UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

| | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended

or

| | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number

STABILIS SOLUTIONS, INC.

(Exact name of registrant as specified in its charter)

| | | ||||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

(Address of principal executive offices, including zip code)

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||

| | | The |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§. 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Act:

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| | ☒ | Smaller reporting company | |

| Emerging growth company | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant on June 30, 2023 was $

As of March 5, 2024, there were

Documents Incorporated by Reference: None

STABILIS SOLUTIONS, INC. AND SUBSIDIARIES

ANNUAL REPORT ON FORM 10-K

For the Fiscal Year Ended December 31, 2023

| Page |

||||||||

| Item 1. |

||||||||

| Item 1A. |

||||||||

| Item 1B. |

||||||||

| Item 1C. | Cybersecurity | 23 | ||||||

| Item 2. |

||||||||

| Item 3. |

||||||||

| Item 4. |

||||||||

| Item 5. |

||||||||

| Item 6. |

||||||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|||||||

| Item 7A. |

||||||||

| Item 8. |

||||||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|||||||

| Item 9A. |

||||||||

| Item 9B. |

||||||||

| Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

|||||||

| Item 10. |

||||||||

| Item 11. |

||||||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|||||||

| Item 13. |

Certain Relationships and Related Transactions and Director Independence |

|||||||

| Item 14. |

||||||||

| Item 15. |

||||||||

| Item 16. |

||||||||

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This document includes statements that constitute forward-looking statements within the meaning of the federal securities laws. Forward-looking statements represent intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks and uncertainties and other factors. These statements may relate to, but are not limited to, information or assumptions about us, our capital and other expenditures, dividends, financing plans, capital structure, cash flow, pending legal and regulatory proceedings and claims, including environmental matters, future economic performance, operating income, cost savings, and management’s plans, strategies, goals and objectives for future operations and growth. These forward-looking statements generally are accompanied by words such as “intend,” “anticipate,” “believe,” “estimate,” “expect,” “should,” “seek,” “project,” “plan” or similar expressions. Any statement that is not a historical fact is a forward-looking statement. It should be understood that these forward-looking statements are necessary estimates reflecting the best judgment of senior management, not guarantees of future performance. Many of the factors that impact forward-looking statements are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. When considering forward-looking statements, you should keep in mind the risk factors as further described in Part I. “Item 1A. Risk Factors” in this document.

We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. All forward-looking statements included in this document are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue.

In this Annual Report on Form 10-K, we may rely on and refer to information from market research reports, analyst reports and other publicly available information. Although we believe that this information is reliable, we cannot guarantee the accuracy and completeness of this information, and we have not independently verified it.

OVERVIEW

Our Company

Stabilis Solutions, Inc. and its subsidiaries (the “Company”, “Stabilis”, “our”, “us” or “we”) is an energy transition company that provides turnkey clean energy production, storage, transportation and fueling solutions primarily using liquefied natural gas (“LNG”) to multiple end markets. We have safely delivered over 470 million gallons of LNG through more than 49,000 truck deliveries during our 20 year operating history, which we believe makes us one of the largest and most experienced small-scale LNG providers in North America. We define “small-scale” LNG production to include liquefiers that produce less than 1.7 million LNG gallons per day (or approximately 1.0 million tonnes per annum ("MTPA")) and “small-scale” LNG distribution to include distribution by trailer or tank container up to 10,000 LNG gallons or marine vessels that carry less than 8.0 million LNG gallons (approximately 30,000 cubic meters). The Company provides LNG solutions to customers in diverse end markets, including aerospace, agriculture, energy, industrial, marine bunkering, mining, pipeline, remote power and utility markets.

The Company also builds power and control systems for the energy industry in China through its 40% owned Chinese joint venture, BOMAY Electric Industries, Inc (“BOMAY”). BOMAY is accounted for as an equity investment.

Our Industry

LNG can be used to replace a variety of alternative fuels, including distillate fuel oil and propane, among others, to provide environmental and economic benefits. LNG can also be used to deliver natural gas to locations where pipeline service is unavailable, has been interrupted, or needs to be supplemented. Increasingly, LNG is being utilized as a transportation fuel in the marine industry and as a propellant in the private rocket launch sector. We believe that these fuel markets are large and provide significant opportunities for LNG usage.

We believe that LNG will provide an important balance between environmental sustainability, security and accessibility, and economic viability when compared to both renewables and other traditional hydrocarbon-based fuels and will play a key role in the energy transition.

OUR BUSINESS

The Company generates revenue by selling and delivering LNG to our customers, renting cryogenic equipment and providing engineering and field support services. We sell our products and services separately or as a bundle depending on the customer’s needs. Pricing depends on market pricing for natural gas and competing fuel sources (such as diesel, fuel oil, and propane among others), as well as the customer’s purchased volume, contract duration and credit profile.

LNG Production and Sales—Stabilis builds and operates cryogenic natural gas processing facilities, called “liquefiers,” which convert natural gas into LNG through a purification and multiple stage cooling process. We currently own and operate a liquefier that can produce up to 100,000 LNG gallons per day in George West, Texas and a liquefier that can produce up to 30,000 LNG gallons per day in Port Allen, Louisiana. We also purchase LNG from third-party production sources, which allows us to support customers in markets where we do not own liquefiers. We make the determination of LNG and transportation supply sources based on the cost of LNG, the transportation cost to deliver to regional customer locations, and the reliability of the supply source. Revenues earned from the production and sales of LNG are included within LNG Product revenue.

Transportation and Logistics Services—Stabilis offers our customers a “virtual natural gas pipeline” by providing turnkey LNG transportation and logistics services in North America. We deliver LNG to our customers’ work sites from both our own production facilities and our network of approximately 30 third-party production sources located throughout North America. We own a fleet of cryogenic trailers to transport and deliver LNG. We also outsource similar equipment and transportation services for LNG from qualified third-party providers as required to support our customer base. Revenues earned from the transportation and logistical services of LNG to our customers are included within LNG Product revenue.

Cryogenic Equipment Rental—Stabilis operates a fleet in excess of 150 mobile LNG storage and vaporization assets, including: transportation trailers, electric and gas-fired vaporizers, ambient vaporizers, storage tanks, and mobile vehicle fuelers. We also own several stationary storage and regasification assets. We believe this is one of the largest fleets of small-scale LNG equipment in North America. Our fleet consists primarily of trailer-mounted mobile assets, making delivery to and between customer locations more efficient. We deploy these assets on job sites to provide our customers with the equipment required to transport, store, and consume LNG in their operations. Revenues earned from cryogenic equipment rental are included within Rental revenue.

Engineering and Field Support Services—Stabilis has experience in the safe, cost effective, and reliable use of LNG in multiple customer applications. We have also developed many processes and procedures that we believe improve our customers’ use of LNG in their operations. Our engineers help our customers design and integrate LNG into their operations and our field service technicians help our customers mobilize, commission and reliably operate on the job site. Revenues earned from engineering and field support services are included within Service revenue.

Stabilis believes that our extensive operating experience positions us to be a leader in the North American small-scale LNG markets. We plan to leverage this experience to grow our business by investing in new production and distribution assets throughout North America.

Market for Small-Scale LNG in North America

LNG can serve as a partner fuel for renewable energy sources and provides an important balance between environmental sustainability, security and access, and economic viability as a source of fuel. LNG can also be used to deliver natural gas to locations where pipeline service is unavailable, has been interrupted, or needs to be supplemented and to replace a variety of other carbon-based fuels. We believe that the current and future markets for LNG are significant and will continue to grow for a number of years.

We believe that the following factors could drive significant small-scale LNG market growth in North America over the next decade:

New and Expanding Markets for LNG such as Marine Bunkering and Rocket Propulsion. Demand for LNG as a marine fuel continues to grow. While LNG bunkering infrastructure is more developed in other regions such as Europe, there is limited LNG bunkering infrastructure currently available in the U.S. The marine industry is expected to drive additional demand for domestically produced LNG in the coming years. The International Maritime Organization (“IMO”) has imposed a global sulfur cap of 0.5% on ships trading outside of established emission control areas starting in January 2020, a level that could be difficult to achieve using common marine fuels, such as heavy fuel oil, but could be achieved using LNG. Large marine vessels, such as cruise vessels and containerships, can take several hundred thousand gallons of LNG in a single fuel bunkering event. At December 31, 2023, there were 497 LNG fueled marine vessels in the global fleet with 532 more new build vessels on order for delivery in 2024 through 2027 which will more than double the number of LNG fueled vessels over the next three years. New build containership vessels represent the largest sector with 244 vessels on order. During the fourth quarter of 2023, the Company entered into a two-year marine bunkering contract for an estimated 22 million gallons per year. The Company expects that additional marine bunkering opportunities will become available as additional marine vessels that use LNG as the primary fuel of choice are delivered to vessel fleets and commence routine operations. Additionally, LNG is increasingly becoming the fuel of choice for reusable rocket propulsion systems due to its higher energy density, reduced risk of explosion and ease and cost to produce. The commercial satellite industry is expected to drive a significant increase in launches and demand for LNG to support this growth.

Lower Emissions than Alternative Fossil Fuels. Natural gas contains less carbon than most other fossil fuels and, as a result, produces fewer carbon dioxide emissions when burned. The National Energy Technology Laboratory indicates that new natural gas power plants emit between 50% and 60% less carbon dioxide compared with emissions from a typical coal plant. The Argonne National Laboratory indicates that natural gas vehicles produce between 13% and 21% fewer greenhouse gas emissions than comparable gasoline and diesel fueled vehicles. Additional studies indicate that natural gas also produces lower particulate matter and sulfur emissions than other fossil fuels. We believe the relative environmental benefits of natural gas as a fuel are becoming increasingly important as our customers expand their corporate sustainability mandates to lower greenhouse gas emissions and increase decarbonization initiatives.

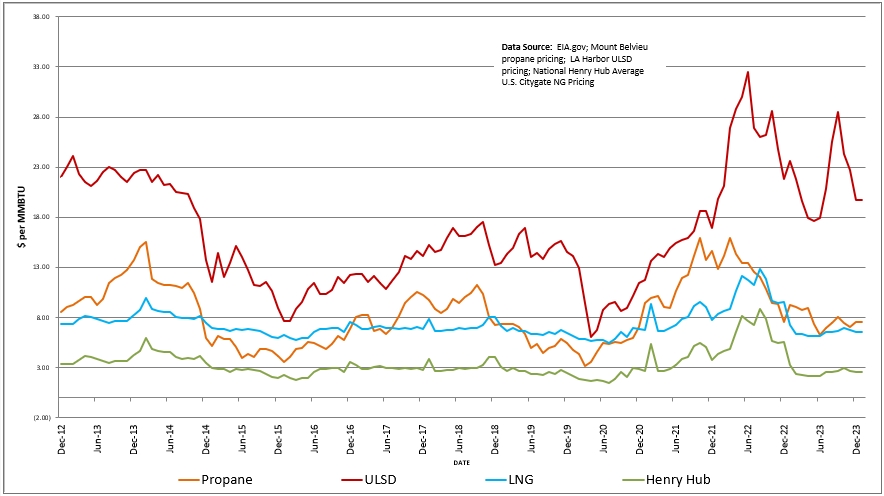

Less Expensive than Other Traditional Fuels. The cost of natural gas compared to other energy sources is a significant driver for the future demand for natural gas and LNG. Technological advances in natural gas production have unlocked significant new gas reserves in North America. We believe that these proven, abundant and growing reserves of natural gas have the potential to produce among the highest volumes of natural gas in the world. This abundant supply of natural gas has supported relatively low natural gas prices in North America. The cost of natural gas in the United States and Canada currently is less than the cost of crude oil on an energy equivalent basis. In addition, because the price of the natural gas commodity makes up a smaller portion of the total cost of LNG relative to the commodity portion of competing fuels, the price of LNG is less sensitive to variations in the underlying commodity cost. These factors have made LNG more economical than competing fuel sources, and we believe that LNG will maintain this cost advantage into the foreseeable future.

The following chart illustrates the lower cost and decreased price sensitivity of LNG compared to propane and diesel, by comparing the historical wholesale price of Propane, Ultra-Low No. 2 Diesel, Indicative Liquefied Natural Gas and Natural Gas (Henry Hub).

ULSD, Propane & LNG pricing- December 31, 2012 to December 31, 2023

Better Safety than Alternative Fuels. The physical characteristics of LNG make it a safer and more environmentally friendly fuel when compared to diesel and propane because it boils and dissipates rapidly into the air when spilled instead of pooling on or near the ground. If released, LNG is also less combustible than diesel and propane because it ignites at relatively high temperatures and within a narrow flammability range when mixed with air. In addition, LNG fuel tanks and systems used in natural gas applications are subjected to a number of required federal and state safety tests, such as fire, environmental hazard, burst pressure and crash testing that ensure their safety.

Established LNG Production and Distribution Technology. Small-scale LNG production and distribution technologies have been proven and are now widely available from multiple vendors. Small-scale liquefiers are available in modular formats from several vendors and many of them have established track records of reliable and safe operating performance. LNG transport trailers, storage vessels, and vaporization equipment are also available from multiple vendors, and most of this equipment also comes with an established operating track record. We believe that the availability of proven small-scale LNG production and distribution technologies reduces the technology risk in growing the industry, but it also places a premium on the owner’s or operator’s construction and operating capabilities.

Our Customers

Stabilis serves customers in a variety of end markets, including aerospace, agriculture, energy, industrial, marine bunkering, mining, pipeline, remote power and utility markets within North America. We believe these customer markets are well suited to use LNG because they consume relatively high volumes of fuel, operate in mobile, temporary or off-pipeline locations, have limited access to alternative fuel sources, and/or are facing increasingly stringent emissions or other environmental requirements. We currently serve approximately 40 customers. For the year ended December 31, 2023, Aggreko Plc accounted for more than 10% of our revenues with several project sites in operation. During such period, no other purchaser accounted for 10% or more of our revenue.

Aerospace. The Aerospace industry utilizes LNG as a propellant for rocket propulsion systems and LNG provides an economical, clean burning, and easily stored fuel for rocket engines. Aerospace firms may also utilize LNG for power generation at remote facilities. Consumption of LNG at aerospace facilities vary significantly by project type.

Agriculture. The Agriculture industry utilizes LNG to power high horsepower engines, greenhouses and also when food processing utilizes agricultural dryers for generating heat as LNG has a clean and consistent burn that makes heating operations more predictable.

Energy. Energy producers use high horsepower engines and turbines to power their drilling and pressure pumping operations. LNG displaces some of the total diesel fuel consumption in these applications using dual-fuel engine technology. We believe that energy producers can use LNG to reduce fuel costs and to meet environmental emissions requirements. Based on our experience, depending upon whether the customer uses dual-fuel pressure pumping engines or turbines, energy customers can consume from 10,000 to 60,000 LNG gallons per day.

Industrial. Industrial applications for LNG include sand and aggregate producers, asphalt plants, food processers, paper mills, and general manufacturing facilities. LNG often replaces propane, fuel oil, or diesel fuel in these applications. These customers often cannot justify the cost of new pipeline infrastructure and using LNG requires minimal up-front costs, regulatory approvals, and lead time requirements. We believe LNG is optimal for these applications because it is cost-effective with stable pricing, offers consistent supply without curtailments, provides an energy density that minimizes storage requirements, and has a clean and consistent burn that makes heating operations more predictable.

Marine Bunkering of LNG. We believe that opportunities to provide LNG as a fuel source to the marine transportation industry represents a significant opportunity for us. As shipping and marine transportation companies expand the use of LNG as a fuel source, we believe that we are positioned to capitalize on future growth. LNG also allows marine transportation providers to meet strict emission requirements that are difficult to achieve using common marine fuels, such as heavy fuel oil, but could be achieved using LNG. Large marine vessels such as containerships can take several hundred thousand gallons of LNG in a single fuel bunkering event. The Company expects that additional marine bunkering opportunities will become available as additional marine vessels that use LNG as the primary fuel of choice are delivered to vessel fleets and commence routine operations in North America.

Mining. Mines, including those producing metals, rare earth materials, and coal, are often located in remote locations that are off the electrical grid and do not have natural gas pipeline access. Mines use LNG to fuel electrical generators and to produce heat for their processing activities. Mines also use LNG as a fuel for their mine trucks and other high horsepower engine equipment. In addition to fuel cost benefits, LNG can help reduce emissions at mines that are often located in environmentally sensitive areas. Based on our experience, power generation and heating applications at mines can consume 10,000 to 100,000 LNG gallons per day.

Pipeline, Remote Power and Utilities. LNG usage in utility and pipeline applications varies by project type. North America has an expansive network of pipelines that, based on age and increasingly more stringent regulations, require routine testing and maintenance. During such events LNG fueling solutions can provide flow assurance to address natural gas supply interruptions during pipeline hydrostatic testing, repairs, gas distribution system curtailments, or unplanned outages. Such solutions can also provide a bridge for large industrial or utility customers before permanent pipelines are installed. LNG is becoming more predominant in regions where natural gas demand is growing and utilities and pipelines are required to continue to meet critical peak gas demand. LNG can provide an economic solution to support these supply requirements during peak weather conditions, gas curtailments and/or pipeline repairs. In addition, utilities and other power providers can also utilize LNG to provide clean distributed power when access to an electrical grid is limited, additional power is needed during times of peak load, or power infrastructure is damaged due to storms such as hurricanes or wildfires.

China. Through our 40% interest in BOMAY, we provide power and control systems for the energy market in China.

Competitive Strengths

Stabilis believes that we are well positioned to execute our business strategies based on the following competitive strengths:

LNG is an economically and environmentally attractive product. Stabilis believes that many of our customers use LNG because it can significantly reduce harmful carbon dioxide, nitrogen oxide, sulfur, particulate matter, and other emissions as compared to other hydrocarbon-based fuels. LNG is also an important partner fuel for renewables such as solar and wind power and will be a key component of the energy transition to more sustainable sources of energy. We also believe that the combination of cost and environmental benefits makes LNG a compelling fuel source for many energy consumers. We believe that LNG can be delivered to customers at prices that are lower and more stable than what they would pay for distillate fuels or propane. In addition, several of our customers have reported that LNG as a fuel decreases their operating costs by reducing equipment maintenance requirements and providing more consistent burn characteristics.

Demonstrated ability to execute LNG projects safely and cost effectively. Stabilis has produced and delivered over 470 million gallons of LNG to our customers throughout our 20-year operating history. Our experience includes building and operating LNG production facilities, delivering LNG from third-party sources to our customers, and designing and executing a wide-variety of turnkey LNG fueling solutions for our customers using our cryogenic equipment fleet supported by our engineers and field service teams. We have experience serving customers in multiple end markets including aerospace, agriculture, energy, industrial, marine bunkering, mining, pipeline, remote power and utilities. We also have experience exporting LNG to Mexico and Canada. Finally, we believe our team is among the most experienced in the small-scale LNG industry. We believe that we can leverage this proven LNG execution experience to grow our business in existing markets and expand our business into new markets.

Comprehensive provider of “virtual natural gas pipeline” solutions throughout North America. Stabilis offers our customers a comprehensive off-pipeline natural gas solution by providing the supply infrastructure, transportation and logistics, and field service support necessary to deliver LNG to them in a program that is tailored to their consumption needs. We believe we own one of the largest fleets of small-scale cryogenic transportation, storage, and vaporization equipment in North America. We can provide our customers LNG and related services for a wide variety of applications almost anywhere in the United States, Canada and Mexico. We believe that our ability to be a “one stop shop” for all of our customers’ off-pipeline natural gas requirements throughout North America is unique among LNG providers.

Ability to leverage existing LNG production and delivery capabilities into new markets. Stabilis believes that our experience producing and distributing LNG can be leveraged to grow into new geographic and service end markets. Since our founding we have expanded our service area across the United States, northern Mexico, and western Canada. We have also expanded our industry coverage to include multiple new end markets and customers. We accomplished this expansion into new markets by leveraging our LNG production and distribution expertise, in combination with our cryogenic engineering and project development capabilities, to meet new customer needs.

Competition

The market for LNG is highly competitive and we have multiple competitors for fuel. Stabilis believes the biggest competition for LNG in these applications are distillate fuels and propane as they power the majority of engines and generators in our target markets. We also compete with other fuel sources including pipeline natural gas and compressed natural gas ("CNG").

Stabilis competes with other natural gas companies, as well as other fossil fuel sources, based on a variety of factors, including, among others, cost, supply, availability, quality, emissions, and safety of the fuel. Location is often a primary competitive factor as transportation costs limit the distance LNG can be transported at competitive prices. We believe we compare favorably with many of our competitors on the basis of these factors. However, some of our competitors have longer operating histories and market-based experience, larger customer bases, more expansive brand recognition, deeper market penetration and substantially greater financial, marketing and other resources than our business. As a result, they may be able to respond more quickly to changes in customer preferences, legal requirements or other industry or regulatory trends, devote greater resources to the development, promotion and sale of their products, adopt more aggressive pricing policies, dedicate more effort to infrastructure and systems development in support of their business or product development activities and exert more influence on the regulatory landscape that impacts the natural gas fuel market. Additionally, utilities and their affiliates typically have unique competitive advantages, including a lower cost of capital, substantial and predictable cash flows, long-standing customer relationships, greater brand awareness, and large sales and marketing organizations.

Stabilis does not believe that we compete with mid-scale and world-scale LNG liquefiers that produce more than 1,700,000 LNG gallons per day (approximately 2,700 tonnes per day or 1.0 MTPA). These large LNG production facilities typically are designed and permitted to fill large marine vessels that deliver cargos of 26.5 million gallons (approximately 42,200 tonnes) of LNG or more to large import terminals in foreign markets. We do not believe that any of them currently have or plan to have truck loading facilities that would be required to supply LNG to small-scale LNG customers.

Sales and Marketing

Stabilis markets our products and services primarily through our direct sales force, which includes sales representatives covering all of our major geographic and customer vertical markets, as well as attendance at trade shows and participation in industry conferences and events. Our technical, sales and marketing teams also work closely with federal, state and local government agencies to provide education about the value of natural gas as a fuel and to keep abreast of proposed and newly adopted regulations that affect our industry.

Seasonality

We did not experience significant seasonal variations in volume of LNG delivered to our customers during 2023, and we do not expect future volumes to be significantly impacted by seasonal variations. However, our revenues are susceptible to variations due to changes in the price of natural gas as we pass this cost onto our customer. The price of natural gas can fluctuate at any time during the year due to isolated factors, but on average, natural gas prices tend to be higher in peak winter and peak summer months when heating and cooling demand is seasonally higher.

Government Regulation and Environmental Matters

Stabilis is subject to a variety of federal, international, state, provincial and local laws and regulations relating to the environment, health and safety, labor and employment, building codes and construction, zoning and land use, public reporting and taxation, among others. Any changes to existing laws or regulations, the adoption of new laws or regulations, or failure by us to comply with applicable laws or regulations could result in significant additional expense to us or our customers or a variety of administrative, civil and criminal enforcement measures, any of which could have a material adverse effect on our business, reputation, financial condition and results of operations. Regulations that significantly affect our operating activities are described below. Compliance with these regulations has not had a material effect on our capital expenditures, earnings or competitive position to date, but new laws or regulations or amendments to existing laws or regulations to make them more stringent could have such an effect in the future. We cannot estimate the costs that may be required for us to comply with potential new laws or changes to existing laws, and these unknown costs are not contemplated by our existing customer agreements or our budgets and cost estimates. We believe that we are in compliance with all environmental and other governmental regulations. Our compliance has, to date, had no material effect on our capital expenditures, earnings, or competitive position.

Construction and Operation of LNG Liquefaction Plants. To build and operate LNG liquefaction plants, Stabilis must apply for facility permits or licenses that address many factors, including building codes, storm water and wastewater discharges, waste handling, and air emissions related to production activities and equipment operation. The construction of LNG plants must also be approved by local planning boards and fire departments.

Transportation of LNG. International, federal and state safety standards require that LNG is moved by qualified drivers in cryogenic containers designed for LNG transportation. Drivers are subject to U.S. Department of Transportation (“USDOT”) regulations, such as Federal Motor Carrier Safety Administration (“FMCSA”), Hazardous Materials Regulations, and state certification requirements, such as certifications by the Alternative Energy Division of the Railroad Commission of Texas. Cryogenic containers have to undergo annual USDOT visual inspections and periodic pressure tests. Motor vehicles equipped with an LNG container or other motor vehicles used principally for transporting LNG in portable containers in Texas have to be registered with the Railroad Commission of Texas.

Transfer of LNG. Transfer of LNG occurs between transport trailers, permanent and temporary facilities as well as marine facilities and vessels. Marine transfers can occur on the shore side to or from a vessel or from vessel to vessel. International, Federal, State and local safety standards and operational regulations require the transfer of LNG to be conducted in accordance with specific written safety standards and operational procedures. These procedures require that trained, qualified personnel be in attendance and manage all transfer operations.

Storage and Vaporization of LNG at Customer Sites. To install and operate both temporary and permanent storage and vaporization equipment, Stabilis may apply for permits or licenses that address many factors, including waste handling and air emissions related to onsite storage and equipment operation or consult with customers so they may apply for needed permits. The operation and siting of storage and vaporization of LNG may also require approval by local planning boards and fire departments.

Import & Export of LNG. During the third quarter of 2022, Stabilis received authorization from the DOE to export domestically produced LNG to all free trade ("FTA") and non-free trade ("non-FTA") countries, for up to 51.75 billion cubic feet per year (or approximately 1.0 MTPA) of natural gas equivalent. The authorization is for a term of 28 years, provided certain milestones of utilization are achieved. As of December 31, 2023, the Company has not made any exports under this approval and has not expended material funds nor entered into any sales commitments. For exports to non-FTA countries, the Company has two years from the date it received authorization with which to initiate exportation of LNG. For exports to FTA countries, the Company has five years from the date it received the authorization with which to initiate exportation of LNG.

The DOE authorization received during the third quarter of 2022 supplements the Company's existing other export license from the DOE, which authorizes the Company to import and export LNG from and to Canada and Mexico, via truck. In 2023, we delivered LNG to Mexico. In 2023, the Company did not deliver LNG to Canada.

Human Capital Resources

Stabilis believes that one of its key assets is the collective expertise, experience and diversity of its workforce. The Company depends on all of its employees, including its executive officers and senior management, to successfully operate its businesses and to successfully execute its strategy going forward. As of December 31, 2023, Stabilis had 104 employees, all of whom were full-time employees. We believe our relations with employees are satisfactory. None of our employees are currently subject to a collective bargaining agreement.

Stabilis seeks to attract and retain its employees by offering competitive compensation packages including base and incentive compensation, attractive benefits and opportunities for advancement and rewarding careers. The Company periodically reviews and adjusts, if needed, its employees’ compensation to ensure that it is competitive within the industry and is consistent with their level of performance. Stabilis considers employee benefits to be an important part of employee total compensation. For this reason, the Company’s benefits include insurance programs for medical, dental, vision, short- and long-term disability, accidental death and disability, and accident, as well as a 401(k) contribution retirement plan. The Company’s ability to attract employees is also significantly influenced by our efforts to create a culture of opportunity, personal growth, respect, collaboration and an appreciation of the diverse backgrounds, skills, and contributions that its employees offer.

Stabilis strives to provide its people with all of the tools and support necessary for them to succeed and safely perform their duties. The safety of its employees, contractors, customers and communities is paramount to the Company’s success. To ensure safe, reliable and efficient operations in a highly regulated environment, the Company supports and utilizes various employee training, educational programs as well as safety programs with detailed safety and health related procedures that all employees are required to follow.

Intellectual Property

The intellectual property portfolio of Stabilis and its subsidiaries includes patents and trademarks. The Company has a patent in the US, Canada and Mexico for the use of natural gas for well enhancement. The Company has two patents for rotary fluid processing systems and a US patent for a gas processing system. The last patent to expire in the U.S. will expire in July 2039, absent any adjustments or extensions. The Company has ten U.S. trademark registrations and one foreign trademark registration (Canada). The Company has no pending trademark applications.

Available Information

Stabilis’ principal executive office is located at 11750 Katy Freeway, Suite 900, Houston, Texas 77079. Our telephone number is 832-456-6500 and our website address is www.stabilis-solutions.com. We make our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, amendments to those reports and other information filed with or furnished to the SEC available, free of charge, through our website, as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC. The reference to Stabilis’ website is not intended to incorporate the information on the website into this report or any of our filings with the SEC. In addition, the SEC maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov. This annual report on Form 10-K, including all exhibits and amendments, has been filed electronically with the SEC.

Investing in shares of our common stock involves a high degree of risk. You should carefully consider the risks described below with all of the other information included in this report in evaluating an investment in our common stock. If any of the following risks were to occur, our business, financial condition, results of operations, and cash flows could be materially adversely affected. In that case, the trading price of our common stock could decline and you could lose all or part of your investment. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations.

Risks Related to Our Business

Our ability to implement our business strategy may be materially and adversely affected by many known and unknown factors.

Our business strategy relies upon our future ability to successfully market LNG to end-users, develop and maintain cost-effective logistics in our supply chain and construct, develop and operate energy-related infrastructure in North America. Our business strategy assumes that we will be able to expand our operations further in North America; enter into strategic, long-term purchase and supply contracts with end-users, power utilities, LNG providers, transportation companies, financing counterparties and other partners; acquire and transport LNG at attractive prices; continue to develop our logistics infrastructure into efficient and profitable operations; construct or acquire liquefaction facilities; obtain approvals from all relevant federal, international, state and local authorities, as needed, for the construction and operation of these projects; and obtain long-term capital appreciation and liquidity with respect to such investments. These assumptions are subject to significant economic, competitive, regulatory and operational uncertainties, contingencies and risks, many of which are beyond our control. We may also acquire operating businesses or other assets in the future to further our business strategy. Any such acquisitions would be subject to significant risks and contingencies, including the risk of integration, and we may not be able to realize the benefits of any such acquisitions.

Our future ability to execute our business strategy is uncertain, and it can be expected that one or more of the following factors will prove to be incorrect or that we will face unanticipated events and circumstances that may adversely affect our business which may adversely affect our financial condition, results of operations and ability to execute our business strategy:

| • |

failure to win new bids or contracts; |

| • |

failure to manage expanding operations in the projected time frame; |

| • |

inability to structure innovative and profitable energy-related transactions, maintain cost-effective logistics solutions and to optimally manage performance and counterparty risks; |

| • |

inability to attract and retain personnel in a timely and cost-effective manner as we are highly dependent on principal members of our management team and certain of our other employees. The loss of which could disrupt our operations, adversely impact the achievement of our objectives and increase our exposure to the other risks described herein; |

| • |

failure of investments in technology and machinery, such as liquefaction technology or LNG tank truck technology, to perform as expected; |

| • |

failure to maintain important pre-existing third-party relationships; |

| • |

increases in competition which could increase costs and undermine profits; |

| • |

inability to source LNG in sufficient quantities and/or at economically attractive prices; |

| • |

failure to anticipate and adapt to new trends in the energy sector in North America and elsewhere; |

| • |

increases in operating costs, including the need for capital improvements, insurance premiums, general taxes, real estate taxes and utilities, affecting our profit margins; |

| • |

inability to raise significant additional debt and equity capital in the future to implement our business strategy as well as to operate and expand our business; |

| • |

inflation, depreciation of the currencies of the countries in which we operate and fluctuations in interest rates; |

| • |

failure to obtain approvals from governmental regulators and relevant local authorities for the construction and operation of potential future projects and other relevant approvals; |

| • |

existing and future governmental laws and regulations as well as potential changes in regulatory, geopolitical, social, economic, tax or monetary policies and other factors within the areas we operate or intend to operate; or |

| • |

inability, or failure, of a significant customer to perform its contractual obligations for any reason, including nonpayment and nonperformance. |

Any failure to perform by our counterparties under agreements may adversely affect our operating results, liquidity and access to financing.

Our business involves our entering into various purchase and sale, hedging and other transactions with numerous third parties (commonly referred to as “counterparties”). In such arrangements, we are exposed to the performance and credit risks of our counterparties, including the risk that one or more counterparties fails to perform its obligation to make deliveries of commodities and/or to make payments. These risks may increase during periods of commodity price volatility. Defaults by suppliers and other counterparties may adversely affect our operating results, liquidity and access to financing.

Cyclical or other changes in the demand for and price of LNG and natural gas may adversely affect our business and the performance of our customers which could have a material adverse effect on our business, contracts, financial condition, operating results, cash flows, liquidity and ability to execute our strategy.

Our business generally is based on assumptions about the future availability and price of natural gas and LNG markets. Natural gas and LNG prices have at various times been and may become volatile due to one or more of the following factors:

| • |

changes in supplies of, demand for, and prices for, alternative energy sources such as coal, oil, nuclear, hydroelectric, wind and solar energy, which may reduce the demand for natural gas; |

| • |

weather conditions and natural disasters; |

| • |

reduced demand and lower prices for natural gas; |

| • |

increased natural gas production deliverable by pipelines, which could suppress demand for LNG; |

| • |

decreased oil and natural gas exploration activities, which may decrease the production of natural gas, or decrease the demand for LNG used in the oil and gas exploration and production process; |

| • |

changes in regulatory, tax or other governmental policies or requirements regarding imported or exported LNG, natural gas or alternative energy sources, which may reduce the demand for imported or exported LNG and/or natural gas; |

| • |

political conditions in natural gas producing regions; and |

| • |

imposition of tariffs by other countries on imports of LNG from the United States. |

Adverse trends or developments affecting any of these factors could result in decreases in the prices at which we are able to sell LNG and natural gas and related services or increases in the prices we have to pay for natural gas or LNG, which could materially and adversely affect the performance of our customers, and could have a material adverse effect on our business, contracts, financial condition, operating results, cash flows, liquidity and ability to execute our strategy.

Operation and/or construction of our LNG infrastructure, liquefaction and other facilities involves significant risks.

The operation of our LNG infrastructure, liquefaction and other facilities involve particular, significant risks that could involve interruption of our operations, including, among others: performing below expected levels of efficiency, breakdowns or failures of equipment, operational errors by trucks, operational errors by us or any contracted facility operator, industrial accidents, labor disputes and weather-related or natural disasters. Additional risks include, but are not limited to: failure to maintain the required license(s) or other permits required to operate our plants; failure in health and safety performance and management of health and safety risks; failure to comply with applicable laws and regulations, including environmental laws and regulations; failure to properly manage environmental risks, including pollution, contamination, and exposure to hazardous materials; the inability, or failure, of any counterparty to any plant-related agreements to perform their contractual obligations to us and planned and unplanned power outages due to maintenance, expansion and refurbishment. We cannot assure you that future occurrences of any of the events listed above or any other events of a similar or dissimilar nature would not significantly decrease or eliminate the revenues from, or significantly increase the costs of operating expenses related to our LNG infrastructure, liquefaction or other operation which could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and ability to execute of our strategy.

Any failure in health and safety performance from our operations may result in an event that causes personal harm or injury to our employees, other persons, and/or the environment, as well as the imposition of injunctive relief and/or penalties for non-compliance with relevant regulatory requirements or litigation. Such a failure, or a similar failure elsewhere in the energy industry (including, in particular, LNG liquefaction, storage, transportation or regasification operations), could generate public concern, which may lead to new laws and/or regulations that would impose more stringent requirements on our operations, have a corresponding impact on our ability to obtain permits and approvals, and otherwise jeopardize our reputation or the reputation of our industry as well as our relationships with relevant regulatory agencies and local communities. Individually or collectively, these developments could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and ability to execute our strategy.

The construction and expansion of energy-related infrastructure, including liquefaction facilities, as well as other future projects, involves numerous operational, regulatory, environmental, political, legal and economic risks beyond our control and may require the expenditure of significant amounts of capital during construction and thereafter. These potential risks include, among other things, the following:

| • |

we may be unable to complete construction projects on schedule or at the budgeted cost due to the unavailability of required construction personnel or materials, inability obtain key permits or land use approvals including those required under environmental laws, occurrence of accidents or weather conditions, changes in regulatory requirements or challenges by citizens groups or non-governmental organizations, including those opposed to fossil fuel energy sources; |

| • |

we will not receive any material increase in operating cash flows until a project is completed, even though we may have expended considerable funds during the construction phase, which may be prolonged; |

| • |

we may construct facilities to capture anticipated future energy consumption growth in a region in which such growth does not materialize; and |

| • |

the completion or success of our construction project may depend on the completion of a third-party construction project that we do not control and that may be subject to numerous additional potential risks, delays and complexities. |

Our insurance may be insufficient to cover losses that may occur to our property or result from our operations.

Our current operations and future projects are subject to the inherent risks associated with the operation of LNG infrastructure as well as liquefaction and other facilities including explosions, pollution, release of toxic substances, fires, seismic events, hurricanes and other adverse weather conditions, and other hazards, each of which could result in significant delays in commencement or interruptions of operations and/or result in damage to or destruction of our facilities and assets or damage to persons and property. In addition, such operations and the modes of transport of third parties on which our current operations and future projects may be dependent face possible risks associated with acts of aggression or terrorism. Some of the regions in which we operate are affected by hurricanes or tropical storms. We do not, nor do we intend to, maintain insurance against all of these risks and losses. In particular, we do not carry business interruption insurance for hurricanes and other natural disasters. Therefore, the occurrence of one or more significant events not fully insured or indemnified against could create significant liabilities and losses which could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and ability to execute our strategy. In addition, our insurance may be voidable by the insurers as a result of certain of our actions.

We maintain insurance against certain risks and losses; however, the occurrence of a significant event that is either uninsured or not fully insured or indemnified against could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and ability to execute our strategy. Further, we may be unable to procure adequate insurance coverage at commercially reasonable rates in the future.

Existing and future environmental, health and safety laws and regulations could result in increased compliance costs or additional operating costs or construction costs and restrictions.

Our business is now and will in the future be subject to extensive federal, international, state and local laws and regulations both in the United States and in other jurisdictions where we operate that regulate and restrict, among other things, the siting and design of our facilities, discharges to air, land and water, the handling, storage and disposal of hazardous materials, and remediation associated with the release of hazardous substances. Many of the federal and state laws with respect to these impose liability, without regard to fault or the lawfulness of the original conduct. As the owner and operator of our facilities and as generators of and arrangers for the transport and disposal of regulated wastes, we could be liable for the costs of cleaning up any such hazardous substances that may be released into the environment at or from our facilities or facilities to which wastes or hazardous substances were transported or disposed, for resulting damage to natural resources, and for certain health studies. We are also subject to laws, regulations regulatory permits, approvals and authorizations, including, but not limited to:

The Clean Air Act (“CAA”) and Clean Water Act (“CWA”), and analogous state laws and regulations that restrict or prohibit the types, quantities and concentration of substances that can be emitted or discharged into the environment in connection with the construction and operation of our facilities which may also require us to obtain and maintain permits and provide governmental authorities with access to our facilities for inspection and reports related to compliance.

The Resource Conservation and Recovery Act (“RCRA”) and analogous state laws which may impose detailed requirements for the generation, handling, storage, processing, treatment and disposal of nonhazardous and hazardous solid wastes. Wastes listed as hazardous wastes or that have hazardous characteristics are subject to more stringent requirements than those considered nonhazardous.

The Occupational Safety and Health Act (“OSHA”) and comparable state statutes whose purpose is to protect the health and safety of workers.

The Emergency Planning and Community Right-to-Know Act, the general duty clause and Risk Management Planning regulations promulgated under section 112(r) of the CAA and comparable state statutes and any implementing regulations that require recordkeeping and disclosure of information about hazardous materials used or produced in our operations and require that this information be provided to employees, state and local governmental authorities and citizens. These laws also require the development of risk management plans for certain facilities to prevent accidental releases of extremely hazardous substances and to minimize the consequences of such releases should they occur.

Pipeline Hazardous Materials Safety Administration (“PHMSA”). PHMSA has promulgated detailed regulations governing LNG facilities under its jurisdiction to address LNG facility siting, design, construction, equipment, operations, maintenance, personnel qualifications and training, fire protection and security. State and local regulators can impose similar siting, design, construction and operational requirements. Additional approvals of the Department of Energy (“DOE”) may be required under Section 3 of the Natural Gas Act (“NGA”). Certain federal permitting processes may trigger the requirements of the National Environmental Policy Act (“NEPA”), which requires federal agencies to evaluate major agency actions that have the potential to significantly impact the environment. We also must comply with foreign regulations regarding to the extent we transport LNG within Canada and Mexico.

Greenhouse Gases/Climate Change. From time to time, there may be federal and state regulatory and policy initiatives to reduce green house ("GHG") emissions in the United States from a variety of sources. Other federal and state initiatives are being considered or may be considered in the future to address GHG emissions through, for example, United States treaty commitments or other international agreements, direct regulation, a carbon emissions tax, or cap-and-trade programs. For example, the U.S. recommitted to the Paris Agreement, an international treaty with the goal of limiting global warming to below 2 degrees Celsius as compared to pre-industrial levels. The Environmental Protection Agency (“EPA”) has adopted regulations for reporting and controlling GHG emissions from certain air emissions sources under its existing authority under the CAA, and may adopt more stringent regulations in the future. In addition, some states and foreign jurisdictions have individually or in regional cooperation, imposed restrictions on GHG emissions under various policies and approaches, including establishing a cap on emissions, requiring efficiency measures, or providing incentives for pollution reduction, use of renewable energy sources, or use of replacement fuels with lower carbon content.

The adoption and implementation of any U.S. federal, state or local regulations or foreign regulations imposing obligations on, or limiting emissions of GHGs from, our equipment and operations could require us to incur significant costs to reduce emissions of GHGs associated with our operations or could adversely affect demand for natural gas and natural gas products. The potential increase in our operating costs could include new costs to operate and maintain our facilities, permit our facilities, install new emission controls on our facilities, acquire allowances to authorize our GHG emissions, pay taxes related to our GHG emissions, and administer and manage a GHG emissions program. We may not be able to recover such increased costs through increases in customer prices or rates. In addition, changes in regulatory policies that result in a reduction in the demand for hydrocarbon products that are deemed to contribute to GHGs, or restrict their use, may reduce volumes available to us for processing, transportation, marketing and storage. These developments could have a material adverse effect on our financial position, results of operations and cash flows.

Fossil Fuels. Our business activities depend upon a sufficient and reliable supply of natural gas feedstock, and are therefore subject to concerns in certain sectors of the public about the exploration, production and transportation of natural gas and other fossil fuels and the consumption of fossil fuels more generally. Legislative and regulatory action, and possible litigation, in response to such public concerns may also adversely affect our operations. We may be subject to future laws, regulations, or actions to address such public concern with fossil fuel generation, distribution and combustion, GHGs and the effects of global climate change. Our customers may also move away from using fossil fuels such as LNG for their power generation needs for reputational or perceived risk-related reasons. These matters represent uncertainties in the operation and management of our business, and could have a material adverse effect on our financial position, results of operations and cash flows.

Failure to comply with any of the above laws and regulations or any other future legislation and regulations could lead to substantial liabilities, fines and penalties or capital expenditures related to pollution control equipment and restrictions or curtailment of operations, which could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, and ability to execute our strategy. Further, we cannot control the outcome of any review and approval process, including whether or when any such permits, approvals and authorizations will be obtained, the terms of their issuance, or possible appeals or other potential interventions by third parties, that could interfere with our ability to obtain and maintain such permits, approvals and authorizations or the terms thereof. Accordingly, there is no assurance that we will timely obtain and maintain these governmental permits, approvals and authorizations on favorable terms, or at all. Failure to obtain and maintain any of these permits, approvals or authorizations could have a material adverse effect on our business, financial condition, operating results, cash flows and ability to execute our strategy.

Global climate change may in the future increase the frequency and severity of weather events and the losses resulting therefrom, which could have a material adverse effect on the economies in the markets in which we operate or plan to operate in the future and therefore on our business.

Over the past several years, changing weather patterns and climatic conditions have added to the unpredictability and frequency of natural disasters in certain parts of the world, including the markets in which we operate and intend to operate, and have created additional uncertainty as to future trends. There is a growing consensus today that climate change increases the frequency and severity of extreme weather events and, in recent years, the frequency of major weather events appears to have increased. We cannot predict whether or to what extent damage that may be caused by natural events, such as severe tropical storms and hurricanes, will affect our operations or the economies in our current or future market areas, but the increased frequency and severity of such weather events could increase the negative impacts to economic conditions in these regions and result in a decline in the value or the destruction of our liquefiers and downstream facilities or affect our ability to transport LNG. In particular, if one of the regions in which we operate is impacted by such a natural catastrophe in the future, it could have a material adverse effect on our business. Further, the economies of such impacted areas may require significant time to recover and there is no assurance that a full recovery will occur. Even the threat of a severe weather event could impact our business, financial condition or the price of our common stock.

Other natural or man-made disasters could result in an interruption of our operations, a delay in the completion of future facilities, higher construction costs or the deferral of the dates on which payments are due under our customer contracts, all of which could adversely affect us.

Other disasters such as explosions, fires, seismic events, floods or accidents, could result in damage to, or interruption of operations in our supply chain, including at our facilities or related infrastructure, as well as delays or cost increases in the construction and the development of our proposed facilities or other infrastructure.

If one or more trailers, terminals, pipelines, facilities, equipment or electronic systems that we own, lease or operate or that deliver products to us or that supply our facilities and our customers’ facilities are damaged by a natural or other disaster, accident, catastrophe, terrorist or cyber-attack or event, our operations could be significantly interrupted. These delays and interruptions could involve significant damage to people, property or the environment, and repairs could take a week or less for a minor incident to six months or more for a major interruption. Any event that interrupts the revenues generated by our operations, or that causes us to make significant expenditures not covered by insurance, could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and ability to execute our strategy.

We expect to be dependent on contractors for the successful completion of our energy-related infrastructure.

Timely and cost-effective completion of energy-related infrastructure, including liquefaction facilities, as well as future projects, in compliance with agreed specifications is central to our business strategy and is highly dependent on the performance of our contractors. The ability of our contractors to perform successfully under their agreements with us is dependent on a number of factors, including the contractor’s ability to:

| • |

design and engineer each of our facilities to operate in accordance with specifications; |

| • |

engage and retain third-party subcontractors and procure equipment and supplies; |

| • |

respond to difficulties such as equipment failure, delivery delays, schedule changes and failures to perform by subcontractors, some of which are beyond their control; |

| • |

attract, develop and retain skilled personnel, including engineers; |

| • |

post required construction bonds and comply with the terms thereof; |

| • |

manage the construction process generally, including coordinating with other contractors and regulatory agencies; and |

| • |

maintain their own financial condition, including adequate working capital. |

Until we have entered into an Engineering, Procurement and Construction (“EPC”) contract for a particular project, in which the EPC contractor agrees to meet our planned schedule and projected total costs for a project, we are subject to potential fluctuations in construction costs and other related project costs. Although some agreements may provide for liquidated damages if the contractor fails to perform in the manner required with respect to certain of its obligations, the events that trigger a requirement to pay liquidated damages may delay or impair the operation of the applicable facility, and any liquidated damages that we receive may be delayed or insufficient to cover the damages that we suffer as a result of any such delay or impairment. The obligations of our primary building contractor and other contractors to pay liquidated damages under their agreements with us are subject to caps on liability, as set forth therein. Furthermore, we may have disagreements with our contractors about different elements of the construction process, which could lead to the assertion of rights and remedies under our contracts and increase the cost of the applicable facility or result in a contractor’s unwillingness to perform further work. If any contractor is unable or unwilling to perform according to the negotiated terms and timetable of its respective agreement for any reason or terminates its agreement for any reason, we would be required to engage a substitute contractor, which could be particularly difficult in certain of the markets in which we operate or plan to operate. This would likely result in significant project delays and increased costs, which could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and ability to execute our strategy. Additionally, in certain instances, we may be jointly and severally liable for our contractor's actions or contract performance.

We may not be able to purchase or receive physical delivery of natural gas in sufficient quantities and/or quality or at economically attractive prices to satisfy our delivery obligations under our commercial agreements, which could have a material adverse effect on our business.

We may not be able to purchase or receive physical delivery of sufficient quantities and/or quality of LNG or natural gas to satisfy delivery obligations either for our own liquefaction facilities or third party LNG suppliers, or both, which may provide customers with the right to terminate our commercial agreements. In addition, price fluctuations in natural gas and LNG may make it expensive or uneconomical for us to acquire adequate supply of these items. If LNG were to become unavailable for current or future volumes of natural gas due to repairs or damage to supplier facilities or pipelines, lack of capacity or any other reason, our ability to continue delivering natural gas to end-users could be restricted, thereby reducing revenues. Any permanent interruption at any key LNG supply chains that causes a material reduction in volumes could have a material adverse effect on our business, financial condition, operating results, cash flow, liquidity and ability to execute our strategy.

We face competition based upon market price for LNG or natural gas.

Our business is subject to the risk of natural gas and LNG price competition which may prevent us from entering into new or replacement customer contracts on economically comparable terms to existing customer contracts, or at all which could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and ability to execute our strategy. Factors which may negatively affect potential demand for LNG from our business are diverse and include, among others:

| • |

increases in worldwide LNG production capacity and availability of LNG for market supply; |

| • |

increases or decreases in the cost of LNG; |

| • | decreases in the cost of competing sources of natural gas, LNG or alternate fuels such as coal, heavy fuel oil and diesel; and |

| • | displacement of LNG or fossil fuels more broadly by alternate fuels or energy sources or technologies (including but not limited to nuclear, wind, solar, biofuels and batteries) in locations where access to these energy sources is not currently available or prevalent. |

Decreased demand for natural gas may result in significant price competition and decrease the prices we are able to charge, which would have a material adverse effect on our results of operations, financial condition and ability to execute our strategy.

Technological innovation may render our processes obsolete.

The success of our current operations and future projects will depend in part on our ability to create and maintain a competitive position in the natural gas liquefaction industry. Although we plan to utilize proven technologies such as those currently in operation at our George West and Port Allen liquefiers, we do not have any exclusive rights to any of these technologies. In addition, such technologies may be rendered obsolete or uneconomical by legal or regulatory requirements, technological advances, more efficient and cost-effective processes or entirely different approaches developed by one or more of our competitors or others. Failure to keep up with the pace of technological innovation could materially and adversely affect our business, ability to realize benefits from future projects, results of operations, financial condition, liquidity and ability to execute our strategy.

Changes in legislation and regulations could have a material adverse impact on our business, results of operations, financial condition, liquidity and ability to execute our strategy.

Our business is subject to governmental laws, rules, and regulations, and requires permits that impose various restrictions and obligations that may have material effects on our results of operations. Future legislation and regulations or changes in existing legislation and regulations, or interpretations thereof, such as those relating to the liquefaction, storage, or regasification of LNG, or its transportation, exportation, or importation could cause additional expenditures, restrictions and delays in connection with our operations as well as other future projects, the extent of which cannot be predicted and which may require us to limit substantially, delay or cease operations in some circumstances. Revised, reinterpreted or additional laws and regulations that result in increased compliance costs or additional operating costs and restrictions could have an adverse effect on our business, results of operations, financial condition, liquidity and execution of our strategy.

We use third party LNG transportation providers that are subject to various trucking safety regulations, including those which are enacted, reviewed and amended by the Federal Motor Carrier Safety Administration (“FMCSA”). These regulatory authorities exercise broad powers, governing activities such as the authorization to engage in motor carrier operations, driver licensing, insurance requirements, financial reporting and review of certain mergers, consolidations and acquisitions, and transportation of hazardous materials. All federally regulated carriers’ safety ratings are measured through a program implemented by the FMCSA known as the Compliance Safety Accountability (“CSA”) program which measures a carrier’s safety performance. The quantity and severity of any violations are compared to a peer group of companies of comparable size and annual mileage. If a company rises above a threshold established by the FMCSA, it is subject to action from the FMCSA and ultimately revocation of the company’s operating authority if the issues are not corrected. To a large degree, intrastate motor carrier operations are subject to state and/or local safety regulations that mirror federal regulations but also regulate the weight and size dimensions of loads. Applicable regulatory requirements and limitations are subject to change, either through new regulations enacted on the federal, state or local level, or by new or modified regulations that may be implemented under existing law. Any changes in trucking operations due to changes in regulations or loss of a LNG transportation provider could have an adverse effect on our business, results of operations, financial condition, liquidity and execution of our strategy.

Some of our competitors have greater financial, technological and other resources than we currently possess.

We plan to operate in the highly competitive area of LNG production and face intense competition from independent, technology-driven companies as well as from both major and other independent oil and natural gas companies. Some of these competitors have longer operating histories, have secured access to, or are pursuing development or acquisition of LNG facilities in North America, have more development experience, greater name recognition, larger staffs and substantially greater financial, technical and marketing resources than we currently possess. We also face competition for the contractors needed to build our facilities. The superior resources that some of these competitors have available for deployment could allow them to compete successfully against us, which could have a material adverse effect on our business, ability to realize benefits from future projects, results of operations, financial condition, liquidity and ability to execute our strategy.

Failure of LNG to be a competitive source of energy in the markets in which we operate, and seek to operate, could adversely affect our expansion strategy.