31, 2009 to December 31, 2010, the prepaid FDIC deposit insurance premiums decreased $1,158,519 (28%) to $2,977,356 due to the utilization of credits for 2010 assessments. The remaining balance consists of estimated insurance assessments to be incurred for fiscal years 2011 and 2012.

As of December 31, 2010, foreclosed assets held for sale consisted primarily of real estate related to single family residences, one commercial property located in Branson, MO of $2.2 million and one commercial development in northwest Arkansas of $3.5 million.

From December 31, 2009 to December 31, 2010, income taxes receivable decreased $3,781,970 (100%) to $0 primarily due to $3,726,331 of refunds received on prior year taxes paid from net operating loss carry backs.

From December 31, 2009 to December 31, 2010, deposits decreased $32,356,829 (6%) to $480,694,273. During this period, checking and savings accounts increased by $5.5 million and certificates of deposit decreased by $37.9 million. The increase in the checking and savings accounts was due to the Bank’s marketing efforts to obtain additional personal and commercial checking business. At December 31, 2010, included in the certificates of deposit totals are $37.3 million in deposits classified as “brokered”, an increase of $17.5 million from December 31, 2009. This was primarily due to a reclassification of $18.4 million of deposits previously classified as “internet” certificates.

From December 31, 2009 to December 31, 2010, the Company’s borrowings from the FHLB decreased $23,000,000 (20%) to $93,050,000 due to principal repayments during the period.

From December 31, 2009 to December 31, 2010, stockholders’ equity (including unrealized appreciation on available-for-sale securities and interest rate swaps, net of tax) increased $630,133 (1%) to $52,040,766. The Company earned net income for the year ended December 31, 2010 of $1,130,771. In conjunction with the Series A Preferred Stock, the Company recorded $850,000 of dividends (5%) as of December 31, 2010. On a per common share basis, stockholders’ equity increased $.02 from $13.49 as of December 31, 2009 to $13.51 as of December 31, 2010.

AVERAGE BALANCES, INTEREST AND AVERAGE YIELDS

The following table shows the balances as of December 31, 2010 of various categories of interest-earning assets and interest-bearing liabilities and the corresponding yields and costs, and, for the periods indicated: (1) the average balances of various categories of interest-earning assets and interest-bearing liabilities, (2) the total interest earned or paid thereon, and (3) the resulting weighted average yields and costs. In addition, the table shows the Company’s rate spreads and net yields. Average balances are based on daily balances. Tax-free income is not material; accordingly, interest income and related average yields have not been calculated on a tax equivalent basis. Average loan balances include non-accrual loans. Dollar amounts are expressed in thousands.

6

Guaranty Federal Bancshares, Inc.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

As of

December 31, 2010

|

Year Ended

December 31, 2010

|

Year Ended

December 31, 2009

|

Year Ended

December 31, 2008

|

|||||||||||||||||||||||||||||||||||||||||

|

Balance

|

Yield / Cost

|

Average Balance

|

Interest

|

Yield / Cost

|

Average Balance

|

Interest

|

Yield / Cost

|

Average Balance

|

Interest

|

Yield / Cost

|

||||||||||||||||||||||||||||||||||

|

ASSETS

|

||||||||||||||||||||||||||||||||||||||||||||

|

Interest-earning:

|

||||||||||||||||||||||||||||||||||||||||||||

|

Loans

|

$ | 517,748 | 5.61 | % | $ | 517,133 | $ | 28,348 | 5.48 | % | $ | 548,847 | $ | 29,695 | 5.41 | % | $ | 555,828 | $ | 33,019 | 5.94 | % | ||||||||||||||||||||||

|

Investment securities

|

97,106 | 3.06 | % | 110,149 | 3,477 | 3.16 | % | 102,096 | 3,744 | 3.67 | % | 58,727 | 3,125 | 5.32 | % | |||||||||||||||||||||||||||||

|

Other assets

|

29,040 | 0.82 | % | 48,054 | 506 | 1.05 | % | 65,853 | 434 | 0.66 | % | 7,869 | 219 | 2.78 | % | |||||||||||||||||||||||||||||

|

Total interest-earning

|

643,894 | 5.01 | % | 675,336 | 32,331 | 4.79 | % | 716,796 | 33,873 | 4.73 | % | 622,424 | 36,363 | 5.84 | % | |||||||||||||||||||||||||||||

|

Noninterest-earning

|

38,774 | 48,148 | 25,294 | 24,092 | ||||||||||||||||||||||||||||||||||||||||

| $ | 682,668 | $ | 723,484 | $ | 742,090 | $ | 646,516 | |||||||||||||||||||||||||||||||||||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

||||||||||||||||||||||||||||||||||||||||||||

|

Interest-bearing:

|

||||||||||||||||||||||||||||||||||||||||||||

|

Savings accounts

|

$ | 19,189 | 0.68 | % | $ | 17,322 | $ | 140 | 0.81 | % | $ | 13,069 | $ | 121 | 0.93 | % | $ | 12,980 | $ | 143 | 1.10 | % | ||||||||||||||||||||||

|

Transaction accounts

|

258,676 | 1.16 | % | 257,629 | 3,968 | 1.54 | % | 215,494 | 6,152 | 2.85 | % | 102,341 | 1,806 | 1.76 | % | |||||||||||||||||||||||||||||

|

Certificates of deposit

|

176,195 | 2.42 | % | 201,090 | 5,520 | 2.75 | % | 262,719 | 9,108 | 3.47 | % | 285,845 | 12,270 | 4.29 | % | |||||||||||||||||||||||||||||

|

FHLB advances

|

93,050 | 2.64 | % | 110,613 | 2,989 | 2.70 | % | 112,851 | 3,152 | 2.79 | % | 119,957 | 3,238 | 2.70 | % | |||||||||||||||||||||||||||||

|

Subordinated debentures

|

15,465 | 6.62 | % | 15,465 | 1,024 | 6.62 | % | 15,465 | 1,024 | 6.62 | % | 15,465 | 1,024 | 6.62 | % | |||||||||||||||||||||||||||||

|

Repurchase agreements

|

39,750 | 3.10 | % | 39,750 | 1,166 | 2.93 | % | 39,750 | 970 | 2.44 | % | 38,604 | 1,043 | 2.70 | % | |||||||||||||||||||||||||||||

|

Total interest-bearing

|

602,325 | 2.01 | % | 641,869 | 14,807 | 2.31 | % | 659,348 | 20,527 | 3.11 | % | 575,192 | 19,524 | 3.39 | % | |||||||||||||||||||||||||||||

|

Noninterest-bearing

|

28,302 | 28,302 | 30,467 | 30,516 | ||||||||||||||||||||||||||||||||||||||||

|

Total liabilities

|

630,627 | 670,171 | 689,815 | 605,708 | ||||||||||||||||||||||||||||||||||||||||

|

Stockholders' equity

|

52,041 | 53,313 | 52,275 | 40,808 | ||||||||||||||||||||||||||||||||||||||||

| $ | 682,668 | $ | 723,484 | $ | 742,090 | $ | 646,516 | |||||||||||||||||||||||||||||||||||||

|

Net earning balance

|

$ | 41,569 | $ | 33,467 | $ | 57,448 | $ | 47,232 | ||||||||||||||||||||||||||||||||||||

|

Earning yield less costing rate

|

3.00 | % | 2.48 | % | 1.62 | % | 2.45 | % | ||||||||||||||||||||||||||||||||||||

|

Net interest income, and net yield spread on interest-earning assets

|

$ | 17,524 | 2.59 | % | $ | 13,346 | 1.86 | % | $ | 16,839 | 2.71 | % | ||||||||||||||||||||||||||||||||

|

Ratio of interest-earning assets to interest-bearing liabilities

|

107 | % | 105 | % | 109 | % | 108 | % | ||||||||||||||||||||||||||||||||||||

7

Guaranty Federal Bancshares, Inc.

Management’s Discussion and Analysis of Financial Condition And Results of Operations

The following table sets forth information regarding changes in interest income and interest expense for the periods indicated resulting from changes in average balances and average rates shown in the previous table. For each category of interest-earning assets and interest-bearing liabilities information is provided with respect to changes attributable to: (i) changes in balance (change in balance multiplied by the old rate), (ii) changes in interest rates (change in rate multiplied by the old balance); and (iii) the combined effect of changes in balance and interest rates (change in balance multiplied by change in rate). Dollar amounts are expressed in thousands.

|

Year ended

|

Year ended

|

|||||||||||||||||||||||||||||||

|

December 31, 2010 versus December 31, 2009

|

December 31, 2009 versus December 31, 2008

|

|||||||||||||||||||||||||||||||

|

Average Balance

|

Interest Rate

|

Rate & Balance

|

Total

|

Average Balance

|

Interest Rate

|

Rate & Balance

|

Total

|

|||||||||||||||||||||||||

|

Interest income:

|

||||||||||||||||||||||||||||||||

|

Loans

|

$ | (1,716 | ) | $ | 392 | $ | (23 | ) | $ | (1,347 | ) | $ | (415 | ) | $ | (2,946 | ) | $ | 37 | $ | (3,324 | ) | ||||||||||

|

Investment securities

|

295 | (521 | ) | (41 | ) | (267 | ) | 2,308 | (972 | ) | (717 | ) | 619 | |||||||||||||||||||

|

Other assets

|

(117 | ) | 259 | (70 | ) | 72 | 1,614 | (167 | ) | (1,232 | ) | 215 | ||||||||||||||||||||

|

Net change in interest income

|

(1,538 | ) | 130 | (134 | ) | (1,542 | ) | 3,507 | (4,085 | ) | (1,912 | ) | (2,490 | ) | ||||||||||||||||||

|

Interest expense:

|

||||||||||||||||||||||||||||||||

|

Savings accounts

|

39 | (15 | ) | (5 | ) | 19 | 1 | (23 | ) | - | (22 | ) | ||||||||||||||||||||

|

Transaction accounts

|

1,203 | (2,833 | ) | (554 | ) | (2,184 | ) | 1,997 | 1,115 | 1,234 | 4,346 | |||||||||||||||||||||

|

Certificates of deposit

|

(2,137 | ) | (1,896 | ) | 445 | (3,588 | ) | (993 | ) | (2,360 | ) | 191 | (3,162 | ) | ||||||||||||||||||

|

FHLB advances

|

(62 | ) | (103 | ) | 2 | (163 | ) | (192 | ) | 113 | (7 | ) | (86 | ) | ||||||||||||||||||

|

Subordinated debentures

|

- | - | - | - | - | - | - | - | ||||||||||||||||||||||||

|

Repurchase agreements

|

- | 196 | - | 196 | 31 | (101 | ) | (3 | ) | (73 | ) | |||||||||||||||||||||

|

Net change in interest expense

|

(957 | ) | (4,651 | ) | (112 | ) | (5,720 | ) | 844 | (1,256 | ) | 1,415 | 1,003 | |||||||||||||||||||

|

Change in net interest income

|

$ | (581 | ) | $ | 4,781 | $ | (22 | ) | $ | 4,178 | $ | 2,663 | $ | (2,829 | ) | $ | (3,327 | ) | $ | (3,493 | ) | |||||||||||

RESULTS OF OPERATIONS - COMPARISON OF YEAR ENDED DECEMBER 31, 2010 AND DECEMBER 31, 2009

|

Average for the Year Shown

|

||||||||||||

|

Prime

|

Ten-Year Treasury

|

One-Year Treasury

|

||||||||||

|

December 31, 2010

|

3.25 | % | 3.22 | % | 0.32 | % | ||||||

|

December 31, 2009

|

3.25 | % | 3.26 | % | 0.47 | % | ||||||

|

Change in rates

|

0.00 | % | -0.04 | % | -0.15 | % | ||||||

Interest Rates. The Bank charges borrowers and pays depositors interest rates that are largely a function of the general level of interest rates. The above table sets forth the weekly average interest rates for the 52 weeks ending December 31, 2010 and December 31, 2009 as reported by the Federal Reserve. The Bank typically indexes its adjustable rate commercial loans to prime and its adjustable rate mortgage loans to the one-year treasury rate. The ten-year treasury rate is a proxy for 30-year fixed rate home mortgage loans.

Rates were steady and remained low for 2010 as the Federal Reserve Open Market Committee (“FOMC”) left the discount rate at 25 basis points. As of December 31, 2010, the prime rate was 3.25% and unchanged from December 31, 2009.

Interest Income. Total interest income decreased $1,541,960 (5%). The average balance of interest-earning assets decreased $41,460,000 (6%) while the yield on average interest earning assets increased 6 basis points to 4.79%.

8

Guaranty Federal Bancshares, Inc.

Management’s Discussion and Analysis of Financial Condition And Results of Operations

Interest on loans decreased $1,347,485 (5%) and the average loan receivable balance decreased $31,714,000 (6%) while the average yield increased 7 basis points to 5.48%. The Company’s yield on loans was negatively impacted due to the expiration of interest income being recognized on a matured interest rate swap as of June 30, 2010. The effect for the year ending December 31, 2010 was approximately $510,000. Another factor that has negatively impacted the Company’s yield on loans is the high level of nonaccrual loans which has decreased to $23.0 million as of December 31, 2010, as compared to $34.3 million as of December 31, 2009.

Interest Expense. Total interest expense decreased $5,719,706 (28%) as the average balance of interest-bearing liabilities decreased $17,479,000 (3%) while the average cost of interest-bearing liabilities decreased 80 basis points to 2.31%.

Interest expense on deposits decreased $5,753,057 (37%) during 2010 as the average balance of interest bearing deposits decreased $15,241,000 (3%), but the average interest rate paid to depositors decreased 111 basis points to 2.02%. The primary reason for the significant decrease in the average cost of interest bearing deposits was the reduction at the beginning of 2010 in the cost of money market deposits generated through an aggressive deposit campaign in the first quarter of 2009.

The average balance of FHLB advances decreased $2,238,000 (2%) while the average cost of those advances decreased 9 basis points to 2.70%. As a result, interest expense on these advances decreased $163,806 (5%). As of December 31, 2010, FHLB advances were 14% of total assets, compared to 16% of total assets as of December 31, 2009.

Net Interest Income. The Company’s net interest income increased $4,177,746 (31%). During the year ended December 31, 2010, the average balance of interest-earning assets exceeded the average balance of interest-bearing liabilities by $33,467,000, resulting in a decrease in the average net earning balance of $23,981,000 (42%), a result of management’s intent to roll off certain high priced deposits with low yielding assets. In addition, the Company’s spread between the average yield on interest-earning assets and the average cost of interest-bearing liabilities increased by 86 basis points from 1.62% to 2.48%.

Provision for Loan Losses. Provisions for loan losses are charged or credited to earnings to bring the total allowance for loan losses to a level considered adequate by the Company to provide for potential loan losses in the existing loan portfolio. When making its assessment, the Company considers prior loss experience, volume and type of lending, local banking trends and impaired and past due loans in the Company’s loan portfolio. In addition, the Company considers general economic conditions and other factors related to collectability of the Company’s loan portfolio.

Based on its internal analysis and methodology, management recorded a provision for loan losses of $5,200,000 and $6,900,000 for the years ended December 31, 2010 and 2009, respectively. Provisions recorded in 2010 are due to the Bank’s charge-offs during the year, continuing concerns over the local and national economy and over certain specific borrowers.

The Bank will continue to monitor its allowance for loan losses and make future additions based on economic and regulatory conditions. Management of the Company anticipates the need to continue increasing the allowance for loan losses through charges to the provision for loan losses if growth in the Bank’s loan portfolio is experienced or other circumstances warrant. Although the Bank maintains its allowance for loan losses at a level which it considers to be sufficient to provide for potential loan losses in its existing loan portfolio, there can be no assurance that future loan losses will not exceed internal estimates. In addition, the amount of the allowance for loan losses is subject to review by regulatory agencies which can order the establishment of additional loan loss provisions.

Non-Interest Income. Non-interest income increased $62,537 (1%). The gain on sale of loans of $1,749,857 for 2010, compared to $1,443,385 for 2009 was due to favorable mortgage rates resulting in increased volume on fixed rate mortgage loan sales. Gains on investment securities for the year ended December 31, 2010 were $275,125 compared to $689,769 for the year ended December 31, 2009. The gains in fiscal 2010 were the result of restructurings of the bond portfolio and to manage interest rate risk. Deposit service charges decreased $249,665 (14%) due primarily to declines in overdraft charges, which is partially due to the adoption of Regulation E. Regulation E has negatively impacted overdraft income due to new requirements on debit card and ATM transactions. The long-term impact cannot be fully determined. Loss on foreclosed assets decreased $31,015 (6%) in 2010, but remained elevated primarily due to the difficult market conditions causing sharp declines in real estate values on foreclosed properties held or sold by the Company. Earnings from bank owned life insurance were $380,090 for 2010 compared to $69,539 for 2009. This increase was due to the original purchase occurring on October 30, 2009.

9

Guaranty Federal Bancshares, Inc.

Management’s Discussion and Analysis of Financial Condition And Results of Operations

Non-Interest Expense. Non-interest expense increased $339,922 (2%). This increase was primarily due to increases in salaries and employee benefits of $684,410 (9%) offsetting the decrease in FDIC deposit insurance premiums of $299,962 (20%).

The increase in compensation was due to normal salary and benefits increases for the Bank’s employees, along with a few key personnel additions in the latter half of the third quarter of 2009 and the second quarter of 2010. The overall staff increased from 162 full-time equivalent employees as of December 31, 2009 to 170 full-time equivalent employees as of December 31, 2010.

Decreases in FDIC deposit insurance premiums were due to the special assessment of $341,000 that was incurred as of June 30, 2009 and paid on September 30, 2009.

Income Taxes. The increase in income tax expense is a direct result of the Company’s increase in taxable income for the year ended December 31, 2010 compared to the taxable loss for the year ended December 31, 2009.

Cash Dividends Paid. The Company did not pay dividends on its common shares during 2010. During 2010, the Company paid $850,000 in dividends on its preferred stock.

RESULTS OF OPERATIONS - COMPARISON OF YEAR ENDED DECEMBER 31, 2009 AND DECEMBER 31, 2008

|

Average for the Year Shown

|

||||||||||||

|

Prime

|

Ten-Year Treasury

|

One-Year Treasury

|

||||||||||

|

December 31, 2009

|

3.25 | % | 3.26 | % | 0.47 | % | ||||||

|

December 31, 2008

|

5.09 | % | 3.66 | % | 1.83 | % | ||||||

|

Change in rates

|

-1.84 | % | -0.40 | % | -1.36 | % | ||||||

Interest Rates. The above table sets forth the weekly average interest rates for the 52 weeks ending December 31, 2009 and December 31, 2008 as reported by the Federal Reserve.

Rates were steady and remained low for 2009 as the FOMC left the discount rate at 25 basis points. As of December 31, 2009, the prime rate was 3.25% and unchanged from December 31, 2008.

Interest Income. Total interest income decreased $2,489,956 (7%). The average balance of interest-earning assets increased $94,372,000 (15%) while the yield on average interest earning assets decreased 111 basis points to 4.73%.

The impact of the Federal Reserve’s interest rate cuts throughout 2008 adversely impacted the Bank’s loan portfolio in 2009, specifically those loans which are directly tied to the prime rate. Interest on loans decreased $3,323,730 (10%) and the average loan receivable balance decreased $6,981,000 (1%) while the average yield decreased 53 basis points to 5.41%. Another factor that adversely impacted the Company’s yield on loans is the level of nonaccrual loans which had increased to $34.3 million as of December 31, 2009, as compared to $20.7 million as of December 31, 2008. Also, during 2009, the Company increased its investment securities and interest-bearing deposits during the year which, because of the low interest rate environment for investment yields, decreased the average yield on investment securities by 165 basis points as compared to fiscal year 2008.

Interest Expense. Total interest expense increased $1,002,361 (5%) as the average balance of interest-bearing liabilities increased $84,156,000 (15%) while the average cost of interest-bearing liabilities decreased 28 basis points to 3.11%.

10

Guaranty Federal Bancshares, Inc.

Management’s Discussion and Analysis of Financial Condition And Results of Operations

The primary increase in interest-bearing liabilities was due to the Bank’s strong emphasis on increasing money market accounts through an aggressive deposit campaign. This initiative to improve core deposit liquidity increased the Bank’s interest expense on deposits. Interest expense on deposits increased $1,161,458 (8%) during 2009 as the average balance of interest bearing deposits increased $90,116,000 (22%), but the average interest rate paid to depositors decreased 41 basis points to 3.13%.

The average balance of FHLB advances decreased $7,106,000 (6%) while the average cost of those advances increased 9 basis points to 2.79%. As a result, interest expense on these advances decreased $85,135 (3%). As of December 31, 2009, FHLB advances were 16% of total assets, compared to 20% of total assets as of December 31, 2008.

Net Interest Income. The Company’s net interest income decreased $3,492,317 (21%). During the year ended December 31, 2009, the average balance of interest-earning assets exceeded the average balance of interest-bearing liabilities by $57,448,000, resulting in an increase in the average net earning balance of $10,216,000 (22%). In addition, the Company’s spread between the average yield on interest-earning assets and the average cost of interest-bearing liabilities decreased by 83 basis points from 2.45% to 1.62%.

Provision for Loan Losses. Provisions for loan losses are charged or credited to earnings to bring the total allowance for loan losses to a level considered adequate by the Company to provide for potential loan losses in the existing loan portfolio. When making its assessment, the Company considers prior loss experience, volume and type of lending, local banking trends and past due loans in the Company’s loan portfolio. In addition, the Company considers general economic conditions and other factors related to collectability of the Company’s loan portfolio.

Based on its internal analysis and methodology, management recorded a provision for loan losses of $6,900,000 and $14,744,079 for the years ended December 31, 2009 and 2008, respectively. Provisions recorded in 2009 were due to the Bank’s charge-offs during the year, increases in nonperforming loans, continuing concerns over the local and national economy and certain specific borrowers. However, despite growing nonperforming loan balances during 2009, the Company experienced a significant decline in overall loan balances as of December 31, 2009, as compared to December 31, 2008 (a decline of $32.5 million or 6%). The Company also experienced lower reserve requirements on newly classified nonperforming credits during the year ended December 31, 2009 and this was reflected in a lower provision requirement for fiscal year 2009, as compared to fiscal year 2008.

The Bank will continue to monitor its allowance for loan losses and make future additions based on economic and regulatory conditions. Management of the Company anticipates the need to continue increasing the allowance for loan losses through charges to the provision for loan losses if growth in the Bank’s loan portfolio is experienced or other circumstances warrant. Although the Bank maintains its allowance for loan losses at a level which it considers to be sufficient to provide for potential loan losses in its existing loan portfolio, there can be no assurance that future loan losses will not exceed internal estimates. In addition, the amount of the allowance for loan losses is subject to review by regulatory agencies which can order the establishment of additional loan loss provisions.

Non-Interest Income. Non-interest income increased $1,971,343 (85%). The gain on sale of loans of $1,443,385 for 2009, compared to $875,010 for 2008, was the result of mortgage banking activities related to the sale of single-family conforming residential loans in the secondary market. The Bank attempts to minimize its risk of price changes by committing to sell loans while the loans are in the origination process. Gains on investment securities for the year ended December 31, 2009 were $689,769, compared to a loss of $563,615 for the year ended December 31, 2008. The gains in fiscal 2009 were due to the Company recognizing certain gains in its available-for-sale portfolio to reduce potential credit and interest rate risk issues. The losses in fiscal 2008 were attributable to other-than-temporary impairment charges on its equity securities associated with companies operating in the financial sector. Deposit service charges decreased $225,403 (11%) due primarily to declines in overdraft charges. Loss on foreclosed assets decreased $260,274 (33%) in 2009, but remained elevated primarily due to the difficult market conditions causing sharp declines in real estate values on foreclosed properties held or sold by the Company.

Non-Interest Expense. Non-interest expense increased $1,949,873 (15%). This increase was primarily due to increases in salaries and employee benefits of $434,820 (6%) and FDIC deposit insurance premiums of $1,135,555 (295%).

11

Guaranty Federal Bancshares, Inc.

Management’s Discussion and Analysis of Financial Condition And Results of Operations

The increase in compensation was due to additions in several key managerial positions in the areas of commercial lending, credit administration, finance and risk management. However, overall staff decreased from 163 full-time equivalent employees as of December 31, 2008 to 162 full-time equivalent employees as of December 31, 2009.

Increases in FDIC deposit insurance premiums were due to increases in premium rates that began in the first quarter of 2009 and the special assessment that was incurred as of June 30, 2009, and was paid on September 30, 2009.

Income Taxes. The credit for income taxes was a direct result of the Company’s taxable loss for the year ended December 31, 2009.

Cash Dividends Paid. The Company did not pay dividends on its common shares during 2009. During 2009, the Company paid $672,917 in dividends on its preferred stock issued under the CPP.

ASSET / LIABILITY MANAGEMENT

The responsibility of managing and executing the Bank’s Asset Liability Policy falls to the Bank’s Asset/ Liability Committee (ALCO.) ALCO seeks to manage interest rate risk so as to capture the highest net interest income, and to stabilize that net interest income, through changing interest rate environments. Management attempts to position the Bank’s instrument repricing characteristics in line with probable rate movements in order to minimize the impact of changing interest rates on the Bank’s net interest income. Since the relative spread between financial assets and liabilities is constantly changing, the Bank’s current net interest income may not be an indication of future net interest income.

The Bank has continued to emphasize the origination of commercial business, home equity, consumer and adjustable-rate, one- to four-family residential loans while originating fixed-rate, one- to four-family residential loans primarily for immediate resale in the secondary market. Management continually monitors the loan portfolio for the purpose of product diversification and over concentration.

The Bank constantly monitors its deposits in an effort to prohibit them from adversely impacting the Bank’s interest rate sensitivity. Rates of interest paid on deposits at the Bank are priced competitively in order to meet the Bank’s asset/liability management objectives and spread requirements. As of December 31, 2010 and 2009, the Bank’s savings accounts, checking accounts, and money market deposit accounts totaled $304,499,807 or 63% of its total deposits and $298,995,433 or 58% of total deposits, respectively. The weighted average rate paid on these accounts decreased 153 basis points from 2.49% on December 31, 2009 to 0.96% on December 31, 2010 primarily due to the Bank’s efforts to reprice its money market deposit accounts. The Bank anticipates the ability to continue cautiously lowering its cost of funds in 2011 while maintaining its liquidity position.

INTEREST RATE SENSITIVITY ANALYSIS

The following table sets forth as of December 31, 2010, management’s estimates of the projected changes in Economic Value of Equity (“EVE”) in the event of instantaneous and permanent increases and decreases in market interest rates. Dollar amounts are expressed in thousands.

|

BP Change

|

Estimated Net Portfolio Value

|

NPV as % of PV of Assets

|

||||||||||||||||||||

|

in Rates

|

$ Amount

|

$ Change

|

% Change

|

NPV Ratio

|

Change

|

|||||||||||||||||

| +300 | 57,455 | (7,063 | ) | -11 | % | 8.57 | % | -0.75 | % | |||||||||||||

| +200 | 59,563 | (4,955 | ) | -8 | % | 8.79 | % | -0.53 | % | |||||||||||||

| +100 | 61,899 | (2,619 | ) | -4 | % | 9.04 | % | -0.28 | % | |||||||||||||

|

NC

|

64,518 | - | 0 | % | 9.32 | % | 0.00 | % | ||||||||||||||

| -100 | 67,669 | 3,151 | 5 | % | 9.66 | % | 0.34 | % | ||||||||||||||

| -200 | 71,831 | 7,313 | 11 | % | 10.13 | % | 0.82 | % | ||||||||||||||

Computations of prospective effects of hypothetical interest rate changes are based on an internally generated model using actual maturity and repricing schedules for the Bank’s loans and deposits, and are based on numerous assumptions, including relative levels of market interest rates, loan repayments and deposit run-offs, and should not be relied upon as indicative of actual results. Further, the computations do not contemplate any actions the Bank may undertake in response to changes in interest rates. All EVE and earnings projections are based on a point in time static balance sheet.

12

Guaranty Federal Bancshares, Inc.

Management’s Discussion and Analysis of Financial Condition And Results of Operations

Management cannot predict future interest rates or their effect on the Bank’s EVE in the future. Certain shortcomings are inherent in the method of analysis presented in the computation of EVE. For example, although certain assets and liabilities may have similar maturities or periods to repricing, they may react in differing degrees to changes in market interest rates. Additionally, certain assets, such as floating-rate loans, which represent the Bank’s primary loan product, have an initial fixed rate period typically from one to five years and over the remaining life of the asset changes in the interest rate are restricted. In addition, the proportion of adjustable-rate loans in the Bank’s loan portfolio could decrease in future periods due to refinancing activity if market interest rates remain constant or decrease in the future. Further, in the event of a change in interest rates, prepayment and early withdrawal levels could deviate significantly from those assumed in the table. Finally, the ability of many borrowers to service their adjustable-rate debt may decrease in the event of an interest rate increase.

The Bank’s Board of Directors is responsible for reviewing the Bank’s asset and liability policies. The Bank’s management is responsible for administering the policies and determinations of the Board of Directors with respect to the Bank’s asset and liability goals and strategies. Management expects that the Bank’s asset and liability policies and strategies will continue as described above so long as competitive and regulatory conditions in the financial institution industry and market interest rates continue as they have in recent years.

LIQUIDITY AND CAPITAL RESOURCES

Liquidity refers to the ability to manage future cash flows to meet the needs of depositors and borrowers and fund operations. Maintaining appropriate levels of liquidity allows the Company to have sufficient funds available for customer demand for loans, withdrawal of deposit balances and maturities of deposits and other liabilities. The Company’s primary sources of liquidity include cash and cash equivalents, customer deposits and FHLB borrowings. The Company also has established borrowing lines available from the Federal Reserve Bank which is considered a secondary source of funds.

The Company’s most liquid assets are cash and cash equivalents, which are cash on hand, amounts due from financial institutions, and certificates of deposit with other financial institutions that have an original maturity of three months or less. The levels of such assets are dependent on the Bank’s operating, financing, and investment activities at any given time. The Company’s cash and cash equivalents totaled $14,145,329 as of December 31, 2010 and $33,016,697 as of December 31, 2009, representing a decrease of $18,871,368. The Company’s interest-bearing deposits totaled $12,785,000 as of December 31, 2010 and $16,560,802 as of December 31, 2009. The variations in levels of cash and cash equivalents are influenced by deposit flows and anticipated future deposit flows, which are subject to, and influenced by, many factors. Management has many policies and controls in place to attempt to manage the appropriate level of liquidity versus the need to invest in loans and securities needed to increase net interest income.

In addition to the capital necessary to meet the Company’s conditional commitments discussed under the caption “Off-Balance Sheet Arrangements” below, the Bank also has $121,003,245 in certificates of deposit that are scheduled to mature in one year or less. Management anticipates that the majority of these certificates will renew in the normal course of operations. Based on existing collateral as well as the FHLB’s limitation of advances to 25% of assets, the Bank has the ability to borrow an additional $57,745,418 from the FHLB, as of December 31, 2010. Based on existing collateral, the Bank has the ability to borrow $39,001,652 from the Federal Reserve Bank as of December 31, 2010. The Bank plans to maintain its FHLB and Federal Reserve Bank borrowings to a level that will provide a borrowing capacity sufficient to provide for contingencies.

The Company’s Tier 1 capital position of $65,174,000 is 9.3% of average assets as of December 31, 2010. The Company has an excess of $37,182,000, $43,545,000, and $28,728,000 of required regulatory levels of tangible, core, and risk-based capital, respectively. In addition, under current regulatory guidelines, the Bank is classified as well capitalized. See also additional information provided under the caption “Regulatory Matters” in Note 1 of the Notes to Consolidated Financial Statements.

13

Guaranty Federal Bancshares, Inc.

Management’s Discussion and Analysis of Financial Condition And Results of Operations

With regards to the securities sold to the Treasury under the Capital Purchase Program, if the Company is unable to redeem the Series A Preferred Stock within five years of its issuance, the cost of capital to the Company will increase significantly from 5% per annum ($850,000 annually) to 9% per annum ($1,530,000 annually). Depending on the Company’s financial condition at the time, the increase in the annual dividend rate on the Series A Preferred Stock could have a material adverse effect on the Company’s liquidity and net income available to common stockholders.

OFF-BALANCE SHEET ARRANGEMENTS

Various commitments and contingent liabilities arise in the normal course of business, which are not required to be recorded on the balance sheet. The most significant of these are loan commitments, lines of credit and standby letters of credit. Commitments to extend credit are agreements to lend to a customer as long as there is no violation of any condition established in the contract. As of December 31, 2010 and 2009, the Bank had outstanding commitments to originate loans of approximately $7,949,000 and $5,589,000, respectively. Lines of credit are agreements to lend to a customer as long as there is no violation of any condition established in the contract. As of December 31, 2010 and 2009, unused lines of credit to borrowers aggregated approximately $50,473,000 and $32,539,000 for commercial lines and $17,525,000 and $17,820,000 for open-end consumer lines. Since a portion of the loan commitment and line of credit may expire without being drawn upon, the total unused commitments and lines do not necessarily represent future cash requirements.

Standby letters of credit are irrevocable conditional commitments issued by the Bank to guarantee the performance of a customer to a third party. The credit risk involved in issuing standby letters of credit is essentially the same as that involved in extending loans to customers. The Bank had total outstanding standby letters of credit amounting to $12,261,000 and $15,623,000 as of December 31, 2010 and 2009, respectively. The commitments extend over varying periods of time.

In connection with the Company’s issuance of the Trust Preferred Securities and pursuant to two guarantee agreements by and between the Company and Wilmington Trust Company, the Company issued a limited, irrevocable guarantee of the obligations of each Trust under the Trust Preferred Securities whereby the Company has guaranteed any and all payment obligations of the Trusts related to the Trust Preferred Securities including distributions on, and the liquidation or redemption price of, the Trust Preferred Securities to the extent each Trust does not have funds available.

AGGREGATE CONTRACTUAL OBLIGATIONS

The following table summarizes the Company’s fixed and determinable contractual obligations by payment date as of December 31, 2010. Dollar amounts are expressed in thousands.

|

Contractual Obligations

|

Total

|

One Year or less

|

One to Three Years

|

Three to Five Years

|

More than Five Years

|

|||||||||||||||

|

Deposits without stated maturity

|

$ | 304,500 | 304,500 | - | - | - | ||||||||||||||

|

Time and brokered certificates of deposit

|

176,194 | 121,003 | 50,077 | 5,046 | 68 | |||||||||||||||

|

Other borrowings

|

39,750 | - | - | - | 39,750 | |||||||||||||||

|

Federal Home Loan Bank advances

|

93,050 | 25,000 | 15,700 | 250 | 52,100 | |||||||||||||||

|

Subordinated debentures

|

15,465 | - | - | - | 15,465 | |||||||||||||||

|

Operating leases

|

599 | 160 | 203 | 163 | 73 | |||||||||||||||

|

Purchase obligations

|

- | - | - | - | - | |||||||||||||||

|

Other long term obligations

|

296,880 | 296,880 | - | - | - | |||||||||||||||

|

Total

|

$ | 926,438 | 747,543 | 65,980 | 5,459 | 107,456 | ||||||||||||||

IMPACT OF INFLATION AND CHANGING PRICES

The Company prepared the consolidated financial statements and related data presented herein in accordance with accounting principles generally accepted in the United States of America which require the measurement of financial position and operating results in terms of historical dollars, without considering changes in the relative purchasing power of money over time due to inflation.

14

Guaranty Federal Bancshares, Inc.

Management’s Discussion and Analysis of Financial Condition And Results of Operations

Unlike most companies, the assets and liabilities of a financial institution are primarily monetary in nature. As a result, interest rates have a more significant impact on a financial institution’s performance than the effects of general levels of inflation. Interest rates do not necessarily move in the same direction or in the same magnitude as the price of goods and services, since such prices are affected by inflation. In the current interest rate environment, liquidity and the maturity structure of the Bank’s assets and liabilities are critical to the maintenance of acceptable performance levels.

CRITICAL ACCOUNTING POLICIES

Management’s Discussion and Analysis of Financial Condition and Results of Operations is based upon the Company’s consolidated financial statements and the notes thereto, which have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements requires management to make estimates and judgments that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reported periods. On an on-going basis, management evaluates its estimates and judgments.

Management bases its estimates and judgments on historical experience and on various other factors that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. There can be no assurance that actual results will not differ from those estimates. If actual results are different than management’s judgments and estimates, the Company’s financial results could change, and such change could be material to the Company.

Material estimates that are particularly susceptible to significant change in the near term relate to the determination of the allowance for loan losses, the valuation of real estate acquired in connection with foreclosures or in satisfaction of loans and fair values. In connection with the determination of the allowance for loan losses and the valuation of foreclosed assets held for sale, management obtains independent appraisals for significant properties.

The Company has identified the accounting policies for the allowance for loan losses and related significant estimates and judgments as critical to its business operations and the understanding of its results of operations. For a detailed discussion on the application of these significant estimates and judgments and our accounting policies, also see Note 1 of the notes to consolidated financial statements in this report.

IMPACT OF NEW ACCOUNTING PRONOUNCEMENTS

In June 2009, the Financial Accounting Standards Board (FASB) issued ASC 810-10, “Amendments to FASB Interpretation No. 46R”. The standard amends the tests for analyzing whether a company’s interest in a variable interest entity (“VIE”) gives it a controlling financial interest. A company must assess whether it has an implicit financial responsibility to ensure that the VIE operates as designed when determining whether it has the power to direct the activities of the VIE that significantly impact its economic performance. Ongoing reassessments of whether a company is the primary beneficiary are also required by the standard. This standard was effective for the Company on January 1, 2010 and did not have a material impact on the Company’s consolidated financial statements.

In January 2010, the FASB issued ASU 2010-06, “Improving Disclosures about Fair Value Measurements” which impacts ASC 820-10, “Fair Value Measurements and Disclosures”. The amendments in this update require new disclosures about significant transfers in and out of Level 1 and Level 2 fair value measurements. The amendment also requires a reporting entity to provide information about activity for purchases, sales, issuances and settlements in Level 3 fair value measurements and clarify disclosures about the level of disaggregation and disclosures about inputs and valuation techniques. The ASU was effective for the Company on January 1, 2010 and did not have a material impact on the Company’s consolidated financial statements.

15

Guaranty Federal Bancshares, Inc.

Management’s Discussion and Analysis of Financial Condition And Results of Operations

In July 2010, the FASB issued ASU 2010-20, “Receivables: Disclosures about the Credit Quality of Financing Receivables and the Allowance for Credit Losses”, to improve disclosures about the credit quality of financing receivables and the allowance for credit losses. Companies will be required to provide more information about the credit quality of their financing receivables in the disclosures to financial statements, such as aging information and credit quality indicators. Both new and existing disclosures must be disaggregated by portfolio segment or class. The disaggregation of information is based on how a company develops its allowance for credit losses and how it manages its credit exposure. Required disclosures as of the end of a reporting period are effective for periods ending on or after December 15, 2010, while required disclosures about activity that occurs during a reporting period are effective for periods beginning on or after December 15, 2010. The impact on our disclosures is reflected in Note 3 of the notes to consolidated financial statements.

SUMMARY OF UNAUDITED QUARTERLY OPERATING RESULTS

|

Year Ended December 31, 2010, Quarter ended

|

||||||||||||||||

|

Mar-10

|

Jun-10

|

Sep-10

|

Dec-10

|

|||||||||||||

|

Interest income

|

$ | 8,265,282 | $ | 8,228,615 | $ | 7,845,909 | $ | 7,991,670 | ||||||||

|

Interest expense

|

4,155,805 | 3,806,088 | 3,659,835 | 3,185,151 | ||||||||||||

|

Net interest income

|

4,109,477 | 4,422,527 | 4,186,074 | 4,806,519 | ||||||||||||

|

Provision for loan losses

|

950,000 | 950,000 | 850,000 | 2,450,000 | ||||||||||||

|

Gain on loans and investment securities

|

458,592 | 372,835 | 513,553 | 680,002 | ||||||||||||

|

Other noninterest income, net

|

733,450 | 687,764 | 665,568 | 238,267 | ||||||||||||

|

Noninterest expense

|

3,635,938 | 3,758,731 | 3,706,621 | 3,948,315 | ||||||||||||

|

Income (loss) before income taxes

|

715,581 | 774,395 | 808,574 | (673,527 | ) | |||||||||||

|

Provision (credit) for income taxes

|

239,715 | 281,892 | 286,370 | (313,725 | ) | |||||||||||

|

Net income (loss)

|

475,866 | 492,503 | 522,204 | (359,802 | ) | |||||||||||

|

Preferred stock dividends and discount accretion

|

281,391 | 281,390 | 281,391 | 281,391 | ||||||||||||

|

Net income (loss) available to common shareholders

|

$ | 194,475 | $ | 211,113 | $ | 240,813 | $ | (641,193 | ) | |||||||

|

Basic income (loss) per common share

|

$ | 0.07 | $ | 0.08 | $ | 0.09 | $ | (0.24 | ) | |||||||

|

Diluted income (loss) per common share

|

$ | 0.07 | $ | 0.08 | $ | 0.09 | $ | (0.24 | ) | |||||||

|

Year Ended December 31, 2009, Quarter ended

|

||||||||||||||||

|

Mar-09

|

Jun-09

|

Sep-09

|

Dec-09

|

|||||||||||||

|

Interest income

|

$ | 8,323,301 | $ | 8,504,112 | $ | 8,534,335 | $ | 8,511,688 | ||||||||

|

Interest expense

|

5,307,991 | 5,204,374 | 5,086,082 | 4,928,138 | ||||||||||||

|

Net interest income

|

3,015,310 | 3,299,738 | 3,448,253 | 3,583,550 | ||||||||||||

|

Provision for loan losses

|

980,000 | 3,300,000 | 670,000 | 1,950,000 | ||||||||||||

|

Gain on loans and investment securities

|

355,410 | 759,812 | 656,036 | 361,896 | ||||||||||||

|

Other noninterest income, net

|

453,562 | 762,651 | 674,332 | 263,795 | ||||||||||||

|

Noninterest expense

|

3,744,565 | 4,035,322 | 3,391,956 | 3,537,840 | ||||||||||||

|

Income (loss) before income taxes

|

(900,283 | ) | (2,513,121 | ) | 716,665 | (1,278,599 | ) | |||||||||

|

Provision (credit) for income taxes

|

(308,163 | ) | (881,039 | ) | 142,202 | (587,620 | ) | |||||||||

|

Net income (loss)

|

(592,120 | ) | (1,632,082 | ) | 574,463 | (690,979 | ) | |||||||||

|

Preferred stock dividends and discount accretion

|

187,594 | 281,390 | 281,391 | 281,391 | ||||||||||||

|

Net income (loss) available to common shareholders

|

$ | (779,714 | ) | $ | (1,913,472 | ) | $ | 293,072 | $ | (972,370 | ) | |||||

|

Basic income (loss) per common share

|

$ | (0.30 | ) | $ | (0.73 | ) | $ | 0.11 | $ | (0.37 | ) | |||||

|

Diluted income (loss) per common share

|

$ | (0.30 | ) | $ | (0.73 | ) | $ | 0.11 | $ | (0.37 | ) | |||||

16

Guaranty Federal Bancshares, Inc.

Consolidated Balance Sheets

December 31, 2010 and 2009

|

December 31,

2010

|

December 31,

2009

|

|||||||

|

ASSETS

|

||||||||

|

Cash and due from banks

|

$ | 2,968,669 | $ | 4,527,813 | ||||

|

Interest-bearing deposits in other financial institutions

|

11,176,660 | 28,488,884 | ||||||

|

Cash and cash equivalents

|

14,145,329 | 33,016,697 | ||||||

|

Interest-bearing deposits

|

12,785,000 | 16,560,802 | ||||||

|

Available-for-sale securities

|

96,844,653 | 102,659,251 | ||||||

|

Held-to-maturity securities

|

260,956 | 472,783 | ||||||

|

Stock in Federal Home Loan Bank, at cost

|

5,025,200 | 5,976,600 | ||||||

|

Mortgage loans held for sale

|

2,685,163 | 3,465,080 | ||||||

|

Loans receivable, net of allowance for loan losses of December 31, 2010 and 2009 - $13,082,703 and $14,076,123, respectively

|

501,980,385 | 525,038,053 | ||||||

|

Accrued interest receivable:

|

||||||||

|

Loans

|

2,058,576 | 2,014,418 | ||||||

|

Investments and interest-bearing deposits

|

611,698 | 657,145 | ||||||

|

Prepaid expenses and other assets

|

6,161,861 | 6,731,409 | ||||||

|

Prepaid FDIC deposit insurance premiums

|

2,977,356 | 4,135,875 | ||||||

|

Foreclosed assets held for sale

|

10,539,867 | 6,759,648 | ||||||

|

Premises and equipment

|

11,324,685 | 11,817,516 | ||||||

|

Bank owned life insurance

|

10,449,630 | 10,069,540 | ||||||

|

Income taxes receivable

|

- | 3,718,970 | ||||||

|

Deferred income taxes

|

4,817,761 | 4,686,065 | ||||||

| $ | 682,668,120 | $ | 737,779,852 | |||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

||||||||

|

LIABILITIES

|

||||||||

|

Deposits

|

$ | 480,694,273 | $ | 513,051,102 | ||||

|

Federal Home Loan Bank advances

|

93,050,000 | 116,050,000 | ||||||

|

Securities sold under agreements to repurchase

|

39,750,000 | 39,750,000 | ||||||

|

Subordinated debentures

|

15,465,000 | 15,465,000 | ||||||

|

Advances from borrowers for taxes and insurance

|

134,002 | 135,610 | ||||||

|

Accrued expenses and other liabilities

|

655,404 | 519,385 | ||||||

|

Accrued interest payable

|

878,675 | 1,398,122 | ||||||

| 630,627,354 | 686,369,219 | |||||||

|

COMMITMENTS AND CONTINGENCIES

|

- | - | ||||||

|

STOCKHOLDERS' EQUITY

|

||||||||

|

Capital Stock:

|

||||||||

|

Series A preferred stock, $0.01 par value; authorized 2,000,000 shares;issued and outstanding December 31, 2010 and 2009 - 17,000 shares

|

16,150,350 | 15,874,788 | ||||||

|

Common stock, $0.10 par value; authorized 10,000,000 shares;issued December 31, 2010 and 2009 - 6,779,800 shares;

|

677,980 | 677,980 | ||||||

|

Common stock warrants; December 31, 2010 and 2009 - 459,459 shares

|

1,377,811 | 1,377,811 | ||||||

|

Additional paid-in capital

|

58,505,046 | 58,523,646 | ||||||

|

Unearned ESOP shares

|

(432,930 | ) | (660,930 | ) | ||||

|

Retained earnings, substantially restricted

|

35,746,914 | 35,741,705 | ||||||

| Accumulated other comprehensive income | ||||||||

|

Unrealized appreciation on available-for-sale securities and effect of interest rate swaps, net of income taxes; December 31, 2010 and 2009 - $1,082,399 and $996,342, respectively

|

1,843,004 | 1,696,502 | ||||||

| 113,868,175 | 113,231,502 | |||||||

|

Treasury stock, at cost; December 31, 2010 and December 31, 2009 -4,080,220 and 4,079,067 shares, respectively

|

(61,827,409 | ) | (61,820,869 | ) | ||||

| 52,040,766 | 51,410,633 | |||||||

| $ | 682,668,120 | $ | 737,779,852 | |||||

See Notes to Consolidated Financial Statements

17

Guaranty Federal Bancshares, Inc.

Consolidated Statements of Operations

Years Ended December 31, 2010, 2009 and 2008

|

2010

|

2009

|

2008

|

||||||||||

|

Interest Income

|

||||||||||||

|

Loans

|

$ | 28,348,002 | $ | 29,695,487 | $ | 33,019,217 | ||||||

|

Investment securities

|

3,476,721 | 3,743,688 | 3,124,862 | |||||||||

|

Other

|

506,753 | 434,261 | 219,313 | |||||||||

| 32,331,476 | 33,873,436 | 36,363,392 | ||||||||||

|

Interest Expense

|

||||||||||||

|

Deposits

|

9,628,133 | 15,381,190 | 14,219,732 | |||||||||

|

Federal Home Loan Bank advances

|

2,988,548 | 3,152,354 | 3,237,489 | |||||||||

|

Subordinated debentures

|

1,023,783 | 1,023,783 | 1,023,783 | |||||||||

|

Other

|

1,166,415 | 969,258 | 1,043,220 | |||||||||

| 14,806,879 | 20,526,585 | 19,524,224 | ||||||||||

|

Net Interest Income

|

17,524,597 | 13,346,851 | 16,839,168 | |||||||||

|

Provision for Loan Losses

|

5,200,000 | 6,900,000 | 14,744,079 | |||||||||

|

Net Interest Income After Provision for Loan Losses

|

12,324,597 | 6,446,851 | 2,095,089 | |||||||||

|

Noninterest Income

|

||||||||||||

|

Service charges

|

1,552,623 | 1,802,288 | 2,027,691 | |||||||||

|

Other fees

|

33,705 | 52,233 | 40,129 | |||||||||

|

Gain (loss) on investment securities

|

275,125 | 689,769 | (563,615 | ) | ||||||||

|

Gain on sale of loans

|

1,749,857 | 1,443,385 | 875,010 | |||||||||

|

Loss on foreclosed assets

|

(492,542 | ) | (523,557 | ) | (783,831 | ) | ||||||

|

Other income

|

1,231,263 | 823,376 | 720,767 | |||||||||

| 4,350,031 | 4,287,494 | 2,316,151 | ||||||||||

|

Noninterest Expense

|

||||||||||||

|

Salaries and employee benefits

|

8,636,515 | 7,952,105 | 7,517,285 | |||||||||

|

Occupancy

|

1,704,790 | 1,806,100 | 1,682,277 | |||||||||

|

FDIC deposit insurance premiums

|

1,220,589 | 1,520,551 | 384,996 | |||||||||

|

Data processing

|

454,611 | 423,205 | 374,123 | |||||||||

|

Advertising

|

300,000 | 316,666 | 399,996 | |||||||||

|

Other expense

|

2,733,100 | 2,691,056 | 2,401,133 | |||||||||

| 15,049,605 | 14,709,683 | 12,759,810 | ||||||||||

|

Income (Loss) Before Income Taxes

|

1,625,023 | (3,975,338 | ) | (8,348,570 | ) | |||||||

|

Provision (Credit) for Income Taxes

|

494,252 | (1,634,620 | ) | (2,988,859 | ) | |||||||

|

Net Income (Loss)

|

$ | 1,130,771 | $ | (2,340,718 | ) | $ | (5,359,711 | ) | ||||

|

Preferred Stock Dividends and Discount Accretion

|

1,125,563 | 1,031,766 | - | |||||||||

|

Net Income (Loss) Available to Common Shareholders

|

$ | 5,208 | $ | (3,372,484 | ) | $ | (5,359,711 | ) | ||||

|

Basic Income (Loss) Per Common Share

|

$ | - | $ | (1.29 | ) | $ | (2.06 | ) | ||||

|

Diluted Income (Loss) Per Common Share

|

$ | - | $ | (1.29 | ) | $ | (2.06 | ) | ||||

See Notes to Consolidated Financial Statements

18

Guaranty Federal Bancshares, Inc.

Consolidated Statements of Cash Flows

Years Ended December 31, 2010, 2009 and 2008

|

2010

|

2009

|

2008

|

||||||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

||||||||||||

|

Net income (loss)

|

$ | 1,130,771 | $ | (2,340,718 | ) | $ | (5,359,711 | ) | ||||

|

Items not requiring (providing) cash:

|

||||||||||||

|

Deferred income taxes

|

(217,737 | ) | 701,199 | (4,143,816 | ) | |||||||

|

Depreciation

|

826,440 | 965,504 | 934,941 | |||||||||

|

Provision for loan losses

|

5,200,000 | 6,900,000 | 14,744,079 | |||||||||

|

Gain on sale of loans and investment securities

|

(2,024,982 | ) | (2,133,154 | ) | (777,222 | ) | ||||||

|

Other than temporary impairment on investment securities

|

- | - | 465,827 | |||||||||

|

Loss on sale of foreclosed assets

|

341,376 | 285,010 | 627,888 | |||||||||

|

Accretion of gain on termination of interest rate swaps

|

(508,746 | ) | (1,017,492 | ) | (169,582 | ) | ||||||

|

Amortization of deferred income, premiums and discounts, net

|

587,769 | 352,345 | (47,702 | ) | ||||||||

|

Stock award plans

|

109,386 | 95,268 | 92,846 | |||||||||

|

Origination of loans held for sale

|

(81,958,753 | ) | (78,535,230 | ) | (51,082,040 | ) | ||||||

|

Proceeds from sale of loans held for sale

|

84,488,527 | 78,447,333 | 52,165,250 | |||||||||

|

Release of ESOP shares

|

100,014 | 121,219 | 408,388 | |||||||||

|

Increase in cash surrender value of bank owned life insurance

|

(380,090 | ) | (69,540 | ) | - | |||||||

|

Changes in:

|

||||||||||||

|

Prepaid FDIC deposit insurance premiums

|

1,158,519 | (4,135,875 | ) | - | ||||||||

|

Accrued interest receivable

|

1,289 | (39,113 | ) | 690,998 | ||||||||

|

Prepaid expenses and other assets

|

569,548 | 767,817 | 372,439 | |||||||||

|

Accrued expenses and other liabilities

|

(551,779 | ) | (214,248 | ) | (67,163 | ) | ||||||

|

Income taxes payable

|

3,887,321 | (3,333,407 | ) | (519,838 | ) | |||||||

|

Net cash provided by (used in) operating activities

|

12,758,873 | (3,183,082 | ) | 8,335,582 | ||||||||

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

||||||||||||

|

Net change in loans

|

7,493,436 | 18,959,641 | (64,369,071 | ) | ||||||||

|

Principal payments on held-to-maturity securities

|

211,827 | 83,682 | 98,467 | |||||||||

|

Principal payments on available-for-sale securities

|

13,855,527 | 13,087,448 | 2,373,721 | |||||||||

|

Purchase of available-for-sale securities

|

(55,262,990 | ) | (82,769,479 | ) | (55,463,436 | ) | ||||||

|

Proceeds from sales of available-for-sale securities

|

17,516,564 | 25,356,214 | - | |||||||||

|

Proceeds from maturities of available-for-sale securities

|

28,956,500 | 8,500,000 | 2,100,000 | |||||||||

|

Purchase of premises and equipment

|

(333,609 | ) | (1,459,557 | ) | (2,816,054 | ) | ||||||

|

Purchase of tax credit investments

|

- | (3,433,867 | ) | (1,596,387 | ) | |||||||

|

Purchase of interest bearing deposits

|

- | (34,605,802 | ) | - | ||||||||

|

Proceeds from maturities of interest bearing deposits

|

5,000,000 | 18,045,000 | - | |||||||||

|

Purchase of bank owned life insurance

|

- | (10,000,000 | ) | - | ||||||||

|

Proceeds from termination of interest rate swaps

|

- | - | 1,695,836 | |||||||||

|

(Purchase) redemption of FHLB stock

|

951,400 | 753,500 | (2,715,400 | ) | ||||||||

|