Exhibit (a)(5)(G)

|

STEPHEN TWISS, Individually and on behalf |

) |

IN THE |

|

of all others similarly situated, and derivatively |

) |

|

|

on behalf of HATTERAS FINANCIAL CORP. |

) |

CIRCUIT COURT |

|

8546 Pavilion Drive |

) |

|

|

Hudson, FL 34667 |

) |

FOR |

|

|

) |

|

|

Plaintiff, |

) |

BALTIMORE CITY |

|

|

) |

|

|

|

) |

Case No. |

|

v. |

) |

|

|

|

) |

|

|

HATTERAS FINANCIAL CORP. |

) |

JURY TRIAL DEMANDED |

|

Paracorp Incorporated |

) |

|

|

245 West Chase Street |

) |

|

|

Baltimore, MD 21201 |

) |

|

|

|

) |

|

|

MICHAEL R. HOUGH |

) |

|

|

Paracorp Incorporated |

) |

|

|

245 West Chase Street |

) |

|

|

Baltimore, MD 21201 |

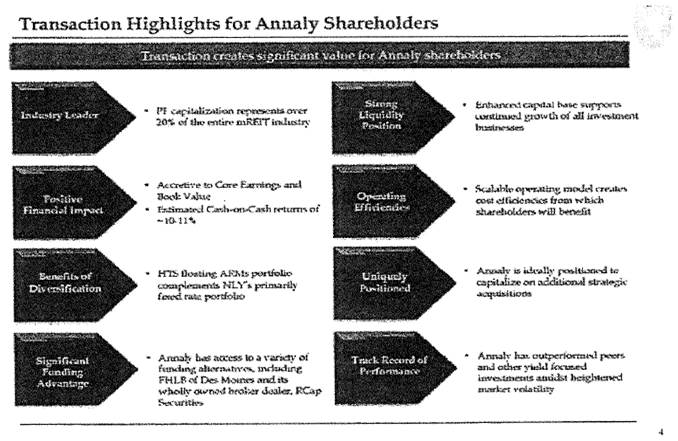

) |

|

|

|

) |

|

|

BENJAMIN M. HOUGH |

) |

|

|

Paracorp Incorporated |

) |

|

|

245 West Chase Street |

) |

|

|

Baltimore, MD 21201 |

) |

|

|

|

) |

|

|

IRA G. KAWALLER |

) |

|

|

Paracorp Incorporated |

) |

|

|

245 West Chase Street |

) |

|

|

Baltimore, MD 21201 |

) |

|

|

|

) |

|

|

DAVID W. BERSON |

) |

|

|

Paracorp Incorporated |

) |

|

|

245 West Chase Street |

) |

|

|

Baltimore, MD 21201 |

) |

|

|

|

) |

|

|

JEFFREY D. MILLER |

) |

|

|

Paracorp Incorporated |

) |

|

|

245 West Chase Street |

) |

|

|

Baltimore, MD 21201 |

) |

|

|

|

) |

|

|

THOMAS D. WREN |

) |

|

|

Paracorp Incorporated |

) |

|

|

245 West Chase Street |

) |

|

|

Baltimore, MD 21201 |

) |

|

|

|

|

|

|

VICKI H. WILSON-MCELREATH |

) |

|

|

Paracorp Incorporated |

) |

|

|

245 West Chase Street |

) |

|

|

Baltimore, MD 21201 |

) |

|

|

|

) |

|

|

WILLIAM V. NUTT |

) |

|

|

Paracorp Incorporated |

) |

|

|

245 West Chase Street |

) |

|

|

Baltimore, MD 21201 |

) |

|

|

|

) |

|

|

RIDGEBACK. MERGER SUB |

) |

|

|

CORPORATION |

) |

|

|

National Registered Agents, Inc. of Maryland |

) |

|

|

351 W. Camden Street |

) |

|

|

Baltimore, MD 21201 |

) |

|

|

|

) |

|

|

and |

) |

|

|

|

) |

|

|

ANNALY CAPITAL MANAGEMENT, INC. |

) |

|

|

National Registered Agents, Inc. of Maryland |

) |

|

|

351 W. Camden Street |

) |

|

|

Baltimore, MD 21201 |

) |

|

|

|

) |

|

|

Defendants. |

) |

|

CLASS ACTION AND DERIVATIVE COMPLAINT

Plaintiff Stephen Twiss (“Plaintiff”), by his undersigned attorneys, alleges upon information and belief, except for his own acts, which are alleged on knowledge, as follows:

NATURE OF THE ACTION

1. Plaintiff brings this as a class action on behalf of the public stockholders of Hatteras Financial Corp. (“Hatteras” or the “Company”) and derivatively on behalf of the Company against the Company’s Board of Directors (the “Board” or the “Individual Defendants”) for their breaches of fiduciary duties arising out of their attempt to merge the Company with Annaly Capital Management (“Annaly”) for inadequate consideration and without providing necessary material information to stockholders.

2. On April 10, 2016, the Company announced that it had signed a definitive agreement (the “Merger Agreement”) under which, Annaly, through its wholly owned subsidiary, Ridgeback Merger Sub Corporation (“Merger Sub.” and together with the Company, the Board and Annaly, “Defendants”), would commence a tender offer (the “Tender Offer”) no later than May 6, 2016 to acquire all of the outstanding shares of Hatteras (the “Proposed Transaction”). Under the terms of the Merger Agreement, Hatteras stockholders can elect to receive either: (i) $5.55 in cash and 0.9894 shares of Annaly stock (the “Mixed Consideration Option”); (ii) $15.85 in cash (the “Cash Consideration Option”); or(iii) 1.5226 shares of Annaly stock (the “Stock Consideration Option”), for each outstanding share of Hatteras they own, subject to proration to ensure that the total consideration paid to stockholders will consist of approximately 65% stock and 35% cash. The Proposed Transaction values Hatteras at $15.85 per share based upon the closing price of Annaly on April 8, 2016, and the aggregate value of the Proposed Transaction is approximately $1.5 billion.

3. Following completion of the Tender Offer, Hatteras and Annaly will promptly effect a second-step merger (the “Merger”) without approval of Hatteras stockholders pursuant to which all remaining shares of Hatters common stock not tendered in the Tender Offer will be converted into the right to receive the same consideration as in the Tender Offer, with the same election options. The Proposed Transaction is expected to close by the end of the third quarter of 2016.

4. Hatteras is a real estate investment trust (“REIT”) that holds itself out to own and manage a portfolio of residential mortgage investments, primarily in residential mortgage securities, with a focus on those secured by adjustable-rate mortgage loans on single-family residences. Annaly is also a REIT, whose principal business objectives are to generate net income

for distribution to stockholders and preserve capital through the prudent selection and management of its investments.

5. Notably, the sale process conducted by the Board was flawed, and resulted in the Proposed Transaction where Annaly will acquire Hatteras for an inadequate price. Indeed, as recently as March 22, 2016, an RBC Capital Markets analyst set a high target price of $20.00 for the Company, Further, the implied value of the merger consideration is at a significant discount to Hatteras’ 52-week high closing price of $18.24 per share.

6. As described in more detail below, given the current volatility in the interest rate markets, the Company has suffered a temporary decline in its financial performance. However, the Company has a proven history of positive financial results. Thus, the merger consideration options stockholders will elect to receive are inadequate and undervalue the Company.

7. Additionally the sale process was rife with conflicts of interest. Annaly entered into 30-month consulting agreements with four members of Hatteras’ executive team, including Michael R. Hough (“M. Hough”), Chairman of the Board and Chief Executive Officer (“CEO”) of the Company, and Benjamin M. Hough (“B. Hough”), President, Chief Operating Officer (“COO”), and a director of the Company. These members of management are highly conflicted and favor the completion of the Proposed Transaction for their own personal benefit which stands in direct contrast to the interests of the Company’s stockholders. Given the clear conflicts of interest, the sale process was tainted and the Board favored a transaction with Annaly for inadequate consideration.

8. Further, given the required proration that the total consideration paid to stockholders will consist of approximately 65% stock and 35% cash, certain stockholders are clearly going to receive all-cash consideration. As such, the Individual Defendants owe a duty of candor and a

duty to maximize stockholder value to Hatteras’ stockholders. Thus, a duty owed to one stockholder is a duty owed to all stockholders.

9. Defendants have exacerbated their breaches of fiduciary duty by agreeing to lock up the Proposed Transaction with unreasonable deal protection devices that may operate to prevent other bidders from making a successful competing offer for the Company. Specifically, pursuant to the Merger Agreement, Defendants agreed to: (i) a strict no-solicitation provision that prevents the Company from soliciting other potential acquirors; (ii) a matching rights provision that provides Annaly with three (3) business days to match any competing proposal in the event that one is made, plus an additional two (2) business days following a material amendment to the terms and conditions of a superior offer and (iii) a provision that requires the Company to pay Annaly a termination fee of nearly $45 million in order to enter into a transaction with a superior unsolicited bidder. These provisions substantially and improperly limit the Board’s ability to act with respect to investigating and pursuing superior proposals and alternatives, including a sale of all or part of Hatteras.

10. On May 5, 2016, Annaly commenced the Tender Offer, which is set to expire at 12:00 midnight Eastern Time, at the end of the day on June 16, 2016 (the “Expiration Date”), unless extended. The Tender Offer provides that Annaly, through Merger Sub, is offering to exchange the Mixed Consideration for each outstanding share of common stock of Hatteras, par value $ 0.001 per share, validly tendered and not properly withdrawn in the Tender Offer. The “Minimum Tender Condition” requires that the number of shares of Hatteras common stock validly tendered, together with the shares then owned by Annaly and Merger Sub (if any), represents at least one more than two-thirds of the then-outstanding shares of Hatteras common stock. The Tender Offer is not subject to any financing condition.

11. Contemporaneously with the commencement of the “Tender Offer, on May 5, 2016, Defendants filed a Solicitation/Recommendation Statement (the “Recommendation Statement”) on Schedule 14D-9 with the U.S. Securities and Exchange Commission (“SEC”). The Recommendation Statement fails to provide the Company’s stockholders with material information and/or provides them with materially misleading information concerning: (i) the sale process leading up to the execution of the Merger Agreement; (ii) the financial analyses performed by Goldman Sachs & Co. (“Goldman Sachs”), the Company’s financial advisor; and (iii) the financial projections provided by Hatters management and Annaly management and relied upon by Goldman Sachs.

12. The Individual Defendants have breached their fiduciary duties of due care, independence, good faith, fair dealing, candor, and maximization of stockholder value, and Hatteras, Annaly, and Merger Sub, have aided and abetted such breaches by Hatteras’ officers and directors.

PARTIES

13. Plaintiff is and has been, at all times relevant times, the owner of shares of common stock of Hatteras.

14. Defendant Hatteras is a REIT incorporated in the State of Maryland. It maintains its principal executive offices at 751 W. Fourth Street, Suite 400, Winston Salem, North Carolina 27101. The Company’s common stock is traded on the NYSE under the symbol “HTS.”

15. Defendant M. Hough has been Chairman of the Board and CEO of the Company since September 2007. M. Hough is also co-founder, CEO and a director of Atlantic Capital Advisors LLC (the “Hatteras External Manager”), the Company’s external manager which manages the Company’s day-to-day operations, as well as co-founder, CEO and a director of ACM

Financial Trust, Inc. (“ACM”), a private mortgage REIT managed by the Hatteras External Manager.

16. Defendant B. Hough has been President, COO, and a director of the Company since September 2007. B. Hough is also co-founder, President, COO and a director of the Hatteras External Manager, as well as co-founder, President, COO, and a director of ACM.

17. Defendant Ira G. Kawaller (“Kawaller”) has served as a director of the Company since November 2007. Kawaller also serves on the Board’s Compensation and Governance Committee and Finance Committee.

18. Defendant David W. Berson (“Berson”) has served as a director of the Company since November 2007. Berson also serves on the Board’s Audit Committee and Compensation and Governance Committee, and is Chair of the Finance Committee.

19. Defendant Jeffrey D. Miller (“Miller”) has served as a director of the Company since November 2007. Miller also serves as Chair of the Board’s Compensation and Governance Committee and a member of the Audit Committee.

20. Defendant Thomas D. Wren (“Wren”) has served as a director of the Company since November 2007. Wren is the Chair of the Board’s Audit Committee and a member of the Finance Committee. Wren is also a director and stockholder of ACM.

21. Defendant Vicki H. Wilson-McElreath (“McElreath”) has served as a director of the Company since June 2014. McElreath is also a member of the Board’s Audit Committee.

22. William V. Nutt (“Nutt”) has served as a director of the Company since February 2015. Nutt is also a member of the Board’s Compensation and Governance Committee and Finance Committee.

23. Defendants referenced in ¶¶ 15-22 are collectively referred to as the Individual Defendants and/or the Board.

24. Defendant Annaly is a REIT incorporated in the State of Maryland. Its principle executive offices are located at 1211 Avenue of the Americas, New York, NY 10036. Annaly’s common stock is traded on the NYSE under the ticker symbol “NLY.”

25. Defendant Merger Sub is a Maryland corporation and a wholly owned subsidiary of Annaly.

JURISDICTION AND VENUE

26. This Court has subject matter jurisdiction pursuant to Md. Code Ann. Cts. & Jud. Proc. § 1-501. This Court has personal jurisdiction over Hatteras, Annaly, and Merger Sub pursuant to Md. Code Ann. Cts. & Jud. Proc. § 6-102(a) as Hatteras, Annaly, and Merger Sub are organized under the laws of Maryland. This Court has personal jurisdiction over the Individual Defendants pursuant to Md. Code Ann. Cts. & Jud. Proc. § 6-103(b)(1) as they are all parties to the Merger Agreement and the Individual Defendants approved the Merger Agreement which can only be given effect in accordance with Maryland General Corporation Law.

27. Venue is proper in this Court pursuant to Md. Code Ann. Cts. & Jud. Proc. § 6-201(a) because Hatteras’ registered agent is Paracorp Incorporated, 245 West Chase Street, Baltimore, MD 21201.

INDIVIDUAL DEFENDANTS’ FIDUCIARY DUTIES

28. Pursuant to common law and Md. Code Ann., Corps. & Ass’ns § 2-405.1, and in the context of a merger transaction like the Proposed Transaction, the Board owes Plaintiff and the Company’s stockholders fiduciary duties of good faith, fair dealing, loyalty, due care, candor, independence, and maximization of stockholder value.

29. Each of the Individual Defendants is required to act in good faith, in a manner he or she reasonably believes to be in the best interests of the corporation, and with the care that an ordinarily prudent person in a like position would use under similar circumstances. To diligently comply with their fiduciary duties, the Individual Defendants may not take any action that:

(a) Adversely affects the value provided to the Company;

(b) Will unreasonably discourage or inhibit alternative offers to purchase control of the Company or its assets;

(c) Contractually prohibits them from complying with their fiduciary duties;

(d) Adversely affects their duty to maximize the value of the stockholders’ shares in the Company; and/or

(e) Will provide the Individual Defendants with preferential treatment at the expense of, or separate from, the Company.

30. In accordance with their fiduciary duties, the Individual Defendants are obligated to refrain from:

(a) Participating in any transaction where the Individual Defendants’ loyalties are divided;

(b) Participating in any transaction where the Individual Defendants receive, or are entitled to receive, a personal financial benefit not equally shared by the public stockholders of the corporation; and/or

(c) Unjustly enriching themselves at the expense or to the detriment of the Company.

31. Plaintiff alleges herein that the Individual Defendants, separately and together, in connection with the Proposed Transaction, are violating their fiduciary duties owed to the

Company’s stockholders and the Company.

CLASS ACTION ALLEGATIONS

32. Plaintiff brings this action as a class action, pursuant to Maryland Rule 2-231, on behalf of all persons and/or entities that own Hatteras common stock (the “Class”). Excluded from the Class are Defendants and their affiliates, immediate families, legal representatives, heirs, successors or assigns and any entity in which Defendants have or had a controlling interest.

33. This action is properly maintainable as a class action.

34. The Class is so numerous that joinder of all members is impracticable. Although the exact number of Class members is unknown to Plaintiff at this time and can only be ascertained through discovery. Plaintiff believes that there are thousands of members in the Class. According to the Recommendation Statement, as of May 3, 2016, 94,529,206 shares of common stock were represented by the Company as outstanding.

35. Questions of law and fact are common to the Class, including, inter alia, the following:

(a) Whether the individual Defendants breached their fiduciary duties owed to Plaintiff and the other members of the Class in connection with the Proposed Transaction; and

(b) Whether Hatteras, Annaly, and Merger Sub aided and abetted the Individual Defendants’ breaches of fiduciary duty.

36. Plaintiff’s claims are typical of the claims of other members of the Class and Plaintiff does not have any interests adverse to the Class. Plaintiff and the other members of the Class have been harmed and will continue to be harmed as a result of Defendants’ wrongful conduct as alleged herein.

37. Plaintiff is an adequate representative of the Class, has retained competent counsel experienced in litigation of this nature and will fairly and adequately protect the interests of the Class.

38. The prosecution of separate actions by individual members of the Class would create a risk of inconsistent or varying adjudications with respect to individual members of the Class which would establish incompatible standards of conduct for the party opposing the Class.

39. A class action is superior to all other available methods for the fair and efficient adjudication of this controversy. Plaintiff knows of no difficulty to be encountered in the management of this action that would preclude its maintenance as a class action. Moreover, Defendants’ harmful actions in conjunction with the Proposed Transaction are generally applicable to the Class, thus making relief with respect to the Class as a whole the appropriate remedy.

DEMAND AND DERIVATIVE ALLEGATIONS

40. Plaintiff also brings this action derivatively in the right and for the benefit of Hatteras to redress injuries suffered and to be suffered by the Company as a result of the breaches of fiduciary duty and other violations of law by the individual Defendants.

41. Plaintiff incorporates all of the allegations in this Complaint as if they were fully set forth herein. Plaintiff owns and has owned Hatteras common stock at all times relevant hereto, Plaintiff will adequately and fairly represent the interests of the Company in enforcing and prosecuting its rights. Plaintiff has retained counsel experienced in these types of actions to prosecute these claims on the Company’s behalf.

42. Plaintiff made an initial demand (“Initial Demand”) by way of a letter sent via Federal Express on April 15,2016 to the Company’s Board, in which Plaintiff informed the Board of the identity of the wrongdoers, described the factual basis for the allegations of wrongdoing,

described how such wrongdoing is harmful to the Company, and requested that the Board take remedial action, including without limitation, to ensure that the transaction’s consideration fairly values Hatteras.

43. As of the filing of this Complaint. Plaintiff received two responses from Defendants dated April 22, 2016 and May 11, 2016, respectively. The first response, from counsel for the Special Committee of the Board (the “Special Committee”), stated that the Special Committee was authorized by the Board to review and evaluate Plaintiff’s demand. The response from counsel for the Special Committee went on to state that the Special Committee would be proceeding with its review promptly and would be back in touch in due course. The second response from counsel for the Special Committee dated May 11, 2016 stated that the Special Committee was currently in the process of reviewing Plaintiff’s Initial Demand and provided a deadline of May 20, 2016 for Plaintiff to provide the Special Committee with any new or additional information not included in the Initial Demand.

44. Plaintiff immediately supplemented his Initial Demand the same day, May 11, 2016, by way of letter sent via email and Federal Express to counsel for the Special Committee, in which Plaintiff included further allegations regarding the sale process and misleading Recommendation Statement and demanded that the Board cure its breaches of fiduciary duties. Since the Tender Offer has already commenced, Plaintiff should not be forced to wait for a response because the Company would he irreparably harmed if the Proposed Transaction was permitted to proceed without first affording the relief requested.

45. Accordingly. Plaintiff now commences this action.

FACTUAL ALLEGATIONS

Company Background

46. The Company was incorporated in Maryland k September 2007. According to the Company’s most recently filed 10-K with the SEC on February 24, 2016, the Company is an externally-managed mortgage REIT that invests primarily in single-family residential mortgage real estate assets, such as mortgage-backed securities, mortgage servicing rights, residential mortgage loans and other financial assets.

47. On June 24, 2015, Hatteras announced that it had entered into a definitive purchase agreement to acquire Pingora Asset Management, LLC (“Pingora Management”) and Pingora Loan Servicing, LLC (“Pingora Servicing” and together with Pingora Management, “Pingora”), a specialized asset manager focused on investing in new production performing mortgage servicing rights and servicing residential mortgage loans. Hatteras expects Pingora’s partnerships to help grow the Company’s existing direct mortgage purchase program to a more meaningful scale. On August 13, 2015, Hatteras closed its acquisition of Pingora.

48. Shortly after the acquisition of Pingora, Hartteras announced its financial results for the second quarter of 2015. For the second quarter of 2015, Hatteras reported comprehensive income (loss) available to common shareholders of $(48.6) million, as compared lo $48.7 million for the prior quarter. As stated in the Company’s press release, the decrease was largely due to rising interest rates and, more specifically, basis widening during the second quarter. Further, net interest margin for the second quarter of 2015 was $53.9 million, compared to $59.8 million for the prior quarter.

49. On October 27,2015, the Company reported its financial results for the third quarter of 2015. Hatteras reported a comprehensive income (loss) available to common shareholders of

$(84.9) million, as compared to $(48.6) million for the prior quarter. Again, the increase in comprehensive loss was largely due to the volatility in the interest rate markets. The Company also reported net interest margin for the third quarter of $51.7 million, compared to $53.9 million for the prior quarter.

50. On February 16, 2016, the Company announced its financial results for the fourth quarter of 2015 and full year ended December 31, 2015. For the fourth quarter of 2015, the Company reported a comprehensive income (loss) available to common shareholders of $7.4 million, as compared to $(84.9) million for the prior quarter. Net interest margin for the quarter improved to $56.1 million, compared to $51.7 million in the prior quarter. For the full year, the Company reported a comprehensive loss of $77.4 million. Defendant M. Hough commented on the full year financial results stating:

While 2015 was a challenging year., the introduction of mortgage servicing rights and mortgage credit to our portfolio will enhance our ability to manage risk more comprehensively and to position the business going forward. Combined with share repurchases, we expect these new revenue sources to diversify our portfolio, lessen our exposure to interest rate and basis risk and create long-term shareholder value.

51. On May 3, 2016, the Company filed its Form 10-Q for the first quarter of 2016 with the SEC. For the first quarter of 2016, the Company reported a comprehensive income (loss) available to common shareholders of ($42) million. The Company also reported net interest margin for the first quarter of $48.4 million.

The Board Conducted a Fundamentally Flawed Sale Process

52. The sale process conducted by the Board was inadequate, and resulted in the Proposed Transaction where Annaly will acquire Hatteras for an inadequate price. Despite the Company forming the Special Committee composed of purportedly independent directors, Defendant M. Hough, who stands to reap substantial personal financial benefits from the Proposed

Transaction, was very active in the sale process and even served as the main point of contact to Kevin G. Keyes (“Keyes”), the CEO and President of Annaly.

53. Indeed, in an article published on MarketRealist.com on April 13, 2016, author Brent Nyitray commented on the inadequate process for the Proposed Transaction stating, “The companies said the negotiations were an exclusive process. This implies that there wasn’t a formal auction for Hatteras.”

54. In August 2015, Defendant M. Hough was approached by a representative of Company A, another mortgage REIT having a market capitalization of comparable size to Hatteras, with an interest in exploring a potential merger between the two companies. Subsequently, Defendant M. Hough briefed the Board regarding these discussions. The Board authorized the execution of a non-disclosure agreement (“NDA”) with Company A, which was executed on September 17, 2015.

55. During the November 4, 2015 Board meeting, the independent members of the Board formed the Hatteras the Special Committee, consisting of Defendants McElreath, Miller (who was later designated as the chairman), and Wren. Among other things, the Special Committee was delegated complete and final authority for dealing with any matters relating to payments under or in respect of Hatteras’ management agreement with the Hatteras External Manager, or any other transactions connected with or related to a potential transaction involving the Hatteras External Manager, due to Defendants M. Hough’s and B. Hough’s affiliation with the Hatteras External Manager.

56. On January 5, 2016, the Special Committee determined to engage Goldman Sachs to act as its financial advisor in connection with a potential transaction with Company A or other strategic alternatives. Although, a formal engagement letter was not executed between the Special

Committee and Goldman Sachs until April 5, 2016.

57. During January 2016, there was a significant deterioration in market conditions for mortgage REITs and stock trading prices across the industry fell to depressed levels, including Hatteras’, At a Special Committee meeting in mid-January 2016, the Special Committee discussed current market conditions with Defendant M. Hough and concluded that a strategic transaction with Company A would not be attractive at such valuations.

58. After Defendant M. Hough had a discussion with the managing director of Company A, they agreed that a possible strategic business combination between the two companies would be difficult to accomplish. Thereafter, on January 20, 2016, the Special Committee determined to terminate discussions with Company A.

59. On February 11, 2016, Keyes and Defendant M. Hough met, and Keyes raised the possibility of exploring a potential merger between the two companies. After the meeting, M. Hough reported to Defendant Miller, Chairman of the Special Committee.

60. On February 18, 2016, Annaly sent a presentation to Hatteras, which was distributed by Defendant M. Hough to the Special Committee, that outlined the strategic considerations for a proposed transaction, including that the transaction consideration may be composed of cash and Annaly common stock, but did not propose any specific financial terms. On February 22, 2016, the Special Committee distributed the Annaly presentation to the other members of the Board. The independent members of the Board re-authorized the Special Committee to, among other things, explore potential strategic alternatives, including one with Annaly.

61. On February 26, 2016, Annaly and Hatteras entered into a mutual NDA.

62. During the period from February 26, 2016 through the signing of the Merger

Agreement, representatives of Annaly and Hatteras. and their respective legal and financial advisors, engaged in their due diligence investigations of one another.

63. Throughout March 2016, Annaly and Hatteras negotiated certain terms of the Merger Agreement, as well as the continued provision of services by the executive officers of the Hatteras External Manager and the Hatteras External Manager’s agreement to terminate the management agreement in connection with the consummation of the Tender Offer and Proposed Transaction.

64. On April 3, 2016, the Special Committee directed its Chairman, Defendant Miller, to engage in negotiations with M. Hough regarding a possible reduction in the termination fee and other benefits that would he received by the Hatteras External Manager and its executives, to the extent such reductions could result in an increase in the consideration offered by Annaly to the holders of Hatteras common stock. In addition, to ensure continuity in Hatteras operations, the Special Committee approved in principle the payment of reasonable retention payments by Hatteras to employees of Hatteras and the Hatteras External Manager, with respect to services that would be provided prior to closing, if the transaction were approved. The Special Committee delegated to Defendant Miller the authority to negotiate the details of such retention payments with Defendant M. Hough.

65. Annaly’s best and final offer, as illustrated in the eventual execution of the Merger Agreement, was conditioned on the Hatteras External Manager agreeing to amend the terms of the Hatteras management agreement to provide for, among other things, the termination of the management agreement in connection with the closing of the transaction for a reduced termination

fee and the Hatteras External Manager’s release of all claims that it may have under the management agreement against Hatteras and its subsidiaries and Annaly and its affiliates.

Additionally, terms were negotiated for consulting agreements pursuant to which each of the Hatteras executive officers: M. Hough; B. Hough; Kenneth A. Steele (“Steele”), Chief Financial Officer, Secretary and Treasurer of Hatters and the Hatteras External Manager; and Frederick J. Boos II (“Boos”), Executive Vice President and Chief Investment Officer of Hatteras and the Hatteras External Manager, would provide certain consulting services to Annaly during a consulting period ending 30 months following the closing of the merger, during which term each of them also agreed to certain non-competition and other covenants.

66. On April 10, 2016, Goldman Sachs delivered its oral opinion to all members of the Board that the consideration to be paid to Hatteras stockholders was fair form a financial point of view to such stockholders. After discussion, the Special Committee: i) unanimously recommended that the Tender Offer and Merger Agreement be submitted to and approved by the Board, (ii) approved and authorized Hatteras to enter into the agreement terminating the Hatteras management agreement at the closing of the Proposed Transaction and to comply with the terms thereof, including the payment of the reduced management agreement termination fee from the amount provided for in the management agreement of four times the average annual management fee to approximately three times the average annual management fee, and (iii) approved the provisions of the Merger Agreement providing for or relating to payments to the Hatteras External Manager and its employees.

67. Immediately after the Special Committee was adjourned, the Board unanimously authorized the Company to execute and deliver the Merger Agreement and resolved to recommend that Hatteras’ stockholders accept the Tender Offer and tender their shares of Hatteras common stock to Annaly in the Tender Offer.

68. Subsequently, Annaly, Hatteras and the Hatteras External Manager and their

respective advisors finalized the Merger Agreement and related schedules and agreements, including the amendment to the management agreement (the “Amendment”) and the consulting agreements.

Summary of the Proposed Transaction

69. On April 11, 2016, Annaly and Hatteras issued a joint press release announcing that they had entered into the Merger Agreement, pursuant to which Annaly will commence the Tender Offer to acquire all outstanding shares of Hatteras. For each share of Hatteras common stock validly tendered in the Tender Offer or converted pursuant to the second-step merger, Hatteras

stockholders may elect to receive: (i) the Mixed Consideration Option; (ii) the Cash Consideration Option; or (iii) the Stock Consideration Option, for each outstanding share of Hatteras they own. Hatteras stockholders who elect the Cash Consideration Option or Stock Consideration Option will be subject to proration, in each of the Tender Offer and subsequent second-step merger, so that the aggregate consideration will consist of approximately 65% of Annaly’s common stock and approximately 35% in cash.

70. Because of the proration, certain stockholders are clearly going to receive Cash Consideration Option. Thus, the Individual Defendants owe a duty of candor and a duty to maximize stockholder value. Specifically, the Recommendation Statement provides:

In lieu of receiving the mixed consideration, each holder of shares of Hatteras common stock may elect to receive, for each share of Hatteras common stock that it holds, (1) $15.85 in cash (we refer to this election as the “all-cash election” and this amount as the “all-cash consideration”) or (2) 1.5226 shares of Annaly common stock, together with cash in lieu of any fractional shares of Annaly common stock (we refer to this election as the “all-stock election” and this amount as the “all-stock consideration”). The mixed consideration, the all-cash consideration and the all-stock consideration (as applicable) will be paid without interest and less any applicable withholding taxes.

71. Additionally, the Recommendation Statement provides that, with respect to the Merger:

[E]ach outstanding share of Hatteras common stock that was not acquired by Annaly or the Offeror will be converted into the mixed consideration or, at the election of the holder of such shares, the all-cash consideration or all-stock consideration, subject to proration so that approximately 65.0% of the aggregate consideration in the merger will be paid in shares of Annaly common stock and approximately 35.0% of the aggregate consideration in the merger will be paid in cash.

72. The terms of the Merger Agreement provide that Merger Sub would commence the Tender Offer within twenty (20) business days following the date of the Merger Agreement. Further, the number of shares of Hatteras common stock that have to be validly tendered, together with the shares then owned by Annaly and Merger Sab (if any), must represent at least one more than two-thirds of the then-outstanding shares of Hatteras common stock as of the Expiration Date, unless the Tender Offer has been extended.

73. As such, Annaly commenced the Tender Offer on May 5, 2016 with the Tender Offer set to expire on June 16, 2016.

74. In addition to the above consideration, Annaly would assume the existing notional $287.5 million in Hatteras 7.625% Series A cumulative redeemable preferred stock.

The Inadequate Merger Consideration

75. The Individual Defendants have agreed to a price that does not adequately compensate Hatteras’ stockholders for the intrinsic value of Hatteras based on the Company’s very positive future outlook. Thus, the merger consideration does not reflect the true value of Hatteras.

76. According to Yahoo! Finance, the Company’s 52-week high closing price is $ 18.24, which occurred on May 5, 2015. Therefore, the implied value of the consideration offered in the Proposed Transaction of $15.85 is at a significant discount when compared to the Company’s

52-week high.

77. The implied value of the consideration being offered is also well below an RBC Capital Markets analyst’s target price of $20.00 per share, set as recently as March 22, 2016.

78. Indeed, the merger consideration fails to adequately compensate Hatteras’ stockholders for the Company’s value, as is being recognized by Annaly. In the press release announcing the Proposed Transaction, Keyes, CEO and President of Annaly, stated:

This strategic transaction represents a unique and sizeable value creation opportunity for our shareholders. With the acquisition of Hatteras, we significantly grow our diversified portfolio and broaden our investment options, further fortifying Annaly’s position as the market leading mortgage REIT.

79. Annaly further touted the significant benefits to Annaly stockholders from the Proposed Transaction in a presentation filed with the SEC on April 11, 2016, as seen in the following slide:

80. Considering the Company’s positive outlook, the discount at which Annaly is acquiring the Company, and the opportunity the deal represents to Annaly, the consideration offered to Hatteras’ stockholders in the Proposed Transaction is inadequate.

Conflicts of Interest

81. Hatteras’ Board and senior management of the Company are severely conflicted causing the Board to effectuate the Proposed Transaction with Annaly at an inadequate price and deprive the Company’s public stockholders of the true value of their shares. Indeed, Annaly entered into 30-month consulting agreements with four members of Hatteras’ executive team. In particular, Defendant M. Hough, Defendant B. Hough, Steele, and Boos are parties to such agreements and will serve as consultants to the combined company.

82. Additionally, pursuant to Section 3.4 of the Merger Agreement, the treatment of the Individual Defendants’ restricted stock is different than the three consideration options stockholders can elect to receive as a result of the Proposed Transaction. In general, each award of restricted shares of the Company’s common stock outstanding will vest and be cancelled in exchange for the right to receive the Mixed Consideration Option in respect of each share subject to such award upon consummation of the Proposed Transaction, except that certain rollover restricted stock awards of the Company’s common stock shall instead be converted into restricted stock awards with respect to Annaly common stock on the terms set forth in the Merger Agreement.

83. The following table sets for certain compensation, excluding the value of restricted stock awards, that the Hatteras named executive officers may receive as a result of the Proposed Transaction. Each individual’s cash amount includes the aggregate fees that would be earned during the 30-month consulting period pursuant to his consulting agreement.

|

Name |

|

Cash ($) |

|

Total ($) |

|

|

Michael R. Hough |

|

7,500,000 |

|

7,500,000 |

|

|

Benjamin M. Hough |

|

7,020,000 |

|

7,020,000 |

|

|

Kenneth A. Steele |

|

3,165,000 |

|

3,165,000 |

|

|

Frederick J. Boos, II |

|

2,205,000 |

|

2,205,000 |

|

84. Further, according to the Recommendation Statement, in connection with the execution of the Merger Agreement, Hatteras and the Hatteras External Manager entered into the Amendment to the Hatteras management agreement. The Amendment provides that upon consummation of the Proposed Transaction, the Hatteras management agreement will terminate, and Hatteras will pay the Hatteras External Manager a termination fee of $45,411,000 prior to, and conditioned on, such termination. As the Hatteras executive officers, which include all four members of Hatteras’ executive team that entered into consulting agreements with Annaly, also serve as executive officers of the Hatteras External Manager and own all of the equity interest in the Hatteras External Manager, they will be further cashed out due to their holdings in the Hatteras External Manager.

85. Given the Individual Defendants’ conflicts of interest due to their own self-interest, which favors consummation of the Proposed Transaction for inadequate consideration, it is clear that the sale process leading up to the Merger Agreement was tainted, whereby the Proposed Transaction threatens to undercompensate the Company’s stockholders for their interests in Hatteras.

The Board Agreed to Unreasonable Deal Protection Provisions

86. In addition, as part of the Merger Agreement, Defendants agreed to certain unreasonably deal protection devices that may operate conjunctively to prevent potentially competing offers from emerging for the Company.

87. Section 6.3 of the Merger Agreement includes a provision barring the Company from soliciting interest from other potential acquirers in order to procure consideration in excess

of the amount offered by Annaly. Section 6.3 demands that the Company terminate any and all prior or on-going discussions with other potential acquirers.

88. Should an unsolicited bidder submit a competing proposal, pursuant to Section 6.3(c) of the Merger Agreement, the Company must notify Annaly within twenty-four (24) hours of receipt of the competing proposal of the material terms and conditions of the bidder’s offer, including the bidder’s identity. Further, Section 6.3(e) demands that should the Board determine to enter into a superior competing proposal, it must grant Annaly three (3) business days in which the Company must negotiate in good faith with Annaly (if Annaly desires to negotiate) and allow Annaly to make a counter-offer so that the competing proposal no longer constitutes a superior proposal. In other words, the Merger Agreement gives Annaly access to any rival bidder’s competing offer and allows Annaly a free right to top any superior offer simply by matching it. Accordingly, no rival bidder is likely to emerge and act as a stalking horse, because the Merger Agreement unfairly assures that any “auction” will favor Annaly, which can piggy-back upon the due diligence of the second bidder.

89. Section 9.2 provides that a termination fee of $44,948,637.45 must be paid to Annaly by Hatteras if the Company decides to pursue the competing offer, thereby essentially requiring that the competing bidder agree to pay a naked premium for the right to provide stockholders with a superior offer.

90. Lastly, the Amendment to the Hatteras management agreement entered into by Hatteras and the Hatteras External Manager provides that Hatteras will pay the Hatteras External Manager a termination fee of $45,411,000 prior to, and conditioned on, such termination. This constitutes additional funds needed beyond the value of the Company and the termination fee already included within the Proposed Transaction, further deterring any potential superior bidder

from coming forward.

91. Ultimately, these preclusive deal protection provisions restrain the Company’s ability to solicit or engage in negotiations with any third party regarding a proposal to acquire all or a significant interest in the Company. Further, the circumstances under which the Board may respond to an unsolicited written bona fide proposal for an alternative acquisition that constitutes or would reasonably be expected to constitute a superior proposal are too narrowly circumscribed to provide an effective “fiduciary out” under the circumstances.

The Materially Misleading Recommendation Statement

92. On May 5, 2016, Defendants filed the Recommendation Statement in connection with the Proposed Transaction, which contains numerous material misstatements and omissions. Namely, the Recommendation Statement fails to include material information concerning: (i) the underlying sale process resulting in the Proposed Transaction; (ii) the financial analyses performed by Goldman Sachs; and (iii) the financial projections provided by Hatters management and Annaly management and relied upon by Goldman Sachs.

93. The Recommendation Statement fails to disclose material information regarding the inadequate sale process underlying the Proposed Transaction, including the following:

(a) The details of the NDA the Company entered into with Company A on September 17, 2015, including whether it contained a standstill provision, and if so, whether that standstill provision is currently precluding Company A from making a topping bid for the Company;

(b) The details of Goldman Sachs’ views on potential strategic alternatives that might be available to Hatteras to enhance Hatteras’ long-term stockholder value;

(c) The basis for the independent members of the Board deciding to begin

discussions with Annaly on February 22, 2016, after terminating discussions with Company A on January 20, 2016 and not resuming discussions with Company A at any point thereafter; and

(d) The value indications of Hatteras discussed at the March 22, 2016 Board meeting of each of the separate potential strategic alternatives available to Hatteras, including remaining independent.

94. With respect to Goldman Sachs’ Selected Companies Analysis, the Recommendation Statement fails to disclose the following: (i) the price / book value for each of the selected companies observed by Goldman Sachs; (ii) the annualized dividend yield for each of the selected companies observed by Goldman Sachs; and (iii) whether Goldman Sachs performed any type of benchmarking analysis for Hatteras in relation the selected companies.

95. With respect to Goldman Sachs’ Illustrative Discounted Dividend Analysis of Hatteras, the Recommendation Statement fails to disclose the following; (i) the individual inputs and assumptions that Goldman Sachs used for the selection of discount rates of 5.3% to 12.6%; (ii) the assumptions that Goldman Sachs used for the selection of a dividend yield range of 9.8% to 16.1%; and (iii) the basis for the range of projected book value per share of 0.57x to 0.99x as used by Goldman Sachs in its analysis.

96. With respect to Goldman Sachs’ Illustrative Pro Forma Combined Company Discounted Dividend Analysis, the Recommendation Statement fails to disclose the following: (i) the individual inputs and assumptions that Goldman Sachs used for the selection of discount rates of 3.9% to 11.6%; (ii) the assumptions that Goldman Sachs used for the selection of a dividend yield range of 10.0% to 15.1%: (iii) the basis for the range of projected book value per share of 0.70x to l.0lx as used by Goldman Sachs in its analysis; (iv) the pro forma dividends on Hatteras and Annaly for each calendar year, from the second quarter of 2016 through 2017, as used by

Goldman Sachs in its analysis; and (v) what synergies, if any, were considered by Goldman Sachs in its analysis.

97. According to the Recommendation Statement, Hatteras management prepared financial projections, which were utilized or relied upon by Goldman Sachs in conducting its financial analyses. However, the Recommendation Statement only discloses three line items — Total Interest Income, MSR. Net Income, and Core Earnings Per Share of Common Stock — of Hatteras management’s projections for the Company for the years 2016-2017. Specifically, the Recommendation Statement wholly omits Hatteras management’s projections for the following line items for the years 2016-2017: (a) Other income; (b) Interest expense; (c) Net interest margin; (d) Stock-based compensation expense; (c) Dividends; (f) Net income; and (g) Book value per share. In particular, the Recommendation Statement provides that in its Illustrative Discounted Dividend Analysis of Hatteras and Illustrative Pro Forma Combined Company Discounted Dividend Analysis, Goldman Sachs performed such analyses using the projections provided by Company management and Annaly management. Goldman Sachs calculated estimates of the net present value of the estimated dividend streams for each analyses for the period beginning with the second quarter of 2016 through 2017, as set forth in the projections.

98. Similarly, the Recommendation Statement provides that Annaly management prepared financial projections, which were also utilized and relied upon by Goldman Sachs in conducting its financial analyses. However, the Recommendation Statement wholly omits any projections for Annaly provided by Annaly management and relied upon by Goldman Sachs in conducting its financial analyses. Notably, Annaly did file a Form S-4 with the SEC (the “S-4”) on the same day that the Recommendation Statement was filed, and the S-4 discloses two line items — Interest Income and Normalized Core Income — of Annaly’s management’s projections.

However, the Recommendation Statement and S-4 wholly omit Annaly management’s projections for the following line items for the years 2016-2017: (a) Other income; (b) Interest expense; (c) Net interest margin; (d) Stock-based compensation expense; (e) Dividends; (f) Net income; and (g) Book value per share. As discussed above, the Recommendation Statement provides that in its Illustrative Pro Forma Combined Company Discounted Dividend Analysis, Goldman Sachs performed such analysis on Hatteras and Annaly using the projections provided by Company management and Annaly management. Goldman Sachs calculated estimates of the net present value of the estimated dividend streams of the combined company for the period beginning with the second quarter of 2016 through 2017, as set forth in the projections.

99. Without the disclosure of this material information, stockholders were misled as to the adequacy of the Proposed Transaction. Accordingly, Plaintiff seeks equitable relief to prevent the irreparable injury that the Company will continue to suffer absent judicial intervention.

COUNT I

Breach of Fiduciary Duties

(Against the Individual Defendants)

100. Plaintiff repeats and realleges each allegation set forth herein.

101. The Individual Defendants have violated their fiduciary duties owed to the public stockholders of Hatteras and have acted to put their personal interests ahead of the interests of the Company’s stockholders.

102. The Individual Defendants have violated their fiduciary duties by proposing and entering Hatteras into the Proposed Transaction without regard to the effect of the Proposed Transaction on Hatteras or its stockholders.

103. As alleged in detail herein, each of the Individual Defendants failed to exercise the care required, and breached their fiduciary duties owed to the stockholders of Hatteras because, among other reasons: (i) they failed to properly value Hatteras and its various assets and

operations; (ii) they agreed to preclusive deal protection devices that lock up the Proposed Transaction; and (iii) they failed to disclose all material information, encompassing the total mix of information, necessary for Plaintiff and the Class to decide whether to tender their shares in favor of the Proposed Transaction.

104. Because the Individual Defendants dominate and control the business and corporate affairs of Hatteras and have access to private corporate information concerning Hatteras’ assets, business, and future prospects, there exists an imbalance and disparity of knowledge and economic power between them and the public stockholders of Hatteras which makes it inherently unfair for them to pursue and recommend any proposed transaction wherein they will reap disproportionate benefits.

105. As a result of the Individual Defendants’ breaches of fiduciary duties, Plaintiff and the Class will be irreparably harmed in that they have not and will not receive their fair portion of the value of Hatteras’ assets and will be prevented from benefitting from a value-maximizing transaction.

106. Plaintiff and the members of the Class have no adequate remedy at law.

COUNT II

Breach of Fiduciary Duties Brought Derivatively on Behalf of Hatteras

(Against the Individual Defendants)

107. Plaintiff repeats and realleges the preceding allegations as if fully set forth herein.

108. Plaintiff asserts a claim derivatively in the right and for the benefit of Hatteras to redress injuries suffered and/or to be suffered by Hatteras as a result of breaches of duties owed by the Individual Defendants to the Company. The Company is hereby named as a nominal defendant in connection with this derivative claim.

109. Plaintiff owns and has owned Hatteras common stock at all times relevant hereto. Plaintiff will adequately and fairly represent the interests of the Company and, indirectly, its stockholders in enforcing and prosecuting the Company’s rights. Plaintiff has retained counsel experienced in these types of actions to prosecute these claims on the Company’s behalf.

110. Plaintiff has made demand on the Board.

111. The Individual Defendants have violated the duties owed by them directly to the Company and, indirectly to its stockholders, and have acted to put their personal interests ahead of the interests of Hatteras and, indirectly its stockholders.

112. By the acts, transactions and courses of conduct alleged herein, the Individual Defendants, individually and acting as a part of a common plan, are attempting to sell the Company for less than its true value.

113. The Individual Defendants have violated their duties owed to the Company by authorizing Hatteras to enter into the Merger Agreement without due regard to the effect of the Proposed Transaction on Hatteras.

114. By reason of the foregoing acts, practices and course of conduct, the Individual Defendants have failed to properly exercise their business judgment.

COUNT III

Aiding and Abetting

(Against Hatteras, Annaly, and Merger Sub)

115. Plaintiff repeats and realleges the preceding allegations as if fully set forth herein.

116. As alleged in more detail above, Defendants Hatteras, Annaly, and Merger Sub have aided and abetted the Individual Defendants’ breaches of fiduciary duties.

117. As a result, Plaintiff and the other members of the Class are being harmed.

118. Plaintiff and the members of the Class have no adequate remedy at law.

PRAYER FOR RELIEF

WHEREFORE, Plaintiff demands judgment against Defendants jointly and severally, as follows:

A. Declaring that Counts 1 and 3 of this action are properly maintainable as a class action and certifying Plaintiff as the representative plaintiff and his counsel as Class counsel;

B. Declaring that Count 2 of this action is properly maintainable as a derivative action, and that Plaintiff is an adequate representative of the Company;

C. Awarding the Company the amount of damages it sustained as a result of the Individual Defendants’ breaches of fiduciary duties and Hatteras’, Annaly’s, and Merger Sub’s aiding and abetting of those breaches of fiduciary duty;

D. In the event the Proposed Transaction is consummated, rescinding it or ordering rescissory damages;

E. Awarding compensatory damages arising from the Proposed Transaction recoverable from Defendants, individually and severally, in an amount to be determined al trial, together with pre-judgment and post-judgment interest at the maximum rate allowable by law;

F. Awarding Plaintiff the costs and disbursements of this action, including reasonable allowance for the fees and expenses of Plaintiff’s attorneys and experts; and

G. Granting such other and further equitable relief as this Court may deem just and proper.

JURY DEMAND

Plaintiff, Stephen Twiss, prays a jury on all issues so triable.

|

Dated: May 12, 2016 |

Respectfully submitted, |

|

|

|

|

|

/s/ Donald J. Enright |

|

|

Donald J. Enright |

|

|

LEVI & KORSINSKY, LLP |

|

|

1101 30th Street NW |

|

|

Suite 115 |

|

|

Washington, D.C. 20007 |

|

|

Tel: 202-524-4290 |

|

|

Fax: 202-333-2121 |

|

|

|

|

|

Attorney for Plaintiff |

|

|

1101 30th Street NW, Suite 115

Donald J. Enright |

May 11, 2016

VIA FEDERAL EXPRESS OVERNIGHT DELIVERY AND EMAIL

Scott R. Haiber

Hogan Lovells US LLP

Harbor East

100 International Drive

Suite 2000

Baltimore, MD 21202

scott.haiber@hoganlovells.com

RE: Supplemental Shareholder Demand on Behalf of Stephen Twiss

Dear Scott:

As you know, we are counsel to Stephen Twiss, a current holder of common stock of Hatteras Financial Corp. (“Hatteras” or the “Company”), who issued a shareholder demand on April 15, 2016 pursuant to Maryland law (the “Demand”) on Hatteras’ Board of Directors (the “Board”). As counsel to Mr. Twiss, we are in receipt of your letters dated April 22, 2016 and May 11, 2016 on behalf of the Special Committee of the Board (the “Special Committee”). Please allow this letter to serve as a supplement to the Demand.(1)

On May 5, 2016, Annaly commenced a tender offer (the “Tender Offer”) and also filed a Solicitation/Recommendation Statement on Schedule 14D-9 (the “Recommendation Statement”) with the United States Securities and Exchange Commission (the “SEC”). Based on the Recommendation Statement, Mr. Twiss further alleges that the sale process conducted by the Board was flawed, and resulted in the Proposed Transaction where Annaly, through its wholly owned subsidiary, Ridgeback Merger Sub Corporation (“Merger Sub”), will acquire Hatteras for an inadequate price. Although the Recommendation Statement discloses that Hatteras formed the Special Committee consisting of independent directors, Vicki H. Wilson-McElreath, Jeffrey D. Miller (chairman), and Thomas D. Wren, the sale process was rife with conflicts of interest as Annaly entered into consulting agreements with four members of Hatteras’ executive team, including Michael R. Hough (“M. Hough”), Chairman of the Board and Chief Executive Officer of the Company, and Benjamin M. Hough, President, Chief Operating Officer, and a director of the Company. Indeed, M. Hough, along with other members of Hatteras’ management, stands to reap substantial personal financial benefits from the Proposed Transaction and was very active in the sale process, even serving as the main point of contact to Kevin G. Keyes, the CEO and President of Annaly.

(1) This supplemental shareholder demand incorporates by reference all of the facts, allegations, and demands contained in the original Demand. Additionally, unless otherwise noted herein, all capitalized terms shall have the same meanings as set forth in the original Demand.

With the clear conflicts of interest, the sale process was tainted and resulted in the Proposed Transaction, in which the Board failed to maximize stockholder value. Given the required proration that the total consideration paid to stockholders will consist of approximately 65% stock and 35% cash, certain stockholders are going to receive all-cash consideration. As such, under Maryland law the Individual Defendants owe a duty to maximize stockholder value to Hatteras’ stockholders. Thus, a duty owed to one stockholder is a duty owed to all stockholders.

The merger consideration, valuing Hatteras at $15.85 per share based upon the closing price of Annaly on April 8, 2016, fails to adequately value the Company. It represents a significant discount to Hatteras’ 52-week high closing price of $18.24 per share. Indeed, as recently as March 22, 2016, an RBC Capital Markets analyst set a target price for the Company of $20.00 per share. Therefore, in addition to the demands previously made, Mr. Twiss demands that the Board take action to correct the flawed sale process and ensure that the Hatteras stockholders will receive the best value available for their shares.

Additionally, Mr. Twiss alleges that the Recommendation Statement is materially deficient and misleading for multiple reasons. The Recommendation Statement fails to set forth material information and/or sets forth materially misleading information concerning: (i) the sale process leading up to the execution of the Merger Agreement; (ii) the financial analyses performed by Goldman Sachs & Co. (“Goldman Sachs”), the Company’s financial advisor; and (iii) the financial projections provided by Hatters management and Annaly management and relied upon by Goldman Sachs.

The Recommendation Statement fails to disclose material information regarding the flawed sale process underlying the Proposed Transaction, including the following:

(a) The details of the NDA the Company entered into with Company A on September 17, 2015, including whether it contained a standstill provision, and if so, whether that standstill provision is currently precluding Company A from making a topping bid for the Company;

(b) The details of Goldman Sachs’ views on potential strategic alternatives that might be available to Hatteras to enhance Hatteras’ long-term stockholder value;

(c) The basis for the independent members of the Board deciding to begin discussions with Annaly on February 22, 2016, after terminating discussions with Company A on January 20, 2016 and not resuming discussions with Company A at any point thereafter; and

(d) The value indications of Hatteras discussed at the March 22, 2016 Board meeting of each of the separate potential strategic alternatives available to Hatteras, including remaining independent.

The Recommendation Statement also fails to disclose material information concerning the financial analyses performed by Goldman Sachs in connection with the rendering of its fairness opinion, including:

(a) With respect to Goldman Sachs’ Selected Companies Analysis, the Recommendation Statement fails to disclose: (i) the price / book value for each of the selected companies observed by Goldman Sachs; (ii) the annualized dividend yield for each of the selected companies observed by Goldman Sachs; and (iii) whether Goldman Sachs performed any type of benchmarking analysis for Hatteras in relation the selected companies.

(b) With respect to Goldman Sachs’ Illustrative Discounted Dividend Analysis of Hatteras, the Recommendation Statement fails to disclose: (i) the individual inputs and assumptions that Goldman Sachs used for the selection of discount rates of 5.3% to 12.6%; (ii) the assumptions that Goldman Sachs used for the selection of a dividend yield range of 9.8% to 16.1%; and (iii) the basis for the range of projected book value per share of 0.57x to 0.99x as used by Goldman Sachs in its analysis.

(c) With respect to Goldman Sachs’ Illustrative Pro Forma Combined Company Discounted Dividend Analysis, the Recommendation Statement fails to disclose: (i) the individual inputs and assumptions that Goldman Sachs used for the selection of discount rates of 3.9% to 11.6%; (ii) the assumptions that Goldman Sachs used for the selection of a dividend yield range of 10.0% to 15.1%; (iii) the basis for the range of projected book value per share of 0.70x to l.01x as used by Goldman Sachs in its analysis; (iv) the pro forma dividends on Hatteras and Annaly for each calendar year, from the second quarter of 2016 through 2017, as used by Goldman Sachs in its analysis; and (v) what synergies, if any, were considered by Goldman Sachs in its analysis.

Moreover, the Recommendation Statement also omits certain material information concerning the financial projections prepared by Hatteras management and Annaly management that were provided to and relied upon by Goldman Sachs in its analyses.

With respect to Hatteras management’s projections for the years 2016-2017, the Recommendation Statement fails to disclose the following line items:

(a) Other income;

(b) Interest expense;

(c) Net interest margin;

(d) Stock-based compensation expense;

(e) Dividends;

(f) Net income; and

(g) Book value per share.

With respect to Annaly management’s projections for the years 2016-2017, the Recommendation Statement fails to disclose the following line items:

(a) Other income;

(b) Interest expense;

(c) Net interest margin;

(d) Stock-based compensation expense;

(e) Dividends;

(f) Net income; and

(g) Book value per share.

Conclusion

Accordingly, pursuant to Maryland law, on behalf of Mr. Twiss, we hereby demand that the Board: (i) undertake (or cause to be undertaken) an independent internal investigation into management’s violations of Maryland law; (ii) commence a civil action against each member of management to recover for the benefit of the Company the amount of damages sustained by the Company and other appropriate relief as a result of their breaches of fiduciary duties alleged herein and in the original Demand, and commence a civil action against Hatteras, Annaly, and Merger Sub for aiding and abetting management’s breaches of fiduciary duties as alleged herein and in the original Demand; and (iii) correct the material omissions identified in the Recommendation Statement.

Finally, we still reserve the right to supplement and reassess our demands upon the issuance of new publicly available information. We also reserve the right initiate litigation prior to any response by the Board to this demand should we believe at any time that the Company will be irreparably harmed by waiting for a response.

|

|

|

Sincerely, |

|

|

|

|

|

|

|

Levi & Korsinsky LLP |

|

|

|

|

|

|

By: |

/s/ Donald J. Enright |

|

|

|

Donald J. Enright |

|

LEVI&KORSINSKY LLP |

1101 30th Street NW, Suite 115 |

|

|

Washington, DC 20007 |

|

|

T: 202-524-4290 |

|

|

F: 202-333-2121 |

|

|

www.zlk.com |

|

|

|

|

|

Donald J. Enright |

|

|

denright@zlk.com |

April 15, 2016

VIA FEDERAL EXPRESS OVERNIGHT DELIVERY

Board of Directors

Hatteras Financial Corp.

751 W. Fourth Street, Suite 400

Winston Salem, NC 27101

RE: Shareholder Litigation Demand Pursuant to Maryland Law

To: The Board of Directors of Hatteras Financial Corp.

This firm represents Mr. Stephen Twiss, a holder of shares of common stock of Hatteras Financial Corp. (“Hatteras” or the “Company”) at all relevant times set forth herein. I write on behalf of Mr. Twiss pursuant to Maryland law, to demand that the Board of Directors take action to remedy breaches of fiduciary duties, as described herein.

As you are obviously aware, by reason of their positions as officers and/or directors of Hatteras and because of their ability to control the business and corporate affairs of Hatteras, the officers and directors of the Company owe Hatteras and its shareholders the fiduciary obligations of loyalty, good faith, and fair dealing when controlling and managing the Company. Mr. Twiss believes that the following directors of the Company violated these core fiduciary duty principles, causing the Company to suffer damages: Michael R. Hough, Benjamin M. Hough, Ira G. Kawaller, David W. Berson, Jeffrey D. Miller, Thomas D. Wren, Vicki H. Wilson-Mcelreath, and William V. Nutt.

On April 11, 2016, Hatteras and Annaly Capital Management, Inc. (“Annaly”) announced a definitive agreement (the “Merger Agreement”) under which Annaly will launch a tender offer no later than May 6, 2016 to purchase all of Hatteras’s outstanding shares in a transaction with an aggregate value of approximately $1.5 billion (the “Proposed Transaction”). Under the terms of the Merger Agreement, Hatteras shareholders can elect to receive either: (i) $5.55 in cash and 0.9894 shares of Annaly stock; (ii) $15.85 in cash; or (iii) 1.5226 shares of Annaly stock, for each outstanding share of Hatteras they own, subject to proration to ensure that the total consideration paid to shareholders will consist of approximately 65% stock and 35% cash.

Mr. Twiss contends that the Proposed Transaction undervalues the Company, and that the Company’s efforts to consummate the Proposed Transaction constitute a violation of the Board’s fiduciary duties of care, loyalty, candor, and good faith, to Hatteras and its shareholders. In light of the current volatility in the interest rate markets, the Company has suffered a temporary decline in its financial performance. However, the Company has a proven history of positive financial results.

On June 24, 2015, Hatteras announced that it had entered into a definitive purchase agreement to acquire Pingora Asset Management, LLC (“Pingora Management”) and Pingora Loan Servicing, LLC (“Pingora Servicing” and together with Pingora Management, “Pingora”), a specialized asset manager focused on investing in new production performing mortgage servicing rights and servicing residential mortgage loans. Hatteras expects Pingora’s partnerships to help grow the Company’s existing direct mortgage purchase program to a more meaningful scale.

Shortly after the acquisition of Pingora, Hatteras announced its financial results for the second quarter of 2015. For the second quarter of 2015, Hatteras reported comprehensive income (loss) available to common shareholders of $(48.6) million, as compared to $48.7 million for the prior quarter. As stated in the Company’s press release, the decrease was largely due to rising interest rates and, more specifically, basis widening during the second quarter. Further, net interest margin for the second quarter of 2015 was $53.9 million, compared to $59.8 million for the prior quarter.

On October 27, 2015, the Company reported its financial results for the third quarter of 2015. Hatteras reported a comprehensive income (loss) available to common shareholders of $(84.9) million, as compared to $(48.6) million for the prior quarter. Again, the increase in comprehensive loss was largely due to the volatility in the interest rate markets. The Company also reported net interest margin for the third quarter of $51.7 million, compared to $53.9 million for the prior quarter.

On February 16, 2016, the Company announced its financial results for the fourth quarter of 2015 and full year ended December 31, 2015. For the fourth quarter of 2015, the Company reported a comprehensive income (loss) available to common shareholders of $7.4 million, as compared to $(84.9) million for the prior quarter. Net interest margin for the quarter improved to $56.1 million, compared to $51.7 million in the prior quarter. For the full year, the Company reported a comprehensive loss of $77.4 million. The Company’s Chairman and Chief Executive Officer (“CEO”), Michael R. Hough commented on the full year financial results:

While 2015 was a challenging year, the introduction of mortgage servicing rights and mortgage credit to our portfolio will enhance our ability to manage risk more comprehensively and to position the business going forward. Combined with share repurchases, we expect these new revenue sources to diversify our portfolio, lessen our exposure to interest rate and basis risk and create long-term shareholder value.

With the expected benefits from the Pingora acquisition and expectation that interest rate conditions will begin to normalize, the consideration offered in the Proposed Transaction is inadequate and undervalues the Company. Indeed, the value of the proposed merger consideration represents a meager 11.2% premium to Hatteras’s closing price on Friday, April 8, 2016. Mr. Twiss does not believe the consideration offered in the Proposed Transaction reflects Hatteras’s true inherent value. As recently as March 22, 2016, Jason Arnold, an analyst at RBC Capital Markets, set a $20.00 target price for Hatteras, $4.15 above the $15.85 implied value of the merger consideration. Further, Hatteras stock’s 52-week trading high is $18.82 per share.

Not only did the Board agree to a.transaction that undervalues the Company, but it also agreed to unreasonable deal protection devices that serve only to unreasonably restrain other bidders from making successful competing offers for the Company. Specifically, pursuant to the Merger Agreement, the Board agreed to: (i) a strict no-solicitation provision that prevents the Company from soliciting other potential acquirers that may maximize shareholder value; (ii) a provision that provides Annaly with three (3) business days to match any competing proposal in the event one is made, plus an additional two (2) business days following a material amendment to the terms and conditions of a superior offer; and (iii) a provision that requires the Company to pay Annaly a termination fee of nearly $45 million in order to enter into a transaction with a superior unsolicited bidder.

Furthermore, as the Board and the Company’s executive officers stand to reap unique benefits from the Proposed Transaction not shared by Mr. Twiss and the other public shareholders of Hatteras, they are conflicted and in further breach of their fiduciary duties. The joint press release announcing the Proposed Transaction provides that Annaly entered into 30-month consulting agreements with four members of Hatteras’s executive team, including Michael R. Hough and Benjamin M. Hough.

We hereby demand that the Board take action to amend the terms of the Proposed Transaction to ensure that the consideration provided is fair to Hatteras and its shareholders and that the terms of the Merger Agreement do not unreasonably restrain potential competing offers. We also demand that the Board remove any conflicts of interest that may have clouded the sale process. By this demand, we ask that the Board cure the breaches of its fiduciary duties as set forth herein, and initiate and prosecute litigation, as necessary, to cure these breaches.

Finally, we reserve the right to supplement and reassess our demand upon the issuance of new publicly available information, including but not limited to, the filing of a recommendation statement with the United States Securities and Exchange Commission. We also reserve the right to initiate litigation prior to any response by the Board to this demand should we believe at any time that the Company will be irreparably harmed by waiting for a response.

|

|

|

Sincerely, |

|

|

|

Levi & Korsinsky LLP |

|

|

| |

|

|

By: |

/s/ Donald J.Enright |

|

|

|

Donald J.Enright |