UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant ☐ Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☒ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

RAIT Financial Trust

(Name of Registrant as Specified In Its Charter)

Highland Capital Management, L.P.

Highland Select Equity Master Fund, L.P.

Highland Select Equity Fund GP, L.P.

Highland Select Equity GP, LLC

Strand Advisors, Inc.

James D. Dondero

Highland Global Allocation Fund

Highland Small-Cap Equity Fund

Highland Capital Management Fund Advisors, L.P.

Strand Advisors XVI, Inc.

NexPoint Real Estate Strategies Fund

NexPoint Advisors, L.P.

NexPoint Advisors GP, LLC

NexPoint Real Estate Advisors, L.P.

HCRE Partners, LLC

Nancy Jo Kuenstner

John M. Pons

Andrew C. Richardson

Matt R. McGraner

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

HIGHLAND CAPITAL MANAGEMENT, L.P.

300 Crescent Court, Suite 700

Dallas, Texas 75201

[●], 2017

Dear Fellow Shareholder:

IMPORTANT: PLEASE READ THESE MATERIALS

Highland Capital Management, L.P. (“Highland”) and certain of its affiliates (“we,” our,” or “us”) are fellow shareholders of RAIT Financial Trust (the “Company”). We are writing to you regarding the Company’s 2017 annual meeting of shareholders scheduled to be held on [●], 2017, including any adjournment or postponement thereof and any meeting that may be called in lieu thereof by the Company (the “Annual Meeting”). We urge you to read the attached materials, INCLUDING THE QUESTIONS AND ANSWERS BEGINNING ON PAGE [4], because we believe that the current board of trustees of the Company (the “Board”) has failed to act in your best interests. AS A RESULT, TO PROTECT YOUR INTERESTS AND YOUR INVESTMENT IN THE COMPANY, WE URGE YOU TO CONSIDER AND:

| 1. | Vote FOR our competing slate of five (5) trustee nominees (each, a “Highland Nominee” and together, the “Highland Nominees”), nominated by our affiliate Highland Select Equity Master Fund, L.P., and named in the attached proxy statement and proxy card, to serve on the Board for the terms specified in the attached proxy statement; |

| 2. | Vote FOR the selection of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2017; |

| 3. | Vote AGAINST the proposed amendment and restatement of the RAIT Financial Trust 2012 Incentive Award Plan; |

| 4. | Vote AGAINST the compensation of the Company’s named executive officers, as disclosed in the Company’s proxy statement for the Annual Meeting; and |

| 5. | Vote ONE YEAR for the frequency of the advisory vote to approve the compensation of the Company’s named executive officers. |

To assist you with your decisions, we have provided a set of questions and answers beginning on page 3 of the attached proxy statement (the “Q&A”). We urge you to carefully consider the Q&A together with the other information contained in the attached proxy statement and then support our efforts by authorizing your vote today by signing, dating and returning the enclosed BLUE proxy card in the postage paid envelope provided. The attached proxy statement and BLUE proxy card are first being furnished to shareholders on or about [●], 2017.

Shareholders of the Company as of the close of business on May [●], 2017 (the “Record Date”), will have the right to vote their shares in connection with the Annual Meeting. If you have already sent a proxy card furnished by the Company’s management to the Company, we urge you to revoke it and change your vote by signing, dating and returning today the enclosed BLUE proxy card in the postage paid envelope provided. Only your latest dated proxy card counts!

If you have any questions or require assistance voting your shares, please contact Okapi Partners LLC, who is assisting us, at their address and toll-free number listed on the following page.

Thank you for your support,

Highland Capital Management, L.P.

If you have any questions or need assistance voting your Shares, please call:

Okapi Partners LLC

1212 Avenue of the Americas, 24th Floor

New York, New York 10036

Banks and Brokerage Firms, Please Call: (212) 297-0720

Shareholders and All Others Call Toll-Free: (877) 629-6357

Email: NEXPOINT@okapipartners.com

4

ANNUAL MEETING OF SHAREHOLDERS OF

RAIT FINANCIAL TRUST

PROXY STATEMENT OF

HIGHLAND CAPITAL MANAGEMENT, L.P.

If your Shares are registered in your own name, please vote your Shares today by signing, dating and returning the BLUE proxy card in the postage paid envelope provided. If your Shares are held in by a brokerage firm or bank, please authorize a proxy to vote your Shares today as described on the enclosed BLUE voting form provided by your broker or bank.

Highland Capital Management, L.P., a Delaware limited partnership (“Highland”) and certain of its affiliates (“we,” “us,” or “our”) are shareholders of RAIT Financial Trust, a Maryland real estate investment trust (the “Company”). We are writing to you because we believe that, for the reasons described herein, the Company’s current board of trustees (the “Board”) has failed to act in your best interests. As a result, to protect your interests and your investment in the Company, we urge you to elect new trustees for the Company at the upcoming 2017 annual meeting of shareholders of the Company scheduled to be held on [●], 2017, at [●], [Eastern] time, at [●], including any adjournments or postponements thereof and any meeting that may be called in lieu thereof by the Company (the “Annual Meeting”). This proxy statement (the “Proxy Statement”) and the enclosed BLUE proxy card are first being furnished to shareholders on or about [●], 2017.

This Proxy Statement and the enclosed BLUE proxy card are being furnished to shareholders of the Company by us in connection with the solicitation of proxies from the Company’s shareholders for the following proposals:

| 1. | Vote FOR our competing slate of five (5) trustee nominees (each, a “Highland Nominee” and together, the “Highland Nominees”), nominated by our affiliate Highland Select Equity Master Fund, L.P. (the “Select Fund”), and named in this Proxy Statement and in the proxy card, to serve on the Board for the terms specified in this Proxy Statement; and |

| 2. | Vote FOR the selection of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2017; |

| 3. | Vote AGAINST the proposed amendment and restatement of the RAIT Financial Trust 2012 Incentive Award Plan (the “Incentive Award Plan”); |

| 4. | Vote AGAINST the compensation of the Company’s named executive officers, as disclosed in the Company’s proxy statement for the Annual Meeting; and |

| 5. | Vote ONE YEAR for the frequency of the advisory vote to approve the compensation of the Company’s named executive officers. |

The Company has set the close of business on May [●], 2017 as the record date (the “Record Date”) for determining shareholders entitled to notice of and to vote at the Annual Meeting. The mailing address of the principal executive offices of the Company is Two Logan Square, 100 N. 18th Street, 23rd Floor, Philadelphia, Pennsylvania 19103. Shareholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting.

1

According to the Company, as of the Record Date there were [●] common shares of beneficial interest, $0.03 par value per share (“Shares”), outstanding. Holders of Shares are entitled to one vote per Share. As of the Record Date, we collectively beneficially owned 5,081,377 Shares and the other participants in this solicitation did not beneficially own any Shares. We intend to vote such Shares FOR the election of the Highland Nominees.

THIS SOLICITATION IS BEING MADE BY HIGHLAND AND CERTAIN OF ITS AFFILIATES AND NOT ON BEHALF OF THE BOARD OF TRUSTEES OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE THE ANNUAL MEETING EXCEPT AS DISCUSSED HEREIN OR IN THE COMPANY’S PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH WE ARE NOT AWARE OF WITHIN A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED BLUE PROXY CARD WILL VOTE ON SUCH MATTERS IN THEIR DISCRETION.

PLEASE DO NOT RETURN ANY WHITE (OR OTHER COLOR) PROXY CARD YOU MAY RECEIVE FROM THE COMPANY OR OTHERWISE AUTHORIZE A PROXY TO VOTE YOUR SHARES AT THE 2017 ANNUAL MEETING, NOT EVEN AS A SIGN OF PROTEST. IF YOU HAVE ALREADY GIVEN A PROXY TO THE COMPANY’S MANAGEMENT, YOU MAY REVOKE THAT PROXY AND VOTE IN FAVOR OF THE HIGHLAND NOMINEES BY SIGNING, DATING AND RETURNING THE ENCLOSED BLUE PROXY CARD TODAY. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS. ANY PROXY MAY BE REVOKED (I) BY DELIVERING A LATER–DATED PROXY, OR BY DELIVERING A WRITTEN NOTICE OF REVOCATION AT ANY TIME PRIOR TO [12:00 A.M. EASTERN TIME], ON [●], 2017 TO US, C/O OKAPI PARTNERS LLC (“OKAPI”), 1212 AVENUE OF THE AMERICAS, 24TH FLOOR, NEW YORK, NY 10036, WHICH IS ASSISTING IN THIS SOLICITATION OR (II) BY VOTING IN PERSON AT THE ANNUAL MEETING.

2

IMPORTANT

YOUR VOTE IS IMPORTANT, NO MATTER HOW MANY OR HOW FEW SHARES YOU OWN.

If you have already sent a proxy card furnished by the Company’s management to the Company, we urge you to change your vote by signing, dating and returning the enclosed BLUE proxy card or, if your Shares are held by a brokerage firm or bank, by following the instructions in the enclosed BLUE voting form provided by your broker or bank. Only your latest dated proxy card counts!

If your Shares are registered in your own name, you may vote your Shares, by signing, dating and mailing the enclosed BLUE proxy card to us, c/o Okapi, in the enclosed postage-paid envelope today.

If any of your Shares are held in the name of a brokerage firm, bank, bank nominee or other institution on the Record Date, you are considered the beneficial owner of the Shares, and these proxy materials, together with a BLUE voting form, are being forwarded to you by your broker or bank. As a beneficial owner, you must instruct your broker, trustee or other representative how to vote. Your broker may not vote your Shares on your behalf with respect to the election of trustees without your instructions. Accordingly, please provide your broker or bank with voting instructions to vote on your behalf the BLUE proxy card. In addition, if you hold your Shares in a brokerage or bank account, your broker or bank may allow you to provide your voting instructions by telephone or Internet. Please follow the instructions on the enclosed BLUE voting form. We urge you to confirm your instructions in writing to the person responsible for your account and to provide a copy of such instructions to us, c/o Okapi, who is assisting in this solicitation, at the address and telephone numbers set forth below and on the back cover of this Proxy Statement, so that we may be aware of all instructions and can attempt to ensure that such instructions are followed.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to

Be Held on [●], 2017.

This Proxy Statement may be viewed online at [●], together with any additional soliciting materials relating to the Annual Meeting issued by us. Such materials, including this proxy statement, will be available to shareholders at [●] through the conclusion of the Annual Meeting.

If you have any questions or need assistance voting your Shares, please contact:

Okapi Partners LLC

1212 Avenue of the Americas, 24th Floor

New York, New York 10036

Banks and Brokerage Firms, Please Call: (212) 297-0720

Shareholders and All Others Call Toll-Free: (877) 629-6357

Email: NEXPOINT@okapipartners.com

3

REASONS FOR SOLICITATION: Q&A

Why are we sending you this proxy statement?

We believe that the Board has failed to act in your best interests by presiding over the reduction of shareholder value and failing to develop or articulate a viable business plan for the Company following the internalization of Independence Realty Trust, Inc.’s (“IRT”) management and the disposition of the Company’s stake in IRT. In addition to the Board’s refusal to negotiate with NexPoint Real Estate Advisors, L.P. (“NexPoint”), the Secretary of the Company apparently refused to accept a shareholder proposal to direct the Board to take the steps necessary to externalize management of the Company and to update shareholders on the externalization process within 60 days of the Annual Meeting. Similarly, the Nominating and Governance Committee of the Board (the “Nominating and Governance Committee”) has attempted to disenfranchise you and your fellow shareholders by refusing to accept our validly and timely delivered nomination notice nominating the Highland Nominees. The Nominating and Corporate Governance Committee delivered a letter to Highland that we believe inaccurately alleges that our over 430 page nominating notice was incomplete. Moreover, the letter appears to be an attempt by management to manufacture a written record of our alleged reluctance to cooperate, despite the fact that each of the Highland Nominees completed and returned supplemental questionnaires and that NexPoint provided a detailed 25-page response to supplemental questions, in each case as requested by or on behalf of the Company.

Accordingly, we believe the Company’s shareholders should vote in favor of the Highland Nominees to position the Company to implement NexPoint’s superior management proposal and to hold both the Board and Company management accountable for this conduct. The Highland Nominees, if elected, will have a controlling vote with respect to future Board action and we believe the Highland Nominees are experienced individuals who all possess significant relevant experience in real estate finance and more specifically, mortgage REITs. We are confident that these well-established individuals with relevant experience will run a thoughtful process to consider all qualifying proposals (including NexPoint’s) to create value for all of the Company’s shareholders.

As a result, to protect your interest and maximize the value of your investment in the Company, we urge you to reject the trustee nominees proposed by the Board by voting FOR electing the Highland Nominees, who will then be able to give proper consideration to the externalization of management to protect your interests.

This is very troubling. Can you tell me more about the Board’s conduct?

On November 10, 2016, NexPoint sent a letter to Mr. Michael J. Malter, the Chairman of the Board, proposing a strategic transaction with the Company and expressing strong disappointment with the Company’s lack of transparency to investors and failure to engage with NexPoint. Less than one week after NexPoint proposed a strategic transaction with the Company, on November 16, 2016, the Board approved amendments to amend and restate the Company’s bylaws. The amended and restated bylaws limit shareholder rights and attempt to disenfranchise shareholders by, among other things, making it more difficult for shareholders to make shareholder proposals and nominate trustees to the Board. The Company’s Nominating and Corporate Governance Committee has now apparently relied on the new bylaws to reject the Highland Nominees.

The Board also has a history of limited communications on recent disclosures and governance changes, including with respect to the Company’s internalization of IRT’s management. The internalization was announced on the morning of September 27, 2016, amid press releases lauding the move as a “transformative” positive for the Company. The Company’s press release on September 27, 2016, trumpeted the fact that it would receive $120 million in gross proceeds from the internalization. The announcement that “the total proceeds to RAIT including the sale of the Company’s shares in IRT is expected to be approximately $120 million” was misleading as it revealed (to our knowledge for the first time in the Form 8-K dated September 27, 2016) that the Company’s IRT stake had been previously margined by $50+ million. It now appears to us that the main initiative previously under the Board’s consideration was a monetization of the Company’s external management contract of IRT through a termination fee payment as part of the internalization of IRT’s management and in our view a poorly executed disposition of the Company’s holdings in IRT, simultaneous with IRT’s secondary issuance of 25 million new shares of common stock. While the internalization may have been a positive development for IRT’s shareholders, we believe its execution was not in the best interests of the Company or the Company’s shareholders.

4

During the Company’s third quarter earnings call on November 3, 2016, Chief Executive Officer Scott Davidson acknowledged that investors “may be eager to hear about [management’s] plans [for the Company],” but indicated that “it will take [management] some time to refine and communicate [its plans].” Both the Chief Financial Officer and Chairman of the Board had been part of the Company’s management for more than a year when Mr. Davidson made these remarks, so it is unclear why management required more time to communicate its plans for the Company. This lack of transparency around a go-forward business plan and poor execution of the internalization should concern shareholders.

On December 5, 2016, NexPoint sent a follow-up letter to Mr. Malter reiterating NexPoint’s interest in engaging in discussions with the Company’s management and Board. On February 8, 2017, NexPoint sent a slide deck presentation to the Board. Both the letter and the presentation pertain to NexPoint’s proposal to (1) simplify the Company’s business by exiting the property management business and selling the Company’s real estate owned assets; (2) deleverage the Company by paying down debt and/or redeeming outstanding preferred shares; (3) externalize management of the Company to be managed by NexPoint and its affiliates; and (4) invest up to $30 million in the Company at a 15% premium to the Company’s 30-day VWAP.

Even though Highland and NexPoint have repeatedly communicated interest in discussing the terms of NexPoint’s proposal with the Board, we believe that the Company has neither (1) engaged us meaningfully in a transactional dialogue, nor (2) put forth a specific business plan that would generate value for shareholders comparable to NexPoint’s proposal.

Are there any alternative proposals on which I can vote?

The only proposals on which you can vote are those set forth in this Proxy Statement and in the Company’s proxy statement.

What does it mean if I receive more than one BLUE proxy card at or about the same time?

It generally means you hold shares registered in more than one account. In order to authorize a proxy to vote all of your shares, please mark, sign, date and return each BLUE proxy card you receive.

If I give you my proxy, is there any circumstance under which my proxy will not be voted?

If we believe that voting the proxies we receive would cause there to be a quorum and that the Highland Nominees would thereby not be elected, we may not attend the Annual Meeting and may withhold all proxies in order to attempt to defeat the Company’s proposals. If we do not attend the Annual Meeting, we may not vote your Shares, and your Shares may not be counted toward a quorum. If you do not believe the foregoing condition is reasonably specified, or if you unconditionally want your Shares to be represented at the Annual Meeting, you should not give us your proxy.

5

BACKGROUND OF THE SOLICITATION

The following is a chronology of material events leading up to this proxy solicitation:

| • | On June 13, 2016, James D. Dondero, the Founder and President of Highland, and Matt R. McGraner, a Managing Director and Chief Investment Officer – Real Estate of Highland, writing on behalf of Highland’s affiliate, NexPoint, sent a private letter to Scott F. Schaeffer, who was then the Chairman of the Board of the Company. The letter identified Highland as a shareholder of the Company and included an unsolicited and nonbinding proposal for a transaction that contemplated, among other aspects, an externalization of the Company’s management, an agreement for NexPoint to serve as the Company’s external advisor (for a fee of approximately $7.5 million annually) pursuant to an advisory agreement that would be terminable by the board in 60 days without penalty or fee and an investment in the Company by NexPoint of up to $30 million, subject to the receipt of a waiver from the Company of its ownership limitations (the “NexPoint Proposal”). The letter also included a discussion of some initiatives that Highland believed the Company should consider pursuing, including the following specific recommendations that NexPoint would undertake the following to create value for shareholders: |

| • | “Sell and/or liquidate the property management businesses (very low-margin, high G&A businesses)” |

| • | “Accelerate the sales and monetization of the REO properties, using the proceeds to pay down debt and/or buy back stock” |

| • | “Optimize Independence Realty Trust (NYSE: IRT) management; monetize IRT stake over the course of 12-24 months, while redeploying the proceeds into commercial real estate debt products.” |

| • | On June 24, 2016, Mr. Schaeffer rebuffed Highland’s proposal. |

| • | On August 23, 2016, Mr. Dondero, writing on behalf of NexPoint, sent the Board a second private letter, dated August 23, 2016, via email. The letter provided more information regarding Highland’s and NexPoint’s desire to enter into a mutually beneficial transaction. The letter specifically suggested that the Board form a special committee to independently evaluate opportunities to increase shareholder value. The letter also reiterated the initiatives described above that Highland believed the Company should consider pursuing. The letter also specifically included a section describing how NexPoint would restructure the IRT management agreement in order to maximize the value of the Company’s approximate 15% stake in IRT, and as valuation improved, monetize the Company’s stake to improve its liquidity position. |

| • | On September 8, 2016, Mr. Schaeffer and Murray Stempel, III, who was then the Board’s lead independent trustee, spoke via telephone with Mr. McGraner. During the course of this telephone call, Messrs. Schaeffer and Stempel communicated to Mr. McGraner that the NexPoint Proposal was not aligned with the Company’s current objectives and, accordingly, the Company was not interested in exploring the NexPoint Proposal further. Messrs. Schaeffer and Stempel advised Mr. McGraner that, in view of Highland’s equity investment in the Company, the Board was amenable to having a discussion with Highland regarding the Company’s current strategic initiatives for enhancing shareholder value if Highland was willing to sign a non-disclosure agreement that included a 24-month standstill provision. |

6

| • | On September 12, 2016, Mr. McGraner telephoned Mr. Schaeffer to inform him that Highland was not willing to sign a non-disclosure agreement and that, while Highland would suspend sending further correspondence to the Company, as a large shareholder, Highland would continue to monitor the Company’s results. |

| • | On September 27, 2016, the Company entered into a definitive agreement to sell its subsidiary, Independence Realty Advisors, LLC, the external advisor of IRT for $43 million (the “Termination Fee”), in a transaction to facilitate the ability of IRT to internalize its management and property management functions (the “IRT Management Internalization”). The Company also announced on such date that, effective upon the closing of the IRT Management Internalization, Scott Davidson, who was then serving as the Company’s President, would become its Chief Executive Officer and would be appointed to the Board, and that Mr. Schaeffer would become the full time Chairman and Chief Executive Officer of IRT. The Company further announced the agreement to sell IRT approximately 7.3 million common shares in IRT that the Company owned, which together with the Termination Fee, constituted “approximately $120 million, before fees and expenses.” Separately, the Company filed a Current Report on Form 8-K with the SEC disclosing that it expected to “use up to $51.5 million to repay indebtedness collateralized by the shares of IRT common stock beneficially owned by the Company.” |

| • | On October 7, 2016, Highland and its affiliates filed an initial Schedule 13D with the SEC regarding their beneficial ownership of the Company’s common stock (the “Highland Schedule 13D”) and disclosed that, as of October 6, 2016, Highland and its affiliates had invested approximately $17.6 million (inclusive of brokerage commissions) in the securities of the Company and beneficially owned 5,807,747 common shares of the Company or approximately 6.3% of the Company’s outstanding common shares. |

| • | On October 13, 2016, Mr. McGraner emailed Mr. Stempel requesting the opportunity to speak with Mr. Stempel regarding the IRT Management Internalization, the Company’s go-forward business plan and Highland’s ideas of how it believed it could help the Company enhance shareholder value. |

| • | On October 25, 2016, Mr. McGraner emailed Mr. Malter, noting that he was reaching out to Mr. Malter as the Company’s new Chairman of the Board and requesting Mr. Malter’s availability for a call with him. |

| • | On October 27, 2016, Mr. Malter emailed Mr. McGraner and indicated that, as the Company’s earnings call was the following week and the Company was currently in a black-out period, it was best that the Company defer connecting with Highland until after the earnings call and requested some dates and times when Mr. McGraner was available. |

| • | On October 28, 2016, Mr. McGraner emailed Mr. Malter and proposed some dates and times that he was available to connect with Mr. Malter. Mr. McGraner also offered to meet in person with Mr. Malter, but Mr. Malter declined. |

| • | On November 3, 2016, the Company delivered its 3rd Quarter results and held a conference call for analysts and investors. On the call, Mr. Davidson, as the Company’s new Chief Executive Officer, stated “I hope you understand that while you may be eager to hear about our plans, it will take us some time to refine and communicate them.” |

7

| • | On November 3, 2016, Mr. Malter emailed Mr. McGraner and indicated that he was willing to speak with Mr. McGraner and learn more about Highland’s thoughts and views on the Company and proposed having a call on November 8, 2016. |

| • | On November 8, 2016, Mr. McGraner and Mr. Malter had a telephone call in which Mr. McGraner inquired about various matters concerning the Internalization Transaction, including (1) the go-forward business plan and the need for management to provide pro forma financial information to investors, (2) the poor execution of the disposition of the IRT Stake, and (3) the revelation on September 27th that the IRT stake had been used as collateral for a margin loan. Mr. Malter declined to comment on the margin loan issue and indicated they would be in a position to disclose a business plan to the investment community in February of 2017. In a follow-up email later that day, Mr. Malter indicated to Mr. McGraner that he intended to relay to the other members of the Board the dialogue that he had had with Mr. McGraner. |

| • | On November 10, 2016, Highland filed Amendment No. 1 to the Highland Schedule 13D with the SEC and publicly disclosed in that filing a letter that NexPoint sent to the Board dated November 10, 2016, which letter discussed the issues Mr. McGraner raised on the call on November 8, 2016, including (1) the go-forward business plan and the need for management to provide pro forma financial information to investors, (2) the poor execution of the disposition of the IRT Stake, and (3) the revelation on September 27th that the IRT stake had been used as collateral for a margin loan. In addition to reiterating NexPoint’s proposal, the letter also urged the Board to consider all strategic alternatives. |

| • | On November 11, 2016, the Company issued a press release commenting on Amendment No. 1 to the Highland Schedule 13D that had been filed with the SEC on November 10, 2016 by Highland. |

| • | On November 16, 2016, the Company amended and restated its bylaws to include lengthy and burdensome advance notice provisions that Highland believes were designed, in part, to make it more difficult for Highland and other shareholders to nominate trustees. |

| • | On December 5, 2016, Highland filed Amendment No. 2 to the Highland Schedule 13D and issued a letter to the Board dated December 5, 2016, which letter included, among other things, further discussion of Highland’s disappointment with management’s lack of a business plan and pro forma financial information. The letter also reiterated NexPoint’s interest in pursuing a mutually beneficial transaction. |

| • | On December 8, 2016, Mr. Malter, on behalf of the Board, responded in writing to Highland’s December 5, 2016 letter to the Board. |

| • | On December 14, 2016, Mr. McGraner, on behalf of Highland, responded in writing to Mr. Malter’s December 8, 2016 letter to Highland. |

| • | On December 15, 2016, the Company received a Rule 14a-8 shareholder proposal from Edward S. Friedman, a RAIT shareholder, which proposal requested the Company’s Board to externalize the Company’s management and cause the Company to enter into an advisory agreement with an external advisor (the “Rule 14a-8 Externalization of Management Proposal”). |

| • | On December 15, 2016, Mr. Malter, on behalf of the Board, emailed Mr. McGraner responding to Mr. McGraner’s December 14, 2016 email to Mr. Malter. In his email, Mr. Malter proposed an in-person meeting to be attended by Mr. McGraner and any other Highland representatives that Mr. McGraner wanted to invite, Mr. Malter and Mr. Davidson. |

8

| • | On December 20, 2016, the IRT Management Internalization closed and Mr. Davidson became the Chief Executive Officer of the Company and a member of the Board. |

| • | On December 22, 2016, Mr. McGraner, on behalf of Highland, emailed Mr. Malter responding to Mr. Malter’s December 15, 2016 email to Mr. McGraner indicating, among other things, that he could meet with Messrs. Malter and Davidson on January 18, 2017. |

| • | On December 22, 2016, Highland filed Amendment No. 3 to its Schedule 13D indicating, among other things, that a Highland affiliate had entered into an indemnity letter with Mr. Friedman in which the Highland affiliate agreed to indemnify Mr. Friedman in connection with any litigation relating to the Rule 14a-8 Externalization of Management Proposal. |

| • | On January 18, 2017, Messrs. Malter and Davidson met in-person with Mr. McGraner in New York, New York. Over the course of the meeting, the parties discussed, among other things, background information about Highland and NexPoint, approaches to corporate governance, the Company’s lack of investor outreach or presentations to the investment community regarding plans for the business and Mr. Davidson’s understanding of the Company’s valuation. Mr. Malter presented Mr. McGraner with numerous questions about NexPoint’s proposal while Mr. Davidson took notes. |

| • | On January 20, 2017, Mr. McGraner, on behalf of Highland, emailed Mr. Malter and requested a private, follow-up telephonic discussion with Mr. Malter. |

| • | On January 24, 2017, the Company submitted to the Staff of the SEC’s Division of Corporation Finance a no-action request letter (the “No-Action Request Letter”) seeking to exclude the Rule 14a-8 externalization of management proposal submitted by Mr. Friedman on December 15, 2016 from the proxy statement for the Annual Meeting. |

| • | On January 27, 2017, Mr. Malter spoke via telephone with Mr. McGraner. Mr. McGraner indicated that Highland was willing to provide the Company with more details regarding its unsolicited and nonbinding externalization of management transaction proposal. |

| • | On February 8, 2017, Highland filed Amendment No. 4 to the Highland Schedule 13D disclosing that on February 8, 2017, NexPoint sent a slide deck presentation to the Board discussing the NexPoint Proposal that Highland had proposed the Company pursue with NexPoint. The slide deck presentation was publicly filed as an exhibit to Amendment No. 4 to the Highland Schedule 13D. |

| • | On February 10, 2017, Mr. Malter, on behalf of the Board, sent a letter to Highland. In his letter, Mr. Malter indicated that, despite the Company’s concerns with Highland’s past actions, the Company remained open to learning more about the NexPoint Proposal and providing Highland with a further opportunity to provide the Company with more details regarding the proposal and to address the questions and concerns that the Company has. |

9

| • | On February 10, 2017, Highland responded to the Company’s February 10, 2017 letter and invited key personnel from the Company to Highland’s offices in Dallas, Texas for a day of meetings and presentations to further discuss the NexPoint Proposal. |

| • | On February 14, 2017, Mr. Malter, on behalf of the Board, sent a letter to Mr. McGraner responding to Mr. McGraner’s February 10, 2017 letter and indicating that Highland would need to provide the Company with additional information if the Board was going to be in a position to thoughtfully consider Highland’s proposal. Mr. Malter also noted that the Company had asked its financial advisors at UBS Investment Bank to contact Mr. McGraner and provide Mr. McGraner with a list of the information they would be requesting from Highland, on behalf of the Company, to further review Highland’s externalization of management proposal. |

| • | On February 17, 2017, the Company’s financial advisor, UBS Investment Bank, provided Highland with a questionnaire containing 58 questions (not including sub-bullet points) relating to the NexPoint Proposal. |

| • | On February 23, 2017, a Highland affiliate submitted a Nominating Notice (the “Nominating Notice”) to the Company regarding its intention to nominate five (5) candidates, James D. Dondero, Mr. McGraner, Nancy Jo Kuenstner, John M. Pons, and Andrew C. Richardson, to stand for election to the Company’s nine (9) member Board of Trustees at the Annual Meeting and, thereby, seek to replace more than a majority of the members of the Board. |

| • | On February 24, 2017, Highland filed Amendment No. 5 to the Highland Schedule 13D indicating that it owned 5.9% of the Company’s common shares, disclosing that it submitted the Nominating Notice to the Company and adding Mr. Friedman, Ms. Kuenstner, Mr. Pons, and Mr. Richardson as parties to the Highland Schedule 13D. |

| • | On February 24, 2017, the Company issued a press release confirming that it had received the Nominating Notice. |

| • | On February 24, 2017, the Company reported its 4th Quarter 2016 results and failed to provide financial guidance for the 2017 fiscal year. |

| • | On February 27, 2017, Highland timely provided UBS Investment Bank with 25 pages of responses to the information requests made by UBS Investment Bank on February 17, 2017. |

| • | On February 28, 2017, the Company’s Corporate Secretary sent Highland a letter acknowledging that the Company had received the Nominating Notice and that the Company was in the process of reviewing the Nominating Notice, in consultation with its advisors, to assess whether it was in compliance with the Company’s newly-enacted bylaws and, accordingly, was unable to confirm that the Nominating Notice, as submitted, was in compliance with the newly-enacted bylaws. |

| • | On March 8, 2017, representatives of UBS Investment Bank had a call with Highland to discuss Highland’s responses to some of the information requests and to request further clarification on a number of items. At the conclusion of the call, UBS Investment Bank confirmed they had everything they needed to evaluate the NexPoint Proposal and make a recommendation to the Board. |

10

| • | On March 24, 2017, the Company’s Corporate Secretary communicated to Highland in writing that, while neither the Nominating and Governance Committee nor the Board had made a final decision with respect to whether the Nominating Notice, as submitted, was in compliance with the newly-enacted bylaws adopted on November 16, 2016 containing new advance notice provisions, the Nominating and Governance Committee believed that the Nominating Notice did not comply with the newly-enacted bylaws, and that, accordingly, Highland had not submitted a timely and proper advance notice of nomination in compliance with the newly-enacted bylaws. In its March 24, 2017 letter, the Company argued at length that the Nominating Notice was deficient in what Highland believes are technical and immaterial aspects under the newly-enacted bylaws and included more than five pages of additional information requests, many of which were redundant. |

| • | On March 30, 2017, Mr. McGraner sent an email to a representative of UBS Investment Bank inquiring as to the status of the Company’s review of the NexPoint Proposal. |

| • | On April 4, 2017, Highland responded to the Company’s March 24, 2017 letter regarding the Nominating Notice, reiterating that it provided approximately 430 pages of disclosure to the Company and that what it submitted was sufficient. |

| • | On April 4, 2017, UBS Investment Bank sent a letter to Highland requesting further information from Highland. |

| • | On April 4, 2017, Highland responded to UBS Investment Bank questioning the Board’s process and careful consideration of NexPoint’s Proposal given the fact that (1) UBS Investment Bank had previously confirmed that it had all the relevant materials from Highland it needed, (2) the Board took a month to send follow-up questions to Highland, and (3) the Board only sent the follow-up questions after Highland requested an update. |

| • | On April 7, 2017, Mr. McGraner, on behalf of Highland, responded to the follow-up information request received from UBS Investment Bank on April 4, 2017 by providing another 10 pages of responses. In his response, Mr. McGraner again requested that the Board form a special committee to undertake a strategic alternatives process to include all qualified proposals from all qualified sponsors. He further stated that |

11

| while NexPoint believes its proposal was actionable and superior to the Company’s current path, he believed that other financial sponsors, mortgage REITs and real estate asset managers could also create significantly more value than the current management team. |

| • | On April 20, 2017, the Company issued a press release announcing that the Board had reviewed the NexPoint Proposal and unanimously determined that pursuing it was not in the best interests of the Company’s shareholders. |

| • | On April 21, 2017, nearly two months after receipt of the Nominating Notice on February 23, 2017, the Company’s Corporate Secretary sent Highland a letter, which the Company publicly filed as an exhibit to a Current Report on Form 8-K that it filed on the same date, indicating that on April 21, 2017, the Board, acting upon the recommendation of the Board’s Nominating and Governance Committee, determined that the Nominating Notice did not comply with the newly-enacted bylaws adopted on November 16, 2016 containing new advance notice provisions and that, accordingly, Highland had not submitted a timely and proper advance notice of nomination in compliance with the newly-enacted bylaws. The letter also indicated that, given the Board’s determination with respect to the Nominating Notice, if Highland attempted to nominate its proposed candidates for election to the Board at the Annual Meeting, then, pursuant to the newly-enacted bylaws, such proposed nominees would be disregarded and any ballots cast for such proposed nominees would be void. |

| • | On April 28, 2017, the Company filed its preliminary proxy statement with the SEC. |

| • | On May 3, 2017, the Company reported 1st Quarter 2017 results. The price of the Company’s common shares finished down 14.82% for the day to a three-month low of $2.65 per share. |

| • | On May 5, 2017, we filed this preliminary proxy statement with the SEC. |

12

PROPOSAL 1

ELECTION OF TRUSTEES

We have nominated a slate of five nominees for trustees, because we believe that the current Board has failed to act in your best interests for the reasons described above.

We have has nominated Nancy Jo Kuenstner, John M. Pons, Andrew C. Richardson, James D. Dondero and Matt R. McGraner for election to the Board at the Annual Meeting. All of the Highland Nominees possess significant relevant experience in real estate finance and more specifically, mortgage REITs. The Highland Nominees are being nominated for one-year terms expiring at the Company’s next annual meeting in 2018 and until their respective successors are duly elected and qualified. The Highland Nominees must be elected by a plurality of votes cast at a meeting at which a quorum is present.

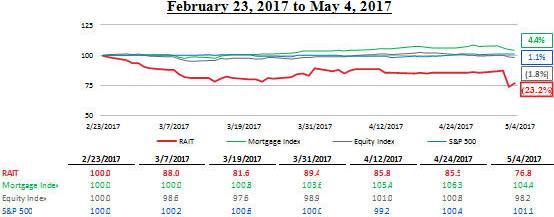

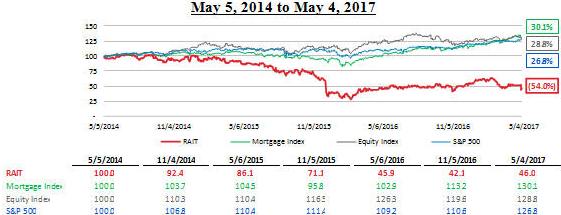

Below is the Company’s cumulative total return on common shares for the period May 5, 2014 to May 4, 2017, with the cumulative total returns of the National Association of Real Estate Investment Trusts Mortgage REIT and Equity Indexes and the S&P 500 Index. The following assumes that each was 100 on the initial day and dividends were reinvested.

Because we are disappointed in the Company’s performance and for the other reasons stated above, we are seeking your support at the Annual Meeting to elect the Highland Nominees in opposition to trustee nominees nominated by the Board. We believe that the current Board’s actions demonstrate that its interests are inappropriately aligned with its entrenched leadership and that current leadership may continue to waste Company resources without fully considering the interests of the Company or its shareholders. Therefore, we believe that the current Board does not have the ability to take the actions we feel are necessary in order to maximize shareholder value. Based on the credentials and experience of the well-established individuals who make up the Highland Nominees, we believe that the Highland Nominees are committed to maximizing shareholder value, and that, if elected, the Highland Nominees will work in good faith, and subject to their duties as trustees, to conduct a thoughtful process to consider all qualifying proposals (including NexPoint’s) to create value for all of the Company’s shareholders.

13

THE HIGHLAND NOMINEES

The following information sets forth the name, age, business address, present principal occupation, and employment and material occupations, positions, offices, or employments for the past five years of each of the Highland Nominees. In addition, for each Highland Nominee, the following information sets forth specific experience, qualifications, attributes, or skills that led to the conclusion that the Highland Nominee should serve as a trustee for the Company in light of the Company’s business and structure.

Nancy Jo Kuenstner, 63. Ms. Kuenstner has been engaged in consulting since 2012, acting as an independent contractor to Cambridge Global Payments and Stifel Nicolaus. She served as President, Chief Executive Officer and Director of The Law Debenture Trust Company of New York from March 2001 to December 2008. She was a Director of CreXus Investment Corp. from September 2009 to May 2013 and has also served as a Director of EOS Preferred Corp from May 2011 to July 2012. Her prior banking and finance experience also includes time at both Citigroup Inc. and JPMorgan & Co., Inc. She holds an MBA from the University of North Carolina, Chapel Hill and a bachelor’s degree in Spanish from Lafayette College, where she is currently a trustee. Ms. Kuenstner’s experience serving on public company boards, strategic consulting experience and more than 30 years of experience in banking and finance will allow her to bring valuable perspective with respect to operational and financing issues and opportunities to the Company’s Board.

John M. Pons, 53. Mr. Pons has served as Chief Legal Officer of Rincon Partners, LLC, a company engaged in commercial real estate acquisition development and syndication, since January 2015. Prior to co-founding Rincon, Mr. Pons served as Executive Vice President and General Counsel, Real Estate, at Cole Real Estate Investments, Inc. (“Cole”) (NYSE:COLE), a NYSE-listed real estate investment trust (“REIT”) and sponsor of SEC registered non-traded REITs, which he joined in September 2003. During his tenure at Cole, Mr. Pons was responsible and oversaw the acquisition of more than $17.0 billion of commercial real estate and more than $10.0 billion in related real estate financing. Prior to joining Cole in 2003, Mr. Pons served as Associate General Counsel at GE Capital Franchise Finance Corporation. Prior to GE Capital, Mr. Pons practiced real estate and finance law in Phoenix, Arizona.

Mr. Pons currently serves as an Independent Director of NexPoint Multifamily Realty Trust, Inc., an SEC registered non-traded REIT and was a member of the board of directors of Cole Credit Property Trust, Inc. from 2004 to 2010. A veteran of the armed forces, Mr. Pons served as a Captain in the United States Air Force as a Missile Combat Crew Commander. Mr. Pons received his bachelor’s degree in mathematics from Colorado State University and a master’s in administration from Central Michigan University before attending the University of Denver Sturm College of Law where he earned his juris doctorate (Order of St. Ives). Mr. Pons’s broad experience in law, real estate acquisition and real estate finance allow him to offer unique insight to the Company’s Board.

Andrew C. Richardson, 50. Mr. Richardson has over 20 years of experience in commercial real estate investment and finance. He most recently served as CFO of the Howard Hughes Corporation (NYSE:HHC) from March 2011 to October 2016. Prior to Howard Hughes from March 2006 to March 2011, he served as Executive Vice President, Chief Financial Officer and Treasurer of NorthStar Realty Finance Corp., and was the President, Chief Financial Officer and Treasurer of NorthStar Real Estate Income Trust, Inc., an SEC registered non-traded REIT advised by NRF. Prior to NorthStar Realty Finance, Mr. Richardson from 2000 to 2006 served as Head of the Capital Markets Group at iStar, Inc., most recently as Executive Vice President. He was an investment banker at Salomon Smith Barney from 1995 to 2000 and served at Ernst & Young from 1988 to 1993. Mr. Richardson holds an MBA from the University of Chicago Booth School of Business and a BBA in Accountancy from the University of Notre Dame. Mr. Richardson’s experience leading the operation of a publicly traded real estate development company and commercial mortgage REIT, coupled with his experience working in real estate finance and investment banking will make him as asset to the Board.

James D. Dondero, 54. Mr. Dondero is Co-founder and President of Highland. Mr. Dondero has over 30 years of experience in the credit and equity markets, focused largely on high-yield and distressed investing. Under Mr. Dondero’s leadership, Highland has been a pioneer in both developing the collateralized loan obligation (“CLO”) market and advancing credit-oriented solutions for institutional and retail investors worldwide. Highland’s product offerings include institutional separate accounts, CLOs, hedge funds, private equity funds, mutual funds, REITs, and ETFs. Mr. Dondero is the Chairman and President of NexPoint Residential Trust, Inc. (NYSE:NXRT),

14

Chairman of NexBank Capital, Inc., Cornerstone Healthcare Group Holding, Inc., and CCS Medical, Inc., and a board member of Jernigan Capital, Inc. (NYSE:JCAP), and MGM Holdings, Inc. He also serves on the Southern Methodist University Cox School of Business Executive Board. A dedicated philanthropist, Mr. Dondero actively supports initiatives in education, veterans’ affairs, and public policy. Prior to founding Highland in 1993, Mr. Dondero was involved in creating the GIC subsidiary of Protective Life, where as Chief Investment Officer he helped take the company from inception to over $2 billion between 1989 and 1993. Between 1985 and 1989, Mr. Dondero was a corporate bond analyst and then portfolio manager at American Express. Mr. Dondero began his career in 1984 as an analyst in the JP Morgan training program. Mr. Dondero graduated from the University of Virginia where he earned highest honors (Beta Gamma Sigma, Beta Alpha Psi) from the McIntire School of Commerce with dual majors in accounting and finance. He has received certification as Certified Public Accountant (CPA) and Certified Managerial Accountant (CMA) and has earned the right to use the Chartered Financial Analyst (CFA) designation. Mr. Dondero’s broad experience will make him an asset to the Board.

Matt R. McGraner, 33. Mr. McGraner is a Managing Director at Highland. Mr. McGraner joined Highland in May 2013. Mr. McGraner also serves as Executive Vice President and Chief Investment Officer of NexPoint Residential Trust, Inc. (NYSE:NXRT). With over nine years of real estate, private equity and legal experience, his primary responsibility are to lead the operations of the real estate platform at Highland, as well as source and execute investment, manage risk and develop potential business opportunities, including fundraising, private investments and joint ventures. Mr. McGraner is also a licensed attorney and was formerly an associate at Jones Day from 2011 to 2013, with a practice primarily focused on private equity, real estate and mergers and acquisitions. Prior to Jones Day, Mr. McGraner practiced law at Bryan Cave LLP from 2009 to 2011. Since 2008, Mr. McGraner has led the acquisition of over $2.5 billion of real estate and advised on $16.3 billion of M&A and private equity transactions. Mr. McGraner also co-founded several small businesses and real estate investment companies before starting his legal career, and served as the director of acquisitions and business development for a commercial real estate investment and development company during law school. Mr. McGraner’s diverse experiences in real estate, private equity and law allow him to offer unique insight to the Board.

Ms. Kuenstner’s business address is 317 Madison Avenue, Spring Lake, New Jersey 07762. Mr. Pons’ business address is 11811 N. Tatum Blvd., Suite P-177, Phoenix, Arizona 85028. The business address for each of Messrs. Richardson, Dondero and McGraner is 300 Crescent Court, Suite 700, Dallas, Texas 75201.

15

ADDITIONAL INFORMATION ABOUT THE HIGHLAND NOMINEES

As of the date hereof, Mr. Dondero may be deemed to beneficially own 5,423,377 Shares and Mr. McGraner may be deemed to beneficially own 3,000 Shares. None of Ms. Kuenstner, Mr. Pons or Mr. Richardson beneficially own any Shares.

We believe that each Highland Nominee presently is, and if elected as a trustee of the Company, each of the Highland Nominees would be, “independent” within the meaning of (1) applicable New York Stock Exchange (“NYSE”) listing standards, and (2) Section 301 of the Sarbanes-Oxley Act of 2002. No Highland Nominee is a member of the Company’s compensation, nominating or audit committee that is not independent under any such committee’s applicable independence standards.

Since the beginning of the Company’s last two completed fiscal years, no Highland Nominee or any of their respective associates was a party to any transaction, or series of similar transactions or is a party to any currently proposed transaction, or series of similar transactions, in which the amount involved exceeded or is to exceed $120,000, to which (1) the Company, (2) any of its officers or (3) any person, or officer thereof, directly or indirectly controlling, controlled by, or under common control of the Company’s investment adviser or principal underwriter, was or is to be a party.

The information provided above has been furnished to us by the Highland Nominees.

There can be no assurance that the election of the Highland Nominees will improve the Company’s business or otherwise enhance shareholder value.

On February 23, 3017, NexPoint entered into indemnification letter agreements with each of Ms. Kuenstner, Mr. Pons and Mr. Richardson against any and all claims of any nature arising from their nomination to the Board and any related transaction.

Highland Global Allocation Fund, Highland Small-Cap Equity Fund, Highland Capital Management Fund Advisors, L.P., Strand Advisors XVI, Inc., NexPoint Real Estate Strategies Fund, NexPoint Advisors, L.P., NexPoint Advisors GP, LLC, Highland Select Equity Master Fund, L.P., Highland Select Equity Fund GP, L.P, Highland Select Equity GP, LLC, Highland Capital Management, L.P., NexPoint Real Estate Advisors, L.P., NexPoint Real Estate Advisors GP, LLC, Strand Advisors, Inc., Nancy Jo Kuenstner, John M. Pons, Andrew C. Richardson, James D. Dondero and Matt R. McGraner have entered into a joint filing agreement and joinder agreement thereto pursuant to which the parties to the joint filing agreement and joinder agreement agree to jointly file on Schedule 13D and any amendments thereto with respect to securities of the Company.

Other than as stated herein, the Highland Nominees will not receive any compensation from us for their services as trustees of the Company, nor are there any arrangements or understandings between us and any of the Highland Nominees or any other person or persons pursuant to which the nomination described herein is to be made, other than the consent by each of the Highland Nominees to be named in this Proxy Statement and to serve as a trustee of the Company if elected as such at the Annual Meeting. None of the Highland Nominees is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries in any material pending legal proceedings.

We expect that the Highland Nominees will be able to stand for election, but, in the event that such persons are unable to serve or for good cause will not serve, the Shares represented by the enclosed BLUE proxy card will be voted for substitute nominees. In addition, we reserve the right to nominate substitute persons if the Company makes or announces any changes to its bylaws or takes or announces any other action that has, or if consummated would have, the effect of disqualifying the Highland Nominees. We also reserve the right to nominate additional persons if the Company increases the size of the Board above its existing size, increases the number of trustees to be elected at the Annual Meeting or calls a meeting to fill any vacancies on the Board. In any of the foregoing cases, Shares represented by the enclosed BLUE proxy card will be voted for such substitute nominees. Additional nominations made pursuant to the preceding sentences are without prejudice to our position that any attempt to increase the size of the current Board or to reconstitute or reconfigure the current Board constitutes an unlawful manipulation of the Company’s corporate machinery. If the Highland Nominees or any substitute nominees nominated by us are not put up for election to the Board at the Annual Meeting, Shares represented by the enclosed BLUE proxy card will be voted AGAINST the trustee nominees nominated by the Board.

YOU ARE URGED TO VOTE FOR THE ELECTION OF THE HIGHLAND NOMINEES ON THE ENCLOSED

BLUE PROXY CARD.

Please do not return any WHITE (or other color) proxy card you may receive from the Company or otherwise authorize a proxy to vote your Shares for the Company’s nominees. If you have already submitted a WHITE (or other color) proxy card that may have been sent to you by the Company or otherwise authorized a proxy to vote your Shares for the Company’s nominees, it is not too late to change your vote. To revoke your prior proxy and change your vote, simply mark, sign and date the enclosed BLUE proxy card and return it in the postage-paid envelope provided to you by us. Only your latest dated proxy will be counted.

16

PROPOSAL 2

SELECTION OF KPMG LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR

THE COMPANY FOR THE FISCAL YEAR ENDING DECEMBER 31, 2017

As discussed in further detail in the Company’s proxy statement, the Company is asking shareholders to approve the selection of KPMG LLP as its independent registered public accounting firm for the fiscal year ending December 31, 2017.

YOU ARE URGED TO VOTE FOR THE SELECTION OF KPMG LLP

ON THE ENCLOSED BLUE PROXY CARD.

17

PROPOSAL 3

AMENDMENT AND RESTATEMENT OF THE COMPANY’S 2012 INCENTIVE AWARD PLAN

As discussed in further detail in the Company’s proxy statement, the Company is asking shareholders to approve the amendment and restatement of its Incentive Award Plan to, among other things, (1) rename the plan as the RAIT Financial Trust 2017 Incentive Award Plan, (2) increase the number of common shares of beneficial interest, par value $0.03 per share (the “Common Shares”), authorized for issuance under the Incentive Award Plan, (3) revise plan features to provide additional shareholder protections and (4) extend the term of the Incentive Award Plan.

We do not believe the amendments to the Incentive Award Plan will address the overcompensation of management or improve the Company’s financial results or corporate governance.

YOU ARE URGED TO VOTE AGAINST THE AMENDMENT AND RESTATEMENT

OF THE INCENTIVE AWARD PLAN ON THE ENCLOSED BLUE PROXY CARD.

18

PROPOSAL 4

ADVISORY VOTE ON EXECUTIVE COMPENSATION

As discussed in further detail in the Company’s proxy statement, the Company is asking shareholders to approve, on a non-binding, advisory basis, the compensation of the Company’s named executive officers, pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the 2016 Summary Compensation Table and the other related compensation tables and narrative discussion.

We believe the Company’s compensation expenses are outsized and that its current compensation practices fail to align the interests of management and shareholders of the Company.

YOU ARE URGED TO VOTE AGAINST THE COMPENSATION OF THE COMPANY’S NAMED

EXECUTIVE OFFICERS ON THE ENCLOSED BLUE PROXY CARD.

19

PROPOSAL 5

ADVISORY VOTE FOR THE FREQUENCY OF THE ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION

As discussed in further detail in the Company’s proxy statement, the Company is asking shareholders to approve, on a non-binding, advisory basis, whether the preferred frequency of an advisory vote on the executive compensation of the Named Executive Officers as set forth in the Company’s proxy statement should be every year, every two years, or every three years.

We believe an annual advisory vote on executive compensation allows shareholders to provide the Company with timely and direct input on its compensation policies, programs and practices.

YOU ARE URGED TO VOTE FOR ONE YEAR FOR THE FREQUENCY OF THE ADVISORY VOTE ON

EXECUTIVE COMPENSATION ON THE ENCLOSED BLUE PROXY CARD.

20

VOTING AND PROXY PROCEDURES

Only shareholders of record as of the close of business on the Record Date will be entitled to notice of and to vote at the Annual Meeting. Holders of Shares are entitled to one vote per Share on all business of the Annual Meeting including any adjournment or postponement thereof.

Shareholders, including those who expect to attend the Annual Meeting, are urged to authorize a proxy to vote their Shares today by following the instructions for voting detailed on the enclosed BLUE proxy card.

Authorized proxies will be voted at the Annual Meeting as marked and, in the absence of specific instructions, will be voted FOR the election of the Highland Nominees to the Board and in accordance with our recommendation on each other matter presented at the Annual Meeting.

The enclosed BLUE proxy card may only be voted for the Highland Nominees and does not confer voting power with respect to the Company’s nominees. Shareholders should refer to the Company’s proxy statement for the names, backgrounds, qualifications and other information concerning the Company’s nominees. The participants in this solicitation intend to vote all of their Shares for the election of the Highland Nominees and will not vote their Shares in favor of any of the Company’s trustee nominees.

If you give us your proxy, we will take all steps necessary and lawful to elect the Highland Nominees. Due to the complexities of corporate law, under certain circumstances, if a quorum (50% of the outstanding Shares) is present at the Annual Meeting, and if the Company has enough affirmative votes to elect its trustee nominees, such a situation could result in the Company’s trustee nominees being elected. As such, voting your Shares at all, even if voted FOR the Highland Nominees, could help create a quorum which could allow the Company’s trustee nominees to be elected. If we believe that voting the proxies we receive would cause there to be a quorum and that the Highland Nominees would thereby not be elected, we may not attend the Annual Meeting and may withhold all proxies in order to attempt to defeat the Company’s proposals.

QUORUM; ADJOURNMENT

A quorum must be present at the Annual Meeting for any business to be conducted. The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the Shares outstanding on the Record Date will constitute a quorum. Broker non-votes and abstentions will be counted for purposes of determining whether a quorum is present. A broker non-vote occurs when a broker, bank, trust or other nominee does not vote shares that it holds in “street name” on behalf of a beneficial owner with respect to a particular non-routine proposal because the beneficial owner has not provided voting instructions to the nominee with respect to such proposal, but the broker, bank, trust or other nominee votes shares that it holds in “street name” on behalf of a beneficial owner with respect to at least one other proposal, because either the beneficial owner has provided voting instructions to the nominee with respect to such proposal or the proposal is routine, such that the nominee may cast a vote on behalf of the beneficial owner even without receiving voting instructions. The NYSE rules governing brokers’ discretionary authority will not permit such brokers to exercise discretionary authority regarding any of the proposals to be voted on at the Annual Meeting. Accordingly, if you hold your Shares in street name with a broker, bank, trust or other nominee, they can only exercise your right to vote with respect to any proposal to be voted on at the Annual Meeting if they receive instructions from you. As of the close of business on the Record Date, according to the Company’s proxy statement, there were [●] Shares outstanding and entitled to vote thereon. Thus, according to the Company’s proxy statement, [●] Shares must be represented by shareholders present at the Annual Meeting or by proxy to establish a quorum.

If a quorum is not present at the Annual Meeting, the shareholders who are present at the Annual Meeting may adjourn the Annual Meeting to such time and place as they may determine.

VOTES REQUIRED FOR APPROVAL

Vote required for the election of trustees. According to the Company’s bylaws, the election of a trustee in a contested election requires a plurality of all the votes cast either in person or by proxy at the Annual Meeting provided that a quorum is present. Each Share entitled to vote may be voted for as many persons as there are trustees to be elected. However, shareholders may not cumulate their votes. If you vote “Withhold Authority” with respect to a trustee nominee, your Shares will not be voted with respect to the person indicated. Because trustees are elected by a plurality of all votes cast, neither broker non-votes or votes marked “Withhold Authority” will have an effect on this matter, but will count for quorum purposes.

21

Vote required for the selection of KPMG LLP as the Company’s independent registered public accounting firm. The Company has stated that the proposal to ratify the selection of KMPG LLP will be approved if it receives the affirmative vote of a majority of votes cast. Abstentions and broker non-votes will have no effect on this proposal.

Vote required for the approval of the amendment to the Incentive Compensation Plan. The Company states that the affirmative vote of the holders of at least a majority of the votes cast is required to approve the amendment and restatement of the Incentive Award Plan. Broker non-votes will have no effect on the voting on this proposal. According to the Company, abstentions with respect to this proposal will be treated as votes cast and will have the same effect as votes against this proposal.

Vote required for the approval of the compensation of the Company’s named executive officers. The Company has stated that this proposal requires the approval of a majority of votes cast to be approved on an advisory, non-binding basis. The Company states that it will review the results of the vote and evaluate whether any actions are necessary to address such results. Abstentions and broker non-votes will have no effect on this proposal.

Vote required for the frequency of the advisory vote on the compensation of the Company’s named executive officers. The frequency that receives a majority of the votes cast will be the frequency approved by the shareholders on an advisory, non-binding basis. The Company states that it will consider the outcome of the vote when determining the frequency of future advisory votes on executive compensation. Abstentions and broker non-votes will have no effect on this proposal.

REVOCATION OF PROXIES

Shareholders of the Company may revoke their proxies (1) by delivering a later-dated proxy, or by delivering a written notice of revocation at any time prior to 12:00 a.m. [Eastern] Time, on [●], 2017 or (2) by attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not in and of itself constitute revocation of a proxy). The delivery of a later-dated proxy which is properly completed will constitute a revocation of any earlier proxy. The revocation may be delivered to us in care of Okapi at 1212 Avenue of the Americas, 24th Floor, New York, NY 10036. Although a revocation is effective if delivered to the Company, we request that either the original or photostatic copies of all revocations be mailed to us in care of Okapi at the above address so that we will be aware of all revocations and can more accurately determine if and when proxies have been received from the holders of record on the Record Date of a majority of the outstanding Shares. Additionally, Okapi may use this information to contact shareholders who have revoked their proxies in order to solicit later-dated proxies for the election of the Highland Nominees and approval of the other proposals described herein.

If you hold Shares through a broker, bank or other nominee, you must follow the instructions you receive from your broker, bank or other nominee in order to revoke your voting instructions.

IF YOU WISH TO VOTE FOR THE ELECTION OF THE HIGHLAND NOMINEES TO THE BOARD, PLEASE VOTE YOUR SHARES AS DESCRIBED HEREIN.

SOLICITATION OF PROXIES

The solicitation of proxies pursuant to this Proxy Statement is being made by us. Proxies may be solicited by mail, facsimile, telephone, Internet, in person and by advertisements.

We have entered into an agreement with Okapi Partners, LLC for solicitation and advisory services in connection with this solicitation, for which Okapi will receive a fee not to exceed $[●], plus costs for solicitation of individual investors, together with reimbursement for its reasonable out-of-pocket expenses, and will be indemnified against certain liabilities and expenses, including certain liabilities under the federal securities laws. Okapi will solicit or will request proxies from individuals, brokers, banks, bank nominees and other institutional

22

holders. We have requested banks, brokerage houses and other custodians, nominees and fiduciaries to forward all solicitation materials to the beneficial owners of the Shares they hold of record. We will reimburse these record holders for their reasonable out-of-pocket expenses in so doing. It is anticipated that Okapi will employ approximately [●] persons to solicit the Company’s shareholders for the Annual Meeting.

The entire expense of soliciting proxies is being borne by us. Costs of this solicitation of proxies are currently estimated to be approximately $[●]. We estimate that through the date hereof, our expenses in connection with this solicitation are approximately $[●].

OTHER PARTICIPANT INFORMATION

The participants in this solicitation are (1) Highland Global Allocation Fund, a series of Highland Funds II, a Massachusetts business trust (the “Global Fund”), (2) Highland Small-Cap Equity Fund, a series of Highland Funds II, a Massachusetts business trust (the “Small-Cap Fund”), (3) Highland Capital Management Fund Advisors, L.P., a Delaware limited partnership (“Highland Fund Advisors”), (4) Strand Advisors XVI, Inc., a Delaware corporation (“Strand XVI”), (5) NexPoint Real Estate Strategies Fund, a Delaware statutory trust (“NRESF”), (6) NexPoint Advisors, L.P., a Delaware limited partnership (“NexPoint Advisors”), (7) NexPoint Advisors GP, LLC, a Delaware limited liability company (“NexPoint Advisors GP”), (8) the Select Fund, (9) Highland Select Equity Fund GP, L.P., a Delaware limited partnership (“Select GP”), (10) Highland Select Equity GP, LLC, a Delaware limited liability company (“Select LLC”), (11) Highland, (12) Strand Advisors, Inc., a Delaware corporation (“Strand”), (13) NexPoint, (14) NexPoint Real Estate Advisors GP, LLC (“NRE Advisors GP”), a Delaware limited liability company, (15) James D. Dondero, (16) Matt R. McGraner, (17) Nancy Jo Kuenstner, (18) John M. Pons and (19) Andrew C. Richardson.

The principal business of Global Fund, Small-Cap Fund, NRESF and Select Fund is making and holding investments. The principal business of Highland Fund Advisors, NexPoint Advisors, NexPoint and Highland is acting as an investment adviser or manager to other persons. The principal business of NRE Advisors GP is serving as the general partner of NexPoint. The principal business of Strand XVI is serving as the general partner of Highland Fund Advisors. Strand XVI may be deemed to beneficially own shares owned or held by or for the account or benefit of Highland Fund Advisors. The principal business of NexPoint Advisors GP is serving as the general partner of NexPoint Advisors. NexPoint Advisors GP may be deemed to beneficially own shares owned or held by or for the account of benefit of NexPoint Advisors. The principal business of Strand is serving as the general partner of Highland. Strand may be deemed to beneficially own shares owned or held by or for the account or benefit of Highland. The principal business of Select GP is serving as the general partner of Select Fund. Select GP may be deemed to beneficially own shares owned or held by or for the account or benefit of Select Fund. The principal business of Select LLC is serving as the general partner of Select GP. Select LLC may be deemed to beneficially own shares owned or held by or for the account or benefit of Select GP.

Each of Mr. Dondero, Mr. McGraner, Ms. Kuenstner, Mr. Pons, and Mr. Richardson is a United States citizen.

The address of the principal business office for each of the Global Fund, the Small-Cap Fund, Highland Fund Advisors, Strand XVI, NRESF, NexPoint Advisors, NexPoint Advisors GP, the Select Fun, Select GP, Select LLC, Highland, Strand, NexPoint and NRE Advisors GP is 300 Crescent Court, Suite 700, Dallas, Texas 75201.

As the date hereof, Global Fund directly owned 2,219,361 Shares. As of the date hereof Small-Cap Fund directly owned 613,889 Shares. As of the date hereof, Highland Fund Advisors, as the investment advisor to Global Fund and Small-Cap Fund, may be deemed the beneficial owner of the 2,883,250 Shares held by Global Fund and Small-Cap Fund. As of the date hereof, Strand XVI, as the general partner of Highland Fund Advisors, the investment advisor to Global Fund and Small-Cap Fund., may be deemed the beneficial owner of the 2,883,250 Shares held by Global Fund and Small-Cap Fund. As of the date hereof, NRESF directly owned 117,040 Shares. As of the date hereof, NexPoint Advisors, as the investment advisor to NRESF, may be deemed the beneficial owner of the 117,040 Shares held by NRESF. As of the date hereof, NexPoint Advisors GP, as the general partner of NexPoint Advisors, the investment advisor to NRESF, may be deemed the beneficial owner of the 117,040 Shares held by NRESF. As of the date hereof, Select Fund directly owned 2,332,087 Shares. As of the date hereof, Select GP, as the general partner of the Select Fund, may be deemed the beneficial owner of 2,332,087 Shares held by

23

Select Fund. As of the date hereof, Select LLC, as the general partner of the Select GP, the general partner of Select Fund, may be deemed the beneficial owner of 2,332,087 Shares held by Select Fund. As of the date hereof, Highland, as the sole member of Select LLC, the general partner of the Select GP, which is the general partner of Select Fund, may be deemed the beneficial owner of 2,332,087 Shares held by Select Fund. As of the date hereof, Strand, as the general partner of Highland, the sole member of Select LLC, which is the general partner of the Select GP, which is the general partner of Select Fund, may be deemed the beneficial owner of 2,332,087 Shares held by Select Fund. As of the date hereof, Mr. Dondero, who is the president of NexPoint Advisors GP (the general partner of the NRESF’s advisor) and Strand (the general partner of the sole member of the general partner of Select Fund’s general partner) and ultimately controls Strand XVI (the general partner of the advisor to Global Fund and Small Cap Fund) and NexPoint Advisors GP, may be deemed the beneficial owner of 5,282,377 Shares held by Global Fund, Small-Cap Fund, NRESF and Select Fund. As of the date hereof, Mr. McGraner directly owned 3,000 Shares.

The Shares purchased by Global Fund, Small-Cap Fund, NRESF and Select Fund were purchased with working capital in open market purchases. The Shares purchased by Mr. McGraner were purchased with his personal funds in open market purchases. The Shares purchased by Mr. Friedman were purchased with his personal funds in open market purchases.

For information regarding purchases and sales of securities of the Company during the past two years by the participants in this solicitation, see Schedule I to this Proxy Statement.

As members of a “group” for the purposes of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended, the participants in this solicitation may be deemed the beneficial owners of the Shares directly owned by the other participants. Each participant disclaims beneficial ownership of such Shares except to the extent of his or its pecuniary interest therein.