UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the quarter ended June 30, 2013

Commission File Number: 001-13425

Ritchie Bros. Auctioneers Incorporated

9500 Glenlyon Parkway

Burnaby, BC, Canada

V5J 0C6

(778) 331 5500

(Address of principal executive offices)

indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F

Form 20-F ¨ Form 40-F x

indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

indicate by check mark whether by furnishing information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934

Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

| PART 1. | FINANCIAL INFORMATION |

| ITEM 1. | FINANCIAL STATEMENTS |

The accompanying unaudited condensed consolidated interim financial statements do not include all information and footnotes required for a complete set of annual financial statements, as prescribed by International Financial Reporting Standards as issued by the IASB (IFRS). However, in the opinion of management, all adjustments (which consist only of normal recurring adjustments) necessary for a fair presentation of the results of operations for the relevant periods have been made. Results for the interim periods are not necessarily indicative of the results to be expected for the year or any other period. These financial statements should be read in conjunction with the summary of accounting policies and the notes to the consolidated financial statements included in the Company's Annual Report on Form 40-F for the fiscal year ended December 31, 2012, a copy of which has been filed with the U.S. Securities and Exchange Commission. These policies have been applied on a consistent basis.

RITCHIE BROS. AUCTIONEERS INCORPORATED

Condensed Consolidated Interim Income Statements

(Expressed in thousands of United States dollars, except share and per share amounts)

(Unaudited)

| Three months ended June 30, |

Six months ended June 30, |

|||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| Auction revenues (note 4) |

$ | 128,322 | $ | 127,213 | $ | 230,380 | $ | 228,489 | ||||||||

| Direct expenses (note 5) |

15,551 | 15,490 | 24,912 | 25,624 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 112,771 | 111,723 | 205,468 | 202,865 | |||||||||||||

| Selling, general and administrative expenses (note 5) |

71,136 | 67,606 | 142,225 | 130,875 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Earnings from operations |

41,635 | 44,117 | 63,243 | 71,990 | ||||||||||||

| Other income (expense): |

||||||||||||||||

| Foreign exchange gain (loss) |

(48 | ) | (172 | ) | 47 | (174 | ) | |||||||||

| Gain (loss) on disposition of property, plant and equipment |

130 | (1,775 | ) | 119 | (1,725 | ) | ||||||||||

| Other |

843 | 528 | 829 | 1,246 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 925 | (1,419 | ) | 995 | (653 | ) | |||||||||||

| Finance income (costs): |

||||||||||||||||

| Finance income |

785 | 684 | 1,332 | 1,243 | ||||||||||||

| Finance costs |

(2,097 | ) | (1,722 | ) | (3,861 | ) | (3,098 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1,312 | ) | (1,038 | ) | (2,529 | ) | (1,855 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Earnings before income taxes |

41,248 | 41,660 | 61,709 | 69,482 | ||||||||||||

| Income tax expense (recovery) (note 6): |

||||||||||||||||

| Current |

9,428 | 11,095 | 14,487 | 19,913 | ||||||||||||

| Deferred |

1,792 | (738 | ) | 3,148 | 297 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 11,220 | 10,357 | 17,635 | 20,210 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net earnings |

$ | 30,028 | $ | 31,303 | $ | 44,074 | $ | 49,272 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net earnings per share (note 7): |

||||||||||||||||

| Basic |

$ | 0.28 | $ | 0.29 | $ | 0.41 | $ | 0.46 | ||||||||

| Diluted |

$ | 0.28 | $ | 0.29 | $ | 0.41 | $ | 0.46 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average number of shares outstanding: |

||||||||||||||||

| Basic |

106,713,312 | 106,422,964 | 106,677,387 | 106,411,229 | ||||||||||||

| Diluted |

107,002,439 | 106,852,613 | 107,008,851 | 106,926,045 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

See accompanying notes to condensed consolidated interim financial statements.

These condensed consolidated interim financial statements were authorized for issue by the Board of Directors on August 1, 2013.

| /s/ Robert G Elton |

/s/ Peter J Blake | |||

| Robert G. Elton | Peter J. Blake | |||

| Director | Chief Executive Officer |

3

RITCHIE BROS. AUCTIONEERS INCORPORATED

Condensed Consolidated Interim Statements of Comprehensive Income

(Expressed in thousands of United States dollars)

(Unaudited)

| Three months ended June 30, |

Six months ended June 30, |

|||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| Net earnings |

$ | 30,028 | $ | 31,303 | $ | 44,074 | $ | 49,272 | ||||||||

| Other comprehensive loss: |

||||||||||||||||

| Item that may be reclassified subsequently to net earnings: |

||||||||||||||||

| Foreign currency translation adjustment |

(10,216 | ) | (8,789 | ) | (17,873 | ) | (4,027 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total comprehensive income |

$ | 19,812 | $ | 22,514 | $ | 26,201 | $ | 45,245 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

See accompanying notes to condensed consolidated interim financial statements.

4

RITCHIE BROS. AUCTIONEERS INCORPORATED

Condensed Consolidated Interim Balance Sheets

(Expressed in thousands of United States dollars)

(Unaudited)

| June 30, 2013 |

December 31, 2012 |

|||||||

| Assets |

||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 272,745 | $ | 178,051 | ||||

| Trade and other receivables |

179,801 | 76,066 | ||||||

| Inventory (note 8) |

49,550 | 60,947 | ||||||

| Advances against auction contracts |

10,557 | 6,816 | ||||||

| Prepaid expenses and deposits |

9,389 | 14,881 | ||||||

| Assets held for sale |

— | 958 | ||||||

| Current portion of loan receivable |

4,869 | 118 | ||||||

| Income taxes receivable |

8,673 | 7,764 | ||||||

|

|

|

|

|

|||||

| 535,584 | 345,601 | |||||||

| Property, plant and equipment (note 10) |

633,969 | 655,677 | ||||||

| Investment property (note 9) |

6,608 | 6,902 | ||||||

| Loan receivable |

— | 4,797 | ||||||

| Other non-current assets |

8,441 | 8,410 | ||||||

| Intangible assets (note 11) |

32,164 | 25,570 | ||||||

| Goodwill (note 12) |

83,518 | 84,247 | ||||||

| Deferred tax assets |

1,248 | 1,294 | ||||||

|

|

|

|

|

|||||

| $ | 1,301,532 | $ | 1,132,498 | |||||

|

|

|

|

|

|||||

| Liabilities and Shareholders’ Equity |

||||||||

| Current liabilities: |

||||||||

| Auction proceeds payable |

$ | 266,517 | $ | 87,139 | ||||

| Trade and other payables |

104,596 | 117,766 | ||||||

| Income taxes payable |

643 | 5,163 | ||||||

| Current borrowings (note 13) |

90,028 | 39,480 | ||||||

|

|

|

|

|

|||||

| 461,784 | 249,548 | |||||||

| Non-current borrowings (note 13) |

148,355 | 200,746 | ||||||

| Other non-current liabilities |

6,109 | 5,193 | ||||||

| Deferred tax liabilities |

23,722 | 20,480 | ||||||

|

|

|

|

|

|||||

| 639,970 | 475,967 | |||||||

|

|

|

|

|

|||||

| Shareholders’ equity: |

||||||||

| Share capital (note 14) |

122,165 | 118,694 | ||||||

| Additional paid-in capital |

28,572 | 27,080 | ||||||

| Retained earnings |

528,163 | 510,222 | ||||||

| Foreign currency translation reserve |

(17,338 | ) | 535 | |||||

|

|

|

|

|

|||||

| 661,562 | 656,531 | |||||||

|

|

|

|

|

|||||

| $ | 1,301,532 | $ | 1,132,498 | |||||

|

|

|

|

|

|||||

Contingencies (note 16)

See accompanying notes to condensed consolidated interim financial statements.

5

RITCHIE BROS. AUCTIONEERS INCORPORATED

Condensed Consolidated Interim Statements of Changes in Equity

(Expressed in thousands of United States dollars, except share amounts)

(Unaudited)

| Foreign | Total | |||||||||||||||||||||||

| Share Capital | Additional | Currency | Share- | |||||||||||||||||||||

| Number of Shares |

Amount | Paid-In Capital |

Retained Earnings |

Translation Reserve |

holders’ Equity |

|||||||||||||||||||

| Balance, December 31, 2011 |

106,386,339 | $ | 115,961 | $ | 22,777 | $ | 480,718 | $ | (1,550 | ) | $ | 617,906 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Comprehensive income |

||||||||||||||||||||||||

| Net earnings |

— | — | — | 49,272 | — | 49,272 | ||||||||||||||||||

| Foreign currency translation adjustment |

— | — | — | — | (4,027 | ) | (4,027 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| — | — | — | 49,272 | (4,027 | ) | 45,245 | ||||||||||||||||||

| Exercise of stock options |

36,588 | 638 | (121 | ) | — | — | 517 | |||||||||||||||||

| Share-based compensation tax adjustment |

— | — | 78 | — | — | 78 | ||||||||||||||||||

| Share-based compensation expense (note 15) |

— | — | 2,023 | — | — | 2,023 | ||||||||||||||||||

| Cash dividends paid |

— | — | — | (23,942 | ) | — | (23,942 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Balance, June 30, 2012 |

106,422,927 | $ | 116,599 | $ | 24,757 | $ | 506,048 | $ | (5,577 | ) | $ | 641,827 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Comprehensive income (loss) |

||||||||||||||||||||||||

| Net earnings |

— | — | — | 30,274 | — | 30,274 | ||||||||||||||||||

| Foreign currency translation adjustment |

— | — | — | — | 6,112 | 6,112 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| — | — | — | 30,274 | 6,112 | 36,386 | |||||||||||||||||||

| Exercise of stock options |

173,884 | 2,095 | (392 | ) | — | 1,703 | ||||||||||||||||||

| Share-based compensation tax adjustment |

— | — | 435 | — | — | 435 | ||||||||||||||||||

| Share-based compensation expense (note 15) |

— | — | 2,280 | — | — | 2,280 | ||||||||||||||||||

| Cash dividends paid |

— | — | — | (26,100 | ) | — | (26,100 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Balance, December 31, 2012 |

106,596,811 | $ | 118,694 | $ | 27,080 | $ | 510,222 | $ | 535 | $ | 656,531 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Comprehensive income (loss) |

||||||||||||||||||||||||

| Net earnings |

— | — | — | 44,074 | — | 44,074 | ||||||||||||||||||

| Foreign currency translation adjustment |

— | — | — | — | (17,873 | ) | (17,873 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| — | — | — | 44,074 | (17,873 | ) | 26,201 | ||||||||||||||||||

| Exercise of stock options |

190,722 | 3,471 | (675 | ) | — | — | 2,796 | |||||||||||||||||

| Share-based compensation tax adjustment |

— | — | (205 | ) | — | — | (205 | ) | ||||||||||||||||

| Share-based compensation expense (note 15) |

— | — | 2,372 | — | — | 2,372 | ||||||||||||||||||

| Cash dividends paid |

— | — | — | (26,133 | ) | — | (26,133 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Balance, June 30, 2013 |

106,787,533 | $ | 122,165 | $ | 28,572 | $ | 528,163 | $ | (17,338 | ) | $ | 661,562 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

See accompanying notes to condensed consolidated interim financial statements.

6

RITCHIE BROS. AUCTIONEERS INCORPORATED

Condensed Consolidated Interim Statements of Cash Flows

(Expressed in thousands of United States dollars)

(Unaudited)

| Three months ended June 30, |

Six months ended June 30, |

|||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| Cash generated by (used in): |

||||||||||||||||

| Operating activities: |

||||||||||||||||

| Net earnings |

$ | 30,028 | $ | 31,303 | $ | 44,074 | $ | 49,272 | ||||||||

| Items before changes in non-cash working capital: |

||||||||||||||||

| Depreciation |

9,819 | 9,821 | 19,258 | 19,486 | ||||||||||||

| Amortization |

900 | 252 | 1,781 | 252 | ||||||||||||

| Share-based compensation expense |

1,263 | 1,066 | 2,372 | 2,023 | ||||||||||||

| Deferred income tax expense |

1,792 | (738 | ) | 3,148 | 297 | |||||||||||

| Foreign exchange loss |

48 | 172 | (47 | ) | 174 | |||||||||||

| Loss (gain) on disposition of property, plant and equipment |

(130 | ) | 1,775 | (119 | ) | 1,725 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 13,692 | 12,348 | 26,393 | 23,957 | |||||||||||||

| Changes in non-cash working capital: |

||||||||||||||||

| Trade and other receivables |

(34,560 | ) | (57,501 | ) | (109,350 | ) | (148,290 | ) | ||||||||

| Inventory |

(15,914 | ) | 29,001 | 10,466 | (3,380 | ) | ||||||||||

| Advances against auction contracts |

(6,392 | ) | (784 | ) | (3,765 | ) | 3,391 | |||||||||

| Prepaid expenses and deposits |

(151 | ) | 1,815 | 5,312 | 1,690 | |||||||||||

| Income taxes receivable |

662 | 4,501 | (909 | ) | 10,751 | |||||||||||

| Income taxes payable |

7,882 | 5,626 | 14,841 | 8,050 | ||||||||||||

| Auction proceeds payable |

(8,347 | ) | 12,911 | 186,365 | 175,819 | |||||||||||

| Trade and other payables |

12,294 | 12,284 | (6,857 | ) | 2,056 | |||||||||||

| Other |

1,690 | 1,559 | 3,188 | 1,221 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (42,836 | ) | 9,412 | 99,291 | 51,308 | ||||||||||||

| Interest paid |

(2,112 | ) | (1,883 | ) | (3,974 | ) | (3,863 | ) | ||||||||

| Income taxes paid |

(8,253 | ) | (8,012 | ) | (19,403 | ) | (13,019 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net cash generated by operating activities |

(9,481 | ) | 43,168 | 146,381 | 107,655 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Investing activities: |

||||||||||||||||

| Acquisition of subsidiaries |

— | (55,617 | ) | — | (55,617 | ) | ||||||||||

| Property, plant and equipment additions |

(9,504 | ) | (10,391 | ) | (17,910 | ) | (34,527 | ) | ||||||||

| Intangible asset additions |

(3,831 | ) | — | (8,375 | ) | — | ||||||||||

| Proceeds on disposition of property, plant and equipment |

824 | 3,805 | 2,065 | 4,217 | ||||||||||||

| Other |

(73 | ) | 27 | (115 | ) | 112 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net cash used in investing activities |

(12,584 | ) | (62,176 | ) | (24,335 | ) | (85,815 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Financing activities: |

||||||||||||||||

| Issuance of share capital |

1,747 | 15 | 2,796 | 517 | ||||||||||||

| Dividends on common shares |

(13,068 | ) | (11,973 | ) | (26,133 | ) | (23,942 | ) | ||||||||

| Proceeds from short-term borrowings |

15,202 | 16,819 | 15,203 | 56,847 | ||||||||||||

| Repayment of short-term borrowings |

— | (22,000 | ) | (9,000 | ) | (22,338 | ) | |||||||||

| Proceeds from long-term borrowings |

— | 62,919 | — | 62,919 | ||||||||||||

| Other |

(252 | ) | — | (205 | ) | (14 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net cash generated by (used in) financing activities |

3,629 | 45,780 | (17,339 | ) | 73,989 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Effect of changes in foreign currency rates on cash and cash equivalents |

(7,686 | ) | (3,164 | ) | (10,013 | ) | (2,016 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Increase in cash and cash equivalents |

(26,122 | ) | 23,608 | 94,694 | 93,813 | |||||||||||

| Cash and cash equivalents, beginning of period |

298,867 | 179,528 | 178,051 | 109,323 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Cash and cash equivalents, end of period |

$ | 272,745 | $ | 203,136 | $ | 272,745 | $ | 203,136 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

See accompanying notes to condensed consolidated interim financial statements.

7

RITCHIE BROS. AUCTIONEERS INCORPORATED

Notes to the Condensed Consolidated Interim Financial Statements

(Tabular dollar amounts expressed in thousands of United States dollars, except share and per share amounts)

(Unaudited)

Six months ended June 30, 2013 and 2012

| 1. | Significant accounting policies: |

| (a) | Basis of preparation: |

These condensed consolidated interim financial statements present the condensed consolidated income statements, statements of comprehensive income, balance sheets, statements of changes in equity and statements of cash flows of the Company. The condensed consolidated interim financial statements have been prepared on the historical cost basis, except for cash flows and the financial instruments valued at fair value through profit and loss that are measured at fair value.

The preparation of these condensed consolidated interim financial statements is based on accounting policies consistent with those used in the preparation of the Company’s audited annual consolidated financial statements for the year ended December 31, 2012, except for the adoption of new and amended accounting standards as disclosed in 1(f) below. A selection of the significant accounting policies that are important for interim financial reporting, or for which there has been a change since the annual consolidated financial statements, is set out below. These condensed consolidated interim financial statements should be read in conjunction with the Company’s audited annual financial statements for the year ended December 31, 2012; a full list of the Company's significant accounting policies is included in those financial statements.

| (b) | Statement of compliance: |

The condensed consolidated interim financial statements of the Company have been prepared under International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) incorporating Interpretations issued by the IFRS Interpretations Committee (“IFRICs”), and complying with the Canada Business Corporations Act 1997.

These condensed consolidated interim financial statements have been prepared in accordance with IAS 34 Interim Financial Reporting. The condensed consolidated interim financial statements do not include all of the information required for full annual consolidated financial statements.

| (c) | Basis of consolidation: |

(i) Subsidiaries:

The condensed consolidated interim financial statements incorporate the assets and liabilities of all subsidiaries of Ritchie Bros. Auctioneers Incorporated for all periods presented and the results of all subsidiaries for the periods then ended. Subsidiaries are all those entities that the Company controls, defined as having power over an investee and having exposure or rights to variable returns from involvement in that investee.

Subsidiaries are fully consolidated from the date on which control is transferred to the Company. They are de-consolidated from the date that control ceases. Inter-entity transactions, balances and unrealized gains on transactions between entities within the consolidated company are eliminated. Unrealized losses are also eliminated unless the transaction provides evidence of impairment of the asset transferred. The Company’s accounting policies are applied consistently throughout the organization.

(ii) Ultimate parent entity

Ritchie Bros. Auctioneers Incorporated is the ultimate parent entity of the consolidated Company.

8

RITCHIE BROS. AUCTIONEERS INCORPORATED

Notes to the Condensed Consolidated Interim Financial Statements

(Tabular dollar amounts expressed in thousands of United States dollars, except share and per share amounts)

(Unaudited)

Six months ended June 30, 2013 and 2012

| 1. | Significant accounting policies (continued): |

| d) | Revenue recognition: |

Auction revenues are comprised mostly of auction commissions, which are earned by the Company acting as an agent for consignors of equipment and other assets, but also include net profits on the sale of inventory, as well as auction fees. Auction fees are made up of administrative and documentation fees on the sale of certain lots and auction advertising fees.

Auction commissions represent the percentage earned by the Company on the gross proceeds from equipment and other assets sold at auction. The majority of auction commissions are earned as a pre-negotiated fixed rate of the gross selling price. Other commissions are earned from at risk contracts, when the Company guarantees a certain level of proceeds to a consignor or purchases inventory from customers to be sold at auction.

Guarantee contracts typically include a pre-negotiated percentage of the guaranteed gross proceeds plus a percentage of proceeds in excess of the guaranteed amount. If actual auction proceeds are less than the guaranteed amount, commission is reduced; if proceeds are sufficiently lower, the Company can incur a loss on the sale. Losses, if any, resulting from guarantee contracts are recorded in the period in which the relevant auction is completed. If a loss relating to a guarantee contract held at the period end to be sold after the period end is known at the financial statement reporting date, the loss is accrued in the financial statements for that period. The Company’s exposure from these guarantee contracts fluctuates over time (note 16).

For inventory contracts, the Company acquires title to items for a short time prior to a particular auction sale. Revenue from inventory sales is presented net within auction revenues on the income statement, as the Company takes title only for a short period of time and the risks and rewards of ownership are not substantially different than the Company’s other at risk revenue contracts.

Revenue is measured at the fair value of the consideration received or receivable. Revenue is shown net of value-added tax and duties.

The Company recognizes revenue when the auction sale is complete and the Company has determined that the auction proceeds are collectible.

| (e) | Share-based payments: |

(i) Equity-settled share-based payments:

The Company has a stock-based compensation plan that provides for the award of stock options to selected employees, directors and officers of the Company. The cost of options granted is measured at the fair value of the underlying option at the grant date using the Black-Scholes option pricing model, further details of which are given in note 16. This fair value is expensed over the period until the vesting date with recognition of a corresponding increase to equity. At the end of each reporting period, the Company revises its estimate of the number of equity instruments expected to vest. The impact of the revision of the original estimates, if any, is recognized in earnings, such that the consolidated expense reflects the revised estimate, with a corresponding adjustment to equity.

9

RITCHIE BROS. AUCTIONEERS INCORPORATED

Notes to the Condensed Consolidated Interim Financial Statements

(Tabular dollar amounts expressed in thousands of United States dollars, except share and per share amounts)

(Unaudited)

Six months ended June 30, 2013 and 2012

| 1. | Significant accounting policies (continued): |

| (e) | Share-based payments (continued): |

(ii) Cash-settled share-based payment:

The Company has share unit compensation plans, which are described in the share-based payment note 15. The cost of cash-settled transactions is measured initially at fair value at the grant date using the volume weighted average price (“VWAP”) of the Company’s common shares for the twenty days prior to grant date. This fair value is expensed over the period until the vesting date with recognition of a corresponding liability. The liability is re-measured at fair value at each reporting date up to and including the settlement date, with changes in fair value recognized through compensation expense.

| (f) | New and amended accounting standards: |

Effective January 1, 2013, the Company adopted the following new and revised applicable standards, along with consequential amendments:

IFRS 10 Consolidated financial statements and IAS 27 Separate financial statements

IFRS 11 Joint arrangements and IAS 28 Investments in associates and joint ventures

IFRS 12 Disclosure of interest in other entities

IFRS 13 Fair value measurement

IFRS 7 Financial instruments: disclosures – offsetting financial assets and financial liabilities (Amendment)

IAS 1 Presentation of items of other comprehensive income (Amendment)

IAS 32 Tax effects of distributions to holders of equity instruments (Amendment)

These changes were made in accordance with the applicable transitional provisions. The nature and effect of adopting these standards is disclosed in the Company’s Q1 2013 consolidated interim financial statements and have been applied consistently in preparation of these consolidated interim financial statements. Accordingly, please refer to the Company’s Q1 2013 consolidated interim financial statements for a full description of the Company’s adoption of these new and revised standards. There was no significant impact to the comparative period presented herein.

10

RITCHIE BROS. AUCTIONEERS INCORPORATED

Notes to the Condensed Consolidated Interim Financial Statements

(Tabular dollar amounts expressed in thousands of United States dollars, except share and per share amounts)

(Unaudited)

Six months ended June 30, 2013 and 2012

| 1. | Significant accounting policies (continued): |

| (f) | New and amended accounting standards (continued): |

Standards issued and not yet effective

At the date of authorization of these financial statements, the following applicable standards and interpretations were issued but not yet effective:

| • | In 2011, the IASB issued Amendments to IFRS 9 Mandatory Effective Date of IFRS 9 and Transition Disclosures to move the effective date of this standard from years beginning on or after January 1, 2013, to a mandatory effective date of January 1, 2015. IFRS 9, as issued, reflects the first phase of the IASB’s work on the replacement of IAS 39 and applies to classification and measurement of financial assets and financial liabilities as defined in IAS 39. The Company is currently evaluating the impact of these amendments on its consolidated financial statements. |

| • | In 2011, the IASB issued amendments to IAS 32 Financial Instruments: Presentation. Currently, IAS 32 requires that a financial asset and a financial liability shall be offset when an entity currently has a legally enforceable right to set off the recognized amounts. The amendments clarify that rights of set-off must not only be legally enforceable in the normal course of business, but must also be enforceable in the event of default of all of the counterparties to the contract, including the reporting entity. The standard is effective for years beginning on or after January 1, 2014, and is to be applied retrospectively. The Company is currently evaluating the impact of these amendments on its consolidated financial statements. |

| • | The IASB has a number of other projects outstanding that will result in exposure drafts and eventually new standards issued. However, the timing and outcome of these projects are too uncertain to list here. |

11

RITCHIE BROS. AUCTIONEERS INCORPORATED

Notes to the Condensed Consolidated Interim Financial Statements

(Tabular dollar amounts expressed in thousands of United States dollars, except share and per share amounts)

(Unaudited)

Six months ended June 30, 2013 and 2012

| 2. | Critical accounting estimates and judgments: |

The preparation of financial statements in conformity with IFRS requires the use of certain critical accounting estimates. It also requires management to exercise its judgment in the process of applying the Company’s accounting policies and assumptions. Estimates and judgments are continually evaluated and are based on historical experience and other factors including expectations of future events that are believed to be reasonable under the circumstances.

Key sources of estimation uncertainty are the areas where assumptions and estimates have a significant risk of causing a material adjustment to the carrying amount of assets and liabilities. These include depreciation and amortization methods; valuation of cash-generating units (CGUs); valuation of at risk business contracts including inventory held at the period end and commitments under guarantee; valuation and recognition of income taxes; and the calculation of share-based payments. The methods of calculating these estimates are discussed elsewhere in these condensed consolidated interim financial statements and in the Company’s audited annual consolidated financial statements for the year ended December 31, 2012. Actual results may differ from these estimates.

Critical judgments that have a higher degree of judgment and the most significant effect on the Company’s financial reporting, apart from those involving estimates (discussed above), include: determination of operating segments and identification of cash-generating units.

| 3. | Seasonality of operations: |

The Company's operations are both seasonal and event driven. Auction revenues tend to be highest during the second and fourth calendar quarters. The Company generally conducts more auctions during these quarters than during the first and third calendar quarters. Late December through mid-February and July through August are traditionally less active periods.

| 4. | Auction revenues: |

| Three months ended June 30, | Six months ended June 30, | |||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| Auction commissions |

$ | 102,138 | $ | 101,927 | $ | 184,181 | $ | 185,170 | ||||||||

| Auction fees |

26,184 | 25,286 | 46,199 | 43,319 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 128,322 | $ | 127,213 | $ | 230,380 | $ | 228,489 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Net profits on inventory sales included in auction commissions are:

| Three months ended June 30, | Six months ended June 30, | |||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| Revenue from inventory sales |

$ | 138,404 | $ | 276,074 | $ | 254,343 | $ | 465,470 | ||||||||

| Cost of inventory sold |

(127,749 | ) | (265,304 | ) | (231,436 | ) | (438,023 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 10,655 | $ | 10,770 | $ | 22,907 | $ | 27,447 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

12

RITCHIE BROS. AUCTIONEERS INCORPORATED

Notes to the Condensed Consolidated Interim Financial Statements

(Tabular dollar amounts expressed in thousands of United States dollars, except share and per share amounts)

(Unaudited)

Six months ended June 30, 2013 and 2012

| 5. | Expenses by nature: |

The Company classifies expenses according to function in the condensed consolidated interim income statements. The following items are listed by function into additional components by nature:

Direct expenses:

| Three months ended June 30, |

Six months ended June 30, |

|||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| Employee compensation expense |

$ | 5,473 | $ | 5,331 | $ | 9,575 | $ | 9,235 | ||||||||

| Travel, advertising and promotion |

6,505 | 6,293 | 10,183 | 9,729 | ||||||||||||

| Other direct expenses |

3,573 | 3,866 | 5,154 | 6,660 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 15,551 | $ | 15,490 | $ | 24,912 | $ | 25,624 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Selling, general and administrative expenses:

| Three months ended June 30, |

Six months ended June 30, |

|||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| Employee compensation expense |

$ | 39,551 | $ | 36,518 | $ | 77,916 | $ | 71,356 | ||||||||

| Buildings and facilities |

10,420 | 9,496 | 20,662 | 19,064 | ||||||||||||

| Travel, advertising and promotion |

4,127 | 4,067 | 10,339 | 8,553 | ||||||||||||

| Other general and administrative expenses |

6,319 | 7,452 | 12,269 | 12,164 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 60,417 | $ | 57,533 | $ | 121,186 | $ | 111,137 | |||||||||

| Depreciation of property, plant and equipment |

9,819 | 9,821 | 19,258 | 19,486 | ||||||||||||

| Amortization of intangible assets |

900 | 252 | 1,781 | 252 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 71,136 | $ | 67,606 | $ | 142,225 | $ | 130,875 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 6. | Income taxes: |

Income tax expense is calculated based on management’s best estimate of the annual effective income tax rate expected by jurisdiction for the full financial year applied to the pre-tax ordinary income of the interim period. The Company’s consolidated effective tax rate in respect of operations for the six months ended June 30, 2013 was 28.6% (2012: 29.1%).

| 7. | Net earnings per share: |

| Three months ended June 30, 2013 |

Six months ended June 30, 2013 |

|||||||||||||||||||||||

| Net earnings |

Shares | Per share amount |

Net earnings |

Shares | Per share amount |

|||||||||||||||||||

| Basic net earnings per share |

$ | 30,028 | 106,713,312 | $ | 0.28 | $ | 44,074 | 106,677,387 | $ | 0.41 | ||||||||||||||

| Effect of dilutive securities: |

||||||||||||||||||||||||

| Stock options |

— | 289,127 | — | — | 331,464 | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Diluted net earnings per share |

$ | 30,028 | 107,002,439 | $ | 0.28 | $ | 44,074 | 107,008,851 | $ | 0.41 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

13

RITCHIE BROS. AUCTIONEERS INCORPORATED

Notes to the Condensed Consolidated Interim Financial Statements

(Tabular dollar amounts expressed in thousands of United States dollars, except share and per share amounts)

(Unaudited)

Six months ended June 30, 2013 and 2012

| 7. | Net earnings per share (continued): |

| Three months ended June 30, 2012 |

Six months ended June 30, 2012 |

|||||||||||||||||||||||

| Net earnings |

Shares | Per share amount |

Net earnings |

Shares | Per share amount |

|||||||||||||||||||

| Basic net earnings per share |

$ | 31,303 | 106,422,964 | $ | 0.29 | $ | 49,272 | 106,411,229 | $ | 0.46 | ||||||||||||||

| Effect of dilutive securities: |

||||||||||||||||||||||||

| Stock options |

— | 429,649 | — | — | 514,816 | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Diluted net earnings per share |

$ | 31,303 | 106,852,613 | $ | 0.29 | $ | 49,272 | 106,926,045 | $ | 0.46 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

For the six months ended June 30, 2013, stock options to purchase 2,933,824 common shares were outstanding but were excluded from the calculation of diluted earnings per share as they were anti-dilutive (2012: 1,554,659).

| 8. | Inventory: |

Every period end inventory is reviewed to ensure that it is recorded at the lower of cost and net realizable value. As at June 30, 2013 no writedown was recorded (December 31, 2012: $160,000).

Of inventory held at June 30, 2013, 81% is expected to be sold prior to the end of September 2013, with the remainder to be sold by the end of December 31, 2013 (December 31, 2012: 72% sold prior to the end of March 2013, with the remainder to be sold by the end of December 31, 2013).

| 9. | Investment property: |

| Balance, December 31, 2012 |

$ | 6,902 | ||

| Foreign exchange movement |

(294 | ) | ||

|

|

|

|||

| Balance, June 30, 2013 |

$ | 6,608 | ||

|

|

|

14

RITCHIE BROS. AUCTIONEERS INCORPORATED

Notes to the Condensed Consolidated Interim Financial Statements

(Tabular dollar amounts expressed in thousands of United States dollars, except share and per share amounts)

(Unaudited)

Six months ended June 30, 2013 and 2012

| 10. | Property, plant and equipment: |

| Land and improvements |

Buildings | Land, buildings and leasehold improvements under development |

Yard and automotive equipment |

Computer software and equipment |

Computer software and equipment under development |

Office equipment |

Leasehold improvements |

Total | ||||||||||||||||||||||||||||

| Cost: |

||||||||||||||||||||||||||||||||||||

| Balance, December 31, 2011 |

$ | 339,937 | $ | 256,309 | $ | 61,878 | $ | 56,003 | $ | 74,575 | $ | 3,384 | $ | 20,300 | $ | 15,179 | $ | 827,565 | ||||||||||||||||||

| Acquisitions from business combination |

— | — | — | — | 187 | 26 | 113 | 1 | 327 | |||||||||||||||||||||||||||

| Additions ~ |

100 | 347 | 37,050 | 10,147 | 225 | 9,837 | 718 | 283 | 58,707 | |||||||||||||||||||||||||||

| Disposals |

(3,293 | ) | (3,592 | ) | (28 | ) | (6,694 | ) | (3,304 | ) | — | (331 | ) | (90 | ) | (17,332 | ) | |||||||||||||||||||

| Transfers from property under development to completed assets |

26,707 | 24,404 | (56,036 | ) | 2,203 | 6,192 | (5,975 | ) | 1,839 | 666 | — | |||||||||||||||||||||||||

| Reclassified as held for sale |

(1,518 | ) | (3,105 | ) | — | — | — | — | — | — | (4,623 | ) | ||||||||||||||||||||||||

| Foreign exchange movement |

(302 | ) | 1,681 | 252 | 723 | 1,987 | 160 | 263 | 141 | 4,905 | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Balance, December 31, 2012 |

$ | 361,631 | $ | 276,044 | $ | 43,116 | $ | 62,382 | $ | 79,862 | $ | 7,432 | $ | 22,902 | $ | 16,180 | $ | 869,549 | ||||||||||||||||||

| Additions ~ |

15 | 57 | 9,348 | 6,240 | 1,196 | — | 288 | 766 | 17,910 | |||||||||||||||||||||||||||

| Disposals |

(729 | ) | (155 | ) | (192 | ) | (2,932 | ) | (23 | ) | — | (245 | ) | — | (4,276 | ) | ||||||||||||||||||||

| Transfers from property under development to completed assets |

21,706 | 6,433 | (29,850 | ) | 579 | 4,305 | (4,305 | ) | 949 | 183 | — | |||||||||||||||||||||||||

| Foreign exchange movement |

(10,634 | ) | (7,100 | ) | (1,097 | ) | (1,725 | ) | (4,458 | ) | (146 | ) | (727 | ) | (70 | ) | (25,957 | ) | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Balalance, June 30, 2013 |

$ | 371,989 | $ | 275,279 | $ | 21,325 | $ | 64,544 | $ | 80,882 | $ | 2,981 | $ | 23,167 | $ | 17,059 | $ | 857,226 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| ~ | During the six months ended June 30, 2013, the cost of additions was adjusted by $1,068,000 in relation to tax credits (year ended December 31, 2012: $1,095,000). |

15

RITCHIE BROS. AUCTIONEERS INCORPORATED

Notes to the Condensed Consolidated Interim Financial Statements

(Tabular dollar amounts expressed in thousands of United States dollars, except share and per share amounts)

(Unaudited)

Six months ended June 30, 2013 and 2012

| 10. | Property, plant and equipment (continued): |

| Land and improvements |

Buildings | Land, buildings and leasehold improvements under development |

Yard and automotive equipment |

Computer software and equipment |

Computer software and equipment under development |

Office equipment |

Leasehold improvements |

Total | ||||||||||||||||||||||||||||

| Accumulated depreciation: |

||||||||||||||||||||||||||||||||||||

| Balance, December 31, 2011 |

$ | (31,530 | ) | $ | (57,363 | ) | $ | — | $ | (29,331 | ) | $ | (49,477 | ) | $ | — | $ | (10,959 | ) | $ | (4,572 | ) | $ | (183,232 | ) | |||||||||||

| Depreciation for the year |

(7,136 | ) | (9,703 | ) | — | (8,212 | ) | (10,218 | ) | — | (2,241 | ) | (1,667 | ) | (39,177 | ) | ||||||||||||||||||||

| Disposals |

366 | 1,748 | — | 4,476 | 3,303 | — | 274 | 57 | 10,224 | |||||||||||||||||||||||||||

| Reclassified as held for sale |

150 | 1,346 | — | — | — | — | — | — | 1,496 | |||||||||||||||||||||||||||

| Foreign exchange movement |

(621 | ) | (694 | ) | — | (458 | ) | (1,332 | ) | — | (64 | ) | (14 | ) | (3,183 | ) | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Balance, December 31, 2012 |

$ | (38,771 | ) | $ | (64,666 | ) | $ | — | $ | (33,525 | ) | $ | (57,724 | ) | $ | — | $ | (12,990 | ) | $ | (6,196 | ) | $ | (213,872 | ) | |||||||||||

| Depreciation for the year |

(3,754 | ) | (4,887 | ) | — | (4,018 | ) | (4,649 | ) | — | (1,046 | ) | (904 | ) | (19,258 | ) | ||||||||||||||||||||

| Disposals |

718 | 153 | — | 1,941 | 13 | — | 190 | — | 3,015 | |||||||||||||||||||||||||||

| Foreign exchange movement |

621 | 1,669 | — | 911 | 3,281 | — | 344 | 32 | 6,858 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Balalance, June 30, 2013 |

$ | (41,186 | ) | $ | (67,731 | ) | $ | — | $ | (34,691 | ) | $ | (59,079 | ) | $ | — | $ | (13,502 | ) | $ | (7,068 | ) | $ | (223,257 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net carrying amount: |

||||||||||||||||||||||||||||||||||||

| As at December 31, 2012 |

$ | 322,860 | $ | 211,378 | $ | 43,116 | $ | 28,857 | $ | 22,138 | $ | 7,432 | $ | 9,912 | $ | 9,984 | $ | 655,677 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| As at June 30, 2013 |

$ | 330,803 | $ | 207,548 | $ | 21,325 | $ | 29,853 | $ | 21,803 | $ | 2,981 | $ | 9,665 | $ | 9,991 | $ | 633,969 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

During the six months ended June 30, 2013, interest of $771,000 (2012: $902,000) was capitalized to the cost of assets under development. These interest costs relating to qualifying assets are capitalized at a weighted average rate of 5.52% (2012: 4.47%).

16

RITCHIE BROS. AUCTIONEERS INCORPORATED

Notes to the Condensed Consolidated Interim Financial Statements

(Tabular dollar amounts expressed in thousands of United States dollars, except share and per share amounts)

(Unaudited)

Six months ended June 30, 2013 and 2012

| 11. | Intangible assets: |

| Trade names and trademarks |

Customer relationships |

Software | Software under development |

Total | ||||||||||||||||

| Cost: |

||||||||||||||||||||

| Balance, December 31, 2012 |

$ | 800 | $ | 19,597 | $ | 3,572 | $ | 3,562 | $ | 27,531 | ||||||||||

| Transfers from software under development to completed assets |

— | — | 1,342 | (1,342 | ) | — | ||||||||||||||

| Additions |

— | — | 688 | 7,687 | 8,375 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance, June 30, 2013 |

$ | 800 | $ | 19,597 | $ | 5,602 | $ | 9,907 | $ | 35,906 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Trade names and trademarks |

Customer relationships |

Software | Software under development |

Total | ||||||||||||||||

| Accumulated amortization: |

||||||||||||||||||||

| Balance, December 31, 2012 |

$ | — | $ | (1,258 | ) | $ | (703 | ) | $ | — | $ | (1,961 | ) | |||||||

| Amortization for the period |

— | (1,007 | ) | (774 | ) | — | (1,781 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance, June 30, 2013 |

$ | — | $ | (2,265 | ) | $ | (1,477 | ) | $ | — | $ | (3,742 | ) | |||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net carrying amount: |

||||||||||||||||||||

| As at December 31, 2012 |

$ | 800 | $ | 18,339 | $ | 2,869 | $ | 3,562 | $ | 25,570 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| As at June 30, 2013 |

$ | 800 | $ | 17,332 | $ | 4,125 | $ | 9,907 | $ | 32,164 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| 12. | Goodwill: |

| Balance, December 31, 2012 |

$ | 84,247 | ||

| Foreign exchange movement |

(729 | ) | ||

|

|

|

|||

| Balance, June 30, 2013 |

$ | 83,518 | ||

|

|

|

Goodwill is subject to annual impairment reviews.

17

RITCHIE BROS. AUCTIONEERS INCORPORATED

Notes to the Condensed Consolidated Interim Financial Statements

(Tabular dollar amounts expressed in thousands of United States dollars, except share and per share amounts)

(Unaudited)

Six months ended June 30, 2013 and 2012

| 13. | Borrowings: |

| Carrying value | ||||||||

| June 30, 2013 |

December 31, 2012 |

|||||||

| Current Borrowings |

$ | 90,028 | $ | 39,480 | ||||

|

|

|

|

|

|||||

| Non-current Borrowings |

||||||||

| Term loan, denominated in Canadian dollars, unsecured, bearing interest at 4.225%, due in quarterly installments of interest only, with the full amount of the principal due in May 2022. |

$ | 32,327 | $ | 34,248 | ||||

| Term loan, denominated in United States dollars, unsecured bearing interest at 3.59%, due in quarterly installments of interest only, with the full amount of the principal due in May 2022. |

30,000 | 30,000 | ||||||

| Term loan, denominated in Canadian dollars, unsecured, bearing interest at 6.385%, due in quarterly installments of interest only, with the full amount of the principal due in May 2016. |

56,957 | 60,327 | ||||||

| Revolving loan, denominated in Canadian dollars, unsecured, bearing interest at Canadian bankers' acceptance rate plus a margin between 0.85% and 1.25%, due in monthly installments of interest only, with the revolving loan available until May 2018. |

29,071 | 31,171 | ||||||

| Term loan, denominated in United States dollars, unsecured, bearing interest at a base rate of 1.65% plus a margin between 0.85% and 1.25%, due in quarterly installments of interest only, with the full amount of the principal due in July 2013. |

— | 15,000 | ||||||

| Term loan, denominated in United States dollars, unsecured, bearing interest at a base rate of 0.48% (2012: 1.16%) plus a margin between 0.85% and 1.25%, due in quarterly installments of interest only, with the full amount of principal due in January 2014. |

— | 30,000 | ||||||

|

|

|

|

|

|||||

| $ | 148,355 | $ | 200,746 | |||||

|

|

|

|

|

|||||

| Total Borrowings |

$ | 238,383 | $ | 240,226 | ||||

|

|

|

|

|

|||||

During the three months ended June 30, 2013, the Company completed the renegotiation of its $225 million credit facility for a five-year term ending in May 2018.

The term loan with principal repayment date in July 2013 has been classified as current borrowings as at June 30, 2013, as the Company expects to repay this borrowing within twelve months from the balance sheet date. Similarly, the term loan with principal repayment date in January 2014 has been classified as current borrowings as the Company expects to repay this loan within twelve months from the balance sheet date.

Current borrowings at June 30, 2013 are comprised of drawings in different currencies on the Company’s committed revolving credit facility, and have a weighted average interest rate of 2.47% (December 31, 2012: 3.01%).

As at June 30, 2013, the carrying value of non-current borrowings approximated its fair value.

18

RITCHIE BROS. AUCTIONEERS INCORPORATED

Notes to the Condensed Consolidated Interim Financial Statements

(Tabular dollar amounts expressed in thousands of United States dollars, except share and per share amounts)

(Unaudited)

Six months ended June 30, 2013 and 2012

| 14. | Share capital: |

| (a) | Authorized: |

Unlimited number of common shares, without par value.

Unlimited number of senior preferred shares, without par value, issuable in series.

Unlimited number of junior preferred shares, without par value, issuable in series.

| (b) | Issued: |

All issued shares are fully paid. No preferred shares have been issued.

| 15. | Share-based payments: |

| (a) | Stock option plan: |

Stock option activity for the six months ended June 30, 2013 and the year ended December 31, 2012 is presented below:

| June 30, 2013 | December 31, 2012 | |||||||||||||||

| Common Shares Under Option |

Weighted Average Exercise Price |

Common Shares Under Option |

Weighted Average Exercise Price |

|||||||||||||

| Outstanding, beginning of period |

3,540,497 | $ | 20.27 | 3,008,169 | $ | 18.97 | ||||||||||

| Granted |

884,500 | 21.34 | 828,344 | 22.71 | ||||||||||||

| Exercised |

(190,722 | ) | 14.66 | (210,472 | ) | 10.56 | ||||||||||

| Forfeited |

(45,309 | ) | 23.31 | (85,544 | ) | 22.30 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Outstanding, end of period |

4,188,966 | $ | 20.72 | 3,540,497 | $ | 20.27 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Exercisable, end of period |

2,803,302 | $ | 20.10 | 2,413,937 | $ | 18.94 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The options outstanding at June 30, 2013 expire on dates ranging to March 5, 2023. The weighted average share price of options exercised during the six months ended June 30, 2013 was $21.11 (2012: $21.53). The following is a summary of stock options outstanding and exercisable at June 30, 2013:

| Options Outstanding | Options Exercisable | |||||||||||||||||||||||

| Range of Exercise Prices |

Number | Weighted Average Remaining Life (years) |

Weighted Average Exercise Price |

Number | Weighted Average Exercise Price |

|||||||||||||||||||

| $8.82 - $10.80 |

84,800 | 1.2 | 10.02 | 84,800 | 10.02 | |||||||||||||||||||

| $14.23 - $14.70 |

821,901 | 5.0 | 14.54 | 815,701 | 14.54 | |||||||||||||||||||

| $18.67 - $19.95 |

392,358 | 5.0 | 19.00 | 298,987 | 18.70 | |||||||||||||||||||

| $21.66 - $23.44 |

2,054,646 | 8.6 | 22.12 | 861,582 | 22.49 | |||||||||||||||||||

| $24.39 - $25.91 |

835,261 | 6.4 | 25.25 | 742,232 | 25.17 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| 4,188,966 | 7.0 | $ | 20.72 | 2,803,302 | $ | 20.10 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

19

RITCHIE BROS. AUCTIONEERS INCORPORATED

Notes to the Condensed Consolidated Interim Financial Statements

(Tabular dollar amounts expressed in thousands of United States dollars, except share and per share amounts)

(Unaudited)

Six months ended June 30, 2013 and 2012

| 15. | Share-based payments (continued): |

| (b) | Share unit plans: |

(i) Restricted Share Unit (“RSU”) Plan and Performance Share Unit (“PSU”) Plan

In connection with a review and redesign of the Company’s long-term incentive plans, the Company has adopted the RSU and PSU plans described below. Effective January 1, 2013, these plans were adopted to replace the Company’s existing long-term term incentive plans for senior management and executives.

Senior management and executive employees of the Company are eligible for RSU grants in respect of financial years commencing after December 31, 2012. Compensation expense for each RSU is equal to the grant-date fair value of the share units awarded and is recognized evenly over the vesting periods of the underlying awards, which range from one to three years.

Executive employees of the Company are eligible for PSU grants in respect of years commencing after December 31, 2012. Compensation expense for each PSU is equal to the grant-date fair value of the share units awarded and is recognized evenly over the three year vesting period of the underlying awards. Compensation expense is adjusted at each reporting date for an estimate of the number of awards expected to vest based on the achievement of specific performance measures.

(ii) Deferred Share Unit (“DSU”) Plan

Effective January 1, 2013, members of the Board, who are not management of the Company, are required to receive a portion of their fees in the form of DSUs until they satisfy an equity ownership requirement. Accordingly, the Company may defer payment of a portion of a director’s fees and, annually award DSUs, which vest on grant date, in the amount of the deferred compensation cost.

(iii) Additional Plan Details

These plans entitle the grant recipient to a cash payment equal to the dividend-adjusted number of share units vested multiplied by the volume-weighted-average-price of the Company’s common shares reported by the New York Stock Exchange for the twenty days prior to vest date or, in the case of DSU recipients, following cessation of service on the Board of Directors.

Upon recognizing share-based compensation expense for the plans above, the Company recognizes a liability in the amount of the future cash-settlement obligation of share units earned. At the end of each reporting period, the Company estimates the number of equity instruments expected to vest, and fair values its share unit cash-settlement obligation. The impacts of these revisions, if any, are recognized in earnings such that the cumulative expense reflects the revised estimate, with a corresponding adjustment to the settlement liability.

| (c) | Share-based compensation: |

During the six months ended June 30, 2013, the Company recognized compensation cost of $2,372,000 (2012: $2,032,000) in selling, general and administrative expenses in respect of grants under its stock option plan.

20

RITCHIE BROS. AUCTIONEERS INCORPORATED

Notes to the Condensed Consolidated Interim Financial Statements

(Tabular dollar amounts expressed in thousands of United States dollars, except share and per share amounts)

(Unaudited)

Six months ended June 30, 2013 and 2012

15. Share-based payments (continued):

| (c) | Share-based compensation (continued): |

The fair value of the stock option grants was estimated on the date of the grant using the Black-Scholes option pricing model with the following assumptions:

| 2013 | 2012 | |||||||

| Risk free interest rate |

0.9 | % | 1.1 | % | ||||

| Expected dividend yield |

2.31 | % | 1.99 | % | ||||

| Expected lives of options |

5 years | 5 years | ||||||

| Expected volatility |

35.2 | % | 35.4 | % | ||||

The weighted average grant date fair value of options granted during the six months ended June 30, 2013 was $5.65 per option (2012: $6.26). The compensation expense arising from option grants is amortized over the relevant vesting periods of the underlying options.

The fair value of the 352,458 share units granted during the six months ended June 30, 2013 was $21.98 (2012: $nil). The compensation expense arising from share unit grants is amortized over the relevant vesting periods of the underlying units. At June 30, 2013, the carrying amount of the Company’s share unit liability was adjusted to reflect a reporting date fair value of $20.39 per share unit, through a reduction in selling, general, and administrative expense. The fair value of the share unit grants is calculated on the valuation date using the 20-day volume weighted average share price of the Company’s common shares listed on the New York Stock Exchange.

| 16. | Contingencies: |

| (a) | Legal and other claims: |

The Company is subject to legal and other claims that arise in the ordinary course of its business. The Company does not believe that the results of these claims will have a material effect on the Company’s balance sheet or income statement.

| (b) | Guarantee contracts: |

In the normal course of its business, the Company will in certain situations guarantee to a consignor a minimum level of proceeds in connection with the sale at auction of that consignor’s equipment.

At June 30, 2013 there was $33,209,000 of industrial equipment guaranteed under contract, of which 81% is expected to be sold prior to the end of September 2013, with the remainder to be sold prior to the end of October 2013 (December 31, 2012: $5,323,000 of which 100% sold prior to the end of March 2013).

At June 30, 2013 there was $6,177,000 of agricultural equipment guaranteed under contract, of which 93% expected to be sold prior to the end of September 2013, with the remainder to be sold prior to the end of October 2013 (December 31, 2012: $14,995,000 of which 94% sold prior to the end of April 2013, with the remainder to be sold prior to the end of June 2013).

The outstanding guarantee amounts are undiscounted and before estimated proceeds from sale at auction.

21

| ITEM 2: | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Forward-Looking Statements

This Management’s Discussion and Analysis of Financial Condition and Results of Operations contains forward-looking statements that involve risks and uncertainties. These statements are based on current expectations and estimates about our business, and include, among others, statements relating to:

| • | our future performance; |

| • | impact of market uncertainty on equipment seller behaviour; |

| • | competition in the used equipment market; |

| • | anticipated pricing environment for late model equipment; |

| • | growth of our operations, including replacement of existing auction sites and adding new auction sites; |

| • | growth potential in established and emerging markets; |

| • | our internet initiatives and the level of participation in our auctions by internet bidders, and the success of our new online marketplace; |

| • | growth of used equipment and truck markets; |

| • | increases in the number of consignors and bidders participating in our auctions; |

| • | our principal operating strengths, our competitive advantages, and the appeal of our auctions to buyers and sellers of industrial assets; |

| • | our ability to draw consistently significant numbers of local and international end-user bidders to our auctions; |

| • | our ability to continue to grow our share of the used equipment market and to meet the needs of our customers; |

| • | our ability to partner with our customers and potential customers; |

| • | our ability to grow our core auction business, including our ability to increase our market share with traditional customer groups and do more business with new customer groups in new markets, among others; |

| • | our ability to add new business and information solutions, including, among others, our ability to use technology to enhance our auction services and support additional value added services; |

| • | our ability to improve sales force productivity, grow our sales force and increase operational efficiency of our sales and operations teams; |

| • | the effect of changes in Territory Manager recruitment and training and of OEM production on our Gross Auction Proceeds and operating results; |

| • | our ability to leverage our Ritchie Bros. brand; |

| • | the relative percentage of Gross Auction Proceeds represented by straight commission, guarantee and inventory contracts, and its impact on auction revenues and profitability; |

22

| • | our Auction Revenue Rates, the sustainability of those rates, the impact of our commission rate and fee changes, and the seasonality of Gross Auction Proceeds and auction revenues; |

| • | our direct expense and income tax rates and selling, general and administrative expenses; |

| • | our future capital expenditures; |

| • | our future plans with regard to our strategic pillars; |

| • | the proportion of our revenues and operating costs denominated in currencies other than the US dollar or the effect of any currency exchange and interest rate fluctuations on our results of operations; |

| • | the impact of our new initiatives and services on us and our customers; and |

| • | financing available to us and the sufficiency of our working capital to meet our financial needs. |

Forward-looking statements are typically identified by such words as “anticipate”, “believe”, “could”, “feel”, “continue”, “estimate”, “expect”, “intend”, “may”, “ongoing”, “plan”, “potential”, “predict”, “will”, “should”, “would”, “could”, “likely”, “generally”, “future”, “period to period”, “long term”, or the negative of these terms, and similar expressions intended to identify forward-looking statements. Our forward-looking statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. While we have not described all potential risks related to our business and owning our common shares, the important factors listed under “Risk Factors” in our 2012 Annual Report on Form 40-F are among those that we consider may affect our performance significantly or could cause our actual financial and operational results to differ significantly from our predictions. Except as required by applicable securities law and regulations of relevant securities exchanges, we do not intend to update publicly any forward-looking statements, even if our predictions have been affected by new information, future events or other developments. You should consider our forward-looking statements in light the factors listed under “Risk Factors” below, under “Risk Factors” in our 2012 Annual Report on Form 40-F and other relevant factors.

About Us

Established in 1958, Ritchie Bros. Auctioneers is the world’s largest industrial auctioneer, specializing in the sale of equipment for the construction, transportation, agricultural, material handling, energy, mining, forestry, marine and other industries. With operations in more than 25 countries, including 44 auction sites worldwide, Ritchie Bros. Auctioneers makes it easy for the world’s builders to buy and sell equipment with confidence.

Ritchie Bros.’ solutions include the core business of unreserved public auctions and a secure online equipment marketplace. Ritchie Bros.’ unreserved auctions are conducted live, with bidding on-site and online at rbauction.com. Ritchie Bros. Auctioneers conducts hundreds of unreserved public auctions each year, selling more equipment to on-site and online bidders than any other auction business in the world. The Ritchie Bros. EquipmentOne online marketplace can be accessed at EquipmentOne.com. Ritchie Bros. also offers a range of value-added services, including equipment financing available through Ritchie Bros. Financial Services (rbauctionfinance.com).

None of the information on the aforementioned websites is incorporated by reference into this document by this or any other references.

23

Overview

The following discussion summarizes significant factors affecting the consolidated operating results and financial condition of Ritchie Bros. Auctioneers Incorporated (“Ritchie Bros.”, the “Company”, “we” or “us”) for the three- and six-month periods ended June 30, 2013 compared to the three- and six-month periods ended June 30, 2012. This discussion should be read in conjunction with our unaudited condensed consolidated interim financial statements and notes thereto for the six-month periods ended June 30, 2013 and 2012, and with the disclosures regarding forward-looking statements and risk factors included within this discussion. You should also consider our audited consolidated financial statements and notes thereto and our Management’s Discussion and Analysis of Financial Condition and Results of Operations for the year ended December 31, 2012, and our most recent Annual Information Form (“AIF”), on our website at www.rbauction.com, on SEDAR at www.sedar.com or on EDGAR at www.sec.gov. None of the information on SEDAR, EDGAR, or our website is incorporated by reference into this document by this or any other reference. The date of this discussion is as of August 1, 2013.

We prepare our consolidated financial statements in accordance with International Financial Reporting Standards, or IFRS. Amounts discussed below are based on our unaudited condensed consolidated interim financial statements and are presented in US dollars. Unless indicated otherwise, all tabular dollar amounts, including related footnotes, presented below are expressed in thousands of dollars, except per share amounts.

Second Quarter Update

Our net earnings and adjusted net earnings for the three months ended June 30, 2013 were $30.0 million, or $0.28 per diluted share. Comparatively, the Company generated net earnings of $31.3 million, or $0.29 per diluted share, and adjusted net earnings of $32.5 million, or $0.30 per diluted share, during the same period in 2012.

While our revenue was flat year over year, our SG&A increased as a result of the incremental increase in overhead costs for EquipmentOne and our larger sales team.

| Financial Overview | Three months ended June 30, | |||||||||||||||

| (in millions of U.S.$, except EPS) |

2013 | 2012 | $ Change | % Change | ||||||||||||

| Auction revenues |

$ | 128,322 | $ | 127,213 | $ | 1,109 | 1 | % | ||||||||

| Direct expense |

15,551 | 15,490 | 61 | 0 | % | |||||||||||

| SG&A expenses(1) |

71,136 | 67,606 | 3,530 | 5 | % | |||||||||||

| Earnings from operations |

41,635 | 44,117 | (2,482 | ) | (6 | %) | ||||||||||

| Other income (expenses) |

925 | (1,419 | ) | 2,344 | 165 | % | ||||||||||

| Finance costs |

(1,312 | ) | (1,038 | ) | (274 | ) | (26 | %) | ||||||||

| Income tax expense |

11,220 | 10,357 | 863 | 8 | % | |||||||||||

| Net earnings |

30,028 | 31,303 | (1,275 | ) | (4 | %) | ||||||||||

| Adjusted Net Earnings (2),(3) |

30,028 | 32,500 | (2,472 | ) | (8 | %) | ||||||||||

| Diluted Adjusted EPS(2) |

$ | 0.28 | $ | 0.30 | $ | (0.02 | ) | (7 | %) | |||||||

| Effective tax rate |

27.2 | % | 24.9 | % | n/a | 9 | % | |||||||||

| Gross Auction Proceeds (2),(4) |

$ | 1,072,942 | $ | 1,194,536 | $ | (121,594 | ) | (10 | %) | |||||||

| Auction Revenue Rate(2),(5) |

11.96 | % | 10.65 | % | n/a | 12 | % | |||||||||

| Direct Expense Rate |

1.45 | % | 1.30 | % | n/a | 12 | % | |||||||||

| EBITDA Margin(2),(6) |

40.8 | % | 42.6 | % | n/a | (4 | %) | |||||||||

24

| (1) | Selling, general and administrative expenses (“SG&A”) include depreciation and amortization expense. |

| (2) | These are non-GAAP measures that do not have a standardized meaning, and are therefore unlikely to be comparable to similar measures presented by other companies. We believe that comparing Adjusted Net Earnings, diluted Adjusted Net Earnings per Share, Gross Auction Proceeds and EBITDA Margin for different financial periods provides additional useful information about our performance for the relevant financial period. |

| (3) | We define Adjusted Net Earnings as financial statement net earnings excluding the after-tax effects of excess property sales and other non-recurring items, and we have provided a reconciliation to net earnings below. |

| (4) | Gross Auction Proceeds represents the total proceeds from all items sold by Ritchie Bros. It is not a measure of our financial performance, liquidity or revenue and is not presented in our annual consolidated income statement. We believe that auction revenues, which is the most directly comparable measure in our Income Statements, and certain other line items, are best understood by considering their relationship to Gross Auction Proceeds. |

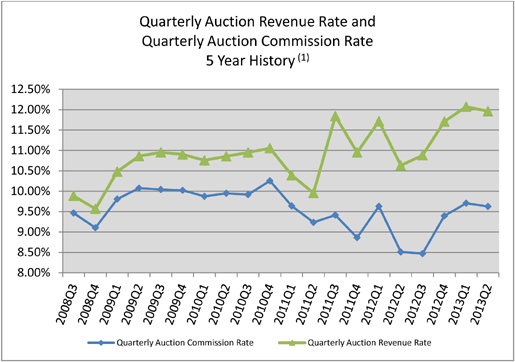

| (5) | Auction Revenue Rate is our auction revenues divided by our Gross Auction Proceeds. |

| (6) | Earnings before interest, taxes, depreciation and amortization (EBITDA) is calculated using the information disclosed in our condensed consolidated interim financial statements by adding back depreciation and amortization expense to earnings from operations. EBITDA is a non-GAAP measure. The EBITDA Margin is EBITDA as a proportion of auction revenues. |

Highlights during the second quarter of 2013 included:

| • | Our $104 million auction in Edmonton, Alberta, over three days in April 2013, which set records for online bidders, online buyers, and total gross auction proceeds from online bidders. |

| • | We launched Ritchie Bros. EquipmentOne, our new online marketplace, for commercial use in April 2013. |

| • | We conducted our first unreserved public auction in Beijing, China, our newest regional auction site, in April 2013. |

| • | We achieved an Auction Revenue Rate of 11.96% for the quarter |

| • | We added net 7 Territory Managers to our sales force for net 21 additions, an increase of 8%, year-to-date |

Subsequent to quarter-end, we implemented a plan to better align our costs with our current revenue levels. These steps included reorganizing certain administrative departments and teams associated with capital infrastructure, and also rationalizing some operational procedures.

Our Gross Auction Proceeds has not grown over prior year comparative period Gross Auction Proceeds for the past three quarters and we believe this is primarily attributable to two issues:

First, the tenure of our sales force has declined over the past 24 months due to the lag in hiring Territory Managers (“TMs”), negatively impacting our productivity. Our sales force actually declined in 2011 with replacement TMs being hired in the second half of 2012, resulting in a net nil increase in the average number of TMs in 2011 and 2012. This was coupled with a historically high turnover rate for our TMs in 2012. As the tenure and experience of our TMs increases, their productivity will also increase as they build relationships with equipment owners. For the twelve months ended June 30, 2013, we have seen our average number of TMs increase and we believe that this factor, when combined with the increasing tenure of our TMs, will have a positive effect on our Gross Auction Proceeds.

Second, the average age of items sold at our auctions has increased, due to OEM production decreases which has reduced the flow of new equipment into the marketplace. Older, less valuable equipment negatively affects our Gross Auction Proceeds. We believe that the rise in construction and transportation OEM production since 2010 will positively affect the used equipment market and our Gross Auction Proceeds.

25

EquipmentOne Update