Exhibit

10.3

MASTER

LEASE AGREEMENT

THIS

MASTER LEASE AGREEMENT (this "Lease") is made as of June 14, 2016 (the "Effective Date"), by

and between STORE CAPITAL ACQUISITIONS, LLC, a Delaware limited liability company ("Lessor"), whose address

is 8501 E. Princess Drive, Suite 190, Scottsdale,

Arizona 85255, and MARQUIS REAL ESTATE HOLDINGS, LLC, a Delaware limited liability company ("Lessee"), whose

address is 3525 Del Mar Heights Road, Suite 765, San Diego, CA 92130. Capitalized terms not defined herein shall have the meanings

set forth in Exhibit A hereto.

In

consideration of the mutual covenants and agreements herein contained, Lessor and Lessee hereby covenant and agree as follows:

ARTICLE

I

BASIC

LEASE TERMS

Section

1.01. Properties. The street addresses and legal descriptions of the Properties are set forth on Exhibit B attached

hereto and incorporated herein.

Section 1.02. Initial Term

Expiration Date. June 30, 2031.

Section

1.03. Extension Options. Five (5) extensions of five (5) years each, as described in Section 3.02.

Section 1.04.

Term Expiration Date (if fully extended). June 30, 2056. Section 1.05. Initial Base Annual Rental. $59,614,

as described in Article IV. Section 1.06. Rental Adjustment. 17.2%, as described in Section 4.02.

Section

1.07. Adjustment Date. July 1, 2017 and annually thereafter during the Lease Term (including any Extension Term).

Section 1.08. Guarantor. Marquis

Industries, Inc., a Georgia corporation.

Section

1.09. Lessee Tax Identification No. 81-2862543.

Section 1.10. Lessor Tax Identification

No. 45-2674893.

ARTICLE

II

LEASE

OF PROPERTIES

Section

2.01. Lease. In consideration of Lessee's payment

of the Rental and other Monetary Obligations and Lessee's performance of all other obligations hereunder, Lessor hereby leases

to Lessee, and Lessee hereby takes and hires, the Properties, "AS IS" and "WHERE IS" without representation

or warranty by Lessor, and subject to the existing state of title, the parties in possession, any statement of facts which an

accurate survey or physical inspection might reveal, and all Legal Requirements now or hereafter in effect.

Section

2.02. Quiet Enjoyment. So long as Lessee shall pay the Rental and other Monetary Obligations provided in this Lease and shall

keep and perform all of the terms, covenants and conditions on its part contained herein and subject to the rights of Lessor under

Section 12.02, Lessee shall have, subject to the terms and conditions set forth herein, the right to the peaceful and quiet enjoyment

and occupancy of the Properties.

ARTICLE

III

LEASE

TERM; EXTENSION

Section

3.01. Initial Term. The initial term of this Lease ("Initial Term") shall commence as of the Effective Date

and shall expire at midnight on June 30, 2031, unless terminated sooner as provided in this Lease and as may be extended as provided

herein. The time period during which this Lease shall actually be in effect, including any Extension Term, is referred to as the

"Lease Term."

Section

3.02. Extensions. Unless this Lease has expired or has been sooner terminated, or an Event of Default has occurred and is continuing

at the time any extension option is exercised, Lessee shall have the right and option (each, an "Extension Option")

to extend the Initial Term for all and not less than all of the Properties for five (5) additional successive periods of five (5)

years each (each, an "Extension Term"), pursuant to the terms and conditions of this Lease then in effect.

Section

3.03. Notice of Exercise. Lessee may exercise the Extension Options by giving written notice thereof to Lessor of its election

to do so no later than one hundred twenty

(120)

days prior to the expiration of the then-current Lease Term. If written notice of the exercise of any Extension Option is

not received by Lessor by the applicable dates described above, then Lessor shall make commercially reasonable efforts to notify

Lessee of the pending expiration of the then-current Lease Term (which shall include providing written notice as provided in Section

15.01 below). Unless otherwise extended, this Lease shall terminate on the last day of the Initial Term or, if applicable, the

last day of the Extension Term then in effect. Upon the request of Lessor or Lessee, the parties hereto will, at the expense of

Lessee, execute and exchange an instrument in recordable form setting forth the extension of the Lease Term in accordance with

this Section 3.03.

Section

3.04. Removal of Personalty. Upon the expiration of the Lease Term, and if Lessee is not then in breach hereof, Lessee may

remove from the Properties and Improvements all personal property belonging to Lessee. Lessee shall leave all of the Properties

and Improvements clean and in good and working condition and repair inside and out, subject to normal wear and tear, casualty and

condemnation. The Improvements, all Personalty and any other left on the Properties on the thirtieth day following the expiration

of the Lease Term shall, at Lessor's option, automatically and immediately become the property of Lessor.

Section

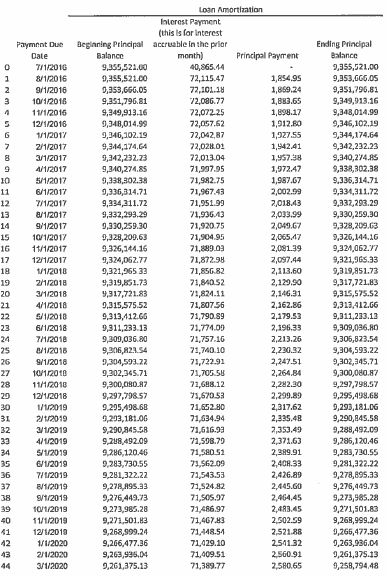

3.05. Lease Termination Prior to Term Expiration Date. As described more fully in the Loan Documents, upon a termination of

this Lease at any time prior to the expiration of the Lease Term, the outstanding principal balance of the Note, all accrued and

unpaid interest, and all other amounts, fees, and charges due under the Loan Documents shall immediately become due and payable

and the Mortgage Loan Lender shall have the right to enforce its liens and security interests and exercise any rights under the

Loan Documents, applicable law, and/or principles of equity.

ARTICLE

IV

RENTAL

AND OTHER MONETARY OBLIGATIONS

Section

4.01. Base Monthly Rental. During the Lease Term, on or before the first day of each calendar month, Lessee shall pay in advance

the Base Monthly Rental then in effect. If the Effective Date is a date other than

the first day of the month, Lessee shall pay to Lessor on the Effective Date the Base Monthly Rental prorated by multiplying the

Base Monthly Rental by a fraction, the numerator of which is the number of days remaining in the month (including the Effective

Date) for which Rental is being paid, and the denominator of which is the total number of days in such month.

Section

4.02. Adjustments. During the Lease Term (including any Extension Term), on the first Adjustment Date and on each Adjustment

Date thereafter, the Base Annual Rental shall increase by an amount equal to the Rental Adjustment; provided,

however, that in no event shall Base Annual Rental be reduced as a result of the application of the Rental Adjustment.

Section

4.03. Additional Rental. Lessee shall pay and discharge, as additional rental ("Additional Rental"), all sums

of money required to be paid by Lessee under this Lease which are not specifically referred to as Rental. Lessee shall pay and

discharge any Additional Rental when the same shall become due, provided that amounts which are billed to Lessor or any third party,

but not to Lessee, shall be paid within fifteen (15) days after Lessor's demand for payment thereof or, if earlier, when the same

are due. In no event shall Lessee be required to pay to Lessor any item of Additional Rental that Lessee is obligated to pay and

has paid to any third party pursuant to any provision of this Lease.

Section

4.04. Rentals to be Net to Lessor. The Base Annual Rental payable hereunder shall be net to Lessor, so that this Lease shall

yield to Lessor the Rentals specified during the Lease Term, and all Costs and obligations of every kind and nature whatsoever

relating to the Properties or the Improvements shall be performed and paid by Lessee. Lessee shall perform all of its obligations

under this Lease at its sole cost and expense. All Rental and other Monetary Obligations which Lessee is required to pay hereunder

shall be the unconditional obligation of Lessee and shall be payable in full when due and payable, without notice or demand, and

without any setoff, abatement, deferment, deduction or counterclaim whatsoever.

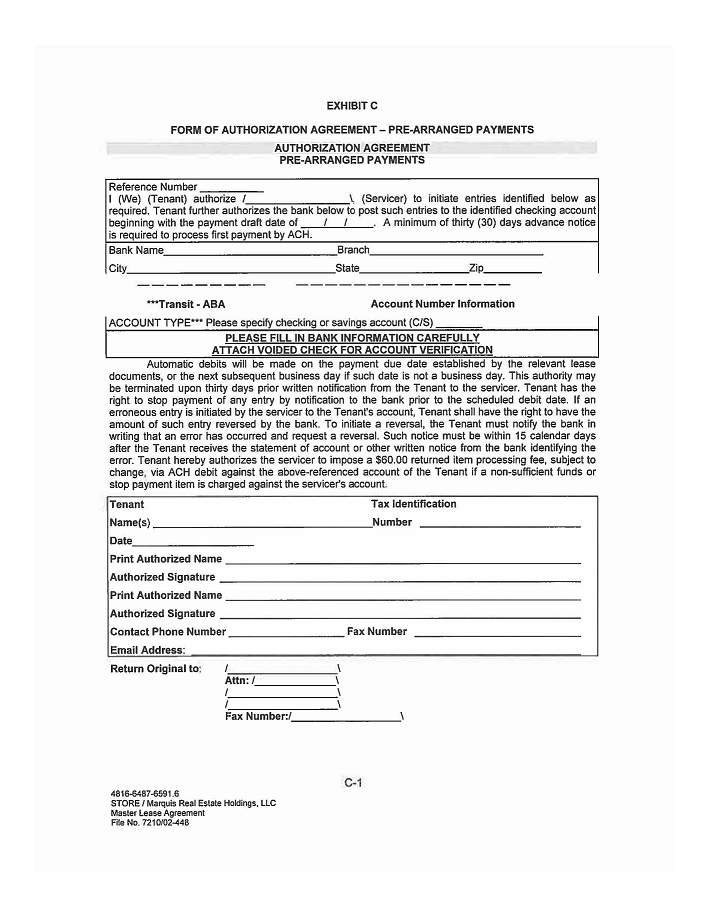

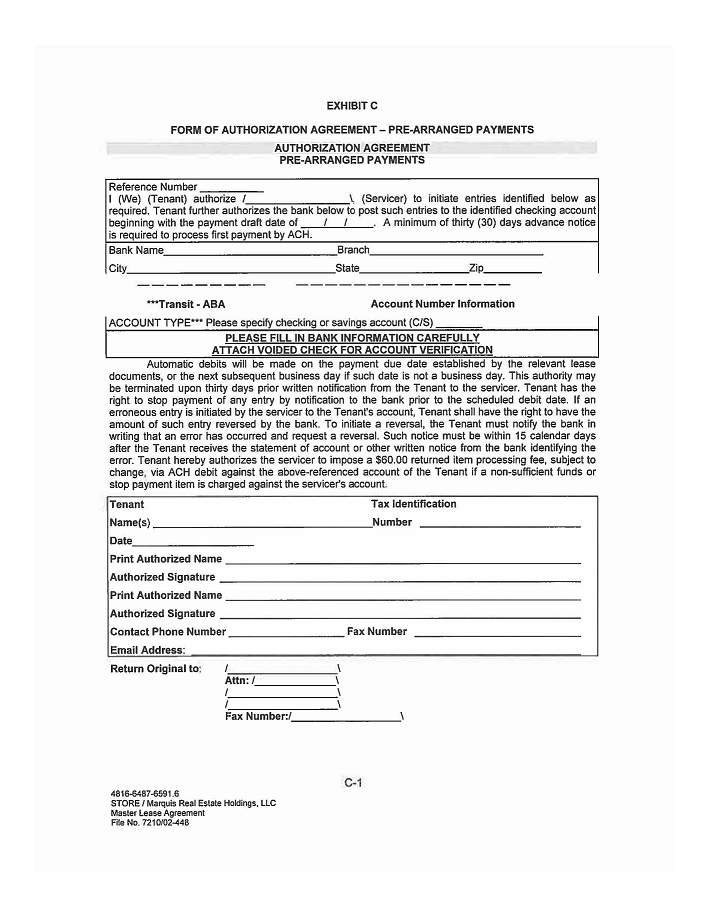

Section

4.05. ACH Authorization. Upon execution of this Lease, Lessee shall deliver to Lessor a complete Authorization Agreement -

Pre-Arranged Payments in the form of Exhibit C attached hereto and incorporated herein by this reference, together with

a voided check for account verification, establishing arrangements whereby payments of the Base Monthly Rental are transferred

by Automated Clearing House Debit initiated by Lessor from an account established by Lessee at a United States bank or other financial

institution to such account as Lessor may designate. Lessee shall continue to pay all Rental by Automated Clearing House Debit

unless otherwise directed by Lessor.

Section

4.06. Late Charges; Default Interest. Any delinquent payment shall, in addition to any other remedy of Lessor, incur a late

charge of five percent (5%) (which late charge is intended to compensate Lessor for the cost of handling and processing such delinquent

payment and should not be considered interest) and bear interest at the Default Rate, such interest to be computed from and including

the date such payment was due through and including the date of the payment; provided, however,

in no event shall Lessee be obligated to pay a sum of late charge and interest higher than the maximum legal rate then

in effect.

Section

4.07. Holdover. If Lessee remains in possession of the Properties after the expiration of the term hereof, Lessee, at Lessor's

option and within Lessor's sole discretion, may be deemed a tenant on a month-to-month basis and shall continue to pay Rentals

and other Monetary Obligations in the amounts herein provided, except that the Base Monthly Rental shall be automatically increased

to one hundred fifty percent (150%) of the last Base Monthly Rental payable under this Lease, and Lessee shall comply with all

the terms of this Lease; provided that nothing herein nor the acceptance of Rental

by Lessor shall be deemed a consent to such holding over. Lessee shall defend, indemnify, protect and hold the Indemnified Parties

harmless from and against any and all Losses resulting from Lessee's failure to surrender possession upon the expiration of the

Lease Term.

Section

4.08. Guaranty. On or before the execution of this Lease, Lessee shall cause Guarantor to execute and deliver to Lessor the

Guaranty.

ARTICLE

V

REPRESENTATIONS

AND WARRANTIES OF LESSEE

The

representations and warranties of Lessee contained in this Article V are being made to induce Lessor to enter into this Lease,

and Lessor has relied, and will continue to rely, upon such representations and warranties. Lessee represents and warrants to Lessor

as follows:

Section

5.01. Organization, Authority and Status of Lessee. Lessee has been duly organized or formed, is validly existing and in good

standing under the laws of its state of formation and is qualified as a foreign limited liability company to do business in any

jurisdiction where such qualification is required. All necessary and appropriate action has been taken to authorize the execution,

delivery and performance by Lessee of this Lease and of the other documents, instruments and agreements provided for herein. Lessee

is not, and if Lessee is a "disregarded entity," the owner of such disregarded entity is not, a "nonresident alien,"

"foreign corporation," "foreign partnership,'' "foreign trust," "foreign estate," or any other

"person" that is not a "United States Person" as those terms are defined in the Code and the regulations promulgated

thereunder. The Person who has executed this Lease on behalf of Lessee is duly authorized to do so.

Section

5.02. Enforceability. This Lease constitutes the legal, valid and binding obligation of Lessee, enforceable against Lessee

in accordance with its terms.

Section

5.03. Litigation. There are no suits, actions, proceedings or investigations pending, or to the best of its knowledge, threatened

against or involving any Lessee Entity or the Properties or the Improvements before any arbitrator or Governmental Authority which

might reasonably result in any Material Adverse Effect.

Section

5.04. Absence of Breaches or Defaults. Lessee is not in default under any document, instrument or agreement to which Lessee

is a party or by which Lessee, the Properties, the Improvements or any of Lessee's property is subject or bound, which has had,

or could reasonably be expected to result in, a Material Adverse Effect. The authorization, execution, delivery and performance

of this Lease and the documents, instruments and agreements provided for herein will not result in any breach of or default under

any document, instrument or agreement to which Lessee is a party or by which Lessee, the Properties, the Improvements or any of

Lessee's property is subject or bound.

Section

5.05. Compliance with OFAC Laws. None of the Lessee Entities, and no individual or entity owning directly or indirectly any

interest in any of the Lessee Entities, is an individual or entity whose property or interests are subject to being blocked under

any of the OFAC Laws or is otherwise in violation of any of the OFAC Laws; provided, however,

that the representation contained in this sentence shall not apply to any Person to the extent such Person's interest

is in or through a U.S. Publicly Traded Entity.

Section

5.06. Solvency. There is no contemplated, pending or threatened Insolvency Event or similar proceedings, whether voluntary

or involuntary, affecting Lessee or any Lessee Entity. Lessee does not have unreasonably small capital to conduct its business.

Section

5.07. Ownership. None of (i) Lessee, (ii) any Affiliate of Lessee, or (iii) any Person owning ten percent (10%) or more of

Lessee, owns, directly or indirectly, ten percent (10%) or more of the total voting power or total value of capital stock in STORE

Capital Corporation.

ARTICLE

VI

TAXES

AND ASSESSMENTS; UTILITIES; INSURANCE

Section 6.01. Taxes.

(a)

Payment. Subject to the provisions of Section 6.01(b) below, Lessee

shall pay, prior to the earlier of delinquency or the accrual of interest on the unpaid balance, all taxes and assessments of

every type or nature assessed against or imposed upon the Properties, the Improvements, Lessee or Lessor during the Lease Term

related to or arising out of this Lease and the activities of the parties hereunder, including without limitation, (i) all taxes

or assessments upon the Properties, the Improvements or any part thereof and upon any personal property located on the Properties,

whether belonging to Lessor or Lessee, or any tax or charge levied in lieu of such taxes and assessments; (ii)

all taxes, charges, license fees and or similar fees imposed by reason of the use of the Properties or the Improvements

by Lessee; (iii) all excise, franchise, transaction, privilege, license, sales, use and other taxes upon the Rental or other Monetary

Obligations hereunder, the leasehold estate of either party or the activities of either party pursuant to this Lease; and (iv)

all franchise, privilege or similar taxes of Lessor calculated on the value of the Properties or on the amount of capital apportioned

to the Properties. Notwithstanding anything in clauses (i) through (iv) to the contrary, Lessee shall not be obligated to pay

or reimburse Lessor for any taxes based on the net income of Lessor.

(b)

Right to Contest. Within thirty (30) days after each tax and assessment payment is required by this Section

6.01 to be paid, Lessee shall provide Lessor with evidence reasonably satisfactory to Lessor that taxes and assessments have been

timely paid by Lessee. In the event Lessor receives a tax bill, Lessor shall use commercially reasonable efforts to forward said

bill to Lessee within fifteen (15) days of Lessor's receipt thereof. Lessee may, at its own expense, contest or cause to be contested

(in the case of any item involving more than $10,000, after prior written notice to Lessor, which shall be given within fifteen

(15) days of Lessee's determination to contest any matter as permitted herein), by appropriate legal proceedings conducted in

good faith and with due diligence, any above-described item or lien with respect thereto, provided that (i) neither the Properties

nor any interest therein would be in any danger of being sold, forfeited or lost by reason of such proceedings; (ii) no Event

of Default has occurred and is continuing; (iii) if and to the extent required by the applicable taxing authority and/or Lessor,

Lessee posts a bond or takes other steps acceptable to such taxing authority and/or Lessor that removes such lien or stays enforcement

thereof; (iv) Lessee shall promptly provide Lessor with

copies of all notices received or delivered by Lessee and filings made by Lessee in connection with such proceeding; and (v) upon

termination of such proceedings, it shall be the obligation of Lessee to pay the amount of any such tax and assessment or part

thereof as finally determined in such proceedings, the payment of which may have been deferred during the prosecution of such

proceedings, together with any costs, fees (including attorneys' fees and disbursements), interest, penalties or other liabilities

in connection therewith. Lessor shall at the request of Lessee, execute or join in the execution of any instruments or documents

necessary in connection with such contest or proceedings, but Lessor shall incur no cost or obligation thereby.

Section

6.02. Utilities. Lessee shall contract, in its own name, for and pay when due all charges for

the connection and use of water, gas, electricity, telephone, garbage collection, sewer use and other utility services supplied

to the Properties or the Improvements during the Lease Term. Under no circumstances shall Lessor be responsible for any interruption

of any utility service.

Section 6.03.

Insurance.

(a)

Coverage. Throughout the Lease Term, Lessee shall maintain, with respect to each of the Properties or the

Improvements, at its sole expense, the following types and amounts of insurance, in addition to such other insurance as Lessor

may reasonably require from time to time:

(i) Insurance

against loss or damage to real property and personal property under an "all risk" or "special form" insurance

policy, which shall include coverage against all risks of direct physical loss, including but not limited to loss by fire, lightning,

wind, terrorism, and other risks normally included in the standard ISO special form (and shall also include National Flood and

Excess Flood insurance for any Property located in Flood Zone A or Flood Zone V, as designated by FEMA, or otherwise located in

a flood zone area identified by FEMA as a 100-year flood zone or special hazard area, and earthquake insurance if any Property

is located within a moderate to high earthquake hazard zone as determined by an approved insurance company set forth in Section

6.03(b)(x) below). Such policy shall also include soft costs, a joint loss agreement, coverage for ordinance or law covering the

loss of value of the undamaged portion of the Properties and the Improvements, costs to demolish and the increased costs of construction

if any of the improvements located on, or the use of, the Properties and the Improvements shall at any time constitute legal non-conforming

structures or uses. Ordinance or law limits shall be in an amount equal to the full replacement cost for the loss of value of

the undamaged portion of the Properties and the Improvements and no less than 25% of the replacement cost for costs to demolish

and the increased cost of construction, or in an amount otherwise specified by Lessor. Such insurance shall be in amounts not

less than 100% of the full insurable replacement cost values (without deduction for depreciation), with an agreed amount endorsement

or without any coinsurance provision, and with sublimits satisfactory to Lessor, as determined from time to time at Lessor's request

but not more frequently than once in any 12-month period.

(ii) Commercial general liability insurance, including products and completed operation liability, covering Lessor and Lessee

against bodily injury liability, property damage liability and personal and advertising injury, including without limitation any

liability arising out of the ownership, maintenance, repair, condition or operation of every Property or adjoining ways, streets,

parking lots or sidewalks. Such insurance policy or policies shall contain a broad form contractual liability endorsement under

which the insurer agrees to insure Lessee's obligations under Article X hereof to the extent insurable, and a "severability

of interest" clause or endorsement which precludes the insurer from denying the claim of Lessee or Lessor because of the negligence

or other acts of the other, shall be in amounts of not less than $10,000,000 per occurrence for bodily injury and property damage,

and $10,000,000 general aggregate per location, or such higher limits as Lessor may reasonably require from time to time, and shall

be of form and substance satisfactory to Lessor. Such limits of insurance can be acquired through Commercial General liability

and Umbrella liability policies.

(iii) Workers' compensation and Employers Liability insurance with statutorily mandated limits covering all persons employed by

Lessee on the Properties and the Improvements in connection with any work done on or about any of the Properties or the Improvements

for which claims for death or bodily injury could be asserted against Lessor, Lessee or the Properties.

(iv) Business interruption insurance including Rental Value Insurance payable to Lessor at all locations for a period of not

less than twelve (12) months. Such insurance is to follow the form of the real property "all risk" or "special form"

coverage and is not to contain a co-insurance clause. Such insurance is to have a minimum of 180 days of extended period of indemnity.

(v) Comprehensive Boiler and Machinery Insurance against loss or damage from explosion of any steam or pressure boilers or similar

apparatus, if any, located in or about each Property and in an amount equal to the lesser of 25% of the 100% replacement cost of

each Property or $5,000,000.

(vi) Such additional and/or other insurance and in such amounts as at the time is customarily carried by prudent owners or tenants

with respect to improvements and personal property similar in character, location and use and occupancy to each Property.

| (b) | Insurance Provisions. All insurance policies

shall: |

(i) provide

for a waiver of subrogation by the insurer as to claims against Lessor, its employees and agents;

(ii) be

primary and provide that any "other insurance" clause in the insurance policy shall exclude any policies of insurance

maintained by Lessor and the insurance policy shall not be brought into contribution with insurance maintained by Lessor;

(iii) contain

deductibles not to exceed $25,000, other than earthquake and flood deductibles which shall not exceed $50,000;

(iv) contain

a standard non-contributory mortgagee clause or endorsement in favor of any Lender designated by Lessor;

(v) provide

that the policy of insurance shall not be terminated, cancelled or amended without at least thirty (30) days' prior written notice

to Lessor and to any Lender covered by any standard mortgagee clause or endorsement;

(vi) be

in amounts sufficient at all times to satisfy any coinsurance requirements thereof;

(vii) except

for workers' compensation insurance referred to in Section 6.03(a)(iii) above, name Lessor and any Lessor Affiliate or Lender requested

by Lessor, as an "additional insured" with respect to liability insurance, and as an "additional named insured"

or "additional insured" with respect to real property and rental value insurance, as appropriate and as their interests

may appear;

(viii) be

evidenced by delivery to Lessor and any Lender designated by Lessor of an Acord Form 28 for property, business interruption and

boiler & machinery coverage (or any other form requested by Lessor) and an Acord Form

25

for commercial general liability, workers' compensation and umbrella coverage (or any other form requested by Lessor); provided

that in the event that either such form is no longer available, such evidence of insurance shall be in a form reasonably satisfactory

to Lessor and any Lender designated by Lessor; and

(ix) be issued by insurance

companies licensed to do business in the states where the Properties are located and which are rated no less than A-X by Best's

Insurance Guide or are otherwise approved by Lessor.

(c)

Additional Obligations. It is expressly understood and agreed that (i) if any insurance required hereunder,

or any part thereof, shall expire, be withdrawn, become void by breach of any condition thereof by Lessee, or become void or in

jeopardy by reason of the failure or impairment of the capital of any insurer, Lessee shall immediately obtain new or additional

insurance reasonably satisfactory to Lessor and any Lender designated by Lessor; (ii) the minimum limits of insurance coverage

set forth in this Section 6.03 shall not limit the liability of Lessee for its acts or omissions as provided in this Lease; (iii)

Lessee shall procure policies for all insurance for periods of not less than one year and shall provide to Lessor and any servicer

or Lender of Lessor certificates of insurance or, upon Lessor's request, duplicate originals of insurance policies evidencing

that insurance satisfying the requirements of this Lease is in effect at all times; (iv) Lessee shall pay as they become due all

premiums for the insurance required by this Section 6.03; (v) in the event that Lessee fails to comply with any of the requirements

set forth in this Section 6.03, within ten (10) days of the giving of written notice by Lessor to Lessee, (A) Lessor shall be

entitled to procure such insurance; and (B) any sums expended by Lessor in procuring such insurance shall be Additional Rental

and shall be repaid by Lessee, together with lnterest thereon at the Default Rate, from the time of payment by Lessor until fully

paid by Lessee immediately upon written demand therefor by Lessor; and (vi) Lessee shall malntaln all insurance policies required

in this Section 6.03 not to be cancelled, invalidated or suspended on account of the conduct of Lessee, its officers, directors,

managers, members, employees or agents, or anyone acting for Lessee or any subtenant or other occupant of the Properties, and

shall comply with all policy conditions and warranties at all times to avoid a forfeiture of all or a part of any insurance payment.

(d)

Blanket Policies. Notwithstanding anything to the contrary in this Section 6.03, any insurance which Lessee

is required to obtain pursuant to this Section 6.3

may be carried under a "blanket" policy or policies covering other properties or liabilities of Lessee provided

that such "blanket" policy or policies otherwise comply with the provisions of this Section 6.03.

Section

6.04. Tax Impound. Upon the occurrence and continuation of such an Event of Default and with respect to each Event of Default,

in addition to any other remedies, Lessor may require Lessee to pay to Lessor on the first day of each month the amount that Lessor

reasonably estimates will be necessary in order to accumulate with Lessor sufficient funds in an impound account (which shall

not be deemed a trust fund) (the "Reserve") for Lessor to pay any and all real estate taxes ("Real Estate

Taxes") for the Properties and the Improvements for the ensuing twelve (12) months, or, if due sooner, Lessee shall pay

the required amount immediately upon Lessor's demand therefor. Lessor shall, upon prior written request of Lessee, provide Lessee

with evidence reasonably satisfactory to Lessee that payment of the Real Estate Taxes was made in a timely fashion. In the event

that the Reserve does not contain sufficient funds to timely pay any Real Estate Taxes, upon Lessor's written notification thereof,

Lessee shall, within five (5) Business Days of such notice, provide funds to Lessor in the amount of such deficiency. Lessor shall

pay or cause to be paid directly to the applicable taxing authorities any Real Estate Taxes then due and payable for which there

are funds in the Reserve; provided, however, that in no event shall Lessor be obligated

to pay any Real Estate Taxes in excess of the funds held in the Reserve, and Lessee shall remain liable for any and all Real Estate

Taxes, including fines, penalties, interest or additional costs imposed by any taxing authority (unless incurred as a result of

Lessor's failure to timely pay Real Estate Taxes for whichit had funds in the Reserve). Lessee shall cooperate fully with Lessor

in assuring that the Real Estate Taxes are timely paid. Lessor may deposit all Reserve funds in accounts insured by any federal

or state agency and may commingle such funds with other funds and accounts of Lessor. Interest or other gains from such funds,

if any, shall be the sole property of Lessor. Upon an Event of Default, in addition to any other remedies, Lessor may apply all

impounded funds in the Reserve against any sums due from Lessee to Lessor. Lessor shall give to Lessee an annual accounting showing

all credits and debits to and from such impounded funds received from Lessee.

ARTICLE

VII

MAINTENANCE; ALTERATIONS

Section

7.01. Condition of Property; Maintenance. Lessee hereby accepts the Properties "AS IS" and "WHERE IS"

with no representation or warranty of Lessor as to the condition thereof. Lessee shall, at its sole cost and expense, be responsible

for (a) keeping all of the building, structures and improvements erected on each of the Properties (including the Improvements)

in good order and repair, free from actual or constructive waste; (b) the repair or reconstruction of any building, structures

or improvements erected on the Properties (including the Improvements) damaged or destroyed by a Casualty; (c) subject to Section

7.02, making all necessary structural, non-structural, exterior and interior repairs and replacements to any building, structures

or improvements erected on the Properties; (d) operating, remodeling, updating and modernizing the Properties and the Improvements

in accordance with prudent business practices; (e) (i) ensuring that no party encroaches upon any Property, (ii) protecting, defending,

indemnifying, releasing and holding the Indemnified Parties harmless from and against any and all claims and Losses arising out

of or in any way relating to any encroachments and/or activities upon any Property caused by any Person; and (iii) prosecuting

any claims that Lessee seeks to bring against any Person relating to Lessee's use and possession of any Property; and (f)

paying all operating costs of the Properties in the ordinary course of business. Lessee waives any right to require Lessor

to maintain, repair or rebuild all or any part of the Properties or make repairs at the expense of Lessor pursuant to any Legal

Requirements at any time in effect. In no event may Lessee remove the Improvements from the Property during the Lease Term.

Section

7.02. Alterations and Improvements. During the Lease Term, Lessee shall not alter the exterior, structural, plumbing or electrical

elements of the Properties or the Improvements in any manner without the consent of Lessor, which consent shall not be unreasonably

withheld or conditioned; provided, however, Lessee may undertake nonstructural alterations

to the Properties or the Improvements, costing less than $500,000 annually in the aggregate without Lessor's prior written consent:(which

may include ancillary work to the plumbing, electrical, HVAC and other building systems in compliance with Legal Requirements).

If Lessor's consent is required hereunder and Lessor consents to the making of any such alterations, the same shall be made by

Lessee at Lessee's sole expense by a licensed contractor. Any work at any time commenced by Lessee on the Properties and the Improvements

shall be prosecuted diligently to completion, shall be of good workmanship and materials and shall comply fully with all the terms

of this Lease and all Legal Requirements. Upon completion of any alterations costing $500,000 or more in the aggregate, Lessee

shall promptly provide Lessor with evidence of full payment to all laborers and materialmen contributing to the alterations. Additionally,

upon completion of any alterations, Lessee shall promptly provide Lessor with (a) an architect's certificate certifying the alterations

to have been completed in conformity with the plans and specifications (if the alterations are of such a nature as would require

the issuance of such a certificate from the architect); (b) a certificate of occupancy (if the alterations are of such a nature

as would require the issuance of a certificate of occupancy); and (c) any other documents or information reasonably requested

by Lessor. Lessee shall keep the Properties and the Improvements free from any liens arising out of any work performed on, or

materials furnished to, the Properties or the Improvements. Lessee shall execute and file or record, as appropriate, a "Notice

of Non-Responsibility," or any equivalent notice permitted under applicable Law in the states where the Properties are located

which provides that Lessor is not responsible for the payment of any costs or expenses relating to the additions or alterations.

In no event may Lessee remove the Improvements from the Property during the Lease Term.

Section

7.03. Encumbrances. Without Lessor's prior written consent, such consent not to be unreasonably withheld, conditioned or delayed,

Lessee shall not grant any easements on, over, under or above the Properties.

ARTICLE

VIII

USE

OF THE PROPERTIES; COMPLIANCE

Section

8.01. Use. During the Lease Term, without the prior written consent of Lessor, such consent not to be unreasonably withheld,

conditioned or delayed, each of the Properties shall be used solely for the operation of a Permitted Facility. Except during periods

when a Property is untenantable due to Casualty or Condemnation (and provided that Lessee continues to strictly comply with the

other terms and conditions of this Lease), Lessee shall at all times during the Lease Term occupy the Properties and shall diligently

operate its business on the Properties. In the event that Lessee shall change the use of the Properties or the concept or brand

operated on the Properties, only as may be expressly permitted herein or consented to by Lessor in writing, Lessee shall provide

Lessor with written notice of any such change and copies of the franchise agreement(s) related to such new concept or brand, if

any.

Section

8.02. Compliance. Lessee's use and occupation of each of the Properties, and the condition thereof, shall, at Lessee's

sole cost and expense, comply fully with all Legal Requirements and all restrictions, covenants and encumbrances of record, and

any owner obligations under such Legal Requirements, or restrictions, covenants and encumbrances of record, with respect to the

Properties, in either event, the failure with which to comply could have a Material Adverse Effect. Without in any way limiting

the foregoing provisions, Lessee shall comply with all Legal Requirements relating to anti-terrorism, trade embargos, economic

sanctions, Anti-Money Laundering Laws, and the Americans with Disabilities Act of 1990, as such act may be amended from time to

time, and all regulations promulgated thereunder, as it affects the Properties now or hereafter in effect. Lessee shall obtain,

maintain and comply with all required licenses and permits, both governmental and private, to use and operate the Properties as

Permitted Facilities. Upon Lessor's written request from time to time during the Lease Term, Lessee shall certify in writing to

Lessor that Lessee's representations, warranties and obligations under Section 5.05 and this Section 8.02 remain true and correct

in all material respects and have not been breached. Lessee shall immediately notify Lessor in writing if any of such representations,

warranties or covenants are no longer true in all material respects or have been breached or if Lessee has a reasonable basis

to believe that they may no longer be true or have been breached. In connection with such an event, Lessee shall comply with all

Legal Requirements and directives of Governmental Authorities and, at Lessor's request, provide to Lessor copies of all notices,

reports and other communications exchanged with, or received from, Governmental Authorities relating to such an event. Lessee

shall also reimburse Lessor for all reasonable Costs incurred by Lessor in evaluating the effect of such an event on the Properties

and this Lease, in obtaining any necessary license from Governmental Authorities as may be necessary for Lessor to enforce its

rights under the Transaction Documents, and in complying with all Legal Requirements applicable to Lessor as the result of the

existence of such an event and for any penalties or fines imposed upon Lessor as a result thereof. Lessee will use its best efforts

to prevent any act or condition to exist on or about the Properties that will materially increase any insurance rate thereon,

except when such acts are required in the normal course of its business and Lessee shall pay for such increase. Lessee agrees

that it will defend, indemnify and hold harmless the Indemnified Parties from and against any and all Losses caused by, incurred

or resulting from Lessee's failure to comply with its obligations under this Section.

Section 8.03. Environmental.

(a)

Covenants.

(i) Lessee covenants to Lessor during the Lease Term, subject to the limitations of subsection (ii) below, as follows:

(A)

All uses and operations on or of the Properties, whether by Lessee or any other Person, shall be in compliance with all

Environmental Laws and permits issued pursuant thereto.

(B)

There shall be no Releases in, on, under or from the Properties, except in Permitted Amounts.

(C)

There shall be no Hazardous Materials or Regulated Substances in, on or under the Properties, except in Permitted Amounts.

Above and below ground storage tanks shall be properly permitted and only used as permitted.

(D)

Lessee shall keep the Properties or cause the Properties to be kept free and clear of all Environmental Liens, whether due

to any act or omission of Lessee or any other Person.

(E)

Lessee shall not act or failto act or allow any other tenant, occupant, guest, customer or other user of the Properties

to act or fail to act in any way that (1) materially increases a risk to human health or the environment, (2) poses an unreasonable

or unacceptable risk of harm to any Person or the environment (whether on or off any of the Properties), (3) has a Material Adverse

Effect, (4) is contrary to any material requirement set forth in the insurance policies

maintained by Lessee or Lessor, (5) violates any covenant, condition, agreement or easement applicable to the Properties in a

material respect, or (6) would result in any reopening or reconsideration of any prior investigation or causes a new investigation

by a Governmental Authority having jurisdiction over any Property.

(F)

Lessee shall, at its sole cost and expense, fully and expeditiously cooperate in all activities pursuant to this Section

8.04, including but not limited to providing all relevant information and making knowledgeable persons available for interviews.

(ii) Notwithstanding any provision of this Lease to the contrary, an Event of Default shall not be deemed to have occurred as

a result of the failure of Lessee to satisfy any one or more of the covenants set forth in subsections (A) through (E) above provided

that Lessee shall be in compliance with the requirements of any Governmental Authority with respect to the Remediation of any Release

at the Properties.

(b)

Notification Requirements. Lessee shall immediately notify Lessor in

writing upon Lessee obtaining actual knowledge of (i) any Releases or Threatened Releases in, on, under or from any of the Properties

other than in Permitted Amounts, or migrating towards any of the Properties; (ii) any non-compliance with any Environmental Laws

related in any way to any of the Properties; (iii) any actual or potential Environmental Lien or activity use limitation; (iv)

any required or proposed Remediation of environmental conditions relating to any of the Properties required by applicable Governmental

Authorities; and (v) any written or oral notice or other communication of which Lessee becomes aware from any source whatsoever

(including but not limited to a Governmental Authority) relating in any way to Hazardous Materials, Regulated Substances or above

or below ground storage tanks, or Remediation thereof at or on any of the Properties, other than in Permitted Amounts, possible

liability of any Person relating to any of the Properties pursuant to any Environmental Law, other environmental conditions in

connection with any of the Properties, or any actual or potential administrative or judicial proceedings in connection with anything

referred to in this Section. Lessee shall, upon Lessor's written request, deliver to Lessor a certificate stating that Lessee is

and has been in full compliance with all of the environmental representations, warranties and covenants in this Lease.

(c)

Remediation. Lessee shall, at its sole cost and expense, and without

limiting any other provision of this Lease, effectuate any Remediation required by any Governmental Authority of any condition

(including, but not limited to, a Release or Threatened Release) in, on, under or from the Properties and take any other reasonable

action deemed necessary by any Governmental Authority for protection of human health or the environment. Should Lessee fail to

undertake any required Remediation in accordance with the preceding sentence, Lessor, after written notice to Lessee and Lessee's

failure to immediately undertake such Remediation, shall be permitted to complete such Remediation, and all Costs incurred in connection

therewith shall be paid by Lessee. Any Cost so paid by Lessor, together with interest at the Default Rate, shall be deemed to be

Additional Rental hereunder and shall be immediately due from Lessee to Lessor.

(d)

Indemnification. Lessee shall, at its sole cost and expense, protect,

defend, indemnify, release and hold harmless each of the Indemnified Parties from and

against

any and all Losses, including, but not limited to, all Costs of Remediation (whether or not performed voluntarily), arising out

of or in any way relating to any Environmental Laws, Hazardous Materials, Regulated Substances, above or below ground storage tanks,

or other environmental matters concerning the Properties or the Improvements. It is expressly understood and agreed that Lessee's

obligations under this Section shall survive the expiration or earlier termination of this Lease for any reason.

(e)

Right of Entry. In the event that Lessor has a reasonable basis to believe

that a Release or a violation of any Environmental Law has occurred, Lessor and any other Person designated by Lessor, including

but not limited to any receiver, any representative of a Governmental Authority, and any environmental consultant, shall have the

right, but not the obligation, to enter upon the Properties at all reasonable times to assess any and all aspects of the environmental

condition of any Property and its use, including but not limited to conducting any environmental assessment or audit (the scope

of which shall be determined in Lessor's sole and absolute discretion) and taking samples of soil, groundwater or other water,

air, or building materials, and conducting other invasive testing. Lessee shall cooperate with and provide access to Lessor and

any other Person designated by Lessor. Any such assessment or investigation shall be at Lessee's sole cost and expense.

(f)

Survival. The obligations of Lessee and the rights and remedies of Lessor

under this Section 8.03 shall survive the termination, expiration and/or release of this Lease.

ARTICLE

IX

ADDITIONAL COVENANTS

Section

9.01. Performance at Lessee's Expense. Lessee acknowledges and confirms that Lessor may impose reasonable administrative, processing

or servicing fees, and collect its reasonable attorneys' fees, costs and expenses in connection with (a) any modification, amendment

(other than for the Extension Options) and termination of this Lease requested by Lessee; (b) any release or substitution of Properties

requested by Lessee; (c) the procurement of consents, waivers and approvals with respect to the Properties or any matter related

to this Lease requested by Lessee; (d) the review of any assignment or sublease or proposed assignment or sublease or the preparation

or review of any subordination or non-disturbance agreement requested by Lessee not to exceed $1,000; (e) the collection, maintenance

and/or disbursement of reserves created under this Lease or the other Transaction Documents (following an Event of Default); and

(f) inspections required to make certain determinations under this

Lease or the other Transaction Documents following Lessor's

reasonable belief of a breach under this Lease or any other Transaction Documents.

Section

9.02. Inspection. Lessor and its authorized representatives shall have the right, at all reasonable times and upon giving

reasonable prior notice (except in the event of an emergency, in which case no prior notice shall be required), to enter the Properties

or any part thereof and inspect the same up to three (3) times in one calendar year or at any time in the event Lessor has a reasonable

basis to believe an Event of Default has occurred and is continuing. Lessee hereby waives any claim for damages for any injury

or inconvenience to or interference with Lessee's business, any loss of occupancy or quiet enjoyment of the Properties and any

other loss occasioned by such entry, but, subject to Section 10.01, excluding damages arising as a result of the gross negligence

or willful misconduct of Lessor.

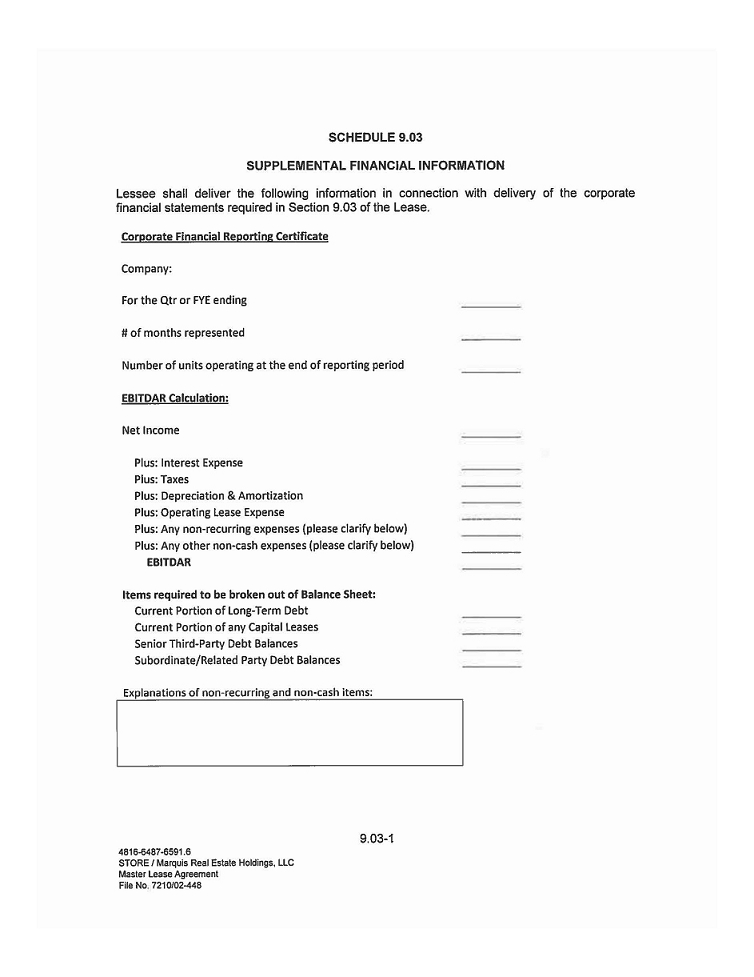

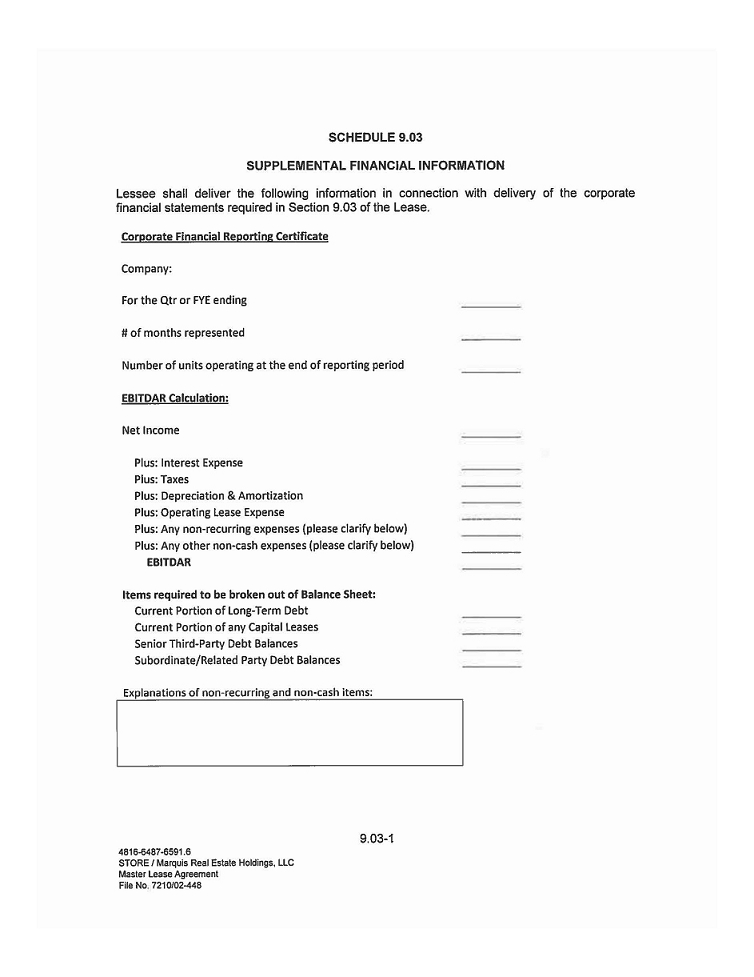

Section 9.03.

Financial Information.

(a)

Financial Statements. Within thirty (30) days after the end of each fiscal

quarter and within one hundred twenty (120) days after the end of each fiscal year of Lessee and Lessee Reporting Entities, Lessee

shall deliver to Lessor complete (and audited in the case of year-end statements) consolidated financial statements that consolidate

Lessee and Lessee Reporting Entities, including a balance sheet, profit and loss statement, statement of stockholders' equity and

statement of cash flows and all other related schedules for the fiscal period then ended, such statements to detail separately

interest expense, income taxes, non-cash expenses, non-recurring expenses, operating lease expense and current portion of long-term

debt - capital leases. All such financial statements shall be prepared in accordance with GMP, and shall be certified to be accurate

and complete by an officer or director of each Lessee Reporting Entity.

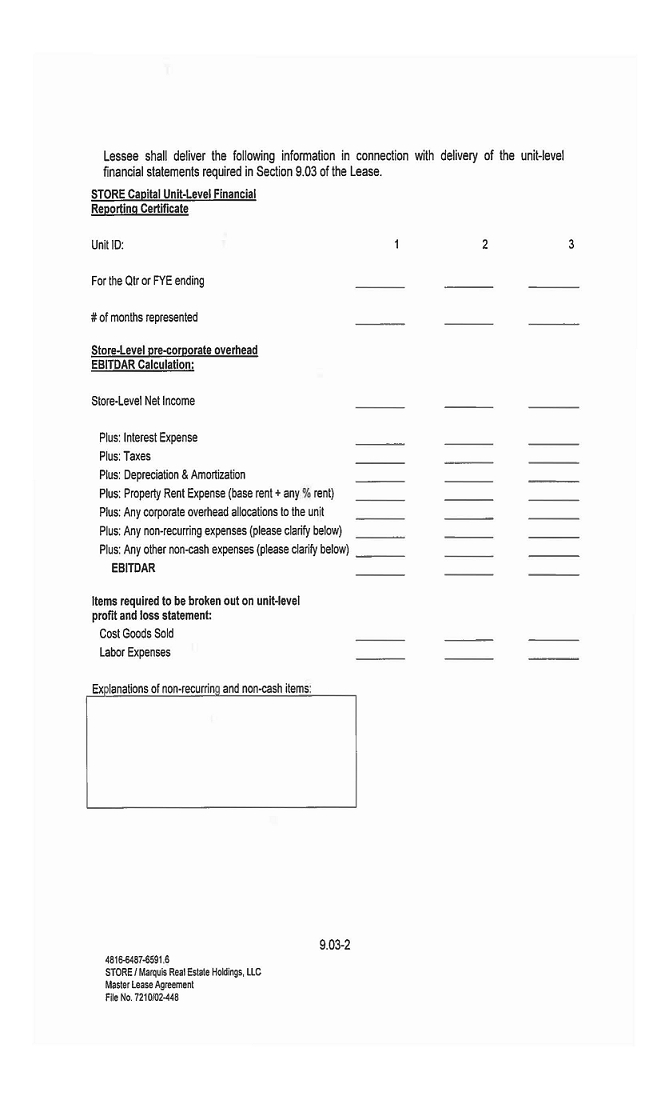

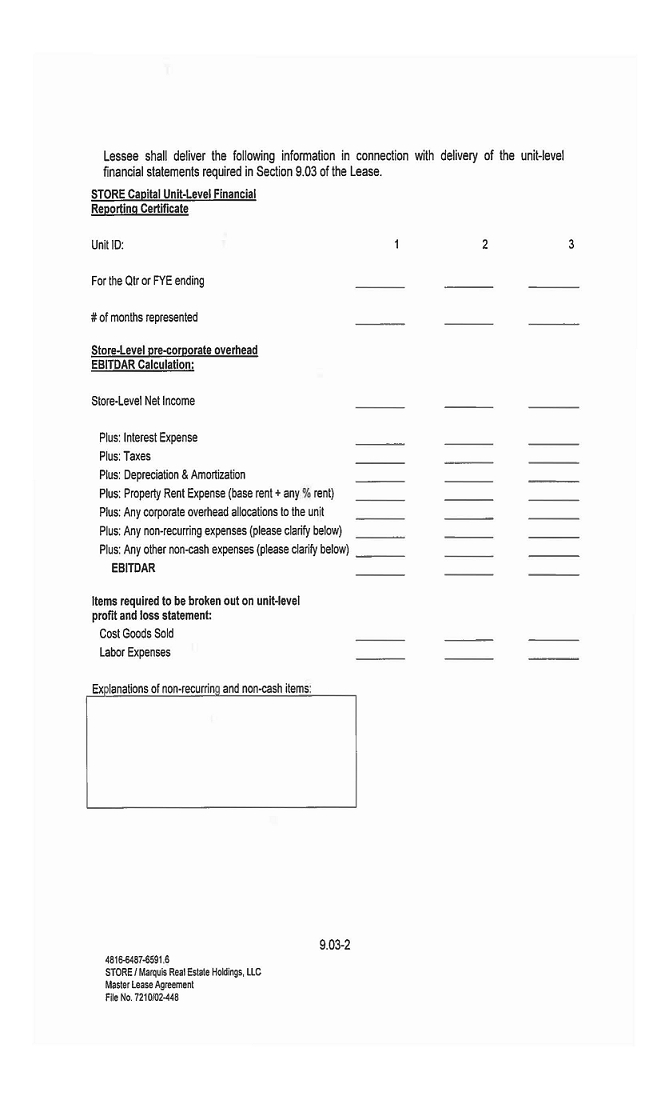

In

addition, in the event Lessee Reporting Entities operate fifteen (15) or more locations (seven (7) in addition to the Properties

under this Lease), Lessee and Lessee Reporting Entities shall provide income statements for the business at each of the Properties

within thirty (30) days after the end of each fiscal quarter and one hundred and twenty (120) days after the end of each fiscal

year; and in such event (15 or more locations) andif

Lessee's business at the Properties is ordinarily consolidated with other business for financial statements purposes, a separate

profit and loss statement shall be provided showing separately the sales, profits and losses pertaining to each Property with interest

expense, income taxes, non-cash expenses, non-recurring expenses and operating lease expense (rent), with the basis for allocation

of overhead or other charges being clearly set forth in accordance with Schedule 9.03.

(b)

Other Information.

Notwithstanding any provision contained herein, upon request at any time, Lessee will

provide to Lessor, at no additional cost or expense to Lessee1

any and all financial information and/or financial statements of Lessee Reporting Entities

(and in the form or forms) as reasonably requested by Lessor if required in connection with Lessor's filings with

or disclosures to the Securities and Exchange Commission or other Governmental Authority.

Section

9.04. OFAC Laws. Upon receipt of notice or upon actual knowledge thereof, Lessee shall immediately notify Lessor in writing

if any Person owning (directly or indirectly) any interest in any of the Lessee Entities, or

any director, officer, shareholder, member, manager or partner of any of such holders is a Person whose property or interests are

subject to being blocked under any of the OFAC Laws, or is otherwise in violation

of any of the OFAC Laws, or is under investigation by any Governmental Authority for, or has been charged with, or convicted of,

drug trafficking, terrorist-related activities or any violation

of the Anti-Money Laundering Laws, has been assessed civil penalties under these or related Laws, or has had funds seized or forfeited

in an action under these or related Laws;provided, however,

that the covenant in this Section 9.04 shall not apply to any Person to the extent such Person's interest is in or through

a U.S. Publicly Traded Entity.

Section

9.05. Estoppel Certificate. At any time, and from time to time, up to twice in one calendar year (other than in the instance

of a proposed sale of the Property), Lessee shall, promptly and in no event later than ten (10) days after a request from Lessor

or any Lender or mortgagee of Lessor, execute, acknowledge and deliver to Lessor or such Lender or mortgagee, as the case may

be, a certificate in the form supplied by Lessor, certifying: (a) that Lessee has accepted the Properties; (b) that this Lease

is in full force and effect and has not been modified (or if modified, setting forth all modifications), or, if this Lease is

not in full force and effect, the certificate shall so specify the reasons therefor; (c) the commencement and expiration dates

of the Lease Term; (d) the date to which the Rentals have been paid under this Lease and the amount thereof then payable; (e)

whether there are then any existing defaults by Lessor in the performance of its obligations under this Lease, and, if there are

any such defaults, specifying the nature and extent thereof; (f) that

no notice has been received by Lessee of any default under this Lease which has not been cured, except as to defaults specified

in the certificate; (g) the capacity of the Person executing such certificate, and that such Person is duly authorized to execute

the same on behalf of Lessee; (h) that neither Lessor nor any Lender or mortgagee has actual involvement in the management or

control of decision making related to the operational aspects or the day-to-day operation of the Properties, including any handling

or disposal of Hazardous Materials or Regulated Substances; and (i) any other information reasonably requested by Lessor or any

Lender or mortgagee, as the case may be. If Lessee shall fail or refuse to sign a certificate in accordance with the provisions

of this Section within ten (10) days following a request by Lessor, Lessee irrevocably constitutes and appoints Lessor as its

attorney-in-fact to execute and deliver the certificate to any such third party, it being stipulated that such power of attorney

is coupled with an interest and is irrevocable and binding.

ARTICLE

X

RELEASE

AND INDEMNIFICATION

Section

10.01. Release and Indemnification. Lessee agrees to use and occupy the Properties at its own risk and hereby releases Lessor

and Lessor's agents and employees from all claims for any damage or injury to the full extent permitted by Law. Lessee agrees

that Lessor shall not be responsible or liable to Lessee or Lessee's employees, agents, customers, licensees or invitees for bodily

injury, personal injury or property damage occasioned by the acts or omissions of any other lessee or any other Person. Lessee

agrees that any employee or agent to whom the Properties or any part thereof shall be entrusted by or on behalf of Lessee shall

be acting as Lessee's agent with respect to the Properties or any part thereof, and neither Lessor nor Lessor's agents, employees

or contractors shall be liable for any loss of or damage to the Properties or any part thereof. Lessee shall indemnify, protect,

defend and hold harmless each of the Indemnified Parties from and against any and all Losses (excluding Losses suffered by an

Indemnified Party arising out of the gross negligence or willful misconduct of such Indemnified Party; provided,

however, that the term "gross negligence" shall not include gross negligence imputed as a matter of Law to

any of the Indemnified Parties solely by reason of Lessor's interest in any Property or Lessor's failure to act in respect of

matters which are or were the obligation of Lessee under this Lease) caused by, incurred or resulting from Lessee's operations

or by Lessee's use and occupancy of the Properties or the Improvements, whether relating to its original design or construction,

latent defects, alteration, maintenance, use by Lessee or any Person thereon, supervision or otherwise, or from any breach of,

default under, or failure to perform, any term or provision of this Lease by Lessee, its officers, employees, agents or other

Persons. It is expressly understood and agreed that Lessee's obligations under this Section shall survive the expiration or earlier

termination of this Lease for any reason whatsoever.

ARTICLE

XI

CONDEMNATION AND CASUALTY

Section 11.01. Notification. Lessee

shall promptly give Lessor written notice of (a) any Condemnation

of any of the Properties or the Improvements, (b) the commencement of any proceedings or negotiations which might result in a

Condemnation of any of the Properties, and (c) any Casualty to any of the Properties, the Improvements, or any part thereof. Such

notice shall provide a general description of the nature and extent of such Condemnation, proceedings, negotiations or Casualty,

and shall include copies of any documents or notices received in connection therewith. Thereafter, Lessee shall promptly send

Lessor copies of all notices, correspondence and pleadings relating to any such Condemnation, proceedings, negotiations or Casualty.

Section

11.02. Total Condemnation. In the event of a Condemnation of all or substantially all of any

of the Properties, and if as a result of such Condemnation:(i) access to a Property to and from the publicly dedicated roads adjacent

to such Property as of the Effective Date is permanently and materially impaired such that Lessee no longer has access to such

dedicated road; (ii) there is insufficient parking to operate such Property as a Permitted Facility under applicable Laws; or (iii)

the Condemnation includes a portion of the building such that the remaining portion is unsuitable for use as a Permitted Facility,

as determined by Lessee in the exercise of good faith business judgment (and Lessee provides to Lessor an officer's certificate

executed by an officer of Lessee certifying to the same) (each such event, a "Total Condemnation"), then,

in such event:

(a)

Termination of Lease. On the date of the Total Condemnation, all obligations

of either party hereunder with respect to the applicable Property shall cease and the Base Annual Rental shall be reduced as set

forth in Section 11.03(c) below; provided, however, that Lessee's obligations to the

Indemnified Parties under any indemnification provisions of this Lease with respect to such Property and Lessee's obligation to

pay Rental and all other Monetary Obligations (whether payable to Lessor or a third party) accruing under this Lease with respect

to such Property prior to the date of termination shall survive such termination. If the date of such Total Condemnation is other

than the first day of a month, the Base Monthly Rental for the month in which such Total Condemnation occurs shall be apportioned

based on the date of the Total Condemnation.

(b)

Net Award. Lessor shall be entitled to receive the entire

Net Award in connection with a Total Condemnation and except as set forth in Section 11.07 below, without deduction for any estate

vested in Lessee by this Lease, and Lessee hereby expressly assigns to Lessor all of its right, title and interest in and to every

such Net Award and agrees that Lessee shall not be entitled to any Net Award or other payment for the value of Lessee's leasehold

interest in this Lease.

Section

11.03. Partial Condemnation or Casualty. In the event of a Condemnation which is not a Total Condemnation (each such event,

a "Partial Condemnation"), or in the event of a Casualty:

(a) Net Awards. All Net Awards shall be paid to Lessor.

(b) Continuance of Lease. This Lease shall continue in full force and effect

upon the following terms:

(i) All Rental and other Monetary Obligations due under this Lease shall continue unabated.

(ii) Lessee shall promptly commence and diligently prosecute restoration of such Property to the same condition, as nearly as

practicable, as prior to such Partial Condemnation or Casualty as approved by Lessor. Subject to the terms and provisions of the

Mortgages and upon the written request of Lessee (accompanied by evidence reasonably satisfactory to Lessor that such amount has

been paid or is due and payable and is properly part of such costs, and

that Lessee has complied with the terms of Section 7.02 in connection with the restoration), Lessor shall promptly make available

in installments, subject to reasonable conditions for disbursement imposed by Lessor, an amount up to but not exceeding the amount

of any Net Award received by Lessor with respect to such Partial Condemnation or Casualty. Prior to the disbursement of any portion

of the Net Award with respect to a Casualty, Lessee shall provide evidence reasonably satisfactory to Lessor of the payment of

restoration expenses by Lessee up to the amount of the insurance deductible applicable to such Casualty. Lessor shall be entitled

to keep any portion of the Net Award which may be in excess of the cost of restoration, and Lessee shall bear all additional Costs

of such restoration in excess of the Net Award.

(c) Rental.

Upon removal of a Property pursuant to Section 11.02 or Section 11.03, the Base Annual Rental shall be reduced by an amount

equal to the Lease Rate multiplied by the Net Award.

Section

11.04. Temporary Taking. In the event of a Condemnation of all or any part of any Property for a temporary use (a "Temporary

Taking"), this Lease shall remain in full force and effect without any reduction of Base Annual Rental, Additional Rental

or any other Monetary Obligation payable hereunder. Except as provided below, Lessee shall be entitled to the entire Net Award

for a Temporary Taking, unless the period of occupation and use by the condemning authorities shall extend beyond the date of expiration

of this Lease, in which event the Net Award made for such Temporary Taking shall be apportioned between Lessor and Lessee as of

the date of such expiration. At the termination of any such Temporary Taking, Lessee will, at its own cost and expense and pursuant

to the provisions of Section 7.02, promptly commence and complete restoration of such Property.

Section

11.05. Adjustment of Losses. Any loss under any property damage insurance required to be maintained by Lessee shall be adjusted

by Lessor and Lessee. Any Net Award relating to a Total Condemnation or a Partial Condemnation shall be adjusted by Lessor or,

at Lessor's election, Lessee. Notwithstanding the foregoing or any other provisions of this Section 11.05 to the contrary, if

at the time of any Condemnation or any Casualty or at any time thereafter an Event of Default shall have occurred and be continuing,

Lessor is hereby authorized and empowered but shall not be obligated, in the name and on behalf of Lessee and otherwise, to file

and prosecute Lessee's claim, if any, for a Net Award on account of such Condemnation or such Casualty and to collect such Net

Award and apply the same to the curing of such Event of Default and any other then existing Event of Default under this Lease

and/or to the payment of any amounts owed by Lessee to Lessor under this Lease, in such order, priority and proportions as Lessor

in its discretion shall deem proper.

Section

11.06. Lessee Obligation in Event of Casualty. During

all periods of time following a Casualty, Lessee shall take reasonable steps to ensure that the affected Property is secure and

does not pose any risk of harm to any adjoining property and Persons (including owners or occupants of such adjoining property).

Section

11.07. Lessee Awards and Payments. Notwithstanding any provision contained in this Article XI,

Lessee shall be entitled to claim and receive any award or payment from the condemning authority expressly granted for the taking

of any personal property owned by Lessee, any insurance proceeds with respect to any personal property owned by Lessee, the interruption

of its business and moving expenses (subject, however, to the provisions of Section 6.03(a)(iv) above).

ARTICLE

XII

DEFAULT,

CONDITIONAL LIMITATIONS,

REMEDIES AND MEASURE OF DAMAGES

Section

12.01. Event of Default. Each of the following shall be an event of default by Lessee under this

Lease (each, an "Event of Default"):

(a)

if any representation or warranty of Lessee set forth in this Lease is false in any material respect when made;

(b)

if any Rental due under this Lease is not paid when due; provided, however, any delay in the payment of Rental as

a result of a technical error in the wiring and/or automated clearinghouse process shall not constitute an Event of Default hereunder

so long as the same is corrected within two (2) Business Days of the date Lessee receives notice thereof;

(c)

if Lessee fails to pay, prior to delinquency, any taxes, assessments or other charges the failure of which to pay will result

in the imposition of a lien against any of the Properties or the Improvements;

(d)

if Lessee vacates or abandons any Property;

(e)

f there is an Insolvency Event affecting Lessee or the Guarantor;

(f)

if Lessee fails to observe or perform any of the other covenants, conditions or obligations of Lessee in this Lease;provided,

however, if any such failure is within the reasonable power of Lessee to promptly cure, all as determined by Lessor in its

reasonable discretion, then such failure shall not constitute an Event of Default hereunder, unless otherwise expressly provided

herein, unless and until Lessor shall have given Lessee notice thereof and a period of thirty (30) days shall have elapsed, during

which period Lessee may correct or cure such failure, upon failure of which an Event of Default shall be deemed to have occurred

hereunder without further notice or demand of any kind being required. If such failure cannot reasonably be cured within such

thirty (30)-day period, as determined by Lessor in its reasonable discretion, and Lessee is diligently pursuing a cure of such

failure, then Lessee shall have a reasonable period to cure such failure beyond such thirty (30)-day period, which shall in no

event exceed ninety (90) days after receiving notice of such failure from Lessor. If Lessee shall fail to correct or cure such

failure within such ninety (90)-day period, an Event of Default shall be deemed to have occurred hereunder without further notice

or demand of any kind being required;

(g)

if a final, nonappealable judgment is rendered by a court against Lessee which has a Material Adverse Effect, and is not

discharged or provision made for such discharge within ninety (90) days from the date of entry thereof;

(h)

if Lessee shall be liquidated or dissolved or shall begin proceedings towards its liquidation or dissolution;

(i)

if the estate or interest of Lessee in any of the Properties shall be levied upon or attached in any proceeding and such

estate or interest is about to be sold or transferred or such process shall not be vacated or discharged within ninety (90) days

after it is made; or

(j)

if there is an "Event of Default" or other breach or default by Lessee or the Guarantor under any of the

other Transaction Documents or any Other Agreement , after the passage of all applicable notice and cure or grace periods; provided,

however, in the event that this Lease has been the subject of a Securitization and any Other Agreement has not been

the subject of the same Securitization or any series relating to such Securitization, an "Event of Default" under such

Other Agreement shall not constitute an Event of Default under this Lease;

(k)

if Lessor does not acquire the Improvements upon expiration of the Lease Term (including any applicable Extension Term),

or upon any other termination of this Lease.

Section

12.02. Remedies. Upon the occurrence of an Event of Default, with or without notice or demand, except as otherwise expressly

provided herein or such other notice as may be required by statute and cannot be waived by Lessee, Lessor shall be entitled to

exercise, at its option, concurrently, successively, or in any combination, all remedies available at Law or in equity, including,

without limitation, any one or more of the following:

(a)

to terminate this Lease, whereupon Lessee's right to possession of the Properties shall cease and this Lease, except as

to Lessee's liability, shall be terminated;

(b) to

the extent not prohibited by applicable Law, to (i) re-enter and take possession of the Properties (or any part thereof), any

fixtures of Lessee upon the Properties and, to the extent permissible, permits and other rights or privileges of Lessee

pertaining to the use and operation of the Properties, and (ii) expel Lessee and those

claiming under or through Lessee, without being deemed guilty in any manner of trespass or becoming liable for any loss or

damage resulting therefrom, without resort to legal or judicial process, procedure or action. No notice from Lessor hereunder

or under a forcible entry and detainer statute or similar Law shall constitute an election by Lessor to terminate this Lease

unless such notice specifically so states. If Lessee shall, after default, voluntarily give up possession of the Properties

to Lessor, deliver to Lessor or its agents the keys to the Properties, or both, such actions shall be deemed to be in

compliance with Lessor's rights and the acceptance thereof by Lessor or its agents shall not be deemed to constitute a

termination of the Lease. Lessor reserves the right following any re-entry and/or reletting to exercise its right to

terminate this Lease by giving Lessee written notice thereof, in which event this Lease will terminate;

(c)

to bring an action against Lessee for any damages sustained by Lessor or any equitable relief available to Lessor and to

the extent not prohibited by applicable Law, to seize all fixtures upon the Properties which Lessee owns or in which it has an

interest, and to dispose thereof in accordance with the Laws prevailing at the time and place of such seizure or to remove all

or any portion of such property and cause the same to be stored in a public warehouse or elsewhere at Lessee's sole expense, without

becoming liable for any loss or damage resulting therefrom and without resorting to legal or judicial process, procedure or action;

(d)

to relet the Properties or any part thereof for such term or terms (including a term which extends beyond the original Lease

Term), at such rentals and upon such other terms as Lessor, in its sole discretion, may determine, with all proceeds received from

such reletting being applied to the Rental and other Monetary Obligations due from Lessee in such order as Lessor may, in its sole

discretion, determine, which other Monetary Obligations include, without limitation, all repossession costs, brokerage commissions,

attorneys' fees and expenses, alteration, remodeling and repair costs and expenses of preparing for such reletting. Except to the

extent required by applicable Law, Lessor shall have no obligation to relet the Properties or any part thereof and shall in no

event be liable for refusal or failure to relet the Properties or any part thereof, or, in the event of any such reletting, for

refusal or failure to collect any rent due upon such reletting, and no such refusal or failure shall operate to relieve Lessee

of any liability under this Lease or otherwise to affect any such liability. Lessor reserves the right following any re-entry and/or

reletting to exercise its right to terminate this Lease by giving Lessee written notice thereof, in which event this Lease will

terminate as specified in said notice;

(e)

except to the extent prohibited by applicable Law to accelerate and recover from Lessee all Rental and other Monetary Obligations

due and owing and scheduled to become due and owing under this Lease both before and after the date of such breach for the entire

original scheduled Lease Term;

(f)

to recover from Lessee all Costs paid or incurred by Lessor as a result of such breach, regardless of whether or not legal

proceedings are actually commenced;

(g)

to immediately or at any time thereafter, and with or without notice, at Lessor's sole option but without any obligation

to do so, correct such breach or default and charge Lessee all Costs incurred by Lessor therein. Any sum or sums so paid by Lessor,

together with interest at the Default Rate, shall be deemed to be Additional Rental hereunder and shall be immediately due from

Lessee to Lessor. Any such acts by Lessor in correcting Lessee's breaches or defaults hereunder shall not be deemed to cure said

breaches or defaults or constitute any waiver of Lessor's right to exercise any or all remedies set forth herein;

(h)

to immediately or at any time thereafter, and with or without notice, except as required herein, set off any money of Lessee

held by Lessor under this Lease or any other Transaction Document or any Other Agreement against any sum owing by Lessee hereunder;

(i)

Without limiting the generality of the foregoing or limiting in any way the rights of Lessor under this Lease or otherwise

under applicable Laws, at any time after the occurrence, and during the continuance, of an Event of Default, Lessor shall be entitled

to apply for and have a receiver appointed under applicable Law by a court of competent jurisdiction (by ex parte motion for appointment

without notice) in any action taken by Lessor to enforce its rights and remedies hereunder in order to protect and preserve Lessor's

interest under this Lease or in the Properties, the Improvements, and the Personalty, and in connection therewith, LESSEE HEREBY

IRREVOCABLY CONSENTS TO AND WAIVES ANY RIGHT TO OBJECT TO OR OTHERWISE CONTEST THE APPOINTMENT OF A RECEIVER AFTER THE OCCURRENCE,

AND DURING THE CONTINUANCE, OF AN EVENT OF DEFAULT; and/or

(j)

to seek any equitable relief available to Lessor, including, without limitation, the right of specific performance.

Section 12.03. Cumulative Remedies. All

powers and remedies given by Section 12.02 to

Lessor, subject to applicable Law, shall be cumulative and not exclusive of one another or of any other right or remedy or of

any other powers and remedies available to Lessor under this Lease, by judicial proceedings or otherwise, to enforce the performance

or observance of the covenants and agreements of Lessee contained in this Lease, and no delay or omission of Lessor to exercise

any right or power accruing upon the occurrence of any Event of Default shall impair any other or subsequent Event of Default

or impair any rights or remedies consequent thereto. Every power and remedy given by this Section or by Law to Lessor may be exercised

from time to time, and as often as may be deemed expedient, by Lessor, subject at all times to Lessor's right in its sole judgment

to discontinue any work commenced by Lessor or change any course of action undertaken by Lessor.

Section

12.04. Lessee Waiver. Lessee hereby expressly waives, for itself and all Persons claiming by, through and under Lessee, including

creditors of all kinds, (a) any right and privilege which Lessee has under any present or future Legal Requirements to redeem

the Properties or to have a continuance of this Lease for the Lease Term after termination of Lessee's right of occupancy by order

or judgment of any court or by any legal process or writ, or under the terms of this Lease; (b) the benefits of any present or

future Legal Requirement that exempts property from liability for debt or for distress for rent; (c) any present or future Legal

Requirement relating to notice or delay in levy of execution in case of eviction of a tenant for nonpayment of rent; and (d) any

benefits and lien rights which may arise pursuant to any present or future Legal Requirement.

ARTICLE

XIII

MORTGAGE,

SUBORDINATION AND ATTORNMENT

Section

13.01. No Liens. Lessor's interest in this Lease and/or the Properties shall not be subordinate to any liens or encumbrances

placed upon the Properties by or resulting from any act of Lessee, and nothing herein contained shall be construed to require such

subordination by Lessor. NOTICE IS HEREBY GIVEN THAT LESSEE IS NOT AUTHORIZED TO PLACE OR ALLOW TO BE PLACED ANY LIEN, MORTGAGE,

DEED OF TRUST, DEED TO SECURE DEBT, SECURITY INTEREST OR ENCUMBRANCE OF ANY KIND UPON OF THE PROPERTIES, THE IMPROVEMENTS OR LESSEE'S

LEASEHOLD INTEREST IN THE PROPERTY, AND ANY SUCH PURPORTED TRANSACTION SHALL BE VOID.

Section

13.02. Subordination. This Lease at all times shall automatically be subordinate to the lien of any and all Mortgages now or

hereafter placed upon any of the Properties by Lessor, and Lessee covenants and agrees to execute and deliver, upon demand,

such further instruments subordinating this Lease to the lien of any or all such Mortgages

as shall be desired by Lessor, or any present or proposed mortgagees under trust deeds, upon the condition that Lessee shall have

the right to remain in possession of the Properties under the terms of this Lease, notwithstanding any default in any or all such

Mortgages, or after the foreclosure of any such Mortgages, so long as no Event of Default shall have occurred and be continuing.

Section

13.03. Attornment. In the event any purchaser or assignee of any Lender at a foreclosure sale acquires title to any of the

Properties, or in the event that any Lender or any purchaser or assignee otherwise succeeds to the rights of Lessor as landlord

under this Lease, Lessee shall attorn to Lender or such purchaser or assignee, as the case may be (a "Successor Lessor"),