Table of Contents

As filed with the Securities and Exchange Commission on November 7, 2014

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CYMABAY THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 94-3103561 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

7999 Gateway Blvd., Suite 130

Newark, CA 94560

(510) 293-8800

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Harold Van Wart, Ph.D.

President and Chief Executive Officer

7999 Gateway Blvd., Suite 130

Newark, CA 94560

(510) 293-8800

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Sujal Shah Chief Financial Officer CymaBay Therapeutics, Inc. 7999 Gateway Blvd., Suite 130 Newark, CA 94560 (510) 293-8800 |

Matthew B. Hemington Brett D. White Cooley LLP 3175 Hanover Street Palo Alto, CA 94304-1130 (650) 843-5000 |

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Offering Price Per Unit(2) |

Proposed Maximum Offering Price(2) |

Amount of Registration Fee (2) | ||||

| Common Stock, par value $0.0001 per share |

(3) | (4) | (4) | — | ||||

| Preferred Stock, par value $0.0001 per share |

(3) | (4) | (4) | — | ||||

| Debt Securities |

(3) | (4) | (4) | — | ||||

| Warrants |

(3) | (4) | (4) | — | ||||

| Total Offering |

$100,000,000 | $100,000,000 | $11,620 | |||||

|

| ||||||||

| (1) | Pursuant to Rule 416 under the Securities Act, the shares being registered hereunder include such indeterminate number of shares of common stock and preferred stock as may be issuable with respect to the shares being registered hereunder as a result of stock splits, stock dividends or similar transactions. |

| (2) | The proposed maximum offering price per unit and proposed maximum aggregate offering price has been calculated pursuant to Rule 457(o) under the Securities Act. |

| (3) | There are being registered hereunder such indeterminate number of shares of common stock and preferred stock, such indeterminate principal amount of debt securities and such indeterminate number of warrants to purchase common stock, preferred stock and/or debt securities to be sold by the Registrant which together shall have an aggregate initial offering price not to exceed $100,000,000. Any securities registered hereunder may be sold separately or in combination with the other securities registered hereunder. The proposed maximum offering price will be determined, from time to time, by the Registrant in connection with the issuance by the Registrant of the securities registered hereunder. The securities registered for also include such indeterminate number of shares of common stock and preferred stock and amount of debt securities as may be issued upon conversion of or exchange for preferred stock or debt securities that provide for conversion or exchange, upon exercise of warrants or pursuant to the antidilution provisions of any such securities. |

| (4) | The proposed maximum aggregate offering price per class of security will be determined from time to time by the Registrant in connection with the issuance by the Registrant of the securities registered hereunder and is not specified as to each class of security pursuant to General Instruction II.D. of Form S-3 under the Securities Act. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

EXPLANATORY NOTE

This registration statement contains two prospectuses:

| • | a base prospectus which covers the offering, issuance and sale by CymaBay of up to a maximum aggregate offering price of $100,000,000 of CymaBay’s common stock, preferred stock, debt securities and warrants; and |

| • | a sales agreement prospectus covering the offering, issuance and sale by CymaBay of up to a maximum aggregate offering price of $25,000,000 of CymaBay’s common stock that may be issued and sold under a sales agreement with Cantor Fitzgerald & Co. |

The base prospectus immediately follows this explanatory note. The sales agreement prospectus immediately follows the base prospectus. The common stock that may be offered, issued and sold by CymaBay under the sales agreement prospectus is included in the $100,000,000 of securities that may be offered, issued and sold by CymaBay under the base prospectus. Upon termination of the sales agreement with Cantor Fitzgerald & Co., any portion of the $25,000,000 included in the sales agreement prospectus that is not sold pursuant to the sales agreement will be available for sale in other offerings pursuant to the base prospectus, and if no shares are sold under the sales agreement, the full $25,000,000 of securities may be sold in other offerings pursuant to the base prospectus and a corresponding prospectus supplement.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities or accept an offer to buy these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any state where such offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER 7, 2014

PROSPECTUS

$100,000,000

Common Stock

Preferred Stock

Debt Securities

Warrants

From time to time, we may offer and sell up to an aggregate amount of $100,000,000 of any combination of the securities described in this prospectus, either individually or in combination. We may also offer common stock or preferred stock upon conversion of debt securities, common stock upon conversion of preferred stock, or common stock, preferred stock or debt securities upon the exercise of warrants.

We will provide the specific terms of these offerings and securities in one or more supplements to this prospectus. We may also authorize one or more free writing prospectuses to be provided to you in connection with these offerings. The prospectus supplement and any related free writing prospectus may also add, update or change information contained in this prospectus. You should carefully read this prospectus, the applicable prospectus supplement and any related free writing prospectus, as well as any documents incorporated by reference, before buying any of the securities being offered.

Our common stock is listed on the NASDAQ Capital Market under the trading symbol “CBAY.” On November 6, 2014, the last reported sale price of our common stock was $7.81 per share. The applicable prospectus supplement will contain information, where applicable, as to other listings, if any, on the NASDAQ Capital Market or other securities exchange of the securities covered by the applicable prospectus supplement.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” on page 6 of this prospectus and any similar section contained in the applicable prospectus supplement and in any free writing prospectuses we have authorized for use in connection with a specific offering, and under similar headings in the documents that are incorporated by reference into this prospectus.

This prospectus may not be used to consummate a sale of securities unless accompanied by a prospectus supplement.

The securities may be sold directly by us to investors, through agents designated from time to time or to or through underwriters or dealers, on a continuous or delayed basis. For additional information on the methods of sale, you should refer to the section entitled “Plan of Distribution” in this prospectus. If any agents or underwriters are involved in the sale of any securities with respect to which this prospectus is being delivered, the names of such agents or underwriters and any applicable fees, commissions, discounts and over-allotment options will be set forth in a prospectus supplement. The price to the public of such securities and the net proceeds we expect to receive from such sale will also be set forth in a prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2014.

Table of Contents

| i | ||||

| 1 | ||||

| 6 | ||||

| 6 | ||||

| 7 | ||||

| 7 | ||||

| 37 | ||||

| 42 | ||||

| 49 | ||||

| 51 | ||||

| 54 | ||||

| 56 | ||||

| 56 | ||||

| 56 | ||||

| 56 | ||||

This prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or SEC, using a “shelf” registration process. Under this shelf registration statement, we may, from time to time, offer and sell, either individually or in combination, in one or more offerings, up to a total dollar amount of $100,000,000 of any combination of the securities described in this prospectus.

This prospectus provides you with a general description of the securities we may offer. Each time we offer securities under this prospectus, we will provide a prospectus supplement that will contain more specific information about the terms of that offering. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. The prospectus supplement and any related free writing prospectus that we may authorize to be provided to you may also add, update or change any of the information contained in this prospectus or in the documents that we have incorporated by reference into this prospectus. We urge you to read carefully this prospectus, any applicable prospectus supplement and any free writing prospectuses we have authorized for use in connection with a specific offering, together with the information incorporated herein by reference as described under the heading “Incorporation of Certain Information by Reference,” before buying any of the securities being offered.

This prospectus may not be used to consummate a sale of securities unless it is accompanied by a prospectus supplement.

You should rely only on the information contained in, or incorporated by reference into, this prospectus and any applicable prospectus supplement, along with the information contained in any free writing prospectuses we have authorized for use in connection with a specific offering. Neither we nor the selling stockholders have authorized anyone to provide you with different or additional information. You must not rely upon any information or representation not contained or incorporated by reference in this prospectus, the accompanying prospectus supplement or in any related free writing prospectus that we may authorize to be provided to you. This prospectus is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so.

i

Table of Contents

The information appearing in this prospectus, any applicable prospectus supplement or any related free writing prospectus is accurate only as of the date on the front of the document and that any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus, any applicable prospectus supplement or any related free writing prospectus, or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

This prospectus contains and incorporates by reference market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although we believe that these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. Although we are not aware of any misstatements regarding the market and industry data presented in this prospectus and the documents incorporated herein by reference, these estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” contained in the applicable prospectus supplement and any related free writing prospectus, and under similar headings in the other documents that are incorporated by reference into this prospectus. Accordingly, investors should not place undue reliance on this information.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the section entitled “Where You Can Find Additional Information.”

ii

Table of Contents

This summary highlights selected information contained elsewhere in this prospectus or incorporated by reference in this prospectus, and does not contain all of the information that you need to consider in making your investment decision. You should carefully read the entire prospectus, the applicable prospectus supplement and any related free writing prospectus, including the risks of investing in our securities discussed under the heading “Risk Factors” contained in the applicable prospectus supplement and any related free writing prospectus, and under similar headings in the other documents that are incorporated by reference into this prospectus. You should also carefully read the information incorporated by reference into this prospectus, including our financial statements, and the exhibits to the registration statement of which this prospectus is a part.

CymaBay Therapeutics, Inc.

Overview

CymaBay Therapeutics, Inc. is focused on developing therapies to treat metabolic diseases with high unmet medical need, including serious rare and orphan disorders. Arhalofenate, our lead product candidate, is being developed for the treatment of gout. Arhalofenate has successfully completed three Phase 2 clinical trials in patients with gout and consistently demonstrated the ability to reduce gout flares and reduce serum uric acid (sUA). Gout flares are recurring and painful episodes of joint inflammation that are triggered by the presence of monosodium urate crystals that form as a result of elevated sUA levels. We believe the potential for arhalofenate to prevent or reduce flares while also lowering sUA could differentiate it from currently available treatments for gout. Arhalofenate has established a favorable safety profile in clinical trials involving nearly 1,000 patients exposed to date. We are currently investigating arhalofenate in a 12-week Phase 2b clinical trial in patients with gout and expect to report data from this trial in the second quarter of 2015. Our second product candidate, MBX-8025, demonstrated favorable effects on cholesterol, triglycerides and markers of liver health in a Phase 2 clinical trial in patients with mixed dyslipidemia. We are considering pursuing MBX-8025 in a number of orphan diseases in which these attributes could be beneficial, such as homozygous familial hypercholestorolemia (HoFH), severe hypertriglyceridemia (SHTG) and primary biliary cirrhosis (PBC). We also believe that MBX-8025 could have utility in the treatment of the more prevalent, but high unmeet need, indication of nonalcoholic steatohepatitis (NASH). We plan to initiate one or more pilot or proof-of-concept studies for MBX-8025, beginning with HoFH, in the first half of 2015.

Risks Associated with our Business

Our business is subject to numerous risks. You should read these risks before you invest in our common stock. In particular, our risks include, but are not limited to, the following:

| • | We will need additional capital in the future to sufficiently fund our operations and research; |

| • | We have incurred significant losses since our inception, we anticipate that we will continue to incur significant losses for the foreseeable future, and we may never achieve or maintain profitability; |

| • | We depend on the success of our lead product candidate, arhalofenate, which is still under clinical development, and MBX-8025, which we currently plan to develop, and may not obtain regulatory approval or successfully commercialize either of these product candidates; |

| • | Our product candidates may cause adverse effects or have other properties that could delay or prevent their regulatory approval or limit the scope of any approved label or market acceptance; |

| • | We rely on third-party manufacturers to produce our preclinical and clinical drug supplies, and we intend to rely on third parties to produce commercial supplies of any approved product candidates; |

| • | We rely on limited sources of supply for the drug substance for our lead product candidate, arhalofenate, and any disruption in the chain of supply may cause delay in developing and commercializing arhalofenate; |

1

Table of Contents

| • | If we are unable to obtain or protect intellectual property rights related to our products and product candidates, we may not be able to compete effectively in our market; and |

| • | Our stock price may be volatile, and our stockholders’ investment in our stock could decline in value. |

Corporate Information

CymaBay Therapeutics, Inc., was incorporated under the laws of the State of Delaware on October 5, 1988, originally under the name Transtech Corporation. Our executive offices are located at 7999 Gateway Blvd., Suite 130 Newark, CA 94560. The telephone number at our executive office is (510) 293-8800. Our corporate website address is www.cymabay.com. We do not incorporate the information contained on, or accessible through, our website into this prospectus, and you should not consider it part of this prospectus.

As used in this prospectus, “CymaBay,” “we,” “us,” and “our” refer to CymaBay Therapeutics, Inc. and its subsidiaries taken as a whole. The word trademark “CymaBay” is registered on the Principal Register of the United States Patent and Trademark Office. This prospectus also contains trademarks and trade names of other companies, and those trademarks and trade names are the property of their respective owners. We do not intend our use or display of other companies’ trademarks or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies or products.

We are an “Emerging Growth Company”

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an “emerging growth company,” we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to public companies. These provisions include:

| • | only two years of audited financial statements in addition to any required unaudited interim financial statements with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; |

| • | reduced disclosure about our executive compensation arrangements; |

| • | omitted compensation discussion and analysis; |

| • | no requirement that we solicit non-binding advisory votes on executive compensation or golden parachute arrangements; and |

| • | exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting. |

We intend to take advantage of the reduced disclosure obligations. Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in the Securities Act of 1933, as amended, or the Securities Act, for complying with new or revised accounting standards. In other words, an emerging growth company can elect to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to avail ourselves of this exemption to take advantage of the extended transition period for complying with new or revised accounting standards.

We could remain an emerging growth company until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, which would occur if the market value of our common stock that are held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, (iii) the date on which we have issued more than $1 billion

2

Table of Contents

in non-convertible debt during the preceding three-year period and (iv) the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common equity securities pursuant to an effective registration statement under the Securities Act. At this time we expect to remain an “emerging growth company” for the foreseeable future.

CymaBay also qualifies as a “smaller reporting company” and thus has the advantage of not being required to provide the same level of disclosure as larger public companies.

The Securities We May Offer

We may offer shares of our common stock and preferred stock, various series of debt securities and/or warrants to purchase any of such securities, either individually or in combination, up to a total dollar amount of $100,000,000, from time to time under this prospectus, together with the applicable prospectus supplement and any related free writing prospectus, at prices and on terms to be determined by market conditions at the time of any offering. We may also offer common stock, preferred stock and/or debt securities upon the exercise of warrants. This prospectus provides you with a general description of the securities we may offer. Each time we offer a type or series of securities under this prospectus, we will provide a prospectus supplement that will describe the specific amounts, prices and other important terms of the securities, including, to the extent applicable:

| • | designation or classification; |

| • | aggregate principal amount or aggregate offering price; |

| • | maturity date, if applicable; |

| • | original issue discount, if any; |

| • | rates and times of payment of interest or dividends, if any; |

| • | redemption, conversion, exercise, exchange or sinking fund terms, if any; |

| • | conversion or exchange prices or rates, if any, and, if applicable, any provisions for changes to or adjustments in the conversion or exchange prices or rates and in the securities or other property receivable upon conversion or exchange; |

| • | ranking; |

| • | restrictive covenants, if any; |

| • | voting or other rights, if any; and |

| • | material or special U.S. federal income tax considerations, if any. |

The applicable prospectus supplement and any related free writing prospectus that we may authorize to be provided to you may also add, update or change any of the information contained in this prospectus or in the documents we have incorporated by reference. However, no prospectus supplement or free writing prospectus will offer a security that is not registered and described in this prospectus at the time of the effectiveness of the registration statement of which this prospectus is a part.

THIS PROSPECTUS MAY NOT BE USED TO CONSUMMATE A SALE OF SECURITIES UNLESS IT IS ACCOMPANIED BY A PROSPECTUS SUPPLEMENT.

We may sell the securities directly to investors or to or through agents, underwriters or dealers. We and the selling stockholders, and our or their agents or underwriters, reserve the right to accept or reject all or part of any

3

Table of Contents

proposed purchase of securities. If we do offer securities to or through agents or underwriters, we will include in the applicable prospectus supplement:

| • | the names of those agents or underwriters; |

| • | applicable fees, discounts and commissions to be paid to them; |

| • | details regarding over-allotment options, if any; and |

| • | the net proceeds to us. |

Common Stock. We may issue shares of our common stock from time to time. The holders of our common stock are entitled to one vote for each share held of record on all matters submitted to a vote of stockholders. Subject to preferences that may be applicable to any outstanding shares of preferred stock, the holders of common stock are entitled to receive ratably such dividends as may be declared by our board of directors out of legally available funds. Upon our liquidation, dissolution or winding up, holders of our common stock are entitled to share ratably in all assets remaining after payment of liabilities and the liquidation preferences of any outstanding shares of preferred stock. Holders of common stock have no preemptive rights and no right to convert their common stock into any other securities. There are no redemption or sinking fund provisions applicable to our common stock. In this prospectus, we have summarized certain general features of the common stock under “Description of Capital Stock — Common stock.” We urge you, however, to read the applicable prospectus supplement (and any related free writing prospectus that we may authorize to be provided to you) related to any common stock being offered.

Preferred Stock. We may issue shares of our preferred stock from time to time, in one or more series. Our board of directors will determine the designations, voting powers, preferences and rights of the preferred stock, as well as the qualifications, limitations or restrictions thereof, including dividend rights, conversion rights, preemptive rights, terms of redemption or repurchase, liquidation preferences, sinking fund terms and the number of shares constituting any series or the designation of any series. Convertible preferred stock will be convertible into our common stock or exchangeable for other securities. Conversion may be mandatory or at your option and would be at prescribed conversion rates.

If we sell any series of preferred stock under this prospectus, we will fix the designations, voting powers, preferences and rights of the preferred stock of each series we issue under this prospectus, as well as the qualifications, limitations or restrictions thereof, in the certificate of designation relating to that series. We will file as an exhibit to the registration statement of which this prospectus is a part, or will incorporate by reference from reports that we file with the SEC, the form of any certificate of designation that contains the terms of the series of preferred stock we are offering. In this prospectus, we have summarized certain general features of the preferred stock under “Description of Capital Stock — Preferred stock.” We urge you, however, to read the applicable prospectus supplement (and any related free writing prospectus that we may authorize to be provided to you) related to the series of preferred stock being offered, as well as the complete certificate of designation that contains the terms of the applicable series of preferred stock.

Debt Securities. We may issue debt securities from time to time, in one or more series, as either senior or subordinated debt or as senior or subordinated convertible debt. The senior debt securities will rank equally with any other unsecured and unsubordinated debt. The subordinated debt securities will be subordinate and junior in right of payment, to the extent and in the manner described in the instrument governing the debt, to all of our senior indebtedness. Convertible debt securities will be convertible into or exchangeable for our common stock or other securities. Conversion may be mandatory or at your option and would be at prescribed conversion rates.

Any debt securities issued under this prospectus will be issued under one or more documents called indentures, which are contracts between us and a national banking association or other eligible party, as trustee. In this prospectus, we have summarized certain general features of the debt securities under “Description of Debt Securities.” We urge you, however, to read the applicable prospectus supplement (and any free writing prospectus that we may authorize to be provided to you) related to the series of debt securities being offered, as well as the complete indentures that contain the terms of the debt securities. We have filed the form of indenture as an exhibit

4

Table of Contents

to the registration statement of which this prospectus is a part, and supplemental indentures and forms of debt securities containing the terms of the debt securities being offered will be filed as exhibits to the registration statement of which this prospectus is a part or will be incorporated by reference from reports that we file with the SEC.

Warrants. We may issue warrants for the purchase of common stock, preferred stock and/or debt securities in one or more series. We may issue warrants independently or in combination with common stock, preferred stock and/or debt securities. In this prospectus, we have summarized certain general features of the warrants under “Description of Warrants.” We urge you, however, to read the applicable prospectus supplement (and any related free writing prospectus that we may authorize to be provided to you) related to the particular series of warrants being offered, as well as any warrant agreements and warrant certificates that contain the terms of the warrants. We have filed forms of the warrant agreements and forms of warrant certificates containing the terms of the warrants that may be offered as exhibits to the registration statement of which this prospectus is a part. We will file as exhibits to the registration statement of which this prospectus is a part, or will incorporate by reference from reports that we file with the SEC, the form of warrant and/or the warrant agreement and warrant certificate, as applicable, that contain the terms of the particular series of warrants we are offering, and any supplemental agreements, before the issuance of such warrants.

Any warrants issued under this prospectus may be evidenced by warrant certificates. Warrants also may be issued under an applicable warrant agreement that we enter into with a warrant agent. We will indicate the name and address of the warrant agent, if applicable, in the prospectus supplement relating to the particular series of warrants being offered.

Use of Proceeds

Except as described in any applicable prospectus supplement or in any free writing prospectuses we have authorized for use in connection with a specific offering, we currently intend to use the net proceeds from the sale of the securities offered by us hereunder, if any, for working capital, capital expenditures and other general corporate purposes. See “Use of Proceeds” in this prospectus.

NASDAQ Capital Market Listing

Our common stock is listed on the NASDAQ Capital Market under the symbol “CBAY.” The applicable prospectus supplement will contain information, where applicable, as to other listings, if any, on the NASDAQ Capital Market or other securities exchange of the securities covered by the applicable prospectus supplement.

5

Table of Contents

Investing in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully the risks and uncertainties described under the heading “Risk Factors” contained in the applicable prospectus supplement and any related free writing prospectus, and discussed under the section entitled “Risk Factors” contained in our most recent Annual Report on Form 10-K and in our most recent Quarterly Report on Form 10-Q, as well as any amendments thereto reflected in subsequent filings with the SEC, which are incorporated by reference into this prospectus in their entirety, together with other information in this prospectus, the documents incorporated by reference and any free writing prospectus that we may authorize for use in connection with this offering. The risks described in these documents are not the only ones we face, but those that we consider to be material. There may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that could have material adverse effects on our future results. Past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be seriously harmed. This could cause the trading price of our common stock to decline, resulting in a loss of all or part of your investment. Please also read carefully the section below entitled “Special Note Regarding Forward-Looking Statements.”

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents we have filed with the SEC that are incorporated by reference contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, or the Exchange Act. These statements relate to future events or to our future operating or financial performance and involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. Forward-looking statements may include, but are not limited to, statements about:

| • | our expectations with respect to the clinical development of arhalofenate and our other product candidates, our clinical trials and the regulatory approval process; |

| • | statements regarding the steps, timing and costs of our development programs; |

| • | any projections of earnings, revenue, sufficiency of cash resources or other financial items; |

| • | the plans and objectives of management for future operations; |

| • | the availability of additional financing and access to capital; |

| • | the formation of a trading market for our common stock; |

| • | discussions and approvals of regulatory agencies; and |

| • | the period of time for which we will be able to fund our operations. |

In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “projects,” “predicts,” “potential” and similar expressions intended to identify forward-looking statements. These statements reflect our current views with respect to future events and are based on assumptions and are subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. We discuss in greater detail many of these risks under the heading “Risk Factors” contained in the applicable prospectus supplement, in any free writing prospectuses we may authorize for use in connection with a specific offering, and in our most recent annual report on Form 10-K and in our most recent quarterly report on Form 10-Q, as well as any amendments thereto reflected in subsequent filings with the SEC, which are incorporated by reference into this prospectus in their entirety. Also,

6

Table of Contents

these forward-looking statements represent our estimates and assumptions only as of the date of the document containing the applicable statement. Unless required by law, we undertake no obligation to update or revise any forward-looking statements to reflect new information or future events or developments. Thus, you should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements. You should read this prospectus, any applicable prospectus supplement, together with the documents we have filed with the SEC that are incorporated by reference and any free writing prospectus that we may authorize for use in connection with this offering completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of the forward-looking statements in the foregoing documents by these cautionary statements.

Except as described in any applicable prospectus supplement or in any free writing prospectuses we have authorized for use in connection with a specific offering, we currently intend to use the net proceeds from the sale of the securities offered by us hereunder, if any, for working capital, capital expenditures and other general corporate purposes, which may include costs of funding future acquisitions or for any other purpose we describe in the applicable prospectus supplement.

CymaBay Overview

CymaBay Therapeutics, Inc. is focused on developing therapies to treat metabolic diseases with high unmet medical need, including serious rare and orphan disorders. Arhalofenate, our lead product candidate, is being developed for the treatment of gout. Arhalofenate has successfully completed three Phase 2 clinical trials in patients with gout and consistently demonstrated the ability to reduce gout flares and reduce serum uric acid (sUA). Gout flares are recurring and painful episodes of joint inflammation that are triggered by the presence of monosodium urate crystals that form as a result of elevated sUA levels. We believe the potential for arhalofenate to prevent or reduce flares while also lowering sUA could differentiate it from currently available treatments for gout. Arhalofenate has established a favorable safety profile in clinical trials involving nearly 1,000 patients exposed to date. We are currently investigating arhalofenate in a 12-week Phase 2b clinical trial in patients with gout and expect to report data from this trial in the second quarter of 2015. Our second product candidate, MBX-8025, demonstrated favorable effects on cholesterol, triglycerides and markers of liver health in a Phase 2 clinical trial in patients with mixed dyslipidemia. We are considering pursuing MBX-8025 in a number of orphan diseases in which these attributes could be beneficial, such as homozygous familial hypercholestorolemia (HoFH), severe hypertriglyceridemia (SHTG) and primary biliary cirrhosis (PBC). We also believe that MBX-8025 could have utility in the treatment of the more prevalent, but high unmeet need, indication of nonalcoholic steatohepatitis (NASH). We plan to initiate one or more pilot or proof-of-concept studies for MBX-8025 in the first half of 2015.

We believe arhalofenate has the potential to address unmet needs in the treatment of gout. Of the eight million patients with gout in the U.S., we estimate that over three million are on urate lowering therapy (ULT). Approximately one million of these patients on ULT continue to experience three or more flares per year, with significant impact to patient quality of life and the health care system. This patient population is poorly served by available therapies. The two primary goals of gout treatment are the prevention of flares and lowering of sUA. The fundamental limitation in achieving these goals is that all currently available ULTs cause an increase in flares upon initiation of treatment, leading many patients to discontinue or avoid therapy. Given this increase in flares, standard of care includes prophylaxis with colchicine and use of anti-inflammatory medications, which are often poorly tolerated or inadvisable for use in gout patients due to their side effects. Despite prophylaxis with colchicine, many patients continue to experience flares. We believe that by decreasing flares while lowering sUA, arhalofenate has the potential to treat patients with gout without the need for colchicine or other anti-inflammatory medications and would thus be differentiated from all currently available gout therapies.

CymaBay Strategy

Our goal is to become a leading biopharmaceutical company focused on developing and commercializing proprietary new medicines for metabolic and rare diseases with high unmet need. Key elements of our strategy are to:

7

Table of Contents

| • | develop arhalofenate as a dual-acting treatment to prevent or reduce flares and lower sUA in patients with gout; |

| • | develop MBX-8025 for high unmet need or orphan indications linked to defects in lipid storage, handling and utilization and certain diseases effecting liver function; |

| • | pursue partnerships to advance and commercialize arhalofenate and potentially other clinical candidates; and |

| • | strengthen our patent portfolio and other means of protecting exclusivity. |

CymaBay Pipeline Overview

Our pipeline includes three unpartnered clinical stage product candidates and a number of preclinical programs.

Arhalofenate—Gout

Gouty arthritis, or simply gout, is the most common form of inflammatory arthritis in men and affects more than eight million people in the United States (U.S.). The hallmark symptom of gout is a flare, characterized by debilitating pain, along with tenderness and inflammation of affected joints. Gout has a significant impact on patients’ quality of life and health care utilization. Patients experiencing gout flares miss an average of 4.6 more days of work per year than those without gout. Gout flares also result in increased health care utilization with approximately 35% of moderate and 50% of severe gout patients who experience a flare having at least one acute care visit per year.

Gout flares are recurring and painful episodes of joint inflammation that are triggered by the presence of monosodium urate (MSU) crystals. MSU crystals are formed in tissues when the concentration of serum uric acid (sUA) exceeds its solubility limit of approximately 6.8 milligrams per deciliter (mg/dL). Elevated levels of sUA, or hyperuricemia, most commonly results from the under excretion of uric acid in the kidney. This is caused by its reabsorption from urine and transport back to the blood by specialized urate transporters/exchangers in the proximal renal tubule. Long term accumulation of MSU crystals in the body leads to the progression of gout with an increase in the frequency of flares, the involvement of multiple joints, the formation of visible masses of MSU crystals (tophi) and the debilitation that results from deformation of joints.

Many scientific surveys and large clinical studies in gout indicate that gout patients have a high incidence of cardiovascular and metabolic comorbidities, such as hypertension (50% or more), coronary artery disease (>35%), chronic kidney disease (~40%), and diabetes (~20%). Managing patients with these comorbidities is challenging because many of them are contraindicated in the medication currently used to treat gout. Examples include corticosteroids which can cause hypertension and worsening of dysglycemia and non-steroidal anti-inflammatory drugs (NSAIDs) which have renal toxicity.

Market Opportunity

Unmet Needs in the Treatment of Gout

Of the eight million patients with gout in the U.S., we estimate that over three million are on urate lowering therapy (ULT) and of these patients on ULTs, about one million will continue to experience three or more flares per year, with significant impact to patient quality of life and the health care system. According to a 2012 study, patients having three or more flares per year typically incur $10,000 more in annual health care costs than patients without gout. In order to halt the progression of the disease and provide long term reduction in flares, MSU crystals must be eliminated from the body. Therefore, the two major goals of gout treatment are to prevent flares and lower sUA to below 6 mg/dL in order to dissolve MSU crystals present in tissue. The most important limitation in achieving these goals is that all existing ULTs paradoxically cause an increase in flares upon initiation of treatment, leading many patients to discontinue or avoid therapy. Non-adherence to therapy is a significant problem. In one long term study, only about 40% of allopurinol patients reached the goal of sUA < 6 mg/dL (Febuxostat Briefing Package FDA Advisory Committee Meeting November 24, 2008). Failure to get to goal results in progression of the disease and continued flaring.

Limitations of Current Therapies

Allopurinol and febuxostat (marketed by Takeda Pharmaceutical Company Limited as Uloric®), the most common drugs prescribed to lower sUA, increase flares for up to 6 – 12 months following initiation of treatment.

8

Table of Contents

The ULT-initiated flare phenomenon is common to marketed ULTs and leads to increased health care utilization and high patient discontinuation with progression of disease.

To address the increase in flare rate associated with initiation of ULT therapy, anti-inflammatory drugs such as colchicine and NSAIDs are co-prescribed with ULTs. However, use of these agents carries a risk for causing adverse effects. Some known adverse effects of colchicine include diarrhea, nausea, vomiting, destruction of skeletal muscle, neuromuscular toxicity, and decreased blood cell production. Chronic use of NSAIDs, which only provide symptom relief, is associated with increased risk of renal toxicity, gastrointestinal (GI) bleeding and cardiovascular events. Similarly, steroids are linked to hypertension and a worsening of blood glucose, which is problematic for diabetics and patients with hypertension and/or heart disease, respectively. Given the prevalence of cardiovascular and metabolic comorbidities in gout patients, the use of these agents can be problematic in a significant number of gout patients.

Anti-Flare Competition

The largest selling branded gout drug in the U.S. is Colcrys® (branded colchicine), marketed by Takeda for the prevention and treatment of gout flares. Despite the availability of low cost generic NSAIDs and steroids, Colcrys had total U.S. sales of approximately $629 million in 2013 per IMS Health data highlighting the importance of preventing and treating gout flares effectively. While colchicine has been shown to reduce the percentage of patients experiencing flares by 57%, it carries limitations in terms of safety and tolerability.

The biologic drugs Ilaris (developed by Novartis) and Arcalyst (developed by Regeneron) which neutralize the proinflammatory cytokine IL-1ß, the trigger for flares, have been shown in clinical trials to suppress gout flares. However, there are safety risks associated with these drugs, and neither drug has gained approval in the U.S. for gout.

Serum Uric Acid Lowering Competition

Xanthine oxidase (XO) inhibitors, allopurinol and febuxostat, dominate the ULT market with generic allopurinol at doses up to 300 mg accounting for about 90% of ULT prescriptions in the U.S. Allopurinol may potentially lead to undertreatment because of the occurrence of skin rash and a rare but serious hypersensitivity reaction which can be fatal. In addition, it must be used with caution in renally impaired patients, a common comorbidity in gout, and is recommended to undergo dose escalation. Febuxostat, approved by the Food and Drug Administration (FDA) in 2009, was the first new treatment approved for gout in more than 40 years.

Lesinurad is a drug in Phase 3 development by AstraZeneca PLC. Like arhalofenate, it lowers sUA by promoting the excretion of uric acid by the kidney. However, lesinurad, like all other ULTs, has been shown to increase flares upon initiation of treatment. Lesinurad is being studied as an add-on treatment to allopurinol patients not reaching target sUA levels, as an add-on to febuxostat in tophaceous gout patients and as monotherapy (given as a single drug) for patients who are intolerant to XO inhibitors.

While medically important, we believe the case for sUA lowering alone is not sufficient to ensure success in the market because hyperuricemia is asymptomatic and patients usually seek treatment for their flares.

Arhalofenate Addresses the Unmet Needs in Gout

We believe that a significant opportunity exists for arhalofenate as a result of its combined anti-flare and sUA lowering profile for the treatment of gout. Arhalofenate has the potential to address key unmet needs by preventing flares and achieving sUA target goals as monotherapy. In patients who need additional sUA lowering, arhalofenate may be combined with other ULTs to significantly reduce sUA without the induction of flares seen with other ULTs.

We have undertaken an analysis of the gout market expected at the time of arhalofenate’s launch. Arhalofenate has dual pharmacology, whereas other gout drugs on the market or in development, are limited to only either anti-flare or sUA lowering. Given arhalofenate has demonstrated the ability in our Phase 2 studies to reduce and prevent flares while also lowering sUA, we believe it has the potential to be the preferred alternative for the approximately 1 million patients who flare three or more times per year despite being on ULT. We believe the poor compliance of patients treated with existing ULTs also leads to more than one million discontinuations and restarts of therapy every year. The cycling of patients on and off ULTs would offer opportunities for physicians to switch patients on other therapies to arhalofenate.

9

Table of Contents

As a monotherapy, we believe arhalofenate has the potential to be a single, safe, easy-to-use replacement for the combination of allopurinol and colchicine, which is the current standard of care.

For those patients needing additional sUA reduction, our clinical trial data have demonstrated that arhalofenate has the potential to be combined with febuxostat to provide large (~60%) reductions in sUA, but without the large increases in the incidence of flares seen with all other ULTs.

Arhalofenate Overview

Scientific Rationale

Arhalofenate is a prodrug which upon absorption is converted to its active form, arhalofenate acid. Arhalofenate acid’s dual actions are to block the MSU crystal-stimulated production of IL-1ß by macrophages (white blood cells that play an important role in the body’s defense against pathogens and foreign matter) in joints and to inhibit uric acid reabsorption by urate transporters in the kidney.

Anti-Inflammatory Activity

We believe, arhalofenate (through arhalofenate acid) is unique among available anti-inflammatory drugs because it prevents the initiation of the inflammatory cascade and acts upstream from other therapies used for the prophylaxis and treatment of gout flares. The anti-inflammatory action comes from a unique trans-repression (a type of inhibition) of peroxisome proliferator-activated receptor-gamma (PPARg) which blocks the production of IL-1ß and other inflammatory proteins by macrophages that produce a flare. Neutralization of IL-1ß has been shown in clinical trials to reduce flares by about 70%. Because arhalofenate acid acts upstream of colchicine, it may be able to replace colchicine.

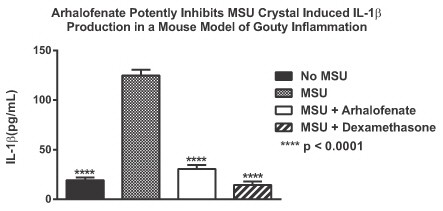

The anti-inflammatory mechanism of arhalofenate acid has been demonstrated in preclinical models. In experiments with isolated macrophages, arhalofenate acid is able to suppress MSU crystal-stimulated release of IL-1ß protein by blocking expression of the precursor pro-IL-1ß gene. Importantly, this activity is seen at concentrations that are achieved in humans.

In vivo confirmation of this effect was seen in a mouse model of gouty inflammation. Injecting MSU crystals into mice produces many of the molecular and cellular steps involved in a gout flare. As shown below, administration of arhalofenate at doses that produce clinically relevant exposures was able to suppress the release of IL-1ß in response to MSU crystals to a degree similar to that of dexamethasone, a potent anti-inflammatory steroid drug. Importantly, it also suppresses other important inflammatory mediators, such as CXCL1, CXCL2 and MCP-1 (chemokine (C-X-C motif) ligand 1 and ligand 2 and monocyte chemotactic protein 1), that colchicine does not.

Uric Acid Lowering Activity

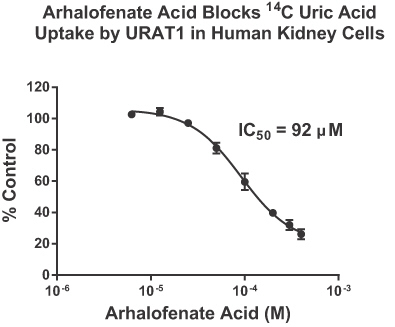

Uric acid is an anionic, or negatively charged, molecule that is removed from the body by filtration through the kidney into urine. For about 80-90% of patients, hyperuricemia is a result of under excretion of uric acid due to its reabsorption by organic anion transporters (OAT) in the proximal renal tubule. Arhalofenate acid blocks 14C-uric acid uptake in an embryonic kidney cell line that expresses human urate transporter 1 (URAT1), one of the predominant renal transporters of urate. The inhibition is pharmacologically relevant because it occurs at

10

Table of Contents

concentrations that are less than those seen in human urine in clinical trials. Arhalofenate acid was shown to inhibit uric acid uptake by URAT1, OAT4 and OAT10, three of the transporters that play a critical role in uric acid reabsorption. This mechanism is consistent with the clinical pharmacology in which arhalofenate was shown to dose-dependently increase urate clearance into urine in gout patients.

The available preclinical evidence provides an explanation for the dual mode-of-action observed for arhalofenate in treating gout patients. CymaBay has completed three clinical studies in gout patients which have shown that arhalofenate has the potential for both decreasing the incidence, severity and duration of gout flares, including those that often occur upon initiation of ULT, and reducing sUA.

CymaBay has completed a nonclinical program for arhalofenate, including genotoxicity, chronic repeat dose toxicology in rats and monkeys, safety pharmacology, reproductive toxicology and two-year rodent carcinogenicity studies. The results of these studies have all been submitted to and received by the FDA.

CymaBay has developed a manufacturing process for arhalofenate and ~200 kg of drug substance is available to initiate the Phase 3 program. Tablets for the Phase 2b study have already been manufactured. Both the drug substance and tablet manufacturing processes will be scaled up to support the registration and commercial chemistry, manufacturing and controls program.

Clinical Studies with Arhalofenate

The Gout Development Program

Arhalofenate has been studied in three Phase 2 gout clinical trials including a monotherapy study, febuxostat combination study and an allopurinol combination study.

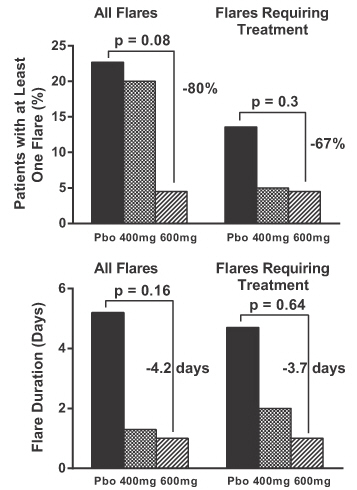

Monotherapy Study

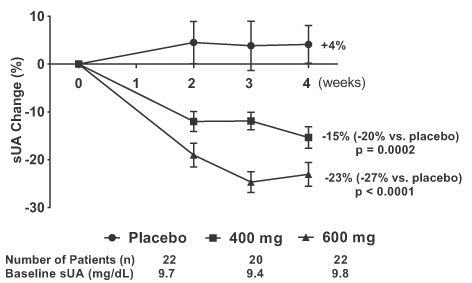

The monotherapy study was a randomized, double-blind, placebo-controlled study evaluating the safety and efficacy of arhalofenate for the treatment of hyperuricemia in patients with gout. Arhalofenate was given daily at doses of 400 mg and 600 mg for four weeks. A total of 64 patients completed the treatment phase: 22 received placebo, 20 received arhalofenate 400 mg, and 22 received arhalofenate 600 mg. All randomized patients also received colchicine 0.6 mg daily as flare prophylaxis, a preventive treatment for flares. Compared to placebo, patients treated with arhalofenate demonstrated dose-dependent reductions in gout flare and sUA, as shown below. The proportion of patients reporting at least one flare during the treatment phase was 23% (5 of 22), 20% (4 of 20), and 5% (1 of 22) in the placebo, 400 mg, and 600 mg groups, respectively. In addition to flare frequency, both

11

Table of Contents

severity and duration of flare were lower in arhalofenate-treated patients. After 4 weeks of treatment, the mean sUA percent (and absolute) changes from Day 1 were: +4% (+0.2 mg/dL) in the placebo group, -15% (-1.4 mg/dL) in the 400 mg arhalofenate group and -23% (-2.3 mg/dL) in the 600 mg arhalofenate group. When compared to placebo, the sUA reductions in both arhalofenate treatment groups were statistically significant (p£0.0002).

12

Table of Contents

Overall, adverse events (AEs) were similar among the placebo and arhalofenate-treated groups. There were no severe or serious AEs, discontinuations due to AEs, or deaths during the study. Overall, the types and frequencies of AEs were similar among patients receiving placebo or arhalofenate 400 mg or 600 mg and there were no clinically meaningful differences observed in safety laboratory test results.

Febuxostat Combination Study

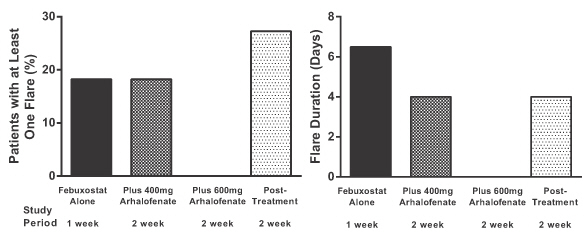

In the febuxostat combination study, arhalofenate up to 600 mg daily was added to febuxostat 80 mg in an open-label, in-patient study to determine the efficacy, safety, and tolerability of arhalofenate in combination with 80 mg febuxostat once daily. A total of 11 patients were dosed with 80 mg febuxostat during Week 1, 80 mg febuxostat plus 400 mg arhalofenate during Weeks 2-3 and 80 mg febuxostat plus 600 mg arhalofenate during Weeks 4-5. All patients also received 0.6 mg colchicine daily as prophylaxis for gout flare.

The proportion of these patients reporting at least one flare was 18% (2 of 11 patients) during Week 1 (febuxostat 80 mg) and 18% (2 of 11 patients) during Weeks 2-3 (febuxostat 80 mg plus arhalofenate 400 mg), respectively. No patient reported the initiation of a flare during Weeks 4-5 (febuxostat 80 mg plus arhalofenate 600 mg). The proportion of patients reporting at least one flare in the two-week follow-up period was 27% (3 of 11 patients).

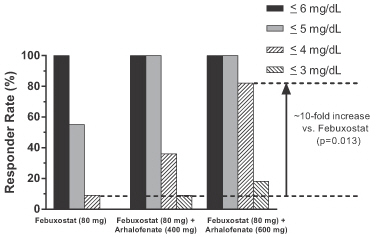

Mean sUA reductions were -48% at Day 8 (febuxostat 80 mg), -54% at Day 22 (febuxostat 80 mg plus arhalofenate 400 mg), and -60% at Day 36 (febuxostat 80 mg plus arhalofenate 600 mg). Historically, one week of dosing with febuxostat 80 mg has been shown to give the full effect of sUA reduction, and the mean reductions in this study at Day 8 are consistent with other reported study results. The proportion of patients who achieved various sUA target levels during treatment is shown below. Patients with advanced gout have large stores of MSU crystals in the body, and driving sUA levels to lower values (e.g., < 4 mg/dL) has been shown with other ULTs to accelerate clinical benefits such as the reduction of tophi (masses of MSU crystals).

13

Table of Contents

No patients experienced severe or serious AEs or deaths, and there were no discontinuations because of AEs. No clinically meaningful differences were observed among the study treatments in safety laboratory test results.

Allopurinol Combination Study

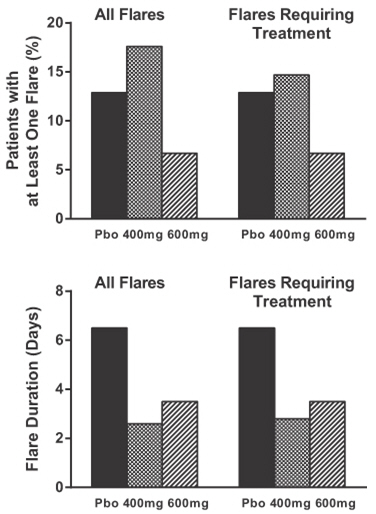

This study was a randomized, double-blind, placebo-controlled clinical trial designed to evaluate the efficacy, safety and tolerability of arhalofenate 400 mg and 600 mg when given in combination with allopurinol 300 mg and also to evaluate the effect of arhalofenate on the pharmacokinetics (PK, drug levels in the blood) of allopurinol and oxypurinol, (the product of metabolism or active metabolite of allopurinol) that forms in the body after ingestion of allopurinol. Arhalofenate (or placebo) was given once daily at doses of 400 mg and 600 mg, in addition to allopurinol 300 mg, for four weeks to patients who had failed to reach the sUA target of <6 mg/dL with allopurinol 300 mg. All randomized patients also received colchicine 0.6 mg daily as flare prophylaxis. A reduction in gout flares was observed in the arhalofenate 600 mg plus allopurinol group compared to the allopurinol only group. The proportion of patients in a pre-specified per protocol population reporting at least one flare during the 4-week treatment phase was 13% (4 of 31) in the allopurinol 300 mg only group, 18% (6 of 34) in the allopurinol 300 mg plus arhalofenate 400 mg group, and 7% (2 of 30) in the allopurinol 300 mg plus arhalofenate 600 mg group. The mean duration of flares was longer in the allopurinol plus placebo group (6.5 days) than in either the allopurinol plus 400 mg arhalofenate group (2.6 days) or the allopurinol plus 600 mg arhalofenate group (3.5 days).

There was no statistically significant difference in sUA reduction in the arhalofenate plus allopurinol groups compared to the allopurinol only group. In the per protocol population, the proportion of patients who reached a sUA target of <6 mg/dL at the end of the treatment phase was 35.5%, 52.9%, and 43.3% in the allopurinol plus placebo group, the allopurinol plus 400 mg arhalofenate group, and the allopurinol plus 600 mg arhalofenate group, respectively. The modest additional sUA reduction observed in the arhalofenate plus allopurinol groups in this study is attributable to an interaction in which arhalofenate reduces the concentration of oxypurinol, the active metabolite of allopurinol. Specifically, arhalofenate promotes the excretion of uric acid as well as oxypurinol given both are typically reabsorbed into the blood stream through the same renal transporters arhalofenate is responsible for blocking.

14

Table of Contents

No severe or serious AEs were reported. Two patients discontinued from the study due to moderate AEs. Overall, the types and frequencies of AEs were similar among the treatment groups and there were no clinically meaningful differences observed among the study treatments in safety laboratory test results.

Prior Clinical Experience with Arhalofenate

Prior to the Phase 2 trials in gout described above, eight Phase 1 studies and four Phase 2 studies in patients with type 2 diabetes mellitus (T2DM) were conducted with arhalofenate. In these studies a total of 873 subjects were studied. Daily treatment with arhalofenate up to 600 mg for up to 24 weeks in T2DM patients was found to be safe and well tolerated. Prior to conducting the third and fourth Phase 2 clinical studies in patients with T2DM, we entered into an exclusive licensing agreement for arhalofenate with Ortho-McNeil in June 2006.

In these T2DM studies, daily treatment with arhalofenate with doses up to 600 mg for up to 24 weeks duration showed improvements in glucose parameters (hemoglobin A1c [HbA1c] and fasting plasma glucose), as well as a lowering of serum triglycerides in patients with elevated levels at baseline. However, given that the observed reductions in HbA1c and fasting plasma glucose were inferior for patients receiving arhalofenate versus for those receiving the comparator drug, ActosTM, arhalofenate’s development for diabetes was abandoned. Ortho-McNeil terminated the license in March 2010 and has no further rights to arhalofenate. Arhalofenate was found to be well tolerated with no meaningful treatment group differences in AEs including those of special interest (edema, weight gain, and upper GI AEs), discontinuation due to AEs, serious AEs, and death. There were no reports of urinary tract stones in any of these studies. No clinically meaningful differences were observed in safety laboratory test results including LFTs and serum creatinine values between placebo and arhalofenate-treated groups. Patients with LFT increase did not demonstrate any increase in serum bilirubin; therefore, no patient met the criteria of Hy’s law of drug induced liver injury.

15

Table of Contents

A pooled analysis of sUA data from these diabetes studies showed statistically significant dose dependent reductions from baseline in mean sUA with arhalofenate: +2% in the placebo group (n=252), -11% in the 200 mg group (n=125), -20% in the 400 mg group (n=174), and -27% in the 600 mg group (n=159); p<0.0001 for each active group vs. placebo comparison. A p-value is a statistical measure of the probability that the difference in two values could have occurred by chance. The smaller the p-value the greater the confidence that the results are significant. For example, in the preceding studies, there is less than a 0.01% probability that the difference between two values is due to chance and, conversely there is a 99.99% probability that the observed difference was not due to chance. Similar sUA reduction was observed in patients with mild to moderate renal impairment and without additional worsening of renal function. Comparable sUA reduction was also achieved with arhalofenate in patients on concomitant low-dose aspirin (up to 325 mg daily) and on diuretics (blood pressure lowering agents).

Conclusions of Arhalofenate’s Clinical Experience

Arhalofenate has been studied in a total of 15 clinical trials with nearly a thousand subjects. These include Phase 1 studies of safety, tolerability and PK, Phase 2 studies of blood glucose effects in diabetics, and Phase 2 studies of sUA and flare effects in gout patients. Arhalofenate has had a consistent pattern of good safety and tolerability. Despite having differing objectives across these studies, arhalofenate demonstrated comparable dose-dependent reductions in sUA.

In addition to its primary characteristics for reduction of flare incidence and duration and in sUA lowering, arhalofenate also has additional features which are important in the gout population. It has shown an ability to lower triglycerides in subsets of patients with elevated serum triglycerides and to improve blood glucose parameters in diabetics, which are common comorbidities in gout patients. In an exploratory analysis, it retained its ability to lower sUA in patients with impaired renal function, another highly prevalent comorbidity in gout patients. In addition, arhalofenate gave comparable reductions in sUA whether or not patients were on low dose aspirin or thiazide diuretic (first-line therapy for uncomplicated hypertension) therapies, these latter agents being known to exacerbate hyperuricemia and to sometimes trigger flares when their treatment is initiated.

In the treatment of over a hundred patients with hyperuricemia and a diagnosis of gout, arhalofenate was safe and well tolerated and produced a consistent reduction in flare incidence and duration and in lowering sUA whether administered alone or in combination with allopurinol 300 mg or febuxostat 80 mg. The time-course of reductions in sUA was gradual and favorable for those of a drug intended to treat gout in which rapid fluctuations in sUA levels are inadvisable. It was shown as a single agent to dose-dependently increase urate excretion and fractional urate clearance, establishing that its sUA mechanism is uricosuria (i.e., it is a uricosuric).

Clinical Development of Arhalofenate for Treatment of Gout

Current Phase 2b Study

The goal of our current Phase 2b study is to investigate the full potential benefit of arhalofenate monotherapy with regard to flare prevention and sUA lowering in a more robust, longer trial. Importantly, we are investigating the benefits of two doses of arhalofenate monotherapy, including a higher dose than we studied in previous gout studies, without colchicine.

This randomized, double-blind, active comparator- and placebo-controlled study will evaluate the safety, flare prevention and sUA-lowering activity of arhalofenate in approximately 250 patients with a diagnosis of gout hyperuricemia and a history of 3 or more flares in the last 12 months. The study has 5 arms including placebo, arhalofenate (600 and 800 mg), allopurinol (300 mg) and allopurinol (300 mg) plus colchicine (0.6 mg). The primary endpoint of the study is the flare incidence rate for the arhalofenate (800 mg) arm vs. allopurinol (300 mg) following twelve weeks of treatment. A key secondary endpoint is the sUA responder rate (the percentage of patients that achieve sUA levels below 6 mg/dL) for the treatment arms. The study is designed to assess whether arhalofenate can provide sUA lowering comparable to the most commonly prescribed dose of allopurinol (300 mg) and flare reduction similar to colchicine.

We began enrollment in our Phase 2b study in March 2014 and announced completion of enrollment on September 29, 2014. We expect to report data from this study in the second quarter of 2015.

16

Table of Contents

Phase 3 Gout Program

The details (design, size, duration, etc.) of the Phase 3 program will be the subject of discussion at an End-of-Phase 2 meeting with the FDA, and will be designed to support an indication for both arhalofenate monotherapy and combination treatment with febuxostat.

In order to support this indication, and the broad use of arhalofenate to both prevent flares and reduce sUA, the Phase 3 clinical program is currently planned to include two pivotal gout studies: one arhalofenate monotherapy study, and one study of arhalofenate in combination with febuxostat. These will both be randomized, double-blind studies, with appropriate controls and statistical power. The program will also include a single arm, open label safety study to accumulate additional longer term safety data needed for the New Drug Application (at least 100 patients dosed for at least one year at the proposed dose). A small number of Phase 1 studies, including necessary drug-drug interaction studies, or special population studies, will also be conducted prior to registration.

MBX-8025

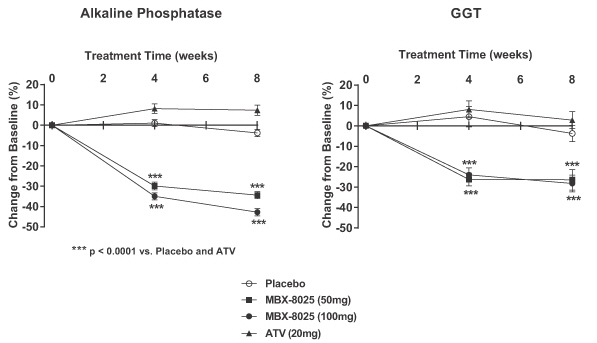

MBX-8025 is a selective agonist (a substance that elicits a response by binding to a receptor) for the peroxisome proliferator-activated receptor delta (PPARd). PPARd is a nuclear receptor that regulates genes involved in lipid storage, transport and metabolism (particularly fatty acid oxidation) and in insulin signaling and sensitivity. MBX-8025 has the potential to treat a variety of disorders characterized by derangements in lipid metabolism and certain diseases of the liver. Previously, MBX-8025 had been in development as a treatment for mixed dyslipidemia (elevated LDL-C and triglycerides (TGs) and often associated with decreased HDL-C). Results from our Phase 2 clinical trial of MBX-8025 in patients with mixed dyslipidemia established a number of clinically and statistically significant effects of the drug that we believe have the potential to benefit patients affected with other conditions. In this trial, MBX-8025 demonstrated an anti-atherogenic profile in which it lowered LDL-C, decreased the more atherogenic (i.e. tending to promote the formation of fatty plaques in the arteries) small dense LDL-C particles and raised HDL-C. In addition, MBX-8025 decreased TGs and free fatty acids. Whereas other lipid lowering drugs lower either TGs or LDL-C or predominantly act on one of these parameters, MBX-8025 has been shown in this trial to lower both at the same time. Treatment with MBX-8025 also led to significant decreases in gamma-glutamyl transferase (GGT), an enzymatic biomarker that has been associated with the liver inflammation that is often associated with the accumulation of fat in the liver (steatosis). Finally, treatment with MBX-8025 resulted in significant reductions in alkaline phosphatase (AP), an enzymatic biomarker associated with liver cholestasis.

Despite these positive results, we have decided not to further develop MBX-8025 for mixed dyslipidemia because of the requirement by the FDA to conduct a preapproval cardiovascular outcome study for all novel drugs in mixed dyslipidemia. This significantly increases the risk, time and cost of development for this indication.

Another factor in our decision to redirect development relates to an issue specific to compounds that work by interacting with the PPAR class of receptors (PPARa, PPARg and PPARd), including MBX-8025. These compounds are subject to a FDA partial clinical hold which limits clinical studies to durations of less than six months until the two-year rodent carcinogenicity studies are completed and evaluated, and the hold is lifted. The decision by the FDA to lift the partial hold involves an assessment of the human relevance and perceived risk of the rodent carcinogenicity findings in relation to the benefit to the patient for the intended indication. We have completed the two-year rodent carcinogenicity studies with MBX-8025 as well as some additional follow-up studies requested by the FDA. After completion of clinical studies for HoFH or other indications described below, the FDA has indicated that they will determine whether to lift the partial hold based on the risk-benefit profile for the patient.

For these reasons, we have decided to redirect the development of MBX-8025 for serious rare and orphan diseases or more prevalent diseases with high unmet medical need for which the risk/benefit assessment of the carcinogenicity findings would be more favorable to the patient and where an outcome study would not be necessary. We have identified a number of such indications in which there is a clear scientific rationale to suggest that the beneficial effects of MBX-8025 observed in our mixed dyslipidemia trial may be retained in that disease population. We believe MBX-8025 may provide a significant benefit for patients across a wide range of rare diseases associated with disorders of lipid metabolism, such as homozygous familial hypercholesterolemia (HoFH) and severe hypertriglyceridemia (SHTG) syndromes, and disorders of liver function, such as primary biliary cirrhosis (PBC). We also believe that MBX-8025 could have utility in the treatment of the more prevalent, but high unmeet need, indication of nonalcoholic steatohepatitis (NASH).

17

Table of Contents

Nonclinical Overview

In in vitro studies with cells and animal tissues, MBX-8025 was shown to up-regulate genes involved in the metabolism and handling of lipids, most notably stimulation of fatty acid transport and oxidation.

In preclinical studies in rodents, dogs and primates, MBX- 8025 demonstrated a variety of beneficial effects on the lipid profile and other metabolic parameters. MBX-8025 treatment increased peripheral oxidation of fatty acids leading to reduced levels of TGs and LDL-C, while raising HDL-C. MBX-8025 also inhibited fat mass accumulation, resulting in attenuation of body weight gain in rodent models of obesity.

Three-month toxicology studies in rodents (alone and in combination with atorvastatin, the generic name of the cholesterol lowering drug Lipitor®) and in monkeys have been completed. In addition, the two-year carcinogenicity studies in mice and rats have been completed. Johnson & Johnson Pharmaceutical Research & Development filed an IND for this compound with the FDA in July 2005 and subsequently transferred the application to CymaBay in March 2007.

Clinical Trials with MBX-8025

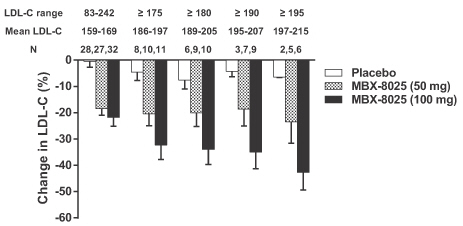

Five Phase 1 and one Phase 2 clinical trials with MBX-8025 have been completed. The largest clinical trial was an eight-week, Phase 2 trial in which MBX-8025 was administered at doses of 50 or 100 mg/day both alone and in combination with 20 mg/day of atorvastatin in moderately obese patients with mixed dyslipidemia. This trial also had a placebo arm and a 20 mg/day atorvastatin only arm.

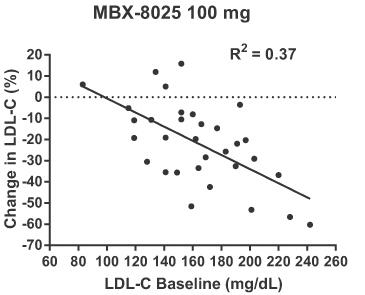

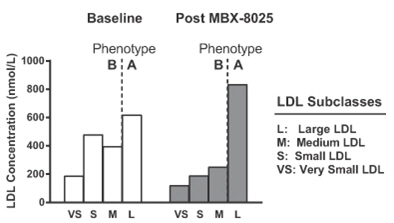

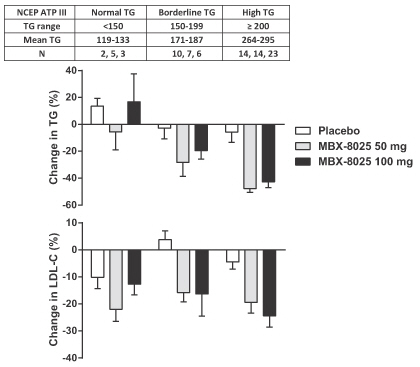

Treatment with MBX-8025 produced multiple beneficial effects on lipid parameters. First, there were significant overall reductions in total LDL–C (~20%), a parameter known to be correlated with risk of cardiovascular disease and death. The onset of the LDL-C lowering was rapid with a maximal effect seen by two weeks of treatment which was stably retained up to the end of the 8 weeks of treatment. LDL-C levels returned to pre-treatment levels within two weeks after treatment was stopped.