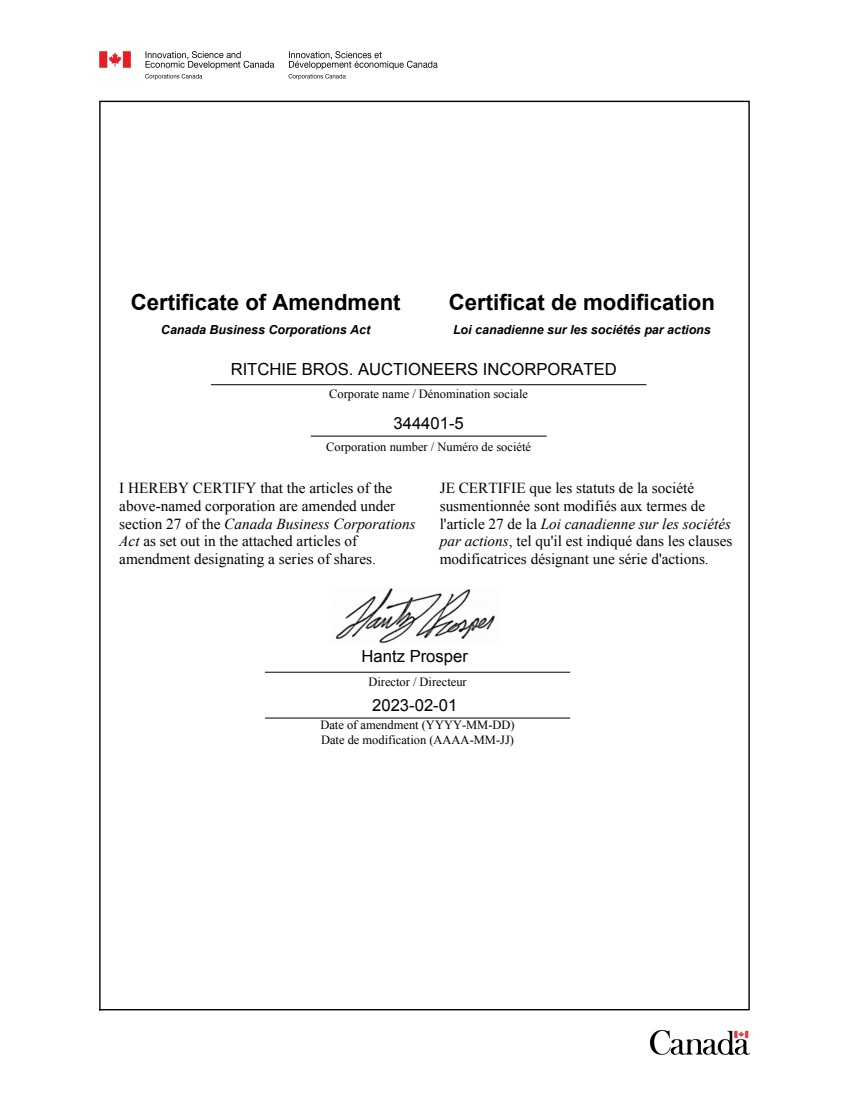

| Certificate of Amendment Loi canadienne sur les sociétés par actions Canada Business Corporations Act Certificat de modification RITCHIE BROS. AUCTIONEERS INCORPORATED 344401-5 Corporate name / Dénomination sociale Corporation number / Numéro de société Hantz Prosper Date of amendment (YYYY-MM-DD) Date de modification (AAAA-MM-JJ) Director / Directeur 2023-02-01 I HEREBY CERTIFY that the articles of the above-named corporation are amended under section 27 of the Canada Business Corporations Act as set out in the attached articles of amendment designating a series of shares. JE CERTIFIE que les statuts de la société susmentionnée sont modifiés aux termes de l'article 27 de la Loi canadienne sur les sociétés par actions, tel qu'il est indiqué dans les clauses modificatrices désignant une série d'actions. |

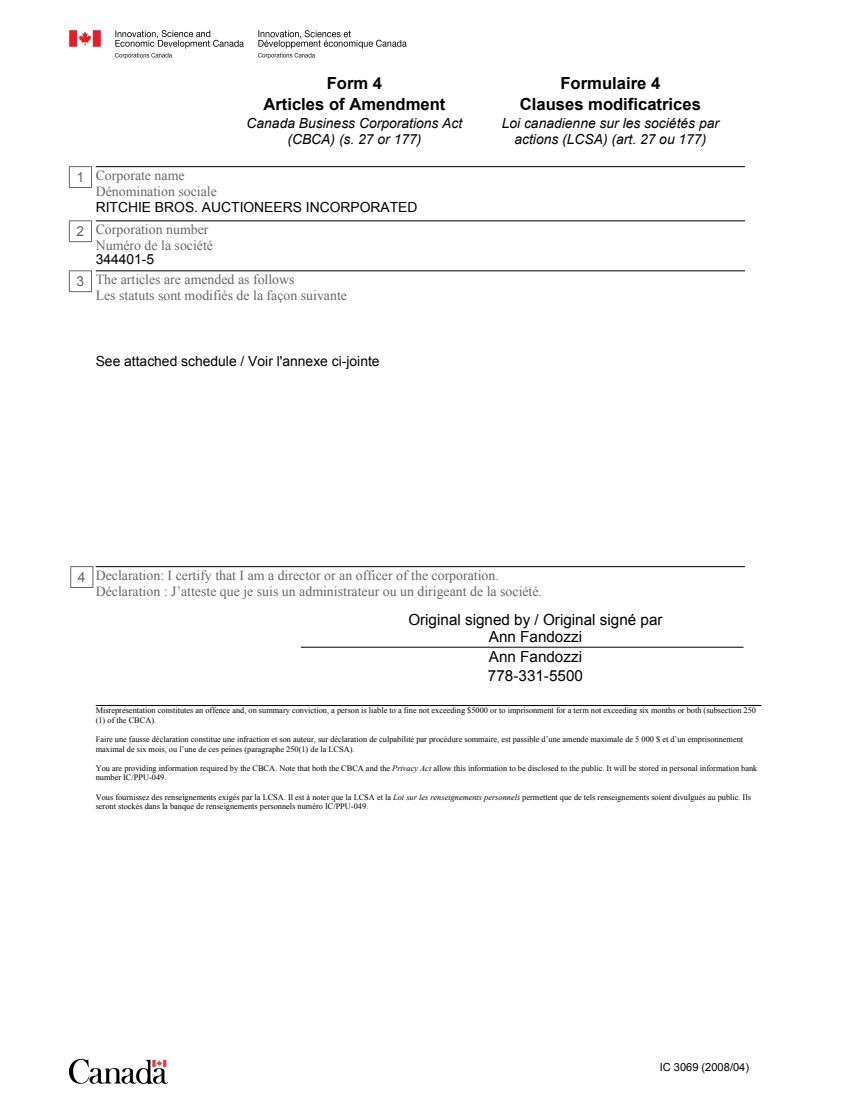

| Form 4 Canada Business Corporations Act (CBCA) (s. 27 or 177) Formulaire 4 Loi canadienne sur les sociétés par actions (LCSA) (art. 27 ou 177) Articles of Amendment Clauses modificatrices Corporate name Dénomination sociale 1 RITCHIE BROS. AUCTIONEERS INCORPORATED Corporation number Numéro de la société 2 344401-5 The articles are amended as follows Les statuts sont modifiés de la façon suivante 3 See attached schedule / Voir l'annexe ci-jointe Misrepresentation constitutes an offence and, on summary conviction, a person is liable to a fine not exceeding $5000 or to imprisonment for a term not exceeding six months or both (subsection 250 (1) of the CBCA). Faire une fausse déclaration constitue une infraction et son auteur, sur déclaration de culpabilité par procédure sommaire, est passible d’une amende maximale de 5 000 $ et d’un emprisonnement maximal de six mois, ou l’une de ces peines (paragraphe 250(1) de la LCSA). You are providing information required by the CBCA. Note that both the CBCA and the Privacy Act allow this information to be disclosed to the public. It will be stored in personal information bank number IC/PPU-049. Vous fournissez des renseignements exigés par la LCSA. Il est à noter que la LCSA et la Loi sur les renseignements personnels permettent que de tels renseignements soient divulgués au public. Ils seront stockés dans la banque de renseignements personnels numéro IC/PPU-049. Ann Fandozzi 778-331-5500 Ann Fandozzi Original signed by / Original signé par 4 Declaration: I certify that I am a director or an officer of the corporation. Déclaration : J’atteste que je suis un administrateur ou un dirigeant de la société. IC 3069 (2008/04) |

SCHEDULE TO

ARTICLES OF AMENDMENT

OF

RITCHIE BROS. AUCTIONEERS INCORPORATED

(the "Company")

The Articles of Amalgamation of the Company, as amended (the "Articles"), be amended as follows:

1. to create a new series of Senior Preferred Shares, designated as Series A Senior Preferred Shares, of which the Company is authorized to issue 485,000,000 Series A Senior Preferred Shares; and

2. to provide that the rights, privileges, restrictions and conditions attaching to the Series A Senior Preferred Shares are as set out in Schedule I,

with the result that after giving effect to the foregoing, the authorized capital of the Company will consist of (i) a class of an unlimited number of Common Shares, (ii) a class of an unlimited number of Preferred Shares designated as Senior Preferred Shares, issuable in series, of which 485,000,000 are designated as Series A Senior Preferred Shares, and (iii) a class of an unlimited number of Preferred Shares designated as Junior Preferred Shares, issuable in series.

SCHEDULE I

The following is a statement of the rights, privileges, restrictions and conditions attaching to the Series A Senior Preferred Shares in the capital of the Company. Capitalized terms not defined in Sections 1 through 17 are defined in Section 18 hereof.

(1) Designation and Amount. There shall be a series of Senior Preferred Shares of the Company designated as the "Series A Senior Preferred Shares" (the "Series A Preferred Shares") and the number of shares constituting such series shall be four hundred eighty five million (485,000,000) shares (each a "Series A Preferred Share").

(2) Ranking. The Series A Preferred Shares shall rank, with respect to rights as to dividends, distributions, redemptions and payments upon the liquidation, dissolution and winding up of the Company (a) senior to all of the Junior Preferred Shares, Common Shares and any other class or series of capital shares of the Company, hereafter issued or authorized, the terms of which do not expressly provide that such class or series ranks senior to or on a parity with the Series A Preferred Shares as to dividends, distributions, redemptions and payments upon the liquidation, dissolution and winding up of the Company (such shares being referred to hereinafter collectively as "Junior Shares"), (b) on a parity basis with each other class or series of capital shares hereafter issued or authorized, the terms of which expressly provide that such class or series ranks on a parity basis with the Series A Preferred Shares as to dividends, distributions, redemptions and payments upon the liquidation, dissolution and winding up of the Company (such shares being referred to hereinafter collectively as "Pari Passu Shares"), and (c) on a junior basis with each other class or series of capital shares hereafter issued or authorized, the terms of which expressly provide that such class or series ranks on a senior basis to the Series A Preferred Shares as to dividends, distributions, redemptions and payments upon the liquidation, dissolution and winding up of the Company (such shares being referred to hereinafter collectively as "Senior Shares"). Notwithstanding anything to the contrary in these Articles of Amendment (these "Articles of Amendment"), the Company shall have the right to create and issue Series A-1 Preferred Shares and Series A-2 Preferred Shares (each as defined below) pursuant to Section 10 without the consent of the Holders.

(3) No Maturity or Sinking Fund. The Series A Preferred Shares shall have no stated maturity and will not be subject to any sinking fund.

(4) Liquidation. In the event of a Liquidation Event, holders of Series A Preferred Shares (each, a "Holder" and collectively, the "Holders") shall be entitled to receive in cash out of the assets of the Company legally available therefor, whether from capital or from earnings available for distribution to its shareholders (the "Liquidation Funds") upon such Liquidation Event, before any amount shall be paid to the holders of Junior Shares, but subject to the rights of Senior Shares and Pari Passu Shares, an amount per Series A Preferred Share equal to the greater of (i) the Conversion Amount per Series A Preferred Share and accrued and unpaid Dividends thereon, if any (and any accrued and unpaid dividends thereon accrued pursuant to Section 5(c)) and (ii) the amount that would have been received had such Series A Preferred Shares and accrued and unpaid Dividends thereon, if any (and any accrued and unpaid dividends thereon accrued pursuant to Section 5(c)) been converted immediately prior to such Liquidation Event at the then effective Conversion Rate (without regard to any limitations on conversion); provided that, if the Liquidation Funds are insufficient to pay the full amount due to the Holders and holders of shares of Pari Passu Shares, if any, then each Holder and each holder of any such Pari Passu Shares shall receive a percentage of the Liquidation Funds equal to the full amount of Liquidation Funds that would be payable to such Holder or holder of Pari Passu Shares as a liquidation preference in accordance with their respective rights set out in the Articles from time to time, as a percentage of the full amount of Liquidation Funds that would be payable to all Holders and holders of Pari Passu Shares in accordance with their respective rights set out in the Articles from time to time.

| - 2 - |

(5) Dividends.

(a) Preferential Dividends.

(i) From and after the Issuance Date, the Holders of record as they appear on the books of the Company on February 15, May 15, August 15 and November 15 of each calendar year following the Issuance Date (each such date, a "Preferential Dividend Record Date") shall be entitled to receive, to the fullest extent permitted by law and out of funds lawfully available therefor, before any dividends shall be declared, set apart for or paid upon the Common Shares or any other Junior Shares, dividends per Series A Preferred Share on the applicable Preferential Dividend Date (as defined below) in arrears for the previous Calendar Quarter equal to an amount calculated at 5.50% per annum (the "Preferential Dividend Rate") on the Issue Price of each such Series A Preferred Share computed on the basis of a 360-day year and twelve 30-day months (the "Preferential Dividends"). For the avoidance of doubt, the first Preferential Dividends to be paid by the Company on March 15, 2023 shall be prorated for the period starting on the Issuance Date through such Preferential Dividend Date.

(ii) Preferential Dividends shall be payable on March 15, June 15, September 15 and December 15 of each calendar year following the Issuance Date, or, if any such date falls on a day that is not a Business Day, the next day that is a Business Day (each such date, a "Preferential Dividend Date").

(iii) Preferential Dividends shall be payable on each Preferential Dividend Date, to the Holders of record on the related Preferential Dividend Record Date, in whole or in part, in cash ("Cash Preferential Dividend") or, so long as there is no Equity Conditions Failure in respect of the Preferential Dividend Shares occurring on the applicable Preferential Dividend Date (subject to waiver of any such Equity Conditions Failure in accordance with clause (v) below) by any Holder with respect to such Holder only, in Common Shares (the "Preferential Dividend Shares"), at the Company's election, subject to any required stock exchange approval to issue such Common Shares. .

| - 3 - |

(iv) The Company shall give written notice (a "Preferential Dividend Election Notice") to each Holder on or prior to the fifteenth (15th) Trading Day immediately prior to the applicable Preferential Dividend Date (the date such notice is delivered to the Holders, the "Preferential Dividend Notice Date") indicating whether it elects to pay Preferential Dividend on any Preferential Dividend Date in Cash Preferential Dividend, in Preferential Dividend Shares or a combination thereof (and if a combination, the proportion that will be paid in Cash Preferential Dividend), which election shall be the same for all Holders. If the Company does not give a Preferential Election Notice in respect of a Preferential Dividend Date in accordance with the immediately preceding sentence, the Company will be deemed to have elected Cash Preferential Dividend in respect of the Preferential Dividends due on such Preferential Dividend Date.

(v) If the Company elects the payment of applicable Preferential Dividend in Preferential Dividend Shares, in whole or in part, in respect of a Preferential Dividend Date, and an Equity Conditions Failure occurs at any time prior to such Preferential Dividend Date that the Company expects will last through such Preferential Dividend Date (which is not waived in writing by such Holder), the Company shall provide each Holder a written notice to that effect by no later than the Trading Day immediately following the date upon which the Company has knowledge of such Equity Conditions Failure, indicating that unless such Holder waives the Equity Conditions Failure in writing, the applicable portion of Preferential Dividend as to which such Holder did not waive the Equity Conditions Failure shall be paid as Cash Preferential Dividend.

(vi) If any portion of Preferential Dividend for a particular Preferential Dividend Date shall be paid in Preferential Dividend Shares, then on the applicable Preferential Dividend Date, the Company shall issue to the Holder, such number of Common Shares equal to (a) the amount of Preferential Dividend payable on the applicable Preferential Dividend Date in Preferential Dividend Shares divided by (b) 97% of the simple average of the daily Weighted Average Prices of the Common Shares on each Trading Day during the ten (10) consecutive Trading Days immediately following the applicable Preferential Dividend Notice Date. Notwithstanding anything herein to the contrary, if the price set forth in clause (b) of the immediately preceding sentence is less than US$59.722 (as adjusted for any share dividend, share split, share combination, reclassification or similar transaction relating to the Common Shares occurring after the Subscription Date) or less than the minimum price required such that the Common Shares are deemed to be issued at or above the market price or otherwise not requiring shareholder approval by the Toronto Stock Exchange (or its successor), then the Company shall be required to pay the applicable Preferential Dividends on the applicable Preferential Dividend Payment Date in cash as a Cash Preferential Dividend. All Preferential Dividend Shares shall be fully paid and nonassessable Common Shares (rounded in accordance with Section 6(b)). By written notice to all Holders, the Company may irrevocably elect to eliminate its ability to pay Preferential Dividends with Preferential Dividend Shares (i) unless and until it receives the approval of its shareholders for the issuance of Common Shares in excess of the Exchange Cap (as defined below) or (ii) subject to no conditions.

| - 4 - |

(b) Participating Dividends. From and after the Issuance Date, the Holders on the record date fixed for holders of Common Shares for dividends or distributions in a Calendar Quarter (or, in the event no such date is fixed in such Calendar Quarter, on the Preferential Dividend Record Date occurring in such Calendar Quarter) shall be entitled to receive, to the fullest extent permitted by law and out of funds lawfully available therefor, concurrently with the payment of regular quarterly cash dividends (or, in the event no such regular quarterly cash dividends are made, on the Preferential Dividend Date) paid to the holders of Common Shares, the greater of (A) such regular quarterly cash dividends paid to the holders of Common Shares to the same extent as if such Holders had converted the Series A Preferred Shares into Common Shares (without regard to any limitations on conversion) and had held such Common Shares on such record date (or, in the event no such date is fixed in such Calendar Quarter, on the Preferential Dividend Record Date occurring in such Calendar Quarter) and (B) US$0.27 (as adjusted for any share dividend, share split, share combination, reclassification or similar transaction relating to the Common Shares occurring after the Subscription Date) per Common Share issuable upon conversion of the Series A Preferred Shares pursuant to Section 6(a) on the applicable record date for payment of such dividend (or, in the event no such date is fixed in such Calendar Quarter, on the Preferential Dividend Record Date occurring in such Calendar Quarter) (without regard to any limitations on conversion) (the "Participating Dividends" and together with the Preferential Dividends, the "Dividends"). For the avoidance of doubt, Holders shall be entitled to receive to the fullest extent permitted by law and out of funds lawfully available therefor the Participating Dividend set forth in Section 5(b)(B) each Calendar Quarter regardless of whether a regular quarterly cash dividend is declared on the Common Shares. Notwithstanding anything to the contrary set forth in this Section 5(b), in no event shall the Participating Dividend include any special cash dividend payable to the holders of Common Shares, including the special cash dividend, if any, to be declared and paid in connection with the transactions contemplated by the Merger Agreement (the "IAA Special Dividend"); provided, however, for the avoidance of doubt, that special cash dividends, including, without limitation, the IAA Special Dividend, shall adjust the Conversion Rate in accordance with Section 7(a)(iii).

| - 5 - |

(c) General. The Dividends shall be paid by the Company to the fullest extent permitted by applicable law and out of funds lawfully available therefor. Dividends on the Series A Preferred Shares shall commence accruing on the Issuance Date, shall be cumulative and shall continue to accrue without interest whether or not declared and whether or not in any fiscal year there shall be net profits or surplus available for the payment of Dividends in such fiscal year, so that if in any fiscal year or years, Dividends in whole or in part are not paid upon the Series A Preferred Shares as required by this Section 5 for any reason, including, without limitation, because there are no funds legally available therefor, unpaid Dividends shall accumulate thereon. If the Company fails to declare and pay full Preferential Dividends on the Series A Preferred Shares on any Preferential Dividend Date as provided in this Section 5, then any Preferential Dividends payable on such Preferential Dividend Date on the Series A Preferred Shares but not paid shall accrue an additional dividend thereon at a rate equal to the Preferential Dividend Rate, computed on the basis of a 360-day year and twelve 30-day months, from and including the applicable Preferential Dividend Date to but excluding the day on which the Company shall have paid in accordance with this Section 5 all Dividends on which the Series A Preferred Shares that are then in arrears or until the conversion, redemption or repurchase of the applicable Series A Preferred Shares. The Company shall not (either directly or through any of its Subsidiaries) redeem or repurchase any Pari Passu Shares or Junior Shares, unless the Company has declared all Dividends on the Series A Preferred Shares that have accrued through the Preferential Dividend Record Date immediately preceding the date of such redemption or repurchase and paid all Dividends on the Series A Preferred Shares that are payable through the Preferential Dividend Date immediately preceding the date of such redemption or repurchase other than redemptions or repurchases of (i) Series A Preferred Shares, Series A-1 Preferred Shares or Series A-2 Preferred Shares, as applicable, (ii) Junior Shares in the ordinary course of business in connection with any employment contract, equity incentive plan, benefit plan or other similar arrangement with or for the benefit of current or former employees, officers, directors or consultants; provided that not more than US$10.0 million is paid by the Company to redeem or repurchase Junior Shares in accordance with this clause (ii) in any 12 consecutive month period; (iii) Pari Passu Shares or Junior Shares as a result of an exchange or conversion of any class or series of Pari Passu Shares or Junior Shares for any other class or series of Pari Passu Shares (in the case of Pari Passu Shares) or Junior Shares (in the case of Pari Passu Shares or Junior Shares); and (iv) fractional interests in Pari Passu Shares or Junior Shares pursuant to the conversion or exchange provisions of such Pari Passu Shares or Junior Shares or the security being converted or exchanged.

(6) Conversion of Series A Preferred Shares into Common Shares. Series A Preferred Shares shall be convertible into Common Shares on the terms and conditions set forth in this Section 6.

| - 6 - |

(a) Holder's Conversion Right. Subject to the provisions of Section 6(e), at any time or times on or after the Issuance Date, any Holder shall be entitled to convert any Series A Preferred Shares into fully paid and nonassessable Common Shares in accordance with this Section 6 at the Conversion Rate (as defined below).

(b) Conversion. The number of Common Shares issuable upon conversion by a Holder of Series A Preferred Shares pursuant to Section 6(a) shall be determined by multiplying (x) the Conversion Amount in respect of the Series A Preferred Shares converted by such Holder pursuant to Section 6(a), by (y) the Conversion Rate. In addition, the Company will deliver, to the fullest extent permitted by law and out of funds lawfully available therefor, cash in respect of accrued and unpaid Dividends, if any (and any accrued and unpaid dividends accrued pursuant to Section 5(c)), with respect to such Series A Preferred Shares converted by such Holder pursuant to Section 6(a). In connection with any conversion request, a Holder must convert at least 1,000 Series A Preferred Shares (unless it holds fewer than 1,000 Series A Preferred Shares at the time of such request, in which case, it must convert such number of Series A Preferred Shares held). No fractional Common Shares are to be issued upon the conversion of any Series A Preferred Share, but rather the number of Common Shares to be issued shall be rounded down to the nearest whole number and the Company shall in lieu of delivering any fractional Common Share issuable upon conversion, to the fullest extent permitted by law and out of funds lawfully available therefor, make a cash payment (calculated to the nearest cent) equal to such fraction multiplied by the Closing Sale Price of the Common Shares on the relevant Conversion Date without interest. The applicable Conversion Rate is subject to adjustment as hereinafter provided.

(c) Mechanics of Conversion. The conversion of Series A Preferred Shares shall be conducted in the following manner:

(i) Holder's Delivery Requirements. To convert Series A Preferred Shares into Common Shares on any date, a Holder shall (A) deliver to the Company for receipt on or prior to 5:30 p.m., New York City Time, on such date, a copy of a properly completed and duly executed notice of conversion executed by the registered Holder of the Series A Preferred Shares subject to such conversion in the form attached hereto as Exhibit I (a "Conversion Notice"); and (B) deliver to the Company funds for the payment of any applicable share transfer, documentary, stamp or similar taxes.

| - 7 - |

(ii) Company's Response. As soon as practicable after the applicable Conversion Date, but in any event within two (2) Trading Days, the Company shall (A) (x) provided the Transfer Agent is participating in the Depository Trust Company ("DTC") Fast Automated Securities Transfer Program ("FAST Program") and the Common Shares issuable upon such conversion are DTC eligible and are issuable without a restricted legend and with an unrestricted CUSIP, as reasonably determined by the Company, credit such aggregate number of Common Shares to which such Holder shall be entitled to such Holder's or its designee's balance account with DTC through its Deposit/Withdrawal at Custodian system, or (y) if the Transfer Agent is not participating in the DTC FAST Program or the Common Shares issuable upon such conversion are not DTC eligible or are not issuable without a restricted legend and with an unrestricted CUSIP, as reasonably determined by the Company, make a book-entry notation registered in the name of such Holder or its designee, for the number of Common Shares to which such Holder shall be entitled and deliver to the address as specified in the applicable Conversion Notice any notice required by law and (B) deliver, to the fullest extent permitted by law and out of funds lawfully available therefor, cash in respect of accrued and unpaid Dividends, if any (and any accrued and unpaid dividends accrued pursuant to Section 5(c)), with respect to such Series A Preferred Shares converted by such Holder pursuant to Section 6(a). While any Series A Preferred Shares are outstanding, the Company shall use a transfer agent that participates in the FAST Program or any successor program.

(iii) Record Holder. To the fullest extent permitted by law, the Person or Persons entitled to receive the Common Shares issuable upon a conversion of Series A Preferred Shares shall be treated for all purposes as the record holder or holders of such Common Shares on the applicable Conversion Date or Mandatory Conversion Date (as defined below), as applicable, irrespective of the date such Common Shares are credited to such Holder's account with DTC or the date of the book-entry notations evidencing such Common Shares, as the case may be.

(iv) Company's Failure to Timely Convert. If a Holder has not received all of the Common Shares to which such Holder is entitled on or within two (2) Trading Days after the applicable share delivery date with respect to a conversion of Series A Preferred Shares for any reason other such Holder's failure to comply with the conditions set forth herein, then such Holder, upon written notice to the Company, may void its Conversion Notice with respect to, and retain or have returned, as the case may be, any Series A Preferred Shares that have not been converted pursuant to such Holder's Conversion Notice.

| - 8 - |

(d) Mandatory Conversion at the Company's Election. If at any time, or from time to time, during the applicable Mandatory Conversion Period (i) the applicable Mandatory Conversion Price Condition is satisfied and (ii) no Equity Conditions Failure exists on the Mandatory Conversion Date, the Company shall from time to time have the right to require the Holders to convert all, or any portion, of the outstanding Series A Preferred Shares, as designated in the Mandatory Conversion Notice (as defined below) relating to the applicable Mandatory Conversion on the applicable Mandatory Conversion Date into fully paid, validly issued and nonassessable Common Shares and the Company will deliver, to the fullest extent permitted by law and out of funds lawfully available therefor, cash in respect of accrued and unpaid Dividends, if any (and any accrued and unpaid dividends accrued pursuant to Section 5(c)), with respect to such Series A Preferred Shares converted by the Company pursuant to this Section 6(d) (a "Mandatory Conversion"). The number of Common Shares issuable to a Holder in connection with a Mandatory Conversion pursuant to this Section 6(d) shall be determined by multiplying (x) the Conversion Amount in respect of the Series A Preferred Shares of such Holder converted by the Company pursuant to this Section 6(d) by (y) the Conversion Rate as of the applicable Mandatory Conversion Date. No fractional Common Shares are to be issued upon the Mandatory Conversion of any Series A Preferred Share, but rather the number of Common Shares to be issued shall be rounded down to the nearest whole number and the Company shall in lieu of delivering any fractional Common Share issuable upon conversion make, to the fullest extent permitted by law and out of funds lawfully available therefor, a cash payment (calculated to the nearest cent) equal to such fraction multiplied by the Closing Sale Price of the Common Shares on the relevant Mandatory Conversion Date without interest. The Company may exercise its right to require conversion under this Section 6(d) by delivering not more than one (1) Trading Day following the end of any such Mandatory Conversion Measuring Period a written notice thereof to all Holders (a "Mandatory Conversion Notice" and the date the Company delivers such notice to all Holders is referred to as a "Mandatory Conversion Notice Date"). Each Mandatory Conversion Notice shall be irrevocable. Each Mandatory Conversion Notice shall (i) state (a) the Trading Day on which the applicable Mandatory Conversion shall occur, which Trading Day shall be the twentieth (20th) Trading Day following the applicable Mandatory Conversion Notice Date (unless an earlier date is agreed to in writing between the Company and a Holder, but only with respect to such Holder) (a "Mandatory Conversion Date"), (b) the aggregate Conversion Amount of the Series A Preferred Shares which the Company has elected to be subject to such Mandatory Conversion from such Holder and all other Holders pursuant to this Section 6(d), (c) the amount of accrued and unpaid Dividends, if any (and any accrued and unpaid dividends accrued pursuant to Section 5(c)), with respect to such Series A Preferred Shares converted by the Company pursuant to this Section 6(d), (d) the number of Common Shares to be issued to such Holder on the applicable Mandatory Conversion Date, (e) in the event such Mandatory Conversion cannot be consummated in full due to the limitations set forth in Section 6(e), state whether the Company shall on the applicable Mandatory Conversion Date, to the fullest extent permitted by law and out of funds lawfully available therefor, redeem the Series A Preferred Shares that cannot be converted due to such limitation (such Series A Preferred Shares that the Company has elected to be subject to a Mandatory Conversion but which cannot be so converted due to the limitations set forth in Section 6(e), the "Excess Mandatory Conversion Shares") and (f) state whether the conversion of all or any portion of the Series A Preferred Shares that the Company has elected to be subject to a Mandatory Conversion will result in the issuance of a greater number of Common Shares than permitted under Section 6(e)(i), and (ii) certify that the applicable Mandatory Conversion Price Condition relating to the applicable Mandatory Conversion has been satisfied and that there is no Equity Conditions Failure as of the Mandatory Conversion Notice Date.

| - 9 - |

If the Company confirmed that there was no such Equity Conditions Failure relating to the applicable Mandatory Conversion as of the applicable Mandatory Conversion Notice Date but an Equity Conditions Failure occurs at any time between the applicable Mandatory Conversion Notice Date and the applicable Mandatory Conversion Date (a "Mandatory Conversion Interim Period") that the Company expects will last through the applicable Mandatory Conversion Date, the Company shall provide each Holder a subsequent written notice to that effect. If there is an Equity Conditions Failure on the applicable Mandatory Conversion Date, then such Mandatory Conversion shall be null and void with respect to all or any part designated by such Holder of the unconverted Series A Preferred Shares subject to the applicable Mandatory Conversion and such Holder shall be entitled to all the rights of a holder of Series A Preferred Shares with respect to such Series A Preferred Shares; provided, however, that if a Holder waives in writing an Equity Conditions Failure during the applicable Mandatory Conversion Interim Period, then the Company shall be required to proceed with the applicable Mandatory Conversion with respect to such Holder. Notwithstanding anything to the contrary in this Section 6(d), until the applicable Mandatory Conversion has occurred, the Series A Preferred Shares subject to the Mandatory Conversion may be converted, in whole or in part, by a Holder into Common Shares pursuant to Sections 6(a)-(c). All Series A Preferred Shares converted by a Holder after a Mandatory Conversion Notice Date shall reduce the Series A Preferred Shares required to be converted on the related Mandatory Conversion Date. If a Mandatory Conversion cannot be consummated in full due to the limitations set forth in Section 6(e), then (i) on the applicable Mandatory Conversation Date, only that portion of the applicable Mandatory Conversion that complies with the limitations set forth in Section 6(e) shall occur, (ii) unless the Company has indicated in the applicable Mandatory Conversion Notice that it shall redeem the applicable Excess Mandatory Conversion Shares on the applicable Mandatory Conversion Date, such Holder must promptly deliver one or more Conversion Notice(s) to the Company upon disposition of any securities of the Company that would permit the conversion of any portion of such Excess Mandatory Conversion Shares and (iii) notwithstanding anything herein to the contrary, Preferential Dividends with respect to the Series A Preferred Shares which the Company has elected to be subject to such Mandatory Conversion shall cease to accrue and be payable as of the applicable Mandatory Conversion Date and all approval, consent or voting rights and any right to a Make-Whole Amount shall cease with respect to the Series A Preferred Shares not able to be so converted. If a Mandatory Conversion consummated in full would violate the limitations set forth in (i) Section 6(e)(ii), the Company may indicate in the related Mandatory Conversion Notice that it shall redeem, to the fullest extent permitted by law and out of funds lawfully available therefor, the Excess Mandatory Conversion Shares on the applicable Mandatory Conversion Date in cash, without interest, at a price equal to the greater of (x) 100% of the Conversion Amount in respect of the applicable Excess Mandatory Conversion Shares and (y) the product of (1) the Conversion Amount of the applicable Excess Mandatory Conversion Shares and (2) the quotient determined by dividing (A) the greatest Closing Sale Price of the Common Shares during the period beginning on the Trading Day immediately preceding the applicable Mandatory Conversion Notice Date and ending on the Trading Day immediately preceding the applicable Mandatory Conversion Date, by (B) the lowest Conversion Price in effect during such period referred to in the immediately preceding clause (y)(2)(A) or (ii) Section 6(e)(i), the Company may indicate in the related Mandatory Conversion Notice that it shall redeem the portion of the Series A Preferred Shares that is subject to a Mandatory Conversion that cannot be converted due to the limitations set forth in Section 6(e)(i) on the applicable Mandatory Conversion Date in cash, without interest, at a price per Common Share that the Company is prohibited from issuing pursuant to Section 6(e)(i) equal to the amount set forth in the last sentence of Section 6(e)(i). If the Company elects to cause a Mandatory Conversion pursuant to this Section 6(d), then it must simultaneously take the same action in the same proportion with respect to all Series A Preferred Shares to the extent practicable or, if the pro rata basis is not practicable for any reason, by lot or such other equitable method as the Company determines in good faith. On the Mandatory Conversion Date, each Series A Preferred Share to be converted pursuant to such Mandatory Conversion shall automatically be converted into fully paid, validly issued, nonassessable Common Shares as described above without any further act or deed on the part of the Company, any Holder or any other Person.

| - 10 - |

(e) Limitation on Conversions.

(i) Principal Market Regulation. The Company shall not be obligated to issue any Common Shares pursuant to the terms of these Articles of Amendment, and the Holders shall not have the right to receive any Common Shares pursuant to the terms of these Articles of Amendment, to the extent the issuance of such Common Shares would exceed 22,165,789 Common Shares (as adjusted for any share dividend, share split, share combination, reclassification or similar transaction relating to the Common Shares occurring after the Subscription Date) (the "Exchange Cap"), except that such limitation shall not apply in the event that the Company obtains the approval of its shareholders as required by the applicable rules of the Principal Market and the Toronto Stock Exchange (or its successor), as applicable, for issuances of Common Shares in excess of such amount or if the Principal Market and the Toronto Stock Exchange (or its successor), as applicable, allows for a greater number of Common Shares to be issued pursuant to these Articles of Amendment. Until such approval is obtained, no Holder shall be issued in the aggregate, pursuant to the terms of these Articles of Amendment, Common Shares in an amount greater than the product of the Exchange Cap multiplied by a fraction, the numerator of which is the number of Series A Preferred Shares issued to such initial Holder pursuant to the Securities Purchase Agreement on the Issuance Date and the denominator of which is the aggregate number of all Series A Preferred Shares issued to the initial Holders pursuant to the Securities Purchase Agreement on the Issuance Date (with respect to each such Holder, the "Exchange Cap Allocation"). In the event that any Holder shall sell or otherwise transfer any of such Holder's Series A Preferred Shares, the transferee shall be allocated a pro rata portion of such Holder's Exchange Cap Allocation, and the restrictions of the prior sentence shall apply to such transferee with respect to the portion of the Exchange Cap Allocation allocated to such transferee. In the event that any Holder shall have converted any of such Holder's Series A Preferred Shares into a number of Common Shares which, in the aggregate, is less than such Holder's Exchange Cap Allocation, then the difference between such Holder's Exchange Cap Allocation and the number of Common Shares actually issued to such Holder shall be allocated to the respective Exchange Cap Allocations of the remaining Holders on a pro rata basis in proportion to the Common Shares underlying the Series A Preferred Shares then held by each such Holder. In the event that the Company is prohibited from issuing any Common Shares in connection with a conversion of Series A Preferred Shares pursuant to Section 6(a) or Section 6(d) or in respect of Preferential Dividend Shares as a result of the operation of this Section 6(e)(i) (the "Exchange Cap Shares"), the Company shall, to the fullest extent permitted by law and out of funds lawfully available therefor, pay cash on or prior to the applicable share delivery date to such Holder in exchange for the redemption of such number of Series A Preferred Shares held by the Holder that are not convertible into such Exchange Cap Shares at a price equal to the product of (x) such number of Exchange Cap Shares and (y) the Closing Sale Price of the Common Shares on the applicable Conversion Date or Mandatory Conversion Date, as the case may be, except that if the Exchange Cap Shares are Preferential Dividend Shares, the Company shall instead pay to such Holder Cash Preferential Dividends on the applicable Preferential Dividend Date in accordance with Section 5.

(ii) HSR Cap. Notwithstanding anything to the contrary contained herein, until the HSR Date the Company shall not effect the conversion of any portion of Series A Preferred Shares held by an HSR Holder in excess of the HSR Amount, and no HSR Holder shall have the right to convert any portion of its Series A Preferred Shares in excess of the HSR Amount pursuant to the terms and conditions of these Articles of Amendment and any such conversion shall be null and void and treated as if never made.

| - 11 - |

(f) Transfer Taxes. The Company shall not be required to pay any documentary stamp or similar tax that may be payable in respect of the issuance, delivery, payment or other transfer of Series A Preferred Shares, Common Shares or other securities, and shall not be required to make any such issuance, delivery, payment or other transfer unless and until the Person entitled to such issuance, delivery, payment or other transfer or any other Person liable for such tax has paid to the Company the amount of any such tax or has established, to the reasonable satisfaction of the Company (as determined in its reasonable discretion), that such tax has been paid or is not payable.

(7) Adjustments to Conversion Rate.

(a) Adjustments. The Conversion Rate will be subject to adjustment, without duplication, upon the occurrence of the following events, except that the Company shall not make any adjustment to the Conversion Rate if each Holder of the Series A Preferred Shares participates, at the same time and upon the same terms as holders of Common Shares and solely as a result of holding Series A Preferred Shares, in any transaction described in this Section 7(a), without having to convert its Series A Preferred Shares, as if it held a number of Common Shares equal to (x) the Conversion Rate, multiplied by (y) the Conversion Amount of Series A Preferred Shares held by such Holder (without regard to any limitations on conversion):

(i) The exclusive issuance of Common Shares as a dividend or distribution on all or substantially all of the Common Shares, or a subdivision or combination of Common Shares or a reclassification of Common Shares into a greater or lesser number of Common Shares, in which event the Conversion Rate shall be adjusted based on the following formula:

CR1 = CR0 x (OS1 / OS0)

CR0 = the Conversion Rate in effect immediately prior to the open of business on (i) the Ex-Dividend Date for such dividend or distribution, or (ii) the effective date of such subdivision, combination or reclassification

CR1 = the new Conversion Rate in effect immediately after the open of business on (i) the Ex-Dividend Date for such dividend or distribution, or (ii) the effective date of such subdivision, combination or reclassification

OS0 = the number of Common Shares outstanding immediately prior to the open of business on (i) the Ex-Dividend Date for such dividend or distribution or (ii) the effective date of such subdivision, combination or reclassification

| - 12 - |

OS1 = the number of Common Shares outstanding immediately after, and solely as a result of, the completion of such event

Any adjustment made pursuant to this clause (i) shall be effective immediately after the open of business on the Ex-Dividend Date for such dividend or distribution, or the effective date of such subdivision, combination or reclassification, as applicable. If any such event is announced or declared but does not occur, the Conversion Rate shall be readjusted, effective as of the date the Company announces that such event shall not occur, to the Conversion Rate that would then be in effect if such event had not been declared.

(ii) The dividend, distribution or other issuance to all or substantially all holders of Common Shares of rights (other than rights, options or warrants distributed in connection with a shareholder rights plan (in which event the provisions of Section 7(a)(vi) shall apply)), options or warrants entitling them to subscribe for or purchase Common Shares for a period expiring forty-five (45) days or less from the date of issuance thereof, at a price per share that is less than the Current Market Price as of the date such dividend, distribution or other issuance is publicly announced (the "Public Announcement Date") for such issuance, in which event the Conversion Rate will be increased based on the following formula:

CR1 = CR0 x [(OS0+X) / (OS0+Y)]

CR0 = the Conversion Rate in effect immediately prior to the open of business on the Ex-Dividend Date for such dividend, distribution or issuance

CR1 = the new Conversion Rate in effect immediately following the open of business on the Ex-Dividend Date for such dividend, distribution or issuance

OS0 = the number of Common Shares outstanding immediately prior to the open of business on the Ex-Dividend Date for such dividend, distribution or issuance

X = the total number of Common Shares issuable pursuant to such rights, options or warrants

Y = the number of Common Shares equal to the aggregate price payable to exercise such rights, options or warrants divided by the Current Market Price as of the Public Announcement Date for such dividend, distribution or issuance

For purposes of this clause (ii), in determining whether any rights, options or warrants entitle the holders to purchase the Common Shares at a price per share that is less than the Current Market Price as of the Public Announcement Date for such dividend, distribution or issuance, there shall be taken into account any consideration the Company receives for such rights, options or warrants, and any amount payable on exercise thereof, with the value of such consideration, if other than cash, to be the Fair Market Value thereof.

| - 13 - |

Any adjustment made pursuant to this clause (ii) shall become effective immediately following the open of business on the Ex-Dividend Date for such dividend, distribution or issuance. In the event that such rights, options or warrants are not so issued, the Conversion Rate shall be readjusted, effective as of the date the Company publicly announces its decision not to issue such rights, options or warrants, to the Conversion Rate that would then be in effect if such dividend, distribution or issuance had not been declared. To the extent that such rights, options or warrants are not exercised prior to their expiration or Common Shares are otherwise not delivered pursuant to such rights, options or warrants upon the exercise of such rights, options or warrants, the Conversion Rate shall be readjusted to the Conversion Rate that would then be in effect had the adjustments made upon the dividend, distribution or issuance of such rights, options or warrants been made on the basis of the delivery of only the number of Common Shares actually delivered.

(iii) The distribution by the Company to all or substantially all holders of its Common Shares (other than for cash in lieu of fractional shares), shares of any class of its share capital, evidences of its indebtedness, assets, other property, securities or special cash dividends (including, without limitation, the IAA Special Dividend, but excluding (A) regular quarterly cash dividends that are Participating Dividends in accordance with Section 5(b)), (B) dividends or distributions referred to in Section 7(a)(i) or Section 7(a)(ii) hereof, (C) Distribution Transactions as to which Section 7(a)(iv) shall apply, (D) rights, options or warrants distributed in connection with a shareholder rights plan as to which Section 7(a)(v) shall apply and (E) distributions of Reference Property in a Corporate Event described in Section 9(c) hereof) (any of such shares of its share capital, indebtedness, assets, property, securities or special cash dividends that are not so excluded are hereinafter called the "Distributed Property"), then, in each such case the Conversion Rate shall be adjusted based on the following formula:

CR1 = CR0 x [SP0 / (SP0 - FMV)]

CR0 = the Conversion Rate in effect immediately prior to the open of business on the Ex-Dividend Date for such dividend or distribution

| - 14 - |

CR1 = the new Conversion Rate in effect immediately after the open of business on the Ex-Dividend Date for such dividend or distribution

SP0 = the Current Market Price as of the Ex-Dividend Date for such dividend or distribution

FMV = the Fair Market Value of the portion of Distributed Property distributed with respect to each outstanding Common Share on the Ex-Dividend Date for such dividend or distribution; provided that in the event of a dividend or distribution of cash, FMV shall equal the amount in cash per Common Share the Company distributes to all or substantially all holders of its Common Shares; provided further that, if FMV is equal or greater than SP0, then in lieu of the foregoing adjustment, the Company shall distribute to each Holder of Series A Preferred Shares on the date the applicable Distributed Property is distributed to holders of Common Shares, but without requiring such Holder to convert its Series A Preferred Shares, in respect of each Series A Preferred Share held by such Holder, the amount of Distributed Property such holder would have received had such holder owned a number of Common Shares equal to the Conversion Rate on the Ex-Dividend Date for such dividend or distribution

Any adjustment made pursuant to this clause (iii) shall be effective immediately after the open of business on the Ex-Dividend Date for such dividend or distribution. If any such dividend or distribution is declared but does not occur, the Conversion Rate shall be readjusted, effective as of the date the Company announces that such dividend or distribution shall not occur, to the Conversion Rate that would then be in effect if such dividend or distribution had not been declared.

(iv) The Company effects a Distribution Transaction, in which case the Conversion Rate shall be increased based on the following formula:

CR1 = CR0 x [(FMV + MP0) / MP0]

CR0 = the Conversion Rate in effect immediately prior to the end of the Valuation Period (as defined below)

CR1 = the new Conversion Rate in effect immediately after the end of the Valuation Period

FMV = the arithmetic average of the Weighted Average Prices for a common share or similar equity interest distributed per Common Share to holders of Common Shares over the first ten (10) consecutive Trading Day period after, and including, the Ex-Dividend Date for the Distribution Transaction (the "Valuation Period"); provided that, if there is no Weighted Average Price of the common share or similar equity interest distributed to holders of the Common Shares on such Ex-Dividend Date, the "Valuation Period" shall be the ten (10) consecutive Trading Day period after, and including, the first Trading Day such Weighted Average Price is available

| - 15 - |

MP0 = the arithmetic average of the Weighted Average Price per Common Share over the Valuation Period

Such adjustment shall become effective immediately following the close of business on the last Trading Day of the Valuation Period. If an adjustment to the Conversion Rate is required under this Section 7(a)(iv), delivery of any additional Common Shares that may be deliverable upon conversion as a result of an adjustment required under this Section 7(a)(iv) shall be delayed to the extent necessary in order to complete the calculations provided for in this Section 7(a)(iv). If any Distribution Transaction is declared but not so paid or made, the Conversion Rate shall be immediately decreased, effective as of the date the Board of Directors of the Company (the "Board") determines not to pay or make such dividend or distribution, to the Conversion Rate that would then be in effect if such dividend or distribution had not been declared or announced.

(v) If the Company or any of its Subsidiaries make a payment in respect of a tender or exchange offer for the Common Shares that is subject to the then applicable tender offer rules under the Exchange Act, other than an odd lot tender offer pursuant to Rule 13e-4(h)(5) under the Exchange Act, to the extent that the cash and value of any other consideration included in the payment per Common Share exceeds the average of the Weighted Average Prices of the Common Shares over the ten (10) consecutive Trading Day period commencing on, and including, the Trading Day next succeeding the last date on which tenders or exchanges may be made pursuant to such tender or exchange offer, the Conversion Rate shall be increased based on the following formula:

CR1 = CR0 x [AC+(SP1 x OS1)] / (OS0 x SP1)

CR0 = the Conversion Rate in effect immediately prior to the close of business on the 10th Trading Day immediately following, and including, the Trading Day next succeeding the date such tender or exchange offer expires

CR1 = the Conversion Rate in effect immediately after the close of business on the 10th Trading Day immediately following, and including, the Trading Day next succeeding the date such tender or exchange offer expires

AC = the aggregate value of all cash and any other consideration (as determined by the Company) paid or payable for Common Shares purchased in such tender or exchange offer

| - 16 - |

OS0 = the number of Common Shares outstanding immediately prior to the date such tender or exchange offer expires (prior to giving effect to the purchase of all Common Shares accepted for purchase or exchange in such tender or exchange offer)

OS1 = the number of Common Shares outstanding immediately after the date such tender or exchange offer expires (after giving effect to the purchase of all Common Shares accepted for purchase or exchange in such tender or exchange offer)

SP1 = the average of the Weighted Average Prices of the Common Shares over the 10 consecutive Trading Day period commencing on, and including, the Trading Day next succeeding the date such tender or exchange offer expires

The adjustment to the Conversion Rate under this Section 7(a)(v) shall occur at the close of business on the 10th Trading Day immediately following, and including, the Trading Day next succeeding the date such tender or exchange offer expires. If an adjustment to the Conversion Rate is required under this Section 7(a)(v), delivery of any additional Common Shares that may be deliverable upon conversion as a result of an adjustment required under this Section 7(a)(v) shall be delayed to the extent necessary in order to complete the calculations provided for in this Section 7(a)(v). If the Company or one of its Subsidiaries is obligated to purchase Common Shares pursuant to any such tender or exchange offer described in the preceding paragraph but the Company is, or such Subsidiary is, permanently prevented by applicable law from effecting any such purchase or all such purchases are rescinded, the Conversion Rate will be decreased to be the Conversion Rate that would then be in effect if such tender or exchange offer had not been made or had been made only in respect of the purchases that have been effected.

(vi) If the Company has a shareholder rights plan in effect with respect to the Common Shares on any Conversion Date or Mandatory Conversion Date, upon conversion of any of the Series A Preferred Shares, Holders of such shares will receive, in addition to the applicable number of Common Shares, the rights under such rights plan relating to such Common Shares, unless, prior to such Conversion Date, the rights have (A) become exercisable or (B) separated from the Common Shares (the first of such events to occur, a "Trigger Event"), in which case, the Conversion Rate will be adjusted, effective automatically at the time of such Trigger Event, as if the Company had made a distribution of such rights to all holders of the Common Shares as described in Section 7(a)(ii) (without giving effect to the forty-five (45) day limit on the exercisability of rights, options or warrants ordinarily subject to such Section 7(a)(ii)), subject to appropriate readjustment in the event of the expiration, termination or redemption of such rights prior to the exercise, deemed exercise or exchange thereof. Notwithstanding the foregoing, to the extent any such shareholder rights are exchanged by the Company for Common Shares or other property or securities, the Conversion Rate shall be appropriately readjusted as if such shareholder rights had not been issued, but the Company had instead issued such Common Shares or other property or securities as a dividend or distribution of Common Shares pursuant to Section 7(a)(i) or Section 7(a)(iii), as applicable.

| - 17 - |

To the extent that such rights are not exercised prior to their expiration, termination or redemption, the Conversion Rate shall be readjusted to the Conversion Rate that would then be in effect had the adjustments made upon the occurrence of the Trigger Event been made on the basis of the issuance of, and the receipt of the exercise price with respect to, only the number of Common Shares actually issued pursuant to such rights.

Notwithstanding anything to the contrary in this Section 7(a)(vi), no adjustment shall be required to be made to the Conversion Rate with respect to any Holder which is, or is an "affiliate" or "associate" of, an "acquiring person" (or analogous term) under such shareholder rights plan or with respect to any direct or indirect transferee of such Holder who receives Series A Preferred Shares in such transfer after the time such Holder becomes, or its affiliate or associate becomes, an "acquiring person" (or analogous term).

(b) Calculation of Adjustments. All adjustments to the Conversion Rate shall be calculated by the Company to the nearest 1/10,000,000th of one Common Share (or if there is not a nearest 1/10,000,000th of a share, to the next lower 1/10,000,000th of a share). No adjustment to the Conversion Rate will be required unless such adjustment would require an increase or decrease of at least one percent of the Conversion Rate; provided, however, that any such adjustment that is not required to be made will be carried forward and taken into account in any subsequent adjustment; provided further that any such adjustment of less than one percent that has not been made will be made upon any conversion.

(c) When No Adjustment Required.

(i) Except as otherwise provided in this Section 7, the Conversion Rate will not be adjusted for the issuance of Common Shares or any securities convertible into or exchangeable for Common Shares or carrying the right to purchase any of the foregoing, or for the repurchase of Common Shares.

(ii) Except as otherwise provided in this Section 7, the Conversion Rate will not be adjusted as a result of the issuance of, the distribution of separate certificates representing, the exercise or redemption of, or the termination or invalidation of, rights pursuant to any shareholder rights plans.

| - 18 - |

(iii) No adjustment to the Conversion Rate will be made:

(A) upon the issuance of any Common Shares pursuant to any present or future plan providing for the reinvestment of dividends or interest payable on securities of the Company and the investment of additional optional amounts in Common Shares under any plan in which purchases are made at market prices on the date or dates of purchase, without discount, and whether or not the Company bears the ordinary costs of administration and operation of the plan, including brokerage commissions;

(B) upon the issuance of any Common Shares or options or rights to purchase such shares pursuant to any present or future employee, director or officer benefit or equity incentive arrangement, plan or program of or assumed by the Company or any of its Subsidiaries or of any employee agreements or arrangements or programs;

(C) except as otherwise provided in this Section 7 upon the issuance of any Common Shares pursuant to any option, warrant, right, or exercisable, exchangeable or any shares or securities directly or indirectly convertible into or exercisable or exchangeable for Common Shares;

(D) for dividends or distributions declared or paid to holders of Common Shares in which Holders participate pursuant to Section 5;

(E) for a third-party tender offer or exchange offer by any party other than a tender offer or exchange offer by one or more of the Company’s Subsidiaries as described in Section 7(a)(v); or

(F) for any accrued and unpaid dividends (in accordance with Section 5(c)) or Dividends.

(d) Successive Adjustments. After an adjustment to the Conversion Rate under this Section 7, any subsequent event requiring an adjustment under this Section 7 shall cause an adjustment to each such Conversion Rate as so adjusted.

(e) Multiple Adjustments. For the avoidance of doubt, if an event occurs that would trigger an adjustment to the Conversion Rate pursuant to this Section 7 under more than one subsection hereof, such event, to the extent fully taken into account in a single adjustment, shall not result in multiple adjustments hereunder; provided, however, that if more than one subsection of this Section 7 is applicable to a single event, the subsection shall be applied that produces the highest adjusted Conversion Rate.

| - 19 - |

(f) Notice of Adjustments. Whenever the Conversion Rate is adjusted as provided under this Section 7, the Company shall as soon as reasonably practicable following the occurrence of an event that requires such adjustment (or if the Company is not aware of such occurrence, as soon as reasonably practicable after becoming so aware) compute the adjusted applicable Conversion Rate in accordance with this Section 7 and prepare and transmit to the Holders and if the Transfer Agent maintains the register and records pursuant to Section 17, the Transfer Agent a certificate of an authorized officer of the Company (an "Officer's Certificate") setting forth the applicable Conversion Rate, the method of calculation thereof, and the facts requiring such adjustment and upon which such adjustment is based.

(g) Transfer Agent. The Transfer Agent shall not at any time be under any duty or responsibility to any Holder to determine whether any facts exist that may require any adjustment of the Conversion Rate or with respect to the nature or extent or calculation of any such adjustment when made, or with respect to the method employed in making the same. The Transfer Agent shall be fully authorized and protected in relying on any Officer's Certificate delivered pursuant to Section 7(f) and any adjustment contained therein and the Transfer Agent shall not be deemed to have knowledge of any adjustment unless and until it has received such certificate. The Transfer Agent shall not be responsible for any failure of the Company to issue, transfer or deliver any Common Shares pursuant to the conversion of Series A Preferred Shares or to comply with any of the duties, responsibilities or covenants of the Company contained in this Section 7.

(8) Offer To Repurchase. If, at any time while any Series A Preferred Shares remain outstanding, the Company redeems or repurchases any of its Common Shares, Junior Shares, options or warrants that are convertible, exchangeable or exercisable for Common Shares after it has redeemed or repurchased from and after the Subscription Date an aggregate of US$2.0 billion of Common Shares (and/or Common Shares underlying any Junior Shares, options or warrants that are convertible, exchangeable or exercisable for Common Shares) (an "Offer to Repurchase Event"), the Company shall deliver a written notice thereof (an "Offer to Repurchase Notice") no later than five (5) Business Days following the end of the Calendar Quarter during which one or more Offer to Repurchase Events occurred to all, but not less than all, of the Holders (the date the Company delivers such notice to all Holders is referred to as an "Offer to Repurchase Notice Date") and offer to repurchase (an "Offer to Repurchase") from each Holder a number of such Holder's Series A Preferred Shares equal to no less than such Holder's Offer to Repurchase Pro Rata Portion of the Offer to Repurchase Percentage of the Series A Preferred Shares then issued and outstanding (such number of Series A Preferred Shares, the "Offer to Repurchase Shares"). An Offer to Repurchase shall offer to redeem each such Offer to Repurchase Share for cash at a price equal to the applicable Offer to Repurchase Price. Within twenty (20) Business Days after the receipt by the Holder of an Offer to Repurchase Notice, each Holder may require the Company to redeem to the fullest extent permitted by law and out of funds lawfully available therefor, at the Offer to Repurchase Price, up to the amount of such Holder's Offer to Repurchase Shares by delivering written notice thereof (an "Acceptance Notice") to the Company which Acceptance Notice shall indicate the number of Offer to Repurchase Shares that such Holder is electing to redeem and the wire instructions for the payment of the applicable Offer to Repurchase Price to such Holder. Each Offer to Repurchase shall occur on the thirtieth (30th) Business Day following the end of the Calendar Quarter during which one more Offers to Repurchase giving rise to the applicable Offer to Repurchase occurred (an "Offer to Repurchase Date"). Each Offer to Repurchase Notice shall (A) describe the applicable Offer to Repurchase Event, including, without limitation, the calculation of the Offer to Repurchase Pro Rata Portion, the Offer to Repurchase Percentage and the Offer to Repurchase Price and (B) state the maximum Offer to Repurchase Price to be paid to such Holder on such Offer to Repurchase Date. On the applicable Offer to Repurchase Date the Company shall deliver or shall cause to be delivered to the Holder to the fullest extent permitted by law and out of funds lawfully available therefor the Offer to Repurchase Price in cash by wire transfer of immediately available funds pursuant to wire instructions provided by the Holder in writing to the Company in its Acceptance Notice. Unless otherwise indicated in a Conversion Notice, all Series A Preferred Shares converted by the Holder after the Offer to Repurchase Notice Date shall reduce the Holder's right to require redemption of the Holder's Offer to Repurchase Shares on a one-for-one basis.

| - 20 - |

(9) Change of Control Redemption Rights.

(a) Holders' Change of Control Redemption Right. No later than ten (10) days prior to the consummation of a Change of Control, or, if not practicable as promptly as reasonably practicable after the Company is aware of such Change of Control, the Company shall deliver written notice thereof to the Holders (a "Change of Control Notice") setting forth a description of such transaction in reasonable detail and the anticipated Change of Control Redemption Date (as defined below) if then known. At any time during the period beginning after a Holder's receipt of a Change of Control Notice and ending on the date that is twenty (20) Trading Days after the consummation of such Change of Control, such Holder may require the Company to redeem (a "Change of Control Redemption"), to the fullest extent permitted by law and out of funds lawfully available therefor, all or any portion of such Holder's Series A Preferred Shares by delivering written notice thereof ("Change of Control Redemption Notice") to the Company and, if the Transfer Agent maintains the register and records pursuant to Section 17, the Transfer Agent, which Change of Control Redemption Notice shall indicate the number of Series A Preferred Shares such Holder is electing to redeem (which number shall be at least one thousand (1,000) Series A Preferred Shares) (unless it holds fewer than 1,000 Series A Preferred Shares at the time of such request, in which case, it must convert such number of Series A Preferred Shares held) and include wire instructions for the payment of the applicable Change of Control Redemption Price. Any Series A Preferred Shares subject to redemption pursuant to this Section 9(a) shall, to the fullest extent permitted by law and out of funds lawfully available therefor, be redeemed by the Company in cash, without interest, at a price equal to the sum of (A) the greater of (x) the Conversion Amount of the Series A Preferred Shares being redeemed and (y) the Change of Control As-Converted Value with respect to the Series A Preferred Shares being redeemed, (B) the Make-Whole Amount and (C) accrued and unpaid Dividends, if any (and any accrued and unpaid dividends accrued pursuant to Section 5(c)), with respect to such Series A Preferred Shares being redeemed (the amount in this clause (C), the “Change of Control Accrued Dividends Payment”, the sum of the amounts in the immediately preceding clauses (A) and (B), the "Base Change of Control Redemption Price" and the sum of the amounts in the immediately preceding clauses (A), (B) and (C), the "Change of Control Redemption Price"); provided, however, that each Holder, at its option, may, instead of requiring the redemption of any Series A Preferred Shares, elect in its Change of Control Redemption Notice to require the Company to exchange such Series A Preferred Shares for (1) such number of Common Shares (the "Redemption Exchange Shares") calculated by dividing (x) the applicable Base Change of Control Redemption Price, by (y) the applicable Make-Whole Share Price, and, (2) to the fullest extent permitted by law and out of funds lawfully available therefor, the applicable Change of Control Accrued Dividends Payment in cash (together with the Redemption Exchange Shares, the “Redemption Exchange Consideration”). The Company shall make payment of the Change of Control Redemption Price, or the exchange of Series A Preferred Shares for Redemption Exchange Consideration, concurrently with the consummation of such Change of Control if such a Change of Control Redemption Notice is received at least five (5) Trading Days prior to the consummation of such Change of Control and within five (5) Trading Days after the Company's receipt of such notice otherwise (the "Change of Control Redemption Date"). Once a Change of Control Redemption Notice has been delivered, the Series A Preferred Shares submitted for redemption (or exchange) under this Section 9(a) may not be converted, in whole or in part, pursuant to Sections 6(a)-(c). In the event that a Holder elects to require the exchange of Series A Preferred Shares for Redemption Exchange Consideration as set forth above, the Company shall make appropriate provision to ensure that such Holder will have the right to receive, in exchange for the Redemption Exchange Shares included in such Redemption Exchange Consideration (or in lieu of Redemption Exchange Shares included in such Redemption Exchange Consideration, if the Change of Control is consummated before the delivery of such Redemption Exchange Shares), such shares of stock, securities, cash, assets or any other property whatsoever (including warrants or other purchase or subscription rights), if any, which are paid to the holders of Common Shares of the Company in connection with such Change of Control in accordance with Section 9(c). Notwithstanding anything to the contrary contained in this Section 9(a), in the event of a Change of Control Redemption, the Company shall only pay the Change of Control Redemption Price in cash as required by this Section 9 after paying in full in cash all obligations of the Company and its Subsidiaries under any credit agreement, indenture or similar agreement evidencing indebtedness for borrowed money (including the termination of all commitments to lend, to the extent required by such credit agreement, indenture or similar agreement) in excess of US$50.0 million, individually, and in existence at the time of such Change of Control Redemption (without giving effect to any amendment, supplement, restatement, replacement, refinance or other modification thereto on or after or in anticipation of such Change of Control) (collectively, the "Debt Documents"), which requires prior payment of the obligations thereunder (and termination of commitments thereunder, if applicable) as a condition to the payment of such Change of Control Redemption Price in cash (all such required payments under the Debt Documents in the event of a Change of Control are collectively referred to as the "Senior Debt Payments"; provided, however, that the Company shall use its commercially reasonable best efforts to pay such Senior Debt Payments without delay in accordance with the terms of the Debt Documents and shall not be allowed to circumvent any payment of a Change of Control Redemption Price by unnecessarily delaying the payment of any Senior Debt Payments.

| - 21 - |

(b) Redemption by the Company Upon a Qualified Change of Control. In the case of a Change of Control as a result of which the Series A Preferred Shares are not convertible into common share capital that is quoted on or listed for trading on an Eligible Market (a "Qualified Change of Control"), any Series A Preferred Shares, may be redeemed, at the option of the Company (or its successor or the acquiring or surviving Person in such Qualified Change of Control), upon not less than thirty (30) days' notice delivered to the Holders not later than ten (10) days after the consummation of such Qualified Change of Control, at a redemption price per share equal to the Change of Control Redemption Price with respect to such Qualified Change of Control. Unless the Company (or its successor or the acquiring or surviving Person in such Qualified Change of Control) defaults in making the redemption payment on the applicable Change of Control Redemption Date, on and after such Change of Control Redemption Date, (A) Dividends shall cease to accrue on the Series A Preferred Shares so called for redemption, (B) all Series A Preferred Shares called for redemption shall no longer be deemed outstanding and (C) all rights with respect to such Series A Preferred Shares shall on such Change of Control Redemption Date cease and terminate, except only the right of the Holders thereof to receive the amount payable in such redemption.

(c) Corporate Events. If there shall occur any Fundamental Transaction, as a result of which the Common Shares are converted into or exchanged for securities, cash, assets or other property (a "Corporate Event"), then following any such Corporate Event, each Series A Preferred Share shall remain outstanding (subject to the last paragraph of Section 14) and be convertible into the number, kind and amount of securities, cash, assets or other property which a Holder would have received in such Corporate Event had such Holder converted its Series A Preferred Share into the applicable number of Common Shares immediately prior to the effective date of the Corporate Event using the Conversion Rate applicable immediately prior to the effective date of such Corporate Event (the "Reference Property"); and, in such case, appropriate adjustment shall be made in the application of the provisions set forth in Section 7 and this Section 9(c) with respect to the rights and interests thereafter of the Holders, to the extent that the provisions set forth in Section 7 and this Section 9(c) (including provisions with respect to changes in and other adjustments of the Conversion Rate) and Section 9 shall thereafter be applicable in relation to any securities, cash, assets or other property thereafter deliverable upon the conversion of the Series A Preferred Shares. The Company (or any successor thereto) shall, no less than twenty (20) Business Days prior to the occurrence of any Corporate Event, provide written notice to the Holders of such occurrence of such event and of the kind and amount of the securities, cash, assets or other property that each Series A Preferred Share will be convertible into under this Section 9(c). Failure to deliver such notice shall not affect the operation of this Section 9(c). The Company shall not enter into any agreement for a transaction constituting a Corporate Event unless, subject to the last paragraph of Section 14, (i) such agreement provides for, or does not interfere with or prevent (as applicable), conversion of the Series A Preferred Shares in a manner that is consistent with and gives effect to this Section 9(c) and (ii) to the extent that the Company is not the surviving entity in such Corporate Event or will be dissolved in connection with such Corporate Event, proper provision shall be made in the agreements governing such Corporate Event for the conversion of the Series A Preferred Shares into the Reference Property and the assumption by such Person of the obligations of the Company under these Articles. If the Corporate Event causes the Common Shares to be converted into, or exchanged for, the right to receive more than a single type of consideration (determined based in part upon any form of shareholder election), then for the purposes of this Section 9(c), the Reference Property into which the Series A Preferred Shares shall be convertible shall be deemed to be the weighted average of the types and amounts of consideration per share actually received by holders of Common Shares. The Company shall notify Holders of the weighted average as soon as practicable after such determination is made. The provisions of this Section shall apply similarly and equally to successive Corporate Events and shall be applied without regard to any limitations on the conversion of the Series A Preferred Shares.

| - 22 - |

(10) Right of the Holders to Convert to Series A-1 and Series A-2 Preferred Shares; Company's Option to Redeem Upon Such Request.

(a) Conversion to Series A-1. Each Holder shall have the right, at such Holder's option on or prior to the thirtieth (30th) day immediately preceding the fourth (4th) anniversary of the Issuance Date, but not prior to the date that is sixty (60) days prior to such date, subject to the conversion procedures set forth in Section 10(e) and the Company's right to effect a Company Dividend Increase Redemption pursuant to Section 11(b)(iii), to convert each Series A Preferred Share of such Holder into one Series A-1 Preferred Share (as defined below) (the "Series A-1 Conversion Right"). The right of conversion may be exercised as to all or any portion of such Holder's Series A Preferred Shares; provided that, in each case, no right of conversion may be exercised by a Holder in respect of less than one (1) Series A Preferred Share (as adjusted for any share dividend, share split, share combination, reclassification or similar transaction relating to the Series A Preferred Shares occurring after the Subscription Date). On the fourth (4th) anniversary of the Issuance Date (the "Series A-1 Conversion Date"), if the Company has not delivered a Company Dividend Increase Redemption Notice prior to such date, then the Company shall convert the amount of Series A Preferred Shares specified in the Dividend Increase Conversion Notice (as defined in Section 10(e)), if any, to Series A-1 Preferred Shares as of the Series A-1 Conversion Date. For the avoidance of doubt, (i) the Conversion Amount of the Series A-1 Preferred Shares to be issued upon such conversion shall equal the Conversion Amount of the Series A Preferred Shares submitted for conversion upon exercise of the Series A-1 Conversion Right set forth herein and (ii) accrued and unpaid Dividends, if any (and any accrued and unpaid dividends accrued pursuant to Section 5(c)), in respect of Series A Preferred Shares converted for Series A-1 Preferred Shares pursuant to this Section 10(a) will be converted into accrued and unpaid Dividends (and any accrued and unpaid dividends accrued pursuant to Section 5(c)), in respect of such Series A-1 Preferred Shares.

| - 23 - |

(b) Series A-1 Preferred Shares. Upon the Holder exercising its Series A-1 Conversion Right pursuant to Section 10(a), the Company shall on or prior to the Series A-1 Conversion Date create the Series A-1 Preferred Shares and, upon such creation, the Company shall at all times reserve and keep available out of its authorized and unissued Senior Preferred Shares, solely for designation as Series A-1 Senior Preferred Shares (each, a "Series A-1 Preferred Share" and collectively, the "Series A-1 Preferred Shares") to be issued upon the conversion of the Series A Preferred Shares, such number of Senior Preferred Shares as shall from time to time be equal to the number of Series A-1 Preferred Shares issuable upon the conversion of all the Series A Preferred Shares then outstanding. Any Series A-1 Preferred Shares issued upon conversion of Series A Preferred Shares shall be duly authorized, validly issued, fully paid and nonassessable.