|

Shareholder Letter

|

1

|

|

Growth of $10,000 or $50,000 Charts

|

5

|

|

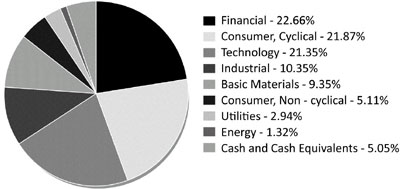

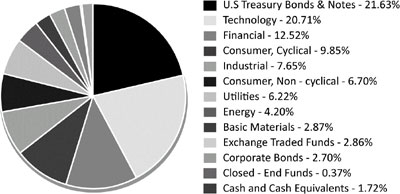

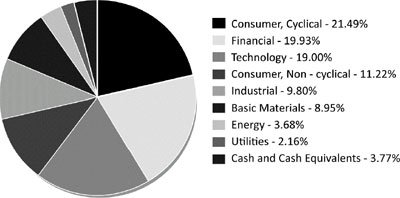

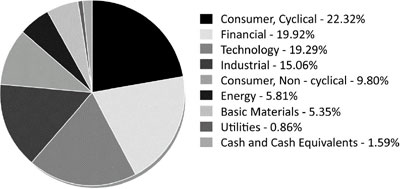

Representation of Schedules of Investments

|

9

|

|

Disclosure of Fund Expenses

|

10

|

|

Schedule of Investments

|

|

|

James Balanced: Golden Rainbow Fund

|

11

|

|

James Small Cap Fund

|

24

|

|

James Mid Cap Fund

|

27

|

|

James Micro Cap Fund

|

30

|

|

James Aggressive Allocation Fund

|

33

|

|

James Long-Short Fund

|

36

|

|

Statements of Assets and Liabilities

|

40

|

|

Statements of Operations

|

42

|

|

Statements of Changes in Net Assets

|

43

|

|

Financial Highlights

|

|

|

James Balanced: Golden Rainbow Fund - Retail Class

|

50

|

|

James Balanced: Golden Rainbow Fund - Institutional Class

|

51

|

|

James Small Cap Fund

|

52

|

|

James Mid Cap Fund

|

53

|

|

James Micro Cap Fund

|

54

|

|

James Aggressive Allocation Fund

|

55

|

|

James Long-Short Fund

|

56

|

|

Notes to Financial Statements

|

57

|

|

Report of Independent Registered Public Accounting Firm

|

65

|

|

Additional Information

|

66

|

|

Disclosure Regarding Approval of Fund Advisory Agreements

|

67

|

|

Trustees & Officers

|

70

|

|

Privacy Policy

|

72

|

|

James Advantage Funds

|

Shareholder Letter

|

June 30, 2017 (Unaudited)

|

Annual Report | June 30, 2017

|

1

|

|

Shareholder Letter

|

James Advantage Funds

|

June 30, 2017 (Unaudited)

| • |

The stock and bond markets have had to adapt to a rising Fed Funds rate. The Federal Reserve (Fed) has started to tighten and is now even looking to reduce holdings on their balance sheet. Much of the stock advance in the last 9 years has come because of the support of the Federal Reserve.

|

| • |

The market has digested the Presidential election and rallied strongly based on the hope of lower regulations and lower taxes. Hope may eventually run dry, but it has sustained the market since the election.

|

| • |

Our economy, while underwhelming, has been stronger than most of the world and this strength attracts investors into the U.S. markets.

|

|

2

|

www.jamesfunds.com

|

|

James Advantage Funds

|

Shareholder Letter

|

June 30, 2017 (Unaudited)

|

Annual Report | June 30, 2017

|

3

|

|

Shareholder Letter

|

James Advantage Funds

|

June 30, 2017 (Unaudited)

|

4

|

www.jamesfunds.com

|

|

James Advantage Funds

|

Growth of $10,000 or $50,000 Charts

|

June 30, 2017 (Unaudited)

|

1 Year

|

5 Years

|

10 Years

|

Since Inception(2)

|

|

|

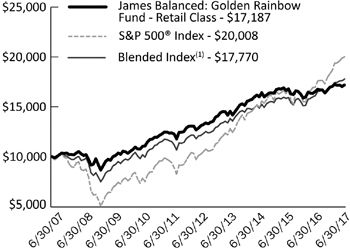

James Balanced: Golden Rainbow – Retail Class

|

3.92%

|

5.96%

|

5.56%

|

7.75%

|

|

S&P 500® Index

|

17.90%

|

14.63%

|

7.18%

|

9.64%

|

|

Blended Index(1)

|

10.21%

|

8.03%

|

5.92%

|

8.03%

|

|

Russell 2000® Index

|

24.60%

|

13.70%

|

6.92%

|

10.05%

|

|

Barclays Capital U.S. Intermediate Government/Credit Bond Index

|

‐0.21%

|

1.77%

|

3.87%

|

5.41%

|

|

(1)

|

The Blended Index is comprised of a 25% weighting in the S&P 500® Index, a 25% weighting in the Russell 2000® Index and a 50% weighting in the Barclays Capital U.S. Intermediate Government/Credit Bond Index.

|

|

(2)

|

Inception was July 1, 1991.

|

|

The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2016, was 0.97%.

|

|

1 Year

|

5 Years

|

Since Inception(2)

|

|

|

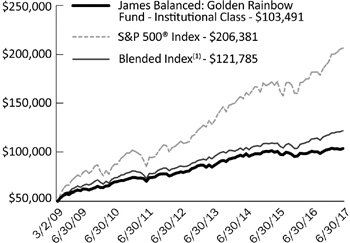

James Balanced: Golden Rainbow – Institutional Class

|

4.23%(3)

|

6.24%

|

9.13%

|

|

S&P 500® Index

|

17.90%

|

14.63%

|

18.56%

|

|

Blended Index(1)

|

10.21%

|

8.03%

|

11.28%

|

|

Russell 2000® Index

|

24.60%

|

13.70%

|

19.20%

|

|

Barclays Capital U.S. Intermediate Government/ Credit Bond Index

|

‐0.21%

|

1.77%

|

3.41%

|

|

(1)

|

The Blended Index is comprised of a 25% weighting in the S&P 500® Index, a 25% weighting in the Russell 2000® Index and a 50% weighting in the Barclays Capital U.S. Intermediate Government/Credit Bond Index.

|

|

(2)

|

Inception was March 2, 2009.

|

|

(3)

|

Excludes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value and total return for shareholder transactions reported to the market may differ from the net asset value for financial reporting purposes.

|

|

The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2016, was 0.72%.

|

|

Annual Report | June 30, 2017

|

5

|

|

Growth of $10,000 or $50,000 Charts

|

James Advantage Funds

|

June 30, 2017 (Unaudited)

Average Annual Total Returns

|

1 Year

|

5 Years

|

10 Years

|

Since Inception(1)

|

|

|

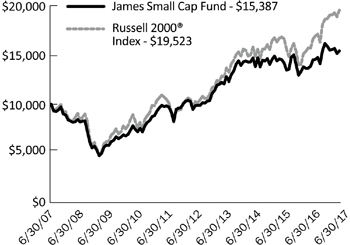

James Small Cap Fund

|

11.36%

|

9.32%

|

4.40%

|

7.90%

|

|

Russell 2000® Index

|

24.60%

|

13.70%

|

6.92%

|

9.18%

|

|

(1)

|

Fund inception was October 2, 1998.

|

|

The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2016, was 1.51%.

|

|

1 Year

|

5 Years

|

10 Years

|

Since Inception(1)

|

|

|

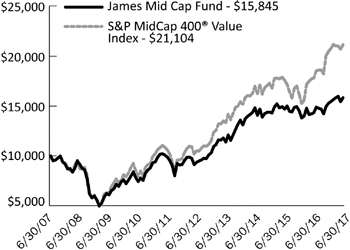

James Mid Cap Fund

|

10.50%

|

11.13%

|

4.71%

|

5.81%

|

|

S&P MidCap 400® Value Index

|

18.47%

|

14.98%

|

7.75%

|

8.68%

|

|

(1)

|

Fund inception was June 30, 2006.

|

|

The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2016, was 1.51%.

|

|

6

|

www.jamesfunds.com

|

|

James Advantage Funds

|

Growth of $10,000 or $50,000 Charts

|

June 30, 2017 (Unaudited)

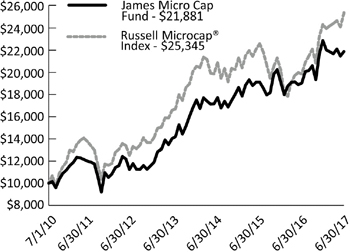

Average Annual Total Returns

|

1 Year

|

5 Year

|

Since Inception(1)

|

|

|

James Micro Cap Fund

|

14.90%

|

13.20%

|

11.84%

|

|

Russell Microcap® Index

|

27.61%

|

13.73%

|

14.21%

|

|

(1)

|

Fund inception was July 1, 2010.

|

|

The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2016, was 1.51%.

|

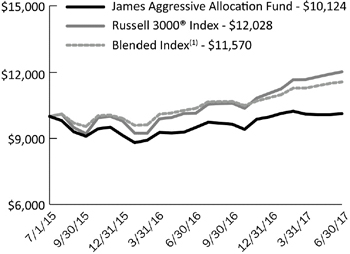

Average Annual Total Returns

|

1 Year

|

Since Inception(2)

|

|

|

James Aggressive Allocation Fund

|

6.54%

|

0.62%

|

|

Russell 3000® Index

|

18.51%

|

9.67%

|

|

Blended Index(1)

|

11.60%

|

7.56%

|

|

(1)

|

The Blended Index is comprised of a 35% weighting in the Barclays U.S. Aggregate Government/Credit Bond Index and a 65% weighting in the Russell 3000® Index.

|

|

(2)

|

Fund inception was July 1, 2015.

|

|

The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2016, was 1.01%.

|

|

Annual Report | June 30, 2017

|

7

|

|

Growth of $10,000 or $50,000 Charts

|

James Advantage Funds

|

June 30, 2017 (Unaudited)

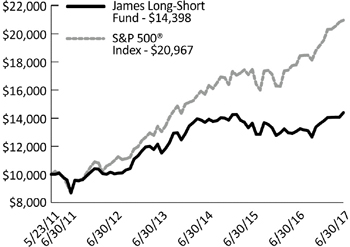

Average Annual Total Returns

|

1 Year

|

5 Years

|

Since Inception(1)

|

|

|

James Long‐Short Fund

|

10.32%

|

7.55%

|

6.15%

|

|

S&P 500® Index

|

17.90%

|

14.63%

|

12.90%

|

|

(1)

|

Fund inception was May 23, 2011.

|

|

The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2016, was 2.53%.

|

|

8

|

www.jamesfunds.com

|

|

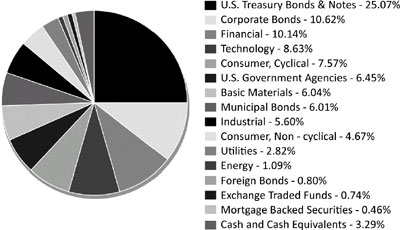

James Advantage Funds

|

Representation of Schedules of Investments

|

June 30, 2017 (Unaudited)

| * |

Holdings are subject to change, and may not reflect the current or future position of the portfolio.

|

|

Annual Report | June 30, 2017

|

9

|

|

Disclosure of Fund Expenses

|

James Advantage Funds

|

June 30, 2017 (Unaudited)

|

Net Expense

Ratio

Annualized

June 30, 2017(a)

|

Beginning

Account Value

January 1, 2017

|

Ending

Account Value

June 30, 2017

|

Expense

Paid During

Period(b)

|

|

|

James Balanced: Golden Rainbow Fund

|

||||

|

Retail Class Actual

|

0.97%

|

$1,000.00

|

$1,013.70

|

$4.84

|

|

Retail Class Hypothetical (5% return before expenses)

|

0.97%

|

$1,000.00

|

$1,019.98

|

$4.86

|

|

Institutional Class Actual

|

0.72%

|

$1,000.00

|

$1,014.70

|

$3.60

|

|

Institutional Class Hypothetical (5% return before expenses)

|

0.72%

|

$1,000.00

|

$1,021.22

|

$3.61

|

|

James Small Cap Fund

|

||||

|

Actual

|

1.50%

|

$1,000.00

|

$953.40

|

$7.27

|

|

Hypothetical (5% return before expenses)

|

1.50%

|

$1,000.00

|

$1,017.36

|

$7.50

|

|

James Mid Cap Fund

|

||||

|

Actual

|

1.50%

|

$1,000.00

|

$1,036.90

|

$7.58

|

|

Hypothetical (5% return before expenses)

|

1.50%

|

$1,000.00

|

$1,017.36

|

$7.50

|

|

James Micro Cap Fund

|

||||

|

Actual

|

1.50%

|

$1,000.00

|

$956.80

|

$7.28

|

|

Hypothetical (5% return before expenses)

|

1.50%

|

$1,000.00

|

$1,017.36

|

$7.50

|

|

James Aggressive Allocation Fund

|

||||

|

Actual

|

0.98%

|

$1,000.00

|

$1,015.20

|

$4.90

|

|

Hypothetical (5% return before expenses)

|

0.98%

|

$1,000.00

|

$1,019.93

|

$4.91

|

|

James Long-Short Fund

|

||||

|

Actual

|

1.57%(c)

|

$1,000.00

|

$1,057.60

|

$8.01

|

|

Hypothetical (5% return before expenses)

|

1.57%(c)

|

$1,000.00

|

$1,017.01

|

$7.85

|

| (a) |

Annualized, based on the Fund's most recent fiscal half year expenses.

|

| (b) |

Expenses are equal to the Fund's annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (181), divided by 365.

|

| (c) |

Dividend and interest expense on securities sold short and interest expense totaled 0.07% (annualized) of average net assets for the six months ended June 30, 2017. Total annual operating expense of 1.57% includes the 0.07% of dividend and interest expense.

|

|

10

|

www.jamesfunds.com

|

|

James Balanced: Golden Rainbow Fund

|

Schedule of Investments

|

|

June 30, 2017

|

|

Shares or Principal Amount

|

Value

|

|||||

|

COMMON STOCKS‐46.56%

|

||||||

|

|

Basic Materials‐6.04%

|

|||||

|

170,565

|

AK Steel Holding Corp.*

|

$

|

1,120,612

|

|||

|

46,770

|

Arconic, Inc.

|

1,059,340

|

||||

|

273,670

|

Avery Dennison Corp.

|

24,184,218

|

||||

|

33,065

|

Brady Corp., Class A

|

1,120,903

|

||||

|

21,095

|

Cabot Corp.

|

1,127,106

|

||||

|

485,865

|

Celanese Corp., Series A

|

46,128,023

|

||||

|

326,280

|

Cloud Peak Energy, Inc.*

|

1,151,768

|

||||

|

254,850

|

Cooper Tire & Rubber Co.

|

9,200,085

|

||||

|

179,445

|

Dow Chemical Co.

|

11,317,596

|

||||

|

80,395

|

Ferro Corp.*

|

1,470,425

|

||||

|

1,095,420

|

Goodyear Tire & Rubber Co.

|

38,295,883

|

||||

|

50,105

|

Huntsman Corp.

|

1,294,713

|

||||

|

279,655

|

Innospec, Inc.

|

18,331,385

|

||||

|

31,500

|

International Paper Co.

|

1,783,215

|

||||

|

18,870

|

KMG Chemicals, Inc.

|

918,403

|

||||

|

30,130

|

Koppers Holdings, Inc.*

|

1,089,199

|

||||

|

75,525

|

Kronos Worldwide, Inc.

|

1,376,066

|

||||

|

47,660

|

Louisiana‐Pacific Corp.*

|

1,149,083

|

||||

|

13,915

|

LyondellBasell Industries NV, Class A

|

1,174,287

|

||||

|

47,010

|

Neenah Paper, Inc.

|

3,772,553

|

||||

|

412,820

|

Newmont Mining Corp.

|

13,371,240

|

||||

|

20,505

|

Nucor Corp.

|

1,186,624

|

||||

|

61,850

|

Orion Engineered Carbons SA

|

1,233,908

|

||||

|

93,230

|

Platform Specialty Products Corp.*

|

1,182,156

|

||||

|

74,590

|

Rayonier Advanced Materials, Inc.

|

1,172,555

|

||||

|

115,050

|

Ryerson Holding Corp.*

|

1,138,995

|

||||

|

35,945

|

Steel Dynamics, Inc.

|

1,287,190

|

||||

|

18,150

|

Trinseo SA

|

1,246,905

|

||||

|

127,160

|

Universal Forest Products, Inc.

|

11,102,340

|

||||

|

86,000

|

Westlake Chemical Corp.

|

5,694,060

|

||||

|

205,680,836

|

||||||

|

|

Consumer, Cyclical‐7.57% | |||||

|

317,220

|

Alaska Air Group, Inc.

|

28,473,667

|

||||

|

20,700

|

AMC Networks, Inc.*

|

1,105,587

|

||||

|

158,300

|

Arcos Dorados Holdings, Inc., Class A*

|

1,179,335

|

||||

|

21,290

|

Asbury Automotive Group, Inc.*

|

1,203,949

|

||||

|

22,950

|

Atlas Air Worldwide Holdings, Inc.*

|

1,196,842

|

||||

|

81,510

|

AV Homes, Inc.*

|

1,634,275

|

||||

|

183,060

|

Avianca Holdings SA, Sponsored ADR

|

1,189,890

|

||||

|

615,710

|

Best Buy Co., Inc.

|

35,298,654

|

||||

|

79,420

|

Big 5 Sporting Goods Corp.

|

1,036,431

|

||||

|

375,395

|

Big Lots, Inc.

|

18,131,578

|

||||

|

81,795

|

Builders FirstSource, Inc.*

|

1,253,099

|

||||

|

32,890

|

CalAtlantic Group, Inc.

|

1,162,661

|

||||

|

21,060

|

Carnival Corp.

|

1,380,904

|

||||

|

16,163

|

Cars.com, Inc.*

|

430,421

|

||||

|

33,035

|

Central Garden & Pet Co., Class A*

|

991,711

|

||||

|

73,030

|

Century Communities, Inc.*

|

1,811,144

|

||||

|

11,215

|

Children's Place, Inc.

|

1,145,051

|

||||

|

60,060

|

China Yuchai International, Ltd.

|

1,093,693

|

||||

|

127,770

|

Commercial Vehicle Group, Inc.*

|

1,079,656

|

||||

|

197,840

|

Container Store Group, Inc.*

|

1,171,213

|

||||

|

See Notes to Financial Statements.

|

|

Annual Report | June 30, 2017

|

11

|

|

Schedule of Investments

|

James Balanced: Golden Rainbow Fund

|

|

June 30, 2017

|

|

Shares or Principal Amount

|

Value

|

|||||

|

|

Consumer, Cyclical (continued)

|

|||||

|

10,710

|

Copa Holdings SA, Class A

|

$

|

1,253,070

|

|||

|

14,875

|

Darden Restaurants, Inc.

|

1,345,295

|

||||

|

42,085

|

Discovery Communications, Inc., Class A*

|

1,087,056

|

||||

|

43,080

|

Discovery Communications, Inc., Class C*

|

1,086,047

|

||||

|

15,620

|

DISH Network Corp., Class A*

|

980,311

|

||||

|

37,125

|

DR Horton, Inc.

|

1,283,411

|

||||

|

76,335

|

Extended Stay America, Inc.

|

1,477,846

|

||||

|

120,740

|

Fiat Chrysler Automobiles NV*

|

1,283,466

|

||||

|

42,520

|

Flexsteel Industries, Inc.

|

2,300,757

|

||||

|

190,000

|

Foot Locker, Inc.

|

9,363,200

|

||||

|

607,670

|

Ford Motor Co.

|

6,799,827

|

||||

|

56,490

|

FTD Cos., Inc.*

|

1,129,800

|

||||

|

36,360

|

General Motors Co.

|

1,270,055

|

||||

|

18,485

|

Group 1 Automotive, Inc.

|

1,170,470

|

||||

|

12,925

|

Hasbro, Inc.

|

1,441,267

|

||||

|

44,930

|

Haverty Furniture Cos., Inc.

|

1,127,743

|

||||

|

316,610

|

Hawaiian Holdings, Inc.*

|

14,864,839

|

||||

|

39,140

|

Herman Miller, Inc.

|

1,189,856

|

||||

|

58,680

|

ILG, Inc.

|

1,613,113

|

||||

|

30,140

|

Insight Enterprises, Inc.*

|

1,205,299

|

||||

|

52,240

|

International Game Technology PLC

|

955,992

|

||||

|

61,910

|

KB Home

|

1,483,983

|

||||

|

62,710

|

Kimball International, Inc., Class B

|

1,046,630

|

||||

|

144,595

|

Lennar Corp., Class A

|

7,709,805

|

||||

|

37,760

|

Liberty Formula One, Class A*

|

1,322,733

|

||||

|

23,760

|

Liberty Ventures, Series A*

|

1,242,410

|

||||

|

61,880

|

M/I Homes, Inc.*

|

1,766,674

|

||||

|

12,535

|

Marriott Vacations Worldwide Corp.

|

1,475,996

|

||||

|

41,510

|

MDC Holdings, Inc.

|

1,466,548

|

||||

|

19,375

|

Meredith Corp.

|

1,151,844

|

||||

|

122,690

|

Meritage Homes Corp.*

|

5,177,518

|

||||

|

51,570

|

MSG Networks, Inc., Class A*

|

1,157,747

|

||||

|

17,990

|

Nexstar Media Group, Inc., Class A

|

1,075,802

|

||||

|

253,350

|

Office Depot, Inc.

|

1,428,894

|

||||

|

45,340

|

Patrick Industries, Inc.*

|

3,303,019

|

||||

|

45,970

|

PCM, Inc.*

|

861,938

|

||||

|

66,675

|

Penn National Gaming, Inc.*

|

1,426,845

|

||||

|

52,610

|

PulteGroup, Inc.

|

1,290,523

|

||||

|

30,765

|

Sinclair Broadcast Group, Inc., Class A

|

1,012,169

|

||||

|

39,290

|

SkyWest, Inc.

|

1,379,079

|

||||

|

577,710

|

Southwest Airlines Co.

|

35,898,899

|

||||

|

48,490

|

TEGNA, Inc.

|

698,741

|

||||

|

13,535

|

Thor Industries, Inc.

|

1,414,678

|

||||

|

115,150

|

Tilly's, Inc., Class A

|

1,168,773

|

||||

|

50,000

|

Time Warner, Inc.

|

5,020,500

|

||||

|

34,800

|

Toll Brothers, Inc.

|

1,374,948

|

||||

|

40,540

|

Twenty‐First Century Fox, Inc., Class B

|

1,129,850

|

||||

|

17,625

|

United Continental Holdings, Inc.*

|

1,326,281

|

||||

|

27,315

|

Viacom, Inc., Class B

|

916,965

|

||||

|

127,135

|

Wabash National Corp.

|

2,794,427

|

||||

|

149,005

|

Wal‐Mart Stores, Inc.

|

11,276,698

|

||||

|

11,800

|

Wyndham Worldwide Corp.

|

1,184,838

|

||||

|

257,184,236

|

||||||

|

See Notes to Financial Statements.

|

|

12

|

www.jamesfunds.com

|

|

James Balanced: Golden Rainbow Fund

|

Schedule of Investments

|

|

June 30, 2017

|

|

Shares or Principal Amount

|

Value

|

|||||

|

|

Consumer, Non‐cyclical‐4.67%

|

|||||

|

34,390

|

Adtalem Global Education, Inc.

|

$

|

1,305,100

|

|||

|

78,625

|

Anthem, Inc.

|

14,791,721

|

||||

|

22,950

|

Brink's Co.

|

1,537,650

|

||||

|

93,310

|

Brookdale Senior Living, Inc.*

|

1,372,590

|

||||

|

194,044

|

DST Systems, Inc.

|

11,972,515

|

||||

|

14,470

|

Eagle Pharmaceuticals, Inc.*

|

1,141,538

|

||||

|

18,635

|

Express Scripts Holding Co.*

|

1,189,658

|

||||

|

20,770

|

Fresh Del Monte Produce, Inc.

|

1,057,401

|

||||

|

122,150

|

Grand Canyon Education, Inc.*

|

9,577,781

|

||||

|

14,045

|

HCA Healthcare, Inc.*

|

1,224,724

|

||||

|

100,000

|

Ingles Markets, Inc., Class A

|

3,330,000

|

||||

|

35,895

|

John B Sanfilippo & Son, Inc.

|

2,265,333

|

||||

|

46,390

|

Kelly Services, Inc., Class A

|

1,041,455

|

||||

|

66,070

|

Lantheus Holdings, Inc.*

|

1,166,136

|

||||

|

180,358

|

ManpowerGroup, Inc.

|

20,136,971

|

||||

|

20,560

|

Medifast, Inc.

|

852,623

|

||||

|

85,000

|

Merck & Co., Inc.

|

5,447,650

|

||||

|

65,000

|

Mylan NV*

|

2,523,300

|

||||

|

142,360

|

Natural Health Trends Corp.

|

3,964,726

|

||||

|

116,870

|

Omega Protein Corp.

|

2,091,973

|

||||

|

700,000

|

Pfizer, Inc.

|

23,513,000

|

||||

|

113,069

|

Sanderson Farms, Inc.

|

13,076,430

|

||||

|

380

|

Seaboard Corp.

|

1,518,100

|

||||

|

385,000

|

Toro Co.

|

26,676,650

|

||||

|

45,050

|

TrueBlue, Inc.*

|

1,193,825

|

||||

|

19,825

|

Tupperware Brands Corp.

|

1,392,310

|

||||

|

19,770

|

Tyson Foods, Inc., Class A

|

1,238,195

|

||||

|

20,630

|

Weis Markets, Inc.

|

1,005,094

|

||||

|

157,604,449

|

||||||

|

|

Energy‐1.09%

|

|||||

|

196,705

|

Chesapeake Energy Corp.*

|

977,624

|

||||

|

140,435

|

Cosan, Ltd., Class A

|

900,188

|

||||

|

92,540

|

FutureFuel Corp.

|

1,396,429

|

||||

|

2,005,900

|

McDermott International, Inc.*

|

14,382,303

|

||||

|

11,040

|

REX American Resources Corp.*

|

1,066,022

|

||||

|

88,890

|

Star Gas Partners LP

|

963,568

|

||||

|

174,950

|

Tesoro Corp.

|

16,375,320

|

||||

|

80,500

|

Transocean, Ltd.*

|

662,515

|

||||

|

36,723,969

|

||||||

|

|

Financial‐10.14%

|

|||||

|

40,795

|

Aaron's, Inc.

|

1,586,925

|

||||

|

28,190

|

AerCap Holdings NV*

|

1,308,862

|

||||

|

61,100

|

AGNC Investment Corp., REIT

|

1,300,819

|

||||

|

33,475

|

Air Lease Corp.

|

1,250,626

|

||||

|

53,755

|

Aircastle, Ltd.

|

1,169,171

|

||||

|

63,055

|

Ally Financial, Inc.

|

1,317,849

|

||||

|

129,448

|

American Financial Group, Inc.

|

12,863,248

|

||||

|

609,372

|

Annaly Capital Management, Inc., REIT

|

7,342,933

|

||||

|

186,295

|

Apollo Investment Corp.

|

1,190,425

|

||||

|

66,675

|

Ares Management LP

|

1,200,150

|

||||

|

200,000

|

Argo Group International Holdings, Ltd.

|

12,120,000

|

||||

|

180,920

|

Ashford Hospitality Trust, Inc., REIT

|

1,099,994

|

||||

|

See Notes to Financial Statements.

|

|

Annual Report | June 30, 2017

|

13

|

|

Schedule of Investments

|

James Balanced: Golden Rainbow Fund

|

|

June 30, 2017

|

|

Shares or Principal Amount

|

Value

|

|||||

|

|

Financial (continued)

|

|||||

|

32,380

|

Assured Guaranty, Ltd.

|

$

|

1,351,541

|

|||

|

72,140

|

B. Riley Financial, Inc.

|

1,338,197

|

||||

|

53,280

|

Bank of America Corp.

|

1,292,573

|

||||

|

109,000

|

Bank of Montreal

|

8,004,960

|

||||

|

112,200

|

BGC Partners, Inc., Class A

|

1,418,208

|

||||

|

37,725

|

CBRE Group, Inc., Class A*

|

1,373,190

|

||||

|

833,101

|

Chimera Investment Corp., REIT

|

15,520,672

|

||||

|

28,350

|

CNA Financial Corp.

|

1,382,062

|

||||

|

38,530

|

CoreCivic, Inc., REIT

|

1,062,657

|

||||

|

39,230

|

CorEnergy Infrastructure Trust, Inc., REIT

|

1,317,736

|

||||

|

7,720

|

Credicorp, Ltd.

|

1,384,891

|

||||

|

6,520

|

Credit Acceptance Corp.*

|

1,676,553

|

||||

|

151,110

|

CYS Investments, Inc., REIT

|

1,270,835

|

||||

|

80,320

|

Enova International, Inc.*

|

1,192,752

|

||||

|

6,625

|

Enstar Group, Ltd.*

|

1,316,056

|

||||

|

64,050

|

ePlus, Inc.*

|

4,746,105

|

||||

|

33,905

|

Essent Group, Ltd.*

|

1,259,232

|

||||

|

16,285

|

Evercore Partners, Inc., Class A

|

1,148,092

|

||||

|

5,365

|

Everest Re Group, Ltd.

|

1,365,875

|

||||

|

123,300

|

EZCORP, Inc., Class A*

|

949,410

|

||||

|

882,250

|

Fifth Third Bancorp

|

22,903,210

|

||||

|

219,865

|

First BanCorp*

|

1,273,018

|

||||

|

32,070

|

FNF Group

|

1,437,698

|

||||

|

96,700

|

Forestar Group, Inc.*

|

1,658,405

|

||||

|

107,650

|

Franklin Resources, Inc.

|

4,821,643

|

||||

|

39,277

|

GEO Group, Inc., REIT

|

1,161,421

|

||||

|

5,470

|

Goldman Sachs Group, Inc.

|

1,213,793

|

||||

|

37,990

|

Green Dot Corp., Class A*

|

1,463,755

|

||||

|

82,150

|

Hercules Capital, Inc.

|

1,087,666

|

||||

|

38,050

|

Hospitality Properties Trust, REIT

|

1,109,157

|

||||

|

66,650

|

Host Hotels & Resorts, Inc., REIT

|

1,217,695

|

||||

|

36,590

|

Houlihan Lokey, Inc.

|

1,276,991

|

||||

|

35,555

|

International Bancshares Corp.

|

1,246,203

|

||||

|

48,910

|

Jernigan Capital, Inc., REIT

|

1,076,020

|

||||

|

518,825

|

JPMorgan Chase & Co.

|

47,420,605

|

||||

|

982,600

|

KeyCorp

|

18,413,924

|

||||

|

66,600

|

LGI Homes, Inc.*

|

2,675,988

|

||||

|

18,960

|

Lincoln National Corp.

|

1,281,317

|

||||

|

26,160

|

Loews Corp.

|

1,224,550

|

||||

|

59,070

|

Maui Land & Pineapple Co., Inc.*

|

1,199,121

|

||||

|

122,655

|

MGIC Investment Corp.*

|

1,373,736

|

||||

|

29,655

|

Morgan Stanley

|

1,321,427

|

||||

|

20,310

|

MutualFirst Financial, Inc.

|

725,067

|

||||

|

78,055

|

Nationstar Mortgage Holdings, Inc.*

|

1,396,404

|

||||

|

377,630

|

Nelnet, Inc., Class A

|

17,752,386

|

||||

|

71,845

|

New Residential Investment Corp., REIT

|

1,117,908

|

||||

|

62,070

|

Old Republic International Corp.

|

1,212,227

|

||||

|

47,150

|

Outfront Media, Inc., REIT

|

1,090,108

|

||||

|

55,920

|

People's Utah Bancorp

|

1,498,656

|

||||

|

17,880

|

Piper Jaffray Cos.

|

1,071,906

|

||||

|

144,825

|

Principal Financial Group, Inc.

|

9,278,938

|

||||

|

11,760

|

Prudential Financial, Inc.

|

1,271,726

|

||||

|

69,055

|

Radian Group, Inc.

|

1,129,049

|

||||

|

74,175

|

Redwood Trust, Inc., REIT

|

1,263,942

|

||||

|

See Notes to Financial Statements.

|

|

14

|

www.jamesfunds.com

|

|

James Balanced: Golden Rainbow Fund

|

Schedule of Investments

|

|

June 30, 2017

|

|

Shares or Principal Amount

|

Value

|

|||||

|

|

Financial (continued) | |||||

|

53,200

|

RLJ Lodging Trust, REIT

|

$

|

1,057,084

|

|||

|

78,170

|

Summit Hotel Properties, Inc., REIT

|

1,457,871

|

||||

|

233,270

|

Torchmark Corp.

|

17,845,155

|

||||

|

60,120

|

TPG Specialty Lending, Inc.

|

1,229,454

|

||||

|

334,224

|

Travelers Cos., Inc.

|

42,289,363

|

||||

|

44,705

|

Triton International, Ltd.

|

1,494,935

|

||||

|

127,500

|

Two Harbors Investment Corp., REIT

|

1,263,525

|

||||

|

501,760

|

Unum Group

|

23,397,069

|

||||

|

29,310

|

Walker & Dunlop, Inc.*

|

1,431,207

|

||||

|

3,531

|

World Acceptance Corp.*

|

264,507

|

||||

|

342,518,429

|

||||||

|

|

Industrial‐5.60% | |||||

|

110,560

|

Advanced Emissions Solutions, Inc.

|

1,012,730

|

||||

|

50,000

|

AGCO Corp.

|

3,369,500

|

||||

|

413,190

|

American Axle & Manufacturing Holdings, Inc.*

|

6,445,764

|

||||

|

135,075

|

American Outdoor Brands Corp.*

|

2,993,262

|

||||

|

80,370

|

Argan, Inc.

|

4,822,200

|

||||

|

53,560

|

CAI International, Inc.*

|

1,264,016

|

||||

|

72,130

|

Casella Waste Systems, Inc., Class A*

|

1,183,653

|

||||

|

69,050

|

Ceco Environmental Corp.

|

633,879

|

||||

|

12,185

|

Cooper‐standard Holding, Inc.*

|

1,229,101

|

||||

|

146,090

|

Costamare, Inc.

|

1,067,918

|

||||

|

8,265

|

Cummins, Inc.

|

1,340,748

|

||||

|

68,155

|

Dana, Inc.

|

1,521,901

|

||||

|

182,500

|

Deere & Co.

|

22,555,175

|

||||

|

16,595

|

Delphi Automotive PLC

|

1,454,552

|

||||

|

233,835

|

DHT Holdings, Inc.

|

970,415

|

||||

|

13,075

|

Dycom Industries, Inc.*

|

1,170,474

|

||||

|

52,400

|

FedEx Corp.

|

11,388,092

|

||||

|

19,940

|

GATX Corp.

|

1,281,544

|

||||

|

177,000

|

Global Brass & Copper Holdings, Inc.

|

5,407,350

|

||||

|

25,480

|

Greenbrier Cos., Inc.

|

1,178,450

|

||||

|

17,600

|

Hill‐Rom Holdings, Inc.

|

1,401,136

|

||||

|

13,305

|

LCI Industries

|

1,362,432

|

||||

|

9,300

|

Lear Corp.

|

1,321,344

|

||||

|

865,890

|

Magna International, Inc.

|

40,116,684

|

||||

|

30,730

|

MasTec, Inc.*

|

1,387,460

|

||||

|

73,855

|

Meritor, Inc.*

|

1,226,732

|

||||

|

28,260

|

Methode Electronics, Inc.

|

1,164,312

|

||||

|

66,730

|

Milacron Holdings Corp.*

|

1,173,781

|

||||

|

15,030

|

NACCO Industries, Inc., Class A

|

1,064,876

|

||||

|

36,820

|

NN, Inc.

|

1,010,709

|

||||

|

17,785

|

Oshkosh Corp.

|

1,225,031

|

||||

|

20,540

|

Owens Corning

|

1,374,537

|

||||

|

60,430

|

Owens‐Illinois, Inc.*

|

1,445,486

|

||||

|

28,690

|

Park‐Ohio Holdings Corp.

|

1,093,089

|

||||

|

50,590

|

Quad/Graphics, Inc.

|

1,159,523

|

||||

|

216,910

|

Sonoco Products Co.

|

11,153,512

|

||||

|

64,970

|

Stoneridge, Inc.*

|

1,001,188

|

||||

|

19,280

|

Sturm Ruger & Co., Inc.

|

1,198,252

|

||||

|

21,185

|

Tenneco, Inc.

|

1,225,129

|

||||

|

56,550

|

Tower International, Inc.

|

1,269,548

|

||||

|

45,730

|

Trinity Industries, Inc.

|

1,281,812

|

||||

|

See Notes to Financial Statements.

|

|

Annual Report | June 30, 2017

|

15

|

|

Schedule of Investments

|

James Balanced: Golden Rainbow Fund

|

|

Shares or Principal Amount

|

Value

|

|||||

|

|

Industrial (continued) | |||||

|

37,840

|

Tutor Perini Corp.*

|

$

|

1,087,900

|

|||

|

309,085

|

United Rentals, Inc.*

|

34,836,970

|

||||

|

54,900

|

Vectrus, Inc.*

|

1,774,368

|

||||

|

13,075

|

Visteon Corp.*

|

1,334,435

|

||||

|

26,230

|

XPO Logistics, Inc.*

|

1,695,245

|

||||

|

13,385

|

Zebra Technologies Corp., Class A*

|

1,345,460

|

||||

|

189,021,675

|

||||||

|

|

Technology-8.63% | |||||

|

743,437

|

ACCO Brands Corp.*

|

8,661,041

|

||||

|

18,635

|

Advanced Energy Industries, Inc.*

|

1,205,498

|

||||

|

54,390

|

Alpha & Omega Semiconductor, Ltd.*

|

906,681

|

||||

|

74,235

|

Amaya, Inc.*

|

1,328,806

|

||||

|

106,925

|

Amkor Technology, Inc.*

|

1,044,657

|

||||

|

15,450

|

Analog Devices, Inc.

|

1,202,010

|

||||

|

15,740

|

Anixter International, Inc.*

|

1,230,868

|

||||

|

31,860

|

Applied Materials, Inc.

|

1,316,137

|

||||

|

316,400

|

Arrow Electronics, Inc.*

|

24,812,088

|

||||

|

27,625

|

Avnet, Inc.

|

1,074,060

|

||||

|

36,700

|

Broadcom, Ltd.

|

8,552,935

|

||||

|

57,175

|

Brooks Automation, Inc.

|

1,240,126

|

||||

|

81,585

|

Cabot Microelectronics Corp.

|

6,023,421

|

||||

|

21,290

|

CDW Corp.

|

1,331,264

|

||||

|

19,075

|

Cirrus Logic, Inc.*

|

1,196,384

|

||||

|

363,070

|

Cisco Systems, Inc.

|

11,364,091

|

||||

|

30,095

|

CommScope Holding Co., Inc.*

|

1,144,513

|

||||

|

487,810

|

Corning, Inc.

|

14,658,690

|

||||

|

711,500

|

Deluxe Corp.

|

49,250,030

|

||||

|

44,890

|

Ducommun, Inc.*

|

1,417,626

|

||||

|

99,930

|

Eastman Kodak Co.*

|

909,363

|

||||

|

175,000

|

Ebix, Inc.

|

9,432,500

|

||||

|

15,970

|

EnerSys

|

1,157,026

|

||||

|

19,180

|

Engility Holdings, Inc.*

|

544,712

|

||||

|

52,840

|

Entegris, Inc.*

|

1,159,838

|

||||

|

195,330

|

Extreme Networks, Inc.*

|

1,800,943

|

||||

|

46,040

|

First Solar, Inc.*

|

1,836,075

|

||||

|

70,500

|

HP, Inc.

|

1,232,340

|

||||

|

37,110

|

II‐VI, Inc.*

|

1,272,873

|

||||

|

461,500

|

Intel Corp.

|

15,571,010

|

||||

|

14,270

|

InterDigital, Inc.

|

1,103,071

|

||||

|

47,120

|

International Business Machines Corp.

|

7,248,470

|

||||

|

137,120

|

Iridium Communications, Inc.*

|

1,515,176

|

||||

|

15,130

|

j2 Global, Inc.

|

1,287,412

|

||||

|

42,915

|

Jabil, Inc.

|

1,252,689

|

||||

|

72,130

|

KEMET Corp.*

|

923,264

|

||||

|

65,685

|

Knowles Corp.*

|

1,111,390

|

||||

|

62,765

|

Kulicke & Soffa Industries, Inc.*

|

1,193,790

|

||||

|

35,325

|

Liberty Global PLC, Class C*

|

1,101,434

|

||||

|

89,930

|

Lockheed Martin Corp.

|

24,965,467

|

||||

|

39,210

|

Logitech International SA

|

1,437,439

|

||||

|

81,460

|

Marvell Technology Group, Ltd.

|

1,345,719

|

||||

|

43,170

|

Micron Technology, Inc.*

|

1,289,056

|

||||

|

18,370

|

MKS Instruments, Inc.

|

1,236,301

|

||||

|

18,565

|

Moog, Inc., Class A*

|

1,331,482

|

||||

|

16

|

www.jamesfunds.com

|

|

James Balanced: Golden Rainbow Fund

|

Schedule of Investments

|

|

Shares or Principal Amount

|

Value

|

|||||

|

|

Technology (continued) | |||||

|

14,790

|

Motorola Solutions, Inc.

|

$

|

1,282,885

|

|||

|

22,680

|

Nanometrics, Inc.*

|

573,577

|

||||

|

27,925

|

NCR Corp.*

|

1,140,457

|

||||

|

30,140

|

NetApp, Inc.

|

1,207,107

|

||||

|

17,500

|

Northrop Grumman Corp.

|

4,492,425

|

||||

|

81,045

|

ON Semiconductor Corp.*

|

1,137,872

|

||||

|

301,625

|

Orbotech, Ltd.*

|

9,839,008

|

||||

|

85,720

|

PC Connection, Inc.

|

2,319,583

|

||||

|

21,520

|

Plexus Corp.*

|

1,131,306

|

||||

|

17,300

|

Qorvo, Inc.*

|

1,095,436

|

||||

|

30,880

|

Sanmina Corp.*

|

1,176,528

|

||||

|

26,820

|

Seagate Technology PLC

|

1,039,275

|

||||

|

261,550

|

SYNNEX Corp.

|

31,375,538

|

||||

|

16,920

|

TE Connectivity, Ltd.

|

1,331,266

|

||||

|

13,675

|

Tech Data Corp.*

|

1,381,175

|

||||

|

40,875

|

Teradata Corp.*

|

1,205,404

|

||||

|

38,610

|

Teradyne, Inc.

|

1,159,458

|

||||

|

54,925

|

Tower Semiconductor, Ltd.*

|

1,309,961

|

||||

|

75,160

|

TTM Technologies, Inc.*

|

1,304,778

|

||||

|

70,120

|

Unisys Corp.*

|

897,536

|

||||

|

121,340

|

Viavi Solutions, Inc.*

|

1,277,710

|

||||

|

14,735

|

Western Digital Corp.

|

1,305,521

|

||||

|

291,203,572

|

||||||

|

|

Utilities-2.82% | |||||

|

225,520

|

American Electric Power Co., Inc.

|

15,666,874

|

||||

|

943,700

|

AT&T, Inc.

|

35,605,801

|

||||

|

314,850

|

CenterPoint Energy, Inc.

|

8,620,593

|

||||

|

79,620

|

DTE Energy Co.

|

8,423,000

|

||||

|

16,190

|

Entergy Corp.

|

1,242,906

|

||||

|

60,940

|

IDT Corp., Class B

|

875,708

|

||||

|

20,345

|

National Fuel Gas Co.

|

1,136,065

|

||||

|

18,335

|

PG&E Corp.

|

1,216,894

|

||||

|

97,210

|

Pinnacle West Capital Corp.

|

8,278,404

|

||||

|

78,220

|

PNM Resources, Inc.

|

2,991,915

|

||||

|

240,510

|

UGI Corp.

|

11,643,089

|

||||

|

95,701,249

|

||||||

|

TOTAL COMMON STOCKS (Cost $1,185,378,801)

|

1,575,638,415

|

|||||

|

EXCHANGE TRADED FUNDS-0.74%

|

||||||

|

107,910

|

iShares® MSCI All Peru Capped ETF

|

3,654,912

|

||||

|

109,760

|

iShares® MSCI Canada ETF

|

2,937,178

|

||||

|

94,410

|

iShares® MSCI Chile Capped ETF

|

3,934,065

|

||||

|

30,590

|

iShares® MSCI Philippines ETF

|

1,096,040

|

||||

|

7,000

|

iShares® National AMT-Free Municipal Bond ETF

|

770,840

|

||||

|

454,760

|

iShares® Silver Trust ETF*

|

7,144,280

|

||||

|

44,610

|

SPDR® Gold Shares ETF*

|

5,264,872

|

||||

|

TOTAL EXCHANGE TRADED FUNDS (Cost $21,876,687)

|

24,802,187

|

|||||

|

Annual Report | June 30, 2017

|

17

|

|

Schedule of Investments

|

James Balanced: Golden Rainbow Fund

|

| Shares or Principal Amount |

Value

|

||||||

| CORPORATE BONDS-10.62 % | |||||||

|

Basic Materials-0.05%

|

|||||||

| $ |

1,500,000

|

E.I. du Pont de Nemours & Co., 5.750%, 3/15/19

|

$

|

1,594,348

|

|||

|

Communications-0.25%

|

|||||||

|

8,000,000

|

Alphabet, Inc., 3.625%, 5/19/21

|

8,468,016

|

|||||

|

Consumer, Cyclical-0.60%

|

|||||||

|

5,000,000

|

eBay, Inc., 2.600%, 7/15/22

|

4,955,425

|

|||||

|

5,000,000

|

Home Depot, Inc., 2.700%, 4/1/23

|

5,072,195

|

|||||

|

5,000,000

|

Home Depot, Inc., 5.950%, 4/1/41

|

6,618,960

|

|||||

|

785,000

|

McDonald's Corp., 5.700%, 2/1/39

|

947,353

|

|||||

|

2,000,000

|

Wal-Mart Stores, Inc., 5.250%, 9/1/35

|

2,441,982

|

|||||

|

20,035,915

|

|||||||

|

Consumer, Non-cyclical-1.40%

|

|||||||

|

10,000,000

|

Coca-Cola Co., 3.200%, 11/1/23

|

10,375,620

|

|||||

|

1,950,000

|

Dr Pepper Snapple Group, Inc., 2.530%, 11/15/21

|

1,948,844

|

|||||

|

3,000,000

|

Hershey Co., 4.125%, 12/1/20

|

3,204,267

|

|||||

|

5,475,000

|

Johnson & Johnson, 4.500%, 9/1/40

|

6,256,020

|

|||||

|

5,000,000

|

Merck & Co., Inc., 2.800%, 5/18/23

|

5,094,085

|

|||||

|

10,000,000

|

Merck & Co., Inc., 4.150%, 5/18/43

|

10,670,750

|

|||||

|

10,000,000

|

PepsiCo, Inc., 5.000%, 6/1/18

|

10,322,820

|

|||||

|

47,872,406

|

|||||||

|

Energy-1.34%

|

|||||||

|

5,000,000

|

Apache Corp., 3.250%, 4/15/22

|

5,072,355

|

|||||

|

5,000,000

|

BP Capital Markets PLC, 3.245%, 5/6/22

|

5,142,845

|

|||||

|

8,271,000

|

Chevron Corp., 3.326%, 11/17/25

|

8,477,626

|

|||||

|

2,000,000

|

Phillips 66, 4.300%, 4/1/22

|

2,142,852

|

|||||

|

5,050,000

|

Shell International Finance BV, 2.375%, 8/21/22

|

5,020,296

|

|||||

|

5,000,000

|

Shell International Finance BV, 6.375%, 12/15/38

|

6,660,580

|

|||||

|

2,625,000

|

Shell International Finance BV, 4.375%, 5/11/45

|

2,751,108

|

|||||

|

10,000,000

|

Statoil ASA, 2.250%, 11/8/19

|

10,063,460

|

|||||

|

45,331,122

|

|||||||

|

Financial-3.56%

|

|||||||

|

8,000,000

|

Aflac, Inc., 3.625%, 11/15/24

|

8,378,352

|

|||||

|

3,000,000

|

American Express Credit Corp., 2.125%, 7/27/18

|

3,011,955

|

|||||

|

5,250,000

|

American Express Credit Corp., 2.600%, 9/14/20

|

5,320,975

|

|||||

|

5,000,000

|

Australia & New Zealand Banking Group, Ltd., 2.625%, 5/19/22

|

5,005,800

|

|||||

|

8,100,000

|

Berkshire Hathaway, Inc., 3.750%, 8/15/21

|

8,622,369

|

|||||

|

10,000,000

|

GE Capital International Funding Co. Unlimited Co., 2.342%, 11/15/20

|

10,079,070

|

|||||

|

10,000,000

|

Goldman Sachs Group, Inc., 2.600%, 4/23/20

|

10,092,140

|

|||||

|

10,000,000

|

HSBC Holdings PLC, 4.000%, 3/30/22

|

10,545,840

|

|||||

|

11,000,000

|

JPMorgan Chase & Co., 4.250%, 10/15/20

|

11,679,734

|

|||||

|

5,000,000

|

National Australia Bank, Ltd., 2.500%, 5/22/22

|

4,971,045

|

|||||

|

5,000,000

|

National Rural Utilities Cooperative Finance Corp., 2.450%, 6/15/22

|

4,954,240

|

|||||

|

15,956,000

|

PNC Bank NA, 1.950%, 3/4/19

|

15,985,487

|

|||||

|

6,000,000

|

PNC Bank NA, 2.950%, 2/23/25

|

5,986,134

|

|||||

|

5,000,000

|

UBS AG, 5.875%, 12/20/17

|

5,101,695

|

|||||

|

5,305,000

|

US Bank NA Cincinnati, 1.473%, 1/24/20(a)

|

5,323,928

|

|||||

|

5,000,000

|

Wells Fargo & Co., 2.500%, 3/4/21

|

5,016,855

|

|||||

|

120,075,619

|

|||||||

|

Industrial-0.80%

|

|||||||

|

1,000,000

|

Caterpillar, Inc., 7.900%, 12/15/18

|

1,087,867

|

|||||

|

1,000,000

|

Caterpillar, Inc., 8.250%, 12/15/38

|

1,622,520

|

|||||

|

18

|

www.jamesfunds.com

|

|

James Balanced: Golden Rainbow Fund

|

Schedule of Investments

|

| Shares or Principal Amount |

Value

|

||||||

|

|

Industrial (continued) | ||||||

| $ |

10,000,000

|

General Electric Co., 1.958%, 4/15/20(a)

|

$

|

10,176,560

|

|||

|

1,000,000

|

General Electric Co., 2.700%, 10/9/22

|

1,017,009

|

|||||

|

2,000,000

|

General Electric Co., 6.875%, 1/10/39

|

2,902,368

|

|||||

|

5,000,000

|

United Parcel Service, Inc., 2.350%, 5/16/22

|

5,023,225

|

|||||

|

5,000,000

|

United Technologies Corp., 3.100%, 6/1/22

|

5,165,965

|

|||||

|

26,995,514

|

|||||||

|

|

Technology-2.30%

|

||||||

|

3,419,000

|

Apple, Inc., 1.550%, 2/7/20

|

3,401,936

|

|||||

|

10,000,000

|

Apple, Inc., 1.379%, 2/7/20(a)

|

10,024,370

|

|||||

|

5,000,000

|

Intel Corp., 3.300%, 10/1/21

|

5,227,715

|

|||||

|

5,000,000

|

Intel Corp., 2.875%, 5/11/24

|

5,017,640

|

|||||

|

7,000,000

|

International Business Machines Corp., 1.875%, 8/1/22

|

6,822,998

|

|||||

|

9,000,000

|

Microsoft Corp., 1.850%, 2/6/20

|

9,022,320

|

|||||

|

3,700,000

|

Microsoft Corp., 5.200%, 6/1/39

|

4,501,738

|

|||||

|

10,000,000

|

Microsoft Corp., 3.500%, 11/15/42

|

9,859,000

|

|||||

|

7,266,000

|

Oracle Corp., 2.500%, 10/15/22

|

7,304,284

|

|||||

|

6,000,000

|

Oracle Corp., 2.400%, 9/15/23

|

5,921,292

|

|||||

|

10,000,000

|

QUALCOMM, Inc., 4.650%, 5/20/35

|

10,909,430

|

|||||

|

78,012,723

|

|||||||

|

|

Utilities-0.32%

|

||||||

|

5,000,000

|

Duke Energy Florida LLC, 5.800%, 9/15/17

|

5,042,055

|

|||||

|

1,000,000

|

Georgia Power Co., 5.400%, 6/1/18

|

1,033,136

|

|||||

|

4,600,000

|

San Diego Gas & Electric Co., 3.000%, 8/15/21

|

4,731,633

|

|||||

|

10,806,824

|

|||||||

|

|

|||||||

| TOTAL CORPORATE BONDS (Cost $354,148,133) |

359,192,487

|

||||||

| Shares or Principal Amount |

Value

|

||||||

| MUNICIPAL BONDS-6.01% | |||||||

|

|

Connecticut-0.18% | ||||||

|

5,350,000

|

State of Connecticut, Series D, 5.000%, 11/1/25

|

6,058,287

|

|||||

|

|

Florida-0.41% | ||||||

|

10,775,000

|

Florida State Board of Education Capital Outlay General Obligation Bonds, Series C, 5.000%, 6/1/23

|

12,857,269

|

|||||

|

1,000,000

|

Florida State Board of Education Capital Outlay General Obligation Bonds, Series D, 5.000%, 6/1/38

|

1,045,570

|

|||||

|

13,902,839

|

|||||||

|

|

Georgia-0.27%

|

||||||

|

3,000,000

|

State of Georgia General Obligation Unlimited Bonds, Series B, 4.500%, 1/1/29

|

3,120,510

|

|||||

|

5,000,000

|

State of Georgia General Obligation Unlimited Bonds, Series D, 5.000%, 2/1/25

|

5,961,150

|

|||||

|

9,081,660

|

|||||||

|

|

Hawaii-0.31%

|

||||||

|

9,000,000

|

City and County of Honolulu General Obligation Unlimited Bonds, Series B, 5.000%, 11/1/25

|

10,554,210

|

|||||

|

|

Illinois-0.03%

|

||||||

|

1,000,000

|

Village of Bolingbrook General Obligation Unlimited Bonds, 5.000%, 1/1/37

|

1,012,050

|

|||||

|

|

Maryland-0.15%

|

||||||

|

5,000,000

|

County of Montgomery General Obligation Unlimited Bonds, Series A, 3.000%, 11/1/29

|

5,071,050

|

|||||

|

Annual Report | June 30, 2017

|

19

|

| Schedule of Investments | James Balanced: Golden Rainbow Fund |

June 30, 2017

| Shares or Principal Amount | Value | |||||||

| Massachusetts-0.03% | ||||||||

| $ | 1,000,000 | Commonwealth of Massachusetts General Obligation Limited Bonds, Series C, Prefunded 8/1/17 @ 100, 5.250%, 8/1/22(b) | $ | 1,003,020 | ||||

| Ohio-1.90% | ||||||||

| 7,450,000 | Beavercreek City School District General Obligation Unlimited Bonds, 3.250%, 12/1/36 | 7,386,228 | ||||||

| 6,395,000 | City of Cincinnati General Obligation Unlimited Bonds, Series A,, 3.000%, 12/1/27 | 6,643,510 | ||||||

| 5,450,000 | City of Columbus General Obligation Various Purpose Limited Tax Bonds, Series B, 3.250%, 8/15/24 | 5,885,455 | ||||||

| 5,000,000 | County of Cuyahoga General Obligation Limited (Capital Improvement), Series A, 4.000%, 12/1/37 | 5,150,700 | ||||||

| 2,580,000 | County of Trumbull OH General Obligation Limited Notes, Series B, 2.000%, 8/31/17 | 2,582,967 | ||||||

| Greenville City School District General Obligation Unlimited Bonds (School Improvement): | ||||||||

| 5,000,000 | 5.000%, 1/1/46 | 5,590,400 | ||||||

| 11,000,000 | 5.500%, 1/1/51 | 12,204,720 | ||||||

| 1,100,000 | Miamisburg City School District General Obligation Unlimited Bonds (School Facilities Construction & Improvement), Prerefunded 12/1/18 @ 100, 5.000%, 12/1/33(b) | 1,160,654 | ||||||

| 500,000 | Mount Healthy City School District General Obligation Unlimited Bonds (School Improvement), Prefunded 6/1/18 @ 100, 5.000%, 12/1/26(b) | 517,880 | ||||||

| 1,000,000 | Ohio State University General Recipients Revenue Bonds, Series C, 4.910%, 6/1/40 | 1,195,630 | ||||||

| 105,000 | Ohio State University Revenue Bonds, Series A, Prefunded 12/1/18 @ 100, 5.000%, 12/1/28(b) | 110,790 | ||||||

| 500,000 | Springboro Community City School District General Obligation Unlimited Bonds, 5.250%, 12/1/23 | 588,050 | ||||||

| State of Ohio General Obligation Unlimited Bonds, Series A, Prefunded 3/1/18 @ 100: | ||||||||

| 365,000 | 5.375%, 9/1/28(b) | 375,384 | ||||||

| 635,000 | 5.375%, 9/1/28(b) | 653,275 | ||||||

| 3,475,000 | State of Ohio General Obligation Unlimited Bonds, Series C, 5.000%, 9/1/19 | 3,760,958 | ||||||

| 6,900,000 | State of Ohio General Obligation Unlimited Bonds, Series S, 5.000%, 5/1/28 | 8,397,714 | ||||||

| 790,000 | The Ohio State University Revenue Bonds, Series A, Prefunded 12/01/18 @100, 5.000%, 12/1/28(b) | 833,560 | ||||||

| 105,000 | The Ohio State University Revenue Bonds, Series A, Unrefunded, 5.000%, 12/1/28 | 110,684 | ||||||

| 1,000,000 | Wright State University Revenue Bonds, 4.000%, 5/1/18 | 1,019,860 | ||||||

| 64,168,419 | ||||||||

| Pennsylvania-1.36% | ||||||||

| Commonwealth of Pennsylvania General Obligation Unlimited Bonds, First Series: | ||||||||

| 20,000,000 | 5.000%, 6/1/24 | 23,051,000 | ||||||

| 12,005,000 | 5.000%, 3/15/25 | 14,380,669 | ||||||

| 7,050,000 | 5.000%, 9/15/26 | 8,605,653 | ||||||

| 46,037,322 | ||||||||

| Tennessee-0.17% | ||||||||

| 5,000,000 | Metropolitan Government of Nashville & Davidson County TN General Obligation Unlimited Bonds, Series C, 4.000%, 7/1/24 | 5,736,750 | ||||||

| Texas-0.69% | ||||||||

| 1,000,000 | Friendswood Independent School District General Obligation Unlimited Bonds (Schoolhouse), Prefunded 2/15/18 @ 100, 5.000%, 2/15/37(b) | 1,024,620 | ||||||

| 5,000,000 | Houston Texas Independent School District General Obligation Limited Bonds, Series A, 5.000%, 2/15/28 | 6,096,750 | ||||||

| 5,335,000 | Port of Houston Authority General Obligation Unlimited Bonds, Series D-1, 5.000%, 10/1/35 | 5,918,329 | ||||||

| 7,620,000 | Referendum Transportation Community Mobility General Obligation Unlimited Bonds, Series A, 5.000%, 10/1/25 | 9,432,493 | ||||||

| Tyler Independent School District General Obligation Unlimited Bonds, Prefunded 2/15/18 @ 100: | ||||||||

| 475,000 | 5.000%, 2/15/34(b) | 486,547 | ||||||

| 290,000 | 5.000%, 2/15/34(b) | 297,050 | ||||||

| 235,000 | Tyler Independent School District General Obligation Unlimited Bonds, Unrefunded 2016, 5.000%, 2/15/34 | 240,631 | ||||||

| 23,496,420 | ||||||||

See Notes to Financial Statements.

| 20 | www.jamesfunds.com |

| James Balanced: Golden Rainbow Fund | Schedule of Investments |

June 30, 2017

| Shares or Principal Amount | Value | |||||||

| Washington-0.34% | ||||||||

| $ | 5,000,000 | State of Washington General Obligation Unlimited Bonds, Series D, 4.000%, 2/1/37 | $ | 5,249,000 | ||||

| 5,845,000 | State of Washington General Obligation Various Purpose Unlimited Bonds, Series D, 5.000%, 2/1/20 | 6,406,821 | ||||||

| 11,655,821 | ||||||||

| Wisconsin-0.17% | ||||||||

| 5,000,000 | State of Wisconsin General Obligation Unlimited Bonds, Series C, Prefunded 5/1/21 @ 100, 5.000%, 5/1/25(b) | 5,681,050 | ||||||

| TOTAL MUNICIPAL BONDS (Cost $199,277,766) | 203,458,898 | |||||||

| Shares or Principal Amount | Value | |||||||

| U.S. GOVERNMENT AGENCIES-6.45% | ||||||||

| Federal Agricultural Mortgage Corporation-0.29% | ||||||||

| $ | 10,000,000 | 1.379%, 1/3/22(a) | 10,012,320 | |||||

| Federal Farm Credit Banks-1.64% | ||||||||

| 10,000,000 | 1.170%, 5/16/19 | 9,945,600 | ||||||

| 10,000,000 | 2.350%, 5/2/24 | 9,858,580 | ||||||

| 5,725,000 | 2.750%, 11/6/26 | 5,732,236 | ||||||

| 10,000,000 | 3.300%, 3/22/27 | 10,056,720 | ||||||

| 10,000,000 | 2.800%, 6/2/28 | 9,792,490 | ||||||

| 10,000,000 | 3.220%, 3/26/31 | 10,157,980 | ||||||

| 55,543,606 | ||||||||

| Federal Home Loan Banks-3.54% | ||||||||

| 50,000,000 | 1.000%, 8/28/18 | 49,743,450 | ||||||

| 11,250,000 | 1.200%, 5/23/19 | 11,183,951 | ||||||

| 5,000,000 | 1.600%, 10/22/20 | 4,943,445 | ||||||

| 10,000,000 | 2.050%, 6/9/23 | 9,899,700 | ||||||

| 10,000,000 | 2.620%, 4/28/26 | 9,790,540 | ||||||

| 10,000,000 | 3.000%, 7/12/27 | 9,848,920 | ||||||

| 5,981,481 | 3.000%, 4/18/31 | 5,975,955 | ||||||

| 19,000,000 | 2.000%, 6/30/31(c) | 18,337,356 | ||||||

| 119,723,317 | ||||||||

| Federal Home Loan Mortgage Corporation-0.44% | ||||||||

| 5,000,000 | 1.125%, 8/26/19(c) | 4,978,670 | ||||||

| 10,000,000 | 1.800%, 4/13/20 | 9,993,760 | ||||||

| 14,972,430 | ||||||||

| Tennessee Valley Authority-0.39% | ||||||||

| 10,000,000 | 5.250%, 9/15/39 | 13,140,440 | ||||||

| United States Department of Housing and Urban Development-0.15% | ||||||||

| 5,000,000 | 2.050%, 8/1/19 | 5,022,645 | ||||||

| TOTAL U.S. GOVERNMENT AGENCIES (Cost $220,298,219) | 218,414,758 | |||||||

| Shares or Principal Amount | Value | |||||||

| MORTGAGE BACKED SECURITIES-0.46% | ||||||||

| Federal National Mortgage Association-0.37% | ||||||||

| 10,809,012 | 3.500%, 9/1/33 | 11,280,132 | ||||||

| 1,274,113 | 4.500%, 9/1/40 | 1,340,915 | ||||||

| 12,621,047 | ||||||||

See Notes to Financial Statements.

| Annual Report | June 30, 2017 | 21 |

| Schedule of Investments | James Balanced: Golden Rainbow Fund |

June 30, 2017

| Shares or Principal Amount | Value | |||||||

| Government National Mortgage Association-0.09% | ||||||||

| $ | 2,897,784 | 4.000%, 12/20/40 | $ | 3,075,355 | ||||

| TOTAL MORTGAGE BACKED SECURITIES (Cost $15,317,614) | 15,696,402 | |||||||

| Shares or Principal Amount | Value | |||||||

| U.S. TREASURY BONDS & NOTES-25.07% | ||||||||

| U.S. Treasury Bonds-7.48% | ||||||||

| $ | 97,500,000 | 2.625%, 11/15/20 | 100,619,220 | |||||

| 48,000,000 | 2.125%, 5/15/25 | 47,692,512 | ||||||

| 60,000,000 | 2.000%, 8/15/25 | 58,968,720 | ||||||

| 20,000,000 | 2.375%, 5/15/27 | 20,128,900 | ||||||

| 25,000,000 | 3.000%, 2/15/47 | 25,833,975 | ||||||

| 253,243,327 | ||||||||

| U.S. Treasury Notes-14.57% | ||||||||

| 5,000,000 | 0.875%, 11/15/17 | 4,995,500 | ||||||

| 155,000,000 | 1.500%, 8/31/18 | 155,290,625 | ||||||

| 180,000,000 | 2.750%, 2/15/19 | 184,000,860 | ||||||

| 30,000,000 | 1.250%, 6/30/19 | 29,901,570 | ||||||

| 25,000,000 | 0.750%, 7/15/19 | 24,676,750 | ||||||

| 30,000,000 | 1.375%, 9/30/20 | 29,776,170 | ||||||

| 15,000,000 | 1.125%, 2/28/21 | 14,694,720 | ||||||

| 25,000,000 | 1.750%, 5/31/22 | 24,850,575 | ||||||

| 25,000,000 | 2.000%, 6/30/24 | 24,695,300 | ||||||

| 492,882,070 | ||||||||

| United States Treasury Inflation Indexed Bonds-3.02% | ||||||||

| 30,927,620 | 1.625%, 1/15/18 | 31,068,557 | ||||||

| 32,544,600 | 0.625%, 7/15/21 | 33,350,892 | ||||||

| 37,809,100 | 0.125%, 1/15/22 | 37,748,568 | ||||||

| 102,168,017 | ||||||||

| TOTAL U.S. TREASURY BONDS & NOTES (Cost $846,652,688) | 848,293,414 | |||||||

| Shares or Principal Amount | Value | |||||||

| FOREIGN BONDS-0.80% | ||||||||

| Australia Government Bond-0.24% | ||||||||

| AUD 10,000,000 | 5.250%, 3/15/19 | 8,133,989 | ||||||

| New Zealand Government Bond-0.34% | ||||||||

| NZD 15,000,000 | 5.000%, 3/15/19 | 11,522,125 | ||||||

| Singapore Government-0.22% | ||||||||

| SGD 10,000,000 | 2.250%, 6/1/21 | 7,466,686 | ||||||

| TOTAL FOREIGN BONDS (Cost $27,536,735) | 27,122,800 | |||||||

See Notes to Financial Statements.

| 22 | www.jamesfunds.com |

| James Balanced: Golden Rainbow Fund | Schedule of Investments |

June 30, 2017

| Shares or Principal Amount | Value | |||||||

| SHORT TERM INVESTMENTS-5.20% | ||||||||

| Mutual Fund-5.20% | ||||||||

| 175,877,619 | First American Treasury Obligations Fund, Class Z, 7-Day Yield 0.839% | $ | 175,877,619 | |||||

| TOTAL SHORT TERM INVESTMENTS (Cost $175,877,619) | 175,877,619 | |||||||

| TOTAL INVESTMENT SECURITIES-101.91% (Cost $3,046,364,262) | 3,448,496,980 | |||||||

| OTHER LIABILITIES IN EXCESS OF OTHER ASSETS-(1.91)% | (64,616,789 | ) | ||||||

| NET ASSETS-100.00% | $ | 3,383,880,191 | ||||||

For Fund compliance purposes, the Fund's industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. Those definitions may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

|

* |

Non-income producing security. |

|

(a) |

Floating or variable rate security. Interest rate disclosed is that which is in effect at June 30, 2017. |

|

(b) |

Prefunded Issues are bonds which are prerefunded and collateralized by U.S. Treasury securities held in escrow and used to pay principal and interest on tax exempt issues and to retire the bonds in full at the earliest refunding date. |

|

(c) |

Step coupon. Coupon increases periodically based upon a predetermined schedule. Interest rate disclosed is that which is in effect as of June 30, 2017. |

AUD - Australian Dollar

NZD - New Zealand Dollar

SGD - Singapore Dollar

See Notes to Financial Statements.

| Annual Report | June 30, 2017 | 23 |

|

Schedule of Investments

|

James Small Cap Fund

|

June 30, 2017

|

Shares

|

Value

|

|||||

|

COMMON STOCKS‐96.23%

|

||||||

|

Basic Materials‐8.95%

|

||||||

|

94,060

|

AK Steel Holding Corp.*

|

$

|

617,974

|

|||

|

16,420

|

Cooper Tire & Rubber Co.

|

592,762

|

||||

|

48,030

|

Ferro Corp.*

|

878,469

|

||||

|

37,810

|

Harsco Corp.*

|

608,741

|

||||

|

43,750

|

Kronos Worldwide, Inc.

|

797,125

|

||||

|

21,830

|

Lydall, Inc.*

|

1,128,611

|

||||

|

34,840

|

Orion Engineered Carbons SA

|

695,058

|

||||

|

10,665

|

Trinseo SA

|

732,686

|

||||

|

6,051,426

|

||||||

|

|

Consumer, Cyclical‐21.49%

|

|||||

|

91,140

|

Arcos Dorados Holdings, Inc., Class A*

|

678,993

|

||||

|

10,580

|

Asbury Automotive Group, Inc.*

|

598,299

|

||||

|

15,125

|

Big Lots, Inc.

|

730,537

|

||||

|

29,520

|

Bloomin' Brands, Inc.

|

626,710

|

||||

|

49,020

|

Builders FirstSource, Inc.*

|

750,986

|

||||

|

15,160

|

Century Communities, Inc.*

|

375,968

|

||||

|

6,135

|

Children's Place, Inc.

|

626,383