EX-99.1

Exhibit 99.1

C.H. Robinson Worldwide, Inc.

14701 Charlson Road

Eden Prairie, Minnesota 55347

Andrew Clarke, Chief Financial

Officer (952) 683-3474

Tim Gagnon, Director, Investor Relations (952)

683-5007

FOR IMMEDIATE RELEASE

C.H. ROBINSON REPORTS FOURTH QUARTER RESULTS

MINNEAPOLIS,

January 31, 2017 – C.H. Robinson Worldwide, Inc. (“C.H. Robinson”) (NASDAQ: CHRW), today reported financial results for the quarter ended December 31, 2016. This table of summary results presents our service line net

revenues consistent with our historical presentation and is on an enterprise basis. The service line net revenues in the table differ from the segment service line net revenues discussed below as our segments have revenues from multiple service

lines. Summarized financial results are set forth in the following table (dollars in thousands, except per share data).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended December 31, |

|

|

Twelve months ended December 31, |

|

| |

|

2016 |

|

|

2015 |

|

|

%

change |

|

|

2016 |

|

|

2015 |

|

|

%

change |

|

| Total revenues |

|

$ |

3,414,975 |

|

|

$ |

3,210,853 |

|

|

|

6.4 |

% |

|

$ |

13,144,413 |

|

|

$ |

13,476,084 |

|

|

|

-2.5 |

% |

|

|

|

|

|

|

|

| Net revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Transportation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Truckload |

|

$ |

296,740 |

|

|

$ |

338,892 |

|

|

|

-12.4 |

% |

|

$ |

1,257,191 |

|

|

$ |

1,316,533 |

|

|

|

-4.5 |

% |

| LTL |

|

|

94,299 |

|

|

|

89,622 |

|

|

|

5.2 |

% |

|

|

381,817 |

|

|

|

360,706 |

|

|

|

5.9 |

% |

| Intermodal |

|

|

7,521 |

|

|

|

8,835 |

|

|

|

-14.9 |

% |

|

|

33,482 |

|

|

|

41,054 |

|

|

|

-18.4 |

% |

| Ocean |

|

|

69,033 |

|

|

|

56,065 |

|

|

|

23.1 |

% |

|

|

244,276 |

|

|

|

223,643 |

|

|

|

9.2 |

% |

| Air |

|

|

23,743 |

|

|

|

18,613 |

|

|

|

27.6 |

% |

|

|

82,167 |

|

|

|

79,096 |

|

|

|

3.9 |

% |

| Customs |

|

|

15,860 |

|

|

|

10,681 |

|

|

|

48.5 |

% |

|

|

50,509 |

|

|

|

43,929 |

|

|

|

15.0 |

% |

| Other logistics services |

|

|

28,404 |

|

|

|

21,217 |

|

|

|

33.9 |

% |

|

|

105,369 |

|

|

|

82,548 |

|

|

|

27.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total transportation |

|

|

535,600 |

|

|

|

543,925 |

|

|

|

-1.5 |

% |

|

|

2,154,811 |

|

|

|

2,147,509 |

|

|

|

0.3 |

% |

| Sourcing |

|

|

25,916 |

|

|

|

26,852 |

|

|

|

-3.5 |

% |

|

|

122,717 |

|

|

|

120,971 |

|

|

|

1.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total net revenues |

|

|

561,516 |

|

|

|

570,777 |

|

|

|

-1.6 |

% |

|

|

2,277,528 |

|

|

|

2,268,480 |

|

|

|

0.4 |

% |

|

|

|

|

|

|

|

| Operating expenses |

|

|

367,951 |

|

|

|

356,198 |

|

|

|

3.3 |

% |

|

|

1,439,997 |

|

|

|

1,410,170 |

|

|

|

2.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from operations |

|

|

193,565 |

|

|

|

214,579 |

|

|

|

-9.8 |

% |

|

|

837,531 |

|

|

|

858,310 |

|

|

|

-2.4 |

% |

| Net income |

|

$ |

122,303 |

|

|

$ |

126,583 |

|

|

|

-3.4 |

% |

|

$ |

513,384 |

|

|

$ |

509,699 |

|

|

|

0.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted EPS |

|

$ |

0.86 |

|

|

$ |

0.88 |

|

|

|

-2.3 |

% |

|

$ |

3.59 |

|

|

$ |

3.51 |

|

|

|

2.3 |

% |

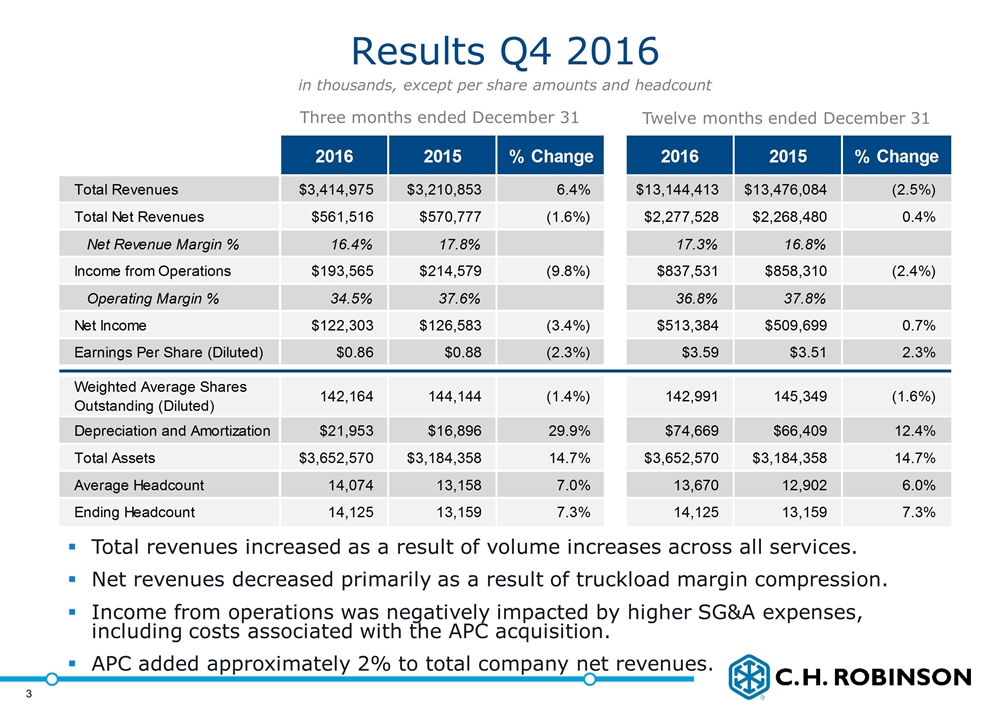

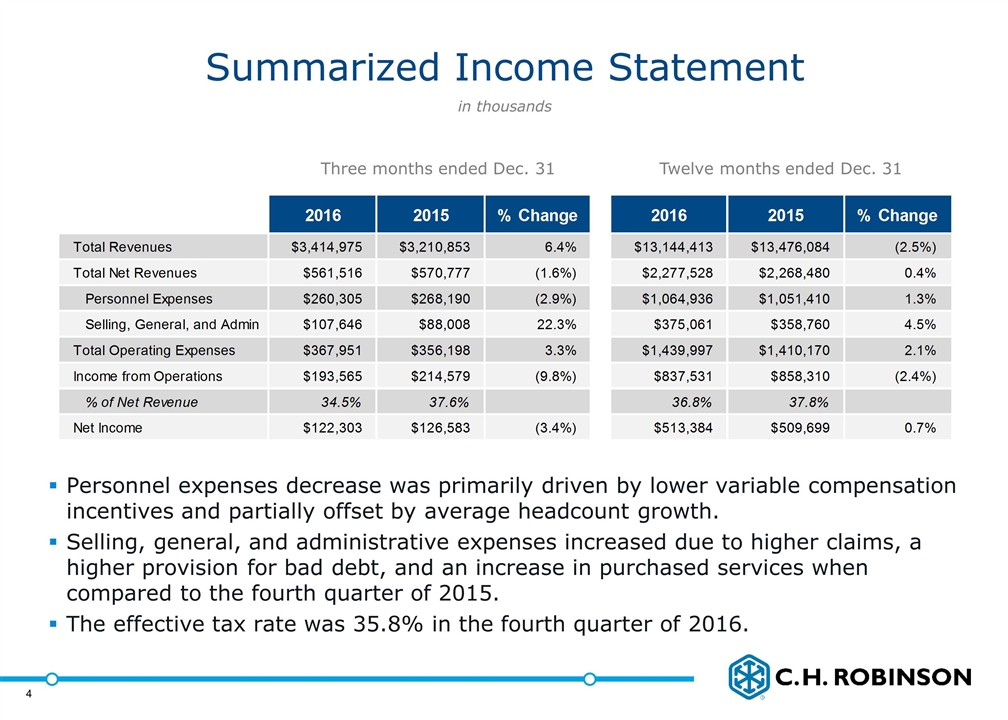

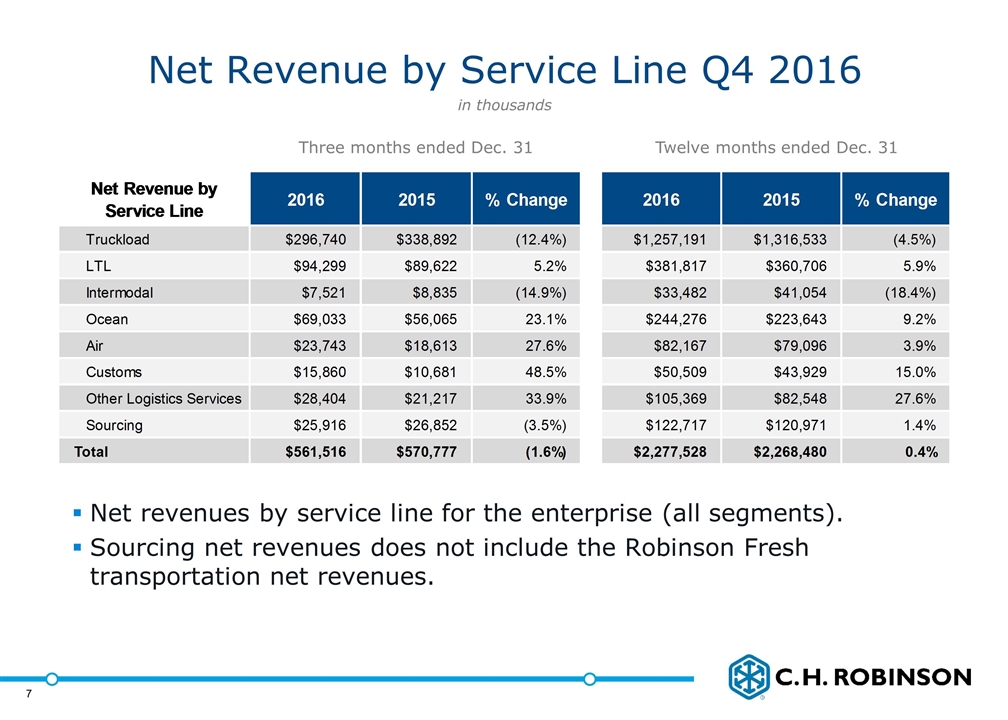

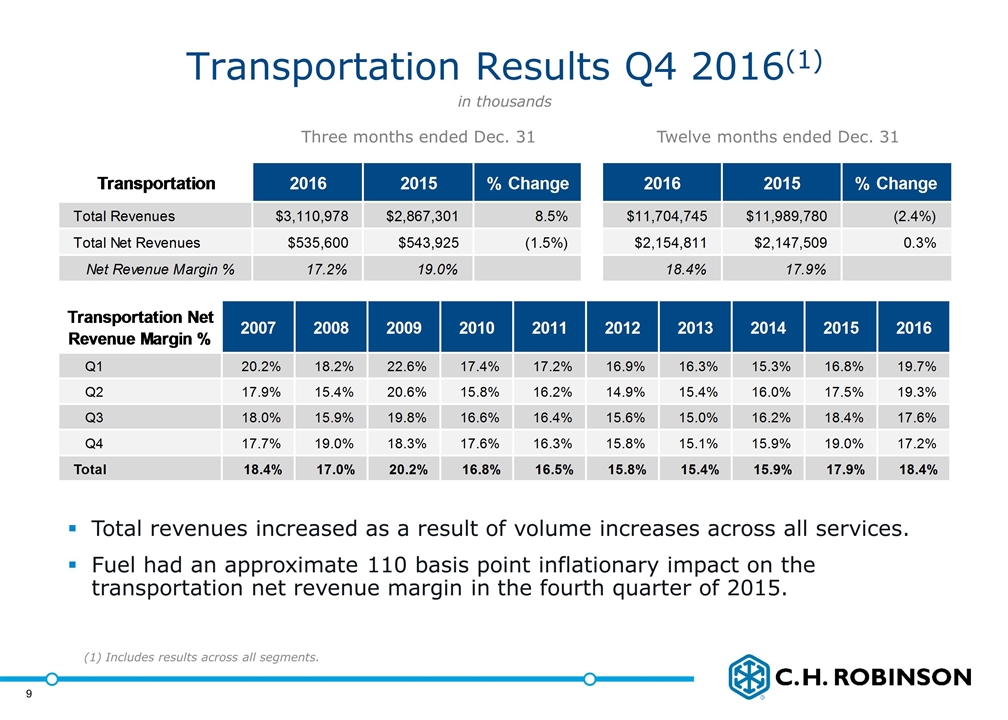

Our total revenues increased 6.4 percent in the fourth quarter of 2016 compared to the fourth quarter of 2015. The

increase in total revenues was driven by volume growth across all of our services. Our total net revenues decreased 1.6 percent in the fourth quarter of 2016 compared to the fourth quarter of 2015. The net revenue decline was primarily the

result of lower truckload margins. APC Logistics (“APC”), which was acquired at the close of business on September 30, 2016, represented approximately two percent of our total net revenues in the fourth quarter of 2016.

For the fourth quarter, our total operating expenses increased 3.3 percent. Total other selling, general, and administrative expenses increased

22.3 percent, driven by growth in claims, bad debt provision, and costs related to the APC acquisition. The increase in other selling, general, and administrative expenses was partially offset by a 2.9 percent decrease in personnel

expenses in the fourth quarter of 2016 compared to the fourth quarter of 2015. The decline in personnel expense was the result of decreased expenses related to incentive plans that are designed to keep expenses variable with changes in net revenues

and profitability. Average headcount increased approximately seven percent in the fourth quarter of 2016 compared to the fourth quarter of 2015.

(more)

C.H. Robinson Worldwide, Inc.

January 31, 2017

Page

2

Interest and other expenses declined approximately $10 million in the fourth quarter of 2016 compared to

the fourth quarter of 2015. In the fourth quarter of 2016, we had approximately $4 million in currency gains, primarily due to a stronger U.S. dollar. In the fourth quarter of 2015, we wrote off a $7.2 million indemnification asset related

to the acquisition of Phoenix International Freight Services, Ltd., as the indemnification expired.

Results by Segment

Commencing with this quarter, we are now reporting operating results based on three reportable segments. Our three reportable segments are: North American

Surface Transportation (“NAST”), Global Forwarding, and Robinson Fresh. The balance of our business is reported as “All Other and Corporate.” All Other and Corporate includes our

non-reportable segments, including Managed Services and Other Surface Transportation.

NAST provides

freight transportation services across North America through a network of offices in the United States, Canada, and Mexico. The primary services provided by NAST include truckload, less than truckload (“LTL”), and intermodal. Summarized

financial results of our NAST segment are as follows (dollars in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended December 31, |

|

|

Twelve months ended December 31, |

|

| |

|

2016 |

|

|

2015 |

|

|

%

change |

|

|

2016 |

|

|

2015 |

|

|

%

change |

|

| Total revenues(1) |

|

$ |

2,281,435 |

|

|

$ |

2,171,427 |

|

|

|

5.1 |

% |

|

$ |

8,737,716 |

|

|

$ |

8,968,349 |

|

|

|

-2.6 |

% |

| Net revenues |

|

|

363,281 |

|

|

|

398,279 |

|

|

|

-8.8 |

% |

|

|

1,524,355 |

|

|

|

1,564,917 |

|

|

|

-2.6 |

% |

| Income from operations |

|

|

157,631 |

|

|

|

183,964 |

|

|

|

-14.3 |

% |

|

|

674,436 |

|

|

|

718,329 |

|

|

|

-6.1 |

% |

| (1) |

Excludes intersegment revenues. |

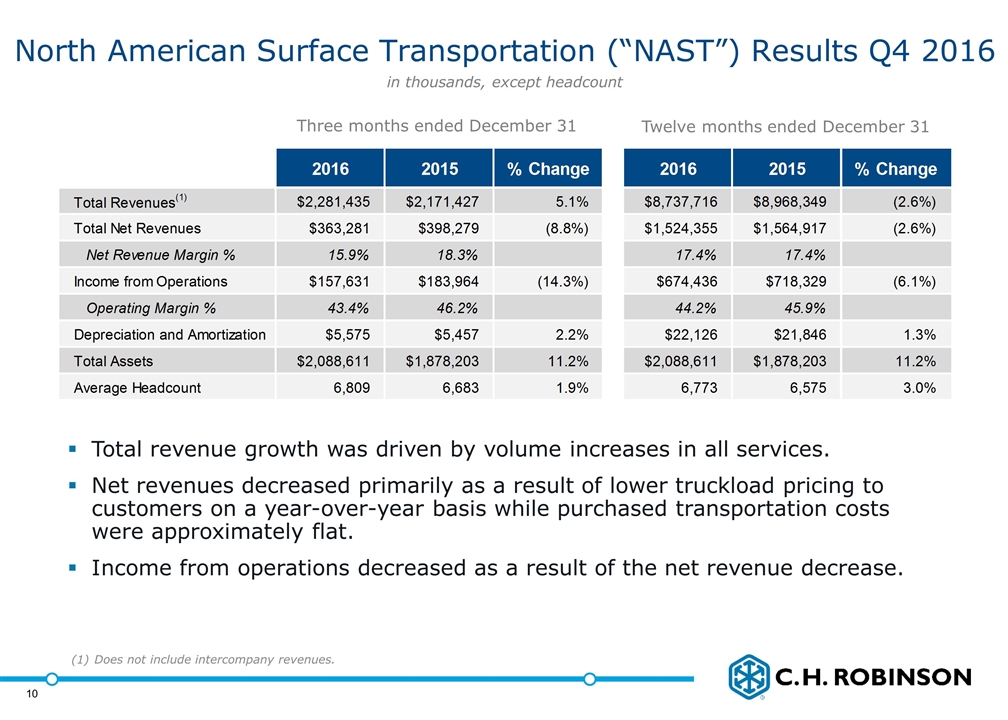

NAST total revenues increased 5.1 percent to $2.3 billion in the

fourth quarter of 2016 from $2.2 billion in the fourth quarter of 2015. This increase was driven by volume increases in all services. NAST net revenues decreased 8.8 percent to $363.3 million in the fourth quarter of 2016 compared to

$398.3 million in the fourth quarter of 2015, primarily from a decline in truckload net revenues.

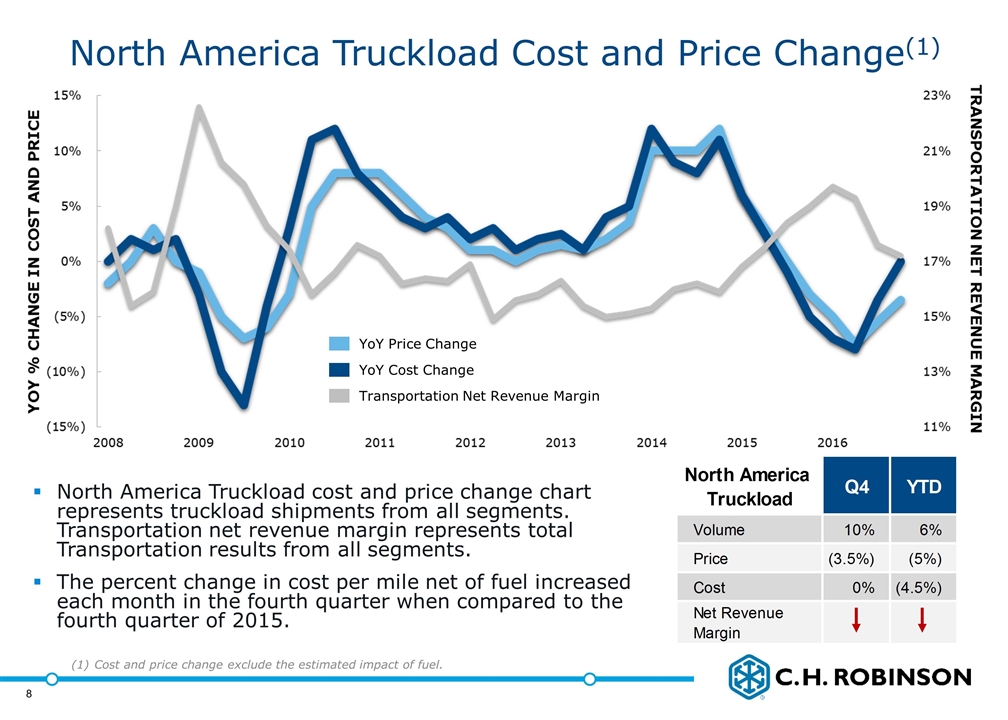

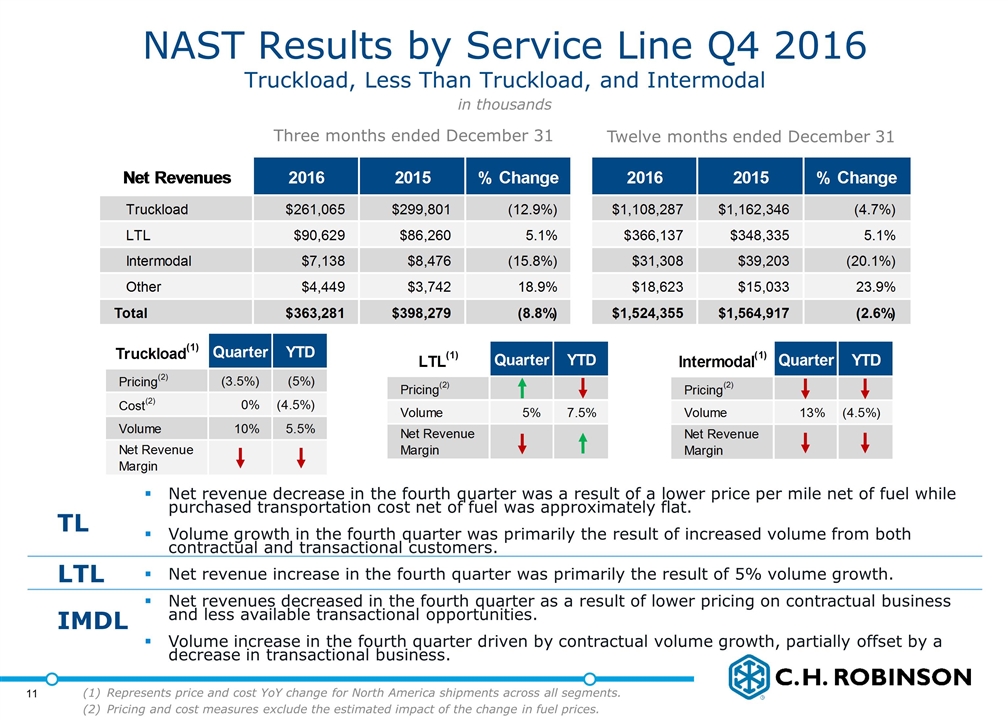

NAST truckload net revenues decreased

12.9 percent to $261.1 million in the fourth quarter of 2016 compared to $299.8 million in the fourth quarter of 2015, while truckload volumes increased approximately 10 percent. NAST truckload net revenue margin decreased in the

fourth quarter of 2016 compared to the fourth quarter of 2015, due primarily to lower customer pricing.

NAST accounted for approximately 92 percent

of our total North America truckload net revenues in the fourth quarter in both 2016 and 2015. The majority of the remaining North American truckload net revenues is included in Robinson Fresh. Excluding the estimated impacts of the change in fuel

prices, our average North America truckload rate per mile charged to our customers decreased approximately 3.5 percent in the fourth quarter of 2016 compared to the fourth quarter of 2015. Our truckload transportation costs were flat, excluding

the estimated impacts of the change in fuel prices.

NAST LTL net revenues increased 5.1 percent to $90.6 million in the fourth quarter of 2016

compared to $86.3 million in the fourth quarter of 2015. NAST LTL volumes increased approximately five percent in the fourth quarter of 2016 compared to the fourth quarter of 2015, and net revenue margin decreased slightly.

NAST intermodal net revenues decreased 15.8 percent to $7.1 million in the fourth quarter of 2016 compared to $8.5 million in the fourth

quarter of 2015. This was primarily due to net revenue margin declines, partially offset by increased volumes. During the fourth quarter of 2016, intermodal opportunities were negatively impacted by the alternative lower cost truck market.

NAST operating expenses decreased 4.0 percent in the fourth quarter of 2016 to $205.7 million compared to $214.3 million in the fourth quarter

of 2015. This was primarily due to decreases in personnel expenses related to incentive plans that are designed to keep expenses variable with changes in net revenues and profitability. These decreases were partially offset by increases in claims

and allowance for doubtful accounts. The operating expenses of NAST and all other segments include allocated corporate expenses.

(more)

C.H. Robinson Worldwide, Inc.

January 31, 2017

Page

3

Global Forwarding provides global logistics services through an international network of offices in

North America, Asia, Europe, Australia, and South America and also contracts with independent agents worldwide. The primary services provided by Global Forwarding include ocean freight services, airfreight services, and customs brokerage. Summarized

financial results of our Global Forwarding segment are as follows (dollars in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended December 31, |

|

|

Twelve months ended December 31, |

|

| |

|

2016 |

|

|

2015 |

|

|

%

change |

|

|

2016 |

|

|

2015 |

|

|

%

change |

|

| Total revenues(1) |

|

$ |

475,971 |

|

|

$ |

376,767 |

|

|

|

26.3 |

% |

|

$ |

1,574,686 |

|

|

$ |

1,639,944 |

|

|

|

-4.0 |

% |

| Net revenues |

|

|

114,079 |

|

|

|

89,491 |

|

|

|

27.5 |

% |

|

|

397,537 |

|

|

|

365,467 |

|

|

|

8.8 |

% |

| Income from operations |

|

|

24,631 |

|

|

|

18,727 |

|

|

|

31.5 |

% |

|

|

80,931 |

|

|

|

76,081 |

|

|

|

6.4 |

% |

| (1) |

Excludes intersegment revenues. |

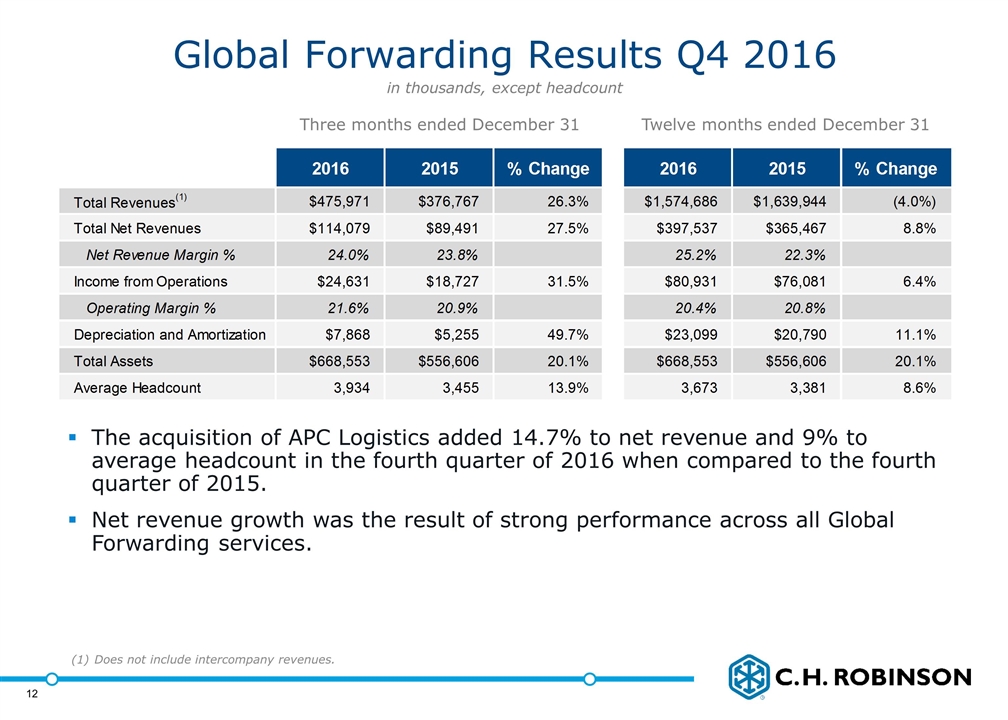

Global Forwarding total revenues increased 26.3 percent in the fourth

quarter of 2016 to $476.0 million from $376.8 million in the fourth quarter of 2015. Global Forwarding net revenues increased 27.5 percent to $114.1 million in the fourth quarter of 2016 compared to $89.5 million in the

fourth quarter of 2015.

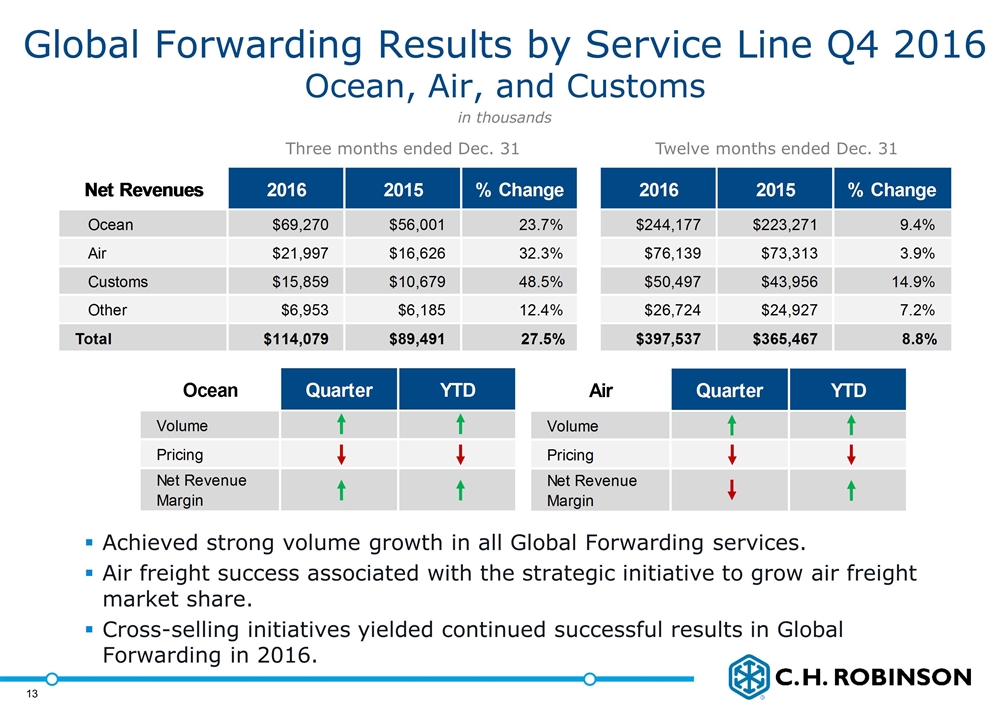

Ocean transportation net revenues increased 23.7 percent to $69.3 million in the fourth quarter of 2016 compared to

$56.0 million in the fourth quarter of 2015. Air net revenues increased 32.3 percent to $22.0 million in the fourth quarter of 2016 compared to $16.6 million in the fourth quarter of 2015. Customs net revenues increased

48.5 percent to $15.9 million in the fourth quarter of 2016 compared to $10.7 million in the fourth quarter of 2015. These increases were primarily due to volume increases, including those from APC.

Global Forwarding operating expenses increased 26.4 percent in the fourth quarter of 2016 to $89.4 million from $70.8 million in the fourth

quarter of 2015. These increases were driven by an average headcount increase of 13.9 percent, an increase in claims, and higher allowance for doubtful accounts in the fourth quarter of 2016 compared to the fourth quarter of 2015. In addition,

the acquisition of APC contributed to the increase in operating expenses, including amortization, for Global Forwarding.

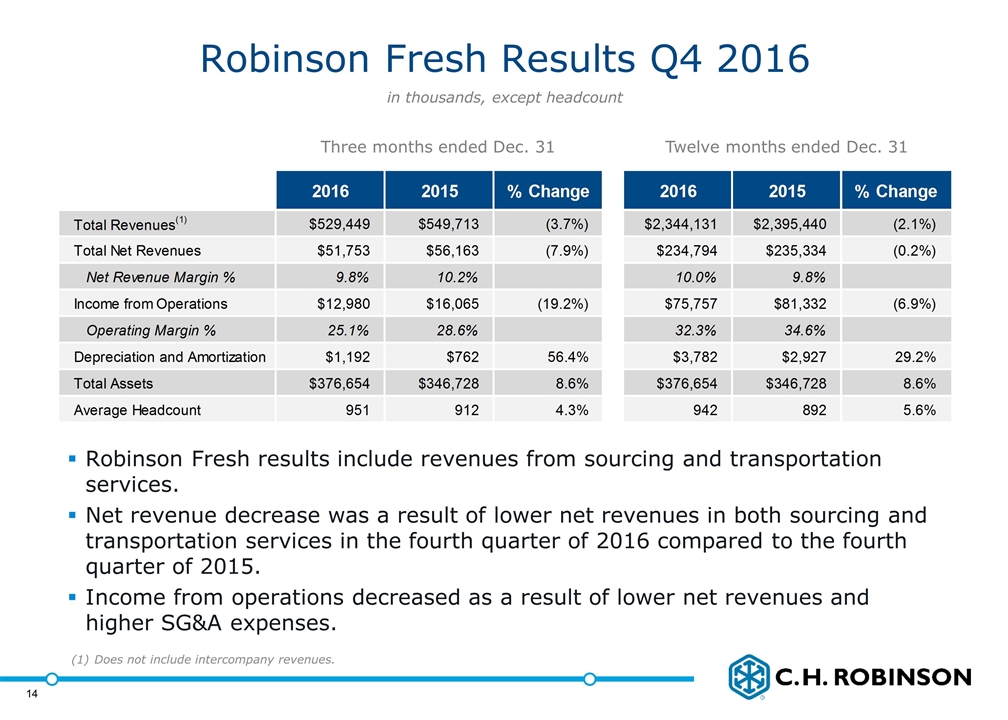

Robinson Fresh provides

sourcing services under the name of Robinson Fresh. Our sourcing services primarily include the buying, selling, and marketing of fresh fruits, vegetables, and other perishable items. Robinson Fresh sources products from around the world and has a

physical presence in North America, Europe, Asia, and South America. This segment often provides the logistics and transportation of the products they sell, in addition to temperature controlled transportation services for its customers. Summarized

financial results of our Robinson Fresh segment are as follows (dollars in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended December 31, |

|

|

Twelve months ended December 31, |

|

| |

|

2016 |

|

|

2015 |

|

|

%

change |

|

|

2016 |

|

|

2015 |

|

|

%

change |

|

| Total revenues(1) |

|

$ |

529,449 |

|

|

$ |

549,713 |

|

|

|

-3.7 |

% |

|

$ |

2,344,131 |

|

|

$ |

2,395,440 |

|

|

|

-2.1 |

% |

| Net revenues |

|

|

51,753 |

|

|

|

56,163 |

|

|

|

-7.9 |

% |

|

|

234,794 |

|

|

|

235,334 |

|

|

|

-0.2 |

% |

| Income from operations |

|

|

12,980 |

|

|

|

16,065 |

|

|

|

-19.2 |

% |

|

|

75,757 |

|

|

|

81,332 |

|

|

|

-6.9 |

% |

| (1) |

Excludes intersegment revenues. |

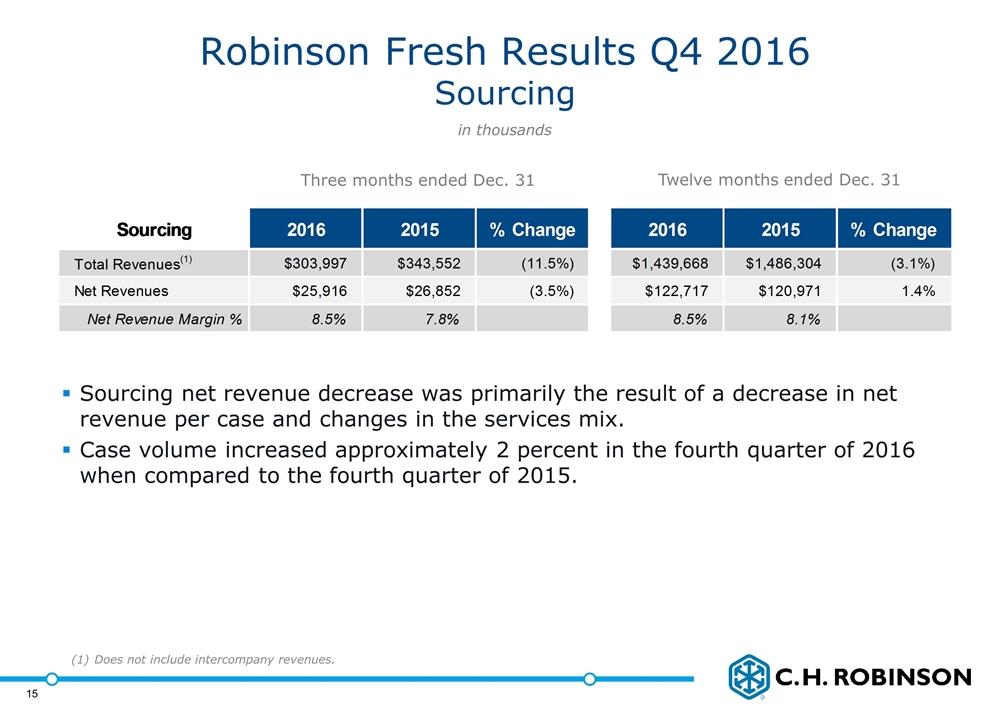

Robinson Fresh total revenues decreased 3.7 percent to

$529.4 million in the fourth quarter of 2016 from $549.7 million in the fourth quarter of 2015. Robinson Fresh net revenues decreased 7.9 percent to $51.8 million in the fourth quarter of 2016 compared to $56.2 million in

the fourth quarter of 2015 as a result of declines in transportation and sourcing net revenues.

Robinson Fresh sourcing net revenues decreased

3.5 percent to $25.9 million in the fourth quarter of 2016 compared to $26.9 million in the fourth quarter of 2015. This decrease was primarily due to lower market pricing and changes in the service mix.

(more)

C.H. Robinson Worldwide, Inc.

January 31, 2017

Page

4

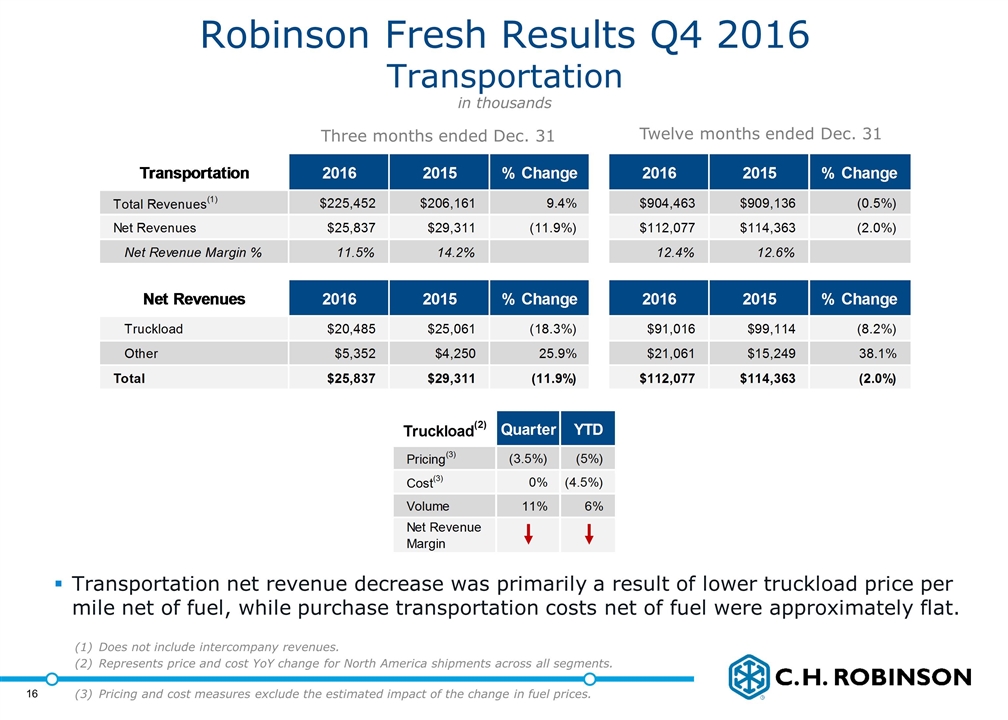

Robinson Fresh transportation net revenues decreased 11.9 percent to $25.8 million in the fourth

quarter of 2016 compared to $29.3 million in the fourth quarter of 2015, primarily due to decreases in truckload revenue, partially offset by increases in their other transportation services net revenues. Robinson Fresh transportation net revenue margin decreased in the fourth quarter of 2016 compared to the fourth quarter of 2015, due primarily to lower customer pricing.

Robinson Fresh operating expenses decreased 3.3 percent in the fourth quarter of 2016 to $38.8 million from $40.1 million in the fourth quarter

of 2015. This was primarily due to decreases in personnel expenses related to incentive plans that are designed to keep expenses variable with changes in net revenues and profitability, partially offset by an increase in warehousing expenses related

to expanding facilities and an increase in average headcount.

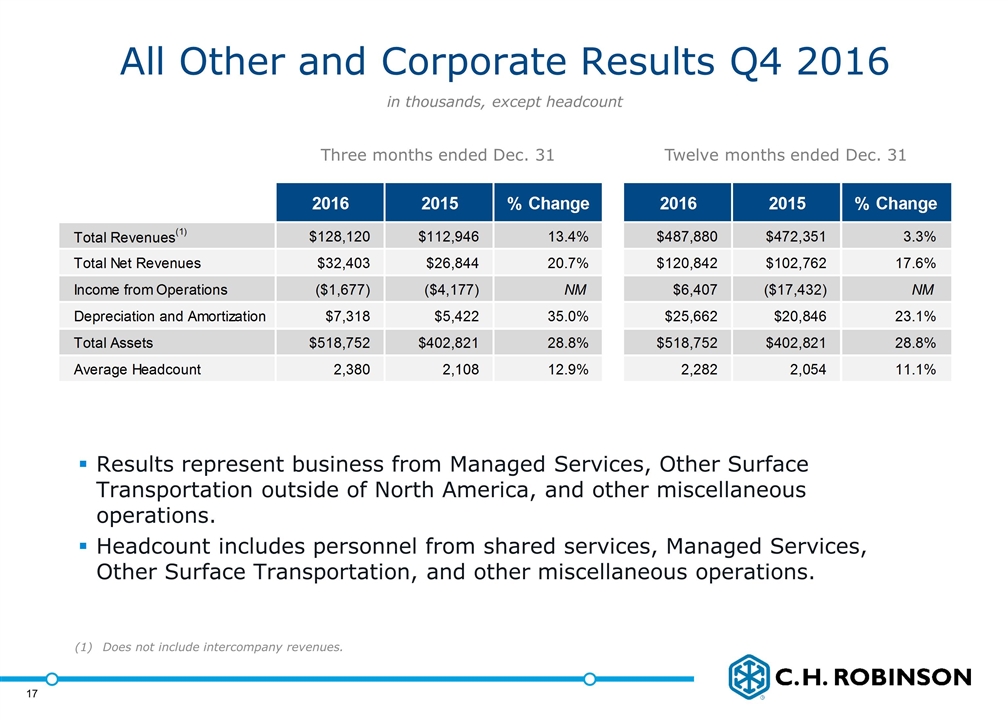

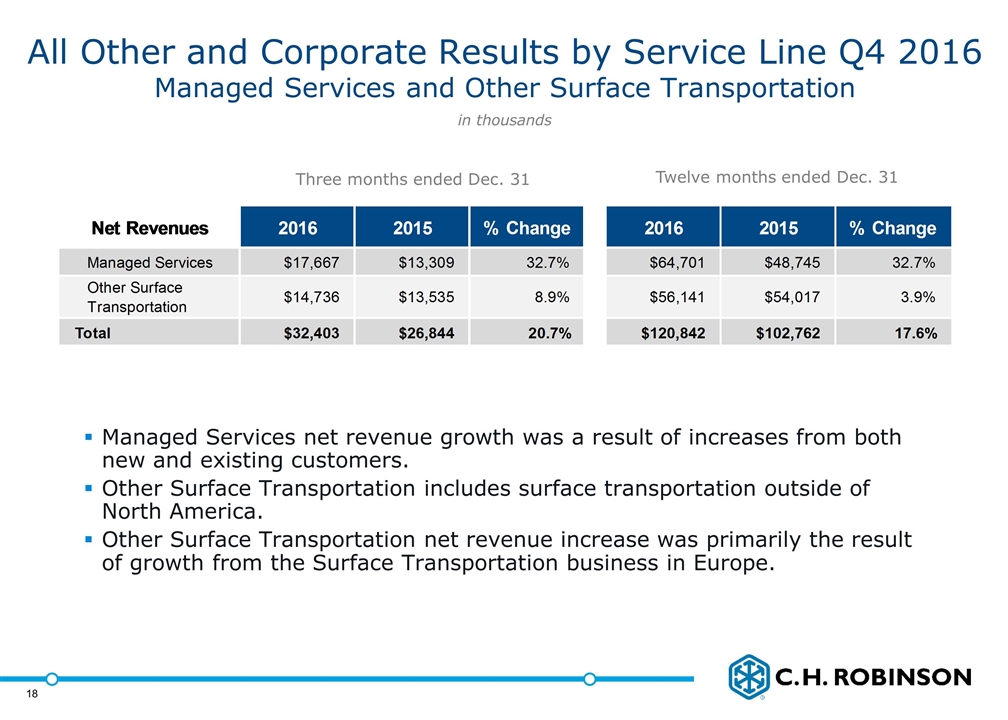

All Other and Corporate includes our Managed Services segment, as well as Other

Surface Transportation outside of North America and other miscellaneous revenues. Other Surface Transportation revenues are primarily earned by Europe Surface Transportation. Europe Surface Transportation provides services similar to NAST across the

European continent. It also includes any unallocated corporate expenses. Managed Services provides Transportation Management Service, or Managed TMS. Summarized financial results are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended December 31, |

|

|

Twelve months ended December 31, |

|

| Net revenues |

|

2016 |

|

|

2015 |

|

|

%

change |

|

|

2016 |

|

|

2015 |

|

|

%

change |

|

| Managed Services |

|

$ |

17,667 |

|

|

$ |

13,309 |

|

|

|

32.7 |

% |

|

$ |

64,701 |

|

|

$ |

48,745 |

|

|

|

32.7 |

% |

| Other Surface Transportation |

|

|

14,736 |

|

|

|

13,535 |

|

|

|

8.9 |

% |

|

|

56,141 |

|

|

|

54,017 |

|

|

|

3.9 |

% |

Managed Services net revenues increased 32.7 percent in the fourth quarter of 2016 to $17.7 million compared to

$13.3 million the fourth quarter of 2015. This increase was a result of growth from both new and existing customers. Other surface transportation increased 8.9 percent in the fourth quarter of 2016 to $14.7 million compared to

$13.5 million in the fourth quarter of 2015, primarily the result of growth in Europe Surface Transportation.

About C.H.

Robinson

At C.H. Robinson, we believe in accelerating global trade to seamlessly deliver the products and goods that drive the world’s economy.

Using the strengths of our knowledgeable people, proven processes, and global technology, we help our customers work smarter, not harder. As one of the world’s largest third-party logistics providers (3PL), we provide a broad portfolio of

logistics services, fresh produce sourcing and managed services for more than 113,000 customers and 71,000 contract carriers through our integrated network of offices and more than 14,000 employees. In addition, the company, our Foundation and our

employees contribute millions of dollars annually to a variety of organizations. Headquartered in Eden Prairie, Minnesota, C.H. Robinson (CHRW) has been publicly traded on the NASDAQ since 1997. For more information, visit

http://www.chrobinson.com or view our company video.

Except for the historical information contained herein, the matters set forth in this

release are forward-looking statements that represent our expectations, beliefs, intentions or strategies concerning future events. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to

differ materially from our historical experience or our present expectations, including, but not limited to such factors as changes in economic conditions, including uncertain consumer demand; changes in market demand and pressures on the pricing

for our services; competition and growth rates within the third party logistics industry; freight levels and increasing costs and availability of truck capacity or alternative means of transporting freight, and changes in relationships with existing

truck, rail, ocean, and air carriers; changes in our customer base due to possible consolidation among our customers; our ability to successfully integrate the operations of acquired companies with our historic operations; risks associated with

litigation and insurance coverage; risks associated with operations outside of the U.S.; risks associated with the potential impacts of changes in government regulations; risks associated with the produce industry, including food safety and

contamination issues; fuel prices and availability; the impact of war on the economy; and other risks and uncertainties detailed in our Annual and Quarterly Reports.

(more)

C.H. Robinson Worldwide, Inc.

January 31, 2017

Page

5

Any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no

obligation to update such statement to reflect events or circumstances arising after such date. All remarks made during our financial results conference call will be current at the time of the call, and we undertake no obligation to update the

replay.

Conference Call Information:

C.H.

Robinson Worldwide Fourth Quarter 2016 Earnings Conference Call

Wednesday, February 1, 2017; 8:30 a.m. Eastern Time

We invite call participants to submit questions in advance of the conference call, and we will respond to as many of the questions as we can in the time

allowed. To submit your question(s) in advance of the call, please email adrienne.brausen@chrobinson.com.

Presentation slides and a

simultaneous live audio webcast of the conference call may be accessed through the Investor Relations link on C.H. Robinson’s website at www.chrobinson.com.

To participate in the conference call by telephone, please call ten minutes early by dialing: 877-269-7756

International callers dial +1-201-689-7817

Callers should reference the conference ID, which is 13652500

Webcast replay available through Investor Relations link at www.chrobinson.com

Telephone audio replay available until 11:30 a.m. Eastern Time on February 8, 2017:

877-660-6853;

passcode: 13652500#

International callers dial

+1-201-612-7415

(more)

C.H. Robinson Worldwide, Inc.

January 31, 2017

Page

6

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(unaudited, in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

December 31, |

|

|

Twelve months ended

December 31, |

|

| |

|

2016 |

|

|

2015 |

|

|

2016 |

|

|

2015 |

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Transportation |

|

$ |

3,110,978 |

|

|

$ |

2,867,301 |

|

|

$ |

11,704,745 |

|

|

$ |

11,989,780 |

|

| Sourcing |

|

|

303,997 |

|

|

|

343,552 |

|

|

|

1,439,668 |

|

|

|

1,486,304 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

|

3,414,975 |

|

|

|

3,210,853 |

|

|

|

13,144,413 |

|

|

|

13,476,084 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purchased transportation and related services |

|

|

2,575,378 |

|

|

|

2,323,376 |

|

|

|

9,549,934 |

|

|

|

9,842,271 |

|

| Purchased products sourced for resale |

|

|

278,081 |

|

|

|

316,700 |

|

|

|

1,316,951 |

|

|

|

1,365,333 |

|

| Personnel expenses |

|

|

260,305 |

|

|

|

268,190 |

|

|

|

1,064,936 |

|

|

|

1,051,410 |

|

| Other selling, general, and administrative expenses |

|

|

107,646 |

|

|

|

88,008 |

|

|

|

375,061 |

|

|

|

358,760 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total costs and expenses |

|

|

3,221,410 |

|

|

|

2,996,274 |

|

|

|

12,306,882 |

|

|

|

12,617,774 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from operations |

|

|

193,565 |

|

|

|

214,579 |

|

|

|

837,531 |

|

|

|

858,310 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest and other expense |

|

|

(3,118 |

) |

|

|

(13,471 |

) |

|

|

(25,581 |

) |

|

|

(35,529 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before provision for income taxes |

|

|

190,447 |

|

|

|

201,108 |

|

|

|

811,950 |

|

|

|

822,781 |

|

| Provisions for income taxes |

|

|

68,144 |

|

|

|

74,525 |

|

|

|

298,566 |

|

|

|

313,082 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

122,303 |

|

|

$ |

126,583 |

|

|

$ |

513,384 |

|

|

$ |

509,699 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per share (basic) |

|

$ |

0.86 |

|

|

$ |

0.88 |

|

|

$ |

3.60 |

|

|

$ |

3.52 |

|

| Net income per share (diluted) |

|

$ |

0.86 |

|

|

$ |

0.88 |

|

|

$ |

3.59 |

|

|

$ |

3.51 |

|

|

|

|

|

|

| Weighted average shares outstanding (basic) |

|

|

141,711 |

|

|

|

143,484 |

|

|

|

142,706 |

|

|

|

144,967 |

|

| Weighted average shares outstanding (diluted) |

|

|

142,164 |

|

|

|

144,144 |

|

|

|

142,991 |

|

|

|

145,349 |

|

(more)

C.H. Robinson Worldwide, Inc.

January 31, 2017

Page

7

BUSINESS SEGMENT INFORMATION

(unaudited, dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

NAST |

|

|

Global

Forwarding |

|

|

Robinson

Fresh |

|

|

All

Other and

Corporate |

|

|

Eliminations |

|

|

Consolidated |

|

| Three months ended December 31, 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

$ |

2,281,435 |

|

|

$ |

475,971 |

|

|

$ |

529,449 |

|

|

$ |

128,120 |

|

|

$ |

— |

|

|

$ |

3,414,975 |

|

| Intersegment revenues (1) |

|

|

86,898 |

|

|

|

6,726 |

|

|

|

36,203 |

|

|

|

1,569 |

|

|

|

(131,396 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

$ |

2,368,333 |

|

|

$ |

482,697 |

|

|

$ |

565,652 |

|

|

$ |

129,689 |

|

|

$ |

(131,396 |

) |

|

$ |

3,414,975 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net revenues |

|

$ |

363,281 |

|

|

$ |

114,079 |

|

|

$ |

51,753 |

|

|

$ |

32,403 |

|

|

|

— |

|

|

$ |

561,516 |

|

| Operating income/(loss) |

|

$ |

157,631 |

|

|

$ |

24,631 |

|

|

$ |

12,980 |

|

|

$ |

(1,677 |

) |

|

|

— |

|

|

$ |

193,565 |

|

| Depreciation and amortization |

|

$ |

5,575 |

|

|

$ |

7,868 |

|

|

$ |

1,192 |

|

|

$ |

7,318 |

|

|

|

— |

|

|

$ |

21,953 |

|

| Total Assets |

|

$ |

2,088,611 |

|

|

$ |

668,553 |

|

|

$ |

376,654 |

|

|

$ |

518,752 |

|

|

|

— |

|

|

$ |

3,652,570 |

|

| Average headcount |

|

|

6,809 |

|

|

|

3,934 |

|

|

|

951 |

|

|

|

2,380 |

|

|

|

— |

|

|

|

14,074 |

|

|

|

|

|

|

|

|

| |

|

NAST |

|

|

Global

Forwarding |

|

|

Robinson

Fresh |

|

|

All

Other and

Corporate |

|

|

Eliminations |

|

|

Consolidated |

|

| Three months ended December 31, 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

$ |

2,171,427 |

|

|

$ |

376,767 |

|

|

$ |

549,713 |

|

|

$ |

112,946 |

|

|

$ |

— |

|

|

$ |

3,210,853 |

|

| Intersegment revenues(1) |

|

|

64,581 |

|

|

|

4,295 |

|

|

|

23,991 |

|

|

|

402 |

|

|

|

(93,269 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

$ |

2,236,008 |

|

|

$ |

381,062 |

|

|

$ |

573,704 |

|

|

$ |

113,348 |

|

|

$ |

(93,269 |

) |

|

$ |

3,210,853 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net revenues |

|

$ |

398,279 |

|

|

$ |

89,491 |

|

|

$ |

56,163 |

|

|

$ |

26,844 |

|

|

|

— |

|

|

$ |

570,777 |

|

| Operating income/(loss) |

|

$ |

183,964 |

|

|

$ |

18,727 |

|

|

$ |

16,065 |

|

|

$ |

(4,177 |

) |

|

|

— |

|

|

$ |

214,579 |

|

| Depreciation and amortization |

|

$ |

5,457 |

|

|

$ |

5,255 |

|

|

$ |

762 |

|

|

$ |

5,422 |

|

|

|

— |

|

|

$ |

16,896 |

|

| Total Assets |

|

$ |

1,878,203 |

|

|

$ |

556,606 |

|

|

$ |

346,728 |

|

|

$ |

402,821 |

|

|

|

— |

|

|

$ |

3,184,358 |

|

| Average headcount |

|

|

6,683 |

|

|

|

3,455 |

|

|

|

912 |

|

|

|

2,108 |

|

|

|

— |

|

|

|

13,158 |

|

| (1) |

Intersegment revenues represent the sales between our segments and are eliminated to reconcile to our consolidated results. |

(more)

C.H. Robinson Worldwide, Inc.

January 31, 2017

Page

8

BUSINESS SEGMENT INFORMATION

(unaudited, dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

NAST |

|

|

Global

Forwarding |

|

|

Robinson

Fresh |

|

|

All

Other and

Corporate |

|

|

Eliminations |

|

|

Consolidated |

|

| Twelve months ended December 31, 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

$ |

8,737,716 |

|

|

$ |

1,574,686 |

|

|

$ |

2,344,131 |

|

|

$ |

487,880 |

|

|

$ |

— |

|

|

$ |

13,144,413 |

|

| Intersegment revenues(1) |

|

|

298,438 |

|

|

|

30,311 |

|

|

|

119,403 |

|

|

|

2,211 |

|

|

|

(450,363 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

$ |

9,036,154 |

|

|

$ |

1,604,997 |

|

|

$ |

2,463,534 |

|

|

$ |

490,091 |

|

|

$ |

(450,363 |

) |

|

$ |

13,144,413 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net revenues |

|

$ |

1,524,355 |

|

|

$ |

397,537 |

|

|

$ |

234,794 |

|

|

$ |

120,842 |

|

|

|

— |

|

|

$ |

2,277,528 |

|

| Operating income |

|

$ |

674,436 |

|

|

$ |

80,931 |

|

|

$ |

75,757 |

|

|

$ |

6,407 |

|

|

|

— |

|

|

$ |

837,531 |

|

| Depreciation and amortization |

|

$ |

22,126 |

|

|

$ |

23,099 |

|

|

$ |

3,782 |

|

|

$ |

25,662 |

|

|

|

— |

|

|

$ |

74,669 |

|

| Total Assets |

|

$ |

2,088,611 |

|

|

$ |

688,553 |

|

|

$ |

376,654 |

|

|

$ |

518,752 |

|

|

|

|

|

|

$ |

3,652,570 |

|

| Average headcount |

|

|

6,773 |

|

|

|

3,673 |

|

|

|

942 |

|

|

|

2,282 |

|

|

|

— |

|

|

|

13,670 |

|

|

|

|

|

|

|

|

| |

|

NAST |

|

|

Global

Forwarding |

|

|

Robinson

Fresh |

|

|

All

Other and

Corporate |

|

|

Eliminations |

|

|

Consolidated |

|

| Twelve months ended December 31, 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

$ |

8,968,349 |

|

|

$ |

1,639,944 |

|

|

$ |

2,395,440 |

|

|

$ |

472,351 |

|

|

$ |

— |

|

|

$ |

13,476,084 |

|

| Intersegment revenues(1) |

|

|

271,557 |

|

|

|

19,102 |

|

|

|

89,033 |

|

|

|

2,107 |

|

|

|

(381,799 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

$ |

9,239,906 |

|

|

$ |

1,659,046 |

|

|

$ |

2,484,473 |

|

|

$ |

474,458 |

|

|

$ |

(381,799 |

) |

|

$ |

13,476,084 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net revenues |

|

$ |

1,564,917 |

|

|

$ |

365,467 |

|

|

$ |

235,334 |

|

|

$ |

102,762 |

|

|

|

— |

|

|

$ |

2,268,480 |

|

| Operating income/(loss) |

|

$ |

718,329 |

|

|

$ |

76,081 |

|

|

$ |

81,332 |

|

|

$ |

(17,432 |

) |

|

|

— |

|

|

$ |

858,310 |

|

| Depreciation and amortization |

|

$ |

21,846 |

|

|

$ |

20,790 |

|

|

$ |

2,927 |

|

|

$ |

20,846 |

|

|

|

— |

|

|

$ |

66,409 |

|

| Total Assets |

|

$ |

1,878,203 |

|

|

$ |

556,606 |

|

|

$ |

346,728 |

|

|

$ |

402,821 |

|

|

|

— |

|

|

$ |

3,184,358 |

|

| Average headcount |

|

|

6,575 |

|

|

|

3,381 |

|

|

|

892 |

|

|

|

2,054 |

|

|

|

— |

|

|

|

12,902 |

|

| (1) |

Intersegment revenues represent the sales between our segments and are eliminated to reconcile to our consolidated results. |

(more)

C.H. Robinson Worldwide, Inc.

January 31, 2017

Page

9

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited, in thousands)

|

|

|

|

|

|

|

|

|

| |

|

December 31,

2016 |

|

|

December 31,

2015 |

|

| Assets |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

247,666 |

|

|

$ |

168,229 |

|

| Receivables, net |

|

|

1,676,003 |

|

|

|

1,505,620 |

|

| Other current assets |

|

|

49,245 |

|

|

|

56,849 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

1,972,914 |

|

|

|

1,730,698 |

|

|

|

|

| Property and equipment, net |

|

|

232,953 |

|

|

|

190,874 |

|

| Intangible and other assets |

|

|

1,446,703 |

|

|

|

1,262,786 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

3,652,570 |

|

|

$ |

3,184,358 |

|

|

|

|

|

|

|

|

|

|

| Liabilities and stockholders’ investment |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable and outstanding checks |

|

$ |

886,543 |

|

|

$ |

783,883 |

|

| Accrued compensation |

|

|

98,107 |

|

|

|

146,666 |

|

| Accrued income taxes |

|

|

15,472 |

|

|

|

12,573 |

|

| Other accrued expenses |

|

|

70,408 |

|

|

|

55,475 |

|

| Current portion of debt |

|

|

740,000 |

|

|

|

450,000 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

1,810,530 |

|

|

|

1,448,597 |

|

| Noncurrent income taxes payable |

|

|

18,849 |

|

|

|

19,634 |

|

| Deferred tax liabilities |

|

|

65,122 |

|

|

|

65,460 |

|

| Long term debt |

|

|

500,000 |

|

|

|

500,000 |

|

| Other long-term liabilities |

|

|

222 |

|

|

|

217 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

2,394,723 |

|

|

|

2,033,908 |

|

|

|

|

| Total stockholders’ investment |

|

|

1,257,847 |

|

|

|

1,150,450 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ investment |

|

$ |

3,652,570 |

|

|

$ |

3,184,358 |

|

|

|

|

|

|

|

|

|

|

(more)

C.H. Robinson Worldwide, Inc.

January 31, 2017

Page

10

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited, in thousands, except operational data)

|

|

|

|

|

|

|

|

|

| |

|

Twelve months ended

December 31, |

|

| |

|

2016 |

|

|

2015 |

|

| Operating activities: |

|

|

|

|

|

|

|

|

| Net income |

|

$ |

513,384 |

|

|

$ |

509,699 |

|

| Stock-based compensation |

|

|

37,565 |

|

|

|

57,661 |

|

| Depreciation and amortization |

|

|

74,669 |

|

|

|

66,409 |

|

| Provision for doubtful accounts |

|

|

5,136 |

|

|

|

11,538 |

|

| Deferred income taxes |

|

|

15,009 |

|

|

|

(17,095 |

) |

| Other |

|

|

1,907 |

|

|

|

7,409 |

|

| Changes in operating elements, net of acquisitions: |

|

|

|

|

|

|

|

|

| Receivables |

|

|

(132,898 |

) |

|

|

107,560 |

|

| Prepaid expenses and other |

|

|

(6,378 |

) |

|

|

(228 |

) |

| Other non-current assets |

|

|

(3,934 |

) |

|

|

741 |

|

| Accounts payable and outstanding checks |

|

|

80,672 |

|

|

|

(53,272 |

) |

| Accrued compensation and profit-sharing contribution |

|

|

(47,570 |

) |

|

|

18,580 |

|

| Accrued income taxes |

|

|

1,459 |

|

|

|

5,178 |

|

| Other accrued liabilities |

|

|

(9,613 |

) |

|

|

4,156 |

|

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

|

|

529,408 |

|

|

|

718,336 |

|

| Investing activities: |

|

|

|

|

|

|

|

|

| Purchases of property and equipment |

|

|

(73,452 |

) |

|

|

(28,115 |

) |

| Purchases and development of software |

|

|

(17,985 |

) |

|

|

(16,527 |

) |

| Restricted cash |

|

|

— |

|

|

|

359,388 |

|

| Acquisitions, net of cash |

|

|

(220,203 |

) |

|

|

(369,833 |

) |

| Other |

|

|

(1,348 |

) |

|

|

641 |

|

|

|

|

|

|

|

|

|

|

| Net cash used for investing activities |

|

|

(312,988 |

) |

|

|

(54,446 |

) |

| Financing activities: |

|

|

|

|

|

|

|

|

| Borrowings on line of credit |

|

|

6,600,000 |

|

|

|

6,833,000 |

|

| Repayments on line of credit |

|

|

(6,310,000 |

) |

|

|

(6,988,000 |

) |

| Net repurchases of common stock |

|

|

(190,332 |

) |

|

|

(225,674 |

) |

| Excess tax benefit on stock-based compensation |

|

|

18,462 |

|

|

|

8,548 |

|

| Cash dividends |

|

|

(245,430 |

) |

|

|

(235,615 |

) |

|

|

|

|

|

|

|

|

|

| Net cash used for financing activities |

|

|

(127,300 |

) |

|

|

(607,741 |

) |

| Effect of exchange rates on cash |

|

|

(9,683 |

) |

|

|

(16,860 |

) |

|

|

|

|

|

|

|

|

|

| Net change in cash and cash equivalents |

|

|

79,437 |

|

|

|

39,289 |

|

| Cash and cash equivalents, beginning of period |

|

|

168,229 |

|

|

|

128,940 |

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents, end of period |

|

$ |

247,666 |

|

|

$ |

168,229 |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As of December 31, |

|

| |

|

2016 |

|

|

2015 |

|

| Operational Data: |

|

|

|

|

|

|

|

|

| Employees |

|

|

14,125 |

|

|

|

13,159 |

|

Source: C.H. Robinson

###