Blueprint

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

(Mark One)

[X] Annual

report pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

For the

fiscal year ended May 31, 2017

or

[

] Transition report pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

For the

transition period from ________________ to

________________

Commission

file number: 000-22893.

AEHR TEST SYSTEMS

(Exact

name of registrant as specified in its charter)

|

CALIFORNIA

|

94-2424084

|

|

(State

or other jurisdiction of

|

(IRS

Employer Identification Number)

|

|

incorporation or

organization)

|

|

|

|

|

|

400

KATO TERRACE, FREMONT, CA

|

94539

|

|

(Address of

principal executive offices)

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (510) 623-9400

Securities

registered pursuant to Section 12(b) of the Act:

Common

Stock, $0.01 par value

Name of

each exchange on which registered: The NASDAQ Capital

Market

Securities

registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as

defined in Rule 405 of the Securities Act.

Yes [ ]

No [X]

Indicate

by check mark if the registrant is not required to file reports

pursuant to Section 13 or Section 15(d) of the Securities Act. Yes

[ ] No [X]

Indicate

by check mark whether the registrant (1) has filed all reports

required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such

shorter period that the registrant was required to file such

reports), and (2) has been subject to such filing requirements for

the past 90 days.

Yes [X]

No [ ]

Indicate

by check mark whether the registrant has submitted electronically

and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405

of Regulation S-T (§232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant

was required to submit and post such files).

Indicate by

check mark if disclosure of delinquent filers pursuant to Item 405

of Regulation S-K (§229.405 of this chapter) is not contained

herein, and will not be contained to the best of the

registrant’s knowledge, in definitive proxy or information

statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form 10-K. [ X ]

Indicate

by check mark whether the registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of

“large accelerated filer,” “accelerated

filer,” “smaller reporting company,” and

“emerging growth company” in Rule 12b-2 of the Exchange

Act (Check one):

|

Large

accelerated filer [ ]

|

Accelerated

filer [ ]

|

|

|

|

|

Non-accelerated

filer [ ]

|

Smaller

reporting company [X]

|

|

(Do not

check if a smaller reporting company)

|

|

|

|

|

|

Emerging growth

company [ ]

|

|

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. [

]

Indicate

by check mark whether the registrant is a shell company (as defined

in Rule 12b-2 of the Exchange Act).

Yes [ ]

No [X]

The

aggregate market value of the registrant’s common stock, par

value $0.01 per share, held by non-affiliates of the registrant,

based upon the closing price of $2.99 on November 30, 2016, as

reported on the NASDAQ Capital Market, was $39,151,174. For

purposes of this disclosure, shares of common stock held by persons

who hold more than 5% of the outstanding shares of common stock

(other than such persons of whom the Registrant became aware only

through the filing of a Schedule 13G filed with the Securities and

Exchange Commission) and shares held by officers and directors of

the Registrant have been excluded because such persons may be

deemed to be affiliates. This determination of affiliate status is

not necessarily conclusive for other purposes.

The

number of shares of registrant’s common stock, par value

$0.01 per share, outstanding at July 31, 2017 was

21,417,011.

AEHR TEST SYSTEMS

FORM 10-K

FISCAL YEAR ENDED MAY 31, 2017

TABLE OF CONTENTS

PART I

|

Item

1. Business

|

4

|

|

Item

1A. Risk Factors

|

9

|

|

Item

1B. Unresolved Staff Comments

|

15

|

|

Item 2.

Properties

|

15

|

|

Item

3. Legal Proceedings

|

15

|

|

Item

4. Mine Safety Disclosures

|

15

|

|

|

|

|

|

|

|

PART II

|

|

|

|

|

Item

5. Market for Registrant’s Common Equity,

Related Stockholder Matters and Issuer Purchases of Equity

Securities

|

16

|

|

Item

6. Selected Consolidated Financial

Data

|

17

|

|

Item

7. Management’s Discussion and Analysis of

Financial Condition and Results of Operations

|

19

|

|

Item

7A. Quantitative and Qualitative Disclosures about Market

Risk

|

24

|

|

Item

8. Financial Statements and Supplementary

Data

|

26

|

|

Item

9. Changes in and Disagreements with Accountants

on Accounting and Financial Disclosure

|

51

|

|

Item

9A. Controls and Procedures

|

51

|

|

Item

9B. Other Information

|

51

|

|

|

|

|

|

|

|

PART III

|

|

|

|

|

Item

10. Directors, Executive Officers and Corporate

Governance

|

52

|

|

Item

11. Executive Compensation

|

52

|

|

Item

12. Security Ownership of Certain Beneficial Owners and Management

and Related Stockholder Matters

|

52

|

|

Item

13. Certain Relationships and Related Transactions

|

52

|

|

Item

14. Principal Accountant Fees and Services

|

52

|

|

|

|

|

|

|

|

PART IV

|

|

|

|

|

Item

15. Exhibits, Financial Statement Schedules

|

53

|

|

|

|

|

|

|

|

Signatures

|

57

|

This

Annual Report on Form 10-K contains forward-looking statements

within the meaning of the Section 27A of the Securities Act of

1933, as amended (the Securities Act), and Section 21E of the

Securities Exchange Act of 1934, as amended (the Exchange Act). All

statements contained in this Annual Report on Form 10-K other than

statements of historical fact, including statements regarding our

future results of operations and financial position, our business

strategy and plans, and our objectives for future operations, are

forward-looking statements. The words “believe,”

“may,” “will,” “estimate,”

“continue,” “anticipate,”

“plan,” “intend,” “expect,”

“could,” “target,” “project,”

“should,” “predict,”

“potential,” “would,” “seek”

and similar expressions and the negative of those expressions are

intended to identify forward-looking statements. These

forward-looking statements are subject to a number of risks,

uncertainties and assumptions that are difficult to predict.

Therefore, actual results may differ materially and adversely from

those expressed in any forward-looking statements. These risks

include but are not limited to those factors identified in

“Risk Factors” beginning on page 9 of this Annual

Report on Form 10-K, those factors that we may from time to time

identify in our periodic filings with the Securities and Exchange

Commission, as well as other factors beyond our control. We

undertake no obligation to revise or update publicly any

forward-looking statements for any reason. Unless the context

requires otherwise, references in this Form 10-K to “Aehr

Test,” the “Company,” “we,”

“us” and “our” refer to Aehr Test

Systems.

PART I

Item 1. Business

THE

COMPANY

Aehr

Test was incorporated in the state of California on May 25, 1977.

We develop, manufacture and sell systems which are designed to

reduce the cost of testing and to perform reliability screening, or

burn-in, of complex logic devices, memory ICs, sensors and optical

devices. These systems can be used to simultaneously perform

parallel testing and burn-in of packaged integrated circuits, or

ICs, singulated bare die or ICs still in wafer form. Increased

quality and reliability needs of the Automotive, Mobility and flash

memory integrated circuit markets are driving additional testing

requirements, capacity needs and opportunities for Aehr Test

products in package and wafer level testing. Leveraging its

expertise as a long-time leading provider of burn-in equipment,

with over 2,500 systems installed worldwide, the Company has

developed and introduced several innovative product families,

including the ABTSTM and FOXTM systems, the

WaferPakTM

cartridge and the DiePak® carrier. The

latest ABTS family of packaged part burn-in and test systems can

perform test during burn-in of complex devices, such as digital

signal processors, microprocessors, microcontrollers and

systems-on-a-chip, and offers individual temperature control for

high-power advanced logic devices. The FOX systems are full wafer

contact parallel test and burn-in systems designed to make contact

with all pads of a wafer simultaneously, thus enabling full wafer

parallel test and burn-in. The WaferPak cartridge includes a

full-wafer probe card for use in testing wafers in FOX systems. The

DiePak carrier is a reusable, temporary package that enables IC

manufacturers to perform cost-effective final test and burn-in of

singulated bare die or very small multi-IC modules.

INDUSTRY

BACKGROUND

Semiconductor

manufacturing is a complex, multi-step process, and defects or

weaknesses that may result in the failure of an integrated circuit,

or IC, may be introduced at any process step. Failures may occur

immediately or at any time during the operating life of an IC,

sometimes after several months of normal use. Semiconductor

manufacturers rely on testing and reliability screening to identify

and eliminate defects that occur during the manufacturing

process.

Testing

and reliability screening involve multiple steps. The first set of

tests is typically performed by IC manufacturers before the

processed semiconductor wafer is cut into individual die, in order

to avoid the cost of packaging defective die into their packages.

This “wafer probe” testing can be performed on one or

many die at a time, including testing the entire wafer at once.

After the die are packaged and before they undergo reliability

screening, a short test is typically performed to detect packaging

defects. Most leading-edge microprocessors, microcontrollers,

digital signal processors, memory ICs, sensors and optical devices

(such as vertical-cavity surface-emitting lasers, or VCSELs) then

undergo an extensive reliability screening and stress testing

procedure known as “burn-in” or “cycling,”

depending on the application. The burn-in process screens for early

failures by operating the IC at elevated voltages and temperatures,

up to 150 degrees Celsius (302 degrees Fahrenheit), for periods

typically ranging from 2 to 48 hours. A typical burn-in system can

process thousands of ICs simultaneously. After burn-in, the ICs

undergo a final test process using automatic test equipment, or

testers. The cycling process screens flash memory devices for

failure to meet write/erase cycling endurance

requirements.

PRODUCTS

The

Company manufactures and markets full wafer contact test systems,

test during burn-in systems, test fixtures, die carriers and

related accessories.

All

of the Company’s systems are modular, allowing them to be

configured with optional features to meet customer requirements.

Systems can be configured for use in production applications, where

capacity, throughput and price are most important, or for

reliability engineering and quality assurance applications, where

performance and flexibility, such as extended temperature ranges,

are essential.

FULL WAFER CONTACT SYSTEMS

The

FOX-1P full wafer parallel test system, introduced in October 2014,

is designed for massively parallel test of devices at wafer level.

The FOX-1P system is designed to make electrical contact to and

test all of the die on a wafer in a single touchdown. The FOX-1P

test head and WaferPak contactor are compatible with

industry-standard 300 mm wafer probers which provide the wafer

handling and alignment automation for the FOX-1P system. The FOX-1P

pattern generator is designed to functionally test

industry-standard memory devices such as flash and DRAMs, plus it

is optimized to test memory or logic ICs that incorporate design

for testability, or DFT, and built-in self-test, or BIST. The

FOX-1P universal per-pin architecture to provide per-pin

electronics and per-device power supplies is tailored to full-wafer

functional test. The Company believes that the FOX-1P system can

significantly reduce the cost of testing IC wafers. The

Company’s FOX-1P system was partially funded through a

development agreement with a leading semiconductor manufacturer.

The Company has received the first production order of this new

system and shipped the first system in July 2016.

The

FOX-XP test and burn-in system, introduced in July 2016, is

designed for devices in wafer, singulated die, and module form that

require test and burn-in times typically measured in hours. The

FOX-XP system can test and burn in up to 18 wafers at a time. For

high reliability applications, such as automotive, mobile devices,

sensors, and SSDs, the FOX-XP system is a cost-effective solution

for producing tested and burned-in die for use in multi-chip

packages. Using Known-Good Die, or KGD, which are fully burned-in

and tested die, in multi-chip packages helps assure the reliability

of the final product and lowers costs by increasing the yield of

high-cost multi-chip packages. Wafer-level burn-in and test enables

lower cost production of KGD for multi-chip modules, 3-D stacked

packages and systems-in-a-package. The FOX-XP system has been

extended for burn-in and test of small multi-die modules by using

DiePak carriers. The DiePak carrier with its multi-module sockets

and high wattage dissipation capabilities has a capacity of

hundreds of modules, much higher than the capacity of a traditional

burn-in system with traditional single-die sockets and heat sinks.

This capability was introduced in March 2017.

The

FOX-15 full wafer parallel test system, the predecessor to the

FOX-XP system, was introduced in October 2007 and was designed for

full-wafer test and burn-in. The FOX-15 system is nearing the end

of its lifecycle and limited shipments are expected in the

future.

One

of the key components of the FOX systems is the patented WaferPak

cartridge system. The WaferPak cartridge contains a full-wafer

single-touchdown probe card which is easily removable from the

system. Traditional probe cards contact only a portion of the

wafer, requiring multiple touchdowns to test the entire wafer. The

unique design is intended to accommodate a wide range of contactor

technologies so that the contactor technology can evolve along with

the changing requirements of the customer’s wafers. The

WaferPak cartridges are custom designed for each device type, each

of which has a typical lifetime of 2 to 7 years, depending on the

application. Therefore, multiple sets of WaferPak cartridges could

be purchased over the life of a FOX system.

A

key new component of the FOX-XP systems is the patent-pending

DiePak carrier system. The DiePak carrier contains many

multi-module sockets with very fine-pitch probes which are easily

removable from the system. Traditional sockets contact only a

single device, requiring multiple large numbers of sockets and

burn-in boards to test a production lot of devices. The unique

design is intended to accommodate a wide range of socket sizes and

densities so that the DiePak carrier technology can evolve along

with the changing requirements of the customer’s devices. The

DiePak carriers are custom designed for each device type, each of

which has a typical lifetime of 2 to 7, years depending on the

application. Therefore, multiple sets of DiePak carriers could be

purchased over the life of a FOX-XP system.

Another

key component of our FOX-XP and FOX-15 test cell is the WaferPak

Aligner. The WaferPak Aligner performs automatic alignment of the

customer’s wafer to the WaferPak cartridge so that the wafer

can be tested and burned-in by the FOX-XP and FOX-15 systems.

Typically one WaferPak Aligner can support several FOX-XP or FOX-15

systems.

Similar

to the WaferPak Aligner for WaferPak cartridges, Aehr Test offers a

DiePak Loader for DiePak carriers. The DiePak Loader performs

automatic loading of the customer’s modules to the DiePak

carrier so that the modules can be tested and burned-in by the

FOX-XP system. Typically one DiePak Loader can support several

FOX-XP systems.

The

full wafer contact systems product category accounted for

approximately 51%, 60% and 31% of the Company’s net sales in

fiscal 2017, 2016 and 2015, respectively.

SYSTEMS FOR PACKAGED PARTS

Test

during burn-in, or TDBI, systems consist of several subsystems:

pattern generation and test electronics, control software, network

interface and environmental chamber. The test pattern generator

allows duplication of most of the functional tests performed by a

traditional tester. Pin electronics at each burn-in board, or BIB,

position are designed to provide accurate signals to the ICs being

tested and detect whether a device is failing the

test.

Devices

being tested are placed on BIBs and loaded into environmental

chambers which typically operate at temperatures from 25 degrees

Celsius (77 degrees Fahrenheit) up to 150 degrees Celsius (302

degrees Fahrenheit) (optional chambers can produce temperatures as

low as -55 degrees Celsius (-67 degrees Fahrenheit)). A single BIB

can hold up to several hundred ICs, and a production chamber holds

up to 72 BIBs, resulting in thousands of memory or logic devices

being tested in a single system.

The

Advanced Burn-in and Test System, or ABTS, was introduced in fiscal

2008. The ABTS family of products is based on a completely new

hardware and software architecture that is intended to address not

only today’s devices, but also future devices for many years

to come. The ABTS system can test and burn-in both high-power logic

and low-power ICs. It can be configured to provide individual

device temperature control for devices up to 70W or more and with

up to 320 I/O channels.

The

MAX system family, the predecessor to the ABTS family, was designed

for monitored burn-in of memory and logic devices. The MAX system

is nearing the end of its lifecycle and limited shipments are

expected in the future.

This

packaged part systems product category accounted for approximately

49%, 40% and 65% of the Company’s net sales in fiscal 2017,

2016 and 2015, respectively.

TEST FIXTURES

The

Company sells, and licenses others to manufacture and sell,

custom-designed test fixtures for its systems. The test fixtures

include BIBs for the ABTS parallel test and burn-in system and for

the MAX monitored burn-in system. These test fixtures hold the

devices undergoing test or burn-in and electrically connect the

devices under test to the system electronics. The capacity of each

test fixture depends on the type of device being tested or

burned-in, ranging from several hundred in memory production to as

few as eight for high pin-count complex Application Specific

Integrated Circuits, or ASICs, or microprocessor devices. Test

fixtures are sold both with new Aehr Test systems and for use with

the Company’s installed base of systems. Test fixtures are

also available from third-party suppliers.

The

Company’s single and multi-die DiePak product line includes a

family of reusable, temporary die carriers and associated sockets

that enable the test and burn-in of bare die and modules. The

singulated die DiePak carriers offer cost-effective solutions for

providing KGD for most types of ICs, including memory,

microcontroller and microprocessor devices. The DiePak carrier

consists of an interconnect substrate, which provides an electrical

connection between the die pads and the socket contacts, and a

mechanical support system. The substrate is customized for each IC

product. The single and multi-die DiePak carriers come in several

different versions, designed to handle ICs ranging from low pin

count sensors, to high pin count microprocessors.

The

Company has received patents or applied for patents on certain

features of the FOX, ABTS and MAX4 test fixtures. The Company has

licensed or authorized several other companies to provide MAX4 BIBs

from which the Company receives royalties. Royalties and revenue

for the test fixtures product category accounted for less than 5%

of net sales in fiscal 2017, 2016 and 2015.

CUSTOMERS

The

Company markets and sells its products throughout the world to

semiconductor manufacturers, semiconductor contract assemblers,

electronics manufacturers and burn-in and test service

companies.

Sales

to the Company’s five largest customers accounted for

approximately 93%, 94%, and 79% of its net sales in fiscal 2017,

2016 and 2015, respectively. During fiscal 2017, Texas Instruments

Incorporated, or Texas Instruments, STMicroelectronics, Inc.,

Intel, and Cypress Semiconductor, accounted for approximately 45%,

19%, 17% and 10%, respectively, of the Company’s net sales.

During fiscal 2016, Apple and Texas Instruments accounted for

approximately 47% and 32%, respectively, of the Company’s net

sales. During fiscal 2015, Texas Instruments, and Micronas GMBH, or

Micronas, accounted for approximately 45% and 11%, respectively, of

the Company’s net sales. No other customers accounted for

more than 10% of the Company’s net sales for any of these

periods. The Company expects that sales of its products to a

limited number of customers will continue to account for a high

percentage of net sales for the foreseeable future. In addition,

sales to particular customers may fluctuate significantly from

quarter to quarter. Such fluctuations may result in changes in

utilization of the Company’s facilities and resources. The

loss of or reduction or

delay

in orders from a significant customer or a delay in collecting or

failure to collect accounts receivable from a significant customer

could materially and adversely affect the Company’s business,

financial condition and operating results.

MARKETING,

SALES AND CUSTOMER SUPPORT

The

Company has sales and service operations in the United States,

Japan, Germany and Taiwan, dedicated service resources in China,

South Korea, and the Philippines, and has established a network of

distributors and sales representatives in certain key parts of the

world. See “REVENUE RECOGNITION” in Item 7 under

“Management’s Discussion and Analysis of Financial

Condition and Results of Operations” for a further discussion

of the Company’s relationship with distributors, and its

effects on revenue recognition.

The

Company’s customer service and support program includes

system installation, system repair, applications engineering

support, spare parts inventories, customer training and

documentation. The Company has applications engineering and field

service personnel located near and sometimes co-located at our

customers and includes resources at the corporate headquarters in

Fremont, California, at customer locations in Texas, at the

Company’s subsidiaries in Japan and Germany, at its branch

office in Taiwan, and also through 3rd party agreements in

China, South Korea, and the Philippines. The Company’s

distributors provide applications and field service support in

other parts of the world. The Company customarily provides a

warranty on its products. The Company offers service contracts on

its systems directly and through its subsidiaries, distributors and

representatives. The Company maintains customer support personnel

in the Philippines, China and South Korea. The Company believes

that maintaining a close relationship with customers and providing

them with ongoing engineering support improves customer

satisfaction and will provide the Company with a competitive

advantage in selling its products to the Company’s

customers.

BACKLOG

At

May 31, 2017, the Company’s backlog was $12.7 million

compared with $5.3 million at May 31, 2016. The Company’s

backlog consists of product orders for which confirmed purchase

orders have been received and which are scheduled for shipment

within 12 months. Due to the possibility of customer changes in

delivery schedules or cancellations and potential delays in product

shipments or development projects, the Company’s backlog as

of a particular date may not be indicative of net sales for any

succeeding period.

RESEARCH

AND PRODUCT DEVELOPMENT

The

Company historically has devoted a significant portion of its

financial resources to research and development programs and

expects to continue to allocate significant resources to these

efforts. Certain research and development expenditures related to

non-recurring engineering milestones have been transferred to cost

of goods sold, reducing research and development expenses. The

Company’s research and development expenses during fiscal

2017, 2016 and 2015 were $4.7 million, $4.3 million and $4.1

million, respectively.

The

Company conducts ongoing research and development to design new

products and to support and enhance existing product lines.

Building upon the expertise gained in the development of its

existing products, the Company has developed the FOX family of

systems for performing test and burn-in of entire processed wafers,

rather than individual die or packaged parts. The Company is

developing enhancements to the ABTS and FOX families of products,

intended to improve the capability and performance for testing and

burn-in of future generation ICs and provide the flexibility in a

wide variety of applications.

MANUFACTURING

The

Company assembles its products from components and parts

manufactured by others, including environmental chambers, power

supplies, metal fabrications, printed circuit assemblies, ICs,

burn-in sockets, high-density interconnects, wafer contactors and

interconnect substrates. Final assembly and testing are performed

within the Company’s facilities. The Company’s strategy

is to use in-house manufacturing only when necessary to protect a

proprietary process or when a significant improvement in quality,

cost or lead time can be achieved and relies on subcontractors to

manufacture many of the components and subassemblies used in its

products. The Company’s principal manufacturing facility is

located in Fremont, California. The Company’s facility in

Utting, Germany provides limited manufacturing and product

customization.

COMPETITION

The

semiconductor equipment industry is intensely competitive.

Significant competitive factors in the semiconductor equipment

market include price, technical capabilities, quality, flexibility,

automation, cost of ownership, reliability, throughput, product

availability and customer service. In each of the markets it

serves, the Company faces competition

from

established competitors and potential new entrants, many of which

have greater financial, engineering, manufacturing and marketing

resources than the Company.

The

Company’s FOX full wafer contact systems face competition

from larger systems manufacturers that have significant

technological know-how and manufacturing capability. Competing

suppliers of full wafer contact systems include Advantest

Corporation, Teradyne Inc., Micronics Japan Co., Ltd., and Tokyo

Electron Limited.

The

Company’s ABTS TDBI systems have faced and are expected to

continue to face increasingly severe competition, especially from

several regional, low-cost manufacturers and from systems

manufacturers that offer higher power dissipation per device under

test. Some users of such systems, such as independent test labs,

build their own burn-in systems, while others, particularly large

IC manufacturers in Asia, acquire burn-in systems from captive or

affiliated suppliers. The market for burn-in systems is highly

fragmented, with many domestic and international suppliers.

Competing suppliers of burn-in and functional test systems that

compete with ABTS systems include Dong-Il Corporation, Micro

Control Company, Incal Technology and Advantest

Corporation.

The

Company’s WaferPak products are facing and are expected to

face increasing competition. Several companies have developed or

are developing full-wafer and single-touchdown probe cards. As the

full-wafer test market develops, the Company expects that other

competitors will emerge. The primary competitive factors in this

market are cost, performance, reliability and assured supply.

Competing suppliers of full-wafer probe cards include FormFactor,

Inc., Japan Electronic Materials Corporation and Micronics Japan

Co., Ltd.

The

Company’s test fixture products face numerous regional

competitors. There are limited barriers to entry into the BIB

market, and as a result, many companies design and manufacture

BIBs, including BIBs for use with the Company’s ABTS and MAX

systems. The Company has granted royalty-bearing licenses to

several companies to make BIBs for use with the Company’s

MAX4 systems and the Company may grant additional licenses as well.

Sales of MAX4 BIBs by licensees result in royalties to the

Company.

The

Company expects that its DiePak products for singulated die will

face significant competition. The Company believes that several

companies have developed or are developing products which are

intended to enable test and burn-in of bare die. If the bare die

market develops, the Company expects that other competitors will

emerge. The DiePak products also face severe competition from other

alternative test solutions. The Company expects that the primary

competitive factors in this market will be cost, performance,

reliability and assured supply. Suppliers with products that

compete with our single die DiePak products include Yamaichi

Electronics Co., Ltd.

The

Company expects its competitors to continue to improve the

performance of their current products and to introduce new products

with improved price and performance characteristics. New product

introductions by the Company’s competitors or by new market

entrants could cause a decline in sales or loss of market

acceptance of the Company’s products. The Company has

observed price competition in the systems market, particularly with

respect to its less advanced products. Increased competitive

pressure could also lead to intensified price-based competition,

resulting in lower prices which could adversely affect the

Company’s operating margins and results. The Company believes

that to remain competitive it must invest significant financial

resources in new product development and expand its customer

service and support worldwide. There can be no assurance that the

Company will be able to compete successfully in the

future.

PROPRIETARY

RIGHTS

The

Company relies primarily on the technical and creative ability of

its personnel, its proprietary software, and trade secrets and

copyright protection, rather than on patents, to maintain its

competitive position. The Company’s proprietary software is

copyrighted and licensed to the Company’s customers. At May

31, 2017, the Company held forty-seven issued United States patents

with expiration date ranges from 2017 to 2029 and had several

additional United States patent applications and foreign patent

applications pending.

The

Company’s ability to compete successfully is dependent in

part upon its ability to protect its proprietary technology and

information. Although the Company attempts to protect its

proprietary technology through patents, copyrights, trade secrets

and other measures, there can be no assurance that these measures

will be adequate or that competitors will not be able to develop

similar technology independently. Further, there can be no

assurance that claims allowed on any patent issued to the Company

will be sufficiently broad to protect the Company’s

technology, that any patent will be issued to the Company from any

pending application or that foreign intellectual property laws will

protect the Company’s intellectual property. Litigation may

be necessary to enforce or determine the validity and scope of the

Company’s proprietary rights, and there can be no assurance

that the Company’s intellectual property rights, if

challenged, will be upheld as valid. Any such litigation could

result in substantial costs and diversion of resources and could

have a material adverse effect on the Company’s business,

financial condition and operating results, regardless of the

outcome of the litigation. In addition, there can be no assurance

that any of the patents issued to the Company will

not be

challenged, invalidated or circumvented or that the rights granted

thereunder will provide competitive advantages to the Company.

Also, there can be no assurance that the Company will have the

financial resources to defend its patents from infringement or

claims of invalidity.

There

are currently no pending claims against the Company regarding

infringement of any patents or other intellectual property rights

of others. However, the Company may, from time to time, receive

communications from third parties asserting intellectual property

claims against the Company. Such claims could include assertions

that the Company’s products infringe, or may infringe, the

proprietary rights of third parties, requests for indemnification

against such infringement or suggest the Company may be interested

in acquiring a license from such third parties. There can be no

assurance that any such claim made in the future will not result in

litigation, which could involve significant expense to the Company,

and, if the Company is required or deems it appropriate to obtain a

license relating to one or more products or technologies, there can

be no assurance that the Company would be able to do so on

commercially reasonable terms, or at all.

EMPLOYEES

As

of May 31, 2017, the Company, including its two foreign

subsidiaries and one branch office, employed 79 persons

collectively, on a full-time basis, of whom 20 were engaged in

research, development and related engineering, 25 were engaged in

manufacturing, 23 were engaged in marketing, sales and customer

support and 11 were engaged in general administration and finance

functions. In addition, the Company from time to time employs a

number of contractors and part-time employees, particularly to

perform customer support and manufacturing. The Company’s

success is in part dependent on its ability to attract and retain

highly skilled workers, who are in high demand. None of the

Company’s employees are represented by a union and the

Company has never experienced a work stoppage. The Company’s

management considers its relations with its employees to be

good.

BUSINESS

SEGMENT DATA AND GEOGRAPHIC AREAS

The

Company operates in a single business segment, the designing,

manufacturing and marketing of advanced test and burn-in products

to the semiconductor manufacturing industry in several geographic

areas. Selected financial information, including net sales and

property and equipment, net for each of the last three fiscal

years, by geographic area is included in Part II, Item 8, Note 14

“Segment Information” and certain risks related to such

operations are discussed in Part I, Item 1A, under the heading

“We sell our products and services worldwide, and our

business is subject to risks inherent in conducting business

activities in geographic regions outside of the United

States.”

AVAILABLE

INFORMATION

The

Company’s common stock trades on the NASDAQ Capital Market

under the symbol “AEHR.” The Company’s annual

report on Form 10-K, quarterly reports on Form 10-Q, current

reports on Form 8-K and amendments to these reports that are filed

with the United States Securities and Exchange Commission, or SEC,

pursuant to Section 13(a) or 15(d) of the Exchange Act, are

available free of charge through the Company’s website at

www.aehr.com as

soon as reasonably practicable after we electronically file them

with, or furnish them to the SEC.

The

public may read and copy any materials filed by the Company with

the SEC at the SEC’s Public Reference Room at 100 F Street,

NE, Washington, DC 20549. The public may obtain information on the

operations of the Public Reference Room by calling the SEC at

1-800-SEC-0330. The SEC maintains an Internet site, www.sec.gov,

that contains reports, proxy and information statements and other

information regarding issuers that file electronically with the

SEC.

In

addition, information regarding the Company’s code of conduct

and ethics and the charters of its Audit, Compensation and

Nominating and Governance Committees, are available free of charge

on the Company’s website listed above.

Item 1A. Risk Factors

You should carefully consider the

risks described below. These risks are not the only risks that we

may face. Additional risks and uncertainties that we are unaware

of, or that we currently deem immaterial, also may become important

factors that affect us. If any of the following risks occur, our

business, financial condition or results of operations could be

materially and adversely affected which could cause our actual

operating results to differ materially from those indicated or

suggested by forward-looking statements made in this Annual Report

on Form 10-K or presented elsewhere by management from time to

time.

We generate a large portion of our sales from a small number of

customers. If we were to lose one or more of our large customers,

operating results could suffer dramatically.

The semiconductor manufacturing

industry is highly concentrated, with a relatively small number of

large semiconductor manufacturers and contract assemblers

accounting for a substantial portion of the purchases of

semiconductor equipment. Sales to our five largest customers

accounted for approximately 93%, 94%, and 79% of our net sales in

fiscal 2017, 2016 and 2015, respectively. During fiscal 2017, Texas

Instruments, STMicroelectronics, Inc., Intel, and Cypress

Semiconductor, accounted for approximately 45%, 19%, 17% and 10%,

respectively, of the Company’s net sales. During fiscal 2016,

Apple and Texas Instruments accounted for approximately 47% and

32%, respectively, of our net sales. During fiscal 2015, Texas

Instruments and Micronas accounted for approximately 45% and 11%,

respectively, of our net sales. No other customers accounted for

more than 10% of our net sales for any of these

periods.

We

expect that sales of our products to a limited number of customers

will continue to account for a high percentage of net sales for the

foreseeable future. In addition, sales to particular customers may

fluctuate significantly from quarter to quarter. The loss of,

reduction or delay in an order, or orders from a significant

customer, or a delay in collecting or failure to collect accounts

receivable from a significant customer could adversely affect our

business, financial condition and operating results.

We rely on increasing market acceptance for our FOX system, and we

may not be successful in attracting new customers or maintaining

our existing customers.

A

principal element of our business strategy is to increase our

presence in the test equipment market through system sales in our

FOX wafer-level and singulated die/module test and burn-in product

family. The market for the FOX systems is in the early stages of

development. Market acceptance of the FOX system is subject to a

number of risks. Before a customer will incorporate the FOX system

into a production line, lengthy qualification and correlation tests

must be performed. We anticipate that potential customers may be

reluctant to change their procedures in order to transfer burn-in

and test functions to the FOX system. Initial purchases are

expected to be limited to systems used for these qualifications and

for engineering studies. Market acceptance of the FOX system also

may be affected by a reluctance of IC manufacturers to rely on

relatively small suppliers such as us. As is common with new

complex products incorporating leading-edge technologies, we may

encounter reliability, design and manufacturing issues as we begin

volume production and initial installations of FOX systems at

customer sites. The failure of the FOX system to achieve increased

market acceptance would have a material adverse effect on our

future operating results, long-term prospects and our stock

price.

The semiconductor equipment industry is intensely competitive. In

each of the markets we serve, we face competition from established

competitors and potential new entrants, many of which have greater

financial, engineering, manufacturing and marketing resources than

us.

Our

FOX wafer level and singulated die/module test and burn in systems

face competition from larger systems manufacturers that have

significant technological know-how and manufacturing capability.

Our ABTS Test During Burn-in (TDBI) systems have faced and are

expected to continue to face increasingly severe competition,

especially from several regional, low-cost manufacturers and from

systems manufacturers that offer higher power dissipation per

device under test. Some users of such systems, such as independent

test labs, build their own burn-in systems, while others,

particularly large IC manufacturers in Asia, acquire burn-in

systems from captive or affiliated suppliers. Our WaferPak products

are facing and are expected to face increasing competition. Several

companies have developed or are developing full-wafer and

single-touchdown probe cards.

We

expect our competitors to continue to improve the performance of

their current products and to introduce new products with improved

price and performance characteristics. New product introductions by

our competitors or by new market entrants could cause a decline in

sales or loss of market acceptance of our products. We have

observed price competition in the systems market, particularly with

respect to its less advanced products. Increased competitive

pressure could also lead to intensified price-based competition,

resulting in lower prices which could adversely affect our

operating margins and results. We believe that to remain

competitive we must invest significant financial resources in new

product development and expand our customer service and support

worldwide. There can be no assurance that we will be able to

compete successfully in the future.

We rely on continued market acceptance of our ABTS system and our

ability to complete certain enhancements.

Continued

market acceptance of the ABTS family is subject to a number of

risks. It is important that we achieve customer acceptance,

customer satisfaction and increased market acceptance as we add new

features and enhancements to the ABTS product. To date, we have

shipped ABTS systems to customers worldwide for use in both

reliability and

production

applications. We have had a strengthening of ABTS product sales

last fiscal year. However, the failure of the ABTS family to grow

revenues above current levels would have a material adverse effect

on our future operating results.

A substantial portion of our net sales is generated by relatively

small volume, high value transactions.

We

derive a substantial portion of our net sales from the sale of a

relatively small number of systems which typically range in

purchase price from approximately $300,000 to well over $1 million

per system. As a result, the loss or deferral of a limited number

of system sales could have a material adverse effect on our net

sales and operating results in a particular period. Most customer

purchase orders are subject to cancellation or rescheduling by the

customer with limited penalties, and, therefore, backlog at any

particular date is not necessarily indicative of actual sales for

any succeeding period. From time to time, cancellations and

rescheduling of customer orders have occurred, and delays by our

suppliers in providing components or subassemblies to us have

caused delays in our shipments of our own products. There can be no

assurance that we will not be materially adversely affected by

future cancellations or rescheduling. For non-standard products

where we have not effectively demonstrated the ability to meet

specifications in the customer environment, we defer revenue until

we have met such customer specifications. Any delay in meeting

customer specifications could have a material adverse effect on our

operating results. A substantial portion of net sales typically are

realized near the end of each quarter. A delay or reduction in

shipments near the end of a particular quarter, due, for example,

to unanticipated shipment rescheduling, cancellations or deferrals

by customers, customer credit issues, unexpected manufacturing

difficulties experienced by us or delays in deliveries by

suppliers, could cause net sales in a particular quarter to fall

significantly below our expectations.

We may experience increased costs associated with new product

introductions.

As

is common with new complex products incorporating leading-edge

technologies, we have encountered reliability, design and

manufacturing issues as we began volume production and initial

installations of certain products at customer sites. Some of these

issues in the past have been related to components and subsystems

supplied to us by third parties who have in some cases limited the

ability of us to address such issues promptly. This process in the

past required and in the future is likely to require us to incur

un-reimbursed engineering expenses and to experience larger than

anticipated warranty claims which could result in product returns.

In the early stages of product development there can be no

assurance that we will discover any reliability, design and

manufacturing issues or, that if such issues arise, that they can

be resolved to the customers’ satisfaction or that the

resolution of such problems will not cause us to incur significant

development costs or warranty expenses or to lose significant sales

opportunities.

Periodic economic and semiconductor industry downturns could

negatively affect our business, results of operations and financial

condition.

Periodic

global economic and semiconductor industry downturns have

negatively affected and could continue to negatively affect our

business, results of operations, and financial condition. Financial

turmoil in the banking system and financial markets has resulted,

and may result in the future, in a tightening of the credit

markets, disruption in the financial markets and global economy

downturn. These events may contribute to significant slowdowns in

the industry in which we operate. Difficulties in obtaining capital

and deteriorating market conditions can pose the risk that some of

our customers may not be able to obtain necessary financing on

reasonable terms, which could result in lower sales. Customers with

liquidity issues may lead to additional bad debt

expense.

Turmoil

in the international financial markets has resulted, and may result

in the future, in dramatic currency devaluations, stock market

declines, restriction of available credit and general financial

weakness. In addition, flash memory and other similar device prices

have historically declined, and will likely do so again in the

future. These developments may affect us in several ways. The

market for semiconductors and semiconductor capital equipment has

historically been cyclical, and we expect this to continue in the

future. The uncertainty of the semiconductor market may cause some

manufacturers in the future to further delay capital spending

plans. Economic conditions may also affect the ability of our

customers to meet their payment obligations, resulting in

cancellations or deferrals of existing orders and limiting

additional orders. In addition, some governments have subsidized

portions of fabrication facility construction, and financial

turmoil may reduce these governments’ willingness to continue

such subsidies. Such developments could have a material adverse

effect on our business, financial condition and results of

operations.

The

current economic conditions and uncertainty about future economic

conditions make it challenging for us to forecast our operating

results, make business decisions, and identify the risks that may

affect our business, financial condition and results of operations.

If such conditions recur, and we are not able to timely and

appropriately adapt to changes resulting from the difficult

macroeconomic environment, our business, financial condition or

results of operations may be materially and adversely

affected.

We sell our products and services worldwide, and our business is

subject to risks inherent in conducting business activities in

geographic regions outside of the United States.

Approximately

59%, 80%, and 64% of our net sales for fiscal 2017, 2016 and 2015,

respectively, were attributable to sales to customers for delivery

outside of the United States. We operate a direct sales, service

and limited manufacturing organization in Germany and sales and

service organizations in Japan and Taiwan as well as direct support

through 3rd party agreements in

China, South Korea, and the Philippines. We expect that sales of

products for delivery outside of the United States will continue to

represent a substantial portion of our future net sales. Our future

performance will depend, in significant part, upon our ability to

continue to compete in foreign markets which in turn will depend,

in part, upon a continuation of current trade relations between the

United States and foreign countries in which semiconductor

manufacturers or assemblers have operations. A change toward more

protectionist trade legislation in either the United States or such

foreign countries, such as a change in the current tariff

structures, export compliance or other trade policies, could

adversely affect our ability to sell our products in foreign

markets. In addition, we are subject to other risks associated with

doing business internationally, including longer receivable

collection periods and greater difficulty in accounts receivable

collection, the burden of complying with a variety of foreign laws,

difficulty in staffing and managing global operations, risks of

civil disturbance or other events which may limit or disrupt

markets, international exchange restrictions, changing political

conditions and monetary policies of foreign

governments.

Approximately

98%, 2% and 0% of our net sales for fiscal 2017 were denominated in

U.S. Dollars, Euros and Japanese Yen, respectively. Although the

percentages of net sales denominated in Euros and Japanese Yen were

small in fiscal 2017, they have been larger in the past and could

become significant again in the future. A large percentage of net

sales to European customers are denominated in U.S. Dollars, but

sales to many Japanese customers are denominated in Japanese Yen.

Because a substantial portion of our net sales is from sales of

products for delivery outside the United States, an increase in the

value of the U.S. Dollar relative to foreign currencies would

increase the cost of our products compared to products sold by

local companies in such markets. In addition, since the price is

determined at the time a purchase order is accepted, we are exposed

to the risks of fluctuations in the U.S. Dollar exchange rate

during the lengthy period from the date a purchase order is

received until payment is made. This exchange rate risk is

partially offset to the extent our foreign operations incur

expenses in the local currency. To date, we have not invested in

any instruments designed to hedge currency risks. Our operating

results could be adversely affected by fluctuations in the value of

the U.S. Dollar relative to other currencies.

Our industry is subject to rapid technological change and our

ability to remain competitive depends on our ability to introduce

new products in a timely manner.

The

semiconductor equipment industry is subject to rapid technological

change and new product introductions and enhancements. Our ability

to remain competitive depends in part upon our ability to develop

new products and to introduce them at competitive prices and on a

timely and cost-effective basis. Our success in developing new and

enhanced products depends upon a variety of factors, including

product selection, timely and efficient completion of product

design, timely and efficient implementation of manufacturing and

assembly processes, product performance in the field and effective

sales and marketing. Because new product development commitments

must be made well in advance of sales, new product decisions must

anticipate both future demand and the technology that will be

available to supply that demand. Furthermore, introductions of new

and complex products typically involve a period in which design,

engineering and reliability issues are identified and addressed by

our suppliers and by us. There can be no assurance that we will be

successful in selecting, developing, manufacturing and marketing

new products that satisfy market demand. Any such failure would

materially and adversely affect our business, financial condition

and results of operations.

Because

of the complexity of our products, significant delays can occur

between a product’s introduction and the commencement of the

volume production of such product. We have experienced, from time

to time, significant delays in the introduction of, and technical

and manufacturing difficulties with, certain of our products and

may experience delays and technical and manufacturing difficulties

in future introductions or volume production of our new products.

Our inability to complete new product development, or to

manufacture and ship products in time to meet customer requirements

would materially adversely affect our business, financial condition

and results of operations.

Our dependence on subcontractors and sole source suppliers may

prevent us from delivering our products on a timely basis and

expose us to intellectual property infringement.

We

rely on subcontractors to manufacture many of the components or

subassemblies used in our products. Our FOX and ABTS systems,

WaferPak contactors and DiePak carriers contain several components,

including environmental chambers, power supplies, high-density

interconnects, wafer contactors, module contactors, signal

distribution substrates, WaferPak Aligners, DiePak Loaders and

certain ICs that are currently supplied by only one or a limited

number of suppliers. Our reliance on subcontractors and single

source suppliers involves a number of significant risks, including

the loss of control over the manufacturing process, the potential

absence of adequate capacity and

reduced

control over delivery schedules, manufacturing yields, quality and

costs. In the event that any significant subcontractor or single

source supplier is unable or unwilling to continue to manufacture

subassemblies, components or parts in required volumes, we would

have to identify and qualify acceptable replacements. The process

of qualifying subcontractors and suppliers could be lengthy, and no

assurance can be given that any additional sources would be

available to us on a timely basis. Any delay, interruption or

termination of a supplier relationship could adversely affect our

ability to deliver products, which would harm our operating

results.

Our

suppliers manufacture components, tooling, and provide engineering

services. During this process, our suppliers are allowed access to

our intellectual property. While we maintain patents to protect

from intellectual property infringement, there can be no assurance

that technological information gained in the manufacture of our

products will not be used to develop a new product, improve

processes or techniques which compete against our products.

Litigation may be necessary to enforce or determine the validity

and scope of our proprietary rights, and there can be no assurance

that our intellectual property rights, if challenged, will be

upheld as valid.

Future changes in semiconductor technologies may make our products

obsolete.

Future

improvements in semiconductor design and manufacturing technology

may reduce or eliminate the need for our products. For example,

improvements in semiconductor process technology and improvements

in conventional test systems, such as reduced cost or increased

throughput, may significantly reduce or eliminate the market for

one or more of our products. If we are not able to improve our

products or develop new products or technologies quickly enough to

maintain a competitive position in our markets, our business may

decline.

If we are not able to reduce our operating expenses sufficiently

during periods of weak revenue, or if we utilize significant

amounts of cash to support operating losses, we may erode our cash

resources and may not have sufficient cash to operate our

business.

In

recent years, in the face of a downturn in our business and a

decline in our net sales, we implemented a variety of cost controls

and restructured our operations with the goal of reducing our

operating costs to position ourselves to more effectively meet the

needs of the then weak market for test and burn-in equipment. While

we took significant steps to minimize our expense levels and to

increase the likelihood that we would have sufficient cash to

support operations during the downturn, from fiscal 2009 through

fiscal 2017, with the exception of fiscal 2014, we experienced

operating losses. We anticipate that our existing cash balance

together with income from operations, collections of existing

accounts receivable, revenue from our existing backlog of products,

the sale of inventory on hand, and deposits and down payments

against significant orders will be adequate to meet our working

capital and capital equipment requirements. Depending on our rate

of growth and profitability, and our ability to obtain significant

orders with down payments, we may require additional equity or debt

financing to meet our working capital requirements or capital

equipment needs. There can be no assurance that additional

financing will be available when required, or if available, that

such financing can be obtained on terms satisfactory to

us.

Our common stock may be delisted from The NASDAQ Capital Market if

we cannot maintain compliance with NASDAQ’s continued listing

requirements.

In

order to maintain our listing on The NASDAQ Capital Market, we are

required to maintain compliance with NASDAQ’s continued

listing requirements. The continued listing requirements include,

among others, a minimum bid price of $1.00 per share and any of:

(i) a minimum stockholders’ equity of $2.5 million; (ii) a

market value of listed securities of at least $35 million; or (iii)

net income from continuing operations of $500,000 in the most

recently completed fiscal year or in two of the last three fiscal

years. There are no assurances that we will be able to sustain

long-term compliance with NASDAQ’s continued listing

requirements. On April 19, 2016, we were notified by NASDAQ that we

were no longer in compliance with NASDAQ’s continued listing

requirements as we did not have a minimum stockholders’

equity of $2.5 million. On October 3, 2016, we were notified by

NASDAQ that we had regained compliance with NASDAQ’s

continued listing requirements. If we fail to maintain compliance

with the applicable NASDAQ continued listing requirements, our

stock may be delisted.

If

we are delisted, we would expect our common stock to be traded in

the over-the-counter market, which could make trading our common

stock more difficult for investors, potentially leading to declines

in our share price and liquidity. Delisting from The NASDAQ Capital

Market would also constitute an event of default under our

convertible notes. In addition, delisting could result in negative

publicity and make it more difficult for us to raise additional

capital.

Our stock price may fluctuate.

The

price of our common stock has fluctuated in the past and may

fluctuate significantly in the future. We believe that factors such

as announcements of developments related to our business,

fluctuations in our operating results, general conditions in the

semiconductor and semiconductor equipment industries as well as the

worldwide economy,

announcement

of technological innovations, new systems or product enhancements

by us or our competitors, fluctuations in the level of cooperative

development funding, acquisitions, changes in governmental

regulations, developments in patents or other intellectual property

rights and changes in our relationships with customers and

suppliers could cause the price of our common stock to fluctuate

substantially. In addition, in recent years the stock market in

general, and the market for small capitalization and high

technology stocks in particular, have experienced extreme price

fluctuations which have often been unrelated to the operating

performance of the affected companies. Such fluctuations could

adversely affect the market price of our common stock.

We depend on our key personnel and our success depends on our

ability to attract and retain talented employees.

Our

success depends to a significant extent upon the continued service

of Gayn Erickson, our President and Chief Executive Officer, as

well as other executive officers and key employees. We do not

maintain key person life insurance for our benefit on any of our

personnel, and none of our employees are subject to a

non-competition agreement with us. The loss of the services of any

of our executive officers or a group of key employees could have a

material adverse effect on our business, financial condition and

operating results. Our future success will depend in significant

part upon our ability to attract and retain highly skilled

technical, management, sales and marketing personnel. There is a

limited number of personnel with the requisite skills to serve in

these positions, and it has become increasingly difficult for us to

hire such personnel. Competition for such personnel in the

semiconductor equipment industry is intense, and there can be no

assurance that we will be successful in attracting or retaining

such personnel. Changes in management could disrupt our operations

and adversely affect our operating results.

We may be subject to litigation relating to intellectual property

infringement which would be time-consuming, expensive and a

distraction from our business.

If

we do not adequately protect our intellectual property, competitors

may be able to use our proprietary information to erode our

competitive advantage, which could harm our business and operating

results. Litigation may be necessary to enforce or determine the

validity and scope of our proprietary rights, and there can be no

assurance that our intellectual property rights, if challenged,

will be upheld as valid. Such litigation could result in

substantial costs and diversion of resources and could have a

material adverse effect on our operating results, regardless of the

outcome of the litigation. In addition, there can be no assurance

that any of the patents issued to us will not be challenged,

invalidated or circumvented or that the rights granted thereunder

will provide competitive advantages to us.

There

are no pending claims against us regarding infringement of any

patents or other intellectual property rights of others. However,

in the future we may receive communications from third parties

asserting intellectual property claims against us. Such claims

could include assertions that our products infringe, or may

infringe, the proprietary rights of third parties, requests for

indemnification against such infringement or suggestions that we

may be interested in acquiring a license from such third parties.

There can be no assurance that any such claim will not result in

litigation, which could involve significant expense to us, and, if

we are required or deem it appropriate to obtain a license relating

to one or more products or technologies, there can be no assurance

that we would be able to do so on commercially reasonable terms, or

at all.

While we believe we have complied with all applicable environmental

laws, our failure to do so could adversely affect our business as a

result of having to pay substantial amounts in damages or

fees.

Federal, state and local regulations

impose various controls on the use, storage, discharge, handling,

emission, generation, manufacture and disposal of toxic and other

hazardous substances used in our operations. We believe that our

activities conform in all material respects to current

environmental and land use regulations applicable to our operations

and our current facilities, and that we have obtained environmental

permits necessary to conduct our business. Nevertheless, failure to

comply with current or future regulations could result in

substantial fines, suspension of production, alteration of our

manufacturing processes or cessation of operations. Such

regulations could require us to acquire expensive remediation

equipment or to incur substantial expenses to comply with

environmental regulations. Any failure to control the use, disposal

or storage of or adequately restrict the discharge of, hazardous or

toxic substances could subject us to significant

liabilities.

If we fail to maintain effective internal control over financial

reporting in the future, the accuracy and timing of our financial

reporting may be adversely affected.

We

are required to comply with Section 404 of the Sarbanes-Oxley Act

of 2002. The provisions of the act require, among other things,

that we maintain effective internal control over financial

reporting and disclosure controls and procedures. Preparing our

financial statements involves a number of complex processes, many

of which are done manually and are dependent upon individual data

input or review. These processes include, but are not limited to,

calculating revenue, deferred revenue and inventory costs. While we

continue to automate our processes and enhance

our

review and put in place controls to reduce the likelihood for

errors, we expect that for the foreseeable future, many of our

processes will remain manually intensive and thus subject to human

error.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

The

Company’s principal administrative and production facilities

are located in Fremont, California, in a 51,289 square foot

building. The Company’s lease was renewed in November 2014

and expires in June 2018. The Company has an option to extend the

lease for an additional three year period at rates to be

determined. The Company’s facility in Japan is located in a

418 square foot office in Tokyo under a lease which expires in June

2019. The Company also maintains a 1,585 square foot warehouse in

Yamanashi under a lease which expires in November 2017. The Company

leases a sales and support office in Utting, Germany. The lease,

which began February 1, 1992 and expires on January 31, 2019,

contains an automatic twelve months renewal, at rates to be

determined, if no notice is given prior to six months from expiry.

The Company’s and its subsidiaries’ annual rental

payments currently aggregate $509,000. The Company periodically

evaluates its global operations and facilities to bring its

capacity in line with demand and to provide cost efficient services

for its customers. In prior years, through this process, the

Company has moved from certain facilities that exceeded the

capacity required to satisfy its needs. The Company believes that

its existing facilities are adequate to meet its current and

reasonably foreseeable requirements. The Company regularly

evaluates its expected future facilities requirements and believes

that alternate facilities would be available if

needed.

Item 3. Legal Proceedings

None.

Item 4. Mine Safety Disclosures

Not

Applicable

PART II

Item

5. Market for Registrant’s Common Equity, Related Stockholder

Matters and Issuer Purchases of Equity

Securities

The

Company’s common stock is publicly traded on the NASDAQ

Capital Market under the symbol “AEHR”. The following

table sets forth, for the periods indicated, the high and low sale

prices for the common stock on such market. These quotations

represent prices between dealers and do not include retail markups,

markdowns or commissions and may not necessarily represent actual

transactions.

|

|

|

|

|

Fiscal

2017:

|

|

|

|

First quarter ended August 31,

2016

|

$3.42

|

$0.96

|

|

Second quarter ended November 30,

2016

|

3.58

|

2.05

|

|

Third quarter ended February 28,

2017

|

5.28

|

2.15

|

|

Fourth quarter ended May 31,

2017

|

6.10

|

3.37

|

|

|

|

|

|

Fiscal

2016:

|

|

|

|

First quarter ended August 31,

2015

|

$2.49

|

$1.95

|

|

Second quarter ended November 30,

2015

|

2.50

|

1.72

|

|

Third quarter ended February 29,

2016

|

2.02

|

1.01

|

|

Fourth quarter ended May 31,

2016

|

1.76

|

0.95

|

At

August 4, 2017, the Company had 145 holders of record of its common

stock. A substantially greater number of holders of the

Company’s common stock are “street name” or

beneficial holders whose shares are held by banks, brokers and

other financial institutions.

The

Company has not paid cash dividends on its common stock or other

securities. The Company currently anticipates that it will retain

its future earnings, if any, for use in the expansion and operation

of its business and does not anticipate paying any cash dividends

on its common stock in the foreseeable future.

The

Company did not repurchase any of its common stock during the

fiscal year ended May 31, 2017.

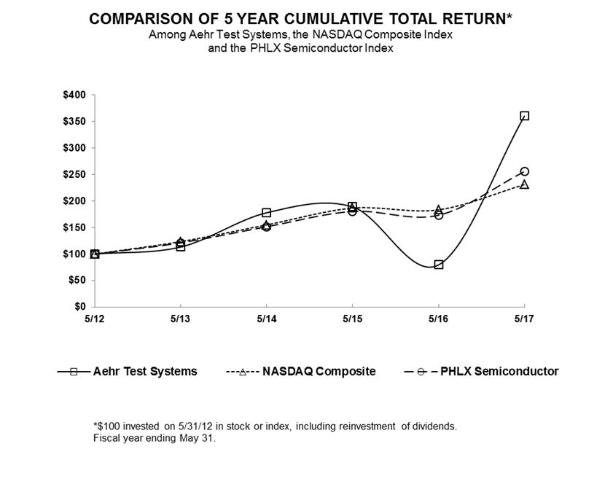

PERFORMANCE

MEASUREMENT COMPARISON

The

following graph shows a comparison of total shareholder return for

holders of the Company's common stock for the last five fiscal

years ended May 31, 2017, compared with the NASDAQ Composite Index