Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

| x | Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the quarterly period ended June 30, 2008

or

| ¨ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission file number 1-14760

RAIT FINANCIAL TRUST

(Exact name of registrant as specified in its charter)

| Maryland | 23-2919819 | |

| State or other jurisdiction of incorporation or organization |

(I.R.S. Employer Identification No.) |

| 2929 Arch Street, 17th Floor, Philadelphia, PA | 19104 | |

| (Address of principal executive offices) | (Zip Code) |

(215) 243-9000

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

A total of 63,810,889 common shares of beneficial interest, par value $0.01 per share, of the registrant were outstanding as of August 4, 2008.

Table of Contents

TABLE OF CONTENTS

Table of Contents

PART I - FINANCIAL INFORMATION

Item 1. - Financial Statements

Consolidated Balance Sheets

(Unaudited and dollars in thousands, except share and per share information)

| As of June 30, 2008 |

As of December 31, 2007 |

|||||||

| Assets |

||||||||

| Investments in mortgages and loans, at amortized cost |

||||||||

| Commercial mortgages, mezzanine loans and other loans |

$ | 2,119,407 | $ | 2,189,939 | ||||

| Residential mortgages and mortgage-related receivables |

3,813,542 | 4,065,083 | ||||||

| Allowance for losses |

(55,473 | ) | (26,389 | ) | ||||

| Total investments in mortgages and loans |

5,877,476 | 6,228,633 | ||||||

| Investments in securities and security-related receivables ($3,082,530 and $2,776,833, respectively, at fair value) |

3,082,530 | 3,827,800 | ||||||

| Investments in real estate interests |

270,578 | 284,252 | ||||||

| Cash and cash equivalents |

59,183 | 127,987 | ||||||

| Restricted cash |

216,892 | 298,433 | ||||||

| Accrued interest receivable |

100,935 | 110,287 | ||||||

| Other assets |

41,736 | 70,725 | ||||||

| Deferred financing costs, net of accumulated amortization of $4,206 and $3,800, respectively |

33,068 | 53,340 | ||||||

| Intangible assets, net of accumulated amortization of $77,609 and $64,444, respectively |

42,958 | 56,123 | ||||||

| Total assets |

$ | 9,725,356 | $ | 11,057,580 | ||||

| Liabilities and Shareholders’ equity |

||||||||

| Indebtedness |

||||||||

| Repurchase agreements |

$ | 47,106 | $ | 138,788 | ||||

| Secured credit facilities and other indebtedness |

151,523 | 146,916 | ||||||

| Mortgage-backed securities issued |

3,564,475 | 3,801,959 | ||||||

| Trust preferred obligations ($259,111 at fair value as of June 30, 2008) |

259,111 | 450,625 | ||||||

| CDO notes payable ($1,100,972 at fair value as of June 30, 2008) |

2,532,222 | 5,093,833 | ||||||

| Convertible senior notes |

404,000 | 425,000 | ||||||

| Total indebtedness |

6,958,437 | 10,057,121 | ||||||

| Accrued interest payable |

68,900 | 65,947 | ||||||

| Accounts payable and accrued expenses |

15,464 | 19,197 | ||||||

| Derivative liabilities |

201,078 | 201,581 | ||||||

| Deferred taxes, borrowers’ escrows and other liabilities |

100,196 | 104,821 | ||||||

| Distributions payable |

29,350 | 28,068 | ||||||

| Total liabilities |

7,373,425 | 10,476,735 | ||||||

| Minority interest |

474,397 | 1,602 | ||||||

| Shareholders’ equity |

||||||||

| Preferred shares, $0.01 par value per share, 25,000,000 shares authorized; |

||||||||

| 7.75% Series A cumulative redeemable preferred shares, liquidation preference $25.00 per share, 2,760,000 shares issued and outstanding |

28 | 28 | ||||||

| 8.375% Series B cumulative redeemable preferred shares, liquidation preference $25.00 per share, 2,258,300 shares issued and outstanding |

23 | 23 | ||||||

| 8.875% Series C cumulative redeemable preferred shares, liquidation preference $25.00 per share, 1,600,000 shares issued and outstanding |

16 | 16 | ||||||

| Common shares, $0.01 par value per share, 200,000,000 shares authorized, 63,808,255 and 61,018,231 issued and outstanding, including 122,192 and 225,440 unvested restricted share awards, respectively |

637 | 607 | ||||||

| Additional paid in capital |

1,602,649 | 1,575,979 | ||||||

| Accumulated other comprehensive income (loss) |

(132,455 | ) | (440,039 | ) | ||||

| Retained earnings (deficit) |

406,636 | (557,371 | ) | |||||

| Total shareholders’ equity |

1,877,534 | 579,243 | ||||||

| Total liabilities and shareholders’ equity |

$ | 9,725,356 | $ | 11,057,580 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

1

Table of Contents

Consolidated Statements of Operations

(Unaudited and dollars in thousands, except share and per share information)

| For the Three-Month Periods Ended June 30 |

For the Six-Month Periods Ended June 30 |

|||||||||||||||

| 2008 | 2007 | 2008 | 2007 | |||||||||||||

| Revenue: |

||||||||||||||||

| Investment interest income |

$ | 177,318 | $ | 233,899 | $ | 362,608 | $ | 439,066 | ||||||||

| Investment interest expense |

(119,823 | ) | (180,770 | ) | (252,848 | ) | (339,901 | ) | ||||||||

| Provision for losses |

(25,310 | ) | (845 | ) | (35,583 | ) | (4,563 | ) | ||||||||

| Net investment income |

32,185 | 52,284 | 74,177 | 94,602 | ||||||||||||

| Rental income |

3,860 | 2,612 | 7,708 | 5,024 | ||||||||||||

| Fee and other income |

4,594 | 1,683 | 12,003 | 9,564 | ||||||||||||

| Total revenue |

40,639 | 56,579 | 93,888 | 109,190 | ||||||||||||

| Expenses: |

||||||||||||||||

| Compensation expense |

8,436 | 5,796 | 16,605 | 14,172 | ||||||||||||

| Real estate operating expense |

3,875 | 2,690 | 7,360 | 5,278 | ||||||||||||

| General and administrative expense |

6,910 | 5,786 | 11,723 | 12,069 | ||||||||||||

| Depreciation expense |

1,385 | 1,103 | 2,766 | 1,871 | ||||||||||||

| Amortization of intangible assets |

6,094 | 14,289 | 13,165 | 28,578 | ||||||||||||

| Total expenses |

26,700 | 29,664 | 51,619 | 61,968 | ||||||||||||

| Income before other income (expense), taxes and discontinued operations |

13,939 | 26,915 | 42,269 | 47,222 | ||||||||||||

| Interest and other income |

59 | 4,891 | 1,172 | 9,356 | ||||||||||||

| Losses on sale of assets |

(142 | ) | (2,760 | ) | (142 | ) | (2,760 | ) | ||||||||

| Gains on extinguishment of debt |

8,662 | — | 8,662 | — | ||||||||||||

| Change in fair value of free-standing derivatives |

— | 1,846 | (37,203 | ) | 5,042 | |||||||||||

| Change in fair value of financial instruments |

97,056 | — | 352,906 | — | ||||||||||||

| Unrealized gains (losses) on interest rate hedges |

(66 | ) | 429 | 15 | 517 | |||||||||||

| Equity in income (loss) of equity method investments |

981 | (4 | ) | 944 | (8 | ) | ||||||||||

| Asset impairments |

(9,629 | ) | — | (20,323 | ) | — | ||||||||||

| (Income) loss allocated to minority interest |

4,712 | (6,111 | ) | (99,347 | ) | (11,875 | ) | |||||||||

| Income before taxes and discontinued operations |

115,572 | 25,206 | 248,953 | 47,494 | ||||||||||||

| Income tax benefit |

2,293 | 4,657 | 2,434 | 5,080 | ||||||||||||

| Income from continuing operations |

117,865 | 29,863 | 251,387 | 52,574 | ||||||||||||

| Income from discontinued operations |

— | 52 | — | 208 | ||||||||||||

| Net income |

117,865 | 29,915 | 251,387 | 52,782 | ||||||||||||

| Income allocated to preferred shares |

(3,415 | ) | (2,527 | ) | (6,821 | ) | (5,046 | ) | ||||||||

| Net income available to common shares |

$ | 114,450 | $ | 27,388 | $ | 244,566 | $ | 47,736 | ||||||||

| Earnings per share—Basic: |

||||||||||||||||

| Continuing operations |

$ | 1.84 | $ | 0.45 | $ | 3.97 | $ | 0.79 | ||||||||

| Discontinued operations |

— | — | — | — | ||||||||||||

| Total earnings per share—Basic |

$ | 1.84 | $ | 0.45 | $ | 3.97 | $ | 0.79 | ||||||||

| Weighted-average shares outstanding—Basic |

62,350,803 | 60,937,911 | 61,593,350 | 60,539,584 | ||||||||||||

| Earnings per share—Diluted: |

||||||||||||||||

| Continuing operations |

$ | 1.83 | $ | 0.45 | $ | 3.97 | $ | 0.79 | ||||||||

| Discontinued operations |

— | — | — | — | ||||||||||||

| Total earnings per share—Diluted |

$ | 1.83 | $ | 0.45 | $ | 3.97 | $ | 0.79 | ||||||||

| Weighted-average shares outstanding—Diluted |

62,426,136 | 61,185,851 | 61,633,724 | 60,801,424 | ||||||||||||

| Distributions declared per common share |

$ | 0.46 | $ | 0.84 | $ | 0.92 | $ | 1.64 | ||||||||

The accompanying notes are an integral part of these consolidated financial statements.

2

Table of Contents

Consolidated Statements of Comprehensive Income

(Unaudited and dollars in thousands)

| For the Three-Month Periods Ended June 30 |

For the Six-Month Periods Ended June 30 |

|||||||||||||||

| 2008 | 2007 | 2008 | 2007 | |||||||||||||

| Net income |

$ | 117,865 | $ | 29,915 | $ | 251,387 | $ | 52,782 | ||||||||

| Other comprehensive income (loss) |

||||||||||||||||

| Change in fair value of interest rate hedges |

39,119 | 119,079 | 585 | 107,220 | ||||||||||||

| Reclassification adjustments associated with unrealized losses (gains) from interest rate hedges included in net income |

66 | (429 | ) | (15 | ) | (517 | ) | |||||||||

| Realized (gains) losses on interest rate hedges reclassified to earnings |

2,405 | (1,875 | ) | 4,915 | (3,082 | ) | ||||||||||

| Change in fair value of available-for-sale securities |

(5,838 | ) | (101,654 | ) | (12,530 | ) | (100,544 | ) | ||||||||

| Realized (gains) losses on available-for-sale securities reclassified to earnings |

2,728 | 2,760 | 4,542 | 2,760 | ||||||||||||

| Total other comprehensive income (loss) before minority interest allocation |

38,480 | 17,881 | (2,503 | ) | 5,837 | |||||||||||

| Allocation to minority interest |

(826 | ) | 5,222 | (433 | ) | (3,743 | ) | |||||||||

| Total other comprehensive income (loss) |

37,654 | 23,103 | (2,936 | ) | 2,094 | |||||||||||

| Comprehensive income |

$ | 155,519 | $ | 53,018 | $ | 248,451 | $ | 54,876 | ||||||||

The accompanying notes are an integral part of these consolidated financial statements.

3

Table of Contents

Consolidated Statements of Cash Flows

(Unaudited and dollars in thousands)

| For the Six-Month Periods Ended June 30 |

||||||||

| 2008 | 2007 | |||||||

| Operating activities: |

||||||||

| Net income |

$ | 251,387 | $ | 52,782 | ||||

| Adjustments to reconcile net income to cash flow from operating activities: |

||||||||

| Minority interest |

99,347 | 11,875 | ||||||

| Provision for losses |

35,583 | 4,563 | ||||||

| Amortization of deferred compensation |

4,453 | 5,737 | ||||||

| Depreciation and amortization |

15,931 | 30,551 | ||||||

| Amortization of deferred financing costs and debt discounts |

7,272 | 16,384 | ||||||

| Accretion of discounts on investments |

(3,329 | ) | (4,245 | ) | ||||

| Losses on sale of assets |

142 | 2,760 | ||||||

| Gains on extinguishment of debt |

(8,662 | ) | — | |||||

| Change in fair value of financial instruments |

(352,906 | ) | — | |||||

| Unrealized gains on interest rate hedges |

(15 | ) | (517 | ) | ||||

| Equity in (income) loss of equity method investments |

(944 | ) | 8 | |||||

| Asset impairments |

20,323 | — | ||||||

| Unrealized foreign currency gains on investments |

(313 | ) | (1,479 | ) | ||||

| Changes in assets and liabilities: |

||||||||

| Accrued interest receivable |

8,869 | (16,424 | ) | |||||

| Other assets |

22,050 | 5,087 | ||||||

| Accrued interest payable |

2,953 | 4,952 | ||||||

| Accounts payable and accrued expenses |

(1,135 | ) | (5,415 | ) | ||||

| Deferred taxes, borrowers’ escrows and other liabilities |

(18,137 | ) | (4,703 | ) | ||||

| Cash flows from operating activities |

82,869 | 101,916 | ||||||

| Investing activities: |

||||||||

| Purchase and origination of securities for investment |

(62,637 | ) | (1,833,178 | ) | ||||

| Proceeds from sale of other securities |

— | 606,363 | ||||||

| Purchase and origination of loans for investment |

(60,055 | ) | (1,076,231 | ) | ||||

| Principal repayments on loans |

348,522 | 515,807 | ||||||

| Investment in real estate interests |

2,139 | (64,169 | ) | |||||

| Proceeds from dispositions of real estate interests |

26,625 | — | ||||||

| (Increase) decrease in restricted cash |

71,211 | (124,152 | ) | |||||

| Decrease in warehouse deposits |

— | 9,816 | ||||||

| Cash flows from investing activities |

325,805 | (1,965,744 | ) | |||||

| Financing activities: |

||||||||

| Proceeds from repurchase agreements and other indebtedness |

25,000 | 1,120,658 | ||||||

| Repayments on repurchase agreements and other indebtedness |

(112,074 | ) | (1,377,367 | ) | ||||

| Proceeds from issuance of residential mortgage-backed securities |

— | 616,542 | ||||||

| Repayments on residential mortgage-backed securities |

(242,978 | ) | (263,064 | ) | ||||

| Proceeds from issuance of CDO notes payable |

56,775 | 1,414,020 | ||||||

| Repayments on CDO notes payable |

(151,512 | ) | — | |||||

| Proceeds from issuance of convertible senior notes |

— | 425,000 | ||||||

| Repayments on convertible senior notes |

(11,858 | ) | — | |||||

| Acquisition of minority interest in CDOs |

(70 | ) | (11,529 | ) | ||||

| Distributions to minority interest holders in CDOs |

— | (12,337 | ) | |||||

| Payments for deferred costs |

(36 | ) | (41,849 | ) | ||||

| Proceeds from cash flow hedges |

— | 1,930 | ||||||

| Common share issuance, net of costs incurred |

22,247 | 367,284 | ||||||

| Repurchase of common shares |

— | (74,381 | ) | |||||

| Distributions paid to preferred shares |

(6,821 | ) | (5,046 | ) | ||||

| Distributions paid to common shares |

(56,151 | ) | (89,832 | ) | ||||

| Cash flows from financing activities |

(477,478 | ) | 2,070,029 | |||||

| Net change in cash and cash equivalents |

(68,804 | ) | 206,201 | |||||

| Cash and cash equivalents at the beginning of the period |

127,987 | 99,367 | ||||||

| Cash and cash equivalents at the end of the period |

$ | 59,183 | $ | 305,568 | ||||

| Supplemental cash flow information: |

||||||||

| Cash paid for interest |

$ | 224,392 | $ | 299,418 | ||||

| Cash paid for taxes |

294 | 12,421 | ||||||

| Non-cash decrease in goodwill |

— | 2,761 | ||||||

| Non-cash increase (decrease) in trust preferred obligations |

(88,125 | ) | (199,648 | ) | ||||

| Non-cash increase (decrease) in convertible senior notes from extinguishment of debt |

(9,142 | ) | — | |||||

| Series C preferred shares, net of costs, subscribed as of June 30, 2007 |

— | 38,340 | ||||||

| Distributions payable |

29,350 | 51,239 | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

4

Table of Contents

Notes to Consolidated Financial Statements

As of June 30, 2008

(Unaudited and dollars in thousands, except share and per share amounts)

NOTE 1: RAIT FINANCIAL TRUST

RAIT Financial Trust is a specialty finance company that provides a comprehensive set of debt financing options to the real estate industry, including investors in commercial real estate, real estate investment trusts, or REITs, and real estate operating companies and their intermediaries, throughout the United States and Europe. References to “RAIT”, “we”, “us”, and “our” refer to RAIT Financial Trust and its subsidiaries, unless the context otherwise requires. We manage and invest in commercial mortgages, including whole and mezzanine loans, commercial real estate investments, preferred equity interests, residential mortgage loans, trust preferred securities and subordinated debentures. We originate and invest in real estate-related assets that are underwritten through our integrated investment process. We conduct our business through our subsidiaries, RAIT Partnership, L.P., or RAIT Partnership, and Taberna Realty Finance Trust, or Taberna, as well as through their respective subsidiaries. We and Taberna are self-managed and self-advised Maryland REITs. Our objective is to provide our shareholders with total returns over time, including quarterly distributions and capital appreciation, while seeking to manage the risks associated with our investment strategy.

NOTE 2: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

a. Basis of Presentation

The accompanying unaudited interim consolidated financial statements have been prepared by management in accordance with U.S. generally accepted accounting principles, or GAAP. Certain information and footnote disclosures normally included in annual consolidated financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to such rules and regulations, although we believe that the included disclosures are adequate to make the information presented not misleading. The unaudited interim consolidated financial statements should be read in conjunction with our audited financial statements as of and for the year ended December 31, 2007 included in our Annual Report on Form 10-K. In the opinion of management, all adjustments, consisting only of normal recurring adjustments, necessary to present fairly our consolidated financial position and consolidated results of operations and cash flows are included. The results of operations for the interim periods presented are not necessarily indicative of the results for the full year. Certain prior period amounts have been reclassified to conform with the current period presentation.

b. Principles of Consolidation

The consolidated financial statements reflect our accounts and the accounts of our majority-owned and/or controlled subsidiaries. We also consolidate entities that are variable interest entities, or VIEs, where we have determined that we are the primary beneficiary of such entities. The portions of these entities that we do not own are presented as minority interest as of the dates and for the periods presented in the consolidated financial statements. All intercompany accounts and transactions have been eliminated in consolidation.

c. Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting periods. Actual results could differ from those estimates.

d. Investments

We invest in commercial mortgages, mezzanine loans, residential mortgages and mortgage-related receivables, debt securities and other types of real estate-related assets. We account for our investments in securities under Statement of Financial Accounting Standards No. 115, “Accounting for Certain Investments in Debt and Equity Securities,” as amended and interpreted, or SFAS No. 115, and designate each investment as a trading security, an available-for-sale security, or a held-to-maturity security based on our intent at the time of acquisition. Under SFAS No. 115, trading securities are recorded at their fair value each reporting period with fluctuations in fair value reported as a component of earnings. Available-for-sale securities are recorded at fair value with changes in fair value reported as a component of other comprehensive income (loss). See “i. Fair Value of Financial Instruments.” Upon the sale of an available-for-sale security, the realized gain or loss on the sale will be recorded as a component of earnings in the respective period. Held-to-maturity investments are carried at amortized cost at each reporting period.

5

Table of Contents

RAIT Financial Trust

Notes to Consolidated Financial Statements

As of June 30, 2008

(Unaudited and dollars in thousands, except share and per share amounts)

On January 1, 2008, we adopted Statement of Financial Accounting Standard No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities”, or SFAS No. 159. See “k. Recent Accounting Pronouncements.” In applying SFAS No. 159, we classified certain of our available for sale securities as trading securities on January 1, 2008. Trading securities are carried at their estimated fair value, with changes in fair value reported in earnings.

We account for our investments in subordinated debentures owned by trust VIEs that we consolidate as available-for-sale securities. These VIEs have no ability to sell, pledge, transfer or otherwise encumber the trust or the assets of the trust until such subordinated debenture’s maturity. We account for investments in securities where the transfer meets the criteria as a financing under Statement of Financial Accounting Standards No. 140, “Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities”, or SFAS No. 140, at amortized cost. Our investments in security-related receivables represent securities that were transferred to issuers of collateralized debt obligations, or CDOs, in which the transferors maintained some level of continuing involvement.

We use our judgment to determine whether an investment in securities has sustained an other-than-temporary decline in value. If management determines that an investment in securities has sustained an other-than-temporary decline in its value, the investment is written down to its fair value by a charge to earnings, and we establish a new cost basis for the investment. Our evaluation of an other-than-temporary decline is dependent on the specific facts and circumstances. Factors that we consider in determining whether an other-than-temporary decline in value has occurred include: the estimated fair value of the investment in relation to our cost basis; the financial condition of the related entity; and the intent and ability to retain the investment for a sufficient period of time to allow for recovery of the fair value of the investment.

We account for our investments in commercial mortgages, mezzanine loans, other loans and residential mortgages and mortgage-related receivables at amortized cost. The carrying value of these investments is adjusted for origination discounts/premiums, nonrefundable fees and direct costs for originating loans which are amortized into income on a level yield basis over the terms of the loans. Mortgage-related receivables represent loan receivables secured by residential mortgages, the legal title to which is held by our consolidated securitizations. These residential mortgages were transferred to the consolidated securitizations in transactions accounted for as financings under SFAS No. 140. Mortgage-related receivables maintain all of the economic attributes of the underlying residential mortgages and all benefits or risks of that ownership inure to the trust subsidiary.

We maintain an allowance for losses on our investments in commercial mortgages, mezzanine loans, other loans and residential mortgages and mortgage-related receivables. Our allowance for losses is based on management’s evaluation of known losses and inherent risks, for example, historical and industry loss experience, economic conditions and trends, estimated fair values, the quality of collateral and other relevant factors. Specific allowances for losses on our commercial and mezzanine loans are established for impaired loans based on a comparison of the recorded carrying value of the loan to either the present value of the loan’s expected cash flow, the loan’s estimated market price or the estimated fair value of the underlying collateral. Our allowance for loss on residential mortgage loans is evaluated collectively for impairment as the mortgage loans are homogenous pools of residential mortgages. The allowance is increased by charges to operations and decreased by charge-offs (net of recoveries).

e. Transfers of Financial Assets

We account for transfers of financial assets under SFAS No. 140 as either sales or financings. Transfers of financial assets that result in sales accounting are those in which (1) the transfer legally isolates the transferred assets from the transferor, (2) the transferee has the right to pledge or exchange the transferred assets and no condition both constrains the transferee’s right to pledge or exchange the assets and provides more than a trivial benefit to the transferor, and (3) the transferor does not maintain effective control over the transferred assets. If the transfer does not meet these criteria, the transfer is accounted for as a financing. Financial assets that are treated as sales are removed from our accounts with any realized gain (loss) reflected in earnings during the period of sale. Financial assets that are treated as financings are maintained on the balance sheet with proceeds received from the legal transfer reflected as securitized borrowings, or security-related receivables.

f. Revenue Recognition

| 1) | Net investment income—We recognize interest income from investments in commercial mortgages, mezzanine loans, residential mortgages and debt and other securities on a yield to maturity basis. Upon the acquisition of a loan at a discount, we assess the portions of the discount that constitutes accretable yields and non-accretable differences. The accretable yield represents the excess of our expected cash flows from the loan over the amount |

6

Table of Contents

RAIT Financial Trust

Notes to Consolidated Financial Statements

As of June 30, 2008

(Unaudited and dollars in thousands, except share and per share amounts)

| we paid for the loan. That amount, the accretable yield, is accreted to interest income over the remaining life of the loan. Many of our commercial mortgages and mezzanine loans provide for the accrual of interest at specified rates which differ from current payment terms. Interest income is recognized on such loans at the accrual rate subject to management’s determination that accrued interest and outstanding principal are ultimately collectible. Management evaluates loans for non-accrual status each reporting period. Payments received for loans on non-accrual status are applied to principal until the loan is removed from non-accrual status. Past due interest is recognized on non-accrual loans when they are removed from non-accrual status and are making current interest payments. For investments that we did not elect to record at fair value under SFAS No. 159, origination fees and direct loan origination costs are deferred and amortized to net investment income, using the effective interest method, over the contractual life of the underlying loan security or loan, in accordance with Statement of Financial Accounting Standards No. 91, “Accounting for Nonrefundable Fees and Costs Associated with Origination or Acquiring Loans and Initial Direct Costs of Leases”, or SFAS No. 91. For investments that we elected to record at fair value under SFAS No. 159, origination fees and direct loan costs are recorded in income and are not deferred. We recognize interest income from interests in certain securitized financial assets on an estimated effective yield to maturity basis. Management estimates the current yield on the amortized cost of the investment based on estimated cash flows after considering prepayment and credit loss experience. |

| 2) | Structuring fees—We receive structuring fees for services rendered in connection with the formation of CDO securitization entities. The structuring fee is a contractual fee paid when the related services are completed. The structuring fee is a negotiated fee with the investment bank acting as placement agent for the CDO securities and is capitalized by the securitization entity as a deferred financing cost. We may decide to invest in the debt or equity securities issued by securitization entities. We evaluate our investment in these entities under Financial Accounting Standards Board, or FASB, Interpretation No. 46R, “Consolidation of Variable Interest Entities”, or FIN 46R, to determine whether the entity is a VIE, and, if so, whether or not we are the primary beneficiary. If we are determined to be the primary beneficiary, we will consolidate the accounts of the securitization entity and, upon consolidation, we eliminate intercompany transactions, specifically the structuring fees and deferred financing costs paid. During the three-month and six-month periods ended June 30, 2007, structuring fees of $5,788 and $11,413, respectively, were received and eliminated upon consolidation of securitization entities. No structuring fees were received during the six-month period ended June 30, 2008. |

| 3) | Fee and other income—We generate fee and other income through our various subsidiaries by providing (a) ongoing asset management services to investment portfolios under cancelable management agreements, (b) providing or arranging to provide financing to our borrowers, and (c) providing financial consulting to our borrowers. We recognize revenue for these activities when the fees are fixed or determinable, are evidenced by an arrangement, collection is reasonably assured and the services under the arrangement have been provided. Asset management fees are an administrative cost of a securitization entity and are paid by the administrative trustee on behalf of its investors. These asset management fees are recognized when earned and are paid quarterly. Asset management fees from consolidated CDOs are eliminated in consolidation. During the three-month periods ended June 30, 2008 and 2007, we earned $6,710 and $7,160, respectively, of asset management fees, of which we eliminated $4,172 and $5,750, respectively, upon consolidation of CDOs of which we are the primary beneficiary. During the six-month periods ended June 30, 2008 and 2007, we earned $14,793 and $12,810, respectively, of asset management fees, of which we eliminated $8,561 and $10,238, respectively, upon consolidation of CDOs of which we are the primary beneficiary. |

g. Off-Balance Sheet Arrangements

We maintain warehouse financing arrangements with various investment banks and engage in CDO securitizations. Prior to the completion of a CDO securitization, our warehouse providers acquire investments in accordance with the terms of the warehouse facilities. We are paid the difference between the interest earned on the investments and the interest charged by the warehouse providers from the dates on which the respective investments were acquired. We bear the first dollar risk of loss, up to our warehouse deposit amount, if (i) an investment funded through the warehouse facility becomes impaired or (ii) a CDO is not completed by the end of the warehouse period, and in either case, the warehouse provider is required to liquidate the securities at a loss. These off-balance sheet arrangements are not consolidated because our risk of loss is generally limited to the cash collateral held by the warehouse providers and our warehouse facilities are not special purpose vehicles. However, since we hold an implicit variable interest in many entities funded under our warehouse facilities, we often consolidate the Trust VIEs while the trust preferred securities, or TruPS, they issue are held on the warehouse lines. These warehouse facilities are considered free-standing derivatives and are recorded at fair value in our financial statements. Changes in fair value are reflected in earnings in the respective period.

7

Table of Contents

RAIT Financial Trust

Notes to Consolidated Financial Statements

As of June 30, 2008

(Unaudited and dollars in thousands, except share and per share amounts)

h. Derivative Instruments

We may use derivative financial instruments to hedge all or a portion of the interest rate risk associated with our borrowings. Certain of the techniques used to hedge exposure to interest rate fluctuations may also be used to protect against declines in the market value of assets that result from general trends in debt markets. The principal objective of such agreements is to minimize the risks and/or costs associated with our operating and financial structure as well as to hedge specific anticipated transactions.

In accordance with Statement of Financial Accounting Standards No. 133, “Accounting for Derivative Instruments and Hedging Activities,” as amended and interpreted, or SFAS No. 133, we measure each derivative instrument (including certain derivative instruments embedded in other contracts) at fair value and record such amounts in our consolidated balance sheet as either an asset or liability. For derivatives designated as fair value hedges, derivatives not designated as hedges, or for derivatives designated as cash flow hedges associated with debt for which we elected the fair value option under SFAS No. 159, the changes in fair value of the derivative instrument is recorded in earnings. For derivatives designated as cash flow hedges, the changes in the fair value of the effective portions of the derivative are reported in other comprehensive income. Changes in the ineffective portions of cash flow hedges are recognized in earnings.

i. Fair Value of Financial Instruments

Effective January 1, 2008, we adopted Statement of Financial Accounting Standards No. 157, “Fair Value Measurements”, or SFAS No. 157, which requires additional disclosures about our assets and liabilities that we measure at fair value. As defined in SFAS No. 157, fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Where available, fair value is based on observable market prices or parameters or derived from such prices or parameters. Where observable prices or inputs are not available, valuation models are applied. These valuation techniques involve management estimation and judgment, the degree of which is dependent on the price transparency for the instruments or market and the instruments’ complexity for disclosure purposes. Beginning in January 2008, assets and liabilities recorded at fair value in the consolidated balance sheets are categorized based upon the level of judgment associated with the inputs used to measure their value. Hierarchical levels, as defined in SFAS No. 157 and directly related to the amount of subjectivity associated with the inputs to fair valuations of these assets and liabilities are as follows:

| • | Level 1: Valuations are based on unadjusted, quoted prices in active markets for identical assets or liabilities at the measurement date. The types of assets carried at level 1 fair value generally are equity securities listed in active markets. As such, valuations of these investments do not entail a significant degree of judgment. |

| • | Level 2: Valuations are based on quoted prices for similar instruments in active markets or quoted prices for identical or similar instruments in markets that are not active or for which all significant inputs are observable, either directly or indirectly. |

Fair value assets and liabilities that are generally included in this category are unsecured REIT note receivables, commercial mortgage-backed securities, or CMBS, receivables, CDO notes payable and certain financial instruments classified as derivatives where the fair value is based on observable market inputs.

| • | Level 3: Inputs are unobservable inputs for the asset or liability, and include situations where there is little, if any, market activity for the asset or liability. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, the level in the fair value hierarchy within which the fair value measurement in its entirety falls has been determined based on the lowest level input that is significant to the fair value measurement in its entirety. Our assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment, and considers factors specific to the asset. Generally, assets carried at fair value and included in this category are TruPS and subordinated debentures where observable market inputs do not exist. |

The availability of observable inputs can vary depending on the financial asset or liability and is affected by a wide variety of factors, including, for example, the type of investment, whether the investment is new, whether the investment is traded on an active exchange or in the secondary market, and the current market condition. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the

8

Table of Contents

RAIT Financial Trust

Notes to Consolidated Financial Statements

As of June 30, 2008

(Unaudited and dollars in thousands, except share and per share amounts)

determination of fair value requires more judgment. Accordingly, the degree of judgment exercised by us in determining fair value is greatest for instruments categorized in level 3. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement in its entirety falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Fair value is a market-based measure considered from the perspective of a market participant who holds the asset or owes the liability rather than an entity-specific measure. Therefore, even when market assumptions are not readily available, our own assumptions are set to reflect those that management believes market participants would use in pricing the asset or liability at the measurement date. We use prices and inputs that management believes are current as of the measurement date, including during periods of market dislocation. In periods of market dislocation, the observability of prices and inputs may be reduced for many instruments. This condition could cause an instrument to be reclassified from Level 1 to Level 2 or Level 2 to Level 3.

Many financial institutions have bid and ask prices that can be observed in the marketplace. Bid prices reflect the highest price that we and others are willing to pay for an asset. Ask prices represent the lowest price that we and others are willing to accept for an asset. For financial instruments whose inputs are based on bid-ask prices, we do not require that fair value always be a predetermined point in the bid-ask range. Our policy is to allow for mid-market pricing and adjusting to the point within the bid-ask range that results in our best estimate of fair value.

Fair value for certain of our Level 3 financial instruments is derived using internal valuation models. These internal valuation models include discounted cash flow analyses developed by management using current interest rates, estimates of the term of the particular instrument, specific issuer information and other market data for securities without an active market. In accordance with SFAS No. 157, the impact of our own credit spreads is also considered when measuring the fair value of financial assets or liabilities, including derivative contracts. Where appropriate, valuation adjustments are made to account for various factors, including bid-ask spreads, credit quality and market liquidity. These adjustments are applied on a consistent basis and are based on observable inputs where available. Management’s estimate of fair value requires significant management judgment and is subject to a high degree of variability based upon market conditions, the availability of specific issuer information and management’s assumptions.

j. Income Taxes

RAIT and Taberna have each elected to be taxed as a REIT and to comply with the related provisions of the Internal Revenue Code of 1986, as amended, or the Internal Revenue Code. Accordingly, we generally will not be subject to U.S. federal income tax to the extent of our distributions to shareholders and as long as certain asset, income and share ownership tests are met. If we were to fail to meet these requirements, we would be subject to U.S. federal income tax, which could have a material adverse impact on our results of operations and amounts available for distributions to our shareholders. Management believes that all of the criteria to maintain RAIT’s and Taberna’s REIT qualification have been met for the applicable periods, but there can be no assurances that these criteria will continue to be met in subsequent periods.

We maintain various taxable REIT subsidiaries, or TRSs, which may be subject to U.S. federal, state and local income taxes and foreign taxes. Current and deferred taxes are provided on the portion of earnings (losses) recognized by us with respect to our interest in domestic TRSs. Deferred income tax assets and liabilities are computed based on temporary differences between the GAAP consolidated financial statements and the federal and state income tax basis of assets and liabilities as of the consolidated balance sheet date. We evaluate the realizability of our deferred tax assets (e.g, net operating loss and capital loss carryforwards) and recognize a valuation allowance if, based on the weight of available evidence, it is more likely than not that some portion or all of our deferred tax assets will not be realized. When evaluating the realizability of our deferred tax assets, we consider estimates of expected future taxable income, existing and projected book/tax differences, tax planning strategies available, and the general and industry specific economic outlook. This realizability analysis is inherently subjective, as it requires management to forecast our business and general economic environment in future periods. Changes in estimate of deferred tax asset realizability, if any, are included in income tax expense on the consolidated statements of income.

From time to time, these TRSs generate taxable income from intercompany transactions. The TRS entities generate taxable revenue from fees for services provided to CDO entities. Some of these fees paid to the TRS entities are capitalized as deferred financing costs by the CDO entities. Certain CDO entities may be consolidated in our financial statements

9

Table of Contents

RAIT Financial Trust

Notes to Consolidated Financial Statements

As of June 30, 2008

(Unaudited and dollars in thousands, except share and per share amounts)

pursuant to FIN 46R. In consolidation, these fees are eliminated when the CDO entity is included in the consolidated group. Nonetheless, all income taxes are accrued by the TRSs in the year in which the taxable revenue is received. These income taxes are not eliminated when the related revenue is eliminated in consolidation.

Certain TRS entities are domiciled in the Cayman Islands and, accordingly, taxable income generated by these entities may not be subject to local income taxation, but generally will be included in our income on a current basis, whether or not distributed. Upon distribution of any previously included income, no incremental U.S. federal, state, or local income taxes would be payable by us. We maintain a TRS entity in the UK that is subject to income tax in that jurisdiction. In addition, in June 2008, we formed a TRS entity in Ireland which will be subject to income tax in Ireland. The income from these entities is not included in our income for U.S. tax purposes until it is distributed.

k. Recent Accounting Pronouncements

In September 2006, the FASB issued SFAS No. 157, which defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The statement also establishes a framework for measuring fair value by creating a three-level fair value hierarchy that ranks the quality and reliability of information used to determine fair value, and requires new disclosures of assets and liabilities measured at fair value based on their level in the hierarchy. The adoption of SFAS No. 157 did not have a material impact on our approach to fair valuing our assets, derivative instruments and certain liabilities. See further discussion below on the impact of adopting SFAS No. 159.

In February 2007, the FASB issued SFAS No. 159, which provides entities with an irrevocable option to report certain financial assets and liabilities at fair value, with subsequent changes in fair value reported in earnings. The election can be applied on an instrument-by-instrument basis. SFAS No. 159 establishes presentation and disclosure requirements designed to facilitate comparisons between entities that choose different measurement attributes for similar types of assets and liabilities. As of January 1, 2008, we adopted SFAS No. 159 and we recorded at fair value certain of our investments in securities, CDO notes payable and trust preferred obligations used to finance those investments and any related interest rate derivatives. Subsequent to January 1, 2008, all changes in the fair value of such investments in securities, CDO notes payable, trust preferred obligations and related interest rate derivatives are recorded in earnings. Upon adoption of SFAS No. 159 on January 1, 2008, we recognized an increase in shareholders’ equity of $1,087,394.

The following table presents information about the eligible instruments for which we elected the fair value option and for which adjustments were recorded as of January 1, 2008:

| Carrying Amount as of December 31, 2007 |

Effect from adoption of SFAS No. 159 |

Carrying Amount as of January 1, 2008 (After adoption of SFAS No. 159) |

||||||||||

| Assets: |

||||||||||||

| Trading securities (1) |

$ | 2,721,360 | $ | — | $ | 2,721,360 | ||||||

| Security-related receivables |

1,050,967 | (99,991 | ) | 950,976 | ||||||||

| Deferred financing costs, net of accumulated amortization |

18,047 | (18,047 | ) | — | ||||||||

| Liabilities: |

||||||||||||

| Trust preferred obligations |

(450,625 | ) | 52,070 | (398,555 | ) | |||||||

| CDO notes payable |

(3,695,858 | ) | 1,520,616 | (2,175,242 | ) | |||||||

| Deferred taxes and other liabilities |

(6,103 | ) | 6,103 | — | ||||||||

| Fair value adjustments before allocation to minority interest |

1,460,751 | |||||||||||

| Allocation of fair value adjustments to minority interest |

— | (373,357 | ) | (373,357 | ) | |||||||

| Cumulative effect on shareholders’ equity from adoption of SFAS No. 159 (2) |

$ | 1,087,394 | ||||||||||

| (1) | Prior to January 1, 2008, trading securities were classified as available-for-sale and carried at fair value. Accordingly, the election of the fair value option under SFAS No. 159 for trading securities did not change their carrying value and resulted in a reclassification of $310,520 from accumulated other comprehensive income (loss) to retained earnings (deficit) on January 1, 2008. |

| (2) | The $1,087,394 cumulative effect on shareholders’ equity from the adoption of SFAS No. 159 on January 1, 2008 was comprised of a $310,520 increase to accumulated other comprehensive income (loss) and a $776,874 increase to retained earnings (deficit). |

10

Table of Contents

RAIT Financial Trust

Notes to Consolidated Financial Statements

As of June 30, 2008

(Unaudited and dollars in thousands, except share and per share amounts)

In December 2007, the FASB issued Statement of Financial Accounting Standards No. 160, “Noncontrolling Interests in Consolidated Financial Statements – an amendment of Accounting Research Bulletin No. 51”, or SFAS No. 160. SFAS No. 160 establishes accounting and reporting standards for ownership interests in subsidiaries held by parties other than the parent, the amount of consolidated net income attributable to the parent and to the noncontrolling interest, changes in a parent’s ownership interest and the valuation of retained noncontrolling equity investments when a subsidiary is deconsolidated. SFAS No. 160 also establishes disclosure requirements that clearly identify and distinguish between the interests of the parent and the interests of the noncontrolling owners. The statement is effective for fiscal years beginning after December 15, 2008. Management is currently evaluating the impact that this statement may have on our consolidated financial statements.

In February 2008, the FASB issued FASB Staff Position No. 140-3, “Accounting for Transfers of Financial Assets and Repurchase Financing Transactions”, or FSP No. 140-3. FSP No. 140-3 provides guidance on accounting for a transfer of a financial asset and a repurchase financing. FSP No. 140-3 presumes that an initial transfer of a financial asset and a repurchase financing are considered part of the same arrangement (linked transaction) under SFAS No. 140. However, if certain criteria are met, the initial transfer and repurchase financing shall not be evaluated as a linked transaction and shall be evaluated separately under SFAS No. 140. The statement is effective for fiscal years beginning after November 15, 2008. Management is currently evaluating the impact that this statement may have on our consolidated financial statements.

In March 2008, the FASB issued Statement of Financial Accounting Standards No. 161, “Disclosures about Derivative Instruments and Hedging Activities – an amendment of SFAS No. 133”, or SFAS No. 161. SFAS No. 161 requires enhanced disclosure related to derivatives and hedging activities and thereby seeks to improve the transparency of financial reporting. Under SFAS No. 161, entities are required to provide enhanced disclosures relating to: (a) how and why an entity uses derivative instruments; (b) how derivative instruments and related hedge items are accounted for under SFAS No. 133 and its related interpretations; and (c) how derivative instruments and related hedged items affect an entity’s financial position, financial performance and cash flows. The statement is effective for fiscal years beginning after November 15, 2008. Management is currently evaluating the impact that this statement may have on our consolidated financial statements.

In May 2008, the FASB issued Staff Position No. Accounting Principles Board 14-1, “Accounting for Convertible Debt Instruments That May Be Settled in Cash upon Conversion (Including Partial Cash Settlement)”, or APB 14-1, which clarifies the accounting for convertible debt instruments that may be settled in cash (including partial cash settlement) upon conversion. APB 14-1 requires issuers to account separately for the liability and equity components of certain convertible debt instruments in a manner that reflects the issuer’s nonconvertible debt (unsecured debt) borrowing rate when interest cost is recognized. The equity component is presented in shareholders’ equity and the accretion of the resulting discount on the debt is recognized as part of interest expense in the consolidated statement of operations. APB 14-1 requires retrospective application to the terms of instruments as they existed for all periods presented. The statement is effective for fiscal years beginning after December 15, 2008. Management is currently evaluating the impact that this statement may have on our consolidated financial statements.

11

Table of Contents

RAIT Financial Trust

Notes to Consolidated Financial Statements

As of June 30, 2008

(Unaudited and dollars in thousands, except share and per share amounts)

NOTE 3: INVESTMENTS IN LOANS

Our investments in mortgages and loans are accounted for at amortized cost.

Investments in Commercial Mortgages, Mezzanine Loans and Other Loans

The following table summarizes our investments in commercial mortgages, mezzanine loans and other loans as of June 30, 2008:

| Unpaid Principal Balance |

Unamortized (Discounts) Premiums |

Carrying Amount |

Number of Loans |

Weighted Average Coupon |

Range of Maturity Dates | ||||||||||||||

| Commercial mortgages |

$ | 1,426,195 | $ | — | $ | 1,426,195 | 120 | 7.7 | % | Aug. 2008 to Aug. 2012 | |||||||||

| Mezzanine loans |

529,297 | (3,227 | ) | 526,070 | 159 | 10.5 | % | Aug. 2008 to Aug. 2021 | |||||||||||

| Other loans |

177,761 | 861 | 178,622 | 11 | 6.2 | % | Dec. 2008 to Oct. 2016 | ||||||||||||

| Total |

2,133,253 | (2,366 | ) | 2,130,887 | 290 | 8.3 | % | ||||||||||||

| Unearned fees |

(11,480 | ) | — | (11,480 | ) | ||||||||||||||

| Total |

$ | 2,121,773 | $ | (2,366 | ) | $ | 2,119,407 | ||||||||||||

The following table summarizes the delinquency statistics of commercial mortgages, mezzanine loans and other loans as of June 30, 2008:

| Delinquency Status |

Principal Amount | ||

| 30 to 59 days |

$ | 86,041 | |

| 60 to 89 days |

20,379 | ||

| 90 days or more |

9,350 | ||

| In foreclosure or bankrupt |

38,858 | ||

| Total |

$ | 154,628 | |

As of June 30, 2008, approximately $42,250 of our commercial mortgages and mezzanine loans were on non-accrual status and had a weighted-average coupon of 12.2%.

Investments in Residential Mortgages and Mortgage-Related Receivables

The following table summarizes our investments in residential mortgages and mortgage-related receivables as of June 30, 2008:

| Unpaid Principal Balance |

Unamortized (Discount) |

Carrying Amount |

Number of Loans and Mortgage- Related Receivables |

Weighted Average Coupon |

Average Contractual Maturity Date | ||||||||||||

| 3/1 Adjustable rate |

$ | 103,434 | $ | (795 | ) | $ | 102,639 | 267 | 5.6 | % | August 2035 | ||||||

| 5/1 Adjustable rate |

3,139,173 | (11,653 | ) | 3,127,520 | 6,507 | 5.6 | % | September 2035 | |||||||||

| 7/1 Adjustable rate |

528,327 | (2,911 | ) | 525,416 | 1,162 | 5.7 | % | July 2035 | |||||||||

| 10/1 Adjustable rate |

58,431 | (464 | ) | 57,967 | 68 | 5.7 | % | June 2035 | |||||||||

| Total |

$ | 3,829,365 | $ | (15,823 | ) | $ | 3,813,542 | 8,004 | 5.6 | % | |||||||

12

Table of Contents

RAIT Financial Trust

Notes to Consolidated Financial Statements

As of June 30, 2008

(Unaudited and dollars in thousands, except share and per share amounts)

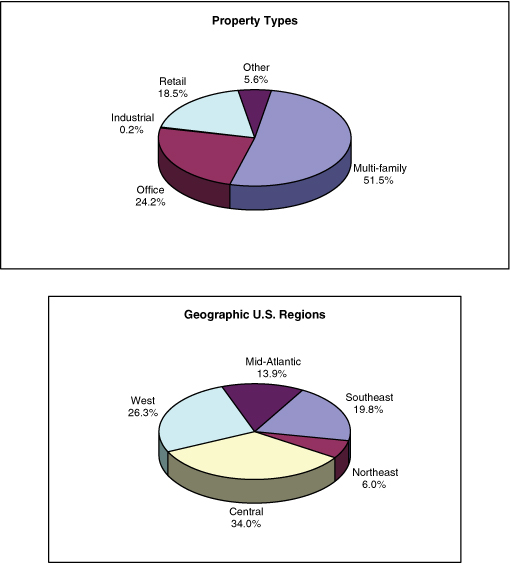

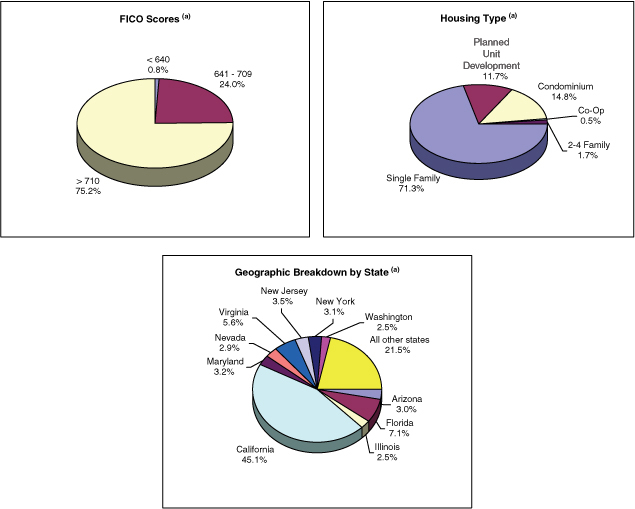

Our residential mortgages and mortgage-related receivables are pledged as collateral with mortgage securitizations. These mortgage securitizations have issued mortgage-backed securities to finance these obligations with a principal balance outstanding of $3,593,375 as of June 30, 2008. These securitization transactions occurred after the residential mortgages were acquired in whole-loan portfolio transactions. In each of these residential mortgage securitizations, we retained all of the subordinated and non-rated mortgage-backed securities issued. These securitization entities are non-qualified special purpose entities and are considered VIEs. Because we retained all of the subordinated and non-rated residential mortgage-backed securities, or RMBS, issued, we are the primary beneficiary of these entities and consolidate each of the residential mortgage securitization trusts. Approximately 45.1% of our residential mortgage loans were in the state of California as of June 30, 2008.

The following table summarizes the delinquency statistics of our residential mortgage loans as of June 30, 2008:

| Delinquency Status |

Principal Amount | ||

| 30 to 59 days |

$ | 37,879 | |

| 60 to 89 days |

19,152 | ||

| 90 days or more |

37,061 | ||

| In foreclosure, bankrupt or real estate owned |

86,489 | ||

| Total |

$ | 180,581 | |

As of June 30, 2008, approximately $142,702 of our residential mortgages and mortgage-related receivables were on non-accrual status and had a weighted-average coupon of 5.9%.

For the six-month period ended June 30, 2008, we recorded asset impairments of $8,509 associated with certain investments in commercial and residential loans. In making this determination, management considered the estimated fair value of the investments to our cost basis, the financial condition of the related entity and our intent and ability to hold the investments for a sufficient period of time to recover our investments. For the identified investments, management believes full recovery is not likely and wrote down the investments to their estimated net realizable value.

Allowance For Losses

We maintain an allowance for losses on our investments in commercial mortgages, mezzanine loans, residential mortgages and mortgage-related receivables and other real estate related assets. Specific allowances for losses are established for impaired loans based on a comparison of the recorded carrying value of the loan to either the present value of the loan’s expected cash flow, the loan’s estimated market price or the estimated net realizable value of the underlying collateral. The allowance is increased by charges to operations and decreased by charge-offs (net of recoveries). Management’s periodic evaluation of the adequacy of the allowance is based upon expected and inherent risks in the portfolio, historical trends in adjustable rate residential mortgages (if applicable), the estimated value of underlying collateral, and current and expected future economic conditions.

As of June 30, 2008 and December 31, 2007, we maintained an allowance for losses as follows:

| As of June 30, 2008 |

As of December 31, 2007 | |||||

| Residential mortgages and mortgage-related receivables |

$ | 16,973 | $ | 11,814 | ||

| Commercial mortgages, mezzanine loans and other real estate related assets |

38,500 | 14,575 | ||||

| Total allowance for losses |

$ | 55,473 | $ | 26,389 | ||

The following table provides a roll-forward of our allowance for losses for the three-month and six-month periods ended June 30, 2008:

| For The Three-Month Period Ended June 30, 2008 |

For The Six-Month Period Ended June 30, 2008 |

|||||||

| Balance, beginning of period |

$ | 35,675 | $ | 26,389 | ||||

| Additions |

25,310 | 35,583 | ||||||

| Charge-offs |

(5,512 | ) | (6,499 | ) | ||||

| Balance, end of period |

$ | 55,473 | $ | 55,473 | ||||

13

Table of Contents

RAIT Financial Trust

Notes to Consolidated Financial Statements

As of June 30, 2008

(Unaudited and dollars in thousands, except share and per share amounts)

NOTE 4: INVESTMENTS IN SECURITIES

Our investments in securities and security-related receivables are accounted for at fair value. The following table summarizes our investments in securities as of June 30, 2008:

| Investment Description |

Amortized Cost |

Net Fair Value Adjustments |

Estimated Fair Value |

Weighted Average Coupon |

Weighted Average Years to Maturity | ||||||||||

| Trading securities (1): |

|||||||||||||||

| TruPS and subordinated debentures |

$ | 3,042,503 | $ | (747,994 | ) | $ | 2,294,509 | 7.0 | % | 26.4 | |||||

| Other securities |

10,000 | (8,500 | ) | 1,500 | 7.4 | % | 44.4 | ||||||||

| Total trading securities |

3,052,503 | (756,494 | ) | 2,296,009 | 7.0 | % | 26.4 | ||||||||

| Available-for-sale securities |

64,704 | (18,805 | ) | 45,899 | 8.7 | % | 33.5 | ||||||||

| Security-related receivables (2): |

|||||||||||||||

| TruPS and subordinated debenture receivables |

374,094 | (102,372 | ) | 271,722 | 7.6 | % | 21.7 | ||||||||

| Unsecured REIT note receivables |

370,889 | (44,022 | ) | 326,867 | 6.0 | % | 8.4 | ||||||||

| CMBS receivables (3) |

213,921 | (84,863 | ) | 129,058 | 5.8 | % | 34.3 | ||||||||

| Other securities |

43,506 | (30,531 | ) | 12,975 | 4.8 | % | 41.7 | ||||||||

| Total security-related receivables |

1,002,410 | (261,788 | ) | 740,622 | 6.5 | % | 18.4 | ||||||||

| Total investments in securities |

$ | 4,119,617 | $ | (1,037,087 | ) | $ | 3,082,530 | 6.9 | % | 24.6 | |||||

| (1) | On January 1, 2008, we adopted SFAS No. 159 and transferred certain of our investments in securities from available-for-sale to trading in accordance with SFAS No. 115 and SFAS No. 159. Subsequent to January 1, 2008, all changes in fair value associated with our trading securities are recorded in earnings as part of our change in fair value of financial instruments. See note 7. |

| (2) | Our investments in security-related receivables represent securities owned by CDO entities that we account for as financings under SFAS No. 140. We elected to record security-related receivables at fair value in accordance with SFAS No. 159 on January 1, 2008. All changes in fair value of our security related receivables were recorded in earnings as part of the change in fair value of financial instruments. See notes 2 and 7. |

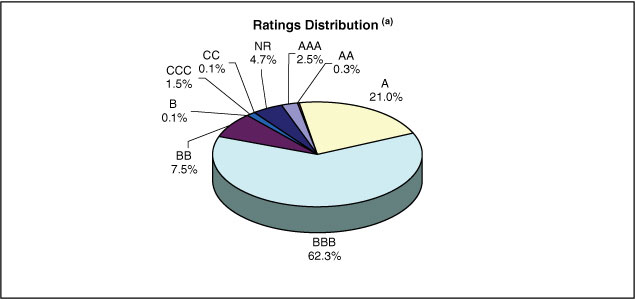

| (3) | CMBS receivables include securities with a fair value totaling $90,851 that are rated “BBB+” and “BBB-” by Standard & Poor’s and securities with a fair value totaling $38,207 that are rated between “AA” and “A-” by Standard & Poor’s. |

TruPS included above as trading securities include (a) investments in TruPS issued by VIEs of which we are not the primary beneficiary and which we do not consolidate and (b) transfers of investments in TruPS securities to us that were accounted for as a sale pursuant to SFAS No. 140. Subordinated debentures included above represent the primary assets of VIEs that we consolidate pursuant to FIN 46R.

As of June 30, 2008, approximately $311,125 in principal amount of TruPS, subordinated debentures, and subordinated debenture receivables were on non-accrual status and had a weighted-average coupon of 8.2%. As of June 30, 2008, approximately $61,983 in principal amount available-for-sale securities were on non-accrual status and had a weighted-average coupon of 6.5%.

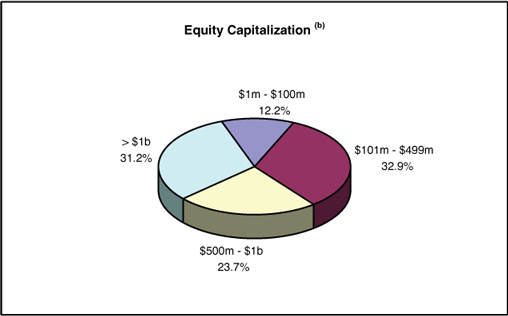

Some of our investments in securities collateralize debt issued through CDO entities. Our TruPS CDO entities are static pools and prohibit, in most cases, the sale of such securities until the mandatory auction call period, typically 10 years from the CDO entity’s inception. At and subsequent to the mandatory auction call date, remaining securities will be offered in the general market and the proceeds from sales of such securities will be used to repay outstanding indebtedness and liquidate the CDO entity. The assets of our consolidated CDOs collateralize the debt of such entities and are not available to our creditors. As of June 30, 2008, investment in securities of $3,221,861 principal amount of TruPS and subordinated debentures and $591,432 principal amount of unsecured REIT note receivables and CMBS receivables collateralized our consolidated CDO notes payable of such entities. Some of these investments were eliminated upon the consolidation of various VIEs that we consolidate and the corresponding subordinated debentures of the VIEs are included as assets in our consolidated balance sheet.

Management evaluates available-for-sale securities for impairment as events and circumstances warrant. As of June 30, 2008, management evaluated these securities and concluded that certain of these securities were other than temporarily impaired as management does not expect full recovery of our investment. Asset impairment expense of $9,627 and $11,814, respectively, was recorded for the three-month and six-month periods ended June 30, 2008 related to these securities and other assets and was included in asset impairments in the accompanying consolidated statements of operations. This impairment reduced the amortized cost basis of these available-for-sale securities.

14

Table of Contents

RAIT Financial Trust

Notes to Consolidated Financial Statements

As of June 30, 2008

(Unaudited and dollars in thousands, except share and per share amounts)

NOTE 5: INDEBTEDNESS

We maintain various forms of short-term and long-term financing arrangements. Generally, these financing agreements are collateralized by assets within CDOs or mortgage securitizations. The following table summarizes our indebtedness as of June 30, 2008:

| Description |

Unpaid Principal Balance |

Carrying Amount |

Interest Rate Terms |

Current Weighted- Average Interest Rate |

Contractual Maturity | ||||||||

| Repurchase agreements |

$ | 47,106 | $ | 47,106 | 3.2% to 3.7 | % | 3.3% | Aug. 2008 (1) | |||||

| Secured credit facilities and other indebtedness |

151,523 | 151,523 | 4.5% to 8.1 | % | 6.1% | Aug. 2008 to 2037 | |||||||

| Mortgage-backed securities issued (2)(3)(4) |

3,593,375 | 3,564,475 | 4.6% to 5.8 | % | 5.1% | 2035 | |||||||

| Trust preferred obligations (5) |

362,500 | 259,111 | 4.2% to 10.1 | % | 6.5% | 2035 | |||||||

| CDO notes payable – amortized cost(2)(6) |

1,431,250 | 1,431,250 | 2.8% to 6.5 | % | 3.2% | 2036 to 2045 | |||||||

| CDO notes payable – fair value (2) (5)(7) |

3,646,142 | 1,100,972 | 2.7% to 10.0 | % | 3.8% | 2035 to 2038 | |||||||

| Convertible senior notes |

404,000 | 404,000 | 6.9 | % | 6.9% | 2027 | |||||||

| Total indebtedness |

$ | 9,635,896 | $ | 6,958,437 | 4.7% | ||||||||

| (1) | We intend to repay or re-negotiate and extend our repurchase agreements as they mature. |

| (2) | Excludes mortgage-backed securities and CDO notes payable purchased by us which are eliminated in consolidation. |

| (3) | Collateralized by $3,829,365 principal amount of residential mortgages and mortgage-related receivables. These obligations were issued by separate legal entities and consequently the assets of the special purpose entities that collateralize these obligations are not available to our creditors. |

| (4) | Rates generally follow the terms of the underlying mortgages, which are fixed for a period of time and variable thereafter. |

| (5) | Relates to liabilities for which we elected to record at fair value under SFAS No. 159. See note 7. |

| (6) | Collateralized by $1,720,057 principal amount of commercial mortgages, mezzanine loans and other loans. These obligations were issued by separate legal entities and consequently the assets of the special purpose entities that collateralize these obligations are not available to our creditors. |

| (7) | Collateralized by $4,178,391 principal amount of investments in securities and security-related receivables and loans, before fair value adjustments. The fair value of these investments as of June 30, 2008 was $3,085,062. These obligations were issued by separate legal entities and consequently the assets of the special purpose entities that collateralize these obligations are not available to our creditors. |

Repurchase Agreements

As of June 30, 2008, we were party to several repurchase agreements that had $47,106 in borrowings outstanding. Our repurchase agreements contain standard market terms and generally renew between one and 30 days. As the assets subject to our repurchase agreements prepay or change in value, we are required to ratably reduce our borrowings outstanding under repurchase agreements. During the three-month and six-month periods ended June 30, 2008, we repaid $20,807 and $91,682, respectively, associated with our repurchase agreements.

Secured Credit Facilities and Other Indebtedness

We have secured credit facilities with three financial institutions with total capacity of $90,000. As of June 30, 2008, we have borrowed $53,494 on these credit facilities leaving $36,506 of availability. As of June 30, 2008, we have $50,200 of junior subordinated notes issued by us outstanding and $47,829 of other indebtedness outstanding relating to loans payable on consolidated real estate interests and other loans.

Trust Preferred Obligations

As of January 1, 2008, we adopted the fair value option under SFAS No. 159 and elected to record trust preferred obligations at fair value. At adoption, we decreased the carrying amount of the trust preferred obligations by $52,070 to reflect these liabilities at fair value in our financial statements. The change in fair value of the trust preferred obligations was a decrease of $12,887 and $51,319 for the three-month and six-month periods ended June 30, 2008, respectively, and was included in the accompanying consolidated statements of operations.

CDO Notes Payable – Fair Value

As of January 1, 2008, we adopted the fair value option under SFAS No. 159 and elected to record CDO notes payable that are collateralized by trading securities, security-related receivables and loans at fair value. At adoption, we decreased the carrying amount of these CDO notes payable by $1,520,616 to reflect these liabilities at fair value in our financial statements. The change in fair value of these CDO notes payable was a decrease of $143,573 and $946,701 for the three-month and six-month periods ended June 30, 2008, respectively, and was included in the accompanying consolidated statements of operations.

15

Table of Contents

RAIT Financial Trust

Notes to Consolidated Financial Statements

As of June 30, 2008

(Unaudited and dollars in thousands, except share and per share amounts)

Convertible Senior Notes

During the three-month and six-month periods ended June 30, 2008, we repurchased, from the market, a total of $21,000 in aggregate principal amount of convertible senior notes for a total purchase price of $11,858. As a result, we recorded gains on extinguishment of debt of $8,662, net of $480 deferred financing costs that were written off associated with the convertible senior notes.

NOTE 6: DERIVATIVE FINANCIAL INSTRUMENTS

Cash Flow Hedges

We have entered into various interest rate swap contracts to hedge interest rate exposure on CDO notes payable and repurchase agreements.

We designate interest rate hedge agreements at inception and determine whether or not the interest rate hedge agreement is highly effective in offsetting interest rate fluctuations associated with the identified indebtedness. At designation, certain of these interest rate swaps had a fair value not equal to zero. However, we concluded, at designation, that these hedging arrangements were highly effective during their term using regression analysis and determined that the hypothetical derivative method would be used in measuring any ineffectiveness. At each reporting period, we update our regression analysis and, as of June 30, 2008, we concluded that these hedging arrangements were highly effective during their remaining term and used the hypothetical derivative method in measuring the ineffective portions of these hedging arrangements.

The following table summarizes the aggregate notional amount and estimated net fair value of our derivative instruments as of June 30, 2008:

| As of June 30, 2008 | |||||||

| Notional | Fair Value | ||||||

| Cash flow hedges: |

|||||||

| Interest rate swaps |

$ | 3,692,342 | $ | (198,789 | ) | ||

| Interest rate caps |

51,000 | 658 | |||||

| Basis swaps |

50,000 | (187 | ) | ||||

| Foreign currency derivatives: |

|||||||

| Currency options |

6,441 | 2 | |||||

| Net fair value |

$ | 3,799,783 | $ | (198,316 | ) | ||

The following tables summarize the effect on income by derivative instrument type for the following periods:

| For the Three-Month Period Ended June 30, 2008 |

For the Three-Month Period Ended June 30, 2007 |

||||||||||||||

| Type of Derivative |

Amounts Reclassified to Earnings for Effective Hedges – Gains (Losses) |

Amounts Reclassified to Earnings for Hedge Ineffectiveness – Gains (Losses) |

Amounts Reclassified to Earnings for Effective Hedges – Gains (Losses) |

Amounts Reclassified to Earnings for Hedge Ineffectiveness – Gains (Losses) |

|||||||||||

| Interest rate swaps |

$ | (2,405 | ) | $ | (62 | ) | $ | 1,875 | $ | 483 | |||||

| Interest rate caps |

— | — | — | (7 | ) | ||||||||||

| Basis swaps |

— | — | — | (24 | ) | ||||||||||

| Currency options |

— | (4 | ) | — | (23 | ) | |||||||||

| Total |

$ | (2,405 | ) | $ | (66 | ) | $ | 1,875 | $ | 429 | |||||

16

Table of Contents

RAIT Financial Trust

Notes to Consolidated Financial Statements

As of June 30, 2008

(Unaudited and dollars in thousands, except share and per share amounts)

| For the Six-Month Period Ended June 30, 2008 |

For the Six-Month Period Ended June 30, 2007 |

|||||||||||||

| Type of Derivative |

Amounts Reclassified to Earnings for Effective Hedges – Gains (Losses) |

Amounts Reclassified to Earnings for Hedge Ineffectiveness – Gains (Losses) |

Amounts Reclassified to Earnings for Effective Hedges – Gains (Losses) |

Amounts Reclassified to Earnings for Hedge Ineffectiveness – Gains (Losses) |

||||||||||

| Interest rate swaps |

$ | (4,915 | ) | $ | 10 | $ | 3,082 | $ | 585 | |||||

| Interest rate caps |

— | — | — | (54 | ) | |||||||||

| Basis swaps |

— | — | — | (41 | ) | |||||||||

| Currency options |

— | 5 | — | 27 | ||||||||||

| Total |

$ | (4,915 | ) | $ | 15 | $ | 3,082 | $ | 517 | |||||

On January 1, 2008, we adopted SFAS No. 159 for certain of our CDO notes payable. Upon the adoption of SFAS No. 159, hedge accounting for any previously designated cash flow hedges associated with these CDO notes payable was discontinued and all changes in fair value of these cash flow hedges are recorded in earnings. At the time of hedge accounting discontinuance on January 1, 2008 for these cash flow hedges, the balance included in accumulated other comprehensive income that will be reclassified to earnings over the remaining term of the related hedges was $102,532. As of June 30, 2008, the notional value associated with these cash flow hedges where hedge accounting was discontinued was $2,855,261 and had a liability balance with a fair value of $155,972. During the six-month period ended June 30, 2008, the change in value of these hedges was a decrease of $31,800 and was recorded as a component of the change in fair value of financial instruments in our statement of operations.

Amounts reclassified to earnings associated with effective cash flow hedges are reported in investment interest expense and the fair value of these hedge agreements is included in other assets or derivative liabilities.

Free-Standing Derivatives

We have maintained warehouse arrangements with various investment banks. These warehouse arrangements are free-standing derivatives under SFAS No. 133. As such, our investment, or first-dollar risk of loss, is recorded at fair value each period with the change in fair value recorded in earnings.

As of June 30, 2008, we maintain a deposit of $6,058 as a first loss deposit on one warehouse facility which has been included in other assets in the accompanying consolidated balance sheet. We do not expect to recover this deposit and have fully accrued for this loss in other liabilities on the accompanying consolidated balance sheet. During the six-month period ended June 30, 2008, two of our warehouse facilities were terminated. Due to these events, $32,059 was charged to earnings through the change in fair value of free-standing derivatives during the six-month period ended June 30, 2008. The write-off of these warehouse deposits represents our only exposure under our warehouse agreements and we have no further obligations thereunder.