Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

| ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the Quarterly Period Ended September 30, 2011 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

Commission File Number 1-13953 |

||

W. R. GRACE & CO.

| Delaware (State of Incorporation) |

65-0773649 (I.R.S. Employer Identification No.) |

7500 Grace Drive

Columbia, Maryland 21044

(410) 531-4000

(Address and phone number of principal executive offices)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date.

| Class | Outstanding at October 31, 2011 | |

|---|---|---|

| Common Stock, $0.01 par value per share | 73,826,771 shares |

Unless the context otherwise indicates, in this Report the terms "Grace," "we," "us," "our" or "the company" mean W. R. Grace & Co. and/or its consolidated subsidiaries and affiliates. Unless otherwise indicated, the contents of websites mentioned in this report are not incorporated by reference or otherwise made a part of this Report. Grace®, the Grace® logo and, except as otherwise indicated, the other product names used in the text of this report are trademarks, service marks, and/or trade names of operating units of W. R. Grace & Co. or its affiliates and/or subsidiaries.

Review by Independent Registered Public Accounting Firm

With respect to the interim consolidated financial statements included in this Quarterly Report on Form 10-Q for the quarter ended September 30, 2011, PricewaterhouseCoopers LLP, the company's independent registered public accounting firm, has applied limited procedures in accordance with professional standards for a review of such information. Their report on the interim consolidated financial statements, which follows, states that they did not audit and they do not express an opinion on the unaudited interim financial statements. Accordingly, the degree of reliance on their report on the unaudited interim financial statements should be restricted in light of the limited nature of the review procedures applied. This report is not considered a "report" within the meaning of Sections 7 and 11 of the Securities Act of 1933, and, therefore, the independent accountants' liability under Section 11 does not extend to it.

1

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors of W.R. Grace & Co.:

We have reviewed the accompanying consolidated balance sheets of W.R. Grace & Co. and its subsidiaries as of September 30, 2011 and 2010, and the related consolidated statements of operations and comprehensive income (loss) for each of the three-month and nine-month periods ending September 30, 2011 and 2010, and the consolidated statements of equity (deficit) and of cash flows for the nine-month periods ended September 30, 2011 and 2010. These interim financial statements are the responsibility of the Company's management.

We conducted our review in accordance with the standards of the Public Company Accounting Oversight Board (United States). A review of interim financial information consists principally of applying analytical procedures and making inquiries of persons responsible for financial and accounting matters. It is substantially less in scope than an audit conducted in accordance with the standards of the Public Company Accounting Oversight Board (United States), the objective of which is the expression of an opinion regarding the financial statements taken as a whole. Accordingly, we do not express such an opinion.

Based on our review, we are not aware of any material modifications that should be made to the accompanying consolidated interim financial statements for them to be in conformity with accounting principles generally accepted in the United States of America.

The accompanying interim consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Notes 1 and 2 to the consolidated interim financial statements, on April 2, 2001, the Company and substantially all of its domestic subsidiaries voluntarily filed for protection under Chapter 11 of the United States Bankruptcy Code, which raises substantial doubt about the Company's ability to continue as a going concern in its present form. Management's intentions with respect to this matter are also described in Notes 1 and 2. The accompanying consolidated interim financial statements do not include any adjustments that might result from the outcome of this uncertainty.

We previously audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheet as of December 31, 2010, and the related consolidated statements of operations, comprehensive income (loss), equity (deficit), and of cash flows for the year then ended (not presented herein), and in our report dated February 25, 2011, we expressed an unqualified opinion on those consolidated financial statements with an explanatory paragraph relating to the Company's ability to continue as a going concern.

McLean,

Virginia

November 4, 2011

2

W. R. Grace & Co. and Subsidiaries

Consolidated Statements of Operations (unaudited)

| |

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

(In millions, except per share amounts)

|

2011 | 2010 | 2011 | 2010 | ||||||||||

Net sales |

$ | 864.2 | $ | 682.1 | $ | 2,386.3 | $ | 1,982.0 | ||||||

Cost of goods sold |

548.7 | 436.6 | 1,515.1 | 1,278.3 | ||||||||||

Gross profit |

315.5 | 245.5 | 871.2 | 703.7 | ||||||||||

Selling, general and administrative expenses |

147.3 | 123.9 | 421.8 | 376.2 | ||||||||||

Restructuring expenses and related asset impairments |

0.1 | 5.7 | 1.0 | 9.1 | ||||||||||

Research and development expenses |

16.8 | 14.8 | 49.1 | 44.9 | ||||||||||

Defined benefit pension expense |

15.9 | 19.1 | 47.5 | 57.3 | ||||||||||

Interest expense and related financing costs |

11.1 | 10.2 | 32.5 | 31.1 | ||||||||||

Provision for environmental remediation |

1.1 | — | 1.6 | — | ||||||||||

Chapter 11 expenses, net of interest income |

4.4 | 3.6 | 16.9 | 14.4 | ||||||||||

Equity in earnings of unconsolidated affiliates |

(5.5 | ) | (1.7 | ) | (13.2 | ) | (13.0 | ) | ||||||

Other expense (income), net |

2.7 | (2.1 | ) | 0.8 | 0.2 | |||||||||

Total costs and expenses |

193.9 | 173.5 | 558.0 | 520.2 | ||||||||||

Income before income taxes |

121.6 | 72.0 | 313.2 | 183.5 | ||||||||||

Provision for income taxes |

(40.4 | ) | (17.1 | ) | (102.5 | ) | (20.9 | ) | ||||||

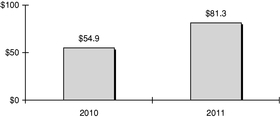

Net income |

81.2 | 54.9 | 210.7 | 162.6 | ||||||||||

Less: Net loss (income) attributable to noncontrolling interests |

0.1 | — | 0.6 | (0.4 | ) | |||||||||

Net income attributable to W. R. Grace & Co. shareholders |

$ | 81.3 | $ | 54.9 | $ | 211.3 | $ | 162.2 | ||||||

Earnings Per Share Attributable to W. R. Grace & Co. Shareholders |

||||||||||||||

Basic earnings per share: |

||||||||||||||

Net income attributable to W. R. Grace & Co. shareholders |

$ | 1.10 | $ | 0.75 | $ | 2.87 | $ | 2.23 | ||||||

Weighted average number of basic shares |

73.7 | 72.8 | 73.5 | 72.7 | ||||||||||

Diluted earnings per share: |

||||||||||||||

Net income attributable to W. R. Grace & Co. shareholders |

$ | 1.07 | $ | 0.74 | $ | 2.80 | $ | 2.17 | ||||||

Weighted average number of diluted shares |

75.7 | 74.3 | 75.5 | 74.6 | ||||||||||

The Notes to Consolidated Financial Statements are an integral part of these statements.

3

W. R. Grace & Co. and Subsidiaries

Consolidated Statements of Cash Flows (unaudited)

| |

Nine Months Ended September 30, |

|||||||

|---|---|---|---|---|---|---|---|---|

(In millions)

|

2011 | 2010 | ||||||

OPERATING ACTIVITIES |

||||||||

Net income |

$ | 210.7 | $ | 162.6 | ||||

Reconciliation to net cash provided by operating activities: |

||||||||

Depreciation and amortization |

89.9 | 86.9 | ||||||

Equity in earnings of unconsolidated affiliates |

(13.2 | ) | (13.0 | ) | ||||

Provision for income taxes |

102.5 | 20.9 | ||||||

Income taxes paid, net of refunds |

(38.3 | ) | (21.8 | ) | ||||

Defined benefit pension expense |

47.5 | 57.3 | ||||||

Payments under defined benefit pension arrangements |

(260.0 | ) | (48.6 | ) | ||||

Changes in assets and liabilities, excluding effect of currency translation: |

||||||||

Trade accounts receivable |

(86.8 | ) | (48.0 | ) | ||||

Inventories |

(89.3 | ) | (47.5 | ) | ||||

Accounts payable |

54.8 | 40.2 | ||||||

All other items, net |

36.9 | (22.9 | ) | |||||

Net cash provided by operating activities |

54.7 | 166.1 | ||||||

INVESTING ACTIVITIES |

||||||||

Capital expenditures |

(97.1 | ) | (69.0 | ) | ||||

Businesses acquired, net of cash acquired |

(55.8 | ) | (2.7 | ) | ||||

Transfer to restricted cash and cash equivalents |

(27.7 | ) | (81.1 | ) | ||||

Other investing activities |

6.8 | 3.2 | ||||||

Net cash used for investing activities |

(173.8 | ) | (149.6 | ) | ||||

FINANCING ACTIVITIES |

||||||||

Net (repayments) borrowings under credit arrangements |

10.0 | (0.4 | ) | |||||

Proceeds from exercise of stock options |

10.3 | 7.9 | ||||||

Other financing activities |

4.7 | 1.3 | ||||||

Net cash provided by financing activities |

25.0 | 8.8 | ||||||

Effect of currency exchange rate changes on cash and cash equivalents |

2.2 | 1.0 | ||||||

Increase (decrease) in cash and cash equivalents |

(91.9 | ) | 26.3 | |||||

Cash and cash equivalents, beginning of period |

1,015.7 | 893.0 | ||||||

Cash and cash equivalents, end of period |

$ | 923.8 | $ | 919.3 | ||||

The Notes to Consolidated Financial Statements are an integral part of these statements.

4

W. R. Grace & Co. and Subsidiaries

Consolidated Balance Sheets (unaudited)

(In millions, except par value and shares)

|

September 30, 2011 |

December 31, 2010 |

||||||

|---|---|---|---|---|---|---|---|---|

ASSETS |

||||||||

Current Assets |

||||||||

Cash and cash equivalents |

$ | 923.8 | $ | 1,015.7 | ||||

Restricted cash and cash equivalents |

125.5 | 97.8 | ||||||

Trade accounts receivable, less allowance of $8.0 (2010—$7.0) |

475.9 | 380.8 | ||||||

Accounts receivable—unconsolidated affiliates |

4.3 | 5.3 | ||||||

Inventories |

355.1 | 259.3 | ||||||

Deferred income taxes |

72.1 | 54.7 | ||||||

Other current assets |

107.1 | 90.6 | ||||||

Total Current Assets |

2,063.8 | 1,904.2 | ||||||

Properties and equipment, net of accumulated depreciation and amortization of $1,765.4 (2010—$1,675.2) |

719.1 | 702.5 | ||||||

Goodwill |

149.0 | 125.5 | ||||||

Deferred income taxes |

843.1 | 845.0 | ||||||

Asbestos-related insurance |

500.0 | 500.0 | ||||||

Overfunded defined benefit pension plans |

40.3 | 35.6 | ||||||

Investments in unconsolidated affiliates |

69.3 | 56.4 | ||||||

Other assets |

116.8 | 102.5 | ||||||

Total Assets |

$ | 4,501.4 | $ | 4,271.7 | ||||

LIABILITIES AND EQUITY (DEFICIT) |

||||||||

Liabilities Not Subject to Compromise |

||||||||

Current Liabilities |

||||||||

Debt payable within one year |

$ | 46.8 | $ | 37.0 | ||||

Debt payable—unconsolidated affiliates |

2.4 | 2.3 | ||||||

Accounts payable |

265.5 | 207.1 | ||||||

Accounts payable—unconsolidated affiliates |

5.2 | 8.5 | ||||||

Other current liabilities |

352.7 | 278.0 | ||||||

Total Current Liabilities |

672.6 | 532.9 | ||||||

Debt payable after one year |

3.0 | 2.9 | ||||||

Debt payable—unconsolidated affiliates |

17.8 | 12.6 | ||||||

Deferred income taxes |

36.8 | 34.6 | ||||||

Underfunded and unfunded defined benefit pension plans |

450.9 | 539.8 | ||||||

Other liabilities |

45.5 | 43.6 | ||||||

Total Liabilities Not Subject to Compromise |

1,226.6 | 1,166.4 | ||||||

Liabilities Subject to Compromise—Note 2 |

||||||||

Debt plus accrued interest |

933.9 | 911.4 | ||||||

Income tax contingencies |

90.0 | 93.8 | ||||||

Asbestos-related contingencies |

1,700.0 | 1,700.0 | ||||||

Environmental contingencies |

138.5 | 144.0 | ||||||

Postretirement benefits |

189.9 | 181.1 | ||||||

Other liabilities and accrued interest |

146.8 | 143.8 | ||||||

Total Liabilities Subject to Compromise |

3,199.1 | 3,174.1 | ||||||

Total Liabilities |

4,425.7 | 4,340.5 | ||||||

Commitments and Contingencies—Note 10 |

||||||||

Equity (Deficit) |

||||||||

Common stock issued, par value $0.01; 300,000,000 shares authorized; outstanding: 2011—73,787,513 (2010—73,120,357) |

0.7 | 0.7 | ||||||

Paid-in capital |

468.6 | 455.9 | ||||||

Retained earnings |

243.0 | 31.7 | ||||||

Treasury stock, at cost: shares: 2011—3,192,247; (2010—3,859,403) |

(38.0 | ) | (45.9 | ) | ||||

Accumulated other comprehensive loss |

(605.1 | ) | (518.1 | ) | ||||

Total W. R. Grace & Co. Shareholders' Equity (Deficit) |

69.2 | (75.7 | ) | |||||

Noncontrolling interests |

6.5 | 6.9 | ||||||

Total Equity (Deficit) |

75.7 | (68.8 | ) | |||||

Total Liabilities and Equity (Deficit) |

$ | 4,501.4 | $ | 4,271.7 | ||||

The Notes to Consolidated Financial Statements are an integral part of these statements.

5

W. R. Grace & Co. and Subsidiaries

Consolidated Statements of Equity (Deficit) (unaudited)

(In millions)

|

Common Stock and Paid-in Capital |

Retained Earnings (Accumulated Deficit) |

Treasury Stock |

Accumulated Other Comprehensive Loss |

Noncontrolling Interests |

Total Equity (Deficit) |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Balance, December 31, 2009 |

$ | 446.6 | $ | (175.4 | ) | $ | (55.9 | ) | $ | (514.5 | ) | $ | 8.7 | $ | (290.5 | ) | |||

Net income |

— | 162.2 | — | — | 0.4 | 162.6 | |||||||||||||

Stock plan activity |

7.9 | — | 6.5 | — | — | 14.4 | |||||||||||||

Other comprehensive loss |

— | — | — | (61.2 | ) | (0.4 | ) | (61.6 | ) | ||||||||||

Balance, September 30, 2010 |

$ | 454.5 | $ | (13.2 | ) | $ | (49.4 | ) | $ | (575.7 | ) | $ | 8.7 | $ | (175.1 | ) | |||

Balance, December 31, 2010 |

$ | 456.6 | $ | 31.7 | $ | (45.9 | ) | $ | (518.1 | ) | $ | 6.9 | $ | (68.8 | ) | ||||

Net income (loss) |

— | 211.3 | — | — | (0.6 | ) | 210.7 | ||||||||||||

Stock plan activity |

12.7 | — | 7.9 | — | — | 20.6 | |||||||||||||

Other comprehensive income (loss) |

— | — | — | (87.0 | ) | 0.2 | (86.8 | ) | |||||||||||

Balance, September 30, 2011 |

$ | 469.3 | $ | 243.0 | $ | (38.0 | ) | $ | (605.1 | ) | $ | 6.5 | $ | 75.7 | |||||

W. R. Grace & Co. and Subsidiaries

Consolidated Statements of Comprehensive Income (Loss) (unaudited)

| |

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

(In millions)

|

2011 | 2010 | 2011 | 2010 | ||||||||||

Net income |

$ | 81.2 | $ | 54.9 | $ | 210.7 | $ | 162.6 | ||||||

Other comprehensive income (loss): |

||||||||||||||

Defined benefit pension and other postretirement plans, net of income taxes |

(114.5 | ) | (11.9 | ) | (79.5 | ) | (72.1 | ) | ||||||

Currency translation adjustments |

(7.6 | ) | 8.5 | (6.3 | ) | 12.8 | ||||||||

Loss from hedging activities, net of income taxes |

(1.7 | ) | (0.7 | ) | (1.2 | ) | (1.9 | ) | ||||||

Total other comprehensive loss attributable to W. R. Grace & Co. shareholders |

(123.8 | ) | (4.1 | ) | (87.0 | ) | (61.2 | ) | ||||||

Total other comprehensive income (loss) attributable to noncontrolling interests |

(0.2 | ) | (0.6 | ) | 0.2 | (0.4 | ) | |||||||

Total other comprehensive loss |

(124.0 | ) | (4.7 | ) | (86.8 | ) | (61.6 | ) | ||||||

Comprehensive income (loss) |

$ | (42.8 | ) | $ | 50.2 | $ | 123.9 | $ | 101.0 | |||||

The Notes to Consolidated Financial Statements are an integral part of these statements.

6

Notes to Consolidated Financial Statements

1. Basis of Presentation and Summary of Significant Accounting and Financial Reporting Policies

W. R. Grace & Co., through its subsidiaries, is engaged in specialty chemicals and specialty materials businesses on a global basis through two operating segments: Grace Davison, which includes specialty catalysts and specialty materials used in a wide range of energy, refining, consumer, industrial, packaging and life sciences applications; and Grace Construction Products, which includes specialty construction chemicals and specialty building materials used in commercial, infrastructure and residential construction.

W. R. Grace & Co. conducts substantially all of its business through a direct, wholly-owned subsidiary, W. R. Grace & Co.-Conn. ("Grace-Conn."). Grace-Conn. owns substantially all of the assets, properties and rights of W. R. Grace & Co. on a consolidated basis, either directly or through subsidiaries.

As used in these notes, the term "Company" refers to W. R. Grace & Co. The term "Grace" refers to the Company and/or one or more of its subsidiaries and, in certain cases, their respective predecessors.

Voluntary Bankruptcy Filing During 2000 and the first quarter of 2001, Grace experienced several adverse developments in its asbestos-related litigation, including: a significant increase in personal injury claims, higher than expected costs to resolve personal injury and certain property damage claims, and class action lawsuits alleging damages from Zonolite® Attic Insulation ("ZAI"), a former Grace attic insulation product.

After a thorough review of these developments, Grace's Board of Directors concluded that a federal court-supervised bankruptcy process provided the best forum available to achieve fairness in resolving these claims and on April 2, 2001 (the "Filing Date"), Grace and 61 of its United States subsidiaries and affiliates, (collectively, the "Debtors"), filed voluntary petitions for reorganization (the "Filing") under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the District of Delaware (the "Bankruptcy Court"). The cases were consolidated and are being jointly administered under case number 01-01139 (the "Chapter 11 Cases"). Grace's non-U.S. subsidiaries and certain of its U.S. subsidiaries were not included in the Filing.

Under Chapter 11, the Debtors have continued to operate their businesses as debtors-in-possession under court protection from creditors and claimants, while using the Chapter 11 process to develop and implement a plan for addressing the asbestos-related claims. Since the Filing, all motions necessary to conduct normal business activities have been approved by the Bankruptcy Court. (See Note 2 for Chapter 11 Information.)

Basis of Presentation The interim Consolidated Financial Statements presented herein are unaudited and should be read in conjunction with the Consolidated Financial Statements presented in the Company's 2010 Annual Report on Form 10-K. Such interim Consolidated Financial Statements reflect all adjustments that, in the opinion of management, are necessary for a fair statement of the results of the interim periods presented; all such adjustments are of a normal recurring nature except for the impacts of adopting new accounting standards as discussed below. Potential accounting adjustments discovered during normal reporting and accounting processes are evaluated on the basis of materiality, both individually and in the aggregate, and are recorded in the accounting period discovered, unless a restatement of a prior period is necessary. All significant intercompany accounts and transactions have been eliminated.

7

Notes to Consolidated Financial Statements (Continued)

1. Basis of Presentation and Summary of Significant Accounting and Financial Reporting Policies (Continued)

The results of operations for the nine-month interim period ended September 30, 2011 are not necessarily indicative of the results of operations for the year ending December 31, 2011.

Reclassifications Certain amounts in prior years' Consolidated Financial Statements have been reclassified to conform to the 2011 presentation. Such reclassifications have not materially affected previously reported amounts in the Consolidated Financial Statements.

Use of Estimates The preparation of financial statements in conformity with U.S. generally accepted accounting principles (U.S. GAAP) requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the Consolidated Financial Statements, and the reported amounts of revenues and expenses for the periods presented. Actual amounts could differ from those estimates, and the differences could be material. Changes in estimates are recorded in the period identified. Grace's accounting measurements that are most affected by management's estimates of future events are:

- •

- Contingent liabilities, which depend on an assessment of the probability of loss and an estimate of ultimate resolution

cost, such as asbestos-related matters (see Notes 2 and 3), income taxes (see Note 7), environmental remediation (see Note 10), and litigation (see Note 10);

- •

- Pension and postretirement liabilities that depend on assumptions regarding participant life spans, future inflation,

discount rates and total returns on invested funds (see Note 8);

- •

- Realization values of net deferred tax assets and insurance receivables, which depend on projections of future income and

cash flows and assessments of insurance coverage and insurer solvency; and

- •

- Recoverability of goodwill, which depends on assumptions used to value reporting units, such as observable market inputs, projections of future cash flows and weighted average cost of capital.

The accuracy of management's estimates may be materially affected by the uncertainties arising under Grace's Chapter 11 proceeding.

Effect of New Accounting Standards—In January 2010, the Financial Accounting Standards Board ("FASB") issued Accounting Standard Update ("ASU") 2010-06 "Improving Disclosures about Fair Value Measurements". This update provides additional guidance and expands the disclosure requirements related to transfers of assets in and out of Levels 1 and 2 as well as the activity for Level 3 fair value measurements. The new disclosures and clarifications of existing disclosures are effective for interim and annual reporting periods beginning after December 15, 2009, except for the disclosures about purchases, sales, issuances, and settlements in the roll forward of activity in Level 3 fair value measurements. Those disclosures are effective for fiscal years beginning after December 15, 2010, and for interim periods within those fiscal years. See Note 6 for further discussion of financial assets and liabilities subject to Accounting Standard Codification ("ASC") 820 "Fair Value Measurements and Disclosures".

In December 2010, the FASB issued ASU 2010-29 "Disclosure of Supplementary Pro Forma Information for Business Combinations". This update provides additional guidance and expands the

8

Notes to Consolidated Financial Statements (Continued)

1. Basis of Presentation and Summary of Significant Accounting and Financial Reporting Policies (Continued)

disclosure requirements related to business combinations that occurred in the reporting period. The new disclosures and clarifications of existing disclosures are effective for the first annual reporting period beginning on or after December 15, 2010. Grace adopted these updates in 2011.

In May 2011, the FASB issued ASU 2011-04 "Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs". This update provides additional guidance and expands the disclosure requirements related to certain aspects of fair value measurement, primarily affecting financial instruments and Level 3 assets. The new disclosures and clarifications of existing disclosures are effective for fiscal years beginning after December 15, 2011, and for interim periods within those fiscal years; early adoption is not permitted. Grace will adopt this standard for 2012 and does not expect it to have a material effect on the Consolidated Financial Statements.

In June 2011, the FASB issued ASU 2011-05 "Presentation of Comprehensive Income". This update is intended to improve the comparability, consistency, and transparency of financial reporting and to increase the prominence of items reported in other comprehensive income. The new disclosure requirements are effective for fiscal years beginning after December 15, 2011, and for interim periods within those fiscal years, with early adoption permitted. Grace will adopt this standard for 2012 and does not expect it to have a material effect on the Consolidated Financial Statements.

In September 2011, the FASB issued ASU 2011-08 "Testing Goodwill for Impairment". This update is intended to simplify how entities test goodwill for impairment, by allowing an entity to first assess qualitative factors to determine whether it is necessary to perform the two-step goodwill impairment test. The new requirements are effective for fiscal years beginning after December 15, 2011, and for interim periods within those fiscal years, with early adoption permitted. Grace will adopt this standard for the fourth quarter of 2011 and does not expect it to have a material effect on the Consolidated Financial Statements.

2. Chapter 11 Information

Official Parties to Grace's Chapter 11 Cases Three creditors' committees, two representing asbestos claimants, the Official Committee of Asbestos Personal Injury Claimants (the "PI Committee") and the Official Committee of Asbestos Property Damage Claimants (the "PD Committee"), and the third representing other unsecured creditors, and the Official Committee of Equity Security Holders (the "Equity Committee"), have been appointed in the Chapter 11 Cases. These committees, a legal representative of future asbestos personal injury claimants (the "PI FCR") and a legal representative of future asbestos property damage claimants (the "PD FCR"), have the right to be heard on all matters that come before the Bankruptcy Court and have important roles in the Chapter 11 Cases. The Debtors are required to bear certain costs and expenses of the committees and the representatives of future asbestos claimants, including those of their counsel and financial advisors.

As discussed below, the Debtors, the Equity Committee, the PI Committee and the PI FCR have filed a joint plan of reorganization, subsequently amended, with the Bankruptcy Court that is designed to address all pending and future asbestos-related claims and all other pre-petition claims as outlined therein (as amended to date, the "Joint Plan"). The committee representing general unsecured creditors, the PD Committee and the PD FCR are not co-proponents of the Joint Plan. On January 31, 2011, the Bankruptcy Court issued an order confirming this Joint Plan. In order to

9

Notes to Consolidated Financial Statements (Continued)

2. Chapter 11 Information (Continued)

become effective, the confirmation order must be affirmed by the United States District Court for the District of Delaware (the "District Court") and all other conditions to the effective date set forth in the Joint Plan must be satisfied or waived.

Plans of Reorganization On November 13, 2004, Grace filed a proposed plan of reorganization with the Bankruptcy Court. On January 13, 2005, Grace filed an amended plan of reorganization (the "Prior Plan") and related documents to address certain objections of creditors and other interested parties. At the time it was filed, the Prior Plan was supported by the committee representing general unsecured creditors and the Equity Committee, but was not supported by the PI Committee, the PD Committee or the PI FCR. At the time of filing of the Prior Plan, the PD FCR had not been appointed.

On July 26, 2007, the Bankruptcy Court terminated Grace's exclusive rights to propose a plan of reorganization and solicit votes thereon. As a result of the termination of these rights, any party-in-interest could propose a competing plan of reorganization. On November 5, 2007, the PI Committee and the PI FCR filed a proposed plan of reorganization (the "PI Plan") with the Bankruptcy Court.

On April 6, 2008, the Debtors reached an agreement in principle with the PI Committee, the PI FCR, and the Equity Committee designed to resolve all present and future asbestos-related personal injury claims (the "PI Settlement").

Prior to the PI Settlement, the Bankruptcy Court entered a case management order for estimating liability for pending and future asbestos personal injury claims. A trial for estimating liability for such claims began in January 2008 but was suspended in April 2008 as a result of the PI Settlement.

As contemplated by the PI Settlement, on September 19, 2008, the Debtors, supported by the Equity Committee, the PI Committee and the PI FCR, as co-proponents, filed the Joint Plan to reflect the terms of the PI Settlement.

On October 17, 2008, the Ontario Superior Court of Justice, in the Grace Canada, Inc. proceeding pending under the Companies' Creditors Arrangement Act, approved an agreement entered into by the Company, Grace Canada, Inc. and legal representatives of Canadian ZAI property damage claimants that would settle all Canadian ZAI property damage claims and demands. On December 13, 2009 and January 17, 2011, the Ontario Superior Court of Justice approved amendments to this agreement (the "Amended Settlement"). Under the Amended Settlement, all Canadian ZAI property damage claims and demands would be paid through a separate Canadian ZAI property damage claims fund of CDN$8.6 million. The Amended Settlement is subject to the effectiveness of the Joint Plan. The Crown has filed objections to the terms of the Joint Plan based on the provisions of, and their treatment under, the Amended Settlement.

On November 21, 2008, the Debtors reached an agreement in principle (the "ZAI PD Term Sheet") with the Putative Class Counsel to the U.S. ZAI claimants, the PD FCR, and the Equity Committee designed to resolve all present and future U.S. ZAI property damage claims and demands as described below.

As contemplated by the PI Settlement and the ZAI PD Term Sheet, the Debtors, supported by the Equity Committee, the PI Committee and the PI FCR, as co-proponents, amended the Joint Plan and several associated documents, including a disclosure statement, trust distribution procedures,

10

Notes to Consolidated Financial Statements (Continued)

2. Chapter 11 Information (Continued)

exhibits and other supporting documents on December 18, 2008, February 3, 2009 and February 27, 2009 through filings with the Bankruptcy Court. The Debtors and co-proponents filed technical modifications to the Joint Plan and certain exhibits on September 4, 2009, October 12, 2009, December 16, 2009, March 19, 2010, December 8, 2010, and December 23, 2010. The Joint Plan is designed to address all pending and future asbestos-related claims and all other pre-petition claims as outlined therein. The Joint Plan supersedes the Prior Plan and the PI Plan.

Under the Joint Plan, two asbestos trusts would be established under Section 524(g) of the Bankruptcy Code. All asbestos-related personal injury claims would be channeled for resolution to one asbestos trust (the "PI Trust") and all asbestos-related property damage claims, including U.S. and Canadian ZAI property damage claims, would be channeled to a separate asbestos trust (the "PD Trust").

The Joint Plan assumes that Cryovac, Inc. ("Cryovac"), a wholly-owned subsidiary of Sealed Air Corporation ("Sealed Air"), will fund the PI Trust and the PD Trust with an aggregate of: (i) $512.5 million in cash (plus interest at 5.5% compounded annually from December 21, 2002); and (ii) 18 million shares (reflecting a two-for-one stock split) of common stock of Sealed Air, pursuant to the terms of a settlement agreement resolving asbestos-related, successor liability and fraudulent transfer claims against Sealed Air and Cryovac, as further described below (the "Sealed Air Settlement"). The value of the Sealed Air Settlement changes daily with the accrual of interest and the trading value of Sealed Air common stock. The Joint Plan also assumes that Fresenius AG ("Fresenius") will fund the PI Trust and the PD Trust with an aggregate of $115.0 million pursuant to the terms of a settlement agreement resolving asbestos-related, successor liability and fraudulent transfer claims against Fresenius, as further described below (the "Fresenius Settlement"). The Sealed Air Settlement and the Fresenius Settlement have been approved by the Bankruptcy Court but remain subject to the fulfillment of specified conditions.

Any plan of reorganization, including the Joint Plan and any plan of reorganization that may be filed in the future by a party-in-interest, will become effective only after a vote of eligible creditors and with the approval of the Bankruptcy Court and the District Court. All classes of creditors entitled to vote accepted the Joint Plan as of May 20, 2009. The class of general unsecured creditors, who voted on a provisional basis pending a determination by the Bankruptcy Court as to whether the class is impaired and therefore entitled to a vote, voted to reject the Joint Plan. The objections filed generally relate to demands for interest at rates higher than provided for in the Joint Plan, assertions that the Joint Plan may impair insurers' contractual rights, assertions that the Joint Plan discriminates against Libby, Montana personal injury claimants and the classification and treatment of claims under the Joint Plan. On January 31, 2011, the Bankruptcy Court issued an order confirming the Joint Plan and overruling all objections. In order to become effective, the confirmation order must be affirmed by the District Court, and all other conditions for effectiveness set forth in the Joint Plan must be satisfied or waived.

Eleven parties filed appeals in the District Court challenging the Bankruptcy Court order confirming the Joint Plan. If those appeals are resolved adversely to Grace and the other Joint Plan proponents by the District Court or an appellate court, certain conditions to the Joint Plan, including for example, payments pursuant to the Sealed Air Settlement and the Fresenius Settlement, might not be satisfied and potential lenders might not be willing to provide the new financing that Grace requires to fund the Joint Plan. The decision of the District Court and resolution of any further

11

Notes to Consolidated Financial Statements (Continued)

2. Chapter 11 Information (Continued)

appeals could have a material effect on the terms and timing of Grace's emergence from Chapter 11.

The Joint Plan is designed to address all pending and future asbestos-related claims and demands and all other pre-petition claims as outlined respectively therein. However, it is possible that the Bankruptcy Court order confirming the Joint Plan will not be affirmed by the District Court or, if affirmed, could be subject to further appeals that reverse affirmance or result in a remand. In either instance, and if the Joint Plan cannot be amended to address any deficiencies identified by the appellate court, the Debtors would expect to resume the estimation trial, which was suspended in April 2008 due to the PI Settlement, to determine the amount of its asbestos-related liabilities. Under those circumstances, a different plan of reorganization may ultimately be confirmed and become effective. Under a different plan of reorganization, the interests of holders of Company common stock could be substantially diluted or cancelled. The value of Company common stock would be significantly affected by the amount of Debtors' asbestos-related liability established under a different plan of reorganization.

Joint Plan of Reorganization Under the terms of the Joint Plan, claims under the Chapter 11 Cases would be satisfied as follows:

Asbestos-Related Personal Injury Claims

All pending and future asbestos-related personal injury claims and demands ("PI Claims") would be channeled to the PI Trust for resolution. The PI Trust would use specified trust distribution procedures to satisfy allowed PI Claims.

The PI Trust would be funded with:

- •

- $250 million in cash plus interest thereon from January 1, 2009 to the effective date of the Joint Plan to

be paid by Grace;

- •

- Cash in the amount of the PD Initial Payment (as described below) and the ZAI Initial Payment (as described below) to be

paid by Grace;

- •

- A warrant to acquire 10 million shares of Company common stock at an exercise price of $17.00 per share, expiring

one year from the effective date of the Joint Plan;

- •

- Rights to all proceeds under all of the Debtors' insurance policies that are available for payment of PI Claims;

- •

- Cash in the amount of $512.5 million plus interest thereon from December 21, 2002 to the effective date of

the Joint Plan at a rate of 5.5% per annum to be paid by Cryovac reduced by the amount of Cryovac's contribution to the PD Initial Payment and the ZAI Initial Payment (as described below) and

18 million shares of Sealed Air common stock to be paid by Cryovac pursuant to the Sealed Air Settlement;

- •

- Cash in the amount of $115 million to be paid by Fresenius pursuant to the Fresenius Settlement reduced by the

amount of Fresenius' contribution to the PD Initial Payment and ZAI Initial Payment (as described below); and

- •

- Deferred payments by Grace of $110 million per year for five years beginning in 2019, and $100 million per year for 10 years beginning in 2024, that would be subordinate to any bank debt or bonds outstanding, guaranteed by the Company and secured by the Company's

12

Notes to Consolidated Financial Statements (Continued)

2. Chapter 11 Information (Continued)

obligation to issue 50.1% of its outstanding common stock (measured as of the effective date of the Joint Plan) to the PI Trust in the event of default.

Asbestos-Related Property Damage Claims

All pending and future asbestos-related property damage claims and demands ("PD Claims") would be channeled to the PD Trust for resolution. The PD Trust would contribute CDN$8.6 million to a separate Canadian ZAI PD Claims fund through which Canadian ZAI PD Claims would be resolved. The PD Trust would generally resolve U.S. ZAI PD Claims that qualify for payment by paying 55% of the claimed amount, but in no event would the PD Trust pay more per claim than 55% of $7,500 (as adjusted for inflation each year after the fifth anniversary of the effective date of the Joint Plan). The PD Trust would satisfy other allowed PD Claims pursuant to specified trust distribution procedures with cash payments in the allowed settlement amount. Unresolved PD Claims and future PD claims would be litigated pursuant to procedures to be approved by the Bankruptcy Court and, to the extent such claims were determined to be allowed claims, would be paid in cash by the PD Trust in the amount determined by the Bankruptcy Court.

The PD Trust would contain two accounts, the PD account and the ZAI PD account. U.S. ZAI PD Claims would be paid from the ZAI PD account and other PD Claims would be paid from the PD account. The separate Canadian ZAI PD Claims would be paid by a separate fund established in Canada. Each account would have a separate trustee and the assets of the accounts would not be commingled. The two accounts would be funded as follows:

The PD account would be funded with:

- •

- Approximately $152 million in cash plus cash in the amount of the estimated first six months of PD Trust expenses,

to be paid by Cryovac and Fresenius (the "PD Initial Payment"), and CDN$8.6 million in cash to be paid by Grace pursuant to the Amended Settlement.

- •

- A Grace obligation (the "PD Obligation") providing for a payment to the PD Trust every six months in the amount of the non-ZAI PD Claims allowed during the preceding six months plus interest and, except for the first six months, the amount of PD Trust expenses for the preceding six months. The aggregate amount to be paid under the PD Obligation would not be capped.

The ZAI PD account would be funded as follows (the "ZAI Assets"):

- •

- $30 million in cash plus interest from April 1, 2009 to the effective date, to be paid by Cryovac and

Fresenius (the "ZAI Initial Payment").

- •

- $30 million in cash on the third anniversary of the effective date of the Joint Plan, to be paid by Grace.

- •

- A Grace obligation providing for the payment of up to 10 contingent deferred payments of $8 million per year during the 20-year period beginning on the fifth anniversary of the effective date of the Joint Plan, with each such payment due only if the ZAI Assets fall below $10 million during the preceding year.

All payments to the PD Trust that were not to be paid on the effective date of the Joint Plan would be secured by the Company's obligation to issue 50.1% of its outstanding common stock (measured as of the effective date of the Joint Plan) to the PD Trust in the event of default. Grace would have the right to conduct annual audits of the books, records and claim processing procedures of the PD Trust.

13

Notes to Consolidated Financial Statements (Continued)

2. Chapter 11 Information (Continued)

Other Claims

All allowed administrative claims would be paid in cash and all allowed priority claims would be paid in cash with interest. Secured claims would be paid in cash with interest or by reinstatement. Allowed general unsecured claims would be paid in cash, including any post-petition interest as follows: (i) for holders of pre-petition bank credit facilities, post-petition interest at the rate of 6.09% from the Filing Date through December 31, 2005 and thereafter at floating prime, in each case compounded quarterly; and (ii) for all other unsecured claims that are not subject to a settlement agreement providing otherwise, interest at 4.19% from the Filing Date, compounded annually, or if pursuant to an existing contract, interest at the non-default contract rate. The general unsecured creditors that hold pre-petition bank debt have asserted that they are entitled to post-petition interest at the default rate specified under the terms of the underlying credit agreements which, at the time of their recent bankruptcy court filings they asserted, was approximately an additional $140 million (Grace believes that if default interest was ultimately determined to be payable, the additional amount of accrued interest would be substantially less than that asserted by the general unsecured creditors.). The Bankruptcy Court has overruled this assertion; this ruling has been appealed to the District Court. Unsecured employee-related claims such as pension, retirement medical obligations and workers compensation claims would be reinstated.

Effect on Company Common Stock

The Joint Plan provides that Company common stock will remain outstanding at the effective date of the Joint Plan, but that the interests of existing shareholders would be subject to dilution by additional shares of Company common stock issued under the warrant or in the event of default in respect of the deferred payment obligations to the PI Trust or the PD Trust under the Company's security obligation.

In order to preserve significant tax benefits which are subject to elimination or limitation in the event of a change in control (as defined by the Internal Revenue Code) of Grace, the Joint Plan provides that under certain circumstances, the Board of Directors would have the authority to impose restrictions on the transfer of Grace common stock with respect to certain 5% shareholders. These restrictions will generally not limit the ability of a person that holds less than 5% of Grace common stock after emergence to either buy or sell stock on the open market. In addition, the Bankruptcy Court has approved trading restrictions on Grace common stock until the effective date of a plan of reorganization. These restrictions prohibit (without the consent of the Company) a person from acquiring more than 4.75% of the outstanding Grace common stock or, for any person already holding more than 4.75%, from increasing such person's holdings. This summary of the stock transfer restrictions does not purport to be complete and is qualified in its entirety by reference to the order of the Bankruptcy Court, which has been filed with the SEC.

Claims Filings The Bankruptcy Court established a bar date of March 31, 2003, for claims of general unsecured creditors, PD Claims (other than ZAI PD Claims) and medical monitoring claims related to asbestos. The bar date did not apply to PI Claims or claims related to ZAI PD Claims.

Approximately 14,900 proofs of claim were filed by the March 31, 2003, bar date. Of these claims, approximately 9,500 were non-asbestos-related, approximately 4,400 were PD Claims, and approximately 1,000 were for medical monitoring. The medical monitoring claims were made by individuals who allege exposure to asbestos through Grace's products or operations. Under the Joint

14

Notes to Consolidated Financial Statements (Continued)

2. Chapter 11 Information (Continued)

Plan, these claims would be channeled to the PI Trust for resolution. In addition, approximately 800 proofs of claim were filed after the bar date.

Approximately 6,685 non-asbestos-related claims were filed by employees or former employees (the "Employee Claims") for benefits arising from Grace's existing plans, programs, and policies regarding employee bonuses and other compensation, indemnity agreements or various medical, insurance, severance, retiree and other benefits (collectively, the "Grace Benefit Programs"). On July 3, 2010, the Bankruptcy Court entered an order disallowing the Employee Claims because: (i) Grace has continued to pay its Grace Benefit Programs obligations during the Chapter 11 Cases and intends to do so for the remainder of the Chapter 11 Cases and thereafter; and (ii) pursuant to the Joint Plan, Grace is assuming its obligations under the Grace Benefit Programs and will continue to pay all such obligations pursuant to the terms and conditions of the applicable Grace Benefit Programs. The omnibus objection to Employee Claims did not address an additional approximately 255 claims filed by employees and former employees. These remaining employee-related claims will be addressed through the claim objection process and the dispute resolution procedures approved by the Bankruptcy Court.

The remaining non-asbestos, non-employee related claims include claims for payment of goods and services, taxes, product warranties, principal and interest under pre-petition credit facilities, amounts due under leases and other contracts, leases and other executory contracts rejected in the Chapter 11 Cases, environmental remediation, pending non-asbestos-related litigation, and non-asbestos-related personal injury. The Debtors analyzed the claims filed pursuant to the March 31, 2003, bar date and found that many are duplicates, represent the same claim filed against more than one of the Debtors, lack any supporting documentation, or provide insufficient supporting documentation. As of September 30, 2011, of the approximately 4,335 non-ZAI PD Claims filed, approximately 410 claims have been resolved and approximately 3,905 claims have been expunged, reclassified by the Debtors or withdrawn by claimants, leaving approximately 20 claims to be addressed through the property damage case management order approved by the Bankruptcy Court and/or the Joint Plan or another plan of reorganization. As of September 30, 2011, of the approximately 3,300 non-asbestos claims filed, approximately 1,925 have been expunged or withdrawn by claimants, approximately 1,205 have been resolved, and an additional approximately 170 claims are to be addressed through the claim objection process and the dispute resolution procedures approved by the Bankruptcy Court.

Additionally, by order dated June 17, 2008, the Bankruptcy Court established October 31, 2008 as the bar date for ZAI PD Claims related to property located in the U.S. As of September 30, 2011, approximately 19,260 U.S. ZAI PD Claims have been filed. In addition, on October 21, 2008, the Bankruptcy Court entered an order establishing August 31, 2009 as the bar date for ZAI PD Claims related to property located in Canada. Under the Amended Settlement, notwithstanding the Canadian ZAI PD Claims Bar Date of August 31, 2009, all Canadian ZAI PD Claimants who have filed a proof of claim by December 31, 2009, shall be entitled to seek compensation from the Canadian ZAI PD Claims Fund to be established pursuant to the Amended Settlement. As of September 30, 2011, approximately 14,100 Canadian ZAI PD Claims have been filed. The Joint Plan provides for the channeling of U.S. ZAI PD Claims and Canadian ZAI PD Claims to the Asbestos PD Trust created under the Joint Plan, and the subsequent transfer of Canadian ZAI PD Claims to a Canadian fund. No bar date has been set for personal injury claims related to ZAI. The Joint Plan provides that ZAI PI Claims would be channeled to the Asbestos PI Trust created under the Joint Plan.

15

Notes to Consolidated Financial Statements (Continued)

2. Chapter 11 Information (Continued)

Grace is continuing to analyze and review unresolved claims in relation to the Joint Plan. Grace believes that its recorded liabilities for claims subject to the March 31, 2003, bar date represent a reasonable estimate of the ultimate allowable amount for claims that are not in dispute or have been submitted with sufficient information to both evaluate the merit and estimate the value of the claim. The PD Claims are considered as part of Grace's overall asbestos liability and are being accounted for in accordance with the conditions precedent under the Prior Plan, as described in Note 3.

Debt Capital All of the Debtors' pre-petition debt is in default due to the Filing. The accompanying Consolidated Balance Sheets reflect the classification of the Debtors' pre-petition debt within "liabilities subject to compromise."

On March 2, 2010, Grace terminated its debtor-in-possession (DIP) facility and replaced it with a $100 million cash-collateralized letter of credit facility with a commercial bank to support existing and new financial assurances. On February 28, 2011, Grace renewed the letter of credit facility for another year.

Accounting Impact The accompanying Consolidated Financial Statements have been prepared in accordance with ASC 852 "Reorganizations". ASC 852 requires that financial statements of debtors-in-possession be prepared on a going concern basis, which contemplates continuity of operations and realization of assets and liquidation of liabilities in the ordinary course of business. However, as a result of the Filing, the realization of certain of the Debtors' assets and the liquidation of certain of the Debtors' liabilities are subject to significant uncertainty. While operating as debtors-in-possession, the Debtors may sell or otherwise dispose of assets and liquidate or settle liabilities for amounts other than those reflected in the Consolidated Financial Statements. Further, the ultimate plan of reorganization could materially change the amounts and classifications reported in the Consolidated Financial Statements.

Pursuant to ASC 852, Grace's pre-petition and future liabilities that are subject to compromise are required to be reported separately on the balance sheet at an estimate of the amount that will ultimately be allowed by the Bankruptcy Court. As of September 30, 2011, such pre-petition liabilities include fixed obligations (such as debt and contractual commitments), as well as estimates of costs related to contingent liabilities (such as asbestos-related litigation, environmental remediation and other claims). Obligations of Grace subsidiaries not covered by the Filing continue to be classified on the Consolidated Balance Sheets based upon maturity dates or the expected dates of payment. ASC 852 also requires separate reporting of certain expenses, realized gains and losses, and provisions for losses related to the Filing as reorganization items. Grace presents reorganization items as "Chapter 11 expenses, net of interest income," a separate caption in its Consolidated Statements of Operations.

As discussed in Note 3, Grace has not adjusted its accounting for asbestos-related assets or liabilities to reflect the Joint Plan.

Grace has not recorded the benefit of any assets that may be available to fund asbestos-related and other liabilities under the Fresenius Settlement and the Sealed Air Settlement, as under the Joint Plan, these assets will be transferred to the PI Trust and the PD Trust. The estimated fair value available under the Fresenius Settlement and the Sealed Air Settlement as measured at September 30, 2011, was $1,235.7 million comprised of $115.0 million in cash from Fresenius and $1,120.7 million in cash and stock from Cryovac under the Joint Plan. Payments under the Sealed Air Settlement will be made directly to the PI Trust and the PD Trust by Cryovac.

16

Notes to Consolidated Financial Statements (Continued)

2. Chapter 11 Information (Continued)

Grace's Consolidated Balance Sheets separately identify the liabilities that are "subject to compromise" as a result of the Chapter 11 proceedings. In Grace's case, "liabilities subject to compromise" represent both pre-petition and future liabilities as determined under U.S. GAAP. Changes to pre-petition liabilities subsequent to the Filing Date reflect: (1) cash payments under approved court orders; (2) the terms of the Prior Plan, as discussed above and in Note 3, including the accrual of interest on pre-petition debt and other fixed obligations; (3) accruals for employee- related programs; and (4) changes in estimates related to other pre-petition contingent liabilities. The accounting for the asbestos-related liability component of "liabilities subject to compromise" is described in Note 3.

Components of liabilities subject to compromise are as follows:

(In millions)

|

September 30, 2011 |

December 31, 2010 |

|||||

|---|---|---|---|---|---|---|---|

Asbestos-related contingencies |

$ | 1,700.0 | $ | 1,700.0 | |||

Pre-petition bank debt plus accrued interest |

900.0 | 878.5 | |||||

Environmental contingencies |

138.5 | 144.0 | |||||

Unfunded special pension arrangements |

127.1 | 119.5 | |||||

Income tax contingencies |

90.0 | 93.8 | |||||

Postretirement benefits other than pension |

73.7 | 70.2 | |||||

Drawn letters of credit plus accrued interest |

33.9 | 32.9 | |||||

Accounts payable |

31.1 | 31.1 | |||||

Retained obligations of divested businesses |

28.8 | 28.6 | |||||

Other accrued liabilities |

86.9 | 84.1 | |||||

Reclassification to current liabilities(1) |

(10.9 | ) | (8.6 | ) | |||

Total Liabilities Subject to Compromise |

$ | 3,199.1 | $ | 3,174.1 | |||

- (1)

- As of September 30, 2011 and December 31, 2010, approximately $10.9 million and $8.6 million, respectively, of certain pension and postretirement benefit obligations subject to compromise have been presented in other current liabilities in the Consolidated Balance Sheets in accordance with ASC 715 "Compensation—Retirement Benefits".

Note that the unfunded special pension arrangements reflected above exclude non-U.S. pension plans and qualified U.S. pension plans that became underfunded subsequent to the Filing. Contributions to qualified U.S. pension plans are subject to Bankruptcy Court approval.

17

Notes to Consolidated Financial Statements (Continued)

2. Chapter 11 Information (Continued)

Change in Liabilities Subject to Compromise

The following table is a reconciliation of the changes in pre-filing date liability balances for the period from the Filing Date through September 30, 2011.

(In millions) (Unaudited)

|

Cumulative Since Filing |

|||

|---|---|---|---|---|

Balance, Filing Date April 2, 2001 |

$ | 2,366.0 | ||

Cash disbursements and/or reclassifications under Bankruptcy Court orders: |

||||

Payment of environmental settlement liability |

(252.0 | ) | ||

Freight and distribution order |

(5.7 | ) | ||

Trade accounts payable order |

(9.1 | ) | ||

Resolution of contingencies subject to Chapter 11 |

(130.0 | ) | ||

Other court orders for payments of certain operating expenses |

(352.9 | ) | ||

Expense/(income) items: |

||||

Interest on pre-petition liabilities |

499.6 | |||

Employee-related accruals |

117.8 | |||

Provision for asbestos-related contingencies |

744.8 | |||

Provision for environmental contingencies |

336.3 | |||

Provision for income tax contingencies |

(79.1 | ) | ||

Balance sheet reclassifications |

(36.6 | ) | ||

Balance, end of period |

$ | 3,199.1 | ||

Additional liabilities subject to compromise may arise due to the rejection of executory contracts or unexpired leases, or as a result of the Bankruptcy Court's allowance of contingent or disputed claims.

For the holders of pre-petition bank credit facilities, beginning January 1, 2006, Grace agreed to pay interest on pre-petition bank debt at the prime rate, adjusted for periodic changes, and compounded quarterly. The effective rate for the nine month periods ended September 30, 2011 and 2010 was 3.25%. From the Filing Date through December 31, 2005, Grace accrued interest on pre-petition bank debt at a negotiated fixed annual rate of 6.09%, compounded quarterly. The general unsecured creditors that hold pre-petition bank credit facilities have asserted that they are entitled to post-petition interest at the default rate specified under the terms of the underlying credit agreements which, at the time of their recent bankruptcy court filings they asserted, was approximately $140 million greater than the interest currently accrued (Grace believes that if default interest was ultimately determined to be payable, the additional amount of accrued interest would be substantially less than that asserted by the general unsecured creditors.). The Bankruptcy Court has overruled this assertion; this ruling has been appealed to the U.S. District Court.

For the holders of claims who, but for the Filing, would be entitled under a contract or otherwise to accrue or be paid interest on such claim in a non-default (or non-overdue payment) situation under applicable non-bankruptcy law, Grace accrues interest at the rate provided in the contract between the Grace entity and the claimant or such rate as may otherwise apply under applicable non-bankruptcy law.

18

Notes to Consolidated Financial Statements (Continued)

2. Chapter 11 Information (Continued)

For all other holders of allowed general unsecured claims, Grace accrues interest at a rate of 4.19% per annum, compounded annually, unless otherwise negotiated during the claim settlement process.

Chapter 11 Expenses

| |

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

(In millions)

|

2011 | 2010 | 2011 | 2010 | |||||||||

Legal and financial advisory fees |

$ | 4.5 | $ | 3.9 | $ | 17.3 | $ | 14.7 | |||||

Interest income |

(0.1 | ) | (0.3 | ) | (0.4 | ) | (0.3 | ) | |||||

Chapter 11 expenses, net of interest income |

$ | 4.4 | $ | 3.6 | $ | 16.9 | $ | 14.4 | |||||

Pursuant to ASC 852, interest income earned on the Debtors' cash balances must be offset against Chapter 11 expenses.

19

Notes to Consolidated Financial Statements (Continued)

2. Chapter 11 Information (Continued)

Condensed Financial Information of the Debtors

W. R. Grace & Co.—Chapter 11 Filing Entities

Debtor-in-Possession Statements of Operations

| |

Nine Months Ended September 30, |

||||||

|---|---|---|---|---|---|---|---|

(In millions) (Unaudited)

|

2011 | 2010 | |||||

Net sales, including intercompany |

$ | 1,046.2 | $ | 875.3 | |||

Cost of goods sold, including intercompany, exclusive of depreciation and amortization shown separately below |

694.8 | 552.2 | |||||

Selling, general and administrative expenses |

210.8 | 187.0 | |||||

Defined benefit pension expense |

32.7 | 43.0 | |||||

Depreciation and amortization |

51.1 | 50.3 | |||||

Chapter 11 expenses, net of interest income |

16.9 | 14.4 | |||||

Research and development expenses |

27.4 | 25.9 | |||||

Interest expense and related financing costs |

29.8 | 30.0 | |||||

Restructuring expenses |

0.9 | 2.7 | |||||

Provision for environmental remediation |

1.7 | — | |||||

Other income, net |

(56.9 | ) | (52.5 | ) | |||

|

1,009.2 | 853.0 | |||||

Income before income taxes and equity in net income of non-filing entities |

37.0 | 22.3 | |||||

Benefit from (provision for) income taxes |

(15.0 | ) | 3.5 | ||||

Income (loss) before equity in net income of non-filing entities |

22.0 | 25.8 | |||||

Equity in net income of non-filing entities |

189.3 | 136.4 | |||||

Net income attributable to W. R. Grace & Co. shareholders |

$ | 211.3 | $ | 162.2 | |||

20

Notes to Consolidated Financial Statements (Continued)

2. Chapter 11 Information (Continued)

W. R. Grace & Co.—Chapter 11 Filing Entities

Debtor-in-Possession Statements of Cash Flows

| |

Nine Months Ended September 30, |

||||||||

|---|---|---|---|---|---|---|---|---|---|

(In millions) (Unaudited)

|

2011 | 2010 | |||||||

Operating Activities |

|||||||||

Net income attributable to W. R. Grace & Co. shareholders |

$ | 211.3 | $ | 162.2 | |||||

Reconciliation to net cash provided by (used for) operating activities: |

|||||||||

Depreciation and amortization |

51.1 | 50.3 | |||||||

Equity in net income of non-filing entities |

(189.3 | ) | (136.4 | ) | |||||

(Benefit from) provision for income taxes |

15.0 | (3.5 | ) | ||||||

Income taxes (paid), net of refunds |

(12.3 | ) | 1.1 | ||||||

Defined benefit pension expense |

32.7 | 43.0 | |||||||

Payments under defined benefit pension arrangements |

(250.0 | ) | (40.1 | ) | |||||

Changes in assets and liabilities, excluding the effect of foreign currency translation: |

|||||||||

Trade accounts receivable |

(32.6 | ) | (28.7 | ) | |||||

Inventories |

(48.6 | ) | (22.9 | ) | |||||

Accounts payable |

36.8 | 19.4 | |||||||

All other items, net |

92.4 | (1.7 | ) | ||||||

Net cash provided by (used for) operating activities |

(93.5 | ) | 42.7 | ||||||

Investing Activities |

|||||||||

Capital expenditures |

(52.5 | ) | (34.5 | ) | |||||

Transfer to restricted cash and cash equivalents |

(6.8 | ) | (75.7 | ) | |||||

Net cash used for investing activities |

(59.3 | ) | (110.2 | ) | |||||

Net cash provided by financing activities |

20.4 | 7.5 | |||||||

Net decrease in cash and cash equivalents |

(132.4 | ) | (60.0 | ) | |||||

Cash and cash equivalents, beginning of period |

787.2 | 685.5 | |||||||

Cash and cash equivalents, end of period |

$ | 654.8 | $ | 625.5 | |||||

21

Notes to Consolidated Financial Statements (Continued)

2. Chapter 11 Information (Continued)

W. R. Grace & Co.—Chapter 11 Filing Entities

Debtor-in-Possession Balance Sheets

(In millions) (Unaudited)

|

September 30, 2011 |

December 31, 2010 |

|||||

|---|---|---|---|---|---|---|---|

ASSETS |

|||||||

Current Assets |

|||||||

Cash and cash equivalents |

$ | 654.8 | $ | 787.2 | |||

Restricted cash and cash equivalents |

81.3 | 74.5 | |||||

Trade accounts receivable, net |

131.9 | 99.3 | |||||

Accounts receivable—unconsolidated affiliates |

3.5 | 4.4 | |||||

Receivables from non-filing entities, net |

97.7 | 106.8 | |||||

Inventories |

152.4 | 103.8 | |||||

Other current assets |

78.6 | 56.4 | |||||

Total Current Assets |

1,200.2 | 1,232.4 | |||||

Properties and equipment, net |

410.1 | 407.2 | |||||

Deferred income taxes |

808.2 | 806.2 | |||||

Asbestos-related insurance |

500.0 | 500.0 | |||||

Investment in non-filing entities |

415.6 | 254.3 | |||||

Loans receivable from non-filing entities, net |

381.5 | 359.4 | |||||

Overfunded defined benefit pension plans |

0.2 | 0.3 | |||||

Investment in unconsolidated affiliates |

69.3 | 56.4 | |||||

Other assets |

78.4 | 83.5 | |||||

Total Assets |

$ | 3,863.5 | $ | 3,699.7 | |||

LIABILITIES AND EQUITY (DEFICIT) |

|||||||

Liabilities Not Subject to Compromise |

|||||||

Current liabilities (including $6.2 due to unconsolidated affiliates) (2010—$6.3) |

$ | 274.1 | $ | 183.5 | |||

Underfunded defined benefit pension plans |

266.6 | 367.7 | |||||

Other liabilities (including $17.8 due to unconsolidated affiliates) (2010—$12.6) |

54.4 | 50.0 | |||||

Total Liabilities Not Subject to Compromise |

595.1 | 601.2 | |||||

Liabilities Subject to Compromise |

3,199.1 | 3,174.1 | |||||

Total Liabilities |

3,794.2 | 3,775.3 | |||||

Total W. R. Grace & Co. Shareholders' Equity (Deficit) |

69.2 | (75.7 | ) | ||||

Noncontrolling interests in Chapter 11 filing entities |

0.1 | 0.1 | |||||

Total Equity (Deficit) |

69.3 | (75.6 | ) | ||||

Total Liabilities and Equity (Deficit) |

$ | 3,863.5 | $ | 3,699.7 | |||

In addition to Grace's financial reporting obligations as prescribed by the SEC, the Debtors are also required, under the rules and regulations of the Bankruptcy Code, to periodically file certain statements and schedules with the Bankruptcy Court. This information is available to the public through the Bankruptcy Court. This information is prepared in a format that may not be comparable to information in Grace's quarterly and annual financial statements as filed with the SEC. These

22

Notes to Consolidated Financial Statements (Continued)

2. Chapter 11 Information (Continued)

statements and schedules are not audited and do not purport to represent the financial position or results of operations of Grace on a consolidated basis.

3. Asbestos-Related Litigation

Grace is a defendant in property damage and personal injury lawsuits relating to previously sold asbestos-containing products. As of the Filing Date, Grace was a defendant in 65,656 asbestos-related lawsuits, 17 involving claims for property damage (one of which has since been dismissed), and the remainder involving 129,191 claims for personal injury. Due to the Filing, holders of asbestos-related claims are stayed from continuing to prosecute pending litigation and from commencing new lawsuits against the Debtors. The PI and PD Committees, representing the interests of asbestos personal injury and asbestos property damage claimants, respectively, and the PI FCR and PD FCR, representing the interests of future asbestos personal injury and property damage claimants, respectively, have been appointed in the Chapter 11 Cases. Grace's obligations with respect to present and future claims will be determined through the Chapter 11 process.

Property Damage Litigation The plaintiffs in asbestos property damage lawsuits generally seek to have the defendants pay for the cost of removing, containing or repairing the asbestos-containing materials in the affected buildings. Various factors can affect the merit and value of PD Claims, including legal defenses, product identification, the amount and type of product involved, the age, type, size and use of the building, the legal status of the claimant, the jurisdictional history of prior cases, the court in which the case is pending, and the difficulty of asbestos abatement, if necessary.

Out of 380 asbestos property damage cases (which involved thousands of buildings) filed prior to the Filing Date, 140 were dismissed without payment of any damages or settlement amounts; judgments after trial were entered in favor of Grace in nine cases; judgments after trial were entered in favor of the plaintiffs in eight cases for a total of $86.1 million; 207 property damage cases were settled for a total of $696.8 million; and 16 cases remain outstanding. Of the 16 remaining cases, eight relate to ZAI and eight relate to a number of former asbestos-containing products (two of which also are alleged to involve ZAI).

Approximately 4,300 additional PD claims were filed prior to the March 31, 2003 claims bar date established by the Bankruptcy Court. (The bar date did not apply to ZAI claims.) Grace objected to virtually all PD claims on a number of different bases, including: no authorization to file a claim; the claim was previously settled or adjudicated; no or insufficient documentation; failure to identify a Grace product; the expiration of the applicable statute of limitations and/or statute of repose, and/or laches; and a defense that the product in place is not hazardous. As of September 30, 2011, following the reclassification, withdrawal or expungement of claims, approximately 430 PD Claims subject to the March 31, 2003 bar date remain outstanding. The Bankruptcy Court has approved settlement agreements covering approximately 410 of such claims for an aggregate allowed amount of $151.6 million.

Eight of the ZAI cases were filed as purported class action lawsuits in 2000 and 2001. In addition, 10 lawsuits were filed as purported class actions in 2004 and 2005 with respect to persons and homes in Canada. These cases seek damages and equitable relief, including the removal, replacement and/or disposal of all such insulation. The plaintiffs assert that this product is in millions of homes and that the cost of removal could be several thousand dollars per home. As a result of the Filing, the eight U.S. cases have been stayed.

23

Notes to Consolidated Financial Statements (Continued)

3. Asbestos-Related Litigation (Continued)

Based on Grace's investigation of the claims described in these lawsuits, and testing and analysis of this product by Grace and others, Grace believes that ZAI was and continues to be safe for its intended purpose and poses little or no threat to human health. The plaintiffs in the ZAI lawsuits dispute Grace's position on the safety of ZAI. In October 2004, the Bankruptcy Court held a hearing on motions filed by the parties to address a number of important legal and factual issues regarding the ZAI claims. In December 2006, the Bankruptcy Court issued an opinion and order holding that, although ZAI is contaminated with asbestos and can release asbestos fibers when disturbed, there is no unreasonable risk of harm from ZAI. The ZAI claimants sought an interlocutory appeal of the opinion and order with the District Court, but that request was denied. In the event the Joint Plan is not affirmed, the ZAI claimants have reserved their right to appeal such opinion and order if and when it becomes a final order.

At the Debtors' request, in July 2008, the Bankruptcy Court established a bar date for U.S. ZAI PD Claims and approved a related notice program that required any person with a U.S. ZAI PD Claim to submit an individual proof of claim no later than October 31, 2008. Approximately 17,960 U.S. ZAI PD Claims were filed prior to the October 31, 2008 claims bar date and, as of September 30, 2011 an additional 1,310 U.S. ZAI PD Claims were filed. As described above, on December 13, 2009, the Ontario Superior Court of Justice, in the Grace Canada, Inc. proceeding pending under the Companies' Creditors Arrangement Act, approved the Amended Settlement that would settle all Canadian ZAI PD Claims on the terms of the Joint Plan. On October 20, 2008, the Bankruptcy Court established August 31, 2009 as the bar date for Canadian ZAI PD Claims. Approximately 13,100 Canadian ZAI PD Claims were filed prior to the bar date and, as of September 30, 2011, an additional 1,000 Canadian ZAI PD Claims were filed. Under the Amended Settlement, all Canadian ZAI PD Claims filed before December 31, 2009 would be eligible to seek compensation from the Canadian ZAI property damage claims fund.

As described in Note 2, on November 21, 2008, the Debtors, the Putative Class Counsel to the U.S. ZAI property damage claimants, the PD FCR, and the Equity Committee reached an agreement in principle designed to resolve all present and future U.S. ZAI PD Claims. The terms of the U.S. and Canadian ZAI agreements in principle have been incorporated into the terms of the Joint Plan and related documents. As described below, Grace's recorded asbestos-related liability does not include the agreements in principle to settle the ZAI liability that is part of the Joint Plan. The recorded asbestos-related liability at September 30, 2011, which is based on the Prior Plan, assumes the risk of loss from ZAI litigation is not probable. If the Joint Plan or another plan of reorganization reflecting the agreements in principle does not become effective and Grace's view as to risk of loss from ZAI litigation is not sustained, Grace believes the cost to resolve the U.S. ZAI litigation may be material.

Personal Injury Litigation Asbestos personal injury claimants allege adverse health effects from exposure to asbestos-containing products formerly manufactured by Grace. Historically, Grace's cost to resolve such claims has been influenced by numerous variables, including the nature of the disease alleged, product identification, proof of exposure to a Grace product, negotiation factors, the solvency of other former producers of asbestos containing products, cross-claims by co-defendants, the rate at which new claims are filed, the jurisdiction in which the claims are filed, and the defense and disposition costs associated with these claims.

Cumulatively through the Filing Date, 16,354 asbestos personal injury lawsuits involving approximately 35,720 PI Claims were dismissed without payment of any damages or settlement

24

Notes to Consolidated Financial Statements (Continued)

3. Asbestos-Related Litigation (Continued)

amounts (primarily on the basis that Grace products were not involved) and approximately 55,489 lawsuits involving approximately 163,698 PI Claims were disposed of (through settlements and judgments) for a total of $645.6 million. As of the Filing Date, 129,191 PI Claims were pending against Grace. Grace believes that a substantial number of additional PI Claims would have been received between the Filing Date and September 30, 2011 had such PI Claims not been stayed by the Bankruptcy Court.