'33

Act

File No. 333-XXXXXX

'40

Act

File No. 811-8301

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

N-6

|

REGISTRATION

UNDER THE SECURITIES ACT OF 1933

|

|

|

Pre-effective

Amendment No.

|

o

|

|

Post-effective

Amendment No.

|

o

|

and/or

|

REGISTRATION

STATEMENT UNDER THE INVESTMENT COMPANY ACT OF

1940

|

|

|

Amendment

No. 137

|

þ

|

(Check

appropriate box or boxes.)

NATIONWIDE

VLI SEPARATE ACCOUNT-4

(Exact

Name of Registrant)

NATIONWIDE

LIFE INSURANCE COMPANY

(Name

of

Depositor)

One

Nationwide Plaza

Columbus,

Ohio 43215

(Address

of Depositor’s Principal Executive Offices) (Zip Code)

Depositor’s

Telephone Number, including

Area Code: (614) 249-7111

Thomas

E. Barnes

SVP

and Secretary

One

Nationwide Plaza

Columbus,

Ohio 43215-2220

(Name

and

Address of Agent for Service)

Approximate

Date of Proposed Public Offering: As soon as practicable after

effectiveness of registration statement February 1,

2009.

The

Registrant hereby agrees to amend this registration statement on such date

or

dates as may be necessary to delay its effective date until the registrant

shall

file a further amendment which specifically states that this registration

statement shall thereafter become effective in accordance with Section 8(a)

of

the Securities Act of 1933 or until the registration statement shall become

effective on such date as the Commission, acting pursuant to said Section

8(a),

may determine.

Nationwide

MarathonSM

CVUL

Corporate

Owned Flexible Premium Adjustable Variable Universal Life Insurance

Policies

issued

by

Nationwide

Life Insurance Company

through

Nationwide

VLI Separate Account-4

The

date

of this prospectus is February 1, 2009.

PLEASE

KEEP THIS PROSPECTUS FOR FUTURE REFERENCE.

Variable

life insurance is complex, and this prospectus is designed to help you become

as

fully informed as possible in making your decision to purchase or not to

purchase this variable life insurance policy. We encourage you to

take the time to understand the policy, its potential benefits and risks, and

how it might or might not benefit you. In consultation with your

financial adviser, you should use this prospectus in conjunction with the policy

and composite illustration to compare the benefits and risks of this policy

against those of other life insurance policies and alternative investment

instruments.

Please

read this entire prospectus and consult with a trusted financial

adviser. If you have policy-specific questions or need additional

information, contact us. Also, contact us for free copies of

the prospectuses for the mutual funds available in the

policy.

|

Telephone:

|

1-877-351-8808

|

||

|

TDD:

Internet

|

1-800-238-3035

www.nationwide.com

|

||

|

U.S.

Mail:

|

Nationwide

Life Insurance Company

|

||

|

Corporate

Insurance Markets

|

|||

|

One

Nationwide Plaza (1-11-08)

|

|||

|

Columbus,

OH 43215-2220

|

|||

You

should carefully read your policy along with this prospectus. This prospectus

is

not an offering in any jurisdiction where such offering may not lawfully be

made.

These

securities have not been approved or disapproved by the SEC nor has the SEC

passed upon the accuracy or adequacy of the prospectus. Any

representation to the contrary is a criminal offense.

|

This

policy is NOT: FDIC insured; a bank deposit; available in every state;

or

insured or endorsed by a bank or any federal government

agency.

|

||

|

This

policy MAY decrease in value to the point of being

valueless.

|

The

purpose of this policy is to provide corporate entities a vehicle to informally

finance certain employee benefit plans.. If your primary need is not

life insurance protection, then purchasing this policy may not be in your best

interest. We make no claim that the policy is in any way

similar or comparable to a systematic investment plan of a mutual

fund.

This

policy includes an Enhancement Benefit which is a partial return of charges

upon

certain surrenders. Policies without such a benefit may have lower

overall charges when compared to the policies described in this

prospectus. There are no additional charges associated with the

Enhancement Benefit, but the Enhancement Benefit does result in overall charges

of the policy being slightly higher when compared to not having an Enhancement

Benefit as part of the policy. The value of this benefit may be more

than off-set by the additional charges associated with offering such a

benefit.

In

thinking about buying this policy to replace existing life insurance, please

carefully consider its advantages versus those of the policy you intend to

replace, as well as any replacement costs. As always, consult your

financial adviser.

Not

all

terms, conditions, benefits, programs, features and investment options are

available or approved for use in every state.

1

We

offer

a variety of variable universal life policies. Despite offering

substantially similar features and investment options, certain policies may

have

lower overall charges than others, including this policy. These

differences in charges may be attributable to differences in sales and related

expenses incurred in one distribution channel versus another.

Table

of Contents

|

Page

|

|

|

In

Summary: Policy

Benefits

|

4

|

|

In

Summary: Policy

Risks

|

6

|

|

In

Summary: Fee

Tables

|

8

|

|

Policy

Investment

Options

|

13

|

|

Fixed

Account

|

|

|

Variable

Investment Options

|

|

|

Valuation

of Accumulation Units

|

|

|

How

Sub-Account Investment Experience is Determined

|

|

|

Transfers

Among and Between the Policy Investment

Options

|

16

|

|

Sub-Account

Transfers

|

|

|

Fixed

Account Transfers

|

|

|

Submitting

a Transfer Request

|

|

|

The

Policy

|

18

|

|

Generally

|

|

|

Policy

Owner and Beneficiaries

|

|

|

Purchasing

a Policy

|

|

|

Right

to Cancel (Examination Right)

|

|

|

Premium

Payments

|

|

|

Cash

Value

|

|

|

Enhancement

Benefit

|

|

|

Changing

the Amount of Base Policy Insurance Coverage

|

|

|

The

Minimum Required Death Benefit

|

|

|

Right

of Conversion

|

|

|

Exchanging

the Policy

|

|

|

Terminating

the Policy

|

|

|

Assigning

the Policy

|

|

|

Reports,

and Illustrations

|

|

|

Policy

Charges

|

23

|

|

Premium

Load

|

|

|

Base

Policy Cost of Insurance

|

|

|

Sub-Account

Asset Charge

|

|

|

Base

Specified Amount Charge

|

|

|

Administrative

Charge

|

|

|

Illustration

Charge

Policy

Rider Charges

Mutual

Fund Operating Expenses

A

Note on Charges

Information

on Underlying Mutual Fund Payments

|

|

|

Policy

Riders and Rider

Charges

|

29

|

|

Change

of Insured Rider

|

|

|

Supplemental

Insurance Rider

|

|

|

Policy

Loans

|

33

|

|

Loan

Amount and Interest Charged

|

|

|

Collateral

and Interest Earned

|

|

|

Net

Effect on Policy Loans

|

|

|

Repayment

|

|

|

Lapse

|

34

|

|

Grace

Period

|

|

|

Reinstatement

|

|

|

Surrenders

|

34

|

|

Full

Surrender

|

|

|

Partial

Surrender

|

2

|

Table

of Contents (continued)

|

|

|

The

Death

Benefit

|

35

|

|

Calculation

of the Death Benefit

|

|

|

Death

Benefit Options

|

|

|

Maximum

Death Benefit

|

|

|

Changes

in the Death Benefit Option

|

|

|

Incontestability

|

|

|

Suicide

|

|

|

Policy

Maturity

|

37

|

|

Extending

Coverage Beyond the Maturity Date

|

|

|

Payment

of Policy

Proceeds

|

38

|

|

Taxes

|

38

|

|

Types

of Taxes

|

|

|

Buying

the Policy

|

|

|

Investment

Gain in the Policy

|

|

|

Periodic

Withdrawals, Non-Periodic Withdrawals, and Loans

|

|

|

Surrendering

the Policy

|

|

|

Withholding

|

|

|

Exchanging

the Policy for Another Life Insurance Policy

|

|

|

Taxation

of Death Benefits

|

|

|

Terminal

Illness

|

|

|

Special

Considerations for Corporations

|

|

|

Taxes

and the Value of Your Policy

|

|

|

Business

Uses of the Policy

|

|

|

Non-Resident

Aliens and Other Persons Who are not Citizens of the United

States

|

|

|

Tax

Changes

|

|

|

Nationwide

Life Insurance

Company

|

43

|

|

Nationwide

VLI Separate

Account-4

|

43

|

|

Organization,

Registration, and Operation

|

|

|

Addition,

Deletion, or Substitution of Mutual Funds

|

|

|

Voting

Rights

|

|

|

Compensation

Paid to Insurance Agents Selling this Product

|

|

|

Direct

Compensation

|

|

|

Indirect

Compensation

|

|

|

Legal

Proceedings

|

45

|

|

Nationwide

Life Insurance Company

|

|

|

Nationwide

Investment Services Corporation

|

|

|

Financial

Statements

|

48

|

|

Appendix

A: Sub-Account

Information

|

49

|

|

Appendix

B:

Definitions

|

58

|

|

Appendix

C: Blending Examples of Policy

Charges

|

61

|

3

Appendix

B defines certain words and phrases used in this prospectus.

In

Summary: Policy Benefits

Death

Benefit

The

primary benefit of your policy is life insurance coverage. While the

policy is In Force, we will pay the Death Benefit to your Beneficiary when

the

Insured dies.

Your

Choice of Death Benefit Options

You

choose one of three (3) available Death Benefit options.

Payout

You

or

your Beneficiary may choose to receive the Policy Proceeds: (1) in a lump sum,

or (2) may leave the proceeds on deposit with us in an interest-bearing

account.

Riders

You

may

elect any of the available Riders. Rider availability varies by state

and there may be an additional charge. Riders available:

|

·

|

Change

of Insured Rider (available at no charge);

and

|

|

·

|

Supplemental

Insurance Rider.

|

Determining

Your Policy Charges

A

majority of business entities that purchase Corporate Owned Variable Universal

Life Insurance utilize the concept of an aggregate

purchase. Aggregate purchase is a strategy where a corporate

purchaser, or Owner, apportions its Single Case Allowable Premium across

multiple individual policies attributed to its Single Case. The

Single Case Allowable Premium is used to determine the charge rate for certain

policy charges that utilize a banded charge structure.

Banded

Charges

Certain

policy charges referred to as banded charges consist of four Single Case

Allowable Premium bands. The Single Case Allowable Premium band that applies

to

your policy will determine your applicable charge rate for banded charges.

Your

policy and each policy issued at the same time, as part of your Single Case,

will share the same Single Case Allowable Premium band. For more

information see the “Policy Charges” provision of this prospectus. The chart

below shows an example of the banded charge structure.

EXAMPLE

POLICY CHARGE WITH A BANDED CHARGE STRUCTURE

|

Band

|

Band

1

|

Band

2

|

Band

3

|

Band

4

|

|

Single

Case Allowable Premium

|

$100,000

- $249,999

|

$250,000

- $499,999

|

$500,000

- $999,999

|

>$1,000,000

|

|

Example

of Policy

Charge

Rate

|

0.90%

|

0.90%

|

0.70%

|

0.60%

|

Banded

Charges include:

|

·

|

Premium

Load

|

|

·

|

Base

Policy Cost of Insurance

|

|

·

|

Supplemental

Insurance Rider Cost of

Insurance

|

|

·

|

Base

Sub-Account Asset Factor

Charge

|

|

·

|

Supplemental

Insurance Rider Asset Factor

Charge

|

|

·

|

Base

Policy Specified Amount

Charge

|

4

|

·

|

Supplemental

Insurance Rider Specified Amount

Charge

|

Non-Banded

Charges include:

|

·

|

Illustration

Charge

|

|

·

|

Per

Policy Charge

|

Additional

Polices Purchased as Part of the Same Single Case

Many

business entities purchase additional policies at some point in time after

the

initial policies included as part of the same Single Case have been

issued.

Determining

the Single Case Allowable Premium Band for Additional Policies Issued as

Part of

the Same Single Case

To

determine the your Single Case Allowable Premium band applicable to additional

policies, add the Allowable Policy Premium for each additional policy included

as part of the new, subsequently issued group of policies and the First Year

Case Premium attributed to any and all previously issued policies included

as

part of your Single Case. To this sum, add the

Allowable

Policy Premium for previously issued policies, if any, that are less than

twelve

months beyond their Policy Date

The

sum

of these three amounts equals your new Single Case Allowable

Premium. Your new Single Case Allowable Premium will determine the

Single Case Allowable Premium band for each new additional, subsequently

issued

policy included as part of your Single Case. All previously issued

policies will retain their original Single Case Allowable Premium

band.

Your

representative can provide you illustrations demonstrating the differences

among

various Single Cases assuming varying Single Case Premium bands and combinations

of coverage under the base policy and the Supplemental Insurance

Rider. You should consider the funding options for your Single Case

carefully, as they impact the charges assessed and total compensation paid

on

your policy. Once the policy has been issued,your Single Case

Allowable Premium band will apply for the life of your policy and each policy

issued as part of the same group included within the same Single

Case.

Coverage

Flexibility

Subject

to conditions, you may choose to:

|

·

|

change

the Death Benefit option;

|

|

·

|

increase

or decrease the Base Specified Amount and Rider Specified

Amount;

|

|

·

|

change

your beneficiaries; and

|

|

·

|

change

who owns the policy.

|

Access

to Cash Value

Subject

to conditions, you may:

|

·

|

Take

a policy loan of no more than 90% of the Cash Value. The

minimum loan amount is $500.

|

|

·

|

Take

a partial surrender of at least

$500.

|

|

·

|

Surrender

the policy for its Cash Surrender Value at any time while the Insured

is

alive. The Cash Surrender Value will be the Cash Value, less

any Indebtedness, plus any Enhancement

Benefit.

|

Premium

Flexibility

You

will

not be required to make Premium payments according to a

schedule. Within limits, you may vary the frequency and amount of

Premium payments, and you might even be able to skip making a Premium

payment.

Investment

Options

You

may

choose to allocate your Net Premiums to the fixed account, subject to certain

conditions, or to one or more Sub-Accounts.

The

fixed

account will earn interest daily at an annual effective rate of at least

2%.

The

variable investment options offered under the policy are mutual funds designed

to be the underlying investment options of variable insurance

products. Nationwide VLI Separate Account-4 contains one Sub-Account

for each of the mutual funds offered in the policy. The value of that

portion of your Cash Value invested in the Sub-Accounts will depend on the

Investment Experience of the Sub-Accounts you choose.

5

Transfers

Between and Among Investment Options

You

may

transfer Cash Value between the fixed account and the variable investment

options, subject to certain conditions. You may transfer among the

Sub-Accounts within limits. We have implemented procedures intended

to reduce the potentially detrimental impact that disruptive trading has on

Sub-Account Investment Experience.

Taxes

Unless

you make a withdrawal, generally, you will not be taxed on any earnings of

the

policy. This is known as tax deferral. Also, the

Beneficiary generally will not have to include the Death Benefit as taxable

income. Estate taxes will apply if the policy is transferred to an

individual.

Assignment

You

may

assign the policy as collateral for a loan or another obligation while the

Insured is alive.

Examination

Right

For

a

limited time, you may cancel the policy and receive a refund. When

you cancel the policy during your examination right the amount we refund will

be

Cash Value or, in certain states, the greater of the initial Premium payment

or

the policy's Cash Value. If the policy is canceled, we will treat the

policy as if it was never issued.

In

Summary: Policy Risks

Improper

Use

Variable

universal life insurance is not suitable as an investment vehicle for short-term

savings. It is designed for long-term financial

planning. You will incur fees at the time of purchase that may more

than offset any favorable Investment Experience. You should not

purchase the policy if you expect that you will need to access its Cash Value

in

the near future.

Unfavorable

Investment Experience

The

Sub-Accounts to which you choose to allocate Net Premium may not generate a

sufficient return to keep the policy from Lapsing. Poor Investment

Experience could cause the Cash Value of your policy to decrease, which could

result in a Lapse of insurance coverage.

Effect

of Partial Surrenders and Policy Loans on Investment

Experience

Partial

surrenders or policy loans may accelerate a Lapse. A partial

surrender will reduce the amount of Cash Value allocated among the Sub-Accounts

you choose and the fixed account, too, if there is insufficient cash value

in

the Sub-Accounts. Thus, the remainder of your policy's Cash Value

would have to generate enough positive Investment Experience to cover policy

and

Sub-Account charges to keep the policy In Force (at least until you repay the

policy loan or make another Premium payment). Partial

surrenders will also decrease the Death Benefit and Total Specified

Amount. Policy loans do not participate in positive Investment

Experience; therefore loans may increase the risk of Lapse or the need to make

additional Premium payments to keep the policy In Force. The policy

does have a Grace Period and the opportunity to reinstate insurance

coverage. Under certain circumstances, however, the policy could

terminate without value and insurance coverage would cease.

Reduction

of the Death Benefit

A

partial

surrender may decrease the policy’s Death Benefit, depending on how the Death

Benefit relates to the policy’s Cash Value and whether the partial surrender

qualifies as “Preferred.”

Adverse

Tax Consequences

Existing

federal tax laws that benefit this policy may change at any

time. These changes could alter the favorable federal income tax

treatment the policy enjoys, such as the deferral of taxation on the gains

in

the policy's Cash Value and the exclusion from taxable income of the Proceeds

we

pay to the policy's Beneficiary. Partial and full surrenders from the

policy may be subject to taxes. The income tax treatment of the

surrender of Cash Value is different in the event the policy is treated as

a

modified endowment contract under the Code. Generally, tax treatment

of modified endowment contracts will be less favorable when compared to having

the policy treated as a life insurance contract. For example,

distributions and loans from modified endowment contracts may currently be

taxed

as ordinary income not a return of investment. For more detailed

information concerning the tax consequences of this policy please see the

Taxes

provision. For detailed information regarding tax treatment of modified

endowment contracts, please see the Periodic Withdrawals, Non-Periodic

Withdrawals and Loans section of the Taxes provision. Consult a qualified

tax

adviser on all tax matters involving your policy.

Fixed

Account Transfer Restrictions and Limitations

In

addition to allocating your Net Premium to one or more of the Sub-Accounts

described above, you may direct part of your Net Premium into the fixed

account.

6

Transfers

to the fixed account. You may transfer amounts between the fixed

account and the Sub-Accounts, subject to limits, without penalty or

adjustment. Except as outlined in the “Right of Conversion” section

of The Policy provision we reserve the right to limit the allocations to

the

fixed account to no more than 25% of the Cash Value.

Transfers

from the fixed account. We reserve the right to limit you to one

transfer from the fixed account to the Sub-Accounts during any ninety (90)

day

period. We reserve the right to limit the amount that you may

transfer during a policy year to the greater of: (a) 15% of that

portion of the Cash Value attributable to the fixed account at the end of the

prior policy year, and (b) 120% of the amount transferred from the fixed account

during the preceding policy year.

Sub-Account

Limitations

Frequent

trading among the Sub-Accounts may dilute the value of Accumulation Units,

cause

the Sub-Account to incur higher transaction costs, and interfere with the

Sub-Accounts' ability to pursue their stated investment

objectives. This could result in lower Investment Experience and Cash

Value. We have instituted procedures to minimize disruptive

transfers. While we expect these procedures to reduce the adverse

effect of disruptive transfers, we cannot ensure that we have eliminated these

risks.

Sub-Account

Investment Risk

A

comprehensive discussion of the risks of the mutual funds held by each

Sub-Account may be found in each mutual fund's prospectus. Read each

mutual fund's prospectus before investing.

7

In

Summary: Fee Tables

The

following tables describe the fees and expenses that you will pay when buying,

owning, and surrendering from the policy. Fees in this table may be

rounded up to the nearest one-hundredth decimal place. The first

table describes the fees and expenses that you will pay at the time that

you

apply Premium to the policy.

|

Transaction

Fees

|

|||||

|

Charge

|

When

Charge is Deducted

|

Deduction

By Amount of Single Case Allowable Premium

|

|||

|

Premium

Load(1)

Target

Premium

Maximum

Current

Excess

Premium

Maximum

Current

|

Upon

making a Premium payment

|

Band

1

$100,000

- $249,999

|

Band

2

$250,000

- $499,999

|

Band

3

$500,000

- $999,999

|

Band

4

>

$1,000,000

|

|

10%

9%

10%

5%

|

10%

5%

10%

3%

|

10%

5%

10%

3%

|

10%

5%

10%

3%

|

||

|

Illustration

Charge(2)

Maximum

Current

|

Upon

requesting an illustration

|

$25

$0

|

|||

8

The

next table describes the fees and expenses that you will pay periodically during

the time that you own the policy, not including mutual fund operating

expenses. Unless otherwise specified, all charges are deducted

proportionally from the Sub-Accounts and the fixed

account.

|

Periodic

Charges Other Than Mutual Fund Operating

Expenses

|

|||||

|

Charge

|

When

Charge is Deducted

|

Amount

of Single Case Allowable Premium

|

|||

|

Base

Policy Cost of Insurance(3)

Maximum

Minimum

Representative:

an individual issue age 45, non-tobacco, in the tenth policy

year, Death

Benefit option 1, issued on a short-form, non-medical

basis.

|

Monthly

|

Band

1

$100,000

- $249,999

|

Band

2

$250,000

-

$499,999

|

Band

3

$500,000

-

$999,999

|

Band

4

>$1,000,000

|

|

$83.34

per $1,000 of Net Amount At Risk.

$0.03

per $1,000 of Net Amount At Risk.

$0.37

|

$83.34

per $1,000 of Net Amount At Risk.

$0.03

per $1,000 of Net Amount At Risk.

$0.30

|

$83.34

per $1,000 of Net Amount At Risk.

$0.03

per $1,000 of Net Amount At

Risk.

$0.28

|

$83.34

per $1,000 of Net Amount At Risk.

$0.03

per $1,000 of Net Amount At Risk.

$0.32

|

||

9

|

Periodic

Charges Other Than Mutual Fund Operating

Expenses

|

|||||||

|

Charge

|

When

Charge is Deducted

|

Amount

of Single Case Allowable Premium

|

|||||

|

Base

Policy Cost of Insurance(3)

Maximum

Minimum

Representative:

an individual issue age 45, non-tobacco, in the tenth policy year,

Death

Benefit option 1, issued on a short-form, non-medical

basis.

|

Monthly

|

Band

1

$100,000

- $249,999

|

Band

2

$250,000

- $499,999

|

Band

3

$500,000

- $999,999

|

Band

4

>$1,000,000

|

||

|

$83.34

per $1,000 of Net Amount

At

Risk.

$0.03

per $1,000 of Net Amount

At

Risk.

$0.37

|

$83.34

per $1,000 of Net Amount At Risk.

$0.03

per $1,000 of Net Amount

At

Risk.

$0.30

|

$83.34

per $1,000 of Net Amount

At

Risk.

$0.03

per $1,000 of Net Amount

At

Risk.

$0.28

|

$83.34

per $1,000 of Net Amount At Risk.

$0.03

per $1,000 of Net Amount At Risk.

$0.32

|

||||

10

|

Periodic

Charges Other Than Mutual Fund Operating Expenses

(Continued)

|

||||||||||||

|

Supplemental

Insurance Rider Cost of Insurance(4)

Maximum

Minimum

Representative:

an individual issue age 45, non-tobacco, in the tenth policy year,

Death

Benefit Option 1, issued on a short-form, non-medical

basis.

|

Monthly

|

Amount

of Single Case Allowable Premium

|

||||||||||

|

Band

1

$100,000

- $249,999

|

Band

2

$250,000

- $499,999

|

Band

3

$500,000

- $999,999

|

Band

4

>$1,000,000

|

|||||||||

|

$83.34

per $1,000 of Rider Net Amount at Risk.

$0.02

per $1,000 of Rider Net Amount at Risk.

$0.34

|

$83.34

per $1,000 of Rider Net Amount at Risk.

$0.02

per $1,000 of Rider Net Amount at Risk.

$0.18

|

$83.34

per $1,000 of Rider Net Amount at Risk.

$0.02

per $1,000 of Rider Net Amount at Risk.

$0.19

|

$83.34

per $1,000 of Rider Net Amount at Risk.

$0.02

per $1,000 of Rider Net Amount at Risk.

$0.22

|

|||||||||

|

Base

Sub-Account Asset Factor Charge(5)

(taken

proportionally from the

Sub-Accounts)

Maximum

Current

|

Monthly,

based on an annual rate

|

Amount

of Single Case Allowable Premium

|

||||||||||

|

Band

1

$100,000

- $249,999

|

Band

2

$250,000

–

$499,999

|

Band

3

$500,000

–

$999,999

|

Band

4

>$1,000,000

|

|||||||||

|

0.90%

0.50%

|

0.90%

0.35%

|

0.90%

0.30%

|

0.90%

0.25%

|

|||||||||

|

Supplemental

Insurance Rider Sub-Account Asset Factor Charge(5)

Maximum

Current

|

Monthly,

based on an annual rate

|

Amount

of Single Case Allowable Premium

|

||||||||||

|

Band

1

$100,000

- $249,999

|

Band

2

$250,000

- $499,999

|

Band

3

$500,000

- $999,999

|

Band

4

>$1,000,000

|

|||||||||

|

0.90%

0.50%

|

0.90%

0.35%

|

0.90%

0.30%

|

0.90%

0.25%

|

|||||||||

|

Base

Specified

Amount

Charge(6)

Maximum

Current

|

Monthly

|

Amount

of Single Case Allowable Premium

$0.40

per $1,000 of Base Specified Amount.

|

||||||||||

|

Band

1

$100,000

-$249,999

|

Band

2

$250,000

- $499,999

|

Band

3

$500,000

- $999,999

|

Band

4

>$1,000,000

|

|||||||||

|

$0.08

per $1,000 of Base Specified Amount

|

$0.065

per $1,000 of Base Specified Amount

|

$0.065

per $1,000 of Base Specified Amount

|

$0.065

per $1,000 of Base Specified Amount

|

|||||||||

|

Supplemental

Insurance Rider Specified Amount Charge(7)

Maximum

Current

|

Monthly

|

Amount

of Single Case Allowable Premium

$0.

40per $1,000 of Rider Specified Amount.

.

|

||||||||||

|

Band

1

$100,000

-$249,999

|

Band

2

$250,000

- $499,999

|

Band

3

$500,000

- $999,999

|

Band

4

>$1,000,000

|

|||||||||

|

$0.04

per $1,000 of Rider Specified Amount

|

$0.03

per $1,000 of Rider Specified Amount

|

$0.03

per $1,000 of Rider Specified Amount

|

$0.03

per $1,000 of Rider Specified Amount

|

|||||||||

|

Periodic

Charges Other Than Mutual Fund Operating Expenses

(Continued)

|

||||||||||||

|

Administrative

Charge

Maximum

Current

|

Monthly

|

$10

per policy.

$5

per policy.

|

||||||||||

|

Policy

Loan Interest Charge

(8)

Maximum

Current

|

Annually,

or on an increase or repayment of the loan

|

3.50%

of Indebtedness.

2.80%

of Indebtedness.

|

||||||||||

Representative

costs may vary from the cost you would incur. Ask for an illustration

for information on the costs applicable to your policy.

The

next item shows the minimum and maximum total operating expenses, as of December

31, 2007, charged by the underlying mutual funds that you may pay periodically

during the time that you own the policy. More detail concerning each

mutual fund's fees and expenses is contained in the mutual fund's

prospectus. Please contact us, at the telephone numbers or address on

the first page of this prospectus, for free copies of the prospectuses for

the

mutual funds available under the policy.

|

Total

Annual Mutual Fund Operating Expenses

|

||

|

Total

Annual Mutual Fund Operating Expenses

(expenses

that are deducted from the mutual fund assets, including management

fees,

distribution (12b-1) fees, and other expenses)

|

Minimum

0.52%

|

Maximum

1.48%

|

11

(1)

The Premium Load

will vary according to the amount of annual Target Premium and Excess Premium.

The maximum Premium Load in the table reflects the maximum that may be charged

in any policy year. Currently, the Premium Load is assessed on

Premiums paid in all policy years. The ultimate Premium Load you pay depends

whether Premium paid is Target Premium or Excess Premium. Target Premium

is 100%

of the maximum annual Premium allowed under the Internal Revenue Code assuming

that: (i) the policy is not a modified endowment contract; (ii) the policy's

death benefit is equal to the Base Specified Amount; (iii) you are paying

seven

level, annual Premiums; (iv) there are no premiums resulting from a Section

1035

exchange; and (v) there are no adjustments due to a state imposed requirement

or

substandard underwriting ratings. For additional information see the "Premium

Load" section of this prospectus.

(2)If

we begin to

charge for illustrations, you will be expected to pay the Illustration Charge

by

check at the time of the request. This charge will not be deducted

from the policy’s Cash Value.

(3)

The Base Policy

Cost of Insurance Charge varies according to the Insured’s age, gender (if not

unisex classified), tobacco use, Substandard Ratings, underwriting class,

the

number of years from the Policy Date, and the Base Specified

Amount. The Cost of Insurance Charge for coverage under the

Supplemental Insurance Rider is different. The maximum charge assumes: the

Insured is either male or female; issue age 85; policy year 35; non-tobacco;

and

non-medical underwriting. Other sets of assumptions may also produce

the maximum charge. The minimum charge assumes: For $100,000 to

$249,999 premium band, the Insured is either male or female; issue age 27;

policy year 1; non-tobacco; and non-medical underwriting. For $250,000 to

$499,999 premium band, the Insured is either male or female; issue age 26;

policy year 1; non-tobacco; and non-medical underwriting. For $500,000 to

$999,999 premium band, the Insured is either male or female; issue age 24;

policy year 1; non-tobacco; and non-medical underwriting. For>$1,000,000

premium band, the Insured is either male or female; issue age 22; policy

year 1;

non-tobacco; and non-medical underwriting. Other sets of assumptions may

also

produce the minimum charge. The charges shown may not be representative of

the

charges that a particular policy owner may pay. For a detailed

description of the Cost of Insurance Charge see the "Base Policy Cost of

Insurance" section of this prospectus.

(4)

The Supplemental

Insurance Rider Cost of Insurance Charge will only be assessed if you purchase

this optional rider. The Cost of Insurance Charge varies by policy based

on

individual characteristics of the person being insured. The maximum

charge assumes: the Insured is either male or female; issue age 85; policy

year

35; non-tobacco; and non-medical underwriting. Other sets of

assumptions may also produce the maximum charge. The minimum charge

assumes: For $100,000 to $249,999 premium band, the Insured is either male

or

female; issue age 27; policy year 1; non-tobacco; and non-medical underwriting.

For $250,000 to $499,999 premium band, the Insured is either male or female;

issue age 26; policy year 1; non-tobacco; and non-medical underwriting. For

$500,000 to $999,999 premium band, the Insured is either male or female;

issue

age 24; policy year 1; non-tobacco; and non-medical underwriting.

For>$1,000,000 premium band, the Insured is either male or female; issue age

22; policy year 1; non-tobacco; and non-medical underwriting. Other sets

of

assumptions may also produce the minimum charge. The charges shown may not

be

representative of the charges that a particular policy owner may

pay. For a detailed description of the Supplemental Insurance Rider

Cost of Insurance see the "Supplemental Insurance Rider" section of this

prospectus.

(5)The

Base Sub-Account

Asset Factor Charge and the Supplemental Insurance Rider Sub-Account Asset

Factor Charge are assessed by us based on assets allocated to the Sub-Accounts

and are in addition to any charges assessed by the mutual

funds underlying the Sub-Accounts. The maximum and minimum charges

are the same in all years and in all Single Case Allowable Premium bands

for the

Base Sub-Account Asset Factor Charge and the Supplemental Insurance Rider

Sub-Account Asset Factor Charge. The maximum guaranteed annual rate for

each charge is 0.90%, but ultimate charges assessed may be higher or lower

because the charge is taken monthly rather than annually. Values in

the table are listed at the annual rate. Maximum guaranteed annual and monthly

rates are also shown on the Policy Data Pages. The Sub-Account Asset Charges

currently decline by policy duration. The current charges shown here

are the highest amounts we currently apply. For more information,

including detailed tables of annual rate charges, see the “Base Sub-Account

Asset Charge” section of the “Policy Charge” provision of this prospectus and

the “Rider Sub-Account Asset Charge” section of the “Policy Riders and Rider

Charges” provision of this prospectus.

(6)The

Base Specified

Amount Charge is only assessed on the Base Specified Amount. A different

charge

will be applied for any Rider Specified Amount under the Supplemental Insurance

Rider. The current and maximum charges do not vary other than by premium

band.

For a more detailed description of the charge, including a complete schedule

of

charges, see the "Base Specified Amount Charge" section of this

prospectus.

(7)The

Supplemental

Insurance Rider Specified Amount Charge is only assessed on the Rider Specified

Amount. A different charge will be applied for any Base Specified Amount

under

the policy. The current and maximum charges do not vary other than by premium

band. For a more detailed description of the charge, including a complete

schedule of charges and an example of how the Rider Specified Amount Charge

is

blended with the Base Specified Amount Charge, see the "Rider Specified Amount

Charge" section of this prospectus.

(8)For

more

information, see the "Net Effect of Policy Loans" section of this

prospectus.

12

Policy

Investment Options

You

designate how your Net Premium payments are allocated among the Sub-Accounts

and/or the fixed account. Allocation instructions must be in whole

percentages and must be at least one percent (1%) and the sum of the allocations

must equal 100%.

Fixed

Account

Net

Premium that you allocate to the fixed investment option is held in the fixed

account, which is part of our general account. Except as provided in

the “Right of Conversion” section of The Policy provision, we reserve the right

to limit allocations to the fixed account to no more than 25% of the policy’s

Cash Value.

The

general account is not subject to the same laws as the separate account and

the

SEC has not reviewed the disclosures in this prospectus relating to the fixed

account.

The

general account contains all of our assets other than those in the separate

accounts, and funds the fixed account. These assets are subject to

our general liabilities from business operations and are used to support our

insurance and annuity obligations. We bear the full investment risk

for all amounts allocated to the fixed account. The amounts you

allocate to the fixed account will not share in the investment performance

of

our general account. Rather, the investment income you earn on your

allocations will be based on varying interest crediting rates that we

set.

We

guarantee that the amounts you allocate to the fixed account will be credited

interest daily at a net effective annual interest rate of no less than the

guaranteed minimum interest crediting rate of 2%. Interest crediting

rates are set at the beginning of each calendar month, but are subject to

change

at any time, in our sole discretion. You assume the risk that the

actual interest crediting rate may not exceed the guaranteed interest crediting

rate. Premiums applied to the policy at different times may receive

different interest crediting rates. We will credit any interest in

excess of the guaranteed minimum interest crediting rate at our sole

discretion. You assume the risk that the actual interest crediting

rate may not exceed the guaranteed minimum interest crediting

rate. Interest that we credit to the fixed account may be

insufficient to pay the policy’s charges.

Variable

Investment Options

The

variable investment options available under the policy are Sub-Accounts that

correspond to mutual funds that are registered with the SEC. The

mutual funds' registration with the SEC does not involve the SEC's supervision

of the management or investment practices or policies of the mutual

funds. The mutual funds listed are designed primarily as investments

for variable annuity contracts and variable life insurance policies issued

by

insurance companies.

Underlying

mutual funds in the variable account are NOT publicly traded mutual

funds. They are only available as investment options in variable

life insurance policies or variable annuity contracts issued by life insurance

companies, or in some cases, through participation in certain qualified pension

or retirement plans.

The

investment advisers of the underlying mutual funds may manage publicly traded

mutual funds with similar names and investment objectives. However,

the underlying mutual funds are NOT directly related to any publicly traded

mutual fund. Policy owners should not compare the performance of a

publicly traded fund with the performance of underlying mutual funds

participating in the separate account. The performance of the

underlying mutual funds could differ substantially from that of any publicly

traded funds.

The

particular underlying mutual funds available under the policy may change from

time to time. Specifically, underlying mutual funds or underlying

mutual fund share classes that are currently available may be removed or closed

off to future investment. New underlying mutual funds or new share

classes of currently available underlying mutual funds may be

added. Policy owners will receive notice of any such changes that

affect their contract. Additionally, not all of the underlying mutual

funds are available in every state.

In

the

future, additional underlying mutual funds managed by certain financial

institutions, brokerage firms or their affiliates may be added to the separate

account. These additional underlying mutual funds may be offered

exclusively to purchasing customers of the particular financial institution

or

brokerage firm, or through other exclusive distribution

arrangements.

Each

Sub-Account’s assets are held separately from the assets of the other

Sub-Accounts, and each Sub-Account portfolio has investment objectives and

policies that are different from those of the other Sub-Accounts. The

result is that each Sub-Account operates independently of the other Sub-Accounts

so the income or losses of one Sub-Account will not affect the Investment

Experience of any other Sub-Account.

The

Sub-Accounts available through this policy are listed below. Appendix

A contains additional information about each of the available Sub-Accounts,

including its respective investment type, adviser, and expense

information. For more information on the mutual funds, please refer

to “Appendix A: Sub-Account Information” and/or the prospectuses for the mutual

funds.

13

AIM

Variable Insurance Funds

|

·

|

AIM

V.I. Capital Development Fund: Series I

Shares

|

|

·

|

AIM

V.I. International Growth Fund: Series I

Shares

|

AllianceBernstein

Variable Products Series Fund, Inc.

|

·

|

AllianceBernstein

Growth and Income Portfolio: Class

A

|

|

·

|

AllianceBernstein

International Value Portfolio: Class

A

|

|

·

|

AllianceBernstein

Small/Mid Cap Value Portfolio: Class

A

|

American

Century Variable Portfolios, Inc.

|

·

|

American

Century VP Mid Cap Value Fund: Class

I

|

|

·

|

American

Century VP Value Fund: Class I*

|

|

·

|

American

Century VP Vista Fund: Class I

|

American

Funds Insurance Series

|

·

|

Asset

Allocation Fund: Class 2

|

|

·

|

Bond

Fund: Class 2

|

BlackRock

|

·

|

BlackRock

Large Cap Core V.I. Fund: Class II

|

Davis

Variable Account Fund, Inc.

|

·

|

Davis

Value Portfolio

|

Dreyfus

|

·

|

Dreyfus

Investment Portfolios - Small Cap Stock Index Portfolio: Service

Shares

|

|

·

|

Dreyfus

Stock Index Fund, Inc.: Initial

Shares

|

|

·

|

Dreyfus

Variable Investment Fund – Appreciation Portfolio: Initial

Shares

|

|

·

|

Dreyfus

Variable Investment Fund – International Value Portfolio: Initial

Shares

|

DWS

Variable Series II

|

·

|

Dreman

High Return Equity VIP: Class B

|

|

·

|

Dreman

Small Mid Cap Value VIP: Class B

|

Federated

Insurance Series

|

·

|

Federated

Quality Bond Fund II: Primary

Shares

|

Fidelity

Variable Insurance Products Fund

|

·

|

VIP

Contrafund® Portfolio: Service

Class

|

|

·

|

VIP

Equity-Income Portfolio: Service

Class*

|

|

·

|

VIP

Freedom 2015 Portfolio: Service Class♦

|

|

·

|

VIP

Freedom 2020 Portfolio: Service Class♦

|

|

·

|

VIP

Freedom 2025 Portfolio: Service Class♦

|

|

·

|

VIP

Freedom 2030 Portfolio: Service Class♦

|

|

·

|

VIP

Growth Portfolio: Service Class

|

|

·

|

VIP

Investment Grade Bond Portfolio: Service

Class*

|

|

·

|

VIP

Mid Cap Portfolio: Service Class

|

Franklin

Templeton Variable Insurance Products Trust

|

·

|

Franklin

Small Cap Value Securities Fund: Class

2

|

|

·

|

Templeton

Global Income Securities Fund: Class

2

|

Janus

Aspen Series

|

·

|

Balanced

Portfolio: Service Shares

|

|

·

|

Forty

Portfolio: Service Shares

|

|

·

|

Global

Technology Portfolio: Service

Shares

|

|

·

|

International

Growth Portfolio: Service Shares

|

Legg

Mason Partners Variable Portfolios I, Inc.

|

·

|

Legg

Mason Partners Small Cap Growth Portfolio: Class

I

|

Lincoln

Variable Insurance Products Trust

|

·

|

Baron

Growth Opportunities Fund: Service

Class

|

Lord

Abbett Series Fund, Inc.

|

·

|

Mid-Cap

Value Portfolio: Class VC

|

MFS®

Variable Insurance Trust

|

·

|

MFS

Value Series: Service Class

|

|

·

|

Research

International Series: Service Class

|

Nationwide

Variable Insurance Trust (“NVIT”)

|

·

|

Federated

NVIT High Income Bond Fund: Class

I*

|

|

·

|

Gartmore

NVIT Emerging Markets Fund: Class I

|

|

·

|

Gartmore

NVIT International Equity Fund: Class I (Formerly, Gartmore NVIT

International Growth Fund: Class I)

|

|

·

|

Gartmore

NVIT Worldwide Leaders Fund: Class

I

|

|

·

|

NVIT

Government Bond Fund: Class (Formerly, Nationwide NVIT Government

Bond

Fund: Class I)

|

|

·

|

NVIT

International Index Fund: Class II

|

|

·

|

NVIT

Investor Destinations Funds: Class II (Formerly,

Nationwide NVIT Investor Destinations Funds:

Class II)

|

|

Ø

|

NVIT

Investor Destinations Conservative Fund: Class II ♦ (Formerly,

Nationwide NVIT Investor Destinations Conservative Fund: Class

II)

|

|

Ø

|

NVIT

Investor Destinations Moderately Conservative Fund: Class II♦

(Formerly, Nationwide NVIT Investor Destinations Moderately Conservative

Fund: Class II)

|

|

Ø

|

NVIT

Investor Destinations Moderate Fund: Class II ♦ (Formerly,

Nationwide NVIT Investor Destinations Moderate Fund: Class

II)

|

|

Ø

|

NVIT

Investor Destinations Moderately Aggressive Fund: Class II ♦

(Formerly, Nationwide NVIT Investor Destinations Moderately Aggressive

Fund: Class II)

|

|

Ø

|

NVIT

Investor Destinations Aggressive Fund: Class II ♦ (Formerly,

Nationwide NVIT Investor Destinations Aggressive Fund: Class

II)

|

|

·

|

NVIT

Mid Cap Index Fund: Class I

|

|

·

|

NVIT

Money Market Fund: Class V (Formerly, Nationwide NVIT Money Market

Fund:

Class V)

|

|

·

|

NVIT

Multi-Manager Large Cap Growth

Fund:

|

Class

I

|

·

|

NVIT

Multi-Manager Mid Cap Growth Fund: Class

I

|

|

·

|

NVIT

Multi-Manager Mid Cap Value Fund: Class

I

|

|

·

|

NVIT

Multi-Manager Small Cap Growth Fund: Class I (Formerly, Nationwide

Multi-Manager NVIT Small Cap Growth Fund: Class

I)

|

|

·

|

NVIT

Multi-Manager Small Cap Value Fund: Class I (Formerly, Nationwide

Multi-Manager NVIT Small Cap Value Fund: Class

I)

|

|

·

|

NVIT

Multi-Manager Small Company Fund: Class I (Formerly, Nationwide

Multi-Manager NVIT Small Company Fund: Class

I)

|

|

·

|

NVIT

Nationwide Fund: Class I

|

|

·

|

NVIT

Short Term Bond Fund: Class I

|

|

·

|

Van

Kampen NVIT Multi Sector Bond Fund:

|

Class

I*

Neuberger

Berman Advisers Management Trust

|

·

|

AMT

Partners Portfolio: I Class

|

|

·

|

AMT

Regency Portfolio: I Class

|

Oppenheimer

Variable Account Funds

|

·

|

Oppenheimer

Capital Appreciation Fund/VA:

|

Non-Service

Shares

|

·

|

Oppenheimer

Global Securities Fund/VA:

|

14

Non-Service

Shares

PIMCO

Variable Insurance Trust

|

·

|

All

Asset Portfolio: Administrative

Class

|

|

·

|

Foreign

Bond Portfolio (unhedged): Administrative

Class

|

|

·

|

Low

Duration Portfolio: Administrative

Class

|

|

·

|

Real

Return Portfolio: Administrative

Class

|

|

·

|

Total

Return Portfolio: Administrative

Class

|

Pioneer

Variable Contracts Trust

|

·

|

Pioneer

Emerging Markets VCT Portfolio:

|

Class

I

Shares

|

·

|

Pioneer

High Yield VCT Portfolio: Class I

Shares*

|

Putnam

Variable Trust

|

·

|

Putnam

VT Small Cap Value Fund: Class IB

|

Royce

Capital Fund

|

·

|

Royce

Micro-Cap Portfolio: Investment

Class

|

T.

Rowe Price Equity Series, Inc.

|

·

|

T.

Rowe Price Equity Income Portfolio: Class

II

|

|

·

|

T.

Rowe Price New America Growth

Portfolio

|

|

·

|

T.

Rowe Price Personal Strategy Balanced

Portfolio

|

Van

Kampen

The

Universal Institutional Funds, Inc.

|

·

|

Capital

Growth Portfolio: Class I (Formerly, Equity Growth Portfolio: Class

I)

|

|

·

|

Emerging

Markets Debt Portfolio: Class I

|

|

·

|

Global

Real Estate Portfolio: Class II

|

|

·

|

Mid

Cap Growth Portfolio: Class I

|

Van

Eck Worldwide Insurance Trust

|

·

|

Worldwide

Hard Assets Fund: Initial Class

|

W&R

Target Funds, Inc.

|

·

|

Asset

Strategy Portfolio

|

|

·

|

Growth

Portfolio

|

|

·

|

Real

Estate Securities Portfolio

|

|

·

|

Science

and Technology Portfolio

|

Wells

Fargo Advantage Variable Trust Funds

|

·

|

Wells

Fargo Advantage VT Discovery Fund

|

|

·

|

Wells

Fargo Advantage VT Small Cap Growth

Fund

|

The

following sub-account is only available in policies issued before December

31,

2008

AIM

Variable Insurance Funds

|

·

|

AIM

V.I. Basic Value Fund: Series I

Shares

|

*These

underlying mutual funds may invest in lower quality debt securities commonly

referred to as junk bonds.

♦These

underlying mutual funds invest in other underlying mutual

funds. Therefore, a proportionate share of the fees and expenses of

the acquired underlying mutual funds are indirectly borne by

investors.

Valuation

of Accumulation Units

We

account for the value of your interest in the Sub-Accounts by using Accumulation

Units. The number of Accumulation Units associated with a given

Premium allocation is determined by dividing the dollar amount of Net Premium

you allocated to the Sub-Account by the Accumulation Unit value for the

Sub-Account, which is determined at the end of the Valuation Period that the

allocation was received. The value of each Accumulation Unit varies

daily based on the Investment Experience of the mutual fund in which the

Sub-Account invests.

On

each

day that the New York Stock Exchange (“NYSE”) is open, each of the mutual funds

in which the Sub-Accounts invest will determine its Net Asset Value (“NAV”) per

share. We use each mutual fund's NAV to calculate the daily

Accumulation Unit value for the corresponding Sub-Account. Note,

however, that the Accumulation Unit value will not equal the mutual fund's

NAV. This daily Accumulation Unit valuation process is referred to as

“pricing” the Accumulation Units.

We

will

price Accumulation Units on any day that the NYSE is open for

business. Any transaction that you submit on a day when the NYSE is

closed will not be effective until the next day that the NYSE is open for

business. Accordingly, we will not price Accumulation Units on these

recognized holidays:

|

●New

Year's Day

|

●Independence

Day

|

|

●Martin

Luther King, Jr. Day

|

●Labor

Day

|

|

●Presidents’

Day

|

●Thanksgiving

|

|

●Good

Friday

|

●Christmas

|

|

●Memorial

Day

|

In

addition, we will not price Accumulation Units if:

|

(1)

|

trading

on the NYSE is restricted;

|

|

(2)

|

an

emergency exists making disposal or valuation of securities held

in the

separate account impracticable; or

|

|

(3)

|

the

SEC, by order, permits a suspension or postponement for the protection

of

security holders.

|

SEC

rules

and regulations govern when the conditions described items (2) and (3)

exist.

Any

transactions that we receive after the close of the NYSE will be effective

as of

the next Valuation Period that the NYSE is open.

15

How

Sub-Account Investment Experience is Determined

The

number of Accumulation Units in your policy will not change unless you add,

remove, or transfer Premium, or for deduction of charges from the

Sub-Accounts. However, the value of the Accumulation Units in your

policy will vary daily depending on the Investment Experience of the mutual

fund

in which the Sub-Account invests. We account for these performance

fluctuations by using a “net investment factor,” as described below, in our

daily Sub-Account valuation calculations. Changes in the net

investment factor may not be directly proportional to changes in the NAV

of the

mutual fund shares.

We

determine the net investment factor for each Sub-Account on each Valuation

Period by dividing (a) by (b), where:

(a)

is

the sum of:

|

·

|

the

NAV per share of the mutual fund held in the Sub-Account as of the

end of

the current Valuation Period; and

|

|

·

|

the

per share amount of any dividend or income distributions made by

the

mutual fund (if the date of the dividend or income distribution occurs

during the current Valuation Period); plus or

minus

|

|

·

|

a

per share charge or credit for any taxes reserved for as a result

of the

Sub-Account's investment operations if changes to the law result

in a

modification to the tax treatment of the separate account;

and

|

|

|

(b)

|

is

the NAV per share of the mutual fund determined as of the end of

the

immediately preceding Valuation

Period.

|

At

the

end of each Valuation Period, we determine the Sub-Account's Accumulation Unit

value. The Accumulation Unit value for any Valuation Period is

determined by multiplying the Accumulation Unit value as of the prior Valuation

Period by the net investment factor for the Sub-Account for the current

Valuation Period.

Transfers

Among and Between the Policy Investment Options

Sub-Account

Transfers

Policy

owners may request transfers to or from the Sub-Accounts once per valuation

day,

subject to the terms and conditions described in this prospectus and the

prospectus of the underlying mutual funds.

Neither

the policies nor the mutual funds are designed to support active trading

strategies that require frequent movement between or among Sub-Accounts

(sometimes referred to as “market-timing” or “short-term

trading”). If you intend to use an active trading strategy, you

should consult your registered representative and request information on other

Nationwide policies that offer mutual funds that are designed specifically

to

support active trading strategies.

We

discourage (and will take action to deter) short-term trading in this policy

because the frequent movement between or among Sub-Accounts may negatively

impact other investors in the policy. Short-term trading can result

in:

|

·

|

the

dilution of the value of the investors' interests in the mutual

fund;

|

|

·

|

mutual

fund managers taking actions that negatively impact performance (i.e.,

keeping a larger portion of the mutual fund assets in cash or liquidating

investments prematurely in order to support redemption requests);

and/or

|

|

·

|

increased

administrative costs due to frequent purchases and

redemptions.

|

To

protect investors in this policy from the negative impact of these practices,

we

have implemented, or reserve the right to implement, several processes and/or

restrictions aimed at eliminating the negative impact of active trading

strategies. We cannot guarantee that our attempts to deter active

trading strategies will be successful. If active trading strategies

are not successfully deterred by our actions, the performance of Sub-Accounts

that are actively traded will be adversely impacted. Policy owners remaining

in

the affected Sub-Account will bear any resulting increased costs.

Policies

Owned by Non-Natural Persons. For policies owned by a

corporation or another legal entity, we monitor transfer activity for

potentially harmful investment practices, but we do not systematically monitor

the transfer instructions of individual persons. Our procedures

include the review of aggregate entity-level transfers, not individual transfer

instructions. It is our intention to protect the interests of all

policy owners. It is possible, however, for some harmful trading to

go on undetected by us. For example, in some instances, an entity may

make transfers based on the instructions of multiple parties such as employees,

partners, or other affiliated persons based on those persons participation

in

entity sponsored programs. We do not systematically monitor the

transfer instructions of these individual persons. We monitor

aggregate trades among the Sub-Accounts for frequency, pattern, and

size. If two or more transfer events are submitted within a 30-day

period, we may impose conditions on your ability to submit

trades. These restrictions include revoking your privilege to make

trades by any means other than written communication submitted via U.S. mail

for

a 12-month period.

Other

Restrictions. We reserve the right to refuse, restrict or limit

transfer requests, or take any other action we deem necessary, in order to

protect policy owners and beneficiaries from the negative investment results

that may result from short-term trading or other harmful investment practices

employed by some policy owners (or third parties acting on their

behalf). In particular, trading strategies designed to avoid or take

advantage of Nationwide's monitoring procedures (and other measures aimed at

curbing harmful trading practices) that are nevertheless determined by us to

constitute harmful trading practices, may be restricted.

16

In

addition, we may add new underlying mutual funds, or new share classes of

currently available underlying mutual funds, that assess short-term trading

fees. In the case of new share class additions, your subsequent

allocations may be limited to that new share class. Short-term

trading fees are a charge assessed by an underlying mutual fund when you

transfer out of a Sub-Account before the end of a stated

period. These fees will only apply to Sub-Accounts corresponding to

underlying mutual funds that impose such a charge. The underlying

mutual fund intends short-term trading fees to compensate the fund and its

shareholders for the negative impact on fund performance that may result from

disruptive trading practices, including frequent trading and short-term trading

(market timing) strategies. The fees are not intended to adversely

impact policy owners not engaged in such strategies. The separate

account will collect the short-term trading fees at the time of the transfer

by

reducing the policy owner’s Sub-Account value. We will remit all such

fees to the underlying mutual fund.

Any

restrictions that we implement will be applied consistently and

uniformly. In the event a restriction we impose results in a transfer

request being rejected, we will notify you that your transfer request has been

rejected. If a short-term trading fee is assessed on your transfer,

we will provide you a confirmation of the amount of the fee

assessed.

Underlying

Mutual Fund Restrictions and Prohibitions. Pursuant to

regulations adopted by the SEC, we are required to enter into written agreements

with the underlying mutual funds which allow the underlying mutual funds

to:

|

(1)

|

request

the taxpayer identification number, international taxpayer identification

number, or other government issued identifier of any of our policy

owners;

|

|

(2)

|

request

the amounts and dates of any purchase, redemption, transfer or exchange

request (“transaction information”);

and

|

|

(3)

|

instruct

us to restrict or prohibit further purchases or exchanges by policy

owners

that violate policies established by the underlying mutual fund (whose

policies may be more restrictive than our

policies).

|

We

are

required to provide such transaction information to the underlying mutual funds

upon their request. In addition, we are required to restrict or

prohibit further purchases or exchange requests upon instruction from the

underlying mutual fund.

We

and

any affected policy owner may not have advance notice of such instructions

from

an underlying mutual fund to restrict or prohibit further purchases or exchange

requests. If an underlying mutual fund refuses to accept a purchase

or exchange request submitted by us, we will keep any affected policy owner

in

their current underlying mutual fund allocation.

Fixed

Account Transfers

Prior

to

the policy’s Maturity Date, you may make transfers involving the fixed account

subject to the limits below, without penalty or adjustment. These

transfers will be in dollars. We reserve the right to limit the

frequency of transfers involving the fixed account.

Transfers

to the Fixed Account. Except as provided in the “Exchanging the

Policy” section later in this prospectus for transfers to the

fixed account, we reserve the right to refuse any transfer to the fixed account

if after such transfer, the fixed account would comprise more than 25% of the

policy’s Cash Value.

Transfers

from the Fixed Account. On transfers from the

fixed account, we reserve the right to limit: (1) the amount you can transfer

from the fixed account to the Sub-Account(s) to the greater of: (a) 15% of

that

portion of the Cash Value attributable to the fixed account as of the end of

the

previous policy year; or (b) 120% of the amount transferred from the fixed

account during the previous policy year; and (2) the number of transfers to

one

during any ninety day period.

Any

restrictions that we implement will

be applied consistently and uniformly.

Submitting

a Transfer Request

You

can

submit transfer requests in writing to our Home Office via first class U.S.

mail. We may also allow you to use other methods of communication that we

deem

acceptable. Our contact information is on the first page of this

prospectus. We will use reasonable procedures to confirm that

transfer instructions are genuine and will not be liable for following

instructions that we reasonably determine to be genuine.

When

we have received your transfer

request we will process it at the end of the current Valuation

Period. This is when the Accumulation Unit value will be next

determined.For more

information regarding valuation of Accumulation Units, see the “Valuation of

Accumulation Units” section under the Policy Investment Options

provision.

In

addition, any computer system can experience slowdowns or outages that could

delay or prevent our ability to process your request. Although we

have taken precautions to help our systems handle heavy usage, we cannot

promise

complete reliability under all circumstances. If you are experiencing

problems, please make your transfer request in writing.

In

instances of disruptive trading that we may determine, or may have already

determined to be harmful to policy owners, we will, through the use of

appropriate means available to us, attempt to curtail or limit the disruptive

trading. If your trading

17

activities,

or those of a third party acting on your behalf, constitute disruptive trading,

we will not limit your ability to initiate the trades as provided in your

policy; however, we may limit your means for making a transfer or take other

action we deem necessary to protect the interests of those investing in the

affected Sub-Accounts. Please see “Sub-Account Transfers” earlier in

this prospectus.

The

Policy

Generally

The

policy is a legal contract. It will comprise and be evidenced by: a

written contract; any Riders; any endorsements; the Policy Data Page(s); and

the

application, including any supplemental application. The benefits

described in the policy and this prospectus, including any optional riders

or

modifications in coverage, may be subject to our underwriting and

approval. We will consider the statements you make in the application

as representations, and we will rely on them as being true and

complete. However, we will not void the policy or deny a claim unless

a statement is a material misrepresentation. If you make an error or

misstatement on the application, we will adjust the Death Benefit (including

the

Supplemental Insurance Rider Death Benefit, if applicable) and Cash Value

accordingly.

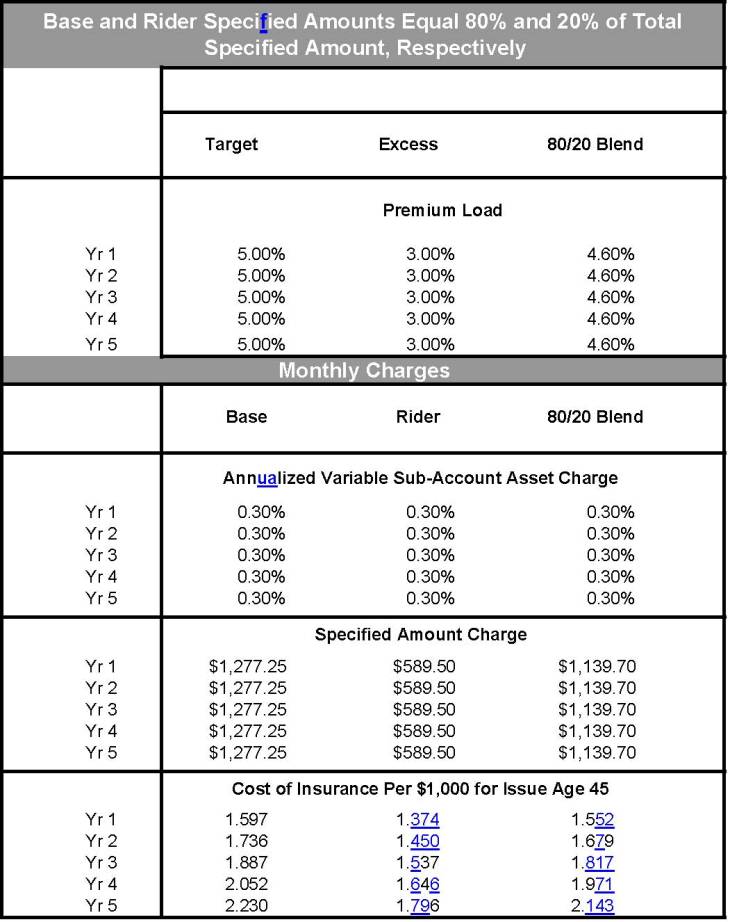

Any