UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2021

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

| For the transition period from__________ to____________ | |||||

Commission file number 001-34501

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||||||||

| (Address of principal executive offices) | (Zip code) | ||||||||||

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filings requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | Emerging growth company | |||||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of voting common stock held by non-affiliates of the registrant was approximately $8,749,000,000 as of June 30, 2021, the last business day of the registrant’s most recently completed second fiscal quarter (based on the closing sales price for the common stock on the New York Stock Exchange on such date).

As of February 9, 2022, there were 322,758,505 shares of the registrant's common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Juniper Networks, Inc.

Form 10-K

Table of Contents

| Page | |||||||||||

3

Forward-Looking Statements

This Annual Report on Form 10-K, which we refer to as the Report, including “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 regarding future events and the future results of Juniper Networks, Inc., which we refer to as “Juniper Networks,” “Juniper,” “we,” “us,” or the “Company,” that are based on our current expectations, estimates, forecasts, and projections about our business, our results of operations, the industry in which we operate and the beliefs and assumptions of our management. All statements other than statement of historical facts are statements that could be deemed to be forward-looking statements. Words such as “expects,” “anticipates,” “targets,” “goals,” “projects,” "will," “would,” “could,” “intends,” “plans,” “believes,” “seeks,” “estimates,” variations of such words, and similar expressions are intended to identify such forward-looking statements. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, and these forward-looking statements are only predictions and are subject to risks, uncertainties, and assumptions that are difficult to predict, including the duration, extent, and continuing impact of the COVID-19 pandemic and the global semiconductor shortage, and our ability to successfully manage the demand, supply, and operational challenges associated with the COVID-19 pandemic and the global semiconductor shortage. Therefore, actual results may differ materially and adversely from those expressed in any forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, those discussed in this Report under the section entitled “Risk Factors” in Item 1A of Part I and elsewhere, and in other reports we file with the U.S. Securities and Exchange Commission, or the SEC. In addition, many of the foregoing risks and uncertainties are, and could be, exacerbated by the COVID-19 pandemic and any worsening of the global business and economic environment as a result of the pandemic. While forward-looking statements are based on reasonable expectations of our management at the time that they are made, you should not rely on them. We undertake no obligation to revise or update publicly any forward-looking statements for any reason, except as required by applicable law.

PART I

ITEM 1. Business

Overview

Juniper Networks designs, develops, and sells products and services for high-performance networks to enable customers to build scalable, reliable, secure, and cost-effective networks for their businesses, while achieving agility and improved operating efficiency through automation. Our high-performance network and service offerings include routing, switching, Wi-Fi, network security, artificial intelligence ("AI") or AI-enabled enterprise networking operations ("AIOps"), and software-defined networking ("SDN") technologies. In addition to our products, we offer our customers a variety of services, including maintenance and support, professional services, Software-as-a-Service ("SaaS"), and education and training programs. We sell our solutions in more than 150 countries in three geographic regions: Americas; Europe, Middle East, and Africa, which we refer to as EMEA; and Asia Pacific, which we refer to as APAC.

Our products and services address high-performance network requirements for our customers within our verticals: Cloud, Service Provider, and Enterprise who view the network as critical to their success. We believe our silicon, systems, and software represent innovations that transform the economics and experience of networking, helping our customers achieve superior performance, greater choice, and flexibility, while reducing overall total cost of ownership.

Further, we have been expanding our software business by introducing new software solutions to our product and service portfolios that simplify the operation of networks, and allow our customers across our key verticals flexibility in consumption and deployment. Our acquisition of Mist Systems, Inc. ("Mist") in 2019 accelerated our ability to execute this belief in cloud-managed AI or AIOps through a combination of cloud-based intelligence, enterprise-grade access points, and EX series switches. Machine learning technology simplifies wireless and wired operations and delivers a more agile cloud services platform. In 2020, we acquired 128 Technology, Inc. ("128 Technology") and Netrounds. Our Session Smart Router ("SSR") portfolio acquired from 128 Technology extended the value of Mist’s secure AI-engine and cloud management capabilities from client to cloud. Also, our acquisition of Netrounds enables service and cloud providers to rapidly deliver software-defined network services with end-to-end service quality. In 2021, we acquired Apstra, Inc. ("Apstra"), an intent-based networking solution that leverages closed-loop automation and assurance along with multivendor support to provide a complete fabric management solution. Additionally, in 2021, we announced an IP licensing arrangement with Netsia, Inc. ("Netsia"), giving us exclusive rights to their RAN Intelligent Controller ("RIC") source code and patents, and expanded our existing team of Open RAN ("O-RAN") and 5G with key subject matter experts from Netsia.

4

Our corporate headquarters are located in Sunnyvale, California. Our website address is www.juniper.net.

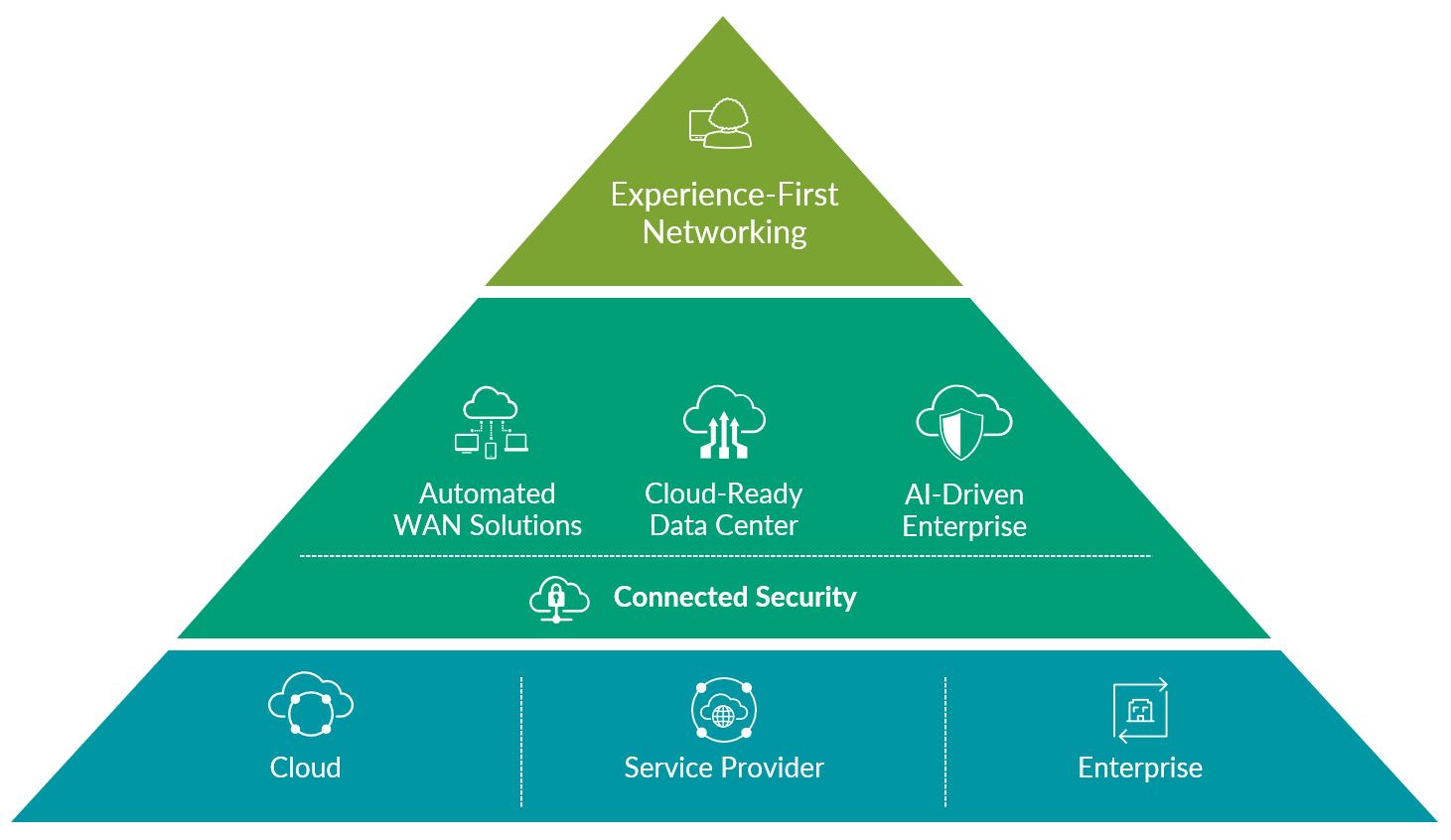

Strategy

We deliver highly scalable, reliable, secure, and cost-effective networks, while transforming the network's agility, efficiency, and value through automation. Our research and development efforts are focused on the following strategic priorities:

•Seize the cloud transition to gain share across our three customer verticals: Cloud, Service Provider, and Enterprise

•Differentiate with innovation in networking, security and software orchestration

•Leverage automation and AI to deliver simplicity of operations for our customers

We believe the networking needs for our customers in our Cloud, Service Provider, and Enterprise verticals are converging as these customers recognize the need for high-performance networks and are adopting cloud architectures for their infrastructure and service delivery, such as large public and private data centers and service provider edge data centers, for improved agility and greater levels of operating efficiency. We believe this industry trend presents an opportunity for us, and we have focused our strategy on maximizing user and IT experiences with secure client-to-cloud automation, insight, and AI-driven actions that we call Experience-First Networking. We have focused our strategy on providing customer solutions for the following use cases and verticals.

Cloud-Ready Data Center

We are focused on continuing to power public and private cloud data centers with high-performance infrastructure. These data centers are the core of cloud transformation by enabling service delivery in a hybrid cloud environment, which is a combination of public cloud, private cloud, and SaaS delivery. We are a recognized leader in data center networking innovation in both software and hardware solutions. Our Junos Operating System, or Junos OS, application-specific integrated circuits, or ASIC, technology, and management and automation software investments across routing, switching, and network security technologies will continue to be key elements to maintaining our technology leadership and transforming the economics and experience of our public and private cloud customers. In 2019, we introduced our next-generation operating system, Junos Evolved, which enables higher availability, accelerated deployment, greater innovation, and improved operational efficiencies. In 2020, we accelerated our investments in operations experience focused automation, to stay ahead of an industry-wide trend to address size and complexity of data centers driven by a rapidly increasing number of cloud-ready workloads. Our Apstra intent-based networking technology enables users to minimize the time and costs associated with deploying and managing complex data center networks.

5

Our Service Provider customers are investing in the build-out of high-performance networks and distributed cloud environments to enable high-speed and low-latency applications. We are committed to support them to rearchitect their infrastructure to enable next-generation mobile network build-outs, or 5G, Internet of Things, or IoT, and service delivery close to their end users.

Automated Wide Area Networking Solutions

In developing our solutions, we strive to design and build best-in-class products and solutions for core, edge, and metro networking infrastructure for connecting users and devices securely to the cloud and to each other. Cloud providers, service providers and enterprises have deployed our product offerings in their wide area networks, or WAN, such as our highly efficient Internet Protocol, or IP, transport PTX product which can cost effectively manage incredible capacity from their end users to the data centers from which they deliver value to those users. We also offer a robust portfolio of SDN-enabled MX series routing platforms that provide system capacity, density, security, and performance with investment protection. MX series routers play at the heart of the digital transformation that service providers, cloud providers, and Enterprises are undergoing. Our SDN Controller for the WAN, Paragon Pathfinder (formerly NorthStar), enables granular visibility and control of IP/Multiprotocol Label Switching, or IP/MPLS, flows for large networks. Our acquisition of Netrounds enhanced our automated WAN solutions with innovative testing and service assurance capabilities for fixed and mobile networks. Netrounds’ solutions (named Paragon Active Assurance) strengthened and complemented our existing capabilities, such as Paragon Insights (formerly Healthbot), Paragon Pathfinder, Paragon Planner, and our partnership with Anuta Networks International LLC to simplify network operations. Leveraging the Netrounds acquisition, we developed the Juniper Paragon Automation, which is a modular portfolio of cloud-native software applications that deliver closed-loop automation in the most demanding 5G and multicloud environments. We are committed to continued investment in cost effective and high-performance IP transport platforms and automation software, which form the basis of these high-performance networks.

AI-Driven Enterprise

Enterprises are consuming more value-as-a-service, where value is delivered in the form of cloud-based software and services driven by AI. We have introduced cloud management and security products, which enable enterprises to consume cloud infrastructure and services securely. We believe the transition to AIOps and SaaS presents an opportunity for us to come to market with innovative network and security solutions for our Enterprise customers, which facilitate their transition to cloud architecture and operational experience. Our Mist AI uses a combination of artificial intelligence, machine learning, and data science techniques to optimize user experiences and simplify operations across the wireless access, wired access, and SD-WAN domains. Machine learning technology simplifies wireless and wired operations and delivers a more agile cloud services platform. Also, our SSR portfolio acquired from 128 Technology extended the value of Mist’s secure AI-engine and cloud management capabilities from client to cloud. Session Smart is the third generation of Software Defined-Wide Area Network (“SD-WAN”), which delivers unique technology that materially reduces WAN overhead, minimizes network latency, and replaces outdated and cumbersome network policies with flexible and real-time actions that are tied to real business and user needs. In recognition of our ability to execute and the completeness of our vision, Juniper was recognized as a Gartner Magic Quadrant Leader for Enterprise Wired and Wireless LAN Infrastructure in 2021, for the second year in a row.

We believe our understanding of high-performance networking technology, cloud architecture, and our strategy, positions us to capitalize on the industry transition to more automated, cost-efficient, scalable networks.

6

Customer Verticals

We sell our high-performance network products and service offerings through direct sales; distributors; value-added resellers, or VARs; and original equipment manufacturers, or OEMs, to end-users in the following verticals: Cloud, Service Provider, and Enterprise.

Further, we believe our solutions benefit our customers by:

•Reducing capital and operational costs by running multiple services over the same network using our secure, high density, highly automated, and highly reliable platforms;

•Creating new or additional revenue opportunities by enabling new services to be offered to new market segments, which includes existing customers and new customers, based on our product capabilities;

•Increasing customer satisfaction, while lowering costs, by optimizing the experience of network operators and their users via automation, AI-enabled troubleshooting and support, and cloud-management;

•Providing increased asset longevity and higher return on investment as our customers' networks can scale to higher throughput based on the capabilities of our platforms;

•Offering network security across every environment—from the data center to campus and branch environments to assist in the protection and recovery of services and applications; and

•Offering operational improvements that enable cost reductions, including lower administrative, training, customer care, and labor costs.

The following is an overview of the trends affecting the market in which we operate by each of our customer verticals. We believe the networking needs for each of our customers will eventually result in cloud-based network architectures for improved agility and greater levels of operating efficiency.

Cloud

Our Cloud vertical includes companies that are heavily reliant on the cloud for their business model’s success. Customers in the Cloud vertical can include cloud service providers, such as the largest public cloud providers, which we refer to as hyperscalers, and Tier-2 cloud providers, as well as enterprises that provide SaaS; infrastructure-as-a-service; or platform-as-a-service.

Cloud providers continue to grow as more organizations take advantage of public infrastructure to run their business. As their businesses grow, we expect they will continue to invest in their networks, which dictates the quality and experience of the products and the services they deliver to their end-customers. Further, as cloud providers adopt new technologies, including the 400-gigabit Ethernet, or 400GbE, and in anticipation of the future adoption of 800-gigabit Ethernet, or 800GbE, and beyond, we believe this should present further opportunities for us across our portfolio as our cloud customers value high-performance, highly compact, power efficient infrastructures, which we support and continue to develop.

In addition, SaaS continues to be an important factor for cloud providers as their customers, such as enterprises, prefer to procure and consume product and service offerings via SaaS models. As a result, we believe that SaaS providers will invest in high performance infrastructure because the quality of experience has proven just as important competitively as software features and functions. Lastly, as a result of regulations and the need for lower latency and high-performance networking, cloud providers have been transitioning to regional network build-outs or distributed cloud environments to address the increasing demand for services, data privacy, data protection, and consumer rights.

As Cloud customers are pushing the envelope in networking, our focus on collaboration combined with networking innovation around automation has made us a strategic partner with these customers, helping them develop high-performance and lower total cost of ownership networking solutions to support their business.

7

Service Provider

Our Service Provider vertical includes wireline and wireless carriers and cable operators, and we support most of the major carrier and operator networks in the world with our high-performance network infrastructure offerings. In recent years, we have seen increased convergence of these different types of customers through acquisitions, mergers, and partnerships.

Service Provider customers recognize the need for high-performance networks and leveraging the cloud to reduce costs from their network operations. This is dictating a change in business models and their underlying infrastructure, which we believe requires investment in the build-out of high-performance networks and the transformation of existing legacy infrastructure to distributed cloud environments in order to satisfy the growth in mobile traffic and video as a result of the increase in mobile device usage including smartphones, tablets, and connected devices of various kinds.

We expect that Network Function Virtualization and SDN will be critical elements to enable our Service Provider customers the flexibility to support enhanced mobile video and dynamic new service deployments. We are engaging with these customers to transition their operations to next-generation cloud operations as the need for a highly efficient infrastructure to handle large amounts of data along with low latency, or minimal delay, plays into the need to have a high performance, scalable infrastructure in combination with the automation and flexibility required to drive down operational costs and rapid provision applications. We consistently deliver leading technologies that transform the economics and experience of networking while significantly improving customer economics by lowering the capital expenditures required to build networks and the operating expenses required to manage and maintain them.

In addition to reducing operating costs, service providers are seeking to create new or additional revenue opportunities to support their evolving business models. These customers are beginning to deploy 5G, which we expect will continue to roll out over the next few years, and IoT, which we believe will give rise to new services like connected cars, smart cities, robotic manufacturing, and agricultural transformation. 5G and IoT require a highly distributed cloud data center architecture from which services are delivered to the end users and will involve a great degree of analytics and embedded security. We expect this trend will present further opportunities for Juniper with our focus on delivering a strong portfolio of network virtualization and software-based orchestration solutions, which position us to deliver on the automation and agility requirements of service providers.

Enterprise

Our high-performance network infrastructure offerings are designed to meet the performance, reliability, and security requirements of the world's most demanding enterprises. We offer enterprise solutions and services for data centers as well as branch and campus applications. Our Enterprise vertical includes enterprises not included in the Cloud vertical. They are industries with high performance, high agility requirements, including retail companies, healthcare institutions, financial services; national, federal, state, and local governments; as well as research and educational institutions. We believe that our Enterprise customers are able to deploy our solutions as a powerful component in delivering the advanced network capabilities needed for their leading-edge applications.

We believe that as our Enterprise customers continue to transition their workloads to the cloud, they continue to seek greater flexibility in how they consume networking and security services, such as pay-per-use models. Additionally, Enterprises are deploying AI-driven architectures, which require end-to-end solutions for managing, orchestrating, and securing distributed cloud resources as a single pool of resources. Also, we are increasingly seeing a convergence of networking and security, such as Secure Access Service Edge ("SASE"), resulting in security becoming an embedded capability in every solution that we offer to our customers.

High-performance enterprises require IP networks that are global, distributed, and always available. We are innovating in key technology areas to meet the needs of our Enterprise customers whether they plan to move to a public cloud architecture or hybrid cloud architecture (which is a mix of public and private cloud, as well as a growing number of SaaS applications).

In 2021, 2020, and 2019, no single customer accounted for 10% or more of our net revenues.

Products, Services, and Technology

Early in our history, we developed, marketed, and sold the first commercially available purpose-built IP backbone router optimized for the specific high-performance requirements of telecom and cable operators. As the need for core bandwidth continued to increase, the need for service-rich platforms at the edge of the network was created.

8

We have expanded our portfolio to address multiple domains in the network: core; edge; access and aggregation; data centers; and campus and branch. We have systematically focused on how we innovate in silicon, systems, and software (including our Junos OS and virtual network functions, or VNF) such as firewall, network orchestration, and automation to provide a range of hardware and software solutions in high-performance, secure networking.

Further, our intent is to expand our software business by introducing new software solutions to our product and services portfolios that simplify the operation of networks, and provide flexibility in consumption and deployment to our customers across our key verticals. Our software offerings include subscriptions, SaaS, and term or time-based perpetual licenses. We believe our software and related services revenues as a percentage of total revenues will increase over time as we introduce new software solutions designed to better monetize the value of software functionality in our offerings.

Significant Product Development Projects and Solutions

In 2021, we continued to execute on our product and service solution strategy and announced several new innovations.

We announced our continuing investment in the SASE market with the introduction of Juniper Security Director Cloud, a cloud-based portal that distributes connectivity and security services to sites, users, and applications, as well as manages customers’ SASE transformations. We also announced version 4.0 of Apstra software, Apstra 4.0, which builds on the unique multivendor capabilities of the Apstra solution to support VMware NSXC-T 3.0 and Enterprise SONiC, in addition to continuing to support data center switching from Juniper, Nvidia (Nvidia Cumulus), Arista Networks, and Cisco Systems. Further, we announced new features within the AI-driven enterprise portfolio that enable customers to scale and simplify the rollout of their campus wired and wireless networks while bringing greater insight and automation to network operators. The enhancements to the Juniper Mist cloud and AI engine, which include EVPN-VXLAN campus fabric management and Marvis Actions for proactive problem remediation, expand on Juniper’s unique automation, AIOps, and cloud capabilities to streamline IT operations, lower costs and deliver agility and scale.

Moreover, we announced our collaboration with Intel to accelerate advancement in the O-RAN ecosystem. This joint initiative represents another milestone for us in our continuing efforts to bring openness and innovation to a traditionally closed-off part of the network, providing a faster route-to-market for service providers and enterprises to deliver 5G, edge computing and AI.

The following is an overview of our principal product families and service offerings in 2021:

Routing Products

•ACX Series: Our ACX Series Universal Access Routers cost-effectively address current operator challenges to rapidly deploy new high-bandwidth services. We believe that the ACX Series is well positioned to address the growing metro Ethernet and mobile backhaul needs of our customers, as we expect 5G mobile network build-outs to roll out over the next few years. The platforms deliver the necessary scale and performance needed to support multi-generation wireless technologies.

•MX Series: Our MX Series is a family of high-performance, SDN-ready, Ethernet routers that function as a Universal Edge platform with high system capacity, density, and performance. The MX Series platforms utilize our custom silicon and provide carrier-class performance, scale, and reliability to support large-scale Ethernet deployments. We also offer the vMX, a virtual version of the MX router, which is a fully featured MX Series 3D Universal Edge Router optimized to run as software on x86 servers.

•PTX Series: Our PTX Series Packet Transport Routers deliver high throughput at a low cost per bit, optimized for the service provider core as well as the scale-out architectures of cloud providers. The PTX Series is built on our custom silicon and utilizes a forwarding architecture that is focused on optimizing IP/MPLS, and Ethernet. This ensures high density and scalability, high availability, and network simplification.

•Paragon Pathfinder: Our wide-area network SDN controller automates the creation of traffic-engineering paths across the network, increasing network utilization and enabling a customized programmable networking experience.

•Session Smart Routers: Our SSR enables agile, secure, and resilient WAN connectivity with breakthrough economics and simplicity. SSR routers transcend inherent inefficiencies and cost constraints of conventional networking products and legacy SD-WAN solutions, delivering a flexible, application-aware network fabric that meets stringent enterprise performance, security, and availability requirements.

9

Switching Products

•EX Series: Our EX Series Ethernet switches address the access, aggregation, and core layer switching requirements of micro branch, branch office, and campus environments, providing a foundation for the fast, secure, and reliable delivery of applications able to support strategic business processes.

•QFX Series: Our QFX Series of core, spine, and top-of-rack data center switches offer a revolutionary approach to switching that are designed to deliver dramatic improvements in data center performance, operating costs, and business agility for enterprises, high-performance computing networks, and cloud providers.

•Juniper Access Points: Our access points provide Wi-Fi access and performance, which is automatically optimized through reinforcement learning algorithms. Our access points also have a dynamic virtual Bluetooth low energy element antenna array for accurate and scalable location services.

Security Products

•SRX Series Services Gateways for the Data Center and Network Backbone: Our mid-range, high-end and virtual SRX Series platforms provide high-performance, scalability, and service integration, which are ideally suited for medium to large enterprise, data centers and large campus environments, where scalability, high performance, and concurrent services, are essential. Our high-end SRX5800 platform is suited for service provider, large enterprise, and public sector networks. The upgrade to our high-end SRX firewall offering with our Services Process Card 3, or SPC3, with our Advanced Security Acceleration line card enhances the SRX5800 to deliver power for demanding use cases, including high-end data centers, IoT, and 5G.

•Branch SRX, Security Policy and Management: The Branch SRX family provides an integrated firewall and next-generation firewall, or NGFW, capabilities. Security Director is a network security management product that offers efficient, highly scalable, and comprehensive network security policy management. These solutions are designed to enable organizations to securely, reliably, and economically deliver powerful new services and applications to all locations and users with superior service quality.

•Virtual Firewall: Our vSRX Firewall delivers all of the features of our physical firewalls, including NGFW functionality, advanced security, and automated lifecycle management capabilities. The vSRX provides scalable, secure protection across private, public, and hybrid clouds. We also offer the cSRX, which has been designed and optimized for container and cloud environments.

•Advanced Malware Protection: Our Advanced Threat Prevention portfolio consists of Sky ATP, a cloud-based service and Juniper ATP, or JATP, a premises-based solution. These products are designed to use both static and dynamic analysis with machine learning to find unknown threat signatures (zero-day attacks).

Services

In addition to our products, we offer maintenance and support, professional, SaaS, and educational services, making it easier for service providers, enterprises, cloud providers, and partners to optimize the operation of their networks. We utilize a multi-tiered support model to deliver services that leverage the capabilities of our own direct resources, channel partners, and other third-party organizations with a focus on personalized, proactive, and predictive experience.

In 2021, we introduced the next phase of our service offerings called Juniper Support Insights. It is a new AI-Driven support offering that transforms the customer experience from reactive to proactive support.

We also train our channel partners in the delivery of support, professional, and educational services to ensure these services can be locally delivered.

As of December 31, 2021, we employed 2,004 people in our worldwide customer service and support organization. We believe that a broad range of services is essential to the successful customer deployment and ongoing support of our products, and we employ remote technical support engineers, on-site resident engineers, spare parts planning and logistics staff, professional services consultants, and educators with proven network experience to provide those services.

10

Platform Software

In addition to our major product families and services, our software portfolio has been a key technology element in our goal to be a leader in high-performance networking.

Our Junos Platform enables our customers to expand network software into the application space, deploy software clients to control delivery, and accelerate the pace of innovation with an ecosystem of developers. At the heart of the Junos Platform is Junos Evolved. We believe Junos Evolved is fundamentally differentiated from other network operating systems not only in its design, but also in its development capabilities. The advantages of Junos Evolved include:

•A modular operating system with common base of code and a single, consistent implementation for each control plane feature;

•A highly disciplined and firmly scheduled development process;

•A common modular software architecture that scales across all Junos-based platforms;

•A central database, which is used by not only Junos native applications but also external applications using application programming interfaces, or API's; and

•A fully distributed general-purpose software infrastructure that leverages all the compute resources on the network element.

Junos Evolved is designed to improve the availability, performance, and security of business applications running across the network. Junos Evolved helps to automate network operations by providing a single consistent implementation of features across the network in a single release train that seeks to minimize the complexity, cost, and risk associated with implementing network features and upgrades.

Orchestration and Monitoring Software

As many of our customers continue moving to programmable and automated network operations, managing, orchestrating, and securing that complex journey can be a challenge. Network automation is the process of automating the configuration, management, testing, deployment, and operations of physical and virtual devices within a network. We believe the keys to achieving success with network and security automation include:

•Architecting networking systems with strong APIs, analytics, and autonomous control; and

•Automating operations to become more reliable in the context of IT systems, teams, processes, and network operation and security operation workflows.

We are committed to providing solutions to help our customers to optimize their programmable and automated networking operations with the following offerings:

•Contrail Networking: Our Contrail Networking offers an open-source, standards-based platform for SDN. This platform enables our customers to securely deploy workloads in any environment. It offers continuous overlay connectivity to any workload, and can run on any compute technologies from traditional bare-metal servers, virtual machines, to containers.

•Wired, Wireless, and WAN Assurance driven by Mist AI: We provide visibility all the way down to the individual client, application and session to optimize individual user experiences from client-to-cloud. With customizable service levels that span the LAN, WLAN, and WAN, our solutions enable our customers to set and measure key metrics and proactively assure optimal user experiences on an ongoing basis. In addition, automated workflows are combined with event correlation, predictive analytics, and proactive self-driving operations to simplify IT operations and minimize end-to-end network troubleshooting costs.

11

•Marvis Virtual Network Assistant driven by Mist AI: Our Marvis Virtual Network Assistant identifies the root cause of issues across the information technology, or IT, domains and automatically resolves many issues proactively. It recommends actions for those connected systems outside of the Mist domain, while offering a real-time network health dashboard that reports issues from configuration to troubleshooting. Marvis has unique Natural Language Processing ("NLP") capabilities with a conversational interface so that IT staff can get accurate answers to normal English language queries.

•Juniper Paragon Automation: Juniper Paragon Automation is a modular portfolio of cloud-native software applications that deliver closed-loop automation in the most demanding 5G and multicloud environments. These solutions translate business intent into real-world performance across the lifecycle of a network and services. They eliminate manual tasks and processes, empowering operations teams to work more quickly, efficiently, and accurately. Also, they protect customers and business by measuring real service quality on the data plane, assuring that users have a consistent, high-quality experience throughout the life of their service.

•Juniper Apstra: Juniper Apstra enables our customers to automate the entire network lifecycle in a single system, easing the adoption of network automation. Juniper Apstra ties the architect’s design to everyday operations with a single source of truth, continuous validation, and powerful analytics and root cause identification. It raises efficiency and results by providing visibility and insights, incident management, change management, compliance and audit, and maintenance and updates.

Research and Development

We have assembled a team of skilled engineers with extensive experience in the fields of high-end computing, network system design, ASIC design, security, routing protocols, software applications and platforms, and embedded operating systems. As of December 31, 2021, we employed 4,019 people in our worldwide research and development, or R&D, organization.

We believe that strong product development capabilities are essential to our strategy of enhancing our core technology, developing additional applications, integrating that technology, and maintaining the competitiveness and innovation of our product and service offerings. In our products, we are leveraging our software, ASIC and systems technology, developing additional network interfaces targeted to our customers' applications, and continuing to develop technology to support the build-out of secure high-performance networks and cloud environments. We continue to expand the functionality of our products to improve performance, reliability and scalability, and provide an enhanced user interface.

Our R&D process is driven by our corporate strategy and the availability of new technology, market demand, and customer feedback. We have invested significant time and resources in creating a structured process for all product development projects. Following an assessment of market demand, our R&D team develops a full set of comprehensive functional product specifications based on inputs from the product management and sales organizations. This process is designed to provide a framework for defining and addressing the steps, tasks, and activities required to bring product concepts and development projects to market.

Sales and Marketing

As of December 31, 2021, we employed 3,025 people in our worldwide sales and marketing organization. These sales and marketing employees operate in different locations around the world in support of our customers.

Our sales organization, with its structure of sales professionals, business development teams, systems engineers, marketing teams, channel teams, and an operational infrastructure team, is based on both vertical markets and geographic regions.

Our sales teams operate in their respective regions and generally either engage customers directly or manage customer opportunities through our distribution and reseller relationships as described below.

We sell to a number of cloud and service provider customers directly. Otherwise, we sell to all of our key customer verticals primarily through distributors and resellers.

Direct Sales Structure

The terms and conditions of direct sales arrangements are governed either by customer purchase orders along with acknowledgment of our standard order terms, or by direct master purchase agreements. The direct master purchase agreements

12

with these customers set forth only general terms of sale and generally do not require customers to purchase specified quantities of our products. We directly receive and process customer purchase orders.

Channel Sales Structure

A critical part of our sales and marketing efforts are our channel partners through which we conduct the majority of our sales. We utilize various channel partners, including, but not limited to the following:

•A global network of strategic distributor relationships, as well as region-specific or country-specific distributors who in turn sell to local VARs who sell to end-user customers. Our distribution channel partners resell routing, switching, and security products, software and services, which are purchased by all of our key customer verticals. These distributors tend to focus on particular regions or countries. For example, we have substantial distribution relationships with Ingram Micro in the Americas and Hitachi in Japan. Our agreements with these distributors are generally non-exclusive, limited by region, and provide product and service discounts and other ordinary terms of sale. These agreements do not require our distributors to purchase specified quantities of our products or services. Further, most of our distributors sell our competitors' products and services, and some sell their own competing products and services.

•VARs and direct value-added resellers, including our strategic worldwide alliance partners referenced below, resell our products to end-users around the world. These channel partners either buy our products and services through distributors, or directly from us, and have expertise in designing, selling, implementing, and supporting complex networking solutions in their respective markets. Our agreements with these channel partners are generally non-exclusive, limited by region, and provide product and service discounts and other ordinary terms of sale. These agreements do not require these channel partners to purchase specified quantities of our products or services. Increasingly, our cloud and service provider customers also resell our products or services to their customers or purchase our products or services for the purpose of providing managed or cloud-based services to their customers.

•Strategic worldwide reseller relationships with established Juniper alliances, comprised of Nippon Telegraph and Telephone Corporation; Ericsson Telecom A.B.; International Business Machines, or IBM; NEC Corporation; Fujitsu Limited; and Atos SE. These companies each offer services and products that complement our own product and service offerings and act as a reseller, and in some instances as an integration partner for our products. Our arrangements with these partners allow them to resell our products and services on a non-exclusive and generally global basis, provide for product and service discounts, and specify other general terms of sale. These agreements do not require these partners to purchase specified quantities of our products or services.

Manufacturing and Operations

As of December 31, 2021, we employed 343 people in worldwide manufacturing and operations who manage our supply chain including relationships with our contract manufacturers, original design manufacturers, component suppliers, warehousing and logistics service providers.

Our manufacturing is primarily conducted through contract manufacturers and original design manufacturers in China, Malaysia, Mexico, and Taiwan. As of December 31, 2021, we utilized Celestica Incorporated, Flextronics International Ltd., Accton Technology Corporation, Foxconn Technology Group and Alpha Networks Inc. for the majority of our manufacturing activity. Our contract manufacturers and original design manufacturers are responsible for all phases of manufacturing from prototypes to full production including activities such as material procurement, surface mount assembly, final assembly, test, control, shipment to our customers, and repairs. Together with our contract manufacturers and original design manufacturers, we design, specify, and monitor the tests that are required to ensure that our products meet internal and external quality standards. We believe that these arrangements provide us with the following benefits:

•We can quickly ramp up and deliver products to customers with turnkey manufacturing;

•We operate with a minimum amount of dedicated space and employees for manufacturing operations; and

•We can reduce our costs by reducing what would normally be fixed overhead expenses.

Our contract manufacturers and original design manufacturers build our products based on our rolling product demand forecasts. Our contract manufacturing partners procure the majority of the components used in our products. To address supply-chain challenges, including increases in component and logistics costs related to the COVID-19 pandemic and global

13

component shortages, we take specific procurement action, including the exercise of strategic purchases of raw material in addition to our partners' normal procurement. Once the components necessary to assemble the products in our forecast are procured, our manufacturing partners assemble and test the products according to agreed-upon specifications. Products are then shipped to our distributors, resellers, or end-customers. However, we also purchase and hold inventory, consisting primarily of components for the production of finished goods, for strategic reasons and to mitigate the risk of shortages of certain critical components. As a result, we may incur additional holding costs and obsolescence charges, particularly resulting from uncertainties in future product demand. Title to the finished goods is generally transferred from the contract manufacturers to us when the products leave the contract manufacturer's or original design manufacturer's location. Customers take title to the products upon delivery at a specified destination. If the product or components remain unused or the products remain unsold for a specified period, we may incur carrying charges or charges for excess or obsolete materials.

Our contracts with our contract manufacturers and original design manufacturers set forth a framework within which the contract manufacturer and original design manufacturer, as applicable, may accept purchase orders from us. These contracts do not represent long-term commitments.

Some of our custom components, such as ASICs and communication integrated circuits, are manufactured primarily by sole or limited sources, each of which is responsible for all aspects of production using our proprietary designs. To ensure the security and integrity of Juniper products during manufacture, assembly and distribution, we have implemented a supply chain risk management framework as part of our overall Brand Integrity Management System. This framework encompasses all aspects of the supply chain as well as enhanced elements specific to security issues applicable to Juniper products and our customers.

By working collaboratively with our suppliers and as members of coalitions such as the Responsible Business Alliance, Responsible Minerals Initiative, and the CDP Supply Chain program, we endeavor to promote socially and environmentally responsible business practices beyond our company and throughout our worldwide supply chain. To this end, we have adopted a business partner code of conduct and promote compliance with such code of conduct to our suppliers. Our business partner code of conduct expresses support for and is aligned with the Ten Principles of the United Nations Global Compact and the Responsible Business Alliance Code of Conduct. The Responsible Business Alliance, a coalition of electronics, retail, auto and toy companies, provides guidelines and resources to drive performance and compliance with critical corporate social responsibility policies. Its goals are to promote ethical business practices, to ensure that working conditions in the electronic industry supply chain are safe, that workers are treated with respect and dignity, and that manufacturing processes are environmentally responsible. By using standard audit and assessment protocols and tools, we measure and monitor manufacturing partners’ and select direct material suppliers’ compliance to the codes of conduct and applicable environmental, health and safety, labor and ethics legal requirements, including but not limited to: onsite audits; risk assessments; CDP climate change and water requests; and conflict minerals surveys. Our Corporate Social Responsibility Report, which details our supply chain efforts, and Business Partner Code of Conduct are available on our website.

Backlog

Our sales are made primarily pursuant to purchase orders under master sales agreements either with our distributors, resellers, or end-customers. At any given time, we have a backlog of orders for products that have not shipped. Because certain orders are cancellable or delivery schedules may be changed, we believe that our backlog at any given date may not be a reliable indicator of future operating results. The COVID-19 pandemic resulted in unprecedented industry-wide supply constraints, and the pandemic continues to play a role with ongoing delays to the global logistics environment. As a result, we experienced a shortage of component parts and logistics timing issues in 2021, which resulted in significantly higher levels of our product backlog. We expect these challenging supply chain conditions to persist in the near term.

As of December 31, 2021 and December 31, 2020, our total product backlog was approximately $1,833.0 million and $419.6 million, respectively. Our product backlog consists of confirmed orders for products scheduled to be shipped to our distributors, resellers, or end-customers, generally within six months for 2020 and within twelve months for 2021, extended primarily for the ongoing impact of supply chain constraints. Backlog excludes certain future revenue adjustments for items such as product revenue deferrals, sales return reserves, service revenue allocations, and early payment discounts.

For further discussion on the risks, uncertainties and actions taken in response to the pandemic, see the section entitled “Risk Factors” in Item 1A of Part I of this Report.

14

Seasonality

We, as do many companies in our industry, experience seasonal fluctuations in customer spending patterns. Historically, we have experienced stronger customer demand in the fourth quarter and weaker demand in the first quarter of the fiscal year. This historical pattern should not be considered a reliable indicator of our future net revenues or financial performance.

Competition

We compete in the network infrastructure markets. These markets are characterized by rapid change, converging technologies, and a migration to solutions that combine high performance networking with cloud technologies. In the network infrastructure business, Cisco Systems, Inc., or Cisco, has historically been the dominant player. However, our principal competitors also include Arista Networks, Inc.; Dell Technologies; Hewlett Packard Enterprise Co., or HPE; Huawei Technologies Co., Ltd., or Huawei; and Nokia Corporation, or Nokia.

Many of our current and potential competitors, such as Cisco, Nokia, HPE, and Huawei, among others, have broader portfolios which enable them to bundle their networking products with other networking and information technology products in a manner that may discourage customers from purchasing our products. Many of our current and potential competitors have greater name recognition, marketing budgets, and more extensive customer bases that they may leverage to compete more effectively. Increased competition could result in price reductions, fewer customer orders, reduced gross margins, and loss of market share, negatively affecting our operating results.

In addition, there are a number of other competitors in the security network infrastructure space, including Cisco, Huawei, Nokia, A10 Networks, Inc.; Palo Alto Networks, Inc.; Check Point Software Technologies, Ltd.; Fortinet, Inc.; Zscaler, Inc.; Netskope, Inc.; and Forcepoint LLC; among others, who tend to be focused specifically on security solutions and, therefore, may be considered specialized compared to our broader product line.

We expect that over time, large companies with significant resources, technical expertise, market experience, customer relationships, and broad product lines, such as Cisco, Nokia, and Huawei, will introduce new products designed to compete more effectively in the market. There are also several other companies that aim to build products with greater capabilities to compete with our products. Further, there has been significant consolidation in the networking industry, with smaller companies being acquired by larger, established suppliers of network infrastructure products. We believe this trend is likely to continue, which may increase the competitive pressure faced by us due to their increased size and breadth of their product portfolios.

In addition to established competitors, a number of public and private companies have announced plans for new products to address the same needs that our products address. We believe that our ability to compete depends upon our ability to demonstrate that our products are superior and cost effective in meeting the needs of our current and potential customers.

As a result, we expect to face increased competition in the future from larger companies with significantly more resources than we have and also from emerging companies that are developing new technologies. Although we believe that our technology and the purpose-built features of our products make them unique and will enable us to compete effectively with these companies, there can be no assurance that new products, enhancements or business strategies will achieve widespread market acceptance.

Material Government Regulations

Our business activities are worldwide and subject us to various federal, state, local, and foreign laws in the countries in which we operate, and our products and services are subject to laws and regulations affecting the sale of our products. To date, costs and accruals incurred to comply with these governmental regulations have not been material to our capital expenditures, results of operations, and competitive position. Although there is no assurance that existing or future governmental laws and regulations applicable to our operations, products or services will not have a material adverse effect on our capital expenditures, results of operations, and competitive position, we do not currently anticipate material expenditures for government regulations. Nonetheless, as discussed below, we believe that environmental and global trade regulations could potentially have a material impact on our business.

Environment

We are committed to maintaining compliance with all environmental laws applicable to our operations, products, and services and to reducing our environmental impact across our business and supply chain. Our operations and many of our products are

15

subject to various federal, state, local, and foreign regulations that have been adopted with respect to the environment, such as the Waste Electrical and Electronic Equipment Directive; Directive on the Restriction of the Use of Certain Hazardous Substances in Electrical and Electronic Equipment; Registration, Evaluation, Authorization, and Restriction of Chemicals; and Substances of Concern In Products, regulations adopted by the European Union, or EU, and China.

Juniper’s greatest impact on the environment is through our products and services. Our product sustainability approach prioritizes: (1) designing products with the environment in mind, (2) providing solutions for responsible end-of-life management and (3) empowering our customers to save energy and reduce their network-related carbon emissions. To help execute on this, Juniper has an environmental program, based on our new product introduction process, that supports a circular economy model for environmental sustainability and focuses on energy efficiency, materials innovation, and recyclability. We consider opportunities to minimize resource impacts and improve efficiencies over a product’s life cycle, from the materials we use and a product’s energy consumption, to packaging and end-of-life activities such as reuse, refurbishment, and recycling. For example, the Juniper Certified Pre-Owned program offers a broad range of refurbished high-performance network solutions from Juniper’s current line and end-of-production hardware portfolios with available Juniper-backed warranty and support services.

We also voluntarily participate in the annual CDP climate change and water security disclosures and encourage our manufacturing partners and select direct material suppliers to do the same. Additionally, we are a signatory supporter of the United Nations Global Compact and a member of the Responsible Business Alliance, or RBA, and have adopted and promote the adoption by our suppliers of the RBA Code of Conduct, as discussed above in the section entitled Manufacturing and Operations. We continue to invest in the infrastructure and systems required to execute on, monitor and drive environmental improvements in our global operations and within our supply chain.

Global Trade

As a global company, the import and export of our products and services are subject to laws and regulations including international treaties, U.S. export controls and sanctions laws, customs regulations, and local trade rules around the world. The scope, nature, and severity of such controls varies widely across different countries and may change frequently over time. Such laws, rules, and regulations may delay the introduction of some of our products or impact our competitiveness through restricting our ability to do business in certain places or with certain entities and individuals, or by requiring us to comply with domestic preference programs, laws concerning transfer and disclosure of sensitive or controlled technology or source code, unique technical standards, localization mandates, and duplicative in-country testing and inspection requirements. In particular, the U.S. and other governments have imposed restrictions on the import and export of, among other things, certain telecommunications products and components, particularly those that contain or use encryption technology. Most of our products are telecommunications products and contain or use encryption technology and, consequently, are subject to restrictions. The consequences of any failure to comply with domestic and foreign trade regulations could limit our ability to conduct business globally. We continue to support open trade policies that recognize the importance of integrated cross-border supply chains that are expected to continue to contribute to the growth of the global economy and measures that standardize compliance for manufacturers to ensure that products comply with safety and security requirements.

For additional information concerning regulatory compliance and a discussion of the risks associated with governmental regulations that may materially impact us, see the section entitled “Risk Factors” in Item 1A of Part I of this Report.

Intellectual Property

Our success and ability to compete are substantially dependent upon our internally developed technology and expertise, as well as our ability to obtain and protect necessary intellectual property rights. While we rely on patent, copyright, trade secret, and trademark law, as well as confidentiality agreements, to protect our technology, we also believe that factors such as the technological and creative skills of our personnel, new product developments, frequent product enhancements, and reliable product maintenance are essential to establishing and maintaining a technology leadership position. There can be no assurance that others will not develop technologies that are similar or superior to our technology.

Patents

As of December 31, 2021, we had over 4,900 patents worldwide and numerous patent applications are pending. Patents generally have a term of twenty years from filing. As our patent portfolio has been built over time, the remaining terms on the individual patents vary. We cannot be certain that patents will be issued on the patent applications that we have filed, that we will be able to obtain the necessary intellectual property rights, or that other parties will not contest our intellectual property rights.

16

Licenses

In addition, we integrate licensed third-party technology into certain of our products and, from time to time, we need to renegotiate these licenses or license additional technology from third parties to develop new products or product enhancements or to facilitate new business models. There can be no assurance that third-party licenses will be available or continue to be available to us on commercially reasonable terms or at all. Our inability to maintain or re-license any third-party licenses required in our products or our inability to obtain third-party licenses necessary to develop new products and product enhancements could require us to obtain substitute technology of lower quality or performance standards or at a greater cost, any of which could harm our business, financial condition, and results of operations.

Trademarks

JUNIPER NETWORKS, JUNIPER, the Juniper Networks logo, JUNOS, RUNNING JUNOS, and other trademarks are registered trademarks of Juniper Networks, Inc. and/or its affiliates in the United States and other countries. Other names may be trademarks of their respective owners.

Human Capital Resources

We believe our success in delivering high-performance networks in the digital transformation era relies on our culture, values, and the creativity and commitment of our people. As of December 31, 2021, we had 10,191 full-time employees, of whom approximately 45%, 41% and 14% resided in the Americas, APAC, and EMEA, respectively. We invest in our people. We strive to maintain healthy, safe, and secure working conditions - a workplace where our employees are treated with respect and dignity. Our vision is to create an inclusive, diverse and authentic community that inspires collaboration, integrity, engagement, and innovation. We are striving to create a world-class employee experience, one that offers opportunity for personal and professional growth, and enables work-life balance that aligns with the core values embodied in the Juniper Way.

Our Values: The Juniper Way

Our mission is to power connections and empower change – to be a responsible global citizen and influence meaningful differences in the world around us. We believe that powering connections will bring us closer together while empowering us all to solve some of the world’s greatest challenges of health and well-being, sustainability, and equity.

To deliver our mission to power connections and empower change, we rely on a committed and consistent practice that we call the Juniper Way. More than a set of shared values, the Juniper Way reflects the company’s commitment to inspire every Juniper employee to do their best work. This foundation is embodied in three values – Be Bold, Build Trust, and Deliver Excellence - along with a set of refined behaviors for each.

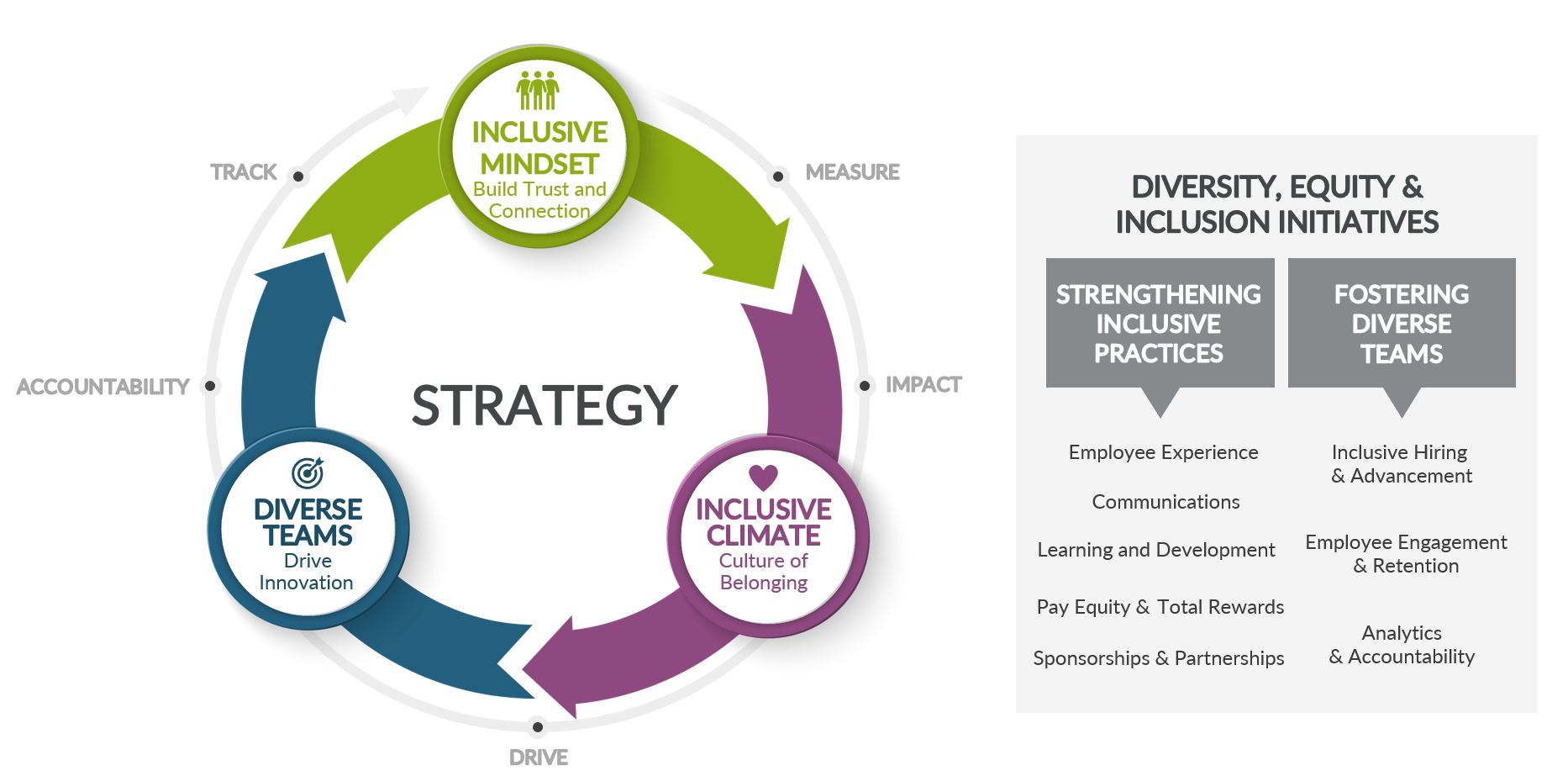

Inclusion and Diversity

As a company, we are committed to innovation and representing diversity with employees of many backgrounds, experiences, and identities. We believe that inclusion and diversity are competitive assets that drive positive change to our company and communities. At our core, we believe excellence depends on seeking out diverse ideas and fostering a culture where all employees belong. We aim to lead with vision and empathy, promoting understanding and awareness across our workforce, and we are committed to improving inclusivity by being engaged and accountable at the highest level of leadership.

17

We monitor our progress against our inclusion and diversity strategy of diversifying our talent base, creating an environment where all employees feel included and valued, and driving accountability across the organization. In 2021, we continued to make progress in our inclusion and diversity efforts. Our global Women's Sponsorship Program, which aims to empower the next generation of women leaders, continued in 2021, providing our female employees with opportunities for development, visibility and growth. We also continued our global Inclusion and Diversity Ambassadors program to extend the reach of our inclusion and diversity efforts throughout Juniper, add new perspectives to the corporate team, uplift the voices of employees, and increase Juniper’s access to diverse talent.

Employee Engagement and Development

We use a framework called Talent Matters to encourage an open and interactive culture between employees and their managers, where individual needs are recognized and met, and company goals are supported. Our professional development approach includes reviewing and assessing our management teams as well as facilitating personal employee development and growth. For employees, growth goals are tied to our corporate objectives and key results to ensure that employees are progressing and are supported by management teams. In early 2020, we launched a People Manager Network to create global consistency in how managers lead teams and support employees, including a specific focus on leading during the COVID-19 pandemic. With this program, managers are empowered and provided with the training and resources to scale employee career growth and provide their teams with the necessary tools to facilitate that growth. Managers are encouraged to schedule Conversation Days with their direct reports to identify opportunities for the company to better support employees and set goals for professional and personal growth. 86% of managers participated in a People Manager Network experience in 2021.

To ensure our employees’ personal and professional growth, we continue to provide training courses focused on building personal capabilities as well as skill development. In response to employee feedback, we launched LinkedIn Learning for all employees, offering online courses on business, technology, and creative skills. Additionally, each year, Juniper employees receive role-specific trainings, which include topics such as human rights, environmental performance, compliance with the Juniper Worldwide Code of Business Conduct, engineering, information security, and other compliance and industry-specific subjects.

We consistently work to improve the employee experience by addressing feedback collected through the annual Juniper Voice Survey and topic-specific surveys, including employee benefits and total rewards packages and Juniper's response to the COVID-19 pandemic.

Employee Retention, Benefits, and Wellness

We continue to prioritize our commitment to retaining and attracting a diverse workforce with the skills needed to deliver Experience-First Networking. We aim to provide benefits and programs that are holistic, flexible, and inclusive. We are committed to pay equity and benefits innovation. From offering childcare and working mother support, to expanding medical coverage for infertility and gender-affirming procedures, to foster and adoptive parent assistance, we have provided benefit offerings that are intended to be as inclusive and diverse as our employees’ needs.

18

Our community engagement program empowers employees to participate authentically, so they can make an impact where it matters most to them. We offer five paid working days per year for employees to give back to their communities and engage with causes of their choice. In 2021, Juniper expanded our employee matching gift program to all global employees and launched the “Empower Change” Challenge in celebration of our 25th anniversary. All employees were given $25 of Juniper Foundation funds to donate to a charity or non-governmental organization of their choice to power connections and empower change.

The health, safety, and well-being of our employees are vital to Juniper's success. In 2021, we continued to offer global programs to support our employees working remotely during the ongoing COVID-19 pandemic, including COVID-19 crisis leave, Employee Assistance Program, remote ergonomic support, work reimbursement for office equipment, furniture and service essentials and TaskHuman. Employees have unlimited access to the TaskHuman platform, a virtual wellness coaching application, which covers hundreds of wellness topics from yoga and nutrition to financial guidance.

Information about our Executive Officers

The following sets forth certain information regarding our executive officers as of the filing of this Report:

Name | Age | Position | ||||||||||||||||||

| Rami Rahim | 51 | Chief Executive Officer and Director | ||||||||||||||||||

| Anand Athreya | 58 | Executive Vice President, Chief Development Officer | ||||||||||||||||||

| Manoj Leelanivas | 52 | Executive Vice President, Chief Product Officer | ||||||||||||||||||

| Robert Mobassaly | 43 | Senior Vice President, General Counsel and Secretary | ||||||||||||||||||

| Kenneth B. Miller | 50 | Executive Vice President, Chief Financial Officer | ||||||||||||||||||

| Thomas A. Austin | 54 | Vice President, Corporate Controller and Chief Accounting Officer | ||||||||||||||||||

| Marcus Jewell | 49 | Executive Vice President, Chief Revenue Officer | ||||||||||||||||||

RAMI RAHIM joined Juniper in January 1997 and became Chief Executive Officer of Juniper, and a member of the Board of Directors, in November 2014. From March 2014 until he became Chief Executive Officer, Mr. Rahim served as Executive Vice President and General Manager of Juniper Development and Innovation. His responsibilities included driving strategy, development and business growth for routing, switching, security, silicon technology, and the Junos operating system. Previously, Mr. Rahim served Juniper in a number of roles, including Executive Vice President, Platform Systems Division, Senior Vice President and General Manager, Edge and Aggregation Business Unit, or EABU, and Vice President, Product Management for EABU. Prior to that, Mr. Rahim spent the majority of his time at Juniper in the development organization where he helped with the architecture, design and implementation of many Juniper core, edge, and carrier Ethernet products. Mr. Rahim holds a bachelor of science degree in Electrical Engineering from the University of Toronto and a master of science degree in Electrical Engineering from Stanford University.

ANAND ATHREYA joined Juniper in August 2004 and became Executive Vice President and Chief Development Officer in August 2017. In this role, he is responsible for Juniper's Engineering organization. Since joining Juniper, Mr. Athreya has held various leadership positions within Engineering, including most recently serving as Senior Vice President of Engineering from May 2014 through August 2017, and Corporate Vice President of Engineering from February 2011 through May 2014. Mr. Athreya joined Juniper from Procket Networks, a maker of routers and routing technology, where he served as Director of Software Engineering. Prior to that, he was Vice President of Engineering at Malibu Networks, a supplier of fixed wireless networking based broadband solutions, Assistant Vice President of Product Management and Strategy at Tiara Networks, a provider of broadband access systems, and held engineering roles at Novell, a software and services company. Mr. Athreya received his bachelor of science degree in Electrical Engineering from Bangalore University, a master of science degree in Computer Science and Engineering from Osmania University, and an MBA from National University. He is also a graduate of the Advanced Management Program at Harvard Business School.

MANOJ LEELANIVAS joined Juniper in March 2018 as Executive Vice President, Chief Product Officer. In this role, Mr. Leelanivas leads all aspects of product strategy and direction for Juniper and helps to align products with our go-to-market strategies and execution, including marketing operations. From June 2013 to September 2017, Mr. Leelanivas was President and Chief Executive Officer of Cyphort, an innovator in scale-out security analytics technology, that was acquired by Juniper in September 2017. From March 1999 to May 2013, he held several key product management positions at Juniper, including Executive Vice President of Advanced Technologies Sales for data center. Mr. Leelanivas holds a bachelor of technology in

19

Computer Engineering from the National Institute of Technology Karnataka, a master of science degree in Computer Science from the University of Kentucky, and is a graduate of the Stanford University Executive Business Program.

ROBERT MOBASSALY joined Juniper in February 2012 and has served as Senior Vice President, General Counsel since July 2021. From July 2016 to July 2021, he served as Vice President, Deputy General Counsel, where he was responsible for managing a team focused on legal functions, including those associated with Juniper’s corporate securities, mergers and acquisitions, corporate governance, stockholder administration, and insurance matters. From May 2015 to July 2016, Mr. Mobassaly served as Associate General Counsel, Senior Director and previously served as Assistant General Counsel, Director. Prior to joining Juniper, Mr. Mobassaly was in private practice. He holds a bachelor’s degree from the University of California, Berkeley, and a J.D. from the University of Pennsylvania Law School.

KENNETH B. MILLER joined Juniper in June 1999 and has served as our Executive Vice President, Chief Financial Officer since February 2016. Mr. Miller served as our interim Chief Accounting Officer while the Company continued to search for a full-time Chief Accounting Officer from February 2019 to September 2019. From April 2014 to February 2016, Mr. Miller served as our Senior Vice President, Finance, where he was responsible for the finance organization across the Company, as well as our treasury, tax and global business services functions. Previously, Mr. Miller served as our Vice President, Go-To-Market Finance, Vice President, Platform Systems Division, Vice President, SLT Business Group Controller and in other positions in our Finance and Accounting organizations. Mr. Miller holds a bachelor of science degree in Accounting from Santa Clara University.

THOMAS A. AUSTIN joined Juniper in September 2019 as our Vice President, Corporate Controller and Chief Accounting Officer. From September 2016 until July 2019, Mr. Austin served as the Vice President of Corporate Finance at Dell Technologies, Inc., a multinational information technology company. From September 2008 until its acquisition by Dell Technologies in September 2016, Mr. Austin served as the Vice President of Corporate Finance at EMC Corporation, a multinational information technology company. From January 2001 through July 2008, Mr. Austin served as the Chief Financial Officer and Treasurer at Arbor Networks, Inc., a network security company. Prior to joining Arbor Networks, Mr. Austin served as a controller for several companies. He began his career in public accounting at PricewaterhouseCoopers, a registered public accounting firm. Mr. Austin holds a bachelor of science degree in Public Accountancy from Providence College and an MBA from Babson College. Mr. Austin is also an adjunct professor of Finance at Providence College School of Business.

MARCUS JEWELL joined Juniper in June 2017 and has served as our Executive Vice President, Chief Revenue Officer since January 2019. From June 2017 to January 2019, Mr. Jewell was Senior Vice President of our EMEA business, where he was responsible for sales operations across the region, including its go-to-market and channel strategies. Mr. Jewell joined Juniper from Brocade Communications, where he ran the EMEA business from March 2011 to June 2017 and was also the global head of the company’s software sales. Mr. Jewell has worked in the technology industry for more than 20 years and has held several senior global sales leadership positions in networking organizations. Mr. Jewell holds a bachelor of engineering (Hons) degree from the University of New South Wales.

Available Information