Canada | | | 7389 | | | 98-0626225 |

(State or other jurisdiction of incorporation or organization) | | | (Primary Standard Industrial Classification Code Number) | | | (I.R.S. Employer Identification Number) |

Stuart M. Cable Lisa R. Haddad Mark S. Opper Jean A. Lee Goodwin Procter LLP 100 Northern Avenue Boston, MA 02210 (617) 570-1000 | | | John Kett Sidney Peryar IAA, Inc. Two Westbrook Corporate Center, Suite 500 Westchester, IL 60154 (708) 492-7000 | | | Jamie Leigh John-Paul Motley Ian Nussbaum Bill Roegge Cooley LLP 3 Embarcadero Center 20th Floor San Francisco, CA 94111-4004 (415) 693-2000 |

Large accelerated filer | | | ☒ | | | Accelerated filer | | | ☐ |

Non-accelerated filer | | | ☐ | | | Smaller reporting company | | | ☐ |

| | | | | Emerging growth company | | | ☐ |

| | |  |

Ann Fandozzi | | |  John W. Kett |

Chief Executive Officer | | | President and Chief Executive Officer |

Ritchie Bros. Auctioneers Incorporated | | | IAA, Inc. |

1. | to approve the issuance of common shares of RBA (the “RBA common shares”) to securityholders of IAA, Inc., a Delaware corporation (“IAA”), in connection with the Agreement and Plan of Merger and Reorganization, dated as of November 7, 2022 (as amended or otherwise modified prior to January 22, 2023, the “original merger agreement”), as amended by that certain Amendment to the Agreement and Plan of Merger and Reorganization, dated as of January 22, 2023 (such amendment, the “merger agreement amendment” and, together with the original merger agreement, as it may be further amended or modified from time to time, the “merger agreement”), by and among RBA, Ritchie Bros. Holdings, Inc., a Washington corporation and a direct and indirect wholly owned subsidiary of RBA (“US Holdings”), Impala Merger Sub I, LLC, a Delaware limited liability company and a direct wholly owned subsidiary of US Holdings, Impala Merger Sub II, LLC, a Delaware limited liability company and a direct wholly owned subsidiary of US Holdings, and IAA, which issuance is referred to as the “RBA share issuance” and which proposal is referred to as the “RBA share issuance proposal”; and |

2. | to approve the adjournment of the RBA special meeting, if necessary or appropriate, to solicit additional proxies if there are insufficient votes at the time of the RBA special meeting to approve the RBA share issuance proposal, which proposal is referred to as the “RBA adjournment proposal.” |

| | | | | Registered Shareholders | | | Beneficial Shareholders | ||

| | | | | | | ||||

| | | | | Common Shares held in own name and represented by a physical certificate or DRS. | | | Common Shares held with a broker, bank or other intermediary. | ||

| | | Internet | | | www.investorvote.com | | | www.proxyvote.com | |

| | | | | | | ||||

| | | Telephone | | | 1-866-732-8683 | | | Call the applicable number listed on the voting instruction form. | |

| | | | | | | ||||

| | | Mail | | | Return the form of proxy in the enclosed postage paid envelope. | | | Return the voting instruction form in the enclosed postage paid envelope. |

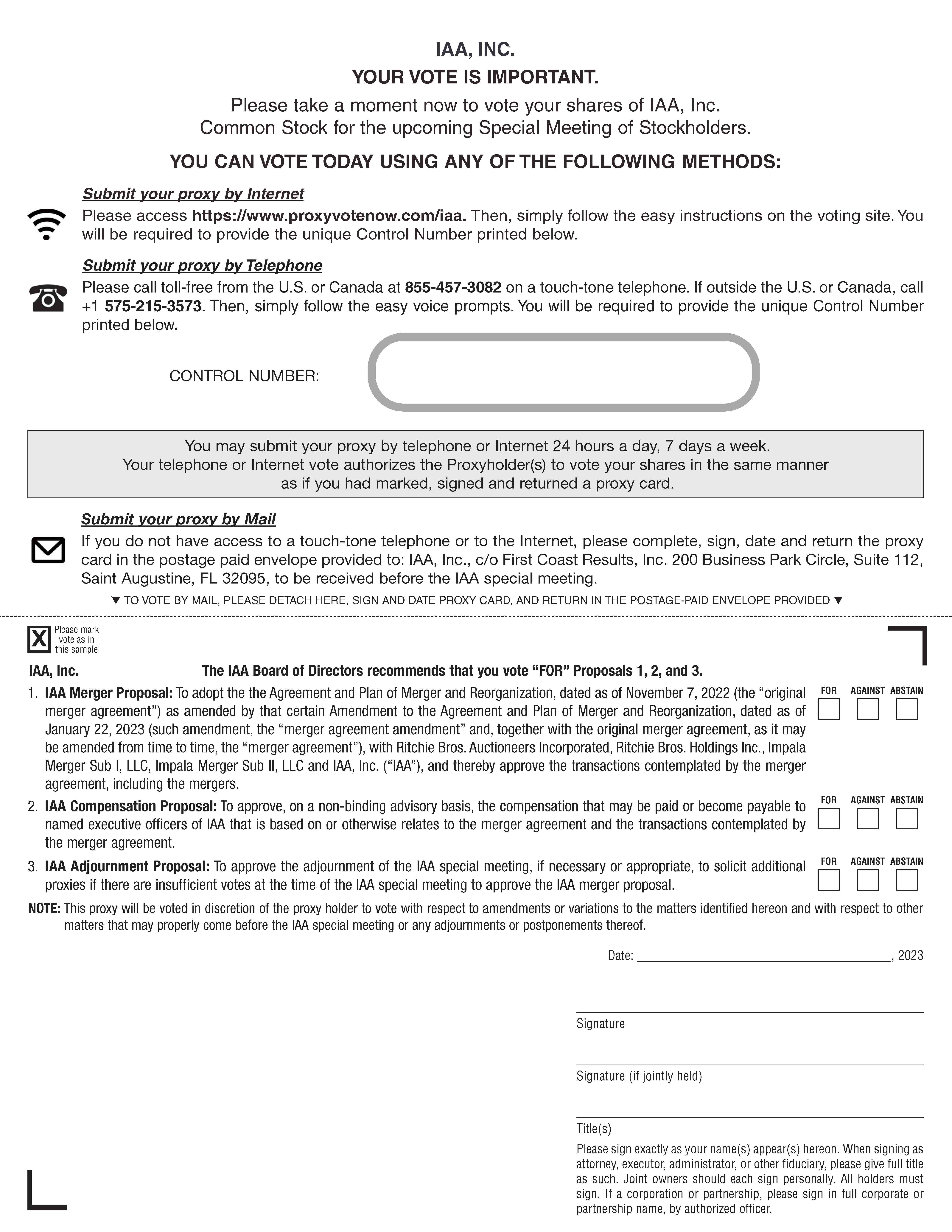

1. | to adopt the merger agreement (as amended or modified) and thereby approve the transactions contemplated by the merger agreement, including the mergers (the “IAA merger proposal”); |

2. | to approve, on a non-binding advisory basis, the compensation that may be paid or become payable to named executive officers of IAA that is based on or otherwise relates to the merger agreement (as amended or modified) and the transactions contemplated by the merger agreement (as amended or modified) (the “IAA compensation proposal”); and |

3. | to approve the adjournment of the IAA special meeting, if necessary or appropriate, to solicit additional proxies if there are insufficient votes at the time of the IAA special meeting to approve the IAA merger proposal (the “IAA adjournment proposal”). |

• | “FOR” the IAA merger proposal; |

• | “FOR” the IAA compensation proposal; and |

• | “FOR” the IAA adjournment proposal. |

| | |  | | |  | | |  | |

| | | John P. Larson Chairman of the Board IAA, Inc. | | | John W. Kett Chief Executive Officer and President IAA, Inc. | | | Sidney Peryar Executive Vice President, Chief Legal Officer & Secretary IAA, Inc. |

For RBA shareholders: | | | For IAA stockholders: |

| | | ||

Ritchie Bros. Auctioneers Incorporated 9500 Glenlyon Parkway, Burnaby, British Columbia, V5J 0C6, Canada Attn: Corporate Secretary (778) 331-5500 | | | IAA, Inc. Two Westbrook Corporate Center, Suite 500, Westchester, Illinois 60154 Attn: Secretary (708) 492-7000 |

For RBA shareholders: | | | For IAA stockholders: |

| | | ||

| | |  |

| | | ||

MacKenzie Partners, Inc. 1407 Broadway, 27th Floor New York, New York 10018 (800) 322-2885 proxy@mackenziepartners.com | | | Innisfree M&A Incorporated 501 Madison Avenue, 20th Floor New York, New York 10022 Stockholders Call Toll-Free: (877) 750-8334 Banks and Brokers Call Collect: (212) 750-5833 |

| | | ||

| | |  |

| | | ||

Laurel Hill 70 University Avenue, Suite 1440 Toronto, ON, M5J 2M4 North America Toll Free: 1-877-452-7184 Outside North America: 1-416-304-0211 Email: assistance@laurelhill.com | | | Kingsdale Advisors 130 King Street West, Suite 2950, P.O. Box 361 Toronto, Ontario M5X 1E2 Call Toll-Free (within North America): 1-866-851-3215 Call Collect (outside North America): (416) 867-2272 E-mail: contactus@kingsdaleadvisors.com |

| | |

| | | Period End | | | Average | | | Low | | | High | |

Year ended December 31, | | | | | | | | | ||||

(C$ per $) | | |||||||||||

2022 | | | 1.3544 | | | 1.3011 | | | 1.2451 | | | 1.3856 |

2021 | | | 1.2678 | | | 1.2535 | | | 1.2040 | | | 1.2942 |

2020 | | | 1.2732 | | | 1.3415 | | | 1.2718 | | | 1.4496 |

2019 | | | 1.2988 | | | 1.3269 | | | 1.2988 | | | 1.3600 |

2018 | | | 1.3642 | | | 1.2957 | | | 1.2288 | | | 1.3642 |

2017 | | | 1.2545 | | | 1.2986 | | | 1.2128 | | | 1.3743 |

| | | Low | | | High | |

Month ended, | | | | | ||

(C$ per $) | | | | | ||

January 2023 (through January 25, 2023) | | | 1.3376 | | | 1.3658 |

December 2022 | | | 1.3433 | | | 1.3687 |

November 2022 | | | 1.3288 | | | 1.3749 |

October 2022 | | | 1.3547 | | | 1.3856 |

September 2022 | | | 1.2980 | | | 1.3726 |

August 2022 | | | 1.2753 | | | 1.3111 |

July 2022 | | | 1.2824 | | | 1.3138 |

June 2022 | | | 1.2540 | | | 1.3035 |

May 2022 | | | 1.2648 | | | 1.3039 |

April 2022 | | | 1.2451 | | | 1.2895 |

March 2022 | | | 1.2470 | | | 1.2867 |

February 2022 | | | 1.2677 | | | 1.2832 |

January 2022 | | | 1.2474 | | | 1.2772 |

December 2021 | | | 1.2642 | | | 1.2942 |

Source: | Bank of Canada website. |

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

Term | | | Definition |

“acquiring person” | | | any person that has become, subject to certain exemptions set out in the RBA rights plan, the beneficial owner of 20% or more of the voting shares of RBA |

“Ancora” | | | Ancora Holdings Group, LLC and/or its applicable affiliates |

“articles of amendment” | | | Articles of Amendment of RBA, filed with Innovation, Science and Economic Development Canada on February 1, 2023 |

“BANA” | | | Bank of America, N.A. |

“BofA” | | | BofA Securities, Inc. together with BANA |

“bridge loan facility” | | | the senior secured 364-day bridge loan facility referenced in the debt commitment letter for an aggregate principal amount of up to $2.8 billion |

“Broadridge” | | | Broadridge Financial Solutions Inc. |

“Canadian Tax Act” | | | the Income Tax Act (Canada) and the regulations thereunder |

“cash consideration” | | | $12.80 in cash, without interest for each share of IAA common stock |

“CBCA” | | | the Canada Business Corporations Act |

“CES” | | | Corporate Election Services, Inc. |

“closing” | | | the closing of the transactions |

“closing date” | | | the date on which the closing actually occurs |

“Code” | | | the Internal Revenue Code of 1986, as amended |

“combined company” | | | the surviving company, including RBA and its subsidiaries, after giving effect to the mergers |

“Competition Act approval” | | | the receipt of an Advance Ruling Certificate or letter from the Canadian Commissioner of Competition that he does not, at that time, intend to make an application under Section 92 of the Competition Act (Canada) in respect of the mergers |

“cooperation agreement” | | | the cooperation agreement, dated as of January 22, 2023, by and between IAA and Ancora |

“debt commitment letter” | | | the Commitment Letter, as amended and restated on December 9, 2022, by and among GS Bank, BANA, BofA, Royal Bank, RBCCM and RBC. |

“DGCL” | | | the Delaware General Corporation Law |

“DTC” | | | Depository Trust Company |

“effective time” | | | the effective time of the first merger |

“equity award exchange ratio” | | | the sum of (a) the quotient (rounded to six (6) decimal places) obtained by dividing (i) the cash consideration by (ii) the volume weighted average price of RBA common shares for the five (5) consecutive trading days immediately prior to, but not including, the closing date as reported by Bloomberg, L.P. (or, to the extent not reported therein, a comparable financial reporting service) and (b) the exchange ratio |

“Exchange Act” | | | the Securities Exchange Act of 1934, as amended |

“exchange ratio” | | | 0.5252 of an RBA common share |

“excluded shares” | | | the shares of IAA common stock held by IAA as treasury stock, held by RBA, US Holdings, Merger Sub 1 or Merger Sub 2 immediately prior to the effective time or owned by IAA stockholders who have validly demanded and not withdrawn appraisal rights in accordance with Section 262 of the DGCL |

“first merger” | | | the merger of Merger Sub 1 with and into IAA, with IAA surviving as an indirect wholly owned subsidiary of RBA and a direct wholly owned subsidiary of US Holdings |

“flip-in event” | | | a transaction or other event pursuant to which any person (other than RBA or any subsidiary of RBA) becomes an acquiring person |

“Goldman Sachs” | | | Goldman Sachs & Co. LLC |

“GS Bank” | | | Goldman Sachs Bank USA |

“Guggenheim Securities” | | | Guggenheim Securities, LLC |

Term | | | Definition |

“HSR Act” | | | the Hart-Scott-Rodino Act, as amended |

“IAA” | | | IAA, Inc., a Delaware corporation |

“IAA adjournment proposal” | | | the proposal at the IAA special meeting to approve the adjournment of the IAA special meeting, if necessary or appropriate, to solicit additional proxies if there are insufficient votes at the time of such adjournment to approve the IAA merger proposal |

“IAA board” | | | the board of directors of IAA |

“IAA board recommendation” | | | the recommendation of the IAA board that the IAA stockholders approve the IAA merger proposal |

“IAA capital stock” | | | IAA common stock and IAA preferred stock |

“IAA common stock” | | | the common stock of IAA, par value $0.01 per share |

“IAA compensation committee” | | | the Compensation Committee of the IAA board |

“IAA compensation proposal” | | | the proposal at the IAA special meeting to approve, on a non-binding advisory basis, the compensation that may be paid or become payable to named executive officers of IAA that is based on or otherwise relates to the transactions contemplated by the merger agreement |

“IAA designees” | | | members of the RBA board effective as of the effective time to be designated by IAA |

“IAA directors deferred compensation plan” | | | the IAA, Inc. Directors Deferred Compensation Plan |

“IAA equity plan” | | | the IAA 2019 Omnibus Stock and Incentive Plan |

“IAA ESPP” | | | the IAA Employee Stock Purchase Plan |

“IAA executive agreement” | | | an employment agreement between IAA and its executive officers that provides for certain severance benefits |

“IAA merger proposal” | | | the proposal at the IAA special meeting to adopt the merger agreement and thereby approve the transactions contemplated by the merger agreement, including the mergers |

“IAA option” | | | each outstanding option to purchase shares of IAA common stock granted under the IAA equity plan |

“IAA phantom stock award” | | | each outstanding IAA phantom stock award granted to a non-employee director pursuant to the IAA equity plan |

“IAA preferred stock” | | | IAA preferred stock |

“IAA proxy solicitors” | | | Innisfree together with Kingsdale |

“IAA PRSU award” | | | each outstanding award of IAA restricted stock units granted pursuant to the IAA equity plan that was subject to performance-based vesting immediately prior to the effective time |

“IAA record date” | | | the close of business on January 25, 2023 |

“IAA restricted stock award” | | | each outstanding IAA restricted stock award granted to a non-employee director pursuant to the IAA equity plan |

“IAA RSU award” | | | each outstanding award of restricted stock units of IAA granted pursuant to the IAA equity plan that was subject solely to time-based vesting immediately prior to the effective time |

“IAA securityholder” | | | holder of IAA capital stock, IAA option, IAA PRSU award, IAA restricted stock award, IAA RSU award or IAA phantom stock award |

“IAA special meeting” | | | a special meeting of IAA stockholders to vote on the proposals necessary to complete the mergers, including the IAA merger proposal, and any adjournments or postponements thereof |

“IAA special meeting website” | | | the website for IAA stockholders to virtually attend and vote at the IAA special meeting |

“IAA spin-off” | | | the separation of IAA from KAR Auction Services, Inc. (“KAR”), which was completed on June 28 2019 |

“IAA stockholder approval” | | | the approval of the IAA merger proposal by the holders of a majority of the outstanding shares of IAA common stock entitled to vote thereon |

“IAA stockholders” | | | the holders of IAA common stock |

Term | | | Definition |

“Innisfree” | | | Innisfree M&A Incorporated |

“J.P. Morgan” | | | J.P. Morgan Securities LLC |

“Kingsdale” | | | Kingsdale Advisors |

“Laurel Hill” | | | Laurel Hill Advisory Group |

“Luxor” | | | Luxor Capital Group, LP and its affiliates |

“MacKenzie Partners” | | | MacKenzie Partners, Inc. |

“merger agreement” | | | the original merger agreement, as amended by the merger agreement amendment and as it may be further amended or modified from time to time |

“merger agreement amendment” | | | the Amendment to the Agreement and Plan of Merger and Reorganization, dated as of January 22, 2023, by and among RBA, US Holdings, Merger Sub 1, Merger Sub 2 and IAA |

“merger consideration” | | | for each outstanding share of IAA common stock (other than excluded shares) outstanding as of the effective time (1) 0.5252 of an RBA common share and (2) $12.80 in cash, without interest and less any applicable withholding taxes |

“Merger Sub 1” | | | Impala Merger Sub I, LLC, a Delaware limited liability company and a direct wholly owned subsidiary of US Holdings |

“Merger Sub 2” | | | Impala Merger Sub II, LLC, a Delaware limited liability company and a direct wholly owned subsidiary of US Holdings and indirect wholly owned subsidiary of RBA |

“mergers” | | | the first merger and the second merger |

“NYSE” | | | the New York Stock Exchange |

“original merger agreement” | | | the Agreement and Plan of Merger and Reorganization, dated as of November 7, 2022, by and among RBA, US Holdings, Merger Sub 1, Merger Sub 2 and IAA, as amended or otherwise modified prior to January 22, 2023 |

“RBA” | | | Ritchie Bros. Auctioneers Incorporated, a company organized under the federal laws of Canada |

“RBA adjournment proposal” | | | the proposal at the RBA special meeting to approve the adjournment of the RBA special meeting, if necessary or appropriate, to solicit additional proxies if there are insufficient votes at the time of the RBA special meeting to approve the RBA share issuance proposal |

“RBA board” | | | the board of directors of RBA |

“RBA board recommendation” | | | the recommendation of the RBA board that the RBA shareholders approve the RBA share issuance proposal |

“RBA capital shares” | | | RBA common shares, RBA preferred shares and the RBA junior preferred shares |

“RBA common shares” | | | the common shares of RBA |

“RBA designees” | | | members of the RBA board to be designated by RBA |

“RBA equity plans” | | | collectively, RBA’s Employee Performance Share Unit Plan (March 2015), RBA’s Senior Executive Performance Share Unit Plan (March 2015), RBA’s Amended and Restated Employee Restricted Share Unit Plan, RBA’s Amended and Restated Senior Executive Restricted Share Unit Plan, and RBA’s Amended and Restated Stock Option Plan |

“RBA ESPP” | | | the RBA 1999 Employee Stock Purchase Plan, as amended |

“RBA junior preferred shares” | | | the junior preferred shares of RBA |

“RBA option” | | | options to purchase RBA common shares |

“RBA preferred shares” or “RBA Series A senior preferred shares” | | | the RBA senior preferred shares designated as Series A senior preferred shares |

“RBA proxy solicitors” | | | MacKenzie Partners together with Laurel Hill |

“RBA record date” | | | the close of business on January 25, 2023 |

“RBA senior preferred shares” | | | the senior preferred shares of RBA |

Term | | | Definition |

“RBA share issuance” | | | the issuance of RBA common shares to IAA securityholders in connection with the mergers pursuant to the merger agreement |

“RBA share issuance proposal” | | | the proposal at the RBA special meeting to approve the RBA share issuance |

“RBA shareholder approval” | | | the approval of the RBA share issuance proposal by the affirmative vote of a majority of the votes cast by holders of the outstanding RBA common shares |

“RBA shareholders” | | | the holders of RBA common shares |

“RBA special meeting website” | | | the website for RBA shareholders to virtually attend and vote at the RBA special meeting |

“RBA special meeting” | | | a special meeting of RBA shareholders to vote on the proposals necessary to complete the mergers, including the RBA share issuance proposal, and any adjournments or postponements thereof |

“RBCCM” | | | RBC Capital Markets, LLC |

“Royal Bank” | | | Royal Bank of Canada |

“SEC” | | | the Securities and Exchange Commission |

“second merger” | | | the merger of IAA, as the surviving corporation of the first merger, with and into Merger Sub 2, with Merger Sub 2 surviving as a wholly owned subsidiary of US Holdings |

“Securities Act” | | | the Securities Act of 1933, as amended |

“SEDAR” | | | the System for Electronic Document Analysis and Retrieval |

“share consideration” | | | a number of RBA common shares for each share of IAA common stock, equal to the exchange ratio |

“special meetings” | | | the IAA special meeting and the RBA special meeting, collectively |

“Starboard” | | | Starboard Value LP and certain of its affiliated funds |

“surviving corporation” | | | the company continuing in existence after the first merger |

“surviving LLC” | | | the surviving company following the second merger |

“transactions” | | | the mergers and the other transactions contemplated by the merger agreement, including the RBA share issuance |

“TSX” | | | the Toronto Stock Exchange |

“U.S. GAAP” | | | U.S. generally accepted accounting principles |

“US Holdings” | | | Ritchie Bros. Holdings, Inc., a Washington corporation and a direct and indirect wholly owned subsidiary of RBA |

• | RBA share issuance: RBA shareholders must approve a proposal to issue RBA common shares to IAA securityholders in connection with the mergers for purposes of applicable NYSE and TSX rules; and |

• | IAA merger proposal: IAA stockholders must approve a proposal to adopt the merger agreement and thereby approve the transactions contemplated by the merger agreement, including the mergers. |

• | Internet: To vote via the internet, go to www.proxyvote.com to complete an electronic proxy card. RBA shareholders will be asked to provide the 16-digit control number from the WHITE proxy card they receive. Internet voting is available 24 hours a day, seven days a week, and will be accessible until 8:30 a.m., Pacific Time, on March 10, 2023. RBA shareholders will be given an opportunity to confirm that their voting instructions have been properly recorded. RBA shareholders who submit a proxy this way need not send in their proxy card by mail. |

• | Telephone: To vote by telephone, dial 1-800-690-6903 (the call is toll-free in the United States and Canada; toll charges apply to calls from other countries) and follow the recorded instructions. Telephone voting is available 24 hours a day and will be accessible until 8:30 a.m., Pacific Time, on March 10, 2023. Easy-to-follow voice prompts will guide shareholders through the voting process and allow them to confirm that their instructions have been properly recorded. RBA shareholders who submit a proxy this way need not send in their proxy card by mail. |

• | Mail: To vote by mail using the WHITE proxy card (if the RBA shareholder requested paper copies of the proxy materials to be mailed to them), RBA shareholders should submit their proxy by properly completing, signing, dating and mailing their proxy card in the postage-paid envelope provided (if mailed in the United States or Canada). RBA shareholders who vote this way should mail the proxy card early enough so that it is received by 8:30 a.m., Pacific Time, on March 10, 2023 before the date of the RBA special meeting. |

• | Virtually via the RBA Special Meeting Website: To vote at the RBA special meeting, visit www.virtualshareholdingmeeting.com/RBA2023SM, where RBA shareholders can virtually attend and vote at the RBA special meeting. RBA shareholders will be asked to provide the 16-digit control number from the WHITE proxy card they receive in order to access the RBA special meeting website. |

• | By Internet Before the IAA Special Meeting: To vote via the internet, IAA stockholders should go to the website listed on their enclosed proxy card and follow the instructions to complete an electronic proxy card. IAA stockholders will be asked to provide their control number included with their proxy materials. Internet voting for IAA stockholders will be available 24 hours a day. IAA stockholder’s votes must be received before the polls close at the IAA special to be counted. If an IAA stockholder votes via the internet, they do not need to return a proxy card by mail; |

• | By Telephone: To vote via telephone, dial the toll-free telephone number shown on your proxy card. IAA stockholders will be asked to provide the control number included with their proxy materials. Telephone voting for IAA stockholders will be available 24 hours a day. IAA stockholder’s votes must be received before the polls close at the IAA special meeting to be counted. If an IAA stockholder votes via telephone, they do not need to return a proxy card by mail; |

• | By Mail: To vote by mail using the proxy card, IAA stockholders need to complete, sign and date the proxy card and return it promptly by mail using the enclosed, pre-addressed, postage paid envelope so that it is received before the polls close at the IAA special meeting. The persons named in the proxy card will vote the shares you own in accordance with your instructions on the proxy card you mail; or |

• | Virtually via the IAA Special Meeting Website: To attend the IAA special meeting, you will need to pre-register for the IAA special meeting by 11:30 a.m., Eastern Time on March 13, 2023. Please have your proxy card, or voting instruction form, containing your control number available and follow the instructions to complete your registration request. After registering, stockholders will receive a confirmation email with a link and instructions for accessing the IAA special meeting. Please verify that you have received the confirmation email in advance of the IAA special meeting, including the possibility that it may be in your spam or junk folder. You must pre-register to vote and/or submit a question during the IAA special meeting. In order for a beneficial holder of shares of IAA common stock to vote by ballot at the IAA special meeting, such holder will need to obtain and submit a legal proxy from his or her bank, broker or other nominee. |

• | properly submitting a new, later-dated proxy card for the applicable special meeting that is received by the deadline specified on the accompanying proxy card (in which case only the later-dated proxy is counted and the earlier proxy is revoked); |

• | giving written notice of your revocation to the registered office of RBA, 9500 Glenlyon Parkway, Burnaby, British Columbia V5J 0C6 or IAA’s Corporate Secretary at Two Westbrook Corporate Center, Suite 500, Westchester, Illinois, 60154, which must be received not less than 24 hours prior to the time that such proxies are exercised and shares are voted at the RBA or IAA special meeting, as applicable; |

• | submitting a proxy via the internet or by telephone at a later date, which must be received before the polls are closed at the IAA special meeting, in the case of IAA stockholders, or before 8:30 a.m., Pacific Time, on March 10, 2023 at the RBA special meeting, in the case of RBA shareholders (in each case, only the later-dated proxy is counted and the earlier proxy is revoked); or |

• | virtually attending and voting at the applicable special meeting via the applicable special meeting website. Note that a proxy will not be revoked if you attend, but do not vote at, the applicable special meeting. Only your last submitted proxy will be considered. |

If you are an RBA shareholder: | | | If you are an IAA stockholder: |

| | | ||

MacKenzie Partners, Inc. 1407 Broadway, 27th Floor New York, New York 10018 (800) 322-2885 proxy@mackenziepartners.com | | |  Innisfree M&A Incorporated 501 Madison Avenue, 20th Floor New York, New York 10022 Stockholders Call Toll-Free: (877) 750-8334 Banks and Brokers Call Collect: (212) 750-5833 |

| | | ||

Laurel Hill 70 University Avenue, Suite 1440 Toronto, ON, M5J 2M4 North America Toll Free: 1-877-452-7184 Outside North America: 1-416-304-0211 Email: assistance@laurelhill.com | | |  Kingsdale Advisors The Exchange Tower 130 King Street West, Suite 2950 Toronto, ON M5X 1E2 North America Toll Free: 1-866-851-3215 Outside North America: (416) 867-2272 Email: contactus@kingsdaleadvisors.com |

• | each IAA equity award held by an executive officer or director will receive the treatment, and is eligible for, the applicable vesting acceleration benefit, described in the section entitled “Interests of IAA Directors and Executive Officers in the Mergers—Treatment of Equity and Equity Based Awards;” |

• | each IAA executive officer is party to an employment agreement with IAA that provides for severance benefits upon a qualifying termination, including enhanced severance benefits if a qualifying termination of the executive officer occurs within two years following a “change in control” (which includes the closing of the mergers) as described in the section entitled “Interests of IAA Directors and Executive Officers in the Mergers—Severance Entitlements;” |

• | each IAA executive officer may become eligible to receive an annual cash incentive bonus for the fiscal year in which the closing of the mergers occurs as described in the section entitled “Interests of IAA Directors and Executive Officers in the Mergers—2023 Annual Bonuses;” |

• | the IAA compensation committee may, but is not obligated to, pay certain IAA executive officers (other than IAA’s Chief Executive Officer) a cash transaction bonus payable on the closing date as described in the section entitled “Interests of IAA Directors and Executive Officers in the Mergers—Transaction Bonuses;” |

• | the IAA compensation committee may, but is not obligated to, pay certain IAA executive officers (but will not make any such payment to IAA’s Chief Executive Officer) cash retention bonuses payable after the closing date as described in the section entitled “Interests of IAA Directors and Executive Officers in the Mergers—Retention Bonuses;” |

• | each IAA executive officer was eligible to receive acceleration of (i) the vesting and/or income inclusion of certain of his or her IAA equity awards and/or (ii) payment of his or her fiscal year 2022 incentive bonus into fiscal year 2022, subject to claw back, as described below in the section entitled “Interests of IAA Directors and Executive Officers in the Mergers—280G Mitigation Actions;” |

• | each IAA executive is eligible to continue to receive certain compensation and benefits for one year following the closing of the mergers as described in the section entitled “The Merger Agreement—Employee Benefits Matters;” |

• | IAA directors and officers are entitled to continued indemnification and insurance coverage under the merger agreement as described in the section entitled “Interests of IAA Directors and Executive Officers in the Mergers—Director and Officer Indemnification and Insurance;” and |

• | RBA’s agreement to add three of IAA’s current directors to the RBA board (as designated by IAA and deemed acceptable by RBA) at the effective time. |

• | each outstanding IAA option to purchase shares of IAA common stock granted under the IAA equity plan whether vested or unvested, will, automatically and without any action on the part of the parties to the merger agreement or any holder of an IAA option, be assumed by RBA and converted into an option to purchase the number of RBA common shares (rounded down to the nearest whole share) equal to the product obtained by multiplying (i) the number of shares of IAA common stock subject to such IAA option immediately prior to the effective time by (ii) the equity award exchange ratio, at an exercise price per RBA common share equal to the quotient obtained by dividing (x) the per share exercise price of such IAA option immediately prior to the effective time by (y) the equity award exchange ratio (rounded down to the nearest whole share). The equity award exchange ratio is equal to the sum of (a) the quotient (rounded to six decimal places) obtained by dividing (i) the cash consideration by (ii) the volume weighted average price of the RBA common shares for the five consecutive trading days immediately prior to, but not including, the closing date of the mergers as reported by Bloomberg, L.P. (or, to the extent not reported therein, a comparable financial reporting service) and (b) the exchange ratio. Except as set forth above, each assumed IAA option will be subject to the same terms and conditions, including vesting, exercise, expiration and forfeiture provisions, applicable to the corresponding IAA option immediately prior to the effective time (including the terms of the IAA equity plan and the applicable stock option agreement); |

• | each outstanding IAA RSU award granted pursuant to the IAA equity plan that was subject solely to time-based vesting immediately prior to the effective time, will automatically and without any action on the part of the parties to the merger agreement or any holder of an IAA RSU award, be assumed by RBA and converted into the right to receive, upon vesting, the number of RBA common shares (rounded down to the nearest whole share) equal to the product obtained by multiplying (i) the number of shares of IAA common stock subject to such IAA RSU award immediately prior to the effective time by (ii) the equity award exchange ratio. Except as set forth above, each assumed IAA RSU award will be subject to the same terms and conditions, including vesting and forfeiture terms, applicable to the corresponding IAA RSU award as of immediately prior to the effective time (including the terms of the IAA equity plan and the applicable restricted stock unit agreement); |

• | each outstanding IAA PRSU award granted pursuant to the IAA equity plan that was subject to performance-based vesting immediately prior to the effective time, will automatically and without any action on the part of the parties to the merger agreement or any holder of an IAA PRSU award, be assumed by RBA and converted into the right to receive, upon vesting, the number of RBA common shares (rounded down to the nearest whole share) equal to the product obtained by multiplying (i) the number of shares of IAA common stock subject to such IAA PRSU award immediately prior to the effective time (determined based on the target number of shares subject to such IAA PRSU award) by (ii) the equity award exchange ratio. Except as set forth above, each assumed IAA PRSU award will be subject to the same terms and conditions, including time-based vesting and forfeiture provisions, but not performance-vesting provisions, as applied to the corresponding IAA PRSU award as of immediately prior to the effective time (including the terms of the IAA equity plan and the applicable restricted stock unit agreement); |

• | each outstanding IAA restricted stock award granted to a non-employee director pursuant to the IAA equity plan will automatically vest in full and each share of IAA common stock underlying such IAA restricted stock award will be treated as an outstanding share of IAA common stock for all purposes of the mergers, including for purposes of receiving the merger consideration; and |

• | each outstanding IAA phantom stock award granted to a non-employee director pursuant to the IAA equity plan will automatically vest in full and each share of IAA common stock underlying such IAA phantom stock award will be treated as an outstanding share of IAA common stock for all purposes of the mergers, including for purposes of receiving the merger consideration. |

• | the approval of the IAA merger proposal by the holders of a majority of the outstanding shares of IAA common stock entitled to vote thereon; |

• | the approval of the RBA share issuance proposal by the affirmative vote of a majority of the votes cast by holders of outstanding RBA common shares entitled to vote thereon; |

• | the expiration or termination of any waiting period under the HSR Act and the receipt of the Competition Act approval; |

• | the absence of any order, injunction or regulation by a court or other governmental entity that prevents or materially impairs the consummation of the mergers; |

• | the effectiveness of the registration statement of which this joint proxy statement/prospectus forms a part and the absence of a stop order or proceedings threatened or initiated by the SEC for that purpose; and |

• | the RBA common shares to be issued pursuant to the mergers having been approved for listing on the NYSE and the TSX. |

• | If RBA terminates the merger agreement: |

○ | due to an IAA change of recommendation, then IAA must pay the termination amount of $189 million in cash by wire transfer of immediately available funds to an account designated by RBA no later than three business days after such termination of the merger agreement; or |

○ | to accept an RBA superior proposal, then RBA must pay the termination amount of $189 million in cash by wire transfer of immediately available funds to an account designated by IAA concurrently with such termination of the merger agreement; |

• | If IAA terminates the merger agreement: |

○ | due to an RBA change of recommendation, then RBA must pay the termination amount of $189 million in cash by wire transfer of immediately available funds to an account designated by IAA no later than three business days after such termination of the merger agreement; or |

○ | to accept an IAA superior proposal (as outlined above), then IAA must pay the termination amount of $189 million in cash by wire transfer of immediately available funds to an account designated by RBA concurrently with such termination of the merger agreement. |

• | RBA Proposal 1—RBA Share Issuance Proposal. To approve the issuance of RBA common shares to IAA securityholders in connection with the mergers; and |

• | RBA Proposal 2—RBA Adjournment Proposal. To approve the adjournment of the RBA special meeting, if necessary or appropriate, to solicit additional proxies if there are insufficient votes at the time of the RBA special meeting to approve the RBA share issuance proposal. |

• | IAA Proposal 1—Adoption of the Merger Agreement: To adopt the merger agreement and thereby approve the transactions contemplated by the merger agreement, including the mergers; |

• | IAA Proposal 2—Advisory Non-Binding Vote on Merger-Related Compensation for Named Executive Officers: To approve, on a non-binding advisory basis, the compensation that may be paid or become payable to named executive officers of IAA that is based on or otherwise relates to the merger agreement and the transactions contemplated by the merger agreement; and |

• | IAA Proposal 3—Adjournment of the IAA Special Meeting: To approve the adjournment of the IAA special meeting, if necessary or appropriate, to solicit additional proxies if there are insufficient votes at the time of the IAA special meeting to approve the IAA merger proposal. |

| | | RBA Common Shares | | | IAA Common Stock | | | Implied Per Share Value of Merger Consideration | |

November 4, 2022 | | | $62.32 | | | $39.25 | | | $45.53(1) |

January 25, 2023 | | | $58.23 | | | $40.88 | | | $43.38 |

(1) | Pursuant to the merger agreement amendment, this implied per share value was calculated by adding (1) $12.80 to the product obtained by (2) multiplying the RBA common share closing price of $62.32 as of November 4, 2022 by an exchange ratio of 0.5252. |

• | the mergers being consummated as anticipated, at a certain time or at all; |

• | the benefits or opportunities the mergers will provide to RBA, IAA, RBA shareholders and IAA stockholders and the significance of such benefits and opportunities; |

• | the financial impact of the mergers on RBA’s financial position and results of operations; |

• | events that will take place or conditions that will exist if the mergers are not consummated; |

• | future announcements and filings; |

• | the special meetings, when the special meetings will be held and the format of such special meetings; |

• | the composition of the RBA board and management team following the consummation of the mergers; |

• | the tax consequences of the first or second merger or any other transaction contemplated by the merger agreement; |

• | the accounting treatment of the mergers, any transaction contemplated by the merger agreement or any assets of or any actions taken or not taken by RBA or IAA or any of their subsidiaries; |

• | the ability of the parties to obtain regulatory approvals for the mergers and the actions required to obtain such approvals; |

• | the amount of cash required to pay the merger consideration, related fees and transaction costs and the source of such funds; |

• | replacement of the RBA bridge loan with permanent financing; |

• | potential future dividend payments, including the special dividend to be paid to RBA shareholders in connection with the mergers; |

• | the number of RBA common shares to be issued in connection with the mergers and the relative ownership of RBA and IAA stockholders following the mergers; and |

• | the expectations of RBA and IAA with respect to the mergers as described in the sections entitled “The Mergers — RBA's Reasons for the Mergers and Recommendation of the RBA Board” and “The Mergers — IAA's Reasons for the Mergers and Recommendation of the IAA Board.” |

• | the possibility that RBA shareholders may not approve the issuance of new RBA common shares in connection with the mergers or that IAA stockholders may not approve the adoption of the merger agreement; |

• | the risk that a condition to closing of the mergers may not be satisfied (or waived), that either party may terminate the merger agreement or that the closing of the mergers might be delayed or not occur at all; |

• | risks relating to fluctuations of the market value of RBA’s and IAA’s common stock before the completion of the mergers, including as a result of uncertainty as to the long term value of the common stock of the combined company or as a result of general economic and market development conditions; |

• | the anticipated tax treatment of the mergers; |

• | potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the mergers; |

• | the diversion of management time on transaction-related issues; |

• | the response of competitors to the mergers; |

• | the ultimate difficulty, timing, cost and results of integrating the operations of RBA and IAA; |

• | the effects of the business combination of RBA and IAA, including the combined company’s future financial condition, results of operations, strategy and plans; |

• | the effects of public comments on the transactions on market perceptions of the combined company’s future financial condition, results of operations, strategy and plans; |

• | the failure (or delay) to receive the required regulatory approvals of the mergers; |

• | the fact that operating costs and business disruption may be greater than expected following the public announcement or consummation of the mergers; |

• | the effect of the announcement, pendency or consummation of the mergers on the trading price of RBA common shares or IAA common stock; |

• | the ability of RBA and/or IAA to retain and hire key personnel and employees; |

• | the significant costs associated with the mergers; |

• | the outcome of any legal proceedings instituted against RBA, IAA and/or others relating to the mergers; |

• | restrictions during the pendency of the mergers that may impact the ability of RBA and/or IAA to pursue non-ordinary course transactions, including certain business opportunities or strategic transactions; |

• | the ability of the combined company to realize anticipated synergies in the amount, manner or time frame expected or at all; |

• | the failure of the combined company to realize potential revenue, growth, operational enhancement, expansion or other value creation opportunities from the sources or in the amount, manner or time frame expected or at all; |

• | changes in capital markets and the ability of the combined company to finance operations in the manner expected or to de-lever in the time frame expected; |

• | the failure of RBA or the combined company to meet financial and/or key performance indicator targets or goals; |

• | any legal impediment to the payment of the special dividend to be paid to RBA shareholders in connection with the mergers, including TSX consent to the dividend record date; |

• | legislative, regulatory and economic developments affecting the business of RBA and IAA; |

• | general economic and market developments and conditions, including, without limitation, fluctuations in the trading prices or trading multiples of RBA, IAA or the combined company; |

• | the evolving legal, regulatory and tax regimes under which RBA and IAA operate; and |

• | unpredictability and severity of catastrophic events, including, but not limited to, pandemics, acts of terrorism or outbreak of war or hostilities, as well as RBA’s or IAA’s response to any of the aforementioned factors. |

• | each company may experience negative reactions from the financial markets, including negative impacts on its stock price or investor perceptions of each company’s board of directors, management and standalone prospects; |

• | each company may experience negative reactions from its customers, partners, suppliers and employees and other key business relations; |

• | each company will be required to pay its respective costs relating to the mergers, such as certain financial advisory, legal, accounting costs and associated fees and expenses, whether or not the mergers are completed; |

• | there may be disruptions to each company’s respective business resulting from the announcement and pendency of the mergers, and any adverse changes in their relationships with their respective customers (including insurance companies), partners, suppliers, vendors (including subhaulers), other business partners and employees may continue or intensify; |

• | each company may be subject to legal proceedings related to the failure to consummate the mergers; and |

• | each company will have committed substantial time and resources to matters relating to the mergers (including integration planning) which would otherwise have been devoted to day-to-day operations and other opportunities that may have been beneficial to either company as an independent company. |

• | delay or defer other decisions concerning RBA, IAA or the combined company, including entering into contracts with RBA or IAA or making other decisions concerning RBA or IAA or seek to change or cancel existing business relationships with RBA or IAA; or |

• | otherwise seek to change the terms on which they do business with RBA, IAA or the combined company. |

• | combining the companies’ operations and corporate functions; |

• | combining the businesses of RBA and IAA and meeting the capital requirements of the combined company in a manner that permits the combined company to achieve any revenue opportunities or operational scale efficiencies anticipated to result from the mergers, the failure of which would result in the anticipated benefits of the mergers not being realized in the time frame currently anticipated or at all; |

• | integrating and retaining personnel from the two companies; |

• | integrating the companies’ technologies; |

• | integrating and unifying each company’s intellectual property; |

• | integrating operating licenses across each company’s network of physical properties; |

• | identifying and eliminating redundant and underperforming functions and assets; |

• | harmonizing the companies’ operating practices, employee development and compensation programs, internal controls and other policies, procedures and processes; |

• | maintaining existing agreements with customers, business partners, suppliers, landlords and vendors, avoiding delays in entering into new agreements with prospective customers, business partners, suppliers, landlords and vendors, and leveraging relationships with such third parties for the benefit of the combined company; |

• | addressing possible differences in business backgrounds, corporate cultures and management philosophies; |

• | consolidating the companies’ administrative and information technology infrastructure; |

• | coordinating sales strategies and go-to-market efforts; |

• | coordinating geographically dispersed organizations; and |

• | effecting actions that may be required in connection with obtaining regulatory or other governmental approvals. |

• | increasing its vulnerability to changing economic, regulatory and industry conditions; |

• | limiting its ability to compete and its flexibility in planning for, or reacting to, changes in its business and the industry; |

• | limiting its ability to borrow additional funds; and |

• | increasing its interest expense and requiring it to dedicate a substantial portion of its cash flow from operations to payments on its debt, thereby reducing funds available for dividends, working capital, capital expenditures, acquisitions, share repurchases, and other purposes. |

• | the combined company’s prospective and existing customers may experience, or may continue to experience, slowdowns in their businesses, which in turn may result in reduced demand for the combined company platform, lengthening of sales cycles, loss of customers and difficulties in collections; |

• | the combined company’s suppliers may experience, or may continue to experience, disruptions in their supply chains, which may result in service interruptions or additional operating expenses, and may increase the price at which the combined company’s suppliers are willing to sell their products to us; |

• | the combined company’s return to work and remote working policies, which continue to evolve, may decrease employee productivity, collaboration and morale and may increase unwanted employee attrition; |

• | the combined company is expected to incur fixed costs, particularly for real estate, and may derive reduced benefit from those costs compared to what may have otherwise been possible; |

• | the combined company may experience disruptions to growth planning, such as for facilities and expansion of the business; |

• | the combined company may incur costs related to returning to work at its facilities, as well as costs associated with complying with new or evolving regulatory requirements, which may vary significantly depending on the jurisdiction; |

• | the combined company may be affected by an uncertain regulatory environment, and may be required to comply with cumbersome and conflicting federal, state and local laws regarding COVID-19, which may pose significant disruption to the combined company’s business operations, require significant management attention to respond to and enforce and result in an increased risk of non-compliance and claims; |

• | the combined company may be subject to legal liability for safe workplace claims; and |

• | the combined company’s critical suppliers or partners could go out of business. |

• | Proposal 1 – RBA share issuance proposal: To approve the issuance of RBA common shares to IAA securityholders in connection with the mergers; and |

• | Proposal 2 – RBA adjournment proposal: To approve the adjournment of the RBA special meeting, if necessary or appropriate, to solicit additional proxies if there are not sufficient votes at the time of the RBA special meeting to approve the RBA share issuance proposal. |

• | Proposal 1: “FOR” the RBA share issuance proposal; and |

• | Proposal 2: “FOR” the RBA adjournment proposal. |

• | Internet: To vote via the internet, go to www.proxyvote.com to complete an electronic proxy card. RBA shareholders will be asked to provide the 16-digit control number from the WHITE proxy card they |

• | Telephone: To vote by telephone, dial 1-800-690-6903 (the call is toll-free in the United States and Canada; toll charges apply to calls from other countries) and follow the recorded instructions. Telephone voting is available 24 hours a day and will be accessible until 8:30 a.m., Pacific Time, on March 10, 2023. Easy-to-follow voice prompts will guide shareholders through the voting process and allow them to confirm that their instructions have been properly recorded. RBA shareholders who submit a proxy this way need not send in their proxy card by mail. |

• | Mail: To vote by mail using the WHITE proxy card (if the RBA shareholder requested paper copies of the proxy materials to be mailed to them), RBA shareholders should submit their proxy by properly completing, signing, dating and mailing their proxy card in the postage-paid envelope provided (if mailed in the United States or Canada). RBA shareholders who vote this way should mail the proxy card early enough so that it is received by 8:30 a.m., Pacific Time, on March 10, 2023 before the date of the RBA special meeting. |

• | Virtually via the RBA Special Meeting Website: To vote at the RBA special meeting, visit www.virtualshareholdermeeting.com/RBA2023SM, where RBA shareholders can virtually attend and vote at the RBA special meeting. RBA shareholders will be asked to provide the 16-digit control number from the WHITE proxy card they receive in order to access the RBA special meeting website. |

• | sending a written notice of revocation to the registered office of RBA, 9500 Glenlyon Parkway, Burnaby, British Columbia V5J 0C6, which must be received not less than 24 hours prior to their RBA common shares being voted at the RBA special meeting; |

• | properly submitting a new, later-dated proxy card, which must be received by 8:30 a.m., Pacific Time, on March 10, 2023 (in which case only the later-dated proxy is counted and the earlier proxy is revoked); |

• | submitting a proxy via the internet or by telephone at a later date, which must be received by 8:30 a.m., Pacific Time, on March 10, 2023 (in which case only the later-dated proxy is counted and the earlier proxy is revoked); or |

• | attending the RBA special meeting and voting virtually; attendance at the RBA special meeting will not, however, in and of itself, constitute a vote or revocation of a prior proxy. |

• | IAA Proposal 1—Adoption of the Merger Agreement: To adopt the merger agreement and thereby approve the transactions contemplated by the merger agreement (as amended or modified), including the mergers; |

• | IAA Proposal 2—Advisory Non-Binding Vote on Merger-Related Compensation for Named Executive Officers: To approve, on a non-binding advisory basis, the compensation that may be paid or become payable to the named executive officers of IAA that is based on or otherwise relates to the merger agreement (as amended or modified) and the transactions contemplated by the merger agreement (as amended or modified); and |

• | IAA Proposal 3—Adjournment of the IAA special meeting: To approve the adjournment of the IAA special meeting, if necessary or appropriate, to solicit additional proxies if there are insufficient votes at the time of the IAA special meeting to approve the IAA merger proposal. |

• | “FOR” the IAA merger proposal, |

• | “FOR” the IAA compensation proposal, and |

• | “FOR” the IAA adjournment proposal. |

Proposal | | | Vote Required | | | Effects of Certain Actions |

IAA Proposal 1: the IAA merger proposal | | | Approval requires the affirmative vote of the holders of a majority of the outstanding shares of IAA common stock entitled to vote thereon at the close of business on the IAA record date. | | | The failure to vote, the failure to instruct your bank, broker or nominee to vote shares held in “street name” in favor of the IAA merger proposal or an abstention from voting will have the same effect as a vote “AGAINST” the IAA merger proposal. |

| | | | | |||

IAA Proposal 2: the IAA compensation proposal | | | Approval requires the affirmative vote of the holders of a majority of the shares of IAA common stock present at the IAA special meeting in person (including virtually) or represented by proxy and entitled to vote thereon. | | | An abstention on the IAA compensation proposal will have the same effect as a vote “AGAINST” the IAA compensation proposal. Any shares not present at the IAA special meeting (including due to the failure of an IAA stockholder who holds shares in “street name” through a bank, broker or other nominee to provide voting instructions with respect to any proposals at the IAA special meeting to such bank, broker or other nominee) will have no effect on the outcome of the IAA compensation proposal, so long as a quorum is otherwise present. |

| | | | | |||

| | | | | |||

IAA Proposal 3: the IAA adjournment proposal | | | Approval requires the affirmative vote of the holders of a majority of the shares of IAA common stock present at the IAA special meeting in person (including virtually) or represented by proxy and entitled to vote thereon. | | | An abstention on the IAA adjournment proposal will have the same effect as a vote “AGAINST” the IAA adjournment proposal. Any shares not present at the IAA special meeting (including due to the failure of an IAA stockholder who holds shares in “street name” through a bank, broker or other nominee to provide voting instructions with respect to any proposals at the IAA special meeting to such bank, broker or other nominee) will have no effect on the outcome of the IAA adjournment proposal, so long as a quorum is otherwise present. |

• | By Internet Before the IAA Special Meeting: To vote via the internet, IAA stockholders should go to the website listed on their enclosed proxy card and follow the instructions to complete an electronic proxy card. IAA stockholders will be asked to provide their control number included with their proxy materials. Internet voting for IAA stockholders will be available 24 hours a day. An IAA stockholder’s votes must be received before the polls close at the IAA special to be counted. If an IAA stockholder votes via the internet, they do not need to return a proxy card by mail; |

• | By Telephone: To vote via telephone, dial the toll-free telephone number shown on your proxy card. IAA stockholders will be asked to provide the control number included with their proxy materials. Telephone voting for IAA stockholders will be available 24 hours a day. An IAA stockholder’s votes must be received before the polls close at the IAA special meeting to be counted. If an IAA stockholder votes via telephone, they do not need to return a proxy card by mail; |

• | By Mail: To vote by mail using the enclosed proxy card, IAA stockholders need to complete, sign and date the proxy card and return it promptly by mail using the enclosed, preaddressed, postage paid envelope so that it is received before the IAA special meeting. The persons named in the proxy card will vote the shares you own in accordance with your instructions on the proxy card you mail; or |

• | Virtually via the IAA Special Meeting Website: To attend the IAA special meeting, IAA stockholders will need to pre-register for the IAA special meeting before the polls close at the IAA special meeting. IAA stockholders should have their proxy card, or voting instruction form, containing their control number available and follow the instructions to complete their registration request. After registering, stockholders will receive a confirmation email with a link and instructions for accessing the IAA special meeting. IAA stockholders should verify that they have received the confirmation email in advance of the IAA special meeting, including the possibility that it may be in your spam or junk folder. IAA stockholders must |

• | by sending a signed written notice of revocation to IAA’s Corporate Secretary, at the address below, which must be received not less than 24 hours prior to the time that such proxies are exercised and shares are voted at the IAA special meeting; |

• | by submitting a validly executed proxy card with a later date either by mail, via the internet or by telephone that is received by IAA’s Secretary before the polls close at the IAA special meeting; or |

• | by virtually attending the IAA special meeting and voting or requesting that your proxy be revoked at the IAA special meeting via the IAA special meeting website as described above. |

• | the expectation that the transaction will create a leading omnichannel marketplace for buyers and sellers across a diverse portfolio of verticals with a combined gross transaction value in excess of $14.5 billion (based on gross transaction value for the last twelve months ended September 30, 2022); |

• | the belief that IAA’s business model is highly complementary to RBA’s marketplace, with the salvage auction process closely resembling RBA’s used equipment auction process; |

• | the belief that diversifying both companies’ end market exposures is likely to enhance the growth profile of the combined company, while simultaneously reducing cyclicality given the historically counter-cyclical and resilient salvage vehicle sector; |

• | the expectation that RBA’s highly expandable platform will benefit from greater transaction volume and higher margin service attach rates; |

• | the expectation that the approximately 275 combined yards of RBA and IAA will enhance each organization’s growth strategy, whereby: |

○ | RBA is expected to benefit from the acceleration of its local yard strategy to unlock new customers and drive incremental gross transaction value and the improvement of yard unit economics through higher and more consistent yard utilization; and |

○ | IAA is expected to benefit from increased catastrophic events capacity for insurance customers via RBA’s expansive yards and an international footprint with auction yards in eleven countries outside of the U.S.; |

• | the expectation that the expanded marketplace of the combined company will also lead to increased footprint/customer proximity, enhanced yard utilization and automation, and improved return on investment on technology investments; |

• | the belief that the combination will drive enhanced customer experience and engagement by merging aligned customer-centric cultures supported by comprehensive tech-enabled solutions; |

• | the expectation that the combined company will be able to achieve at least $100-120 million in annual run-rate cost synergies by the end of 2025; |

• | the expectation that the transaction will be accretive to (i) RBA’s Adjusted EBITDA margins when considering the run-rate cost synergies (based on financials for the last twelve months period ended September 30, 2022) and (ii) RBA’s adjusted earnings per share when considering the realizable cost synergies, as each such metric is reported by RBA; |

• | the expectation that the combination of RBA and IAA will provide significant revenue growth opportunities for the combined company, beyond the identified cost synergies, to accelerate the revenue growth otherwise achievable by RBA and IAA on a standalone basis, including through cross-selling opportunities, accelerated marketplace innovation, and acceleration of IAA’s international expansion; |

• | the expectation that the cash flow of the combined company will enable RBA to de-leverage while providing capital allocation flexibility; |

• | the relevant automotive sector expertise of RBA’s management team and their experience in successfully integrating acquisitions; |

• | the fact that, upon completion of the mergers, existing RBA shareholders will continue to own in excess of a majority of the outstanding RBA shares on a fully diluted basis with the opportunity to share in any future price appreciation of, and dividends declared on, RBA common shares; |

• | the oral opinions rendered by Goldman Sachs, subsequently confirmed in writing dated as of each of November 7, 2022 and January 22, 2023, to the RBA board that, as of each such date and based upon and subject to the factors and assumptions set forth therein, the merger consideration to be paid by RBA for each share of IAA common stock pursuant to the original merger agreement (as amended by the merger agreement amendment with respect to the January 22, 2023 opinion) was fair from a financial point of view to RBA. See the section entitled “— Opinions of RBA’s Financial Advisor” and Annex D; |

• | the oral opinions rendered by Guggenheim Securities, subsequently confirmed in writing dated as of each of November 6, 2022 and January 22, 2023, to the RBA board that, as of each such date and based upon and subject to the factors and assumptions set forth therein, the merger consideration to be paid by RBA for each share of IAA common stock pursuant to the original merger agreement (as amended by the merger agreement amendment with respect to the January 22, 2023 opinion) was fair from a financial point of view to RBA. See the section entitled “—Opinions of RBA’s Financial Advisor” and Annex E; |

• | the likelihood that the mergers would be consummated, including, among other things, the limited conditions set forth in the merger agreement and the probability that regulatory approvals for the mergers would be obtained in a timely manner without the imposition of any conditions that RBA would find unacceptable; and |

• | other terms of the merger agreement, including, among other things: |

○ | the fact that the exchange ratio is fixed and will not be adjusted to compensate for any decrease in the trading price of RBA’s common shares prior to the completion of the mergers, which provides certainty to RBA shareholders as to their pro forma percentage ownership of the combined company immediately after the completion of the mergers; |

○ | the extensive representations and warranties made by IAA in the merger agreement, as well as the covenants in the merger agreement relating to the conduct of IAA’s business during the period from the date of the original merger agreement through the effective time; |

○ | that the RBA share issuance is subject to approval by holders of RBA common shares, and that no termination fee is payable by RBA if its shareholders do not vote to approve the RBA share issuance at the RBA shareholder meeting, other than, among other circumstances, if the RBA board makes a RBA change of recommendation or in specified circumstances following a third party making an acquisition proposal for RBA, except for the reimbursement of IAA’s out-of-pocket expenses up to a maximum of $5 million, as described in the section entitled “The Merger Agreement – Termination Amount and Expenses; Liability for Breach”; |

○ | RBA’s ability, under certain circumstances prior to receipt of the requisite approval of the RBA shareholders, to consider and respond to an unsolicited alternative acquisition proposal, to furnish information to the person making such a proposal, and to engage in discussions or negotiations with the person making such a proposal; |

○ | the RBA board’s ability, under certain circumstances prior to receipt of the requisite approval of the RBA shareholders, to effect a RBA change of recommendation, including to withdraw, qualify or modify the RBA board’s recommendation in favor of the RBA share issuance proposal; |

○ | the RBA board’s ability, under certain circumstances prior to receipt of the requisite approval of the RBA shareholders, to terminate the merger agreement in order to enter into an alternative acquisition agreement providing for a superior proposal, subject to payment to IAA of a termination fee of $189 million; |

○ | that IAA, subject to certain exceptions, is prohibited from soliciting or engaging in discussions or entering into agreements with respect to alternative acquisition proposals; and |

○ | with respect to the merger agreement amendment, the feedback received from RBA shareholders regarding the mergers, and the benefits to RBA shareholders of (i) the decrease in the exchange ratio |

• | the risk that IAA’s financial performance may not meet RBA’s expectations; |

• | the risk that the anticipated benefits to RBA and IAA following completion of the combination, including the cost synergies and revenue growth opportunities described above, will not be realized, will cost more to realize, or will take longer to realize than expected; |

• | the risk that IAA may not be able to maintain or renew certain material contracts and relationships on favorable terms or at all; |

• | the possible disruption of RBA’s and IAA’s respective operations that may result from the combination, including the potential for diversion of management and employee attention from other strategic opportunities or operational matters, and the potential effect of the combination on RBA’s and IAA’s respective businesses, operating results and relations with business partners, suppliers and other parties; |

• | the difficulties and challenges inherent in completing the combination and integrating the businesses, operations and workforces of RBA and IAA; |

• | the risk that, because the exchange ratio under the merger agreement would not be adjusted for changes in the market price of RBA common shares or IAA common stock, the then-current trading price of the RBA common shares to be issued to holders of shares of IAA common stock upon the consummation of the mergers could be significantly higher than the trading price prevailing at the time the merger agreement was executed; |

• | the fact that RBA’s current shareholders will have reduced ownership and voting interests after the completion of the combination (compared to their current ownership and voting interests in RBA) and will exercise less influence over the RBA board and management and policies of RBA (compared to their current influence over the RBA board and management and policies of RBA); |

• | the possibility that the mergers may not be completed, including as a result of the failure to obtain the requisite shareholder or regulatory approvals, or that completion may be unduly delayed; |

• | the risk that governmental entities may impose conditions on the combined company that may adversely affect the ability of the combined company to realize the expected benefits of the transactions; |

• | the fact that IAA’s obligation to complete the mergers is conditioned on its receipt of a tax opinion from Cooley; |

• | the fact that RBA will have higher leverage following the transactions due to its incurrence of indebtedness in order to fund the cash portion of the merger consideration and repay certain indebtedness in connection with the mergers, which could have adverse consequences to RBA’s business and financial position or its ability to pursue acquisition opportunities following the mergers; |

• | the significant costs incurred by RBA in connection with negotiating and entering into the merger agreement, which, if the transactions are not consummated, will generally be borne by RBA; |

• | the fact that the separate opinions of each of Goldman Sachs and Guggenheim Securities to the RBA board that, as of the date thereof and based upon and subject to the factors and assumptions set forth therein, the merger consideration to be paid by RBA for each share of IAA common stock pursuant to the merger agreement was fair from a financial point of view to RBA, speak only as of the date of delivery and do not take into account events occurring or information that has become available after such date, including any changes in the operations and prospects of RBA or IAA, general market and economic conditions and other factors which may be beyond the control of RBA and IAA and on which the fairness opinions were based; |

• | the fact that in certain circumstances, including if RBA terminates the merger agreement to accept a superior proposal or if IAA terminates the merger agreement as a result of the RBA board changing its recommendation in favor of the RBA share issuance, RBA would be required to pay IAA a termination amount of $189 million; |

• | the risk of litigation in connection with the mergers; |

• | that provisions in the merger agreement placing certain restrictions on the operation of RBA’s business during the period between the signing of the merger agreement and consummation of the mergers may delay or prevent RBA from pursuing business opportunities that may arise or other actions it would otherwise take with respect to its operations; |

• | the increase in the aggregate cash consideration payable to IAA stockholders pursuant to the terms of the merger agreement amendment; and |

• | various other risks associated with the transactions and the businesses of RBA, IAA and the combined company described in the section entitled “Risk Factors.” |

• | the implied value of the merger consideration to be received by IAA stockholders in the transactions of 0.5252 RBA common shares and $12.80 cash per share of IAA common stock which, using RBA’s 10-day volume-weighted average price on the NYSE as of January 20, 2023 of $59.3581, equals a purchase price of $44.40 per share, which represents a premium of: |

○ | 13.1% to the closing price of IAA common stock on November 4, 2022, the last trading day prior to the initial public announcement of the merger agreement and the transactions; |

○ | 34.5% to the closing price of IAA common stock on October 3, 2022, the last trading day before the IAA board agreed in principle to the initial $46.88 headline price; and |

○ | 9.2% to the closing price of IAA common stock on January 20, 2023, the last trading day before the initial public announcement of the merger agreement amendment; |

• | the possibility that the trading price of IAA common stock on the NYSE, absent the transactions, would not reach and sustain at least the level implied by the merger consideration in the near term, or at all; |

• | the fact that the receipt of RBA common shares as merger consideration provides IAA stockholders with an approximately 37.2% ownership interest in the combined company and the opportunity to share in any future price appreciation of, and dividends declared on, RBA common shares, and that the transactions are expected to provide a number of significant strategic opportunities and benefits to the combined company to support such appreciation, including the following: |

○ | the transactions combine two independent, strong companies and complementary business models across near-adjacent verticals with significant synergy potential, and positions the combined company to significantly expand and enhance growth for both RBA and IAA; |

○ | the parties expect (1) to achieve $100 million – $120+ million in annual run-rate cost synergies by the end of 2025, (2) that certain revenue opportunities will also be available, including growing IAA sales domestically and abroad, growing RBA’s gross transaction value, growing financing solutions sales at IAA, growing services attachment at IAA, capturing whole car sales market share and entering incremental salvage markets, and (3) that the transactions will deliver adjusted earnings accretion in the first full year following closing; |

○ | IAA will benefit from the experience, talent, technology and industry relationships of RBA, with a more diversified customer base across a broad set of attractive end-markets, as well as stronger data analytics capabilities, creating an even stronger organization; |

○ | the combination is expected to enable (1) IAA to expand its global digital marketplace technology, further strengthen its operating model, and expand into additional supply categories as well as new geographies, (2) RBA to enter the adjacent, high-growth automotive sector and increase the efficiency of certain processes using IAA technology, and (3) the combined company to capitalize on new revenue opportunities; |

○ | the combined company will be able to provide both companies’ customers with multiple selling options, a comprehensive suite of technology-enabled services and enhanced insights, allowing them to maximize the return of their commercial and automotive assets; |

○ | the combined company will afford both IAA and RBA a footprint closer to both companies’ customers, enabling the combined company to offer faster service and a greatly improved, seamless experience while providing access to more real estate and increased flexibility to drive low-cost growth; |

○ | the expected ability of the combined company to quickly de-leverage following the closing of the transactions and, in the case of the merger agreement amendment, the fact that the merger agreement amendment and related transactions were leverage neutral relative to the transactions as initially announced; and |

○ | RBA’s expectation that it will maintain its current quarterly dividend and may consider further increases following closing as the combined company de-levers its balance sheet; |

• | the fact that the cash component of the merger consideration, including the increased cash consideration provided by the merger agreement amendment, would provide immediate liquidity and certainty of value to IAA stockholders; |

• | the benefits that IAA was able to obtain as a result of negotiations with RBA, in the case of the original merger agreement, despite the macroeconomic and financing environment worsening and IAA revising down its near term standalone outlook over the course of negotiations, including: |

○ | an increase in the price RBA was willing to offer to acquire IAA in the original merger agreement from an initial headline value of $46.00 per share of IAA stock to the final proposal of $46.88 per IAA share, and the IAA board’s belief that this was the highest price per share that RBA was willing to pay; and |

○ | in the case of the merger agreement amendment, that the $2.80 per share of increased cash consideration would provide immediate liquidity and certainty of value to IAA stockholders and that the IAA board was unwilling to accept any revised transaction structure that resulted in more than a modest total implied value decrease in the merger consideration; |

• | the potential strategic alternatives available to IAA, taking into account the covenants imposed by the non-compete agreement with KAR, and the risks and costs associated with pursuing those potential alternatives, including the possibility of remaining a standalone company and the anticipated value that IAA’s standalone plan and prospects would deliver to IAA stockholders relative to the risk adjusted value associated with the transactions; |