UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Date of report: March 27, 2014

Commission File Number: 001-13425

Ritchie Bros. Auctioneers Incorporated

9500 Glenlyon Parkway

Burnaby, BC, Canada

V5J 0C6

(778) 331 5500

(Address of principal executive offices)

indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F

Form 20-F ¨ Form 40-F x

indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

indicate by check mark whether by furnishing information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934

Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

This Form 6-K incorporates the Notice of Annual Meeting of Shareholders, Information Circular and Form of Proxy distributed to the Company’s shareholders of record as of March 20, 2014. The Information Circular was provided to shareholders in connection with the Company’s annual meeting to be held on May 1, 2014.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| RITCHIE BROS. AUCTIONEERS INCORPORATED | ||||||

| (Registrant) | ||||||

| Date: March 27, 2014 | By: | /s/ DARREN WATT | ||||

| Darren Watt, Corporate Secretary | ||||||

RITCHIE BROS. AUCTIONEERS INCORPORATED

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO THE SHAREHOLDERS:

NOTICE IS HEREBY GIVEN that an Annual Meeting (the “Meeting”) of the shareholders of RITCHIE BROS. AUCTIONEERS INCORPORATED (the “Company”) will be held at Ritchie Bros. Auctioneers’ offices at 9500 Glenlyon Parkway, Burnaby, British Columbia, V5J 0C6, on Thursday, May 1, 2014 at 11:00 a.m. (Vancouver time), for the following purposes:

| (1) | to receive the financial statements of the Company for the financial year ended December 31, 2013 and the report of the auditors thereon; |

| (2) | to elect the directors of the Company to hold office until their successors are elected at the next annual meeting of the Company; |

| (3) | to appoint the auditors of the Company to hold office until the next annual meeting of the Company and to authorize the directors to fix the remuneration to be paid to the auditors; |

| (4) | to transact such other business as may properly be brought before the Meeting. |

Further information regarding the matters to be considered at the Meeting is set out in the accompanying Information Circular.

The directors of the Company have fixed the close of business on March 20, 2014 as the record date for determining shareholders entitled to receive notice of and to vote at the Meeting. Only registered shareholders of the Company as of March 20, 2014 will be entitled to vote, in person or by proxy, at the Meeting.

Shareholders are requested to date, sign and return the accompanying form of proxy for use at the Meeting, whether or not they are able to attend personally. To be effective, forms of proxy must be received by Computershare Trust Company of Canada, Attention Proxy Department, 100 University Avenue, 9th Floor, Toronto, Ontario, M5J 2Y1, no later than 48 hours (excluding Saturdays, Sundays and holidays) before the time of the Meeting or any adjournment thereof. Shareholders may also vote on the internet by visiting the website included on the proxy form and following the online voting instructions.

All non-registered shareholders who receive these materials through a broker or other intermediary should complete and return the materials in accordance with the instructions provided to them by such broker or intermediary.

DATED at Vancouver, British Columbia, as of this 27th day of March, 2014.

By Order of the Board of Directors

Darren Watt

Corporate Secretary

RITCHIE BROS. AUCTIONEERS INCORPORATED

ANNUAL MEETING OF SHAREHOLDERS INFORMATION CIRCULAR

Unless otherwise provided the information herein is given as of March 3, 2014 and dollar amounts are presented in U.S. dollars.

Solicitation of Proxies

This Information Circular is being furnished to the shareholders of the Company in connection with the solicitation of proxies for use at the Annual Meeting to be held on May 1, 2014 (the “Meeting”) by management of the Company. The solicitation will be primarily by mail; however, proxies may also be solicited personally or by telephone by the directors, officers or employees of the Company. The Company may also pay brokers or other persons holding common shares of the Company (the “Common Shares”) in their own names or in the names of nominees for their reasonable expenses of sending proxies and proxy materials to beneficial shareholders for the purposes of obtaining their proxies. The costs of this solicitation are being borne by the Company.

PARTICULARS OF MATTERS TO BE ACTED UPON AT THE MEETING

PROPOSAL 1: Election of Directors

Under the Articles of Amalgamation of the Company, the number of directors of the Company is set at a minimum of three (3) and a maximum of ten (10) and the board of directors (the “Board”) is authorized to determine the actual number of directors within that range. The Company currently has eight (8) directors. Pursuant to the provisions of the Canada Business Corporations Act, a majority of the total number of directors constitutes a quorum at any meeting of directors. Each director of the Company is elected annually and holds office until the next annual meeting of shareholders of the Company unless he or she sooner ceases to hold office. The Articles of the Company also provide that the Board has the power to increase the number of directors at any time between annual meetings of shareholders and appoint one or more additional directors, provided that the total number of directors so appointed shall not exceed one-third of the number of directors elected at the previous annual meeting. At the annual meeting of shareholders of the Company held in 2013, seven (7) directors were elected. In June 2013 the Board determined that the number of directors should be increased to eight (8) and appointed Erik Olsson as an additional director. The number of directors to be elected at the Meeting is eight (8).

Peter Blake, the current Chief Executive Officer of the Company, is currently a director of the Company. Mr. Blake intends to resign as Chief Executive Officer of the Company. The Company is in the process of conducting a search to identify and hire a new Chief Executive Officer, but, as of the date of this Information Circular, the Board has not yet selected or hired such replacement. If the Company has identified and hired a new Chief Executive Officer prior to the Meeting, Mr. Blake intends to resign as Chief Executive Officer at the time of the Meeting. Failing that, Mr. Blake has agreed to remain as Chief Executive Officer for a further interim period while the Company continues the search process. In addition, to assist in the transition period surrounding the identification and hiring of a new Chief Executive Officer, Mr. Blake has agreed to stand for re-election as a director. It is anticipated that, if elected as a director at the Meeting, Mr. Blake would, following the hiring of the new Chief Executive Officer, resign from the Board, and the new Chief Executive Officer will be appointed as a director by resolution of the Board at some point subsequent to the date of the Meeting.

1

As set out in the Company’s Corporate Governance Guidelines, the Board has established a mandatory retirement for directors at 72 years of age. Robert Murdoch, the Chairman of the Board, will reach the mandatory retirement age in 2014. The Board has requested that Mr. Murdoch delay his retirement and stand for re-election at the Meeting, in order to provide continued support to management and the Board in connection with the identification, hiring and transitioning of a new Chief Executive Officer in 2014. If elected at the Meeting, it is anticipated that Mr. Murdoch will be appointed as Chair of the Board, but will step down as Chair following the hiring of the new Chief Executive Officer. Subject to being elected at the meeting, it is anticipated that Beverley Briscoe, the current Deputy Chairperson of the Board, will be appointed as Chair following Mr. Murdoch’s retirement from such position.

The Board has adopted a majority voting policy that will apply to any uncontested election of directors. Pursuant to this policy, any nominee for director who receives a greater number of votes “withheld” than votes “for” such election will promptly tender his or her resignation to the Chair of the Board of directors following such meeting of the Company’s shareholders. The Board’s Nominating and Corporate Governance Committee will consider the offer of resignation and make a recommendation to the Board whether to accept it.

In making its recommendation with respect to a director’s resignation, the Nominating and Corporate Governance Committee will consider, in the best interests of the Company, the action to be taken with respect to such offered resignation, which may include (i) accepting the resignation, (ii) recommending that the director continue on the Board but addressing what the Nominating and Corporate Governance Committee believes to be the underlying reasons why shareholders “withheld” votes for election from such director or (iii) rejecting the resignation.

The Board will consider the Nominating and Corporate Governance Committee’s recommendation within 90 days following the Company’s annual meeting, and in considering such recommendation, the Board will consider the factors taken into account by the Nominating and Corporate Governance Committee and such additional information and factors that the Board considers to be relevant. The Board will promptly disclose its decision by a press release, such press release to include the reasons for rejecting the resignation, if applicable. A director who tends his or her resignation pursuant to this majority voting policy will not be permitted to participate in any meeting of the Board or the Nominating and Corporate Governance Committee at which the resignation is considered. If the resignation is accepted, subject to any applicable law, the Board may leave the resultant vacancy unfilled until the next annual general meeting, fill the vacancy through the appointment of a new director whom the Board considers to merit the confidence of the shareholders, or call a special meeting of shareholders at which there will be presented one or more nominees to fill any vacancy or vacancies.

The Company intends to nominate each of the persons listed below for election as a director of the Company at the Meeting. The persons proposed for nomination are, in the opinion of the Board and management, well qualified to act as directors for the ensuing year. The persons named in the enclosed form of proxy intend to vote for the election of such nominees.

The information presented in the table below, other than the number of deferred share units (“DSUs”) held, has been provided by the respective nominee as of March 3, 2014. The number of Shares owned, controlled or directed includes Common Shares beneficially owned, controlled or directed, directly or indirectly, by the proposed nominee.

2

| ROBERT WAUGH MURDOCH

Residence: Salt Spring Island, B.C., Canada Age: 72 Independent Director since: February 20, 2006

Shares owned, controlled or directed: 18,856 DSUs held: 13,031 (1)

Committees:

Member of the Nominating and Corporate Governance Committee |

Mr. Murdoch is currently Chairman of the Board of the Company, a position he has held since 2008. Mr. Murdoch is a corporate director and spent most of his career with Lafarge, S.A. and affiliates (NYSE: “LR”; Paris Stock Exchange (Eurolist): “LG”), starting in Vancouver in 1967 and retiring from the position of President and Chief Executive Officer of Lafarge North America Inc. (NYSE and TSX: “LAF”), North America’s largest diversified supplier of construction materials, in 1992. Mr. Murdoch was a member of the Board of Directors of Lafarge, S.A., the Paris-based parent company of Lafarge North America, until 2005. Mr. Murdoch holds a Bachelor of Laws degree from the University of Toronto.

Other directorships:

Lallemand Inc. (a private company specializing in the development, production and marketing of yeast and bacteria products)—Director

Weatherhaven Inc. (a private company supplying portable shelter systems) – Advisory Board Chair

| |

| PETER JAMES BLAKE

Residence: Vancouver, B.C., Canada Age: 52 Not Independent Director since: December 12, 1997

Shares owned, controlled or directed: 146,608 DSUs held: nil(1)

Committees:

N/A |

Mr. Blake is currently Chief Executive Officer of the Company, a position he has held since 2004. Prior to his appointment, and since joining the Company in 1991, Mr. Blake held various positions with the Company, including Chief Financial Officer (1997-2004), Vice President, Finance (1994 to 1997) and Controller (1991 to 1994). Mr. Blake is a Fellow of the Institute of Chartered Accountants and has a Bachelor of Commerce Degree from the University of Alberta. | |

|

BEVERLEY ANNE BRISCOE

Residence: Vancouver, B.C., Canada Age: 59 Independent Director since: October 29, 2004

Shares owned, controlled or directed: 15,288 DSUs held: 6,093 (1)

Committees:

Member of the Audit Committee. Member of the Nominating and Corporate Governance Committee. Member of the CEO Search Committee. Chair of the Transition Committee. |

Ms. Briscoe was appointed Deputy Chairperson of the Board of the Company effective September 23, 2013. Ms. Briscoe is currently the owner and President of Briscoe Management Ltd., a consulting company that she has owned since 2004. From 2003 to 2007, Ms. Briscoe was also Chair of the Industry Training Authority for British Columbia. Ms. Briscoe’s previous employment includes: from 1997 to 2004 she was President and owner of Hiway Refrigeration Limited; from 1994 to 1997 she was Vice President and General Manager of Wajax Industries Limited; from 1989 to 1994 she was Chief Financial Officer for the Rivtow Group of Companies; from 1983 to 1989 she held various executive positions with several operating divisions of The Jim Pattison Group; and from 1977 to 1983 she worked with a predecessor firm of PricewaterhouseCooopers. Ms. Briscoe is a Fellow of the Institute of Chartered Accountants and has a Bachelor of Commerce degree from the University of British Columbia, and is also a Fellow of the Institute of Corporate Directors.

Other directorships:

Goldcorp Inc. (TSX: “G”; NYSE: “GG” – a public gold and precious metal company) – Director; Chair of the Audit Committee and member of the Environmental Health and Safety Committee |

3

| ROBERT GEORGE ELTON

Residence: Vancouver, B.C., Canada Age: 62 Independent Director since: April 30, 2012

Shares owned, controlled or directed: nil DSUs held: 4,505 (1)

Committees:

Chair of the Audit Committee. Member of the Compensation Committee. Member of the Transition Committee. |

Mr. Elton is currently acting as Executive Sponsor, Banking Transformation, of Vancouver City Savings Credit Union. Mr. Elton is also a corporate director and an adjunct professor at the University of British Columbia’s Sauder School of Business. Mr. Elton was President and Chief Executive Officer of BC Hydro, a government-owned electric utility, from 2003 to 2009. Prior to this he was Executive Vice President Finance and Chief Financial Officer of BC Hydro (2002 – 2003), Powerex (2001-2002), a subsidiary of BC Hydro, and Eldorado Gold Corporation (1996-2001) (TSX: “ELD”; NYSE “EGO”; ASX: “EAU”). Mr. Elton spent over 20 years with PriceWaterhouseCoopers and predecessor firms, becoming Partner in 1987 before leaving the firm in 1996. He is a Fellow of the Institute of Chartered Accountants in British Columbia and has a Master of Arts degree from Cambridge University, U.K.

Other directorships:

Aquatics Informatics Inc. (a private software company) – Director Corix Utilities (a private utility infrastructure company) – Director Nurse Next Door (a private company) – Chair, Business Advisory Board | |

|

ERIK OLSSON

Residence: Scottsdale, AZ, USA Age: 51 Independent Director since: June 1, 2013

Shares owned, controlled or directed: nil DSUs held: 1,547 (1)

Committees:

Subject to being elected at the Meeting, Mr. Olsson is expected to be appointed as a member of the Compensation Committee. |

Mr. Olsson is currently President, Chief Executive Officer and a Director of Mobile Mini, Inc. (NASDAQ-GS: MINI), the world’s leading provider of portable storage solutions. Mr. Olsson had previously been President, Chief Executive Officer, and a Director of RSC Holdings, Inc., a premier provider of rental equipment in North America, prior to its acquisition by United Rentals, Inc. in April 2012. Prior to that he served as Chief Financial Officer and Chief Operating Officer of RSC Holdings, Inc. In addition, he held various senior positions in the United States, Brazil, and Sweden in his 13 years with mining equipment maker Atlas Copco AB, an industrial group with world-leading positions in compressors, construction and mining equipment. Erik holds a degree in Business Administration and Economics from the University of Gothenburg.

Other directorships:

Mobile Mini, Inc. (NASDAQ-GS: “MINI” – self storage company) | |

|

ERIC PATEL

Residence: Vancouver, B.C., Canada Age: 55 Independent Director since: April 16, 2004

Shares owned, controlled or directed: 19,445 DSUs held: 5,430 (1)

Committees:

Chair of Nominating and Corporate Governance Committee. |

Mr. Patel is currently a business consultant and corporate director. He was previously Chief Financial Officer of Pembrook Mining Corp., a private mining company, from 2007 until 2010. Prior to joining Pembrook, Mr. Patel was the Chief Financial Officer of Crystal Decisions, Inc., a privately held software company. Mr. Patel joined Crystal Decisions in 1999 after holding executive level positions, including that of Chief Financial Officer, with University Games, Inc., a privately held manufacturer of educational toys and games. Before 1997, Mr. Patel worked for Dreyer’s Grand Ice Cream as Director of Strategy, for Marakon Associates strategy consultants and for Chemical Bank. Mr. Patel holds an MBA degree from Stanford University and a Bachelor of Arts degree from Brown University. | |

|

Member of the Audit Committee. Chair of the CEO Search Committee. |

Other directorships:

ACL Services Ltd. (a private software company) – Advisory Board Chair

Daiya Foods Inc. (a private food company) – Chair

Terramera Inc. (a private bio-pesticides company) – Director |

4

|

EDWARD BALTAZAR PITONIAK

Residence: Exeter, RI, U.S.A. Age: 58 Independent Director since: July 28, 2006

Shares owned, controlled or directed: 7,121 DSUs held: 5,430 (1)

Committees:

Chair of Compensation Committee. Member of the Audit Committee. Member of the Transition Committee. |

Mr. Pitoniak is currently a corporate director. Mr. Pitoniak retired in 2009 from the position of President and Chief Executive Officer and Director of bcIMC Hospitality Group, a hotel property and brand ownership entity (formerly a public income trust called Canadian Hotel Income Properties Real Estate Investment Trust (CHIP) – TSX: “HOT.un”), where he was employed since January 2004. Mr. Pitoniak was also a member of CHIP’s Board of Trustees before it went private. Prior to joining CHIP, Mr. Pitoniak was a Senior Vice-President at Intrawest Corporation (TSX: “ITW”; NYSE “IDR” – a ski and golf resort operator and developer) for nearly eight years. Before Intrawest, Mr. Pitoniak spent nine years with Times Mirror Magazines, where he served as editor-in-chief and advertising director with Ski Magazine. Mr. Pitoniak has a Bachelor of Arts degree from Amherst College.

Other directorships:

Regal Lifestyle Communities Inc. (TSX: “RLG” a public company) – Director; Chair of the Investment & Environmental Committee and member of the Audit Committee | |

|

CHRISTOPHER ZIMMERMAN

Residence: Manhattan Beach, CA, USA Age: 54 Independent Director since: April 11, 2008

Shares owned, controlled or directed: 6,856 DSUs held:5,430 (1)

Committees:

Member of the Compensation Committee |

Mr. Zimmerman is currently Principal of Bonfire Ventures, a business consultancy focused on developing disruptive growth strategies. Prior to this, he was President of Easton Sports, a designer, developer and marketer of sports equipment and accessories. Prior to joining Easton Sports, Mr. Zimmerman was President and Chief Executive Officer of Canucks Sports and Entertainment, a sports entertainment company in Vancouver, B.C, from 2006 until 2009. Before joining Canucks Sports and Entertainment, Mr. Zimmerman was the President and Chief Executive Officer of Nike Bauer Inc., a hockey equipment company. Prior to this appointment in March 2003, Mr. Zimmerman was General Manager of Nike Golf USA. He joined Nike Golf in 1998 after spending 16 years in a variety of senior advertising positions, including USA Advertising Director for the Nike Brand and Senior Vice President at Saatchi and Saatchi Advertising in New York. Mr. Zimmerman has an MBA from Babson College. |

| (1) | For information regarding DSUs and the Company’s Non-Executive Director Deferred Share Unit Plan (the “DSU Plan”), see “Non-Executive Director Deferred Share Unit Plan” on page 9 of this Information Circular. |

The Company is not aware that any of the above nominees will be unable or unwilling to serve as a director of the Company. However, should the Company become aware of such an occurrence before the election of directors takes place at the Meeting, the Board may select substitute nominees at its discretion. The persons named in the enclosed form of proxy intend to vote for the election of any such substitute nominees.

5

In addition to the information presented above regarding Common Shares beneficially owned, controlled or directed, Mr. Blake, the Chief Executive Officer of the Company, was the only director to hold stock options as of March 3, 2014. None of the Company’s non-executive directors have been granted stock options since their appointment. The Company ceased granting stock options to non-executive directors in 2004, and, pursuant to the Company’s Policy Regarding the Granting of Equity Based Compensation Awards (the “Stock Option Policy”), will not do so in the future.

Chair of the Board

Robert Murdoch is currently the Chairman of the Board and is an independent director and, therefore, the Board has not appointed a Lead Independent Director. Beverley Briscoe is currently the Deputy Chairperson of the Board and is an independent director. As indicated above, if Ms. Briscoe is re-elected as a director at the Meeting, it is anticipated that she will be appointed Chair of the Board upon Mr. Murdoch’s retirement from that position. Any shareholder wishing to contact the Chair of the Board may do so by phoning [778-331-5300] or by sending an email to LeadDirector@rbauction.com.

Committees of the Board

The Board has the following standing committees:

| • | Audit Committee |

| • | Nominating and Corporate Governance Committee |

| • | Compensation Committee |

Information regarding these committees and their functions is included under “Report on Corporate Governance” on page 41.

Additional disclosure relating to the Company’s Audit Committee as required under Multilateral Instrument 52-110 is contained in the Company’s Annual Information Form under the heading “Audit Committee Information”. The Annual Information Form of the Company has been filed on SEDAR and is available on their website at www.sedar.com. A copy of the Company’s Annual Information Form may also be obtained by making a request to the Corporate Secretary of the Company.

In October 2013, the Board formed two additional temporary committees of the Board:

| • | CEO Search Committee –formed for the purpose of overseeing the identification and hiring of a new Chief Executive Officer to replace Mr. Blake |

| • | Transition Committee – formed to oversee the transition of management and the Company’s ongoing strategic plans under the new Chief Executive Officer, once appointed |

Board and Committee Attendance

The following tables present information about Board and committee meetings and attendance by directors at such meetings for the year ended December 31, 2013. The overall 2013 attendance record by directors at Board and committee meetings was 100%.

6

Board and Committee Meetings Held

| Number of Meetings | ||||

| Board of Directors |

12 | |||

| Audit Committee |

4 | |||

| Compensation Committee |

3 | |||

| Nominating and Corporate Governance Committee |

5 | |||

| CEO Search Committee |

6 | |||

| Transition Committee |

2 | |||

Summary of Attendance of Directors

| Director |

Board Meetings |

Audit Committee Meetings |

Compensation Committee Meetings |

Nominating & Corporate Governance Committee Meetings |

CEO Search Committee |

Transition Committee | ||||||

| Robert Murdoch |

12 of 12 (Chair) | N/A | N/A | 5 of 5 | 6 of 6 | N/A | ||||||

| Peter Blake (1) |

9 of 9 | N/A | N/A | N/A | N/A | N/A | ||||||

| Beverley Briscoe |

12 of 12 | 4 of 4 | N/A | 5 of 5 | 6 of 6 | 2 of 2 (Chair) | ||||||

| Robert Elton (2) |

12 of 12 | 4 of 4 (Chair) | 3 of 3 | N/A | N/A | 2 of 2 | ||||||

| Erik Olsson (3) |

9 of 9 | 1 of 1 | N/A | 1 of 1 | N/A | N/A | ||||||

| Eric Patel |

12 of 12 | 4 of 4 | N/A | 5 of 5 (Chair) | 6 of 6 (Chair) | N/A | ||||||

| Edward Pitoniak |

12 of 12 | 4 of 4 | 3 of 3 (Chair) | N/A | N/A | 2 of 2 | ||||||

| Christopher Zimmerman |

12 of 12 | N/A | 3 of 3 | N/A | N/A | N/A |

| (1) | As discussed on page 1. Mr. Blake has agreed to stand for re-election as a director, but intends to resign as a director following the appointment of a new Chief Executive Officer of the Company. Three of the 12 Board meetings were designated as in-camera meetings of the Independent Directors, which Mr. Blake did not attend. |

| (2) | Mr. Elton was appointed Chair of the Audit Committee effective April 25, 2013. |

| (3) | Mr. Olsson was appointed as a director in June 2013 and the attendance noted in the table for him reflects the number of Board meetings that took place after his appointment. While Mr. Olsson was not a member of the Audit or Nominating & Corporate Governance Committees, he attended meetings of the committees as part of his orientation as a new director. |

Skills Matrix

The Nominating & Corporate Governance Committee maintains and updates from time to time an inventory of the competencies, capabilities and skills of current Board members. The following matrix is used as a reference tool for the ongoing assessment of Board composition, to ensure that diversity is considered as new Board members are being assessed and to identify any gaps in the competencies that are required to successfully advance the overall strategy of the Company.

7

| General Business Skills |

Functional Experience |

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Name |

Large Organization Experience |

CEO Experience |

Overseas Experience |

Accounting Knowledge |

Employee Recruitment & Development |

Environmental, Health & Safety |

Financial / Investment |

IT Software, Infrastructure & Security |

Marketing | Organizational Structure |

Sales | Strategic Planning |

Industrial Equipment Industry |

|||||||||||||||||||||||||||||||||||||||

| Robert Murdoch |

x | x | x | x | x | x | x | x | ||||||||||||||||||||||||||||||||||||||||||||

| Beverley Briscoe |

x | x | x | x | x | x | x | x | x | x | ||||||||||||||||||||||||||||||||||||||||||

| Robert Elton |

x | x | x | x | x | x | x | |||||||||||||||||||||||||||||||||||||||||||||

| Erik Olsson |

x | x | x | x | x | x | x | x | x | |||||||||||||||||||||||||||||||||||||||||||

| Eric Patel |

x | x | x | x | x | x | x | |||||||||||||||||||||||||||||||||||||||||||||

| Edward Pitoniak |

x | x | x | x | x | x | x | x | x | |||||||||||||||||||||||||||||||||||||||||||

| Christopher Zimmerman |

x | x | x | x | x | x | x | |||||||||||||||||||||||||||||||||||||||||||||

DIRECTOR COMPENSATION

Annual Meeting Fees

Non-executive directors of the Company, other than the Board Chairman and Deputy Chairperson, receive, in addition to reimbursement of reasonable travel and lodging expenses, an annual fee of $100,000 for service on the Board. The Board Chairman was paid an annual fee of $240,000. On September 23, 2013 the Board appointed Beverly Briscoe to the position of Deputy Chairperson in anticipation of Robert Murdoch’s retirement as Chair of the Board in 2014. The Deputy Chairperson received, commencing in the fourth fiscal quarter of the Company, an annual fee of $200,000, which was prorated for 2013.

In addition to the fee paid to non-executive directors as described above, the chair of the Audit Committee receives an additional $15,000 annual fee, and the chair of each of the Compensation Committee and Nominating & Corporate Governance Committee receives an additional $10,000 annual fee. The chair of the CEO Search Committee received a one-time fee of $10,000, paid in 2013. The chair of the Transition Committee does not receive a separate fee.

8

Non-executive directors also receive a $1,500 fee per minuted meeting, in person or by teleconference, in excess of 30 minutes. The Board Chairman and Deputy Chairperson are not entitled to meeting fees. Non-executive directors required to travel a day other than a meeting date when scheduling does not permit travel on the day of the meeting are also entitled to receive, in addition to reimbursement for travel expenses, a $1,500 travel fee.

Subject to the provisions of the DSU Plan (see discussion below), annual retainer and other fees were paid to non-executive directors on the following basis:

| Description of Fee |

Amount of Fee (U.S.$) |

|||

| Annual fee for Board Chair (1) |

240,000 | |||

| Annual fee for Deputy Chairperson(2) |

200,000 | |||

| Annual fee for Board Membership (1) |

100,000 | |||

| Annual fee for Audit Committee chair |

15,000 | |||

| Annual fee for Compensation Committee chair |

10,000 | |||

| Annual fee for Nominating & Corporate Governance Committee chair |

10,000 | |||

| Annual fee for CEO Search Committee chair(3) |

10,000 | |||

| Meeting fee (per minuted meeting in excess of 30 minutes) |

1,500 | |||

| Travel fee (4) |

1,500 | |||

| (1) | Subject to the provisions of the DSU Plan, the annual fees are payable in four equal amounts on a quarterly basis (less applicable source deductions). |

| (2) | Ms. Briscoe was appointed to the newly created temporary position of Deputy Chairperson effective September 23, 2013. |

| (3) | One-time fee paid in 2013. It is not anticipated that any fee will be paid to the chair of the CEO Search Committee or the Transition Committee in 2014. |

| (4) | A travel fee is paid to non-executive directors required to travel on a day other than the meeting date when scheduling does not permit travel on the day of the particular meeting. This fee is in addition to reimbursement for travel expenses. |

Non-Executive Director Deferred Share Unit Plan

Effective January 1, 2012, the Board approved the adoption of a deferred share unit plan for non-executive directors to further align the interests of directors with the interests of the Company’s shareholders and provide a tax effective way for directors to build share ownership (or the equivalent thereof). The Board also introduced share ownership guidelines for directors, which require each non-executive director to hold a minimum of three times their annual fee for Board service in Common Shares or deferred share units.

If a non-executive director has not, prior the commencement of the current year, satisfied share ownership guidelines, the director must receive 60% of his or her annual Board retainer (the annual fees paid to a director for service on the Board, including the annual fee paid to the Board Chair and Deputy Chairperson, but excluding fees for chairmanship of Board committees and other fees) in the form of DSUs, rather than in cash. The remainder of the annual Board retainer is paid in cash, quarterly in arrears. If a non-executive director has satisfied share ownership guidelines, the director may elect to receive all or none of the 60% in DSUs, with the remainder paid in cash. The portion of the annual Board retainer which is paid in the form of DSUs is credited annually in arrears, following the end of the year to which the fees relate. The number of DSUs credited to a director is calculated by dividing the dollar amount of the annual Board retainer to be paid in the form of DSUs by the fair market value of a Common Share on the date the DSUs are credited, being the volume weighted average price of the Common Shares reported by the New York Stock Exchange for the immediately preceding twenty trading days.

9

On March 11, 2014, the following DSUs were credited to non-executive directors in respect of 2013:

| Director(1) |

Number of DSUs Credited(2) | |||

| Robert Murdoch |

6,366 | |||

| Beverley Briscoe |

3,316 | |||

| Robert Elton |

2,653 | |||

| Erik Olsson |

1,547 | |||

| Eric Patel |

2,653 | |||

| Edward Pitoniak |

2,653 | |||

| Christopher Zimmerman |

2,653 | |||

| (1) | Mr. Blake does not participate in the DSU Plan. |

| (2) | All DSUs indicated were credited on March 11, 2014. The grant date fair value was $22.62 per DSU. The grant date fair value of the DSUs credited is included in the Directors’ Total Compensation table below. |

Although DSUs vest immediately upon being granted under the DSU Plan, no amount is payable to the non-executive director holding the DSUs until the director ceases to be a director, following which the director will be entitled to receive a lump sum cash payment, net of any applicable withholdings, equal to the number of DSUs held multiplied by the fair market value of one Common Share (determined as described above) as of the 24th business day after the first publication of the Company’s interim or annual financial statements and management’s discussion and analysis for the fiscal quarter of the Company next ending following the director ceasing to hold office. Additional DSUs are credited under the DSU Plan corresponding to dividends declared on the Common Shares. DSUs are considered equivalent to Common Shares for purposes of determining whether a director is complying with or satisfying share ownership guidelines.

In connection with the adoption of the DSU Plan, the Company’s long term incentive plan for non-executive directors (the “Non-Executive Director LTIP”) was amended to provide that the Company would cease to pay contributions for participants under such plan to the plan administrator in respect of annual fees earned after January 1, 2012.

Long Term Incentive Plan for Non-Executive Directors

The Company adopted the Non-Executive Director LTIP in 2009. Under this plan, prior to 2012, part of the annual retainer of non-executive directors was used to purchase Common Shares. Such shares were purchased by the administrator of the plan through open market purchases and held by the plan administrator on behalf of the participants. Participants are not permitted to withdraw any Common Shares so held unless a certain event occurs or certain conditions are satisfied (e.g. the termination, retirement or resignation of the participant as a director of the Company). Commencing in 2012, with the introduction of the DSU Plan discussed above, non-executive directors ceased to contribute to the Non-Executive Director LTIP. However, Common Shares previously acquired and held under the plan are required to be held in the plan until participants cease to serve on the Board.

10

Directors’ Total Compensation

The following table sets out the total compensation by director for the year ended December 31, 2013:

| Director |

Annual Board fees (1) |

Committee chair fees |

Meeting fees |

Travel fees |

Total fees |

Share- based awards (2) |

All other comp.(3) |

Total | ||||||||||||||||||||||||

| Robert Murdoch |

$ | 96,000 | Nil | Nil | $ | 21,000 | $ | 117,000 | $ | 144,000 | $ | 2,500 | $ | 263,500 | ||||||||||||||||||

| Peter Blake (4) |

Nil | Nil | Nil | Nil | Nil | Nil | Nil | Nil | ||||||||||||||||||||||||

| Beverley Briscoe (5) |

$ | 50,000 | $ | 4,725 | $ | 21,000 | Nil | $ | 75,725 | $ | 75,000 | $ | 1,050 | $ | 151,775 | |||||||||||||||||

| Robert Elton (6) |

$ | 40,000 | $ | 10,275 | $ | 30,000 | Nil | $ | 80,275 | $ | 60,000 | $ | 700 | $ | 140,975 | |||||||||||||||||

| Erik Olsson (7) |

$ | 23,333 | Nil | $ | 16,500 | $ | 6,000 | $ | 45,833 | $ | 35,000 | Nil | $ | 80,833 | ||||||||||||||||||

| Eric Patel |

$ | 40,000 | $ | 20,000 | $ | 40,500 | Nil | $ | 100,500 | $ | 60,000 | $ | 1,050 | $ | 161,550 | |||||||||||||||||

| Edward Pitoniak |

$ | 40,000 | $ | 10,000 | $ | 30,000 | $ | 21,000 | $ | 101,000 | $ | 60,000 | $ | 1,050 | $ | 162,050 | ||||||||||||||||

| Christopher Zimmerman |

$ | 40,000 | Nil | $ | 21,000 | $ | 9,000 | $ | 70,000 | $ | 60,000 | $ | 1,050 | $ | 131,050 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total |

$ | 329,333 | $ | 45,000 | $ | 159,000 | $ | 57,000 | $ | 590,333 | $ | 494,000 | $ | 7,400 | $ | 1,091,733 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| (1) | Represents annual fees for service on the Board, including the annual fee paid to the Board Chairman and Deputy Chairperson. This column does not include annual Board fees paid in DSUs, rather than in cash, pursuant to the DSU Plan. The DSU Plan is more fully described under “Non-Executive Deferred Share Unit Plan” on page 9. Pursuant to the terms of the DSU Plan, each of the non-executive directors received 60 percent of their annual Board fees in the form of DSUs, rather than in cash. The value of such DSUs is set out under the “Share- based awards” column. The DSUs were credited on March 11, 2014 in respect of 2013 annual director fees. |

| (2) | This column reflects the value of the DSUs received by non-executive directors in lieu of payment of a portion of annual Board fees payable in cash. The DSU Plan provides that the DSUs will be credited at a value equal to the volume weighted average price of the Common Shares reported by the New York Stock Exchange for the twenty trading days preceding the date the DSUs are credited. The amounts reflected in this column reflect the amount of the Board fees that otherwise would have been paid in cash but were paid in the form of DSUs, and represents the value which the Board has determined is the grant date fair value, which is also the accounting fair value. As noted in Note (1) the DSUs were credited on March 11, 2014 in respect of 2013 annual director fees. As the DSUs represent annual Board fees that are paid in the form of DSUs rather than in cash, they do not represent an incentive plan award. |

| (3) | All other compensation consists of the value of additional DSUs credited to non-executive directors during 2013 corresponding to dividends declared and paid by the Company on Common Shares during 2013. The value of such dividend equivalent additional DSUs was calculated by multiplying the number of such additional DSUs credited by the fair market value of a Common Share on the date the dividend was paid (determined as described under “Non-Executive Deferred Share Unit Plan”). |

| (4) | Mr. Blake is the Chief Executive Officer of the Company and therefore does not receive compensation as a director. Mr. Blake’s compensation was as summarized in the Summary Compensation Table on page 33. |

| (5) | Ms. Briscoe was appointed Deputy Chairperson on September 23, 2013 and her Board fee and Deputy Chairperson fee were pro-rated accordingly. |

| (6) | Mr. Elton was appointed Chair of the Audit Committee on April 25, 2013 and the payment of his fees were pro-rated accordingly. |

| (7) | Mr. Olsson became a director in June 2013 and the payment of his fees was pro-rated accordingly. |

11

Outstanding Share Based Awards

The following table sets out for each director (except Peter Blake, the Company’s Chief Executive Officer) all share-based awards outstanding as at December 31, 2013:

| Name(1) |

Share-based awards (2) | |||||||||||

| Number of shares or units of shares that have not vested (#) |

Market or payout value of share-based awards that have not vested ($) |

Market or payout value of vested share-based awards not paid out or distributed (3) ($) |

||||||||||

| Robert Murdoch |

— | — | 145,491 | |||||||||

| Beverly Briscoe |

— | — | 60,621 | |||||||||

| Robert Elton |

— | — | 40,422 | |||||||||

| Erik Olsson(4) |

— | — | — | |||||||||

| Eric Patel |

— | — | 60,621 | |||||||||

| Edward Pitoniak |

— | — | 60,621 | |||||||||

| Christopher Zimmerman |

— | — | 60,621 | |||||||||

| (1) | Mr. Blake is the Chief Executive Officer of the Company and therefore does not receive any compensation as a director. See “Statement of Executive Compensation” beginning on page 16 for information regarding Mr. Blake’s compensation. |

| (2) | The non-executive directors do not participate in the Company’s stock option plan and do not hold any outstanding option-based awards. The only share-based amounts received by the non-executive directors are DSUs under the DSU Plan which vest immediately. As discussed in Note (2) to the Directors’ Total Compensation table above, the DSUs do not represent an incentive plan award but instead annual Board fees that are paid in the form of DSUs. Additional DSUs are credited under the DSU Plan in respect of DSUs held corresponding to dividends declared on the Common Shares. |

| (3) | DSUs vest immediately upon being credited under the DSU Plan. The number of DSUs held by the directors as at the date of this Information Circular is shown as part of information regarding the proposed director nominees beginning on page 3. The amount reflected in this column represents the value of DSUs held by directors as at December 31, 2013, including DSUs credited corresponding to dividends declared on the Common Shares. The value was calculated by multiplying the number of outstanding DSUs by the 20-day volume weighted average closing price of the Common Shares on the New York Stock Exchange on December 31, 2013, being $21.83. As described above under “Non-Executive Director Deferred Share Plan”, DSUs received by non-executive directors in lieu of annual Board fees are credited annually in arrears, following the end of the year to which the fees relate. As a result, this table does not include DSUs received after December 31, 2013 in lieu of annual director fees for 2013. Such DSUs are described in Notes (1) and (2) to the Directors’ Total Compensation table. |

| (4) | Mr. Olsson was appointed to the Board in June 2013 and, accordingly, had not received any DSUs as of December 31, 2013 as they are granted annually in arrears. |

12

Director Share-Based Awards-Value Vested or Earned During the Year

The following table sets out for each director (except Peter Blake, the Company’s Chief Executive Officer) the share-based awards received by the directors for the fiscal year ended December 31, 2013.

| Share-based awards – value vested during the year(2) | ||||||||||||||||

| Number vested during the year | Value vested during the year(5) ($) |

|||||||||||||||

| Name(1) |

Received in lieu of fees(3) |

Dividend equivalents(4) (#) |

Total (#) |

|||||||||||||

| Robert Murdoch |

6,540 | 125 | 6,665 | 145,491 | ||||||||||||

| Beverly Briscoe |

2,725 | 52 | 2,777 | 60,621 | ||||||||||||

| Robert Elton |

1,817 | 35 | 1,852 | 40,422 | ||||||||||||

| Erik Olsson(6) |

— | — | — | — | ||||||||||||

| Eric Patel |

2,725 | 52 | 2,777 | 60,621 | ||||||||||||

| Edward Pitoniak |

2,725 | 52 | 2,777 | 60,621 | ||||||||||||

| Christopher Zimmerman |

2,725 | 52 | 2,777 | 60,621 | ||||||||||||

| (1) | Mr. Blake is the Chief Executive Officer of the Company and therefore does not receive any compensation as a director. See “Statement of Executive Compensation” beginning on page 16 for information regarding Mr. Blake’s compensation. |

| (2) | The non-executive directors do not participate in the Company’s stock option plan and do not hold any outstanding option-based awards, and do not receive any non-equity incentive plan compensation. The only share-based amounts received by the non-executive directors are DSUs under the DSU Plan which vest immediately. As discussed in Note (2) to the Directors’ Total Compensation table, under the DSU Plan, DSUs do not represent an incentive plan award and instead represent annual Board fees that are paid in the form of DSUs rather than in cash. Additional DSUs are credited under the DSU Plan in respect of DSUs held corresponding to dividends declared on the Common Shares. Although DSUs vest immediately, no amount is payable to the non-executive director until the director ceases to be a director. |

| (3) | This column represents the number of DSUs received by the director in lieu of a portion of the annual fees payable to the non-executive director for the fiscal year ended December 31, 2013. As described under “Non-Executive Director Deferred Share Unit Plan” on page 9, the portion of the annual director fees which is paid in DSUs is credited annually in arrears. The DSUs specified in this column reflect DSUs credited to the non-executive directors on March 11, 2014 in respect of 2013 annual fees. Although these DSUs technically were only received, and vested, in March, 2014, they are included in the table since they were received in respect of 2013. The value of these DSUs is included under “Share-based awards” in the Directors’ Total Compensation table on page 11. The number of DSUs received was equal to the dollar value of the annual director fees paid in the form of DSU, divided by the fair value of a Common Share on such date, being the volume weighted average price of the Common Shares reported by the New York Stock Exchange for the immediately preceding twenty trading days. This column does not represent DSUs received in respect of years prior to 2013, including DSUS that were credited in March 2013 in lieu of a portion of the annual fees payable to the non-executive directors for the fiscal year ended December 31, 2012. |

| (4) | This column represents the number of dividend equivalent DSUs credited on outstanding DSUs during 2013. The number of such additional dividend equivalent DSUs is computed by dividing (i) the product obtained by multiplying the amount of a dividend declared and paid by the Company on the Common Shares on a per share basis by the number of DSUs held by a director on the record date for the payment of such dividend by (ii) the fair market value of a Common Share on the date the dividend is paid, determined as described under “Non-Executive Deferred Share Unit Plan” on page 9. |

| (5) | This column represents the value of DSUs (i) received by the directors in lieu of a portion of their annual fees for the fiscal year ended December 31, 2013, and (ii) dividend equivalent DSUs credited on outstanding DSUs during 2013. As noted above, DSUs received in lieu of annual Board fees were only received, and vested, in March 2014, but were received in respect of 2013. The value of the DSUs received by directors in lieu of annual fees is included under “Share-based awards” in the Directors’ Total Compensation table on page 11, and reflects the amount of the Board fees that otherwise would have been paid in cash which were paid in the form of DSUs . The value of dividend equivalent additional DSUs is calculated by multiplying the number of such additional DSUs by the fair market value of a Common Share on the date the dividend was paid, and is included under “All other compensation” in the Directors’ Total Compensation table. |

| (6) | Mr. Olsson was appointed to the Board in June 2013 and, accordingly, had not received any DSUs as of December 31, 2013 as they are granted annually in arrears. |

For additional disclosure in relation to the Board and Corporate Governance, please refer to the section “Report on Corporate Governance” on page 41.

13

PROPOSAL 2: Appointment of Auditors

The Company proposes that Ernst & Young LLP, Chartered Accountants of Vancouver, British Columbia, be appointed as auditors of the Company for the year ending December 31, 2014 and that the Audit Committee be authorized to fix their remuneration. Ernst & Young LLP has been the Auditors of the Company since April 25, 2013. The Audit Committee is satisfied that Ernst & Young LLP meets the relevant independence requirements and is free from conflicts of interest that could impair their objectivity in conducting the Company’s audit. The resolution appointing auditors must be passed by a majority of the votes cast by the shareholders who vote in respect of that resolution.

In addition to retaining Ernst & Young LLP to audit the consolidated financial statements of the Company and its subsidiaries for the year ended December 31, 2013, the Company retained Ernst & Young LLP to provide various non-audit services in 2013. The Audit Committee is required to pre-approve all non-audit related services performed by Ernst & Young LLP. The aggregate fees billed for professional services by the auditors and its affiliates around the world during fiscal 2013 and 2012 were as follows:

| Fiscal 2013 | Fiscal 2012 (1) | |||||||

| Audit Fees |

$ | 849,400 | $ | 1,311,200 | ||||

| Audit-Related Fees |

— | — | ||||||

| Tax Fees |

— | 275,800 | ||||||

| All Other Fees |

— | — | ||||||

|

|

|

|

|

|||||

| Total Fees |

$ | 849,400 | $ | 1,587,000 | ||||

|

|

|

|

|

|||||

| (1) | Fiscal 2012 fees were paid to KPMG LLP as former auditor of the Company. During the term of KPMG’s appointment as auditors of the Company, there were no reportable events within the meaning ascribed to that term in National Instrument 51-102. The report of the Company’s auditors of the financial statements of the Company for Fiscal 2012 contained no adverse opinion or disclaimer of opinion and was not qualified or modified as to uncertainty, audit scope or accounting principles. |

The nature of each category of fees is as follows:

Audit Fees:

Audit fees were paid for professional services rendered by the auditors for the audit and interim reviews of the Company’s consolidated financial statements or services provided in connection with statutory and regulatory filings or engagements.

Audit-Related Fees:

Audit-related fees were paid for assurance and related services that are reasonably related to the performance of the audit or review of the Company’s financial statements and are not reported under the Audit Fees item above.

Tax Fees:

Tax fees were paid for tax compliance, tax advice and tax planning professional services. These services consisted of: tax compliance including the review of tax returns; assistance with questions regarding tax audits; assistance in completing routine tax schedules and calculations; and tax planning and advisory services relating to common forms of domestic and international taxation (i.e., income tax, capital tax, Goods and Services Tax and Value Added Tax).

14

The Audit Committee is responsible for the appointment, compensation and oversight of the work of the Company’s independent auditor and is required to pre-approve all non-audit related services performed by the auditors. Accordingly, the Audit Committee has adopted a pre-approval policy. The policy outlines the procedures and the conditions pursuant to which permissible services proposed to be performed by the auditors are pre-approved, provides a general pre-approval for certain permissible services and outlines a list of prohibited services.

15

STATEMENT OF EXECUTIVE COMPENSATION

Composition of the Compensation Committee

The Compensation Committee of the Company currently consists of Messrs. Edward Pitoniak (chair), Christopher Zimmerman and Robert Elton. The Board has determined that all three members of the Compensation Committee are independent directors (as defined under applicable securities legislation and securities exchange regulations). Each of the committee members has direct experience that is relevant to his responsibilities with respect to executive compensation by virtue of the fact that he has played a principal executive role at a large company with overall responsibility for designing and implementing executive compensation policies and programs.

The responsibilities, powers and operation of the Compensation Committee are defined in its charter, which states that the purpose of the committee is to assist the Board in discharging its responsibilities relating to compensation of the Company’s executive officers and general corporate compensation and benefit programs. The Compensation Committee has overall responsibility for recommending to the Board the Company’s compensation philosophy for the Company’s executive officers, evaluating and approving compensation plans, policies and programs in respect of the Chief Executive Officer, making recommendations to the Board regarding the compensation plans, policies and programs in respect of the Company’s executive officers other than the Chief Executive Officer and overseeing the evaluation of management and management succession plans.

Compensation Discussion and Analysis

Compensation Objectives and Strategy

The Company’s policy with respect to the compensation of the Chief Executive Officer, the Chief Financial Officer and the Company’s three most highly compensated executive officers other than the Chief Executive Officer and the Chief Financial Officer (such officers are hereafter collectively called the “Named Executive Officers”) is based upon the principles that total compensation must: (1) be competitive in order to help attract and retain the talent needed to lead and grow the Company’s business; (2) provide a strong incentive for executives and key employees to work towards the achievement of the Company’s goals, including long-term earnings growth and return on invested capital goals; and (3) ensure that the interests of management and the Company’s shareholders are aligned and that the compensation packages are fair to senior management, employees, the shareholders and other stakeholders.

The Company’s strategy is to pay for performance, with the aim of paying total cash compensation at or above the median (50th percentile) for comparable companies, with top performers achieving total direct compensation above the 75th percentile when an individual exceeds his or her personal objectives and the Company exceeds its earnings targets. In addition, the Company believes in pay at risk for the Chief Executive Officer and the other Named Executive Officers, as well as all senior management of the Company. As any employee’s responsibility increases, so does the amount of pay at risk, which the Company believes is important for aligning executive compensation with shareholder interests. As employees move to higher levels of responsibility with more direct influence over the Company’s strategy and performance, their base salary as a percentage of total direct compensation decreases and they have a higher percentage of pay at risk.

16

Benchmarking

In 2011 the Compensation Committee retained the services of Towers Watson (“Towers”) to conduct a formal review of the Company’s executive compensation arrangements. The first step in the review was to define the group of comparable companies against which the Company’s compensation practices would be compared and evaluated. The Company has no direct peers in the industrial auction sector, so this step involved defining and developing the methodology for identifying comparable companies. Together with Towers, the Compensation Committee cited net income and market capitalization as the key financial metrics that would define the comparable group of companies, with an emphasis on growth companies with global operations. Net income and market capitalization were chosen because they are the primary financial value produced for the Company’s shareholders, and because, in the view of the Compensation Committee and Towers, neither of the Company’s key revenue-related metrics would yield meaningful comparisons. Auction revenues would potentially understate the complexity and scale of the Company’s value creation and its profitability. Using net income and market capitalization as the key financial metrics, the Board with input from the CEO and analysis by Towers developed a group of 19 comparable companies, located in both the United States and Canada and across diverse industries. The following is the list of comparable companies:

| Canadian Comparable Companies

Finning International, Inc.

Macdonald, Dettwiler & Associates Ltd.

Methanex Corp.

ShawCor Ltd.

Toromont Industries Ltd.

Trican Well Services Ltd.

Wajax Corporation

West Fraser Timer Co. Ltd. |

U.S. Comparable Companies

Copart, Inc.

Harsco Corporation

KAR Auction Services, Inc.

Lennox International, Inc.

LKQ Corp.

Rollins Inc.

RPC Inc.

Shaw Group Inc.

Sotheby’s

Toro Co.

United Rentals, Inc. |

Compensation Consultants

The Compensation Committee from time to time retains independent consultants to provide advice and recommendations regarding executive compensation matters. However, the Compensation Committee is ultimately responsible for its decisions and, in making its determinations and decisions, or recommendations to the Board, takes into consideration information and considerations other than the information, advice and recommendations provided by consultants.

In addition, the Nominating and Corporate Governance Committee from time to time retains independent consultants to provide advice to that committee regarding compensation for the directors of the Company. During 2011, the Nominating and Corporate Governance Committee engaged Towers to perform a review of Board compensation. Based, in part, on that review, the Board approved certain amendments to the Company’s Board compensation program which became effective in 2011 and 2012, including the creation and adoption of the DSU Plan, and introduction of share ownership guidelines for directors, as described under “Non-Executive Director Deferred Share Unit Plan” on page 9.

17

In addition, as noted above, in 2011 the Compensation Committee retained Towers to conduct a formal review of the Company’s executive compensation arrangements. Such review by Towers concluded that the structure and philosophy of the Company’s compensation programs were generally in line with the identified comparable companies, as to the relative balance of base salary, and short-term and long-term incentive compensation. Towers noted that certain aspects of the Company’s long-term incentive plan were not in line with the long-term incentive plans of the comparable group of companies. In general, Towers also found that most Named Executive Officers were receiving total cash compensation in line with market medians for comparable companies, with the Company’s Chief Executive Officer and Chief Financial Officer notably below the median. The Compensation Committee and Board increased the Chief Executive Officer’s compensation with effect from July 1, 2011 and again from March 1, 2012, and increased the Chief Financial Officer’s compensation with effect from July 1, 2011 to reduce this unintended gap.

During 2012 the Company, based on the 2011 findings by Towers, undertook a review and redesign of its long term incentive plans. In connection with such review and redesign, during 2012 the Compensation Committee sought further advice from Towers regarding the Company’s compensation programs for senior executives and an additional detailed compensation analysis of the proposed new long term incentive compensation framework to permit management and the Compensation Committee to understand the payout potentials under a variety of business outcomes. In making its determinations, in addition to the findings and advice received from Towers, the Compensation Committee also took into account other factors and information, including, among others, various individual and overall corporate performance reviews and other relevant indicators. The redesign of the Company’s long term incentive plans, which became effective in 2013, is described in more detail under “New Long Term Incentive Plan” below.

During 2013, Towers Watson was engaged to assist in the global application of a new retirement savings plan for executives. The details of this plan are described under the “Defined Contribution Plan” section of this document. Under the retirement savings plan, executives will receive a Company match, up to a maximum of 10% of base salary, of amounts they contribute to a long-term investment from post-tax savings. The amount matched by the Company will be treated as regular income.

Then aggregate fees billed by Towers to the Company over the past two years are set out below, which fees were approved by the Compensation Committee:

| Executive Compensation Related Fees |

All Other Fees | |||||||

| 2013 |

$ | 45,000 | $ | 58,200 | ||||

| 2012 |

$ | 38,000 | $ | 9,700 | ||||

Elements of Executive Compensation

The total cash compensation paid to each of the Chief Executive Officer and the other Named Executive Officers of the Company in 2013 consisted primarily of base salary and an incentive bonus tied to individual achievement of personal objectives and the Company’s financial performance. All Named Executive Officers also received Long Term Incentive awards that consist of performance share units, restricted share units, and stock options in accordance with the Company’s Long Term Incentive Plan (see “Long Term Incentive Plan” below). The Company believes that the mix of base salary, performance-based bonus and participation in in a long term incentive plan creates a balanced approach to executive compensation consistent with the compensation principles of the Company stated above.

18

Compensation Philosophy

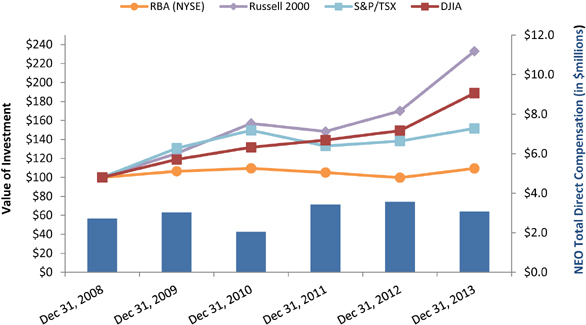

A key principle of the Company’s compensation philosophy is to provide for a significant portion of the senior executives’ compensation to be at risk based on corporate performance. The chart below shows the amount of pay at risk as a percentage of target total direct compensation for the Named Executive Officers for 2013. Total direct compensation includes base salary, short-term incentive (bonus), and long-term incentives (performance share units, restricted share units and stock options).

| Pay at Risk | ||||||||||||||||||||

| Short-term Incentive |

Long-term Incentive |

Target Total Pay at Risk |

||||||||||||||||||

| Name |

Salary | Bonus(1) (at target) |

Share units(2) (at target) |

Stock options(3) (at target) |

||||||||||||||||

| Peter J. Blake Chief Executive Officer |

35 | % | 30 | % | 23 | % | 12 | % | 65 | % | ||||||||||

| Robert A. McLeod Chief Financial Officer |

40 | % | 20 | % | 27 | % | 13 | % | 60 | % | ||||||||||

| Robert S. Armstrong Chief Strategic Development Officer |

38 | % | 23 | % | 26 | % | 13 | % | 62 | % | ||||||||||

| Steven C. Simpson Chief Sales Officer |

36 | % | 28 | % | 24 | % | 12 | % | 64 | % | ||||||||||

| Robert K. Mackay President |

36 | % | 28 | % | 24 | % | 12 | % | 64 | % | ||||||||||

| (1) | Short-term incentive bonus awards are formula driven based on the achievement of personal objectives and Company earnings performance compared to a Board approved target (see below) and are payable in cash. The percentage indicated reflects the target incentive bonus amount. |

| (2) | Performance share unit and restricted share units are awarded under the Company’s performance share unit and restricted share units plans adopted in January 2013, which collectively constitute the Company’s new Executive Long Term Incentive Plan. PSU awards are formula driven based on Company earnings performance compared to Board approved targets The percentage indicated is based on the grant date fair value of the restricted share units and target number of performance share units awarded in 2013. |

| (3) | The percentage indicated reflects the grant date fair value of stock options, which is based on a percentage of base salary (see below). |

Base Salaries

The Compensation Committee reviews the base salaries of the Chief Executive Officer and other Named Executive Officers, and from time to time makes, or in the case of case of the Chief Executive Officer, recommends to the Board, changes that the Compensation Committee considers appropriate. The Board approves the Chief Executive Officer’s annual base salary based on the Compensation Committee’s recommendations. The Compensation Committee, with input from the Chief Executive Officer as described below, approves the annual base salary of the Named Executive Officers other than the Chief Executive Officer.

19

In determining the base salary (and other compensation) received by the Chief Executive Officer, the Compensation Committee takes into consideration the individual performance of the Chief Executive Officer, considers the salary levels of comparable executives with similar responsibilities and experience at comparable companies, the Company’s performance for the prior year and completes a detailed assessment of these factors for presentation to the Board. These considerations include the Company’s pre-tax earnings performance for the year measured against the earnings target for the year, the return on invested capital performance for the year, and the Chief Executive Officer’s achievement of strategic objectives as outlined in the Company’s strategic plan, as well as the achievement of various individual performance objectives. The Chair of the Compensation Committee also interviews all officers of the Company who directly report to the Chief Executive Officer to provide a full 360-degree view of his performance.

Base salary levels for the Named Executive Officers other than the Chief Executive Officer are determined primarily on the basis of (i) the Compensation Committee’s review of the Chief Executive Officer’s assessment of each Named Executive Officer’s individual performance; (ii) the scope of each executive’s job responsibilities; and (iii) the Compensation Committee’s understanding of normal and appropriate salary levels for executives with responsibilities and experience comparable to those of such Named Executive Officers. In making such determination, external sources are consulted when deemed necessary by the Compensation Committee.

As described above under “Particulars of Matters to be Acted Upon at the Meeting – Proposal 1: Election of Directors”, Peter Blake, the Current Chief Executive Officer of the Company, intends to resign as Chief Executive Officer. During the transition period while the Company is seeking to identify and hire a new Chief Executive Officer, Mr. Blake will continue as Chief Executive Officer. Mr. Blake intends to resign as Chief Executive Officer either at the time of the Meeting, or, if the Company has not at such time identified and hired a new Chief Executive Officer, sometime in 2014 following a further interim period while the Company continues its search process. During the transition period in 2014 the Company will pay Mr. Blake his base salary, but Mr. Blake will not be entitled to an incentive bonus or grants of stock options, restricted share units or performance share units in respect of 2014. Following his resignation, Mr. Blake will cease to be an employee of the Company and will be entitled to receive payments in relation thereto as described under “Termination and Change of Control Benefits”.

Short-term Incentive Bonus

Under the Company’s short-term incentive plan, the Company has adopted a scorecard system for its executives, with each individual participant’s short term incentive being determined by their personal performance relative to goals established at the beginning of the year (the personal performance factor) and the Company’s earnings performance relative to a target set by the Board at the beginning of the year (the corporate performance factor). The Company’s short-term incentive plan is a multiplicative plan, whereby each participant’s personal performance factor is multiplied by the Company’s corporate performance factor. The product of these two factors is multiplied by each individual’s target bonus amount, being 85% of base salary for the Chief Executive Officer, 75% of base salary for the Chief Sales Officer and the President, 60% of base salary for the Chief Strategic Development Officer, and 50% of base salary for the Chief Financial Officer, to arrive at the annual bonus amount.

The corporate performance factor is linked directly to a formula that provides for specified increases in the factor as pre-tax earnings (adjusted to exclude amounts not considered part of the Company’s normal operations) approach the target level established by the Compensation Committee and approved by the Board at the beginning of the year, and for accelerated increases in the bonus pool if adjusted pre-tax earnings exceed the target level. Pretax earnings was chosen as the metric for executive incentive bonus because pre-tax earnings directly drive shareholder value through earnings per share and are an element over which executives of the Company can have the most direct influence by their performance. If the Company’s adjusted pre-tax earnings are at the target level, the corporate performance factor would be 1.0. If adjusted pre-tax earnings are greater or less than the earnings target, the corporate performance factor is a percentage of 1.0, based on actual earnings achieved. Individual bonuses are not subject to any minimum amount but are subject to a maximum of 175% to 225% of base salary for the Named Executive Officers.

20

The adjusted pre-tax earnings target for purposes of determining the corporate performance factor for 2013 was $174.4 million. At that level, the corporate performance factor would have been 1.0. The Company achieved adjusted pre-tax earnings of $134.8 million for 2013, or 85% of the earnings target after defined earnings adjustments, resulting in a corporate performance factor of approximately 0.44 for the Named Executive Officers.

Following the end of each year the Compensation Committee assesses the personal performance of the Chief Executive Officer relative to the goals established at the beginning of the year, and assigns a personal performance factor which is subsequently reviewed and approved by the Board. For other Named Executive Officers, the Chief Executive Officer assesses their personal performance relative to the goals established at the beginning of the year and assigns personal performance factors which are reviewed and approved by the Compensation Committee. The personal performance factors assigned are 1.0 if goals are met or a percentage which is greater or less than 1.0 based on the extent that goals are exceeded or not met, respectively.

Long Term Incentive Plan – Prior to 2013

In respect of years to and including 2012, the Chief Executive Officer and other Named Executive Officers participated in the Company’s executive long term incentive plan (the “Original ELTIP”), the fundamental purpose of which was to facilitate senior management’s direct investment in and ownership of Common Shares. Under the Original ELTIP, the Named Executive Officers other than the Chief Financial Officer were entitled to a maximum cash ELTIP award of $125,000, which was paid by the Company when the executives contributed an equivalent amount to the ELTIP, and was invested by the plan administrator in Common Shares purchased on the New York Stock Exchange. In respect of years to and including 2012, the Chief Financial Officer was entitled to a maximum cash ELTIP award of $100,000. Awards could be carried forward for one year in the event a participant chose not to contribute to the ELTIP in a particular year. Please refer to the “Original Executive Long Term Incentive Plan” on page 36 for further information regarding the Original ELTIP.

Long Term Incentive Plan

As noted above, during 2012 the Compensation Committee and the Board undertook a review and redesign of the Company’s long term incentive plans, in part based on the 2011 findings by Towers that certain aspects of the Company’s long term incentive plan were not in line with long term incentive plans at comparable companies. As part of such review and redesign, the Compensation Committee and Board approved:

| • | Adoption of new restricted share unit plans pursuant to which restricted share units can be granted to participating employees, in respect of financial years commencing after December 31, 2012. |

| • | Adoption of a new performance share unit plan pursuant to which performance share units can be granted to participating employees, in respect of financial years commencing after December 31, 2012. |

| • | Amendment of the Original ELTIP pursuant to which after December 31, 2013, Original ELTIP participants are no longer entitled to receive any entitlement or award under that plan in respect of any year after December 31, 2012 and will not be permitted to make contributions under the Original ELTIP in any year commencing after December 31, 2013, provided that participants that do not contribute the full amount of their ELTIP entitlement under that plan in 2013 (in respect of 2012) are entitled to contribute in 2014 up to the amount of the participant’s one year carry forward entitlement from 2013. |

| • | Amendment of the share ownership guidelines for senior officers and senior employees previously adopted in connection with the Original ELTIP to include and be applicable to Common Shares owned outside of the Original ELTIP. See “Share Ownership Guidelines” on page 26 for a further discussion regarding these guidelines. |

| • | Integration of the Company’s stock option plan as part of the revised overall Long Term Incentive Plan |

21

Grants of restricted share units, performance share units and stock options under the new plan are based on set percentages of participants’ base salaries, rather than fixed dollar amounts as applied under the Original ELTIP. The set percentages range from 80% to 140% for senior executives.

The following table outlines the mix of long term incentive compensation applicable to various levels of employees.

| Level of Role |

Stock Options | Restricted Share Units | Performance Share Units | |||||||||

| Senior Managers |

N/A | 100 | % | N/A | ||||||||

| Executives |

50 | % | 50 | % | N/A | |||||||

| Senior Executives |

33.3 | % | 33.3 | % | 33.3 | % | ||||||

Following is a brief summary of the new long term incentive plans.

Restricted Share Unit Plans

In January 2013 the Board approved and adopted restricted share unit plans (the “RSU Plans”) pursuant to which restricted share units (“RSUs”) are granted to participating employees, commencing in 2013. Restricted share units entitle the participant, following vesting of the units, to a lump sum cash payment, net of applicable withholdings, equal to the number of restricted share units multiplied by the fair market value of one Common Share, based on the volume weighted average price of the Common Shares reported by the New York Stock Exchange for the twenty days prior to the date of vesting. Unless the Board or Compensation Committee otherwise determines, restricted share units will vest following a three year vesting period. For example, RSUs granted on March 5, 2013 would vest on March 4, 2016. Additional restricted share units are credited on RSUs held by participants corresponding to dividends declared on the Common Shares. Such additional RSUs will vest when the RSUs in respect of which the additional dividend RSUs were credited vest. RSUs do not entitle participants to any voting or other shareholder rights.

Performance Share Unit Plan