Filed Pursuant to Rule 424(b)(2)

Registration No. 333-257113

|

Pricing Supplement dated June 17, 2022 |

|

Canadian Imperial Bank of Commerce

Senior Global Medium-Term Notes

$10,000,000 Floating Rate Notes Linked to the 2-Year U.S. Dollar SOFR ICE Swap Rate®, due June 23, 2025

| · | The notes are senior unsecured debt securities issued by Canadian Imperial Bank of Commerce (“CIBC”). All payments and the return of the principal amount on the notes are subject to our credit risk .. | |

| · | The notes will mature on June 23, 2025. At maturity, you will receive a cash payment equal to 100% of the principal amount of the notes, plus any accrued and unpaid interest. | |

| · | Interest will be paid on March 23, June 23, September 23 and December 23 of each year, commencing on September 23, 2022, with the final interest payment date occurring on the maturity date. | |

| · | The notes will accrue interest quarterly at a rate per annum equal to the sum of the 2-Year U.S. Dollar SOFR ICE Swap Rate® (“SOFR CMS2”) and 0.25%, subject to a minimum rate of 3.00%. | |

| · | At maturity, you will receive a cash payment equal to the principal amount of the notes, plus any accrued but unpaid interest. | |

| · | The notes will be offered at varying public offering prices related to prevailing market prices. The public offering price will include accrued interest from June 22, 2022, if settlement occurs after that date. | |

| · | The notes will not be listed on any securities exchange. |

The notes:

| Are Not FDIC or CDIC Insured | Are Not Bank Guaranteed | May Lose Value |

|

Per Note

|

Total

| ||

| Public Offering Price(1) | 100.00% | $10,000,000.00 | |

| Underwriting Discount(1)(2) | 0.40% | $40,000.00 | |

| Proceeds (before expenses) to CIBC | 99.60% | $9,960,000.00 |

| (1) | Certain dealers who purchase the notes for sale to certain fee-based advisory accounts and/or eligible institutional investors may forgo some or all of their selling concessions, fees or commissions. The price to public for investors purchasing the notes in these accounts and/or for an eligible institutional investor will be as low as $996.00 (99.60%) per $1,000 in principal amount of the notes. See “Supplemental Plan of Distribution” in this pricing supplement. |

| (2) | BofA Securities, Inc. (“BofAS”) will pay varying selling concessions at an average of 0.40% in connection with the distribution of the notes to other registered broker-dealers. |

The notes are unsecured debt securities and are not savings accounts or insured deposits of a bank. The notes are not insured or guaranteed by the Canada Deposit Insurance Corporation (the “CDIC”), the U.S. Federal Deposit Insurance Corporation (the “FDIC”) or any other governmental agency of Canada, the United States or any other jurisdiction, and involve investment risks. The notes are not bail-inable debt securities (as defined on page 6 of the prospectus).

Potential purchasers of the notes should consider the information in “Risk Factors” beginning on page PS-5 of this pricing supplement, page S-1 of the attached prospectus supplement, and page 1 of the attached prospectus.

None of the Securities and Exchange Commission (the “SEC”), any state or provincial securities commission, or any other regulatory body has approved or disapproved of these notes or passed upon the adequacy or accuracy of this pricing supplement, the accompanying prospectus supplement, or the accompanying prospectus. Any representation to the contrary is a criminal offense.

We will deliver the notes in book-entry form only through The Depository Trust Company (“DTC”) on June 22, 2022 against payment in immediately available funds.

BofA Securities

ABOUT THIS PRICING SUPPLEMENT

You should read this pricing supplement together with the prospectus dated September 2, 2021 (the “prospectus”) and the prospectus supplement dated September 2, 2021 (the “prospectus supplement”), relating to our Senior Global Medium-Term Notes, of which these notes are a part, for additional information about the notes. Information in this pricing supplement supersedes information in the prospectus supplement and prospectus to the extent it is different from that information. Certain defined terms used but not defined herein have the meanings set forth in the prospectus supplement or the prospectus.

You should rely only on the information contained in or incorporated by reference in this pricing supplement, the accompanying prospectus supplement and the accompanying prospectus. This pricing supplement may be used only for the purpose for which it has been prepared. No one is authorized to give information other than that contained in this pricing supplement, the accompanying prospectus supplement and the accompanying prospectus, and in the documents referred to in this pricing supplement, the prospectus supplement and the prospectus and which are made available to the public. We have not, and BofAS has not, authorized any other person to provide you with different or additional information. If anyone provides you with different or additional information, you should not rely on it.

We are not, and BofAS is not, making an offer to sell the notes in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in or incorporated by reference in this pricing supplement, the accompanying prospectus supplement or the accompanying prospectus is accurate as of any date other than the date of the applicable document. Our business, financial condition, results of operations and prospects may have changed since that date. Neither this pricing supplement, nor the accompanying prospectus supplement, nor the accompanying prospectus constitutes an offer, or an invitation on our behalf or on behalf of BofAS, to subscribe for and purchase any of the notes and may not be used for or in connection with an offer or solicitation by anyone in any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation.

References to “CIBC,” the “Issuer,” the “Bank,” “we,” “us” and “our” in this pricing supplement are references to Canadian Imperial Bank of Commerce and not to any of our subsidiaries, unless we state otherwise or the context otherwise requires.

You may access the prospectus supplement and prospectus on the SEC website www.sec.gov as follows (or if such address has changed, by reviewing our filing for the relevant date on the SEC website):

| · | Prospectus supplement dated September 2, 2021: | |

| https://www.sec.gov/Archives/edgar/data/1045520/000110465921112440/tm2123981d29_424b5.htm |

| · | Prospectus dated September 2, 2021: | |

| https://www.sec.gov/Archives/edgar/data/1045520/000110465921112558/tm2123981d24_424b3.htm |

PS-2

SUMMARY OF TERMS

This pricing supplement supplements the terms and conditions in, and should be read in conjunction with, the prospectus and the prospectus supplement.

| • | Issuer: | Canadian Imperial Bank of Commerce |

| • | Type of Note: | Floating Rate Notes Linked to the 2-Year U.S. Dollar SOFR ICE Swap Rate®, due June 23, 2025 |

| • | CUSIP/ISIN: | CUSIP: 13607XAC1 / ISIN: US13607XAC11 |

| • | Principal Amount: | $1,000 per note |

| • | Aggregate Principal Amount Initially Being Issued: | $10,000,000 |

| • | Currency: | U.S. Dollars (“$”) |

| • | Trade Date: | June 17, 2022 |

| • | Issue Date: | June 22, 2022 |

| • | Interest Accrual Date: | June 22, 2022 |

| • | Maturity Date: | June 23, 2025, subject to postponement as described in “—Business Day” below. |

| • | Minimum Denominations: | $1,000 and multiples of $1,000 in excess of $1,000 |

| • | Ranking: | Senior, unsecured |

| • | Day Count Fraction: | 30/360 Unadjusted |

| • | Interest Payment Dates: | Quarterly, on March 23, June 23, September 23 and December 23 of each year, beginning on September 23, 2022, with the final interest payment date occurring on the maturity date. The interest payment dates are subject to postponement as described in “—Business Day” below. |

| • | Interest Rate: | The notes will accrue interest quarterly at a floating rate per annum equal to:

SOFR CMS2 Rate + 0.25%, subject to the Minimum Rate

|

| • | Minimum Rate: | 3.00% per annum |

| • | Initial Interest Rate (per Annum): | The greater of (i) the Minimum Rate and (ii) the sum of SOFR CMS2 as of June 17, 2022 and 0.25%. |

| • | Interest Period: | Quarterly. Each interest period (other than the first interest period, which will begin on the issue date) will begin on, and will include, an interest payment date, and will extend to, but will exclude, the next succeeding interest payment date or the maturity date, as applicable. |

| • | Reference Rate: | SOFR CMS2. With respect to an Interest Determination Date, the rate for SOFR-linked interest rate swaps with a maturity of 2 years (Bloomberg ticker: USISS002 <Index>), expressed as a percentage and as published by ICE Benchmark Administration Limited (including any successor administrator, “ICE” or the “Administrator”) on its website opposite the heading “2 Years” at approximately 11:00 a.m., New York City time, on the corresponding Interest Determination Date or, if such rate is temporarily not published or an Index Cessation Event or Administrator/Benchmark Event occurs, an alternative rate as described below in “Additional Terms of the Notes.” |

| • | Interest Determination Date: | The second U.S. Government Securities Business Day immediately preceding the related Interest Reset Date, with the first Interest Determination Date being the second U.S. Government Securities Business Day prior to the issue date. |

PS-3

| A “U.S. Government Securities Business Day” is any day, except for a Saturday, Sunday or a day on which the Securities Industry and Financial Markets Association recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in U.S. government securities. | ||

| • | Interest Reset Dates: | The interest rate for each interest period will be reset on the first day of that interest period, which we refer to as the “interest reset date.” |

| • | Payment at Maturity: | The payment at maturity will equal the principal amount of the notes, plus any accrued but unpaid interest. |

| • | Business Day: | Following. If any scheduled payment date is not a Business Day, the payment will be made on the next succeeding Business Day. No additional interest will accrue on the notes as a result of such postponement, and no adjustment will be made to the length of the relevant interest period. A “Business Day” means a Monday, Tuesday, Wednesday, Thursday or Friday that is neither a legal holiday nor a day on which banking institutions are authorized or required by law or regulation to close in New York, New York. |

| • | Repayment at Option of Holder: | None |

| • | Record Dates for Interest Payments: | Interest will be payable to the persons in whose names the notes are registered at the close of business on the Business Day immediately preceding each interest payment date, which we refer to as a “regular record date,” except that the interest due at maturity will be paid to the persons in whose names the notes are registered on the maturity date. |

| • | Calculation Agent: | CIBC and Merrill Lynch Capital Services, Inc. We may appoint a different calculation agent without your consent and without notifying you.

All determinations made by the calculation agent will be at its sole discretion, and, in the absence of manifest error, will be conclusive for all purposes and binding on us and you. All percentages and other amounts resulting from any calculation with respect to the notes will be rounded at the calculation agent’s discretion. The calculation agent will have no liability for its determinations.

|

| • | Listing: | None |

| • | Withholding: | CIBC or the applicable paying agent will deduct or withhold from a payment on a note any present or future tax, duty, assessment or other governmental charge that CIBC determines is required by law or the interpretation or administration thereof to be deducted or withheld. Payments on a note will not be increased by any amount to offset such deduction or withholding. |

PS-4

RISK FACTORS

Your investment in the notes entails significant risks, many of which differ from those of a conventional security. Your decision to purchase the notes should be made only after carefully considering the risks of an investment in the notes, including those discussed below and in “Risk Factors” beginning on page S-1 of the prospectus supplement and page 1 of the prospectus, with your advisors in light of your particular circumstances. The notes are not an appropriate investment for you if you are not knowledgeable about significant elements of the notes or financial matters in general.

Structure-related Risks

The interest rate for each interest period is variable and may be as low as the minimum rate. You will receive interest on the applicable interest payment date at the interest rate fixed on the corresponding Interest Determination Date, which may be as low as the Minimum Rate. The interest rate applicable to each interest payment date will fluctuate because it is equal to the sum of SOFR CMS2 and 0.25%, subject to the Minimum Rate. If SOFR CMS2 were to decline such that the rate on any Interest Determination Date were less than 2.75%, the interest rate for the relevant Interest Period would be equal to the Minimum Rate. SOFR CMS2, on which the interest rate is based, will vary and may be less than 2.75% on most or all of the Interest Determination Dates. The return on the notes may be lower than the return on conventional debt securities of comparable maturity.

The repayment of the principal amount applies only at maturity. The notes offer repayment of the principal amount only if you hold your notes until the maturity date. If you sell the notes prior to maturity, you may lose some of the principal amount.

The interest payments on the notes are not linked to SOFR CMS2 at any time other than the Interest Determination Dates. The interest payments will be based on the level of SOFR CMS2 on each Interest Determination Date. As a result, the level of SOFR CMS2 on any other date will not be taken into account in determining the interest payments you receive. Accordingly, even if the level of SOFR CMS2 increases substantially prior to an Interest Determination Date, but then decreases on that Interest Determination Date, your interest payment in respect of the relevant interest period will be determined based on the level of SOFR CMS2 on the relevant Interest Determination Date, subject to the Minimum Rate. The payments on the notes will not benefit from the level of SOFR CMS2 at any time other than the Interest Determination Dates.

Payments on the notes are subject to our credit risk, and actual or perceived changes in our creditworthiness are expected to affect the value of the notes. The notes are our senior unsecured debt obligations and are not, either directly or indirectly, an obligation of any third party. As further described in the accompanying prospectus and prospectus supplement, the notes will rank on par with all of our other unsecured and unsubordinated debt obligations, except such obligations as may be preferred by operation of law. All payments to be made on the notes depend on our ability to satisfy our obligations as they come due. As a result, the actual and perceived creditworthiness of us may affect the market value of the notes and, in the event we were to default on our obligations, you may not receive the amounts owed to you under the terms of the notes. If we default on our obligations under the notes, your investment would be at risk and you could lose some or all of your investment. See “Description of the Notes We May Offer—Events of Default” in the accompanying prospectus supplement.

The notes are not insured by any third parties. The notes will be solely our obligations. Neither the notes nor your investment in the notes are insured by the FDIC, the CDIC, the Bank Insurance Fund or any other government agency or instrumentality of the United States, Canada or any other jurisdiction.

Valuation- and Market-related Risks

The inclusion of dealer spread and projected profit from hedging in the public offering price is likely to adversely affect secondary market prices. Assuming no change in market conditions or any other relevant factors, the price, if any, at which BofAS or any other party is willing to purchase the notes at any time in secondary market transactions will likely be significantly lower than the public offering price, since secondary market prices are likely to exclude underwriting commissions paid with respect to the notes and the cost of hedging our obligations under the notes that are included in the public offering price. The cost of hedging includes the projected profit that we and/or our affiliates may realize in consideration for assuming the risks inherent in managing the hedging transactions. These secondary market prices are also likely to be reduced by the costs of unwinding the related hedging transactions. In addition, any secondary market prices may differ from values determined by pricing models used by BofAS as a result of dealer discounts, mark-ups or other transaction costs.

We cannot assure you that a trading market for the notes will ever develop or be maintained. We will not list the notes on any securities exchange. We cannot predict how the notes will trade in any secondary market, or whether that market will be liquid or illiquid.

PS-5

The development of a trading market for the notes will depend on our financial performance and other factors. The number of potential buyers of the notes in any secondary market may be limited. We anticipate that BofAS or its affiliates will act as a market-maker for the notes, but they are not required to do so. BofAS and its affiliates may discontinue their market-making activities as to the notes at any time. To the extent that BofAS or its affiliates engage in any market-making activities, they may bid for or offer the notes. Any price at which BofAS or its affiliates may bid for, offer, purchase, or sell any notes may differ from the values determined by pricing models that each may respectively use, whether as a result of dealer discounts, mark-ups, or other transaction costs. These bids, offers, or completed transactions may affect the prices, if any, at which the notes might otherwise trade in the market.

In addition, if at any time BofAS or its affiliates were to cease acting as a market-maker for the notes, it is likely that there would be significantly less liquidity in the secondary market and there may be no secondary market at all for the notes. In such a case, the price at which the notes could be sold likely would be lower than if an active market existed and you should be prepared to hold the notes until maturity.

Many economic and other factors will impact the market value of the notes. The market for, and the market value of, the notes may be affected by a number of factors that may either offset or magnify each other, including:

| · | The rate and the volatility of SOFR CMS2; |

| · | the time remaining to maturity of the notes; |

| · | the aggregate amount outstanding of the notes; |

| · | the level, direction, and volatility of market interest rates generally (in particular, increases in U.S. interest rates, which may cause the market value of the notes to decrease); |

| · | general economic conditions of the capital markets in the United States; |

| · | geopolitical conditions and other financial, political, regulatory, and judicial events that affect the capital markets generally; |

| · | our financial condition and creditworthiness; and |

| · | any market-making activities with respect to the notes. |

Conflict-related Risks

Certain business and trading activities may create conflicts with your interests and could potentially adversely affect the value of the notes. We, BofAS or one or more of our or their respective affiliates may engage in trading and other business activities that are not for your account or on your behalf (such as holding or selling of the notes for our proprietary account or effecting secondary market transactions in the notes for other customers). These activities may present a conflict between your interest in the notes and the interests we, BofAS or one or more of our or their respective affiliates may have in our or their proprietary account. We, BofAS and our or its respective affiliates may engage in any such activities without regard to the notes or the effect that such activities may directly or indirectly have on the value of the notes.

BofAS and its affiliates have engaged in, and may in the future engage in, investment banking and other commercial dealings in the ordinary course of business with CIBC and its affiliates. BofAS has received, or may in the future receive, customary fees and commissions for these transactions. In addition, in the ordinary course of its business activities, BofAS and its affiliates may make or hold a broad array of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account and for the accounts of their customers. Such investments and securities activities may involve securities and/or instruments of CIBC or its affiliates. To the extent that BofAS or its affiliates has a lending relationship with CIBC or any of its affiliates, they would routinely hedge their credit exposure to CIBC or its affiliates, as applicable, consistent with their customary risk management policies. Typically, BofAS or its affiliates would hedge such exposure by entering into transactions which consist of either the purchase of credit default swaps or the creation of short positions in CIBC or its affiliates’ securities, including potentially the notes offered hereby. Any such short positions could adversely affect future trading prices of the notes offered hereby. BofAS or its affiliates may also make investment recommendations and/or publish or express independent research views in respect of such securities or financial instruments and may hold, or recommend to clients that they acquire, long and/or short positions in such securities and instruments.

Moreover, we, BofAS and our or its respective affiliates play a variety of roles in connection with the issuance of the notes, including hedging our obligations under the notes. We expect to hedge our obligations under the notes through BofAS, one of our or its affiliates and/or another unaffiliated counterparty, which may include any dealer from which you purchase the notes. In connection with such

PS-6

activities, the economic interests of us, BofAS and our respective affiliates may be adverse to your interests as an investor in the notes. Any of these activities may adversely affect the value of the notes. In addition, because hedging our obligations entails risk and may be influenced by market forces beyond our control, this hedging activity may result in a profit that is more or less than expected, or it may result in a loss. We, BofAS, one or more of our respective affiliates or any unaffiliated counterparty will retain any profits realized in hedging our obligations under the notes even if investors do not receive a favorable investment return under the terms of the notes or in any secondary market transaction. Any profit in connection with such hedging activities will be in addition to any other compensation that we, BofAS, our respective affiliates or any unaffiliated counterparty receive for the sale of the notes, which creates an additional incentive to sell the notes to you. We, BofAS, our respective affiliates or any unaffiliated counterparty will have no obligation to take, refrain from taking or cease taking any action with respect to these transactions based on the potential effect on an investor in the notes.

There are potential conflicts of interest between you and the calculation agent.

The calculation agent will, among other things, determine the interest rate and decide the amount of your payment for any interest payment date on the notes. The calculation agent will exercise its judgment when performing its functions. Because determinations made by the calculation agent may affect payments on the notes, the calculation agent may have a conflict of interest if it needs to make any such determination.

In addition, and without limiting the generality of the previous paragraph, the calculation agent may make certain determinations if a “Benchmark Transition Event” (as discussed under “Additional Terms of the Notes” below) occurs or it may administer a successor rate in certain circumstances as also described herein. For the avoidance of doubt, any decision made by the calculation agent will be effective without consent from the holders of the notes or any other party. Potential conflicts of interest may exist between the Bank, the calculation agent and holders of the notes. All determinations made by the calculation agent in such a circumstance will be conclusive for all purposes and binding on the Bank and holders of the notes. In making these potentially subjective determinations, the Bank and/or the calculation agent may have economic interests that are adverse to your interests, and such determinations may adversely affect the value of and return on your notes. Because the continuation of SOFR CMS2 on the current basis cannot and will not be guaranteed, the calculation agent is likely to exercise more discretion in respect of calculating interest payable on the notes than would be the case in the absence of such a need to select a successor rate.

Tax-related Risks

The tax treatment of the notes is uncertain. Significant aspects of the tax treatment of the notes are uncertain. You should consult your tax advisor about your own tax situation. See “U.S. Federal Income Tax Considerations” and “Certain Canadian Income Tax Considerations” in this pricing supplement.

Reference Rate-related Risk Factors

The USD SOFR ICE swap rate is a new market rate and has a very limited history. The USD SOFR ICE Swap Rate began publication on November 8, 2021. Consequently, there is very little trading history with respect to this rate. We cannot predict whether the USD SOFR ICE Swap Rate will gain market acceptance, or whether an active secondary market will develop with respect to this rate. Due to the short history of the USD SOFR ICE Swap Rate, any historical information presented herein will be brief and, as always, not indicative of future performance.

The occurrence of a temporary non-publication of the USD SOFR ICE Swap Rate, an Index Cessation Event or an Administrator/Benchmark Event could adversely affect the return (if any) on the notes. A temporary non-publication of the USD SOFR ICE Swap Rate, an Index Cessation Event or an Administrator/Benchmark Event (each as defined in “Additional Terms of the Notes”) could occur during the term of the notes. Any resulting alternative replacement and calculation agent adjustments and determinations could adversely affect the value of and the return on your notes.

If there is a temporary non-publication of the USD SOFR ICE Swap Rate, then the calculation agent shall determine a commercially reasonable alternative for the USD SOFR ICE Swap Rate, taking into account all available information that in good faith it considers relevant including a rate implemented by central counterparties and/or futures exchanges (if any), in each case with trading volumes in derivatives or futures referencing the USD SOFR ICE Swap Rate that the calculation agent considers sufficient for that rate to be a representative alternative rate.

If an Index Cessation Event or an Administrator/Benchmark Event occur, then the USD SOFR ICE Swap Rate would be replaced by either the Alternative Post-Nominated Index Rate or the Calculation Agent Nominated Replacement Index rate, as discussed in “Additional Terms of the Notes.”

PS-7

We cannot predict the result of the USD SOFR ICE Swap Rate (or any alternative) being determined by the calculation agent or being replaced with either the Alternative Post-Nominated Index Rate or the Calculation Agent Nominated Replacement Index rate. In any of these cases, the value of, and payments (if any) on, the notes may be adversely affected.

The secured overnight financing rate (“SOFR”), which is an element of the USD SOFR ICE Swap Rate, is a relatively new market index and as the related market continues to develop, there may be an adverse effect on the return on or value of the notes; SOFR may be modified or discontinued. The Federal Reserve Bank of New York notes on its publication page for SOFR that use of SOFR is subject to important limitations, indemnification obligations and disclaimers, including that the Federal Reserve Bank of New York may alter the methods of calculation, publication schedule, rate revision practices or availability of SOFR at any time without notice. There can be no guarantee that SOFR will not be discontinued or fundamentally altered in a manner that is materially adverse to the interests of investors in the notes. If the manner in which SOFR is calculated is changed or if SOFR is discontinued, that change, or discontinuance may result in a reduction of the interest or other applicable payments payable on the notes and a reduction in the trading price of the notes.

SOFR has a very limited history, and the future performance of SOFR cannot be predicted based on historical performance. The publication of SOFR began in April 2018, and, therefore, it has a very limited history. In addition, the future performance of SOFR cannot be predicted based on the limited historical performance. Prior observed patterns, if any, in the behavior of market variables and their relation to SOFR, such as correlations, may change in the future. While some pre-publication historical data have been released by the Federal Reserve Bank of New York, such analysis inherently involves assumptions, estimates and approximations. The future performance of SOFR is impossible to predict and therefore no future performance of SOFR may be inferred from any of the historical actual or historical indicative data. Hypothetical or historical performance data are not indicative of, and have no bearing on, the potential performance of SOFR. You should not rely on any historical changes or trends in SOFR as an indicator of the future performance of SOFR. Since the initial publication of SOFR, daily changes in the rate have, on occasion, been more volatile than daily changes in comparable benchmark or market rates.

SOFR may be more volatile than other benchmark or market rates. Since the initial publication of SOFR, daily changes in the rate have, on occasion, been more volatile than daily changes in other benchmark or market rates, such as the U.S. dollar LIBOR Rate, during corresponding periods, and SOFR may bear little or no relation to the historical actual or historical indicative data.

Any failure of SOFR to gain market acceptance could adversely affect the notes. SOFR was developed for use in certain U.S. dollar derivatives and other financial contracts as an alternative to U.S. dollar LIBOR in part because it is considered a good representation of general funding conditions in the overnight U.S. Treasury Repo market. However, as a rate based on transactions secured by U.S. Treasury securities, it does not measure bank-specific credit risk and, as a result, is less likely to correlate with the unsecured short-term funding costs of banks. This may mean that market participants would not consider SOFR a suitable replacement or successor for all of the purposes for which U.S. dollar LIBOR historically has been used (including, without limitation, as a representation of the unsecured short-term funding costs of banks), which may, in turn, lessen market acceptance of SOFR. Any failure of SOFR to gain market acceptance could adversely affect the return on and value of the notes and the price at which investors can sell the notes in the secondary market.

The secondary trading market for securities linked to SOFR may be limited. Since SOFR is a relatively new market index, SOFR-linked securities likely will have no established trading market when issued or otherwise, and an established trading market may never develop or may not be very liquid. If SOFR does not prove to be widely used as a benchmark in securities that are similar or comparable to the notes, the trading price of the notes may be lower than those of securities that are linked to rates that are more widely used. Similarly, market terms for securities that are linked to SOFR, including, but not limited to, the spread over the reference rate reflected in the benchmark transition provisions, may evolve over time, and as a result, trading prices of the notes may be lower than those of later-issued securities that are based on SOFR. Investors in the notes may not be able to sell the notes at all or may not be able to sell the notes at prices that will provide them with a yield comparable to similar investments that have a developed secondary market, and may consequently suffer from increased pricing volatility and market risk.

Historical levels of SOFR CMS2 do not guarantee future levels. The historical levels of SOFR CMS2 do not guarantee future levels of SOFR CMS2. It is not possible to predict whether SOFR CMS2 will rise or fall during the term of the notes.

PS-8

ADDITIONAL TERMS OF THE NOTES

Temporary Non-Publication of SOFR CMS2

Subject to the provisions below, if SOFR CMS2 is not published by the later of (i) 11:00 a.m., New York City time, on the Interest Determination Date and (ii) the related Interest Reset Date, then the calculation agent shall determine a commercially reasonable alternative for SOFR CMS2, taking into account all available information that in good faith it considers relevant including a rate implemented by central counterparties and/or futures exchanges (if any), in each case with trading volumes in derivatives or futures referencing SOFR CMS2 that the calculation agent considers sufficient for that rate to be a representative alternative rate.

Index Cessation Event or Administrator/Benchmark Event

If an Index Cessation Event or an Administrator/Benchmark Event occurs with respect to SOFR CMS2, then, from and including the Index Cessation Effective Date or the Administrator/Benchmark Event Date, as applicable, the Alternative Post-Nominated Index rate will apply to the notes. However, if by 5:00 p.m., New York City time, on the Cut-off Date, more than one Relevant Nominating Body formally designates, nominates or recommends an Alternative Post-Nominated Index and those designations, nominations or recommendations are not the same, then the Calculation Agent Nominated Replacement Index rate will apply to the notes.

In the event of a replacement of SOFR CMS2 by either the Alternative Post-Nominated Index rate or the Calculation Agent Nominated Replacement Index rate, the calculation agent shall (i) apply the Adjustment Spread (if applicable) to the Alternative Post-Nominated Index rate or the Calculation Agent Nominated Replacement Index rate, as applicable, and (ii) after taking into account such Adjustment Spread, make any other adjustments to the terms of the notes that are necessary to account for the effect on the notes of referencing the Alternative Post-Nominated Index rate or the Calculation Agent Nominated Replacement Index rate, as applicable.

Whenever the calculation agent is required to act, make a determination or exercise judgement pursuant to a replacement of SOFR CMS2 by either the Alternative Post-Nominated Index rate or the Calculation Agent Nominated Replacement Index rate, it shall do so by reference to Relevant Market Data available at, or a reasonable period of time prior to, the time of notification. The calculation agent shall notify the Bank of any determination it makes pursuant to the replacement of SOFR CMS2 by either the Alternative Post-Nominated Index rate or the Calculation Agent Nominated Replacement Index rate as soon as reasonably practicable after either of these replacement rates first apply and, in any event, at least two Business Days before the Cut-off Date. However, any failure to provide such a notification shall not give rise to an Event of Default (as defined in the Indenture).

Certain defined terms, as used in this section:

“Adjustment Spread” means the adjustment, if any, determined by the calculation agent in its sole discretion, which is required in order to reduce or eliminate, to the extent reasonably practicable, any transfer of economic value from (i) us to the holders of the notes or (ii) the holders of the notes to the Bank, in each case, that would otherwise arise as a result of the replacement made pursuant to the application of the Calculation Agent Nominated Replacement Index or the Alternative Post Nominated Index. Any such adjustment may take account of, without limitation, any anticipated transfer of economic value as a result of any difference in the term structure or tenor of the Calculation Agent Nominated Replacement Index or the Alternative Post Nominated Index by comparison to the Applicable Benchmark. The Adjustment Spread may be positive, negative or zero or determined pursuant to a formula or methodology.

“Administrator/Benchmark Event” means the delivery of a notice by the Bank to the holders of the notes (which can include posting of such notice through DTC) specifying, and citing Publicly Available Information that reasonably confirms, an event or circumstance which has the effect that the Bank or the calculation agent are not, or will not be, permitted under any applicable law or regulation to use the Applicable Benchmark to perform our or its respective obligations under the terms of the notes.

“Administrator/Benchmark Event Date” means, in respect of an Administrator/Benchmark Event, the date from which the Applicable Benchmark may no longer be used under any applicable law or regulation by the Bank or the calculation agent or, if that date occurs before the issue date, the issue date.

“Alternative Post-Nominated Index” means, in respect of an Applicable Benchmark, any index, benchmark or other price source which is formally designated, nominated or recommended by: (i) any Relevant Governmental Body; or (ii) the Administrator or sponsor of the Applicable Benchmark, provided that such index, benchmark or other price source is substantially the same as the Applicable Benchmark, in each case, to replace the Applicable Benchmark. If a replacement is designated, nominated or recommended under both clauses (i) and (ii) above, then the replacement under clause (i) above shall be the “Alternative Post-nominated Index.”

PS-9

“Applicable Benchmark” means SOFR CMS2.

“Calculation Agent Nominated Replacement Index” means, in respect of an Applicable Benchmark, the index, benchmark or other price source that the calculation agent determines to be a commercially reasonable alternative for the Applicable Benchmark.

“Cut-off Date” means fifteen Business Days following the Administrator/Benchmark Event Date. However, if more than one Relevant Nominating Body formally designates, nominates or recommends an Alternative Post-Nominated Index or a spread or methodology for calculating a spread and one or more of those Relevant Nominating Bodies does so on or after the day that is three Business Days before that date, then the Cut-off Date will instead be the second Business Day following the date that, but for this sentence, would have been the Cut-off Date.

“Index Cessation Effective Date” means, with respect to one or more Index Cessation Events, the first date on which the Applicable Benchmark would ordinarily have been published or provided and is no longer published or provided.

“Index Cessation Event” means, with respect to an Applicable Benchmark, (a) a public statement or publication of information by or on behalf of the Administrator of the Applicable Benchmark announcing that it has ceased or will cease to provide the Applicable Benchmark permanently or indefinitely, provided that, at the time of the statement or publication, there is no successor administrator or provider, as applicable, that will continue to provide the Applicable Benchmark; or (b) a public statement or publication of information by the regulatory supervisor for the Administrator of the Applicable Benchmark, the central bank for the currency of the Applicable Benchmark, an insolvency official with jurisdiction over the Administrator for the Applicable Benchmark, a resolution authority with jurisdiction over the Administrator for the Applicable Benchmark or a court or an entity with similar insolvency or resolution authority over the Administrator for the Applicable Benchmark, which states that the Administrator of the Applicable Benchmark has ceased or will cease to provide the Applicable Benchmark permanently or indefinitely, provided that, at the time of the statement or publication, there is no successor administrator or provider that will continue to provide the Applicable Benchmark.

“Publicly Available Information” means, in respect of an Administrator/Benchmark Event, one or both of the following: (a) information received from or published by (i) the Administrator or sponsor of the Applicable Benchmark or (ii) any national, regional or other supervisory or regulatory authority which is responsible for supervising the Administrator or sponsor of the Applicable Benchmark or regulating the Applicable Benchmark. However, where any information of the type described in (i) or (ii) is not publicly available, it shall only constitute Publicly Available Information if it can be made public without violating any law, regulation, agreement, understanding or other restriction regarding the confidentiality of that information; or (b) information published in a Specified Public Source (regardless of whether the reader or user thereof pays a fee to obtain that information).

“Relevant Governmental Body” means the Board of Governors of the Federal Reserve System and/or the Federal Reserve Bank of New York, or a committee officially endorsed or convened by the Board of Governors of the Federal Reserve System and/or the Federal Reserve Bank of New York or any successor thereto.

“Relevant Market Data” means, in relation to a determination, any relevant information that: (i) has been supplied by one or more third parties (which may include central counterparties, exchanges, dealers in the relevant market, information vendors, brokers or other recognized sources of market information) but not any third party that is an affiliate of the calculation agent or (ii) to the extent that the information is not readily available from such third parties or would not produce a commercially reasonable result, has been obtained from internal sources (which may include an affiliate of the calculation agent, provided that the information is of the same type as that used by the calculation agent in a comparable manner in the ordinary course of its business).

“Relevant Nominating Body” means (i) the Board of Governors of the Federal Reserve System or any central bank or other supervisor which is responsible for supervising either the USD SOFR ICE Swap Rate or the Administrator; or (ii) any working group or committee officially endorsed or convened by: (a) the Board of Governors of the Federal Reserve System; (b) any central bank or other supervisor which is responsible for supervising either the USD SOFR ICE Swap Rate or the Administrator; (c) a group of those central banks or other supervisors; or (d) the Financial Stability Board or any part thereof.

“Specified Public Source” means each of Bloomberg, Refinitiv, Dow Jones Newswires, The Wall Street Journal, The New York Times, the Financial Times and, in each case, any successor publications, the main source(s) of business news in the country in which the Administrator or the sponsor of the Applicable Benchmark is incorporated or organized and any other internationally recognized published or electronically displayed news sources.

PS-10

THE REFERENCE RATE

All information regarding the SOFR CMS2 set forth in this document has been derived from publicly available information. Neither we nor any of our affiliates have independently verified the accuracy or the completeness of all information regarding SOFR CMS2 that we have derived from publicly available sources. Neither we nor any of our affiliates are under any obligation to update, modify or amend all information regarding SOFR CMS2 or the historical performance of SOFR CMS2.

SOFR CMS2 for any U.S. Government Securities Business Day is the 2 Year SOFR-linked interest rate swap (Bloomberg ticker: USISS002 <Index>) , as published on the ICE website opposite the heading “2 Years” at approximately 11:00 a.m., New York City time, on the applicable U.S. Government Securities Business Day. SOFR CMS2 measures the fixed rate of interest payable on a hypothetical fixed-for-floating SOFR interest rate swap transaction with a maturity of 2 years. In such a hypothetical swap transaction, the fixed rate of interest, payable annually on the basis of the actual number of days over 360 days in the relevant year, is exchangeable for a floating payment stream of SOFR compounded in arrears for twelve months using standard market conventions.

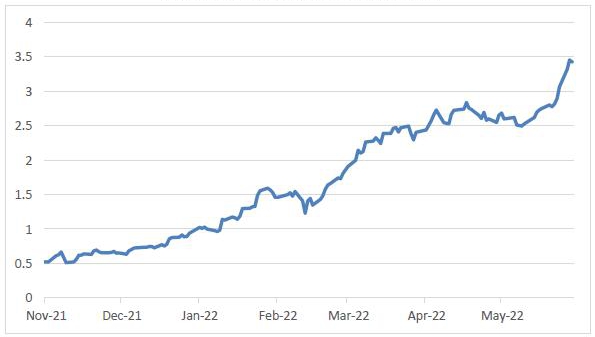

Historical Performance of SOFR CMS2

The following graph sets forth of the historical performance of SOFR CMS2 for the period from November 18, 2021 to June 16, 2022. On June 16, 2022, the rate of SOFR CMS2 was 3.338%. We obtained the rates below from Bloomberg Professional® Service (“Bloomberg”) without independent verification. The historical performance of SOFR CMS2 should not be taken as an indication of its future performance, and no assurances can be given as to SOFR CMS2 at any time during the term of the notes, including the Interest Determination Dates. We cannot give you assurance that SOFR CMS2 will outperform the Minimum Rate as of any Interest Determination Date.

Historical Performance of SOFR CMS2

Source: Bloomberg

PS-11

U.S. FEDERAL INCOME TAX CONSIDERATIONS

The following discussion is a brief summary of the material U.S. federal income tax considerations relating to an investment in the notes. The following summary is not complete and is both qualified and supplemented by (although to the extent inconsistent supersedes) the discussion entitled “Material Income Tax Consequences—United States Taxation” in the accompanying prospectus, which you should carefully review prior to investing in the notes. It applies only to those U.S. Holders who are not excluded from the discussion of United States Taxation in the accompanying prospectus. You should consult your tax advisor concerning the U.S. federal income tax and other tax consequences of your investment in the notes in your particular circumstances, including the application of state, local or other tax laws and the possible effects of changes in federal or other tax laws.

We intend to treat the notes as debt instruments for U.S. federal income tax purposes. Accordingly, the coupon on a note will be taxable to a U.S. Holder as ordinary interest income at the time it accrues or is received in accordance with the U.S. Holder’s normal method of accounting for tax purposes.

Upon the sale, exchange, retirement or other disposition of a note, a U.S. Holder will recognize taxable gain or loss equal to the difference, if any, between the amount realized on the sale, exchange, retirement or other disposition, other than accrued but unpaid interest which will be taxable as interest, and such U.S. Holder’s adjusted tax basis in the note. A U.S. Holder’s adjusted tax basis in a note generally will equal the cost of the note to such U.S. Holder, and any such gain or loss will generally be capital gain or loss. For a non-corporate U.S. Holder, under current law, the maximum marginal U.S. federal income tax rate applicable to the gain will be generally lower than the maximum marginal U.S. federal income tax rate applicable to ordinary income if the U.S. Holder’s holding period for the notes exceeds one year (i.e., such gain is long-term capital gain). Any gain or loss realized on the sale, exchange, retirement or other disposition of a note generally will be treated as U.S. source gain or loss, as the case may be. Consequently, a U.S. Holder may not be able to claim a credit for any non-U.S. tax imposed upon a disposition of a note. The deductibility of capital losses is subject to limitations.

PS-12

CERTAIN CANADIAN INCOME TAX CONSIDERATIONS

In the opinion of Blake, Cassels & Graydon LLP, our Canadian tax counsel, the following summary describes the principal Canadian federal income tax considerations under the Income Tax Act (Canada) and the regulations thereto (the “Canadian Tax Act”) generally applicable at the date hereof to a purchaser who acquires beneficial ownership of a note pursuant to this pricing supplement and who for the purposes of the Canadian Tax Act and at all relevant times: (a) is neither resident nor deemed to be resident in Canada; (b) deals at arm’s length with the Issuer and any transferee resident (or deemed to be resident) in Canada to whom the purchaser disposes of the note; (c) does not use or hold and is not deemed to use or hold the note in, or in the course of, carrying on a business in Canada; (d) is entitled to receive all payments (including any interest and principal) made on the note; (e) is not a, and deals at arm’s length with any, “specified shareholder” of the Issuer for purposes of the thin capitalization rules in the Canadian Tax Act; and (f) is not an entity in respect of which the Issuer is a “specified entity” for purposes of the Hybrid Mismatch Proposals, as defined below (a “Non-Resident Holder”). For these purposes, a “specified shareholder” generally includes a person who (either alone or together with persons with whom that person is not dealing at arm’s length for the purposes of the Canadian Tax Act) owns or has the right to acquire or control or is otherwise deemed to own 25% or more of the Issuer’s shares determined on a votes or fair market value basis, and an entity in respect of which the Issuer is a ”specified entity” generally includes (i) an entity that is a specified shareholder of the Issuer (as defined above), (ii) an entity in which the Issuer (either alone or together with entities with whom the Issuer is not dealing at arm’s length for purposes of the Canadian Tax Act) owns or has the right to acquire or control or is otherwise deemed to own a 25% or greater equity interest, and (iii) an entity in which an entity described in (i) (either alone or together with entities with whom such entity is not dealing at arm’s length for purposes of the Canadian Tax Act) owns or has the right to acquire or control or is otherwise deemed to own a 25% or greater equity interest. Special rules which apply to non-resident insurers carrying on business in Canada and elsewhere are not discussed in this summary.

For greater certainty, this summary takes into account all specific proposals to amend the Canadian Tax Act publicly announced by or on behalf of the Minister of Finance (Canada) prior to the date hereof, including the proposals released on April 29, 2022 with respect to “hybrid mismatch arrangements” (the “Hybrid Mismatch Proposals”). This summary assumes that no amount paid or payable to a holder described herein will be the deduction component of a “hybrid mismatch arrangement” under which the payment arises within the meaning of proposed paragraph 18.4(3)(b) of the Canadian Tax Act contained in the Hybrid Mismatch Proposals. Investors should note that the Hybrid Mismatch Proposals are in consultation form, are highly complex, and there remains significant uncertainty as to their interpretation and application. There can be no assurance that the Hybrid Mismatch Proposals will be enacted in their current form, or at all.

This summary is supplemental to and should be read together with the description of material Canadian federal income tax considerations relevant to a Non-Resident Holder owning notes under “Material Income Tax Consequences—Canadian Taxation” in the accompanying prospectus and a Non-Resident Holder should carefully read that description as well.

This summary is of a general nature only and is not intended to be, nor should it be construed to be, legal or tax advice to any particular Non-Resident Holder. Non-Resident Holders are advised to consult with their own tax advisors with respect to their particular circumstances.

Based on Canadian tax counsel’s understanding of the Canada Revenue Agency’s administrative policies, and having regard to the terms of the notes, interest payable on the notes should not be considered to be “participating debt interest” as defined in the Canadian Tax Act and accordingly, a Non-Resident Holder should not be subject to Canadian non-resident withholding tax in respect of amounts paid or credited or deemed to have been paid or credited by the Issuer on a note as, on account of or in lieu of payment of, or in satisfaction of, interest.

Non-Resident Holders should consult their own advisors regarding the consequences to them of a disposition of notes to a person with whom they are not dealing at arm’s length for purposes of the Canadian Tax Act.

PS-13

SUPPLEMENTAL PLAN OF DISTRIBUTION

Pursuant to the terms of a distribution agreement, BofAS will purchase the notes from CIBC at the price to public less the underwriting discount set forth on the cover page of this pricing supplement for distribution to other registered broker-dealers, or will offer the notes directly to investors. BofAS will pay varying selling concessions at an average of 0.40% in connection with the distribution of the notes to other registered broker-dealers. Certain dealers who purchase the notes for sale to certain fee-based advisory accounts and/or eligible institutional investors may forgo some or all of their selling concessions, fees or commissions. The price to public for investors purchasing the notes in these accounts and/or for an eligible institutional investor will be as low as $996.00 (99.60%) per $1,000 in principal amount of the notes.

BofAS and any of its affiliates may use this pricing supplement, and the accompanying prospectus supplement and prospectus for offers and sales in secondary market transactions and market-making transactions in the notes. However, they are not obligated to engage in such secondary market transactions and/or market-making transactions. BofAS’ affiliates may act as principal or agent in these transactions, and any such sales will be made at prices related to prevailing market prices at the time of the sale.

PS-14

VALIDITY OF THE NOTES

In the opinion of Blake, Cassels & Graydon LLP, as Canadian counsel to the Bank, the issue and sale of the notes has been duly authorized by all necessary corporate action of the Bank in conformity with the indenture, and when the notes have been duly executed, authenticated and issued in accordance with the indenture, the notes will be validly issued and, to the extent validity of the notes is a matter governed by the laws of the Province of Ontario or the federal laws of Canada applicable therein, will be valid obligations of the Bank, subject to applicable bankruptcy, insolvency and other laws of general application affecting creditors’ rights, equitable principles, and subject to limitations as to the currency in which judgments in Canada may be rendered, as prescribed by the Currency Act (Canada). This opinion is given as of the date hereof and is limited to the laws of the Province of Ontario and the federal laws of Canada applicable therein. In addition, this opinion is subject to customary assumptions about the trustee’s authorization, execution and delivery of the indenture and the genuineness of signature, and to such counsel’s reliance on the Bank and other sources as to certain factual matters, all as stated in the opinion letter of such counsel dated June 15, 2021, which has been filed as Exhibit 5.2 to the Bank’s Registration Statement on Form F-3 filed with the SEC on June 15, 2021.

In the opinion of Mayer Brown LLP, when the notes have been duly completed in accordance with the indenture and issued and sold as contemplated by this pricing supplement and the accompanying prospectus supplement and prospectus, the notes will constitute valid and binding obligations of the Bank, entitled to the benefits of the indenture, subject to bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium and similar laws of general applicability relating to or affecting creditors’ rights and to general equity principles. This opinion is given as of the date hereof and is limited to the laws of the State of New York. This opinion is subject to customary assumptions about the trustee’s authorization, execution and delivery of the indenture and such counsel’s reliance on the Bank and other sources as to certain factual matters, all as stated in the legal opinion dated June 15, 2021, which has been filed as Exhibit 5.1 to the Bank’s Registration Statement on Form F-3 filed with the SEC on June 15, 2021.

PS-15