EXHIBIT NO. 1

ANNUAL INFORMATION FORM FOR THE YEAR ENDED

DECEMBER 31, 2012

February 26, 2013

Ritchie Bros. Auctioneers Incorporated

9500 Glenlyon Parkway

Burnaby, British Columbia

Canada V5J 0C6

(778) 331-5500

www.rbauction.com

1-1

TABLE OF CONTENTS

| Forward Looking Statements |

3 | |

| The Company |

4 | |

| Overview |

6 | |

| History and Development of Our Business |

7 | |

| Industry |

7 | |

| Competitive Advantages |

8 | |

| Growth Strategies |

11 | |

| Operations |

13 | |

| Marketing and Sales |

16 | |

| International Network of Auction Sites |

16 | |

| Competition |

18 | |

| Governmental and Environmental Regulations |

18 | |

| Risk Factors |

19 | |

| Dividends |

19 | |

| Capital Structure |

20 | |

| Market for Securities |

20 | |

| Directors and Executive Officers |

21 | |

| Audit Committee Information |

23 | |

| Legal and Regulatory Actions |

27 | |

| Code of Ethics |

27 | |

| Transfer Agent |

27 | |

| Interests of Experts |

27 | |

| Additional Information |

27 | |

Unless the context otherwise requires, “Ritchie Bros.”, the “Company”, “we”, or “us” each refer to Ritchie Bros. Auctioneers Incorporated and its predecessor entities, either alone or together with its subsidiaries. Unless otherwise specified, references to years are references to calendar years and references to quarters are references to calendar quarters. All dollar amounts are denominated in United States Dollars.

Certain names in this document are our trademarks.

1-2

FORWARD LOOKING STATEMENTS

This Annual Information Form contains forward-looking statements that involve risks and uncertainties. These statements are based on our current expectations and estimates about our business, and include, among others, statements relating to:

| • | our future performance and long-term financial objectives; |

| • | impact of market uncertainty on equipment seller behaviour; |

| • | competition in the used equipment market; |

| • | anticipated pricing environment for late model equipment; |

| • | growth of our operations, including replacement of existing auction sites and adding new auction sites; |

| • | growth potential in established and emerging markets; |

| • | our internet initiatives and the level of participation in our auctions by internet bidders, including the timing of the next major release and full commercial launch of our new online marketplace; |

| • | integration of AssetNation’s personnel, technology and e-commerce expertise to reach new segments of the equipment market; |

| • | growth of used equipment and truck markets; |

| • | increases in the number of consignors and bidders participating in our auctions; |

| • | our principal operating strengths, our competitive advantages, and the appeal of our auctions to buyers and sellers of industrial assets; |

| • | our ability to draw consistently significant numbers of local and international end-user bidders to our auctions; |

| • | our ability to continue to grow our share of the used equipment market and to meet the needs of our customers; |

| • | our ability to partner with our customers and potential customers; |

| • | our ability to utilize the excess capacity in our sales team and auction site network to help sustain our growth; |

| • | our ability to grow our core auction business, including our ability to increase our market share with traditional customer groups and do more business with new customer groups in new markets, among others; |

| • | our ability to add new business and information solutions, including, among others, utilizing technology to enhance our auction services and support additional value added services; |

| • | our ability to perform by building an inspired high-performance customer focused team, to improve sales force productivity and growth in our sales force; |

| • | our ability to improve sales force productivity, employee engagement and management bench strength and increase operational efficiency of our sales and operations teams; |

| • | our ability to leverage our Ritchie Bros. brand; |

1-3

| • | the relative percentage of Gross Auction Proceeds represented by straight commission, guarantee and inventory contracts, and its impact on auction revenues and profitability; |

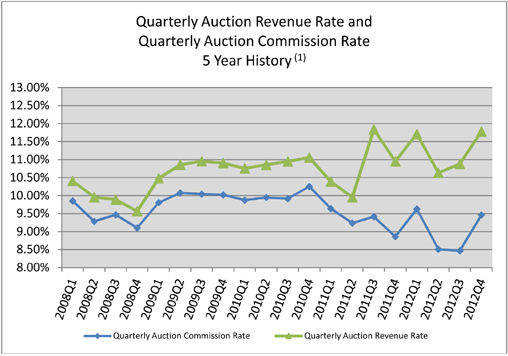

| • | our Auction Revenue Rates, the sustainability of those rates, the impact of our commission rate and fee changes, and the seasonality of Gross Auction Proceeds and auction revenues; |

| • | our direct expense and income tax rates, depreciation and amortization expenses and general and administrative expenses; |

| • | our future capital expenditures; |

| • | our future plans with regard to our strategic pillars; |

| • | the proportion of our revenues and operating costs denominated in currencies other than the US dollar or the effect of any currency exchange and interest rate fluctuations on our results of operations; |

| • | the impact of our new initiatives and services on us and our customers; and |

| • | financing available to us and the sufficiency of our working capital to meet our financial needs. |

Forward-looking statements are typically identified by such words as “anticipate”, “believe”, “could”, “feel”, “continue”, “estimate”, “expect”, “intend”, “may”, “ongoing”, “plan”, “potential”, “predict”, “will”, “should”, “would”, “could”, “likely”, “generally”, “future”, “period to period”, “long term”, or the negative of these terms, and similar expressions intended to identify forward-looking statements. Our forward-looking statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. While we have not described all potential risks related to our business and owning our common shares, the important factors listed under “Risk Factors” in our Management’s Discussion and Analysis of Financial Condition and Results of Operations for the year ended December 31, 2012, which is incorporated by reference in this document, are among those we consider that may affect our performance significantly or could cause our actual financial and operational results to differ significantly from our predictions. Except as required by applicable securities law and regulations of relevant securities exchanges, we do not intend to update publicly any forward-looking statements, even if our predictions have been affected by new information, future events or other developments. You should consider our forward-looking statements in light of these and other relevant factors.

THE COMPANY

Ritchie Bros. Auctioneers Incorporated was amalgamated on December 12, 1997 under, and is governed by, the Canada Business Corporation Act. Our registered office is located at 1300 —777 Dunsmuir Street, Vancouver, British Columbia, Canada V7Y 1K2. Our executive office is located at 9500 Glenlyon Parkway, Burnaby, British Columbia, Canada V5J 0C6 and our telephone number is (778) 331-5500. We maintain a website at www.rbauction.com. None of the information on our website is incorporated into this Annual Information Form by this or any other reference.

1-4

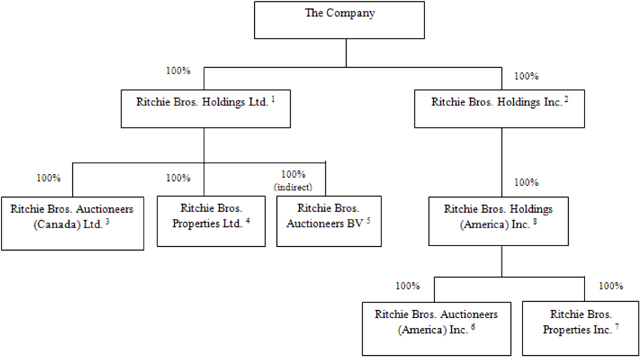

The following diagram illustrates the primary intercorporate relationships of our company and our principal operating subsidiaries:

Notes:

| 1. | Ritchie Bros. Holdings Ltd. is a corporation continued under the laws of Canada. |

| 2. | Ritchie Bros. Holdings Inc. is a corporation incorporated under the laws of the State of Washington, U.S.A. |

| 3. | Ritchie Bros. Auctioneers (Canada) Ltd. is a corporation incorporated under the laws of Canada. |

| 4. | Ritchie Bros. Properties Ltd. is a corporation incorporated under the laws of Canada. |

| 5. | Ritchie Bros. Auctioneers B.V. is a corporation incorporated under the laws of The Netherlands. |

| 6. | Ritchie Bros. Auctioneers (America) Inc. is a corporation incorporated under the laws of the State of Washington, U.S.A. |

| 7. | Ritchie Bros. Properties Inc. is a corporation incorporated under the laws of the State of Washington, U.S.A. |

| 8. | Ritchie Bros. Holdings (America) Inc. is a corporation incorporated under the laws of the State of Washington, U.S.A. |

1-5

OVERVIEW

Ritchie Bros. is the world’s largest auctioneer of industrial equipment. Our world headquarters are located in Vancouver, British Columbia, Canada, and as of the date of this discussion we operated from over 110 locations in more than 25 countries, including 44 auction sites worldwide. Our mission is to create compelling business solutions that enable the world’s builders to easily and confidently exchange equipment. We sell, primarily through unreserved public auctions, a broad range of used and unused industrial assets, including equipment, trucks and other assets used in the construction, transportation, agricultural, material handling, mining, forestry, petroleum and marine industries.

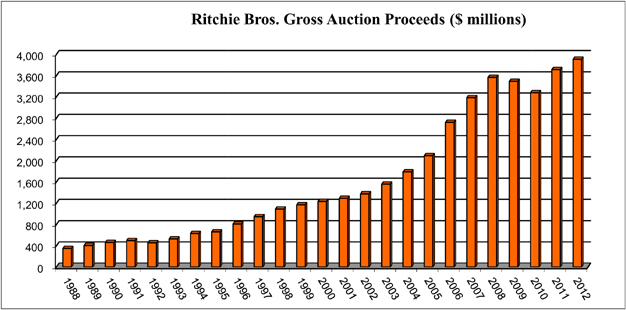

Gross Auction Proceeds1 represent the total proceeds from all items sold at our auctions. Our Gross Auction Proceeds were a record $3.9 billion for the year ended December 31, 2012, which was 5% higher than 2011. We believe that we sell more used equipment than any other company in the world and that our annual Gross Auction Proceeds are far greater than any of our auction competitors. Consignment volumes at our auctions are affected by a number of factors, including regular fleet upgrades and reconfigurations, financial pressure, retirements, and inventory reductions, as well as by the timing of the completion of major construction and other projects.

Adherence to the unreserved auction process is one of our founding principles and, we believe, one of our significant competitive advantages. Unreserved means that there are no minimum or reserve prices on anything sold at a Ritchie Bros. auction – each item sells to the highest bidder on sale day, regardless of the price. In addition, consignors (or their agents) are not allowed to bid on or buy back or in any way influence the selling price of their own equipment. We maintain this commitment to the unreserved auction process because we believe that an unreserved auction is a fair auction.

Our customers are both buyers and sellers of equipment, trucks and other industrial assets. The majority of our buyers are end users of equipment (retail buyers), such as contractors, with the remainder being primarily truck and equipment dealers, rental companies and brokers (wholesale buyers). Consignors to our auctions represent a broad mix of equipment owners, the majority being end users of equipment, with the balance being finance companies, truck and equipment dealers and equipment rental companies, among others.

We attract a broad base of bidders from around the world to our auctions. Our worldwide marketing efforts help to attract bidders, and we believe they are willing to travel long distances or participate online in part because of our reputation for conducting fair auctions. These diverse multinational bidding audiences provide a global marketplace that allows our auctions to transcend local market conditions, which we believe is a significant competitive advantage. Evidence of this is the fact that in recent periods an average of approximately 55% of the value of equipment sold at our auctions has left the region of the sale.

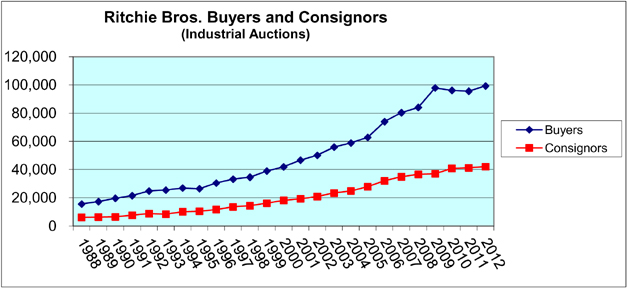

We believe that our ability to consistently draw significant numbers of local and international bidders from many different end markets to our auctions, most of whom are end users rather than resellers, is appealing to sellers of used trucks and equipment and helps us to attract consignments to our auctions. Higher consignment volumes attract more bidders, which in turn attract more consignments, and so on in a self-reinforcing process that we believe creates momentum in our business.

| 1 | Our definition of Gross Auction Proceeds may differ from those used by other participants in our industry. Gross Auction Proceeds is an important measure we use in comparing and assessing our operating performance. It is not a measure of our financial performance, liquidity or revenue and is not presented in our consolidated financial statements. We believe that auction revenues, which is the most directly comparable measure in our Statement of Operations, and certain other line items, are best understood by considering their relationship to Gross Auction Proceeds. |

1-6

HISTORY AND DEVELOPMENT OF OUR BUSINESS

Our company was founded in 1958 in the small town of Kelowna, British Columbia, Canada. We held our first major industrial auction in 1963, selling over $600,000 worth of construction equipment in Radium, British Columbia. While our early auction sales were held primarily in Western Canada, Ritchie Bros. expanded eastward in Canada through the 1960s.

By 1970, we had established operations in the United States and held our first U.S. sale in Beaverton, Oregon. Throughout the 1970s and 1980s, we held auctions in additional locations across Canada and an increasing number of American states. In 1987, we held our first European auctions in Liverpool, U.K. and Rotterdam, The Netherlands. Our first Australian auction was held in 1990, and this was followed by expansion into Asia, with subsequent sales in Japan, the Philippines, Hong Kong, Thailand and Singapore. We held our first Mexican auction in 1995, our first Middle Eastern auction in Dubai, U.A.E., in 1997, our first African auction in Durban, in the Republic of South Africa, in 2003, our first auction in Eastern Europe in Poland in 2008, and our first auctions in India and Turkey in 2009. Although we expect that most of our growth in the near future will come from expanding our business and increasing our penetration in regions where we already have a presence, such as the United States and Western Europe, we anticipate that emerging markets in developing countries such as China and Brazil will be important in the longer term.

In 1994, we introduced our prototype auction facility, opening new permanent auction sites in Fort Worth, Texas and Olympia, Washington that represented significant improvements over the facilities being used at the time by other industrial equipment auctioneers. We have since constructed similar facilities in various locations in Canada, the United States, Mexico, Europe, Australia, Asia and the Middle East. We had 44 auction sites at the date of this discussion.

In March 1998, we completed an initial public offering of our common shares. Our common shares trade on the New York Stock Exchange and the Toronto Stock Exchange, under the ticker symbol “RBA”.

On May 15, 2012, we purchased AssetNation, an online marketplace and solutions provider for surplus and salvage assets based in the United States. Leveraging AssetNation’s technology and e-commerce expertise in January 2013 we launched our new online marketplace, Ritchie Bros. EquipmentOne. Ritchie Bros. EquipmentOne is a complementary solution to our flagship unreserved auction business, this marketplace will allow buyers and sellers to negotiate, complete and settle their transactions in a safe and transparent environment. We believe that EquipmentOne will help us meet the diverse and evolving preferences of a segment of the equipment market that we have not traditionally reached with our unreserved auctions.

INDUSTRY

We operate mainly in the auction segment of the global industrial equipment marketplace. Our primary target markets within that marketplace are the used equipment and truck sectors, which are large and fragmented. The supply of used trucks and equipment continues to grow, primarily as a result of the cumulative supply of used trucks and equipment, which is driven by the ongoing production of new trucks and equipment. We recently updated our analysis of the used equipment marketplace and estimate that the annual value of used equipment transactions, worldwide, is in excess of $200 billion. Of this total, only a fraction is currently traded through auctions, with the majority being sold directly by the owner or through truck and equipment dealers and brokers. Although we sell more used equipment than any other company in the world, our share of this fragmented market is small.

1-7

As we grow our business we intend to capitalize on a number of key characteristics of the global industrial equipment market:

Growth of the Auction Segment of the Industrial Equipment Market. We believe that auctions represent an increasingly popular distribution channel for industrial equipment for the following reasons:

| 1. | The ability of auctioneers to sell a wide range of equipment and related assets and therefore, offer a comprehensive and convenient service to buyers and sellers; |

| 2. | The increasing transparency of the international used equipment market due in large part to the depth of information now available and the ease of conducting commerce on the internet; |

| 3. | The increasing preference of sellers to access the auction marketplace to achieve a sale quickly and efficiently; and |

| 4. | The ability of auctioneers to deliver high net proceeds on the sale of equipment. |

Attractiveness of the Industrial Equipment Auction Market. In addition to the growth potential of the auction segment of the industrial equipment market, we believe that the following are attractive characteristics of the industrial equipment auction business:

| • | Many of the factors that prompt owners to sell equipment also create an environment in which equipment buyers opt for high quality used equipment rather than typically more expensive new equipment. In addition, much of the equipment that we sell can be used in multiple end markets and in diverse geographic locations; |

| • | Industrial equipment auctioneers are not restricted to selling lines of equipment provided by a particular manufacturer or manufactured for a particular industry, or to conducting sales in a particular geographic region; |

| • | Auction companies do not typically bear the risks associated with holding inventory over extended periods; |

| • | The industrial equipment auction industry is highly fragmented (and we are the largest participant in that industry); and |

Used industrial equipment is well-suited to the auction method of buying and selling because items of used equipment cannot be valued on a commodity basis – their value is dependent mainly on their condition. The transparency of the unreserved auction method gives buyers and sellers confidence that the equipment has traded at a fair market price.

COMPETITIVE ADVANTAGES

Our key strengths provide distinct competitive advantages and have enabled us to attract an increasing number of consignors and bidders to our auctions, allowing us to achieve significant and profitable growth over the long term. Our Gross Auction Proceeds have grown at a compound annual growth rate of 10.4% over the last 25 years, as illustrated below.

1-8

Reputation for Conducting Unreserved Auctions. We believe that our widely known commitment to fair dealing and the unreserved auction process is a key contributor to our growth and success. All of our auctions are unreserved, meaning that there are no minimum bids or reserve prices; each and every item is sold to the highest bidder on the day of the auction regardless of the price. Consignors are prohibited by contract from bidding on their own consigned items at the auction or in any way artificially affecting the auction results. Bidders at our auctions have confidence that if they are the high bidder on an item, then they are the buyer of that item, regardless of price. We believe that Ritchie Bros.’ reputation for conducting only unreserved auctions is a major reason why bidders are willing to commit the necessary time and effort to participate in our auctions, and we believe that the size and breadth of the resulting bidding audiences enable us generally to achieve higher prices than our competitors.

Ability to Transcend Local Market Conditions. We market each auction to a global customer base of potential bidders, through the use of digital media, print media and the internet. Because bidders are willing to travel between regions and countries to attend our auctions, and are able to participate over the internet if they are unable or choose not to attend in person, consignors have confidence that they will receive the world market price for their equipment. In recent periods, an average of approximately 55% of the value of equipment sold at any particular auction has left the region of the sale.

International Scope. We have substantial expertise in marketing, assembling and conducting auctions in international markets. We have conducted auctions in more than 20 countries and we regularly hold auctions in North America, Central America, Europe, Australia, Asia and the Middle East.

Extensive Network of Auction Sites. Our international network of auction sites is attractive to consignors of trucks and equipment with widely dispersed fleets and also to manufacturers wanting to access multiple regional markets. We believe that our network of auction sites has allowed us to achieve economies of scale by holding more frequent and larger auctions at our existing facilities, thereby taking advantage of our considerable operating capacity without incurring significant incremental costs. In addition, many of our auction sites are equipped with state of the art painting and refurbishing facilities which, together with purpose-built auction theatres and equipment display yards, allow us to deliver a uniquely high level of service to our customers. Our secure yards enable our bidders to inspect, test and compare assets available for sale at our auctions, and give them confidence that the assets on which they are bidding exist and will be in the same condition when they pick them up as they were when the purchased them. Our consignors take comfort knowing their assets are under our care, custody and control, and that we are looking after all details in connection with the auction, including load out by buyers.

1-9

Proprietary Databases. We maintain sophisticated databases containing information on several million pieces of equipment sold at auctions around the world, detailed information regarding new equipment prices and listings of stolen equipment. Together with our unique and comprehensive information about the flow of equipment coming to market, these databases help us to identify market trends and estimate equipment values.

We also maintain a proprietary customer information database containing detailed information on more than 560,000 unique customers from approximately 190 countries, including each customer’s auction attendance, trade association memberships, buying habits and other information. This database enables us to identify customers who might be interested in the equipment being sold at any particular auction.

Internet Services. We believe that our extensive internet presence and the tools available on our website are valuable to buyers and sellers of equipment and represent a distinct competitive advantage for Ritchie Bros. Our online bidding service has enhanced our ability to transcend local market conditions and offer international scope to equipment buyers and sellers. It has also increased the number of bidders participating in our auctions, which we believe has led to higher selling prices. We launched our online service in 2002 and in 2012 we sold over $1.3 billion of equipment to users of this service. In 2012, customers bidding in our live industrial auctions over the internet accounted for over 60% of total industrial auction registrations. Our internet bidding service gives our customers the choice of how they want to do business with us and access to the best of both worlds – live and online auction participation. The average number of registered bidders, both online and on-site, participating in our industrial auctions has increased 63% to 1,760 registered bidders from 1,080 bidders in 2001, prior to the implementation our online service.

In 2010 we launched our new 21-language website, with enhanced features such as high quality zoomable photos, watch lists and other valuable features. The website (www.rbauction.com) now enables customers to interact with us more easily, as well as search for and purchase the equipment they need, and we believe it is a powerful tool for attracting new non-English speaking customers. In total we had over 5.6 million unique visitors to our website in 2012, a 40% increase compared to the previous year.

In 2011 we launched our detailed equipment information, or DEI, program, in which we provide free of charge on our website to all customers much more detailed information and photos about the equipment to be sold at our auctions. We believe this program is allowing customers to shop with greater ease and bid with more confidence, and has made our auctions more appealing to a broader range of equipment owners.

Size and Financial Resources. In addition to being the world’s largest auctioneer of industrial equipment, we believe that we sell more used trucks and equipment than any other company, including non-auction companies such as manufacturers, dealers and brokers, making us the largest participant in this highly fragmented market. In addition to our strong market position, we have the financial resources to offer our consignors flexible contract options such as guarantee and outright purchase contracts, to invest in new technologies and services and to expand into new markets.

1-10

Dedicated and Experienced Workforce. Our sales and support team is a key part of our customer service effort. We had 1,414 full-time employees at December 31, 2012, including 305 sales representatives and 21 trainee territory managers. Our senior leadership team has extensive industry experience – the seven members of our senior leadership team have over 100 years of combined experience in the auction industry.

These competitive advantages have enabled us to hold successful auctions that are appealing to both buyers and consignors, as evidenced by the growth in the number of buyers and consignors participating in our auctions, set out in the graph below, and the resulting growth in our Gross Auction Proceeds.

We believe that our auctions generally draw a larger number of bidders than most other industrial equipment auctions. Also, the majority of the bidders at our auctions are end-users of equipment (typically retail buyers) rather than brokers or dealers (typically wholesale buyers). In recent periods, approximately 70% to 80% of our Gross Auction Proceeds went to end-users of equipment, such as contractors. Large end-user bidder audiences from diverse industries, including international bidders and internet bidders, enable us to deliver world market prices and transcend local market conditions. The ability to deliver high prices on the sale of trucks and equipment is a core part of our value proposition and helps to attract consignments, which attract larger bidder audiences in a self-reinforcing process that we believe has been working in our favor for over 50 years. We believe that this momentum, together with our reputation, size and financial resources, gives our customers confidence in our auction services, which contributes to our growth over the long term.

1-11

GROWTH STRATEGIES

Our mission is to provide compelling business solutions that enable the world’s builders to easily and confidently exchange equipment. Our customers are the people who buy and sell equipment and trucks to build our homes and offices, schools and community centers, bridges and roads, as well as the people who grow our food and those who support all of these activities, such as finance companies, rental companies, transportation companies and equipment dealers, among others. In 2010 Ritchie Bros adopted a new mission statement that transitioned us from strictly an auction company to a company that provides solutions for the exchange of equipment. This mission is supported by our three strategic pillars and our core values as outlined below:

Our three strategic pillars can be expanded upon as follows:

GROW

We believe unreserved public auctions offer significant benefits over other sales channels, including certainty of sale, fairness and transparency. We continue to focus on increasing our market share with our traditional customer groups, while simultaneously seeking to do more business with new customer groups and in new markets.

We believe that most of our near-term growth will come from our established regions, primarily the United States and Western Europe, and that emerging markets, such as China, Brazil and other developing countries offer significant potential for growth in the long-term.

In addition, we intend to continue to invest in our network of auction sites by adding or replacing existing auction sites as necessary to provide capacity for increased consignment volumes. Our auction site network supports our long-term growth and is a critical competitive advantage, which helps us to sustain efficient and scalable growth and give our customers confidence. We also intend to continue to hold offsite auctions in new regions to expand the scope of our operations.

Another key focus of this pillar is to streamline and simplify our auctions, to make them easy for our customers. Many of our new customers have little or no experience buying or selling at unreserved auctions; we want to make the process as easy and customer friendly as possible, so they feel confident on auction day and throughout the whole process.

Lastly, as a part of this strategic initiative we are pursuing opportunities to partner with our customers and potential customers by making strategic investments in various entities that we expect will generate equipment consignments to our auctions over the long term.

1-12

ADD

We intend to add new business and information solutions that will assist the world’s builders to easily and confidently exchange equipment.

Technology and innovation have played key roles in our business in the past, allowing us to enhance our auctions and broaden their appeal to more equipment owners. We will continue to investigate new services to meet the needs of equipment owners, and harness the latest technology to supplement and enhance our auction services.

We are investing in new solutions enhanced business intelligence and data analysis tools to improve our understanding of the equipment market, and position Ritchie Bros. as a knowledge and information authority. We intend to continue to enhance our website at www.rbauction.com by making it easier to use, more powerful and more valuable to equipment owners, with the goal of making it the preferred global equipment website.

We have also invested in new solutions for equipment owners whose needs may not be met by our unreserved auctions. Most significantly, on May 15, 2012, we purchased AssetNation, an online marketplace and solutions provider for surplus and salvage assets. We will leverage AssetNation’s technology and e-commerce expertise to develop new solutions that we believe will double our addressable market and help us meet the diverse and evolving preferences of a segment of the equipment market that we have not traditionally reached with our unreserved auctions. While we believe that the opportunity is significant we expect that it will take several years to have a material impact on our overall business results. We believe that we will be able to significantly leverage our Ritchie Bros. brand through this strategy and that this is a unique opportunity for our business.

PERFORM

To maintain our high standards of customer service we employ people who we believe embody our core values, especially the value of putting our customers first. In order to grow our business we believe that we must continue to build a high performance customer focused team, particularly our sales team.

Our primary focus areas in the coming years will be improving our sales force productivity and the efficiency of our auction operations, as well as further enhancing employee engagement and management bench strength. We are focused on developing future managers and we are taking steps to improve our ability to attract, develop and retain key employees.

1-13

OPERATIONS

During 2012 we conducted 221 unreserved industrial auctions at locations in North and Central America, Europe, the Middle East, and Australia. We also held 107 unreserved agricultural auctions in 2012. Although our auctions varied in size, the average Ritchie Bros. industrial auction in 2012 had the following characteristics:

| Gross Auction Proceeds | $16.5 million | |

| Bidder registrations |

1,760 | |

| Lots offered for sale |

1,300 | |

| Consignors |

190 |

Approximately 48% of our auction revenues were earned from operations in the United States (2011: 50%), 28% earned in Canada (2011: 25%) and 14% earned in Europe (2011: 13%). The remaining 10% was earned from operations primarily in Australia, the Middle East and Mexico (2011: 12%).

In 2012, approximately 90% of our Gross Auction Proceeds were attributable to auctions held at our permanent auction sites and regional auction sites (2011: 91%). Please see further discussion below under International Network of Auction Sites for a discussion of our properties.

The remaining 10% of our Gross Auction Proceeds in 2012 came from “off-site” auctions (2011: 9%), typically held on rented or consignor-owned land. The decision as to whether to hold a particular auction at one of our sites instead of at an off-site location is influenced by the nature, amount and location of the equipment to be sold. The majority of our agricultural auctions are held at off-site locations, usually on the consignor’s farm.

Our Gross Auction Proceeds and auction revenues are affected by the seasonal nature of the auction business. Our Gross Auction Proceeds and auction revenues tend to increase during the second and fourth calendar quarters, during which time we generally conduct more business than in the first and third calendar quarters.

Some of the key elements of our auction process include:

Attracting Bidders. We believe our proprietary customer database, which contains over 560,000 customer names from approximately 190 countries, significantly enhances our ability to market our auctions effectively. We typically send tens of thousands of print and digital direct marketing materials to strategically selected customers from our database as part of our comprehensive auction marketing service. We also conduct targeted regional and industry-specific advertising and marketing campaigns and use social media to generate awareness. In addition, we present information about the majority of the consigned equipment at upcoming auctions on our website so that potential bidders can review equipment descriptions and view photographs of many of the items to be sold. We had over 389,500 bidder registrations at our industrial auctions in 2012 compared to approximately 385,000 in 2011.

1-14

Attracting Equipment. We solicit equipment consignments ranging from single pieces of equipment consigned by local owner-operators to large equipment fleets offered by multi-national consortiums upon the completion of major construction projects. For larger consignments, our service typically begins with an equipment appraisal that gives the prospective consignor a credible estimate of the value of the appraised equipment. We believe that our consignors choose to sell their equipment at our auctions, rather than through other channels or other auctioneers, because they believe that selling at a Ritchie Bros. auction is the best way to maximize the net proceeds on the sale of their assets.

Our willingness to take consignment of a customer’s full equipment fleet, including ancillary assets such as inventories, parts, tools, attachments and construction materials, rather than only accepting selected items, is another valuable service that we offer to consignors that sets us apart from most of our competitors.

Attractive Contract Options. We offer consignors several contract options to meet their individual needs and sale objectives. These can include a straight commission contract, where the consignor receives the gross proceeds from the sale less a pre-negotiated commission rate, as well as alternate arrangements including guarantee contracts (where the consignor receives a guaranteed minimum amount plus an additional amount if proceeds exceed a specified level) or an outright purchase of the equipment by us for resale. We refer to guarantee and outright purchase contracts as our underwritten or at risk business. Our at risk business represented approximately 32% of our Gross Auction Proceeds in 2012.

When negotiating an at risk contract with a customer we consider a multitude of strategic factors, including, the timing of the deal in relation to a particular auction and its impact on attracting additional consignments, the type and condition of the equipment, the competitive environment, our ability to build our market share and the relationship with the customer. We have a rigorous approach to appraising and evaluating the items included in a potential at risk deal and have a well developed, strict internal approval process for entering into at risk contracts.

As we work with our customers to assist in their equipment transactions we will determine, in certain strategic cases to present proposals that include at risk contracts in order to build our business and position ourselves in the marketplace. In making the decision to strategically use an at risk proposal, we consider a multitude of factors, including, the size and the mix of the equipment in the proposal, the condition of the equipment, the timing of the contract in relation to a particular auction and its impact on attracting additional consignments, the competitive environment, our ability to build our market share and the relationship with the customer. We have a rigorous approach to appraising and evaluating the items included in a potential at risk deal and have a well developed, strict internal approval process for entering into at risk contracts.

Due to the multiple strategic factors which motivate us to enter into at risk contracts, on an annual basis the performance of our at risk business may be below that of our straight commission business. Consistent with this, in four of the past five years the performance of our at risk business has performed below our straight commission while our overall Auction Revenue Rate has remained within our expected range.

The mix of contracts in a particular quarter or year fluctuates and is not necessarily indicative of the mix in future periods. The composition of our auction commissions and our Auction Revenue Rate are affected by the mix and performance of contracts entered into with consignors in the particular period and fluctuates from period to period.

1-15

Value-Added Services. We provide a wide array of services to make the auction process convenient for buyers and sellers of equipment. Examples of these services include:

| • | conducting title searches, where registries are commercially available, to ensure equipment is sold free and clear of all liens and encumbrances (if we are not able to deliver clear title, we provide a full refund up to the purchase price to the buyer); |

| • | making equipment available for inspection, testing and comparison by prospective buyers; |

| • | displaying high quality, zoomable photographs of equipment on our website; |

| • | providing free detailed equipment information on our website for most equipment; |

| • | providing financing services, as well as insurance and powertrain warranty products; |

| • | providing access at our auctions to transportation companies, customs brokerages and other service providers, and online through our partner, uShip; |

| • | providing facilities for on-site cleaning, painting and refurbishment of equipment; and |

| • | handling all pre-auction marketing, as well as collection and disbursement of proceeds. |

MARKETING AND SALES

At December 31, 2012, we employed 305 sales representatives and 21 trainee territory managers (2011: 294 and 16, respectively). These representatives are deployed by geographic region around the world. Each sales representative is primarily responsible for the development of customer relationships and sourcing consignments in the representative’s territory. Sales representatives are also involved in the appraisal and proposal presentation process. To encourage global teamwork and superior customer service, none of our employees is paid on a commission basis. All members of our sales force are compensated primarily by a combination of base salary and incentive bonus.

To support our sales representatives, we follow a dual marketing strategy, promoting Ritchie Bros. and the unreserved auction process in general, as well as marketing specific auctions. This dual strategy is designed to attract both consignors and bidders to our auctions. Our advertising and promotional efforts include the use of trade journals and magazines and attendance at numerous trade shows held around the world. We also participate in international, national and local trade associations. Digital marketing, social media and our rbauction.com website are other important components of our marketing effort. During 2012, we had over 5.6 million unique visitors to our website and more than 12.9 million visits in total, both of which increased significantly compared to 2011.

In addition to regional marketing through our sales representatives, we market through our national accounts team to large multi-national customers, including rental companies, manufacturers and finance companies, who have equipment disposition requirements in various regions and countries and can therefore benefit from our international network of auction sites.

1-16

INTERNATIONAL NETWORK OF AUCTION SITES

We generally attempt to establish our auction sites in industrial areas close to major cities. Although we lease some auction sites, we prefer to purchase land and construct purpose-built facilities once we have established a base of business and determined that a region can generate sufficient financial returns to justify the investment. We generally do not construct a permanent auction site in a particular region until we have conducted a number of offsite sales in the area, and often we will operate from a regional auction site for several years before considering a more permanent investment. This process allows us to establish our business and evaluate the market potential before we make a significant investment. We will not invest in a permanent auction site unless we believe there is an opportunity for significant, profitable growth in a particular region. Our average expenditure on a permanent auction site has been in the range of $20 to $25 million in recent years, including land, improvements and buildings.

We currently have 44 locations in our auction site network. A permanent auction site includes locations that we own and on which we have constructed an auction theatre and other facilities (e.g. refurbishment), and that we lease with an original term longer than three years and on which we have built permanent structures with an investment of more than $1.5 million. We currently have 39 permanent auction sites as of the date of this discussion.

A regional auction site is a location that we lease on a term longer than one year, have limited investment in facilities (i.e. less than $1.5 million) and on which we average more than two auctions per year on a rolling two year basis and have at least two full time staff. This category also includes sites located on land that we own with limited investment in facilities. We currently have five regional auction sites as of the date of this discussion.

1-17

Our auction site network as of the date of this discussion is as follows:

Permanent Auction Sites:

| Size (Acres) | Year Placed in Service |

|||||||

| Canada |

||||||||

| Edmonton, Alberta |

125 | 2002 | ||||||

| Toronto, Ontario |

63 | 1998 | ||||||

| Saskatoon, Saskatchewan |

62 | 2006 | ||||||

| Prince George, British Columbia |

60 | 2003 | ||||||

| Grande Prairie, Alberta |

60 | 2009 | ||||||

| Montreal, Quebec |

60 | 2000 | ||||||

| Halifax, Nova Scotia |

28 | 1997 | ||||||

| Vancouver, British Columbia |

24 | 2010 | ||||||

| Regina, Saskatchewan |

22 | 2007 | ||||||

| United States |

||||||||

| Orlando, Florida |

182 | 2002 | ||||||

| Fort Worth, Texas |

113 | 1994 | ||||||

| Columbus, Ohio |

95 | 2007 | ||||||

| Sacramento, California |

90 | 2005 | ||||||

| Houston, Texas |

90 | 2009 | ||||||

| North East, Maryland |

85 | 2001 | ||||||

| Chehalis, Washington |

100 | 2012 | ||||||

| Nashville, Tennessee |

76 | 2006 | ||||||

| Las Vegas, Nevada |

75 | 2007 | ||||||

| Denver, Colorado |

70 | 2007 | ||||||

| Minneapolis, Minnesota |

70 | 2009 | ||||||

| Atlanta, Georgia |

64 | 1996 | ||||||

| St Louis, Missouri |

63 | 2010 | ||||||

| Los Angeles, California |

59 | 2000 | ||||||

| Chicago, Illinois |

51 | 2000 | ||||||

| Phoenix, Arizona |

48 | 2002 | ||||||

| Kansas City, Missouri |

40 | 2007 | ||||||

| Raleigh-Durham, North Carolina |

45 | 2012 | ||||||

| Salt Lake City, Utah |

37 | 2010 | ||||||

| Albuquerque, New Mexico |

11 | 1999 | ||||||

| Other Countries |

||||||||

| Moerdijk, The Netherlands |

62 | 1999 | ||||||

| Mexico City (Polotitlan), Mexico |

60 | 2009 | ||||||

| Madrid (Ocaña), Spain |

60 | 2010 | ||||||

| Melbourne (Geelong), Australia |

40 | 2013 | ||||||

| Paris (St. Aubin sur Gaillon), France |

50 | 2008 | ||||||

| Milan (Caorso), Italy |

50 | 2010 | ||||||

| Dubai, United Arab Emirates |

44 | 2005 | ||||||

| Brisbane, Australia |

42 | 1999 | ||||||

| Meppen, Germany |

41 | 2010 | ||||||

| Tokyo (Narita), Japan |

17 | 2010 | ||||||

| Regional Auction Sites: |

||||||||

| Moncofa, Spain |

Hartford, Connecticut | |||||||

| Tipton, California |

|

Donington Park, United Kingdom |

| |||||

| Beijing, China |

||||||||

1-18

We also have a collection of developing auction sites, which are locations that we rent on a term less than two years and on which we have had more than two auctions in a rolling two year period (updated annually), or lease on a term longer than two years but do not have any full time staff on site. Examples of this type of site include Istanbul, Turkey and Torreon, Mexico. We do not include these sites in our auction site network definition, which includes only permanent and regional auction sites.

In the mid-2012, we completed the sale of our former Olympia, Washington permanent auction site and replaced it with our new Chehalis, Washington permanent auction site. Additionally, we replaced our former Statesville, North Carolina, permanent auction site with our new Raleigh-Durham, North Carolina permanent auction site which began operations in September 2012.

At many of our auction sites we own additional property that is available for future expansion or sale. We also own land in other areas not listed or described above that may be available for future expansion or sale. Examples of this include land held for future expansion near Phoenix, Arizona and Tulare, California.

COMPETITION

Both the global used industrial equipment market and the auction segment of that market are highly fragmented. We compete for potential purchasers and sellers of industrial equipment with other auction companies and with non-auction competitors such as equipment manufacturers, distributors and dealers, and equipment rental companies. When sourcing equipment to sell at our auctions, we compete with other auction companies, dealers and brokers, and equipment owners who have traditionally disposed of equipment through private sales.

GOVERNMENTAL AND ENVIRONMENTAL REGULATIONS

Our operations are subject to a variety of federal, provincial, state and local laws, rules and regulations throughout the world relating to, among other things, the auction business, imports and exports of equipment, worker health and safety, privacy of customer information and the use, storage, discharge and disposal of environmentally sensitive materials. In addition, our development or expansion of auction sites depends upon the receipt of required licenses, permits and other governmental authorizations, and we are subject to various local zoning requirements with regard to the location of our auction sites, which vary among jurisdictions.

Under some of the laws regulating the use, storage, discharge and disposal of environmentally sensitive materials, an owner or lessee of, or other person involved in, real estate may be liable for the costs of removal or remediation of certain hazardous or toxic substances located on or in, or emanating from, such property, as well as related costs of investigation and property damage. These laws often impose liability without regard to whether the owner or lessee or other person knew of, or was responsible for, the presence of such hazardous or toxic substances.

We typically obtain Phase I environmental assessment reports prepared by independent environmental consultants in connection with our site acquisitions and leases. A Phase I assessment consists of a site visit, historical record review, interviews and reports, with the purpose of identifying potential environmental conditions associated with the subject property. There can be no assurance, however, that acquired or leased sites have been operated in compliance with environmental laws and regulations or that future uses or conditions will not result in the imposition of environmental liability upon us or expose us to third-party actions such as tort suits. Although we have insurance to protect us from such liability, there can also be no assurance that it will cover any or all potential losses.

1-19

There are restrictions in the United States and Europe that may affect the ability of equipment owners to transport certain equipment between specified jurisdictions. One example of these restrictions is environmental certification requirements in the United States, which prevent non-certified equipment from being entered into commerce in the U.S. In addition, engine emission standards in some jurisdictions limit the operation of certain trucks and equipment in those markets. We expect these emission standards to be implemented in additional jurisdictions or to be strengthened in existing jurisdictions in the future.

We are committed to contributing to the protection of the natural environment by preventing and reducing adverse impacts of our operations. As part of our commitment, we aim to:

| • | empower our employees to identify and address environmental issues; |

| • | consider environmental impacts as part of all business decisions; |

| • | conduct business in compliance with applicable regulations and legislation, and where appropriate, adopt the most stringent standards as our global benchmark; |

| • | use resources wisely and efficiently to minimize our environmental impact; |

| • | communicate transparently with our stakeholders about environmental matters; |

| • | conduct ongoing assessments to ensure compliance and good stewardship; and |

| • | hold management accountable for providing leadership on environmental matters, achieving targets and providing education to employees. |

We believe that by following these principles, we will be able to achieve our objective to be in compliance with applicable environmental laws and make a positive contribution to the protection of the natural environment.

We believe that we are in compliance in all material respects with all laws, rules, regulations and requirements that affect our business, and that compliance with such laws, rules, regulations and requirements does not impose a material impediment on our ability to conduct our business.

RISK FACTORS

Disclosure relating to risk factors concerning us and our business is included under “Risk Factors” in our Management’s Discussion and Analysis of Financial Condition and Results of Operations for the year ended December 31, 2012, which has been filed on SEDAR at www.sedar.com, and is incorporated in this document by reference.

DIVIDENDS

We currently pay a regular quarterly cash dividend of $0.1225 per common share. We currently intend to continue to declare and pay a regular quarterly cash dividend on our common shares. However, any decision to declare and pay dividends in the future will be made at the discretion of our Board of Directors, after taking into account our operating results, financial condition, cash requirements, financing agreement restrictions and other factors our Board of Directors may deem relevant. In 2012, we paid total cash dividends of $0.47 per common share, compared to $0.44 per share in 2011 and $0.41 per share in 2010.

Because Ritchie Bros. Auctioneers Incorporated is a holding company with no material assets other than the shares of its subsidiaries, our ability to pay dividends on our common shares depends on the income and cash flow of our subsidiaries. No financing agreements to which our subsidiaries are party currently restrict those subsidiaries from paying dividends.

1-20

Pursuant to income tax legislation, Canadian resident individuals who receive “eligible dividends” in 2006 and subsequent years will be entitled to an enhanced gross-up and dividend tax credit on such dividends. All dividends that we pay are “eligible dividends” unless indicated otherwise.

CAPITAL STRUCTURE

We have the following shares authorized for issuance and issued and outstanding as of February 24, 2013:

| Number | Number Issued | |||||

| Description |

Authorized | and Outstanding | ||||

| Common shares, without par value |

Unlimited | 106,637,761 | ||||

| Senior preferred shares, without par value, issuable in series |

Unlimited | None | ||||

| Junior preferred shares, without par value, issuable in series |

Unlimited | None | ||||

Our Board of Directors is authorized to determine the designations, rights and restrictions to be attached to the Senior preferred shares and Junior preferred shares (together, the “preferred shares”) upon issuance. No preferred shares have been issued.

Holders of our common shares are entitled to one vote for each share held on all matters submitted to a vote of shareholders. Subject to preferences that may be applicable to any preferred shares outstanding at the time, holders of common shares are entitled to receive ratably any dividends as may be declared from time to time by our Board of Directors out of funds legally available for dividends. Please read the “Dividends” section above. In the event of a liquidation, dissolution or winding up, holders of common shares are entitled to share ratably in all assets of the Company remaining after payment of liabilities and any liquidation preferences of any outstanding preferred shares.

We have adopted a Shareholder Rights Plan, the purpose of which is to discourage discriminatory or unfair take-over offers for our company and to provide our Board of Directors with time, if appropriate, to pursue alternatives to maximize shareholder value in the event of an unsolicited takeover bid for our company

MARKET FOR SECURITIES

Our common shares are listed for trading on the New York Stock Exchange, or the NYSE, and on the Toronto Stock Exchange, or the TSX, in each case under the ticker symbol “RBA”. The closing price of our common shares on February 24, 2013 on the NYSE was $22.50 and on the TSX was CA$22.98.

1-21

Our trading volumes and price ranges on the NYSE and the TSX for the year ended December 31, 2012 were as follows:

| NYSE (US$) | TSX (CA$) | |||||||||||||||||||||||||||||||

| Date |

High Price | Low Price | Closing Price | Total Volume | High Price | Low Price | Closing Price | Total Volume | ||||||||||||||||||||||||

| December 2012 |

22.95 | 20.52 | 20.89 | 9,391,300 | 22.71 | 20.42 | 20.75 | 2,023,600 | ||||||||||||||||||||||||

| November 2012 |

22.92 | 20.50 | 22.91 | 9,970,000 | 22.76 | 20.55 | 22.72 | 1,732,900 | ||||||||||||||||||||||||

| October 2012 |

23.57 | 19.01 | 22.49 | 12,839,400 | 23.53 | 18.80 | 22.15 | 1,621,600 | ||||||||||||||||||||||||

| September 2012 |

20.41 | 18.20 | 19.23 | 13,155,900 | 20.06 | 18.05 | 18.91 | 1,801,400 | ||||||||||||||||||||||||

| August 2012 |

21.30 | 17.81 | 18.66 | 19,358,100 | 21.34 | 17.84 | 18.37 | 2,491,400 | ||||||||||||||||||||||||

| July 2012 |

22.42 | 20.02 | 21.07 | 7,738,800 | 22.76 | 20.41 | 21.21 | 1,352,300 | ||||||||||||||||||||||||

| June 2012 |

21.42 | 18.83 | 21.25 | 8,546,300 | 21.82 | 19.59 | 21.82 | 1,369,000 | ||||||||||||||||||||||||

| May 2012 |

21.87 | 19.25 | 19.82 | 10,823,900 | 21.99 | 19.64 | 20.37 | 2,059,100 | ||||||||||||||||||||||||

| April 2012 |

23.88 | 20.05 | 21.13 | 9,210,300 | 23.69 | 19.84 | 20.90 | 2,116,300 | ||||||||||||||||||||||||

| Mar 2012 |

24.61 | 22.93 | 23.76 | 6,894,000 | 24.27 | 22.96 | 23.76 | 1,702,600 | ||||||||||||||||||||||||

| February 2012 |

26.00 | 23.36 | 24.42 | 10,824,900 | 25.88 | 23.28 | 24.14 | 3,489,700 | ||||||||||||||||||||||||

| January 2012 |

24.25 | 20.90 | 23.55 | 5,729,600 | 24.41 | 21.26 | 23.63 | 1,401,600 | ||||||||||||||||||||||||

DIRECTORS AND EXECUTIVE OFFICERS

Under our Articles of Amalgamation, our number of directors is set at a minimum of three and a maximum of ten and the directors are authorized to determine the actual number of directors to be elected from time to time. We currently have seven directors. Each of our directors is elected annually and holds office until our next annual meeting of shareholders unless he or she ceases to hold office before that date. Information concerning our directors is as follows:

1-22

Directors

| Name and Municipality of Residence |

Position with the Company |

Principal Occupation or Employment (1) |

Previous Service as a Director | |||

| Robert W. Murdoch(2) | Chairman of the Board | Businessman | Director since | |||

| Salt Spring Island, | and a Director | February 20, 2006 | ||||

| B.C., Canada | ||||||

| Peter J. Blake | Chief Executive | Chief Executive Officer of | Director since | |||

| Vancouver, B.C., | Officer and a Director | the Company | December 12, | |||

| Canada | 1997 | |||||

| Eric Patel(2)(3) | Director | Businessman | Director since | |||

| Vancouver, B.C., | April 16, 2004 | |||||

| Canada | ||||||

| Beverley A. Briscoe(2)(3) | Director | Owner and President of | Director since | |||

| Vancouver, B.C., | Briscoe Management Ltd. | October 29, 20041 | ||||

| Canada | ||||||

| Edward B. Pitoniak(3)(4) | Director | Businessman | Director since | |||

| Exeter, RI, | July 28, 2006 | |||||

| USA | ||||||

| Christopher Zimmerman(4) | Director | President, Easton Sports, Inc. | Director since | |||

| Manhattan Beach, CA, | April 11, 2008 | |||||

| USA, | ||||||

| Robert G. Elton(3)(4) | Director | Businessman | Director since | |||

| Vancouver, B.C., | April 25, 2012 | |||||

| Canada | ||||||

| (1) | This information has been provided by the respective director as of February 26, 2013. |

| (2) | Our Board of Directors has a nominating and corporate governance committee comprised of Messrs. Patel (Chair), Murdoch and Ms. Briscoe. |

| (3) | Our Board of Directors has an audit committee comprised of Ms. Briscoe (Chair) and Messrs. Patel, Pitoniak, and Elton. |

| (4) | Our Board of Directors has a compensation committee comprised of Messrs. Pitoniak (Chair), Zimmerman and Elton. |

We do not have a Lead Director because our Chairman, Robert W. Murdoch, is an independent director and fulfills this role. Mr. Murdoch can be reached at (778) 331-5300 or by email at rmurdoch@rbauction.com.

1-23

Executive Officers

As of February 26, 2013, the following Executive Officers have been appointed by our Board of Directors:

| Name and Municipality of Residence |

Position with the Company | |

| Peter J. Blake | Chief Executive Officer | |

| Vancouver, B.C., Canada | ||

| Robert K. Mackay | President | |

| Delta, B.C., Canada | ||

| Robert S. Armstrong | Chief Strategic Development Officer | |

| New Westminster, B.C., Canada | ||

| Robert A. McLeod | Chief Financial Officer | |

| Vancouver, B.C., Canada | ||

| Steven C. Simpson | Chief Sales Officer | |

| Surrey, B.C., Canada | ||

| Andrew Muller | Chief People Officer | |

| North Vancouver, B.C. Canada | ||

| Kenton H. Low | Chief Marketing Officer | |

| Vancouver, B.C. Canada | ||

| Darren Watt | Corporate Secretary | |

| Vancouver, B.C., Canada |

||

As of February 26, 2013, our directors and executive officers as a group beneficially owned, directly or indirectly, or exercised control or direction over, approximately 1% of our issued and outstanding common shares.

AUDIT COMMITTEE INFORMATION

Our Audit Committee primarily assists our Board of Directors in overseeing:

| • | the integrity of our financial statements; |

| • | our compliance with legal and regulatory requirements; |

| • | the independent auditor’s qualifications and independence; and |

| • | the performance of our internal audit function and independent auditor. |

In particular, our Audit Committee’s role includes, among other things, ensuring that management properly develops and adheres to a sound system of disclosure controls and procedures and internal controls. The full text of our Audit Committee charter, which complies with NYSE and TSX rules and applicable securities laws, is available on our website, www.rbauction.com.

1-24

As of February 26, 2012, the Audit Committee of our Board of Directors was composed of the following members:

| Member |

Independent | Financially Literate |

Relevant Education and Experience | |||

| Beverley |

Yes | Yes | Current employment: | |||

| A. Briscoe |

• Owner and president — Briscoe Management Ltd. | |||||

| (Chair) |

Past employment: | |||||

| • President and owner — Hiway Refrigeration Limited – 1997 to 2004 | ||||||

| • Vice President and General Manager — Wajax Industries Limited. | ||||||

| • Chief Financial Officer — Rivtow Group of Companies | ||||||

| • Various executive positions — several operating divisions of The Jim Pattison Group | ||||||

| • Audit Manager — Coopers & Lybrand | ||||||

| Other board membership: | ||||||

| • Director, Chair of the Audit Committee and member of the Governance and Nominating Committee and the Environmental Health and Safety Committee, Goldcorp Inc. (TSX: G), and director of several non-public companies | ||||||

| Education: | ||||||

| • Fellow of the Institute of Chartered Accountants | ||||||

| • Bachelor of Commerce degree from the University of British Columbia | ||||||

| Eric Patel |

Yes | Yes | Current employment: | |||

| • Business consultant and corporate director | ||||||

| Past employment: | ||||||

| • Chief Financial Officer — Pembrook Mining Corp., a private mining company | ||||||

| • Chief Financial Officer — Crystal Decisions, Inc., a privately held software company – 1999 to 2004 | ||||||

| • Executive positions, including CFO — University Games, Inc., a privately held manufacturer of educational toys and games – 1997 to 1999 | ||||||

| • Director of Strategy — Dreyer’s Grand Ice Cream | ||||||

| • Strategy consultant — Marakon Associates | ||||||

| Other board membership: | ||||||

| • Advisory Board Chair, ACL Services Ltd., a private software company | ||||||

| • Director, Daiya Food Inc., a private food company | ||||||

| Education: | ||||||

| • MBA degree from Stanford University | ||||||

1-25

| Member |

Independent | Financially Literate |

Relevant Education and Experience | |||

| Edward B. |

Yes | Yes | Current employment: | |||

| Pitoniak |

• Corporate director | |||||

| Past employment: | ||||||

| • Various positions, including President, CEO and Director, with CHIP REIT – 2004 to 2009 | ||||||

| • Senior Vice-President at Intrawest Corporation – 1996 to 2004 | ||||||

| • Editor-in-chief and Advertising Director, with Times Mirror Magazines | ||||||

| Other board membership: | ||||||

| • Director, Chair of Investment & Environmental Committee, and Member, Audit Committee, Regal Lifestyle Communities (TSX: “RLG”) | ||||||

| Education: | ||||||

| • Bachelor of Arts degree from Amherst College | ||||||

| Robert G. |

Yes | Yes | Current employment: | |||

| Elton |

• Interim Chief Financial Officer – Vancouver City Savings Credit Union | |||||

| • Adjunct Professor – Sauder School of Business, University of British Columbia | ||||||

| Past employment: | ||||||

| • Various positions, including President and Chief Executive Officer, with BC Hydro – 2001 – 2009 | ||||||

| • Chief Financial Officer, Eldorado Gold Corporation – 1996 – 2001 | ||||||

| • Partner, PricewaterhouseCoopers | ||||||

| Other board membership: | ||||||

| • Director, Aquatic Informatics Inc., a private software company | ||||||

| • Chair, Business Advisory Board, Nurse Next Door | ||||||

| Education: | ||||||

| • Fellow of the Institute of Chartered Accountants | ||||||

| • Master of Arts from Cambridge University | ||||||

In fulfilling its responsibilities, our Audit Committee held regular meetings in 2012 with our external auditors and with our management. In these meetings, the Audit Committee discussed with management and the external auditors, among other things, the quality and acceptability of accounting principles and significant transactions or issues encountered during the period. In addition, our Audit Committee met with our external auditors independent of our management to provide for independent and confidential assessment of our management and our internal controls as they relate to the quality and reliability of our financial statements.

In addition to retaining KPMG LLP to audit our consolidated financial statements for the year ended December 31, 2012, we retained KPMG LLP to provide various non-audit services in 2012. The aggregate fees billed for professional services by KPMG LLP and its affiliates during 2012 and 2011 were as follows:

1-26

| Fiscal 2012 | Fiscal 2011 | |||||||

| Audit Fees |

$ | 1,311,200 | $ | 1,228,200 | ||||

| Audit-Related Fees |

— | 29,400 | ||||||

| Tax Fees |

275,800 | 630,900 | ||||||

| All Other Fees |

— | — | ||||||

|

|

|

|

|

|||||

| Total Fees |

$ | 1,587,000 | $ | 1,888,500 | ||||

|

|

|

|

|

|||||

The nature of each category of fees is as follows:

Audit Fees:

Audit fees were paid for professional services rendered by the auditors for the audit and interim reviews of our consolidated financial statements or services provided in connection with statutory and regulatory filings or engagements.

Audit-Related Fees:

Audit-related fees were paid for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements and are not reported under the Audit Fees item above.

Tax Fees:

Tax fees were paid for tax compliance, tax advice and tax planning professional services. These services consisted of: tax compliance, including the review of original and amended tax returns; assistance with questions regarding tax audits; assistance in completing routine tax schedules and calculations; and tax planning and advisory services relating to common forms of domestic and international taxation (i.e., income tax, capital tax, Goods and Services Tax and Value Added Tax).

Pre-Approval Policies and Procedures:

The Audit Committee has considered whether the provision of services other than audit services is compatible with maintaining auditors’ independence and has adopted a policy governing the provision of these services. This policy requires the pre-approval by the Audit Committee of all audit and non-audit services provided by the external auditor, other than any de minimus non-audit services allowed by applicable law or regulation. The policy outlines the procedures and the conditions pursuant to which permissible services proposed to be performed by KPMG LLP are pre-approved, provides a general pre-approval for certain permissible services and for subsequent reporting to the Audit Committee, and outlines a list of prohibited services.

All requests for KPMG LLP to provide services that do not require specific approval by the Audit Committee are reported to and documented by our Chief Financial Officer. If the proposed services are not covered by a pre-approval and the estimated fees for the proposed engagement are more than CA$5,000, the engagement of KPMG LLP to provide such services requires specific approval by the Audit Committee. Any proposed engagement to provide services that requires specific approval by the Audit Committee pursuant to the terms of the policy is submitted to the Chief Financial Officer for presentation to the Audit Committee for its consideration.

Additional information regarding our corporate governance practices is included in our Information Circular for our 2013 Annual Meeting of Shareholders and on our website.

1-27

LEGAL AND REGULATORY ACTIONS

From time to time we have been, and expect to continue to be, subject to legal proceedings and claims in the ordinary course of our business. Such claims, even if lacking merit, could result in the expenditure of significant financial and managerial resources. We are not aware of any legal proceedings or claims that we believe will have, individually or in the aggregate, a material adverse effect on us or on our financial condition or results of operation or that involve a claim for damages, excluding interest and costs that could be material.

CODE OF ETHICS

We have adopted a Code of Business Conduct and Ethics (the Code of Conduct) that applies to all of our employees, officers and directors. Our Code of Conduct includes, among other things, written standards for our principal executive officer, principal financial officer and principal accounting officer that are required by the U.S. Securities and Exchange Commission (or SEC) for a code of ethics applicable to such officers. Our Code of Conduct is available on our internet website, www.rbauction.com. We intend to disclose on our website within five days thereof, any amendment or waiver of the code of ethics portion of our Code of Conduct applicable to these officers that is required by SEC rules or regulations to be disclosed publicly, and to keep such disclosure available on our website for at least a 12-month period.

TRANSFER AGENT

Our transfer agent for our common shares in Canada is Computershare Trust Company of Canada. The register of transfers of our common shares maintained by Computershare is located at their offices in Vancouver, British Columbia, Canada and Toronto, Ontario, Canada.

INTERESTS OF EXPERTS

Our consolidated financial statements for the years ended December 31, 2012 and 2011 have been audited by KPMG LLP, Chartered Accountants, our external auditors.

ADDITIONAL INFORMATION

Additional information, including our directors’ and officers’ remuneration and indebtedness to us, principal holders of our securities and securities authorized for issuance under equity compensation plans, where applicable, is contained in our Information Circular for our most recent annual meeting of shareholders that involved the election of directors.

Additional financial information is provided in our consolidated financial statements and our management’s discussion and analysis of financial condition and results of operations for our most recently completed financial year. This and other information about our company can be found on the SEDAR website at www.sedar.com. None of the information on the SEDAR website is incorporated by reference into this document by this or any other reference, unless otherwise specified.

Copies of these documents may be obtained upon request from our Corporate Secretary, 9500 Glenlyon Parkway, British Columbia, V5J 0C6 (telephone number: (778) 331-5500).

1-28