| This filing relates to the proposed acquisition of IAA, Inc., a Delaware corporation (the “Company”), by Ritchie Bros. Auctioneers Incorporated, a company organized under the federal laws of Canada (“Parent”), pursuant to the terms of that certain Agreement and Plan of Merger and Reorganization, dated as of November 7, 2022, by and among the Company, Parent, Ritchie Bros. Holdings Inc., a Washington corporation and a direct and indirect wholly owned subsidiary of Parent (“US Holdings”), Impala Merger Sub I, LLC, a Delaware limited liability company and a direct wholly owned subsidiary of US Holdings, and Impala Merger Sub II, LLC, a Delaware limited liability company and a direct wholly owned subsidiary of US Holdings. |

Filed by Ritchie Bros. Auctioneers Incorporated pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934

Subject Company: IAA, Inc. Date: January 23, 2023 |

Investor Update Ritchie Bros.’ Acquisition of IAA January 23, 2023

2 Forward - Looking Statements This communication contains information relating to a proposed business combination transaction between Ritchie Bros. Auctioneers Incorporated (“RBA”) and IAA, Inc. (the “Company”). This communication includes forward - looking information within the meaning of Canadian securities legislation and forward - looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (collectively, “forward - looking statements”). Forward - looking statements may include statements relating to future events and anticipated results of operations, business strategies, the anticipated benefits of the proposed transaction, the anticipated impact of the proposed transaction on the combined company’s business and future financial and operating results, the expected or estimated amount, achievability, sources, impact and timing of cost synergies and revenue, growth, operational enhancement, expansion and other value creation opportunities from the proposed transaction, the expected debt, de - leveraging and capital allocation of the combined company, the anticipated closing date for the proposed transaction, other aspects of RBA’s or the Company’s respective businesses, operations, financial condition or operating results and other statements that are not historical facts. There can be no assurance that the proposed transaction will in fact be consummated. These forward - looking statements generally can be identified by phrases such as “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “goal,” “projects,” “contemplates,” “believes,” “p red icts,” “potential,” “continue,” “foresees,” “forecasts,” “estimates,” “opportunity” or other words or phrases of similar import. It is uncertain whether any of the events anticipated by the forward - looking statements will transpire or occur, or if any of them do, what impact they will have on the results of operations and financial condition of the combined companies or the price of RBA’s common shares or the Company’s common stock . Therefore, you should not place undue reliance on any such statements and caution must be exercised in relying on forward - looking statements . While RBA’s and the Company’s management believe the assumptions underlying the forward - looking statements are reasonable, these forward - looking statements involve certain risks and uncertainties, many of which are beyond the parties’ control, that could cause actual results to differ materially from those indicated in such forward - looking statements, including but not limited to : the possibility that shareholders of RBA may not approve the issuance of new common shares of RBA in the transaction or that stockholders of the Company may not approve the adoption of the merger agreement ; the risk that a condition to closing of the proposed transaction may not be satisfied (or waived), that either party may terminate the merger agreement or that the closing of the proposed transaction might be delayed or not occur at all ; the anticipated tax treatment of the proposed transaction ; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the proposed transaction ; the diversion of management time on transaction - related issues ; the response of competitors to the proposed transaction ; the ultimate difficulty, timing, cost and results of integrating the operations of RBA and the Company ; the effects of the business combination of RBA and the Company, including the combined company’s future financial condition, results of operations, strategy and plans ; the failure (or delay) to receive the required regulatory approval of the transaction ; the fact that operating costs and business disruption may be greater than expected following the public announcement or consummation of the proposed transaction ; the effect of the announcement, pendency or consummation of the proposed transaction on the trading price of RBA’s common shares or the Company’s common stock ; the ability of RBA and/or the Company to retain and hire key personnel and employees ; the significant costs associated with the proposed transaction ; the outcome of any legal proceedings that could be instituted against RBA, the Company and/or others relating to the proposed transaction ; restrictions during the pendency of the proposed transaction that may impact the ability of RBA and/or the Company to pursue non - ordinary course transactions, including certain business opportunities or strategic transactions ; the ability of the combined company to realize anticipated synergies in the amount, manner or timeframe expected or at all ; the failure of the combined company to realize potential revenue, growth, operational enhancement, expansion or other value creation opportunities from the sources or in the amount, manner or timeframe expected or at all ; the failure of the trading multiple of the combined company to normalize or re - rate and other fluctuations in such trading multiple ; changes in capital markets and the ability of the combined company to finance operations in the manner expected or to de - lever in the timeframe expected ; the failure of RBA or the combined company to meet financial and/or KPI targets ; the failure to satisfy any of the conditions to closing of the Starboard investment in RBA, including TSX acceptance of the private placement ; any legal impediment to the payment of the special dividend, including TSX consent to the dividend record date ; legislative, regulatory and economic developments affecting the business of RBA and the Company ; general economic and market developments and conditions ; the evolving legal, regulatory and tax regimes under which RBA and the Company operates ; unpredictability and severity of catastrophic events, including, but not limited to, pandemics, acts of terrorism or outbreak of war or hostilities, as well as RBA’s or the Company’s response to any of the aforementioned factors . These risks, as well as other risks related to the proposed transaction, are included in the registration statement on Form S - 4 and joint proxy statement/prospectus filed with the Securities and Exchange Commission (the “SEC”) and applicable Canadian securities regulatory authorities in connection with the proposed transaction . While the list of factors presented here is, and the list of factors presented in the registration statement on Form S - 4 are, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties . For additional information about other factors that could cause actual results to differ materially from those described in the forward - looking statements, please refer to RBA’s and the Company’s respective periodic reports and other filings with the SEC and/or applicable Canadian securities regulatory authorities, including the risk factors identified in RBA’s most recent Quarterly Reports on Form 10 - Q and Annual Report on Form 10 - K and the Company’s most recent Quarterly Reports on Form 10 - Q and Annual Report on Form 10 - K . The forward - looking statements included in this communication are made only as of the date hereof . Neither RBA nor the Company undertakes any obligation to update any forward - looking statements to reflect actual results, new information, future events, changes in its expectations or other circumstances that exist after the date as of which the forward - looking statements were made, except as required by law .

Additional Disclaimers 3 No Offer or Solicitation This communication is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction . No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U . S . Securities Act of 1933 , as amended, or pursuant to an exemption from, or in a transaction not subject to, such registration requirements . Important Additional Information and Where to Find It In connection with the proposed transaction, RBA filed with the SEC and applicable Canadian securities regulatory authorities a registration statement on Form S - 4 to register the common shares of RBA to be issued in connection with the proposed transaction on December 14 , 2022 . The registration statement includes a joint proxy statement/prospectus which will be sent to the shareholders of RBA and the stockholders of the Company seeking their approval of their respective transaction - related proposals . Each of RBA and the Company may also file other relevant documents with the SEC and/or applicable Canadian securities regulatory authorities regarding the proposed transaction . This document is not a substitute for the proxy statement/prospectus or registration statement or any other document that RBA or the Company may file with the SEC and/or applicable Canadian securities regulatory authorities . INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT ON FORM S - 4 AND THE RELATED JOINT PROXY STATEMENT/PROSPECTUS, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC AND APPLICABLE CANADIAN SECURITIES REGULATORY AUTHORITIES IN CONNECTION WITH THE PROPOSED TRANSACTION OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT/PROSPECTUS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE, BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT RBA, THE COMPANY AND THE PROPOSED TRANSACTION . Investors and security holders may obtain copies of these documents (when they are available) free of charge through the website maintained by the SEC at www . sec . gov, SEDAR at www . sedar . com or from RBA at its website, investor . ritchiebros . com, or from the Company at its website, investors . iaai . com . Documents filed with the SEC and applicable Canadian securities regulatory authorities by RBA (when they are available) will be available free of charge by accessing RBA’s website at investor . ritchiebros . com under the heading Financials/SEC Filings, or, alternatively, by directing a request by telephone or mail to RBA at 9500 Glenlyon Parkway, Burnaby, BC, V 5 J 0 C 6 , Canada, and documents filed with the SEC by the Company (when they are available) will be available free of charge by accessing the Company’s website at investors . iaai . com or by contacting the Company’s Investor Relations at investors@iaai . com . Participants in the Solicitation RBA and the Company and certain of their respective directors and executive officers and other members of management and employees, and Jeffrey C . Smith, may be deemed to be participants in the solicitation of proxies from the stockholders of RBA and the Company in respect of the proposed transaction under the rules of the SEC . Information about RBA’s directors and executive officers is available in RBA’s definitive proxy statement on Schedule 14 A for its 2022 Annual Meeting of Shareholders, which was filed with the SEC and applicable Canadian securities regulatory authorities on March 15 , 2022 , and certain of its Current Reports on Form 8 - K . Information about the Company’s directors and executive officers is available in the Company’s definitive proxy statement on Schedule 14 A for its 2022 Annual Meeting of Stockholders, which was filed with the SEC on May 2 , 2022 , and certain of its Current Reports on Form 8 - K . Other information regarding persons who may be deemed participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, including information with respect to Mr . Smith, are contained or will be contained in the joint proxy statement/prospectus and other relevant materials filed or to be filed with the SEC and applicable Canadian securities regulatory authorities regarding the proposed transaction when they become available . Investors should read the joint proxy statement/prospectus carefully before making any voting or investment decisions . You may obtain free copies of these documents from RBA or the Company free of charge using the sources indicated above .. Non - GAAP Financial Measures This presentation contains certain non - GAAP financial measures, including EBITDA and adjusted EBITDA . These non - GAAP financial measures are not calculated in accordance with GAAP and may exclude items that are significant in understanding and assessing a company’s financial condition or operating results . Therefore, these measures should not be considered in isolation or as alternatives to financial measures under GAAP . In addition, these measures may not be comparable to similarly - titled measures used by other companies . Further information regarding non - GAAP financial measures is included in the respective filings with the SEC and/or applicable Canadian securities regulatory authorities of RBA and the Company . All figures are presented in U . S . dollars .

Increase in cash consideration to IAA shareholders and one - time special dividend to RBA shareholders Updated IAA Transaction Parameters Original Agreement (7 - Nov - 2022) Revised Agreement (23 - Jan - 2023) 0.5804x - 0.5252x $10.00 / share $1.08 / share (Represents 4 Quarters of Current RBA Dividends) Payable Upon Closing of Merger³ Special Dividend to Pre - Closing RBA Shareholders $12.80 / share (+$2.80) Pro Forma O wn e r s h ip Exchange Ratio Cash Consideration per IAA Share RBA: ~59% | IAA: ~41% RBA: ~59.1% | IAA: ~37.2% Starboard: ~3.7%² $44.92 $44.40 Offer Value per IAA Share (20 - Jan - 2023)¹ ¹ Offer Values calculated based on RBA closing price of $60.17 as of 20 - Jan - 2023. ² Represents pro forma ownership including the Starboard investment on as - converted basis. RBA has the right to redeem the convertible preferred at 102% of par plus accrued and unpaid dividends if the IAA transaction is terminated or has not closed by 7 - Aug - 2023. ³ Special dividend would be payable contingent upon the closing of the merger to RBA shareholders of record as of a pre - closing record date to be determined with consent of the TSX. 4

Preferred Dividends • Initial rate of 5.50% per annum, plus participation in regular (quarterly) RBA common dividends on an as - converted basis, subject to a floor of $0.27 per common share • Starboard may request increases in the dividend rate at year 4 (to 7.50%) and at year 9 (fixed rate equivalent to SOFR+600bps, or 10.50% if greater). Upon either such request by Starboard, RBA will have a 45 - day call right at par, plus any accrued and unpaid dividends Size & Structure • $485mm of senior preferred shares, convertible into common shares • $15mm of common shares Conversion Price / Common Share Purchase Price • Initial preferred conversion price of $73.00 — Represents a premium to RBA 52 - week high of $72.66 — Subject to customary anti - dilution protection • Common shares to be purchased at a price per share of $59.72 Forced Conversion / Company Redemption Rights • If RBA’s common share closing price exceeds 190% of conversion price for 20 trading days (whether or not consecutive) in any 30 consecutive trading day period after year 3, RBA has the right to convert the security to common shares, with the trigger level reduced to 175% of conversion price after year 7 • Company call right any time after year 9 at par, plus any accrued and unpaid dividends Voting / Governance • Preferred shares vote on an as converted basis • Starboard will not vote the shares underlying the convertible preferred shares or its common share investment at the RBA shareholder meeting held with respect to the IAA acquisition • Jeff Smith to join Board of RBA upon approval of the IAA acquisition by both RBA and IAA shareholders • IAA will continue to designate 4 directors to the RBA Board upon completion, including one independent director identified by Ancora New Investment by Starboard Value LP: Summary Terms¹ 5 Note: RBA has the right to redeem the convertible preferred at 102% of par plus accrued and unpaid dividends if the IAA transaction is terminated or has not closed by 7 - Aug - 2023 ¹ Remains subject to satisfaction of customary closing conditions, including TSX acceptance of the proposed terms.

Impact from Potential Revenue Opportunities Significantly Exceeds Estimated Cost Synergies Note: Potential opportunities and related information included for illustrative purposes only and do not imply future targets, expectations or guidance. Estimates do not incorporate potential costs to achieve or specific timeframes.¹ Values include midpoint of range of estimated run - rate cost synergies ($110mm). Low and high end represent range of revenue opportunities – see page 20 for details. Commentary Illustrative Pro Forma EBITDA Opportunities ($mm) 1 6 • The IAA transaction presents numerous revenue opportunities for the combined company that could yield an incremental >$800mm of EBITDA • Represents multiples of previously announced $100 - $120mm+ cost synergies • Opportunities considered include growing IAA sales domestically and abroad, growing RBA GTV, financing, parts and services attachment, whole car sales as well as accessing incremental salvage markets • Detailed bottoms - up build is provided on slide 20 • Growing the combined business and executing on all opportunities in our scope is core to acquisition thesis in order to maximize value for all shareholders IAA transaction provides significant value creation upside relative to standalone plan $ 100 - 120+ ~ $ 350 ~ $ 900 Revenue Opportunities (Low End) Estimated Cost Synergies Estimated Cost Synergies + Estimated Cost Synergies + Revenue Opportunities (High End)

Highlights of Today’s Announcements and Rationale 7 • Amended merger agreement provides benefits for both RBA and IAA shareholders: • $2.80 incremental cash consideration to IAA shareholders, driving greater up - front value with the opportunity to also participate in the combined company through the stock portion of the consideration • One - time special dividend to pre - closing RBA shareholders (~$120mm) provides for immediate cash return upon closing, reflecting management conviction in the strong cash flow generation of the combined business¹ • RBA shareholders’ pro forma ownership in the enlarged company accretes slightly versus original transaction • Updated terms were unanimously approved by the Boards of Directors of Ritchie Bros. and IAA • Significant investment from Starboard who has substantial knowledge of the automotive salvage industry and believes in this compelling value creation opportunity for all shareholders • Investment only converts to equity above $73.00 per share • Shares held by Starboard are non - votable in connection with the transaction • The net effect of the two transactions is leverage neutral and maintains combined company’s capital allocation flexibility • Integration planning supports significant revenue opportunities to drive shareholder value, far in excess of announced cost synergies ¹ Special dividend of $1.08 per share would be payable contingent upon closing of the merger to RBA shareholders of record as of a pre - closing record date to - be determined with consent of TSX.

Disciplined Integration 2 Management and Cost Synergy Realization Ensure Success of Core RBA 1 Accelerate Growth of Combined Business (1+1=4) 3 Capture Significant Incremental Value Upside Potential 1 4 RBA management has and will continue to deliver on its commitments and marketplace strategy – the evidence of success is demonstrable, and the IAA transaction represents an expected accelerant to that vision The Integration Management Office will focus on efficient resource utilization and cost synergy realization across the combined business to drive margins, de - lever and provide capital allocation flexibility; expect regular updates to investors on progress Management has identified opportunities and processes to cross utilize yards, driving incremental Gross Transaction Value (GTV) growth while strengthening IAA’s catastrophic event (CAT) response and insurance carrier relationships We believe cost synergies, growth opportunities and operational enhancements at IAA provide an opportunity for $21 - 61 of incremental value per RBA share . Expected multiple normalization (re - rating) of combined company above current depressed levels represents further upside potential Acquiring and Integrating Creates Shareholder Value Opportunities 8 ¹ Potential opportunities and related information included for illustrative purposes only and do not imply future targets, expectations or guidance. Please see pages 20 - 21 for incremental detail. Areas of Focus

The “Core” RBA Value Creation Roadmap Remains Unchanged 1 Core RBA Success • Over the last three years, RBA management has worked to position the business through investments in our offerings, systems and people • As the equipment cycle turns to provide a tailwind to our business, we remain uniquely positioned to realize returns on our investments • As we begin to integrate IAA, we will be focused on ensuring success of the core RBA business so that we can capitalize on the growth opportunities ahead • Our sales teams, omnichannel marketplaces and service offerings will have defined owners — who are not participating in formal integration workstreams — and KPIs to deliver against • By clearly defining success in our core business, we expect a seamless integration of IAA while continuing to strengthen the core of RBA 9 Management Results | Last Three Years x x x O u t pe r f o rm e d the Market² Grew GTV¹ Enhanced Service Offerings Via M&A ~41% Total Shareholder Return (Greater than NASDAQ, S&P 500 and TSX) + $800 m m x Enhanced Mar k e t p l a ce Offerings Ensuring Success in “Core” RBA is of Utmost Importance 1 RBA GTV reflects total proceeds from all items sold at RBA auctions and online marketplaces. Reflects total increase from 2019A – LTM Q3 2022. ² Shareholder returns from 3 - Jan - 2020 to 30 - Dec - 2022.

RBA’s Sales Team Will Be Unaffected by Integration and Remains Positioned to Drive GTV Growth RBA’s Go - to - Market Segmentation Drivers of Go - to - Market Continuity Strategic Ac c o u n t s Territory M a n a g e r s Inside Sales • Target large, geographic and multi - national relationships with a vertical focus • Sector verticals: Rental, OEM, Financial Services, Energy, Construction, Transportation, Insurance • Provide regional coverage across a wide - array of industries with long - standing RBA customers and targeted net new prospects • Dedicated team to pursue long - tail customers with <$70k in GTV No cost synergies attributed to salesforce rationalization x Financial plan accounts for additional hiring of salespeople for core RBA across all geographies x Dedicated team pursuing the sourcing of inventory globally, further driving GTV growth x 10 1 Core RBA Success Dedicated owner with no integration responsibilities in place x Progression Toward Evergreen Model’s High Single Digits to Low Teens GTV Growth Targets KPI Note: KPI targets do not imply, and should not be relied upon as, future expectations or guidance.

Omnichannel Platform Will Continue to Drive Buyer and Seller Activity Transaction Solutions Support A Variety of Verticals Drivers of Platform Continuity Current infrastructure will remain intact for the foreseeable future x Thoughtworks will remain engaged in RB2.0 transformation x Investments budgeted as part of financial plan to accelerate RB2.0 strategy x Channels 11 1 Core RBA Success Dedicated owner with no integration responsibilities in place x >99.9% Service Up - Time KPI Primary Verticals Construction Gov er n m e nt Surplus Commercial T r an s po r t at i on Agriculture Lifting & Material Handling Co mmerc i al Accessories Note: KPI targets do not imply, and should not be relied upon as, future expectations or guidance.

RBA is Poised for Further Acceleration of Revenue Growth as Marketplace Services Attach to Increased Volumes Core Marketplace Services Drivers of Services Attach Transactional Services Asset and Inventory Management Parts and Services Data Analytics / Insights Storage O w n e rs h ip Services Category RB Solution Financial Services Appraisals, Valuation, Advisory Inspections Auction Technologies (Simulcast) Secure Transaction Management PurchaseSafe 䉼 Repairs and Refurbishment Transportation 3 rd Party Partners x Financial plan includes budget for dedicated services - origination headcount additions International growth continues, but resources have been allocated to drive services attach x x “Portability” of services – can attach to both RB auction, and non - RB auction, volumes 12 1 Core RBA Success Dedicated owners in place x Progression Toward Evergreen Model’s Low Double Digits to High Teens Service Revenue Growth KPI Note: KPI targets do not imply, and should not be relied upon as, future expectations or guidance.

Integration Management Office Will Lead IAA Integration Effort to Drive Cost Synergy and Revenue Opportunity Realization Integration Management Office (IMO) Structure IMO Guiding Principles Steering Committee Integration Ma n a g e m e n t Office F un c t i o n a l Teams People (i n cl u d i ng Comms) Value: Cost S y ne r g i e s Value: P o s t - clo s e Revenue Opptys. Deal close & R e g u l at o r y HR Technology Fi n a n ce Operations L e g a l Marketing • RBA has engaged a leading third - party consultant to help execute its integration playbook • The Steering Committee, IMO and functional teams will have clear charters, milestones, and KPIs to drive accountability • IMO stakeholders represent <1% of RBA staff, ensuring minimal impact to core business • IMO structure will ensure that organization focuses on areas of greatest business impact and highest value drivers • IMO will lead cost synergy realization efforts and ensure cross - functional collaboration • Management will provide regular updates to shareholders on integration progress and cost synergy realization 13 2 Integration & Synergies

Executive Leadership We Have Confidence in the Sources, Achievability and Timeline of Cost Synergies Near - Term Focus on “Quick Wins” to Drive Near - Term Value Creation Confidence In Our Initial Synergy Estimates with High Visibility on Expected Time - To - Achieve Public Company Costs Vendor Consolidation Vacant Positions x Consolidation of duplicative roles x Harmonization of long - term incentive plans x Board of Director fees x Redundant costs associated with reporting, listing and governance requirements x Cross - company vendor consolidation and buy - better initiatives x Long - tail vendor management within each legacy organization x Cross - company staffing for vacant and unfilled roles Opportunity Key Components Estimated Sizing Human Capital and Public Company Costs Executives $44 – 53mm+ Incentive Compensation Public Company Costs Finance & T ec hn o l ogy Business Technology $27 – 33mm+ Finance Back - Office Conso li d a t i on HR $14 – 17mm+ Marketing Legal Indirect G&A Procurement $8 – 9mm+ IT Licenses Other Real Estate Efficiencies $7 – 8mm+ Other Estimated Total $100 - 120mm+ 2 Integration & Synergies Cost synergy realization expected to begin post - close and to reach annual run - rate by end of 2025 14

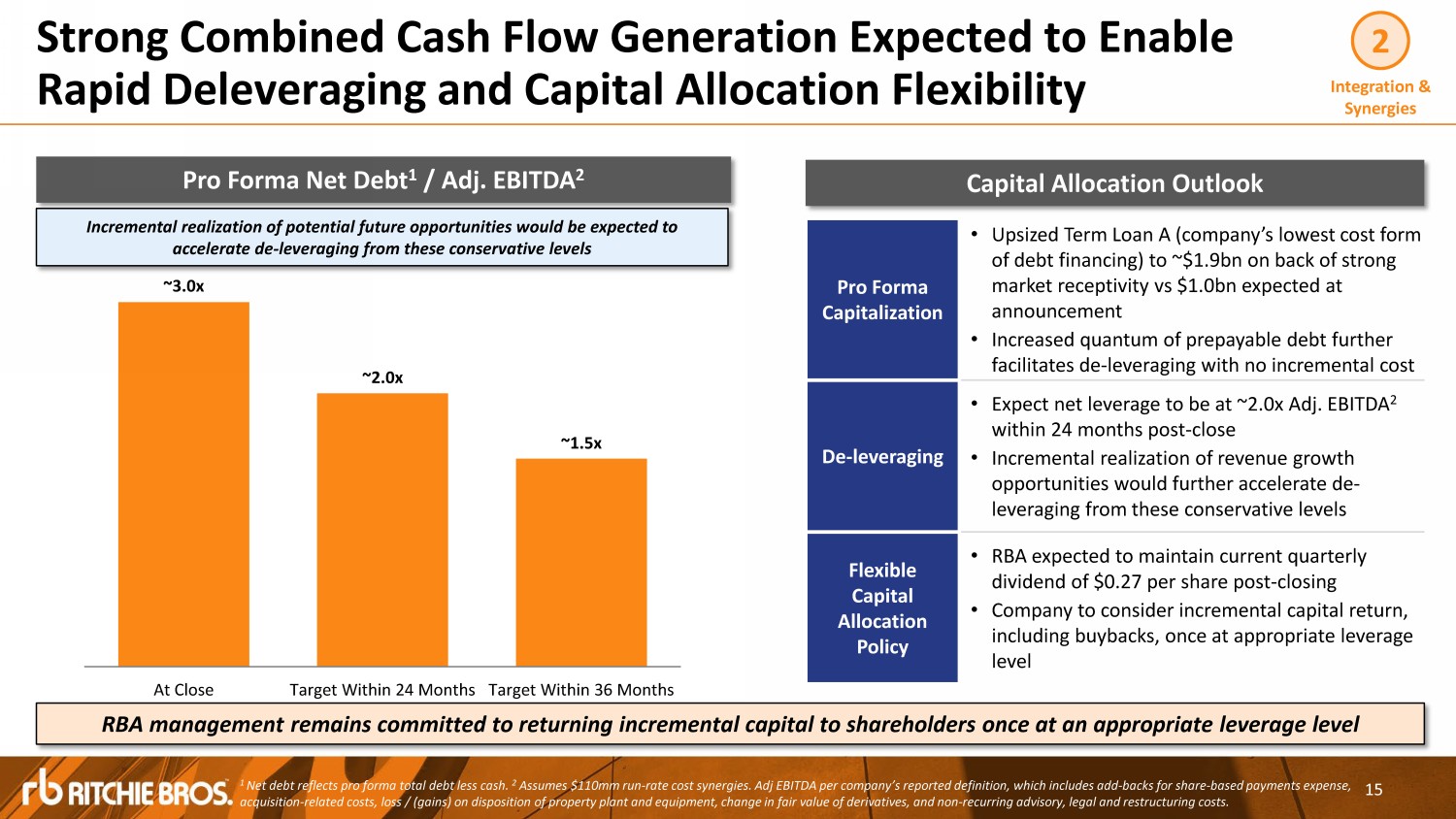

~3.0x ~2.0x ~1.5x At Close Target Within 24 Months Target Within 36 Months Strong Combined Cash Flow Generation Expected to Enable Rapid Deleveraging and Capital Allocation Flexibility 1 Net debt reflects pro forma total debt less cash. 2 Assumes $110mm run - rate cost synergies. Adj EBITDA per company’s reported definition, which includes add - backs for share - based payments expense, acquisition - related costs, loss / (gains) on disposition of property plant and equipment, change in fair value of derivatives, and non - recurring advisory, legal and restructuring costs. Pro Forma Capi t ali z a t i o n • Upsized Term Loan A (company’s lowest cost form of debt financing) to ~$1.9bn on back of strong market receptivity vs $1.0bn expected at announcement • Increased quantum of prepayable debt further facilitates de - leveraging with no incremental cost De - leveraging • Expect net leverage to be at ~ 2 . 0 x Adj . EBITDA 2 within 24 months post - close • Incremental realization of revenue growth opportunities would further accelerate de - leveraging from these conservative levels Flexible Capital Allo c a t ion Policy • RBA expected to maintain current quarterly dividend of $ 0 . 27 per share post - closing • Company to consider incremental capital return, including buybacks, once at appropriate leverage level Pro Forma Net Debt 1 / Adj. EBITDA 2 Capital Allocation Outlook Incremental realization of potential future opportunities would be expected to accelerate de - leveraging from these conservative levels 15 2 Integration & Synergies RBA management remains committed to returning incremental capital to shareholders once at an appropriate leverage level

The Combination Enhances RBA’s Satellite Yard Coverage Via IAA’s Existing Footprint IAA’s Highly Attractive Yard Footprint is Well Suited to RBA’s Satellite Strategy… …Enabling the Acceleration of RBA’s Satellite Yard Strategy To Drive Incremental GTV Growth 210+ IAA Locations with ~10,000 Acres of Capacity¹ 3 Acc e l e ra t e Growth RBA’s Go - to - Market Strategy Will Help Identify Optimal Locations for RBA Satellite Yards within IAA Geographies Strong Team in Place to Manage Zoning and Regulatory Requirements Disciplined Evaluation of Yard and Infrastructure for Optimal Suitability and Operational Efficiencies Aligned Operational Workflows to Enable Efficient Cross - Utilization of Yards “Best - of - the - Best” Operating Systems and Practices to Maximize Integration and Inter - Operability 1 2 3 4 5 16 Attractive Metropolitan Locations and Proximity to Customers Can Support Transportation and Smaller Equipment Typically Stored at RBA’s Satellite Yards ~75% of IAA Yards Have 5+ Acres of Excess Capacity IAA Yards Well Suited to Accommodate RBA Satellite Yards’ ~5 Acre Size and Layout ¹ Capacity does not include acreage under option contracts.

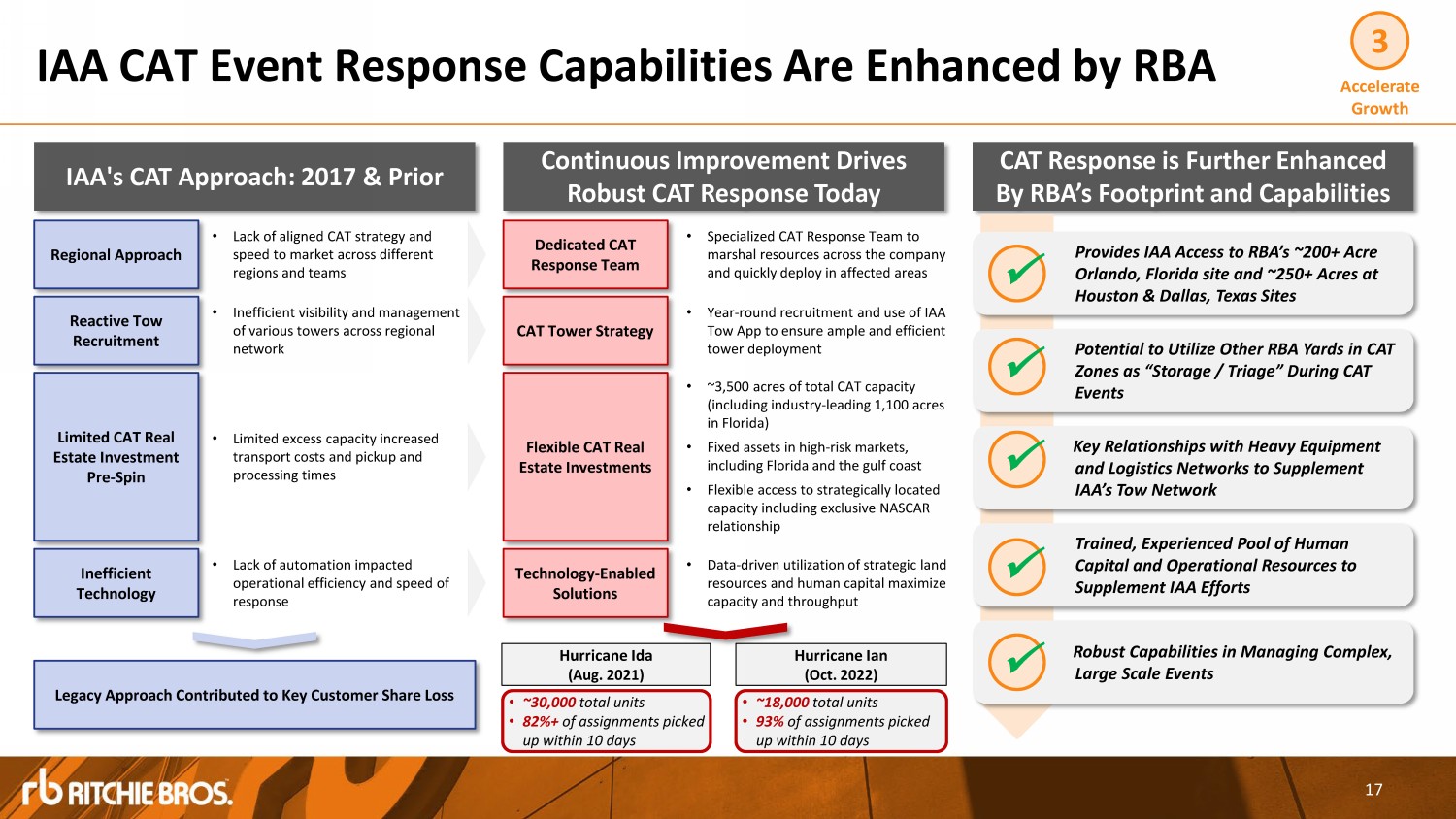

Hurricane Ian (Oct. 2022) • ~18,000 total units • 93% of assignments picked up within 10 days IAA CAT Event Response Capabilities Are Enhanced by RBA IAA's CAT Approach: 2017 & Prior Continuous Improvement Drives Robust CAT Response Today CAT Response is Further Enhanced By RBA’s Footprint and Capabilities 17 Provides IAA Access to RBA’s ~ 200 + Acre Orlando, Florida site and ~ 250 + Acres at Houston & Dallas, Texas Sites Trained, Experienced Pool of Human Capital and Operational Resources to Supplement IAA Efforts Key Relationships with Heavy Equipment and Logistics Networks to Supplement IAA’s Tow Network Robust Capabilities in Managing Complex, Large Scale Events x x Potential to Utilize Other RBA Yards in CAT Zones as “Storage / Triage” During CAT Events x x x Hurricane Ida (Aug. 2021) • ~30,000 total units • 82%+ of assignments picked up within 10 days Regional Approach Limited CAT Real Estate Investment Pre - Spin Reactive Tow Recruitment • Lack of aligned CAT strategy and speed to market across different regions and teams • Inefficient visibility and management of various towers across regional network • Limited excess capacity increased transport costs and pickup and processing times Inefficient T e c hn o l o g y • Lack of automation impacted operational efficiency and speed of response Dedicated CAT Response Team CAT Tower Strategy Flexible CAT Real Estate Investments Technology - Enabled Solutions • Specialized CAT Response Team to marshal resources across the company and quickly deploy in affected areas • Year - round recruitment and use of IAA Tow App to ensure ample and efficient tower deployment • ~3,500 acres of total CAT capacity (including industry - leading 1,100 acres in Florida) • Fixed assets in high - risk markets, including Florida and the gulf coast • Flexible access to strategically located capacity including exclusive NASCAR relationship • Data - driven utilization of strategic land resources and human capital maximize capacity and throughput Legacy Approach Contributed to Key Customer Share Loss 3 Acc e l e ra t e Growth

Salvage Volume Throughput Speed of Response Carmen Thiede Chief Transformation and People Officer We Understand What Insurance Carriers Value Most and Plan to Deliver On It Baron Concors Chief Product & Technology Officer Matt Ackley Chief Marketing Officer Eric Jacobs Ann Fandozzi Chief Financial Officer Chief Executive Officer Jim Kessler President / Chief Operating Officer Kevin Geisner Chief Strategy Officer Together With IAA Executives, Our Team Has the Right Experience… Select Prior Experience …We Understand What Carriers Value… …And We Have a Framework to Build Engagement with Carriers Best Price Realization Catastrophe Response Capabilities Scale and Yard Footprint Sophisticated Logistics Capabilities Experience in Managing Carrier KPIs to Ensure Client Satisfaction Our Network of Insurance Industry Talent Will Help Us to Drive Operational Performance Robust Experience in Digital Marketing to Generate and Sustain Buyer Demand x x x Deep Knowledge and Experience in Managing Yard Processes across Different Asset Classes 18 Track Record of Handling Multiple Business Objectives While Performing Against High Growth Targets x x 3 Acc e l e ra t e Growth

RBA’s International Operations Are Expected to Accelerate IAA’s Expansion in High - Potential Markets RBA Operates Yards in Several Attractive Geographies Where IAA Does Not… …RBA Has the Framework to Accelerate IAA’s International Expansion Region Car Parc 1 Germany 48mm x - Italy 40mm x - France 38mm x - Mexico 34mm x - Spain 25mm x - Australia 15mm x - Netherlands 9mm x - Total 210mm Source: ACEA Vehicles in Use in Europe 2022; Australian Bureau of Statistics; INEGI. 1 Car parc defined as passenger cars in 2020. Existing International Business & Legal Entities Fixed, Owned International Real Estate & Infrastructure International Regulatory and Zoning Acumen Experienced Overseas Management & Personnel Trusted Relationships with International Buyers & Sellers Prioritization of Geographies for Planned Expansions 1 2 3 4 5 6 19 3 Acc e l e ra t e Growth

Incremental Opportunities Through Combination Drive Potential for Significant Value Creation 4 Capture Value Upside 20 Note: Potential opportunities and related information included for illustrative purposes only and do not imply future targets, expectations or guidance. Estimates do not incorporate potential costs to achieve or specific timeframes. Opportunity Description Potential Drivers of Estimated EBITDA Opportunity Range ($mm) Announced Cost Synergies • Removal of duplicative costs and functions across combined company $100 $120+ Grow Domestic IAA Sales • Differentiated offerings and enhanced CAT resources drive incremental volumes $75 Gain 4% incremental market share $200 Attain 50/50 market share split with top competitor Grow International IAA Sales • Leverage RBA international presence to allow for more rapid expansion $40 Use existing RB international footprint to close 25% of intl. volume gap to top competitor $150 Close 100% of intl. volume gap to top competitor Grow RBA GTV • Drive incremental GTV growth utilizing excess capacity at IAA yards $40 Utilize IAA yards with open capacity as satellite RB yards, where RB salesforce coverage exits $125 Expand RB salesforce to cover additional IAA yards with open capacity Financing • Deploy RBFS salesforce into IAA customers to drive incremental attachment of financing solutions $25 Close financing attach rate gap to RBA by 25%, targeting rebuilders only $100 Financing attach rate in line with RBA Parts and Services • Leverage learnings from existing RBA offerings to drive services attach at IAA $20 Close attach rate gap to RBA by 12% $75 Close attach rate gap to RBA by 50% Whole Car Sales • Capture portion of used whole car auction market using existing IAA systems and processes $25 5% of leading dealer’s auction volumes $70 15% of leading dealer’s auction volumes Incremental Salvage Markets • Gain access to salvage commercial equipment inventory through IAA carrier and fleet relationships $25 Line of sight to 3% incremental GTV opportunity $70 8% incremental GTV opportunity Total Estimated Potential EBITDA Opportunity $350 $900

Combination of Future Opportunities and Market Re - Rating Represents Extensive Shareholder Value Opportunity 4 Capture Value Upside Source: Bloomberg, IBES Median Estimates. Note: Potential opportunities and related information included for illustrative purposes only and do not imply future targets, expectations or guidance. Estimates do not incorporate potential costs to achieve or specific timeframes.¹ Reflects illustrative EV / NTM EBITDA range, based on pre - transaction blend at the low end and illustrative ~3.0x re - rating at the high end, informed by observed blend of top decile observed EV / NTM EBITDA multiples for RBA and IAA over last twelve month period ending 4 - Nov - 2022. 2 Reflects midpoint of range of estimated run - rate cost synergies ($110mm). Figures are illustrative and un - discounted. Commentary Illustrative Pro Forma Synergy Value per Share 2 21 • Cost synergy opportunity ($100 - 120mm+) could create ~$8 incremental value per share 2 • >10% value creation opportunity compared to undisturbed RBA share price of $62.32 as of 4 - Nov - 2022 • Revenue opportunities could represent an incremental >$800mm in EBITDA opportunity • At illustrative pre - transaction blended multiple, cost synergies and revenue opportunities represent a ~$21 - 61 per share 2 value creation opportunity. An illustrative 3x re - rate represents an incremental ~$5 – 15 per share from these opportunities • Revenue opportunities are expected to represent greater value creation potential than run - rate cost synergies Total estimated potential EBITDA opportunity represents significant upside to standalone plan 16.0 x I ll ust r at i v e Re - Rated + $ 9 + $ 26 + $ 42 + $ 59 + $ 76 Multiple 14.5 x + 8 + 23 + 38 + 53 + 69 13.0 x + 8 + 21 + 34 + 48 + 61 Approximate Pre - T r ansa c t i on Blended Multiple Cost Syngs. Only Cost Syngs. + Illustrative % of Revenue Opportunities Realized $100 - 120+ M M 25 % 50 % 75% 100% ($900 M ) Illustrative PF Trading Multiple¹

Disciplined Integration 2 Management and Cost Synergy Realization Ensure Success of Core RBA 1 Accelerate Growth of Combined Business (1+1=4) 3 Capture Significant Incremental Value Upside Potential 1 4 RBA management has and will continue to deliver on its commitments and marketplace strategy – the evidence of success is demonstrable, and the IAA transaction represents an expected accelerant to that vision The Integration Management Office will focus on efficient resource utilization and cost synergy realization across the combined business to drive margins, de - lever and provide capital allocation flexibility; expect regular updates to investors on progress Management has identified opportunities and processes to cross utilize yards, driving incremental Gross Transaction Value (GTV) growth while strengthening IAA’s catastrophic event (CAT) response and insurance carrier relationships We believe cost synergies, growth opportunities and operational enhancements at IAA provide an opportunity for $21 - 61 of incremental value per RBA share . Expected multiple normalization (re - rating) of combined company above current depressed levels represents further upside potential Acquiring and Integrating Creates Shareholder Value Opportunities 22 ¹ Potential opportunities and related information included for illustrative purposes only and do not imply future targets, expectations or guidance. Please see pages 20 - 21 for incremental detail. Areas of Focus