UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10- Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the quarterly period ended: | March 31, 2015 |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

Commission File Number: 000-51203

First Colombia Gold Corp.

(Exact name of registrant as specified in its charter)

| Nevada | 98-0425310 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

|

6000 Poplar Avenue , Suite 250, Memphis , TN 34119 (Address of principal executive offices) | ||

| 888-224-6561 | ||

| (Registrant’s telephone number, including area code) | ||

| __________________________________________________________________ | ||

| (Former name, former address and former fiscal year, if changed since last report) | ||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer,” and “a smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o |

|

Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes x No

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date:

| Class | Outstanding at April 30, 2015 | |

| Common Stock, $0.00001 par value | 2,697,961,680 |

Table of Contents

|

FORM 10-Q FIRST COLOMBIA GOLD CORP. March 31, 2015

TABLE OF CONTENTS

|

Page | |

| PART I – FINANCIAL INFORMATION | ||

| Item 1. | Interim Consolidated Financial Statements. | 3 |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. | 4 |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk. | 24 |

| Item 4. | Controls and Procedures. | 25 |

| PART II – OTHER INFORMATION | ||

| Item 1. | Legal Proceedings. | 26 |

| Item 1A. | Risk Factors. | 26 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds. | 26 |

| Item 3. | Defaults Upon Senior Securities. | 26 |

| Item 4. | Mine Safety Disclosures. | 26 |

| Item 5. | Other Information . | 26 |

| Item 6. | Exhibits. | 28 |

| Signatures | ||

| Certifications | ||

- 2 -

Table of Contents

PART I - FINANCIAL INFORMATION

Item 1. Interim Consolidated Financial Statements

| Our interim condensed consolidated financial statements included in this Form 10-Q as of March 31,2015 are as follows: | |

| F-1 | Condensed Consolidated Balance Sheets as of March 31, 2015 and December 31, 2014. |

| F-2 | Condensed Consolidated Statements of Operations for the three months ended March 31, 2015 and 2014. |

| F-3 | Condensed Consolidated Statements of Cash Flows for the three months ended March 31, 2015 and 2014. |

| F-4 | Notes to Condensed Consolidated Financial Statements. |

The accompanying notes are an integral part of these condensed consolidated financial statements.

- 3 -

Table of Contents

| FIRST COLOMBIA GOLD CORP. AND SUBSIDIARY | |

| Condensed Consolidated Balance Sheets |

| 31 March | 31 December | |||||||

| 2015 | 2014 | |||||||

| $ | $ | |||||||

| Assets | ||||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | 22,170 | $ | 33,833 | ||||

| Prepaid expenses | - | - | ||||||

| Accounts Receivable | - | - | ||||||

| Total current assets | 22,170 | 33,833 | ||||||

| Property and Equipment | 393,235 | 493,901 | ||||||

| Total Assets | $ | 415,405 | $ | 527,734 | ||||

| Liabilities and Stockholders' Equity (Deficit) | ||||||||

| Current Liabilities | ||||||||

| Accounts payable and accrued liabilities | $ | 378,422 | $ | 289,438 | ||||

| Accounts payable, related parties | 29,550 | 29,550 | ||||||

| Accrued interest | - | - | ||||||

| Convertible notes payable | 627,556 | 473,148 | ||||||

| Notes Payable | - | - | ||||||

| Advances - related parties | - | - | ||||||

| Current portion of long term notes payable | - | - | ||||||

| Derivative liabilities | 2,769,327 | 544,392 | ||||||

| Total Current Liabilities | 3,804,855 | 1,336,528 | ||||||

| Long term notes payable | 264,100 | 264,100 | ||||||

| Asset Retirement Obligation | 125,221 | 125,221 | ||||||

| Total Liabilities | 4,194,176 | 1,725,849 | ||||||

| Liabilities and Stockholders' Deficit | ||||||||

| Stockholders' Deficit | ||||||||

| Preferred Stock | ||||||||

| Blank check preferred stock, par value $0, 150,000,000 shares authorized, | ||||||||

| 0 shares issued and outstanding at March 31, 2015 and March 31, 2014 | - | - | ||||||

| Series A convertible preferred stock, par value $.001, 50,000,000 shares | ||||||||

| authorized, 46,818,000 shares issued and outstanding | ||||||||

| at March 31, 2015 and March 31, 2014, respectively | 46,819 | 46,819 | ||||||

| Series B convertible preferred stock, par value $.001, 33,181,818 shares | ||||||||

| authorized, 0 and 0 shares issued and outstanding | ||||||||

| at March 31, 2015 and March 31, 2014, respectively | - | - | ||||||

| Common Stock | ||||||||

| Par value $.00001, 10,000,000,000 shares authorized, 2,378,622,897 and | ||||||||

| 398,707,651 shares issued and outstanding at March 31, 2015 and | ||||||||

| December 31, 2014, respectively | 23,786 | 3,987 | ||||||

| Additional paid-in capital | 75,756,993 | 73,775,496 | ||||||

| Accumulated deficit | (75,024,417 | ) | (75,024,417 | ) | ||||

| Total Stockholders' Deficit | (3,778,771 | ) | (1,198,115 | ) | ||||

| Total liabilities and stockholders' deficit | $ | 415,405 | $ | 527,734 | ||||

F - 1

Table of Contents

| For the | For the | |||||||

| three month | three month | |||||||

| period ended | period ended | |||||||

| 31 March | 31 March | |||||||

| 2015 | 2014 | |||||||

| $ | $ | |||||||

| Income | 10,001 | - | ||||||

| Oil Revenue | 10,001 | - | ||||||

| Total Revenue | ||||||||

| Expenses | ||||||||

| Operating Expenses | 2,204,110 | 28,560 | ||||||

| Loss from operations | (2,194,109 | ) | (28,560 | ) | ||||

| Other Income/(Expense) | ||||||||

| Gain on debt extinguishment | 293,143 | - | ||||||

| Interest expense | (645,268) | (40,619) | ||||||

| Gain/(Loss) on derivative liabilities | (2,035,718) | 283,455 | ||||||

| Total Other Income/(Expense) | (2,387,843 | ) | 242,836 | |||||

| Net loss | (4,581,952 | ) | 214,276 | |||||

| Loss per common share - basic and diluted | (0.00 | ) | (.01 | ) | ||||

| Weighted average shares outstanding of common - basic and diluted | 1,080,596,439 | 33,911,362 | ||||||

The accompanying notes are an integral part of these condensed consolidated financial statements

F - 2

Table of Contents

| FIRST COLOMBIA GOLD CORP. AND SUBSIDIARY | |

| Condensed Consolidated Statement of Cash Flows |

| For the | For the | |||||||

| three month | nine month | |||||||

| period ended | period ended | |||||||

| 31March | 31 March | |||||||

| 2015 | 2014 | |||||||

| $ | $ | |||||||

| Cash Flows Used in Operating Activities: | ||||||||

| Net Income (Loss) | (4,581,952 | ) | 214,276 | |||||

| Adjustments to reconcile net loss with net cash used in operating activities: | ||||||||

| Depreciation and amortization | 121,150 | 441 | ||||||

| Common stock issued as compensation | 1,800,000 | - | ||||||

| Consulting fees | 482,360 | - | ||||||

| Debt discount amortization and origination interest | - | 35,841 | ||||||

| Gain on extinguishment of debt | (293,143) | - | ||||||

| Gain/(Loss) on derivative liabilities | 2,035,718 | (283,455) | ||||||

| Changes in operating assets and liabilities | ||||||||

| Other Receivable & Prepaid Expenses | - | 3,000 | ||||||

| Increase (decrease) in accounts payable – related parties | - | - | ||||||

| Increase (decrease) in accounts payable and accrued liabilities | (88,984) | 16,397 | ||||||

| Net Cash used in Operating Activities | (346,883) | (13,500 | ) | |||||

| Net Cash Used In Investing Activities | ||||||||

| Sale of fixed assets | 85,000 | - | ||||||

| Net Cash Used In Investing Activities | 85,000 | - | ||||||

| Cash Flows From Financing Activities: | ||||||||

| Proceeds from notes payable | 250,220 | 13,500 | ||||||

| Cost of repurchase of common stock | - | - | ||||||

| Warrants exercised | - | - | ||||||

| Issuance of common stock, net of share issue costs | - | - | ||||||

| Net Cash Provided by Financing Activities | 250,220 | 13,500 | ||||||

| Net Increase (Decrease) in Cash | (11,663) | - | ||||||

| Cash at Beginning of Period | 33,833 | - | ||||||

| Cash at End of Period | 22,170 | - | ||||||

| Supplemental disclosure of noncash investing and financing activities : | ||||||||

| Common shares issued upon conversion of promissory notes | - | 5,780 | ||||||

| Common shares issued for settlement of accounts payable | 201,296 | - | ||||||

| Common shares issued for services | 1,800,000 | - | ||||||

The accompanying notes are an integral part of these condensed consolidated financial statements

F - 3

Table of Contents

FIRST COLOMBIA GOLD CORP. AND SUBSIDIARY

Notes to condensed consolidated financial statements

March 31, 2015

| 1. | Nature, Basis of Presentation and Continuance of Operations |

First Colombia Gold Corp. (the “Company”) was incorporated under the laws of the State of Nevada, U.S.A. under the name “Gondwana Energy, Ltd.” On 5 September 1997. On 23 January 2007, the Company changed its name to “Finmetal Mining Ltd.”. On 27 November 2006, the Company completed the acquisition of 100% of the shares of Finmetal Mining OY (“Finmetal OY”), a company incorporated under the laws of Finland. During the fiscal year ended 31 December 2006, the Company changed its operational focus from development of oil and gas properties, to acquisition of, exploration for and development of mineral properties in Finland.

On 22 May 2008, the Company changed its name to “Amazon Goldsands Ltd.” And on 18 September 2008, the Company entered into a Mineral Rights Option Agreement and concurrently re-focused on the acquisition of, exploration for and development of mineral properties located in Peru. On 29 November 2010, the Company changed its name to “First Colombia Gold Corp.”. The Company changed its name pursuant to a parent/subsidiary merger between the Company (as Amazon Goldsands Ltd.) and its wholly-owned non-operating subsidiary, First Colombia Gold Corp., which was established for the purpose of giving effect to this name change. In 2011 the Company expanded geographic focus to include North America, acquiring two mineral property interests while terminating its agreements related to the mineral property located in Peru in September 2011.

The business of mining and exploring for minerals involves a high degree of risk and there can be no assurance that current exploration programs will result in profitable mining operations. The recoverability of the carrying value of exploration properties and the Company’s continued existence are dependent upon the preservation of its interest in the underlying properties, the discovery of economically recoverable reserves, the achievement of profitable operations, or the ability of the Company to raise alternative financing, if necessary, or alternatively upon the Company’s ability to dispose of its interests on an advantageous basis. Changes in future conditions could require material write downs of the carrying values.

Although the Company has taken steps to verify the title to the properties on which it is conducting exploration and in which it has an interest, in accordance with industry standards for the current stage of exploration of such properties, these procedures do not guarantee the Company’s title. Property title may be subject to unregistered prior agreements and non-compliance with regulatory requirements.

The accompanying consolidated financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) applicable to exploration stage enterprises, and are expressed in U.S. dollars. The Company’s fiscal year end is 31 December.

The Company’s consolidated financial statements as at 31 March 2015 and the three then ended have been prepared on a going concern basis, which contemplates the realization of assets and the settlement of liabilities and commitments in the normal course of business.

The Company had a net loss of $4,581,952 for the three months ended 31 March 2015 (31 March 2014– Net loss of $214,276) and has a working capital deficit of $346,883 at 31 March 2015 (31 March 2014 – $13,500), but management cannot provide assurance that the Company will ultimately achieve profitable operations or become cash flow positive, or raise additional debt and/or equity capital. The Company’s solvency, ability to meet its liabilities as they become due, and to continue its operations, has been dependent on funding provided by numerous financing institutions. If these parties are unwilling to provide ongoing funding to the Company and/or if the Company is unable to raise additional capital in the immediate future, the Company will need to curtail operations, liquidate assets, seek additional capital on less favorable terms and/or pursue other remedial measures or cease operations. This material uncertainty may cast significant doubt about the ability of the Company to continue as a going concern. These condensed consolidated financial statements do not include any adjustments that might be necessary should the Company be unable to continue as a going concern including adjustments related to employee severance pay and other costs related to ceasing operations.

F - 4

Table of Contents

FIRST COLOMBIA GOLD CORP. AND SUBSIDIARY

Notes to condensed consolidated financial statements

March 31, 2015

If the Company is unable to raise additional capital in the immediate future, the Company will need to curtail operations, liquidate assets, seek additional capital on less favorable terms and/or pursue other remedial measures or cease operations. This material uncertainty may cast significant doubt about the ability of the Company to continue as a going concern. These condensed consolidated financial statements do not include any adjustments that might be necessary should the Company be unable to continue as a going concern including adjustments related to employee severance pay and other costs related to ceasing operations.

These condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America for interim financial information and the SEC instructions to Form 10-Q. In the opinion of management, all adjustments considered necessary for a fair presentation have been included, and consist solely of normal recurring adjustments. Operating results for the interim period ended March 31, 2015 are not necessarily indicative of the results that can be expected for the full year.

| 2. | Significant Accounting Policies |

The following is a summary of significant accounting policies used in the preparation of these condensed consolidated financial statements.

Principles of consolidation

The accompanying condensed consolidated financial statements include the accounts of the Company and its wholly-owned subsidiary, Finmetal OY, a company incorporated under the laws of Finland, since its date of acquisition on 27 November 2006 and the results of Beardmore Holdings, Inc. (“Beardmore”), a company incorporated under the laws of Panama, to the date of disposal on 21 September 2011. All inter-company balances and transactions have been eliminated in these condensed consolidated financial statements.

Cash and cash equivalents

The Company considers all highly liquid instruments with a maturity of three months or less at the time of issuance to be cash equivalents. As at 31 March 2015 and as 31 March 2014, the Company had $22,170 and $0 in cash and cash equivalents.

Property and equipment

Furniture, computer equipment, office equipment and computer software are carried at cost and are amortized over their estimated useful lives of three to five years at rates as follows:

| Furniture, computer and office equipment | Five years |

| Computer software | Three Years |

The property and equipment is written down to its net realizable value if it is determined that its carrying value exceeds estimated future benefits to the Company.

Mineral property costs

Mineral property acquisition costs are initially capitalized as tangible assets when purchased. At the end of each fiscal quarter, the Company assesses the carrying costs for impairment. If proven and probable reserves are established for a property and it has been determined that a mineral property can be economically developed, costs will be amortized using the units-of-production method over the estimated life of the probable reserve.

F - 5

Table of Contents

FIRST COLOMBIA GOLD CORP. AND SUBSIDIARY

Notes to condensed consolidated financial statements

March 31, 2015

Mineral property exploration costs are expensed as incurred.

Estimated future removal and site restoration costs, when determinable, are provided over the life of proven reserves on a units-of-production basis. Costs, which include production equipment removal and environmental remediation, are estimated each period by management based on current regulations, actual expenses incurred, and technology and industry standards. Any charge is included in exploration expense or the provision for depletion and depreciation during the period and the actual restoration expenditures are charged to the accumulated provision amounts as incurred.

As of the date of these condensed consolidated financial statements, the Company has not established any proven or probable reserves on its mineral properties and incurred only acquisition and exploration costs.

Although the Company has taken steps to verify title to mineral properties in which it has an interest, according to the usual industry standards for the stage of exploration of such properties, these procedures do not guarantee the Company’s title. Such properties may be subject to prior agreements or transfers and title may be affected by undetected defects.

Environmental costs

Environmental expenditures that are related to current operations are charged to operations or capitalized as appropriate. Expenditures that relate to an existing condition caused by past operations, and which do not contribute to current or future revenue generation, are charged to operations. Liabilities are recorded when environmental assessments and/or remedial efforts are probable, and the cost can be reasonably estimated. Generally, the timing of these accruals coincides with the earlier of completion of a feasibility study or the Company’s commitments to a plan of action based on the then known facts.

Stock-based compensation

Effective 1 January 2006, the Company adopted the provisions of ASC 718, “ Compensation – Stock Compensation ”, which establishes accounting for equity instruments exchanged for employee services. Under the provisions of ASC 718, stock-based compensation cost is measured at the grant date, based on the calculated fair value of the award, and is recognized as an expense over the employees’ requisite service period (generally the vesting period of the equity grant).

Basic and diluted loss per share

The Company computes net loss per share in accordance with ASC 260, “ Earnings per Share ”. ASC 260 requires presentation of both basic and diluted earnings per share (“EPS”) on the face of the income statement. Basic EPS is computed by dividing net loss available to common stockholders (numerator) by the weighted average number of shares outstanding (denominator) during the period. Diluted EPS gives effect to all dilutive potential common shares outstanding during the period using the treasury stock method and convertible preferred stock using the if-converted method. In computing diluted EPS, the average stock price for the period is used in determining the number of shares assumed to be purchased from the exercise of stock options or warrants. Diluted EPS excluded all dilutive potential shares if their effect was anti-dilutive.

Financial instruments

The carrying value of amounts receivable, bank indebtedness, accounts payable and convertible promissory notes approximates their fair value because of the short maturity of these instruments. The Company’s financial risk is the risk that arises from fluctuations in foreign exchange rates and the degree of volatility of these rates. Currently, the Company does not use derivative instruments to reduce its exposure to foreign currency risk.

F - 6

Table of Contents

FIRST COLOMBIA GOLD CORP. AND SUBSIDIARY

Notes to condensed consolidated financial statements

March 31, 2015

Income taxes

Deferred income taxes are reported for timing differences between items of income or expense reported in the financial statements and those reported for income tax purposes in accordance with ASC 740, “ Income Taxes ”, which requires the use of the asset/liability method of accounting for income taxes. Deferred income taxes and tax benefits are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases, and for tax losses and credit carry-forwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The Company provides for deferred taxes for the estimated future tax effects attributable to temporary differences and carry-forwards when realization is more likely than not.

Long-lived assets impairment

Long-term assets of the Company are reviewed for impairment whenever events or circumstances indicate that the carrying amount of assets may not be recoverable, pursuant to guidance established in ASC 360-10-35-15, “Impairment or Disposal of Long-Lived Assets” . Management considers assets to be impaired if the carrying value exceeds the future projected cash flows from related operations (undiscounted and without interest charges). If impairment is deemed to exist, the assets will be written down to fair value. Fair value is generally determined using a discounted cash flow analysis. The company recorded an impairment loss of $0 and $0 for the three months ended March 31, 2015and 2014, respectively.

Asset retirement obligations

The Company has adopted ASC 410, “Assets Retirement and Environmental Obligations” , which requires that the fair value of a liability for an asset retirement obligation be recognized in the period in which it is incurred. ASC 410 requires the Company to record a liability for the present value of the estimated site restoration costs with a corresponding increase to the carrying amount of the related long-lived assets. The liability will be accreted and the asset will be depreciated over the life of the related assets. Adjustments for changes resulting from the passage of time and changes to either the timing or amount of the original present value estimate underlying the obligation will be made. As at 30 September 2014 and 31 December 2013, the Company did not have any asset retirement obligations.

Convertible debt

The Company has adopted ASC 470-20, “Debt with Conversion and Other Options” and applies this guidance retrospectively to all periods presented upon those fiscal years. The Company records a beneficial conversion feature related to the issuance of convertible debts that have conversion features at fixed or adjustable rates. The beneficial conversion feature for the convertible instruments is recognized and measured by allocating a portion of the proceeds as an increase in additional paid-in capital and as a reduction to the carrying amount of the convertible instrument equal to the intrinsic value of the conversion features. The beneficial conversion feature will be accreted by recording additional non-cash interest expense over the expected life of the convertible notes.

As of January 1, 2013, it was determined that the conversion features in the convertible debt were derivative liabilities. Accordingly, we have separately measured and accounted for these derivative liabilities, in accordance with ASC 815-15.

Use of estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of revenues and expenses during the period. Actual results may differ from those estimates.

F - 7

Table of Contents

FIRST COLOMBIA GOLD CORP. AND SUBSIDIARY

Notes to condensed consolidated financial statements

March 31, 2015

Reclassifications

Certain prior period amounts have been reclassified to conform to current period presentation.

Recent Accounting Pronouncements

In June 2014, the FASB issued ASU 2014-10, “Development Stage Entities (Topic 915): Elimination of Certain Financial Reporting Requirements, Including an Amendment to Variable Interest Entities Guidance in Topic 810, Consolidation”. The guidance eliminates the definition of a development stage entity thereby removing the incremental financial reporting requirements from U.S. GAAP for development stage entities, primarily presentation of inception to date financial information. The provisions of the amendments are effective for annual reporting periods beginning after December 15, 2014, and the interim periods therein. However, early adoption is permitted. Accordingly, the Company has adopted this standard as of June 30, 2014.

The Company does not expect the adoption of any other recent accounting pronouncements to have a material impact on its financial statements.

| 3. | Mineral Property Interests |

Boulder Hill Project

On December 16, 2011, we entered into a Purchase and Sale Agreement (“Purchase Agreement”) with Boulder Hill Mines Inc., an Idaho corporation (“Boulder Hill”) relating to the purchase from Boulder Hill of three unpatented mining claims situated in Lincoln County, Montana (the “Boulder Hill Claims”).

During the year ended 31 December 2013, the Company decided to cancel the portion of the Boulder Hill project involving the state lease, and is in the process of re-staking unpatented mining claims. During the six month period ended 30 June 2014 the Company spent $1,250 in consulting fees related to preparation for the re-staking ($0 exploration costs during six month period ended 30 June 2013).

South Idaho Silver Project

On 7 December 2011 (the “Effective Date”), the Company entered into an Assignment and Assumption Agreement (the “CCS Assignment”) with Castle Creek Silver Inc. (“Castle Creek”), an Idaho corporation, and Robert Ebisch (“Robert E”) to acquire by way of assignment from Castle Creek all of its rights, responsibilities and obligations under an Option to Purchase and Royalty Agreement (the “Purchase Agreement”) dated 15 July 2011, by and between Castle Creek and Robert E. Castle Creek, under the Purchase Agreement, had the option to acquire an undivided 100% of the right, title and interest of Robert E in the unpatented mining claims owned and situated in Owyhee County, Idaho (the “South Idaho Property”).

Pursuant to the terms of the CCS Assignment, Castle Creek transferred and assigned the Company all of its right, title and interest, in, to and under the Purchase Agreement and the Company assumed the assignment of the Purchase Agreement agreeing to be bound, the same extent as Castle Creek, to the terms and conditions of the Purchase Agreement.

The Company is currently in default with regards to certain obligations related to the South Idaho Property and is in the process of renegotiating the terms with Castle Creek, or determining to re-stake the mining claims. During 2013, the Company recorded a provision for write-down of mineral property interests of in the amount of $36,650 related to the South Idaho Property. During the six month period ended 30 September 2014, the Company paid $1,250 for a review and update of its database in preparation of re-staking (no exploration costs were incurred during the six month period ended 30 June 2013).

F - 8

Table of Contents

FIRST COLOMBIA GOLD CORP. AND SUBSIDIARY

Notes to condensed consolidated financial statements

March 31, 2015

Skip Silver Prospect

The Company owns two unpatented mining claims covering approximately forty acres in central Montana.

Energy Division – Oil and Gas Leases

The Company acquired during the quarter ending September 30, 2014 ownership interests of certain oil wells, leases and working interests in the counties of Cumberland (KY), Monroe (KY), Overton (TN) and Clinton (KY). This totaled reportedly 113 wells, (our 8k filing is incorporated by reference and an exhibit to this report). We currently have interests in 96 wells with a gross acreage of 4,302 acres.

| 4. | Property and Equipment |

During the period ending March 31, 2015 the total value of property and equipment were $393,235.

| 5. | Convertible Promissory Notes |

Other than as described below, there were no issuances of securities without registration under the Securities Act of 1933 during the reporting period which were not previously included in a Quarterly Report on Form 10-Q or Current Report on Form 8-K.

On July 25, 2014, the Company entered in convertible note agreement with a private and accredited investor, Anubis Capital, in the amount of $149,500, unsecured, with principal and interest amounts due and payable upon maturity on July 25, 2015 (the “Anubis Note #1”). After six months, the note holder has the option to convert any portion of the unpaid principal balance into the Company’s common shares at any time. The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rates ranging from .03% to .08%; Dividend rate of 0%; and, historical volatility rates ranging from 875.95% to 887.82%.

On August 20, 2014, the Company entered in convertible note agreement with a private and accredited investor, LDM Limited, in the amount of $222,150, unsecured, with principal and interest amounts due and payable upon maturity on August 20, 2015 (the “LDM #1”). After six months, the note holder has the option to convert any portion of the unpaid principal balance into the Company’s common shares at any time. The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rates ranging from .03% to .08%; Dividend rate of 0%; and, historical volatility rates ranging from 875.95% to 887.82%.

On August 24, 2014, the Company entered in convertible note agreement with a private and accredited investor, Fire Hole Capital, in the amount of $100,000, unsecured, with principal and interest amounts due and payable upon maturity on August 24, 2015 (the “FHC #1”). After six months, the note holder has the option to convert any portion of the unpaid principal balance into the Company’s common shares at any time. The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rates ranging from .03% to .08%; Dividend rate of 0%; and, historical volatility rates ranging from 875.95% to 887.82%.

On August 26, 2014, the Company entered in convertible note agreement with a private and accredited investor, LG Capital, in the amount of $105,000, unsecured, with principal and interest amounts due and payable upon maturity on August 26, 2015 (the “LG Note #1”). After six months, the note holder has the option to convert any portion of the unpaid principal balance into the Company’s common shares at any time. The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rates ranging from .03% to .08%; Dividend rate of 0%; and, historical volatility rates ranging from 875.95% to 887.82%.

F - 9

Table of Contents

FIRST COLOMBIA GOLD CORP. AND SUBSIDIARY

Notes to condensed consolidated financial statements

March 31, 2015

On August 29, 2014, the Company entered in convertible note agreement with a private and accredited investor, Union Capital, in the amount of $100,000, unsecured, with principal and interest amounts due and payable upon maturity on August 29, 2015 (the “Union Note #1”). After six months, the note holder has the option to convert any portion of the unpaid principal balance into the Company’s common shares at any time. The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rates ranging from .03% to .08%; Dividend rate of 0%; and, historical volatility rates ranging from 875.95% to 887.82%.

On September 3, 2014, the Company entered in convertible note agreement with a private and accredited investor, JSJ Capital, in the amount of $100,000, unsecured, with principal and interest amounts due and payable upon maturity on September 3, 2015 (the “JSJ Note #1”). After six months, the note holder has the option to convert any portion of the unpaid principal balance into the Company’s common shares at any time. The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rates ranging from .03% to .08%; Dividend rate of 0%; and, historical volatility rates ranging from 875.95% to 887.82%.

On September 15, 2014, the Company entered in convertible note agreement with a private and accredited investor, Adar Bays, in the amount of $50,000, unsecured, with principal and interest amounts due and payable upon maturity on September 15, 2015 (the “Adar Bays Note #1”). After six months, the note holder has the option to convert any portion of the unpaid principal balance into the Company’s common shares at any time. The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rates ranging from .03% to .08%; Dividend rate of 0%; and, historical volatility rates ranging from 875.95% to 887.82%.

On October 14, 2014, the Company entered in convertible note agreement with a private and accredited investor, Vista Capital, in the amount of $25,000, unsecured, with principal and interest amounts due and payable upon maturity on October 15, 2015 (the “Vista Note #1”). After six months, the note holder has the option to convert any portion of the unpaid principal balance into the Company’s common shares at any time. The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rates ranging from .03% to .08%; Dividend rate of 0%; and, historical volatility rates ranging from 875.95% to 887.82%.

On October 16, 2014, the Company entered in convertible note agreement with a private and accredited investor, Auctus Private Equity, in the amount of $70,000, unsecured, with principal and interest amounts due and payable upon maturity on October 16, 2015 (the “Auctus Note #1”). After six months, the note holder has the option to convert any portion of the unpaid principal balance into the Company’s common shares at any time. The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rates ranging from .03% to .08%; Dividend rate of 0%; and, historical volatility rates ranging from 875.95% to 887.82%.

On October 22, 2014, the Company entered in convertible note agreement with a private and accredited investor, JMJ Capital, in the amount of $50,000, unsecured, with principal and interest amounts due and payable upon maturity on October 22, 2015 (the “JMJ #1”). After six months, the note holder has the option to convert any portion of the unpaid principal balance into the Company’s common shares at any time. The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rates ranging from .03% to .08%; Dividend rate of 0%; and, historical volatility rates ranging from 875.95% to 887.82%.

F - 10

Table of Contents

FIRST COLOMBIA GOLD CORP. AND SUBSIDIARY

Notes to condensed consolidated financial statements

March 31, 2015

On October 27, 2014, the Company entered in convertible note agreement with a private and accredited investor, Iconic Capital, in the amount of $50,000, unsecured, with principal and interest amounts due and payable upon maturity on October 27, 2015 (the “ICONIC #1”). After six months, the note holder has the option to convert any portion of the unpaid principal balance into the Company’s common shares at any time. The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rates ranging from .03% to .08%; Dividend rate of 0%; and, historical volatility rates ranging from 875.95% to 887.82%.

On October 27, 2014, the Company entered in convertible note agreement with a private and accredited investor, Eastmore Capital, in the amount of $93,500, unsecured, with principal and interest amounts due and payable upon maturity on October 27, 2015 (the “EASTMORE #1”). After six months, the note holder has the option to convert any portion of the unpaid principal balance into the Company’s common shares at any time. The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rates ranging from .03% to .08%; Dividend rate of 0%; and, historical volatility rates ranging from 875.95% to 887.82%.

On November 6, 2014, the Company entered in convertible note agreement with a private and accredited investor, Coventry Capital, in the amount of $50,000, unsecured, with principal and interest amounts due and payable upon maturity on November 6, 2015 (the “COVENTRY #1”). After six months, the note holder has the option to convert any portion of the unpaid principal balance into the Company’s common shares at any time. The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rates ranging from .03% to .08%; Dividend rate of 0%; and, historical volatility rates ranging from 875.95% to 887.82%.

On November 10, 2014, the Company entered in convertible note agreement with a private and accredited investor, JSJ Capital, in the amount of $50,000, unsecured, with principal and interest amounts due and payable upon maturity on November 10, 2015 (the “JSJ #2”). After six months, the note holder has the option to convert any portion of the unpaid principal balance into the Company’s common shares at any time. The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rates ranging from .03% to .08%; Dividend rate of 0%; and, historical volatility rates ranging from 875.95% to 887.82%.

On November 18, 2014, the Company entered in convertible note agreement with a private and accredited investor, Chicago Venture Group, in the amount of $50,000, unsecured, with principal and interest amounts due and payable upon maturity on November 18, 2015 (the “CVG #1”). After six months, the note holder has the option to convert any portion of the unpaid principal balance into the Company’s common shares at any time. The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rates ranging from .03% to .08%; Dividend rate of 0%; and, historical volatility rates ranging from 875.95% to 887.82%.

On November 19, 2014, the Company entered in convertible note agreement with a private and accredited investor, Iconic Capital, in the amount of $100,000, unsecured, with principal and interest amounts due and payable upon maturity on November 19, 2015 (the “ICONIC #2”). After six months, the note holder has the option to convert any portion of the unpaid principal balance into the Company’s common shares at any time. The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rates ranging from .03% to .08%; Dividend rate of 0%; and, historical volatility rates ranging from 875.95% to 887.82%.

On December 4, 2014, the Company entered in convertible note agreement with a private and accredited investor, Sojourn Investments, in the amount of $15,000, unsecured, with principal and interest amounts due and payable upon maturity on December 4, 2015 (the “SOJOURN #1”). After six months, the note holder has the option to convert any portion of the unpaid principal balance into the Company’s common shares at any time. The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rates ranging from .03% to .08%; Dividend rate of 0%; and, historical volatility rates ranging from 875.95% to 887.82%.

F - 11

Table of Contents

FIRST COLOMBIA GOLD CORP. AND SUBSIDIARY

Notes to condensed consolidated financial statements

March 31, 2015

On December 16, 2014, the Company entered in convertible note agreement with a private and accredited investor, Union Capital, in the amount of $100,000, unsecured, with principal and interest amounts due and payable upon maturity on December 16, 2015 (the “UNION #2”). After six months, the note holder has the option to convert any portion of the unpaid principal balance into the Company’s common shares at any time. The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rates ranging from .03% to .08%; Dividend rate of 0%; and, historical volatility rates ranging from 875.95% to 887.82%.

On January 16, 2015, the Company entered in convertible note agreement with a private and accredited investor, Mud Lake Capital, in the amount of $50,000, unsecured, with principal and interest amounts due and payable upon maturity on January 16, 2016 (the “Mud Lake #2”). After six months, the note holder has the option to convert any portion of the unpaid principal balance into the Company’s common shares at any time. The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rates ranging from .03% to .08%; Dividend rate of 0%; and, historical volatility rates ranging from 875.95% to 887.82%.

On January 26, 2015, the Company entered in convertible note agreement with a private and accredited investor, Eastmore Capital, in the amount of $64,000, unsecured, with principal and interest amounts due and payable upon maturity on January 26, 2016 (the “Eastmore #2”). After six months, the note holder has the option to convert any portion of the unpaid principal balance into the Company’s common shares at any time. The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rates ranging from .03% to .08%; Dividend rate of 0%; and, historical volatility rates ranging from 875.95% to 887.82%.

On January 30, 2015, the Company entered in convertible note agreement with a private and accredited investor, Mud Lake Capital, in the amount of $50,000, unsecured, with principal and interest amounts due and payable upon maturity on January 30, 2016 (the “Mud Lake #3”). After six months, the note holder has the option to convert any portion of the unpaid principal balance into the Company’s common shares at any time. The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rates ranging from .03% to .08%; Dividend rate of 0%; and, historical volatility rates ranging from 875.95% to 887.82%.

On February 6, 2015, the Company entered in convertible note agreement with a private and accredited investor, KBM Worldwide, in the amount of $50,000, unsecured, with principal and interest amounts due and payable upon maturity on February 6, 2016 (the “KBM #1”). After six months, the note holder has the option to convert any portion of the unpaid principal balance into the Company’s common shares at any time. The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rates ranging from .03% to .08%; Dividend rate of 0%; and, historical volatility rates ranging from 875.95% to 887.82%.

On March 13, 2015, the Company entered in convertible note agreement with a private and accredited investor, Service Trading Company, in the amount of $25,000, unsecured, with principal and interest amounts due and payable upon maturity on March 13, 2016 (the “STC #1”). After six months, the note holder has the option to convert any portion of the unpaid principal balance into the Company’s common shares at any time. The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rates ranging from .03% to .08%; Dividend rate of 0%; and, historical volatility rates ranging from 875.95% to 887.82%.

On March 18, 2015, the Company entered in convertible note agreement with a private and accredited investor, GW Holdings, in the amount of $25,000, unsecured, with principal and interest amounts due and payable upon maturity on March 18, 2016 (the “GW #1”). After six months, the note holder has the option to convert any portion of the unpaid principal balance into the Company’s common shares at any time. The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rates ranging from .03% to .08%; Dividend rate of 0%; and, historical volatility rates ranging from 875.95% to 887.82%.

F - 12

Table of Contents

FIRST COLOMBIA GOLD CORP. AND SUBSIDIARY

Notes to condensed consolidated financial statements

March 31, 2015

The Company issued this Note convertible into shares of the Company’s restricted common stock, in a transaction pursuant to exemptions from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”). The investors of these notes were “accredited investor,” as such term is defined in Rule 501(a) of Regulation D of the Securities Act. The Transactions were made in reliance upon the exemption from registration provided by Section 4(2) of the Securities Act and Rule 506 of Regulation D of the Securities Act. The sale of the Notes did not involve a public offering and was made without general solicitation or general advertising. Neither the Notes nor the underlying shares of Common Stock issuable upon the conversion of the Notes have been registered under the Securities Act and neither may be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

6 . Related Party Transactions

During the periods ended 31 March 2015, the Company accrued $29,550 for management fees to officers and directors of the Company. Additionally, 1,500,000,000 shares of common stock were issued to officers and directors for services rendered.

7. Stockholders’ Deficit

Authorized

The total authorized capital consists of

| 10,000,000,000 common shares with par value of $0.00001 | |

| 150,000,000 blank check preferred shares with no par value | |

| 50,000,000 Series A preferred shares with a par value of $0.001 |

Issued and outstanding

Common Stock

On 3 January 2014, the Company effected a 500 to 1 reverse split of its common stock. All share references in these condensed consolidated financial statements have been retroactively adjusted for this split.

During period ended 31 March 2015, the Company had 2,378,622,897 common shares outstanding.

Preferred Stock

Preferred A

On November 15, 2012, the Company filed a Certificate of Designation for its Class Series A Preferred Convertible Stock with the Secretary of State of Nevada designating 50,000,000 shares of its authorized Preferred Stock as Class A Preferred Convertible Stock. The Class A Preferred Shares have a par value of $.001 per share. The Class A Preferred Shares are convertible into shares of the Company’s common stock at a rate of 1 preferred share equals 2 common shares. In addition, the Class A Preferred Shares rank senior to the Company’s common stock. The Class A Preferred Shares have voting rights equal to that of the common stockholders and may vote on any matter that common shareholders may vote. One Class A Preferred Shares is the voting equivalent of two common shares. The Company has the right, at its discretion, to redeem the Class A Preferred shares at a price of $.01 per share.

On February 1, 2013 the Company agreed to issue 47,568,500 shares of its Class A Preferred Convertible Stock, in exchange for the settlement of debt of approximately $104,651 to both unrelated parties and certain officers and directors of the Company. The Class A Preferred shares were issued at a price of $0.0022 per share. Related forgiveness of debt income was recorded of $50,730 as of 31 December 2013.

F - 13

Table of Contents

FIRST COLOMBIA GOLD CORP. AND SUBSIDIARY

Notes to condensed consolidated financial statements

March 31, 2015

8. Commitments and Contingencies

The Company is committed to making repayments related to the convertible promissory notes payable.

9 . Fair Value of Financial Instruments

A fair value hierarchy was established that prioritizes the inputs used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurement) and the lowest priority to unobservable inputs (Level 3 measurements).

The fair values of the financial instruments were determined using the following input levels and valuation techniques:

| Level 1: | classification is applied to any asset or liability that has a readily available quoted market price from an active market where there is significant transparency in the executed/quoted price. |

| Level 2: | classification is applied to assets and liabilities that have evaluated prices where the data inputs to these valuations are observable either directly or indirectly, but do not represent quoted market prices from an active market. |

| Level 3: | classification is applied to assets and liabilities when prices are not derived from existing market data and requires us to develop our own assumptions about how market participants would price the asset or liability. |

Our financial assets and (liabilities) carried at fair value measured on a recurring basis as of March 31, 2015, consisted of the following:

| Fair Value Measurements Using | ||||||||||||

| Total Fair | Quoted prices in | Significant other | Significant | |||||||||

| Value at | active markets | observable inputs | Unobservable inputs | |||||||||

| Description | March 31, 2015 | (Level 2) | (Level 2) | (Level 3) | ||||||||

| Derivative liabilities | $ | 2,769,327 | $ | - | $ | 2,769,327 | $ | - | ||||

Credit Risk

Credit risk is the risk of an unexpected loss if a customer or counterparty to a financial instrument fails to meet its contractual obligations and arises primarily from the Company’s cash and cash equivalents. The Company manages its credit risk relating to cash and cash equivalents by dealing only with highly-rated United States financial institutions. As a result, credit risk is considered insignificant.

Currency Risk

The majority of the Company’s cash flows and financial assets and liabilities are denominated in US dollars, which is the Company’s functional and reporting currency. Foreign currency risk is limited to the portion of the Company’s business transactions denominated in currencies other than the US dollar.

The Company monitors and forecasts the values of net foreign currency cash flow and balance sheet exposures and from time to time could authorize the use of derivative financial instruments such as forward foreign exchange contracts to economically hedge a portion of foreign currency fluctuations. Currently, the Company does not use derivative instruments to reduce its exposure to foreign currency risk.

F - 14

Table of Contents

FIRST COLOMBIA GOLD CORP. AND SUBSIDIARY

Notes to condensed consolidated financial statements

March 31, 2015

Liquidity Risk

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they fall due. The Company manages liquidity risk by continuously monitoring actual and projected cash flows and matching the maturity profile of financial assets and liabilities. The Company had a working capital deficit of $346,883 at 31 March 2015, and $13,500 at 31 March 2014, but management cannot provide assurance that the Company will ultimately achieve profitable operations or become cash flow positive, or raise additional debt and/or equity capital.

Other Risks

Unless otherwise noted, the Company is not exposed to significant interest rate risk and commodity price risk.

10. Other receivable

As of 31 December 2013, the Company has recorded other receivable for loan proceeds, where the debt instrument was finalized, but proceeds were not received until after period end.

11. Subsequent Events

On April 2 the company announced it has entered into an agreement with Triangle Restaurant Group to acquire their operations and to join with them in developing a fast food franchise. The company is looking to open its first two locations by the end of September 2015.

F - 15

Table of Contents

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. The words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “may,” “should,” “could,” “will,” “plan,” “future,” “continue,” and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters identify forward-looking statements. These forward-looking statements are based largely on our expectations or forecasts of future events, can be affected by inaccurate assumptions, and are subject to various business risks and known and unknown uncertainties, a number of which are beyond our control. Therefore, actual results could differ materially from the forward-looking statements contained in this document, and readers are cautioned not to place undue reliance on such forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. A wide variety of factors could cause or contribute to such differences and could adversely impact revenues, profitability, cash flows and capital needs. There can be no assurance that the forward-looking statements contained in this document will, in fact, transpire or prove to be accurate.

Important factors that may cause the actual results to differ from the forward-looking statements, projections or other expectations include, but are not limited to, the following:

| ● | risk that we will not be able to remediate identified material weaknesses in our internal control over financial reporting and disclosure controls and procedures; |

| ● | risk that we are not able to meet the requirements of agreements under which we may have any cash payments to on the option or any exploration obligations that we have regarding these properties, which could result in the loss of our right to exercise these options to acquire certain mining, oil mineral rights underlying these properties; or loan guarantees that Company is obligated for; |

| ● | the risk that we will be unable to pay our debt obligations as they become due or comply with the covenants contained in agreements with debt holders; |

| ● | risk that we will be unable to secure additional financing in the near future in order to commence and sustain our planned exploration work and be forced to cease our exploration and development program; |

| ● | risk that we cannot attract, retain and motivate qualified personnel, particularly employees, consultants and contractors for our operations in the United States; |

| ● | risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; |

| ● | results of initial feasibility, pre-feasibility and feasibility studies, and the possibility that future exploration, development or mining results or oil production will not be consistent with our expectations; |

| ● | Mining or Oil and development risks, including risks related to accidents, equipment breakdowns, labor disputes or other unanticipated difficulties with or interruptions in production; |

| ● | the potential for delays in exploration or development activities or the completion of feasibility studies; |

| ● | risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; |

| ● | risks related to commodity price fluctuations; |

| ● | the uncertainty of profitability based upon our history of losses; |

| ● | risks related to failure to obtain adequate financing on a timely basis and on acceptable terms for our planned exploration and development projects; |

| ● | risks related to environmental regulation and liability; |

| ● | risks that the amounts reserved or allocated for environmental compliance, reclamation, post-closure control measures, monitoring and on-going maintenance may not be sufficient to cover such costs; |

| ● | risks related to tax assessments; |

| ● | Risks that our interest in oil leases and wells may not produce revenue due to complications related to prior joint ventures with claims on oil lease and well revenue |

| ● | political and regulatory risks associated with mining development and exploration; and |

| ● | other risks and uncertainties related to our prospects, properties and business strategy. |

The foregoing list is not an exhaustive list of the factors that may affect any of our forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on our forward-looking statements.

- 4 -

Table of Contents

As used in this Quarterly Report, the terms “we,” “us,” “our,” “the Company”, and “First Colombia” mean First Colombia Gold Corp. and our subsidiaries unless otherwise indicated.

Corporate History

We were incorporated in the State of Nevada under the name Gondwana Energy, Ltd. on September 5, 1997, and previously operated under the name Finmetal Mining Ltd. and Amazon Goldsands Ltd. Our operations have historically focused on the acquisition and development of mineral property interests in varying locations, including Finland and Peru. The current focus of our business and operations is on the development of our mineral and oil property interests on properties located in the western United States and we are evaluating mineral and oil property interests and seeking opportunities in other geographical areas.

We no longer have any interest in any properties located in northeastern Peru. For reasons which include our inability to secure sufficient financing to be able to cure our default on notes we used to finance our acquisition of the property interests in Peru, we reached an agreement to relinquish our entire interest in the property interests in Peru in exchange for the cancellation of such notes and related outstanding obligations.

In 2011, we reviewed potential properties for acquisition in Colombia, and expanded our focus to North America which resulted in our acquiring certain mineral property interests in Montana and Idaho in late 2011. Company personnel and consultants are planning our exploration plans, conducting site visits, and reviewing several projects for potential acquisition, and in 2012 we added to our mineral property position through the acquisition of the Skip claims in Montana. We also in 2011 entered into agreements to acquire mineral property interest in the South Idaho Silver and Boulder Hill projects, conducting active due diligence and acquisition work in Croatia, and in 2013 signed a memorandum of understanding on the Nile Mine project in Montana.

In 2014 the Company elected to operate through both a Mining and through an Energy division.

The Company announced a Letter of Intent for a Purchase and Sale Agreement which was entered into on July 15, 2014, and subsequently amended on August 27, 2014. This resulted in the Company acquiring various personal property including transportation and drilling equipment, land and buildings, and other assets including interests in oil wells and leases. The Company has established a divisional office in Albany, Kentucky for its energy division in September 2014. The Company’s current activities are primarily focused on initiating and expanding oil production.

The Company is in a process of reviewing its mining division strategy and business plan to re-focus on projects with a shorter time frame for development or securing joint-venture partners.

The Company has hired several operations personnel and is expecting more significant production to begin in the fourth quarter of the current fiscal year. The Company’s short term objective is to reach a target monthly production of 1,000 to 2,500 barrels of oil per month, which is subject to working capital availability and the risk factors described herein.

Overview

We are in the business of precious minerals exploration and oil and gas exploration and production, operating through a Mining Division and an Energy Division. The Company aims to build assets, cash flow and revenue through the acquisition, development, leasing and production from assets, mineral or oil and gas interests. We face significant challenges form competition, financing availability, regulatory issues and world commodity prices that effect our ability to successfully implement our business plan.

Our strategy is to identify undervalued assets, acquire or gain an interest in, and add value through exploration, development, leasing or joint-ventures, and where feasible go into production. Our plan to implement this strategy building multiple revenue streams from production, acquiring royalties and net working interests, leasing or join-venturing projects acquired, and providing oil field services using equipment we have acquired.

Our current focus is integrating the assets acquired in Kentucky during the quarter, and establishing and building production through providing management, working capital and implementing enhanced recovery techniques to the assets and oil interests acquired.

Mining Division

Description of our Mineral Property Interests

South Idaho Silver Project

On December 7, 2011 (the “Effective Date”), we entered into an Assignment and Assumption Agreement (“Assignment Agreement”) with a private corporation. (“Castle Creek”), an Idaho corporation, and a private individual (‘Ebisch”). Castle Creek and Ebisch are parties to an Option to Purchase and Royalty Agreement dated July 15, 2011 (the “Option Agreement”), for Castle Creek’s option to acquire an undivided 100% of the right, title and interest of Ebisch in and to the PB 7, 9, 11, 12, 23, 25, 27, and 29 lode mining claims (IMC #’s, respectively, 196852, 196854, 196856, 196857, 196866, 196867, 196868, and 196869), situated in Owyhee County, Idaho,. Pursuant to the terms of the Assignment Agreement, Castle Creek transferred and assigned us all of its right, title and interest, in, to and under the Option Agreement and we assumed the assignment of the Option Agreement agreeing to be bound, the same extent as Castle Creek, to the terms and conditions of the Option Agreement.

- 5 -

Table of Contents

During 2013, the Company recorded a provision for write-down of mineral property interests of in the amount of $36,650 related to the South Idaho Property.

The Company has elected in 2014 to let this agreement lapse, and to use utilize the database of exploration information developed to target through re-staking a more favorable land position, or to enter into a new agreement with the Ebisch group.

Boulder Hill Project

Purchase and Sale Agreement of Unpatented Mining Claims

On December 16, 2011, we entered into a Purchase and Sale Agreement (“Purchase Agreement”) with Boulder Hill Mines Inc., an Idaho corporation (“Boulder Hill”) relating to the purchase from Boulder Hill of three unpatented mining claims situated in Lincoln County, Montana (the “Boulder Hill Claims”). As consideration for the Boulder Hill Claims, we issued Boulder Hill 1,000 (500,000 pre-reverse )restricted shares of our common stock, are obligated to pay Boulder Hill $25,000 in cash within twelve (12) months of the Effective Date, which is December 16, 2012, and $25,000 in cash within twenty-four (24) months of the Effective Date, which is December 16, 2013.

We received a waiver of the $25,000 cash payment requirement, such payment was due in May 2013, and the Company was unable to make this payment, The Company elected to not continue under the former agreement, nor to explore further in the area after September 30, 2014.

The Purchase Agreement included customary representations and warranties. Under the terms of the Purchase Agreement, Boulder Hill has agreed to indemnify us from claims resulting from any breach or inaccuracy of any representation or warranty made by Boulder Hill in the Purchase Agreement. The Company has been unable to make the required payments, and currently is not planning on re-staking clams in the area in 2014.

Assignment and Assumption of Lease Agreement

On December 16, 2011 (the “Effective Date”), we entered into an Assignment and Assumption Agreement (“Boulder Hill Assignment Agreement”) with Boulder Hill, and a private individual (“Ebisch”). Boulder Hill and Ebisch are parties to an Option to Purchase and Royalty Agreement dated July 15, 2008, as amended on August 1, 2011 (the “ Boulder Hill Option Agreement”) which granted to Boulder Hill an option to acquire an undivided 100% of the right, title and interest of Ebisch in and to that certain Montana State Metal ferrous Gold Lease M-1974-06 dated August 21,2006 he entered into with the State of Montana (the “Montana Gold Lease”) under which Ebisch was granted the exclusive right to prospect, explore, develop and mine for gold, silver and other minerals on property situated in Lincoln County, Montana. The Montana Gold Lease is for a ten (10) year term and is subject to the 5% net smelter return due to the State of Montana. Pursuant to the terms of the Boulder Hill Assignment Agreement, Boulder Hill transferred and assigned us all of its right, title and interest, in, to and under the Option Agreement and we assumed the assignment of the Boulder Hill Option Agreement agreeing to be bound, the same extent as Boulder Hill, to the terms and conditions of the Boulder Hill Option Agreement. As consideration for the Boulder Hill Assignment Agreement, we issued Boulder Hill 1,000 (500,000 pre reverse) restricted shares of our common stock and are obligated to pay Boulder Hill $25,000 in cash within twelve (12) months of the Effective Date, which is December 16, 2012, waived until May 2013, and $25,000 in cash within twenty-four (24) months of the Effective Date, which is December 16, 2013.

The Boulder Hill Option Agreement provided for certain cash payments, some of which were met, however the Company has elected to let the agreement lapse.

- 6 -

Table of Contents

Nile Mine Project

Memorandum of Understanding to Earn-Interest in the Nile Mine Project

On May 1, 2013, the Company with GMRV, a branch of 4uX, LLC, a private Montana company (“GMRV”) entered into a Memorandum of Understanding (“MOU”) to enter into a Definitive Agreement within 180 days for the Company to earn a fifty percent interest in the Nile Mine project. The Company has not entered into a final and definitive agreement at this time. In May 2014 GMRV waived 2013 cash payments in exchange for an agreed upon payments by June and September 30 of 2014, respectively, and provided additional time for preparation and implementation of a definitive agreement. The Company made a payment of the $5,000 due by June 2014 in the form of cash and restricted common shares. The Company is discussing modification and further extensions of the MOU and/or entering into a final definitive agreement, but did not make the required payments as of September 30, 2014. The Memorandum of Understanding therefore is in default.

Land Status

The project is owned/controlled by GMRV and private interests. The Company signed a Memorandum of Understanding (“MOU”) on the project effective May 1, 2013 containing the following terms and conditions for the Company to earn a 50% interest in the project, subsequently amended in May 2014:

Paying within 180 days of the signing of this MOU $2,500 which will be payable in cash or the issuance of restricted shares of the Company at the market bid price, or the equivalent in restricted preferred shares of the Company, subject to an subscription agreement signed by GMRV acceptable to the Company. The Company has agreed to an initial work commitment of $5,000 in 2013, and upon mutual agreement of an exploration plan for 2014, an increased work commitment of at least $10,000 for 2014.As described above this understanding has been extended eliminating cash payments during the extension period and instead the Company may make cash payments or in restricted common stock. The Company during the quarter met the $5,000 commitment through the issuance of restricted stock and prior cash payments.

The Company agreed that work commitment will include the consulting services that will be provided by GMRV. The parties in good faith agree to enter into a definitive agreement with duration of 10 years, with a work commitment for this period of $250,000 and annual minimum advance royalty payments of $5,000 per year in cash, common shares, or preferred shares, at First Colombia’s option, for First Colombia to earn a 50% interest in the project. Should a mutually agreed upon definitive agreement not be agreed on and implemented within the effective date of this agreement, the payment referred to above shall be non-refundable. As above this requirement is temporarily waived.

On the effective Date: May 1, 2013, The Company was responsible for all property maintenance fees, estimated not to exceed $500 annually at the current BLM Maintenance Fee rate.

The foregoing description of the MOU does not purport to be complete and is qualified in its entirety by reference to the MOU, previously filed on the Form 8-K and is incorporated herein by reference.

Description of Property

Location

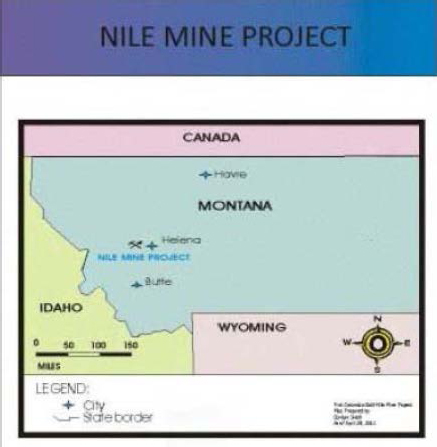

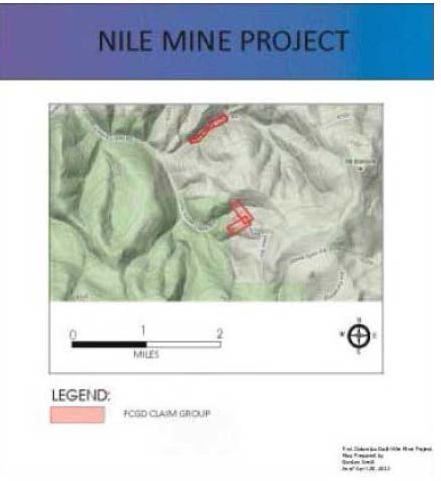

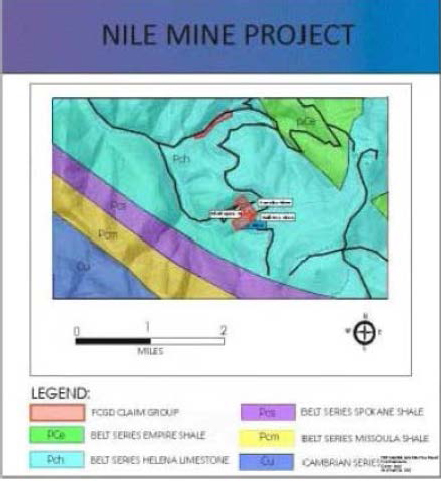

The project is located in Marysville Mining District in the Marysville area, and is comprised of the Nile Mine and nearby Springer II Placer mining claim, comprising approximately fifty-five acres.

The Nile Mine Project consists of two unpatented lode claims covering the over 1,000 feet of the unpatented section of Nile and South Nile Veins and the Nile Cross-Cut located in Section 4, T11N, R6W.

- 7 -

Table of Contents

The Springer II Placer consists of one unpatented placer claim covering three tailing ponds and nearly 0.3 miles of old dredge piles in Section 32, T12N, R6W. The mill tailings are from the Empire Mill located further up the drainage.

- 8 -

Table of Contents

History