UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 2)*

Compania Cervecerias Unidas S.A.

(Name of Issuer)

Common stock without nominal (par) value

Title of Class of Securities

204429104

(CUSIP Number)

Rosita Covarrubias Gatica

Enrique Foster Sur 20, 14th Floor

Santiago, Chile

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

October, 2013

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box. ☐

*The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

1

|

NAME OF REPORTING PERSON

S.S. or I.R.S. IDENTIFICATION NOS. OF ABOVE PERSON

Inversiones y Rentas S.A.

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☒

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS*

BK

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

☐ |

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Chile

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

221,701,716

|

|

8

|

SHARED VOTING POWER

|

|

9

|

SOLE DISPOSITIVE POWER

221,701,716

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

221,701,716

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

☐ |

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.0%

|

|

|

14

|

TYPE OF REPORTING PERSON*

CO

|

|

|

1

|

NAME OF REPORTING PERSON

S.S. OR I.R.S. IDENTIFICATION NOS. OF ABOVE PERSON

Inversiones IRSA Limitada

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☒

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS*

BK

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Chile

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

25,279,991

|

|

8

|

SHARED VOTING POWER

|

|

9

|

SOLE DISPOSITIVE POWER

25,279,991

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

221,701,716

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.0%

|

|

|

14

|

TYPE OF REPORTING PERSON*

CO

|

|

|

1

|

NAME OF REPORTING PERSON

S.S. OR I.R.S. IDENTIFICATION NOS. OF ABOVE PERSON

Quiñenco S.A.

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☒

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS*

BK

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Chile

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

8

|

SHARED VOTING POWER

221,701,716

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

10

|

SHARED DISPOSITIVE POWER

221,701,716

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

221,701,716

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.0%

|

|

|

14

|

TYPE OF REPORTING PERSON*

CO

|

|

|

1

|

NAME OF REPORTING PERSON

S.S. OR I.R.S. IDENTIFICATION NOS. OF ABOVE PERSON

Heineken N.V.

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☒

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS*

BK

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

The Netherlands

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

8

|

SHARED VOTING POWER

221,701,716

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

10

|

SHARED DISPOSITIVE POWER

221,701,716

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

221,701,716

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.0%

|

|

|

14

|

TYPE OF REPORTING PERSON*

CO

|

|

|

1

|

NAME OF REPORTING PERSON

S.S. OR I.R.S. IDENTIFICATION NOS. OF ABOVE PERSON

Luksburg Foundation

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☒

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS*

BK

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Liechtenstein

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

8

|

SHARED VOTING POWER

221,701,716

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

10

|

SHARED DISPOSITIVE POWER

221,701,716

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

221,701,716

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.0%

|

|

|

14

|

TYPE OF REPORTING PERSON*

HC

|

|

|

1

|

NAME OF REPORTING PERSON

S.S. OR I.R.S. IDENTIFICATION NOS. OF ABOVE PERSON

Lanzville Investments Establishment

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☒

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS*

BK

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Liechtenstein

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

8

|

SHARED VOTING POWER

221,701,716

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

10

|

SHARED DISPOSITIVE POWER

221,701,716

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

221,701,716

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.0%

|

|

|

14

|

TYPE OF REPORTING PERSON*

HC

|

|

|

1

|

NAME OF REPORTING PERSON

S.S. OR I.R.S. IDENTIFICATION NOS. OF ABOVE PERSON

Dolberg Finance Corporation Establishment

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☒

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS*

BK

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Liechtenstein

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

8

|

SHARED VOTING POWER

221,701,716

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

10

|

SHARED DISPOSITIVE POWER

221,701,716

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

221,701,716

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

☐ |

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.0%

|

|

|

14

|

TYPE OF REPORTING PERSON*

HC

|

|

|

1

|

NAME OF REPORTING PERSON

SS. OR I.R.S. IDENTIFICATION NOS. OF ABOVE PERSON

Geotech Establishment

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☒

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS*

BK

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

☐ |

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Liechtenstein

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

8

|

SHARED VOTING POWER

221,701,716

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

10

|

SHARED DISPOSITIVE POWER

221,701,716

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

221,701,716

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

☐ |

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.0%

|

|

|

14

|

TYPE OF REPORTING PERSON*

CO

|

|

|

1

|

NAME OF REPORTING PERSON

SS. OR I.R.S. IDENTIFICATION NOS. OF ABOVE PERSON

Andsberg Ltd.

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☒

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS*

BK

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

☐ |

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Jersey, Channel Islands

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

8

|

SHARED VOTING POWER

221,701,716

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

10

|

SHARED DISPOSITIVE POWER

221,701,716

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

221,701,716

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

☐ |

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.0%

|

|

|

14

|

TYPE OF REPORTING PERSON*

HC

|

|

|

1

|

NAME OF REPORTING PERSON

SS. OR I.R.S. IDENTIFICATION NOS. OF ABOVE PERSON

Andsberg Inversiones Ltd.

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☒

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS*

BK

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

☐ |

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Jersey, Channel Islands

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

8

|

SHARED VOTING POWER

221,701,716

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

10

|

SHARED DISPOSITIVE POWER

221,701,716

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

221,701,716

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

☐ |

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.0%

|

|

|

14

|

TYPE OF REPORTING PERSON*

HC

|

|

|

1

|

NAME OF REPORTING PERSON

SS. OR I.R.S. IDENTIFICATION NOS. OF ABOVE PERSON

Andsberg Inversiones Ltda.

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☒

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS*

BK

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

☐ |

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Chile

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

8

|

SHARED VOTING POWER

221,701,716

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

10

|

SHARED DISPOSITIVE POWER

221,701,716

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

221,701,716

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

☐ |

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.0%

|

|

|

14

|

TYPE OF REPORTING PERSON*

HC

|

|

|

1

|

NAME OF REPORTING PERSON

SS. OR I.R.S. IDENTIFICATION NOS. OF ABOVE PERSON

Ruana Copper Corporation Establishment

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☒

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS*

BK

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

☐ |

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Liechtenstein

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

8

|

SHARED VOTING POWER

221,701,716

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

10

|

SHARED DISPOSITIVE POWER

221,701,716

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

221,701,716

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

☐ |

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.0%

|

|

|

14

|

TYPE OF REPORTING PERSON*

HC

|

|

|

1

|

NAME OF REPORTING PERSON

SS. OR I.R.S. IDENTIFICATION NOS. OF ABOVE PERSON

Guillermo Luksic Craig1

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☒

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS*

BK

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Chile

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

8

|

SHARED VOTING POWER

221,701,716

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

10

|

SHARED DISPOSITIVE POWER

221,701,716

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

221,701,716

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.0%

|

|

|

14

|

TYPE OF REPORTING PERSON*

OO

|

|

1 Mr. Guillermo Luksic Craig passed away on March 27, 2013. Following his passing, his individual holdings of common stock became part of his estate, which is currently the subject of ordinary course proceedings to finalize its distribution. The executor of the estate does not have the ability to direct the voting or disposition of such shares of common stock.

|

1

|

NAME OF REPORTING PERSON

SS. OR I.R.S. IDENTIFICATION NOS. OF ABOVE PERSON

Nicolás Luksic Puga

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☒

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS*

BK

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Chile

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

8

|

SHARED VOTING POWER

221,701,716

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

10

|

SHARED DISPOSITIVE POWER

221,701,716

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

221,701,716

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.0%

|

|

|

14

|

TYPE OF REPORTING PERSON*

IN

|

|

|

1

|

NAME OF REPORTING PERSON

SS. OR I.R.S. IDENTIFICATION NOS. OF ABOVE PERSON

Inmobiliaria e Inversiones Río Claro S.A.

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☒

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS*

BK

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Chile

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

8

|

SHARED VOTING POWER

221,701,716

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

10

|

SHARED DISPOSITIVE POWER

221,701,716

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

221,701,716

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.0%

|

|

|

14

|

TYPE OF REPORTING PERSON*

HC

|

|

|

1

|

NAME OF REPORTING PERSON

SS. OR I.R.S. IDENTIFICATION NOS. OF ABOVE PERSON

Andrónico Luksic Craig

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☒

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS*

BK

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Chile

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

8

|

SHARED VOTING POWER

221,701,716

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

10

|

SHARED DISPOSITIVE POWER

221,701,716

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

221,701,716

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.0%

|

|

|

14

|

TYPE OF REPORTING PERSON*

IN

|

|

|

1

|

NAME OF REPORTING PERSON

SS. OR I.R.S. IDENTIFICATION NOS. OF ABOVE PERSON

Patricia Lederer Tcherniak

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☒

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS*

BK

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Chile

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

8

|

SHARED VOTING POWER

221,701,716

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

10

|

SHARED DISPOSITIVE POWER

221,701,716

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

221,701,716

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.0%

|

|

|

14

|

TYPE OF REPORTING PERSON*

IN

|

|

|

1

|

NAME OF REPORTING PERSON

SS. OR I.R.S. IDENTIFICATION NOS. OF ABOVE PERSON

Inversiones Consolidadas Ltda.

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☒

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS*

BK

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Chile

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

8

|

SHARED VOTING POWER

221,701,716

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

10

|

SHARED DISPOSITIVE POWER

221,701,716

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

221,701,716

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.0%

|

|

|

14

|

TYPE OF REPORTING PERSON*

HC

|

|

|

1

|

NAME OF REPORTING PERSON

SS. OR I.R.S. IDENTIFICATION NOS. OF ABOVE PERSON

Inversiones Salta S.A.

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☒

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS*

BK

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Chile

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

8

|

SHARED VOTING POWER

221,701,716

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

10

|

SHARED DISPOSITIVE POWER

221,701,716

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

221,701,716

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.0%

|

|

|

14

|

TYPE OF REPORTING PERSON*

HC

|

|

|

1

|

NAME OF REPORTING PERSON

SS. OR I.R.S. IDENTIFICATION NOS. OF ABOVE PERSON

Andrónico Luksic Lederer

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☒

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS*

BK

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Chile

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

8

|

SHARED VOTING POWER

221,701,716

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

10

|

SHARED DISPOSITIVE POWER

221,701,716

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

221,701,716

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.0%

|

|

|

14

|

TYPE OF REPORTING PERSON*

IN

|

|

|

1

|

NAME OF REPORTING PERSON

SS. OR I.R.S. IDENTIFICATION NOS. OF ABOVE PERSON

Davor Luksic Lederer

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☒

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS*

BK

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Chile

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

8

|

SHARED VOTING POWER

221,701,716

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

10

|

SHARED DISPOSITIVE POWER

221,701,716

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

221,701,716

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.0%

|

|

|

14

|

TYPE OF REPORTING PERSON*

IN

|

|

|

1

|

NAME OF REPORTING PERSON

SS. OR I.R.S. IDENTIFICATION NOS. OF ABOVE PERSON

Max Luksic Lederer

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☒

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS*

BK

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Chile

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

8

|

SHARED VOTING POWER

221,701,716

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

10

|

SHARED DISPOSITIVE POWER

221,701,716

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

221,701,716

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.0%

|

|

|

14

|

TYPE OF REPORTING PERSON*

IN

|

|

|

1

|

NAME OF REPORTING PERSON

SS. OR I.R.S. IDENTIFICATION NOS. OF ABOVE PERSON

Dax Luksic Lederer

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☒

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS*

BK

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Chile

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

8

|

SHARED VOTING POWER

221,701,716

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

10

|

SHARED DISPOSITIVE POWER

221,701,716

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

221,701,716

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.0%

|

|

|

14

|

TYPE OF REPORTING PERSON*

IN

|

|

|

1

|

NAME OF REPORTING PERSON

SS. OR I.R.S. IDENTIFICATION NOS. OF ABOVE PERSON

Inversiones Río Claro Ltda.

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☒

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS*

BK

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Chile

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

8

|

SHARED VOTING POWER

221,701,716

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

10

|

SHARED DISPOSITIVE POWER

221,701,716

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

221,701,716

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.0%

|

|

|

14

|

TYPE OF REPORTING PERSON*

CO

|

|

|

1

|

NAME OF REPORTING PERSON

SS. OR I.R.S. IDENTIFICATION NOS. OF ABOVE PERSON

Inversiones Orengo S.A.

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☒

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS*

BK

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

☐ |

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Chile

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

8

|

SHARED VOTING POWER

221,701,716

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

10

|

SHARED DISPOSITIVE POWER

221,701,716

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

221,701,716

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.0%

|

|

|

14

|

TYPE OF REPORTING PERSON*

CO

|

|

|

1

|

NAME OF REPORTING PERSON

SS. OR I.R.S. IDENTIFICATION NOS. OF ABOVE PERSON

Inversiones Alaska Ltda.

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☒

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS*

BK

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Chile

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

8

|

SHARED VOTING POWER

221,701,716

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

10

|

SHARED DISPOSITIVE POWER

221,701,716

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

221,701,716

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.0%

|

|

|

14

|

TYPE OF REPORTING PERSON*

CO

|

|

|

1

|

NAME OF REPORTING PERSON

SS. OR I.R.S. IDENTIFICATION NOS. OF ABOVE PERSON

Antonia Luksic Puga

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☒

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS*

BK

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Chile

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

8

|

SHARED VOTING POWER

221,701,716

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

10

|

SHARED DISPOSITIVE POWER

221,701,716

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

221,701,716

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

☐ |

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.0%

|

|

|

14

|

TYPE OF REPORTING PERSON*

IN

|

|

|

1

|

NAME OF REPORTING PERSON

SS. OR I.R.S. IDENTIFICATION NOS. OF ABOVE PERSON

Isidora Luksic Prieto

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☒

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS*

BK

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Chile

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

8

|

SHARED VOTING POWER

221,701,716

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

10

|

SHARED DISPOSITIVE POWER

221,701,716

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

221,701,716

|

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.0%

|

|

| 14 |

TYPE OF REPORTING PERSON*

IN

|

|

|

1

|

NAME OF REPORTING PERSON

SS. OR I.R.S. IDENTIFICATION NOS. OF ABOVE PERSON

Mara Luksic Prieto

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☒

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS*

BK

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

☐ |

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Chile

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

8

|

SHARED VOTING POWER

221,701,716

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

10

|

SHARED DISPOSITIVE POWER

221,701,716

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

221,701,716

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

☐ |

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.0%

|

|

|

14

|

TYPE OF REPORTING PERSON*

IN

|

|

|

1

|

NAME OF REPORTING PERSON

SS. OR I.R.S. IDENTIFICATION NOS. OF ABOVE PERSON

Elisa Luksic Prieto

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☒

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS*

BK

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

☐ |

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Chile

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

8

|

SHARED VOTING POWER

221,701,716

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

10

|

SHARED DISPOSITIVE POWER

221,701,716

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

221,701,716

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

☐ |

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.0%

|

|

|

14

|

TYPE OF REPORTING PERSON*

IN

|

|

|

1

|

NAME OF REPORTING PERSON

SS. OR I.R.S. IDENTIFICATION NOS. OF ABOVE PERSON

Fernanda Luksic Lederer

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

(a) ☒

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS*

BK

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

☐ |

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Chile

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

8

|

SHARED VOTING POWER

221,701,716

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

10

|

SHARED DISPOSITIVE POWER

221,701,716

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

221,701,716

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

☐ |

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.0%

|

|

|

14

|

TYPE OF REPORTING PERSON*

IN

|

|

The statement on Schedule 13D filed on September 30, 2005, as amended and supplemented on April 3, 2006 (the “Schedule 13D”), relating to the common stock without nominal (par) value (the “Common Stock”), of Compania Cervecerias Unidas S.A. (“CCU”), a company organized under the laws of Chile, is hereby amended as set forth below by this Amendment No. 2 to the Schedule 13D. Capitalized terms used herein and not otherwise defined herein shall have the respective meanings assigned to such terms in the Schedule 13D.

|

Item 2.

|

Identity and Background.

|

Item 2 of Schedule 13D is hereby amended to add the following persons:

(a) – (c), (f) This statement is being filed by the following persons:

Inversiones Río Claro Ltda., a limited liability company organized under the laws of Chile, is a holding company whose main purpose is to hold shares of Quinenco and various other companies. Inversiones Río Claro Ltda.’s principal business address is at Enrique Foster Sur 20, Floor 21, Santiago, Chile. Inversiones Río Clara Ltda. is a member of the Quinenco Group.

Inversiones Orengo S.A., a corporation organized under the laws of Chile, is a holding company whose main purpose is to hold shares of Quinenco and various other companies. Inversiones Orengo S.A.’s principal business address is at Apoquindo 4001, Floor 14, Las Condes, Santiago, Chile. Inversiones Orengo S.A. is a member of the Quinenco Group.

Inversiones Alaska Ltda., a limited liability company organized under the laws of Chile, is a subsidiary of Inversiones Consolidadas Ltda., and its main purpose is to hold shares of Quiñenco S.A. Inversiones Alaska Ltda.’s principal business address is at Enrique Foster Sur 20, 18th Floor, Las Condes, Santiago, Chile. Inversiones Alaska Ltda. is a member of the Quinenco Group.

Antonia Luksic Puga, a Chilean citizen, resides in Chile and has her principal business address at Enrique Foster Sur 20, Floor 21, Santiago, Chile. Mrs. Antonia Luksic Puga is a member of the Quinenco Group.

Isidora Luksic Prieto, a Chilean citizen, resides in Chile and has her principal business address at Enrique Foster Sur 20, Floor 21, Santiago, Chile. Ms. Isidora Luksic Prieto is a member of the Quinenco Group.

Mara Luksic Prieto, a Chilean citizen, resides in Chile and has her principal business address at Enrique Foster Sur 20, Floor 21, Santiago, Chile. Ms. Mara Luksic Prieto is a minor and is a member of the Quinenco Group.

Elisa Luksic Prieto, a Chilean citizen, resides in Chile and has her principal business address at Enrique Foster Sur 20, Floor 21, Santiago, Chile. Ms. Elisa Luksic Prieto is a minor and is a member of the Quinenco Group.

Fernanda Luksic Lederer, a Chilean citizen, resides in Chile and has her principal business address at Enrique Foster Sur 20, Floor 18, Santiago, Chile. Ms. Fernanda Luksic Lederer is a member of the Quinenco Group.

(d) None of the Reporting Persons, or to the best knowledge of each of the Reporting Persons, any of the persons listed in Schedule A hereto, has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) during the last five years.

(e) During the last five years, none of the Reprting Persons, or to the best knowledge of each Reporting Person, any of the persons listed in Schedule A hereto, has been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction as a result of which any such person was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation of such law.

|

Item 3.

|

Source and Amount of Funds or Other Consideration.

|

Item 3 of the Schedule 13D is hereby supplemented as follows:

On June 18, 2013, shareholders at CCU’s Extraordinary Shareholders’ Meeting approved a capital increase of Ch$340,000,000,000* through the issuance of 51,000,000 new shares of the same series. On October 8, 2013, Inversiones IRSA Limitada participated in the capital increase in the amount of Ch$72,366,346,000, representing the acquisition of 11,133,284 additional shares at a subscription price of Ch$6,500 per share. The purchase of the shares by Inversiones IRSA Limitada was financed with a capital contribution received from Inversiones y Rentas S.A. (“IRSA”). IRSA financed the capital contribution with long-term bank credit loans and its own funds.

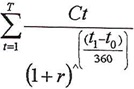

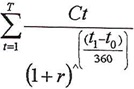

Long-term indebtedness of IRSA to finance the capital contribution to Inversiones IRSA Limitada consisted of a Loan Agreement, dated July 25, 2013, between Inversiones y Rentas S.A. and Banco del Estado de Chile, and a Credit Line Agreement, dated August 6, 2013, between Inversiones y Rentas S.A. and Banco de Crédito e Inversiones, as follows:

|

Lender

|

Date of Incurrence

|

Principal Amount**

|

Interest Rate

|

Maturity Date

|

|

Banco de Credito

e Inv.

|

September 12, 2013

|

UF1,535,000

|

UF+

+ 4.12% p.a.

|

May 31, 2023

|

|

Banco Estado

|

September 12, 2013

|

UF1,500,000

|

UF+

+ 3.95% p.a.

|

May 31, 2023

|

|

Banco Estado

|

October 8, 2013

|

UF130,000

|

UF+

+ 3.95% p.a.

|

May 31, 2023

|

* Chilean Pesos.

** Unidades de Fomento (UFs), which are inflation-indexed, peso-denominated monetary units. The UF rate is set daily in advance based on changes in the previous month's inflation rate in Chile.

|

Item 4.

|

Purpose of the Transaction.

|

Item 4 of the Schedule 13D is hereby amended and restated in its entirety as follows:

Inversiones IRSA Limitada purchased the shares referred to in Item 3 above in connection with CCU’s capital increase to maintain, jointly with IRSA, a 60% ownership interest in CCU.

|

Item 5.

|

Interests in Securities of the Issuer.

|

Item 5 of the Schedule 13D is hereby amended and restated in its entirety as follows:

(a)-(b) See pages 1-31 of this Amendment No. 2 to the Schedule 13D for the aggregate number and percentage of Common Shares beneficially owned by each Reporting Person, the number of Common Shares as to which there is sole or shared power to vote, or to direct the vote, and sole or shared power to dispose or to direct the disposition.

(c) On October 8, 2013, Inversiones IRSA Limitada purchased 11,133,284 shares of CCU’s Common Stock at a purchase price of Ch$6,500 per share, for an aggregate purchase price of Ch$72,366,346,000.

(d) Not applicable.

(e) Not applicable.

|

Item 6.

|

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

|

Item 6 of the Schedule 13D is hereby supplemented as follows:

Item 3 of this statement on Schedule 13D is incorporated herein by reference.

Pursuant to the Loan Agreement, dated July 25, 2013, between Inversiones y Rentas S.A. and Banco del Estado de Chile, IRSA agreed to, among other things, maintain direct ownership of at least 50.1% of the shares issued by CCU.

Pursuant to the Credit Line Agreement, dated August 6, 2013, between Inversiones y Rentas S.A. and Banco de Crédito e Inversiones, IRSA agreed to, among other things, (i) maintain control over CCU (contemplated in the agreement as direct or indirect ownership of over 50.1% of CCU shares with voting rights at shareholder meetings, and control over rights and interests in CCU’s capital allowing IRSA the right to appoint or elect the majority of the members of the board of directors of CCU), and (ii) continue to hold, directly or indirectly, at least 50.1% of CCU’s shares.

Copies of English language translations of the Loan Agreement and the Credit Line Agreement are being filed as exhibits hereto.

|

Item 7.

|

Material to be Filed as Exhibits.

|

Item 7 of the Schedule 13D is hereby amended and restated in its entirety as follows:

The following are filed with this statement:

|

Exhibit No.

|

Description

|

|

1

|

Joint Filing Agreements, together with Powers of Attorney from each of Luksburg Foundation, Dolberg Finance Corporation Establishment, Lanzville Investments Establishment, Ruana Copper Corporation Establishment, Geotech Establishment, Andsberg Ltd., Andsberg Inv. Ltd., Andsberg Inversiones Ltda., Patricia Lederer Tcherniak, Nicolas Luksic Puga, Guillermo Luksic Craig, Andronico Luksic Craig, Inmobiliaria e Inversiones Rio Claro S.A., Inversiones Salta S.A., Inversiones Consolidadas S.A., Andronico Luksic Lederer, Davor Luksic Lederer, Max Luksic Lederer, Dax Luksic Lederer and LQ Inversiones Financieras S.A. *

|

|

2

|

Amended Shareholder's Agreement dated January 13, 2003 between Quinenco and Heineken Chile.*

|

|

3

|

Syndicated Loan Agreement among Inversiones y Rentas, Banco de Estado de Chile, Banco de Credito e Inversiones and Banco Bilbao Vizcaya Argentaria, Chile dated August 5, 2005.*

|

|

4

|

Syndicated Loan Agreement - Inversiones y Rentas S.A. and Banco del Estado de Chile and Others.*

|

|

5

|

Modification of Syndicated Loan Agreement – Inversiones Y Rentas S.A. and Banco del Estado de Chile and Others.*

|

|

6

|

Joint Filing Agreements for each of Inversiones y Rentas S.A., Inversiones IRSA Limitada, Inmobiliaria e Inversiones Río Claro S.A., Inversiones Río Claro Ltda., Inversiones Orengo S.A., Inversiones Alaska Ltda., Nicolás Luksic Puga, Antonia Luksic Puga, Isidora Luksic Prieto, Mara Luksic Prieto, Elisa Luksic Prieto and Fernanda Luksic Lederer; and

Powers of Attorney for each of Inversiones y Rentas S.A., Inversiones IRSA Limitada, Inmobiliaria e Inversiones Río Claro S.A., Inversiones Río Claro Ltda., Inversiones Orengo S.A., Inversiones Alaska Ltda., Nicolás Luksic Puga, Antonia Luksic Puga, Isidora Luksic Prieto, Mara Luksic Prieto, Elisa Luksic Prieto and Fernanda Luksic Lederer.

|

|

7

|

Loan Agreement, dated July 25, 2013, between Inversiones y Rentas S.A. and Banco del Estado de Chile.

|

|

8

|

Credit Line Agreement, dated August 6, 2013, between Inversiones y Rentas S.A. and Banco de Crédito e Inversiones.

|

* Exhibit previously filed

Schedule A-1

Schedule A-1 of the Schedule 13D is hereby amended in its entirety as follows:

Directors and General Manager of Inversiones y Rentas S.A.

Directors:

|

1.

|

Name:

|

Andrónico Luksic Craig

|

| |

|

Principal Occupation:

Chairman of the Board of Directors of Quinenco S.A., LQIF S.A., SM Chile S.A. and CCU S.A., and Vice Chairman of the Board of Directors of Banco de Chile and CSVA S.A. Director of various companies

|

| |

Business Address:

|

Enrique Foster Sur 20, 16th Floor

|

| |

|

Santiago, Chile

|

| |

Citizenship:

|

Chilean

|

| |

|

|

|

2.

|

Name:

|

Phillipe Pasquet

|

| |

Principal Occupation:

|

Director of various companies

|

| |

Business Address:

|

Av. das Americas 500, bloco 12, Barra da Tijuca

|

| |

|

Rio de Janeiro 22640-100, Brasil

|

| |

Citizenship:

|

French

|

| |

|

|

|

3.

|

Name:

|

Francisco Pérez Mackenna

|

| |

Principal Occupation:

|

Chief Executive Officer of Quinenco

|

| |

Business Address:

|

Enrique Foster Sur 20, 16th Floor

|

| |

|

Santiago, Chile

|

| |

Citizenship:

|

Chilean

|

| |

|

|

|

4.

|

Name:

|

Manuel Jose Noguera Eyzaguirre

|

| |

Principal Occupation:

|

Quinenco S.A. Chairman and Board Advisor

|

| |

Business Address:

|

Enrique Foster Sur 20, 16th Floor

|

| |

|

Santiago, Chile

|

| |

Citizenship:

|

Chilean

|

| |

|

|

|

5.

|

Name:

|

John Ross Nicolson

|

| |

Principal Occupation:

|

Chairman of the Board of Directors of Inversiones y

|

| |

|

Rentas S.A.

|

| |

|

Director of various companies

|

| |

Business Address:

|

AG Barr. 4 Mollins Road, Westfield Ind Estate,

|

| |

|

Cumbernauld, G68 9HD, UK

|

| |

Citizenship:

|

British

|

| |

|

|

|

6.

|

Name:

|

Jorge Luis Ramos Santos

|

| |

Principal Occupation:

|

Director of various companies

|

| |

Business Address:

|

Esperanza 110. Garza García

|

| |

|

Nuevo León, México. ZP 66240

|

| |

Citizenship:

|

Mexican

|

General Manager:

|

1.

|

Name:

|

Alessandro Bizzarri Carvallo

|

| |

Principal Occupation:

|

Partner, Law Offices Carvallo, Bizzarri & García Abogados

|

| |

Business Address:

|

Av. Nueva Costanera 4229, of 206

|

| |

|

Santiago, Chile

|

| |

Citizenship:

|

Chilean

|

Schedule A-2

Schedule A-2 of the Schedule 13D is hereby amended in its entirety as follows:

Authorized Signatories of Inversiones IRSA Limitada.

|

1.

|

Name:

|

Andrónico Luksic Craig

|

| |

Principal Occupation:

|

Chairman of the Board of Directors of Quinenco

|

| |

|

S.A., LQIF S.A., SM Chile S.A. and CCU S.A.,

|

| |

|

and Vice Chairman of the Board of Directors of

|

| |

|

Banco de Chile and CSVA S.A. Director of

|

| |

|

various companies

|

| |

Business Address:

|

Enrique Foster Sur 20, 16th Floor

|

| |

|

Santiago, Chile

|

| |

Citizenship:

|

Chilean

|

| |

|

|

|

2.

|

Name:

|

Phillipe Pasquet

|

| |

Principal Occupation:

|

Director of various companies

|

| |

Business Address:

|

Av. das Americas 500, bloco 12, Barra da Tijuca

|

| |

|

Rio de Janeiro 22640-100, Brasil

|

| |

Citizenship:

|

French

|

| |

|

|

|

3.

|

Name:

|

Francisco Pérez Mackenna

|

| |

Principal Occupation:

|

Chief Executive Officer of Quinenco

|

| |

Business Address:

|

Enrique Foster Sur 20, 16th Floor

|

| |

|

Santiago, Chile

|

| |

Citizenship:

|

Chilean

|

| |

|

|

|

4.

|

Name:

|

Manuel Jose Noguera Eyzaguirre

|

| |

Principal Occupation:

|

Quinenco S.A. Chairman and Board Advisor

|

| |

Business Address:

|

Enrique Foster Sur 20, 16th Floor

|

| |

|

Santiago, Chile

|

| |

Citizenship:

|

Chilean

|

| |

|

|

|

5.

|

Name:

|

John Ross Nicolson

|

| |

Principal Occupation:

|

Chairman of the Board of Directors of Inversiones y

|

| |

|

Rentas S.A.

|

| |

|

Director of various companies

|

| |

Business Address:

|

AG Barr. 4 Mollins Road,Westfield Ind Estate,

|

| |

|

Cumbernauld, G68 9HD, UK

|

| |

Citizenship:

|

British

|

| |

|

|

|

6.

|

Name:

|

Jorge Luis Ramos Santos

|

| |

Principal Occupation:

|

Director of various companies

|

| |

Business Address:

|

Esperanza 110. Garza García

|

| |

|

Nuevo León, México. ZP 66240

|

| |

Citizenship:

|

Mexican

|

|

7.

|

Name:

|

Alessandro Bizzarri Carvallo

|

| |

Principal Occupation:

|

Partner, Law Offices Carvallo, Bizzarri & García Abogados

|

| |

|

|

| |

Business Address:

|

Av. Nueva Costanera 4229, of 206

|

| |

|

Santiago, Chile

|

| |

Citizenship:

|

Chilean

|

| |

|

|

|

8.

|

Name:

|

Rosita Covarrubias Gatica

|

| |

Principal Occupation:

|

Finance Manager Inversiones y Rentas S.A.

|

| |

Business Address:

|

Enrique Foster Sur 20, 14th Floor

|

| |

|

Santiago, Chile

|

| |

Citizenship:

|

Chilean

|

Schedule A-3

Schedule A-3 of the Schedule 13D is hereby amended in its entirety as follows:

Directors and Executive Officers of Quiñenco S.A.

Directors:

|

1.

|

Name:

|

Andrónico Luksic Craig

|

| |

Principal Occupation:

|

Chairman of the Board of Directors of Quiñenco, Vice Chairman of the Board of Directors of Banco de Chile, Director of various companies

|

| |

Business Address:

|

Enrique Foster Sur 20, 16th Floor

|

| |

|

Santiago, Chile

|

| |

Citizenship:

|

Chilean

|

| |

|

|

|

2.

|

Name:

|

Jean-Paul Luksic Fontbona

|

| |

Principal Occupation:

|

Non-Executive Chairman of Antofagasta plc,Vice Chairman of the Board of Directors of Quiñenco, Director of various companies

|

| |

Business Address:

|

Apoquindo 4001, 22nd Floor

|

| |

|

Santiago, Chile

|

| |

Citizenship:

|

Chilean

|

| |

|

|

|

3.

|

Name:

|

Nicolás Luksic Puga

|

| |

Principal Occupation:

|

Chief Executive Officer of Ionix S.A., Director of Quiñenco,

|

| |

|

Director of various companies

|

| |

Business Address:

|

Enrique Foster Sur 20, 21st Floor

|

| |

|

Santiago, Chile

|

| |

Citizenship:

|

Chilean

|

| |

|

|

|

4.

|

Name:

|

Andrónico Luksic Lederer

|

| |

Principal Occupation:

|

Vice Chairman of Inversiones Consolidadas Limitada; Corporate Manager, International Development, Antofagasta Minerals S.A.; Director of Quiñenco

|

| |

Business Address:

|

Apoquindo 4001, 21st Floor

|

| |

|

Santiago, Chile

|

| |

Citizenship:

|

Chilean

|

| |

|

|

|

5.

|

Name:

|

Gonzalo Menéndez Duque

|

| |

Principal Occupation:

|

Director of various companies

|

| |

Business Address:

|

Agustinas 972, Suite 701

|

| |

|

Santiago, Chile

|

| |

Citizenship:

|

Chilean

|

| |

|

|

|

6.

|

Name:

|

Hernán Büchi Buc

|

| |

Principal Occupation:

|

Director of various companies

|

| |

Business Address:

|

Alcántara 498

|

| |

|

Las Condes, Santiago, Chile

|

| |

Citizenship:

|

Chilean

|

| |

|

|

|

7.

|

Name:

|

Fernando Cañas Berkowitz

|

| |

Principal Occupation:

|

Director of various companies

|

| |

Business Address:

|

Lo Fontecilla 441

|

| |

|

Santiago, Chile

|

| |

Citizenship:

|

Chilean

|

| |

|

|

|

8.

|

Name:

|

Matko Koljatic Maroevic

|

| |

Principal Occupation:

|

Business Administrator

|

| |

Business Address:

|

Vicuña Mackenna 4860

|

| |

|

Escuela de Administración PUC,

|

| |

|

Santiago, Chile

|

| |

Citizenship:

|

Chilean

|

Executive Officers:

|

1.

|

Name:

|

Francisco Pérez Mackenna

|

| |

Title:

|

Chief Executive Officer

|

| |

Citizenship:

|

Chilean

|

| |

|

|

|

2.

|

Name:

|

Luis Fernando Antúnez Bories

|

| |

Title:

|

Chief Financial Officer

|

| |

Citizenship:

|

Chilean

|

| |

|

|

|

3.

|

Name:

|

Felipe Joannon Vergara

|

| |

Title:

|

Managing Director, Business Development

|

| |

Citizenship:

|

Chilean

|

| |

|

|

|

4.

|

Name:

|

Martín Rodríguez Guiraldes

|

| |

Title:

|

Managing Director, Mergers & Acquisitions

|

| |

Citizenship:

|

Chilean

|

| |

|

|

|

5.

|

Name:

|

Rodrigo Hinzpeter Kirberg

|

| |

Title:

|

Chief Legal Counsel

|

| |

Citizenship:

|

Chilean

|

| |

|

|

|

6.

|

Name:

|

Pedro Marín Loyola

|

| |

Title:

|

Managing Director, Performance Appraisal and Internal Auditing

|

| |

Citizenship:

|

Chilean

|

A-3-2

|

7.

|

Name:

|

María Carolina García de la Huerta Aguirre

|

| |

Title:

|

Managing Director, Corporate Affairs and Communications

|

| |

Citizenship:

|

Chilean

|

| |

|

|

|

8.

|

Name:

|

Alvaro Sapag Rajevic

|

| |

Title:

|

Managing Director, Sustainability

|

| |

Citizenship:

|

Chilean

|

| |

|

|

|

9.

|

Name:

|

Andrea Tokman Ramos

|

| |

Title:

|

Chief Economist

|

| |

Citizenship:

|

Chilean, U.S.

|

A-3-3

Schedule A-4

Schedule A-4 of the Schedule 13D is hereby amended in its entirety as follows:

Directors of Heineken N.V.

Members of the Executive Board:

|

1.

|

Name:

|

Jean-Francois van Boxmeer

|

| |

Principal Occupation:

|

Chairman of the Executive Board of Heineken N.V. CEO

|

| |

|

|

| |

Business Address:

|

Tweede Weteringplantsoen 21,

|

| |

|

1017 2D Amsterdam, Netherlands

|

| |

Citizenship:

|

Belgian

|

| |

|

|

|

2.

|

Name:

|

René Hooft Graafland

|

| |

Principal Occupation:

|

Member of the Executive Board of Heineken N.V. CFO

|

| |

|

|

| |

Business Address:

|

Tweede Weteringplantsoen 21,

|

| |

|

1017 2D Amsterdam, Netherlands

|

| |

Citizenship:

|

Dutch

|

Schedule A-5

Schedule A-5 of the Schedule 13D is hereby amended in its entirety as follows:

Members of the Foundation Council of the Luksburg Foundation

|

1.

|

Name:

|

Andrónico Luksic Craig

|

| |

Principal Occupation:

|

Chairman of the Board of Directors of Quiñenco,Vice Chairman of the Board of Directors of Banco de Chile, Director of various companies

|

| |

Business Address:

|

Enrique Foster Sur 20, 16th Floor

|

| |

|

Santiago, Chile

|

| |

Citizenship:

|

Chilean

|

| |

|

|

|

2.

|

Name:

|

Jean-Paul Luksic Fontbona

|

| |

Principal Occupation:

|

Non-Executive Chairman of Antofagasta plc, Vice Chairman of the Board of Directors of Quiñenco, Director of various companies

|

| |

Business Address:

|

Apoquindo 4001, 22nd Floor

|

| |

|

Santiago, Chile

|

| |

Citizenship:

|

Chilean

|

| |

|

|

|

3.

|

Name:

|

Nicolás Luksic Puga

|

| |

Principal Occupation:

|

Chief Executive Officer of Ionix S.A., Director of Quiñenco,

|

| |

|

Director of various companies |

| |

Business Address:

|

Enrique Foster Sur 20, 21st Floor

|

| |

|

Santiago, Chile

|

| |

Citizenship:

|

Chilean

|

| |

|

|

|

4.

|

Name:

|

Karl Josef Hier

|

| |

Principal Occupation:

|

Lawyer, Marxer & Partner

|

| |

Business Address:

|

Heiligkreuz 6

|

| |

|

Vaduz, Liechtenstein

|

| |

Citizenship:

|

Austrian

|

Schedule A-6

Schedule A-6 of the Schedule 13D is hereby amended in its entirety as follows:

Directors of Lanzville Investments Establishment

|

1.

|

Name:

|

Andrónico Luksic Craig

|

| |

Principal Occupation:

|

Chairman of the Board of Directors of Quiñenco, Vice Chairman of the Board of Directors of Banco de Chile, Director of various companies

|

| |

Business Address:

|

Enrique Foster Sur 20, 16th Floor

|

| |

|

Santiago, Chile

|

| |

Citizenship:

|

Chilean

|

| |

|

|

|

2.

|

Name:

|

Jean-Paul Luksic Fontbona

|

| |

Principal Occupation:

|

Non-Executive Chairman of Antofagasta plc, Vice Chairman of the Board of Directors of Quiñenco,Director of various companies

|

| |

Business Address:

|

Apoquindo 4001, 22nd Floor

|

| |

|

Santiago, Chile

|

| |

Citizenship:

|

Chilean

|

| |

|

|

|

3.

|

Name:

|

Karl Josef Hier

|

| |

Principal Occupation:

|

Lawyer, Marxer & Partner

|

| |

Business Address:

|

Heiligkreuz 6

|

| |

|

Vaduz, Liechtenstein

|

| |

Citizenship:

|

Austrian

|

Schedule A-7

Schedule A-7 of the Schedule 13D is hereby amended in its entirety as follows:

Directors of Dolberg Finance Corporation Establishment

|

1.

|

Name:

|

Andrónico Luksic Craig

|

| |

Principal Occupation:

|

Chairman of the Board of Directors of Quiñenco, Vice Chairman of the Board of Directors of Banco de Chile, Director of various companies

|