Table of Contents

As filed with the Securities and Exchange Commission on September 23, 2013

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BIOCEPT, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 8071 | 80-0943522 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

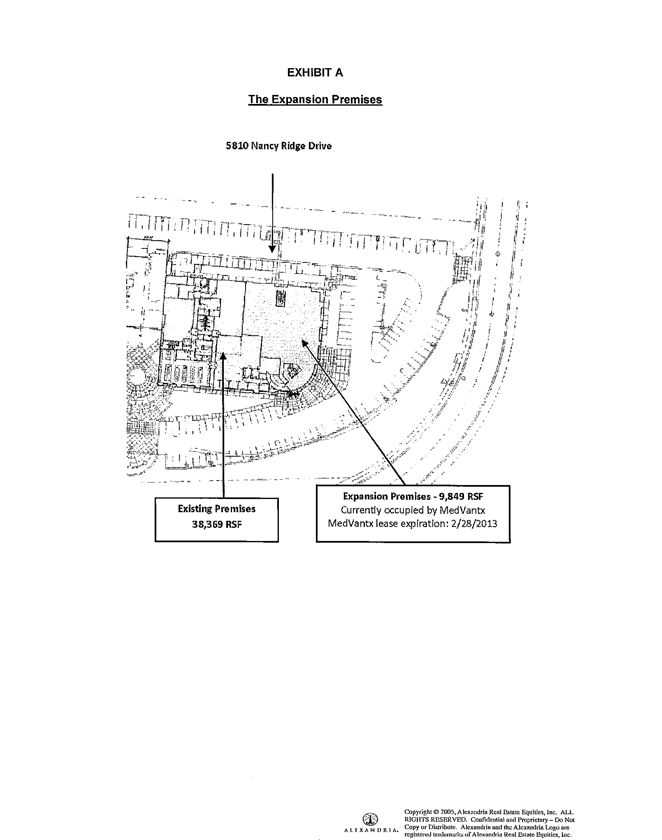

5810 Nancy Ridge Drive

San Diego, CA 92121

(858) 320-8200

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Michael W. Nall

Chief Executive Officer and President

Biocept, Inc.

5810 Nancy Ridge Drive

San Diego, CA 92121

(858) 320-8200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Michael J. Brown, Esq. Hayden J. Trubitt, Esq. Michael L. Lawhead, Esq. Stradling Yocca Carlson & Rauth, P.C. 4365 Executive Drive, Suite 1500 San Diego, CA 92121 (858) 926-3000 |

William G. Kachioff Senior Vice-President, Finance and Chief Financial Officer Biocept, Inc. 5810 Nancy Ridge Drive San Diego, CA 92121 (858) 320-8200 |

Ivan K. Blumenthal, Esq. Merav Gershtenman, Esq. Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C. 666 Third Avenue New York, NY 10017 (212) 935-3000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Table of Contents

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee(2) | ||

| Common Stock, $0.0001 par value per share(3) |

$23,000,000 | $3,137.20 | ||

| Representative’s Warrants to Purchase Common Stock(3)(4) |

— | — | ||

| Common Stock Underlying Representative’s Warrants(3)(5) |

$1,250,000 | $170.50 | ||

| Total Registration Fee |

$24,250,000 | $3,307.70 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the Registration Fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. Includes the offering price of shares of common stock the underwriters have the option to purchase to cover over-allotments, if any. |

| (2) | Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price. |

| (3) | Pursuant to Rule 416 under the Securities Act, the shares of common stock registered hereby also include an indeterminate number of additional shares of common stock as may from time to time become issuable by reason of stock splits, stock dividends, recapitalizations or other similar transactions. |

| (4) | No registration fee pursuant to Rule 457(g) under the Securities Act. |

| (5) | Estimated solely for the purposes of calculating the registration fee pursuant to Rule 457(g) under the Securities Act. The warrants are exercisable at a per share exercise price equal to 125% of the public offering price. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the Registration Statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED SEPTEMBER , 2013 |

Shares

Common Stock

This is the initial public offering of shares of common stock of Biocept, Inc. No public market currently exists for our shares. We are offering all of the shares of common stock offered by this prospectus. We expect the public offering price of our shares of common stock to be between $[ . ] and $[ . ] per share.

We expect to implement a 1-for-10 reverse stock split of our outstanding common stock just before the effective time of this prospectus; all common share and per-common-share figures in this prospectus have been adjusted to reflect this reverse stock split. We have applied to list our common stock on The NASDAQ Capital Market under the symbol “BIOC.” No assurance can be given that our application will be approved.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012, and, as such, we have elected to take advantage of certain reduced public company reporting requirements for this prospectus and future filings.

Investing in our common stock involves a high degree of risk. See “Risk Factors ” beginning on page 12 of this prospectus for a discussion of information that should be considered in connection with an investment in our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Offering proceeds to us, before expenses |

$ | $ | ||||||

| (1) | See “Underwriting” beginning on page 131 of this prospectus for a description of compensation payable to the underwriters. |

We have granted a 45-day option to the underwriters to purchase up to additional shares of common stock to cover over-allotments, if any.

The underwriters expect to deliver the shares against payment therefor on or about , 2013.

Aegis Capital Corp

The date of this prospectus is , 2013.

Table of Contents

| Page | ||||

| 1 | ||||

| 10 | ||||

| 12 | ||||

| 41 | ||||

| 42 | ||||

| 42 | ||||

| 43 | ||||

| 44 | ||||

| 45 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

49 | |||

| 61 | ||||

| 95 | ||||

| 100 | ||||

| 115 | ||||

| 120 | ||||

| 123 | ||||

| 129 | ||||

| 131 | ||||

| 140 | ||||

| 140 | ||||

| 140 | ||||

| 141 | ||||

| F-1 | ||||

Neither we nor the underwriters have authorized anyone to provide you with information that is different from that contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. When you make a decision about whether to invest in our common stock, you should not rely upon any information other than the information in this prospectus or in any free writing prospectus that we may authorize to be delivered or made available to you. Neither the delivery of this prospectus nor the sale of our common stock means that the information contained in this prospectus or any free writing prospectus is correct after the date of this prospectus or such free writing prospectus. This prospectus is not an offer to sell or the solicitation of an offer to buy the shares of common stock in any circumstances under which the offer or solicitation is unlawful.

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market share, is based on information from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. Our management estimates have not been verified by any independent source, and we have not independently verified any third-party information. In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Special Note Regarding Forward-Looking Statements.”

Table of Contents

We use in this prospectus our BIOCEPT LABORATORIES logo, for which we hold a registered United States trademark, our mark CEE, which is a registered United States trademark, and our marks OncoCEE-BR, OncoCEE-LU, CEE-Selector, CEE-Cap, CEE-Enhanced, CEE-Sure, OncoCEE-GA, OncoCEE-PR, OncoCEE-ME, OncoCEE-CR and OncoCEE, which in the United States are unregistered trademarks. This prospectus also includes trademarks, tradenames and service marks that are the property of other organizations. Solely for convenience, trademarks and tradenames referred to in this prospectus appear (after the first usage) without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or that the applicable owner will not assert its rights, to these trademarks and tradenames.

Table of Contents

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, especially the “Risk Factors” section of this prospectus and the financial statements and related notes appearing at the end of this prospectus before making an investment decision.

Unless the context provides otherwise, all references in this prospectus to “Biocept,” “we,” “us,” “our,” the “Company,” or similar terms, refer to Biocept, Inc. We reincorporated from California to Delaware in July 2013. Except where otherwise expressly stated, no distinction is made in this prospectus between historic activities and results of the California and Delaware corporations.

Our Company

We are a cancer diagnostics company that develops and commercializes proprietary circulating tumor cell, or CTC, and circulating tumor DNA, or ctDNA, tests utilizing a standard blood sample. These tests (including our OncoCEE-BRTM breast cancer CTC test, which is already on the market) are designed to provide information to oncologists to enable them to select appropriate treatment for their patients due to better, timelier and more-detailed data on the characteristics of tumors. Our marketed test and our tests in development for the detection and analysis of CTCs utilize our Cell Enrichment and Extraction, or CEE®, technology, and our tests in development for the detection and analysis of ctDNA utilize our CEE-Selector™ technology, each performed on a standard blood sample. CEE is an internally invented and developed, microfluidics-based CTC capture and analysis platform, with enabling features that change how CTC testing can be used by clinicians by providing real-time biomarker monitoring with only a standard blood sample. The CEE-Selector technology enables mutation detection with enhanced sensitivity and specificity and is applicable to nucleic acid from CTCs or other sample types, such as blood plasma for ctDNA.

At our corporate headquarters facility located in San Diego, California, we operate a clinical laboratory that is certified under the Clinical Laboratory Improvement Amendments of 1988, or CLIA, and accredited by the College of American Pathologists, or CAP. We also manufacture our CEE microfluidic channels, related equipment and certain reagents to perform our tests at this facility.

We are in the process of commercializing our first proprietary test, OncoCEE-BR. The OncoCEE-BR is a breast cancer CTC test that is performed on a standard blood sample. It detects CTCs, which are typically very rare, and determines the patient’s human epidermal growth factor receptor 2, or HER2, status by fluorescence in situ hybridization, or FISH. Pursuant to an agreement that we entered into with Clarient Diagnostic Services, Inc., or Clarient, a GE Healthcare Company, Clarient is cooperating with us on a nonexclusive basis to market, sell and otherwise commercialize OncoCEE-BR tests.

We anticipate launching OncoCEE-LUTM, a proprietary test performed on a standard blood sample for non-small cell lung cancer, or NSCLC, in the first half of 2014. The OncoCEE-LU test’s biomarker analysis would include FISH for echinoderm microtubule-associated protein-like 4/ anaplastic lymphoma kinase, or EML4/ALK, and c-ros oncogene 1, receptor tyrosine kinase, or ROS1, gene fusions, as well as mutation analysis for the epidermal growth factor receptor, or EGFR, gene, the K-ras gene and the B-raf gene. Life Technologies Corporation will be collaborating with us in the commercialization of the OncoCEE-LU test.

Other biomarker analyses can be added to these tests as their clinical relevance is demonstrated, for example, ret proto-oncogene gene fusions in NSCLC. In addition, we are developing a series of other proprietary CTC and ctDNA tests for different solid tumor types, including colorectal cancer, prostate cancer, gastric cancer and melanoma, each incorporating treatment-associated biomarker analyses specific to that cancer, planned to be launched over the next two to three years. We also have a research and development program focused on technology enhancements and novel platform development, and a translational research group evaluating clinical applications for our cancer diagnostic tests in different cancer types and clinical settings. We plan to launch new tests for these solid tumor types at the rate of at least 1-2 per year for the next 3 years.

We collaborate with physicians and researchers at The University of Texas MD Anderson Cancer Center and the Dana-Farber Cancer Institute and plan to expand our current collaborative relationships to include other key thought leaders for the types of cancer we are targeting with our current and planned CTC and ctDNA tests. Such relationships help us

- 1 -

Table of Contents

develop and validate the effectiveness and utility of our current test and our planned tests in specific clinical settings and provide us access to patient samples and data.

Market Overview

Despite many advances in the treatment of cancer, cancer remains one of the greatest areas of unmet medical need. In 2008, the World Health Organization attributed 7.6 million deaths worldwide to cancer-related causes. The World Health Organization projects that by 2030 this number will rise to 13.1 million deaths per year. They also project that worldwide, cancer has surpassed cardiovascular disease as the leading cause of death. The incidence of, and deaths caused by, the major cancers are staggering.

Cancer constitutes a heterogeneous class of diseases, characterized by uncontrollable cell growth, that result from a combination of both environmental and hereditary risk factors. Many different tissue types can become malignant, such as breast, lung, liver, and skin, and even within a particular tumor there is heterogeneity, with certain cancer cells in a patient bearing specific cellular or genetic biomarkers, while other cells in the tumor may not have these markers. It has only been in recent years that technology has progressed far enough to enable researchers to understand many cancers at a molecular level and attribute specific cancers to associated genetic changes.

Limitations of Traditional Cancer Diagnostic and Profiling Approaches

Cancer is difficult to diagnose and manage due to its heterogeneity at visual, genetic and clinical levels. Traditional methods of diagnosis for solid tumors, routinely used as the initial step in cancer detection, involve a tissue biopsy, followed by a pathologist examining a thin slice of potentially cancerous tissue under a microscope. The tissue sample must be used in combination with chemical staining techniques to enable analysis of the biopsy. Through visual inspection, the pathologist determines whether the biopsy contains normal or cancerous cells, with those cells that are deemed cancerous being graded on a level of aggressiveness. In recent years, molecular (or genetic) testing has become the standard of care and will also be performed in order to provide information about which drugs a patient is likely or unlikely to respond to. After the diagnosis, a clinical workup is performed according to established guidelines for the specific cancer type. From there, the physician determines the stage of progression of the cancer based on a series of clinical measures, such as size, grade, metastasis rates, symptoms and patient history, and decides on a treatment plan that may include surgery, watchful waiting, radiation, chemotherapy, or stem cell transplant.

Molecular analysis is dependent on the availability of a relevant tissue biopsy for the pathologist to analyze. Such a biopsy is often not available. A tumor may not be readily accessible for biopsy, a patient’s condition may be such that a biopsy is not advised, and for routine periodic patient monitoring to evaluate potential progression or recurrence, a biopsy is a fairly invasive procedure and not typically performed. As the length of time between when the original biopsy, diagnosis or surgery is conducted to the current evaluation of the patient increases, the likelihood that an original biopsy specimen is truly representative of the current disease condition declines, as does the usefulness of the original biopsy for making treatment decisions. This risk intensifies in situations where a drug therapy is being administered, because the drug can put selective pressure on the tumor cells to adapt and change. Similarly, the heterogeneity referred to above means that different parts or areas of the same tumor can have different molecular features or properties. In evaluating a biopsy specimen, the pathologist will take a few thin slices of the tumor for microscopic review rather than exhaustively analyzing the whole tumor mass. The pathologist can only report on the tumor sections analyzed, and if other parts of the tumor have different features, such as biomarkers corresponding to specific treatments, they can be missed. A more representative analysis of the entire tumor, as well as any metastases if they are present, is very helpful.

CTCs, ctDNA and Cancer

Circulating tumor cells, or CTCs, are cancer cells that have detached from the tumor and invaded the patient’s blood or other bodily fluids. These cells are representative of the tumor and its metastases, and can function as their surrogates. Testing CTCs can complement pathologic information drawn from a biopsy or resected tissue sample, helping to insure that the analysis is comprehensive and not biased by tumor heterogeneity and sampling issues. Testing CTCs can also provide critical data when a biopsy is not possible. Clinical studies have demonstrated that the presence and number of CTCs provides information on the likely course of the cancer for the patient, or in other words they are considered “prognostic.” Since CTCs are understood to be representative of the tumor, they can also be used for biomarker analysis, for

- 2 -

Table of Contents

example, to help guide therapy selection. In this way they are “predictive” in that they offer insight into the likely responsiveness or resistance to particular therapies. After surgery and during any subsequent therapy or monitoring period, blood samples can periodically be drawn and analyzed to evaluate a therapy’s continuing effectiveness, as well as to detect other biomarkers, such as new genetic mutations that may arise as a result of selection pressure by a particular therapy or by chance. Physicians can use this information to determine which therapy is most likely to benefit their patients at particular times through the course of their disease. Treatment decisions based on patient-specific information are the foundation of personalized medicine, and tests, or assays, that guide a physician in the selection of individualized therapy for a patient are termed “predictive assays.”

Nucleic acid that is released into blood by dying tumor cells is called ctDNA. Cell death occurs in all tissues, especially those that are rapidly dividing, and in cancer, where cell growth is not only rapid but also uncontrolled, parts of tumors often outgrow their blood supply, resulting in cell death. As a consequence, ctDNA is common in cancer patients, and like CTCs, scientists believe that it may be more representative of a patient’s tumor than a few thin sections from a tissue biopsy, thus reducing the heterogeneity problem. ctDNA is found in the plasma component of blood, and is readily accessible in a standard blood sample. Analyzing ctDNA for mutations that are used as biomarkers for therapy selection shows great promise. One of its strengths, in addition to not requiring a tissue biopsy, is that it is not dependent on capturing rare tumor cells from blood to provide a sample for testing. The negative side of this approach is that the cellular context is lost, as the ctDNA is mixed with a much larger amount of circulating DNA from normal cells that are continuously dying and being replaced in the body, thus making analysis challenging. This requires a mutation detection methodology with enhanced sensitivity and specificity, to distinguish mutations in particular gene regions in cancer cells from the normal gene sequence which co-exist in blood as normal cells die and are replaced in the body. Our CEE-Selector technology provides the necessary sensitivity and specificity, creating an opportunity for ctDNA testing to complement CTC analysis or potentially to serve as stand-alone tests.

Use of CTC- and ctDNA-Derived Biomarker Data in Cancer Treatment

CTCs and ctDNA are derived from, and are understood to be representative of, a solid tumor and its metastases and can be analyzed as adjuncts to, or in place of, the tumor, especially when a recent tumor biopsy is not available. Almost any analysis that can be performed on tumor tissue can also be performed on CTCs, while the number of currently available assays that can be performed on ctDNA is more limited. We have focused our analysis of CTCs and ctDNA on known biomarkers associated with specific therapies to support treatment decisions and therapy selection made by oncologists. We analyze proteins and genetic aberrations and mutations which are detected in CTCs or ctDNA by molecular diagnostic tests, such as PCR and gene sequencing. Specific examples include (i) the detection of the estrogen receptor protein in breast cancer, indicative of the likely responsiveness to hormonal therapies like tamoxifen, often sold under the trade name Nolvadex®, (ii) the presence of an amplified HER2 gene in breast cancer, indicative of the likely responsiveness to HER2-targeted agents like Herceptin®, and (iii) the presence of an EGFR activating mutation in Non-Small Cell Lung Cancer (NSCLC) , indicative of the likely responsiveness to EGFR-targeted agents like Tarceva®. All of these biomarkers are currently tested on tumor tissue and can be tested on CTCs, while ctDNA only provides information on mutations. The resulting information is then used to guide patient care, specifically treatment selection.

To date, these types of molecular and genetic detection methods have been successfully utilized to provide predictive information for several cancers, including breast, colon, NSCLC, melanoma and others in the form of companion diagnostics, typically performed on tumor tissue. CTC and ctDNA tests analyze the same biomarkers in a more convenient, standard blood test format that permits periodic testing.

Our Business Strategy

We plan to provide oncologists with a straightforward means to profile and characterize their patients’ tumors on a real-time basis by analyzing CTCs and ctDNA found in standard blood test draws. Biomarkers are currently detected and analyzed primarily in tissue biopsy specimens. We believe that our technology, which not only provides information on CTC enumeration (quantitation of CTCs) but also the assessment of treatment-associated biomarkers identified within the

- 3 -

Table of Contents

CTCs or in ctDNA, provide information to oncologists that improve patient treatment and management and will become a key component in the standard of care for personalized cancer treatment.

Our approach is to develop and commercialize proprietary CTC and ctDNA tests and services to enable us to offer to oncologists standard blood sample based, real-time, testing solutions for a range of solid tumor types, starting with breast cancer and progressing to future launches of tests for NSCLC, gastric cancer, colorectal cancer, prostate cancer, melanoma and others, to improve patient treatment with better prognostic and predictive tools. To achieve this, we intend to:

| • | Develop and commercialize a portfolio of proprietary CTC and ctDNA tests and services. |

| • | Establish our internal sales and marketing capabilities in a scalable manner. |

| • | Develop and expand our collaborations with leading university hospitals and research centers. |

| • | Enhance our efforts in reaching and educating community oncologists about CTC and ctDNA tests and services. |

| • | Increase our efforts to provide biopharmaceutical companies and clinical research organizations with our current and planned proprietary CTC and ctDNA tests and services. |

| • | Support our current test and our planned tests with clinical utility studies to drive adoption and facilitate reimbursement. |

| • | Continue to enhance our current and planned proprietary CTC and ctDNA tests and reduce the costs associated with providing them through internal research and development and partnering with leading technology developers and reagent suppliers. |

Our Competitive Advantages

We believe that our competitive advantages are as follows:

Our current and planned proprietary CTC and ctDNA tests enable detailed analysis of a patient’s cancer utilizing a standard blood sample, facilitating testing at any time, including when a biopsy is not available or inconclusive, offering real-time monitoring of the cancer and the response of the cancer to therapy, and allowing oncologists to select timely modifications to treatment regimens. CTCs and ctDNA, because they are derived from the primary tumor or its metastases, function as surrogates for the tumor, with the advantage of being readily accessible in a standard blood sample, which is especially important in situations where a biopsy is not available or advised. The simplicity of obtaining a standard blood sample permits repeat testing in a monitoring mode to detect recurrence or progression, and to offer information on treatment modifications based on a current assessment of the cancer’s properties.

Our current test and our planned tests provide more information than competitors’ existing tests, including predictive information on biomarkers linked to specific therapies. Such additional biomarker information enables a physician to develop a personalized treatment plan. By including biomarker information in our analysis in addition to CTC enumeration, our current test and our planned tests are designed to provide a more complete profile of a patient’s disease than existing CTC tests can. The biomarker information assists physicians in selecting appropriate therapies for individual patients. Our ctDNA tests are expected to offer enhanced sensitivity and specificity based on the CEE-Selector technology, enabling earlier detection of therapy-associated mutation targets or resistance markers, again supporting treatment decisions.

Our current and planned CTC tests are designed to capture and detect a broader range of CTCs than existing tests and are applicable to, or can be quickly modified for, a wide range of cancer types. Our CEE-CapTM antibody capture cocktail is comprised of antibodies targeting not only EpCAM, the traditional epithelial CTC capture antigen utilized in Janssen Diagnostics, LLC’s CellSearch® system and in other platforms, but also other epithelial antigens and mesenchymal and cancer stem cell antigens, indicative of cells having undergone the epithelial-to-mesenchymal transition, or EMT. These cells may be more relevant for metastasis. Our detection modalities include cytokeratin staining, with a broader range of cytokeratin isotypes than existing CTC tests. We plan to introduce our CEE-EnhancedTM staining, which would enable detection of cells specifically captured with our antibody cocktail, including EMT cells lacking cytokeratin. Through CEE-Enhanced staining, more CTCs and different types of CTCs can be identified, potentially at earlier stages of disease, resulting in fewer non-informative cases and more information for physicians.

- 4 -

Table of Contents

Our current and planned CTC and ctDNA tests are flexible, and can readily be configured to accommodate new biomarkers with clinical relevance as they are identified. Our CEE platform permits almost any analysis that is currently performed on tumor tissue to be performed on CTCs. As new therapies are approved, we will be able to include them in our tests with minimal changes. This is attractive to pharmaceutical and biotechnology companies that are developing such therapies, or seeking ways to make their clinical trials more efficient, as it enables them to focus on patients more likely to respond to a particular therapy and demonstrate a benefit from that therapy.

Collaborative relationships with physicians at MD Anderson Cancer Center. We work closely with a number of physicians at MD Anderson Cancer Center in Houston, Texas, with various collaborative projects in different cancer types, including breast, NSCLC, prostate, colorectal, ovarian, bladder, renal and endometrial cancers. These projects provide us access to leading researchers, leading clinicians and key thought leaders, access to valuable patient samples and insight into clinical applications for tests. Some of these projects have resulted in publications in leading journals, such as Cancer Discovery and Cancer Medicine, which enhances our standing in the oncology community and supports our marketing efforts.

Our planned CEE-Selector mutation tests are not platform dependent. These tests can be performed on almost any molecular instrument, which provides flexibility to us in our laboratory operations. To the extent we elect to develop these tests as in vitro diagnostic kits, or IVDs, including pursuing CE marks for them to be marketed outside the United States, the ability to rapidly deploy them on different approved instrument platforms already in many laboratories greatly simplifies their distribution and commercialization.

Focus on targeting oncologists at private and group practices and at community hospitals, where approximately 85% of all cancer patients in the United States are initially diagnosed. Our sales and marketing efforts will be directed primarily at oncologists at community hospitals to better service their oncology patients. Our current test and our planned proprietary tests and testing services can help oncologists and community hospitals deliver a higher value of service to their cancer patients.

Our Proprietary Tests and Services

We are in the process of commercializing our first proprietary test, OncoCEE-BR for breast cancer, and plan to continue to launch a series of tests for CTCs in different tumor types, including NSCLC, gastric, colorectal and prostate cancers and melanoma, incorporating analyses for different biomarkers, at the rate of at least 1-2 per year for the next 3 years. OncoCEE-BR and the planned future tests are based on the CEE technology platform. The CEE system isolates CTCs from blood samples of cancer patients for enumeration (or count) and genetic analysis. A sample is shipped to us in our proprietary blood collection tube called the CEE-SureTM tube for recovery and analysis of CTCs. When performing the CTC assay, the sample is processed in our laboratory. The specimen of blood is separated into its parts (red blood cells, buffy coat and plasma). The buffy coat is incubated with the antibody solution and passed through a proprietary microfluidic channel containing 9,000 microscopic posts coated with reagents to capture antibody-labeled tumor cells. The captured cells are suitable for further testing of whole cells directly in the microfluidic channel or by releasing the cells from the microfluidic channel and performing CEE-Selector or similar techniques.

Clinicians acknowledge limitations of currently available CTC test systems such as the CellSearch® that rely on capture solely by anti-EpCAM antibodies and detection by anti-cytokeratin antibodies. Capture and detection based only on these two antigens is unlikely to identify all CTCs, and clinically this may result in no CTCs being detected in cases in which they are present. For example, some tumor cells that have been released into the circulatory system have undergone an EMT. These mesenchymal cells are less differentiated than epithelial cells and more similar to stem cells.

- 5 -

Table of Contents

We have developed several assays that have enabled the capture of significantly more CTCs than is accomplished through the use of traditional anti-EpCAM immuno-capture alone.

In addition to enhanced capture, we are also improving identification of CTCs. We have developed alternative methods of fluorescent cell staining that are uniquely possible within the CEE system to enhance detection of CTCs. This technology is called CEE-Enhanced. We believe that the combination of our assay with more sensitive fluorescent detection of CTCs through CEE-Enhanced staining will lead to major advances in the capture, enumeration and analysis of CTCs. CEE-Enhanced staining is expected to be included in our commercially available and planned tests by the end of 2013.

Analysis of CTCs performed by us incorporates both standard and novel methods. Immunocytochemistry which looks at proteins, analogous to the immunohistochemistry, or IHC, performed on tissues, can be readily applied and performed in the microfluidic channel, dependent only on suitable biomarkers. Similarly, FISH, used to evaluate genetic abnormalities in cells, may be performed in our microfluidic channel using validated assays available from a number of vendors. For genetic mutation analysis, standard technologies can be applied. We have also developed proprietary CEE-Selector technology for mutation analysis in CTCs and ctDNA, with enhanced sensitivity and specificity.

As indicated, CEE-Selector was developed specifically for analysis of CTCs, which are generally very rare and outnumbered many-fold by white blood cells. This complexity has been a challenge for standard technologies. CEE-Selector offers enhanced specificity and sensitivity (greater than 1 in 10,000 of mutated sequence to normal sequence in a complex genetic background) compared to other approaches, and potentially has broader application than just CTC analysis, including analysis of ctDNA in plasma, both in a CLIA lab setting and as an IVD.

We are developing and offering Laboratory Developed Tests for CTCs and ctDNA. FDA clearance or approval is not currently required to offer these types of tests in our laboratory once they have been clinically and analytically validated. We seek licenses and approvals for our laboratory facility and for our LDTs from the appropriate regulatory authorities, such as the Centers for Medicare & Medicaid Services, or CMS, which oversees CLIA, and various state regulatory bodies. Certain states, such as New York and Florida, require us to obtain approval of our proprietary tests in order for us to be paid for testing patient specimens from that state. We are currently in the process of addressing the requirements for licensure in New York, and we have all required licenses and approvals from all other states.

Clinical Trial Services

Industry research has shown many promising drugs have produced disappointing results in clinical trials. For example, a study by Princess Margaret Hospital in Toronto estimated that 85% of the phase III trials testing new therapies for solid tumors studied over a five-year period failed to meet their primary endpoint. Given such a high failure rate of oncology drugs in clinical development, combined with constrained budgets for biopharmaceutical companies, there is a significant need for drug developers to utilize molecular diagnostics to decrease these failure rates. For specific molecular-targeted therapeutics, the identification of appropriate biomarkers potentially may help to optimize clinical trial patient selection and success rates by helping clinicians identify patients that are most likely to benefit from a therapy based on their individual genetic profile.

Although historically the bulk of our commercial revenues have come from performing our breast cancer test, we also offer clinical trial testing services to help increase the efficiency and economic viability of clinical trials for biopharmaceutical companies and clinical research organizations. Our clinical trial services could include developing customizable tests and techniques utilizing our proprietary CTC and ctDNA technologies to provide sensitive, real-time characterization of individual patient’s tumors using a standard blood sample. These tests may also be useful as, and ultimately developed into, companion diagnostics associated with a specific therapeutic. Additionally, through our services we hope to gain further insights into disease progression and the latest drug development that we can incorporate into our proprietary tests and services.

- 6 -

Table of Contents

Risks That We Face

An investment in our common stock involves a high degree of risk. You should carefully consider the risks summarized below. The risks are discussed more fully in the “Risk Factors” section of this prospectus immediately following this prospectus summary. These risks include, but are not limited to, the following:

| • | we are an early-stage company with an accumulated deficit of approximately $117 million (at June 30, 2013). Before 2008, we were pursuing a business plan relating to fetal genetic disorders and other fields, all of which were unrelated to cancer diagnostics. The portion of our accumulated deficit that relates to the period from inception through December 31, 2007 is approximately $66.5 million. |

| • | we may never achieve sustained profitability; |

| • | our business depends upon our ability to introduce additional tests and increase sales of our cancer diagnostic test; |

| • | our current cash resources are insufficient to fund our operations without this offering; |

| • | our business depends on executing on our sales and marketing strategy for our cancer diagnostic tests and gaining acceptance of our current test and future tests in the market; |

| • | our business depends on our ability to continually develop new cancer diagnostic tests and enhance our current test and future tests; |

| • | our business depends on being able to obtain adequate reimbursement from governmental and other third-party payors for tests and services; |

| • | our business depends on satisfying any applicable United States (including FDA) and international regulatory requirements with respect to tests and services; and many of these requirements are new and still evolving; |

| • | our business depends on our ability to effectively compete with other diagnostic tests, methods and services that now exist or may hereafter be developed; |

| • | we depend on our senior management and in August 2013 we hired a new chief executive officer; |

| • | we depend on our ability to attract and retain scientists, clinicians and sales personnel with extensive experience in oncology, who are in short supply; and |

| • | we need to obtain or maintain patents or other appropriate protection for the intellectual property utilized in our current and planned proprietary tests and services. |

Company Information

We maintain our principal executive offices at 5810 Nancy Ridge Drive, San Diego, California 92121. Our telephone number is (858) 320-8200 and our website address is www.biocept.com. The information contained in, or that can be accessed through, our website is not incorporated into and is not part of this prospectus. We were incorporated in California on May 12, 1997 and reincorporated as a Delaware corporation on July 30, 2013.

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or JOBS Act, enacted in April 2012. An “emerging growth company” may take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| • | being permitted to present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations in this prospectus; |

| • | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act; |

| • | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and |

| • | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

- 7 -

Table of Contents

We may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the date of the first sale of our common equity securities pursuant to an effective registration statement under the Securities Act of 1933, as amended, or the Securities Act, which such fifth anniversary will occur in 2018. However, if certain events occur before the end of such five-year period, including if we become a “large accelerated filer,” our annual gross revenues exceed $1.0 billion or we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company before the end of such five-year period.

We have elected to take advantage of certain of the reduced disclosure obligations and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information that we provide to our stockholders may be different than the information you might receive from other public reporting companies in which you hold equity interests.

The Offering

| Common stock offered by us |

[ ] shares of our common stock. |

| Over-allotment option |

We have granted the underwriters a 45-day option to purchase up to [ ] additional shares of our common stock from us at the public offering price less underwriting discounts and commissions. |

| Common stock outstanding after this offering |

[ ] shares. |

| Use of proceeds |

We estimate that the net proceeds from our sale of shares of our common stock in this offering will be approximately $[ . ] million, or approximately $[ . ] million if the underwriters exercise their over-allotment option in full, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We currently expect to use the net proceeds from this offering as follows: |

| • | approximately $5 million to hire sales and marketing personnel and support increased sales and marketing activities; |

| • | approximately $5 million to fund further research and development, clinical utility studies and future enhancements of our current proprietary test and our planned proprietary tests and services; |

| • | approximately $3 million to acquire equipment, implement automation and scale our capabilities to prepare for significant test volume; |

| • | approximately $1 million to satisfy deferred salary obligations; and |

| • | the balance for general corporate purposes and to fund ongoing operations and expansion of our business. |

| For additional information please refer to the section entitled “Use of Proceeds” on page 42 of this prospectus. |

| Risk Factors |

See the section entitled “Risk Factors” beginning on page 12 of this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

| NASDAQ Capital Market symbol |

BIOC. |

- 8 -

Table of Contents

The number of shares of our common stock to be outstanding after this offering is based on 255,376 shares of our common stock outstanding as of June 30, 2013 and excludes as of such date:

| • | 73,899 shares of our common stock issuable upon the exercise of stock options as of June 30, 2013, with a weighted average exercise price of $3.54 per share; |

| • | 45,873 shares of our common stock issuable upon the exercise of outstanding restricted stock units as of June 30, 2013; |

| • | other shares of our common stock reserved for future issuance under our 2013 and 2007 Equity Incentive Plans; |

| • | an estimated 424,178 shares of our common stock issuable upon the exercise of outstanding common stock warrants as of June 30, 2013, at an estimated weighted average exercise price of $4.31 per share; |

| • | 269,184 common stock equivalents issuable upon the exercise of our outstanding warrants to purchase preferred stock (the warrants overlying all but 2,222 of which will terminate upon the closing of our initial public offering in accordance with their terms); |

| • | any shares of our common stock issuable upon exercise of the underwriters’ over-allotment option; and |

| • | any shares of common stock that will underlie the representative’s warrant. |

Unless otherwise indicated, this prospectus reflects and assumes the following:

| • | the filing of our amended certificate of incorporation and the adoption of our amended and restated bylaws, which will occur immediately before the closing of this offering; |

| • | a 1-for-10 reverse stock split of our common stock to be effected before the completion of this offering; |

| • | the automatic conversion of all outstanding shares of our Series A preferred stock into 2,314,001 (post-reverse-split) shares of our common stock immediately before the closing of the offering; |

| • | the automatic issuance of an estimated 46,422 (post-reverse-split) shares of common stock immediately before or immediately after the closing of the offering, pursuant to the terms of certain outstanding restricted stock units currently expressed in shares of Series A preferred stock; but otherwise no settlement of the outstanding restricted stock units described above; |

| • | the automatic conversion of all outstanding convertible notes, at a conversion price equal to the public offering price per share of this offering, into shares of common stock upon the closing of this offering; |

| • | no exercise of the outstanding options or warrants described above; |

| • | no exercise by the underwriters of their option to purchase additional shares of our common stock to cover over-allotments, if any; |

| • | the issuance of the warrants to be issued to the representative of the underwriters in connection with this offering as described in the “Underwriting—Representative’s Warrants” section of this prospectus; and |

| • | no exercise by the representative of the underwriters of such representative’s warrants. |

- 9 -

Table of Contents

The following tables set forth a summary of our historical financial data as of, and for the period ended on, the dates indicated. We have derived the statement of operations data for the years ended December 31, 2011 and 2012 and the balance sheet data as of December 31, 2012 from our audited financial statements appearing elsewhere in this prospectus. We have derived the statements of operations data for the six months ended June 30, 2012 and 2013 and balance sheet data as of June 30, 2013 from our unaudited financial statements appearing elsewhere in this prospectus. All “Weighted average shares outstanding” data and all “Net loss per common share” data, whether derived from our audited financial statements or from our unaudited financial statements, have been adjusted to reflect a 1-for-10 reverse stock split which we intend to effect before the effective date of this prospectus. The unaudited financial statements have been prepared on a basis consistent with our audited financial statements included in this prospectus and, in the opinion of management, reflect all adjustments, consisting only of normal recurring adjustments, necessary to fairly state our financial position as of June 30, 2013 and results of operations for the six months ended June 30, 2012 and 2013. You should read this data together with our financial statements and related notes appearing elsewhere in this prospectus and the sections in this prospectus entitled “Capitalization,” “Selected Historical Financial Data,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our historical results for any prior period are not necessarily indicative of our future results.

| Year ended December 31, | For the six months ended June 30, | |||||||||||||||

| 2011 | 2012 | 2012 | 2013 | |||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||

| (in thousands, except share and per share data) | ||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||

| Revenues |

$ | 1 | $ | 109 | $ | 64 | $ | 84 | ||||||||

| Cost of revenues |

17 | 1,201 | 465 | 1,141 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit |

(16 | ) | (1,092 | ) | (401 | ) | (1,057 | ) | ||||||||

| Research and development expenses |

8,853 | 6,562 | 3,797 | 1,401 | ||||||||||||

| General and administrative expenses |

2,729 | 2,063 | 1,165 | 929 | ||||||||||||

| Sales and marketing expenses |

673 | 786 | 402 | 124 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from operations |

(12,271 | ) | (10,503 | ) | (5,765 | ) | (3,511 | ) | ||||||||

| Total other income/(expense) |

(1,357 | ) | (1,756 | ) | (677 | ) | (389 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss Before Income Taxes |

$ | (13,628 | ) | $ | (12,259 | ) | $ | (6,442 | ) | $ | (3,900 | ) | ||||

| Income tax expense |

1 | 1 | 1 | 1 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss & comprehensive loss |

$ | (13,629 | ) | $ | (12,260 | ) | $ | (6,443 | ) | $ | (3,901 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average shares outstanding used in computing net loss per common share: |

||||||||||||||||

| Basic |

159,377 | 224,672 | 224,672 | 252,751 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted |

159,377 | 224,672 | 224,672 | 252,751 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss per common share |

||||||||||||||||

| Basic |

$ | (85.52 | ) | $ | (54.57 | ) | $ | (28.68 | ) | $ | (15.43 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

- 10 -

Table of Contents

| Year ended December 31, | For the six months ended June 30, | |||||||||||||||

| 2011 | 2012 | 2012 | 2013 | |||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||

| (in thousands, except share and per share data) | ||||||||||||||||

| Diluted |

$ | (85.52 | ) | $ | (54.57 | ) | $ | (28.68 | ) | $ | (15.43 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| As of December 31, 2012 | As of June 30, 2013 | |||||||||||

| Actual | Actual | Pro Forma(1) | ||||||||||

| (Unaudited) | (Unaudited) | |||||||||||

| Balance Sheet Data: |

||||||||||||

| Cash and cash equivalents |

$ | 185 | $ | 4 | $ | |||||||

| Total assets |

$ | 1,470 | $ | 992 | $ | |||||||

| Notes payable, net of debt discount |

$ | 22,376 | $ | 3,816 | $ | |||||||

| Total liabilities |

$ | 28,855 | $ | 9,207 | $ | |||||||

| Convertible preferred stock |

$ | 3 | $ | 7 | $ | |||||||

| Total shareholders’ deficit |

$ | (27,385 | ) | $ | (8,215 | ) | $ | |||||

| (1) | Gives effect to (i) the automatic conversion of all outstanding shares of our Series A preferred stock (including shares issued in July 2013 which, as of June 30, 2013, were classified as to-be-issued for conversion of debt and accrued interest) into 2,314,001 shares of common stock, (ii) the conversion of convertible promissory notes and accrued interest in the amount of $[ ] million into an aggregate of [ ] shares of our common stock in connection with the closing of our initial public offering, (iii) the issuance of an estimated 46,422 shares of common stock upon such initial public offering pursuant to the settlement of certain restricted stock units (which are currently expressed in shares of preferred stock) in accordance with their terms, (iv) the termination of certain warrants upon the closing of our initial public offering in accordance with their terms and (v) the reclassification to shareholders’ deficit of the fair value of certain warrants the exercise price and/or exercisability period length of which will be fixed upon the closing of our initial public offering in accordance with their terms, assuming for all such items an initial public offering price of $[ ] per share, the midpoint of the price range listed on the cover page of this prospectus. The pro forma information is illustrative only and will be adjusted based on the actual initial public offering price and other terms of our initial public offering determined at pricing. |

The unaudited pro forma balance sheet information as of June 30, 2013 assumes that the completion of our initial public offering had occurred as of June 30, 2013 and excludes shares of common stock issued in the initial public offering and any related net proceeds.

- 11 -

Table of Contents

An investment in our common stock involves a high degree of risk. You should consider carefully the specific risk factors described below in addition to the other information contained in this prospectus, including our financial statements and related notes and Management’s Discussion and Analysis of Financial Condition and Results of Operations included elsewhere in the prospectus, before making your investment decision. The occurrence of any of the events or developments described below could harm our business, financial condition, results of operations and growth prospects. In such an event, the market price of our common stock could decline, and you may lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations.

Risks Relating to Our Financial Condition and Capital Requirements

We are an early stage company with a history of net losses; we expect to incur net losses in the future, and we may never achieve sustained profitability.

We have historically incurred substantial net losses, including net losses of $13.6 million in 2011, $12.3 million in 2012 and $3.9 million in the first six months of 2013, and we have never been profitable. At June 30, 2013, our accumulated deficit was approximately $117 million. Before 2008, we were pursuing a business plan relating to fetal genetic disorders and other fields, all of which were unrelated to cancer diagnostics. The portion of our accumulated deficit that relates to the period from inception through December 31, 2007 is approximately $66.5 million.

We expect our losses to continue as a result of costs relating to our lab operations as well as increased sales and marketing costs and ongoing research and development expenses. These losses have had, and will continue to have, an adverse effect on our working capital, total assets and stockholders’ equity. Because of the numerous risks and uncertainties associated with our commercialization efforts, we are unable to predict when we will become profitable, and we may never become profitable. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis. Our inability to achieve and then maintain profitability would negatively affect our business, financial condition, results of operations and cash flows. Our chief executive officer Michael W. Nall, who joined us in August 2013, has not previously been the chief executive officer of a public or private company.

Our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern.

As described in Note 2 of our accompanying audited financial statements, our auditors have included a “going concern” provision in their opinion on our financial statements, expressing substantial doubt that we can continue as an ongoing business for the next twelve months. Our financial statements do not include any adjustments that may result from the outcome of this uncertainty. If we cannot secure the financing needed to continue as a viable business, our stockholders may lose some or all of their investment in us.

We will need to raise additional capital.

We believe our current cash resources and committed borrowing capacity are sufficient to satisfy our liquidity requirements at our current level of operations only into November of 2013. We need to raise additional financing by the fourth quarter of 2013, through this offering or otherwise, to fund our current level of operations. Such financing may not be available to us on favorable terms, if at all. Without proceeds from this offering or other sources of financing, we would need to scale back our general and administrative activities and certain of our research and development activities. Our forecast pertaining to the adequacy of our current financial resources supporting our current level of operations until the fourth quarter of 2013 is a forward-looking statements and involves risks and uncertainties.

We will also need to raise additional capital to expand our business to meet our long-term business objectives. Additional financing, which is not in place at this time, may be from the sale of equity or convertible or other debt securities in a public or private offering, from an additional credit facility or strategic partnership coupled with an investment in us or a combination of both. We may be unable to raise sufficient additional financing on terms that are acceptable to us, if at all. Failure to raise additional capital in sufficient amounts would significantly impact our ability to expand our business. For further discussion of our liquidity requirements as they relate to our long-term plans, see the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.”

- 12 -

Table of Contents

Risks Relating to Our Business and Strategy

If we are unable to increase sales of our OncoCEE-BR breast cancer diagnostic tests or successfully develop and commercialize other proprietary tests, our revenues will be insufficient for us to achieve profitability.

We currently derive substantially all of our revenues from sales of cancer diagnostic tests. We recently began offering our OncoCEE-BR breast cancer test through our CLIA-accredited and state licensed laboratory. We are in varying stages of research and development for other cancer diagnostic tests that we may offer. If we are unable to increase sales of our OncoCEE-BR breast cancer diagnostic test or successfully develop and commercialize other cancer diagnostic tests, we will not produce sufficient revenues to become profitable.

- 13 -

Table of Contents

If we are unable to execute our sales and marketing strategy for cancer diagnostic tests and are unable to gain acceptance in the market, we may be unable to generate sufficient revenue to sustain our business.

We are an early-stage company and have engaged in only limited sales and marketing activities for the OncoCEE-BR breast cancer diagnostic tests we offer through our CLIA laboratory. To date, we have received very limited revenue.

Although we believe that our current test and our planned diagnostic tests represent a promising commercial opportunity, our tests may never gain significant acceptance in the marketplace and therefore may never generate substantial revenue or profits for us. We will need to establish a market for our cancer diagnostic tests and build that market through physician education, awareness programs and the publication of clinical trial results. Gaining acceptance in medical communities requires publication in leading peer-reviewed journals of results from studies using our current test and/or our planned cancer tests. The process of publication in leading medical journals is subject to a peer review process and peer reviewers may not consider the results of our studies sufficiently novel or worthy of publication. Failure to have our studies published in peer-reviewed journals would limit the adoption of our current test and our planned tests.

Our ability to successfully market the cancer diagnostic tests that we may develop will depend on numerous factors, including:

| • | conducting clinical utility studies of such tests in collaboration with key thought leaders to demonstrate their use and value in important medical decisions such as treatment selection; |

| • | whether healthcare providers believe such diagnostic tests provide clinical utility; |

| • | whether the medical community accepts that such diagnostic tests are sufficiently sensitive and specific to be meaningful in patient care and treatment decisions; and |

| • | whether health insurers, government health programs and other third-party payors will cover and pay for such cancer diagnostic tests and, if so, whether they will adequately reimburse us. |

Failure to achieve widespread market acceptance of our current test and our planned cancer diagnostic tests would materially harm our business, financial condition and results of operations.

If we cannot develop tests to keep pace with rapid advances in technology, medicine and science, our operating results and competitive position could be harmed.

In recent years, there have been numerous advances in technologies relating to the diagnosis and treatment of cancer. Several new cancer drugs have been approved, and a number of new drugs in clinical development may increase patient survival time. There have also been advances in methods used to identify patients likely to benefit from these drugs based on analysis of biomarkers. We must continuously develop new cancer diagnostic tests and enhance any existing tests to keep pace with evolving standards of care. Our current test and our planned tests could become obsolete unless we continually innovate and expand them to demonstrate benefit in the diagnosis, monitoring or prognosis of patients with cancer. New cancer therapies typically have only a few years of clinical data associated with them, which limits our ability to develop cancer diagnostic tests based on, for example, biomarker analysis related to the appearance or development of resistance to those therapies. If we cannot adequately demonstrate the applicability of our current test and our planned tests to new treatments, by incorporating important biomarker analysis, sales of our tests could decline, which would have a material adverse effect on our business, financial condition and results of operations.

If our current test and our planned tests do not continue to perform as expected, our operating results, reputation and business will suffer.

Our success depends on the market’s confidence that we can continue to provide reliable, high-quality diagnostic results. We believe that our customers are likely to be particularly sensitive to test defects and errors. As a result, the failure of our current or planned tests to perform as expected would significantly impair our reputation and the public image of our cancer tests, and we may be subject to legal claims arising from any defects or errors.

- 14 -

Table of Contents

If our sole laboratory facility becomes damaged or inoperable, or we are required to vacate the facility, our ability to sell and provide cancer diagnostic tests and pursue our research and development efforts may be jeopardized.

We currently derive our revenues from our OncoCEE-BR breast cancer diagnostic tests conducted in our CLIA laboratory. We do not have any clinical reference laboratory facilities outside of our facility in San Diego, California. Our facilities and equipment could be harmed or rendered inoperable by natural or man-made disasters, including fire, earthquake, flooding and power outages, which may render it difficult or impossible for us to perform our diagnostic tests for some period of time. The inability to perform our current test and our planned tests or the backlog of tests that could develop if our facility is inoperable for even a short period of time may result in the loss of customers or harm to our reputation or relationships with scientific or clinical collaborators, and we may be unable to regain those customers or repair our reputation in the future. Furthermore, our facilities and the equipment we use to perform our research and development work could be costly and time-consuming to repair or replace.

The San Diego area has recently experienced serious fires and power outages, and is considered to lie in an area with earthquake risk.

Additionally, a key component of our research and development process involves using biological samples as the basis for our diagnostic test development. In some cases, these samples are difficult to obtain. If the parts of our laboratory facility where we store these biological samples were damaged or compromised, our ability to pursue our research and development projects, as well as our reputation, could be jeopardized. We carry insurance for damage to our property and the disruption of our business, but this insurance may not be sufficient to cover all of our potential losses and may not continue to be available to us on acceptable terms, if at all.

Further, if our CLIA laboratory became inoperable we may not be able to license or transfer our proprietary technology to another facility with the necessary state licensure and CLIA accreditation under the scope of which our current test and our planned cancer diagnostic tests could be performed. Even if we find a facility with such qualifications to perform Biocept tests, it may not be available to us on commercially reasonable terms.

If we cannot compete successfully with our competitors, we may be unable to increase or sustain our revenues or achieve and sustain profitability.

Our principal competition comes from mainstream diagnostic methods, used by pathologists and oncologists for many years, which focus on tumor tissue analysis. It may be difficult to change the methods or behavior of oncologists to incorporate our CTC and ctDNA testing, including molecular diagnostic testing, in their practices in conjunction with or instead of tissue biopsies and analysis. In addition, companies offering capital equipment and kits or reagents to local pathology laboratories represent another source of potential competition. These kits are used directly by the pathologist, which can facilitate adoption. We plan to focus our marketing and sales efforts on medical oncologists rather than pathologists.

We also face competition from companies that offer products or are conducting research to develop products for CTC or ctDNA testing in various cancers. In particular, Janssen Diagnostics, LLC markets its CellSearch® test and Atossa Genetics markets its ArgusCYTE® test, which are competitive to our OncoCEE-BR test for CTC enumeration, and HER2 analysis, respectively. CTC and ctDNA testing is a new area of science and we cannot predict what tests others will develop that may compete with or provide results similar or superior to the results we are able to achieve with the tests we develop. In addition to Janssen Diagnostics and Atossa Genetics, our competitors also include public companies such as Alere (Adnagen) and Illumina as well as many private companies, including Apocell, EPIC Sciences, Clearbridge Biomedics, Cynvenio Biosystems, Fluxion Biosciences, RareCells, ScreenCell and Silicon Biosystems. Many of these groups, in addition to operating research and development laboratories, are establishing CLIA-certified testing laboratories while others are focused on selling equipment and reagents.

We expect that pharmaceutical and biopharmaceutical companies will increasingly focus attention and resources on the personalized cancer diagnostic sector as the potential and prevalence of molecularly targeted oncology therapies approved by the FDA along with companion diagnostics increases. For example, the FDA has recently approved two such agents—Xalkori® from Pfizer Inc. along with its companion anaplastic lymphoma kinase FISH test from Abbott Laboratories, Inc., Zelboraf® from Daiichi-Sankyo/Genentech/Roche along with its companion B-raf kinase V600 mutation

- 15 -

Table of Contents

test from Roche Molecular Systems, Inc. and Tafinlar® from GlaxoSmithKline along with its companion B-raf kinase V600 mutation test from bioMerieux. These recent FDA approvals are only the second, third and fourth instances of simultaneous approvals of a drug and companion diagnostic, the first being the 1998 approval of Genentech’s Herceptin® for HER2 positive breast cancer along with the HercepTest from partner Dako A/S. Our competitors may invent and commercialize technology platforms or tests that compete with ours.

There are a number of companies which are focused on the oncology diagnostic market, such as Biodesix, Caris, Clarient, Foundation Medicine, Neogenomics, Response Genetics, Agendia, Genomic Health, and Genoptix, who while not currently offering CTC or ctDNA tests are selling to the medical oncologists and pathologists. Large laboratory services companies, such as Sonic USA, Quest and LabCorp, provide more generalized cancer diagnostic testing.

Additionally, projects related to cancer diagnostics and particularly genomics have received increased government funding, both in the United States and internationally. As more information regarding cancer genomics becomes available to the public, we anticipate that more products aimed at identifying targeted treatment options will be developed and that these products may compete with ours. In addition, competitors may develop their own versions of our current or planned tests in countries where we did not apply for patents or where our patents have not issued and compete with us in those countries, including encouraging the use of their test by physicians or patients in other countries.

Some of our present and potential competitors have widespread brand recognition and substantially greater financial and technical resources and development, production and marketing capabilities than we do. Others may develop lower-priced, less complex tests that payors, pathologists and oncologists could view as functionally equivalent to our current or planned tests, which could force us to lower the list price of our tests and impact our operating margins and our ability to achieve and maintain profitability. In addition, technological innovations that result in the creation of enhanced diagnostic tools that are more sensitive or specific than ours may enable other clinical laboratories, hospitals, physicians or medical providers to provide specialized diagnostic tests similar to ours in a more patient-friendly, efficient or cost-effective manner than is currently possible. If we cannot compete successfully against current or future competitors, we may be unable to increase or create market acceptance and sales of our current or planned tests, which could prevent us from increasing or sustaining our revenues or achieving or sustaining profitability.

We expect to continue to incur significant expenses to develop and market cancer diagnostic tests, which could make it difficult for us to achieve and sustain profitability.

In recent years, we have incurred significant costs in connection with the development of cancer diagnostic tests. For the year ended December 31, 2011, our research and development expenses were $8.9 million and our sales and marketing expenses were $0.7 million. For the year ended December 31, 2012, our research and development expenses were $6.6 million and our sales and marketing expenses were $0.8 million. We expect our expenses to continue to increase for the foreseeable future as we conduct studies of our current test and our planned cancer diagnostic tests, establish a sales and marketing organization, drive adoption of and reimbursement for our diagnostic tests and develop new tests. As a result, we need to generate significant revenues in order to achieve sustained profitability.

If oncologists decide not to order OncoCEE-BR breast cancer diagnostic tests or our future cancer diagnostic tests, we may be unable to generate sufficient revenue to sustain our business.

To generate demand for our current test and our planned cancer diagnostic tests, we will need to educate oncologists, pathologists, and other health care professionals on the clinical utility, benefits and value of the tests we provide through published papers, presentations at scientific conferences, educational programs and one-on-one education sessions by members of our sales force. In addition, we need to assure oncologists of our ability to obtain and maintain adequate reimbursement coverage from third-party payors. We need to hire additional commercial, scientific, technical and other personnel to support this process. If we cannot convince medical practitioners to order our current test and our planned tests, we will likely be unable to create demand in sufficient volume for us to achieve sustained profitability.

- 16 -

Table of Contents

Clinical utility studies are important in demonstrating to both customers and payors a test’s clinical relevance and value. If we are unable to identify collaborators willing to work with us to conduct clinical utility studies, or the results of those studies do not demonstrate that a test provides clinically meaningful information and value, commercial adoption of such test may be slow, which would negatively impact our business.

Clinical utility studies show when and how to use a clinical test, and describe the particular clinical situations or settings in which it can be applied and the expected results. Clinical utility studies also show the impact of the test results on patient care and management. Clinical utility studies are typically performed with collaborating oncologists at medical centers and hospitals, analogous to a clinical trial, and generally result in peer-reviewed publications. Sales and marketing representatives use these publications to demonstrate to customers how to use a clinical test, as well as why they should use it. These publications are also used with payors to obtain coverage for a test, helping to assure there is appropriate reimbursement.