UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Information Required in Proxy Statement

Schedule 14a Information

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. 1)

Filed by the Registrant ¨

Filed by a Party other than the Registrant x

Check the appropriate box:

x Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

¨ Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Under Rule 14a-12

|

ONESPAN INC. |

| (Name of Registrant as Specified in Its Charter) |

|

LEGION PARTNERS HOLDINGS, LLC LEGION PARTNERS, L.P. I LEGION PARTNERS, L.P. II LEGION PARTNERS OFFSHORE I SP I LEGION PARTNERS, LLC LEGION PARTNERS ASSET MANAGEMENT, LLC CHRISTOPHER S. KIPER RAYMOND T. WHITE Sarika Garg Sagar Gupta Michael J. McConnell Rinki Sethi |

| (Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

¨ Fee paid previously with preliminary materials:

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

(1) Amount previously paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

REVISED PRELIMINARY COPY SUBJECT

TO COMPLETION

DATED MARCH 26, 2021

LEGION PARTNERS HOLDINGS, LLC

___________________, 2021

Dear Fellow Stockholders:

Legion Partners Holdings, LLC, a Delaware limited liability company (“Legion Partners Holdings”), and the other participants in this solicitation (collectively, “Legion” or “we”) are significant stockholders of OneSpan Inc., a Delaware corporation (“OneSpan” or the “Company”), who beneficially own, in the aggregate, 2,790,121 shares of common stock, $0.001 par value per share (the “Common Stock”), of the Company, constituting approximately 6.9% of the outstanding Common Stock. We are seeking your support at the 2021 Annual Meeting of Stockholders (the “2021 Annual Meeting”) to elect Legion Partners Holdings’ four highly qualified nominees to the Company’s Board of Directors (the “Board”).

Since first investing in OneSpan in April 2018, we have repeatedly sought to engage privately with the Board and management team to help improve the Company’s persistently low valuation. We believe the Company’s undervaluation is perpetuated, at least in large part by a lack of meaningful financial disclosures and investor communications regarding recurring software revenue. We also strongly believe that the Company’s legacy Hardware segment imposes a structural impediment to OneSpan’s ability to trade at its fair value in the public markets. However, we believe it is the Board’s failure to take decisive action to correct this valuation discount and help management appropriately communicate pertinent business metrics and a clear transition story of making OneSpan into a modern, pure play software business, which has kept OneSpan from reaching its full potential. Accordingly, we have nominated four highly qualified and experienced technologists, operators, executives and investors who will bring fresh perspectives to address these issues in the boardroom.

Legion Partners Holdings believes the terms of nine directors currently serving on the Board expire at the 2021 Annual Meeting. This Proxy Statement is not only soliciting proxies to elect our four nominees, but also the candidates who have been nominated by the Company other than [ ], [ ], [ ] and [ ]. This gives stockholders who wish to vote for our nominees the ability to vote for a full slate of nine nominees in total. The names, backgrounds and qualifications of the Company’s nominees, and other information about them, can be found in the Company’s proxy statement. Your vote to elect our nominees will have the legal effect of replacing four incumbent directors with our nominees. If elected, our nominees will constitute a minority on the Board – accordingly, there can be no guarantee that our nominees will be able to implement the actions that they believe are necessary to unlock stockholder value. However, we believe the election of our nominees is an important step in achieving an appropriate valuation of the Common Stock.

We urge you to carefully consider the information contained in the attached Proxy Statement and then support our efforts by signing, dating and returning the enclosed WHITE proxy card today. The attached Proxy Statement and the enclosed WHITE proxy card are first being furnished to the stockholders on or about ____________, 2021.

If you have already voted for the incumbent management slate, you have every right to change your vote by signing, dating and returning a later dated WHITE proxy card or by voting at the 2021 Annual Meeting.

If you have any questions or require any assistance with your vote, please contact Saratoga Proxy Consulting LLC, which is assisting us, at its address and toll-free number listed below.

Thank you for your support,

Legion Partners Holdings, LLC

Christopher S. Kiper

|

If you have any questions, require assistance in voting your WHITE proxy card, or need additional copies of Legion’s proxy materials, please contact:

Stockholders call toll-free at (888) 368-0379 Email: info@saratogaproxy.com

|

REVISED PRELIMINARY COPY SUBJECT TO COMPLETION

DATED MARCH 26, 2021

2021 ANNUAL MEETING OF STOCKHOLDERS

OF

ONESPAN

INC.

_________________________

PROXY STATEMENT

OF

Legion Partners Holdings, LLC

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED WHITE PROXY CARD TODAY

Legion Partners Holdings, LLC, a Delaware limited liability company (“Legion Partners Holdings”), and the other participants in this solicitation (collectively, “Legion” or “we”) are significant stockholders of OneSpan Inc., a Delaware corporation (“OSPN”, “OneSpan” or the “Company”), who beneficially own, in the aggregate, 2,790,121 shares of common stock, $0.001 par value per share (the “Common Stock”), of the Company, constituting approximately 6.9% of the outstanding Common Stock. We believe that the Board of Directors of the Company (the “Board”) must be refreshed to ensure that the Board takes the necessary steps to maximize value for all of the Company’s stockholders. We have nominated four highly qualified directors who have strong, relevant backgrounds and who are committed to fully exploring all opportunities to unlock stockholder value. Accordingly, we are furnishing this proxy statement and accompanying WHITE proxy card to holders of Common Stock of OSPN in connection with our solicitation of proxies in connection with the Company’s 2021 annual meeting of stockholders (including any and all adjournments, postponements, continuations or reschedulings thereof, or any other meeting of stockholders held in lieu thereof) (the “2021 Annual Meeting”). As of the date of this Proxy Statement, the Company has not publicly disclosed the date, time or location at which the 2021 Annual Meeting will take place. Once the Company publicly discloses such information, Legion Partners Holdings intends to supplement this Proxy Statement with such information and file revised definitive materials with the SEC. This Proxy Statement and the enclosed WHITE proxy card are first being mailed to stockholders on or about [ ], 2021.

We are seeking your support at the 2021 Annual Meeting for the following:1

| 1. | To elect Legion Partners Holdings’ four director nominees, Sarika Garg, Sagar Gupta, Michael J. McConnell and Rinki Sethi (each a “Nominee” and, collectively, the “Nominees”) to hold office until the 2022 Annual Meeting of Stockholders (the “2022 Annual Meeting”) and until their respective successors have been duly elected and qualified; |

___________________

1 As of the date of this Proxy Statement, the Company’s proxy statement for the 2021 Annual Meeting has not yet been filed with the SEC. Accordingly, the proposal numbers in this Proxy Statement may not correspond to the proposal numbers that will be used in the Company’s proxy statement and we have omitted certain information from this Proxy Statement that is not yet publicly available, including the date, time and place of the Annual Meeting, which we expect to be included in the Company’s proxy statement. Once the Company publicly discloses this information, we intend to supplement this Proxy Statement to disclose such information and make any other necessary updates and file revised definitive materials with the SEC.

| 2. | To vote on a non-binding, advisory resolution to approve the compensation of the Company’s named executive officers; |

| 3. | To ratify the appointment of KPMG LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2021; and |

| 4. | To transact such other business as may properly come before the 2021 Annual Meeting. |

The Board is currently composed of nine directors. Through this Proxy Statement, we are soliciting proxies to elect not only our four Nominees, but also the candidates who have been nominated by the Company, other than [ ], [ ], [ ] and [ ]. This gives stockholders who wish to vote for our Nominees the ability to vote for all nine directorships up for election. The names, backgrounds and qualifications of the Company’s nominees, and other information about them, can be found in the Company’s proxy statement. Your vote to elect our Nominees will have the legal effect of replacing four incumbent directors with our Nominees. If elected, our Nominees will constitute a minority on the Board and there can be no guarantee that our Nominees will be able to implement the actions that they believe are necessary to maximize stockholder value at the Company. However, we believe the election of our Nominees is a necessary step towards enhancing long-term value at the Company.

The Company has not yet publicly disclosed the record date for determining stockholders entitled to notice of and to vote at the 2021 Annual Meeting (the “Record Date”) or the number of shares of Common Stock outstanding as of the Record Date. Once the Company publicly discloses such information, we intend to supplement this Proxy Statement with such information and file revised definitive materials with the SEC. The mailing address of the principal executive offices of the Company is 121 West Wacker Drive, Suite 2050, Chicago, Illinois 60601. Stockholders of record at the close of business on the Record Date will be entitled to vote at the 2021 Annual Meeting. As of February 23, 2021, there were 40,391,202 shares of Common Stock outstanding, which is the total number of shares outstanding as reported in the Company’s Annual Report on Form 10-K filed with the SEC on February 25, 2021.

As of March 26, 2021, Legion Partners Holdings, LLC, a Delaware limited liability company (“Legion Partners Holdings”), Legion Partners, L.P. I, a Delaware limited partnership (“Legion Partners I”), Legion Partners, L.P. II, a Delaware limited partnership (“Legion Partners II”), Legion Partners Offshore I SP I, a segregated portfolio company of Legion Partners Offshore Opportunities SPC I, a company organized under the laws of the Cayman Islands (“Legion Partners Offshore I”), Legion Partners, LLC, a Delaware limited liability company (“Legion Partners GP”), Legion Partners Asset Management, LLC, a Delaware limited liability company (“Legion Partners Asset Management”), Christopher S. Kiper, and Raymond T. White (collectively, “Legion”) and each of the Nominees (each a “Participant” and collectively, the “Participants”), collectively beneficially own 2,790,121 shares of Common Stock (the “Legion Shares”). We intend to vote the Legion Shares FOR the election of the Nominees, AGAINST the approval of the non-binding advisory resolution on the compensation of the Company’s named executive officers and FOR the ratification of the selection of KPMG LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2021, as further described herein.

We urge you to carefully consider the information contained in this Proxy Statement and then support our efforts by signing, dating and returning the enclosed WHITE proxy card today.

2

THIS SOLICITATION IS BEING MADE BY LEGION AND NOT ON BEHALF OF THE BOARD OF DIRECTORS OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE THE 2021 ANNUAL MEETING OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH LEGION IS NOT AWARE OF A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE 2021 ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED WHITE PROXY CARD WILL VOTE ON SUCH MATTERS IN OUR DISCRETION.

LEGION URGES YOU TO SIGN, DATE AND RETURN THE WHITE PROXY CARD IN FAVOR OF THE ELECTION OF THE NOMINEES.

IF YOU HAVE ALREADY SENT A PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS DESCRIBED IN THIS PROXY STATEMENT BY SIGNING, DATING, AND RETURNING THE ENCLOSED WHITE PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE 2021 ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR THE 2021 ANNUAL MEETING OR BY VOTING AT THE 2021 ANNUAL MEETING.

Important Notice Regarding the Availability of Proxy Materials for the 2021 Annual Meeting—This Proxy Statement and our WHITE proxy card are available at

www.protectonespan.com

3

IMPORTANT

Your vote is important, no matter the number of shares of Common Stock you own. Legion urges you to sign, date, and return the enclosed WHITE proxy card today to vote FOR the election of the Nominees and in accordance with Legion’s recommendations on the other proposals on the agenda for the 2021 Annual Meeting.

| · | If your shares of Common Stock are registered in your own name, please sign and date the enclosed WHITE proxy card and return it to Legion, c/o Saratoga Proxy Consulting LLC (“Saratoga”) in the enclosed postage-paid envelope today. |

| · | If your shares of Common Stock are held in a brokerage account or bank, you are considered the beneficial owner of the shares of Common Stock, and these proxy materials, together with a WHITE voting form, are being forwarded to you by your broker or bank. As a beneficial owner, you must instruct your broker, trustee or other representative how to vote. Your broker cannot vote your shares of Common Stock on your behalf without your instructions. |

| · | Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosed voting form. |

Since only your latest dated proxy card will count, we urge you not to return any proxy card you receive from the Company. Even if you return the Company’s proxy card marked “withhold” as a protest against the incumbent directors, it will revoke any proxy card you may have previously sent to us. Remember, you can vote for our four Nominees only on our WHITE proxy card. So please make certain that the latest dated proxy card you return is the WHITE proxy card.

|

If you have any questions, require assistance in voting your WHITE proxy card, or need additional copies of Legions proxy materials, please contact:

Stockholders call toll-free at (888) 368-0379 Email: info@saratogaproxy.com

|

4

BACKGROUND OF THE SOLICITATION

| · | From May 2018 through February 2021, members of Legion (as defined below) had regular calls with Scott Clements, Chief Executive Officer of the Company, and Mark Hoyt, Chief Financial Officer of the Company, to discuss the Company’s business and quarterly earnings results. |

| · | On June 14, 2018, members of Legion met with Mr. Hoyt at the Company’s headquarters in Chicago and delivered a presentation outlining numerous recommendations regarding investor relations, investor communications (including hosting an Investor Day), financial disclosures, governance practices, capital allocation, as well as perspectives on valuation of the Common Stock and the need to refresh the Board. |

| · | On November 1, 2018, Legion filed a Schedule 13D with the SEC which included Legion’s perspectives on long-term valuation of the Common Stock, and engagement with the Company regarding adding directors with industry and governance expertise to the Board. |

| · | On November 13, 2018, members of Legion met with Mr. Clements to express an interest in collaborating on Board refreshment and communicated that Legion had identified several director candidates for the Board to consider in an effort to refresh the Board and who possessed the industry, capital markets and governance experience and skills that Legion believed were needed on the Board. |

| · | On December 7, 2018, members of Legion held a telephone call with Messrs. Clements and Hoyt to discuss adding upwards of three new directors to the Board pursuant to a potential cooperation agreement. |

| · | On December 21, 2018, members of Legion held a telephone call with Messrs. Clements and Hoyt and subsequently provided Mr. Clements and the Board, under no preconditions, resumes and contact information for three highly-qualified candidates for the Board, including the former head of M&A at a prominent, public cybersecurity software company, the now-CFO of a prominent, public cybersecurity software company, and Mr. Michael McConnell, a Nominee. |

| · | From December 2018 through March 2019, members of Legion held multiple telephone calls with Messrs. Clements and Hoyt to discuss collaboration on Board refreshment and Legion’s candidates. |

| · | From December 2018 through April 2019, the Company conducted telephone and virtual interviews with two director candidates proposed by Legion (including Mr. McConnell), and an in-person interview with one candidate proposed by Legion. |

| · | On January 1, 2019, director Art Gilliland tendered his resignation from the Board, which the Board accepted on January 3, 2019. |

| · | On January 3, 2019, the Board appointed Mr. John Fox as Chairman of the Board, who was previously Lead Independent Director, replacing Founder and Former CEO, Mr. T. Kendall Hunt, who remained on the Board as a director following his resignation as Chairman of the Board. |

| · | On March 11, 2019, Mr. Clements sent an email to members of Legion stating that the Company would agree to add just one of Legion’s director candidates to the Board pursuant to a cooperation agreement. The Company rejected Legion’s two other highly-qualified candidates, including Mr. McConnell. The proposed terms of the cooperation agreement, which Legion felt were grossly unreasonable, included at least a two year standstill which could be extended in the sole discretion of the Company in the event the Company agreed to re-nominate Legion’s director candidate, a requirement to compel Legion’s director candidate to immediately resign from the Board, versus serving out the full elected term, upon the termination of the standstill or the Company’s determination that Legion or the nominee had breached the cooperation agreement or Board’s policies. |

5

| · | On May 7, 2019, the Company announced directors Mr. Marc Boroditsky and Dr. Marc Zenner as nominees for election to the Board at its 2019 Annual Meeting of Stockholders. |

| · | On May 9, 2019, members of Legion met with Mr. Clements to express continued interest in collaborating on further Board refreshment despite the recent failure to achieve an agreement prior to the expiration of the deadline to nominate director candidates at the Company’s 2019 annual meeting of stockholders. |

| · | On June 14, 2019, given the lack of response from the Board following the May 9, 2019 meeting, Legion sent a letter to the Board expressing deep concern over the Board’s poor governance practices, persistent insider selling of stock, the Board’s overall lack of industry experience, prolonged financial and share price underperformance, overall composition of the Board and the need for refreshment through the replacement of directors, as well as reiterating numerous recommendations regarding financial disclosures, capital allocation and investor communications (including hosting an Investor Day) to help address the Company’s undervaluation in the public markets. The letter requested a formal response from the Board regarding additional collaboration on Board refreshment, to which the Board never responded. |

| · | On August 21, 2019, members of Legion met with Messrs. Clements and Hoyt at the Company’s headquarters in Chicago and delivered a presentation outlining numerous recommendations regarding investor relations, investor communications (including hosting an Investor Day), financial disclosures, corporate governance practices, capital allocation decisions, as well as perspectives on valuation of the Company’s securities and the need to refresh the Board through replacements of directors rather than additions. |

| · | On December 4, 2019, the Company held an Investor Day in New York City where members of Legion met with Messrs. Clements, Hoyt, and Fox, and notified the Company it had identified several additional director candidates who possess relevant industry, capital markets and governance experience and skills for the Board’s consideration. Legion also reiterated its continued interest in collaborating on Board refreshment despite not receiving a response from the Board on this topic following the June 14, 2019 letter. |

| · | On December 13, 2019, Legion sent a private letter to the Board expressing continued concern over the Board’s composition and prolonged underperformance, and enclosed, under no preconditions, the resumes and contact information of three director candidates for the Board’s consideration, including the Chief Security Officer of a prominent, public financial technology software company, the Chief Operating Officer of a prominent sales productivity software company, and Ms. Sarika Garg, a Nominee. |

| · | From December 2019 through February 2021, the Company held a telephone interview with one director candidate, and in-person interviews with two director candidates, including Ms. Garg. Members of Legion also held multiple telephone calls with Messrs. Clements and Fox, and the Chair of the Corporate Governance and Nominating Committee, Ms. Jean Holley, to discuss terms regarding a potential cooperation agreement. |

6

| · | On January 29, 2020, members of Legion entered into a non-disclosure agreement with the Company to hold detailed discussions regarding the composition of the Board and potential Board candidates in connection with the 2020 Annual Meeting of Stockholders, and subsequently held a telephone call with Messrs. Clements and Fox and Ms. Holley regarding this matter. |

| · | In February 2020, members of Legion conducted telephone interviews with two director candidates identified by the Company, Ms. Naureen Hassan and another individual. |

| · | On February 7, 2020, members of Legion sent an email to Messrs. Clements and Fox and Ms. Holley expressing support for Ms. Hassan’s candidacy to the Board as well as the desire to collaborate with the Board on additional Board refreshment, which could include the addition of Legion’s proposed director candidates. |

| · | On February 21, 2020, members of Legion held a telephone call with Messrs. Clements and Fox who notified Legion that the Board had decided to reject all of Legion’s proposed candidates, including Ms. Garg, despite their outstanding qualifications, and the Board’s intent to appoint Ms. Hassan and Ms. Marianne Johnson to the Board in the near future. |

| · | On March 3, 2020, the Board announced the appointment of Mses. Hassan and Johnson to the Board, effective March 15, 2020. |

| · | On March 6, 2020, members of Legion held a video meeting with Messrs. Clements and Hoyt to discuss the Company’s fourth quarter earnings results and potential strategic actions to unlock intrinsic stockholder value, including a potential sale of the Hardware and eSignature businesses, as well as valuation perspectives on the Common Stock. |

| · | On May 8, 2020, members of Legion held a video meeting with Messrs. Clements and Hoyt to again discuss the Company’s financial performance, general strategy, operations and product offerings, as well as potential strategic actions to unlock intrinsic stockholder value, including a potential sale of the Company’s Hardware and eSignature businesses. |

| · | On May 12, 2020, members of Legion sent an email to Mr. Hoyt containing additional analysis and feedback regarding peer valuations, peer financial disclosures, and the valuation of the Common Stock relative to the share price of the Company’s peers. |

| · | On May 18, 2020, members of Legion held a video meeting with Mr. Hoyt to further discuss the information emailed to Mr. Hoyt on May 12, 2020. |

| · | On May 20, 2020, members of Legion held a video meeting with Mr. Clements to discuss valuation perspectives on the Common Stock, as well as the Company’s financial disclosures and investor communications. |

| · | On May 21, 2020, members of Legion emailed Messrs. Clements and Hoyt additional analysis and feedback regarding peer valuations, peer financial disclosures, and the valuation of the Common Stock relative to the share price of the Company’s peers. |

| · | On June 9, 2020, members of Legion held a video meeting with Mr. Hoyt to further discuss the information emailed to Messrs. Clements and Hoyt on May 21, 2020. Subsequent to the video meeting, members of Legion emailed Mr. Hoyt additional analysis and feedback regarding peer valuations, peer financial disclosures, and the valuation of the Common Stock relative to the share price of the Company’s peers. |

7

| · | On June 15, 2020, the Company reported that at the 2020 Annual Meeting held on June 10, 2020, a majority of the shares present and voting at the meeting (including Legion) voted FOR the Company’s say-on-pay proposal to be approved on an annual basis in line with widely accepted best governance practices, rather than voting in line with the Board’s recommendation of continuing to approve the say-on-pay proposal only every three years. |

| · | On August 13, 2020, members of Legion held a video meeting with Messrs. Clements and Hoyt to discuss the Company’s recent second quarter earnings. On the video meeting, members of Legion expressed deep concern regarding Mr. Hunt’s ill-timed stock sales occurring one day before the Company announced it missed its earnings, causing the stock to decline by roughly 40%. Legion called for the resignation of Mr. Hunt and the addition of new directors to the Board. |

| · | On August 16 and 17, 2020, the Company’s counsel, Sidley Austin LLP (“Sidley”), had discussions with Legion Partners’ counsel, Olshan Frome Wolosky LLP (“Olshan”), regarding the concerns raised by Legion on August 13, 2020 and the need for Mr. Hunt to step down promptly. Sidley indicated the Board needed more time to persuade Mr. Hunt to step down and indicated the Company could not force him to resign. |

| · | On August 18, 2020, Legion published a public letter to the Board outlining Legion’s deep concern over the Board’s poor governance practices, insider selling of stock before missing earnings, the lack of industry experience possessed by members of the Board, the Company’s prolonged financial and share price underperformance, overall composition of the Board and need to refresh the Board through the replacement of existing members, as well as reiterating numerous recommendations regarding strategic initiatives (including the potential sale of the Company’s Hardware and eSignature businesses), financial disclosures, capital allocation and investor communications to help address the Company’s undervaluation in the public markets. In addition, Legion outlined its deep concern in the letter regarding Mr. Hunt’s continued presence on the Board, called for his immediate resignation, and proposed a representative of Legion to replace Mr. Hunt on the Board. |

| · | On August 21, 2020, members of Legion sent an email to Messrs. Clements and Hoyt containing a sample quarterly earnings presentation in the hopes of encouraging changes to investor communications and financial disclosures that would further improve transparency and investors’ understanding of OSPN’s intrinsic value. |

| · | On September 10, 2020, members of Legion held a video meeting with Mr. Hoyt to discuss the Company’s financial performance, general strategy, operations and product offerings, as well as the presentation emailed to him by Legion on August 21, 2020. |

| · | On September 11, 2020, Legion Partners held an additional video meeting with Mr. Hoyt to discuss the presentation emailed on August 21, 2020. |

| · | On September 14, 2020, the Company announced the retirement of Mr. Hunt from the Board. |

| · | On September 15, 2020, members of Legion held a video meeting with Mr. Clements to discuss the Company’s general performance and operations, Mr. Hunt’s departure from the Board, the need to refresh the Board further through replacement of existing directors, as well as potential strategic actions to unlock intrinsic stockholder value, including a potential sale of the Company’s Hardware and eSignature businesses. Legion also inquired as to whether the Board planned to respond to the August 18, 2020 letter, to which Mr. Clements stated that the Board has chosen not to engage directly with Legion but to instead respond indirectly through public actions and announcements (such as Mr. Hunt’s retirement from the Board). |

8

| · | On September 18, 2020, given the lack of response from the Board following the publication of the August 18, 2020 letter, Legion sent a private letter to the Board in an attempt to once again constructively collaborate with the Board regarding Board refreshment for the betterment of all stockholders. In the letter, Legion recommended the appointment of Mr. Sagar Gupta, a Nominee and employee of Legion Partners Asset Management, along with two new independent director candidates, to be mutually agreed upon by OSPN and Legion, who possessed modern software industry experience. Legion requested a specific response to this proposal from the Board by September 23, 2020. |

| · | In October 2020, Sidley communicated to Olshan that the Board was not interested in interviewing and appointing Mr. Gupta to the Board. The Board did not communicate directly with Legion nor respond directly to the September 18, 2020 letter. |

| · | From November 2020 through February 2021, members of Legion held multiple video meetings with Messrs. Clements and Hoyt to discuss the Company’s general performance and operations, as well as the Company’s recent quarterly earnings results. |

| · | On January 26, 2021, Legion requested the Company’s form of director and officer questionnaire. |

| · | On February 8, 2021, Legion’s counsel sent a letter to the Company’s counsel contesting certain overreaching requirements of the questionnaire, including the consent of the Nominees to be named as the Company’s nominees in the Company’s proxy statement. |

| · | On February 22, 2021, the Company filed a Current Report on Form 8-K disclosing that director Mr. Michael Cullinane would not stand for re-election to the Board at the 2021 Annual Meeting. |

| · | On February 25, 2021, Legion Partners Holdings delivered a letter (the “Nomination Letter”) to the Company notifying the Company of Legion Partners Holdings’ intent to nominate the Nominees for election to the Board at the 2021 Annual Meeting. |

| · | Also on February 25, 2021, Legion issued a press release and public letter to fellow OSPN stockholders announcing the nomination of the Nominees for election to the Company’s Board at the 2021 Annual Meeting. |

| · | On February 26, 2021, Legion Partners Holdings delivered to the Company a demand to inspect its books and records, pursuant to Section 220 of the Delaware General Corporation Law. |

| · | On February 26, 2021, the Company filed with the SEC its Annual Report on Form 10-K, which disclosed that Ms. Hassan had submitted her resignation as a director to the Board on February 24, 2021, effective March 1, 2021. |

| · | On March 3, 2021, Ms. Holley sent an email directly to the Nominees requesting that they make themselves available for interviews with the Board. In response, on March 3, 2021, members of Legion responded to Ms. Holley and the Company’s General Counsel, Mr. Steven Worth, acknowledging receipt of Ms. Holley’s email from the same day and expressing a lack of confidence in the Board’s ability to objectively assess the Nominees given the Board’s track record of refusing to collaborate in good faith with Legion regarding Board refreshment. In addition, Legion offered that the Board may interview the Nominees if Legion and the Board could come to an understanding regarding Board refreshment to avoid a drawn-out proxy contest. |

| · | On March 4, 2021, Ms. Holley sent an email to Legion requesting clarification on what Legion was requesting in the March 3, 2021 email exchange in order for the Board to interview the Nominees. |

9

| · | On March 8, 2021, members of Legion sent an email to Ms. Holley and Mr. Worth with a high-level proposal to avoid a proxy contest. The proposal requested that three Nominees join the Board immediately, Mr. Cullinane would step down from the Board immediately, the Board would be resized at eight from and after the 2021 Annual Meeting and the Board would immediately form a strategic review committee to explore and make recommendations to the Board with respect to a potential transaction of the Company’s hardware business, eSignature business or the entire company. |

| · | On March 11, 2021, Ms. Holley again sent an email to the Nominees requesting an interview and separately responded to Legion’s email from March 8, 2021, stating that the Board’s unanimous view is to not proceed in discussing a settlement agreement based on the proposed terms outlined by Legion in its March 8, 2021 email. |

| · | On March 22, 2021, Legion filed a preliminary proxy statement. |

| · | On

March 26, 2021, Legion filed this revised preliminary proxy statement. |

10

REASONS FOR THE SOLICITATION

We Believe that the Time for Action is Now

We are long-term stockholders of OSPN and have believed in the Company’s potential growth and long-term value opportunity since having first invested in April 2018. That is why during the course of our investment we have sought to engage privately with the Board and management team to help improve OSPN’s persistently low share price valuation. In over 30 meetings over nearly three years we sought to collaborate with management and the Board on matters including financial disclosures, investor communications, Board refreshment, asset divestitures, capital allocation and other governance issues. Despite our good faith effort to work constructively with the Company, we have watched as the Board has only undertaken, in our view, reactive, incremental changes that have failed to address the Company’s stock price and operational underperformance. That is why we have nominated a slate of four highly qualified director candidates to run in opposition to four of the Company’s long-tenured directors who we believe lack the independence and skillsets to help ensure an appropriate valuation for the Common Stock.

The Board Has Overseen Prolonged Stock Price Underperformance

The Company’s total shareholder returns have drastically lagged its peers and major indices over multiple time periods.

| OSPN Relative TSR vs. Major Benchmarks | |||||

| OSPN vs. | 1 Year | 2 Year | 3 Year | 5 Year | 10 Year |

| Direct Software Peers | (129%) | (172%) | (255%) | (360%) | (503%) |

| Cybersecurity Peers | (77%) | (59%) | (152%) | (256%) | (157%) |

| ISS Peers | (39%) | (61%) | (155%) | (332%) | (317%) |

| Russell 3000 | 2% | 7% | 7% | (63%) | (46%) |

| MSCI ACWI/Software Index | (21%) | (42%) | (73%) | (212%) | (292%) |

| IGV | (31%) | (44%) | (80%) | (217%) | (352%) |

| NASDAQ | (23%) | (35%) | (38%) | (134%) | (231%) |

Source: Capital IQ (as of 12/31/20)

Notes: Direct Software Peers include CRWD, DOCU, DT, NCNO, NET, NICE, OKTA, PING, QLYS, SPLK, VRNS, ZS; Cybersecurity Peers include

CHKP, CRWD, CYBR, FEYE, FTNT, MIME, MITK, NET, OKTA, PANW, PFPT, PING, QLYS, RDWR, RPD, SAIL, SCWX, TENB, VRNS, ZS; ISS Peers include

AMSWA, ATEN, BL, BNFT, EVBG, FIVN, MODN, PRO, QADA, QLYS, QTWO, RPD, SNCR, SPSC, VRNS, WK, ZIXI; IGV references the iShares Expanded

Tech-Software Sector ETF

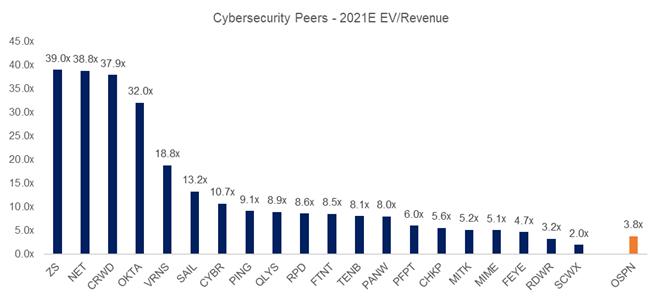

OSPN’s valuation also continues to trade near the bottom of public cybersecurity peers:

11

Source: Capital IQ (as of 2/24/21)

We view this underperformance to be unacceptable and believe meaningful improvements to OSPN’s strategy and execution – led by a more substantially refreshed Board – are necessary to successfully complete its transition to a cloud-first recurring revenue software Company and implement thoughtful capital allocation.

We Believe the Board’s Long-Tenured Directors Lack Relevant Skillsets

We believe that the Board, and in particular its long tenured directors, have demonstrated an inability to take decisive strategic action towards addressing the structural and governance issues that we believe are significantly hampering the Company’s success. These long-tenured directors gained the bulk of their technology “experience” long before the proliferation of cloud computing, and for some, the Internet. Yet the very same directors that oversaw former CEO Mr. Hunt’s less than desirable operational performance for over a decade are still leading the Board and its key committees today.

Chairman of the Board, John Fox, for example, has been a director for over 15 years, and has also chaired the Compensation Committee since 2006 in addition to being an ex-officio member of the Finance and Strategy Committee. Similarly, Jean Holley, who has served on the Board for over 14 years, has served as Chair of the Governance and Nominating Committee since 2014. Until the recent announcement that Mr. Cullinane did not plan to seek reelection at the 2021 Annual Meeting (less than one month after we requested a director questionnaire for purposes of preparing a director nomination), Mr. Cullinane also served as Chair of the Audit Committee despite serving on the Board for over 22 years.

In addition, as noted below, the Board generally lacks cloud-first recurring revenue experience, despite attempting to transition into a pure play cloud-first software company.

12

| Board Director and Position | Ownership % | Cloud-First Recurring Revenue Experience | Age | Tenure |

| Michael P. Cullinane Chair of Audit Committee (since 2001) |

0.479% | NO | 70 | 22 Years |

|

John N. Fox, Jr. Chair of Compensation Committee (since 2006); former Lead Independent Director (2017-2018) |

0.278% | NO | 77 | 15 Years |

| Jean K. Holley Chair of Governance and Nominating Committee (since 2014) |

0.289% | NO | 61 | 14 Years |

| Matthew Moog Independent Director |

0.138% | NO | 49 | 8 Years |

| Marc Boroditsky Independent Director |

0.018% | YES | 57 | 1 Year |

| Marc Zenner Independent Director |

0.035% | NO | 57 | 1 Year |

| Marianne Johnson Independent Director |

0.017% | NO | 55 | <1 Year |

| Alfred Nietzel Independent Director |

0.000% | NO | 59 | <1 Year |

| Scott Clements Director; CEO & President |

0.348% | NO | 57 | 3 Years |

While we were pleased to see Mr. Hunt resign from the Board following the sale of significant stock one day before the Company announced missed earnings in August 2020 and the announcement that Mr. Cullinane will not be nominated for reelection at the 2021 Annual Meeting, we view these changes as reactive and steps that likely would not have been undertaken without our involvement and pressure over the past three years. The Board needs leadership and cultural change – not incremental change and the status-quo – in order to fully address its valuation gap and transition to a pure play cloud-first software company.

The Board Has Failed to Fully Explore Strategic Action

We believe that the Company’s legacy Hardware business imposes a structural impediment to the Common Stock’s ability to trade at its fair value in the public markets. The legacy Hardware authenticator token business is in secular decline and the revenue base is shifting towards software-based mobile and identity cybersecurity solutions. The Hardware segment has become increasingly difficult for management to predict. In 2020, for example, the Company’s Hardware revenue was down 36% year-over-year.

In our view, the Hardware segment carries inferior gross margins, produces volatile quarterly results, and is perceived to have high customer concentration. Despite the Company’s recent announcement regarding certain operational restructurings of the Hardware segment, we believe such steps should have been executed years ago, and by the previous management team, and the delay highlights the Board’s strong inertia and lack of effective oversight of inefficiencies in what was once the Company’s sole core business.

We have privately recommended on multiple prior occasions that the Company undertake a strategic review process to monetize the Hardware business. With the sale of the Hardware business, we believe investors will be able to analyze and appropriately value OSPN’s remaining high-value, high-growth components, thereby unlocking significant value for stockholders as outlined above. Unfortunately, not only has the Board apparently refused to hire an independent investment bank to explore a sale of the Hardware segment, we have also been informed that the Board has ignored inbound interest from parties interested in strategic transactions. We believe this demonstrates the insular nature of current Board leadership and is highly detrimental to long-term value for the Company and its stockholders.

13

Our Nominees Are Highly Qualified and Committed to Exploring All Means to Improve Stockholder Value

Our slate consists of highly experienced technologists, operators, executives and investors. We believe these individuals, if elected, would bring unique and diverse perspectives to the Board. Consistent with their fiduciary duties, our Nominees would seek to explore all means to unlock stockholder value, including the exploration of strategic alternatives not only of the Hardware segment but the entire company.

We have included brief biographies of our Nominees below:

Sarika Garg

| · | Sarika Garg is currently a strategic advisor to, and the former Chief Strategy Officer of, Tradeshift, the largest business commerce company in the world providing a global commerce SaaS platform that connects and enables payments between buyers and sellers – the company has grown to over 800 employees with offices in 13 countries having attained a private market valuation of $1.1 billion. |

| · | As the former Chief Strategy Officer, Ms. Garg led corporate strategy (organic and inorganic growth, including four acquisitions), brand and product innovation, go-to-market strategy, and marketing & communications. |

| · | Prior to Tradeshift, Ms. Garg spent over a decade at SAP as a top executive within the Office of the CEO with a focus on product innovation and strategy. |

| · | At SAP, Ms. Garg played a leading role in the post-merger integration of the $3.4 billion acquisition of SuccessFactors, focusing on the market launch of the SAP Cloud strategy and portfolio (successfully executed within a record three months of the merger) as well as on enabling the sales teams to reach aggressive Cloud targets. |

| · | In addition, Ms. Garg was tapped to lead product management for Ariba Network following its $4.3 billion acquisition by SAP – in this role she drove over $200 million in revenue as head of Ariba Seller Cloud. |

| · | Ms. Garg is considered a world-renowned expert on SaaS operations, sales and architectures, particularly in the financial technology space, and was featured in the Wall Street Journal and as a speaker at the World Economic Forum in Davos on leadership in the technology industry. |

| · | Ms. Garg was also recognized as one of the Top 50 Women Leaders in SaaS in The Software Report in both 2018 and 2019. |

| · | Since 2018, Ms. Garg has served as a member of the board of directors at Fyle, a private company focused on intelligent expense management within email; she is also a member of the invitation-only Forbes Business Development Council for senior-level sales and business development executives. |

Sagar Gupta

| · | Sagar Gupta has spent over a decade advising and investing in public technology, media and telecommunications (TMT) companies and currently leads all TMT investing at Legion Partners as a Senior Analyst. |

| · | Prior to joining Legion Partners, Mr. Gupta was an investment analyst at Balyasny Asset Management, a global hedge fund with approximately $9 billion in assets under management, where he focused on long/short TMT equities investments. |

14

| · | Prior to Balyasny Asset Management, Mr. Gupta was an investment professional at KKR & Co. (NYSE: KKR), a leading global investment firm, where he focused on special situations and private debt investments across all industries. |

| · | Mr. Gupta began his career as an investment banker at UBS, a leading global financial services firm, where he focused on advising TMT companies globally in all matters of capital raising and M&A. |

| · | In addition, Mr. Gupta was a private angel investor in Teachable, a SaaS platform for creators and educators, which was acquired by Hotmart Technology in March 2020 for over $200 million. |

| · | Legion Partners is the second-largest institutional investor in OneSpan – we believe our firm and Mr. Gupta are well-aligned with the broader OneSpan stockholder base which deserves true, independent ownership representation on the Board. |

Michael McConnell

| · | Michael McConnell is a private investor who brings over 20 years of public company non-executive Board, CEO operating and public company investor experience. |

| · | Mr. McConnell is currently an Independent Director on the board of Vonage (Nasdaq: VG), an enterprise communications SaaS company, since 2019. |

| · | Mr. McConnell previously served on the board of SPS Commerce (Nasdaq: SPSC), a leading supply chain SaaS company, from 2018 through 2019. |

| · | During his tenure on the board of SPS Commerce, the company overhauled its sales strategy resulting in significantly higher sales productivity and shareholder value creation. |

| · | Mr. McConnell previously served as chairman of the board of Spark Networks (NYSE: LOV), a global Internet subscription company, from 2014 until the company was sold in 2017; Mr. McConnell also served as Interim Executive Chairman and Chief Executive Officer of Spark Networks during his board tenure. |

| · | Mr. McConnell previously served on the board of Guidance Software (Nasdaq: GUID), a provider of forensic security and risk management applications, from 2016 until the company was sold in 2017. |

| · | Mr. McConnell is currently an independent director at Adacel Technologies (ASX: ADA), a developer of air traffic management systems and technology and has led a significant recent operational turnaround. |

| · | Mr. McConnell is the former Managing Director of Shamrock Capital Advisors, an investment manager of private equity and hedge funds, where he was a member of the Executive Committee and head of the Shamrock Activist Value Fund. |

| · | Mr. McConnell has served on numerous other public and private company boards in the United States, Australia, New Zealand, Israel and Ireland. |

Rinki Sethi

| · | Rinki Sethi is the Chief Information Security Officer at Twitter (NYSE: TWTR), a social networking platform. |

| · | Ms. Sethi is an award-winning leader in security innovation with experience leading and developing innovative security infrastructure for Fortune 500 companies including IBM, Walmart.com, Intuit and eBay. |

| · | Ms. Sethi has more than 16 years of experience leading strategy and vision in product security, security operations and security architecture, including previously leading a technical team of over 500 engineers globally and its $500 million budget. |

| · | Ms. Sethi was recognized by CSO Magazine & Executive Women’s Forum with the “One to Watch” award, and in 2010 she led a team at eBay to receive the “Information Security Team of the Year” by SC Magazine. |

15

| · | In addition, Ms. Sethi recently won an award for Senior Information Security Practitioner by ISC2, the most recognized non-profit security organization. |

| · | Prior to Twitter, Ms. Sethi served as the first Chief Information Security Officer at Rubrik, a private cloud data management company – the company has over 1,400 employees across six global offices having attained a private market valuation of $3.3 billion. |

| · | Prior to Rubrik, Ms. Sethi served as the Enterprise Chief Information Security Officer at IBM (NYSE: IBM), where she was responsible for driving a world-class security operations center as well as identity and access management practice. |

| · | Prior to IBM, Ms. Sethi served as the Vice President of Security Operations & Strategy at Palo Alto Networks (NYSE: PANW), a leading next-generation cybersecurity software company, where she was responsible for creation, coordination and execution of the company’s security strategy. |

| · | In addition, at Palo Alto Networks, Ms. Sethi was deeply involved in the technical M&A due diligence of numerous acquisitions including LightCyber, Secdo and Evident.io. |

| · | Ms. Sethi previously served on the board of directors of WiCyS (Women in Cybersecurity), a non-profit dedicated to recruitment, retention and advancement of women in cybersecurity. |

| · | Ms. Sethi is a member of ISACA, ISC2, SANS, IEEE and Infragard; in addition, she is certified in CISSP (#83820), GIAC GSEC, NSA-IAM, CEH, CISA and from Palo Alto Networks, ASE and ACE. |

16

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Board is currently composed of nine directors, each with a term expiring at the 2021 Annual Meeting. Legion Partners Holdings has nominated four independent, highly-qualified Nominees for election to the Board to replace four incumbent directors. If all four Nominees are elected, they will still represent a minority of the members of the Board and there can be no guarantee that the Nominees will be able to implement the actions that they believe are necessary to unlock stockholder value. However, we believe the election of our Nominees is an important step in the right direction for igniting the Company’s otherwise stagnant performance.

This Proxy Statement is soliciting proxies to elect not only our four nominees, but also the candidates who have been nominated by the Company other than [ ], [ ], [ ] and [ ]. This gives stockholders who wish to vote for our Nominees the ability to vote for a full slate of nine nominees in total. The names, backgrounds and qualifications of the Company’s nominees, and other information about them, can be found in the Company’s proxy statement.

THE NOMINEES

The following information sets forth the name, age, business address, present principal occupation, and employment and material occupations, positions, offices, or employments for the past five years of each of the Nominees. The nominations were made in a timely manner and in compliance with the applicable provisions of the Company’s governing instruments. The specific experience, qualifications, attributes and skills that led us to conclude that the Nominees should serve as directors of the Company are set forth above in the section entitled “Reasons for the Solicitation” and below. This information has been furnished to us by the Nominees. All of the Nominees are citizens of the United States.

Sarika Garg, age 45, has served as Founder and CEO at Silverbond, Inc., a B2B embedded financing company, since October 2020. Ms. Garg has also served as a Strategic Advisor to Tradeshift Inc., a cloud-based business network and platform for supply chain payments, marketplaces, and apps, since January 2020, where she previously served in several senior executive roles including as Chief Strategy Officer, from January 2018 to January 2020, Senior Vice President and General Manager of Marketplaces, from March 2016 to January 2018, and Vice President of Product Marketing, from May 2015 to February 2016. Prior to that, Ms. Garg served as Head of Product Development at Ariba Network (n/k/a SAP Ariba), a software and information technology services company, from December 2012 to April 2015, following its acquisition by SAP SE (NYSE: SAP), a multinational software corporation, where Ms. Garg served in a number of roles from 2001 to 2012, including most recently serving as Senior Director of Product Management from 2011 to 2012. Ms. Garg has served on the board of directors of Fyle Inc., an expense management software provider, since March 2019. Ms. Garg has also served as Co-Chair of the Founders & Funders Committee at Neythri.org, a non-profit global community of South Asian women professionals committed to helping each other succeed, from January 2020 to January 2021. Ms. Garg received a Master of Science in Management Information Systems from Creighton University and a Bachelor of Science in Biology from University Maharani College.

We believe that Ms. Garg’s significant software operational, sales, technology and M&A leadership experience make her well-qualified to serve on the Board.

17

Sagar Gupta, age 33, has served as Senior Analyst at Legion Partners Asset Management LLC, a long-only, value-oriented activist manager, since January 2018. Previously, Mr. Gupta served as a Founding Senior Analyst at Finchwood Capital, L.P., a long-term oriented long-short investment firm, from March 2015 to January 2018. Prior to that, Mr. Gupta served as an Analyst at Balyasny Asset Management L.P., an institutional investment firm, from March 2014 to February 2015. Mr. Gupta served as an Associate at Kohlberg Kravis Roberts & Co. Inc., a global investment firm that manages multiple alternative asset classes, from July 2012 to March 2014. Previously, Mr. Gupta served as an Analyst at UBS Investment Bank, a subsidiary investment bank of UBS Group AG (NYSE: UBS), from July 2010 to June 2012. In addition, Mr. Gupta was a private angel investor in Teachable, a SaaS platform for creators and educators, which was acquired by Hotmart Technology in March 2020 for over $200 million. Mr. Gupta previously served as President of the Board of Performing Arts Workshop, a non-profit organization dedicated to helping young people develop critical thinking, creative expression and basic learning skills through the arts, from May 2013 to June 2018. Mr. Gupta received a Bachelor of Science in Business Administration from the University of California, Berkeley.

We believe that Mr. Gupta’s deep understanding of the Company and financial and investment expertise make him well-qualified to serve on the Board.

Michael J. McConnell, age 54, currently serves as a private investor. Mr. McConnell served as the Managing Director of Shamrock Capital Advisors, a private investment company managing private equity/hedge funds for the Disney family, from 1994 to 2007. Additionally, he served as Interim Executive Chairman and Chief Executive Officer of Spark Networks SE (“Spark”) (NYSE: LOV), a leader in affinity-based online subscription dating networks, from August 2014 through December 2014. Prior to Spark, he served as the Executive Chairman at Redflex Holdings Ltd. (ASX: RDF), a provider of intelligent transport system solutions and services, from February 2013 to February 2014 and a nonexecutive director from August 2011 to November 2014. Mr. McConnell also served as the Chief Executive Officer of Collectors Universe, Inc. (NASDAQ: CLCT), a provider of third-party authentication and grading of high value collectibles, from March 2009 to October 2012. Currently, Mr. McConnell serves on the board of directors of Vonage Holdings Corp. (NASDAQ: VG), a cloud communications provider, since March 2019 and Adacel Technologies Limited (ASX: ADA), an Australian based air traffic management and air traffic control simulation and training company, since May 2017 and as its Chairman since April 2019. Previously, Mr. McConnell served on the board of directors of SPS Commerce, Inc. (NASDAQ: SPSC), a provider of cloud-based supply chain management services, from March 2018 to May 2019, Guidance Software, Inc. (formerly NASDAQ: GUID), a global provider of forensic security solutions, from April 2016 until the company was sold in November 2017 and Spark from July 2014 until the company was sold in November 2017. Mr. McConnell also serves on the board of privately held Jacob Stern & Sons, Inc., an importer, exporter, processor and distributor of specialty agricultural products, since July 2019. He is also a member of the City of La Canada Finance and Investment Advisory committee. Mr. McConnell received a B.A. in Economics from Harvard University and an M.B.A from the Darden School (Shermet Scholar) of the University of Virginia.

We believe that Mr. McConnell’s extensive public and private international board experience and experience as a chief executive officer at various technology and software-oriented companies make him well-qualified to serve on the Board.

18

Rinki Sethi, age 38, has served as Vice President and Chief Information Security Officer of Twitter, Inc. (NYSE: TWTR), a microblogging and social networking service, since September 2020, and on the board of directors of OneProsper International, a non-profit empowering girls in rural India to attend school, since January 2020. Ms. Sethi also serves as an Advisor to various companies, such as Fika Ventures, a seed fund that focuses on enterprise and B2B software, FinTech, marketplaces, and digital health, since September 2020, 11.2 Capital, an early stage venture capital fund, since December 2020, LevelOps, an engineering optimization platform, since September 2019, Authomize, a startup developing a cloud-based authorization solution, since March 2020, apisec.ai, an enterprise-class API security management platform, since June 2020 and Oort, a venture-backed security and infrastructure startup, since October 2020. Ms. Sethi also serves as an Investor in Silicon Valley CISO Investments, a group of Chief Information Security Officers that operate as an angel investor syndicate, since October 2019 and Board Advisor of SecureWorld, a cybersecurity conference series, providing globally relevant education and networking for InfoSec professionals, since January 2012. Previously, Ms. Sethi served as Vice President and Chief Information Security Officer of Rubrik, Inc., a cloud data management company, from April 2019 to September 2020. Prior to that, Ms. Sethi served as Vice President of Information Security of International Business Machines Corporation (NYSE: IBM), a multinational technology company, from October 2018 to April 2019. Ms. Sethi served in various roles at Palo Alto Networks Inc. (NYSE: PANW), a multinational cybersecurity company, including most recently as Vice President of Information Security and Senior Director of Information Security, from November 2015 to October 2018. Ms. Sethi also served in numerous roles at Intuit Inc. (NASDAQ: INTU), a business and financial software company, including most recently serving as Director & Head of Product Security and Principal of Security Business Partner, from October 2012 to November 2015. Earlier in her career, Ms. Sethi served in several roles at eBay Inc. (NASDAQ: EBAY), a multinational e-commerce corporation, including serving as Chief of Staff & Senior Manager of Global Fraud, Global Infosec Communication & Strategy Manager and Global Infosec Policy & Strategy Manager. Prior to that, Ms. Sethi served as a Security Engineer at Walmart.com, an ecommerce team of Walmart Inc. (NYSE: WMT) and as an Information Security Specialist at Pacific Gas and Electric Company (NYSE: PCG), a natural gas and electric utilities company. Ms. Sethi served on the board of directors of Women in CyberSecurity, a non-profit organization focused on recruiting, retaining & advancing women in cybersecurity, from December 2017 to November 2018. Ms. Sethi received a Master of Science in Information Security from Capella University and a Bachelor of Science in Computer Science Engineering from the University of California, Davis.

We believe that Ms. Sethi’s extensive experience gained serving as a senior executive in numerous companies operating in the technology, cybersecurity and information security industries make her well-qualified to serve on the Board.

The principal business address of Ms. Garg is 960 Crooked Creek Dr., Los Altos, CA 94024. The principal business address of Mr. Gupta is 12121 Wilshire Blvd., Suite 1240, Los Angeles, CA 90025. The principal business address of Mr. McConnell is 2031 Tondolea Lane, La Canada, CA 91011. The principal business address of Ms. Sethi is 1355 Market Street, San Francisco, CA 94103.

As of March 26, 2021, neither Mr. Gupta nor Ms. Sethi own beneficially or of record any shares of Common Stock and have not entered into any transactions in shares of the Common Stock during the past two (2) years. Mr. Gupta is an employee of Legion Partners Asset Management, however, he does not have voting or dispositive power over the shares of Common Stock beneficially owned by Legion Partners Asset Management and its affiliates.

As of March 26, 2021, Mr. McConnell may be deemed to beneficially own 6,000 shares of Common Stock. Ms. Garg may be deemed to beneficially own 8,275 shares of Common Stock. The shares of Common Stock purchased by Mr. McConnell and Ms. Garg were purchased with personal funds.

Each of the Nominees is deemed to be a member of a “group” together with the other Participants for the purposes of Section 13(d)(3) of the Exchange Act, and accordingly, the group is deemed to beneficially own the 2,790,121 shares of Common Stock beneficially owned in the aggregate by the Participants. Each Participant disclaims beneficial ownership with respect to the shares of Common Stock reported owned in this Proxy Statement, except to the extent of its, his or her pecuniary interest therein. Each Participant may be deemed to have the power to vote and dispose of the shares of Common Stock disclosed herein that he, she or it directly beneficially owns or he, she or it may be deemed to beneficially own. For information regarding purchases and sales of securities of the Company during the past two (2) years by the Participants, see Schedule I.

19

Each Nominee presently is, and if elected as a director of OSPN would be an “independent director” within the meaning of (i) applicable NASDAQ listing standards applicable to board composition, including Rule 5605(a)(2), and (ii) Section 301 of the Sarbanes-Oxley Act of 2002. Notwithstanding the foregoing, no director of a NASDAQ-listed company qualifies as “independent” under the NASDAQ listing standards unless the board of directors of such company affirmatively determines that such director is independent under such standards. Accordingly, if the Nominees are elected, the determination of each Nominee’s independence under the NASDAQ listing standards ultimately rests with the judgment and discretion of the Board. No Nominee is a member of the Company’s compensation, nominating or audit committee that is not independent under any such committee’s applicable independence standards.

On February 25, 2021, the Participants entered into a Joint Filing and Solicitation Agreement, in which, among other things, (a) they agreed, to the extent required by applicable law, to the joint filing on behalf of each of them of statements on Schedule 13D with respect to the securities of the Company, (b) they agreed to solicit proxies or written consents for the election of the Nominees, or any other person(s) nominated Legion Partners Holdings, to the Board at the 2021 Annual Meeting (the “Solicitation”), (c) Legion agreed to bear all pre-approved expenses incurred in connection with the Solicitation, and (d) the Nominees agreed, not to undertake or effect any purchase, sale, acquisition or disposal of any securities of the Company, undertake any expenses in connection with the Solicitation or communicate on behalf of Legion with regards to the Company without the prior written consent of Legion.

On February 25, 2021, Legion Partners Holdings entered into letter agreements (the “Indemnification Agreements”) with each of the Nominees other than Mr. Gupta pursuant to which Legion Partners Holdings has agreed to indemnify such Nominees against claims arising from the Solicitation and any related transactions.

Each of the Nominees has granted Raymond White and Christopher S. Kiper powers of attorney (the “POAs”) to execute certain SEC filings and other documents in connection with the Solicitation.

As an employee of Legion Partners Asset Management, Mr. Gupta receives compensation in the form of a salary, a discretionary bonus and a portion of incentive allocations earned by Legion Partners Asset Management. Other than as stated herein, there are no arrangements or understandings between or among any members of Legion or any other person or persons pursuant to which the nomination of the Nominees described herein is to be made, other than the consent by each of the Nominees to be named in this Proxy Statement and to serve as a director of the Company if elected as such at the 2021 Annual Meeting. None of the Nominees is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries in any material pending legal proceedings.

Legion Partners Holdings reserves the right to nominate additional person(s), to the extent this is not prohibited under OSPN’s organizational documents and applicable law, if OSPN increases the size of the Board above its existing size or increases the number of directors whose terms expire at the 2021 Annual Meeting. Additional nominations made pursuant to the preceding sentence are without prejudice to our position that any attempt to increase the size of the current Board or to classify the Board constitutes an unlawful manipulation of OSPN’s corporate machinery.

WE STRONGLY URGE YOU TO VOTE “FOR” THE ELECTION OF THE NOMINEES ON THE ENCLOSED WHITE PROXY CARD

20

PROPOSAL NO. 2

ADVISORY VOTE ON EXECUTIVE COMPENSATION

As discussed in further detail in the Company’s proxy statement, the Company is asking stockholders to approve, on an advisory basis, the Company’s compensation of its named executive officers as described under “Compensation Discussion and Analysis” in the Company’s proxy statement. Accordingly, the Company is asking stockholders to vote for the following resolution:

“RESOLVED, that the stockholders approve the compensation of the named executive officers of OneSpan Inc. as disclosed in this proxy statement pursuant to the compensation disclosure rules of the Securities and Exchange Commission (which includes the Compensation Discussion and Analysis, the compensation tables and related narrative discussion).”

As discussed in the Company’s proxy statement, while the vote on the executive compensation resolution is non-binding, the Compensation Committee and the Board will review and carefully consider the voting results when evaluating OSPN’s executive compensation programs.

Legion does not believe the Company’s executive compensation plan is adequately aligned with long-term stockholder value creation and has failed to adequately incentivize the now approximately four-year old transition from hardware to a software and services business model.

In our view, the Company’s executive compensation plan has over-emphasized high-level revenue oriented metrics and even duplicates the use of these metrics between the annual incentive plan and the long-term plan.

In addition, we believe that optimal long-term valuation for the Common Stock can be achieved through executing a full transition to a pure play recurring revenue software model. Rather than place greater emphasis on this transition, the Company’s executive compensation plan has utilized metrics with potentially unintended incentives. For example, we believe the “software and services revenue” metric can perversely incentive management to focus on perpetual licensing software sales, which are recognized entirely upfront in GAAP revenue, rather than pursuing term-based licensing and subscription software sales, which are recognized as GAAP revenue over the duration of the contract and typically drive greater long-term value. As the Company is transitioning from perpetual licensing to term-based licensing and subscription software revenue, we believe the “software and services revenue” performance metric should be replaced with Annual Recurring Revenue (as defined in Exhibit 99.1 to the Company’s Current Report on Form 8-K filed with the SEC on February 23, 2021) which we believe would better align long-term value creation.

FOR THESE REASONS,

AMONG OTHERS, WE RECOMMEND A VOTE “AGAINST” THE APPROVAL OF THE NON-BINDING ADVISORY RESOLUTION ON THE COMPENSATION

OF THE COMPANY’S NAMED EXECUTIVE OFFICERS AND INTEND TO VOTE OUR SHARES “AGAINST” THIS PROPOSAL.

21

PROPOSAL NO. 3

RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

As discussed in further detail in the Company’s proxy statement, the Company has proposed that the stockholders ratify the Audit Committee’s appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021. Additional information regarding this proposal is contained in the Company’s proxy statement.

WE MAKE NO RECOMMENDATION WITH RESPECT TO THE RATIFICATION OF THE APPOINTMENT OF KPMG LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM OF THE COMPANY FOR ITS FISCAL YEAR ENDING DECEMBER 31, 2021 AND INTEND TO VOTE OUR SHARES “FOR” THIS PROPOSAL.

22

VOTING AND PROXY PROCEDURES

Stockholders are entitled to one vote for each share of Common Stock held of record on the Record Date with respect to each matter to be acted on at the 2021 Annual Meeting. Only stockholders of record on the Record Date will be entitled to notice of and to vote at the 2021 Annual Meeting. Stockholders who sell their shares of Common Stock before the Record Date (or acquire them without voting rights after the Record Date) may not vote such shares of Common Stock. Stockholders of record on the Record Date will retain their voting rights in connection with the 2021 Annual Meeting even if they sell such shares of Common Stock after the Record Date. Based on publicly available information, Legion believes that the only outstanding class of securities of the Company entitled to vote at the 2021 Annual Meeting is the Common Stock.

Shares of Common Stock represented by properly executed WHITE proxy cards will be voted at the 2021 Annual Meeting as marked and, in the absence of specific instructions, will be voted FOR the election of the Nominees, AGAINST the approval of the non-binding advisory resolution on the compensation of the Company’s named executive officers, FOR the ratification of KPMG LLP as the Company’s independent registered public accounting firm of the Company for the fiscal year ending December 31, 2021, and in the discretion of the persons named as proxies on all other matters as may properly come before the 2021 Annual Meeting, as described herein.

According to the Company’s proxy statement for the 2021 Annual Meeting, the current Board intends to nominate nine candidates for election at the 2021 Annual Meeting. This Proxy Statement is soliciting proxies to elect our Nominees as directors in opposition to four of the incumbent directors. Stockholders who vote on the enclosed WHITE proxy card will also have the opportunity to vote for the candidates who have been nominated by the Company other than [ ], [ ], [ ] and [ ]. Stockholders will therefore be able to vote for the total number of directors up for election at the 2021 Annual Meeting. Under applicable proxy rules we are required either to solicit proxies only for our Nominees, which could result in limiting the ability of stockholders to fully exercise their voting rights with respect to the Company’s nominees, or to solicit for our Nominees while also allowing stockholders to vote for fewer than all of the Company’s nominees, which enables a stockholder who desires to vote for our Nominees to also vote for certain of the Company’s nominees. The names, backgrounds and qualifications of the Company’s nominees, and other information about them, can be found in the Company’s proxy statement. In the event that some of the Nominees are elected, there can be no assurance that the Company nominee(s) who get the most votes and are elected to the Board will choose to serve as on the Board with the Nominees who are elected.

QUORUM; BROKER NON-VOTES; DISCRETIONARY VOTING

A quorum is the minimum number of shares of Common Stock that must be represented at a duly called meeting in person or by proxy in order to legally conduct business at the meeting. For the 2021 Annual Meeting, the presence in person or by proxy of a majority of the votes entitled to be cast on matters to be considered as of the Record Date at the meeting will constitute a quorum for the transaction of business.

Abstentions are counted as present and entitled to vote for purposes of determining a quorum. Shares represented by “broker non-votes” also are counted as present and entitled to vote for purposes of determining a quorum. However, if you hold your shares in street name and do not provide voting instructions to your broker, your shares will not be voted on any proposal on which your broker does not have discretionary authority to vote (a “broker non-vote”). Under applicable rules, your broker will not have discretionary authority to vote your shares at the 2021 Annual Meeting on any of the proposals.

23

If you are a stockholder of record, you must deliver your vote by mail or attend the 2021 Annual Meeting and vote in order to be counted in the determination of a quorum.

VOTES REQUIRED FOR APPROVAL

Election of Directors ─ The Company has adopted a plurality vote standard for contested director elections and majority vote standard for uncontested director elections. In a contested election, the nine nominees receiving the highest number of affirmative votes will be elected as directors of the Company. If you abstain from voting on any of the nominees, your shares will be counted for purposes of determining whether there is a quorum, but will have no effect on the election of those nominees. Proxy cards specifying that votes should be withheld with respect to one (1) or more nominees will result in those nominees receiving fewer votes but will not count as votes against the nominees. Neither an abstention nor a broker non-vote will count as a vote cast “FOR” or “AGAINST” a director nominee. Therefore, abstentions and broker non-votes will have no direct effect on the outcome of the election of directors.

Advisory Resolution to Approve Executive Compensation ─ According to the Company’s proxy statement, although the vote is non-binding, assuming that a quorum is present, the advisory vote on the Company’s named executive officers’ compensation requires the approval of a majority of the votes cast and entitled to vote thereon. Abstentions and broker non-votes will have no direct effect on the outcome of this proposal.

Ratification of Appointment of Accountants ─ According to the Company’s proxy statement, assuming that a quorum is present, the selection of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021 requires the approval of a majority of the votes cast and entitled to vote thereon. Abstentions and broker non-votes will have no direct effect on the outcome of this proposal.

If you sign and submit your WHITE proxy card without specifying how you would like your shares voted, your shares will be voted in accordance with Legion’s recommendations specified herein and in accordance with the discretion of the persons named on the WHITE proxy card with respect to any other matters that may be voted upon at the 2021 Annual Meeting.

REVOCATION OF PROXIES