Exhibit 99.1

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2020

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________to_________

Commission File Number

000-23115

YUNHONG CTI LTD.

(Exact name of registrant as specified in its charter)

|

Illinois |

36-2848943 |

|

|

(State or other jurisdiction of |

(I.R.S. Employer Identification No.) |

|

|

incorporation or organization) |

||

|

22160 N. Pepper Road |

||

|

Lake Barrington, Illinois |

60010 |

|

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (847) 382-1000

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Ticker symbol(s) |

Name of each exchange on which registered |

|

Common Stock, no par value per share |

CTIB |

The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐ |

Accelerated filer ☐ |

Non-accelerated filer ☐ |

Smaller Reporting Company ☑ |

Emerging Growth Company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

Based upon the closing price of $2.60 per share of the Registrant’s Common Stock as reported on NASDAQ Capital Market tier of The NASDAQ Stock Market on June 30, 2020, the aggregate market value of the voting common stock held by non-affiliates of the Registrant was then approximately $5,866,000. (The determination of stock ownership by non-affiliates was made solely for the purpose of responding to the requirements of the Form and the Registrant is not bound by this determination for any other purpose.)

The number of shares outstanding of the Registrant’s Common Stock as of April 12, 2021 was 5,886,750(excluding treasury shares).

DOCUMENTS INCORPORATED BY REFERENCE

The Registrant’s definitive Proxy Statement for the Annual Meeting of Stockholders (the “2021 Proxy Statement”) is incorporated by reference in Part III of this Form 10-K to the extent stated herein. The 2021 Proxy Statement, or an amendment to this Form 10-K, will be filed with the SEC within 120 days after December 31, 2020. Except with respect to information specifically incorporated by reference in this Form 10-K, the Proxy Statement is not deemed to be filed as a part hereof.

INDEX

FORWARD LOOKING STATEMENTS

|

Part I |

||

|

Item No. 1 |

1 |

|

|

Item No. 1B |

6 |

|

|

Item No. 2 |

7 |

|

|

Item No. 3 |

7 |

|

|

Part II |

||

|

Item No. 5 |

7 |

|

|

Item No. 7 |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

8 |

|

Item No. 7A |

Quantitative and Qualitative Disclosures Regarding Market Risk |

13 |

|

Item No. 8 |

13 |

|

|

Item No. 9 |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

13 |

|

Item No. 9A |

13 |

|

|

Item No. 9B |

14 |

|

|

Part III |

||

|

Item No. 10 |

14 |

|

|

Item No. 11 |

18 |

|

|

Item No. 12 |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

20 |

|

Item No. 13 |

22 |

|

|

Item No. 14 |

22 |

|

|

Part IV |

||

|

Item No. 15 |

22 |

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes both historical and “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. We have based these forward-looking statements on our current expectations and projections about future results. Words such as “may,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” or similar words are intended to identify forward-looking statements, although not all forward-looking statements contain these words. Although we believe that our opinions and expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements, and our actual results may differ substantially from the views and expectations set forth in this Annual Report on Form 10-K. We disclaim any intent or obligation to update any forward-looking statements after the date of this Annual Report on Form 10-K to conform such statements to actual results or to changes in our opinions or expectations. These forward-looking statements are affected by factors, risks, uncertainties and assumptions that we make, including, without limitation, our participation in highly competitive markets, potential changes in the cost or availability of raw materials, our dependence on a limited number of suppliers, the possible inability to obtain an adequate supply of raw materials, our reliance on a limited number of key customers, the loss of one or more of our key customers, changing consumer demands, developments or changes in technology, risks of international operations and political environments, dependence on our intellectual property, compliance with federal, state or local regulations, the resolution of litigation or other legal proceedings to which we may become involved, restrictions included in the Company’s credit facility, the availability of funds under the Company’s credit facility, damage to or destruction of one or both of the Company’s principal plants, our ability to service our indebtedness, our ability to invest in needed plant or equipment.

PART I

Business Overview

We develop, produce, distribute and sell a number of consumer products throughout the United States and in over 30 other countries, and we produce film products for commercial and industrial uses in the United States. Many of our products utilize flexible films and, for a number of years, we have been a leading developer of innovative products which employ flexible films including novelty balloons, pouches and films for commercial packaging applications.

Our principal lines of products include:

Novelty Products consisting principally of foil and latex balloons and other inflatable toy items; and

Flexible Films for food and other commercial and packaging applications.

In addition to these principal product lines, for the past several years, we have engaged in (i) the assembly and sale of Candy Blossoms (small gift bouquets of arranged candy items often including ribbons and/or a small foil balloon), and (ii) the distribution of party goods products in Mexico.

We leverage our technology to design and develop proprietary products which we develop, market and sell for our customers. We have been engaged in the business of developing flexible film products for over 40 years and have acquired significant technology and know-how in that time. We currently hold several patents related to flexible film products, including specific films, zipper closures, valves and other features of these products.

We print, process and convert flexible film into finished products and we produce latex balloons and novelty items. Our principal production processes include:

|

● |

Coating and laminating rolls of flexible film. Generally, we adhere polyethylene film to another film such as nylon or polyester; |

|

● |

Printing film and latex balloons. We print both plastic and latex films, with a variety of graphics, for use as packaging film or for balloons; |

|

● |

Converting printed film to balloons; |

|

● |

Converting film to flexible containers; |

|

● |

Producing latex balloons and other latex novelty items; and |

|

● |

Assembling and inflating of novelty products and balloons and Candy Blossoms. |

In 1978, we began manufacturing metalized balloons (often referred to as "foil" balloons), which are balloons made of a base material (usually nylon or polyester) often having vacuum deposited aluminum and polyethylene coatings. These balloons remain buoyant when filled with helium for much longer periods than latex balloons and permit the printing of graphic designs on the surface. In 1985, we began marketing latex balloons and, in 1988, we began manufacturing latex balloons. In 1999, we acquired an extrusion coating and laminating machine and began production of coated and laminated films, which we have produced since that time.

For more than 20 years, we have been engaged in the coating, laminating and printing of flexible films for our novelty and container products and for the production of laminated and printed films we supply to others.

We market and sell our foil and latex balloons and related novelty items throughout the United States, Canada and Mexico and in a number of other countries in Latin America and Europe. We supply directly to retail stores and chains and through distributors, who in turn sell to retail stores and chains. Our balloon and novelty products are sold to consumers through a wide variety of retail outlets including general merchandise, discount and drugstore chains, grocery chains, card and gift shops and party goods stores, as well as through florists and balloon decorators.

Most of our foil balloons contain printed characters, designs and social expression messages, such as “Happy Birthday,” “Get Well” and similar items. We may obtain licenses from time to time for well-known characters and print those characters and messages on our balloons.

We provide customized laminated films and printed films to customers who utilize the film to produce bags or pouches for the packaging of food, liquids and other items. In 2014, we began assembling and producing Candy Blossoms - containers including candy items and, at times, air-inflated balloons. In 2015, we commenced the distribution of party goods in Mexico.

In 2020, our revenues from our product lines, as a percent of total revenues were:

|

● |

Novelty Products |

82% of revenues | |

|

● |

Flexible Film Products |

3% of revenues | |

|

● |

Candy Blossoms |

12% of revenues | |

|

● |

Other Products |

3% of revenues |

We are an Illinois corporation with our principal offices and plant at 22160 N. Pepper Road, Lake Barrington, Illinois.

Business Strategies and Developments

Our business strategies, and recent developments related to our business, include:

|

● |

Management. During December 2019, Mr. Jeffrey Hyland, retired from his roles as President and Chief Executive Officer with the Company for personal reasons. The then Chief Financial Officer, Mr. Frank Cesario, who joined CTI during 2017, became both President and Chief Executive Officer. During 2020 we changed our name to Yunhong CTI Ltd., as we received a significant investment from LF International Pte, Ltd. Mr. Yubao Li, Chairman of the Yunhong China Group, became a director and then Chairman of Yunhong CTI Ltd. He replaced Mr. Cesario in September 2020 as Chief Executive Officer, at which time Mr. Cesario retired from the Company as an officer. During 2020 Ms. Jana Schwan became our Chief Operating Officer after having served as Vice President of Operations and a number of other roles during her nearly 20 years with the Company, and Ms. Jennifer Connerty became our Chief Financial Officer after having served as Controller since 2018. |

|

● |

Financing. During 2018 and 2019 we had multiple events of default with our primary lender, resulting in the Company incurring a variety of penalties and fees. In addition, the Company had to enter into several forbearance agreements, pursuant to which the lender agreed to not take action against the Company for its default. During 2020 we entered into several individual securities purchase agreements with certain accredited investors for the purchase of shares of our Series A and B Convertible Preferred Stock. We sold Series C Convertible Preferred Stock during January 2021. |

|

● |

Strategy. Our management determined to focus on achieving growth and profitability within the current scope of our core product lines – foil balloons and related products – from our United States based business. We reviewed our operations and, during 2019, decided to sell or liquidate our subsidiaries in the UK and Europe, and attempted to sell our subsidiary in Mexico in early 2020 and it was ultimately not successful at the time due to the Covid-19 pandemic. In an effort to increase profitability, we announced an intention to relocate our warehousing and light assembly facility from Lake Zurich, IL to Laredo, TX during 2020. Due to certain factors including the Covid-19 pandemic, we instead relocated this facility to Elgin, IL during March 2021. |

|

● |

Focus on our Core Assets and Expertise. We have been engaged in the development, production and sale of film and container products for 40 years and have developed assets, technology and expertise which, we believe, enable us to develop, manufacture, purchase, market and sell innovative products of high quality within our areas of knowledge and expertise. We plan to focus our efforts on these core assets and areas of expertise – film novelty products, specialty film products, laminated films and printed films – to develop new products, to market and sell our products and to build our revenues. |

|

● |

Develop New Products, Product Improvements and Technologies. We engage in research, design, innovation and development for the purpose of developing and improving products, materials, methods and technologies within our core product categories. We work to develop and identify new products, to improve existing products and to develop new technologies within our core product areas in order to enhance our competitive position and increase our sales. We seek to leverage our technology to develop innovative and proprietary products. In our novelty product lines, our development work includes new designs, new character licenses, new product developments, new materials and improved production methods. We work with customers to develop custom film products which serve the unique needs or requirements of the customer. |

|

● |

Develop New Channels of Distribution and New Sales Relationships. We seek to organically develop new channels of distribution and new sales relationships, both for existing and new products. Over the past several years, we have developed new distributors and customers for our products in the United States and in Europe, Mexico, Latin America and Australia. |

|

● |

Product and Line Extensions. We intend to pursue new product lines and product line extensions, through internal developments. |

Products

Foil Balloons. We have designed, produced and sold foil balloons since 1979 and, we believe, are approximately the second largest manufacturer of foil balloons in the United States. Currently, we produce several hundred foil balloon designs, in different shapes and sizes.

In addition to size and shape, a principal element of our foil balloon products is the printed design or message contained on the balloon. These designs may include figures and licensed characters, but frequently are of our own design. We recognize that consumer trends and preferences, and competing products, are constantly changing. In order to compete effectively in this product line we must constantly innovate and develop new designs, shapes and products.

Latex Balloons. Through our subsidiary in Guadalajara, Mexico, Flexo Universal, S. de R.L. de C.V. (“Flexo Universal”), we manufacture latex balloons in a wide variety of sizes and colors. Many of these balloons are marketed under the name Partyloons® and balloons are also marketed on a private label basis. We also manufacture toy balloon products including punch balls, water bombs and "Animal Twisties."

Packaging Films and Custom Film Products. A large and increasing number of both consumer and commercial products are packaged in pouches or containers utilizing flexible films. Often such containers include printed labels and designs. We produce and sell films that may be utilized for the packaging of a wide variety of products and liquids. We laminate, extrusion coat and adhesive coat flexible films for these purposes and we provide flexographic printing for the films we produce. We can produce a variety of customized film products, and printing services, to meet the specific packaging needs of a wide variety of customers.

Other Products. In 2014, we began assembly and sale of our Candy Blossom product line. We have since supplemented this product line with related products.

Markets

Foil Balloons

The foil balloon came into existence in the late 1970s. During the 1980s, the market for foil balloons grew rapidly. Initially, the product was sold principally to individual vendors, small retail outlets and at fairs, amusement parks, shopping centers and other outdoor facilities and functions. Foil balloons remain buoyant when filled with helium for extended periods of time and they permit the printing and display of graphics and messages. As a result, the product has significant appeal as a novelty and message item. Foil balloons became part of the "social expression" industry, carrying graphics designs, characters and messages like greeting cards. In the mid-1980s, we and other participants in the market began licensing character and cartoon images for printing on the balloons and directed marketing of the balloons to retail outlets including grocery, general merchandise, discount and drug store chains, card and gift shops, party goods stores as well as florists and balloon decorators. These outlets now represent the principal means for the sale of foil balloons throughout the United States and in a number of other countries, although individual vendors remain a means of distribution in a number of areas.

Foil balloons are now sold in virtually every region of the world. The United States, however, remains the largest market for these products.

Foil balloons are sold in the United States and foreign countries directly by producers to retail outlets and through distributors and wholesalers. Often the sale of foil balloons by the wholesalers/distributors is accompanied by related products including latex balloons, floral supplies, candy containers, mugs, plush toys, baskets and a variety of party goods.

Latex Balloons

For a number of years, latex balloons and related novelty/toy latex items have been marketed and sold throughout the United States and in many other countries. Latex balloons are sold as novelty/toy items for decorative purposes, as part of floral designs and as party goods and favors. In addition to standard size and shape balloons, inflatable latex items include punch balls, water bombs, balloons to be twisted into shapes, and other specialty designs. Often, latex balloons include printed messages or designs.

Latex balloons are sold principally in retail outlets, including party goods stores, general merchandise stores, discount chains, gift stores and drugstore chains. Latex balloons are also purchased by balloon decorators and floral outlets for use in decorative or floral designs. Printed latex balloons are sold both in retail outlets and for balloon decoration purposes including floral designs.

Latex balloons are sold both through distributors and directly to retail outlets by the producers.

Printed and Specialty Films

The industry and market for printed and specialty films are fragmented and include many participants. There are hundreds of manufacturers of printed and specialty film products in the United States and in other markets. In many cases, companies who provide food and other products in film packages also produce or process the films used for their packages. The market for the Company's film products consists principally of companies who utilize the films for the packaging of their products, including food products and other items, usually by converting the film to a flexible container.

Marketing, Sales and Distribution

Balloon Products

We work in collaboration with our customers on designs, promotions, and other elements of marketing and selling. Our customers are typically retailers who sell our products to individual consumers. These relationships generally can be terminated unilaterally by our customers. We must maintain good relationships with our customers if this sales model is to be successful.

We market and sell our foil balloon, latex balloon and related novelty products throughout the United States and in a number of other countries. We maintain marketing, sales and support staff and a customer service department in the United States. We sell directly to foreign customers from the United States on a limited basis, and seek to engage distributors in the UK and Europe in the future. Flexo Universal, our subsidiary in Mexico, conducts sales and marketing activities for the sale of balloon products in Mexico, Latin America, and certain other markets.

We sell and distribute our balloon products (i) through our sales staff and customer service personnel in the United States, (ii) through a network of distributors and wholesalers, (iii) through several groups of independent sales representatives, and (iv) to retail chains. Our balloon products are generally sold through retail outlets including grocery, general merchandise and drug store chains, card and gift shops, party goods stores as well as florists and balloon decorators.

We engage in a variety of advertising and promotional activities to promote the sale of our balloon products. We produce a complete catalog of our balloon products, and also prepare various flyers and brochures for special or seasonal products, which we disseminate to thousands of customers, potential customers and others. We participate in several trade shows for the gift, novelty, balloon and other industries and advertise in several trade and other publications. We maintain websites which show images of our products.

Printed and Specialty Films

We market and sell printed and laminated films directly and through independent sales representatives throughout the United States. We sell laminated and printed films to companies that utilize these films to produce packaging for a variety of products, including food products, in both solid and liquid form, such as cola syrup, coffee, juices and other items. We seek to identify and maintain customer relationships in which we provide added value in the form of technology or systems.

Other Products

Other products are sold by our internal sales force directly to customers and also by independent sales representatives. These products are generally sold directly to consumers or to retail outlets.

Production and Operations

We conduct our operations at our facilities including: (i) our 68,000 square feet facility in Lake Barrington, Illinois, incorporating our headquarters office, production and warehouse space, (ii) our 118,000 square foot facility in Lake Zurich, Illinois consisting of warehouse, packaging and office space, which has been relocated to Elgin, Illinois in March of 2021, (iii) a 73,000 square foot facility in Guadalajara, Mexico, consisting of office, warehouse and production space for Flexo Universal.

Our production operations include (i) lamination and extrusion coating of films, (ii) slitting of film rolls, (iii) printing on film and on latex balloons, (iv) converting film to completed products including balloons, flexible containers and pouches, (v) producing latex balloon products, (vi) inflating of air-filled balloons, and (vii) assembling Candy blossoms. We perform all of the lamination, extrusion coating and slitting activities in our Lake Barrington, Illinois plant and produce all of our latex balloon products at our Guadalajara, Mexico plant. We print on films in Lake Barrington, Illinois and we print on latex balloons in Guadalajara, Mexico. We complete air-filling and assembly of balloons in all our facilities except Lake Barrington, Illinois. We currently assemble Candy blossoms in our Elgin, Illinois facility.

We warehouse raw materials at our plants in Lake Barrington, Illinois and Guadalajara, Mexico and we warehouse finished goods at our facilities in Lake Barrington, Illinois; Elgin, Illinois; Guadalajara, Mexico. We maintain customer service and fulfillment operations at each of our warehouse locations. We conduct sales operations for the United States and for all other markets, except those that are handled by Flexo Universal, at the Lake Barrington, Illinois facility. In addition to warehouse and sales activities at these locations, we engage in some assembly, balloon inflation and related activities.

We maintain a graphic arts and development department at our Lake Barrington, Illinois facility which designs our balloon products and graphics. Our creative department operates a networked, computerized graphic arts system for the production of these designs and of printed materials including catalogues, advertisements and other promotional materials. As many of our products are custom designed or created to fulfill promotional schedules, we sometimes have excess inventory that must be sold at a discount or disposed of. Any such disposition will typically negatively impact our profit margin.

We conduct administrative and accounting functions at our headquarters in Lake Barrington, Illinois and occasionally, when needed, at our Guadalajara, Mexico, facility.

Raw Materials

The principal raw materials we use in manufacturing our products are (i) petroleum or natural gas-based films, (ii) petroleum or natural gas-based resin, (iii) latex, and (iv) printing inks. The cost of raw materials represents a significant portion of the total cost of our products, with the result that fluctuations in the cost of raw materials have a material effect on our profitability. During the past several years, we have experienced significant fluctuations in the cost of these raw materials. We do not have any long-term agreements for the supply of raw materials and may experience wide fluctuations in the cost of raw materials in the future. Further, although we have been able to obtain adequate supplies of raw materials in the past, there can be no assurance that we will be able to obtain adequate supplies of one or more of our raw materials in the future.

Many of the foil balloons we produce and sell are intended to be filled with helium in order to be buoyant. Over the past several years, the price of helium has fluctuated substantially and the availability of helium has, on occasion, been limited. During 2018 and 2019, the availability of helium declined and the cost of helium increased. The supply of helium has since improved significantly. Any future occurrence of limited availability and/or an increase in the cost of helium could adversely affect our sales of foil balloons.

Competition

The balloon and novelty industry is highly competitive, with numerous competitors. We believe there are presently five principal manufacturers of foil balloons whose products are sold in the United States including Anagram International, Inc., Pioneer Balloon Company, Convertidora International S.A. de C.V., and Betallic, LLC. Several companies market and sell foil balloons designed by them and manufactured by others for them. In addition, there are several additional foil balloon manufacturers in Europe and China who participate in our markets.

We compete for the sale of latex balloons in the United States, Canada, Mexico, Latin America, the United Kingdom, Australia and Europe. There are a number of other companies situated in the United States, Mexico, Asia, South America and Europe who manufacture latex balloons and with whom we compete in the markets in which we participate. The markets are highly competitive with respect to price, quality and terms.

The market for films, packaging, and custom products is fragmented, and competition in this area is difficult to gauge. However, there are numerous participants in this market and the Company can expect to experience intense quality and price competition.

Many of the companies in these markets offer products and services that are the same or similar to those offered by us and our ability to compete depends on many factors within and outside our control. There are a number of well-established competitors in each of our product lines, several of which possess substantially greater financial, marketing and technical resources and have established extensive, direct and indirect channels of distribution for their products and services. As a result, such competitors may be able to respond more quickly to new developments and changes in customer requirements, or devote greater resources to the development, promotion and sale of their products and services than we can. Competitive pressures include, among other things, price competition, new designs and product development and copyright licensing.

Patents, Trademarks and Copyrights

We have developed or acquired a number of intellectual property rights which we believe are significant to our business. As of December 31, 2020, we held 6 issued patents in the United States and 7 issued patents in foreign countries. These patents are scheduled to expire at various times during the 2020s. While these intellectual property rights are helpful, their degree of protection is uncertain. Competitors may violate our intellectual property rights, forcing us to decide whether to challenge them. Such rights may or may not withstand challenge. Conversely, entities may charge us with violating their intellectual property rights. Failure to protect our rights, or conflict with the rights of one or more other entities, may negatively impact our financial and competitive position.

Proprietary Designs and Copyright Licenses. We design the shapes and graphic designs of most of our foil balloon products.

Trademarks. We own five registered trademarks in the United States relating to our balloon products. Some of these trademarks are registered in foreign countries, principally in the European Union.

Patent Rights. We own, or have license rights under, or have applied for, patents related to our balloon products, certain film products and certain flexible container products.

Research and Development

We maintain a product development and research group for the development or identification of new products, product designs, product components and sources of supply. Research and development includes (i) creative product development and design, (ii) creative marketing, and (iii) engineering development. During each of the fiscal years ended December 31, 2020 and 2019, we estimate that the total amount spent on research and development activities was approximately $317,000 and $287,000, respectively.

Employees

As of December 31, 2020, the Company had 68 full-time employees in the United States, of whom 17 are executive or supervisory, 2 are in sales, 36 are in manufacturing or warehouse functions and 13 are clerical. As of that same date, Flexo Universal, our Mexico subsidiary, had 298 full-time employees, of whom 6 are executive or supervisory, 14 are in the warehouse, 5 are in sales, 259 are in manufacturing and 14 are clerical. The Company is not a party to any collective bargaining agreement in the United States, has not experienced any work stoppages, and believes that its relationship with its employees is satisfactory.

Beginning November 2018, the Company experienced severe difficulty in securing adequate seasonal workers in its US operations, forcing it to pay substantially higher costs in the form of overtime and a holiday premium. The Company expects its local labor market in the US (near Chicago) to continue to become more costly over time, which, if not changed, would negatively impact its future profitability.

Regulatory Matters

Our manufacturing operations in the United States are subject to the U.S. Occupational Safety and Health Act ("OSHA"). We believe we are in material compliance with OSHA. The Company generates liquid, gaseous and solid waste materials in its operations in Lake Barrington, Illinois and the generation, emission or disposal of such waste materials are, or may be, subject to various federal, state and local laws and regulations regarding the generation, emission or disposal of waste materials. We believe we are in material compliance with applicable environmental rules and regulations. Several states have enacted laws limiting or restricting the release of helium filled foil balloons. We do not believe such legislation will have any material effect on our operations.

An increasing number of regulations and actions relate to the integrity and security of individually identifiable data. Additionally, we require the effective use of data in running our business. While we are not aware of losses in the past, access of such data by unauthorized persons may expose us to costs, fines, penalties, and loss of customer confidence.

International Operations

We conduct operations in one location outside of the United States:

|

● |

Flexo Universal, a 99%-owned subsidiary in Guadalajara, Mexico. Flexo Universal maintains a plant, offices and warehouse in Guadalajara, Mexico where we produce latex and foil balloons and print latex balloons. Flexo Universal conducts sales, warehousing and fulfillment operations, servicing principally the Company and other customers in the United States, Mexico, Latin America and certain customers in Europe. |

Our domestic and international sales from continuing operations to outside customers and assets by area over the period 2019-2020 have been as follows:

|

Net Sales to Outside Customers |

||||||||

|

For the Year Ended |

||||||||

|

December 31, |

||||||||

|

2020 |

2019 |

|||||||

|

United States |

$ | 21,192,000 | $ | 23,754,000 | ||||

|

Mexico |

5,280,000 | 8,518,000 | ||||||

| $ | 26,473,000 | $ | 32,272,000 | |||||

|

Total Assets at |

||||||||

|

December 31, |

December 31, |

|||||||

|

2020 |

2019 |

|||||||

|

United States |

$ | 12,459,000 | $ | 17,450,000 | ||||

|

Mexico |

8,798,000 | 10,897,000 | ||||||

|

Assets Held for Sale |

294,000 | 2,974,000 | ||||||

| $ | 21,551,000 | $ | 31,321,000 | |||||

Available Information

We maintain our corporate website at www.ctiindustries.com and we make available, free of charge, through this website our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports that we file with, or furnish to, the Securities and Exchange Commission (“SEC”), as soon as reasonably practicable after we electronically file that material with, or furnish it to, the SEC. You may also read and copy material filed by us with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549, and you may obtain information on the operation of the Public Reference Room by calling the SEC in the U.S. at 1-800-SEC-0330. In addition, the SEC maintains an Internet website, www.sec.gov, which contains reports, proxy and information statements and other information that we file electronically with the SEC. Our website also includes corporate governance information, including our Code of Ethics and our Board Committee Charters. The information contained on our website does not constitute a part of this report.

Our business and results of operations have been and may continue to be negatively impacted by the spread of COVID-19.

We sell our products throughout the United States and in many foreign countries and may be impacted by public health crises beyond our control. This could disrupt our operations and negatively impact consumer spending and confidence levels, and supply availability and costs, all of which can affect our financial results, condition, and outlook. Our customers, suppliers and distributors may experience similar disruption. Importantly, the global pandemic resulting from COVID-19 has disrupted global health, economic and market conditions

Throughout 2020 and into 2021 the landscape improved, but the issue continues to drive elements of disruption in the ability to travel, attract and retain workers, manage production configurations and protocols, the supply chain and customer base. While we cannot predict the duration or scope of the COVID-19 pandemic, the resurgence of infections in one or more markets, or the impact of vaccines across the globe, the COVID-19 pandemic has negatively impacted our business and is expected to continue to impact our financial results, condition and outlook in a way that may be material.

COVID-19 has also delayed certain strategic transactions the Company intended to close during 2020, most notably its potential relocation of certain activities to the Laredo, Texas area, and the Company does not know if and when these transactions will be completed.

The ability of the Company to continue as a going concern is dependent on the Company obtaining adequate capital to fund operating losses. Management’s plans to continue as a going concern include raising additional capital through sales of equity securities and borrowing. However, management cannot provide any assurances that the Company will be successful in accomplishing any of its plans. The COVID-19 pandemic has impacted the Company’s business operations to some extent and is expected to continue to do so and, in light of the effect of such pandemic on financial markets, these impacts may include reduced access to capital. The ability of the Company to continue as a going concern is dependent upon its ability to successfully secure other sources of financing and attain profitable operations. There is substantial doubt about the ability of the Company to continue as a going concern for one year from the issuance of the accompanying consolidated financial statements. The accompanying consolidated financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

Item No. 1B – Unresolved Staff Comments

As of the filing of this Annual report on Form 10-K, we had no unresolved comments from the staff of the Securities and Exchange Commission.

We own our principal plant and offices located in Lake Barrington, Illinois, approximately 45 miles northwest of Chicago, Illinois. The facility includes approximately 68,000 square feet of office, manufacturing and warehouse space.

In September 2012, we entered into a lease agreement, expiring on February 28, 2017 to rent approximately 118,000 square feet of warehouse and office space in Lake Zurich, Illinois. Effective March 1, 2017, this lease was renewed for three years, at a remaining basic rental cost of $42,000 per month. We extended this lease due in part to COVID-19 and vacated this facility during March 2021, relocating this operation to Elgin, Illinois.

In August 2011, Flexo Universal entered into a 5-year lease agreement, expiring July 31, 2016, for the lease of approximately 73,000 square feet of manufacturing, warehouse and office space in Guadalajara, Mexico. The lease was extended to February 28, 2017. Effective March 1, 2017, Flexo Universal entered into a five-year lease for these premises at a cost of 493,090 Mexican Pesos per month (approximately $20,000 per month).

We believe that our properties have been adequately maintained, are in generally good condition and are suitable for our business as presently conducted. We believe our existing facilities provide sufficient production capacity for our present needs and for our presently anticipated needs in the foreseeable future. We also believe that, with respect to leased properties, upon the expiration of our current leases, we will be able to either secure renewal terms or to enter into leases for alternative locations at market terms.

Item No. 3 – Legal Proceedings

The Company may be party to certain lawsuits or claims arising in the normal course of business. The ultimate outcome of these matters is unknown but, in the opinion of management, we do not believe any of these proceedings will have, individually or in the aggregate, a material adverse effect upon our financial condition, cash flows or future results of operation.

In July, 2017, God’s Little Gift, Inc. (d\b\a) Helium and Balloons Across America and Gary Page (“Claimants”) filed an action against the Company based on disputed compensation amounts over several years. This action was resolved by mutual agreement between the parties during January 2019. Mr. Page received 20,000 shares of CTI common stock, $5,000 in cash, and a minimum payout in his monthly royalty calculation of $7,667 beginning March 1, 2019 and ending August 1, 2021. The Company accrued the $0.3 million in committed costs under this settlement in its December 31, 2018 financial statements.

FedEx Trade Networks Transport and Brokerage Inc. v. CTI Industries Corp., Case No. 20 L 46, was filed on January 27, 2020 in the Circuit Court of the 19th Judicial Circuit, Lake County, Illinois. The complaint for breach of contract sought $163,964.75 in damages, plus interest and court costs. On October 15, 2020, the case was dismissed with leave to reinstate pursuant to settlement. The settlement calls for the payment of $100,400.00 in monthly installments of $10,000 per month for a period of ten (10) months and with the last payment being in the amount of $10,400. The first payment came due and was made on October 30, 2020, and payments have been made monthly.

Airgas USA, LLC v. CTI Industries Corp., Case No. 01-20-0014-7852 was filed with the American Arbitration Association on or about September 8, 2020. The claim seeks $212,000, plus interest, attorneys’ fees and costs for breach of contract. Claimant agreed to give CTI an extension to respond to the claim so the parties could attempt to resolve. On February 10, 2021, Airgas accepted CTI’s offer to pay $125,000 over 10 months. Airgas agreed to the settlement in March of 2021.

On October 19, 2020, Jules and Associates, Inc. sent CTI a demand letter related to the lease of certain equipment. The letter demanded $65,846.99 for alleged past due amounts under the lease as well as a return of the equipment. Discussions regarding the return of the equipment are ongoing and no lawsuit has been filed. On April 5, 2020 Jules & Associates, Inc. filed and served on CTI a demand for arbitration with JAMS related to the lease of certain equipment. The demand requests $98,244.55 for alleged past due amounts under the lease as well as a return of the equipment or its fair market value. The Company accrued the $0.1 million in committed costs under this settlement in its December 31, 2020 financial statements.

On October 19, 2020, Redwood Multimodal sent CTI a demand for the withholding of payment in the amount $98,960.88 for loads brokered by Redwood. Settlement discussions are ongoing and no lawsuit has been filed. The Company accrued the $0.1 million in committed costs under this settlement in its December 31, 2020 financial statements.

Benchmark Investments, Inc. v. Yunhong CTI Ltd filed a case in the United States District Court for the Southern District of New York on March 16, 2021 and served on CTI on March 31, 2021. CTI has through April 21, 2021 to file its response to the complaint. The complaint seeks damages in excess of $500,000.

Item No. 4. – Mine Safety Disclosures

Not Applicable.

PART II

Item No. 5 – Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

The Company's common stock was admitted to trading on the NASDAQ SmallCap Market (now the NASDAQ Capital Market) under the symbol “CTIB” on November 5, 1997.

As of December 31, 2020 there were approximately 441 holders of record of the Company’s Common Stock. The Company’s total number of beneficial owners of common stock of the Company was approximately 30.

The Company did not pay any cash dividends on its Common Stock during 2020 or 2019 and has no plans to pay dividends in the foreseeable future. Under the terms of the Company’s current loan agreements, the amount of dividends the Company may pay is limited by the terms of the financial covenants.

On April 9, 2021, our common stock closed at $2.19 per share.

Equity Compensation Plan Information

There were no stock option incentive plans outstanding as of December 31, 2020.

Item No. 6 – Selected Financial Data

We are a smaller reporting company, as defined by Rule 12b-2 of the Securities Exchange Act of 1934, as amended, and are not required to provide the information required under this item.

Item No. 7 – Management's Discussion and Analysis of Financial Condition and Results of Operations

Overview

The Company produces film products for novelty, packaging container and custom film product applications. These products include foil balloons, latex balloons and related products, films for packaging applications, and custom film products. We produce all of our film products for packaging and container applications at our facilities in Lake Barrington, Illinois. We produce all of our latex balloons and latex products at our facility in Guadalajara, Mexico. Substantially all of our film products for packaging applications and flexible containers for packaging and storage are sold to customers in the United States. We market and sell our novelty items – principally foil balloons and latex balloons – in the United States, Mexico, and a number of additional countries. In addition, the Company assembles and sells Candy Blossoms (containers of arranged candy items) in the United States.

As determined by the Board of Directors in the third quarter 2019, we have been exiting our European operations in order to focus on our North America operations, particularly on foil balloons and related products. The sales entity in the UK, CTI Balloons, was liquidated in 2019. The sales and distribution entity in Germany is currently closing and is expected to be fully closed during 2021. Additionally, we stopped selling our vacuum sealing products as of March 30, 2020, after allowing the related license agreement to expire. These operations have been presented as discontinued operations in this Annual Report on Form 10-K (see Note 23).

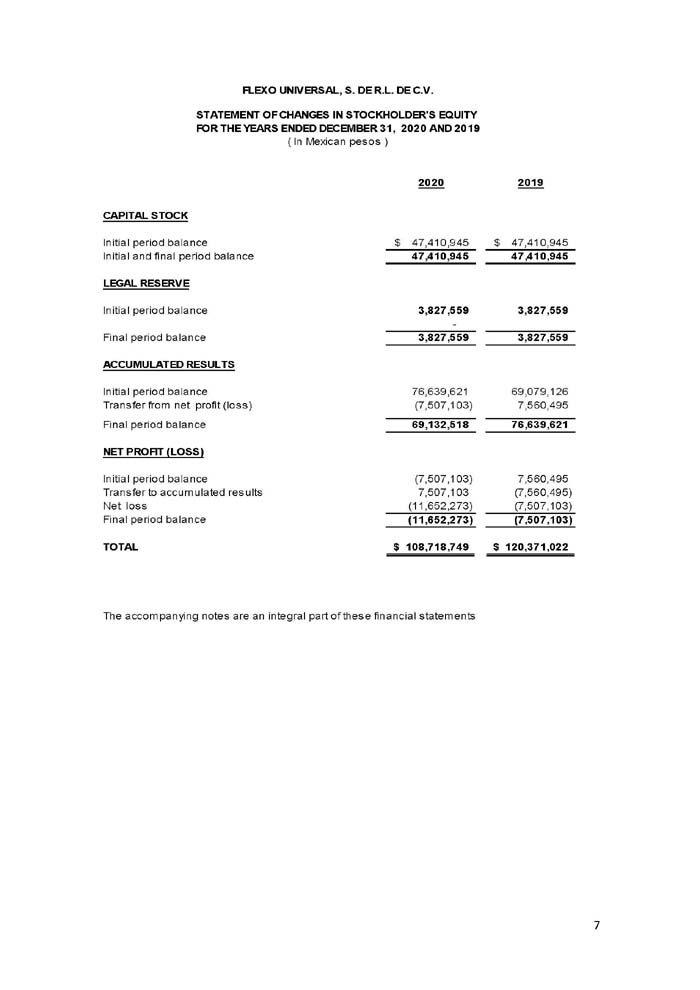

We have also changed our capital structure. On January 3, 2020, the Company entered into a stock purchase agreement, as amended on February 24, 2020 and April 13, 2020, (the “LF Purchase Agreement”), pursuant to which the Company agreed to issue and sell, and LF International Pte. Ltd., a Singapore private limited company (the “LF International”), which is controlled by Company director Mr. Yubao Li, agreed to purchase, up to 500,000 shares of the Company’s newly created Series A Convertible Preferred Stock (“Series A Preferred”), with each share of Series A Preferred initially convertible into ten shares of the Company’s common stock, at a purchase price of $10.00 per share, for aggregate gross proceeds of $5,000,000 (the “LF International Offering”). As a result of the LF International Offering, a change of control of the Company may occur. As permitted by the Purchase Agreement, the Company may, in its discretion issue up to an additional 200,000 shares of Series A Preferred for a purchase price of $10.00 per share (the “Additional Shares Offering,” and collectively with the LF International Offering, the “Offering”). On January 13, 2020, the Company conducted its first closing of the LF International Offering, resulting in aggregate gross proceeds of $2,500,000. Pursuant to the LF Purchase Agreement, LF International received the right to nominate and elect one member to the Company’s board of directors (the “Board”) (subject to certain adjustments), effective as of the first closing, as well as a second director by the earlier of (i) the Company’s upcoming 2020 annual meeting of shareholders and (ii) May 15, 2020. Pursuant to LF International’s nomination, effective January 13, 2020, the Board appointed Mr. Yubao Li as a director of the Company. Additionally, pursuant to the LF Purchase Agreement, on March 12, 2020, the Company changed its name to Yunhong CTI Ltd. To date, the Company has issued approximately 600,000 shares of Series A Preferred to LF International and other accredited investors for aggregate gross proceeds of approximately $5.6 million.

Additionally, in November 2020, we issued 170,000 shares of Series B Preferred for an aggregate purchase price of $1,500,000. As the Series B Preferred may be redeemed at the option of the holder, but is not mandatorily redeemable, the Series B Preferred has been classified as mezzanine equity and initially recognized at fair value of $1.5 million.

Our revenues from continuing operations from each of our product categories in each of the past two years have been as follows:

|

Twelve Months Ended |

||||||||||||||||

|

December 31, 2020 |

December 31, 2019 |

|||||||||||||||

|

$ |

% of |

$ |

% of |

|||||||||||||

|

Product Category |

(000) Omitted |

Net Sales |

(000) Omitted |

Net Sales |

||||||||||||

|

Foil Balloons |

17,061 | 64 | % | 17,630 | 55 | % | ||||||||||

|

Latex Balloons |

4,718 | 18 | % | 7,409 | 23 | % | ||||||||||

|

Film Products |

804 | 3 | % | 1,883 | 6 | % | ||||||||||

|

Other |

3,890 | 15 | % | 5,350 | 17 | % | ||||||||||

|

Total |

26,473 | 100 | % | 32,272 | 100 | % | ||||||||||

Our primary expenses include the cost of products sold and selling, general and administrative expenses.

Cost of products sold primarily consists of expenses related to raw materials, labor, quality control and overhead expenses such as supervisory labor, depreciation, utilities expense and facilities expense directly associated with production of our products, warehousing and fulfillment expenses and shipping costs relating to the shipment of products to customers. Cost of products sold is impacted by the cost of the raw materials used in our products, the cost of shipping, along with our efficiency in managing the production of our products.

Selling, general and administrative expenses include the compensation and benefits paid to our employees, all other selling expenses, marketing, promotional expenses, travel and other corporate administrative expenses. These other corporate administrative expenses include professional fees, depreciation of equipment and facilities utilized in administration, occupancy costs, communication costs and other similar operating expenses. Selling, general and administrative expenses can be affected by a number of factors, including staffing levels and the cost of providing competitive salaries and benefits, the cost of regulatory compliance and other administrative costs.

Purchases by a limited number of customers represent a significant portion of our total revenues. During 2020 and 2019, respectively, sales to our top 10 customers represented 85% and 75%, respectively, of net revenues for each year. During 2020 and 2019, there were two customers to whom our sales represented more than 10% of net revenues.

Our principal customer sales for 2020 and 2019 were:

|

Customer |

Product |

2020 Sales |

% of 2020 Revenues |

2019 Sales |

% of 2019 Revenues |

|||||||||||||

|

Wal-Mart |

Balloons; Candy Blossoms |

$ | 3,745,000 | 14 |

% |

$ | 3,935,000 | 12 |

% |

|||||||||

|

Dollar Tree Stores |

Balloons |

$ | 12,536,000 | 47 |

% |

$ | 11,332,000 | 35 |

% |

|||||||||

The loss of one or both of these principal customers, or a significant reduction in purchases by one or both of them, could have a material adverse effect on our business.

We generally do not have agreements with our customers under which customers are obligated to purchase any specific or minimum amount of product from us.

Year Ended December 31, 2020 Compared to Year Ended December 31, 2019

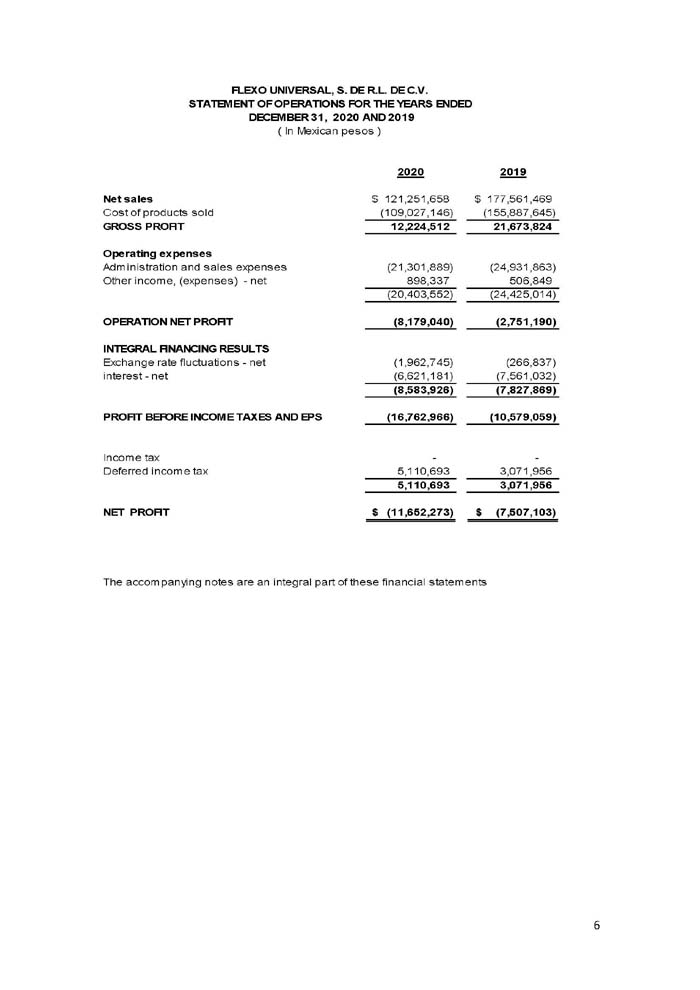

Net Sales

For the fiscal year ended December 31, 2020, consolidated net sales from continuing operations of the sale of all products were $26,473,000 compared to consolidated net sales of $32,272,000 for the year ended December 31, 2019, a decrease of 18% as more fully described below.

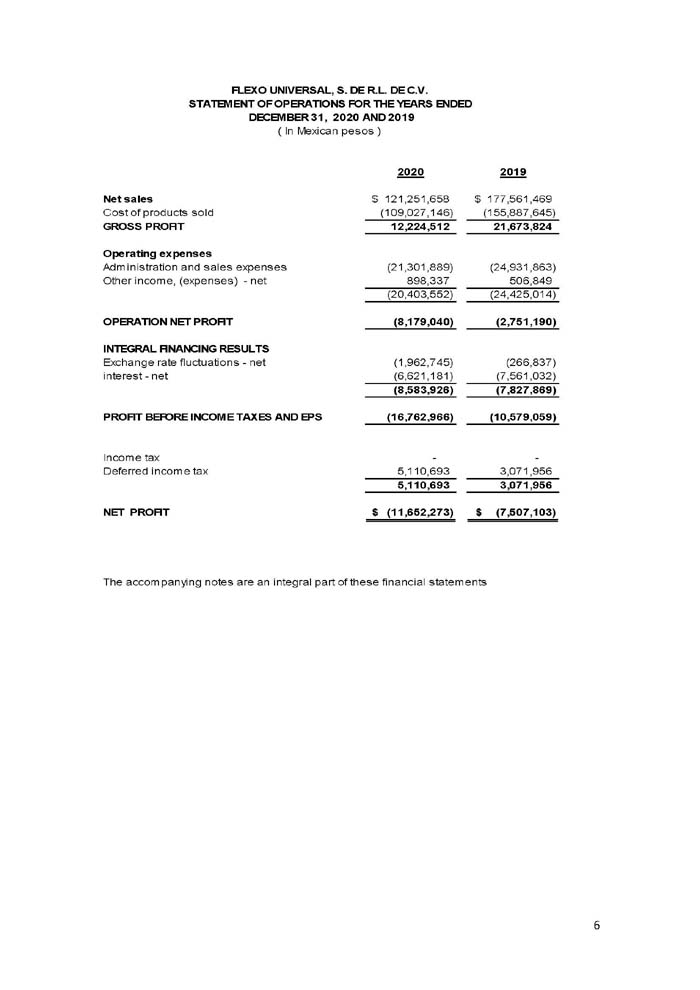

Sales of foil balloons from continuing operations were $17,061,000 in 2020 and $17,653,000 in 2019, a decrease of 3%. Our largest customer for foil balloons was Dollar Tree Stores. The remaining sales were made to hundreds of customers including distributors and retail stores or chains in the United States, Canada, Mexico, the United Kingdom, Europe and Latin America.

Sales of latex balloons from continuing operations were $4,718,000 in 2020 and $7,409,000 in 2019, a decrease of 36%. The decrease resulted principally from the COVID-19 pandemic which negatively impacted operations in our Mexico facility.

Sales of film products from continuing operations were $804,000 in 2020 and $1,883,000 in 2019, a decrease of 57%.

Sales of other products from continuing operations decreased to $3,890,000 in 2020 from $5,350,000 in 2019, a decrease of 27%. This category includes (i) sales of helium and accessory items for our balloon products, (ii) sales of Candy Blossoms, (iii) sales of party goods in Mexico by Flexo Universal.

Cost of Sales

Cost of sales from continuing operations decreased to $22,921,000 in 2020 from $27,896,000 in 2019. The decrease in cost of sales was primarily attributable to the decrease in sales – cost of sales as a percentage of sales was 86.6% in 2020 and 86.4% in 2019. Additionally, the reduction in sales volume negatively impacted our ability to absorb fixed overhead costs.

General and Administrative Expenses

General and administrative expenses from continuing operations decreased to $4,512,000 in 2020 from $5,358,000 in 2019. Many of the cost reductions realized during 2020 were in the administrative and marketing areas, including personnel costs, consulting and outside services.

Selling and Marketing

Selling expenses from continuing operations decreased to $145,000 in 2020 from $425,000 in 2019. Marketing and advertising expenses decreased to $350,000 in 2020, from $546,000 in 2019. The primary savings from selling, marketing and advertising was the net reduction of outside consulting services and a decrease of commission expense due to the reduction in sales volume.

Other Income or Expense

During 2020, we incurred net interest expense from continuing operations of $1,269,000 compared to net interest expense of $2,028,000 during 2019. The decrease in interest expense was primarily attributable to the lower average outstanding balance of debt in 2020 as compared to 2019. Additionally, in 2020, we recorded a $1,047,700 gain on the forgiveness of our Payroll Protection Plan loan. A $1,276,000 reserve against our related party note receivable was entered into other expense during 2020.

Deemed Dividends on Preferred Stock and Amortization of Beneficial Conversion Feature

In 2020 the Company issued Series A Preferred Stock and Series B Preferred Stock. In connection with these preferred stock issuances, and the related beneficial conversion features, the Company had deemed dividends of $4.4 million in 2020. Although these deemed dividends do not impact Net loss attributable to Yunhong CTI, Ltd., they do impact Net loss attributable to Yunhong CTI Ltd. Common Shareholders and EPS.

Financial Condition, Liquidity and Capital Resources

Cash Provided By Operating Activities

During fiscal 2020, cash provided by operating activities amounted to $1,752,000, compared to cash provided by operating activities during fiscal 2019 of $3,667,000. Significant changes in working capital items affecting cash flow used in operating activities were:

|

● |

Depreciation and amortization of $964,000 compared to depreciation and amortization for 2019 of $1,150,000; |

|

|

● |

A decrease in inventories of $2,730,000 compared to a decrease of inventories of $4,507,000 in 2019; |

|

|

● |

A decrease in accounts receivable of $4,158,000 compared to a decrease in accounts receivable of $475,000 in 2019; |

|

|

● |

An increase in prepaid expenses and other assets of $269,000 compared to a decrease in prepaid expenses and other assets of $28,000 in 2019; and |

|

|

● |

A decrease in trade payables of $1,302,000 compared to an increase in trade payables of $1,177,000 in 2019. |

Cash Used In Investing Activities

During fiscal 2020, cash used in investing activities amounted to $202,000 compared to cash used in investing activities during fiscal 2019 of $80,000.

Cash Provided By Financing Activities

During fiscal 2020, cash used in financing activities amounted to $1,593,000, compared to cash used by financing activities of $3,587,000 during fiscal 2019. The Company had proceeds from PPP of $1,048,000 and repayment of debt and revolving line of credit of $10,995,000.

As discussed in Note 3, in the Series A Offering, the Company sold 500,000 shares of Series A Preferred and 400,000 shares of common stock for aggregate gross proceeds of $5,000,000.

In November 2020, we issued 170,000 shares of Series B Preferred for an aggregate purchase price of $1,500,000.

In October 2020, we received an advance of $1,500,000 from an investor. In January 2021, we finalized the transaction with the investor and issued 170,000 shares of newly authorized Series C Preferred Stock.

Going Concern, Liquidity and Financial Condition

The Company’s financial statements are prepared using accounting principles generally accepted in the United States (“U.S. GAAP”) applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. The Company has a cumulative net loss from inception to December 31, 2020 of over $14 million.. The accompanying financial statements for the year ended December 31, 2020 have been prepared assuming the Company will continue as a going concern. The Company’s cash resources will likely be insufficient to meet its anticipated needs during the next twelve months. The Company will require additional financing to fund its future planned operations.

The ability of the Company to continue as a going concern is dependent on the Company obtaining adequate capital to fund operating losses. Management’s plans to continue as a going concern include raising additional capital through sales of equity securities and borrowing. However, management cannot provide any assurances that the Company will be successful in accomplishing any of its plans. The COVID-19 pandemic has impacted the Company’s business operations to some extent and is expected to continue to do so and, in light of the effect of such pandemic on financial markets, these impacts may include reduced access to capital. The ability of the Company to continue as a going concern is dependent upon its ability to successfully secure other sources of financing and attain profitable operations. There is substantial doubt about the ability of the Company to continue as a going concern for one year from the issuance of the accompanying consolidated financial statements. The accompanying consolidated financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

Until December 2017, we had in place a series of credit facility and related agreements with BMO Harris Bank, N.A. and BMO Private Equity (U.S.), (collectively, “BMO”), in the aggregate amount of approximately $17 million. During December 2017, we terminated those agreements and fully repaid all amounts owed to BMO under those agreements, including associated fees and costs related to termination, as we entered in new financing agreements with PNC Bank, National Association (“PNC”). The financing agreements with PNC (the “PNC Agreements”) included a $6 million term loan and an $18 million revolving credit facility (the “Revolving Credit Facility”), with a credit facility termination date of December 2022.

We notified PNC of our failure to meet two financial covenants under the Revolving Credit Facility as of March 31, 2018. On June 8, 2018, we entered into Waiver and Amendment No. 1 (“Amendment 1”) to our PNC Agreements. Amendment 1 modified certain covenants, added others, waived our failure to comply as previously reported, and included an amendment fee and temporary increase in interest rate. During September 2018, we filed a preliminary prospectus on Form S-1 for a planned equity issuance. On October 8, 2018, we entered into Consent and Amendment No. 2 (“Amendment 2”) to our PNC Agreements. Amendment 2 reduced the amount of new funding proceeds that must be used to repay the term loan from $5 million to $2 million and waived the calculation of financial ratios for the period ended September 30, 2018, in exchange for a new covenant committing to raise at least $7.5 million in gross proceeds from an equity issuance by November 15, 2018 and pay an amendment fee. Market conditions ultimately forced us to postpone the offering, and thus no proceeds were received by the November 15, 2018 requirement. We engaged PNC to resolve this failure, and as of March 2019, entered into a forbearance agreement that ended during July 2019. We then entered a new forbearance agreement in October 2019 that terminated in January 2020 and, in connection with a new equity financing arrangement, was replaced on January 13, 2020, with a Limited Waiver, Consent, Amendment No. 5 and Forbearance Agreement (the “2020 Forbearance Agreement”) between PNC and the Company. Pursuant to the 2020 Forbearance Agreement, PNC agreed to (i) waive the PNC Agreements’ requirement that the Company apply the net proceeds of the Offering first to the Term Loans (as defined in the PNC Agreements), and agreed that the Company shall instead apply the net proceeds of the Offering to the Revolving Advances (as defined in the PNC Agreements) and in connection therewith the Revolving Commitment Amount (as defined in the PNC Agreements) shall be reduced on a dollar for dollar basis by the amount so applied to the Revolving Advances, and (ii) forebear from exercising the rights and remedies in respect of the Existing Defaults (as defined in the Loan Agreement) afforded to PNC under the PNC Agreements for a period ending no later than December 31, 2020. As forbearance is a temporary condition, we have reclassified long-term bank debt to current liabilities on our balance sheet. See Note 3 for a related discussion of the impact of this event.

Available credit under the Revolving Credit facility is determined by eligible receivables and inventory at CTI Industries (U.S.) and Flexo Universal (Mexico).

Certain terms of the PNC Agreements include:

|

● |

Restrictive Covenants: The Credit Agreement includes several restrictive covenants under which we are prohibited from, or restricted in our ability to: |

|

o |

Borrow money; |

|

|

o |

Pay dividends and make distributions; |

|

|

o |

Make certain investments; |

|

|

o |

Use assets as security in other transactions; |

|

|

o |

Create liens; |

|

|

o |

Enter into affiliate transactions; |

|

|

o |

Merge or consolidate; or |

|

|

o |

Transfer and sell assets. |

|

● |

Financial Covenants: The Credit Agreement includes a series of financial covenants we are required to meet including: |

|

o |

We are required to maintain a "Leverage Ratio", which is defined as the ratio of (a) Funded Debt (other than the Shareholder Subordinated Loan) as of such date of determination to (b) EBITDA (as defined in the PNC Agreements) for the applicable period then ended. The highest values for this ratio allowed by the PNC Agreements are: |

|

Fiscal Quarter Ratio |

|||||

|

March 31, 2019 |

not applicable |

||||

|

June 30, 2019 |

3.00 | to | 1.00 | ||

|

September 30, 2019 |

2.75 | to | 1.00 | ||

|

January, 2020 and thereafter |

not applicable |

||||

|

o |

We are required to maintain a "Fixed Charge Coverage Ratio", which is defined as the ratio of (a) EBITDA for such fiscal period, minus Unfinanced Capital Expenditures made during such period, minus distributions (including tax distributions) and dividends made during such period, minus cash taxes paid during such period to (b) all Debt Payments made during such period. This ratio must not exceed the following for any quarterly calculation: |

|

Fiscal Quarter Ratio |

|||||

|

March 31, 2020 |

0.75 | to | 1.00 | ||

|

June 30, 2020 |

0.85 | to | 1.00 | ||

|

September 30, 2020 |

0.95 | to | 1.00 | ||

|

December 31, 2020 |

1.05 | to | 1.00 | ||

|

March 31, 2021 and thereafter |

1.15 | to | 1.00 |

The credit agreement provides for interest at varying rates in excess of the prime rate, depending on the level of senior debt to EBITDA over time. We also entered into a swap agreement with PNC Bank to fix the interest for $3 million over 3 years. This swap was terminated during 2019 with our first forbearance agreement.

Failure to comply with these covenants has caused us to pay a higher rate of interest (by a cumulative 4% per the Agreements), and other potential penalties may impact the availability of the credit facility itself, and thus might negatively impact our ability to remain a going concern. As described in Notes 3 and 9, we believe that we were not in compliance with this credit facility as of December 31, 2020 and 2019.

Additionally, we have encountered difficulties with seasonal cash flow needs, including increasing costs associated with obtaining seasonal workers in the Chicago area. The failure to properly manage seasonal cash needs could put strain on the Company, up to and including our ability to continue as a going concern (see Note 3 for additional discussion).

In October 2020, the Company received $1.5 million from an unrelated third party as an advance on a proposed sale of Series C Redeemable Convertible Preferred Stock. As of December 31, 2020, the Company was in the process of negotiating and finalizing the terms of the arrangement. As the agreement was not finalized as of December 31, 2020, the $1.5 million advance is classified as Advance from Investor within liabilities on the accompanying balance sheet.

Seasonality

In the foil balloon product line, sales have historically been seasonal with approximately 40% occurring in the period from December through March of the succeeding year and 24% being generated in the period July through October in recent years. Approximately half of these sales are considered “everyday” in nature while the other half tend to be event driven (certain holidays, graduation season, and other events). The COVID-19 pandemic changed the shape of graduation season for 2020, resulting in a lower demand for balloons during the second quarter 2020, but then a surge of demand related to at-home parties and events. This increase in demand continued into 2021.

Critical Accounting Policies

The financial statements of the Company are based on the selection and application of significant accounting policies which require management to make various estimates and assumptions. The following are some of the more critical judgment areas in the application of our accounting policies that currently affect our financial condition and results of operation.

Revenue Recognition. Substantially all of the Company's revenues are derived from the sale of products. With respect to the sale of products, revenue from a transaction is recognized once it has (i) identified the contract(s) with a customer, (ii) identified the performance obligations in the contract, (iii) determined the transaction price, (iv) allocated the transaction price to the performance obligations in the contract, and (v) recognized revenue as the company satisfies a performance obligation. The Company generally recognizes revenue for the sale of products when the products have been shipped and invoiced. In some cases, product is provided on consignment to customers. In those cases, revenue is recognized when the customer reports a sale of the product.

The Company adopted Accounting Standards Codification (ASC) Topic 606, Revenue from Contracts with Customers. Our revenue arrangements generally consist of a single performance obligation to transfer promised goods at a fixed price.

Net sales include revenues from sales of products and shipping and handling charges, net of estimates for product returns. Revenue is measured at the amount of consideration the Company expects to receive in exchange for the transferred products. Revenue is recognized at the point in time when we transfer the promised products to the customer and the customer obtains control over the products. The Company recognizes revenue for shipping and handling charges at the time the goods are shipped to the customer, and the costs of outbound freight are included in cost of sales, as we have elected the practical expedient included in ASC 606.

The Company provides for product returns based on historical return rates. While we incur costs for sales commissions to our sales employees and outside agents, we recognize commission costs concurrent with the related revenue, as the amortization period is less than one year and we have elected the practical expedient included in ASC 606. We do not incur incremental costs to obtain contracts with our customers. Our product warranties are assurance-type warranties, which promise the customer that the products are as specified in the contract. Therefore, the product warranties are not a separate performance obligation and are accounted for as described herein. Sales taxes assessed by governmental authorities are accounted for on a net basis and are excluded from net sales.

Allowance for Doubtful Accounts. We estimate our allowance for doubtful accounts based on an analysis of specific accounts, an analysis of historical trends, payment and write-off histories. Our credit risks are continually reviewed, and management believes that adequate provisions have been made for doubtful accounts. However, unexpected changes in the financial condition of customers or changes in the state of the economy could result in write-offs which exceed estimates and negatively impact our financial results.

Inventory Valuation. Inventories are stated at the lower of cost or net realizable value. Cost is determined using standard costs which approximate costing determined on a first-in, first out basis. Standard costs are reviewed and adjusted at the time of introduction of a new product or design, periodically and at year-end based on actual direct and indirect production costs. On a periodic basis, the Company reviews its inventory levels for estimated obsolescence or unmarketable items, in reference to future demand requirements and shelf life of the products. As of December 31, 2020, the Company had established a reserve for obsolescence, marketability or excess quantities with respect to inventory in the aggregate amount of $311,000. As of December 31, 2019, the amount of the reserve was $352,000. In addition, on a periodic basis, the Company disposes of inventory deemed to be obsolete or unsaleable and, at such time, charges reserve for the value of such inventory. We record freight income as a component of net sales and record freight costs as a component of cost of goods sold.

Valuation of Long-Lived Assets. We evaluate whether events or circumstances have occurred which indicate that the carrying amounts of long-lived assets (principally property and equipment and goodwill) may be impaired or not recoverable. Significant factors which may trigger an impairment review include: changes in business strategy, market conditions, the manner of use of an asset, underperformance relative to historical or expected future operating results, and negative industry or economic trends. We apply the provisions of generally accepted accounting principles in the United States of America (“U.S. GAAP”) U.S. GAAP, under which goodwill is evaluated at least annually for impairment.

The Company identified an impairment indicator related to the goodwill associated with Clever Container, a VIE that was consolidated through June 30, 2019. As a result of an impairment test, the Company fully impaired the goodwill related to Clever in the first quarter of 2019 and recorded an impairment charge of $220,000. In the first quarter of 2019, the Company identified an impairment indicator related to the goodwill associated with Flexo. As a result of an impairment test, the Company fully impaired the goodwill related to Flexo in the first quarter of 2019 and recorded an impairment charge of approximately $1 million. We performed a quantitative assessment for the year ended December 31, 2019 in which we considered the assets and liabilities of the Company as one operating segment, both recognized and unrecognized, as well as the cash flows necessary to operate the business relating to the assets and liabilities.

Foreign Currency Translation. All balance sheet accounts are translated using the exchange rates in effect at the balance sheet date. Statements of operations amounts are translated using the average exchange rates for the year-to-date periods. The gains and losses resulting from the changes in exchange rates during the period have been reported in other comprehensive income or loss, except that, on November 30, 2012, the Company determined that it does have an expectation of receiving payment with respect to indebtedness of Flexo Universal to the Company, and accordingly, as of and after that date foreign currency gains and losses with respect to such indebtedness will be reported in the statement of operations.

Stock-Based Compensation. We follow U.S. GAAP which requires all stock-based payments to employees, including grants of employee stock options, to be recognized in the consolidated financial statements based on their grant-date fair values.

We use the Black-Scholes option pricing model to determine the fair value of stock options which requires us to estimate certain key assumptions. In accordance with the application of U.S. GAAP, we incurred employee stock-based compensation cost of $178,000 for the year ended December 31, 2019. At December 31, 2019, we had no unrecognized compensation cost relating to stock options.

Income Taxes and Deferred Tax Assets. Income taxes are accounted for as prescribed in U.S. GAAP. Under the asset and liability method of U.S. GAAP, the Company recognizes the amount of income taxes currently payable. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities, and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years these temporary differences are expected to be recovered or settled.