C.H. ROBINSON WORLDWIDE, INC.0001043277DEF 14Afalse00010432772022-01-012022-12-31iso4217:USDxbrli:pure00010432772021-01-012021-12-3100010432772020-01-012020-12-310001043277ecd:PeoMemberchrw:ValueOfAwardsAdjustmentMember2022-01-012022-12-310001043277ecd:PeoMemberchrw:ValueOfAwardsAdjustmentMember2021-01-012021-12-310001043277ecd:PeoMemberchrw:ValueOfAwardsAdjustmentMember2020-01-012020-12-310001043277ecd:PeoMemberchrw:StockAwardsUnvestedAdjustmentMember2022-01-012022-12-310001043277ecd:PeoMemberchrw:StockAwardsUnvestedAdjustmentMember2021-01-012021-12-310001043277ecd:PeoMemberchrw:StockAwardsUnvestedAdjustmentMember2020-01-012020-12-310001043277ecd:PeoMemberchrw:StockAwardsVestedAdjustmentMember2022-01-012022-12-310001043277ecd:PeoMemberchrw:StockAwardsVestedAdjustmentMember2021-01-012021-12-310001043277ecd:PeoMemberchrw:StockAwardsVestedAdjustmentMember2020-01-012020-12-310001043277ecd:PeoMemberchrw:EquityAwardsReportedValueMember2022-01-012022-12-310001043277ecd:PeoMemberchrw:EquityAwardsReportedValueMember2021-01-012021-12-310001043277ecd:PeoMemberchrw:EquityAwardsReportedValueMember2020-01-012020-12-310001043277ecd:PeoMemberchrw:EquityAwardsGrantedInPriorYearsVestedMember2022-01-012022-12-310001043277ecd:PeoMemberchrw:EquityAwardsGrantedInPriorYearsVestedMember2021-01-012021-12-310001043277ecd:PeoMemberchrw:EquityAwardsGrantedInPriorYearsVestedMember2020-01-012020-12-310001043277chrw:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2022-01-012022-12-310001043277chrw:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2021-01-012021-12-310001043277chrw:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2020-01-012020-12-310001043277ecd:PeoMember2022-01-012022-12-310001043277ecd:PeoMember2021-01-012021-12-310001043277ecd:PeoMember2020-01-012020-12-310001043277ecd:NonPeoNeoMemberchrw:ValueOfAwardsAdjustmentMember2022-01-012022-12-310001043277ecd:NonPeoNeoMemberchrw:ValueOfAwardsAdjustmentMember2021-01-012021-12-310001043277ecd:NonPeoNeoMemberchrw:ValueOfAwardsAdjustmentMember2020-01-012020-12-310001043277ecd:NonPeoNeoMemberchrw:StockAwardsUnvestedAdjustmentMember2022-01-012022-12-310001043277ecd:NonPeoNeoMemberchrw:StockAwardsUnvestedAdjustmentMember2021-01-012021-12-310001043277ecd:NonPeoNeoMemberchrw:StockAwardsUnvestedAdjustmentMember2020-01-012020-12-310001043277chrw:StockAwardsVestedAdjustmentMemberecd:NonPeoNeoMember2022-01-012022-12-310001043277chrw:StockAwardsVestedAdjustmentMemberecd:NonPeoNeoMember2021-01-012021-12-310001043277chrw:StockAwardsVestedAdjustmentMemberecd:NonPeoNeoMember2020-01-012020-12-310001043277chrw:EquityAwardsReportedValueMemberecd:NonPeoNeoMember2022-01-012022-12-310001043277chrw:EquityAwardsReportedValueMemberecd:NonPeoNeoMember2021-01-012021-12-310001043277chrw:EquityAwardsReportedValueMemberecd:NonPeoNeoMember2020-01-012020-12-310001043277chrw:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2022-01-012022-12-310001043277chrw:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2021-01-012021-12-310001043277chrw:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2020-01-012020-12-310001043277chrw:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2022-01-012022-12-310001043277chrw:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2021-01-012021-12-310001043277chrw:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2020-01-012020-12-310001043277ecd:NonPeoNeoMember2022-01-012022-12-310001043277ecd:NonPeoNeoMember2021-01-012021-12-310001043277ecd:NonPeoNeoMember2020-01-012020-12-31000104327712022-01-012022-12-3100010432771ecd:NonPeoNeoMember2022-01-012022-12-3100010432772ecd:NonPeoNeoMember2022-01-012022-12-3100010432773ecd:NonPeoNeoMember2022-01-012022-12-3100010432774ecd:NonPeoNeoMember2022-01-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| | | | | | | | | | | |

| ☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant |

| | | | | |

CHECK THE APPROPRIATE BOX: |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☑ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

C.H. Robinson Worldwide, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | |

PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): |

☑ | No fee required |

☐ | Fee paid previously with preliminary materials |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | |

| | Together, we move the world’s

supply chains C.H. Robinson brings together customers, carriers, and suppliers to connect supply chains. As the world’s largest and most connected logistics platform, we operate at the heart of global commerce. People get the goods they need through our scale, multimodal solutions, technology, and global teams. With nearly 17,000 supply chain experts in over 35 countries, we are the way supply chains move. | | |

| | | | | | |

| | | | | | |

| | | Mission Our people, processes, and technology improve the world’s transportation and supply chains, delivering exceptional value to our customers and suppliers. | | |

| | | | | | |

| | | | | | |

| | | Vision Accelerating commerce through the world’s most powerful supply chain platform. | | |

| | | | | | |

| | | | | | |

| | | Our Leading EDGE Values | | |

| | 1.Evolve Constantly Challenge the status quo and surface new ideas. 2.Deliver Excellence Encourage big thinking to consistently drive value. | 3.Grow Together

Serve and empower our teams to grow and advance. 4.Embrace Integrity

Recognize diversity makes us a smarter, stronger team. | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | |

| |

“C.H. Robinson continues to be uniquely positioned to deliver an unparalleled experience for our customers and carriers and is leveraging an unmatched combination of global scale and services, expertise, data, and technology to drive profitable growth.” Jodee Kozlak, Chair of the Board | |

| |

Dear Fellow Shareholders:

The last few years have underscored how vital supply chains are to global commerce and our way of life. Companies around the world recognize that smart, resilient supply chains and efficient transportation and logistics drive competitive advantage. C.H. Robinson continues to be uniquely positioned to deliver an unparalleled experience for our customers and carriers and is leveraging an unmatched combination of global scale and services, expertise, data, and technology to drive profitable growth. This past year the company and the Board made important, impactful moves to set the company up for future success as we navigated a global landscape of profound disruption. As C.H. Robinson enters its next phase, the Board has thoughtfully refreshed its composition and we have a search underway to identify a new Chief Executive Officer (CEO) who will lead and steward our 100+ year old company through a new chapter of exciting growth and transformation.

While the Board conducts its search, Scott Anderson, a former public company CEO who has served as a director for 10 years and Chair of the Board for the past three years, has been appointed Interim CEO. Scott brings significant leadership expertise and relevant knowledge of the C.H. Robinson business to the interim role. The Board is confident that Scott and the leadership team will continue delivering for our customers and carriers and will accelerate the pace of change to unlock long-term shareholder value.

Sustainable, Profitable Growth Strategy

C.H. Robinson is focused on delivering sustainable, profitable growth by increasing our market share, growing our global capabilities and presence, and increasing our operating leverage. To achieve this goal, we have been taking actions across the company including:

•Scaling our digital operating model, by optimizing processes and increasing digital execution across all touchpoints in the lifecycle of a load, to be more efficient, enhance productivity, and reduce costs while continuing to leverage our information advantage for our customers and carriers.

•Reducing our overall cost structure, which is expected to result in $150 million in net annualized cost savings by the fourth quarter of 2023. This reduction is net of inflationary costs in the business expected to occur this year.

•Continuing to strategically invest in our talented team and capabilities to strengthen our competitive advantage and amplify our expertise.

•Continuing our balanced approach to capital allocation to drive growth, minimize risk, optimize our balance sheet, and return capital to shareholders.

Board Refreshment

The Board continues to actively ensure that it has the right mix of directors to meet both current and long-term needs and provide the necessary oversight of the company’s evolving corporate strategy and risks. This time last year we added Jay Winship, Henry Maier, and Mark Goodburn as new independent directors. Most recently, Jim Barber became the newest independent member of the Board. Each brings a fresh and valuable perspective, and collectively have deepened the Board’s existing overall expertise on capital markets, corporate governance, transportation, and logistics. In addition, the Board made the Capital Allocation and Planning Committee, created a year ago, a standing committee and added additional directors to the Committee with relevant expertise to support management’s ongoing review of capital allocation, operations, and strategic initiatives and to assess value creation opportunities.

True to Our Values

As a responsible global citizen, C.H. Robinson is proud to contribute financial support, volunteer time, and thought leadership to causes that matter to our employees, the company, and our Foundation. We recognize the role we can play to advance sustainability across our organization and for our customers and our industry. Through a combination of efficiency projects to the use of renewable energy, we are on track to meet—and exceed—our 2025 goal of reducing Scope 1 & 2 emissions intensity by 40%. Further, as part of our commitment to transparency across our value chain, we will continue to report on our emissions annually, including Scope 3 emissions, which we began reporting in 2021. As a talent and performance-driven company, C.H. Robinson understands the importance of having a diverse and inclusive culture and we take our diversity, equity, and inclusion responsibilities seriously. We have tied a portion of executive compensation to improvement on key metrics to drive representation and a more inclusive workplace.

Uniquely Positioned for the Future

As we look ahead to 2023, I am confident in the company’s ability to capitalize on its competitive advantages and execute its strategy. The heightened efforts to improve processes, leverage technology, and tighten costs will help bring innovation to market more rapidly and enable more efficient scale. I am excited by our broad and diverse portfolio of customers across multiple industries, geographies, and services, and how they interplay with our people, our information advantage, and our suite of differentiated, integrated logistics services. In combination, these forge together to deliver operational excellence and innovation agility that will keep C.H. Robinson on the path forward to drive sustainable growth and shareholder value.

To our shareholders, thank you for your trust as we navigate these exciting and dynamic times. We look forward to continued dialogue with you, and welcome your feedback as we execute our growth strategy. Thank you for your investment in and continued commitment to C.H. Robinson.

Sincerely,

Jodee Kozlak

Chair of the Board

Table of Contents

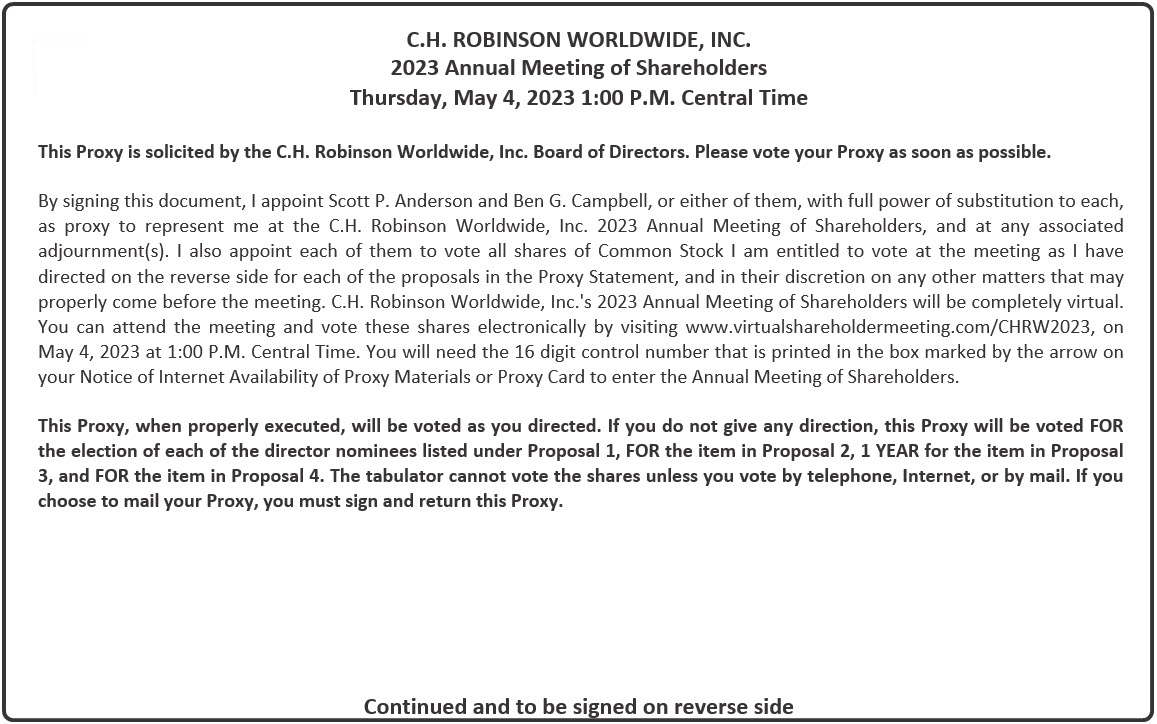

Notice of 2023 Annual Meeting of Shareholders

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | |

| DATE AND TIME

Thursday, May 4, 2023

at 1:00 p.m. (CT) | | LOCATION

www.virtualshareholdermeeting.com/

CHRW2023 | | WHO CAN VOTE

Shareholders of record at the close of business on March 8, 2023 |

| | | | | |

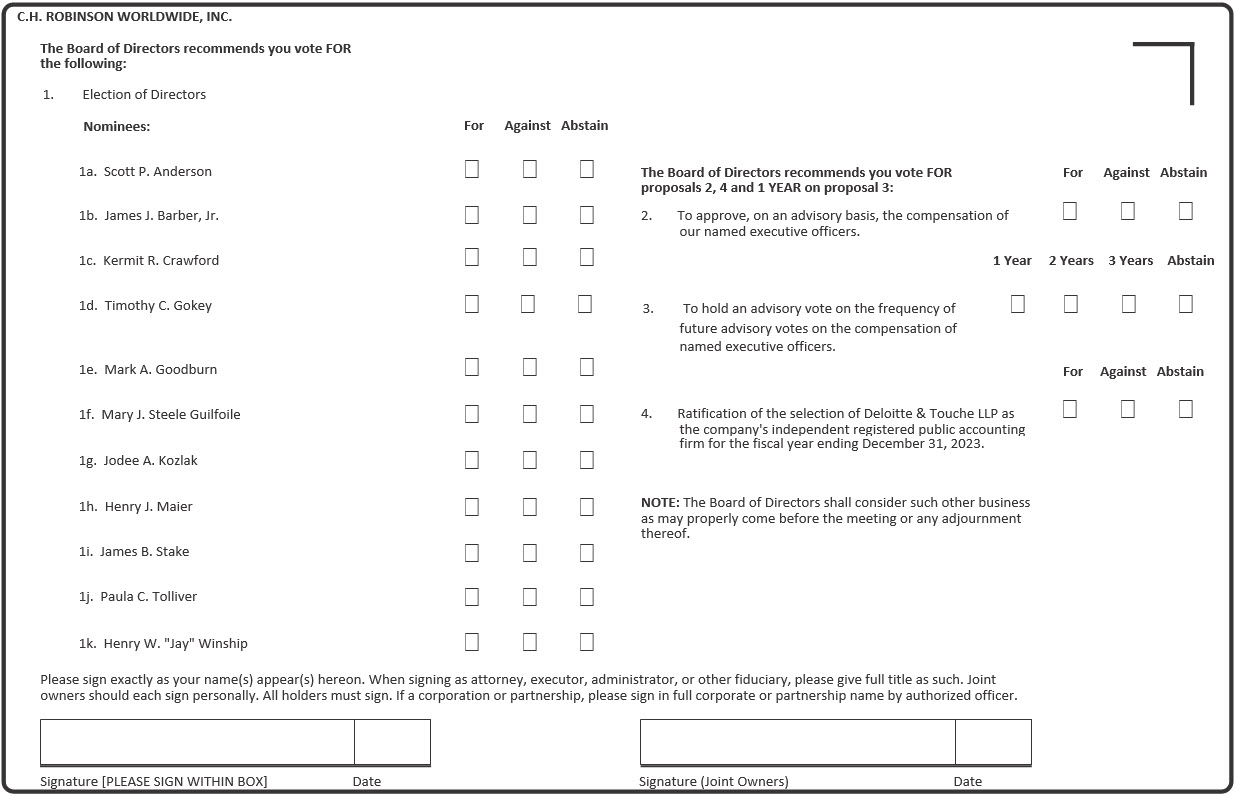

Voting Items

| | | | | | | | | | | | | | |

| Proposals | Board Vote Recommendation | For Further Details |

| 1 | To elect 11 directors to serve for a term of one year | | FOR each director nominee | |

| 2 | To approve, on an advisory basis, the compensation of named executive officers | | FOR | |

| 3 | To hold an advisory vote on the frequency of future advisory votes on the compensation of named executive officers | | 1 YEAR | |

| 4 | To ratify the selection of Deloitte & Touche LLP as the company’s independent registered public accounting firm for the fiscal year ending December 31, 2023 | | FOR | |

We will also conduct any other business that properly comes before the meeting and any adjournment or postponement of the meeting.

We use the internet to distribute proxy materials to our shareholders. We believe it is an efficient and cost-effective way to provide the material and it reduces the environmental impact of our Annual Meeting. The Notice of Internet Availability of Proxy Materials for the Annual Meeting and the associated Proxy Statement and Annual Report are available at www.proxyvote.com.

Mailing of the Notice of Internet Availability of Proxy Materials to our shareholders is expected to commence on March 21, 2023, and be completed by March 24, 2023. The notice has instructions on how to access our 2023 Proxy Statement and Annual Report, attend our virtual only meeting, and vote online. Shareholders who have requested hard copies of the proxy materials will receive the Proxy Statement and Annual Report by mail.

By Order of the Board of Directors:

Ben G. Campbell

Chief Legal Officer and Secretary

March 21, 2023How to Vote

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | |

| Online

www.proxyvote.com | | By Telephone

1-800-690-6903 | | By Mail

Mark, date, and sign your proxy card and return it by mail in the postage-paid envelope provided to you. |

| | |

|

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be Held on May 4, 2023. The Proxy Statement and the Annual Report are available at www.proxyvote.com. |

|

About C.H. Robinson

Overview

C.H. Robinson brings together customers, carriers, and suppliers to connect and grow supply chains around the world.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | $24.7B 2022 Total Revenues | 17,400 Employees Worldwide | 100,000 Active Customers

Worldwide | 96,000 Active Carriers

and Suppliers | | |

| | | | | | | |

| | | | | | | |

Sustainable Growth Strategy

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | Increase

Share | Profitable Growth | Scale

Digitally | Optimize

Processes | Spend

Strategically | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

2023 Strategic Priorities

àContinue driving long-term diversified growth across an intentional combination of modes, services, and geographic footprint

àDesign scalable solutions by transforming our processes, accelerating the pace of development, and prioritizing data integrity, in order to improve the customer and carrier experience, drive profitable growth, and improve efficiency

àMaintain a healthy financial profile and attractive margins across the business by leveraging technology advantages and competitive pricing, increasing productivity, and managing costs

àUphold a balanced approach to capital allocation to drive growth and return capital to shareholders

àInvest in talent and capabilities, as customers and carriers rely on our teams and digital products

Performance Highlights

Driving growth today and building long-term shareholder value into the future.

| | | | | |

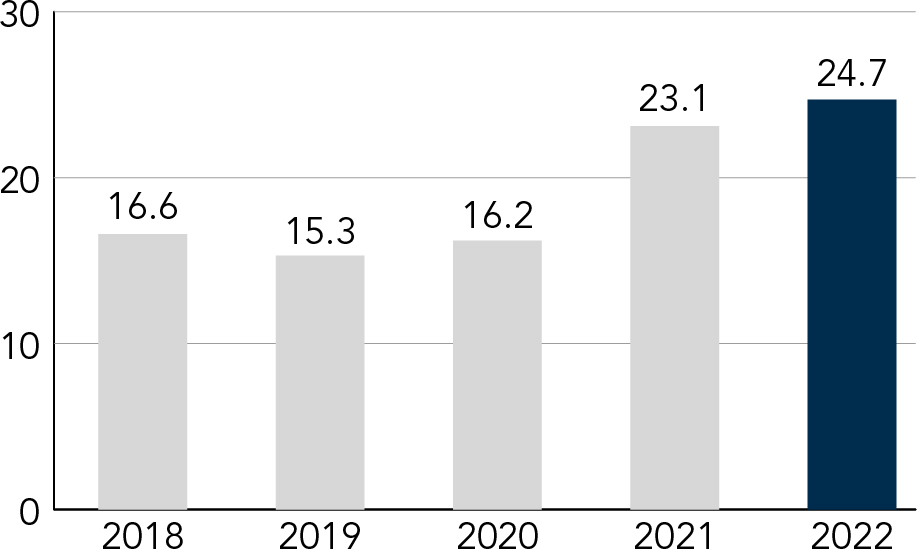

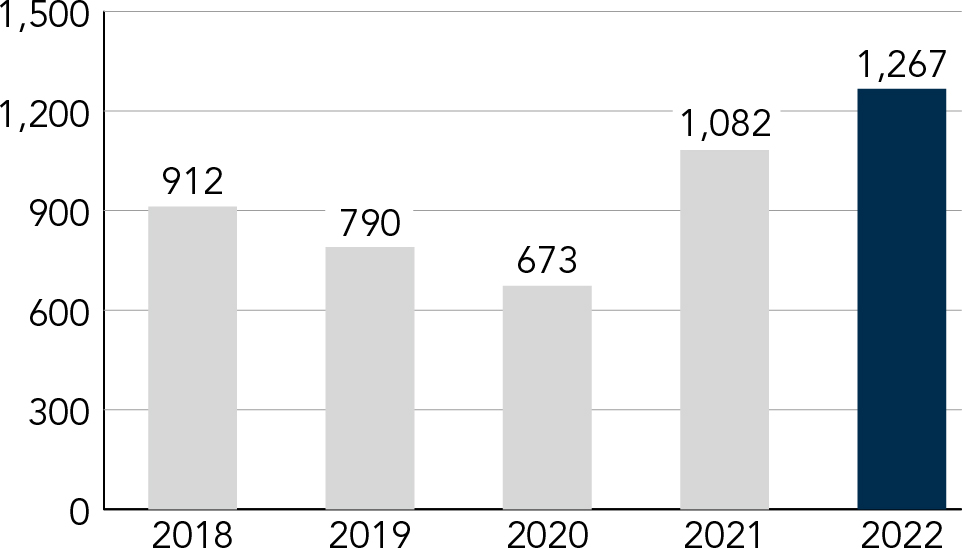

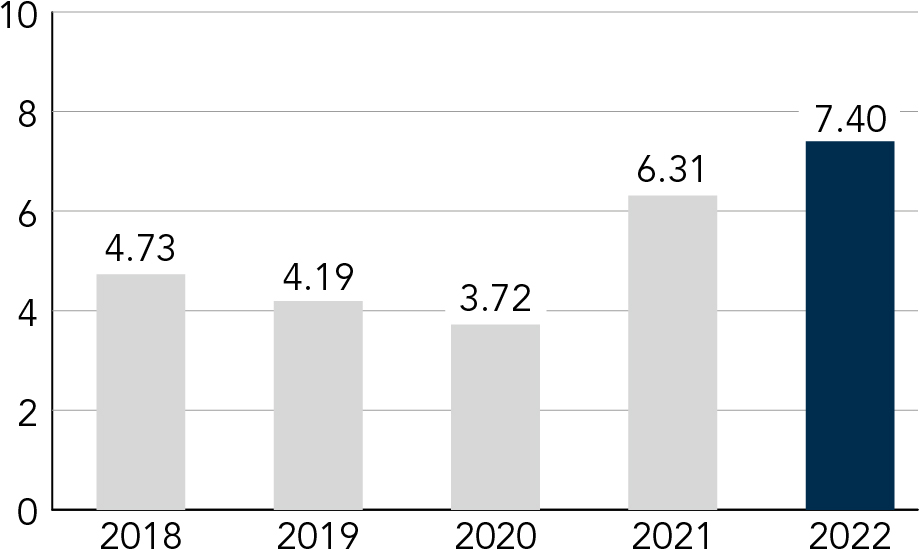

Total Revenues ($)

(in billions)

[+7% Y/Y] | Adjusted Gross Profits ($)(1)

(in billions)

[+14% Y/Y] |

| |

| |

| | | | | |

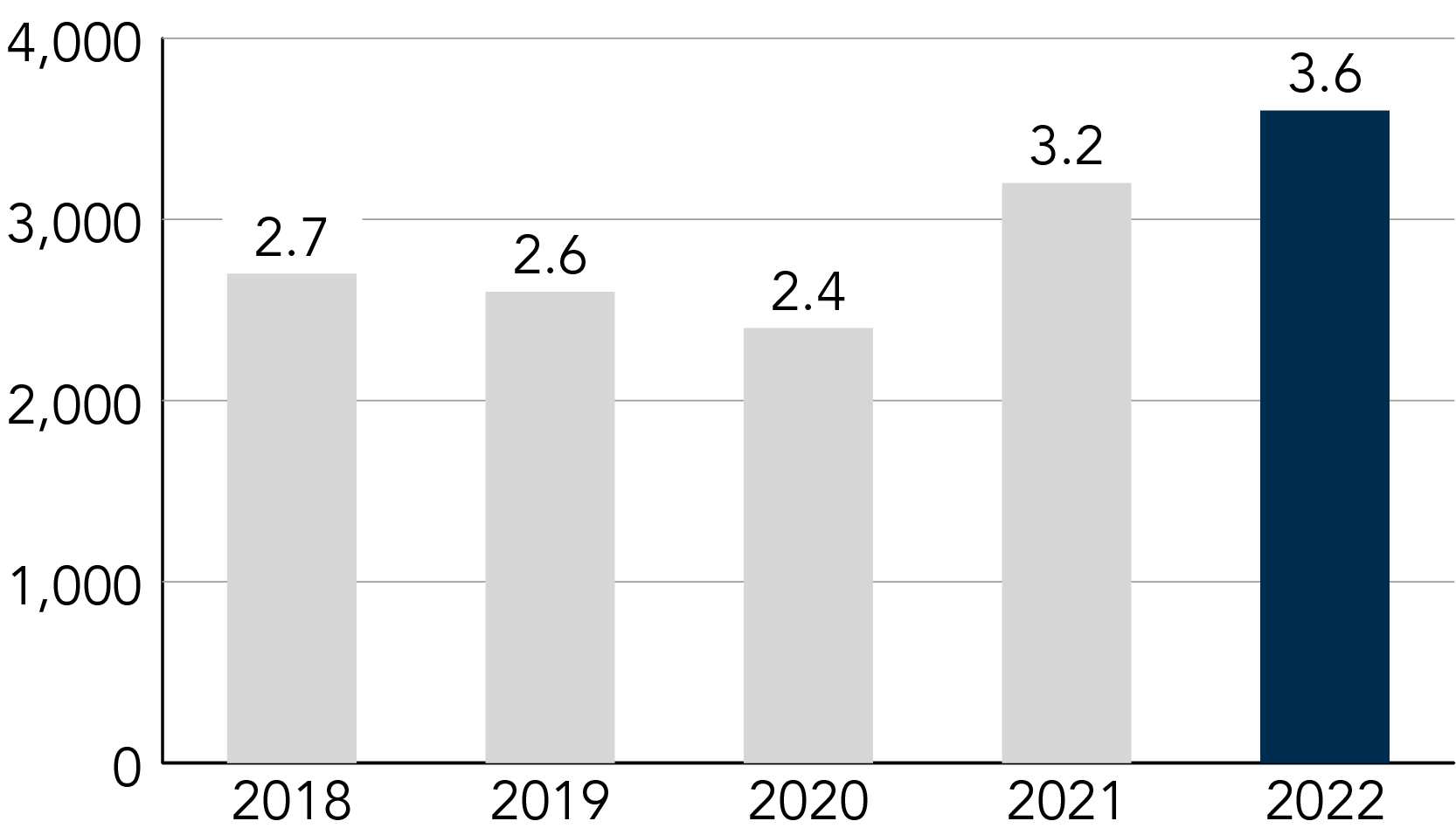

Income from Operations ($)

(in millions)

[+17% Y/Y] | Diluted Earnings Per Share ($)

[+17% Y/Y] |

| |

| |

| | | | | |

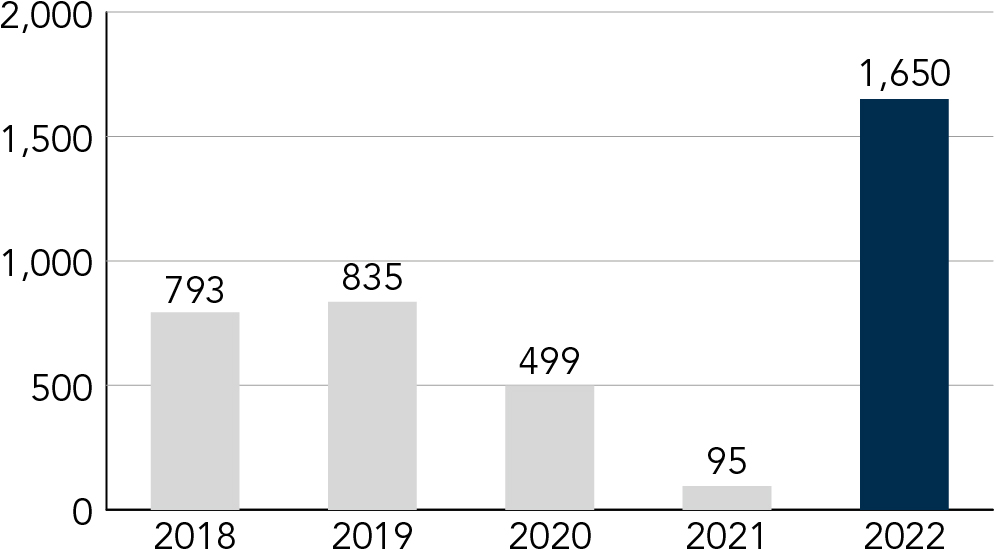

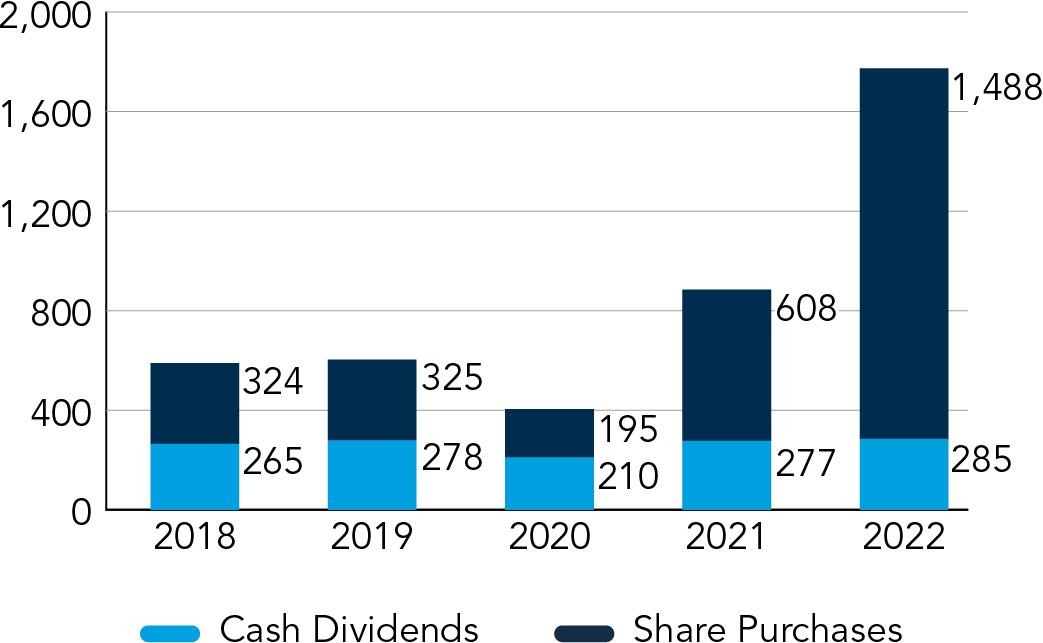

Cash Flow from Operations ($)

(in millions) | Capital Distribution ($)

(in millions) |

| |

| |

(1)Adjusted gross profit is a non-GAAP measure. Additional information about adjusted gross profit, including a reconciliation to gross profit, is available in our Annual Report on Form 10-K for the year ended December 31, 2022.

Accelerating Our Impact

Global supply chains are vital to our way of life. By delivering the products people need and want, we help move the world’s economy. At C.H. Robinson, we share a passion for engaging with companies, uncovering improvement opportunities, and building logistics success through our scalable, digital model. We excel at building relationships and use configurable, marketing-leading solutions to drive supply chain outcomes.

| | | | | |

Industry classifications often label us as a transportation company. In reality, C.H. Robinson is unique from traditional asset-owning transportation companies because we deliver a global suite of solutions without an owned fleet. It’s our adaptable model that uniquely positions us to meet the needs of dynamic supply chain environments—excelling in even the most demanding situations. See some of the key areas we are focusing on today. |

| | | | | |

| |

| |

Company

Culture | àGoing above and beyond is part of our culture. We deliver exceptional results by building on our fast-paced, service-driven, inclusive culture, where cross-functional collaboration and the pursuit of common goals unites us. As such, we empower our people to do their best work and develop the skill sets and capabilities to win, always guided by our EDGE values (evolve constantly, deliver excellence, grow together, and embrace integrity). These values are brought to life through our Leadership Principles: Adapt and Change; Constantly Innovate and Improve; Deliver Exceptional Results; Compete to Win; Value Differences; Inspire, Coach and Develop our People; and Think Like the Customer. Our Leadership Principles are unique to us and provide a shared understanding of what it means to lead at C.H. Robinson; they reinforce our culture and help drive exceptional results. |

| |

| |

| Talent Strategies | àOur talent strategy enables our organization’s focus on scalability through the right talent that is aligned, incented, and skilled to drive business results. Our strategic priorities for talent include the following: 1. Build a strong and diverse leadership team for now and the future. 2. Leverage workforce planning. 3. Right skill our people for the future. 4. Align incentives to drive outcomes. 5. Build an inclusive workplace that promotes optimal performance. |

| |

| |

Environmental,

Social &

Governance | àC.H. Robinson works to create resilient, sustainable supply chains that drive the global economy and make a positive impact on our people, customers, carriers, communities, and planet. àIn spring 2023, we will issue our latest Environmental, Social, and Governance (ESG) Report, and in summer of 2023, we will publish our second annual Task Force on Climate-related Financial Disclosures (TCFD) Report. The TCFD Report is in alignment with the recommendations set forth by the TCFD and is organized by the four TCFD recommendation pillars: Governance, Risk Management, Strategy, and Metrics and Targets. Our ESG Report, which will include disclosures aligned to the Sustainability Accounting Standards Board (SASB), as well as the TCFD will, among other things, outline significant progress on our ESG objectives: •Publicly reporting Scope 1, 2, and 3 emissions •Progress toward science-aligned climate goal •Advances in diversity, equity, and inclusion initiatives •Engagement opportunities for employees, customers, and industry partners on environmental and social topics |

| |

Stakeholder Engagement

At C.H. Robinson, we regularly engage with our stakeholders to identify priorities, gauge risks and opportunities, and help ensure responsible business practices.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | |

| | Who We Engage | | | | |

| | | | | | |

| | EMPLOYEES | CUSTOMERS | INVESTORS | | |

| | Our diverse network connects the world through technology, innovation, and collaboration to enact long-term, sustainable change for global supply chains. | As part of our mission to improve the world’s supply chains, we solve logistics challenges for customers across industries and geographies. | We connect with investors to share company progress and collaborate to understand the topics that they care about most. | | |

| | | | | | |

| | CONTRACT CARRIERS & SUPPLIERS | GOVERNMENT & REGULATORS | COMMUNITY | | |

| | Through stability, support, and technology, we keep operations moving for the contract carriers, suppliers, and growers integral to supply chains around the world. | Memberships and relationships with industry associations and government agencies keep us connected to existing and proposed rules and regulations. | We support the causes our people are passionate about, contributing to our communities as well as organizations that support our industry and align with our diversity, equity, and inclusion (“DEI”) efforts. | | |

| | | | |

| | How We Engage with Our Investors We continuously seek to strengthen investor relationships through proactive engagement focused on gaining insight into what matters most to those who choose to invest in our organization. We know their perspectives are critical to our continued success. The long-standing investor outreach program at C.H. Robinson centers around listening and responding to the positions and priorities of our investors through quarterly earnings calls, individual investor calls and meetings, investor conferences, as well as our annual shareholders meeting. | | |

| | | | | | | |

| | | | | |

| | TOPICS OF ENGAGEMENT àBusiness overview and marketplace dynamics àFinancial performance drivers àStrategic initiatives àCapital allocation strategy àTalent, culture, and DEI àESG priorities and initiatives àAdditional topics from governance and board composition to executive compensation, among many others | WHO IS INVOLVED IN ENGAGEMENT àChair of the Board àChief Executive Officer àChief Financial Officer àChief Operating Officer àDirector of Investor Relations àAdditional members of the C.H. Robinson Executive Team, including our Chief Human Resources & ESG Officer | | |

| | | | | | | |

Voting Roadmap

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting. Page references are supplied to help you find further information in this Proxy Statement.

| | | | | | | | |

PROPOSAL 1 | | |

Election of Directors |

The Board recommends a vote FOR each director nominee. | |

| | |

Director Nominees

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Director Since | Committee Membership |

| Director Name | Independent | Age | AC | TCC | GC | CAPC |

| Scott P. Anderson

Interim Chief Executive Officer; Former CEO of Patterson Companies | | 56 | 2012 |

| |

| |

| James J. Barber, Jr.

Retired Chief Operating Officer, United Parcel Service | | 62 | 2022 | | | | |

| Kermit R. Crawford

Retired President and Chief Operating Officer, Rite Aid | | 63 | 2020 | | | | |

| Timothy C. Gokey

Chief Executive Officer, Broadridge Financial Solutions | | 61 | 2017 | | | | |

| Mark A. Goodburn

Retired Chairman and Global Head of Advisory, KPMG International | | 60 | 2022 | | |

| |

| Mary J. Steele Guilfoile

Former Executive Vice President, JP Morgan Chase | | 68 | 2012 | | | | |

| Jodee A. Kozlak

Chair of the Board; Former Executive Vice President and Chief Human Resources Officer, Target Corporation | | 59 | 2013 | | | | |

| Henry J. Maier

Retired President and Chief Executive Officer of FedEx Ground | | 69 | 2022 | | | | |

| James B. Stake

Retired Executive Vice President, 3M | | 70 | 2009 | | | | |

| Paula C. Tolliver

Retired Corporate Vice President and Chief Information Officer, Intel | | 58 | 2018 | | | | |

| Henry W. “Jay” Winship

Founder, President and Managing Member of Pacific Point Capital | | 55 | 2022 | | | | |

| | | | | | | | | | | | | | | | | |

AC - Audit Committee GC - Governance Committee | TCC - Talent & Compensation Committee CAPC - Capital Allocation and Planning Committee | | Chair | | Member |

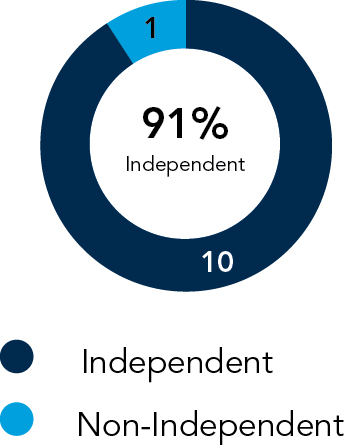

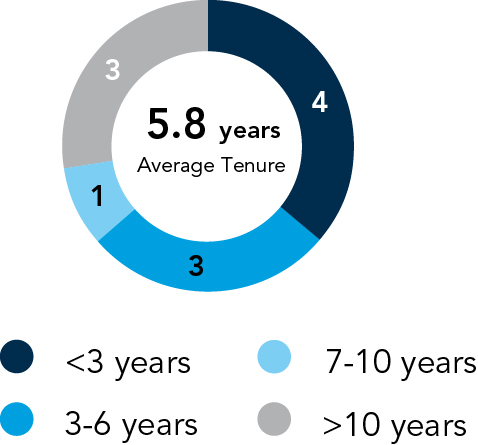

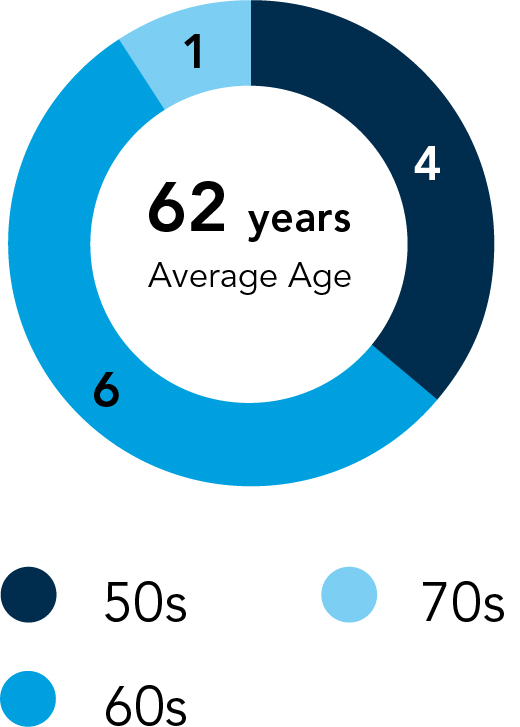

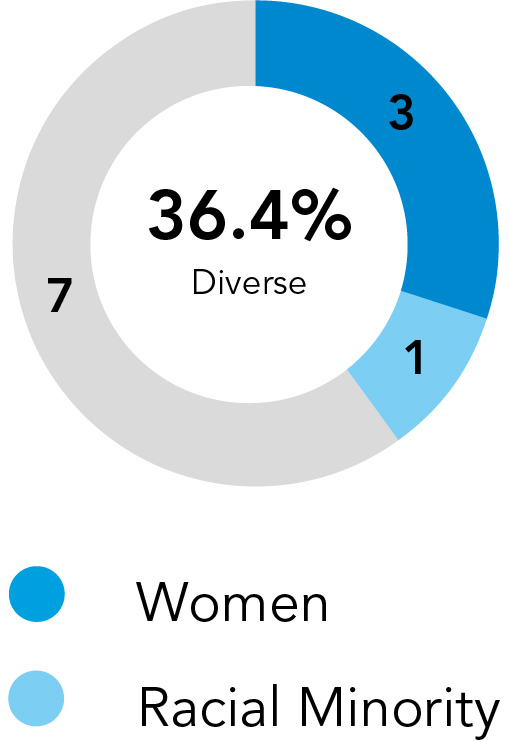

Board Demographics | | | | | | | | | | | |

| Independence | Tenure | Age | Diversity |

| | | |

| | | | | | | | |

PROPOSAL 2 | | |

Advisory Vote on the Compensation of Named Executive Officers |

The Board recommends a vote FOR this proposal | |

| | |

2022 Compensation Components

Our compensation philosophy is built on the following principles:

•Align pay for performance;

•Align the interests of management to our owners, the shareholders;

•Reward profitable long-term growth;

•Support company goals, business transformation, and company culture; and

•Pay market competitive compensation that attracts, retains, and motivates top talent and allows for upside opportunity to reward that talent if the company achieves superior performance.

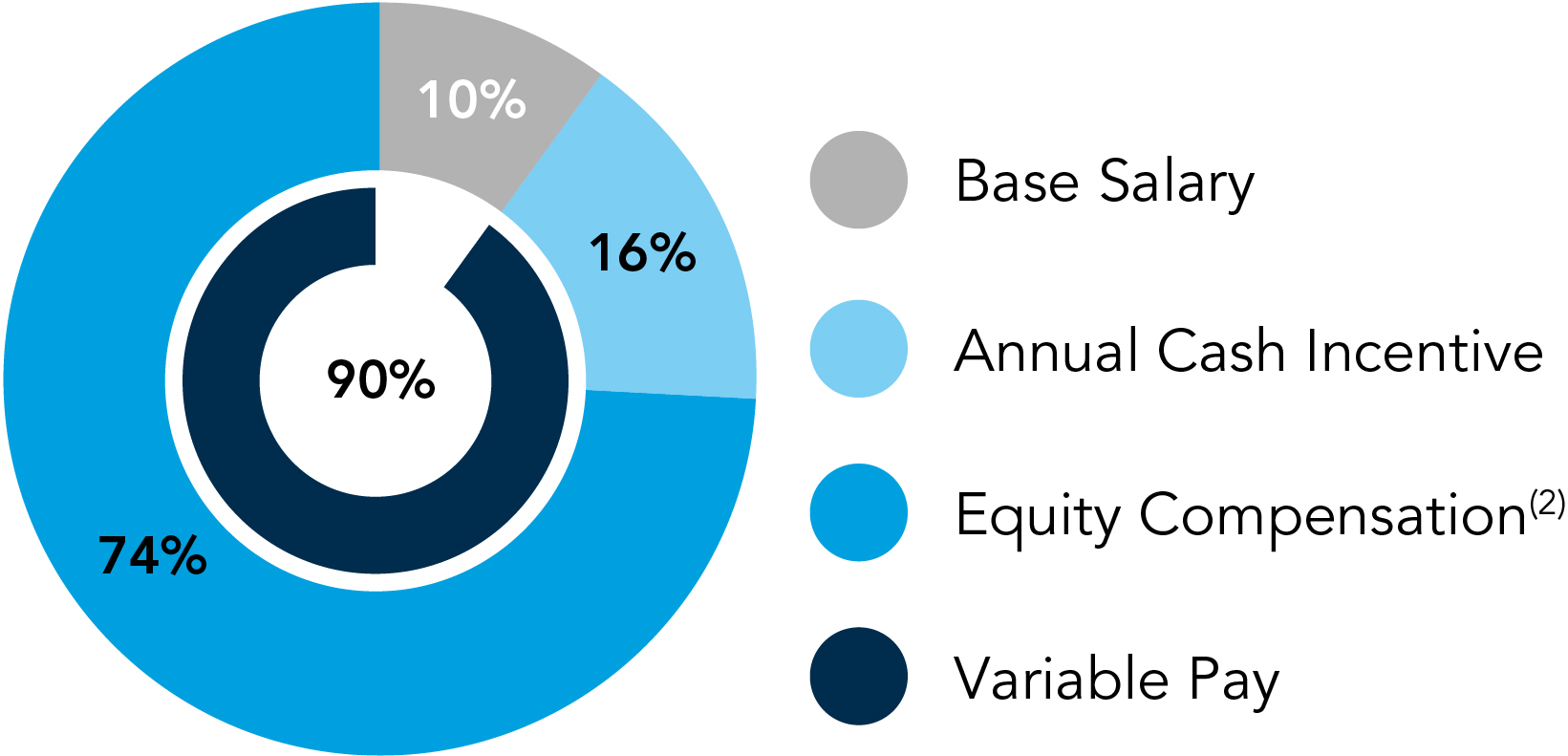

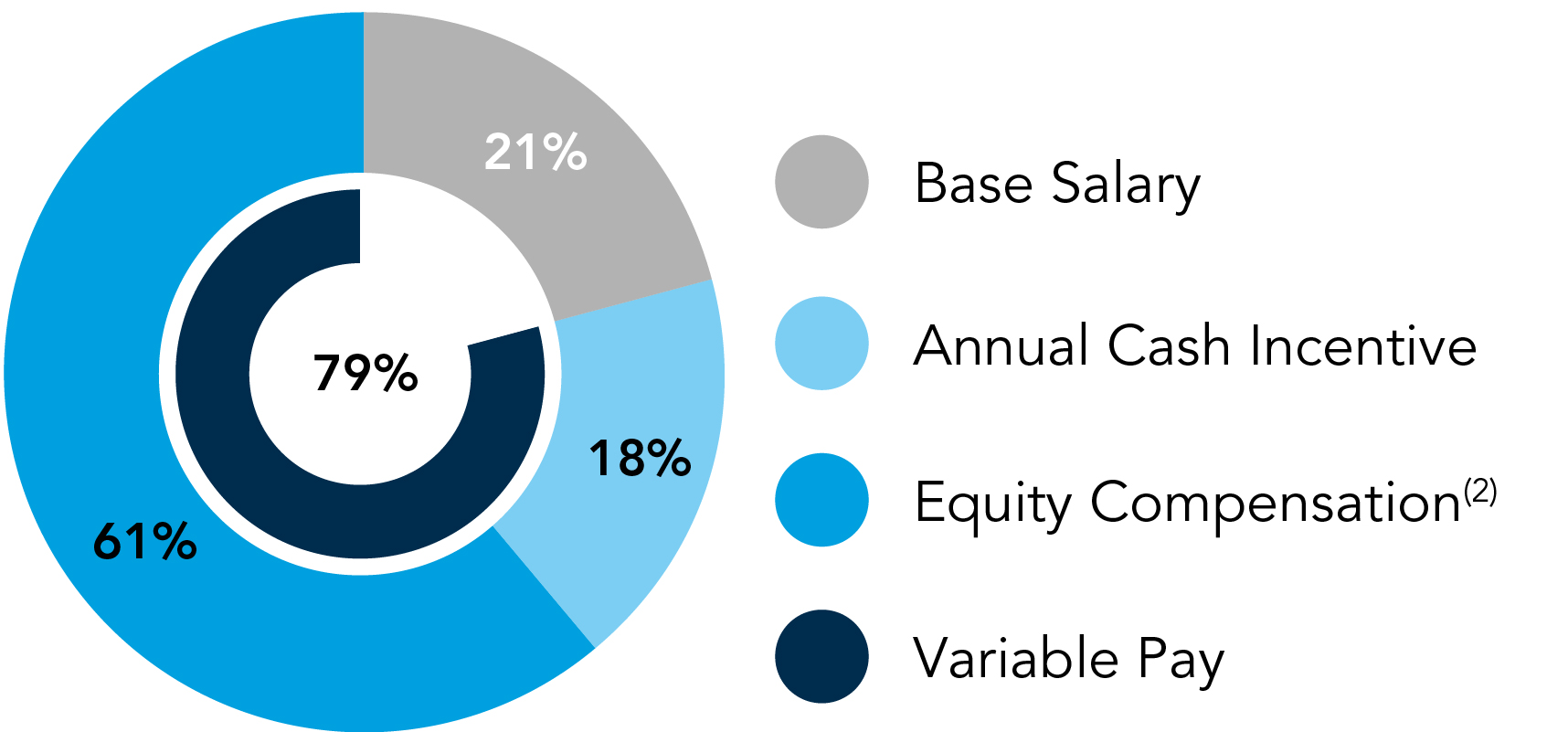

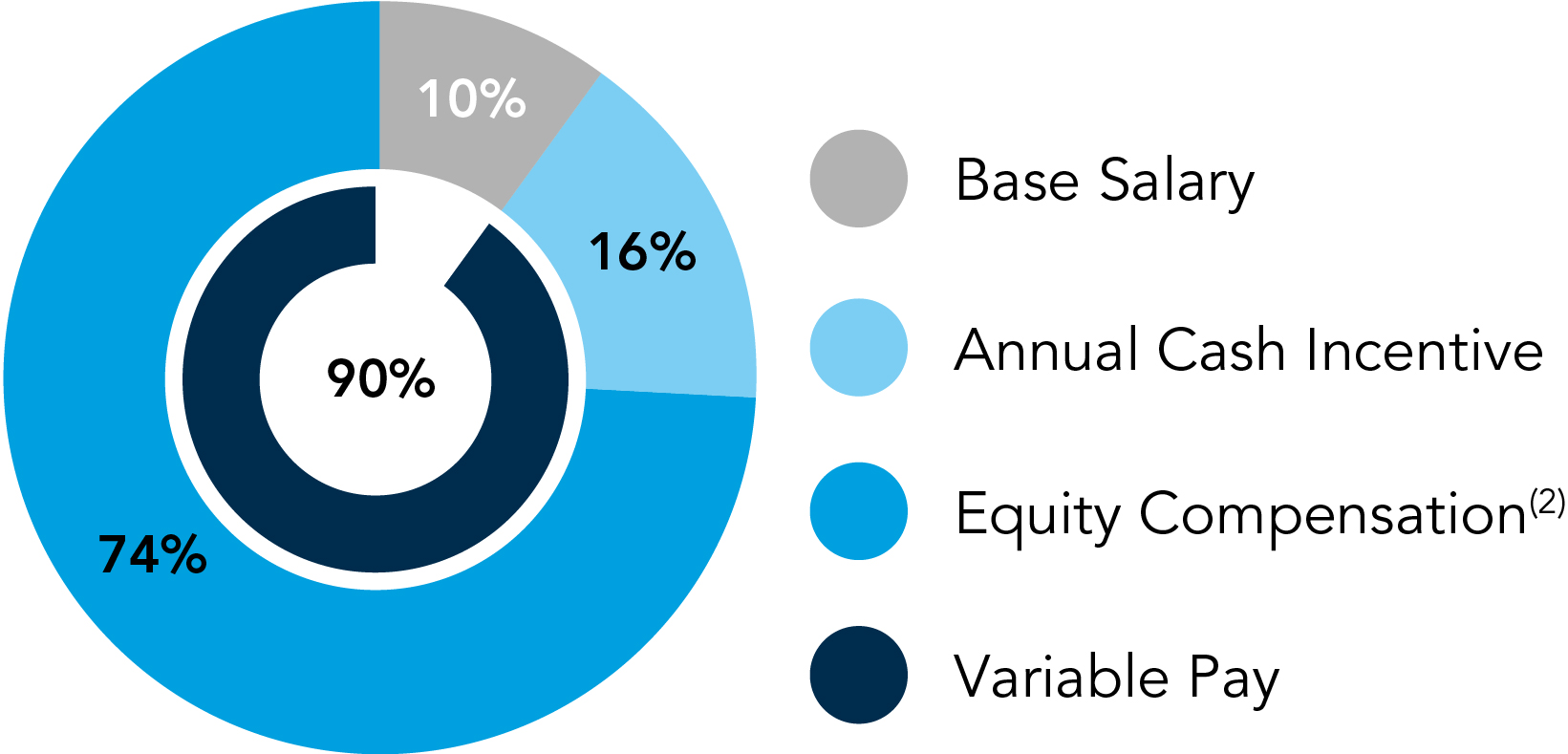

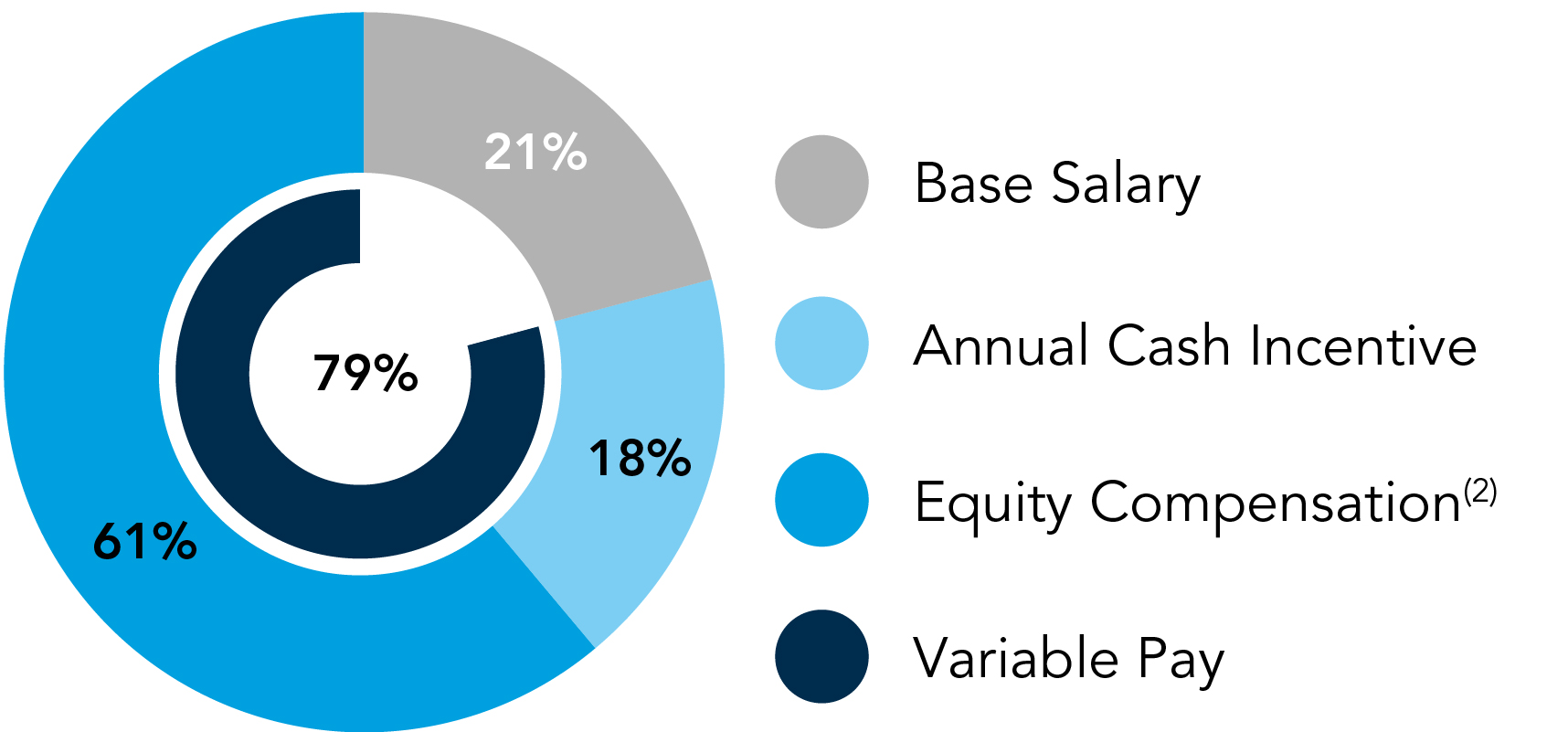

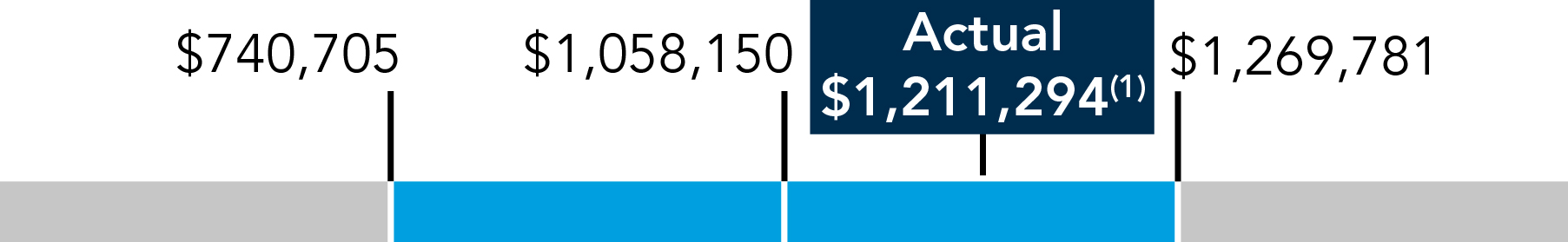

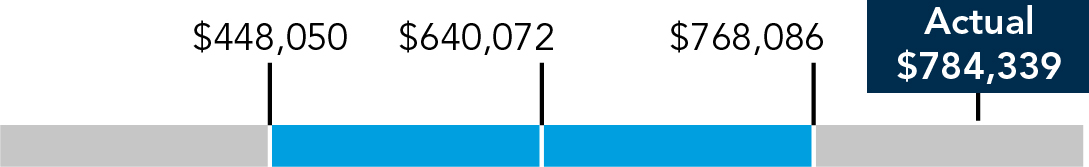

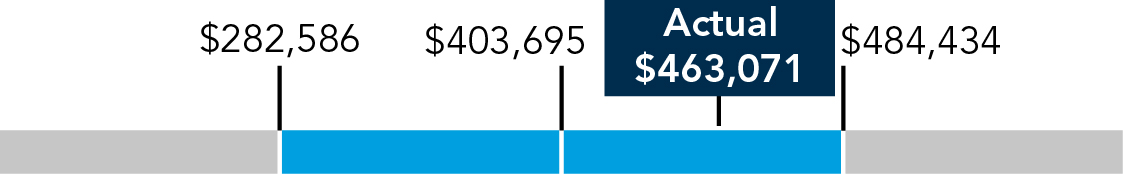

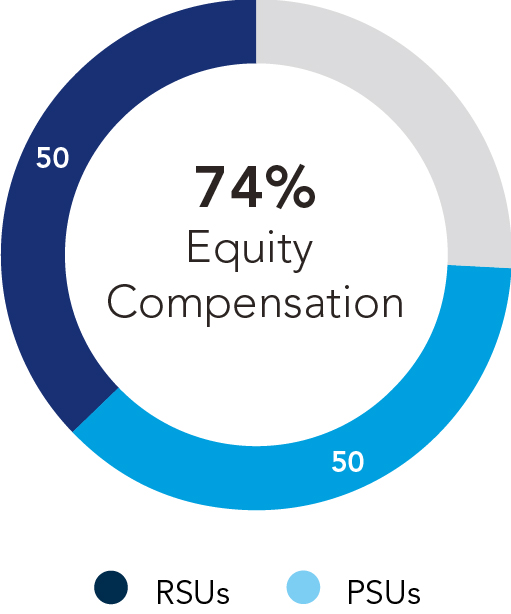

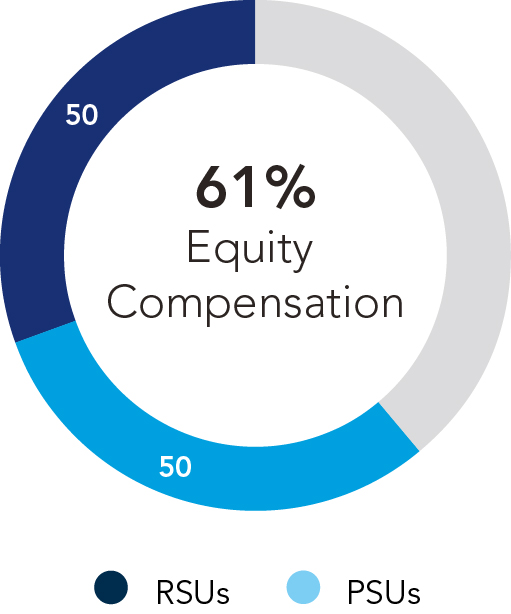

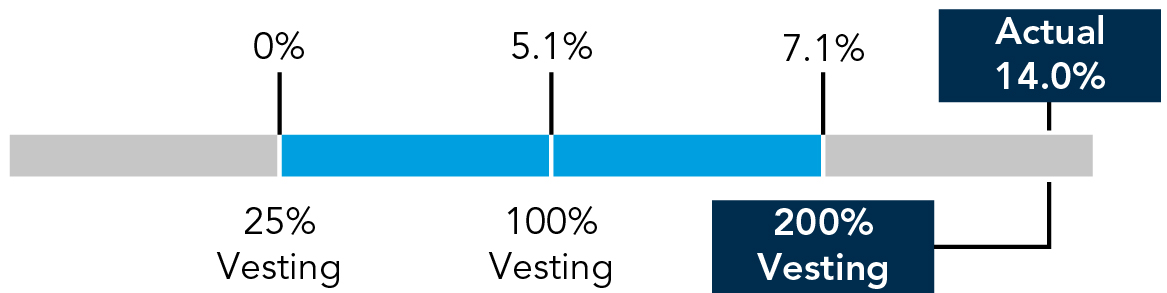

Our CEO’s target total compensation includes a mix of pay that is heavily weighted to long-term, equity-based incentives (74%). Our NEOs other than our CEO have an average of 61% of total compensation targeted to be paid in long-term, equity-based incentives. This is consistent with our philosophy of strong linkage between pay and performance.

| | | | | |

CEO 2022 Target Compensation(1) | Average Other NEO 2022 Target Compensation |

| |

| |

(1)CEO 2022 Target Compensation refers to former CEO Robert C. Biesterfeld Jr.

(2)Equity compensation includes 50% Performance Stock Units (“PSUs”) and 50% Restricted Stock Units (“RSUs”).

| | | | | | | | |

PROPOSAL 3 | | |

| Advisory Vote on the Frequency of Future Advisory Votes on the Compensation of Named Executive Officers |

The Board recommends a vote for 1 YEAR as the frequency for which shareholders shall have future advisory votes on the compensation of named executive officers | |

| | |

As described in Proposal 2, the C.H. Robinson shareholders are being provided with the opportunity to vote on a non-binding proposal to approve the compensation of the company’s named executive officers. Proposal 3 offers shareholders the opportunity to cast a non-binding advisory vote on how frequently the C.H. Robinson shareholders will have an advisory vote to approve the compensation of the company’s named executive officers.

| | | | | | | | |

PROPOSAL 4 | | |

Ratification of the Selection of Independent Auditors |

The Board recommends a vote FOR this proposal | |

| | |

The Audit Committee has selected Deloitte & Touche LLP as the independent registered public accountant firm for C.H. Robinson for the fiscal year ending December 31, 2023.

| | | | | | | | |

| | |

| | |

| Proposal 1: Election of Directors Background There are 11 nominees for election to the C.H. Robinson Board of Directors (the “Board of Directors” or the “Board”) for a one-year term. All 11 of the nominees are current directors. The Board of Directors has set the number of directors constituting the Board of Directors effective at the Annual Meeting at 11. Scott P. Anderson, James J. Barber, Jr., Kermit R. Crawford, Timothy C. Gokey, Mary J. Steele Guilfoile, Jodee A. Kozlak, Henry J. Maier, James B. Stake, Paula C. Tolliver, and Henry W. “Jay” Winship are directors whose terms expire at the Annual Meeting. Mr. Barber is standing for election by shareholders for the first time at the Annual Meeting. Mr. Barber was identified as a potential candidate for election to the Board of Directors by multiple sources, including non-employee directors and shareholders. The Board of Directors has determined that all the directors and nominees, except for Mr. Anderson, are independent under the current standards for “independence” established by the Nasdaq Stock Market, on which the C.H. Robinson stock is listed under the symbol “CHRW”. In connection with its evaluation of director independence, the Board of Directors considered the following transactions, each of which were entered into in the ordinary course of business: For Mr. Gokey, services provided in the ordinary course of business on behalf of the company by Broadridge Financial Solutions where Mr. Gokey is employed, and for which payments were less than 1% of either companies’ revenues or operations in the last three fiscal years. For Mr. Goodburn, services provided in the ordinary course of business on behalf of the company by KPMG LLP where Mr. Goodburn was employed until 2020, and for which payments were less than 1% of either companies’ revenues or operations in the last three fiscal years. Mr. Goodburn currently serves KPMG as a consultant in an advisory role. The Board considered these relationships and their significance in determining that these directors are independent. Information concerning each nominee is provided below. Messrs. Maier and Winship were each selected as a director pursuant to the cooperation agreements with the Ancora Group in 2022 and 2023. Based on their service on the Board of Directors over the last year, the Governance Committee and the Board believe they are qualified nominees who are committed to promoting the long-term interests of our shareholders. As required by the cooperation agreement in effect at the time, the Ancora Group consented to increasing the size of the Board to accommodate the election of Mr. Barber. On the recommendation of our Governance Committee, the Board of Directors has nominated Anderson, Barber, Crawford, Gokey, Goodburn, Guilfoile, Kozlak, Maier, Stake, Tolliver, and Winship for election to the Board of Directors at the Annual Meeting for terms of one year each. Each has indicated a willingness to serve. Mr. Anderson and Ben G. Campbell will vote the proxies received by them for the election of director nominees Anderson, Barber, Crawford, Gokey, Goodburn, Guilfoile, Kozlak, Maier, Stake, Tolliver, and Winship unless otherwise directed. If any nominee becomes unavailable for election at the Annual Meeting, Messrs. Anderson and Campbell may vote for a substitute nominee at their discretion as recommended by the Board of Directors, subject to the terms of the cooperation agreement with the Ancora Group described on page 25.

| |

| | |

| | |

| BOARD VOTING RECOMMENDATION The Board of Directors recommends a vote FOR the election of Scott P. Anderson, James J. Barber, Jr., Kermit R. Crawford, Timothy C. Gokey, Mark A. Goodburn, Mary J. Steele Guilfoile, Jodee A. Kozlak, Henry J. Maier, James B. Stake, Paula C. Tolliver, and Henry W. “Jay” Winship as directors of C.H. Robinson Worldwide, Inc. | |

| | |

Board Skills, Experience, and Attributes

The Governance Committee determines the selection criteria and qualifications of director nominees based upon the needs of the company. The Board of Directors believes that the directors should possess the highest personal and professional ethics and integrity and be committed to representing the long-term interests of the company’s shareholders. Preferred qualifications also include current or recent experience as a chief executive officer or senior leader and expertise in a particular business discipline, and diversity of talent, experience, accomplishments, and perspective. Directors should be able to provide insights and practical wisdom based on their experience and expertise.

Diversity

The company is committed to diversity, equity, and inclusion, and as such, the Corporate Governance Guidelines provide, and the Governance Committee believes, that creating a Board of Directors with a diversity of gender, ethnicity, background, talent, experience, accomplishments, and perspectives is in the best interests of the company and its shareholders. The company is committed to considering candidates for the Board of Directors, regardless of gender, ethnicity, and national origin. Any search firm retained to assist the Governance Committee in seeking director candidates is instructed to consider these commitments.

The information below reflects the diversity of the current members of the Board of Directors.

| | | | | | | | |

| Female | Male |

Board Diversity Matrix (As of March 21, 2023) | | |

| Total Number of Directors | 11 |

Part I: Gender Identity | | |

Directors | 3 | 8 |

Part II: Demographic Background | | |

African American or Black | 0 | 1 |

White | 3 | 7 |

Director Nominee Biographies and Qualifications

| | | | | | | | | | | |

| |

|

| Director Qualifications Mr. Anderson has significant public company senior management and executive experience through his service in several senior leadership positions at Patterson Companies. He also has public company board experience, having served as a member of Patterson’s board of directors from 2010 to 2017 and as a director and member of the Audit Committee at Duke Realty Corporation in 2022. Mr. Anderson also brings substantial sales and marketing expertise to the company, having served as Patterson’s vice president, sales and vice president, marketing. |

|

|

|

|

| |

| Background àC.H. Robinson Worldwide, Inc. (Nasdaq: CHRW) •Interim Chief Executive Officer (2023 – Present) •Chairman of the Board (2020 – 2022) •Lead Independent Director (2019 – 2020) •Director (2012 – Present) àPatterson Companies, Inc. (Nasdaq: PDCO), a provider of animal and dental health products and services •Senior Advisor (2017 – 2019) •President and Chief Executive Officer (2010 – 2017) •Chairman of the Board (2013 – 2017) •Director (2010 – 2017) •President of Patterson Dental Supply, Inc. (2006 – 2010) •Held senior management positions in the dental unit, including vice president, sales and vice president, marketing àOther Experience •Senior Advisor, TPG Capital Healthcare •Executive Council Head, Carlson Private Capital Partners •Trustee and Former Chairman of the Board, Gustavus Adolphus College •Former Director, Ordway Theater •Former Chairman, Dental Trade Alliance Public Board Experience àDuke Realty Corporation (NYSE: DRE) •Former Director and member of the Audit Committee (2022) Education àMaster of Business Administration, Northwestern University, Kellogg School of Management àBachelor of Arts, Gustavus Adolphus College |

NON-INDEPENDENT (Director Nominee) Age: 56 Director Since: January 2012 Committees: àCapital Allocation and Planning | |

| | | | | | | | |

| | |

| Director Qualifications Mr. Barber possesses an extensive 35+ year background at UPS, one of the world’s largest package delivery companies. This experience encompassed leadership positions in UPS’s Domestic and International business units, as well as in Supply Chain Solutions, including both Global Freight Forwarding and Coyote Logistics, and provides our Board with valuable insights into key topics relevant to our business. Mr. Barber also has demonstrated experience in the areas of finance and accounting, as well as growth strategies and operations and currently serves on another public company board, US Foods. Mr. Barber meets the definition of an “Audit Committee Financial Expert” as established by the Securities and Exchange Commission. |

| |

INDEPENDENT (Director Nominee) Age: 62 Director Since: December 2022 Committees: àAudit | | |

| Background àC.H. Robinson Worldwide, Inc. (Nasdaq: CHRW) •Director (2022 – Present) àUnited Parcel Service, Inc. (“UPS”) (NYSE: UPS), a package delivery company and leading provider of global supply chain management solutions •Chief Operating Officer (2018 – 2020) •President of UPS International (2013 – 2018) •President UPS Europe (2011 – 2013) •Other roles of increasing responsibility, including Region and District Manager, Mergers & Acquisition Transaction Manager, Region and District Controller, Accounting Manager and various other management positions in Finance & Accounting •Began career at UPS as a package delivery driver in 1985 àOther Experience •Former Trustee, The UPS Foundation •Former Board member, UNICEF •Former Board member, Folks Center for International Business at the University of South Carolina Public Board Experience àUS Foods, Inc. (NYSE: USFD) •Director and member of the Compensation and Human Capital Committee (2022 – Present) Education àBachelor of Science in Finance, Auburn University |

| | | | | | | | |

| | |

| Director Qualifications Mr. Crawford has significant executive and leadership experience based on his senior roles with Rite Aid Corporation and Walgreens. He has also developed expertise in the areas of strategic investment and digital transformation. Mr. Crawford has relevant public company board experience through his membership on the boards of Visa and The Allstate Corporation, as well as his prior board experience at TransUnion and LifePoint Health. |

| |

| |

| Background àC.H. Robinson Worldwide, Inc. (Nasdaq: CHRW) •Director (2020 – Present) àRite Aid Corporation (NYSE: RAD), a retail drugstore chain •President and Chief Operating Officer (2017 – 2019) àSycamore Partners, a private equity firm specializing in consumer, distribution, and retail-related investments •Operating Partner and Advisor (2015 – 2017) àWalgreen Company, one of the largest drugstore chains in the United States (“Walgreens”) •Executive Vice President and President of Pharmacy, Health, and Wellness (2011 – 2014) •Multiple roles of increasing responsibility (1983 – 2011), including as Executive Vice President and President of Pharmacy Services àOther Experience •Director, Northwestern Medicine North/Northwest Region •Trustee, The Field Museum Chicago Public Board Experience àThe Allstate Corporation (NYSE: ALL) •Director and Chairman of the Audit Committee (2013 – Present) àVisa Inc. (NYSE: V) •Director and member of the Audit & Risk Committee and Nominating & Corporate Governance Committee (2022 – Present) àTransUnion (NYSE: TRU) •Director, member of the Audit and Compliance Committee and Technology, Privacy and Cybersecurity Committee (2019 – 2021) àLifePoint Health (NYSE: LPNT; no longer publicly traded) •Director and member of the Audit and Compliance Committee, Compensation Committee, Corporate Governance & Nominating Committee, and Quality Committee (2016-2018) Education àBachelor of Science, The College of Pharmacy and Health Sciences at Texas Southern University |

INDEPENDENT (Director Nominee) Age: 63 Director Since: September 2020 Committees: àGovernance (Chair) àTalent & Compensation | |

| | | | | | | | |

| | |

| Director Qualifications Through his service in a variety of leadership roles, including his current role as chief executive officer, at Broadridge Financial Solutions, Mr. Gokey has developed exceptional leadership and business execution skills and has broad public company knowledge and expertise. He is also deeply involved in Broadridge’s international operations and technology organization. In his prior roles with Broadridge, as well as H&R Block and McKinsey & Company, Mr. Gokey has demonstrated expertise in the areas of mergers and acquisitions, sales and marketing, and other growth-related activities. Mr. Gokey meets the definition of an “Audit Committee Financial Expert” as established by the Securities and Exchange Commission. |

INDEPENDENT (Director Nominee) Age: 61 Director Since: October 2017 Committees: àAudit àTalent & Compensation | |

| |

| |

| Background àC.H. Robinson Worldwide, Inc. (Nasdaq: CHRW) •Director (2017 – Present) àBroadridge Financial Solutions (NYSE: BR), a public corporate services and financial technology company •Chief Executive Officer (2019 – Present) •Director (2019 – Present) •President (2017 – 2020) •Senior Vice President and Chief Operating Officer (2012 – 2019) •Chief Corporate Development Officer (2010 – 2012) àH&R Block, a tax preparation company •President, Retail Tax (2004 – 2009) àMcKinsey & Company, a business strategy consulting company •Partner (1986 – 2004) àOther Experience •Director, Partnership for New York City Public Board Experience àNone Education àDoctorate in Finance; Bachelor of Arts/Master of Arts in Philosophy, Politics, and Economics, University of Oxford as a Rhodes Scholar àBachelor of Arts in Public Affairs and Management Engineering, Princeton University |

| | | | | | | | |

| | |

| Director Qualifications Mr. Goodburn has significant executive and leadership experience based on his senior leadership roles with KPMG. Specifically, Mr. Goodburn has deep experience and expertise in the areas of strategy, finance, mergers and acquisitions, and global management and operations. Mr. Goodburn meets the definition of an “Audit Committee Financial Expert” as established by the Securities and Exchange Commission. |

| |

| |

| Background àC.H. Robinson Worldwide, Inc. (Nasdaq: CHRW) •Director (2022 – Present) àKPMG International, a multinational professional services network •Senior Advisor to KPMG LLP (2021 – Present) •Global Head of Strategic Investments and Innovation (2018 – 2021) •Chairman and Global Head of Advisory (2011 – 2020) •Vice Chairman of KPMG LLP and Americas Head of Advisory and Strategic Investments (2005 – 2011) •Various roles, including as Managing Partner-Silicon Valley Office, Member of KPMG US and Americas Board of Directors and Global Head of KPMG’s Technology, Media and Telecommunications (1997 – 2005) •Roles of increasing responsibility at KPMG LLP (1984 – 1997) àOther Experience •Presidents National Advisory Council member, Minnesota State University •Executive Board member, Cox School of Business Executive Board, Southern Methodist University Public Board Experience àNone Education àBachelor of Science in Business, Minnesota State University, Mankato àCertified Public Accountant |

INDEPENDENT (Director Nominee) Age: 60 Director Since: May 2022 Committees: àAudit àCapital Allocation & Planning | |

| | | | | | | | |

| | |

| Director Qualifications Ms. Guilfoile has significant experience and expertise in the areas of corporate mergers and acquisitions, business integration, and financing through her association with the investment banks of several large financial institutions. She also has public board experience through her membership on the boards of, among others, Interpublic, Dufry (a Swiss-based company on the Swiss stock exchange), and Pitney Bowes. |

| |

| |

| Background àC.H. Robinson Worldwide, Inc. (Nasdaq: CHRW) •Director (2012 – Present) àMG Advisors, Inc., a privately-owned financial services merger and acquisition advisory and consulting services firm •Chair (2002 – Present) àThe Beacon Group, LP, a private equity investment partnership •Partner (1998 – Present) àJP Morgan Chase (and its predecessor companies, Chase Manhattan Corporation and Chemical Banking Corporation), a multinational bank •Executive Vice President, Corporate Treasurer (2000 – 2002) •Various leadership roles (1986 - 1996), including as Chief Administrative Officer and Strategic Planning Officer for its investment bank, as well as various merger integration, executive management and strategic planning positions àOther Experience •Former Partner, CFO and COO, The Beacon Group, LLC •Consultant, Booz Allen Hamilton •Manager in Audit Services, Coopers & Lybrand (now part of PwC) Public Board Experience àThe Interpublic Group of Companies (NYSE: IPG) •Director, Chair of the Audit Committee and member of the Corporate Governance and Social Responsibility Committee (2007 – Present) àPitney Bowes Inc. (NYSE: PBI) •Director and member of the Finance Committee and Audit Committee (2018 – Present) àDufry AG (publicly traded on the SIX Swiss Exchange) •Director and Chair of the Audit Committee (2020 – Present) Education àMaster of Business Administration, Columbia University Graduate School of Business àBachelor of Science in Accounting, Boston College àCertified Public Accountant |

INDEPENDENT (Director Nominee) Age: 68 Director Since: October 2012 Committees: àGovernance àTalent & Compensation | |

| | | | | | | | |

| | |

| Director Qualifications Through her human resources executive leadership at Target and Alibaba Group and extensive public board experience, Ms. Kozlak has developed significant knowledge and expertise in human capital strategy, global operations, and digital transformation. Her experience has also given her a deep understanding of executive compensation within a public company. |

| |

| |

| Background àC.H. Robinson Worldwide, Inc. (Nasdaq: CHRW) •Chair of the Board (January 2023 – Present) •Director (2013 – Present) àKozlak Capital Partners, LLC •Founder and CEO (2017 – Present) àAlibaba Group (NYSE: BABA), a multinational conglomerate specializing in e-commerce, retail, Internet, and technology •Global Senior Vice President of Human Resources (2016 – 2017) àTarget Corporation (NYSE: TGT), one of the largest U.S. retailers •Executive Vice President and Chief Human Resources Officer (2006 – 2016) •Senior Vice President, Human Resources (2004 – 2006) •General Counsel, Owned Brand Sourcing and Labor & Employment (2001 – 2004) àOther Experience •Former Partner in the litigation practice, Greene Espel, PLLP •Former Senior Auditor, Arthur Andersen & Co •Past fellow, Distinguished Careers Institute (DCI) at Stanford University Public Board Experience àK.B. Home (NYSE: KBH) •Director and member of the Compensation Committee (2021 – Present) àMGIC Investment Corp. (NYSE: MTG) •Director, Chair of the Business Transformation and Technology Committee and member of the Management Development, Nominating and Governance Committee (2018 – Present) àLeslie’s, Inc. (Nasdaq: LESL) •Director, Chair of the Nominating and Corporate Governance Committee and member of the Compensation Committee (2020 – March 2023) Education àJuris Doctor, University of Minnesota àBachelor of Arts in Accounting, College of St. Thomas |

INDEPENDENT (Director Nominee) Age: 59 Director Since: February 2013 Committees: àTalent & Compensation (Chair) àGovernance | |

| | | | | | | | |

| | |

| Director Qualifications Throughout his career at FedEx and 40 years of experience in the transportation industry, Mr. Maier gained significant experience and expertise in the areas of capital markets, corporate governance, and logistics. Mr. Maier also has relevant public company board experience through his membership on the boards of CalAmp Corporation, Carparts.com, Inc., and Kansas City Southern (formerly a publicly traded company). |

| |

| |

| Background àC.H. Robinson Worldwide, Inc. (Nasdaq: CHRW) •Director (2022 – Present) àFedEx Corp. (NYSE: FDX), multinational conglomerate holding company focused on transportation, e-commerce and business services •President and Chief Executive Officer of FedEx Ground (2013 – 2021) •Executive Vice President, Strategic Planning and Communication of FedEx Ground (2009 – 2013) •Senior Vice President, Strategic Planning and Communications (2006 – 2009) •Various other roles, including as a member of the Strategic Management Committee and leadership positions in logistics, sales, marketing and communications Public Board Experience àCalAmp Corp. (Nasdaq: CAMP) •Independent Chair of the Board, member of the Governance and Nominating Committee and Human Capital Committee (2021 – Present) àCarParts.com, Inc. (Nasdaq: PRTS) •Director and member of the Nominating and Corporate Governance Committee (2021 – Present) àKansas City Southern (NYSE: KSU; no longer publicly traded) •Director, Chair of the Compensation & Organization Committee, member of the Finance & Strategic Investment Committee (2017 – Present) Education àBachelor of Arts in Economics, University of Michigan |

INDEPENDENT (Director Nominee) Age: 69 Director Since: February 2022 Committees: àGovernance àCapital Allocation and Planning | |

| | | | | | | | |

| | |

| Director Qualifications Throughout his career at 3M Company, Mr. Stake gained extensive public company senior management experience at a large company that operates worldwide. In particular, Mr. Stake’s foreign leadership positions and his position with 3M’s Enterprise Services, provide valuable perspective for C.H. Robinson international operations and its information technology systems. Mr. Stake also has public company board experience through his long tenure on the board of Otter Tail Corporation. Mr. Stake meets the definition of an “Audit Committee Financial Expert” as established by the Securities and Exchange Commission. |

| |

INDEPENDENT (Director Nominee) Age: 70 Director Since: January 2009 Committees: àAudit (Chair) | | |

| Background àC.H. Robinson Worldwide, Inc. (Nasdaq: CHRW) •Director (2009 – Present) à3M Company (NYSE: MMM), multinational conglomerate operating in the fields of industrial, consumer, healthcare, electronics, and worker safety •Executive Vice President of 3M’s Enterprise Services (2006 – 2008) •Various positions of increasing responsibility leading global health care, industrial, and commercial businesses during his more than 30 years with 3M Company •Over 12 years of foreign assignments in Europe and South America àAtiva Medical Corp. •Chairman of the Board (2008 – 2020) àOther Experience •Adjunct Professor, University of Minnesota’s Carlson School of Management •Board of Trustees, Twin Cities Public Television Public Board Experience àOtter Tail Corporation (Nasdaq: OTTR) •Director, Chair of the Compensation and Human Capital Committee and member of the Audit Committee (2008 – retirement announced for April 2023) Education àMaster of Business Administration, Wharton School, University of Pennsylvania àBachelor of Science in Chemical Engineering, Purdue University |

| | | | | | | | |

| | |

| Director Qualifications Ms. Tolliver has developed broad multi-national executive and leadership experience as a senior leader at both Dow and Intel corporations. She has deep expertise in information technology, digital transformation, advanced analytics, and cybersecurity, as well as demonstrated experience in driving innovation, growth, and operational excellence. Ms. Tolliver has relevant public company board experience and meets the definition of an “Audit Committee Financial Expert” as established by the Securities and Exchange Commission. |

| |

| |

INDEPENDENT (Director Nominee) Age: 58 Director Since: October 2018 Committees: àAudit àCapital Allocation & Planning | | Background àC.H. Robinson Worldwide, Inc. (Nasdaq: CHRW) •Director (2018 – Present) àTech Edge, LLC, a technology consulting firm •Founder and Principal (2020 – Present) àIntel Corporation (Nasdaq: INTC), a multinational technology company •Corporate Vice President and Chief Information Officer (2016 – 2019) àThe Dow Chemical Company (a wholly owned subsidiary of Dow, Inc.) (NYSE: DOW), a global materials science leader in packaging, infrastructure, and consumer care •Corporate Vice President of Business Services and Chief Information Officer

(2012 – 2016) •Vice President, Procurement (2006 – 2011) •Chief Information Officer and Chief Digital Officer of Dow AgroScience (2000 – 2006) •Various other roles of increasing responsibility in Information Technology including as Europe Information Services Director (1996 – 2000) àSyniti, a pioneering data software and services company •Director and member of the Technology Committee (2020 – Present) Public Board Experience àInvesco (NYSE: IVZ) •Director and member of the Nomination and Corporate Governance Committee, Compensation Committee and Audit Committee (2021 – Present) Education àBachelor of Science in Business Information Systems and Computer Science, Ohio University |

|

| | | | | | | | |

| | |

| Director Qualifications Mr. Winship has significant experience and expertise in the areas of capital allocation, mergers and acquisitions, corporate governance, and logistics. He is an active portfolio manager, which provides our Board with valuable insights from an institutional investor perspective. Mr. Winship also has public board experience through his membership on the board of Bunge Limited, and his prior membership on the boards of CoreLogic, Inc. and Esterline Technologies Corporation. |

| |

| |

| Background àC.H. Robinson Worldwide, Inc. (Nasdaq: CHRW) •Director (2022 – Present) àPacific Point Companies, a privately owned asset management firm •Founder, President and Managing Member of Pacific Point Capital LLC

(2016 – Present) •Founder and Managing Member of Pacific Point Advisor, LLC

(2016 – Present) àRelational Investors LLC, an activist investment fund •Principal, Senior Managing Director and Investment Committee member

(1996 – 2015) Other Experience •Advisor, Corporate Governance Institute at San Diego State University Fowler College of Business Public Board Experience àBunge Limited (NYSE: BG) •Director, Chair of the Audit Committee and member of the Corporate Governance and Nominations Committee and Human Resources and Compensation Committee (2018 – Present) àCoreLogic, Inc. (NYSE: CLGX; no longer publicly traded) •Former Director àEsterline Technologies Corporation (NYSE: ESL; no longer publicly traded) •Former Director Education àMaster of Business Administration, University of California, Los Angeles àBachelor of Business Administration in Finance, University of Arizona àCertified Public Accountant àChartered Financial Analyst |

INDEPENDENT (Director Nominee) Age: 55 Director Since: February 2022 Committees: àTalent & Compensation àCapital Allocation and Planning (Chair) | |

Board Refreshment and Nomination Process

Our Board of Directors, with the assistance of the Governance Committee, prioritizes the review and refreshment of its membership. In connection with this objective, the Governance Committee, on an as-needed basis and at least annually, reviews the structure and composition of the Board to ensure that the proper skills and experience are represented on the Board. In 2022, two long-term directors concluded their terms at the 2022 annual meeting and four new directors joined the Board during the year. In 2023, our former CEO, who departed the company on January 1, also resigned from the Board. We believe this refreshment process has resulted in an increased depth of experience and broader scope of qualifications to our Board of Directors.

Director Nominee Recommendations

The Governance Committee considers director nominee recommendations from a wide variety of sources, including members of the Board of Directors, business contacts, community leaders, and members of management. The Governance Committee will also consider shareholder recommendations for director nominees using the same selection criteria and qualifications as nominees identified by other sources, as described below. The Governance Committee may also engage search firms to assist in the director recruitment process. The table below outlines the typical director nomination process when the Board of Directors seeks to identify a new candidate for the Board.

Director Nomination Process

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | |

| The Governance Committee initially evaluates a prospective nominee based on his or her resume and other background information that has been provided to the committee. | | | For further review, a member of the Governance Committee will contact those candidates whom the Governance Committee believes are qualified, may fulfill a specific need of the Board of Directors, and would otherwise best contribute to the Board of Directors. | | | Based on the information the Governance Committee learns during this process, it determines which nominee(s) to recommend to the Board of Directors to submit for election. |

| | | | | | |

The Governance Committee uses the same process for evaluating all nominees, regardless of the source of the nomination.

Any shareholder interested in presenting a nomination for consideration by the Governance Committee prior to the 2024 Annual Meeting should do so as early as possible to provide adequate time to consider the nominee and comply with our Bylaws.

Ancora Holdings Group, LLC Cooperation Agreement

On January 6, 2023, the company entered into a cooperation agreement with Ancora Catalyst Institutional, LP and its investment advisor affiliates and other individuals and entities in its shareholder group (the “Ancora Group”). This agreement is substantially similar to the cooperation agreement the company entered into with the Ancora Group on February 28, 2022, pursuant to which we appointed Mr. Maier and Mr. Winship to the Board of Directors, among other things. The cooperation agreement also governs certain aspects of the composition of the Board’s committees. Effective upon execution of the cooperation agreement, the Ancora Group also agreed not to nominate director candidates for election to the Board and to support the Board’s full slate of directors at the 2023 Annual Meeting.

Shareholder Nominations

Shareholders who would like to directly nominate a director candidate must give written notice to the company’s corporate secretary, either by personal delivery or by United States mail, at the following address: 14701 Charlson Road, Eden Prairie, MN 55347. The shareholder’s notice must be received by the corporate secretary no later than (a) 90 days before the anniversary date of the previous year’s Annual Meeting or (b) the close of business on the tenth day following the date on which notice of a special meeting of shareholders for election of directors is first given to shareholders. Accordingly, nominations for the 2024 Annual Meeting must be received by February 4, 2024, unless the alternative deadline is triggered. For each proposed nominee, the shareholder’s notice must comply with and include all information that is required to be disclosed under our Bylaws, any applicable Securities and Exchange Commission rules and regulations, and any applicable laws. The written notice must also include a written consent of the proposed nominee, agreeing to stand for election if nominated by the Governance Committee, and to serve as a director if appointed by the Board of Directors. The shareholder’s notice must also include:

1.The name and address of the shareholder making the nomination;

2.The number of C.H. Robinson shares entitled to vote at the meeting held by the shareholder;

3.A representation that the shareholder is a holder of record of C.H. Robinson common stock entitled to vote at the meeting and intends to appear in person or by proxy at the meeting to nominate the person named in the notice; and

4.A description of all arrangements or understandings between the shareholder and each nominee.

In addition, to comply with the universal proxy rules, shareholders who intend to solicit proxies in support of director nominees other than the company’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Securities Exchange Act of 1934 no later than March 5, 2024.

Proxy Access

We also provide shareholders with a “proxy access” right that entitles shareholders meeting certain eligibility requirements to include nominees for director in our proxy statement. The proxy access right entitles a shareholder, or group of up to 20 shareholders, owning at least 3% of our outstanding shares of common stock continuously for at least three years to nominate and include in our proxy statement director nominees constituting up to the greater of two individuals or 20% of the Board of Directors. The shareholder’s notice must be delivered to the company’s corporate secretary as set forth above and must be received by the corporate secretary no earlier than 150 days, and no later than 120 days, before the anniversary date of the mailing of the previous year’s proxy statement, unless an alternative deadline under our Bylaws is triggered. Accordingly, nominations for inclusion in our proxy statement for the 2024 Annual Meeting must be received no earlier than October 23, 2023, and no later than November 22, 2023, unless an alternative deadline is triggered. In addition, the shareholder’s notice must comply with the information requirements described above for other direct nominations of director candidates, as well as the additional notice and information requirements described in our Bylaws.

Over-Boarding Policy

Our directors are expected to devote sufficient time to fulfill their responsibilities effectively. Directors are required to advise the Chair of the Governance Committee prior to accepting a position on the board of another publicly held company.

Director Independence

Our Board of Directors is comprised of 10 independent directors and 1 non-independent director who is not independent solely by virtue of his service as our Interim CEO. Accordingly, we are in compliance with the Nasdaq listing standards requirement that a majority of board members must be independent. For additional information on how we made this independence determination for our directors and nominees, see "Proposal 1: Election of Directors.”

Our Board of Directors is elected annually using a majority voting standard for any uncontested director election. This means that a director is elected if the number of votes cast “for” the director’s election exceeds the number of votes cast “against” that director, provided that a quorum is present.

If any incumbent director fails to receive a majority vote in an uncontested election, the director is required to tender his or her resignation, subject to acceptance by the Board. Our Governance Committee will make a recommendation to the Board on whether to accept the resignation, and the Board will act upon such resignation within 90 days from the date the election results are certified and then publicly disclose its determination. The director who tenders his or her resignation will not participate in the recommendation or decision with respect to his or her resignation.

In the event of a contested election in which the number of nominees exceeds the number of directors to be elected, directors would be elected using a plurality voting standard. The plurality voting standard means that the nominees receiving the most affirmative votes would be elected to our Board.

Corporate Governance

Introduction

Comprehensive Governance Practices

Our Board’s oversight of the development and implementation of our corporate strategy is supported by

C.H. Robinson’s robust governance practices, policies, and procedures. Ensuring that our governance practices are aligned with our stakeholders’ concerns and objectives is a high priority for us and to that end, we regularly engage with our stakeholders. See the section on “Stakeholder Engagement” in this Proxy Statement for more information on how we seek feedback from our stakeholders. To facilitate continual improvement and effectiveness, the Board is also committed to maintaining its independent oversight and ensuring that its membership consists of the appropriate skill sets and range of experience.

The highlights outlined below are evidence of our commitment to a strong corporate governance structure, comprehensive policies, and procedures that support that structure, and a strong tone at the top.

Corporate Governance Highlights

| | | | | |

| |

Active, Independent Board | •10 of 11 directors are independent •Executive sessions of independent directors held at each regularly scheduled meeting •Independent Board Chair •Independent Audit Committee, Governance Committee, and Talent & Compensation Committee •High rate of attendance at Board and committee meetings •Complete access to management •Access to outside advisors at the company’s expense |

Robust Corporate Governance | •Board review of company strategy on at least an annual basis •Active Board involvement in management succession planning •Robust Board oversight on ESG matters •Comprehensive and strategic approach to enterprise risk management •Declassified Board •Majority vote standard in uncontested elections •Commitment to Board refreshment with four new Board members added in 2022 with a diverse set of skills and experience |

Shareholder Rights | •Proxy access right •No poison pill •Proactive investor outreach program; see "Stakeholder Engagement” on page 8 •Annual election of all directors •Plurality vote standard in contested elections •Annual “say-on-pay” vote |

Board and Management Checks and Balances | •Prohibition on pledging and hedging •Stock ownership guidelines for directors and management •Annual Board and Committee self-evaluation •Clawback policy |

Board Meetings and Attendance

The Board of Directors has a policy that all directors and nominees nominated for election at the Annual Meeting are expected to attend the Annual Meeting. In 2022, all of the ten director nominees who were directors at that time attended the Annual Meeting.

During 2022, the Board of Directors held 14 meetings. Each director holding office during the year attended at least 75% of the aggregate meetings of the Board (held during the period for which he or she had been a director) and the meetings of the committees of the Board on which he or she served (held during the period for which he or she served on a committee).

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | |

| | Engaged and Active Board of Directors | | |

| | | | | | | |

| | 14 | | | | | |

| | Board of Director meetings in 2022 | All directors attended at least 75% of 2022 Board and committee meetings | 100% Director nominee attendance at the 2022 Annual Meeting | Each 2022 regularly scheduled Board meeting also included a non-management director executive session | | |

| | | | | | | |

| | | | | | | |

Committee Charters and Governance Documents

The charters for each of the required committees of the Board of Directors, our Corporate Governance Guidelines, and our company’s Code of Ethics, which are all a part of our Corporate Compliance Program, are posted under the Governance section of the Investors page of our website at investor.chrobinson.com. Each of our committees reviews its charter on an annual basis to assess its adequacy and effectiveness and then recommends any proposed changes to the Board for approval. Our Corporate Governance Guidelines are reviewed by our Board and the Governance Committee on a regular basis to determine whether any revisions are advisable based on stakeholder feedback, changes in rules or regulations, or updated best governance practices.

Certain sections of this Proxy Statement reference or refer you to materials on our website at www.chrobinson.com. These materials are not incorporated by reference in, and are not a part of, this Proxy Statement.

Board Structure

Board Leadership Structure

Ms. Kozlak, an independent director who has served on the Board since 2013, serves as the independent Chair of the Board. Our Board believes it important to retain the flexibility to allocate the responsibilities of the Board chair and CEO positions in any manner that it determines to be in the best interests of the company based on the then-current circumstances. We have remained committed to having an independent Chair of the Board during this time of our CEO transition when our prior Chairman of the Board is no longer independent due to his service as Interim CEO.

Our Corporate Governance Guidelines provide that the Board chair, in consultation with other Board members, sets the agenda for regular meetings of the Board of Directors, and the chair of each committee is responsible for the agendas for the meetings of the applicable committee. Directors and committee members are encouraged to suggest agenda items and may raise other matters at meetings.

We believe that our leadership structure supports the Board’s risk oversight function. Strong independent directors serve on our Audit Committee—the committee most directly involved in the risk oversight function—and there is open communication between management and the Board, and all directors are involved in the risk oversight function.

Board Committees

The Board has four committees: the Audit Committee, the Talent & Compensation Committee, the Governance Committee, and the Capital Allocation and Planning Committee. Currently, members and chairs of these committees are:

| | | | | | | | | | | | | | |

| Directors | Audit | Talent & Compensation | Governance | Capital Allocation and Planning |

Scott P. Anderson |

| |

| |

James J. Barber, Jr.(1) | | | | |

Kermit R. Crawford(1) | | | | |

Timothy C. Gokey(1) | | | | |

Mark A. Goodburn(1) | | | | |

Mary J. Steele Guilfoile(1) | | | | |

Jodee A. Kozlak(1) | | | | |

Henry J. Maier(1) | | | | |

James B. Stake(1) | | | | |

Paula C. Tolliver(1) | | | | |

Henry W. “Jay” Winship(1) | | | | |

| | | | | | | | | | | | | | |

(1)Director is indicated as independent. | | Member | | Chair |

| | | | | | | | | | | | | | | | | | | | |

| | | | |

| | Audit Committee 2022 Meetings: 7 | James B. Stake, Chair | Other Members: àJames J. Barber, Jr. àTimothy C. Gokey àMark A. Goodburn àPaula C. Tolliver | | |

| | | | | | |

| | | | | | |

| | Function: The Audit Committee assists the Board in fulfilling its oversight responsibilities relating to the quality and integrity of the financial reports of the company. The Audit Committee has the sole authority to appoint, review, and discharge our independent auditors, and has established procedures for the receipt, retention, and response to complaints regarding accounting, internal controls, or audit matters. | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | Key Responsibilities: Among other responsibilities in the Audit Committee Charter, the Audit Committee is responsible for: 1.Reviewing the scope, timing, and costs of the audit with the company’s independent registered public accounting firm and reviewing the results of the annual audit; 2.Assessing the independence of the outside auditors on an annual basis, including receipt and review of a written report from the independent auditors regarding their independence consistent with applicable rules of the Public Company Accounting Oversight Board; 3.Reviewing and approving in advance the services provided by the independent auditors; 4.Overseeing the internal audit function; 5.Reviewing the company’s significant accounting policies, financial results, and earnings releases and the adequacy of our internal controls and procedures; 6.Reviewing the risk management status of the company, including cybersecurity risks; and 7.Reviewing and approving related-party transactions. | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | Independence and Financial Expertise: All of our Audit Committee members are “independent” under applicable Nasdaq listing standards and Securities and Exchange Commission rules and regulations. James J. Barber, Jr. was appointed to the Audit Committee on January 1, 2023. The Board has determined that all five members of the Audit Committee, Messrs. Barber, Gokey, Goodburn, and Stake, and Ms. Tolliver, meet the definition of an “Audit Committee Financial Expert” as established by the Securities and Exchange Commission. | | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | |

| | Talent & Compensation Committee 2022 Meetings: 5 |

Jodee A. Kozlak, Chair | Other Members: àKermit R. Crawford àTimothy C. Gokey àMary J. Steele Guilfoile àHenry W. “Jay” Winship | | |

| | | | | | |

| | | | | | |

| | Function: The Talent & Compensation Committee has oversight responsibilities relating to overall talent strategy, executive compensation, employee compensation and benefits programs and plans, succession and leadership development, and diversity, equity & inclusion. | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | Key Responsibilities: Among other responsibilities in the Talent & Compensation Committee Charter, the Talent & Compensation Committee is responsible for: 1.Reviewing the performance of the Chief Executive Officer; 2.Determining all elements of the compensation and benefits for the Chief Executive Officer and other executive officers of the company; 3.Reviewing and approving the company’s compensation program, including equity-based plans, for management employees generally; 4.Reviewing the company’s policies, practices, performance, disclosures, and progress toward goals with respect to significant issues of DEI and Human Capital Management, including the alignment of such efforts with the Company’s overall strategy; 5.Overseeing the company’s process of conducting advisory shareholder votes on executive compensation; and 6.Reviewing executive officers’ employment agreements; separation and severance agreements; change in control agreements; and other compensatory contracts, arrangements, and benefits. | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | Independence: All of our Talent & Compensation Committee members are “independent” under applicable Nasdaq listing standards and Internal Revenue Service and Securities and Exchange Commission rules and regulations. | | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | |

| | Governance Committee 2022 Meetings: 4 | Kermit R. Crawford, Chair | Other Members: àMary J. Steele Guilfoile àJodee A. Kozlak àHenry J. Maier | |

| | | | | | |

| | | | | | |

| | Function: The Governance Committee identifies for the Board individuals qualified to become Board members, considers nominees recommended by shareholders, and recommends nominees to the Board for election as directors. The Committee also adopts and revises corporate governance guidelines applicable to the Company and serves in an advisory capacity to the Board on matters of organization and the conduct of Board activities. | | |

| | | | | | |

| | | | | | |

| | | | | | |

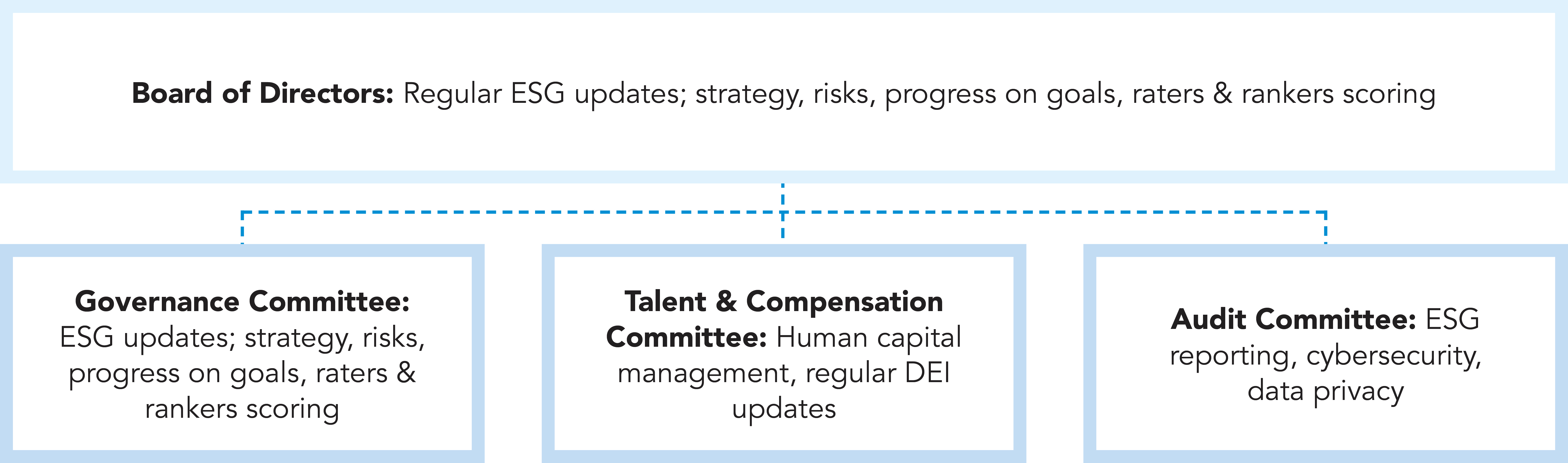

| | Key Responsibilities: Among other responsibilities in the Governance Committee Charter, the Governance Committee is responsible for: 1.Periodically reviewing and making recommendations to the Board as to the size, diversity, and composition of the Board and criteria for director nominees; 2.Identifying and recommending candidates for service on the Board; 3.Reviewing and revising the company’s Corporate Governance Guidelines, including recommending any necessary changes to the Corporate Governance Guidelines to the Board; 4.Leading the Board in an annual review of the performance of the Board and the Board committees; 5.Making recommendations to the Board regarding Board committee assignments; 6.Making recommendations to the Board on whether each director is independent under all applicable requirements; 7.Making recommendations to the Board with respect to the compensation of non-employee directors; 8.Periodically reviewing with the company’s Chief Legal Officer developments that may have a material impact on the company’s corporate governance programs, including related compliance policies; and 9.Reviewing, at least annually, the company’s policies, practices, performance, disclosures, and progress toward goals with respect to significant issues of Environmental, Social, and Governance (“ESG”), including the alignment of such efforts with the company’s overall strategy. | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | Independence: All members of our Governance Committee are “independent” under applicable Nasdaq listing standards. | | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | |

| | Capital Allocation and Planning Committee 2022 Meetings: 12 | Henry W. “Jay” Winship, Chair | Other Members: àScott P. Anderson àMark A. Goodburn àHenry J. Maier àPaula C. Tolliver | | |

| | | | | | |

| | | | | | |

| | Function: The Capital Allocation and Planning Committee objectively assesses value creation opportunities and supports and makes recommendations to the Board to assist in its and management’s review of, and planning for, the company’s capital allocation, operations and strategy, and enhanced transparency and disclosures to shareholders. | | |

| | | | | | |

| | | | | | |

| | | | | | |