Exhibit 99.1

EXCERPTS FROM PRELIMINARY OFFERING MEMORANDUM, DATED OCTOBER 13, 2021

CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This offering memorandum contains numerous “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements address our future objectives, plans and goals, as well as our intent, beliefs and current expectations regarding future operating performance, results and events, and can generally be identified by words such as “may,” “will,” “should,” “believe,” “expect,” “estimate,” “anticipate,” “intend,” “plan,” “foresee” and other similar words or phrases.

These forward-looking statements are based on our current estimates and assumptions and involve various risks and uncertainties. As a result, you are cautioned that these forward-looking statements are not guarantees of future performance and that actual results could differ materially from those projected in these forward-looking statements. Factors which may cause actual results to differ materially from our projections include those risks described in “Risk Factors” and elsewhere in this offering memorandum and in our filings with the SEC that are incorporated by reference into this offering memorandum, as well as:

| • | the number of new and used vehicles sold in the United States as compared to our expectations and the expectations of the market; |

| • | the reputation and financial condition of vehicle manufacturers whose brands we represent, the financial incentives vehicle manufacturers offer and their ability to design, manufacture, deliver and market their vehicles successfully; |

| • | our relationships with manufacturers, which may affect our ability to obtain desirable new vehicle models in inventory or to complete additional acquisitions or dispositions; |

| • | our ability to consummate and achieve the benefits of the Acquisition; |

| • | our ability to combine the RFJ Auto and Sonic businesses in a manner that facilitates growth opportunities and realizes anticipated cost synergies and performance improvements; |

| • | our business and growth strategies, including, but not limited to, our EchoPark store operations; |

| • | our ability to generate sufficient cash flows or to obtain additional financing to fund our EchoPark expansion, capital expenditures, our share repurchase program, dividends on our common stock, acquisitions and general operating activities; |

| • | the adverse resolution of one or more significant legal proceedings against us or our franchised dealerships or EchoPark stores; |

| • | the significant flexibility provided by the indentures that will govern the notes to pursue a strategic transaction involving our EchoPark business and to use the proceeds therefrom without noteholder consent; |

| • | changes in laws and regulations governing the operation of automobile franchises, accounting standards, taxation requirements and environmental laws, including any change in law or regulations in response to the COVID-19 pandemic; |

| • | changes in vehicle and parts import quotas, duties, tariffs or other restrictions, including supply shortages that could be caused by the COVID-19 pandemic or other supply chain disruptions; |

| • | the severity and duration of the COVID-19 pandemic and the actions taken by vehicle manufacturers, governmental authorities, businesses or consumers in response to the pandemic, including in response to a worsening or “next wave” of the pandemic or as a result of a variant of COVID-19 or otherwise; |

| • | the inability of vehicle manufacturers and their suppliers to obtain, produce and deliver vehicles or parts and accessories to meet demand at our franchised dealerships for sale and use in our parts, service and collision repair operations; |

| • | general economic conditions in the markets in which we operate, including fluctuations in interest rates, employment levels, the level of consumer spending and consumer credit availability; |

| • | high levels of competition in the retail automotive industry, which not only create pricing pressures on the products and services we offer, but also on businesses we may seek to acquire; |

| • | the impact of pursuing or not pursuing strategic alternatives relating to certain of our operations; |

| • | our ability to successfully integrate potential future acquisitions; |

| • | the significant control that our principal stockholders exercise over us and our business matters; and |

| • | the rate and timing of overall economic expansion or contraction. |

These forward-looking statements speak only as of the date of this offering memorandum or the documents incorporated by reference into the offering memorandum, as applicable, and we undertake no obligation to revise or update these statements to reflect subsequent events or circumstances.

SPECIAL NOTE REGARDING NON-GAAP FINANCIAL MEASURES

In evaluating its business, the Company considers and uses Adjusted EBITDA, Adjusted EBITDAR and certain ratios and other measures calculated using Adjusted EBITDA as supplemental measures of its operating performance. Adjusted EBITDA is defined as net income plus non-floor plan interest expense, income taxes, impairment charges, (gain) loss on disposal of dealerships and real estate, (gain) loss on exit of leased dealerships, (gain) loss on retirement of debt, long term compensation expense, non-cash stock-based compensation expense, depreciation and amortization, and certain other non-recurring items, for all operations, continuing and discontinued. Adjusted EBITDAR is defined as Adjusted EBITDA plus rent expense.

The terms Adjusted EBITDA and Adjusted EBITDAR are not defined under accounting principles generally accepted in the United States (“U.S. GAAP”) and they and the ratios and measures calculated using them are not measures of operating income, operating performance or liquidity presented in accordance with U.S. GAAP. Adjusted EBITDA, Adjusted EBITDAR and ratios and measures calculated using them have limitations as analytical tools, and when assessing the Company’s operating performance, investors should not consider Adjusted EBITDA or Adjusted EBITDAR or ratios and measures calculated using Adjusted EBITDA in isolation, or as substitutes for net income (loss), cash flow from operations, or other consolidated income statement data prepared in accordance with U.S. GAAP or calculated using such data prepared in accordance with U.S. GAAP. Among other things, Adjusted EBITDA and Adjusted EBITDAR do not reflect the Company’s actual cash expenditures. Other companies may calculate similar measures differently than the Company, limiting their usefulness as comparative tools.

ii

While Adjusted EBITDA and Adjusted EBITDAR should not be construed as a substitute for net income (loss) or as a better measure of liquidity than net cash provided by operating activities, it is included in our discussion of earnings to provide additional information regarding the amount of cash our business is generating with respect to our ability to meet future debt services, capital expenditures and working capital requirements. Consistent with industry practices, Sonic’s management uses Adjusted EBITDA and Adjusted EBITDAR as one factor when valuing dealership operations.

For a reconciliation of Adjusted EBITDA and Adjusted EBITDAR to the most directly comparable U.S. GAAP financial measure, see “Summary Historical and Pro Forma Financial Data and Operating Data of the Company” included elsewhere in this offering memorandum.

INDUSTRY, MARKET AND COMPETITIVE POSITION DATA

We obtained the industry, market and competitive position data included in and incorporated by reference into this offering memorandum from our own internal estimates and research as well as from industry publications and research, studies and surveys conducted by third parties. Industry publications, studies and surveys generally state that they have been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe that each of these publications, studies and surveys is reliable, we have not independently verified industry, market and competitive position data from third-party sources. While we believe our internal business research is reliable and the market definitions are appropriate, neither such research nor these definitions have been verified by any independent source. Accordingly, investors should not place undue weight on the industry, market and competitive position data presented in this offering memorandum.

Certain Defined Terms Used Herein

Except as otherwise indicated or as the context otherwise requires, all references in this offering memorandum to (i) “Sonic,” the “Company,” “we,” “us” and “our” mean Sonic Automotive, Inc. and its subsidiaries and (ii) “SAI” mean Sonic Automotive, Inc. but not any of its subsidiaries. All references to the “Combined Company” refer to Sonic Automotive, Inc. and its subsidiaries, after giving effect to the Acquisition.

When used herein, unless the context requires otherwise, or as specifically described below:

| • | The term “2021 Floor Plan Facilities” means, together, the amended and restated syndicated new and used vehicle floor plan credit facilities that we entered into on April 14, 2021. |

iii

| • | The term “2021 New Vehicle Floor Plan Facility” means, as amended, the new vehicle revolving floor plan facility under the 2021 Floor Plan Facilities. |

| • | The term “2021 Used Vehicle Floor Plan Facility” means, as amended, the used vehicle revolving floor plan facility under the 2021 Floor Plan Facilities. |

| • | The term “2029 Notes” means the Company’s % Senior Notes due 2029. |

| • | The term “2031 Notes” means the Company’s % Senior Notes due 2031. |

| • | The term “6.125% Notes” means our outstanding 6.125% Senior Subordinated Notes due 2027. |

| • | The term “Acquisition” means the acquisition of RFJ Auto pursuant to the Merger Agreement, pursuant to which we will acquire the new and used automotive retail business of RFJ Auto, together with the associated real estate, inventory and other related assets. |

| • | The term “CPO” means certified pre-owned. |

| • | The term “CSI” means Customer Satisfaction Index. |

| • | The term “Exchange Act” means the Securities Exchange Act of 1934, as amended. |

| • | The terms “finance and insurance” or “F&I” mean, collectively, the arrangement of extended warranties, service contracts, financing, insurance and other aftermarket products. |

| • | The term “Fixed Operations” means, collectively, sales of replacement parts and performance of vehicle maintenance, manufacturer warranty repairs, and paint and collision repair services. |

| • | The term “HSR Act” means the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended. |

| • | The term “LTM Period” means for the twelve months ended June 30, 2021. |

| • | The term “Merger Agreement” means that certain Agreement and Plan of Merger, dated as of September 17, 2021, by and among Sonic Automotive, Inc., RFJ Auto and the other parties thereto. |

| • | The term “notes” means, together, the 2029 Notes and the 2031 Notes. |

| • | The term “RFJ Auto” means RFJ Auto Partners, Inc., together with its subsidiaries. |

| • | The term “Special Mandatory Redemption” means the requirement that we redeem $700.0 million aggregate principal amount of the notes, with such redemption being allocated to each series of notes on a pro rata basis on the aggregate principal amount of each series of notes, at a redemption price equal to |

iv

| 100% of the principal amount thereof (the “Mandatory Redemption Amount”), plus accrued and unpaid interest to, but excluding, the redemption date, if (i) the consummation of the Acquisition does not occur on or before January 31, 2022 (the “End Date”) or (ii) the Company notifies the trustee of its abandonment or termination of the Merger Agreement or its determination that the consummation of the Acquisition will not occur before the End Date. |

| • | The term “SEC” means the U.S. Securities and Exchange Commission. |

| • | The term “Securities Act” means the Securities Act of 1933, as amended. |

| • | The term “U.S. GAAP” means accounting principles generally accepted in the United States. |

v

OFFERING MEMORANDUM SUMMARY

This summary highlights selected information included in or incorporated by reference into this offering memorandum. The following summary does not contain all of the information that you should consider before investing in the notes and is qualified in its entirety by the more detailed information appearing elsewhere in this offering memorandum and the financial statements and the documents incorporated by reference herein. You should carefully read this entire offering memorandum, including the “Risk Factors” section beginning on page 22 and the risk factors incorporated by reference herein, before making an investment decision. See “Where You Can Find More Information About Sonic.”

Overview

We are one of the largest automotive retailers in the United States (as measured by total revenue). For the twelve months ended June 30, 2021 (the “LTM Period”), the Company generated revenue of $11.5 billion, net income of $285.2 million and Adjusted EBITDA of $536.6 million. For a reconciliation of the Company’s Adjusted EBITDA to net income (loss), which is the most directly comparable U.S. GAAP financial measure, see “Summary Historical and Pro Forma Financial Data and Operating Data of the Company.” Included in the Company’s results for the LTM Period were revenue of $1.9 billion and an Adjusted EBITDA deficit of $3.0 million from the EchoPark Segment, which represented, as of June 30, 2021, 18.4% of the Company’s total assets and 18.2% of the Company’s total liabilities. The EchoPark subsidiaries will initially guarantee the notes but may be designated by the Company at any time as unrestricted subsidiaries, subject only to no event of default, at which time they would cease to guarantee the notes and would not be subject to the indenture’s restrictive covenants. See “Risk Factors– Risks Related to the Notes—The indentures that will govern the notes will provide us with significant flexibility to pursue a strategic transaction involving the EchoPark business without noteholder consent.”

On September 17, 2021, SAI and one of its subsidiaries entered into the Merger Agreement with RFJ Auto and the representative of RFJ Auto’s equityholders, pursuant to which RFJ Auto will merge with and into a subsidiary of SAI with RFJ Auto surviving the merger and becoming a direct, wholly owned subsidiary of SAI. RFJ Auto was established in 2014 and is based in Plano, Texas. It is one of the largest privately owned automotive retail platforms in the United States (as measured by total revenue), with approximately 1,700 employees and a dealership footprint of 33 rooftops located in seven states throughout the Pacific Northwest, Midwest and Southwest. The RFJ Auto brand portfolio includes 16 automotive brands, as well as specialty pre-owned vehicle locations. It has developed a diverse product offering through an efficient omnichannel platform and includes the highest volume Chrysler Jeep dealership in the world.

During the LTM Period, RFJ Auto generated revenue of $3.2 billion, net income of $57.4 million and Adjusted EBITDA of $118.5 million. For a reconciliation of RFJ Auto’s Adjusted EBITDA to net income, which is the most directly comparable U.S. GAAP financial measure, see “Summary Historical Financial Data of RFJ Auto.”

Combination Rationale

We believe that the Acquisition strengthens our long-term growth plan by incorporating RFJ Auto’s innovative omnichannel sales strategy with the culture and growth strategy of Sonic’s franchised dealership business to create a company (“Combined Company”) that is expected to be one of the largest U.S. dealer groups by total revenue. We expect that pairing the experienced RFJ Auto management team with our demonstrated success in acquiring and integrating well-run businesses will provide us the opportunity to leverage the best practices of both businesses going forward, creating long-term growth potential.

On a pro forma basis for the twelve months ended June 30, 2021, RFJ’s revenue contribution to the Combined Company would have been approximately $3.2 billion and it would have represented approximately 34% of the Combined Company’s franchised dealership revenues. Six of the seven states in the RFJ Auto footprint

1

are new markets for Sonic, strategically expanding the markets in which Sonic operates while also adding five new brands to the Sonic brand portfolio, further broadening our vehicle and service offerings to consumers. The geographic footprint covered by the 142 stores in the Combined Company is as follows.

We believe that we can achieve meaningful run-rate synergies and operational improvements following the closing of the Acquisition, consisting of: (i) a reduction in corporate overhead costs as a result of our ability to leverage our scale to reduce costs related to purchasing certain equipment, supplies, and services through national vendor relationships; (ii) a reduction in the effective interest rate on inventory floor plan financing; and (iii) expected operational improvements primarily with respect to finance and insurance revenues and parts, service and collision repair revenues and gross margins, among other areas.

The below information demonstrates the highly complementary brand and geographic diversification benefits of the Combined Company created by the Acquisition.

2

| (1) | Based on new vehicle revenues for the LTM Period. “Other” includes Nissan, Cadillac, Hyundai, Volkswagen, MINI and other imports. |

| (2) | Based on new vehicle revenues for the LTM Period applied to brand mix allocations for the twelve month period ending May 31, 2021. |

| (3) | Pro Forma excludes Sonic acquisitions since June 30, 2021, besides the Acquisition. “Other” includes Nissan, Cadillac, Hyundai, Volkswagen, MINI and other imports. |

| (1) | Based on new vehicle revenues for the LTM Period. |

| (2) | Based on total revenues for the LTM Period. |

As a result of the way we manage our business, we had two reportable segments as of the date of this offering memorandum: (i) the Franchised Dealerships Segment and (ii) the EchoPark Segment. For management and operational reporting purposes, we group certain businesses together that share management and inventory (principally used vehicles) into “stores.” As of the date of this offering memorandum, we operated 87 stores in the Franchised Dealerships Segment and 31 stores in the EchoPark Segment. The Franchised Dealerships Segment consists of 99 new vehicle franchises (representing 22 different brands of cars and light trucks) and 14 collision repair centers in 12 states. The Franchised Dealerships Segment provides comprehensive services, including (1) sales of both new and used cars and light trucks; (2) sales of replacement parts and performance of vehicle maintenance, manufacturer warranty repairs, and paint and collision repair services (collectively, “Fixed Operations”); and (3) arrangement of extended warranties, service contracts, financing, insurance and other aftermarket products (collectively, “finance and insurance” or “F&I”) for our guests. The EchoPark Segment sells used cars and light trucks and arranges F&I product sales for our guests in pre-owned vehicle specialty retail locations. Our EchoPark business generally operates independently from our franchised dealerships business (except for certain shared back-office functions and corporate overhead costs). Sales operations for EchoPark

3

began in the fourth quarter of 2014, and, as of the date of this offering memorandum, we operated 31 EchoPark stores in 16 states.

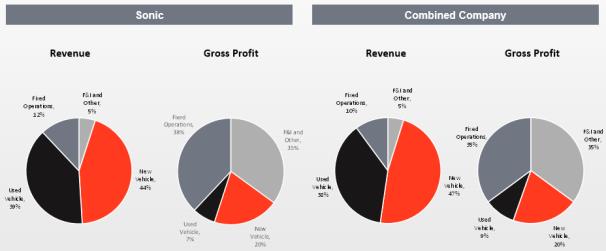

The following charts depict Sonic’s and the Combined Company’s multiple sources of continuing operations revenue and gross profit for the LTM Period:

4

Business Strategy

Expand Our Omni-Channel Capabilities. Automotive consumers have become increasingly more comfortable using technology to research their vehicle buying alternatives, communicate with store personnel, and complete a portion or all of a vehicle purchase online. The internet presents a marketing, advertising and sales channel that we will continue to utilize to drive value for our stores and enhance the guest experience. Our existing platforms give us the ability to leverage new technology to integrate systems, customize our dealership websites and use our data to improve the effectiveness of our advertising and interaction with our guests. These platforms also allow us to market all of our products and services to a national audience and, at the same time, support the local market penetration of our individual stores. We believe that the ongoing development of our e-commerce platform will drive incremental revenues and an improved guest experience in the future.

Focus on the Guest Experience. We focus on providing a high-quality guest experience and maintaining high levels of customer satisfaction. Our personalized sales process is designed to appeal to our guests by providing high-quality vehicles and service through a positive, “guest-centric” experience. Several manufacturers offer specific financial incentives on a per vehicle basis if certain Customer Satisfaction Index (“CSI”) levels (which vary by manufacturer) are achieved by a dealership. In addition, all manufacturers consider CSI scores in approving acquisitions or awarding new dealership open points. To keep dealership and executive management focused on customer satisfaction, we include CSI results as a component of our incentive-based compensation programs for certain groups of associates and executive management.

Train, Develop and Retain Our Teammates. We believe our teammates are the cornerstone of our business and crucial to our financial success. Our goal is to develop our teammates and foster an environment where our teammates can contribute and grow with the Company. Teammate satisfaction is very important to us, and we believe a high level of teammate satisfaction reduces turnover and enhances our guests’ experience at our stores by pairing our guests with well-trained support personnel. We believe that our comprehensive training of our teammates provides us with an advantage over other competitors in providing a high-quality guest experience.

Execute Our EchoPark Expansion Plan. We have developed a diversified business model by augmenting our manufacturer-franchised dealership operations with our EchoPark pre-owned vehicle specialty retail business. Sales operations for EchoPark began in the fourth quarter of 2014, and, as the date of this offering memorandum, we operated 31 EchoPark stores in 16 states. During 2020, we announced an accelerated EchoPark growth plan in which we hope to open 25 additional EchoPark stores annually from 2021 to 2025 as we build out an expected 140-plus point nationwide EchoPark distribution network by 2025 covering approximately 90% of the U.S. population. As has been previously announced, Sonic’s Board of Directors continues to work with financial and legal advisors to consider a full range of potential strategic alternatives for its EchoPark business. No timetable has been established for the completion of the review, and the review may not result in any transaction. The indentures that will govern the notes will be designed to allow Sonic to pursue such a transaction without noteholder consent and will give Sonic substantial flexibility in the use of the proceeds from such a transaction. See “Risk Factors— Risks Related to the Notes—The indentures that will govern the notes will provide us with significant flexibility to pursue a strategic transaction involving the EchoPark business and use the proceeds therefrom without noteholder consent.”

Maximize Asset Returns Through Process Execution. We have developed standardized operating processes that are documented in operating playbooks for our stores. Through the continued implementation of our operating playbooks, we believe organic growth opportunities exist by offering a more favorable buying experience to our guests and creating efficiencies in our business processes. We believe the development, refinement and implementation of these operating processes will enhance the guest experience, make us more competitive in the markets we serve and drive profit growth across each of our revenue streams. We believe that attractive acquisition opportunities continue to exist for dealership groups with the capital and experience to identify, acquire and professionally manage dealerships and we continue to evaluate these opportunities in the ordinary course.

5

Maintain Diverse Revenue Streams. We have multiple diverse revenue streams among our two operating segments. In addition to new vehicle sales, our revenue sources include used vehicle sales (including through our EchoPark segment), which we believe are less sensitive to economic cycles and seasonal influences that affect new vehicle sales. Our Fixed Operations sales carry a higher gross margin than new and used vehicle sales and, in the past, have not been as sensitive to economic conditions as new vehicle sales. We also offer guests assistance in obtaining financing and a range of automobile-related warranty, aftermarket and insurance products.

Manage Portfolio. Our long-term growth and acquisition strategy is primarily focused on large metropolitan markets that meet certain strategic criteria for population growth and vehicle registration rates, among other considerations. A majority of our franchised dealerships are either luxury or mid-line import brands. For the LTM Period, approximately 89.1% of our total new vehicle revenue was generated by luxury and mid-line import dealerships, which usually have higher operating margins, more stable Fixed Operations departments, lower associate turnover and lower inventory levels.

Increase Sales of Higher-Margin Products and Services. We continue to pursue opportunities to increase our sales of higher-margin products and services by expanding the following:

Finance, Insurance and Other Aftermarket Products. Each sale of a new or used vehicle gives us an opportunity to provide our guests with financing and insurance options and earn financing fees and insurance and other aftermarket product commissions. We also offer our guests the opportunity to purchase extended warranties, service contracts and other aftermarket products from third-party providers whereby we earn a commission for arranging the contract sale. We currently offer a wide range of non-recourse financing, leasing, other aftermarket products, extended warranties, service contracts and insurance products to our guests. We emphasize menu-selling techniques and other best practices to increase our sales of F&I products at our franchised dealerships and EchoPark stores.

Parts, Service and Collision Repair. Each of our franchised dealerships offers a fully integrated service and parts department. Manufacturers permit warranty work to be performed only at franchised dealerships such as ours. As a result, our franchised dealerships are uniquely qualified and positioned to perform work covered by manufacturer warranties on increasingly complex vehicles. We believe we can continue to grow our profitable parts and service business over the long term by increasing service capacity, investing in sophisticated equipment and well-trained technicians, using competitive variable-rate pricing structures, focusing on the guest experience, and efficiently managing our parts inventory. In addition, we believe our emphasis on selling extended service contracts and maintenance contracts associated with retail new and used vehicle sales will drive further service and parts business in our franchised dealerships as we increase the potential to retain current service and parts guests beyond the term of the standard manufacturer warranty period.

Certified Pre-Owned Vehicles. Various manufacturers provide franchised dealers the opportunity to sell certified pre-owned (“CPO”) vehicles. This certification process extends the standard manufacturer warranty on the CPO vehicle, which we believe increases our potential to retain the pre-owned purchaser as a future parts and service customer. As CPO vehicles can only be sold by franchised dealerships and CPO warranty work can only be performed at franchised dealerships, we believe CPO vehicles add additional sales volume and will increase our Fixed Operations business over the long term.

The Transactions

Acquisition of RFJ Auto

The purchase price payable pursuant to the Merger Agreement is expected to be approximately $965.7 million, comprising (i) approximately $576.1 million for goodwill and other intangible assets, (ii) plus approximately $136.5 million for property and equipment including real estate assets, (iii) plus approximately $271.5 million for inventory, (iv) plus approximately $67.0 million for accounts receivable, (v) minus approximately $85.4 million related to liabilities assumed net of other miscellaneous assets. The value, and therefore the resulting purchase price, of RFJ Auto’s parts and accessories inventory, supplies, repair work-in-process and new and used vehicle inventories and other assets acquired or liabilities assumed by Sonic are all subject to change based on natural fluctuations in the business of RFJ Auto prior to the closing of the Acquisition and the foregoing amounts are management’s best estimate as of the date hereof.

6

The Merger Agreement contains customary representations, warranties and covenants by SAI, RFJ Auto and the other parties thereto. The consummation of the Acquisition is subject to various closing conditions, including, among other things, (i) the expiration or termination of all applicable waiting periods under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”), and (ii) the consent to or the approval of the transactions contemplated by the Merger Agreement by each Manufacturer (as defined in the Merger Agreement) whose consent or approval is required. The Merger Agreement may be terminated under certain circumstances, including by Sonic or RFJ Auto if the closing of the Acquisition does not occur on or before 5:00 p.m., Eastern Time, on December 15, 2021, unless such party’s breach of the Merger Agreement has prevented the consummation of the Acquisition by such time.

Redemption of 6.125% Notes

On October 13, 2021, Sonic issued a notice to redeem the entire $250.0 million aggregate principal amount of the Company’s outstanding 6.125% Notes, with such redemption scheduled to occur on October 28, 2021. The redemption of the 6.125% Notes is conditioned on the successful completion of this offering. Until we are able to apply a portion of the net proceeds of the offering to redeem the 6.125% Notes, the 6.125% Notes will remain outstanding and the net proceeds of this offering may be deposited in floor plan deposit accounts or with banks.

In this offering memorandum, we refer to the Acquisition, the additional borrowings contemplated by the “Use of Proceeds” section and the redemption of the 6.125% Notes collectively as the “Transactions.” We cannot assure you that we will complete the Acquisition or any other transaction constituting the Transactions on the terms contemplated in this offering memorandum or at all. The consummation of this offering of notes is not conditioned on the consummation of the Acquisition. If the Acquisition is not consummated, the notes will be subject to a Special Mandatory Redemption. See “Description of Notes—Special Mandatory Redemption.”

Recent Developments

Third Quarter 2021 Activity and Preliminary Results

Sonic continues to grow its business through strategic operational initiatives, acquisitions, the expansion of its EchoPark footprint, and opportunistic share repurchases. A timeline of these events subsequent to June 30, 2021 includes:

| • | Franchised Dealerships Segment |

| • | Acquired one Audi franchise, one Subaru franchise, and two Volkswagen franchises in Colorado |

| • | EchoPark Segment |

| • | Opened five new delivery centers in Florida, Kentucky, Louisiana, Texas, and Utah |

| • | Opened one new retail hub in Nevada |

| • | Company |

| • | Repurchased approximately 0.5 million shares of Class A Common Stock for approximately $24.8 million in open-market transactions at prevailing market prices |

During the third quarter ended September 30, 2021, global supply-chain disruptions continued to impact automobile production, resulting in low levels of new vehicle inventory for Sonic and the industry in general. As of September 30, 2021, Sonic had approximately 2,400 new vehicles in inventory, compared to 12,900 new vehicles in inventory as of September 30, 2020. Due to lack of available new vehicle inventory, Sonic expects to report lower new vehicle retail unit sales volume in the third quarter of 2021 compared to the second quarter of 2021. Further, as a result of low new vehicle inventory levels, average used vehicle transaction prices and retail used vehicle gross profit per unit remain elevated above normal levels. Parts, service and collision repair activities have continued to improve as pandemic-related governmental restrictions have loosened and vehicle owners have begun to return to normal driving habits. From a finance and insurance perspective, Sonic has continued to see good credit availability for car buyers and continued strength in warranty and insurance product penetration. The expense reduction measures that Sonic put in place beginning in March and April of 2020 continue to drive higher overall profitability despite new vehicle inventory-related challenges.

7

With the above considerations, based on preliminary results for the third quarter ended September 30, 2021 Sonic estimates total revenues to be in the range of $3.0 billion to $3.1 billion, net income to be in the range of $81.8 million to $85.6 million and Adjusted EBITDA to be in the range of $147.0 million to $153.0 million. Comparable figures for the fiscal quarter ended September 30, 2020 were total revenues of $2.55 billion, net income of $59.8 million and Adjusted EBITDA of $113.9 million.

The following table shows the calculation of Sonic’s Adjusted EBITDA and reconciles Adjusted EBITDA to its closest U.S. GAAP measurement, net income, for the periods presented in the table below:

| Sonic | ||||||||||||

| Reported September 30, |

Preliminary Results for the Three Months Ending September 30, 2021 |

|||||||||||

| 2020 | Low | High | ||||||||||

| Adjusted EBITDA |

$ | 113,924 | $ | 147,000 | $ | 153,000 | ||||||

| Subtract: (1) |

||||||||||||

| Non-floor plan interest (2) |

9,928 | 9,800 | 9,800 | |||||||||

| Provision for income taxes |

20,620 | 27,000 | 28,500 | |||||||||

| Depreciation & amortization (3) |

23,767 | 24,900 | 24,900 | |||||||||

| Stock-based compensation expense |

3,153 | 3,700 | 3,700 | |||||||||

| Long-term compensation-related charges |

— | 500 | 500 | |||||||||

| Asset impairment charges |

26 | — | — | |||||||||

| Loss (gain) on franchise and real estate disposals |

(3,388 | ) | — | — | ||||||||

|

|

|

|

|

|

|

|||||||

| Net income |

$ | 59,818 | $ | 81,100 | $ | 85,600 | ||||||

|

|

|

|

|

|

|

|||||||

| (1) | Items include both continuing operations and discontinued operations. |

| (2) | Includes the following, net of any amortization of debt issuance costs or net debt discount/premium included in footnote (3) below: interest expense, other, net; interest expense, non-cash, convertible debt; and interest expense/amortization, non-cash, cash flow swaps. |

| (3) | Includes: depreciation and amortization of property and equipment; debt issuance cost amortization; and net debt discount/premium amortization and other amortization. |

Based on preliminary results for the third quarter ended September 30, 2021, RFJ Auto estimates total revenues to be in the range of $760.0 million to $800.0 million and net income to be in the range of $16.0 million to $18.0 million, which is consistent in trend with RFJ Auto’s results for the six months ended June 30, 2021.

Each of the Company’s and RFJ Auto’s closing procedures for the three months ended September 30, 2021 will not be complete, and the Company’s financial results for the three months ended September 30, 2021 will not be publicly available, until after the expected completion of the offering of the notes. The Company’s and RFJ Auto’s actual financial results could be different from these preliminary financial results, and any differences could be material due to the completion of financial closing procedures, final adjustments and other developments that may arise between now and the time the financial results for our interim period are finalized The preliminary financial information presented above has been prepared by the Company’s and RFJ Auto’s management and is based on a number of assumptions. Neither of the Company’s independent registered public accounting firm nor RFJ Auto’s independent certified public accountants has performed review procedures with respect to the summary preliminary financial information of the Company or RFJ Auto set forth herein, nor have they expressed any opinion or provided any other form of assurance on such information. The information presented above should not be considered a substitute for full unaudited quarterly financial statements, and you should not place undue reliance on these preliminary estimates. In addition, the preliminary estimated financial results set forth below are not necessarily indicative of results the Company may achieve in any future period.

8

Summary Historical and Pro Forma Financial Data and Operating Data of the Company

The following table summarizes historical financial data of Sonic and pro forma financial data of the Combined Company. The summary historical consolidated income statement data for the years ended December 31, 2020, 2019 and 2018 and the summary historical consolidated balance sheet data as of December 31, 2020 and 2019 have been derived from our audited historical consolidated financial statements, which are incorporated by reference into this offering memorandum from our Annual Report on Form 10-K for the year ended December 31, 2020. The summary historical consolidated balance sheet data as of December 31, 2018 has been derived from our audited historical consolidated financial statements as of and for the year ended December 31, 2018, which are not included in or incorporated by reference into this offering memorandum. This summary consolidated financial and operating data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes thereto, which are incorporated by reference into this offering memorandum. The summary historical consolidated balance sheet data and income statement data for the six months ended June 30, 2021 and 2020 and as of June 30, 2021 have been derived from our unaudited historical interim consolidated financial statements incorporated by reference into this offering memorandum. The unaudited historical interim consolidated financial statements have been prepared on the same basis as the audited historical consolidated financial statements and, in the opinion of our management, include all adjustments (which include only normal recurring adjustments) necessary for a fair presentation of the information set forth herein. Interim financial results are not necessarily indicative of results to be expected for the full fiscal year or any future reporting period. The summary income statement data for the LTM Period has been calculated by taking our audited historical consolidated income statement for the year ended December 31, 2020, less our unaudited historical consolidated income statement data for the six months ended June 30, 2020, plus our unaudited historical consolidated income statement data for the six months ended June 30, 2021.

The summary unaudited pro forma condensed combined financial information of the Combined Company for the LTM Period and as of June 30, 2021 has been derived from the unaudited pro forma condensed combined financial statements included elsewhere in this offering memorandum. The summary unaudited pro forma condensed combined income statement data for the LTM Period has been calculated by taking the unaudited pro forma condensed combined income statement information for the year ended December 31, 2020, less the unaudited pro forma condensed combined income statement information for the six months ended June 30, 2020, plus the unaudited pro forma condensed combined income statement information for the six months ended June 30, 2021. The summary unaudited pro forma condensed combined income statement information for the LTM Period has been adjusted to give effect to the Transactions as if they occurred on January 1, 2020. The summary unaudited pro forma condensed combined balance sheet data have been adjusted to give effect to the Transactions as if they occurred as of July 1, 2020. For a further description of the pro forma adjustments, see “Unaudited Pro Forma Condensed Combined Financial Statements.”

The summary unaudited pro forma condensed combined financial information of the Combined Company is for informational purposes only and does not purport to present what our results of operations and financial condition would have been had the Acquisition actually occurred during such time period, and should not be considered representative of our future results of operations or financial position. The summary unaudited pro forma condensed combined financial information also does not reflect (1) future cost savings or run-rate synergies, restructuring or integration charges or operational improvements that are expected to result from the Acquisition, except as indicated below or (2) the impact of non-recurring items directly related to the Acquisition.

Other than as described above in respect of the pro forma financial data, we have accounted for all of our dealership acquisitions using the purchase method of accounting and, as a result, we do not include in our consolidated financial statements the results of operations of acquired dealerships prior to the date they were acquired. The summary consolidated financial and operating data provided below reflects the results of operations and financial position of each of the dealerships acquired prior to June 30, 2021 for the portions of the periods presented following the acquisition of such dealerships. As a result of the effects of our acquisitions and other potential factors in the future, the summary consolidated financial and operating data set forth below is not necessarily indicative of our results of operations and financial position in the future or the results of operations and financial position that would have resulted had such acquisitions occurred at the beginning of the periods presented below.

9

The following financial data for all periods presented reflects our classification of operating results between continuing operations and discontinued operations as of December 31, 2020, which we performed in accordance with the provisions of “Presentation of Financial Statements” in the Accounting Standards Codification and as reflected in our Annual Report on Form 10-K for the year ended December 31, 2020. Such classification of operating results between continuing operations and discontinued operations has not changed subsequent to December 31, 2020.

10

| Year Ended December 31, |

Six Months Ended June 30, |

Last Twelve Months Ended June 30, |

Combined Company Pro Forma Last Twelve Months Ended June 30, |

|||||||||||||||||||||||||

| 2020 | 2019 | 2018 | 2021 | 2020 | 2021 | 2021 | ||||||||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||||||||||||

| Income Statement Data: |

||||||||||||||||||||||||||||

| Revenues: |

||||||||||||||||||||||||||||

| New vehicles |

$ | 4,281,223 | $ | 4,889,171 | $ | 4,974,097 | $ | 2,619,210 | $ | 1,859,492 | $ | 5,040,941 | $ | 6,946,467 | ||||||||||||||

| Used vehicles |

3,564,832 | 3,489,972 | 2,973,498 | 2,356,794 | 1,658,930 | 4,262,696 | 5,124,259 | |||||||||||||||||||||

| Wholesale vehicles |

197,378 | 202,946 | 217,625 | 159,614 | 81,718 | 275,274 | 381,162 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total vehicles |

8,043,433 | 8,582,089 | 8,165,220 | 5,135,618 | 3,600,140 | 9,578,911 | 12,451,888 | |||||||||||||||||||||

| Parts, service and collision repair |

1,233,735 | 1,395,303 | 1,380,887 | 681,509 | 593,738 | 1,321,506 | 1,472,525 | |||||||||||||||||||||

| Finance, insurance and other, net |

489,874 | 476,951 | 405,523 | 321,916 | 226,064 | 585,726 | 705,642 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total revenues |

9,767,042 | 10,454,343 | 9,951,630 | 6,139,043 | 4,419,942 | 11,486,143 | 14,630,055 | |||||||||||||||||||||

| Cost of sales |

(8,343,397 | ) | (8,933,326 | ) | (8,505,505 | ) | (5,227,342 | ) | (3,761,981 | ) | (9,808,758 | ) | (12,618,513 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Gross profit |

1,423,645 | 1,521,017 | 1,446,125 | 911,701 | 657,961 | 1,677,385 | 2,011,542 | |||||||||||||||||||||

| Selling, general and administrative expenses |

(1,028,666 | ) | (1,099,374 | ) | (1,145,325 | ) | (609,976 | ) | (512,515 | ) | (1,126,127 | ) | (1,340,088 | ) | ||||||||||||||

| Impairment charges |

(270,017 | ) | (20,768 | ) | (29,514 | ) | — | (268,833 | ) | (1,184 | ) | (2,548 | ) | |||||||||||||||

| Depreciation and amortization |

(91,023 | ) | (93,169 | ) | (93,623 | ) | (48,448 | ) | (44,944 | ) | (94,527 | ) | (101,264 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Operating income (loss) |

33,939 | 307,706 | 177,663 | 253,277 | (168,331 | ) | 455,547 | 567,642 | ||||||||||||||||||||

| Other income (expense): |

||||||||||||||||||||||||||||

| Interest expense, floor plan |

(27,228 | ) | (48,519 | ) | (48,398 | ) | (9,441 | ) | (16,822 | ) | (19,847 | ) | (27,737 | ) | ||||||||||||||

| Interest expense, other, net |

(41,572 | ) | (52,953 | ) | (54,059 | ) | (20,363 | ) | (20,762 | ) | (41,173 | ) | (71,678 | ) | ||||||||||||||

| Other income (expense), net |

97 | (6,589 | ) | 106 | 100 | 100 | 97 | (1,220 | ) | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total other income (expense) |

(68,703 | ) | (108,061 | ) | (102,351 | ) | (29,704 | ) | (37,484 | ) | (60,923 | ) | (100,635 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Income (loss) from continuing operations before taxes |

(34,764 | ) | 199,645 | 75,312 | 223,573 | (205,815 | ) | 394,624 | 467,007 | |||||||||||||||||||

| Provision for income taxes for continuing operations—benefit (expense) |

(15,900 | ) | (55,108 | ) | (22,922 | ) | (55,893 | ) | 37,680 | (109,473 | ) | (128,531 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Income (loss) from continuing operations |

(50,664 | ) | 144,537 | 52,390 | 167,680 | (168,135 | ) | 285,151 | 338,476 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Income (loss) from discontinued operations |

(721 | ) | (400 | ) | (740 | ) | 387 | (407 | ) | 73 | 73 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net income (loss) |

$ | (51,385 | ) | $ | 144,137 | $ | 51,650 | $ | 168,067 | $ | (168,542 | ) | $ | 285,224 | $ | 338,549 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Other Financial Data: |

||||||||||||||||||||||||||||

| Net cash provided by (used in) operating activities |

$ | 281,079 | $ | 170,914 | $ | 143,675 | $ | (34,658 | ) | $ | 227,748 | $ | 18,646 | $ | 83,657 | |||||||||||||

| Adjusted Cash Flow from Operations (a) |

341,875 | 136,171 | 147,543 | 279,648 | 163,627 | 457,869 | 509,428 | |||||||||||||||||||||

| Adjusted EBITDA (b) |

370,302 | 308,485 | 259,287 | 300,943 | 134,664 | 536,581 | 654,247 | |||||||||||||||||||||

| EchoPark Revenue |

1,418,984 | 1,162,018 | 700,177 | 1,102,741 | 646,987 | 1,874,739 | ||||||||||||||||||||||

| EchoPark Adjusted EBITDA |

10,967 | 21,399 | (10,608 | ) | (3,255 | ) | 10,737 | (3,025 | ) | |||||||||||||||||||

| Capital Expenditures |

127,183 | 125,576 | 163,619 | 105,091 | 61,733 | 170,541 | 183,624 | |||||||||||||||||||||

| Ratio of Adjusted EBITDA to interest expense, other, net (b) |

8.9x | 5.8x | 4.8x | 14.8x | 6.5x | 13.0 | 9.1x | |||||||||||||||||||||

| Ratio of total long-term debt to Adjusted EBITDA (b)(c) |

1.9x | 2.3x | 3.6x | 2.3x | 5.3x | 1.3x | 2.2x | |||||||||||||||||||||

| Adjusted EBITDAR (b) |

425,797 | 363,642 | 324,055 | 327,828 | 162,325 | 591,300 | 714,380 | |||||||||||||||||||||

| Margin Data: |

||||||||||||||||||||||||||||

| Adjusted EBITDA Margin (b)(d) |

3.8 | % | 3.0 | % | 2.6 | % | 4.9 | % | 3.0 | % | 4.7 | % | 4.5 | % | ||||||||||||||

| Gross Profit Margin (e) |

14.6 | % | 14.5 | % | 14.5 | % | 14.9 | % | 14.9 | % | 14.6 | % | 13.7 | % | ||||||||||||||

| New vehicles |

5.5 | % | 4.8 | % | 4.9 | % | 7.2 | % | 4.9 | % | 6.6 | % | 5.9 | % | ||||||||||||||

| Retail used vehicles |

3.0 | % | 4.2 | % | 4.8 | % | 2.8 | % | 3.6 | % | 2.6 | % | 3.6 | % | ||||||||||||||

| Parts, service and collision repair |

48.2 | % | 47.9 | % | 48.3 | % | 48.6 | % | 47.5 | % | 48.7 | % | 48.0 | % | ||||||||||||||

| Balance Sheet Data (at end of period): |

||||||||||||||||||||||||||||

| Cash and cash equivalents (f) |

$ | 170,313 | $ | 29,103 | $ | 5,854 | $ | 239,617 | $ | 239,617 | ||||||||||||||||||

11

| Inventories |

1,247,254 | 1,517,875 | 1,528,461 | 1,016,566 | 1,288,054 | |||||||||||||||||||||||

| Total assets |

3,745,993 | 4,071,035 | 3,796,807 | 3,656,345 | 4,755,875 | |||||||||||||||||||||||

| Notes payable-floor plan |

1,324,244 | 1,539,094 | 1,534,040 | 1,086,103 | 1,341,796 | |||||||||||||||||||||||

| Total long-term debt (b) |

720,067 | 706,886 | 945,083 | 686,393 | 1,413,197 | |||||||||||||||||||||||

| Stockholders’ equity |

814,805 | 944,764 | 823,116 | 946,354 | 936,480 | |||||||||||||||||||||||

| Other Operating Data: |

||||||||||||||||||||||||||||

| Number of operating stores |

100 | 95 | 104 | 109 | 95 | 142 | ||||||||||||||||||||||

| New units sold |

93,281 | 114,131 | 122,717 | 54,860 | 41,615 | 106,526 | 151,475 | |||||||||||||||||||||

| Used retail units sold |

159,025 | 162,149 | 139,605 | 96,717 | 77,204 | 178,538 | 207,913 |

| (a) | Adjusted Cash Flow from Operations is defined as Net cash provided by (used in) operating activities plus Floor plan non-trade borrowings/(repayments) in financing cash flows. The following table shows the calculation of Adjusted Cash Flow from Operations: |

| Year Ended December 31, | Six Months Ended June 30, |

Last Twelve Months Ended June 30, |

Pro Forma Combined Company Last Twelve Months Ended June 30, |

|||||||||||||||||||||||||

| 2020 | 2019 | 2018 | 2021 | 2020 | 2021 | 2021 | ||||||||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||||||||||||

| Net cash provided by (used in) operating activities |

$ | 281,079 | $ | 170,914 | $ | 143,675 | $ | (34,685 | ) | $ | 227,748 | $ | 18,646 | $ | 83,657 | |||||||||||||

| Floor plan non-trade borrowings/(repayments) in financing cash flows |

60,796 | (34,743 | ) | 3,868 | 314,306 | (64,121 | ) | 439,223 | 409,982 | |||||||||||||||||||

| Adjusted cash flow from operations |

$ | 341,875 | $ | 136,171 | $ | 147,543 | $ | 279,621 | $ | 163,627 | $ | 457,869 | $ | 493,639 | ||||||||||||||

| (b) | Adjusted EBITDA is defined as net income plus non-floor plan interest expense, income taxes, impairment charges, (gain) loss on disposal of dealerships and real estate, (gain) loss on exit of leased dealerships, (gain) loss on retirement of debt, long-term compensation expense, non-cash stock-based compensation expense, depreciation and amortization, and certain other non-recurring items, for all operations, continuing and discontinued. While Adjusted EBITDA should not be construed as a substitute for net income or as a better measure of liquidity than net cash provided by operating activities, which are determined in accordance with U.S. GAAP, it is included in our discussion of earnings to provide additional information regarding the amount of cash our business is generating with respect to our ability to meet future debt services, capital expenditures and working capital requirements. Adjusted EBITDAR is defined as Adjusted EBITDA plus rent expense. Adjusted EBITDA and Adjusted EBITDAR should not be used as indicators of our operating performance. Consistent with industry practices, Sonic’s management utilizes Adjusted EBITDA as one factor when valuing dealership operations. These measures may not be comparable to similarly titled measures reported by other companies. The following table shows the calculation of Adjusted EBITDA and Adjusted EBTIDAR and reconciles Adjusted EBITDA and Adjusted EBITDAR to net income (loss) its closest U.S. GAAP financial measure for the periods presented in the table below: |

| Year Ended December 31, | Six Months Ended June 30, |

Last Twelve Months Ended June 30, |

Pro Forma Combined Company Last Twelve Months Ended June 30, |

|||||||||||||||||||||||||

| 2020 | 2019 | 2018 | 2021 | 2020 | 2021 | 2021 | ||||||||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||||||||||||

| Adjusted EBITDAR |

$ | 425,797 | $ | 363,642 | $ | 324,055 | $ | 327,828 | $ | 162,325 | $ | 591,300 | $ | 714,380 | ||||||||||||||

| Subtract: (1) |

||||||||||||||||||||||||||||

| Rent expense |

55,495 | 55,157 | 64,768 | 26,885 | 27,661 | 54,719 | 60,133 | |||||||||||||||||||||

| Adjusted EBITDA |

370,302 | 308,485 | 259,287 | 300,943 | 134,664 | 536,581 | 654,247 | |||||||||||||||||||||

| Subtract: (1) |

||||||||||||||||||||||||||||

| Non-floor plan interest(2) |

38,672 | 50,475 | 52,049 | 18,704 | 19,580 | 37,796 | 71,678 | |||||||||||||||||||||

| Provision for income taxes |

15,619 | 54,954 | 22,645 | 56,022 | (37,846 | ) | 109,487 | 128,545 | ||||||||||||||||||||

12

| Depreciation & amortization(3) |

93,922 | 95,646 | 96,652 | 50,106 | 46,124 | 97,904 | 101,264 | |||||||||||||||||||||

| Stock-based compensation expense |

11,704 | 10,797 | 11,853 | 7,474 | 5,398 | 13,780 | 13,953 | |||||||||||||||||||||

| Long-term compensation-related changes |

— | — | 32,522 | 1,000 | — | 1,000 | 1,355 | |||||||||||||||||||||

| Asset impairment charges |

270,017 | 20,768 | 29,514 | — | 268,833 | 1,184 | 2,548 | |||||||||||||||||||||

| Loss (gain) on debt extinguishment |

— | 6,690 | — | — | — | — | 231 | |||||||||||||||||||||

| Loss (gain) on exit of leased dealerships |

— | (170 | ) | 1,709 | — | — | — | — | ||||||||||||||||||||

| Loss (gain) on franchise and real estate disposals |

(8,247 | ) | (74,812 | ) | (39,307 | ) | (430 | ) | 1,117 | (9,794 | ) | (9,815 | ) | |||||||||||||||

| Private equity management fees and costs |

— | — | — | — | — | — | 3,828 | |||||||||||||||||||||

| Acquisition related costs |

— | — | — | — | — | — | 2,135 | |||||||||||||||||||||

| Other |

— | — | — | — | — | — | (24 | ) | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net income (loss) |

$ | (51,385 | ) | $ | 144,137 | $ | 51,650 | $ | 168,067 | $ | (168,542 | ) | $ | 285,224 | $ | 338,549 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Add/(subtract): |

||||||||||||||||||||||||||||

| Depreciation and amortization(3) |

$ | 87,571 | $ | 89,949 | $ | 93,617 | $ | 45,392 | $ | 43,462 | $ | 89,501 | $ | 101,264 | ||||||||||||||

| Deferred income taxes |

(33,677 | ) | (20,845 | ) | (20,606 | ) | (5,962 | ) | (60,035 | ) | 20,396 | 20,374 | ||||||||||||||||

| Net distributions from equity investee |

93 | (101 | ) | (225 | ) | (262 | ) | 465 | (634 | ) | (634 | ) | ||||||||||||||||

| Asset impairment charges |

270,017 | 20,768 | 29,514 | — | 268,833 | 1,184 | 2,548 | |||||||||||||||||||||

| (Gain) loss on disposal of dealerships and property and equipment |

(7,298 | ) | (75,318 | ) | (43,164 | ) | (490 | ) | 2,364 | (10,152 | ) | (9,815 | ) | |||||||||||||||

| (Gain) loss on exit of leased dealerships |

— | (170 | ) | 1,709 | — | — | — | 231 | ||||||||||||||||||||

| (Gain) loss on retirement of debt |

— | 6,690 | — | — | — | — | — | |||||||||||||||||||||

| Other changes in assets and liabilities that relate to operations |

15,758 | 5,804 | 31,180 | (241,403 | ) | 141,201 | (366,846 | ) | (368,860 | ) | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net cash provided by (used in) operating activities |

$ | 281,079 | $ | 170,914 | $ | 143,675 | $ | (34,658 | ) | $ | 227,748 | $ | 18,673 | $ | 83,657 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) | Items include both continuing operations and discontinued operations. |

| (2) | Includes the following, net of any amortization of debt issuance costs or net debt discount/premium included in footnote (3) below: interest expense, other, net; interest expense, non-cash, convertible debt; and interest expense/amortization, non-cash, cash flow swaps. |

| (3) | Includes: depreciation and amortization of property and equipment; debt issuance cost amortization; and net debt discount/premium amortization and other amortization. |

| (c) | Long-term debt, including current portion. See our consolidated financial statements and the related notes which are incorporated by reference into this offering memorandum from our Annual Report on Form 10-K for the year ended December 31, 2020 and from our Quarterly Report on Form 10-Q for the three and six months ended June 30, 2021. |

| (d) | Adjusted EBITDA margin is calculated as Adjusted EBITDA (as defined above) divided by total revenues. |

| (e) | Gross profit margin is defined as gross profit divided by total revenues. |

| (f) | Cash and cash equivalents does not include cash deposited in floor plan accounts of $75,000, as of June 30, 2021, and $73,180, as of December 31, 2020, which are included in current assets in the Company’s consolidated financial statements incorporated by reference in this offering memorandum. |

13

Summary Historical Financial Data and Operating Data of RFJ Auto

The following table summarizes historical consolidated financial data of RFJ Auto. The summary historical consolidated income statement data for the years ended December 31, 2020 and 2019 the summary historical consolidated balance sheet data as of December 31, 2020 and 2019 are derived from the audited historical consolidated financial statements of RFJ Auto, which are incorporated by reference into this offering memorandum from our Current Report on Form 8-K filed on October 13, 2021. The summary balance sheet data and income statement data as of and for the six months ended June 30, 2021 and 2020 have been derived from the unaudited historical interim consolidated financial statements of RFJ Auto incorporated by reference into this offering memorandum from our Current Report on Form 8-K filed on October 13, 2021. The summary income statement data for the LTM Period has been derived by taking the historical audited consolidated income statement of RFJ Auto for the year ended December 31, 2020, less the historical unaudited consolidated income statement data of RFJ Auto for the six months ended June 30, 2020, plus the historical unaudited consolidated income statement data of RFJ Auto for the six months ended June 30, 2021.

This information is only a summary and should be read in conjunction with “Special Note Regarding Non-GAAP Financial Measures,” “Risk Factors,” “Summary—The Transactions,” “Capitalization” and the audited and unaudited consolidated financial statements of RFJ Auto and the accompanying notes incorporated by reference in this offering memorandum, as well as the other financial information included herein.

| Year Ended December 31, |

Six Months Ended June 30, |

Last Twelve Months Ended June 30, |

||||||||||||||||||

| 2020 | 2019 | 2021 | 2020 | 2021 | ||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||||

| Income Statement Data: |

||||||||||||||||||||

| Sales |

$ | 2,729,076 | $ | 2,180,143 | $ | 1,500,336 | $ | 1,130,159 | $ | 3,099,253 | ||||||||||

| Cost of sales |

2,551,942 | 2,060,065 | 1,382,025 | 1,053,584 | 2,880,383 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit from sales |

177,134 | 120,078 | 118,311 | 76,575 | 218,870 | |||||||||||||||

| Financing, insurance, service contract and other income, net |

105,516 | 71,110 | 65,893 | 50,233 | 121,176 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

282,650 | 191,188 | 184,204 | 126,808 | 340,046 | |||||||||||||||

| Expenses: |

||||||||||||||||||||

| Variable selling |

70,082 | 48,618 | 45,511 | 32,151 | 83,442 | |||||||||||||||

| Advertising |

12,038 | 12,741 | 6,872 | 5,918 | 12,992 | |||||||||||||||

| Floor plan interest |

13,226 | 21,121 | 3,545 | 8,453 | 8,318 | |||||||||||||||

| Personnel |

62,547 | 49,891 | 37,362 | 29,293 | 70,616 | |||||||||||||||

| Semi-fixed |

29,872 | 21,386 | 15,863 | 13,147 | 32,588 | |||||||||||||||

| Fixed |

24,123 | 16,290 | 13,460 | 11,343 | 26,240 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total expenses |

211,888 | 170,047 | 122,613 | 100,305 | 234,196 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income from operations |

70,762 | 21,141 | 61,591 | 26,503 | 105,850 | |||||||||||||||

| Other Expenses: |

||||||||||||||||||||

| Interest expense, other than floor plan |

8,985 | 8,646 | 4,461 | 4,564 | 8,882 | |||||||||||||||

| Amortization expense |

17,151 | 12,696 | 8,980 | 8,168 | 17,963 | |||||||||||||||

| Other expense/(income) |

279 | (3,078 | ) | 482 | (556 | ) | 1,317 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total other expenses |

26,415 | 18,264 | 13,923 | 12,176 | 28,162 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income before income taxes |

44,347 | 2,877 | 47,668 | 14,327 | 77,688 | |||||||||||||||

| Income tax expense |

11,713 | 2,119 | 12,582 | 4,002 | 20,293 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

$ | 32,634 | $ | 758 | $ | 35,086 | $ | 10,325 | $ | 57,395 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Other Financial Data: |

||||||||||||||||||||

| Net cash provided by (used in) operating activities |

$ | 254,661 | $ | 10,970 | $ | 46,399 | $ | 220,287 | $ | 80,773 | ||||||||||

| Adjusted Operating Cash Flows (a) |

71,807 | 21,239 | 25,183 | 45,458 | 51,532 | |||||||||||||||

| Adjusted EBITDA (b) |

83,484 | 27,307 | 66,986 | 31,959 | 118,511 | |||||||||||||||

| Adjusted EBITDA Margin (c)(d) |

2.9 | % | 1.2 | % | 4.3 | % | 2.8 | % | 3.7 | % | ||||||||||

| Adjusted EBITDAR (c) |

$ | 88,530 | $ | 28,470 | $ | 69,551 | $ | 34,156 | $ | 123,925 | ||||||||||

| Balance Sheet Data (at end of period): |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 18,389 | $ | 20,100 | $ | 35,827 | ||||||||||||||

19

| Inventories, net |

301,255 | 422,282 | 278,541 | |||||||||||||||||

| Total Assets |

698,891 | 752,319 | 663,145 | |||||||||||||||||

| Floor plan notes payable – trade |

53,578 | 35,541 | 10,431 | |||||||||||||||||

| Other Operating Data: |

||||||||||||||||||||

| New units sold |

41,232 | 38,130 | 19,467 | 15,171 | 45,528 | |||||||||||||||

| Used retail units sold |

28,448 | 19,474 | 16,133 | 14,619 | 29,962 |

| (a) | Adjusted Cash Flow from Operations is defined as Net cash provided by (used in) operating activities plus Floor plan non-trade borrowings/(repayments) in financing cash flows. The following table shows the calculation of Adjusted Cash Flow from Operations: |

| Year Ended December 31, |

Six Months Ended June 30, |

Last Twelve Months Ended June 30, |

||||||||||||||||||

| 2020 | 2019 | 2021 | 2020 | 2021 | ||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||||

| Net cash provided by (used in) operating activities |

$ | 254,661 | $ | 10,970 | $ | 46,399 | $ | 220,287 | $ | 80,773 | ||||||||||

| Floor plan non-trade borrowings/(repayments) in financing cash flows |

(182,854 | ) | 10,269 | (21,216 | ) | (174,829 | ) | (29,241 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted cash flow from operations |

$ | 71,807 | $ |

21,239 |

|

$ | 25,183 | $ | 45,458 | $ | 51,532 | |||||||||

| (c) | Adjusted EBITDA for RFJ Auto is defined as net income plus non-floor plan interest expense, income taxes, impairment charges, (gain) loss on disposal of dealerships and real estate, non-cash stock-based compensation expense, depreciation and amortization, and certain other non-recurring items, for all operations, continuing and discontinued. While Adjusted EBITDA for RFJ Auto should not be construed as a substitute for net income or as a better measure of liquidity than net cash provided by operating activities, which are determined in accordance with U.S. GAAP, it is included in the discussion of earnings to provide additional information regarding the amount of cash the business is generating with respect to its ability to meet future debt services, capital expenditures and working capital requirements. Adjusted EBITDAR is defined as Adjusted EBITDA plus rent expense. Adjusted EBITDA and Adjusted EBITDAR for RFJ Auto should not be used as indicators of its operating performance. These measures may not be comparable to similarly titled measures reported by other companies. The following table shows the calculation of Adjusted EBITDA and Adjusted EBITDAR for RFJ Auto and reconciles Adjusted EBITDA and Adjusted EBITDAR to its closest U.S. GAAP financial measure for the periods presented in the table below: |

| Year Ended December 31, |

Six Months Ended June 30, |

Last Twelve Months Ended June 30, |

||||||||||||||||||

| 2020 | 2019 | 2021 | 2020 | 2021 | ||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||||

| Adjusted EBITDAR |

$ | 88,530 | $ | 28,470 | $ | 69,551 | $ | 34,156 | $ | 123,925 | ||||||||||

| Subtract: (1) |

||||||||||||||||||||

| Rent expense |

5,046 | 1,163 | 2,565 | 2,197 | 5,414 | |||||||||||||||

| Adjusted EBITDA |

83,484 | 27,307 | 66,986 | 31,959 | 118,511 | |||||||||||||||

| Subtract/(add): |

||||||||||||||||||||

| Non-floor plan interest |

8,985 | 8,646 | 4,461 | 4,564 | 8,882 | |||||||||||||||

| Provision for income taxes |

11,713 | 2,119 | 12,582 | 4,002 | 20,293 | |||||||||||||||

| Depreciation & amortization |

23,018 | 17,965 | 11,963 | 11,081 | 23,900 | |||||||||||||||

| Stock-based compensation expense |

175 | 128 | 87 | 89 | 173 | |||||||||||||||

| Long-term compensation-related charges |

565 | 347 | — | 210 | 355 | |||||||||||||||

| Impairment |

871 | 232 | 493 | — | 1,364 | |||||||||||||||

| Loss (gain) on retirement of debt |

450 | — | — | 219 | 231 | |||||||||||||||

20

| Loss (gain) on franchise and real estate disposals |

(21 | ) | (3,334 | ) | — | — | (21 | )) | ||||||||||||

| Private equity management fees and costs |

2,327 | 682 | 2,165 | 664 | 3,828 | |||||||||||||||

| Acquisition related costs (benefits) |

2,791 | (236 | ) | 149 | 805 | 2,135 | ||||||||||||||

| Other |

(24 | ) | — | — | — | (24 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

32,634 | 758 | 35,086 | 10,325 | 57,395 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Add/(subtract): |

||||||||||||||||||||

| Depreciation & amortization (1) |

23,018 | 17,695 | 11,963 | 11,081 | 23,900 | |||||||||||||||

| Deferred income taxes |

(22 | ) | (65 | ) | — | — | (22 | ) | ||||||||||||

| Impairment |

871 | 232 | 493 | — | 1,364 | |||||||||||||||

| (Gain) loss on disposal of dealerships and real estate disposals |

(21 | ) | (3,334 | ) | 165 | (6 | ) | 150 | ||||||||||||

| Other changes in assets and liabilities that relate to operations |

198,181 | (4,586 | ) | (1,308 | ) | 198,887 | (2,008 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net cash provided by (used in) operating activities |

$ | 254,661 | $ | 10,970 | $ | 46,399 | $ | 220,287 | $ | 80,773 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

| (1) | Includes amortization of goodwill and property and equipment. |

| (d) | Adjusted EBITDA margin is calculated as Adjusted EBITDA (as defined above) divided by total revenues (defined as Sales plus Financing, insurance, service contract and other income, net). |

21

RISK FACTORS

This section describes some, but not all, of the risks of acquiring the notes. Before making an investment decision, you should carefully consider the risk factors described below, the risk factors included in our Annual Report on Form 10-K for the year ended December 31, 2020, which are incorporated by reference herein, and the risks described in our other filings with the SEC that are incorporated by reference herein.

Risks Related to the Acquisition

The Acquisition may not be completed within the expected timeframe, or at all, and the pendency of the Acquisition could adversely affect our business, financial condition, results of operations and cash flows.

Completion of the Acquisition is subject to the satisfaction (or waiver) of a number of conditions, many of which are beyond our control and may prevent, delay or otherwise negatively affect its completion. Such conditions include, among others, (i) the expiration or termination of all applicable waiting periods under the HSR Act and (ii) the consent to or the approval of the transactions contemplated by the Merger Agreement by each Manufacturer whose consent or approval is required. The Merger Agreement may be terminated under certain circumstances, including by Sonic or RFJ Auto if the closing of the Acquisition does not occur on or before 5:00 p.m., Eastern Time, on December 15, 2021, unless such party’s breach of the Merger Agreement has prevented the consummation of the Acquisition by such time.

The conditions to the closing of the Acquisition may not be satisfied and the Merger Agreement could be terminated. In addition, satisfying the conditions to the Acquisition may take longer, and could cost more, than we and RFJ Auto expect; in particular, we could be required to take certain actions which we would not ordinarily take in order to obtain consents that may be required under the HSR Act or any other applicable regulatory laws. The occurrence of any of these events individually or in combination may adversely affect the benefits we expect to achieve from the Acquisition and adversely affect our business, financial condition, results of operations and cash flows.

In addition, if the Acquisition does not close, the attention of our management will have been diverted to the Acquisition, rather than our operations and pursuit of other opportunities. Failure to complete the Acquisition would, and any delay in completing the Acquisition could, prevent us from realizing the anticipated benefits from the Acquisition. Additionally, if we fail to close the Acquisition and are otherwise in breach of our obligations, we could be liable for damages.

We may fail to realize the benefits of the Acquisition.

The success of the Acquisition will depend on, among other things, our ability to combine the RFJ Auto and Sonic businesses in a manner that facilitates growth opportunities and realizes anticipated cost synergies and performance improvements. Our ability to realize the expected benefits of the Acquisition is therefore subject to a number of risks and uncertainties, many of which are outside of our control. These risks and uncertainties could adversely impact our business, financial condition and operating results, and include, among other things:

| • | our ability to retain the service of senior management and other key personnel; |

| • | our ability to preserve customer, supplier and other important relationships; |

| • | the risk that certain of our customers and suppliers will opt to discontinue business with us or exercise their right to terminate their agreements as a result of the Acquisition pursuant to change of control provisions in their agreements or otherwise; and |

22

| • | difficulties in achieving anticipated cost savings, business opportunities, and growth prospects following the Acquisition |

We must successfully combine the businesses of RFJ Auto and Sonic in a manner that permits these cost synergies and performance improvements to be realized. In addition, we must achieve the anticipated synergies and improvements without adversely affecting current revenues and investments in future growth. If we are not able to successfully achieve these objectives, the anticipated benefits of the Acquisition may not be realized fully, or at all, or may take longer to realize than expected.

The failure to integrate successfully certain business and operations of RFJ Auto and Sonic in the expected time frame may adversely affect our future results.

Historically, RFJ Auto and Sonic have operated as independent companies, and they will continue to do so until the consummation of the Acquisition. Our management may face significant challenges in consolidating certain businesses and the functions of RFJ Auto and Sonic, integrating their technologies, organizations, procedures, policies and operations, addressing differences in the business cultures of the two companies and retaining key personnel. The integration may also be complex and time consuming and require substantial resources and effort. The integration process and other disruptions resulting from the Acquisition may also disrupt RFJ Auto’s and Sonic’s ongoing businesses or cause inconsistencies in standards, controls, procedures and policies that adversely affect our relationships with manufacturers, employees, suppliers, customers and others with whom RFJ Auto and Sonic have business or other dealings or limit our ability to achieve the anticipated benefits of the Acquisition. In addition, difficulties in integrating the businesses or regulatory functions of RFJ Auto and Sonic could harm our reputation.

Combining the business of RFJ Auto and Sonic may be more difficult, costly or time consuming than expected, which may adversely affect our results.