UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-08411

(Investment Company Act file number)

The James Advantage Funds

(Exact name of registrant as specified in charter)

1349 Fairground Road

Xenia, Ohio 45385

(Address of principal executive offices) (Zip code)

Barry R. James

P.O. Box 8

Alpha, Ohio 45301

(Name and address of agent for service)

Registrant’s telephone number, including area code: (937) 426-7640

Date of fiscal year end: June 30

Date of reporting period: July 1, 2020 – December 31, 2020

Item 1. Reports to Stockholders.

(a)

TABLE OF CONTENTS

| Shareholder Letter | 1 |

| Growth of $10,000 or $50,000 Charts | 4 |

| Representation of Schedules of Investments | 7 |

| Disclosure of Fund Expenses | 8 |

| Schedule of Investments | |

| James Balanced: Golden Rainbow Fund | 9 |

| James Small Cap Fund | 14 |

| James Micro Cap Fund | 17 |

| James Aggressive Allocation Fund | 19 |

| Statements of Assets and Liabilities | 23 |

| Statements of Operations | 24 |

| Statements of Changes in Net Assets | 25 |

| Financial Highlights | |

| James Balanced: Golden Rainbow Fund - Retail Class | 30 |

| James Balanced: Golden Rainbow Fund - Institutional Class | 31 |

| James Small Cap Fund | 32 |

| James Micro Cap Fund | 33 |

| James Aggressive Allocation Fund | 34 |

| Notes to Financial Statements | 35 |

| Additional Information | 42 |

| Privacy Policy | 43 |

| James Advantage Funds | Shareholder Letter |

| December 31, 2020 (Unaudited) |

LETTER TO THE SHAREHOLDERS

OF THE JAMES ADVANTAGE FUNDS

First and foremost, all of us at the James Advantage Funds hope you and your family are in good health, both physically and mentally. To say 2020 was “wild” or “unprecedented” does not fully do justice to how extreme the year truly was. Unfortunately, millions of people across the United States have lost their jobs due to the global pandemic and the need to temporarily close down businesses to slow the spread of Covid-19. Nobody would have believed you if you told them in March they would celebrate Thanksgiving and Christmas with family over a Zoom call or that many stocks and indices would be setting record highs by the end of the year.

The Markets Over the Past Six Months

With 20/20 hindsight, the second half of 2020 saw spectacular returns for the markets. Fear of the virus and shutdowns, turned into hope and optimism as states began to open back up. Enthusiasm grew even more as several pharmaceutical companies announced a potentially effective vaccine to ward off Covid-19. In the second half of calendar year 2020, the Russell 1000® Index increased 24.46% and the NASDAQ advanced by 28.67%. The Russell 2000® Index, which is comprised of small capitalization stocks, was the market leader in the second half of the year advancing 37.85%, perhaps showing more investor confidence as smaller companies are often more vulnerable to major market events.

While stocks were advancing, fixed income investments (bonds) made money too, just not as much as the stock market. Case in point, the Bloomberg Barclays Capital U.S. Intermediate Government/Credit Bond Index, a broad based benchmark of treasuries, government related notes and corporate issues, posted a positive return of 1.10% over the same timeframe.

Investment Goals and Objectives

The James Balanced: Golden Rainbow Fund (the “Golden Rainbow Fund”) seeks to provide total return through a combination of growth and income and preservation of capital in declining markets. The Golden Rainbow Fund will generally hold positions in common stocks that in aggregate constitute between 35 percent and 55 percent of the net assets. Bonds held in the fund must be rated at or above Baa2 by Moody’s or BBB by S&P at the time of purchase. The Golden Rainbow Fund may hold municipal bonds, but generally buys them when we feel they are attractively priced compared with taxable bonds.

The Golden Rainbow Fund’s benchmark is a blend of 25% Russell 1000® Index, 25% Russell 2000® Index and 50% Bloomberg Barclays Capital U.S. Intermediate Government/Credit Bond Index. The benchmark is the same for all share classes of the Golden Rainbow Fund. We believe this index to be an appropriate benchmark for the Fund as it provides representation from both large, mid and small capitalization stocks as well as a fixed income component.

The James Aggressive Allocation Fund (the “Aggressive Allocation Fund”) seeks to provide total return through a combination of growth and income, but preservation of capital in declining markets is a secondary objective. Shareholders should be aware this Fund will likely have a higher level of volatility than the Golden Rainbow Fund. The Aggressive Allocation Fund’s benchmark is a blend of 65% Russell 3000® Index and 35% Bloomberg Barclays U.S. Aggregate Government/Credit Bond Index.

The James Small Cap Fund (the “Small Cap Fund”) and the James Micro Cap Fund (the “Micro Cap Fund”) each seek to provide long-term capital appreciation. These Funds hold only equity securities and cash/cash equivalents, under most circumstances. The Small Cap Fund’s benchmark is the Russell 2000® Index, and the Micro Cap Fund’s benchmark is the Russell Microcap® Index.

Investment Philosophy

James Investment Research, Inc., the James Advantage Funds’ adviser (the “Adviser” or “JIR”), commenced operations in 1972 and became known as a value manager, identifying stocks with good relative valuations, profitability and price momentum. The Adviser’s research, along with much academic research, supports the view that value investing tends to outperform growth investing over the longer-run. There are times however when traditional valuation techniques do not equate to future stock market performance. This is why we use a three factor approach, often times relying more on profitability and momentum.

The James Advantage Funds offer several different styles, but they all use the Adviser’s “bargain” or value approach to stock selection. The Aggressive Allocation Fund generally takes on greater risk than the Golden Rainbow Fund in terms of its higher allocation to stocks, but still seeks to reduce that risk in anticipation of a major decline in stock prices. Due to potentially higher equity levels, Aggressive Allocation Fund shareholders should generally have higher risk appetites for their mutual fund investments than those in the Golden Rainbow Fund.

| Semi-Annual Report | December 31, 2020 | 1 |

| Shareholder Letter | James Advantage Funds |

| December 31, 2020 (Unaudited) |

The Micro Cap Fund and the Small Cap Fund invest in smaller capitalization companies. The Small Cap and Micro Cap Funds are niche products designed to meet the objectives of investors who want to establish diversified positions in these areas. As these Funds are equity products, they are intrinsically riskier than other products holding bonds and the shareholder should expect relatively greater volatility in Net Asset Value (“NAV”) prices and a higher standard deviation of returns. Still, these portfolios hold stocks that are ranked highly by the Adviser’s models and pass a thorough review by the Adviser’s researchers and portfolio managers.

The Adviser has no soft-dollar arrangements, and does not purchase research from any broker/dealers.

Strategy for Seeking to Meet Fund Objectives

For the Balanced: Golden Rainbow and the Aggressive Allocation, the main objective is to provide total return through growth and income. The Adviser has always held to the belief preservation of capital in down markets is the key to long-term investment success. Hence, the Golden Rainbow Fund seeks to preserve capital by constructing a portfolio of both bonds and stocks. In the past, stocks have often provided capital appreciation when the economy has proven to be strong. Bonds, in general, are uncorrelated with stocks, and can provide asset class diversification as well as an income stream. In times when the stock market is strong, some investors may forget these positive characteristics of bonds, but the Golden Rainbow Fund has always held a significant position in bonds. The Aggressive Allocation Fund has a similar portfolio construction however it tends to hold a higher allocation to stocks and lower investment in bonds.

The Small Cap Fund and the Micro Cap Fund look for stocks the Adviser believes to be undervalued, using its proprietary research to screen a database of over 3,000 stocks. Deterioration in a stock’s fundamental value characteristics can lead the Adviser to trim or sell the position.

Fund Performance

The Golden Rainbow Fund and the Aggressive Allocation Fund both hold significant bond positions. The expectation is that in periods of strong stock market returns, the Funds will participate, however not to the full extent, in the all stock indices. The same can be said should stocks fall. These balanced styles strive to lessen the volatility many pure stock funds experience. Over the six-month period ended December 31, 2020, the Retail Class shares of the Golden Rainbow Fund advanced 7.19% and the Institutional Class shares advanced 7.32%. The Golden Rainbow Fund paid out a regular dividend every quarter. The Retail Class shares paid 5.23 cents per share in September and 4.91 cents per share in December. The Institutional Class shares paid 6.58 cents per share in September and 6.28 cents per share in December. Additionally, in December the Golden Rainbow Fund paid all shareholders a long-term capital gains distribution of 2.92 cents per share.

Over the six months ended December 31, 2020, the Small Cap Fund increased 29.34%. The Small Cap Fund paid an ordinary dividend of 12.51 cents per share in December and did not pay a capital gain for the year.

The Micro Cap Fund increased 24.57% for the six months ended December 31, 2020. The Fund did not pay a long-term capital gain in December, but it did pay an ordinary dividend of 8.42 cents per share.

The Aggressive Allocation Fund is like the Golden Rainbow Fund in the sense that its strategy requires the Fund to hold both stocks and bonds. However, it is a more aggressive fund and generally will hold a higher allocation to stocks than the Golden Rainbow Fund. The Aggressive Allocation Fund paid an ordinary dividend of 8.86 cents per share in December. No capital gain distribution was paid. For the six months ended December 31, 2020, the Aggressive Allocation Fund increased by 12.99%.

Expectations for the Future

Looking back, we noted the virus and the accompanying shut-downs. However, as we look ahead, we believe there is potential for economic growth due to re-openings and pent up demand. We envision a return to ‘regular life’ with vacations, attending a sporting event and looking forward to, believe it or not, going back into the office. Should the vaccines be distributed in an efficient manner and prove to be successful, all of these things are within our reach. With talk of another additional stimulus plan, consumers may have cash in hand to make these purchases a reality. As such, even at elevated prices, we believe there may be room for stocks to grow.

One casualty of additional government spending may be fixed income investments, bonds. Large sums of money being sent out into the economy could be viewed as inflationary which would erode the future value of fixed income payments.

| 2 | www.jamesinvestment.com |

| James Advantage Funds | Shareholder Letter |

| December 31, 2020 (Unaudited) |

There is certainly a possibility this is a very slow process and takes a while longer than expected, or there may be setbacks due to spikes in Covid-19 numbers. We understand these speedbumps and expect them along the way. As issues arise, our active management approach allows us to remain flexible and take action accordingly.

Thank you once again for your continued support and confidence in the James Advantage Funds.

Brian P. Shepardson

Secretary

The James Advantage Funds

Brian Shepardson is a registered representative of ALPS Distributors, Inc.

The statements and opinions expressed are those of the author, are as of the date of this report, are subject to change, and may not reflect the writer’s current views. All information is historical and not indicative of future results and subject to change. It should not be assumed that an investment in the securities mentioned will be profitable in the future. This information is not a recommendation to buy or sell.

You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund and should be read carefully before investing. You may obtain a current copy of the Fund’s prospectus by calling 1-800-995-2637.

Past performance is no guarantee of future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Investors may obtain performance information current to the last month-end at www.jamesinvestment.com.

NASDAQ is a global electronic marketplace for buying and selling securities, as well as the benchmark index for U.S. technology stocks.

Standard deviation is a measure of the dispersion of a set of data from its mean and is one of the key fundamental risk measures used in the financial services industry.

Credit ratings apply the underlying holdings of the Fund, and not to the Fund itself. Moody’s and S&P study the financial condition of an entity to ascertain its creditworthiness. The credit ratings reflect the rating agency's opinion of the holdings financial condition and histories. The ratings shown (Baa2 by Moody’s/BBB by S&P) are all considered investment grade and are listed by highest to lowest in percentage of what the Fund holds.

Diversification does not eliminate the risk of experiencing investment loss.

ALPS Distributors, Inc. 1290 Broadway, Ste. 1000, Denver, CO 80203 (Member FINRA). ALPS is not affiliated with James Investment Research, Inc.

| Semi-Annual Report | December 31, 2020 | 3 |

| Growth of $10,000 or $50,000 Charts | James Advantage Funds |

| December 31, 2020 (Unaudited) |

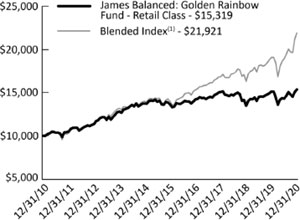

Comparison of the Change in Value of a $10, 000 Investment in the James Balanced: Golden Rainbow Fund – Retail Class

James Balanced: Golden Rainbow Fund – Retail Class Average Annual Total Returns

| 1 Year | 5 Years | 10 Years | Since Inception(2) | |

| James Balanced: Golden Rainbow – Retail Class | 1.54% | 2.39% | 4.36% | 7.03% |

| Blended Index(1) | 14.66% | 9.44% | 8.17% | 8.25% |

| Russell 1000® Index | 20.96% | 15.60% | 14.01% | 10.56% |

| Russell 2000® Index | 19.96% | 13.26% | 11.20% | 10.22% |

| Bloomberg Barclays U.S. Intermediate Government/ Credit Bond Index | 6.43% | 3.64% | 3.11% | 5.25% |

| (1) | The Blended Index is comprised of a 25% weighting in the Russell 1000® Index, a 25% weighting in the Russell 2000® Index and a 50% weighting in the Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index. |

| (2) | Fund and Class inception was July 1, 1991. |

| The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2020, was 1.13%. |

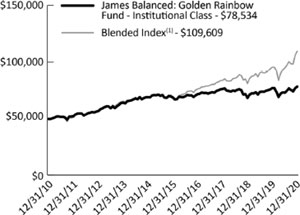

Comparison of the Change in Value of a $50,000 Investment in the James Balanced: Golden Rainbow Fund – Institutional Class

James Balanced: Golden Rainbow Fund – Institutional Class Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

Since Inception(2) | |

| James Balanced: Golden Rainbow – Institutional Class | 1.83% | 2.65% | 4.62% | 6.99% |

| Blended Index(1) | 14.66% | 9.44% | 8.17% | 10.78% |

| Russell 1000® Index | 20.96% | 15.60% | 14.01% | 17.96% |

| Russell 2000® Index | 19.96% | 13.26% | 11.20% | 16.86% |

| Bloomberg Barclays U.S. Intermediate Government/ Credit Bond Index | 6.43% | 3.64% | 3.11% | 3.61% |

| (1) | The Blended Index is comprised of a 25% weighting in the Russell 1000® Index, a 25% weighting in the Russell 2000® Index and a 50% weighting in the Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index. | |

| (2) | Class inception was March 2, 2009. |

| The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2020, was 0.88%. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. These performance figures do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Please call 1-800-995-2637 for most recent month-end performance information.

The Russell 1000® Index is an index of approximately 1,000 of the largest companies in the U.S. equity market. The Russell 1000® Index is a subset of the Russell 3000® Index. It represents the top companies by market capitalization.

The Russell 2000® Index is a widely recognized, unmanaged index comprised of the 2,000 smallest U.S. domiciled publicly-traded common stocks of the Russell 3000® Index, which represents approximately 8% of the total market capitalization of the Russell 3000® Index, an unmanaged index of the 3,000 largest U.S. domiciled publicly-traded common stocks by market capitalization.

The Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index measures the performance of U.S. Dollar denominated U.S. Treasuries, government-related and investment grade U.S. corporate securities that have a remaining maturity of greater than one year and less than ten years.

The Russell 1000® Index, Russell 2000® Index, Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index and Blended Index are widely recognized unmanaged indices of security prices and are representative of a broader market and range of securities than is found in the Fund’s portfolio. The Index returns do not reflect the deduction of expenses, which have been deducted from a Fund’s returns. The Index returns assume reinvestment of all distributions and do not reflect the deduction of taxes and fees. Individuals cannot invest directly in any Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

| 4 | www.jamesinvestment.com |

| James Advantage Funds | Growth of $10,000 or $50,000 Charts |

| December 31, 2020 (Unaudited) |

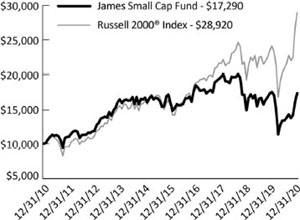

Comparison of the Change in Value of a $10,000 Investment in the James Small Cap Fund

James Small Cap Fund

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

Since Inception(1) | |

| James Small Cap Fund | -1.11% | 1.65% | 5.63% | 6.54% |

| Russell 2000® Index | 19.96% | 13.26% | 11.20% | 9.54% |

| (1) | Fund inception was October 2, 1998. |

| The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2020, was 1.51%. |

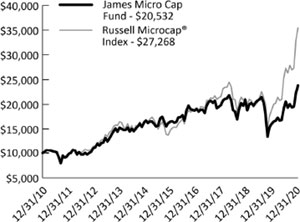

Comparison of the Change in Value of a $10,000 Investment in the James Micro Cap Fund

James Micro Cap Fund

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years | Since Inception(1) | |

| James Micro Cap Fund | -4.20% | 4.48% | 7.46% | 8.61% |

| Russell Microcap® Index | 20.96% | 11.89% | 10.55% | 12.80% |

| (1) | Fund inception was July 1, 2010. |

| The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2020, was 1.51%. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. These performance figures do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Please call 1-800-995-2637 for most recent month-end performance information.

Small and Micro Cap investing involve greater risk not associated with investing in more established companies, such as greater price volatility, business risk, less liquidity and increased competitive threat.

The Russell Microcap® Index measures the performance of the microcap segment of the U.S. equity market. It makes up less than 3% of the U.S. equity market. It includes 1,000 of the smallest securities in the small cap Russell 2000® Index, plus the next smallest eligible securities by market cap.

The Russell 2000® Index is a widely recognized, unmanaged index comprised of the 2,000 smallest U.S. domiciled publicly-traded common stocks of the Russell 3000® Index, which represents approximately 8% of the total market capitalization of the Russell 3000® Index, an unmanaged index of the 3,000 largest U.S. domiciled publicly-traded common stocks by market capitalization.

The Russell 2000® Index and Russell Microcap® Index are widely recognized unmanaged indices of security prices and are representative of a broader market and range of securities than is found in the Fund’s portfolio. The Index returns do not reflect the deduction of expenses, which have been deducted from a Fund’s returns. The Index returns assume reinvestment of all distributions and do not reflect the deduction of taxes and fees. Individuals cannot invest directly in any Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

| Semi-Annual Report | December 31, 2020 | 5 |

| Growth of $10,000 or $50,000 Charts | James Advantage Funds |

| December 31, 2020 (Unaudited) |

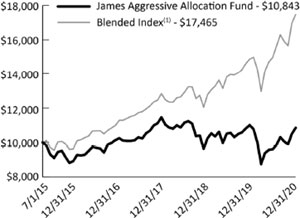

Comparison of the Change in Value of a $10,000 Investment in the James Aggressive Allocation Fund

James Aggressive Allocation Fund

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception(2) | |

| James Aggressive | -1.43% | 3.47% | 1.48% |

| Blended Index(1) | 17.43% | 12.01% | 10.67% |

| Russell 3000® Index | 20.89% | 15.43% | 13.50% |

| Bloomberg Barclays U.S. Aggregate Government/ Credit Bond Index | 8.92% | 4.98% | 4.68% |

| (1) | The Blended Index is comprised of a 65% weighting in the Russell 3000® Index and a 35% weighting in the Bloomberg Barclays U.S. Aggregate Government/Credit Bond Index. | |

| (2) | Fund inception was July 1, 2015. |

| The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2020, was 0.99%. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. These performance figures do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Please call 1-800-995-2637 for most recent month-end performance information.

The Russell 3000® Index is a stock market index of U.S. stocks. The Index measures the performance of 3,000 publicly held U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

The Bloomberg Barclays U.S. Aggregate Government/Credit Bond Index is an unmanaged index generally representative of U.S. Dollar denominated U.S. Treasuries, government related and investment grade U.S. corporate securities, that have a remaining maturity greater than one year.

The Russell 3000® Index, Bloomberg Barclays U.S. Aggregate Government/Credit Bond Index and the Blended Index are widely recognized unmanaged indices of security prices and are representative of a broader market and range of securities than is found in the Fund’s portfolio. The Index returns do not reflect the deduction of expenses, which have been deducted from a Fund’s returns. The Index returns assume reinvestment of all distributions and do not reflect the deduction of taxes and fees. Individuals cannot invest directly in any Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

| 6 | www.jamesinvestment.com |

| James Advantage Funds | Representation of Schedules of Investments |

| December 31, 2020 (Unaudited) |

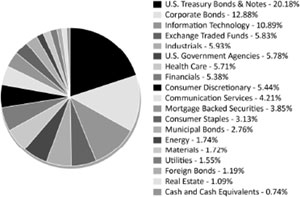

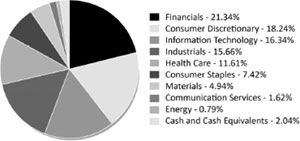

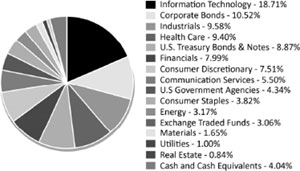

The illustrations below provide the industry sectors for the James Balanced: Golden Rainbow Fund, James Small Cap Fund, James Micro Cap Fund and James Aggressive Allocation Fund.

James

Balanced: Golden Rainbow Fund - Industry Sector Allocation

(% of Net Assets)*

James

Micro Cap Fund - Industry Sector Allocation

(% of Net Assets)*

James

Small Cap Fund - Industry Sector Allocation

(% of Net Assets)*

James

Aggressive Allocation Fund - Industry Sector Allocation

(% of Net Assets)*

| * | Holdings are subject to change, and may not reflect the current or future position of the portfolio. |

| Semi-Annual Report | December 31, 2020 | 7 |

| Disclosure of Fund Expenses | James Advantage Funds |

| December 31, 2020 (Unaudited) |

Example. As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including reinvested dividends or other distributions, and redemption fees; and (2) ongoing costs, including management fees, distribution (12b-1) fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period July 1, 2020 through December 31, 2020.

Actual Expenses. The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expense Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of the table below provides information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

Net Expense Ratio Annualized December 31, 2020(a) |

Beginning Account Value July 1, 2020 |

Ending Account Value December 31, 2020 |

Expense Paid During Period(b) | ||

| James Balanced: Golden Rainbow Fund | |||||

| Retail Class Actual | 1.17% | $ 1,000.00 | $ 1,071.90 | $ | 6.11 |

| Retail Class Hypothetical (5% return before expenses) | 1.17% | $ 1,000.00 | $ 1,019.31 | $ | 5.96 |

| Institutional Class Actual | 0.92% | $ 1,000.00 | $ 1,073.20 | $ | 4.81 |

| Institutional Class Hypothetical (5% return before expenses) | 0.92% | $ 1,000.00 | $ 1,020.57 | $ | 4.69 |

| James Small Cap Fund | |||||

| Actual | 1.50% | $ 1,000.00 | $ 1,293.40 | $ | 8.67 |

| Hypothetical (5% return before expenses) | 1.50% | $ 1,000.00 | $ 1,017.64 | $ | 7.63 |

| James Micro Cap Fund | |||||

| Actual | 1.50% | $ 1,000.00 | $ 1,244.70 | $ | 8.49 |

| Hypothetical (5% return before expenses) | 1.50% | $ 1,000.00 | $ 1,017.64 | $ | 7.63 |

| James Aggressive Allocation Fund | |||||

| Actual | 1.01% | $ 1,000.00 | $ 1,129.90 | $ | 5.42 |

| Hypothetical (5% return before expenses) | 1.01% | $ 1,000.00 | $ 1,020.11 | $ | 5.14 |

| (a) | Annualized, based on the Fund's most recent fiscal half year expenses. |

| (b) | Expenses are equal to the Fund's annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (184), divided by 365. |

| 8 | www.jamesinvestment.com |

| James Balanced: Golden Rainbow Fund | Schedule of Investments |

| December 31, 2020 (Unaudited) |

| Shares or Principal Amount | Value | |||||||

| COMMON STOCKS-52.62% | ||||||||

| Communication Services-4.21% | ||||||||

| 7,000 | Alphabet, Inc., Class A* | $ | 12,268,480 | |||||

| 130,904 | Comcast Corp., Class A | 6,859,370 | ||||||

| 16,700 | Facebook, Inc., Class A* | 4,561,772 | ||||||

| 55,000 | Verizon Communications, Inc. | 3,231,250 | ||||||

| 26,920,872 | ||||||||

| Consumer Discretionary-5.44% | ||||||||

| 9,610 | Alibaba Group Holding, Ltd., Sponsored ADR* | 2,236,535 | ||||||

| 1,500 | Amazon.com, Inc.* | 4,885,395 | ||||||

| 12,831 | Deckers Outdoor Corp.* | 3,679,674 | ||||||

| 26,000 | Helen of Troy, Ltd.* | 5,776,940 | ||||||

| 16,930 | Home Depot, Inc. | 4,496,947 | ||||||

| 10,000 | LGI Homes, Inc.* | 1,058,500 | ||||||

| 30,000 | McDonald's Corp. | 6,437,400 | ||||||

| 20,540 | Target Corp. | 3,625,926 | ||||||

| 37,500 | TJX Cos., Inc. | 2,560,875 | ||||||

| 34,758,192 | ||||||||

| Consumer Staples-3.13% | ||||||||

| 40,000 | Coca-Cola Co. | 2,193,600 | ||||||

| 6,220 | Costco Wholesale Corp. | 2,343,572 | ||||||

| 46,000 | Procter & Gamble Co. | 6,400,440 | ||||||

| 62,785 | Walmart, Inc. | 9,050,458 | ||||||

| 19,988,070 | ||||||||

| Energy-1.74% | ||||||||

| 49,400 | Chevron Corp. | 4,171,830 | ||||||

| 23,000 | Pioneer Natural Resources Co. | 2,619,470 | ||||||

| 20,000 | Renewable Energy Group, Inc.* | 1,416,400 | ||||||

| 52,177 | Valero Energy Corp. | 2,951,653 | ||||||

| 11,159,353 | ||||||||

| Exchange Traded Funds-5.83% | ||||||||

| 457,836 | iShares® Gold Trust* | 8,300,567 | ||||||

| 50,330 | iShares® Russell 2000® ETF | 9,867,700 | ||||||

| 45,000 | iShares® Russell 2000 Value ETF | 5,928,750 | ||||||

| 140,000 | Schwab Emerging Markets Equity ETF | 4,291,000 | ||||||

| 85,000 | Vanguard® FTSE All-World ex-US ETF | 4,960,600 | ||||||

| 27,480 | Vanguard® Small-Cap Value ETF | 3,907,931 | ||||||

| 37,256,548 | ||||||||

| Financials-5.38% | ||||||||

| 12,000 | Arthur J Gallagher & Co. | 1,484,520 | ||||||

| 7,000 | BlackRock, Inc. | 5,050,780 | ||||||

| 81,694 | Fifth Third Bancorp | 2,252,304 | ||||||

| 83,070 | JPMorgan Chase & Co. | 10,555,705 | ||||||

| 40,034 | LPL Financial Holdings, Inc. | 4,172,343 | ||||||

| 7,500 | MSCI, Inc. | 3,348,975 | ||||||

| 17,630 | Nelnet, Inc., Class A | 1,255,961 | ||||||

| 40,000 | Progressive Corp. | 3,955,200 | ||||||

| See Notes to Financial Statements. |

| Semi-Annual Report | December 31, 2020 | 9 |

| Schedule of Investments | James Balanced: Golden Rainbow Fund |

| December 31, 2020 (Unaudited) |

| Shares or Principal Amount | Value | |||||||

| Financials (continued) | ||||||||

| 6,111 | SVB Financial Group* | $ | 2,370,029 | |||||

| 34,445,817 | ||||||||

| Health Care-5.71% | ||||||||

| 40,003 | Abbott Laboratories | 4,379,928 | ||||||

| 9,000 | Anthem, Inc. | 2,889,810 | ||||||

| 95,000 | AstraZeneca PLC, Sponsored ADR | 4,749,050 | ||||||

| 10,000 | Danaher Corp. | 2,221,400 | ||||||

| 16,455 | Eli Lilly & Co. | 2,778,262 | ||||||

| 43,170 | Johnson & Johnson | 6,794,095 | ||||||

| 110,000 | Pfizer, Inc. | 4,049,100 | ||||||

| 18,780 | UnitedHealth Group, Inc. | 6,585,770 | ||||||

| 12,500 | Zoetis, Inc. | 2,068,750 | ||||||

| 36,516,165 | ||||||||

| Industrials-5.93% | ||||||||

| 34,500 | AGCO Corp. | 3,556,605 | ||||||

| 17,352 | Caterpillar, Inc. | 3,158,411 | ||||||

| 9,801 | Deere & Co. | 2,636,959 | ||||||

| 27,300 | Eaton Corp. PLC | 3,279,822 | ||||||

| 17,000 | FedEx Corp. | 4,413,540 | ||||||

| 15,000 | Generac Holdings, Inc.* | 3,411,150 | ||||||

| 8,300 | Lockheed Martin Corp. | 2,946,334 | ||||||

| 32,500 | MasTec, Inc.* | 2,215,850 | ||||||

| 10,000 | Old Dominion Freight Line, Inc. | 1,951,800 | ||||||

| 62,500 | Schneider Electric SE, ADR | 1,809,375 | ||||||

| 21,500 | Union Pacific Corp. | 4,476,730 | ||||||

| 17,500 | United Rentals, Inc.* | 4,058,425 | ||||||

| 37,915,001 | ||||||||

| Information Technology-10.89% | ||||||||

| 6,000 | Adobe, Inc.* | 3,000,720 | ||||||

| 107,500 | Apple, Inc. | 14,264,175 | ||||||

| 11,000 | ASML Holding NV | 5,364,920 | ||||||

| 18,048 | Cadence Design Systems, Inc.* | 2,462,289 | ||||||

| 38,000 | Insight Enterprises, Inc.* | 2,891,420 | ||||||

| 24,300 | Invesco S&P® 500 Equal Weight Technology ETF | 6,161,265 | ||||||

| 7,175 | Lam Research Corp. | 3,388,537 | ||||||

| 12,500 | Mastercard, Inc., Class A | 4,461,750 | ||||||

| 52,500 | Microsoft Corp. | 11,677,050 | ||||||

| 6,161 | NVIDIA Corp. | 3,217,274 | ||||||

| 21,000 | PayPal Holdings, Inc.* | 4,918,200 | ||||||

| 5,372 | ServiceNow, Inc.* | 2,956,910 | ||||||

| 29,819 | SYNNEX Corp. | 2,428,459 | ||||||

| 22,500 | Taiwan Semiconductor Manufacturing Co., Ltd., ADR | 2,453,400 | ||||||

| 69,646,369 | ||||||||

| Materials-1.72% | ||||||||

| 21,770 | Avery Dennison Corp. | 3,376,745 | ||||||

| 22,745 | Celanese Corp. | 2,955,485 | ||||||

| 8,000 | Ecolab, Inc. | 1,730,880 | ||||||

| 44,072 | James Hardie Industries PLC, ADR* | 1,307,175 | ||||||

| See Notes to Financial Statements. |

| 10 | www.jamesinvestment.com |

| James Balanced: Golden Rainbow Fund | Schedule of Investments |

| December 31, 2020 (Unaudited) |

| Shares or Principal Amount | Value | ||||||

| Materials (continued) | |||||||

| 35,000 | Sealed Air Corp. | $ | 1,602,650 | ||||

| 10,972,935 | |||||||

| Real Estate-1.09% | |||||||

| 6,000 | Equinix, Inc., REIT | 4,285,080 | |||||

| 27,000 | Prologis, Inc., REIT | 2,690,820 | |||||

| 6,975,900 | |||||||

| Utilities-1.55% | |||||||

| 37,500 | American Water Works Co., Inc. | 5,755,125 | |||||

| 53,540 | NextEra Energy, Inc. | 4,130,611 | |||||

| 9,885,736 | |||||||

| TOTAL COMMON STOCKS | |||||||

| (Cost $265,119,882) | 336,440,958 | ||||||

| Shares or Principal Amount | Value | |||||||

| CORPORATE BONDS-12.88% | ||||||||

| Communication Services-0.17% | ||||||||

| $ | 1,000,000 | AT&T, Inc., 2.950%, 7/15/26 | 1,105,208 | |||||

| Consumer Discretionary-2.34% | ||||||||

| 5,000,000 | eBay, Inc., 2.600%, 7/15/22 | 5,146,177 | ||||||

| 5,000,000 | Home Depot, Inc., 2.700%, 4/1/23 | 5,243,859 | ||||||

| 785,000 | McDonald's Corp., 5.700%, 2/1/39 | 1,133,232 | ||||||

| 1,000,000 | Ross Stores, Inc., 4.700%, 4/15/27 | 1,179,697 | ||||||

| 2,000,000 | Starbucks Corp., 2.550%, 11/15/30 | 2,162,276 | ||||||

| 14,865,241 | ||||||||

| Consumer Staples-0.77% | ||||||||

| 1,950,000 | Keurig Dr Pepper, Inc., 2.530%, 11/15/21 | 1,985,942 | ||||||

| 2,000,000 | Walmart, Inc., 5.250%, 9/1/35 | 2,909,858 | ||||||

| 4,895,800 | ||||||||

| Exchange Traded Funds-0.94% | ||||||||

| 25,000 | iShares® Convertible Bond ETF | 2,413,750 | ||||||

| 25,000 | iShares® Trust 5-10 Year Investment Grade Corporate Bond ETF | 1,544,750 | ||||||

| 25,000 | SPDR® Bloomberg Barclays Convertible Securities ETF | 2,069,750 | ||||||

| 6,028,250 | ||||||||

| Financials-2.76% | ||||||||

| 8,100,000 | Berkshire Hathaway, Inc., 3.750%, 8/15/21 | 8,272,552 | ||||||

| 2,000,000 | Citigroup, Inc., 3.875%, 3/26/25 | 2,232,195 | ||||||

| 1,000,000 | Goldman Sachs Group, Inc., 3.500%, 4/1/25 | 1,112,021 | ||||||

| 5,000,000 | Wells Fargo & Co., 2.500%, 3/4/21 | 5,016,909 | ||||||

| 1,000,000 | Wells Fargo & Co., 2.000%, 5/15/25 | 1,001,836 | ||||||

| 17,635,513 | ||||||||

| Health Care-0.79% | ||||||||

| 5,000,000 | Johnson & Johnson, 1.300%, 9/1/30 | 5,019,061 | ||||||

| Industrials-0.90% | ||||||||

| 1,000,000 | Caterpillar, Inc., 8.250%, 12/15/38 | 1,810,016 | ||||||

| 1,000,000 | General Electric Co., 2.700%, 10/9/22 | 1,043,045 | ||||||

| 2,000,000 | General Electric Co., 6.875%, 1/10/39 | 2,943,610 | ||||||

| 5,796,671 | ||||||||

| See Notes to Financial Statements. |

| Semi-Annual Report | December 31, 2020 | 11 |

| Schedule of Investments | James Balanced: Golden Rainbow Fund |

December 31, 2020 (Unaudited) |

| Shares or Principal Amount | Value | |||||||

| Information Technology-4.21% | ||||||||

| $ | 2,500,000 | Apple, Inc., 2.050%, 9/11/26 | $ | 2,672,621 | ||||

| 2,000,000 | Automatic Data Processing, Inc., 1.250%, 9/1/30 | 1,995,141 | ||||||

| 5,000,000 | Intel Corp., 3.300%, 10/1/21 | 5,110,929 | ||||||

| 5,000,000 | Intel Corp., 2.875%, 5/11/24 | 5,394,566 | ||||||

| 3,700,000 | Microsoft Corp., 5.200%, 6/1/39 | 5,576,819 | ||||||

| 5,000,000 | Oracle Corp., 2.500%, 5/15/22 | 5,133,553 | ||||||

| 1,000,000 | PayPal Holdings, Inc., 2.650%, 10/1/26 | 1,098,924 | ||||||

| 26,982,553 | ||||||||

| TOTAL CORPORATE BONDS | ||||||||

| (Cost $74,594,836) | 82,328,297 | |||||||

| Shares or Principal Amount | Value | |||||||

| MUNICIPAL BONDS-2.76% | ||||||||

| Hawaii-1.53% | ||||||||

| 9,000,000 | City and County of Honolulu General Obligation Unlimited Bonds, Series B, 5.000%, 11/1/25 | 9,776,250 | ||||||

| Ohio-1.23% | ||||||||

| 7,450,000 | Beavercreek City School District General Obligation Unlimited Bonds, 3.250%, 12/1/36 | 7,883,516 | ||||||

| TOTAL MUNICIPAL BONDS | ||||||||

| (Cost $16,789,001) | 17,659,766 | |||||||

| Shares or Principal Amount | Value | |||||||

| U.S. GOVERNMENT AGENCIES-5.78% | ||||||||

| Federal Farm Credit Banks Funding Corp.-1.32% | ||||||||

| 2,000,000 | 0.670%, 8/4/25 | 2,000,141 | ||||||

| 5,725,000 | 2.750%, 11/6/26 | 6,426,811 | ||||||

| 8,426,952 | ||||||||

| Federal Home Loan Banks-3.28% | ||||||||

| 10,000,000 | 2.875%, 6/13/25 | 11,103,989 | ||||||

| 2,000,000 | 0.580%, 9/11/25 | 1,992,842 | ||||||

| 2,500,000 | 0.850%, 10/15/27 | 2,486,138 | ||||||

| 5,000,000 | 4.080%, 5/25/33 | 5,407,948 | ||||||

| 20,990,917 | ||||||||

| Tennessee Valley Authority-1.18% | ||||||||

| 5,000,000 | 5.250%, 9/15/39 | 7,501,632 | ||||||

| TOTAL U.S. GOVERNMENT AGENCIES | ||||||||

| (Cost $33,901,678) | 36,919,501 | |||||||

| Shares or Principal Amount | Value | |||||||

| MORTGAGE BACKED SECURITIES-3.85% | ||||||||

| Fannie Mae Pool-3.60% | ||||||||

| 5,951,201 | 3.500%, 9/1/33 | 6,434,624 | ||||||

| 15,646,739 | 2.500%, 1/1/57 | 16,606,710 | ||||||

| 23,041,334 | ||||||||

| Fannie Mae REMICS-0.25% | ||||||||

| 1,529,558 | 3.500%, 5/25/47 | 1,571,068 | ||||||

| TOTAL MORTGAGE BACKED SECURITIES | ||||||||

| (Cost $22,647,407) | 24,612,402 | |||||||

| See Notes to Financial Statements. |

| 12 | www.jamesinvestment.com |

| James Balanced: Golden Rainbow Fund | Schedule of Investments |

| December 31, 2020 (Unaudited) |

| Shares or Principal Amount | Value | |||||||

| U.S. TREASURY BONDS & NOTES-20.18% | ||||||||

| U.S. Treasury Bonds-10.86% | ||||||||

| $ | 24,000,000 | 2.000%, 8/15/25 | $ | 25,845,937 | ||||

| 28,000,000 | 2.750%, 2/15/28 | 32,095,000 | ||||||

| 10,000,000 | 2.625%, 2/15/29 | 11,473,828 | ||||||

| 69,414,765 | ||||||||

| U.S. Treasury Notes-6.30% | ||||||||

| 40,000,000 | 2.375%, 4/15/21 | 40,256,250 | ||||||

| United States Treasury Inflation Indexed Bonds-3.02% | ||||||||

| 18,344,900 | 0.625%, 4/15/23 | 19,314,151 | ||||||

| TOTAL U.S. TREASURY BONDS & NOTES | ||||||||

| (Cost $120,325,010) | 128,985,166 | |||||||

| Shares or Principal Amount | Value | ||||||

| FOREIGN BONDS-1.19% | |||||||

| Singapore Government Bond-1.19% | |||||||

| SGD 10,000,000 | 2.250%, 6/1/21 | 7,622,579 | |||||

| TOTAL FOREIGN BONDS | |||||||

| (Cost $7,421,474) | 7,622,579 | ||||||

| Shares or Principal Amount | Value | ||||||

| SHORT TERM INVESTMENTS-0.63% | |||||||

| Mutual Fund-0.63% | |||||||

| 4,039,394 | First American Treasury Obligations Fund, Class X, 7-Day Yield 0.040% | 4,039,394 | |||||

| TOTAL SHORT TERM INVESTMENTS | |||||||

| (Cost $4,039,394) | 4,039,394 | ||||||

| TOTAL INVESTMENT SECURITIES-99.89% | |||||||

| (Cost $544,838,682) | 638,608,063 | ||||||

| OTHER ASSETS IN EXCESS OF LIABILITIES-0.11% | 723,727 | ||||||

| NET ASSETS-100.00% | $ | 639,331,790 | |||||

For Fund compliance purposes, the Fund's industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. Those definitions may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

| * | Non-income producing security. |

SGD - Singapore Dollar

See Notes to Financial Statements.

| Semi-Annual Report | December 31, 2020 | 13 |

| Schedule of Investments | James Small Cap Fund |

| December 31, 2020 (Unaudited) |

| Shares | Value | |||||||

| COMMON STOCKS-97.38% | ||||||||

| Consumer Discretionary-13.69% | ||||||||

| 3,270 | Deckers Outdoor Corp.* | $ | 937,771 | |||||

| 3,045 | Helen of Troy, Ltd.* | 676,569 | ||||||

| 5,300 | LGI Homes, Inc.* | 561,005 | ||||||

| 23,300 | MDC Holdings, Inc. | 1,132,380 | ||||||

| 3,800 | Meritage Homes Corp.* | 314,716 | ||||||

| 11,480 | Patrick Industries, Inc. | 784,658 | ||||||

| 10,200 | PetMed Express, Inc. | 327,012 | ||||||

| 4,734,111 | ||||||||

| Consumer Staples-3.04% | ||||||||

| 10,975 | Ingles Markets, Inc., Class A | 468,193 | ||||||

| 13,770 | Village Super Market, Inc., Class A | 303,766 | ||||||

| 5,855 | Weis Markets, Inc. | 279,928 | ||||||

| 1,051,887 | ||||||||

| Energy-2.43% | ||||||||

| 35,000 | Frontline, Ltd. | 217,700 | ||||||

| 7,600 | HollyFrontier Corp. | 196,460 | ||||||

| 52,365 | WPX Energy, Inc.* | 426,775 | ||||||

| 840,935 | ||||||||

| Financials-26.12% | ||||||||

| 18,080 | American Equity Investment Life Holding Co. | 500,093 | ||||||

| 3,870 | American Financial Group, Inc. | 339,089 | ||||||

| 16,000 | Assured Guaranty, Ltd. | 503,840 | ||||||

| 47,725 | Chimera Investment Corp., REIT | 489,181 | ||||||

| 13,520 | Evercore, Inc., Class A | 1,482,333 | ||||||

| 77,700 | First BanCorp | 716,394 | ||||||

| 36,000 | Genworth Financial, Inc., Class A* | 136,080 | ||||||

| 6,300 | Green Dot Corp., Class A* | 351,540 | ||||||

| 4,700 | Houlihan Lokey, Inc. | 315,981 | ||||||

| 55,410 | Ladder Capital Corp., REIT | 541,910 | ||||||

| 7,300 | LPL Financial Holdings, Inc. | 760,806 | ||||||

| 13,975 | Piper Sandler Cos. | 1,410,078 | ||||||

| 31,700 | Radian Group, Inc. | 641,925 | ||||||

| 40,575 | Sixth Street Specialty Lending, Inc. | 841,931 | ||||||

| 9,031,181 | ||||||||

| Health Care-7.69% | ||||||||

| 57,000 | Innoviva, Inc.* | 706,230 | ||||||

| 8,690 | Integer Holdings Corp.* | 705,541 | ||||||

| 11,650 | National HealthCare Corp. | 773,677 | ||||||

| 24,240 | Tivity Health, Inc.* | 474,862 | ||||||

| 2,660,310 | ||||||||

| Industrials-18.97% | ||||||||

| 2,300 | AGCO Corp. | 237,107 | ||||||

| 24,030 | Boise Cascade Co. | 1,148,634 | ||||||

| 18,955 | Encore Wire Corp. | 1,148,104 | ||||||

| 4,570 | FTI Consulting, Inc.* | 510,560 | ||||||

| 5,980 | Generac Holdings, Inc.* | 1,359,912 | ||||||

| 24,198 | Hillenbrand, Inc. | 963,080 | ||||||

| See Notes to Financial Statements. | |||

| 14 | www.jamesinvestment.com | ||

| James Small Cap Fund | Schedule of Investments |

| December 31, 2020 (Unaudited) |

| Shares | Value | |||||||

| Industrials (continued) | ||||||||

| 12,200 | MasTec, Inc.* | $ | 831,796 | |||||

| 4,435 | TriNet Group, Inc.* | 357,461 | ||||||

| 6,556,654 | ||||||||

| Information Technology-17.79% | ||||||||

| 5,350 | Avnet, Inc. | 187,838 | ||||||

| 4,465 | CMC Materials, Inc. | 675,554 | ||||||

| 5,035 | Concentrix Corp.* | 496,954 | ||||||

| 5,200 | EVERTEC, Inc. | 204,464 | ||||||

| 6,990 | Insight Enterprises, Inc.* | 531,869 | ||||||

| 20,245 | Nova Measuring Instruments, Ltd.* | 1,429,297 | ||||||

| 13,500 | PC Connection, Inc. | 638,415 | ||||||

| 21,500 | Super Micro Computer, Inc.* | 680,690 | ||||||

| 10,360 | Sykes Enterprises, Inc.* | 390,261 | ||||||

| 2,535 | SYNNEX Corp. | 206,450 | ||||||

| 9,700 | TTEC Holdings, Inc. | 707,421 | ||||||

| 6,149,213 | ||||||||

| Materials-3.52% | ||||||||

| 16,000 | Cleveland-Cliffs, Inc. | 232,960 | ||||||

| 2,686 | Innospec, Inc. | 243,701 | ||||||

| 13,120 | Schnitzer Steel Industries, Inc., Class A | 418,659 | ||||||

| 7,130 | Sealed Air Corp. | 326,483 | ||||||

| 1,221,803 | ||||||||

| Real Estate-2.46% | ||||||||

| 32,500 | Lexington Realty Trust, REIT | 345,150 | ||||||

| 33,280 | Xenia Hotels & Resorts, Inc., REIT | 505,856 | ||||||

| 851,006 | ||||||||

| Utilities-1.67% | ||||||||

| 3,385 | IDACORP, Inc. | 325,062 | ||||||

| 5,935 | Portland General Electric Co. | 253,840 | ||||||

| 578,902 | ||||||||

| TOTAL COMMON STOCKS | ||||||||

| (Cost $25,848,929) | 33,676,002 | |||||||

| Shares | Value | ||||||

| SHORT TERM INVESTMENTS-2.57% | |||||||

| Mutual Fund-2.57% | |||||||

| 890,309 | First American Treasury Obligations Fund, Class X, 7-Day Yield 0.040% | 890,309 | |||||

| TOTAL SHORT TERM INVESTMENTS | |||||||

| (Cost $890,309) | 890,309 | ||||||

| TOTAL INVESTMENT SECURITIES-99.95% | |||||||

| (Cost $26,739,238) | 34,566,311 | ||||||

| OTHER ASSETS IN EXCESS OF LIABILITIES-0.05% | 15,596 | ||||||

| NET ASSETS-100.00% | $ | 34,581,907 | |||||

| See Notes to Financial Statements. |

| Semi-Annual Report | December 31, 2020 | 15 |

| Schedule of Investments | James Small Cap Fund |

| December 31, 2020 (Unaudited) |

For Fund compliance purposes, the Fund's industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. Those definitions may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

| * | Non-income producing security. |

See Notes to Financial Statements.

| 16 | www.jamesinvestment.com |

| James Micro Cap Fund | Schedule of Investments |

| December 31, 2020 (Unaudited) |

| Shares | Value | |||||||

| COMMON STOCKS-97.96% | ||||||||

| Communication Services-1.62% | ||||||||

| 21,500 | Gray Television, Inc.* | $ | 384,635 | |||||

| 384,635 | ||||||||

| Consumer Discretionary-18.24% | ||||||||

| 16,230 | Century Communities, Inc.* | 710,549 | ||||||

| 30,210 | Haverty Furniture Cos., Inc. | 835,911 | ||||||

| 20,820 | M/I Homes, Inc.* | 922,118 | ||||||

| 20,326 | Patrick Industries, Inc. | 1,389,282 | ||||||

| 10,000 | PetMed Express, Inc. | 320,600 | ||||||

| 8,856 | Sportsman's Warehouse Holdings, Inc.* | 155,423 | ||||||

| 4,333,883 | ||||||||

| Consumer Staples-7.42% | ||||||||

| 19,230 | Ingles Markets, Inc., Class A | 820,352 | ||||||

| 6,557 | John B Sanfilippo & Son, Inc. | 517,085 | ||||||

| 7,364 | Rite Aid Corp.* | 116,572 | ||||||

| 14,030 | Village Super Market, Inc., Class A | 309,502 | ||||||

| 1,763,511 | ||||||||

| Energy-0.79% | ||||||||

| 7,145 | NACCO Industries, Inc., Class A | 187,913 | ||||||

| 187,913 | ||||||||

| Financials-21.34% | ||||||||

| 57,215 | Ares Commercial Real Estate Corp., REIT | 681,431 | ||||||

| 26,746 | Donnelley Financial Solutions, Inc.* | 453,880 | ||||||

| 48,590 | Enova International, Inc.* | 1,203,574 | ||||||

| 9,320 | Federal Agricultural Mortgage Corp., Class C | 692,010 | ||||||

| 17,136 | Merchants Bancorp | 473,468 | ||||||

| 25,456 | OFG Bancorp | 471,954 | ||||||

| 10,830 | Piper Sandler Cos. | 1,092,747 | ||||||

| 5,069,064 | ||||||||

| Health Care-11.61% | ||||||||

| 24,730 | Innoviva, Inc.* | 306,405 | ||||||

| 5,270 | Integer Holdings Corp.* | 427,871 | ||||||

| 48,010 | Kamada, Ltd.* | 311,105 | ||||||

| 33,200 | Lantheus Holdings, Inc.* | 447,868 | ||||||

| 11,475 | PetIQ, Inc.* | 441,214 | ||||||

| 6,030 | Semler Scientific, Inc.* | 566,820 | ||||||

| 19,495 | Vanda Pharmaceuticals, Inc.* | 256,164 | ||||||

| 2,757,447 | ||||||||

| Industrials-15.66% | ||||||||

| 102,175 | ACCO Brands Corp. | 863,379 | ||||||

| 13,035 | ArcBest Corp. | 556,203 | ||||||

| 5,000 | Boise Cascade Co. | 239,000 | ||||||

| 27,900 | CAI International, Inc. | 871,596 | ||||||

| 3,928 | Northwest Pipe Co.* | 111,162 | ||||||

| 21,680 | Vectrus, Inc.* | 1,077,930 | ||||||

| 3,719,270 | ||||||||

| See Notes to Financial Statements. |

| Semi-Annual Report | December 31, 2020 | 17 |

| Schedule of Investments | James Micro Cap Fund |

| December 31, 2020 (Unaudited) |

| Shares | Value | |||||||

| Information Technology-16.34% | ||||||||

| 2,300 | ePlus, Inc.* | $ | 202,285 | |||||

| 6,240 | Insight Enterprises, Inc.* | 474,801 | ||||||

| 7,368 | International Money Express, Inc.* | 114,351 | ||||||

| 20,435 | Nova Measuring Instruments, Ltd.* | 1,442,711 | ||||||

| 29,692 | PC Connection, Inc. | 1,404,135 | ||||||

| 6,500 | Sykes Enterprises, Inc.* | 244,855 | ||||||

| 3,883,138 | ||||||||

| Materials-4.94% | ||||||||

| 4,000 | Innospec, Inc. | 362,920 | ||||||

| 18,045 | Schnitzer Steel Industries, Inc., Class A | 575,816 | ||||||

| 2,070 | United States Lime & Minerals, Inc. | 235,980 | ||||||

| 1,174,716 | ||||||||

| TOTAL COMMON STOCKS | ||||||||

| (Cost $16,725,364) | 23,273,577 | |||||||

| Shares | Value | ||||||

| SHORT TERM INVESTMENTS-2.06% | |||||||

| Mutual Fund-2.06% | |||||||

| 489,987 | First American Treasury Obligations Fund, Class X, 7-Day Yield 0.040% | 489,987 | |||||

| TOTAL SHORT TERM INVESTMENTS | |||||||

| (Cost $489,987) | 489,987 | ||||||

| TOTAL INVESTMENT SECURITIES-100.02% | |||||||

| (Cost $17,215,351) | 23,763,564 | ||||||

| OTHER LIABILITIES IN EXCESS OF OTHER ASSETS-(0.02)% | (3,877 | ) | |||||

| NET ASSETS-100.00% | $ | 23,759,687 | |||||

For Fund compliance purposes, the Fund's industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. Those definitions may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

| * | Non-income producing security. |

See Notes to Financial Statements.

| 18 | www.jamesinvestment.com |

| James Aggressive Allocation Fund | Schedule of Investments |

| December 31, 2020 (Unaudited) |

| Shares or Principal Amount | Value | |||||||

| COMMON STOCKS-72.23% | ||||||||

| Communication Services-5.50% | ||||||||

| 200 | Alphabet, Inc., Class A* | $ | 350,528 | |||||

| 6,160 | Comcast Corp., Class A | 322,784 | ||||||

| 3,825 | NetEase, Inc., ADR | 366,320 | ||||||

| 3,875 | Verizon Communications, Inc. | 227,656 | ||||||

| 1,267,288 | ||||||||

| Consumer Discretionary-7.51% | ||||||||

| 100 | Amazon.com, Inc.* | 325,693 | ||||||

| 2,190 | Best Buy Co., Inc. | 218,540 | ||||||

| 90 | Chipotle Mexican Grill, Inc.* | 124,804 | ||||||

| 1,450 | Home Depot, Inc. | 385,149 | ||||||

| 1,000 | LGI Homes, Inc.* | 105,850 | ||||||

| 970 | McDonald's Corp. | 208,143 | ||||||

| 1,355 | Target Corp. | 239,198 | ||||||

| 885 | Tractor Supply Co. | 124,413 | ||||||

| 1,731,790 | ||||||||

| Consumer Staples-3.82% | ||||||||

| 6,950 | Kroger Co. | 220,732 | ||||||

| 1,690 | Procter & Gamble Co. | 235,147 | ||||||

| 2,950 | Walmart, Inc. | 425,243 | ||||||

| 881,122 | ||||||||

| Energy-3.17% | ||||||||

| 2,350 | Chevron Corp. | 198,457 | ||||||

| 5,550 | EOG Resources, Inc. | 276,778 | ||||||

| 3,600 | Renewable Energy Group, Inc.* | 254,952 | ||||||

| 730,187 | ||||||||

| Exchange Traded Funds-3.06% | ||||||||

| 11,255 | iShares® Gold Trust* | 204,053 | ||||||

| 5,600 | iShares® MSCI Emerging Markets ETF | 289,352 | ||||||

| 550 | iShares® Russell 2000® ETF | 107,833 | ||||||

| 800 | iShares® Russell 2000 Value ETF | 105,400 | ||||||

| 706,638 | ||||||||

| Financials-7.99% | ||||||||

| 475 | BlackRock, Inc. | 342,731 | ||||||

| 300 | FactSet Research Systems, Inc. | 99,750 | ||||||

| 12,885 | Fifth Third Bancorp | 355,239 | ||||||

| 1,150 | Goldman Sachs Group, Inc. | 303,266 | ||||||

| 2,000 | JPMorgan Chase & Co. | 254,140 | ||||||

| 2,430 | LPL Financial Holdings, Inc. | 253,255 | ||||||

| 2,355 | Progressive Corp. | 232,862 | ||||||

| 1,841,243 | ||||||||

| Health Care-9.40% | ||||||||

| 3,015 | Abbott Laboratories | 330,112 | ||||||

| 998 | Anthem, Inc. | 320,448 | ||||||

| 6,000 | ARK Genomic Revolution ETF | 559,560 | ||||||

| 1,295 | Johnson & Johnson | 203,807 | ||||||

| 3,125 | Medtronic PLC | 366,063 | ||||||

| See Notes to Financial Statements. |

| Semi-Annual Report | December 31, 2020 | 19 |

| Schedule of Investments | James Aggressive Allocation Fund |

| December 31, 2020 (Unaudited) |

| Shares or Principal Amount | Value | |||||||

| Health Care (continued) | ||||||||

| 3,220 | Pfizer, Inc. | $ | 118,528 | |||||

| 399 | Viatris, Inc.* | 7,477 | ||||||

| 1,595 | Zoetis, Inc. | 263,973 | ||||||

| 2,169,968 | ||||||||

| Industrials-9.58% | ||||||||

| 3,475 | AGCO Corp. | 358,238 | ||||||

| 1,935 | Caterpillar, Inc. | 352,209 | ||||||

| 1,295 | Deere & Co. | 348,420 | ||||||

| 1,240 | FedEx Corp. | 321,929 | ||||||

| 495 | Generac Holdings, Inc.* | 112,568 | ||||||

| 575 | Lockheed Martin Corp. | 204,114 | ||||||

| 3,310 | MasTec, Inc.* | 225,676 | ||||||

| 1,220 | United Rentals, Inc.* | 282,930 | ||||||

| 2,206,084 | ||||||||

| Information Technology-18.71% | ||||||||

| 720 | Adobe, Inc.* | 360,086 | ||||||

| 5,725 | Apple, Inc. | 759,650 | ||||||

| 777 | ASML Holding NV | 378,958 | ||||||

| 1,900 | Cadence Design Systems, Inc.* | 259,217 | ||||||

| 800 | Lam Research Corp. | 377,816 | ||||||

| 3,650 | Logitech International SA | 354,744 | ||||||

| 820 | Mastercard, Inc., Class A | 292,691 | ||||||

| 2,090 | Microsoft Corp. | 464,858 | ||||||

| 600 | NVIDIA Corp. | 313,320 | ||||||

| 1,600 | PayPal Holdings, Inc.* | 374,720 | ||||||

| 685 | ServiceNow, Inc.* | 377,045 | ||||||

| 4,313,105 | ||||||||

| Materials-1.65% | ||||||||

| 735 | Avery Dennison Corp. | 114,006 | ||||||

| 4,475 | Newmont Mining Corp. | 268,008 | ||||||

| 382,014 | ||||||||

| Real Estate-0.84% | ||||||||

| 270 | Equinix, Inc., REIT | 192,829 | ||||||

| 192,829 | ||||||||

| Utilities-1.00% | ||||||||

| 6,155 | NRG Energy, Inc. | 231,120 | ||||||

| 231,120 | ||||||||

| TOTAL COMMON STOCKS | ||||||||

| (Cost $13,789,671) | 16,653,388 | |||||||

| Shares or Principal Amount | Value | |||||||

| CORPORATE BONDS-10.52% | ||||||||

| Consumer Discretionary-2.35% | ||||||||

| $ | 500,000 | Starbucks Corp., 2.550%, 11/15/30 | 540,569 | |||||

| Exchange Traded Funds-4.14% | ||||||||

| 4,894 | iShares® Convertible Bond ETF | 472,516 | ||||||

| See Notes to Financial Statements. |

| 20 | www.jamesinvestment.com |

| James Aggressive Allocation Fund | Schedule of Investments |

| December 31, 2020 (Unaudited) |

| Shares or Principal Amount | Value | |||||||

| Exchange Traded Funds (continued) | ||||||||

| 5,821 | SPDR® Bloomberg Barclays Convertible Securities ETF | $ | 481,921 | |||||

| 954,437 | ||||||||

| Financials-1.64% | ||||||||

| 250,000 | Citigroup, Inc., 3.875%, 3/26/25 | 279,024 | ||||||

| 100,000 | Wells Fargo & Co., 2.000%, 5/15/25 | 100,184 | ||||||

| 379,208 | ||||||||

| Health Care-1.08% | ||||||||

| 250,000 | AstraZeneca PLC, 0.700%, 4/8/26 | 248,620 | ||||||

| Industrials-0.23% | ||||||||

| 50,000 | General Electric Co., 2.700%, 10/9/22 | 52,152 | ||||||

| Information Technology-1.08% | ||||||||

| 250,000 | Automatic Data Processing, Inc., 1.250%, 9/1/30 | 249,392 | ||||||

| TOTAL CORPORATE BONDS | ||||||||

| (Cost $2,132,439) | 2,424,378 | |||||||

| Shares or Principal Amount | Value | |||||||

| U.S. GOVERNMENT AGENCIES-4.34% | ||||||||

| Federal Farm Credit Banks Funding Corp.-2.17% | ||||||||

| 500,000 | 0.670%, 8/4/25 | 500,036 | ||||||

| Federal National Mortgage Association-2.17% | ||||||||

| 500,000 | 0.560%, 10/22/25 | 500,208 | ||||||

| TOTAL U.S. GOVERNMENT AGENCIES | ||||||||

| (Cost $1,000,000) | 1,000,244 | |||||||

| Shares or Principal Amount | Value | |||||||

| U.S. TREASURY BONDS & NOTES-8.87% | ||||||||

| U.S. Treasury Bonds-4.98% | ||||||||

| 1,000,000 | 2.625%, 2/15/29 | 1,147,383 | ||||||

| U.S. Treasury Notes-2.24% | ||||||||

| 500,000 | 1.125%, 2/28/25 | 517,558 | ||||||

| United States Treasury Inflation Indexed Bonds-1.65% | ||||||||

| 375,469 | 0.625%, 7/15/21 | 380,341 | ||||||

| TOTAL U.S. TREASURY BONDS & NOTES | ||||||||

| (Cost $1,932,853) | 2,045,282 | |||||||

See Notes to Financial Statements.

| Semi-Annual Report | December 31, 2020 | 21 |

| Schedule of Investments | James Aggressive Allocation Fund |

| December 31, 2020 (Unaudited) |

| Shares or Principal Amount | Value | ||||||

| SHORT TERM INVESTMENTS-3.98% | |||||||

| Mutual Fund-3.98% | |||||||

| 917,821 | First American Treasury Obligations Fund, Class X, 7-Day Yield 0.040% | $ | 917,821 | ||||

| TOTAL SHORT TERM INVESTMENTS | |||||||

| (Cost $917,821) | 917,821 | ||||||

| TOTAL INVESTMENT SECURITIES-99.94% | |||||||

| (Cost $19,772,784) | 23,041,113 | ||||||

| OTHER ASSETS IN EXCESS OF LIABILITIES-0.06% | 13,208 | ||||||

| NET ASSETS-100.00% | $ | 23,054,321 | |||||

For Fund compliance purposes, the Fund's industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. Those definitions may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

| * | Non-income producing security. |

See Notes to Financial Statements.

| 22 | www.jamesinvestment.com |

| James Advantage Funds | Statements of Assets and Liabilities |

| December 31, 2020 (Unaudited) |

| James Balanced: Golden Rainbow Fund | James Small Cap Fund | James Micro Cap Fund | James Aggressive Allocation Fund | |||||||||||||

| ASSETS: | ||||||||||||||||

| Investment securities: | ||||||||||||||||

| At cost | $ | 544,838,682 | $ | 26,739,238 | $ | 17,215,351 | $ | 19,772,784 | ||||||||

| At value | $ | 638,608,063 | $ | 34,566,311 | $ | 23,763,564 | $ | 23,041,113 | ||||||||

| Dividends and interest receivable | 1,836,506 | 59,793 | 25,365 | 32,164 | ||||||||||||

| Receivable for capital shares sold | 8,471 | 1,040 | – | – | ||||||||||||

| Other assets | 52,664 | – | – | – | ||||||||||||

| Total Assets | 640,505,704 | 34,627,144 | 23,788,929 | 23,073,277 | ||||||||||||

| LIABILITIES: | ||||||||||||||||

| Payable for capital shares redeemed | 494,486 | 2,393 | – | – | ||||||||||||

| Accrued expenses: | ||||||||||||||||

| Management fees | 400,863 | 35,486 | 29,222 | 18,932 | ||||||||||||

| 12b-1 distribution and service fees | 106,398 | 7,246 | – | – | ||||||||||||

| Trustee fees | 3,187 | 112 | 20 | 24 | ||||||||||||

| Other payables | 168,980 | – | – | – | ||||||||||||

| Total Liabilities | 1,173,914 | 45,237 | 29,242 | 18,956 | ||||||||||||

| Net Assets | $ | 639,331,790 | $ | 34,581,907 | $ | 23,759,687 | $ | 23,054,321 | ||||||||

| NET ASSETS CONSIST OF: | ||||||||||||||||

| Paid-in capital | $ | 526,559,628 | $ | 33,274,142 | $ | 19,511,054 | $ | 22,186,716 | ||||||||

| Total Distributable Earnings | 112,772,162 | 1,307,765 | 4,248,633 | 867,605 | ||||||||||||

| Net Assets | $ | 639,331,790 | $ | 34,581,907 | $ | 23,759,687 | $ | 23,054,321 | ||||||||

| PRICING OF RETAIL CLASS SHARES: | ||||||||||||||||

| Net assets | $ | 497,643,568 | N/A | N/A | N/A | |||||||||||

| Shares of beneficial interest outstanding (unlimited number of shares authorized, no par) | 23,262,815 | N/A | N/A | N/A | ||||||||||||

| Net assets value, offering price and redemption price per share | $ | 21.39 | N/A | N/A | N/A | |||||||||||

| PRICING OF INSTITUTIONAL CLASS SHARES: | ||||||||||||||||

| Net assets | $ | 141,688,222 | N/A | N/A | N/A | |||||||||||

| Shares of beneficial interest outstanding (unlimited number of shares authorized, no par) | 6,711,811 | N/A | N/A | N/A | ||||||||||||

| Net assets value, offering price and redemption price per share | $ | 21.11 | N/A | N/A | N/A | |||||||||||

| PRICING OF SHARES | ||||||||||||||||

| Net assets | N/A | $ | 34,581,907 | $ | 23,759,687 | $ | 23,054,321 | |||||||||

| Shares of beneficial interest outstanding (unlimited number of shares authorized, no par) | N/A | 1,429,665 | 1,507,848 | 2,230,340 | ||||||||||||

| Net assets value, offering price and redemption price per share | N/A | $ | 24.19 | $ | 15.76 | $ | 10.34 | |||||||||

See Notes to Financial Statements.

| Semi-Annual Report | December 31, 2020 | 23 |

| Statements of Operations | James Advantage Funds |

| For the Six Months Ended December 31, 2020 (Unaudited) |

| James Balanced: Golden Rainbow Fund | James Small Cap Fund | James Micro Cap Fund | James Aggressive Allocation Fund | |||||||||||||

| INVESTMENT INCOME: | ||||||||||||||||

| Dividends (Net of withholding taxes of $13,850, $777, $416 and $618, respectively) | $ | 2,968,044 | $ | 350,893 | $ | 231,622 | $ | 144,974 | ||||||||

| Interest | 4,117,519 | – | – | 46,437 | ||||||||||||

| Total Investment Income | 7,085,563 | 350,893 | 231,622 | 191,411 | ||||||||||||

| EXPENSES: | ||||||||||||||||

| Management fees | 2,480,536 | 188,905 | 154,305 | 107,882 | ||||||||||||

| 12b-1 distribution and service fees - Retail Class | 653,702 | – | – | – | ||||||||||||

| 12b-1 distribution and service fees | – | 38,602 | – | – | ||||||||||||

| Interest expense | 16 | – | – | – | ||||||||||||

| Administration fee | 233,235 | – | – | – | ||||||||||||

| Transfer agent fee | 73,769 | – | – | – | ||||||||||||

| Custodian fees | 27,731 | – | – | – | ||||||||||||

| Professional fees | 92,697 | – | – | – | ||||||||||||

| Trustee fees | 98,342 | 4,104 | 2,727 | 2,959 | ||||||||||||

| Registration fees | 21,950 | – | – | – | ||||||||||||

| Shareholder report printing and mailing | 35,529 | – | – | – | ||||||||||||

| Other expenses | 46,855 | – | – | – | ||||||||||||

| Total Expenses | 3,764,362 | 231,611 | 157,032 | 110,841 | ||||||||||||

| Net Investment Income | 3,321,201 | 119,282 | 74,590 | 80,570 | ||||||||||||

| REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | ||||||||||||||||

| Net realized gain/(loss) from: | ||||||||||||||||

| Investments | 27,638,399 | 426,777 | 77,565 | 471,312 | ||||||||||||

| Foreign currency transactions | 1,657 | – | – | (13 | ) | |||||||||||

| Total realized gain/(loss) | 27,640,056 | 426,777 | 77,565 | 471,299 | ||||||||||||

| Net change in unrealized appreciation on investments | 16,127,667 | 7,534,949 | 4,541,222 | 2,118,532 | ||||||||||||

| Net change in unrealized appreciation on foreign currency translation | 219 | – | – | 24 | ||||||||||||

| Total change in unrealized appreciation | 16,127,886 | 7,534,949 | 4,541,222 | 2,118,556 | ||||||||||||

| Net Realized and Unrealized Gain on Investments | 43,767,942 | 7,961,726 | 4,618,787 | 2,589,855 | ||||||||||||

| Net Increase in Net Assets Resulting from Operations | $ | 47,089,143 | $ | 8,081,008 | $ | 4,693,377 | $ | 2,670,425 | ||||||||

See Notes to Financial Statements.

| 24 | www.jamesinvestment.com |

| James Balanced: Golden Rainbow Fund | Statements of Changes in Net Assets |

| For the Six Months Ended

December 31, 2020 (Unaudited) | For the Year Ended June 30, 2020 | |||||||

| FROM OPERATIONS: | ||||||||

| Net investment income | $ | 3,321,201 | $ | 11,393,186 | ||||

| Net realized gain | 27,640,056 | 107,085 | ||||||

| Net change in unrealized appreciation/(depreciation) | 16,127,886 | (17,921,840 | ) | |||||

| Net increase/(decrease) in net assets resulting from operations | 47,089,143 | (6,421,569 | ) | |||||

| DISTRIBUTIONS TO SHAREHOLDERS: | ||||||||

| Retail Class Shares: | ||||||||

| From distributable earnings | (3,139,391 | ) | (11,438,111 | ) | ||||

| Institutional Class Shares: | ||||||||

| From distributable earnings | (1,121,627 | ) | (4,402,203 | ) | ||||

| Decrease in net assets from distributions to shareholders | (4,261,018 | ) | (15,840,314 | ) | ||||

| CAPITAL SHARE TRANSACTIONS: | ||||||||

| Retail Class Shares: | ||||||||

| Proceeds from shares sold | 5,799,146 | 27,111,849 | ||||||

| Net asset value of shares issued in reinvestment of distributions to shareholders | 3,060,963 | 11,140,768 | ||||||

| Payments for shares redeemed | (78,392,112 | ) | (258,653,190 | ) | ||||

| Net Decrease in net assets from Retail Class capital share transactions | (69,532,003 | ) | (220,400,573 | ) | ||||

| Institutional Class Shares: | ||||||||

| Proceeds from shares sold | 3,855,652 | 20,785,892 | ||||||

| Net asset value of shares issued in reinvestment of distributions to shareholders | 1,037,342 | 3,792,084 | ||||||

| Payments for shares redeemed | (44,344,987 | ) | (152,450,448 | ) | ||||

| Net Decrease in net assets from Institutional Class capital share transactions | (39,451,993 | ) | (127,872,472 | ) | ||||

| Total Decrease in Net Assets | (66,155,871 | ) | (370,534,928 | ) | ||||

| NET ASSETS: | ||||||||

| Beginning of period | 705,487,661 | 1,076,022,589 | ||||||

| End of period | $ | 639,331,790 | $ | 705,487,661 | ||||

See Notes to Financial Statements.

| Semi-Annual Report | December 31, 2020 | 25 |

| Statements of Changes in Net Assets | James Balanced: Golden Rainbow Fund |

| For the Six Months Ended

December 31, 2020 (Unaudited) | For the Year Ended June 30, 2020 | |||||||

| SUMMARY OF CAPITAL SHARE ACTIVITY: | ||||||||

| Retail Class Shares: | ||||||||

| Shares sold | 278,592 | 1,306,726 | ||||||

| Shares issued in reinvestment of distributions to shareholders | 145,706 | 540,113 | ||||||

| Shares redeemed | (3,764,270 | ) | (12,537,191 | ) | ||||

| Net Decrease in shares outstanding | (3,339,972 | ) | (10,690,352 | ) | ||||

| Shares outstanding, beginning of year | 26,602,787 | 37,293,139 | ||||||

| Shares outstanding, end of year | 23,262,815 | 26,602,787 | ||||||

| Institutional Class Shares: | ||||||||

| Shares sold | 187,863 | 1,024,302 | ||||||

| Shares issued in reinvestment of distributions to shareholders | 50,064 | 186,405 | ||||||

| Shares redeemed | (2,161,466 | ) | (7,468,833 | ) | ||||

| Net Decrease in shares outstanding | (1,923,539 | ) | (6,258,126 | ) | ||||

| Shares outstanding, beginning of year | 8,635,350 | 14,893,476 | ||||||

| Shares outstanding, end of year | 6,711,811 | 8,635,350 | ||||||

See Notes to Financial Statements.

| 26 | www.jamesinvestment.com |

| James Small Cap Fund | Statements of Changes in Net Assets |

| For

the Six Months Ended December 31, 2020 (Unaudited) | For the Year Ended June 30, 2020 | |||||||

| FROM OPERATIONS: | ||||||||

| Net investment income | $ | 119,282 | $ | 167,785 | ||||

| Net realized gain/(loss) | 426,777 | (4,498,063 | ) | |||||

| Net change in unrealized appreciation/(depreciation) | 7,534,949 | (3,226,659 | ) | |||||

| Net increase/(decrease) in net assets resulting from operations | 8,081,008 | (7,556,937 | ) | |||||

| DISTRIBUTIONS TO SHAREHOLDERS: | ||||||||

| From distributable earnings | (177,673 | ) | – | |||||

| Decrease in net assets from distributions to shareholders | (177,673 | ) | – | |||||

| CAPITAL SHARE TRANSACTIONS: | ||||||||

| Proceeds from shares sold | 567,166 | 2,570,677 | ||||||

| Net asset value of shares issued in reinvestment of distributions to shareholders | 176,005 | – | ||||||

| Payments for shares redeemed | (3,070,583 | ) | (8,273,579 | ) | ||||

| Net Decrease in net assets from capital share transactions | (2,327,412 | ) | (5,702,902 | ) | ||||

| Total Increase/(Decrease) in Net Assets | 5,575,923 | (13,259,839 | ) | |||||

| NET ASSETS: | ||||||||

| Beginning of period | 29,005,984 | 42,265,823 | ||||||

| End of period | $ | 34,581,907 | $ | 29,005,984 | ||||

| SUMMARY OF CAPITAL SHARE ACTIVITY: | ||||||||

| Shares sold | 26,552 | 119,537 | ||||||

| Shares issued in reinvestment of distributions to shareholders | 7,349 | – | ||||||

| Shares redeemed | (147,356 | ) | (396,690 | ) | ||||

| Net Decrease in shares outstanding | (113,455 | ) | (277,153 | ) | ||||

| Shares outstanding, beginning of year | 1,543,120 | 1,820,273 | ||||||

| Shares outstanding, end of year | 1,429,665 | 1,543,120 | ||||||

See Notes to Financial Statements.

| Semi-Annual Report | December 31, 2020 | 27 |

| Statements of Changes in Net Assets | James Micro Cap Fund |

| For the Six Months Ended

December 31, 2020 (Unaudited) | For the Year Ended June 30, 2020 | |||||||

| FROM OPERATIONS: | ||||||||

| Net investment income | $ | 74,590 | $ | 96,482 | ||||

| Net change in unrealized appreciation/(depreciation) | 4,541,222 | (2,592,497 | ) | |||||

| Net increase/(decrease) in net assets resulting from operations | 4,693,377 | (4,625,148 | ) | |||||

| DISTRIBUTIONS TO SHAREHOLDERS: | ||||||||

| From distributable earnings | (125,693 | ) | (880,621 | ) | ||||

| Decrease in net assets from distributions to shareholders | (125,693 | ) | (880,621 | ) | ||||

| CAPITAL SHARE TRANSACTIONS: | ||||||||

| Proceeds from shares sold | 326,184 | 1,113,550 | ||||||

| Net asset value of shares issued in reinvestment of distributions to shareholders | 125,625 | 877,987 | ||||||

| Payments for shares redeemed, net of redemption fee | (840,270 | ) | (3,505,536 | ) | ||||

| Net Decrease in net assets from capital share transactions | (388,461 | ) | (1,513,999 | ) | ||||

| Total Increase/(Decrease) in Net Assets | 4,179,223 | (7,019,768 | ) | |||||

| NET ASSETS: | ||||||||

| Beginning of period | 19,580,464 | 26,600,232 | ||||||

| End of period | $ | 23,759,687 | $ | 19,580,464 | ||||

| SUMMARY OF CAPITAL SHARE ACTIVITY: | ||||||||

| Shares sold | 22,599 | 76,686 | ||||||

| Shares issued in reinvestment of distributions to shareholders | 8,043 | 53,384 | ||||||

| Shares redeemed | (61,383 | ) | (262,319 | ) | ||||

| Net Decrease in shares outstanding | (30,741 | ) | (132,249 | ) | ||||

| Shares outstanding, beginning of year | 1,538,589 | 1,670,838 | ||||||

| Shares outstanding, end of year | 1,507,848 | 1,538,589 | ||||||

See Notes to Financial Statements.

| 28 | www.jamesinvestment.com |

| James Aggressive Allocation Fund | Statements of Changes in Net Assets |

| For

the Six Months Ended December 31, 2020 (Unaudited) | For the Year Ended June 30, 2020 | |||||||

| FROM OPERATIONS: | ||||||||

| Net investment income | $ | 80,570 | $ | 263,686 | ||||

| Net realized gain/(loss) | 471,299 | (2,408,560 | ) | |||||

| Net increase/(decrease) in net assets resulting from operations | 2,670,425 | (1,948,371 | ) | |||||

| DISTRIBUTIONS TO SHAREHOLDERS: | ||||||||

| From distributable earnings | (195,964 | ) | (245,700 | ) | ||||

| Decrease in net assets from distributions to shareholders | (195,964 | ) | (245,700 | ) | ||||

| CAPITAL SHARE TRANSACTIONS: | ||||||||

| Proceeds from shares sold | 131,855 | 2,170,346 | ||||||

| Net asset value of shares issued in reinvestment of distributions to shareholders | 195,716 | 244,861 | ||||||

| Payments for shares redeemed | (542,729 | ) | (2,361,900 | ) | ||||

| Net Increase/(Decrease) in net assets from capital share transactions | (215,158 | ) | 53,307 | |||||

| Total Increase/(Decrease) in Net Assets | 2,259,303 | (2,140,764 | ) | |||||

| NET ASSETS: | ||||||||

| Beginning of period | 20,795,018 | 22,935,782 | ||||||

| End of period | $ | 23,054,321 | $ | 20,795,018 | ||||

| SUMMARY OF CAPITAL SHARE ACTIVITY: | ||||||||

| Shares sold | 13,376 | 209,430 | ||||||

| Shares issued in reinvestment of distributions to shareholders | 19,057 | 23,100 | ||||||

| Shares redeemed | (55,147 | ) | (228,978 | ) | ||||

| Net Increase/(Decrease) in shares outstanding | (22,714 | ) | 3,552 | |||||

| Shares outstanding, beginning of year | 2,253,054 | 2,249,502 | ||||||

| Shares outstanding, end of year | 2,230,340 | 2,253,054 | ||||||

See Notes to Financial Statements.

| Semi-Annual Report | December 31, 2020 | 29 |

| Financial Highlights | James Balanced: Golden Rainbow Fund – Retail Class |

For a share outstanding throughout the years or period indicated.

| For

the Six Months Ended December 31, 2020 (Unaudited) | For

the Year Ended June 30, 2020 | For

the Year Ended June 30, 2019 | For

the Year Ended June 30, 2018 | For

the Year Ended June 30, 2017 | For

the Year Ended June 30, 2016 | |||||||||||||||||||

| Net asset value - beginning of year | $ | 20.08 | $ | 20.69 | $ | 23.32 | $ | 24.70 | $ | 24.14 | $ | 24.96 | ||||||||||||

| Income/(Loss) from investment operations: | ||||||||||||||||||||||||

| Net investment income(a) | 0.10 | 0.26 | 0.25 | 0.26 | 0.25 | 0.25 | ||||||||||||||||||

| Net realized and unrealized gain/(loss) | 1.34 | (0.50 | ) | (0.64 | ) | 0.24 | 0.68 | (0.41 | ) | |||||||||||||||

| Total from investment operations | 1.44 | (0.24 | ) | (0.39 | ) | 0.50 | 0.93 | (0.16 | ) | |||||||||||||||

| Less distributions: | ||||||||||||||||||||||||

| From net investment income | (0.10 | ) | (0.22 | ) | (0.29 | ) | (0.27 | ) | (0.28 | ) | (0.23 | ) | ||||||||||||

| From net realized gain on investments | (0.03 | ) | (0.15 | ) | (1.95 | ) | (1.61 | ) | (0.09 | ) | (0.43 | ) | ||||||||||||

| Total distributions | (0.13 | ) | (0.37 | ) | (2.24 | ) | (1.88 | ) | (0.37 | ) | (0.66 | ) | ||||||||||||

| Paid-in capital from redemption fees | – | – | – | – | 0.00 | (b) | – | |||||||||||||||||

| Net asset value at end of year | $ | 21.39 | $ | 20.08 | $ | 20.69 | $ | 23.32 | $ | 24.70 | $ | 24.14 | ||||||||||||

| Total return | 7.19 | %(c) | (1.18 | )% | (1.24 | )% | 1.87 | % | 3.92 | % | (0.64 | )% | ||||||||||||

| Net assets, end of year (in thousands) | $ | 497,644 | $ | 534,314 | $ | 771,733 | $ | 1,514,451 | $ | 2,163,786 | $ | 2,892,809 | ||||||||||||