As filed with the Securities and Exchange Commission on December 10, 2018

Registration No. 333-228566

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Biocept, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

8071 |

80-0943522 |

|

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

5810 Nancy Ridge Drive

San Diego, CA 92121

(858) 320-8200

(Address, including zip code, and telephone number, including

area code, of registrant’s principal executive offices)

Michael W. Nall

Chief Executive Officer and President

Biocept, Inc.

5810 Nancy Ridge Drive

San Diego, CA 92121

(858) 320-8200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

|

Charles J. Bair Cooley LLP 4401 Eastgate Mall San Diego, CA 92121 (858) 550-6142 |

Barry L. Grossman Sarah E. Williams Ellenoff Grossman & Schole LLP 1345 Avenue of the Americas New York, NY 10105 (212) 370-1300 |

|

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☒ |

|

|

|

|

|

|||

|

|

|

|

|

Emerging growth company |

|

☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

Title of Securities being Registered |

|

|

|

Proposed Maximum |

|

|

Amount of |

|

Shares of common stock, $0.0001 par value per share |

|

|

|

$10,000,000 |

|

|

$1,212 |

|

Warrants to purchase shares of common stock(3) |

|

|

|

|

|

|

|

|

Shares of common stock issuable upon exercise of the Warrants |

|

|

|

$10,000,000 |

|

|

$1,212 |

|

Pre-Funded Warrants to purchase shares of common stock |

|

|

|

(4) |

|

|

|

|

Shares of common stock issuable upon exercise of the Pre-Funded Warrants (3) |

|

|

|

|

|

|

|

|

Total |

|

|

|

$20,000,000 |

|

|

$2,424 |

|

|

(1) |

Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended, or the Securities Act. |

|

|

(2) |

Pursuant to Rule 416, the securities being registered hereunder include such indeterminate number of additional securities as may be issuable to prevent dilution resulting from stock splits, stock dividends or similar transactions. |

|

|

(3) |

No fee is required pursuant to Rule 457(i) under the Securities Act. |

|

|

(5) |

$2,424 of which was previously paid. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS, SUBJECT TO COMPLETION, DATED DECEMBER 10, 2018

9,708,737 Shares of Common Stock

Or

Pre-Funded Warrants to Purchase up to 9,708,737 Shares of Common Stock

Warrants to Purchase up to 9,708,737 Shares of Common Stock

Biocept, Inc. is offering 9,708,737 shares of common stock and warrants to purchase up to 9,708,737 shares of our common stock, at an assumed combined offering price of $1.03 per share of common stock and accompanying warrant (the last reported sale price of our common stock on The Nasdaq Capital Market on December 7, 2018). Each share of our common stock is being sold together with a warrant to purchase one share of our common stock. Each warrant will have an exercise price per share of not less than 100% of the last reported sale price of our common stock on the trading day immediately preceding the pricing of this offering, will be immediately exercisable and will expire on the fifth anniversary of the original issuance date. The shares of our common stock and warrants are immediately separable and will be issued separately, but will be purchased together in this offering.

We are also offering to those purchasers, if any, whose purchase of our common stock in this offering would otherwise result in such purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% of our outstanding common stock immediately following the consummation of this offering, the opportunity, in lieu of purchasing common stock, to purchase pre-funded warrants to purchase shares of our common stock, or Pre-Funded Warrants. The purchase price of each Pre-Funded Warrant will equal the price per share at which shares of our common stock are being sold to the public in this offering, minus $0.01, and the exercise price of each Pre-Funded Warrant will equal $0.01 per share of common stock. For each Pre-Funded Warrant purchased in this offering in lieu of common stock, we will reduce the number of shares of common stock being sold in the offering by one. Pursuant to this prospectus, we are also offering the shares of common stock issuable upon the exercise of the warrants and Pre-Funded Warrants offered hereby.

Each Pre-Funded Warrant is exercisable for one share of our common stock (subject to adjustment as provided for therein) at any time at the option of the holder until such Pre-Funded Warrant is exercised in full, provided that the holder will be prohibited from exercising Pre-Funded Warrants for shares of our common stock if, as a result of such exercise, the holder, together with its affiliates, would own more than 4.99% of the total number of shares of our common stock then issued and outstanding. However, any holder may increase such percentage to any other percentage not in excess of 9.99%, provided that any increase in such percentage shall not be effective until 61 days after such notice to us.

Our common stock is listed on The Nasdaq Capital Market under the symbol “BIOC.” On December 7, 2018, the last reported sale price of our common stock on The Nasdaq Capital Market was $1.03 per share. There is no established trading market for the warrants or Pre-Funded Warrants and we do not expect a market to develop. In addition, we do not intend to apply for the listing of the warrants or Pre-Funded Warrants on any national securities exchange or other trading market. Without an active trading market, the liquidity of the warrants and the Pre-Funded Warrants will be limited.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012, and, as such, we have elected to take advantage of certain reduced public company reporting requirements for this prospectus and future filings.

You should read this prospectus, together with additional information described under the headings “Incorporation of Certain Information by Reference” and “Where You Can Find More Information,” carefully before you invest in any of our securities.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 6 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Per Share |

|

Per Pre-Funded Warrant |

|

Per Warrant |

|

Total (No Exercise) (1) |

|

Total (Full Exercise) (1) |

|

Public offering price |

$ |

|

|

|

$ |

|

$ |

|

$ |

|

Underwriting discounts and commissions(1) |

|

|

|

|

|

|

|

|

|

|

Proceeds, before expenses, to us |

$ |

|

|

|

$ |

|

$ |

|

$ |

|

(1) |

See “Underwriting” on page 16 for additional disclosure regarding underwriting discounts and commissions and reimbursement of expenses. |

We have granted the underwriters an option for a period of 45 days from the date of this prospectus to purchase up to an additional shares of common stock and/or warrants to purchase shares of common stock at the public offering price, less the underwriting discount.

We anticipate that delivery of the shares, Pre-Funded Warrants and warrants against payment will be made on or about , 2018.

Book-Running Manager

Maxim Group LLC

Co-Manager

Dawson James Securities, Inc.

The date of this prospectus is , 2018.

|

|

1 |

|

|

|

6 |

|

|

|

8 |

|

|

|

9 |

|

|

|

10 |

|

|

|

12 |

|

|

|

13 |

|

|

|

16 |

|

|

|

21 |

|

|

|

21 |

|

|

|

21 |

|

|

|

22 |

We have not, and the underwriters have not, authorized anyone to provide you with information that is different from that contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. When you make a decision about whether to invest in our securities, you should not rely upon any information other than the information in this prospectus or in any free writing prospectus that we may authorize to be delivered or made available to you. Neither the delivery of this prospectus nor the sale of our securities means that the information contained in this prospectus or any free writing prospectus is correct after the date of this prospectus or such free writing prospectus. This prospectus is not an offer to sell or the solicitation of an offer to buy our securities in any circumstances under which the offer or solicitation is unlawful.

For investors outside the United States: We have not, and the underwriters have not, taken any action that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities covered hereby and the distribution of this prospectus outside the United States.

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market share, is based on information from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. Our management estimates have not been verified by any independent source, and we have not independently verified any third-party information. In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Special Note Regarding Forward-Looking Statements.”

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to the registration statement of which this prospectus is a part were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

We use in this prospectus our BIOCEPT logo, for which a United States trademark application has been filed. This prospectus also includes trademarks, tradenames and service marks that are the property of other organizations. Solely for convenience, trademarks and tradenames referred to in this prospectus appear (after the first usage) without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or that the applicable owner will not assert its rights, to these trademarks and tradenames.

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, especially the “Risk Factors” section of this prospectus before making an investment decision.

Our Company

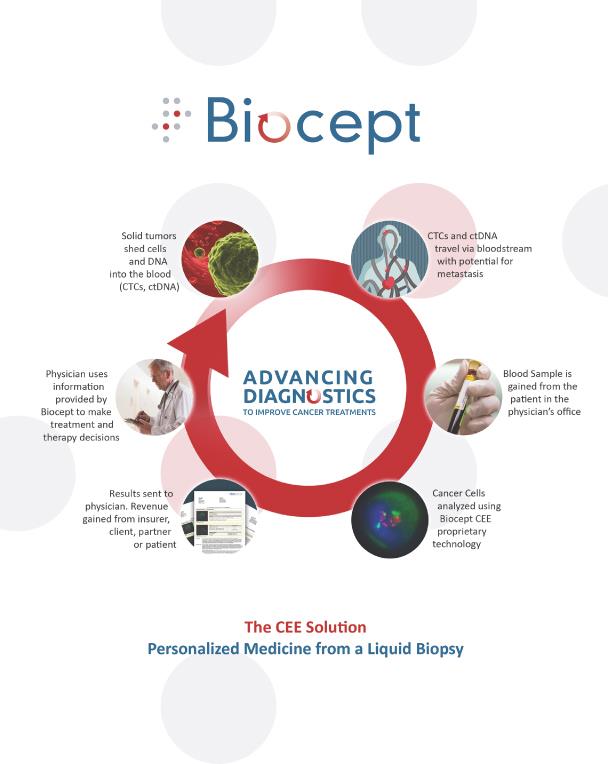

We are an early stage molecular oncology diagnostics company that develops and commercializes proprietary circulating tumor cell, or CTC, and circulating tumor DNA, or ctDNA, assays utilizing a standard blood sample, or “liquid biopsy.” Our current and planned assays are intended to provide information to aid healthcare providers to identify specific oncogenic alterations that may qualify a subset of cancer patients for targeted therapy at diagnosis, progression or used for monitoring in order to identify specific resistance mechanisms. Sometimes traditional procedures, such as surgical tissue biopsies, result in tumor tissue that is insufficient and/or unable to provide the molecular subtype information necessary for clinical decisions. Our assays, performed on blood, have the potential to provide more contemporaneous information on the characteristics of a patient’s disease when compared with tissue biopsy and radiographic imaging.

Our current assays and our planned future assays focus on key solid tumor indications utilizing our Target-SelectorTM liquid biopsy technology platform for the biomarker analysis of CTCs and ctDNA from a standard blood sample. Our patented Target-Selector CTC offering is based on an internally developed microfluidics-based cell capture and analysis platform, with enabling features that change how information provided by CTC testing is used by clinicians. Our CTC technology could also be validated on cerebral spinal fluid in order to provide information for patients with central nervous system (CNS) tumors both primary and metastatic. Our patented Target-Selector ctDNA technology enables detection of mutations and genome alterations with enhanced sensitivity and specificity, and is applicable to nucleic acid from ctDNA, and could potentially be validated for other sample types such as bone marrow, pleural effusions, ascitic fluid, tissue (surgical resections and/or biopsies) or cerebrospinal fluid. Our Target-Selector CTC and ctDNA platforms provide both biomarker detection as well as monitoring capabilities and require only a patient blood sample. We believe that our Target-Selector platform technology has the potential to be developed and commercialized as in vitro diagnostic (IVD) test kits, and we are currently pursuing this strategy.

At our corporate headquarters facility located in San Diego, California, we operate a clinical laboratory that is certified under the Clinical Laboratory Improvement Amendments of 1988, or CLIA, and accredited by the College of American Pathologists, or CAP. We also performed research and development that led to our current assays, and continue to perform research and development for our planned assays, at this same facility. In addition, we manufacture our microfluidic channels, related equipment and certain reagents. The assays we offer and intend to offer are classified as laboratory developed tests, or LDTs, under CLIA regulations. CLIA certification is required before any clinical laboratory, including ours, may perform testing on human specimens for the purpose of obtaining information for the diagnosis, prevention, or treatment of disease or the assessment of health. In addition, we participate in and have received CAP accreditation, which includes rigorous biennial laboratory inspections and adherence to specific quality standards.

Our primary sales strategy is to engage medical oncologists and other physicians in the United States at private and group practices, hospitals, laboratories and cancer centers. In addition, we market our clinical trial and research services to pharmaceutical and biopharmaceutical companies and clinical research organizations. Additionally, commencing in October 2017, our pathology partnership program, branded as Empower TCTM, provides the unique ability for pathologists to participate in the interpretation of liquid biopsy results and is available to pathology practices and hospital systems throughout the United States. Further, sales to laboratory supply distributors of our proprietary blood collection tubes, or BCTs, commenced during the three months ending June 30, 2018, which allow for the intact transport of liquid biopsy samples for research use only, or RUO, from regions around the world. We also plan to develop and market kits containing our patented and proprietary Target Selector testing to laboratories and researchers worldwide.

Our revenue generating efforts are focused in three areas:

|

|

• |

medical oncologists, surgical oncologists, pulmonologists, pathologists and other physicians who use the biomarker information we provide in order to determine the best treatment plan for their patients; |

|

|

• |

laboratory services utilizing both our CTC and ctDNA testing in order to help pharmaceutical and biopharmaceutical companies developing drug candidate therapies to treat cancer; and |

|

|

• |

licensing and/or selling our proprietary testing and/or technologies, including our BCTs, to partners in the United States and abroad. |

-1-

An investment in our common stock involves a high degree of risk. You should carefully consider the risks summarized below. The risks are discussed more fully in the “Risk Factors” section of this prospectus immediately following this prospectus summary. These risks include, but are not limited to, the following:

|

|

• |

we are an early stage company with a history of substantial net losses. We have never been profitable and we have an accumulated deficit of approximately $214.4 million (as of September 30, 2018); |

|

|

• |

we expect to incur net losses in the future, and we may never achieve sustained profitability; |

|

|

• |

we need to raise additional capital to continue as a going concern; |

|

|

• |

our failure to meet the continued listing requirements of The Nasdaq Capital Market could result in a de-listing of our common stock; |

|

|

• |

our financial condition may be materially adversely affected in an event of default under our credit facility; |

|

|

• |

our sale of our common stock may cause substantial dilution to our existing stockholders and could cause the price of our common stock to decline; |

|

|

• |

our business depends upon our ability to increase sales of our current products and assays and to develop and commercialize other products and assays; |

|

|

• |

our business depends on executing on our sales and marketing strategy for our products and diagnostic assays and gaining acceptance of our current products and assays and future products and assays in the market, for which we expect to continue to incur significant expenses; |

|

|

• |

our business depends on our ability to continually develop new products and diagnostic assays and enhance our current products assays and future products and assays, for which we expect to continue to incur significant expenses; |

|

|

• |

our business depends on our ability to effectively compete with other products and diagnostic assays, methods and services that now exist or may hereafter be developed; |

|

|

• |

our business depends on our senior management; |

|

|

• |

our business depends on our ability to attract and retain scientists, clinicians and sales personnel with extensive experience in oncology, who are in short supply; |

|

|

• |

our business depends on our ability to enter into agreements with commercialization partners, who may not perform adequately or be locatable, for the sales, marketing and commercialization of our current products and assays and our planned future products and assays; |

|

|

• |

we expect to expand our business internationally, which would increase our exposure to business, regulatory, political, operational, financial and economic risks associated with doing business outside of the United States; |

|

|

• |

our financial condition may be materially adversely affected by healthcare policy changes, including legislation reforming the United States health care system; |

|

|

• |

our business depends on being able to obtain coverage and adequate reimbursement from governmental and other third-party payers for assays and services; |

|

|

• |

our business depends on satisfying any applicable United States (including Food and Drug Administration) and international regulatory requirements with respect to products, assays and services, and many of these requirements are new and still evolving; and |

|

|

• |

we need to obtain or maintain patents or other appropriate protection for the intellectual property utilized in our current and planned products, assays and services, and we must avoid infringement of third-party intellectual property. |

Company Information

We maintain our principal executive offices at 5810 Nancy Ridge Drive, San Diego, California 92121. Our telephone number is (858) 320-8200 and our website address is www.biocept.com. The information contained in, or that can be accessed through, our

-2-

website is not incorporated into and is not part of this prospectus. We were incorporated in California on May 12, 1997 and reincorporated as a Delaware corporation on July 30, 2013.

Implications of Being an Emerging Growth Company

As a company with less than $1.07 billion in gross revenues during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or JOBS Act, enacted in April 2012. An “emerging growth company” may take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

|

|

• |

not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act; |

|

|

• |

reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and |

|

|

• |

exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

We may take advantage of these provisions until December 31, 2019. However, if certain events occur prior to December 31, 2019, including if we become a “large accelerated filer,” our annual gross revenues exceed $1.07 billion or we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company before such date.

We have elected to take advantage of certain of the reduced disclosure obligations and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information that we provide to our stockholders may be different than the information you might receive from other public reporting companies in which you hold equity interests.

-3-

|

Common stock offered by us |

9,708,737 shares (assuming a combined public offering price of $1.03 per share and related warrant, the last reported sale price of our common stock on The Nasdaq Capital Market on December 7, 2018). |

|

|

|

|

Pre-Funded Warrants offered by us |

We are also offering to those purchasers, if any, whose purchase of common stock in this offering would otherwise result in such purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% of our outstanding common stock immediately following the consummation of this offering, the opportunity, in lieu of purchasing common stock, to purchase Pre-Funded Warrants to purchase up to 9,708,737 shares of our common stock. The purchase price of each Pre-Funded Warrant will equal the price per share at which the shares of common stock are being sold to the public in this offering, minus $0.01, and the exercise price of each Pre-Funded Warrant will be $0.01 per share of common stock. Each Pre-Funded Warrant will be exercisable immediately upon issuance and will not expire. This prospectus also relates to the offering of the shares of common stock issuable upon exercise of such Pre-Funded Warrants. See “Description of the Securities We are Offering–Pre-Funded Warrants” for a discussion on the terms of the Pre-Funded Warrants.

Each Pre-Funded Warrant is exercisable for one share of our common stock (subject to adjustment as provided therein) at any time at the option of the holder, provided that the holder will be prohibited from exercising its Pre-Funded Warrant for shares of our common stock if, as a result of such exercise, the holder, together with its affiliates, would own more than 4.99% of the total number of shares of our common stock then issued and outstanding. However, any holder may increase such percentage to any other percentage not in excess of 9.99%, provided that any increase in such percentage shall not be effective until 61 days after such notice to us. |

|

|

|

|

Warrants offered by us |

Warrants to purchase up to 9,708,737 shares of our common stock (assuming a combined public offering price of $1.03 per share and related warrant, the last reported sale price of our common stock on The Nasdaq Capital Market on December 7, 2018). Each share of our common stock is being sold together with a warrant to purchase one share of our common stock. Each warrant will have an exercise price per share of not less than 100% of the last reported sale price of our common stock on the trading day immediately preceding the pricing of this offering, will be immediately exercisable and will expire on the fifth anniversary of the original issuance date. This prospectus also relates to the offering of the shares of common stock issuable upon exercise of such warrants. |

|

|

|

|

Common stock outstanding after this offering |

13,645,963 shares (assuming a combined public offering price of $1.03 per share and related warrant, the last reported sale price of our common stock on The Nasdaq Capital Market on December 7, 2018) (or 23,354,700 shares if the warrants sold in this offering are exercised in full). The foregoing assumes only shares of common stock are sold in this offering. For each Pre-Funded Warrant purchased in this offering in lieu of common stock, we will reduce the number of shares of common stock being sold in the offering by one. |

|

|

|

|

Use of proceeds |

Based on an assumed combined public offering price of $1.03 per share and related warrant (the last reported sale price of our common stock on The Nasdaq Capital Market on December 7, 2018), we estimate that the net proceeds from our sale of shares of our common stock and warrants in this offering will be approximately $9.1 million, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We currently expect to use the net proceeds from this offering for general corporate purposes and to fund ongoing operations and expansion of our business. For additional information please refer to the section entitled “Use of Proceeds” on page 9 of this prospectus. |

|

|

|

-4-

|

Investing in our securities involves a high degree of risk. You should carefully review and consider the “Risk Factors” section of this prospectus for a discussion of factors to consider before deciding to invest in shares of our common stock. |

|

|

|

|

|

Market Symbol and trading |

Our common stock is listed on The Nasdaq Capital Market under the symbol “BIOC.” There is no established trading market for the warrants or Pre-Funded Warrants and we do not expect a market to develop. In addition, we do not intend to apply for the listing of the warrants or Pre-Funded Warrants on any national securities exchange or other trading market. Without an active trading market, the liquidity of the warrants and Pre-Funded Warrants will be limited. |

Unless otherwise stated, all information contained in this prospectus assumes no investor purchased Pre-Funded Warrants in lieu of common stock sold in this offering.

The number of shares of our common stock to be outstanding after this offering is based on 3,937,226 shares of our common stock outstanding as of September 30, 2018 and excludes as of such date:

|

• |

up to 7,005 shares of common stock issuable upon the conversion of Series A Convertible Preferred Stock outstanding as of September 30, 2018; |

|

• |

114,641 shares of our common stock issuable upon the exercise of stock options, with a weighted-average exercise price of $72.02 per share; |

|

• |

360 shares of our common stock issuable upon the settlement of outstanding restricted stock units; |

|

• |

4,814,927 shares of our common stock issuable upon the exercise of outstanding warrants, with a weighted-average exercise price of $5.44 per share; and |

|

• |

194,649 other shares of our common stock reserved for future issuance under our 2013 Amended and Restated Equity Incentive Plan. |

-5-

A purchase of shares of our common stock is an investment in our securities and involves a high degree of risk. You should carefully consider the risks and uncertainties and all other information contained in or incorporated by reference in this prospectus, including the risks and uncertainties discussed under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2017, our Quarterly Report on Form 10-Q for the quarter ended March 31, 2018, our Quarterly Report on Form 10-Q for the quarter ended June 30, 2018, and our Quarterly Report on Form 10-Q for the quarter ended September 30, 2018. All of these risk factors are incorporated by reference herein in their entirety. If any of these risks actually occur, our business, financial condition and results of operations would likely suffer. In that case, the market price of our common stock could decline, and you may lose part or all of your investment in our company. Additional risks of which we are not presently aware or that we currently believe are immaterial may also harm our business and results of operations.

Risks Relating to This Offering

If you purchase our securities in this offering, you may incur immediate and substantial dilution in the book value of your shares.

The combined public offering price per share of our common stock and related warrant may be substantially higher than the net tangible book value per share of our common stock immediately prior to the offering. After giving effect to the assumed sale of shares of our common stock and related warrants in this offering, at an assumed combined public offering price of $1.03 per share and related warrant (the last reported sale price of our common stock on The Nasdaq Capital Market on December 7, 2018), and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us and attributing no value to the warrants sold in this offering, purchasers of our common stock in this offering will incur immediate dilution of $(0.29) per share in the net tangible book value of the common stock they acquire. In the event that you exercise your warrants, you may experience additional dilution to the extent that the exercise price of the warrants is higher than the tangible book value per share of our common stock. For a further description of the dilution that investors in this offering may experience, see “Dilution.”

In addition, to the extent that outstanding stock options or warrants have been or may be exercised or other shares issued, you may experience further dilution.

We have broad discretion in the use of the net proceeds we receive from this offering and may not use them effectively.

Our management will have broad discretion in the application of the net proceeds we receive in this offering, including for any of the purposes described in the section entitled “Use of Proceeds,” and you will not have the opportunity as part of your investment decision to assess whether our management is using the net proceeds appropriately. Because of the number and variability of factors that will determine our use of our net proceeds from this offering, their ultimate use may vary substantially from their currently intended use. The failure by our management to apply these funds effectively could result in financial losses that could have a material adverse effect on our business and cause the price of our common stock to decline. Pending their use, we may invest our net proceeds from this offering in short-term, investment-grade, interest-bearing securities. These investments may not yield a favorable return to our stockholders.

Future sales of substantial amounts of our common stock could adversely affect the market price of our common stock.

We may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. If additional capital is raised through the sale of equity or convertible debt securities, or perceptions that those sales could occur, the issuance of these securities could result in further dilution to investors purchasing our common stock in this offering or result in downward pressure on the price of our common stock, and our ability to raise capital in the future.

Holders of our warrants and Pre-Funded Warrants will have no rights as a common stockholder until they acquire our common stock.

Until you acquire shares of our common stock upon exercise of your warrants or Pre-Funded Warrants, you will have no rights with respect to shares of our common stock issuable upon exercise of your warrants or Pre-Funded Warrants. Upon exercise of your warrants or Pre-Funded Warrants, you will be entitled to exercise the rights of a common stockholder only as to matters for which the record date occurs after the exercise date.

-6-

The warrants may not have any value.

Each warrant will have an exercise price of not less than 100% of the last reported sale price of our common stock as of the close of the trading day immediately preceding the pricing of this offering and will expire on the fifth anniversary of the date they first become exercisable. In the event our common stock price does not exceed the exercise price of the warrants during the period when the warrants are exercisable, the warrants may not have any value.

There is no public market for the warrants to purchase shares of our common stock or Pre-Funded Warrants being offered in this offering.

There is no established public trading market for the warrants or Pre-Funded Warrants being offered in this offering, and we do not expect a market to develop. In addition, we do not intend to apply to list the warrants or Pre-Funded Warrants on any national securities exchange or other nationally recognized trading system, including The Nasdaq Capital Market. Without an active trading market, the liquidity of the warrants and Pre-Funded Warrants will be limited.

-7-

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements, which reflect our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. These forward-looking statements speak only as of the date of this prospectus and are subject to a number of risks, uncertainties and assumptions described under the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in our Annual Report on Form 10-K for the year ended December 31, 2017, our Quarterly Report on Form 10-Q for the quarter ended March 31, 2018, our Quarterly Report on Form 10-Q for the quarter ended June 30, 2018, and our Quarterly Report on Form 10-Q for the quarter ended September 30, 2018, which are incorporated by reference herein. Forward-looking statements are identified by terms such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which are based on the information available to management at this time and which speak only as of this date. Examples of our forward-looking statements include:

|

|

• |

our ability to increase sales of our products, assays and services; |

|

|

• |

our ability to continually develop new products, diagnostic assays, services and enhance our current products, assays and services and future products, assays, and services; |

|

|

• |

our ability to effectively compete with other products, diagnostic assays, methods and services that now exist or may hereafter be developed; |

|

|

• |

our ability to expand our business internationally; |

|

|

• |

our ability to obtain coverage and adequate reimbursement from governmental and other third-party payers for assays and services; |

|

|

• |

our expectations regarding the use of our existing cash and the expected net proceeds of this offering; |

|

|

• |

our ability to enter into agreements with commercialization partners for the sales, marketing and commercialization of our current products, assays and services, and our planned future products, assays and services; |

|

|

• |

our ability to satisfy any applicable United States and international regulatory requirements with respect to products, assays and services; and |

|

|

• |

our ability to obtain or maintain patents or other appropriate protection for the intellectual property utilized in our current and planned products, assays and services. |

Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond our control, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Moreover, we operate in an evolving environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise. The forward-looking statements contained in this prospectus are excluded from the safe harbor protection provided by the Private Securities Litigation Reform Act of 1995 and Section 27A of the Securities Act of 1933, as amended, or the Securities Act.

This prospectus also incorporates by reference estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk.

-8-

We estimate that the net proceeds of this offering will be approximately $9.1 million assuming the sale of 9,708,737 shares of our common stock and warrants to purchase up to 9,708,737 shares of our common stock at an assumed combined public offering price of $1.03 per share and related warrant (the last reported sale price of our common stock on The Nasdaq Capital Market on December 7, 2018), after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us, and excluding the proceeds, if any, from the exercise of the warrants. Each $0.25 increase (decrease) in the assumed combined public offering price of $1.03 per share would increase (decrease) the net proceeds to us from this offering by approximately $2.3 million, assuming the number of shares and warrants offered by us, as set forth on the cover page of this prospectus, remains the same, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. We may also increase or decrease the number of shares of our common stock and warrants we are offering. An increase (decrease) of 1 million in the number of shares sold in this offering would increase (decrease) the expected net proceeds of the offering to us by approximately $1.0 million, assuming that the assumed combined public offering price per share and the related warrant coverage remains the same. We currently intend to use the net proceeds of the offering for general corporate purposes and to fund ongoing operations and expansion of our business, including, but not limited to, initiatives to:

|

|

• |

fund our commercial strategy; |

|

|

• |

complete a physician portal for our pathology partnership strategy; |

|

|

• |

launch our pharma partnership strategy; |

|

|

• |

implement laboratory automation initiatives; and |

|

|

• |

outsource microchannel manufacturing. |

-9-

DILUTION

If you purchase shares of our common stock in this offering, you may experience dilution to the extent of the difference between the combined public offering price per share and related warrant in this offering and our as adjusted net tangible book value per share immediately after this offering assuming no value is attributed to the warrants, and such warrants are accounted for and classified as equity. Net tangible book value per share is equal to the amount of our total tangible assets, less total liabilities, divided by the number of outstanding shares of our common stock. As of September 30, 2018, our net tangible book value was approximately $8.9 million, or approximately $2.27 per share.

After giving effect to the assumed sale by us of 9,708,737 shares of our common stock (assuming no Pre-Funded Warrants in lieu of common stock issued) and warrants to purchase up to 9,708,737 shares of our common stock in this offering at an assumed combined public offering price of $1.03 per share and related warrant (the last reported sale price of our common stock on The Nasdaq Capital Market on December 7, 2018), after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us, our as adjusted net tangible book value as of September 30, 2018 would have been approximately $18.0 million, or approximately $1.32 per share. This represents an immediate decrease in net tangible book value of $0.95 per share to existing stockholders and an immediate increase in net tangible book value of $0.29 per share to new investors purchasing shares of our common stock and related warrants in this offering, attributing none of the assumed combined public offering price to the warrants offered hereby. The following table illustrates this per share dilution:

|

Assumed combined public offering price per share and related warrant |

|

|

|

|

$ |

1.03 |

|

|

Net tangible book value per share as of September 30, 2018 |

$ |

2.27 |

|

|

|

|

|

|

Decrease in net tangible book value per share after this offering |

|

(0.95) |

|

|

|

|

|

|

As adjusted net tangible book value per share after this offering |

|

|

|

|

|

1.32 |

|

|

Dilution per share to new investors |

|

|

|

|

$ |

(0.29) |

|

A $0.25 increase in the assumed combined public offering price of $1.03 per share and related warrant would result in an increase (decrease) in our as adjusted net tangible book value of approximately $11.4 million, or approximately $(0.78) per share, and would result in an increase in net tangible book value to new investors of approximately $0.21 per share, assuming that the number of shares of our common stock and related warrants sold by us remains the same, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. A decrease of $0.25 in the assumed combined public offering price of $1.03 per share and related warrant would result in an increase (decrease) in our as adjusted net tangible book value of approximately $6.8 million, or approximately $(1.11) per share, and would result in an increase in net tangible book value to new investors of approximately $0.38 per share, assuming that the number of shares of our common stock and related warrants sold by us remains the same, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

We may also increase or decrease the number of shares of common stock and related warrants we are offering from the assumed number of shares of common stock and related warrants set forth above. An increase of 1.0 million in the assumed number of shares of common stock and related warrants sold by us in this offering would result in an increase (decrease) in our as adjusted net tangible book value of approximately $10.1 million, or approximately $(0.97) per share, and would result in an increase in net tangible book value to new investors of approximately $0.27 per share, assuming that the assumed combined public offering price remains the same, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. A decrease of 1.0 million in the assumed number of shares of common stock and related warrants sold by us in this offering would result in an increase (decrease) in our as adjusted net tangible book value of approximately $8.1 million, or approximately $(0.92) per share, and would result in an increase in the net tangible book value to new investors of approximately $0.32 per share, assuming that the assumed combined public offering price remains the same, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. The information discussed above is illustrative only and will adjust based on the actual public offering price, the actual number of shares and related warrants sold in this offering and other terms of this offering determined at pricing.

The foregoing discussion and table do not take into account further dilution to new investors that could occur upon the exercise of outstanding options or warrants having a per share exercise price less than the per share offering price to the public in this offering. In addition, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

-10-

The table and discussion above are based on 3,937,226 shares of our common stock outstanding as of September 30, 2018 and excludes as of such date:

|

|

• |

up to 7,005 shares of common stock issuable upon the conversion of Series A Convertible Preferred Stock outstanding as of September 30, 2018; |

|

|

• |

114,641 shares of our common stock issuable upon the exercise of stock options, with a weighted-average exercise price of $72.02 per share; |

|

|

• |

360 shares of our common stock issuable upon the settlement of outstanding restricted stock units; |

|

|

• |

4,814,927 shares of our common stock issuable upon the exercise of outstanding warrants, with a weighted-average exercise price of $5.44 per share; and |

|

|

• |

194,649 other shares of our common stock reserved for future issuance under our 2013 Amended and Restated Equity Incentive Plan. |

-11-

We have never declared dividends on our equity securities, and currently do not plan to declare dividends on shares of our common stock in the foreseeable future. We expect to retain our future earnings, if any, for use in the operation and expansion of our business. Subject to the foregoing, the payment of cash dividends in the future, if any, will be at the discretion of our board of directors and will depend upon such factors as earnings levels, capital requirements, our overall financial condition and any other factors deemed relevant by our board of directors.

-12-

DESCRIPTION OF THE SECURITIES WE ARE OFFERING

As of the date of this prospectus, our amended certificate of incorporation authorizes us to issue 150,000,000 shares of common stock, par value $0.0001 per share, and 5,000,000 shares of preferred stock, par value $0.0001 per share.

We are offering 9,708,737 shares of our common stock together with warrants to purchase up to an aggregate of 9,708,737 shares of our common stock (based on an assumed combined offering price of $1.03, the last reported sale price of our common stock on The Nasdaq Capital Market on December 7, 2018). Each share of our common stock is being sold together with a warrant to purchase one share of common stock. The shares of our common stock and related warrants will be issued separately. We are also registering the shares of our common stock issuable from time to time upon exercise of the warrants offered hereby.

The following description of our capital stock is not complete and is subject to and qualified in its entirety by our amended certificate of incorporation and amended and restated bylaws, which are filed as exhibits to the registration statement of which this prospectus is a part, and by the relevant provisions of the Delaware General Corporation Law.

Common Stock

The holders of our common stock are entitled to the following rights:

Voting Rights. Holders of our common stock are entitled to one vote per share in the election of directors and on all other matters on which stockholders are entitled or permitted to vote. Holders of our common stock are not entitled to cumulative voting rights.

Dividend Rights. Subject to the terms of any then outstanding series of preferred stock, the holders of our common stock are entitled to dividends in the amounts and at times as may be declared by the board of directors out of funds legally available therefor.

Liquidation Rights. Upon liquidation or dissolution, holders of our common stock are entitled to share ratably in all net assets available for distribution to stockholders after we have paid, or provided for payment of, all of our debts and liabilities, and after payment of any liquidation preferences to holders of any then outstanding shares of preferred stock.

Other Matters. Holders of our common stock have no redemption, conversion or preemptive rights pursuant to our amended certificate of incorporation or amended and restated bylaws. There are no sinking fund provisions applicable to our common stock. The rights, preferences and privileges of the holders of our common stock are subject to the rights of the holders of shares of any series of preferred stock that we may issue in the future.

Outstanding Registration Rights. Under the terms of the warrants issued to certain designees of the representative of the underwriters in connection with our initial public offering, the holders have the right to include its shares of common stock in any registration statement we file. If we register any securities for public sale, the holder will have the right to include its shares of common stock in the registration statement, provided that the underwriters of any such underwritten offering will have the right to limit the number of shares to be included in the registration statement. These piggyback registration rights expire on February 4, 2021.

All of our outstanding shares of common stock are fully paid and nonassessable.

Our common stock is listed on Nasdaq under the symbol “BIOC.”

Pre-Funded Warrants

The following summary of certain terms and provisions of the Pre-Funded Warrants that are being offered hereby is not complete and is subject to, and qualified in its entirety by the provisions of, the Pre-Funded Warrant. Prospective investors should carefully review the terms and provisions of the form of Pre-Funded Warrant for a complete description of the terms and conditions of the Pre-Funded Warrants.

The term “pre-funded” refers to the fact that the purchase price of our common stock in this offering includes almost the entire exercise price that will be paid under the Pre-Funded Warrants, except for a nominal remaining exercise price of $0.01. The purpose of the Pre-Funded Warrants is to enable investors that may have restrictions on their ability to beneficially own more than

-13-

4.99% (or, upon election of the holder, 9.99%) of our outstanding common stock following the consummation of this offering the opportunity to invest capital into the Company without triggering their ownership restrictions, by receiving Pre-Funded Warrants in lieu of our common stock which would result in such ownership of more than 4.99% (or 9.99%), and receive the ability to exercise their option to purchase the shares underlying the Pre-Funded Warrants at such nominal price at a later date.

Duration. The Pre-Funded Warrants offered hereby will entitle the holders thereof to purchase shares of our common stock at a nominal exercise price of $0.01 per share, commencing immediately on the date of issuance.

Exercise Limitation. A holder will not have the right to exercise any portion of the Pre-Funded Warrant if the holder (together with its affiliates) would beneficially own in excess of 4.99% (or, upon election of the holder, 9.99%) of the number of shares of our common stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the Pre-Funded Warrants. However, any holder may increase or decrease such percentage, provided that any increase will not be effective until the 61st day after such election.

Exercise Price. The Pre-Funded Warrants will have an exercise price of $0.01 per share. The exercise price is subject to appropriate adjustment in the event of certain stock dividends and distributions, stock splits, stock combinations, reclassifications or similar events affecting our common stock and also upon any distributions of assets, including cash, stock or other property to our stockholders.

Transferability. Subject to applicable laws, the Pre-Funded Warrants may be offered for sale, sold, transferred or assigned without our consent.

Exchange Listing. There is no established trading market for the Pre-Funded Warrants and we do not expect a market to develop. In addition, we do not intend to apply for the listing of the Pre-Funded Warrants on any national securities exchange or other trading market. Without an active trading market, the liquidity of the Pre-Funded Warrants will be limited.

Fundamental Transactions. If a fundamental transaction occurs, then the successor entity will succeed to, and be substituted for us, and may exercise every right and power that we may exercise and will assume all of our obligations under the Pre-Funded Warrants with the same effect as if such successor entity had been named in the Pre-Funded Warrant itself. If holders of our common stock are given a choice as to the securities, cash or property to be received in a fundamental transaction, then the holder shall be given the same choice as to the consideration it receives upon any exercise of the Pre-Funded Warrant following such fundamental transaction.

Rights as a Stockholder. Except as otherwise provided in the Pre-Funded Warrants or by virtue of such holder’s ownership of shares of our common stock, the holder of a Pre-Funded Warrant does not have the rights or privileges of a holder of our common stock, including any voting rights, until the holder exercises the Pre-Funded Warrant.

Warrants

The following summary of certain terms and provisions of the warrants offered hereby is not complete and is subject to, and qualified in its entirety by, the provisions of the warrant, the form of which has been filed as an exhibit to the registration statement of which this prospectus is a part. Prospective investors should carefully review the terms and provisions of the form of warrant for a complete description of the terms and conditions of the warrants.

Form. The warrants will be issued as individual warrant agreements to the investors.

Exercisability. The warrants are exercisable at any time after their original issuance, expected to be , 2018, and at any time up to the date that is five years after their original issuance. The warrants will be exercisable, at the option of each holder, in whole or in part by delivering to us a duly executed exercise notice and, at any time a registration statement registering the issuance of the shares of common stock underlying the warrants under the Securities Act is effective and available for the issuance of such shares, or an exemption from registration under the Securities Act is available for the issuance of such shares, by payment in full in immediately available funds for the number of shares of common stock purchased upon such exercise. If a registration statement registering the issuance of the shares of common stock underlying the warrants under the Securities Act is not effective or available and an exemption from registration under the Securities Act is not available for the issuance of such shares, the holder may, in its sole discretion, elect to exercise the warrant through a cashless exercise, in which case the holder would receive upon such exercise the net number of shares of common stock determined according to the formula set forth in the warrant. No fractional shares of common stock will be issued in connection with the exercise of a warrant. In lieu of fractional shares, we will pay the holder an amount in cash equal to the fractional amount multiplied by the exercise price.

-14-

Exercise Limitation. A holder will not have the right to exercise any portion of the warrant if the holder (together with its affiliates) would beneficially own in excess of 4.99% (or, upon election of the holder, 9.99%) of the number of shares of our common stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the warrants. However, any holder may increase or decrease such percentage, provided that any increase will not be effective until the 61st day after such election.

Exercise Price. The warrants will have an exercise price of $ per share. The exercise price is subject to appropriate adjustment in the event of certain stock dividends and distributions, stock splits, stock combinations, reclassifications or similar events affecting our common stock and also upon any distributions of assets, including cash, stock or other property to our stockholders.

Transferability. Subject to applicable laws, the warrants may be offered for sale, sold, transferred or assigned without our consent.

Exchange Listing. There is no established trading market for the warrants and we do not expect a market to develop. In addition, we do not intend to apply for the listing of the warrants on any national securities exchange or other trading market. Without an active trading market, the liquidity of the warrants will be limited.

Fundamental Transactions. If a fundamental transaction occurs, then the successor entity will succeed to, and be substituted for us, and may exercise every right and power that we may exercise and will assume all of our obligations under the warrants with the same effect as if such successor entity had been named in the warrant itself. If holders of our common stock are given a choice as to the securities, cash or property to be received in a fundamental transaction, then the holder shall be given the same choice as to the consideration it receives upon any exercise of the warrant following such fundamental transaction.

Rights as a Stockholder. Except as otherwise provided in the warrants or by virtue of such holder’s ownership of shares of our common stock, the holder of a warrant does not have the rights or privileges of a holder of our common stock, including any voting rights, until the holder exercises the warrant.

Transfer Agent

The transfer agent of our common stock being offered hereby is Continental Stock Transfer & Trust Company.

-15-

We have entered into an underwriting agreement with the underwriters named below with respect to the shares of our common stock and related warrants and Pre-Funded Warrants and related warrants subject to this offering. Subject to certain conditions, we have agreed to sell to the underwriters, and the underwriters have agreed to purchase, the number of shares of our common stock, pre-funded warrants and corresponding warrants provided below opposite each underwriter’s name. Maxim Group LLC and Dawson James Securities, Inc. are acting as the representatives of the underwriters.

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

Underwriter |

|

Number of Shares |

|

Number of Pre-Funded Warrants |

|

Number of Warrants |

|

|

Maxim Group LLC |

|

|

|

|

|

|

|

|

Dawson James Securities, Inc. |

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

The underwriters are offering the shares of our common stock and related warrants and Pre-Funded Warrants and related warrants subject to their acceptance of our common stock, the Pre-Funded Warrants and the warrants from us and subject to prior sale. The underwriting agreement provides that the obligations of the underwriters to pay for and accept delivery of the shares of our common stock and related warrants and Pre-Funded Warrants and related warrants offered by this prospectus are subject to the approval of certain legal matters by their counsel and to certain other conditions. The underwriters are obligated to take and pay for all of the shares of our common stock and related warrants and Pre-Funded Warrants and related warrants if any such shares of our common stock and related warrants or Pre-Funded Warrants and related warrants are taken.

We have granted the underwriters an option for a period of 45 days from the date of this prospectus to purchase up to an additional shares of common stock and/or warrants to purchase shares of common stock at the public offering price, less the underwriting discount.

Underwriter Compensation

We have agreed to pay the underwriters an aggregate fee equal to 7.0% of the gross proceeds of this offering and expect the net proceeds from this offering to be approximately $ after deducting $ in underwriting commissions and $ in our other estimated offering expenses. We have also agreed to pay the underwriters an accountable expense allowance for certain of the underwriters’ expenses relating to the offering up to a maximum aggregate amount of $85,000, including the underwriters’ legal fees incurred in this offering.

We have paid an expense deposit of $25,000 to Maxim which will be applied against actual, out-of-pocket accountable expenses that will be paid by us to the underwriters in connection with this offering. Any portion of the $25,000 expense deposit paid to Maxim will be returned to us to the extent that offering expenses are not actually incurred by the underwriters in compliance with FINRA Rule 5110(f)(2)(C).

Discounts and Expenses

The underwriters have advised us that they propose to offer the shares of our common stock, Pre-Funded Warrants and related warrants to the public at the respective public offering price set forth on the cover page of this prospectus and to certain dealers at that price less a concession not in excess of $ per share of our common stock and related warrant or $ per Pre-Funded Warrants and related warrants. After this offering, the public offering price and concession to dealers may be changed by the representative. No such change shall change the amount of proceeds to be received by us as set forth on the cover page of this prospectus. The shares of our common stock, Pre-Funded Warrants and related warrants are offered by the underwriters as stated herein, subject to receipt and acceptance by them and subject to their right to reject any order in whole or in part. The underwriters have informed us that they do not intend to confirm sales to any accounts over which they exercise discretionary authority.

The following table shows the public offering price, underwriting discount payable to the underwriters by us and proceeds before expenses to us, assuming both no exercise and full exercise of the underwriters' option to purchase additional shares of common stock and/or warrants. The underwriting commissions are equal to the combined public offering price per share, Pre-Funded Warrants and

-16-

related warrants, less the amount per share the underwriters pay us for the shares of common stock, Pre-Funded Warrants and warrants:

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Per Share |

|

Per Pre-Funded Warrant |

|

Per Warrant |

|

Total (No Exercise) |

|

Total (Full Exercise) |

|

Public offering price |

$ |

|

|

|

$ |

|

$ |

|

$ |

|

Underwriting discounts and commissions |

|

|

|

|

|

|

|

|

|

|

Proceeds, before expenses, to us |

$ |

|

|

|

$ |

|

$ |

|

$ |

In addition, we have agreed to reimburse the underwriters for reasonable out-of-pocket expenses not to exceed $85,000 in the aggregate. We will also pay $45,000 to Chardan Capital Markets, LLC for financial advisory services in connection with this offering. Chardan will not participate in the selling efforts for this offering. We estimate that total expenses payable by us in connection with this offering, other than the underwriting discount referred to above, will be approximately $200,000.

Indemnification

We have agreed to indemnify the underwriters against certain liabilities, including liabilities under the Securities Act.

Lock-up Agreements

We have agreed, subject to limited exceptions, for a period of 75 days after the closing of this offering, and our officers and directors have agreed, subject to limited exceptions, for a period of 90 days after the closing of this offering, not to offer, sell, contract to sell, pledge, grant any option to purchase, make any short sale or otherwise dispose of, directly or indirectly any shares of common stock or any securities convertible into or exchangeable for our common stock either owned as of the date of the underwriting agreement or thereafter acquired without the prior written consent of Maxim Group LLC and Dawson James Securities, Inc. Maxim Group LLC and Dawson James Securities, Inc. may, in their sole discretion and at any time or from time to time before the termination of the lock-up period, without notice, release all or any portion of the securities subject to lock-up agreements.

Price Stabilization, Short Positions and Penalty Bids

In connection with the offering the underwriters may engage in stabilizing transactions, over-allotment transactions, syndicate covering transactions and penalty bids in accordance with Regulation M under the Exchange Act:

|

|

|

|

• |

Stabilizing transactions permit bids to purchase the underlying security so long as the stabilizing bids do not exceed a specified maximum. |

|

|

|

|

• |

Over-allotment involves sales by the underwriters of shares in excess of the number of shares the underwriters are obligated to purchase, which creates a syndicate short position. The short position may be either a covered short position or a naked short position. In a covered short position, the number of shares over-allotted by the underwriters is not greater than the number of shares that they may purchase in the over-allotment option. In a naked short position, the number of shares involved is greater than the number of shares in the over-allotment option. The underwriters may close out any covered short position by either exercising their over-allotment option and/or purchasing shares in the open market. |

|

|

|

-17-

|

|

|

|

• |

Penalty bids permit the underwriters to reclaim a selling concession from a syndicate member when the common stock originally sold by the syndicate member is purchased in a stabilizing or syndicate covering transaction to cover syndicate short positions. |

These stabilizing transactions, syndicate covering transactions and penalty bids may have the effect of raising or maintaining the market price of our common stock or preventing or retarding a decline in the market price of the common stock. As a result, the price of our common stock may be higher than the price that might otherwise exist in the open market. These transactions may be discontinued at any time.

Neither we nor the underwriters make any representation or prediction as to the direction or magnitude of any effect that the transactions described above may have on the price of our shares of common stock. In addition, neither we nor the underwriters make any representation that the underwriters will engage in these transactions or that any transaction, if commenced, will not be discontinued without notice.

Electronic Distribution

This prospectus in electronic format may be made available on websites or through other online services maintained by the underwriters, or by their affiliates. Other than this prospectus in electronic format, the information on the underwriters’ websites and any information contained in any other websites maintained by the underwriters is not part of this prospectus or the registration statement of which this prospectus forms a part, has not been approved and/or endorsed by us or the underwriters in their capacity as underwriters, and should not be relied upon by investors.

Other

From time to time, the underwriters and/or their affiliates have provided, and may in the future provide, various investment banking and other financial services for us for which services it has received and, may in the future receive, customary fees.

Except for the services provided in connection with this offering and other than as described below, the underwriters have not provided any investment banking or other financial services during the 180-day period preceding the date of this prospectus.

On September 20, 2018, the Company completed an offering of 642,438 shares of the Company’s common stock and pre-funded warrants to purchase up to an aggregate of 120,000 shares of its common stock. The shares were sold at a purchase price of $3.285 per share and the pre-funded warrants were sold at a purchase price of $3.275 per pre-funded warrant which represents the per share purchase price for the shares less the $0.01 per share exercise price for each such pre-funded warrant. In addition, in a concurrent private placement, the Company issued to purchasers a warrant to purchase one share of the Company’s common stock for each share and pre-funded warrant purchased for cash in the offering. All warrants issued in the offering have an exercise price of $3.16 per share, are exercisable upon the six-month anniversary of issuance and expire five years from such date. Maxim Group LLC and Dawson James Securities, Inc. acted as placement agents in connection with such offering (the “September 2018 Offering”).

In connection with the September 2018 Offering, we agreed, for a period of twelve months following the commencement of sales of such offering, to grant Maxim Group LLC the right of first refusal to act as lead managing underwriter and book runner and/or lead placement agent, with at least eighty percent of the economics, and to grant Dawson James Securities, Inc. the right of first refusal to act as a co-placement agent or underwriter or co-manager, with at least twenty percent of the economics, for any and all future equity, equity-linked or debt offerings undertaken by us during such period.

-18-

Notice to Prospective Investors in Canada

This prospectus constitutes an “exempt offering document” as defined in and for the purposes of applicable Canadian securities laws. No prospectus has been filed with any securities commission or similar regulatory authority in Canada in connection with the offer and sale of the securities. No securities commission or similar regulatory authority in Canada has reviewed or in any way passed upon this prospectus or on the merits of the securities and any representation to the contrary is an offence.