Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-08411

(Investment Company Act file number)

James Advantage Funds

(Exact name of registrant as specified in charter)

1349 Fairground Road

Beavercreek, Ohio 45385

(Address of principal executive offices) (Zip code)

Barry R. James

P.O. Box 8

Alpha, Ohio 45301

(Name and address of agent for service)

Registrant’s telephone number, including area code: (937) 426-7640

Date of fiscal year end: June 30

Date of reporting period: July 1, 2012 – December 31, 2012

Table of Contents

Item 1. Reports to Stockholders.

Table of Contents

Table of Contents

| 1 | ||||

| 3 | ||||

| 6 | ||||

| 7 | ||||

| 8 | ||||

| 17 | ||||

| 20 | ||||

| 22 | ||||

| 24 | ||||

| 26 | ||||

| 28 | ||||

| 29 | ||||

| 35 | ||||

| 36 | ||||

| 37 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| 41 | ||||

| 42 | ||||

| 49 | ||||

| 50 | ||||

Table of Contents

| James Advantage Funds | Shareholder Letter | |

| December 31, 2012 (Unaudited) |

Just about everybody was happy that the 2012 presidential elections were finally over, but the markets corrected soon afterward. The markets fell sharply after the results were posted, but started to recover relatively quickly. The September high was not surpassed until January 2013, but the S&P 500 still scored an impressive 16.00 percent return for the year and small capitalization companies, as measured by the Russell 2000 returned 16.35 percent. Concerns over the impact of the Affordable Health Care Act, Dodd-Frank and other regulatory initiatives gave way to improvements in housing data, automobile sales and consumer financial health. The Federal Reserve’s policy of Quantitative Easing also helped.

The Markets Over the Past Six Months

Over the last six months of 2012, the S&P 500® Index rose 5.95 percent, the Russell 2000® Index advanced 7.20 percent, the Russell Microcap® Index rose 5.96 percent and the S&P 400® MidCap Value Index advanced 9.53 percent. The election dominated the headlines, and some investors fretted over an expanding government and the costs of new regulations. The election results were met with a temporary sell-off in stocks, driving the S&P 500 down almost 9 percent from its September high to its November 16 low. Still, accumulating evidence of fundamental improvement in the U.S economy and a gradual dissipation of worries over Europe’s banking crisis and China’s slowing growth rate provided the underpinnings for a sustainable rally in stocks. The James Advantage Funds did participate in this rising confidence and the Golden Rainbow Fund added to its allocation to stocks on the weakness after the election.

The U.S. dollar weakened against almost all of its major trading partners during the calendar year. Of course, a weakening dollar is generally good news for holdings in foreign stocks and bonds. The Golden Rainbow Fund benefitted from the weaker dollar through its holdings of bonds issued in foreign currencies, including the Canadian dollar, the Australian dollar, the euro, and the Swedish krona. These holdings are detailed in the Schedule of Investments on page 14 of this report.

Investment Goals and Objectives

Preservation of capital and income are the two primary objectives of the Balanced: Golden Rainbow Fund. The Fund’s investments in bonds helped to meet the income objective in 2012. The Fund’s management is pleased that, even with interest rates at historic lows, the Golden Rainbow paid out a dividend every quarter, and supplemented income needs of shareholders with a capital gains dividend in December. We note also that many corporations paid unusually large and unanticipated dividends in the final days of 2012. Their objective was to reward shareholders with dividend income before the new, higher tax rates on dividends took effect in 2013. The higher than usual ordinary dividends paid to shareholders of the Golden Rainbow Fund retail shares ($0.13/share), the Golden Rainbow Institutional shares ($0.1565/share), and the Small Cap Fund ($0.512/share) were a result of these special dividends, and investors are cautioned not to assume those distributions are normal or that they will be repeated.

The Small Cap Fund, the Mid Cap Fund, the Long-Short Fund and the Micro Cap Fund seek long term capital appreciation as their primary objective. These Funds look for stocks the Adviser believes to be undervalued, using its proprietary research to sift through a database of over 8,500 stocks. The Long-Short Fund may employ a short-selling strategy when the Adviser’s research shows a higher probability of a market decline and may also leverage itself through the use of a bank line of credit. The basic research is the same for all the Funds. The Adviser prides itself on its own research and does not buy outside research. These Funds do not seek to pay dividends, but will distribute net income when it is earned through dividends or other sources.

Investment Philosophy

Since 1972, James Investment Research, Inc., adviser to the James Advantage Funds, has embraced conservative principles of investing. Experience has taught us that stocks with strong earnings growth, low valuations and relative strength are more likely to outperform the broad stock market over time, and we have found that preserving capital in down markets is very important in achieving long term growth. Our independent research is generally free of Wall Street hype and allows us to take a different path. We do not participate in IPOs (initial public offerings), as they have a relatively poor track record of rewarding shareholders and because our research requires an extensive amount of history that IPOs cannot provide.

Strategy for Meeting Fund Objectives

When the Adviser’s risk research indicates that the risk in the stock market is low and that opportunities for stocks to move higher are great, the Fund’s portfolio managers will increase the allocation to common stocks in the James Balanced: Golden Rainbow Fund. Of course, a balanced fund will always hold both bonds and stocks, and the Golden Rainbow normally will not fall below 25% in its allocation to either stocks or bonds. To help meet the income objective of the Fund, the portfolio managers have added high quality municipal bonds and sovereign bonds to the portfolio. In 2012, we increased our holdings in corporate bonds, mortgage-backed bonds and federal agency debentures, while lowering the exposure to U.S. Treasury Securities.

The Small Cap Fund, the Mid Cap Fund, the Micro Cap Fund and the Long-Short Fund use the same proprietary research, but concentrate on separate strategies that include market capitalization niches for the first three funds and allows for both long and short positions in all market capitalizations for the Long-Short Fund. The Adviser’s Research staff is actively working on ranking stocks and on top-down analysis designed to gauge the direction of the U.S. economy as well as the global economy. The Adviser often identifies the risk levels in the broad stock market through its research, which then helps Fund managers adjust the Fund holdings accordingly. If the research points towards a decline in economic

| Semi-Annual Report | December 31, 2012 | 1 |

Table of Contents

| Shareholder Letter | James Advantage Funds | |

| December 31, 2012 (Unaudited) |

activity and in stock prices, all the funds will prefer defensive stocks, such as utilities, health care and non-cyclicals, while still retaining the Adviser’s strategy of seeking out bargain stocks. In addition, the Golden Rainbow Fund will increase its holdings in bonds and reduce exposure to common equities, and the Long-Short Fund will add short positions. Stocks the Adviser considers to be bargains generally have low value ratios, such as price to earnings and price to cash, but also generally have strong earnings and relative strength. The Adviser has found this strategy to be very useful over the long run.

All of the Funds in the James Advantage Funds family employ a disciplined SELL strategy, eliminating securities that lose their value traits or otherwise fall out of favor due to macro-economic changes, management changes or similar events. The Adviser’s staff regularly monitors all of the Funds’ holdings and employs multiple screens to detect changes in a company profile. Still, as you will see in the Financial Highlights report, the Funds’ turnover ratios are low by most industry standards.

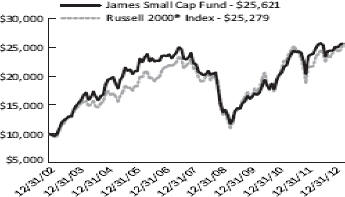

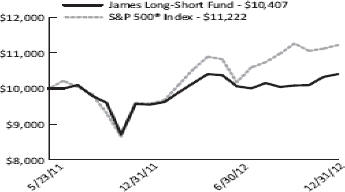

Fund Performance

Over the last six months of 2012, The Golden Rainbow Retail Class advanced 5.27 percent and the Institutional Class shares rose 5.44 percent, besting their blended Index benchmark, which rose 4.18 percent (see benchmark details on page 3 of this report). The Small Cap Fund rose 5.37 percent over the last six months of the year versus a 7.20 percent increase in its benchmark. The Mid Cap Fund advanced 10.05 percent, beating its benchmark, (the S&P 400® MidCap Value Index), return of 9.53 percent. The Micro Cap Fund lagged during the last half of the year, returning only 1.02 percent versus its benchmark, (the Russell Microcap® Index), return of 5.96 percent. The Long-Short Fund rose 4.01 percent, lagging its benchmark, (the S&P 500® Index), return of 5.95 percent. The excess performance by the Golden Rainbow Fund was due to an increase in the allocation to stocks, moving from about 49 percent in September to about 55 percent in December, a reduced allocation to long-term Treasury and bonds the strong success of the firm’s proprietary stock research over the fourth quarter. While the Adviser’s stock selection methodology had not been superior in the first part of 2012, it returned to favor in the fourth quarter. Consider the following returns over the fourth quarter versus their benchmarks: The Small Cap Fund returned 2.33 percent versus 1.85 percent on the Russell 2000® Index; the Mid Cap Fund returned 5.41 percent versus a 4.51 percent return on the S&P 400® MidCap Value Index; the Micro Cap Fund returned 2.51 percent versus 0.04 percent return on the Russell Microcap® Index; and the Long-Short Fund rose 3.18 percent, while the S&P 500® Index fell 0.38 percent. We believe this across the board outperformance is strong evidence that our methodology is back in favor and we note that we did not change our methodology over the course of the year.

Expectations for the Future

Our research points to a difficult year for the stock market if Congress and the Obama Administration cannot resolve important issues on the debt ceiling, sequestration and the budget. While international economies are showing signs of improvement, it is premature to forecast a strengthening global economy, and additional weaknesses may develop. While we continue to be encouraged by the improving housing market and we see consumer financial health a plus, we are still worried about the excessively high unemployment rate. We also note that the post-election year is often a difficult year for the stock market. Unlike many years in the past, where bond holdings served to offset declines in prices, we fear the interest rates are too low to provide the same degree of safety and that bond rallies may be briefer and less rewarding than in the past. Still, various sectors of the stock market will add value over the course of the year and active management will be key in creating and retaining excess portfolio returns.

Thomas L. Mangan

Chief Financial Officer

The statements and opinions expressed are those of the author and are as of the date of this report. All information is historical and not indicative of future results and subject to change. It should not be assumed that an investment in the securities mentioned will be profitable in the future. This information is not a recommendation to buy or sell.

You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing. You may obtain a current copy of the Fund’s prospectus by calling 1-800-995-2637.

Past performance is no guarantee of future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

| 2 | www.jamesfunds.com |

Table of Contents

| James Advantage Funds | Growth of $10,000 Charts | |

| December 31, 2012 (Unaudited) |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. These performance figures do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Please call 1-800-995-2637 for most recent month-end performance information.

The S&P 500® Index, Russell 2000® Index, Barclays Capital Intermediate Government/Credit Index, S&P Mid Cap 400® Index, and Russell Microcap® Index are widely recognized unmanaged indices of security prices and are representative of a broader market and range of securities than is found in the Fund’s portfolio. The Index returns do not reflect the deduction of expenses, which have been deducted from a Fund’s returns. The Index returns assume reinvestment of all distributions and do not reflect the deduction of taxes and fees. Individuals cannot invest directly in any Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

| Semi-Annual Report | December 31, 2012 | 3 |

Table of Contents

| Growth of $10,000 Charts | James Advantage Funds | |

| December 31, 2012 (Unaudited) |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. These performance figures do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Please call 1-800-995-2637 for most recent month-end performance information.

The Mid-Cap Fund invests in stocks of mid-cap companies which tend to be more volatile and can be less liquid than stocks of large-cap companies. Diversification does not guarantee a profit or protect against loss. Current and future portfolio holdings are subject to risk.

Mid, Small and Micro Cap investing involve greater risk not associated with investing in more established companies, such as greater price volatility, business risk, less liquidity and increased competitive threat.

The S&P 500® Index, Russell 2000® Index, Barclays Capital Intermediate Government/Credit Index, S&P MidCap 400® Index, and Russell Microcap® Index are widely recognized unmanaged indices of security prices and are representative of a broader market and range of securities than is found in the Fund’s portfolio. The Index returns do not reflect the deduction of expenses, which have been deducted from a Fund’s returns. The Index returns assume reinvestment of all distributions and do not reflect the deduction of taxes and fees. Individuals cannot invest directly in any Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

The S&P MidCap 400® Value Index is a recognized, unmanaged index of mid cap stocks considered to be value stocks using Standard and Poor’s methodology.

The Russell Microcap® Index measures the performance of the microcap segment of the U.S. equity market. It makes up less than 3% of the U.S. equity market. It includes 1,000 of the smallest securities in the small cap Russell 2000® Index, plus the next smallest eligible securities by market cap.

| 4 | www.jamesfunds.com |

Table of Contents

| James Advantage Funds | Growth of $10,000 Charts | |

| December 31, 2012 (Unaudited) |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. These performance figures do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Please call 1-800-995-2637 for most recent month-end performance information.

Short selling incurs significant additional risk; theoretically, stocks sold short have unlimited upside risk potential. In addition, this strategy depends on the Adviser’s ability to correctly identify undervalued and overvalued stocks, and that the stock markets are reasonable and efficient. Periods of extreme volatility may harm the performance of this product. The Long-Short Fund may have a high portfolio turnover rate. A high portfolio turnover rate can result in increased brokerage commission costs and may expose taxable shareholders to potentially larger current tax liability.

The S&P 500® Index, Russell 2000® Index, Barclays Capital Intermediate Government/Credit Index, S&P MidCap 400® Index, and Russell Microcap® Index are widely recognized unmanaged indices of security prices and are representative of a broader market and range of securities than is found in the Fund’s portfolio. The Index returns do not reflect the deduction of expenses, which have been deducted from a Fund’s returns. The Index returns assume reinvestment of all distributions and do not reflect the deduction of taxes and fees. Individuals cannot invest directly in any Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

The S&P 500® Index is an unmanaged index of 500 common stocks chosen for market size, liquidity and industry group representation.

| Semi-Annual Report | December 31, 2012 | 5 |

Table of Contents

| Representation of Schedules of Investments | James Advantage Funds | |

| December 31, 2012 (Unaudited) |

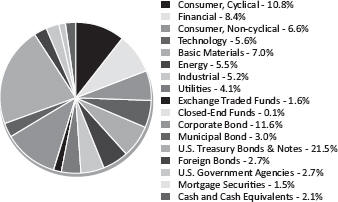

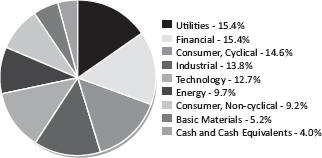

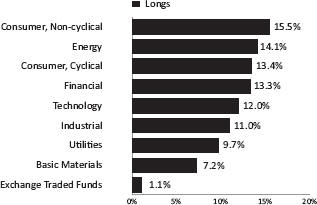

The illustrations below provide the industry sectors for the James Balanced: Golden Rainbow Fund, James Small Cap Fund, James Mid Cap Fund, James Micro Cap Fund, and James Long-Short Fund.

| 6 | www.jamesfunds.com |

Table of Contents

| James Advantage Funds | Disclosure of Fund Expenses | |

| December 31, 2012 (Unaudited) |

Example. As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including reinvested dividends or other distributions, and redemption fees; and (2) ongoing costs, including management fees, distribution (12b-1) fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period July 1, 2012 through December 31, 2012.

Actual Expenses. The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expense Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of the table below provides information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

| Net Expense Ratio Annualized |

Beginning Account Value July 1, 2012 |

Ending Account Value December 31, 2012 |

Expense Paid During Period(b) |

|||||||||||||

| James Balanced: Golden Rainbow Fund | ||||||||||||||||

| Retail Class Actual |

1.05 | % | $ | 1,000.00 | $ | 1,052.70 | $ | 5.43 | ||||||||

| Retail Class Hypothetical (5% return before expenses) |

1.05 | % | $ | 1,000.00 | $ | 1,019.91 | $ | 5.35 | ||||||||

| Institutional Class Actual |

0.80 | % | $ | 1,000.00 | $ | 1,054.40 | $ | 4.14 | ||||||||

| Institutional Class Hypothetical (5% return before expenses) |

0.80 | % | $ | 1,000.00 | $ | 1,021.17 | $ | 4.08 | ||||||||

| James Small Cap Fund | ||||||||||||||||

| Actual |

1.50 | % | $ | 1,000.00 | $ | 1,053.70 | $ | 7.76 | ||||||||

| Hypothetical (5% return before expenses) |

1.50 | % | $ | 1,000.00 | $ | 1,017.64 | $ | 7.63 | ||||||||

| James Mid Cap Fund | ||||||||||||||||

| Actual |

1.50 | % | $ | 1,000.00 | $ | 1,100.50 | $ | 7.94 | ||||||||

| Hypothetical (5% return before expenses) |

1.50 | % | $ | 1,000.00 | $ | 1,017.64 | $ | 7.63 | ||||||||

| James Micro Cap Fund | ||||||||||||||||

| Actual |

1.50 | % | $ | 1,000.00 | $ | 1,010.20 | $ | 7.60 | ||||||||

| Hypothetical (5% return before expenses) |

1.50 | % | $ | 1,000.00 | $ | 1,017.64 | $ | 7.63 | ||||||||

| James Long-Short Fund | ||||||||||||||||

| Actual |

2.80 | %(c) | $ | 1,000.00 | $ | 1,040.10 | $ | 14.40 | ||||||||

| Hypothetical (5% return before expenses) |

2.80 | %(c) | $ | 1,000.00 | $ | 1,011.09 | $ | 14.19 | ||||||||

| (a) | Annualized, based on the Fund’s most recent fiscal half year expenses. |

| (b) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (184), divided by 365. Note the expense example is typically based on a six-month period. |

| (c) | Dividend and interest expense on securities sold short and interest expense totaled 1.30% (annualized) of average net assets for the six months ended December 31, 2012. |

| Semi-Annual Report | December 31, 2012 | 7 |

Table of Contents

| Schedule of Investments | James Balanced: Golden Rainbow Fund | |

| December 31, 2012 (Unaudited) |

| Shares or Principal Amount | Value | |||||||

|

|

COMMON STOCKS-53.2% |

| ||||||

| Basic Materials-7.0% | ||||||||

| 50,000 | Aceto Corp. |

$502,000 | ||||||

| 209,000 | Barrick Gold Corp. |

7,317,090 | ||||||

| 410,000 | Buckeye Technologies, Inc. |

11,771,100 | ||||||

| 113,300 | Cabot Corp. |

4,508,207 | ||||||

| 113,000 | CF Industries Holdings, Inc. |

22,957,080 | ||||||

| 55,000 | Cooper Tire & Rubber Co. |

1,394,800 | ||||||

| 13,600 | Eastman Chemical Co. |

925,480 | ||||||

| 95,000 | FMC Corp. |

5,559,400 | ||||||

| 10,000 | H.B. Fuller Co. |

348,200 | ||||||

| 66,000 | Huntsman Corp. |

1,049,400 | ||||||

| 152,000 | Innospec, Inc. |

5,242,480 | ||||||

| 72,000 | International Paper Co. |

2,868,480 | ||||||

| 25,210 | NewMarket Corp. |

6,610,062 | ||||||

| 132,000 | Newmont Mining Corp. |

6,130,080 | ||||||

| 200,000 | PH Glatfelter Co. |

3,496,000 | ||||||

| 311,040 | PolyOne Corp. |

6,351,437 | ||||||

| 141,200 | PPG Industries, Inc. |

19,111,420 | ||||||

| 77,040 | Terra Nitrogen Co. LP |

16,493,493 | ||||||

|

|

|

|||||||

| 122,636,209 | ||||||||

|

|

|

|||||||

| Consumer, Cyclical-10.8% |

||||||||

| 694,600 | Alaska Air Group, Inc. * |

29,930,314 | ||||||

| 213,000 | The Cato Corp., Class A |

5,842,590 | ||||||

| 287,100 | Destination Maternity Corp. |

6,189,876 | ||||||

| 248,800 | Dillard’s, Inc., Class A |

20,841,976 | ||||||

| 98,900 | DineEquity, Inc. * |

6,626,300 | ||||||

| 84,000 | DIRECTV, Class A * |

4,213,440 | ||||||

| 20,000 | Dollar Tree, Inc. * |

811,200 | ||||||

| 203,100 | Foot Locker, Inc. |

6,523,572 | ||||||

| 1,524,165 | Ford Motor Co. |

19,737,937 | ||||||

| 176,300 | KB Home |

2,785,540 | ||||||

| 114,400 | LeapFrog Enterprises, Inc. * |

987,272 | ||||||

| 617,800 | Macy’s, Inc. |

24,106,556 | ||||||

| 151,300 | Moody’s Corp. |

7,613,416 | ||||||

| 31,900 | PetSmart, Inc. |

2,180,046 | ||||||

| 170,000 | RR Donnelley & Sons Co. |

1,530,000 | ||||||

| 720,315 | Sinclair Broadcast Group, Inc., Class A |

9,090,375 | ||||||

| 228,050 | Target Corp. |

13,493,718 | ||||||

| 85,000 | TJX Cos., Inc. |

3,608,250 | ||||||

| 163,500 | Viacom, Inc., Class A |

8,873,145 | ||||||

| 147,000 | Viacom, Inc., Class B |

7,752,780 | ||||||

| 116,000 | Wal-Mart Stores, Inc. |

7,914,680 | ||||||

|

|

|

|||||||

| 190,652,983 | ||||||||

|

|

|

|||||||

| Consumer, Non-cyclical-6.6% |

||||||||

| 199,000 | Dean Foods Co. * |

3,285,490 | ||||||

| 341,100 | Eli Lilly & Co. |

16,823,052 | ||||||

| 45,000 | Grand Canyon Education, Inc.* |

1,056,150 | ||||||

| 202,600 | Ingredion, Inc. |

13,053,518 | ||||||

| 12,000 | Kimberly-Clark Corp. |

1,013,160 | ||||||

| 75,000 | LifePoint Hospitals, Inc. * |

2,831,250 | ||||||

| 449,200 | Merck & Co., Inc. |

18,390,248 | ||||||

| 442,000 | Mylan, Inc. * |

12,146,160 | ||||||

| See Notes to Financial Statements. | ||

| 8 | www.jamesfunds.com |

Table of Contents

| James Balanced: Golden Rainbow Fund | Schedule of Investments | |

| December 31, 2012 (Unaudited) |

| Shares or Principal Amount | Value | |||||||

| Consumer, Non-cyclical (continued) |

||||||||

| 155,000 | Newell Rubbermaid, Inc. |

$3,451,850 | ||||||

| 649,000 | Pfizer, Inc. |

16,276,920 | ||||||

| 2,850 | Seaboard Corp. |

7,210,158 | ||||||

| 94,300 | The Toro Co. |

4,053,014 | ||||||

| 30,000 | Tupperware Brands Corp. |

1,923,000 | ||||||

| 228,300 | UnitedHealth Group, Inc. |

12,382,992 | ||||||

| 40,075 | WellPoint, Inc. |

2,441,369 | ||||||

|

|

|

|||||||

| 116,338,331 | ||||||||

|

|

|

|||||||

| Energy-5.5% |

||||||||

| 86,500 | Apache Corp. |

6,790,250 | ||||||

| 156,970 | Chevron Corp. |

16,974,736 | ||||||

| 9,000 | ConocoPhillips |

521,910 | ||||||

| 34,000 | Delek US Holdings, Inc. |

860,880 | ||||||

| 28,800 | Diamond Offshore Drilling, Inc. |

1,957,248 | ||||||

| 140,500 | Exxon Mobil Corp. |

12,160,275 | ||||||

| 553,044 | HollyFrontier Corp. |

25,744,198 | ||||||

| 130,000 | Pioneer Energy Services Corp. * |

943,800 | ||||||

| 93,800 | Plains All American Pipeline LP |

4,243,512 | ||||||

| 80,000 | Stone Energy Corp. * |

1,641,600 | ||||||

| 552,500 | Tesoro Corp. |

24,337,625 | ||||||

| 42,000 | Valero Energy Corp. |

1,433,040 | ||||||

|

|

|

|||||||

| 97,609,074 | ||||||||

|

|

|

|||||||

| Financial-8.4% |

||||||||

| 42,500 | Allied World Assurance Co. Holdings AG |

3,349,000 | ||||||

| 304,000 | American Financial Group, Inc. |

12,014,080 | ||||||

| 137,900 | AmTrust Financial Services, Inc. |

3,956,351 | ||||||

| 251,000 | Aspen Insurance Holdings, Ltd. |

8,052,080 | ||||||

| 654,000 | Brookfield Office Properties, Inc. |

11,124,540 | ||||||

| 145,000 | Capital One Financial Corp. |

8,399,850 | ||||||

| 370,000 | CBL & Associates Properties, Inc., REIT |

7,847,700 | ||||||

| 40,000 | Coinstar, Inc. * |

2,080,400 | ||||||

| 100,000 | EZCORP, Inc., Class A* |

1,986,000 | ||||||

| 110,000 | FBL Financial Group, Inc., Class A |

3,763,100 | ||||||

| 996,000 | Fifth Third Bancorp |

15,129,240 | ||||||

| 90,000 | First Industrial Realty Trust, Inc., REIT* |

1,267,200 | ||||||

| 19,000 | Home Properties, Inc., REIT |

1,164,890 | ||||||

| 339,250 | JPMorgan Chase & Co. |

14,916,822 | ||||||

| 993,000 | KeyCorp |

8,361,060 | ||||||

| 36,000 | National Financial Partners Corp. * |

617,040 | ||||||

| 340,000 | Nelnet, Inc., Class A |

10,128,600 | ||||||

| 10,000 | PNC Financial Services Group, Inc. |

583,100 | ||||||

| 35,000 | Post Properties, Inc., REIT |

1,748,250 | ||||||

| 278,870 | Protective Life Corp. |

7,970,105 | ||||||

| 316,060 | Rent-A-Center, Inc. |

10,859,822 | ||||||

| 44,100 | Southside Bancshares, Inc. |

928,746 | ||||||

| 101,600 | Torchmark Corp. |

5,249,672 | ||||||

| 262,025 | Unum Group |

5,455,360 | ||||||

|

|

|

|||||||

| 146,953,008 | ||||||||

|

|

|

|||||||

| Industrial-5.2% |

||||||||

| 17,000 | AGCO Corp. * |

835,040 | ||||||

| 117,800 | Amerco, Inc. |

14,938,218 | ||||||

| See Notes to Financial Statements. | ||

| Semi-Annual Report | December 31, 2012 | 9 |

Table of Contents

| Schedule of Investments | James Balanced: Golden Rainbow Fund | |

| December 31, 2012 (Unaudited) |

| Shares or Principal Amount | Value | |||||||

| Industrial (continued) |

||||||||

| 437,000 | American Axle & Manufacturing Holdings, Inc. * |

$4,894,400 | ||||||

| 37,800 | Cascade Corp. |

2,430,540 | ||||||

| 25,000 | CNH Global NV |

1,007,250 | ||||||

| 63,000 | Cummins, Inc. |

6,826,050 | ||||||

| 3,500 | Deere & Co. |

302,470 | ||||||

| 71,000 | Eaton Corp. PLC |

3,848,200 | ||||||

| 60,400 | FedEx Corp. |

5,539,888 | ||||||

| 12,600 | Ingersoll-Rand PLC |

604,296 | ||||||

| 111,900 | Jarden Corp. |

5,785,230 | ||||||

| 100,000 | Littelfuse, Inc. |

6,171,000 | ||||||

| 26,000 | Magna International, Inc. |

1,300,520 | ||||||

| 49,605 | NACCO Industries, Inc., Class A |

3,010,528 | ||||||

| 8,000 | Republic Services, Inc. |

234,640 | ||||||

| 15,000 | Seaspan Corp. |

240,450 | ||||||

| 392,000 | Sturm Ruger & Co., Inc. |

17,796,800 | ||||||

| 120,000 | Timken Co. |

5,739,600 | ||||||

| 174,625 | TRW Automotive Holdings Corp. * |

9,361,646 | ||||||

|

|

|

|||||||

| 90,866,766 | ||||||||

|

|

|

|||||||

| Technology-5.6% |

||||||||

| 348,000 | Amkor Technology, Inc. * |

1,479,000 | ||||||

| 150,000 | Arrow Electronics, Inc. * |

5,712,000 | ||||||

| 165,000 | Avnet, Inc. * |

5,050,650 | ||||||

| 431,910 | Deluxe Corp. |

13,924,779 | ||||||

| 41,000 | Equifax, Inc. |

2,218,920 | ||||||

| 326,000 | Intel Corp. |

6,725,380 | ||||||

| 77,500 | International Business Machines Corp. |

14,845,125 | ||||||

| 193,000 | Intersections, Inc. |

1,829,640 | ||||||

| 240,500 | Kulicke & Soffa Industries, Inc. * |

2,883,595 | ||||||

| 62,000 | Lexmark International, Inc., Class A |

1,437,780 | ||||||

| 17,000 | Lockheed Martin Corp. |

1,568,930 | ||||||

| 18,300 | Microsoft Corp. |

489,159 | ||||||

| 85,740 | Northrop Grumman Corp. |

5,794,309 | ||||||

| 25,000 | Photronics, Inc. * |

149,000 | ||||||

| 130,400 | SYNNEX Corp.* |

4,483,152 | ||||||

| 293,840 | Triumph Group, Inc. |

19,187,752 | ||||||

| 268,200 | Western Digital Corp. |

11,395,818 | ||||||

|

|

|

|||||||

| 99,174,989 | ||||||||

|

|

|

|||||||

| Utilities-4.1% |

||||||||

| 144,500 | American Electric Power Co., Inc. |

6,167,260 | ||||||

| 320,500 | AT&T, Inc. |

10,804,055 | ||||||

| 464,000 | BCE, Inc. |

19,924,160 | ||||||

| 100,000 | Cleco Corp. |

4,001,000 | ||||||

| 112,840 | DTE Energy Co. |

6,776,042 | ||||||

| 112,000 | El Paso Electric Co. |

3,573,920 | ||||||

| 60,000 | Exelon Corp. |

1,784,400 | ||||||

| 31,200 | NorthWestern Corp. |

1,083,576 | ||||||

| 10,000 | OGE Energy Corp. |

563,100 | ||||||

| 49,100 | PG&E Corp. |

1,972,838 | ||||||

| 193,000 | PNM Resources, Inc. |

3,958,430 | ||||||

| 255,000 | Portland General Electric Co. |

6,976,800 | ||||||

| See Notes to Financial Statements. | ||

| 10 | www.jamesfunds.com |

Table of Contents

| James Balanced: Golden Rainbow Fund | Schedule of Investments | |

| December 31, 2012 (Unaudited) |

| Shares or Principal Amount | Value | |||||||

| Utilities (continued) | ||||||||

| 67,000 | TELUS Corp. | $4,364,380 | ||||||

|

|

|

|||||||

| 71,949,961 | ||||||||

|

|

|

|||||||

|

|

TOTAL COMMON STOCKS (Cost $777,422,165) |

936,181,321 | ||||||

|

|

|

|||||||

| CLOSED-END FUNDS-0.1% | ||||||||

| 140,000 | Eaton Vance Risk-Managed Diversified Equity Income Fund | 1,460,200 | ||||||

| 11,500 | Nuveen Ohio Quality Income Municipal Fund, Inc. | 219,075 | ||||||

| 50,000 | Nuveen Premium Income Municipal Fund 2 | 760,000 | ||||||

|

|

|

|||||||

|

|

TOTAL CLOSED-END FUNDS (Cost $2,276,870) |

2,439,275 | ||||||

|

|

|

|||||||

| EXCHANGE TRADED FUNDS-1.6% |

||||||||

| 50,000 | iShares® Cohen & Steers Realty Majors Index Fund | 3,927,000 | ||||||

| 55,000 | iShares® MSCI Canada Index Fund | 1,562,000 | ||||||

| 15,000 | iShares® MSCI Germany Index Fund | 370,800 | ||||||

| 70,000 | iShares® MSCI Indonesia Investable Market Index Fund | 2,118,200 | ||||||

| 32,900 | iShares® MSCI New Zealand Investable Market Index Fund | 1,137,682 | ||||||

| 30,000 | iShares® MSCI Philippines Investable Market Index Fund | 1,036,500 | ||||||

| 64,540 | iShares® MSCI Poland Investable Market Index Fund | 1,911,675 | ||||||

| 338,000 | iShares® MSCI Singapore Index Fund | 4,627,220 | ||||||

| 12,000 | iShares® MSCI South Korea Index Fund | 760,320 | ||||||

| 70,000 | iShares® MSCI Switzerland Index Fund | 1,876,000 | ||||||

| 10,000 | iShares® S&P® National Municipal Bond Fund | 1,106,400 | ||||||

| 5,000 | iShares® Silver Trust Index Fund* | 146,750 | ||||||

| 122,900 | SPDR® Nuveen Barclays Capital Short Term Municipal Bond ETF | 2,987,699 | ||||||

| 146,450 | SPDR® S&P® Homebuilders ETF | 3,895,570 | ||||||

|

|

|

|||||||

|

|

TOTAL EXCHANGE TRADED FUNDS (Cost $25,996,229) |

27,463,816 | ||||||

|

|

|

|||||||

| PREFERRED STOCKS-0.0%(a) |

||||||||

| Financial-0.0%(a) | ||||||||

| 8,000 | General Electric Capital Corp., 6.000%(b) | 208,800 | ||||||

|

|

|

|||||||

|

|

TOTAL PREFERRED STOCKS (Cost $197,406) |

208,800 | ||||||

|

|

|

|||||||

| CORPORATE BONDS-11.0% |

||||||||

| Basic Materials-0.7% | ||||||||

| $5,000,000 | BHP Billiton Finance USA, Ltd., 1.000%, 2/24/15 | 5,036,725 | ||||||

| 5,000,000 | E.I. du Pont de Nemours & Co., 2.750%, 4/1/16 | 5,276,305 | ||||||

| 1,500,000 | E.I. du Pont de Nemours & Co., 5.750%, 3/15/19 | 1,825,435 | ||||||

|

|

|

|||||||

| 12,138,465 | ||||||||

|

|

|

|||||||

| Communications-0.3% | ||||||||

| 5,000,000 | BellSouth Corp., 5.200%, 9/15/14 | 5,370,580 | ||||||

|

|

|

|||||||

| Consumer, Cyclical-0.8% | ||||||||

| 5,000,000 | eBay, Inc., 2.600%, 7/15/22 | 5,045,395 | ||||||

| 5,000,000 | The Home Depot, Inc., 5.950%, 4/1/41 | 6,731,335 | ||||||

| 785,000 | McDonald’s Corp., 5.700%, 2/1/39 | 1,022,177 | ||||||

| See Notes to Financial Statements. | ||

| Semi-Annual Report | December 31, 2012 | 11 |

Table of Contents

| Schedule of Investments | James Balanced: Golden Rainbow Fund | |

| December 31, 2012 (Unaudited) |

| Shares or Principal Amount | Value | |||||||

| Consumer, Cyclical (continued) | ||||||||

| $2,000,000 | Wal-Mart Stores, Inc., 5.250%, 9/1/35 | $2,423,082 | ||||||

|

|

|

|||||||

| 15,221,989 | ||||||||

|

|

|

|||||||

| Consumer, Non-cyclical-1.5% | ||||||||

| 5,000,000 | Colgate-Palmolive Co., 3.150%, 8/5/15 | 5,333,165 | ||||||

| 3,000,000 | The Hershey Co., 4.125%, 12/1/20 | 3,431,226 | ||||||

| 5,475,000 | Johnson & Johnson, 4.500%, 9/1/40 | 6,383,160 | ||||||

| 5,000,000 | PepsiCo, Inc., 0.800%, 8/25/14 | 5,026,090 | ||||||

| 5,465,000 | Wyeth LLC, 5.500%, 2/15/16 | 6,240,566 | ||||||

|

|

|

|||||||

| 26,414,207 | ||||||||

|

|

|

|||||||

| Energy-1.6% | ||||||||

| 5,000,000 | Apache Corp., 3.250%, 4/15/22 | 5,293,215 | ||||||

| 5,000,000 | BP Capital Markets PLC, 3.245%, 5/6/22 | 5,261,590 | ||||||

| 5,000,000 | Occidental Petroleum Corp., 1.750%, 2/15/17 | 5,125,550 | ||||||

| 5,050,000 | Shell International Finance BV, 2.375%, 8/21/22 | 5,067,544 | ||||||

| 5,000,000 | Shell International Finance BV, 6.375%, 12/15/38 | 7,005,230 | ||||||

|

|

|

|||||||

| 27,753,129 | ||||||||

|

|

|

|||||||

| Financial-2.8% | ||||||||

| 5,000,000 | Aflac, Inc., 2.650%, 2/15/17 | 5,254,465 | ||||||

| 5,000,000 | Bank of America Corp., 5.100%, 4/27/16(c) | 4,906,000 | ||||||

| 5,000,000 | Berkshire Hathaway, Inc., 3.750%, 8/15/21 | 5,502,055 | ||||||

| 5,000,000 | Citigroup, Inc., 4.450%, 1/10/17 | 5,537,355 | ||||||

| 4,000,000 | General Electric Capital Corp., 0.811%, 2/6/14(d) | 4,005,504 | ||||||

| 2,000,000 | General Electric Capital Corp., 6.875%, 1/10/39 | 2,711,386 | ||||||

| 5,000,000 | Morgan Stanley & Co., 3.450%, 11/2/15 | 5,209,125 | ||||||

| 5,000,000 | Morgan Stanley & Co., 4.750%, 3/22/17 | 5,453,125 | ||||||

| 5,000,000 | National City Corp., 4.900%, 1/15/15 | 5,391,090 | ||||||

| 5,000,000 | UBS AG, 5.875%, 12/20/17 | 5,949,205 | ||||||

|

|

|

|||||||

| 49,919,310 | ||||||||

|

|

|

|||||||

| Industrial-0.5% | ||||||||

| 1,000,000 | Caterpillar, Inc., 7.900%, 12/15/18 | 1,355,919 | ||||||

| 1,000,000 | Caterpillar, Inc., 8.250%, 12/15/38 | 1,690,997 | ||||||

| 5,000,000 | United Technologies Corp., 3.100%, 6/1/22 | 5,288,880 | ||||||

|

|

|

|||||||

| 8,335,796 | ||||||||

|

|

|

|||||||

| Technology-2.2% | ||||||||

| 8,000,000 | Google, Inc., 3.625%, 5/19/21 | 8,893,624 | ||||||

| 5,000,000 | Hewlett-Packard Co., 3.750%, 12/1/20 | 4,839,910 | ||||||

| 5,000,000 | Intel Corp., 3.300%, 10/1/21 | 5,296,165 | ||||||

| 3,000,000 | International Business Machines Corp., 1.950%, 7/22/16 | 3,116,955 | ||||||

| 7,000,000 | International Business Machines Corp., 1.875%, 8/1/22 | 6,727,952 | ||||||

| 3,700,000 | Microsoft Corp., 5.200%, 6/1/39 | 4,514,285 | ||||||

| 5,000,000 | Oracle Corp., 2.500%, 10/15/22 | 5,038,945 | ||||||

|

|

|

|||||||

| 38,427,836 | ||||||||

|

|

|

|||||||

| Utilities-0.6% | ||||||||

| 5,000,000 | Florida Power Corp., 5.800%, 9/15/17 | 5,978,590 | ||||||

| 4,600,000 | San Diego Gas & Electric Co., 3.000%, 8/15/21 | 4,865,093 | ||||||

|

|

|

|||||||

| 10,843,683 | ||||||||

|

|

|

|||||||

|

|

TOTAL CORPORATE BONDS

(Cost $187,614,216) |

194,424,995 | ||||||

|

|

|

|||||||

| See Notes to Financial Statements. | ||

| 12 | www.jamesfunds.com |

Table of Contents

| James Balanced: Golden Rainbow Fund | Schedule of Investments | |

| December 31, 2012 (Unaudited) |

| Shares or Principal Amount | Value | |||||||

|

|

MORTGAGE BACKED SECURITIES-1.5% |

|||||||

| Federal National Mortgage Association-1.0% | ||||||||

| $4,025,652 | 3.000%, 3/1/27, Pool #AB4726 | $4,254,736 | ||||||

| 4,610,335 | 3.000%, 4/1/27, Pool #AB4927 | 4,908,712 | ||||||

| 7,627,189 | 4.500%, 9/1/40, Pool #MA0547 | 8,074,829 | ||||||

|

|

|

|||||||

| 17,238,277 | ||||||||

|

|

|

|||||||

| Government National Mortgage Association-0.5% | ||||||||

| 8,003,640 | 4.000%, 12/20/40, Pool #4882 | 8,782,178 | ||||||

|

|

|

|||||||

|

|

TOTAL MORTGAGE BACKED SECURITIES (Cost $25,025,318) |

26,020,455 | ||||||

|

|

|

|||||||

| U.S. GOVERNMENT AGENCIES-3.0% | ||||||||

| Federal Farm Credit Bank-0.8% | ||||||||

| 15,000,000 | 0.390%, 6/12/14 | 15,000,345 | ||||||

|

|

|

|||||||

| Federal Government Loan Mortgage Corporation-0.3% | ||||||||

| 4,483,725 | 3.500%, 5/1/42 | 4,781,485 | ||||||

|

|

|

|||||||

| Federal Home Loan Bank-1.1% | ||||||||

| 5,000,000 | 1.600%, 10/22/20 | 4,994,960 | ||||||

| 5,000,000 | 1.250%, 7/25/22 (c) | 5,003,555 | ||||||

| 10,000,000 | 2.430%, 10/11/22 | 10,005,780 | ||||||

|

|

|

|||||||

| 20,004,295 | ||||||||

|

|

|

|||||||

| Federal Home Loan Mortgage Corporation-0.5% | ||||||||

| 7,819,025 | 3.000%, 11/1/26 | 8,222,518 | ||||||

|

|

|

|||||||

| United States Department of Housing and Urban Development-0.3% | ||||||||

| 5,000,000 | 2.050%, 8/1/19 | 5,263,110 | ||||||

|

|

|

|||||||

|

|

TOTAL U.S. GOVERNMENT AGENCIES (Cost $52,699,896) |

53,271,753 | ||||||

|

|

|

|||||||

| U.S. TREASURY BONDS & NOTES-21.5% | ||||||||

| U.S. Treasury Bonds-0.7% | ||||||||

| 10,000,000 | 3.500%, 2/15/39 | 11,264,060 | ||||||

|

|

|

|||||||

| U.S. Treasury Inflation Indexed Notes-4.0% | ||||||||

| 15,749,525 | 2.500%, 7/15/16 | 18,094,724 | ||||||

| 29,260,505 | 1.625%, 1/15/18 | 33,921,616 | ||||||

| 16,048,062 | 1.375%, 1/15/20 | 19,014,450 | ||||||

|

|

|

|||||||

| 71,030,790 | ||||||||

|

|

|

|||||||

| U.S. Treasury Notes-16.8% | ||||||||

| 34,300,000 | 3.875%, 2/15/13 | 34,454,075 | ||||||

| 40,000,000 | 2.625%, 12/31/14 | 41,887,520 | ||||||

| 20,000,000 | 2.000%, 1/31/16 | 20,987,500 | ||||||

| 35,000,000 | 1.000%, 9/30/16 | 35,656,250 | ||||||

| 58,000,000 | 4.625%, 2/15/17 | 67,588,096 | ||||||

| 70,000,000 | 2.750%, 2/15/19 | 77,459,340 | ||||||

| 15,000,000 | 3.500%, 5/15/20 | 17,403,510 | ||||||

|

|

|

|||||||

| 295,436,291 | ||||||||

|

|

|

|||||||

|

|

TOTAL U.S. TREASURY BONDS & NOTES (Cost $352,539,018) |

377,731,141 | ||||||

|

|

|

|||||||

| See Notes to Financial Statements. | ||

| Semi-Annual Report | December 31, 2012 | 13 |

Table of Contents

| Schedule of Investments | James Balanced: Golden Rainbow Fund | |

| December 31, 2012 (Unaudited) |

| Shares or Principal Amount | Value | |||||||

|

|

FOREIGN BONDS-3.0% |

|||||||

| Australia Government-0.7% | ||||||||

| AUD 10,000,000 | 5.250%, 3/15/19 | $11,737,022 | ||||||

|

|

|

|||||||

| Canada Government-0.6% | ||||||||

| CAD 5,000,000 | 3.750%, 6/1/19 | 5,698,603 | ||||||

| CAD 5,000,000 | 3.500%, 6/1/20 | 5,679,300 | ||||||

|

|

|

|||||||

| 11,377,903 | ||||||||

|

|

|

|||||||

| International Bank for Reconstruction and Development-0.3% | ||||||||

| TRY 8,000,000 | 9.000%, 1/25/13 | 4,490,709 | ||||||

|

|

|

|||||||

| Netherlands Government-0.3% | ||||||||

| EUR 3,000,000 | 4.000%, 7/15/19 | 4,731,672 | ||||||

|

|

|

|||||||

| Norway Government-0.2% | ||||||||

| NOK 21,000,000 | 4.500%, 5/22/19 | 4,405,607 | ||||||

|

|

|

|||||||

| Queensland Treasury Corp.-0.3% | ||||||||

| AUD 5,000,000 | 6.000%, 10/14/15 | 5,601,857 | ||||||

|

|

|

|||||||

| Sweden Government-0.6% | ||||||||

| SEK 52,000,000 | 5.000%, 12/1/20 | 10,130,675 | ||||||

|

|

|

|||||||

|

|

TOTAL FOREIGN BONDS (Cost $46,059,355) |

52,475,445 | ||||||

|

|

|

|||||||

|

|

MUNICIPAL BONDS-3.0% |

|||||||

| California-0.0%(a) | ||||||||

| $ 1,000,000 | Citrus Community College District General Obligation Unlimited Bonds, Series B,4.750%, 6/1/31 | 1,116,810 | ||||||

|

|

|

|||||||

| Colorado-0.1% | ||||||||

| 1,000,000 | Adams County School District No. 14 General Obligation Unlimited Bonds, 5.000%, 12/1/26 | 1,129,520 | ||||||

|

|

|

|||||||

| Connecticut-0.4% | ||||||||

| 5,350,000 | State of Connecticut, Series B, 5.000%, 11/1/25 | 6,502,390 | ||||||

|

|

|

|||||||

| Florida-0.1% | ||||||||

| 1,000,000 | Florida State Board of Education Capital Outlay General Obligation Bonds, Series D, 5.000%, 6/1/38 | 1,155,890 | ||||||

|

|

|

|||||||

| Georgia-0.2% | ||||||||

| 3,000,000 | State of Georgia General Obligation Unlimited Bonds, Series B, 4.500%, 1/1/29 | 3,489,600 | ||||||

|

|

|

|||||||

| Illinois-0.1% | ||||||||

| 500,000 | Kane & DeKalb Counties Community Unit School District No. 302 Kaneland General Obligation Unlimited Bonds (School Building), 5.500%, 2/1/28 | 550,515 | ||||||

| 1,000,000 | Village of Bolingbrook General Obligation Unlimited Bonds, 5.000%, 1/1/37 | 1,079,080 | ||||||

|

|

|

|||||||

| 1,629,595 | ||||||||

|

|

|

|||||||

| Massachusetts-0.1% | ||||||||

| 1,000,000 | Commonwealth of Massachusetts General Obligation Limited Bonds, Series C, 5.250%, 8/1/22 | 1,183,190 | ||||||

|

|

|

|||||||

| See Notes to Financial Statements. | ||

| 14 | www.jamesfunds.com |

Table of Contents

| James Balanced: Golden Rainbow Fund | Schedule of Investments | |

| December 31, 2012 (Unaudited) |

| Shares or Principal Amount | Value | |||||||

| Michigan-0.0%(a) | ||||||||

| $1,000,000 | Marysville Public School District General Obligation Unlimited Bonds (School Building & Site), 5.000%, 5/1/32 | $1,075,470 | ||||||

|

|

|

|||||||

| Ohio-0.8% | ||||||||

| 4,620,000 | Columbus City School District Taxable Facilities & Improvement Build America Bonds, Series B, 6.150%, 12/1/33 | 5,069,249 | ||||||

| 1,100,000 | Miamisburg City School District General Obligation Unlimited Bonds (School Facilities Construction & Improvement), 5.000%, 12/1/33 | 1,272,392 | ||||||

| 500,000 | Mount Healthy City School District General Obligation Unlimited Bonds (School Improvement), 5.000%, 12/1/26 | 565,015 | ||||||

| 1,000,000 | Ohio State University General Recipients Revenue Bonds, 4.910%, 6/1/40 | 1,181,260 | ||||||

| 1,000,000 | Ohio State University General Recipients Revenue Bonds, Series A, 5.000%, 12/1/28 | 1,179,200 | ||||||

| 500,000 | Springboro Community City School District General Obligation Unlimited Bonds, 5.250%, 12/1/23 | 632,740 | ||||||

| 1,000,000 | State of Ohio General Obligation Unlimited Bonds, Series A, 5.375%, 9/1/28 | 1,195,480 | ||||||

| 2,000,000 | State of Ohio General Obligation Unlimited Bonds, Series B, 5.000%, 2/1/22 | 2,101,020 | ||||||

| 1,000,000 | Wright State University Revenue Bonds, 4.000%, 5/1/18 | 1,117,680 | ||||||

|

|

|

|||||||

| 14,314,036 | ||||||||

|

|

|

|||||||

| Texas-0.6% | ||||||||

| 1,000,000 | Friendswood Independent School District General Obligation Unlimited Bonds (Schoolhouse), 5.000%, 2/15/37 | 1,139,900 | ||||||

| 1,000,000 | Judson Independent School District General Obligation Unlimited Bonds (School Building), 5.000%, 2/1/37 | 1,118,910 | ||||||

| 500,000 | Lamar Consolidated Independent School District General Obligation Unlimited Bonds (Schoolhouse), 5.000%, 2/15/38 | 563,795 | ||||||

| 5,335,000 | Port of Houston Authority General Obligation Unlimited Bonds, Series D-1, 5.000%, 10/1/35 | 6,272,413 | ||||||

| 1,000,000 | Tyler Independent School District General Obligation Unlimited Bonds (School Building), 5.000%, 2/15/34 | 1,107,130 | ||||||

|

|

|

|||||||

| 10,202,148 | ||||||||

|

|

|

|||||||

| Washington-0.3% | ||||||||

| 5,000,000 | State of Washington General Obligation Unlimited Bonds, Series D, 4.000%, 2/1/37 | 5,280,500 | ||||||

|

|

|

|||||||

| Wisconsin-0.3% | ||||||||

| 5,000,000 | State of Wisconsin General Obligation Unlimited Bonds, Series C, 5.000%, 5/1/25 | 6,076,500 | ||||||

|

|

|

|||||||

|

|

TOTAL MUNICIPAL BONDS (Cost $49,455,330) |

53,155,649 | ||||||

|

|

|

|||||||

| SHORT TERM INVESTMENTS-2.5% | ||||||||

| 43,292,718 | First American Government Obligations Fund, 7-Day Yield 0.016% | 43,292,718 | ||||||

|

|

|

|||||||

|

|

TOTAL SHORT TERM INVESTMENTS (Cost $43,292,718) |

43,292,718 | ||||||

|

|

|

|||||||

|

|

TOTAL INVESTMENT SECURITIES-100.4% (Cost $1,562,578,521) |

1,766,665,368 | ||||||

| OTHER LIABILITIES IN EXCESS OF ASSETS-(0.4)% | (6,467,016 | ) | ||||||

|

|

|

|||||||

| NET ASSETS-100.0% | $1,760,198,352 | |||||||

|

|

|

|||||||

Percentages shown are based on Net Assets. The classifications shown on the Schedule of Investments are unaudited.

| See Notes to Financial Statements. | ||

| Semi-Annual Report | December 31, 2012 | 15 |

Table of Contents

| Schedule of Investments | James Balanced: Golden Rainbow Fund | |

| December 31, 2012 (Unaudited) |

| * | Non-income producing security. |

| (a) | Less than 0.05% of Net Assets |

| (b) | Fair valued security. |

| (c) | Step bond. Coupon increases periodically based upon a predetermined schedule. Interest rate disclosed is that which is in effect at December 31, 2012. |

| (d) | Variable rate security. Interest rate disclosed is that which is in effect at December 31, 2012. |

AG - Aktiengesellschaft is a German term that refers to a corporation that is limited by shares, i.e., owned by the shareholders

AUD - Australian Dollar

BV - Besloten Vennootschap is the Dutch term for private limited liability company

CAD - Canadian Dollar

ETF - Exchange Traded Fund

EUR - Euro

LLC - Limited Liability Company

LP - Limited Partnership

Ltd. - Limited

MSCI - Morgan Stanley Capital International

NOK - Norwegian Krone

NV - Naamloze Vennootschap is the Dutch term for a public limited liability corporation

PLC - Public Limited Company

REIT - Real Estate Investment Trust

S&P - Standard & Poor’s

SEK - Swedish Krona

SPDR - Standard & Poor’s Depositary Receipts

| Foreign Bonds Securities Allocation | ||

| % of Net Assets | ||

| Asia - Pacific |

1.0% | |

| Europe |

0.8% | |

| Europe - Euro |

0.6% | |

| North America |

0.6% | |

|

| ||

| 3.0% | ||

|

|

| See Notes to Financial Statements. | ||

| 16 | www.jamesfunds.com |

Table of Contents

| James Small Cap Fund | Schedule of Investments | |

| December 31, 2012 (Unaudited) |

| Shares | Value | |||||||

| COMMON STOCKS-96.0% | ||||||||

| Basic Materials-5.2% | ||||||||

| 23,920 | A Schulman, Inc. | $692,006 | ||||||

| 33,965 | Aceto Corp. | 341,009 | ||||||

| 23,375 | Innophos Holdings, Inc. | 1,086,937 | ||||||

| 68,855 | Innospec, Inc. | 2,374,809 | ||||||

| 54,906 | Material Sciences Corp.* | 495,801 | ||||||

| 22,194 | Neenah Paper, Inc. | 631,863 | ||||||

| 63,720 | PH Glatfelter Co. | 1,113,826 | ||||||

|

|

|

|||||||

| 6,736,251 | ||||||||

|

|

|

|||||||

| Consumer, Cyclical-14.6% | ||||||||

| 50,250 | 1-800-Flowers.com, Inc., Class A* | 184,417 | ||||||

| 113,370 | The Cato Corp., Class A | 3,109,739 | ||||||

| 26,500 | Destination Maternity Corp. | 571,340 | ||||||

| 73,510 | Dorman Products, Inc. | 2,597,843 | ||||||

| 13,520 | Flexsteel Industries, Inc. | 290,004 | ||||||

| 40,720 | Fred’s, Inc., Class A | 541,983 | ||||||

| 8,740 | Kona Grill, Inc.* | 75,776 | ||||||

| 390,045 | LeapFrog Enterprises, Inc.* | 3,366,088 | ||||||

| 58,145 | Luby’s, Inc.* | 388,990 | ||||||

| 247,650 | Myers Industries, Inc. | 3,751,898 | ||||||

| 37,830 | PC Connection, Inc. | 435,045 | ||||||

| 30,245 | Rocky Brands, Inc.* | 393,790 | ||||||

| 176,725 | Sinclair Broadcast Group, Inc., Class A | 2,230,270 | ||||||

| 13,530 | Susser Holdings Corp.* | 466,650 | ||||||

| 39,825 | Town Sports International Holdings, Inc. | 424,136 | ||||||

|

|

|

|||||||

| 18,827,969 | ||||||||

|

|

|

|||||||

| Consumer, Non-cyclical-9.2% | ||||||||

| 12,765 | Alico, Inc. | 467,582 | ||||||

| 49,340 | Carriage Services, Inc. | 585,666 | ||||||

| 44,280 | Elizabeth Arden, Inc.* | 1,993,043 | ||||||

| 109,195 | LifePoint Hospitals, Inc.* | 4,122,111 | ||||||

| 9,195 | Nature’s Sunshine Products, Inc. | 133,144 | ||||||

| 22,050 | Pozen, Inc.* | 110,470 | ||||||

| 64,235 | Sciclone Pharmaceuticals, Inc.* | 276,853 | ||||||

| 98,100 | The Toro Co. | 4,216,338 | ||||||

|

|

|

|||||||

| 11,905,207 | ||||||||

|

|

|

|||||||

| Energy-9.7% | ||||||||

| 11,220 | Adams Resources & Energy, Inc. | 393,485 | ||||||

| 113,960 | Delek US Holdings, Inc. | 2,885,467 | ||||||

| 143,225 | EPL Oil & Gas, Inc.* | 3,229,724 | ||||||

| 18,275 | Mitcham Industries, Inc.* | 249,088 | ||||||

| 84,390 | Sunoco Logistics Partners LP | 4,196,715 | ||||||

| 51,273 | TGC Industries, Inc. | 419,926 | ||||||

| 30,940 | Transmontaigne Partners LP | 1,174,792 | ||||||

|

|

|

|||||||

| 12,549,197 | ||||||||

|

|

|

|||||||

| Financial-15.4% | ||||||||

| 7,040 | Allied World Assurance Co. Holdings AG | 554,752 | ||||||

| 2,438 | Altisource Asset Management Corp.* | 199,875 | ||||||

| 24,375 | Altisource Portfolio Solutions SA* | 2,112,216 | ||||||

| 8,125 | Altisource Residential Corp., Class B* | 128,700 | ||||||

| See Notes to Financial Statements. | ||

| Semi-Annual Report | December 31, 2012 | 17 |

Table of Contents

| Schedule of Investments | James Small Cap Fund | |

| December 31, 2012 (Unaudited) |

| Shares | Value | |||||||

| Financial (continued) | ||||||||

| 124,660 | American Financial Group, Inc. | $4,926,563 | ||||||

| 8,600 | BofI Holding, Inc.* | 239,682 | ||||||

| 27,270 | Coinstar, Inc.* | 1,418,313 | ||||||

| 17,235 | ePlus, Inc. | 712,495 | ||||||

| 14,540 | Federal Agricultural Mortgage Corp., Class C | 472,550 | ||||||

| 10,753 | Homeowners Choice, Inc. | 223,555 | ||||||

| 39,090 | MainSource Financial Group, Inc. | 495,270 | ||||||

| 32,360 | National Financial Partners Corp.* | 554,650 | ||||||

| 16,305 | Nicholas Financial, Inc. | 202,182 | ||||||

| 24,960 | Peoples Bancorp, Inc. | 509,933 | ||||||

| 133,645 | Rent-A-Center, Inc. | 4,592,042 | ||||||

| 43,475 | Southside Bancshares, Inc. | 915,584 | ||||||

| 20,920 | World Acceptance Corp.* | 1,559,795 | ||||||

|

|

|

|||||||

| 19,818,157 | ||||||||

|

|

|

|||||||

| Industrial-13.8% | ||||||||

| 81,145 | Alamo Group, Inc. | 2,648,573 | ||||||

| 28,410 | Amerco, Inc. | 3,602,672 | ||||||

| 25,975 | Ballantyne Strong, Inc.* | 85,717 | ||||||

| 34,380 | Celadon Group, Inc.* | 621,247 | ||||||

| 24,925 | Franklin Electric Co., Inc. | 1,549,587 | ||||||

| 15,785 | Park-Ohio Holdings Corp.* | 336,378 | ||||||

| 12,485 | Standex International Corp. | 640,356 | ||||||

| 42,407 | StealthGas, Inc.* | 336,287 | ||||||

| 166,247 | Sturm Ruger & Co., Inc. | 7,547,614 | ||||||

| 19,264 | UFP Technologies, Inc.* | 345,211 | ||||||

|

|

|

|||||||

| 17,713,642 | ||||||||

|

|

|

|||||||

| Technology-12.7% | ||||||||

| 12,000 | Aware, Inc. | 65,760 | ||||||

| 31,225 | BioDelivery Sciences International, Inc.* | 134,580 | ||||||

| 34,452 | CalAmp Corp.* | 286,641 | ||||||

| 142,525 | Deluxe Corp. | 4,595,006 | ||||||

| 95,190 | Kulicke & Soffa Industries, Inc.* | 1,141,328 | ||||||

| 88,731 | Lionbridge Technologies, Inc.* | 356,699 | ||||||

| 197,345 | Mentor Graphics Corp.* | 3,358,812 | ||||||

| 27,450 | Online Resources Corp.* | 62,311 | ||||||

| 13,850 | Rudolph Technologies, Inc.* | 186,282 | ||||||

| 24,650 | SMTC Corp.* | 59,406 | ||||||

| 10,970 | Tessco Technologies, Inc. | 242,876 | ||||||

| 87,150 | Triumph Group, Inc. | 5,690,895 | ||||||

| 10,250 | Zygo Corp.* | 160,925 | ||||||

|

|

|

|||||||

| 16,341,521 | ||||||||

|

|

|

|||||||

| Utilities-15.4% | ||||||||

| 40,800 | Cbeyond, Inc.* | 368,832 | ||||||

| 115,550 | Cleco Corp. | 4,623,156 | ||||||

| 143,445 | El Paso Electric Co. | 4,577,330 | ||||||

| 56,140 | The Laclede Group, Inc. | 2,167,565 | ||||||

| 65,995 | NorthWestern Corp. | 2,292,006 | ||||||

| 93,120 | PNM Resources, Inc. | 1,909,891 | ||||||

| 130,635 | Portland General Electric Co. | 3,574,174 | ||||||

| 8,894 | Shenandoah Telecommunications Co. | 136,167 | ||||||

| See Notes to Financial Statements. | ||

| 18 | www.jamesfunds.com |

Table of Contents

| James Small Cap Fund | Schedule of Investments | |

| December 31, 2012 (Unaudited) |

| Shares | Value | |||||||

| Utilities (continued) | ||||||||

| 81,850 | Vonage Holdings Corp.* | $193,985 | ||||||

|

|

|

|||||||

| 19,843,106 | ||||||||

|

|

|

|||||||

|

|

TOTAL COMMON STOCKS (Cost $98,402,016) |

123,735,050 | ||||||

|

|

|

|||||||

|

|

SHORT TERM INVESTMENTS-5.7% |

|||||||

| 7,279,345 | First American Government Obligations Fund, 7-Day Yield 0.016% | 7,279,345 | ||||||

|

|

|

|||||||

|

|

TOTAL SHORT TERM INVESTMENTS (Cost $7,279,345) |

7,279,345 | ||||||

|

|

|

|||||||

|

|

TOTAL INVESTMENT SECURITIES-101.7% (Cost $105,681,361) |

131,014,395 | ||||||

| OTHER LIABILITIES IN EXCESS OF ASSETS-(1.7)% | (2,195,876) | |||||||

|

|

|

|||||||

| NET ASSETS-100.0% | $128,818,519 | |||||||

|

|

|

|||||||

Percentages shown are based on Net Assets. The classifications shown on the Schedule of Investments are unaudited.

| * | Non-income producing security. |

AG - Aktiengesellschaft is a German term that refers to a corporation that is limited by shares, i.e., owned by the shareholders

LP - Limited Partnership

SA - Generally designates corporations in various countries, mostly those employing the civil law

| See Notes to Financial Statements. | ||

| Semi-Annual Report | December 31, 2012 | 19 |

Table of Contents

| Schedule of Investments | James Mid Cap Fund | |

| December 31, 2012 (Unaudited) |

| Shares | Value | |||||||

|

|

COMMON STOCKS-93.5% |

|||||||

| Basic Materials-11.0% | ||||||||

| 7,500 | Buckeye Technologies, Inc. | $215,325 | ||||||

| 2,500 | Cabot Corp. | 99,475 | ||||||

| 4,125 | Domtar Corp. | 344,520 | ||||||

| 5,150 | FMC Corp. | 301,378 | ||||||

| 1,000 | NewMarket Corp. | 262,200 | ||||||

| 15,500 | PolyOne Corp. | 316,510 | ||||||

|

|

|

|||||||

| 1,539,408 | ||||||||

|

|

|

|||||||

| Consumer, Cyclical-11.6% | ||||||||

| 8,250 | Alaska Air Group, Inc.* | 355,492 | ||||||

| 3,000 | Dillard’s, Inc., Class A | 251,310 | ||||||

| 12,000 | Dollar Tree, Inc.* | 486,720 | ||||||

| 6,500 | Foot Locker, Inc. | 208,780 | ||||||

| 15,000 | KB Home | 237,000 | ||||||

| 10,000 | RR Donnelley & Sons Co. | 90,000 | ||||||

|

|

|

|||||||

| 1,629,302 | ||||||||

|

|

|

|||||||

| Consumer, Non-cyclical-14.3% | ||||||||

| 4,125 | Ingredion, Inc. | 265,774 | ||||||

| 10,325 | LifePoint Hospitals, Inc.* | 389,769 | ||||||

| 10,000 | Newell Rubbermaid, Inc. | 222,700 | ||||||

| 75 | Seaboard Corp. | 189,741 | ||||||

| 6,400 | The Toro Co. | 275,072 | ||||||

| 7,225 | Tupperware Brands Corp. | 463,122 | ||||||

| 10,325 | Tyson Foods, Inc., Class A | 200,305 | ||||||

|

|

|

|||||||

| 2,006,483 | ||||||||

|

|

|

|||||||

| Energy-9.6% | ||||||||

| 2,600 | Diamond Offshore Drilling, Inc. | 176,696 | ||||||

| 8,250 | HollyFrontier Corp. | 384,038 | ||||||

| 10,000 | Stone Energy Corp.* | 205,200 | ||||||

| 9,300 | Tesoro Corp. | 409,665 | ||||||

| 4,125 | World Fuel Services Corp. | 169,826 | ||||||

|

|

|

|||||||

| 1,345,425 | ||||||||

|

|

|

|||||||

| Financial-14.8% | ||||||||

| 8,775 | American Financial Group, Inc. | 346,788 | ||||||

| 8,000 | Aspen Insurance Holdings, Ltd. | 256,640 | ||||||

| 12,900 | Brookfield Office Properties, Inc. | 219,429 | ||||||

| 4,125 | Home Properties, Inc., REIT | 252,904 | ||||||

| 11,350 | Nelnet, Inc., Class A | 338,116 | ||||||

| 6,825 | Protective Life Corp. | 195,059 | ||||||

| 13,425 | Rent-A-Center, Inc. | 461,283 | ||||||

|

|

|

|||||||

| 2,070,219 | ||||||||

|

|

|

|||||||

| Industrial-13.6% | ||||||||

| 7,225 | AGCO Corp.* | 354,892 | ||||||

| 3,000 | Amerco, Inc. | 380,430 | ||||||

| 7,750 | Jarden Corp. | 400,675 | ||||||

| 6,700 | Timken Co. | 320,461 | ||||||

| 8,250 | TRW Automotive Holdings Corp.* | 442,282 | ||||||

|

|

|

|||||||

| 1,898,740 | ||||||||

|

|

|

|||||||

| See Notes to Financial Statements. | ||

| 20 | www.jamesfunds.com |

Table of Contents

| James Mid Cap Fund | Schedule of Investments | |

| December 31, 2012 (Unaudited) |

| Shares | Value | |||||||

| Technology-10.3% | ||||||||

| 34,525 | Amkor Technology, Inc.* | $146,731 | ||||||

| 7,750 | Arrow Electronics, Inc.* | 295,120 | ||||||

| 3,500 | Cirrus Logic, Inc.* | 101,395 | ||||||

| 13,950 | Deluxe Corp. | 449,748 | ||||||

| 25,500 | LSI Corp.* | 180,540 | ||||||

| 4,125 | Triumph Group, Inc. | 269,363 | ||||||

|

|

|

|||||||

| 1,442,897 | ||||||||

|

|

|

|||||||

| Utilities-8.3% | ||||||||

| 15,550 | CMS Energy Corp. | 379,109 | ||||||

| 4,975 | DTE Energy Co. | 298,749 | ||||||

| 6,000 | NorthWestern Corp. | 208,380 | ||||||

| 8,000 | Portland General Electric Co. | 218,880 | ||||||

| 25,825 | Vonage Holdings Corp.* | 61,205 | ||||||

|

|

|

|||||||

| 1,166,323 | ||||||||

|

|

|

|||||||

|

|

TOTAL COMMON STOCKS (Cost $10,248,645) |

13,098,797 | ||||||

|

|

|

|||||||

| EXCHANGE TRADED FUNDS-1.8% | ||||||||

| 3,100 | iShares® Cohen & Steers Realty Majors Index Fund | 243,474 | ||||||

|

|

|

|||||||

|

|

TOTAL EXCHANGE TRADED FUNDS (Cost $217,509) |

243,474 | ||||||

|

|

|

|||||||

| SHORT TERM INVESTMENTS-4.7% | ||||||||

| 665,043 | First American Government Obligations Fund, 7-Day Yield 0.016% | 665,043 | ||||||

|

|

|

|||||||

|

|

TOTAL SHORT TERM INVESTMENTS (Cost $665,043) |

665,043 | ||||||

|

|

|

|||||||

|

|

TOTAL INVESTMENT SECURITIES-100.0% (Cost $11,131,197) |

14,007,314 | ||||||

| OTHER LIABILITIES IN EXCESS OF ASSETS-0.0%(a) | (1,292) | |||||||

|

|

|

|||||||

| NET ASSETS-100.0% | $14,006,022 | |||||||

|

|

|

|||||||

Percentages shown are based on Net Assets. The classifications shown on the Schedule of Investments are unaudited.

| * | Non-income producing security. |

| (a) | Less than 0.05% of Net Assets |

REIT - Real Estate Investment Trust

| See Notes to Financial Statements. | ||

| Semi-Annual Report | December 31, 2012 | 21 |

Table of Contents

| Schedule of Investments | James Micro Cap Fund | |

| December 31, 2012 (Unaudited) |

| Shares | Value | |||||||

| COMMON STOCKS-92.4% | ||||||||

| Basic Materials-9.7% | ||||||||

| 26,220 | Aceto Corp. | $263,249 | ||||||

| 34,277 | Material Sciences Corp.* | 309,521 | ||||||

| 15,085 | Neenah Paper, Inc. | 429,470 | ||||||

|

|

|

|||||||

| 1,002,240 | ||||||||

|

|

|

|||||||

| Consumer, Cyclical-17.4% | ||||||||

| 31,340 | 1-800-Flowers.com, Inc., Class A* | 115,018 | ||||||

| 8,425 | Flexsteel Industries, Inc. | 180,716 | ||||||

| 11,880 | Kona Grill, Inc.* | 103,000 | ||||||

| 39,520 | Luby’s, Inc.* | 264,389 | ||||||

| 25,715 | PC Connection, Inc. | 295,722 | ||||||

| 18,853 | Rocky Brands, Inc.* | 245,466 | ||||||

| 9,202 | Susser Holdings Corp.* | 317,377 | ||||||

| 27,060 | Town Sports International Holdings, Inc. | 288,189 | ||||||

|

|

|

|||||||

| 1,809,877 | ||||||||

|

|

|

|||||||

| Consumer, Non-cyclical-10.0% | ||||||||

| 8,680 | Alico, Inc. | 317,948 | ||||||

| 30,781 | Carriage Services, Inc. | 365,370 | ||||||

| 5,760 | Nature’s Sunshine Products, Inc. | 83,405 | ||||||

| 19,200 | Pozen, Inc.* | 96,192 | ||||||

| 40,060 | Sciclone Pharmaceuticals, Inc.* | 172,659 | ||||||

|

|

|

|||||||

| 1,035,574 | ||||||||

|

|

|

|||||||

| Energy-5.7% | ||||||||

| 7,620 | Adams Resources & Energy, Inc. | 267,234 | ||||||

| 2,757 | Mitcham Industries, Inc.* | 37,578 | ||||||

| 34,849 | TGC Industries, Inc. | 285,413 | ||||||

|

|

|

|||||||

| 590,225 | ||||||||

|

|

|

|||||||

| Financial-21.5% | ||||||||

| 7,580 | BofI Holding, Inc.* | 211,254 | ||||||

| 16,490 | ePlus, Inc. | 681,697 | ||||||

| 9,880 | Federal Agricultural Mortgage Corp., Class C | 321,100 | ||||||

| 10,128 | Homeowners Choice, Inc. | 210,561 | ||||||

| 26,560 | MainSource Financial Group, Inc. | 336,515 | ||||||

| 10,202 | Nicholas Financial, Inc. | 126,505 | ||||||

| 16,960 | Peoples Bancorp, Inc. | 346,493 | ||||||

|

|

|

|||||||

| 2,234,125 | ||||||||

|

|

|

|||||||

| Industrial-13.0% | ||||||||

| 16,200 | Ballantyne Strong, Inc.* | 53,460 | ||||||

| 9,860 | Park-Ohio Holdings Corp.* | 210,116 | ||||||

| 8,485 | Standex International Corp. | 435,196 | ||||||

| 31,598 | StealthGas, Inc.* | 250,572 | ||||||

| 4,130 | Sturm Ruger & Co., Inc. | 187,502 | ||||||

| 12,004 | UFP Technologies, Inc.* | 215,112 | ||||||

|

|

|

|||||||

| 1,351,958 | ||||||||

|

|

|

|||||||

| Technology-10.7% | ||||||||

| 7,900 | Aware, Inc. | 43,292 | ||||||

| 26,175 | BioDelivery Sciences International, Inc.* | 112,814 | ||||||

| See Notes to Financial Statements. | ||

| 22 | www.jamesfunds.com |

Table of Contents

| James Micro Cap Fund | Schedule of Investments | |

| December 31, 2012 (Unaudited) |

| Shares | Value | |||||||

| Technology (continued) | ||||||||

| 26,592 | CalAmp Corp.* | $221,245 | ||||||

| 58,701 | Lionbridge Technologies, Inc.* | 235,978 | ||||||

| 18,075 | Online Resources Corp.* | 41,030 | ||||||

| 11,400 | Rudolph Technologies, Inc.* | 153,330 | ||||||

| 16,250 | SMTC Corp.* | 39,163 | ||||||

| 7,245 | Tessco Technologies, Inc. | 160,404 | ||||||

| 6,775 | Zygo Corp.* | 106,368 | ||||||

|

|

|

|||||||

| 1,113,624 | ||||||||

|

|

|

|||||||

| Utilities-4.4% | ||||||||

| 26,875 | Cbeyond, Inc.* | 242,950 | ||||||

| 6,050 | Shenandoah Telecommunications Co. | 92,625 | ||||||

| 51,040 | Vonage Holdings Corp.* | 120,965 | ||||||

|

|

|

|||||||

| 456,540 | ||||||||

|

|

|

|||||||

|

|

TOTAL COMMON STOCKS (Cost $8,049,925) |

9,594,163 | ||||||

|

|

|

|||||||

| SHORT TERM INVESTMENTS-7.4% | ||||||||

| 773,773 | First American Government Obligations Fund, 7-Day Yield 0.016% | 773,773 | ||||||

|

|

|

|||||||

|

|

TOTAL SHORT TERM INVESTMENTS (Cost $773,773) |

773,773 | ||||||

|

|

|

|||||||

|

|

TOTAL INVESTMENT SECURITIES-99.8% (Cost $8,823,698) |

10,367,936 | ||||||

| OTHER ASSETS IN EXCESS OF LIABILITIES-0.2% | 21,892 | |||||||

|

|

|

|||||||

| NET ASSETS-100.0% | $10,389,828 | |||||||

|

|

|

|||||||

Percentages shown are based on Net Assets. The classifications shown on the Schedule of Investments are unaudited.

| * | Non-income producing security. |

| See Notes to Financial Statements. | ||

| Semi-Annual Report | December 31, 2012 | 23 |

Table of Contents

| Schedule of Investments | James Long-Short Fund | |

| December 31, 2012 (Unaudited) |

| Shares | Value | |||||||

| COMMON STOCKS-96.2% | ||||||||

| Basic Materials-7.2% | ||||||||

| 10,690 | Aceto Corp. | $107,327 | ||||||

| 12,560 | Buckeye Technologies, Inc. | 360,598 | ||||||

| 500 | CF Industries Holdings, Inc. | 101,580 | ||||||

| 465 | Terra Nitrogen Co. LP | 99,552 | ||||||

|

|

|

|||||||

| 669,057 | ||||||||

|

|

|

|||||||

| Consumer, Cyclical-13.4% | ||||||||

| 3,380 | Alaska Air Group, Inc.* | 145,644 | ||||||

| 3,510 | Dillard’s, Inc., Class A | 294,033 | ||||||

| 5,380 | KB Home | 85,004 | ||||||

| 10,070 | LeapFrog Enterprises, Inc.* | 86,904 | ||||||

| 16,975 | Sinclair Broadcast Group, Inc., Class A | 214,224 | ||||||

| 1,775 | Target Corp. | 105,027 | ||||||

| 2,500 | Viacom, Inc., Class A | 135,675 | ||||||

| 2,635 | Wal-Mart Stores, Inc. | 179,786 | ||||||

|

|

|

|||||||

| 1,246,297 | ||||||||

|

|

|

|||||||

| Consumer, Non-cyclical-15.5% | ||||||||

| 6,585 | Eli Lilly & Co. | 324,772 | ||||||

| 2,340 | Merck & Co., Inc. | 95,800 | ||||||

| 12,945 | Pfizer, Inc. | 324,661 | ||||||

| 6,450 | The Toro Co. | 277,221 | ||||||

| 6,260 | UnitedHealth Group, Inc. | 339,542 | ||||||

| 2,450 | USANA Health Sciences, Inc.* | 80,678 | ||||||

|

|

|

|||||||

| 1,442,674 | ||||||||

|

|

|

|||||||

| Energy-14.1% | ||||||||

| 970 | Apache Corp. | 76,145 | ||||||

| 2,445 | Chevron Corp. | 264,403 | ||||||

| 19,355 | Flotek Industries, Inc.* | 236,131 | ||||||

| 6,955 | HollyFrontier Corp. | 323,755 | ||||||

| 19,780 | Parker Drilling Co.* | 90,988 | ||||||

| 7,225 | Tesoro Corp. | 318,261 | ||||||

|

|

|

|||||||

| 1,309,683 | ||||||||

|

|

|

|||||||

| Financial-13.3% | ||||||||

| 3,220 | Brookfield Office Properties, Inc. | 54,772 | ||||||

| 1,365 | Capital One Financial Corp. | 79,074 | ||||||

| 3,490 | CBL & Associates Properties, Inc., REIT | 74,023 | ||||||

| 18,350 | Fifth Third Bancorp | 278,737 | ||||||

| 2,530 | JPMorgan Chase & Co. | 111,244 | ||||||

| 13,670 | KeyCorp | 115,101 | ||||||

| 3,820 | PNC Financial Services Group, Inc. | 222,744 | ||||||

| 6,365 | Protective Life Corp. | 181,912 | ||||||

| 5,776 | Southside Bancshares, Inc. | 121,643 | ||||||

|

|

|

|||||||

| 1,239,250 | ||||||||

|

|

|

|||||||

| Industrial-11.0% | ||||||||

| 2,500 | AGCO Corp.* | 122,800 | ||||||

| 1,230 | Amerco, Inc. | 155,976 | ||||||

| 2,835 | Cascade Corp. | 182,290 | ||||||

| 750 | NACCO Industries, Inc., Class A | 45,518 | ||||||

| 7,595 | Sturm Ruger & Co., Inc. | 344,813 | ||||||

| See Notes to Financial Statements. | ||

| 24 | www.jamesfunds.com |

Table of Contents

| James Long-Short Fund | Schedule of Investments | |

| December 31, 2012 (Unaudited) |

| Shares | Value | |||||||

| Industrial (continued) | ||||||||

| 1,485 | Timken Co. | $71,028 | ||||||

| 2,000 | TRW Automotive Holdings Corp.* | 107,220 | ||||||

|

|

|

|||||||

| 1,029,645 | ||||||||

|

|

|

|||||||

| Technology-12.0% | ||||||||

| 8,175 | Deluxe Corp. | 263,562 | ||||||

| 14,595 | Kulicke & Soffa Industries, Inc.* | 174,994 | ||||||

| 1,585 | Lockheed Martin Corp. | 146,280 | ||||||

| 810 | Northrop Grumman Corp. | 54,740 | ||||||

| 7,005 | Symantec Corp.* | 131,764 | ||||||

| 3,185 | Triumph Group, Inc. | 207,980 | ||||||

| 3,240 | Western Digital Corp. | 137,668 | ||||||

|

|

|

|||||||

| 1,116,988 | ||||||||

|

|

|

|||||||

| Utilities-9.7% | ||||||||

| 5,075 | AT&T, Inc. | 171,078 | ||||||

| 2,125 | DTE Energy Co. | 127,607 | ||||||

| 6,365 | PNM Resources, Inc. | 130,546 | ||||||

| 11,400 | Portland General Electric Co. | 311,904 | ||||||

| 67,165 | Vonage Holdings Corp.* | 159,181 | ||||||

|

|

|

|||||||

| 900,316 | ||||||||

|

|

|

|||||||

|

|

TOTAL COMMON STOCKS (Cost $7,927,543) |

8,953,910 | ||||||

|

|

|