UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2016

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ___________

Commission File Number 000-28827

PETMED EXPRESS, INC.

(Exact name of registrant as specified in its charter)

| FLORIDA | 65-0680967 |

| (State or other jurisdiction of | (IRS Employer |

| incorporation or organization) | Identification No.) |

1441 S.W. 29th Avenue, Pompano Beach, Florida 33069

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (954) 979-5995

Securities registered under Section 12(b) of the Act:

| Title of each class | Name

of each exchange on which registered |

| COMMON STOCK, $.001 PAR VALUE | The NASDAQ Stock Market LLC (NASDAQ Global Select Market) |

Securities registered under Section 12(g) of the Act:

NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceeding12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “accelerated filer”, “large accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | x |

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the registrant’s Common Stock held by non-affiliates of the registrant as of September 30, 2015, the last business day of the registrant’s most recently completed second fiscal quarter, was $313.4 million based on the closing sales price of the registrant’s Common Stock on that date, as reported on the NASDAQ Global Select Market.

The number of shares of the registrant’s Common Stock outstanding as of May 24, 2016 was 20,446,942.

DOCUMENTS INCORPORATED BY REFERENCE

Information to be set forth in our Proxy Statement relating to our 2016 Annual Meeting of Stockholders to be held on July 29, 2016 is incorporated by reference in Items 10, 11, 12, 13, and 14 of Part III of this report.

PETMED EXPRESS, INC.

2016 Annual Report on Form 10-K

TABLE OF CONTENTS

| Page | ||

| PART I | 1 | |

| Item 1. | Business | 1 |

| Item 1A. | Risk Factors | 6 |

| Item 1B. | Unresolved Staff Comments | 10 |

| Item 2. | Properties | 10 |

| Item 3. | Legal Proceedings | 10 |

| Item 4. | Mine Safety Disclosures | 10 |

| PART II | 11 | |

| Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 11 |

| Item 6. | Selected Financial Data | 14 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 15 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 22 |

| Item 8. | Financial Statements and Supplementary Data | 23 |

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 41 |

| Item 9A. | Controls and Procedures | 41 |

| Item 9B. | Other Information | 41 |

| PART III | 42 | |

| Item 10. | Directors, Executive Officers, and Corporate Governance | 42 |

| Item 11. | Executive Compensation | 42 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 42 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 42 |

| Item 14. | Principal Accountant Fees and Services | 42 |

| PART IV | 43 | |

| Item 15. | Exhibits, Financial Statement Schedules | 43 |

| SIGNATURES | 45 | |

PART I

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Certain information in this Annual Report on Form 10-K includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. You can identify these forward-looking statements by the words "believes," "intends," "expects," "may," "will," "should," "plan," "projects," "contemplates," "intends," "budgets," "predicts," "estimates," "anticipates," or similar expressions. These statements are based on our beliefs, as well as assumptions we have used based upon information currently available to us. Because these statements reflect our current views concerning future events, these statements involve risks, uncertainties and assumptions. Actual future results may differ significantly from the results discussed in the forward-looking statements. A reader, whether investing in our common stock or not, should not place undue reliance on these forward-looking statements, which apply only as of the date of this Annual Report.

When used in this Annual Report on Form 10-K, "PetMed Express," "1-800-PetMeds," “PetMeds,” "PetMed," “PetMeds.com,” "PetMed Express.com," "the Company," "we," "our," and "us" refer to PetMed Express, Inc. and our wholly-owned subsidiaries.

ITEM 1. BUSINESS

General

PetMed Express, Inc. and subsidiaries, d/b/a 1-800-PetMeds, is a leading nationwide pet pharmacy. The Company markets prescription and non-prescription pet medications, and other health products for dogs and cats, direct to the consumer. The Company offers consumers an attractive alternative for obtaining pet medications in terms of convenience, price, and speed of delivery.

The Company markets its products through national television, online, and direct mail/print advertising campaigns, which aim to increase the recognition of the “1-800-PetMeds” brand name, and “PetMeds” family of trademarks, increase traffic on its website at www.1800petmeds.com, acquire new customers, and maximize repeat purchases. Our fiscal year end is March 31, our executive offices are currently located at 1441 S.W. 29th Avenue, Pompano Beach, Florida 33069, and our telephone number is (954) 979-5995. In the third quarter of fiscal 2017 our executive offices will be located at 420 South Congress Avenue, Delray Beach, Florida 33445.

Our Products

We offer a broad selection of products for dogs and cats. Our current product line contains approximately 3,000 SKUs of the most popular pet medications, health products, and supplies. These products include a majority of the well-known brands of medication, such as Frontline Plus®, K9 Advantix® II, Advantage® II, Heartgard Plus®, Sentinel®, Revolution®, and Rimadyl®. Generally, our prices are competitive with the prices for medications charged by veterinarians and retailers. In March 2010, we started offering for sale additional pet supplies on our website, which are drop shipped to our customers by third parties. These pet supplies include: food, beds, crates, stairs, strollers, and other popular pet supplies.

We research new products, and regularly select new products or the latest generation of existing products to become part of our product selection. In addition, we also refine our current products to respond to changing consumer-purchasing habits. Our website is designed to give us the flexibility to change featured products or promotions. Our product line provides customers with a wide variety of selections across the most popular health categories for dogs and cats. Our current products include:

Non-Prescription Medications (OTC) and supplies: Flea and tick control products, bone and joint care products, vitamins, treats, nutritional supplements, hygiene products, and supplies.

Prescription Medications (Rx): Heartworm and flea and tick preventatives, arthritis, thyroid, diabetes, pain medications, antibiotics, and other specialty medications, as well as generic substitutes.

| 1 |

Sales

We offer our products through three main sales channels: Internet through our website, telephone contact center through our toll-free number, and direct mail/print through 1-800-PetMeds catalogs, brochures, and postcards. We have designed our website and catalogs to provide a convenient, cost-effective, and informative shopping experience that encourages consumers to purchase products important for a pet’s health and quality of life. We believe that these multiple channels allow us to increase the visibility of our brand name and provide our customers with increased shopping flexibility and excellent service.

Internet

We seek to combine our product selection and pet health information with the shopping ease of the Internet to deliver a convenient and personalized shopping experience. Our website offers health and nutritional product selections for dogs and cats, and relevant editorial and easily obtainable or retrievable resource information. From our home page, customers can search our website for products and access resources on a variety of information on dogs and cats. Customers can shop at our website by category, product line, individual product, or symptom. We attracted approximately 33 million visitors to our website during fiscal 2016, approximately 8% of those visitors placed an order, and our website generated approximately 81% of our total sales for the same time period. On our website pet owners have access to health information covering pets’ behavior and illnesses, and natural and pharmaceutical remedies specifically for a pet’s problem. The pet education content on our main website is periodically updated with the latest research for pet owners.

Telephone Contact Center

Our customer care representatives receive and process inbound and outbound customer calls, facilitate our live web chat, and process customer e-mails. Our telephone system is equipped with certain features including pop-up screens and call blending capabilities that give us the ability to efficiently utilize our customer care representatives’ time, providing excellent customer care, service, and support. Our customer care representatives receive a base salary and are rewarded with commissions for sales, and bonuses and other awards for achieving certain quality goals.

Direct Mail/Print

The 1-800-PetMeds catalog is a full-color catalog that features our most popular products. The catalog is produced by a combination of in-house writers, production artists, and independent contractors. We mail catalogs, brochures, and postcards in response to requests generated from our advertising and as part of direct mail campaigns to our customers.

Our Customers

Approximately 2.3 million customers have purchased from us within the last two years. We attracted approximately 489,000 and 529,000 new customers in fiscal 2016 and 2015, respectively. Our customers are located throughout the United States, with approximately 50% of customers residing in California, Florida, Texas, New York, Pennsylvania, North Carolina, Virginia, and Georgia. Our primary focus has been on retail customers and the average purchase was approximately $81 for fiscal 2016 compared to $77 for fiscal 2015.

Marketing

The goal of our marketing strategy is to build brand recognition, increase customer traffic, add new customers, build strong customer loyalty, maximize reorders, and develop incremental revenue opportunities. We have an integrated marketing campaign that includes television advertising, online marketing, direct mail/print and e-mail.

Television Advertising

Our television advertising is designed to build brand equity, create brand awareness, and generate initial purchases of products via the telephone and the Internet. We have used :30 and :15 second television commercials to attract new customer orders. Our television commercials typically focus on our ability to rapidly deliver to customers the same medications offered by veterinarians, but at reduced prices. We generally purchase advertising to target our key demographic group – women, ages 30 to 65. We believe that television advertising is particularly effective and instrumental in building brand awareness.

| 2 |

Online Marketing

We supplement our traditional advertising with online advertising and marketing efforts. We make our brand available to Internet consumers by purchasing targeted keywords and achieving prominent placement on the top search engines and search engine networks, including Google, Bing™, and Yahoo®. We utilize Internet display and video advertisements, social media, and comparison shopping, and we are also members of the LinkShare Network, which is an affiliate program with merchant clients and affiliate websites.

Direct Mail/Print and E-mail

We use direct mail/print and e-mail to acquire new customers and to remind our existing customers to reorder.

Operations

Order Processing

Our website allows customers to easily browse and purchase all of our products online. Our website is designed to be fast, secure, and easy to use with order and shipping confirmations, and with online order tracking capabilities. We provide our customers with toll-free telephone access to our customer care representatives. Our call center generally operates from 8:00 AM to 11:00 PM, Monday through Thursday, 8:00 AM to 9:00 PM on Friday, 9:00 AM to 6:00 PM on Saturday, and 10:00 AM to 5:00 PM on Sunday, Eastern Time. The process of customers purchasing products from 1-800-PetMeds consists of a few simple steps. A customer first places an order online or a call to our toll-free telephone number. The following information is needed to process prescription orders: pet information, prescription information, and the veterinarian’s name and phone number. This information is entered into our computer system. Then our pharmacists and pharmacy technicians verify all prescriptions. The order process system checks for the verification for prescription medication orders and a valid payment method for all orders. An invoice is generated and printed in our fulfillment center, where items are picked, and then shipped via United States Postal Service, Federal Express, or UPS. Our customers enjoy the convenience of rapid home delivery, with the majority of all orders being shipped within 24 hours of ordering.

Customer Care and Support

We believe that a high level of customer care and support is critical in retaining and expanding our customer base. Customer care representatives participate in ongoing training programs under the supervision of our training managers. These training sessions include a variety of topics such as product knowledge, computer usage, customer service tips, and the relationship between our Company and veterinarians. Our customer care representatives respond to customers’ e-mails, calls, and live chats that are related to products, order status, prices, and shipping. We believe our customer care representatives are a valuable source of feedback regarding customer satisfaction.

Warehousing and Shipping

We inventory our products and fill most customer orders from our corporate headquarters in Pompano Beach, Florida. We have an in-house fulfillment and distribution operation, which is used to manage the entire supply chain, beginning with the placement of the order, continuing through order processing, and then fulfilling and shipping of the product to the customer. We offer a variety of shipping options, including next day delivery. We ship to anywhere in the United States served by the United States Postal Service or Federal Express. Priority orders are expedited in our fulfillment process. Our goal is to ship the products the same day that the order is received. For prescription medications, our goal is to ship the product immediately after the prescription has been authorized by the customer’s veterinarian.

Purchasing

We purchase our products from a variety of sources, including certain manufacturers, domestic distributors, and wholesalers. There were four suppliers from whom we purchased approximately 50% of all products in fiscal 2016. We purchase the majority of the health and nutritional supplements directly from manufacturers. We believe having strong relationships with product manufacturers will ensure the availability of an adequate volume of products ordered by our customers, and will enable us to provide more and better product information.

| 3 |

Historically, many of the major manufacturers of prescription and non-prescription medications have declined to sell these products to direct marketing companies, such as our Company. (See Risk Factors.) Part of our growth strategy includes developing direct relationships with the leading pharmaceutical manufacturers of the more popular prescription and non-prescription medications.

Technology

We utilize integrated technologies in our call centers, e-commerce, order entry, and inventory control/fulfillment operations. Our systems are custom configured by the Company to optimize our computer telephone integration and mail-order processing. The systems are designed to maintain a large database of specialized information and process a large volume of orders efficiently and effectively. Our systems provide our customer care representatives, and our customers on our website, with real time product availability information and updated customer information to enhance our customer care. We also have an integrated direct connection for processing credit cards to ensure that a valid credit card number and authorization have been received at the same time our customer care representatives are on the phone with the customer or when a customer submits an order on our website. Our information systems provide our customer care representatives with records of all prior contact with a customer, including the customer’s address, phone number, e-mail address, prescription information, order history, payment history, and notes.

Competition

The pet medications market is competitive and highly fragmented. Our competitors consist of veterinarians, and online and traditional retailers. We believe that the following are the principal competitive factors in our market:

| · | Product selection and availability, including the availability of prescription and non-prescription medications; |

| · | Brand recognition; |

| · | Reliability and speed of delivery; |

| · | Personalized service and convenience; |

| · | Price; and |

| · | Quality of website content. |

We compete with veterinarians for the sale of prescription and non-prescription pet medications and other health products. Many pet owners may prefer the convenience of purchasing their pet medications or other health products at the time of a veterinarian visit. In order to effectively compete with veterinarians, we must continue to educate pet owners about the service, convenience, and savings offered by our Company.

According to the American Pet Products Manufacturers Association, pet spending in the United States increased 3.9% to $60.3 billion in 2015. Pet supplies and medications represented $14.3 billion, or 24% of the total spending on pets in the United States. The pet medication market that we participate in is estimated to be approximately $4.2 billion, with veterinarians having the majority of the market share. The dog and cat population is approximately 164 million, with approximately 65% of all households having a pet.

We believe that the following are the main competitive strengths that differentiate 1-800-PetMeds from the competition:

| · | Channel leader, in an estimated $4.2 billion industry; |

| · | “1-800-PetMeds” brand name; |

| · | Licensed pharmacy to conduct business in 50 states, and awarded Vet-VIPPSCM (Veterinary-Verified Internet Pharmacy Practice Site) accreditation by the National Association of Boards of Pharmacy®; |

| · | Exceptional customer care and support |

Intellectual Property

We conduct our business under the trade name “1-800-PetMeds” and use a family of trade names all containing the term “PetMeds” or “PetMed” in some form. We believe the “1-800-PetMeds” trade name, which is also our toll-free telephone number, and the “PetMeds” family of trademarks, has added significant value and is an important factor in the marketing of our products. We have also obtained the right to use and control the Internet addresses www.1800petmeds.com, www.1888petmeds.com, www.petmedexpress.com, www.petmed.com, and www.petmeds.com.

| 4 |

We also obtained the right to use and control the Internet addresses www.petmeds.pharmacy and www.1800petmeds.pharmacy, through a National Association of Boards of Pharmacy® initiative to ensure high standards for online pharmacies. We do not expect to lose the ability to use the Internet addresses; however, there can be no assurance in this regard and the loss of these addresses may have a material adverse effect on our financial position and results of operations. We are the exclusive owners of United States Trademark Registrations for “PetMed Express and Design®,” “1888PetMeds and Design®,” “1-800-PetMeds and Design®,” “1-800-PetMeds®,” and “PetMeds®,” among numerous others.

Government Regulation

Dispensing prescription medications is governed at the state level by Boards of Pharmacy, or similar regulatory agencies, of each state where prescription medications are dispensed. We are subject to regulation by the State of Florida and are licensed as a community pharmacy by the Florida Board of Pharmacy. Our current license is valid until February 28, 2017, and prior to that date a renewal application will be submitted to the Board of Pharmacy. During fiscal 2015 we obtained a federal registration, and state registrations/permits as required, to dispense Schedule IV controlled substances, Our pharmacy practice is also licensed and/or regulated by 49 other state pharmacy boards, the District of Columbia Board of Pharmacy, and the United States Drug Enforcement Administration, and with respect to our products, by other regulatory authorities including, but not necessarily limited to, the United States Food and Drug Administration (“FDA”) and the United States Environmental Protection Agency. As a licensed pharmacy in the State of Florida, we are subject to the Florida Pharmacy Act and regulations promulgated thereunder. To the extent that we are unable to maintain our license as a community pharmacy with the Florida Board of Pharmacy, or if we do not maintain the licenses granted by other state pharmacy boards, or if we become subject to actions by the FDA, or other enforcement regulators, our distribution of prescription medications to pet owners could cease, which could have a material adverse effect on our financial condition and results of operations.

Employees

We currently have 178 full time employees, including: 110 in customer care and marketing; 27 in fulfillment and purchasing; 30 in our pharmacy; 3 in information technology; 3 in administrative positions; and 5 in management. None of our employees are represented by a labor union, or governed by any collective bargaining agreements. We consider relations with our employees to be satisfactory.

Available Information

We file annual, quarterly, and current reports, proxy statements, and other information with the Securities and Exchange Commission ("SEC"). Our SEC filings, including our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports filed or furnished pursuant to the Exchange Act are available free of charge over the Internet on our website at www.1800petmeds.com or at the SEC's web site at www.sec.gov. Our SEC filings will be available through our website as soon as reasonably practicable after we have electronically filed or furnished them to the SEC. Information contained on our website is not incorporated by reference into this Annual Report on Form 10-K.

| 5 |

ITEM 1A. RISK FACTORS

You should carefully consider the risks and uncertainties described below, and all the other information included in this Annual Report on Form 10-K before you decide to invest in our common stock. Any of the following risks could materially adversely affect our business, financial condition, or operating results and could result in a loss of your investment.

We may inadvertently fail to comply with various state or federal regulations covering the dispensing of prescription pet medications which may subject us to reprimands, sanctions, probations, fines, suspensions, or the loss of one or more of our pharmacy licenses.

The sale and delivery of prescription pet medications is generally governed by state laws and state regulations, and with respect to controlled substances, by federal law. Since our pharmacy is located in the State of Florida, the Company is governed by the laws and regulations of the State of Florida. Each prescription pet medication sale we make is likely also to be covered by the laws of the state where the customer is located. The laws and regulations relating to the sale and delivery of prescription pet medications vary from state to state, but generally require that prescription pet medications be dispensed with the authorization from a prescribing veterinarian. To the extent that we are unable to maintain our license as a community pharmacy with the Florida Board of Pharmacy, or if we do not maintain the licenses granted by other state boards, or if we become subject to actions by the FDA, or other enforcement regulators, our dispensing of prescription medications to pet owners could cease, which could have a material adverse effect on our operations. The Company is a party to routine litigation and administrative complaints incidental to its business. Management does not believe that the resolution of any or all of such routine litigation and administrative complaints is likely to have a material adverse effect on the Company’s financial condition or results of operations. While we make every effort to fully comply with all applicable state rules, laws, and regulations, from time to time we have been the subject of administrative complaints regarding the authorization of prescriptions prior to shipment. We cannot assure you that we will not continue to be the subject of administrative complaints in the future. We cannot guarantee you that we will not be subject to reprimands, sanctions, probations, or fines, or that one or more of our pharmacy licenses will not be suspended or revoked. If we were unable to maintain our license as a community pharmacy in the State of Florida, or if we are not granted licensure in a state that begins to require licensure, or if one or more of the licenses granted by other state boards should be suspended or revoked, our ability to continue to sell prescription medications and to continue our business as it is presently conducted could be in jeopardy.

We currently purchase a portion of our prescription and non-prescription medications from third party distributors and we are not an authorized distributor of these products. We do not have any guaranteed supply of medications at any pre-established prices.

The majority of our sales were attributable to sales of prescription and non-prescription medications. Historically, many of the major pharmaceutical manufacturers have declined to sell prescription and non-prescription pet medications directly to us. In order to assure a supply of these products, we purchase medications from various secondary sources, including a variety of domestic distributors. Our business strategy includes seeking to establish direct purchasing arrangements with major pet pharmaceutical manufacturing companies. If we are not successful in achieving this goal, we will continue to rely upon secondary sources. We cannot guarantee that if we continue to purchase prescription and non-prescription pet medications from secondary sources that we will be able to purchase an adequate supply to meet our customers’ demands, or that we will be able to purchase these products at competitive prices. As these products represent a significant portion of our sales, our failure to fill customer orders for these products could adversely impact our sales. If we are forced to pay higher prices for these products to ensure an adequate supply, we cannot guarantee that we will be able to pass along to our customers any increases in the prices we pay for these medications. This inability to pass along increased prices could materially adversely affect our gross margins, financial condition and results of operations.

Our failure to properly manage our inventory may result in excessive inventory carrying costs, or inadequate supply of products, which could materially adversely affect our financial condition and results of operations.

Our current product line contains approximately 3,000 SKUs. A significant portion of our sales is attributable to products representing approximately 100 SKUs, including the most popular flea and tick, and heartworm preventative brands. We need to properly manage our inventory to provide an adequate supply of these products and avoid excessive inventory of the products representing the balance of the SKUs. We generally place orders for products with our suppliers based upon our internal estimates of the amounts of inventory we will need to fill future orders. These estimates may be significantly different from the actual orders we receive.

| 6 |

In the event that subsequent orders fall short of original estimates, we may be left with excess inventory. Significant excess inventory could result in price discounts and increased inventory carrying costs. Similarly, if we fail to have an adequate supply of some SKUs, we may lose sales opportunities. We cannot guarantee that we will maintain appropriate inventory levels. Any failure on our part to maintain appropriate inventory levels may have a material adverse effect on our financial condition and results of operations.

Resistance from veterinarians to authorize prescriptions, or attempts/efforts on their part to discourage pet owners to purchase from internet mail-order pharmacies could cause our sales to decrease and could materially adversely affect our financial condition and results of operations.

Since we began our operations some veterinarians have resisted providing our customers with a copy of their pet’s prescription or authorizing the prescription to our pharmacy staff, thereby effectively preventing us from filling such prescriptions under state law. We have also been informed by customers and consumers that veterinarians have tried to discourage pet owners from purchasing from internet mail-order pharmacies. Although veterinarians in some states are required by law to provide a pet owner with a prescription if medically appropriate, if the number of veterinarians who refuse to authorize prescriptions should increase, or if veterinarians are successful in discouraging pet owners from purchasing from internet mail-order pharmacies, our sales could decrease and our financial condition and results of operations may be materially adversely affected.

Significant portions of our sales are made to residents of eight states. If we should lose our pharmacy license in one or more of these states, our financial condition and results of operations would be materially adversely affected.

While we ship pet medications to customers in all 50 states, approximately 50% of our sales for the fiscal year ended March 31, 2016 were made to customers located in the states of California, Florida, Texas, New York, Pennsylvania, North Carolina, Virginia, and Georgia. If for any reason our license to operate a pharmacy in one or more of those states should be suspended or revoked, or if it is not granted or renewed, our ability to sell prescription medications to residents of those states would cease and our financial condition and results of operations in future periods would be materially adversely affected.

We face significant competition from veterinarians and online and traditional retailers and may not be able to compete profitably with them.

We compete directly and indirectly with veterinarians for the sale of pet medications and other health products. Veterinarians hold a competitive advantage over us because many pet owners may find it more convenient or preferable to purchase these products directly from their veterinarians at the time of an office visit. We also compete directly and indirectly with both online and traditional retailers. Both online and traditional retailers may hold a competitive advantage over us because of longer operating histories, established brand names, greater resources, and/or an established customer base. Online retailers may have a competitive advantage over us because of established affiliate relationships to drive traffic to their website. Traditional retailers may hold a competitive advantage over us because pet owners may prefer to purchase these products from a store instead of online or through catalog or telephone methods. In order to effectively compete in the future, we may be required to offer promotions and other incentives, which may result in lower operating margins and adversely affect the results of operations. We also face a significant challenge from our competitors forming alliances with each other, such as those between online and traditional retailers. These relationships may enable both their retail and online stores to negotiate better pricing and better terms from suppliers by aggregating the demand for products and negotiating volume discounts, which could be a competitive disadvantage to us.

The content of our website could expose us to various kinds of liability, which, if prosecuted successfully, could negatively impact our business.

Because we post product and pet health information and other content on our website, we face potential liability for negligence, copyright infringement, patent infringement, trademark infringement, defamation, and/or other claims based on the nature and content of the materials we post. Various claims have been brought, and sometimes successfully prosecuted, against Internet content distributors. We could be exposed to liability with respect to the unauthorized duplication of content or unauthorized use of other parties’ proprietary technology. Although we maintain general liability insurance, our insurance may not cover potential claims of this type, or may not be adequate to indemnify us for all liability that may be imposed. Any imposition of liability that is not covered by insurance, or is in excess of insurance coverage, could materially adversely affect our financial condition and results of operations.

| 7 |

We may not be able to protect our intellectual property rights, and/or we may be found to infringe on the proprietary rights of others.

We rely on a combination of trademarks, trade secrets, copyright laws, and contractual restrictions to protect our intellectual property rights. These afford only limited protection. Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy our non-prescription private label generic equivalents, when and if developed, as well as aspects of our sales formats, or to obtain and use information that we regard as proprietary, including the technology used to operate our website and our content, and our trademarks. Litigation or proceedings before the United States Patent and Trademark Office or other bodies may be necessary in the future to enforce our intellectual property rights, to protect our trade secrets and domain names, or to determine the validity and scope of the proprietary rights of others. Any litigation or adverse proceeding could result in substantial costs and diversion of resources, and could seriously harm our business and operating results. Third parties may also claim infringement by us with respect to past, current, or future technologies. We expect that participants in our market will be increasingly involved in infringement claims as the number of services and competitors in our industry segment grows. Any claim, whether meritorious or not, could be time-consuming, result in costly litigation, cause service upgrade delays, or require us to enter into royalty or licensing agreements. These royalty or licensing agreements might not be available on terms acceptable to us or at all.

If we are unable to protect our Internet addresses or to prevent others from using Internet addresses that are confusingly similar, our business may be adversely impacted.

Our Internet addresses, www.1800petmeds.com, www.1888petmeds.com, www.petmedexpress.com, www.petmed.com, www.petmeds.com, www.petmeds.pharmacy, and www.1800petmeds.pharmacy, are critical to our brand recognition and our overall success. If we are unable to protect these Internet addresses, our competitors could capitalize on our brand recognition. There may be similar Internet addresses used by competitors. Governmental agencies and their designees generally regulate the acquisition and maintenance of Internet addresses. The regulation of Internet addresses in the United States and in foreign countries has changed, and may undergo further change in the near future. Furthermore, the relationship between regulations governing Internet addresses and laws protecting trademarks and similar proprietary rights is unclear. Therefore, we may not be able to protect our own Internet addresses, or prevent third parties from acquiring Internet addresses that are confusingly similar to, infringe upon, or otherwise decrease the value of our Internet addresses.

Since all of our operations are housed in a single location, we are more susceptible to business interruption in the event of damage to or disruptions in our facility.

Our headquarters and distribution center are currently located in two buildings in one location in South Florida, and most of our shipments of products to our customers are made from this sole distribution center. We have no present plans to establish any additional distribution centers or offices. Because we consolidate our operations in one location, we are more susceptible to power and equipment failures, and business interruptions in the event of fires, floods, and other natural disasters than if we had additional locations. Furthermore, because we are located in South Florida, which is a hurricane-sensitive area, we are particularly susceptible to the risk of damage to, or total destruction of, our headquarters and distribution center and surrounding transportation infrastructure caused by a hurricane.

We cannot assure you that we are adequately insured to cover the amount of any losses relating to any of these potential events, business interruptions resulting from damage to or destruction of our headquarters and distribution center, or power and equipment failures relating to our call center or websites, or interruptions or disruptions to major transportation infrastructure, or other events that do not occur on our premises. The occurrence of one or more of these events could adversely impact our ability to generate revenues in future periods.

| 8 |

Our operating results are difficult to predict and may fluctuate, and a portion of our sales are seasonal.

Factors that may cause our operating results to fluctuate include:

| · | Our ability to obtain new customers at a reasonable cost, retain existing customers, or encourage reorders; |

| · | Our ability to increase the number of visitors to our website, or our ability to convert visitors to our website into customers; |

| · | The mix of medications and other pet products sold by us; |

| · | Our ability to manage inventory levels or obtain an adequate supply of products; |

| · | Our ability to adequately maintain, upgrade, and develop our website, the systems that we use to process customers’ orders and payments, or our computer network; |

| · | Increased competition within our market niche; |

| · | Price competition; |

| · | New products introduced to the market, including generics; |

| · | Increases in the cost of advertising; |

| · | The amount and timing of operating costs and capital expenditures relating to expansion of our product line or operations; |

| · | Disruption of our toll-free telephone service, technical difficulties, or systems and Internet outages or slowdowns; and |

| · | Unfavorable general economic trends. |

Because our operating results are difficult to predict, we believe that quarter-to-quarter comparisons of our operating results are not a good indication of our future performance. The majority of our product sales are affected by the seasons, due to the seasonality of mainly heartworm, and flea and tick medications. For the quarters ended June 30, 2015, September 30, 2015, December 31, 2015, and March 31, 2016, Company sales were 30%, 24%, 22%, and 24%, respectively. In addition to the seasonality of our sales, our annual and quarterly operating results have fluctuated in the past and may fluctuate significantly in the future due to a variety of factors, including weather, many of which are out of our control. Any change in one or more of these factors could materially adversely affect our financial condition and results of operations in future periods.

Our stock price fluctuates from time to time and may fall below expectations of securities analysts and investors, and could subject us to litigation, which may result in you suffering a loss on your investment.

The market price of our common stock may fluctuate significantly in response to a number of factors, many of which are out of our control. These factors include: quarterly variations in operating results; changes in accounting treatments or principles; announcements by us or our competitors of new products and services offerings; significant contracts, acquisitions, or strategic relationships; additions or departures of key personnel; any future sales of our common stock or other securities; stock market price and volume fluctuations of publicly-traded companies; and general political, economic, and market conditions.

In some future quarter our operating results may fall below the expectations of securities analysts and investors, which could result in a decrease in the trading price of our common stock. In the past, securities class action litigation has often been brought against a company following periods of volatility in the market price of its securities. We may be the target of similar litigation in the future. Securities litigation could result in substantial costs and divert management's attention and resources, which could seriously harm our business and operating results.

We may issue additional shares of preferred stock that could defer a change of control or dilute the interests of our common stockholders. Our charter documents could defer a takeover effort which could inhibit your ability to receive an acquisition premium for your shares.

Our charter permits our Board of Directors to issue up to 5.0 million shares of preferred stock without stockholder approval. Currently there are 2,500 shares of our Convertible Preferred Stock issued and outstanding. This leaves a little less than 5.0 million shares of preferred stock available for issuance at the discretion of our Board of Directors. These shares, if issued, could contain dividend, liquidation, conversion, voting, or other rights which could adversely affect the rights of our common stockholders and which could also be utilized, under some circumstances, as a method of discouraging, delaying, or preventing a change in control. Provisions of our articles of incorporation, bylaws and Florida law could make it more difficult for a third party to acquire us, even if many of our stockholders believe it is in their best interest.

| 9 |

A failure of our information systems or any security breach or unauthorized disclosure of confidential information could have a material adverse effect on our business.

Our business is dependent upon the efficient operation of our information systems. In particular, we rely on our information systems to effectively manage our business model strategy, with tools to track and manage sales, inventory, marketing, customer service efforts, the preparation of our consolidated financial and operating data, credit card information, and customer information. The failure of our information systems to perform as designed or the failure to maintain and enhance or protect the integrity of these systems could disrupt our business operations, adversely impact sales and the results of operations, expose us to customer or third-party claims, or result in adverse publicity. Additionally, we collect, process, and retain sensitive and confidential customer information in the normal course of our business. Despite the security measures we have in place and any additional measures we may implement in the future, our facilities and systems, and those of our third-party service providers, could be vulnerable to security breaches, computer viruses, lost or misplaced data, programming errors, human errors, acts of vandalism, or other events. Any security breach or event resulting in the misappropriation, loss, or other unauthorized disclosure of confidential information, whether by us directly or our third-party service providers, could damage our reputation, expose us to the risks of litigation and liability, disrupt our business, or otherwise affect our results of operations.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None

ITEM 2. PROPERTIES

Our facilities, including our principal executive offices, are located at 1441 S.W. 29th Avenue and 2900 Gateway Drive, Pompano Beach, Florida 33069. The Company leases its 65,300 square foot executive offices, warehouse facility and customer service and pharmacy contact centers under a non-cancelable operating lease, through December 1, 2016. The Company is responsible for certain maintenance costs, taxes, and insurance under this lease. The future minimum annual lease payments for the year ended March 31, 2017 is $519,000. Rent expense was $781,000, $794,000, and $785,000 for the fiscal years ended March 31, 2016, 2015 and 2014, respectively.

In January 2016 we completed the acquisition of real property located at 420 South Congress Avenue, Delray Beach, Florida, and improvements thereon (collectively referred to herein as the “Property”), the assignment and assumption of all leases and service agreements affecting the Property, and certain tangible and intangible personal property related to the Property, for a purchase price of $18.5 million, plus closing costs. The Property consists of approximately 634,000 square feet of land or 14.6 acres with two building complexes totaling approximately 185,000 square feet, with additional land for future use. The first building complex consists of approximately 125,000 square feet consisting of both office and warehouse. The second building complex consists of approximately 60,000 square feet consisting of both office and warehouse space. Once the Property is renovated to the Company’s specifications and ready for its operation, expected in the third quarter of fiscal 2017, the Company intends to occupy approximately 97,000 square feet of the first building for its principal offices and distribution center, and to continue to operate the remaining office and warehouse space pursuant to existing leases. As of March 31, 2016, 48% of the Property was leased to two tenants with a remaining weighted average lease term of 4.0 years. We believe that our facilities will be sufficient for our current needs and are in good condition in all material respects.

ITEM 3. LEGAL PROCEEDINGS

The Company has settled complaints that had been filed with various states’ pharmacy boards in the past. There can be no assurances made that other states will not attempt to take similar actions against the Company in the future. The Company initiates litigation to protect its trade or service marks. There can be no assurance that the Company will be successful in protecting its trade or service marks. Legal costs related to the above matters are expensed as incurred.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

| 10 |

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Price Range of Common Stock

Our common stock is traded on the NASDAQ Global Select Market (“NASDAQ”) under the symbol “PETS.” The prices set forth below reflect the high and low sale prices per share in each of the quarters of fiscal 2016 and 2015 as reported by the NASDAQ.

| Fiscal 2016: | High | Low | ||||||

| First Quarter | $ | 17.73 | $ | 15.82 | ||||

| Second Quarter | $ | 18.23 | $ | 15.72 | ||||

| Third Quarter | $ | 17.88 | $ | 16.04 | ||||

| Fourth Quarter | $ | 18.70 | $ | 15.77 | ||||

| Fiscal 2015: | High | Low | ||||||

| First Quarter | $ | 13.80 | $ | 12.63 | ||||

| Second Quarter | $ | 14.54 | $ | 13.24 | ||||

| Third Quarter | $ | 14.72 | $ | 12.56 | ||||

| Fourth Quarter | $ | 16.59 | $ | 14.04 | ||||

Holders

There were 93 holders of record of our common stock at May 24, 2016, and approximately 19,800 of our holders are “street name” or beneficial holders, whose shares are held by banks, brokers, or other financial institutions.

Dividends

During fiscal 2015 and 2016, our Board of Directors declared the following dividends:

| Declaration Date | Per Share Dividend | Record Date | Total Amount (In thousands) | Payment Date | ||||||||

| May 2, 2014 | $ | 0.17 | May 14, 2014 | $ | 3,432 | May 23, 2014 | ||||||

| July 21, 2014 | $ | 0.17 | August 4, 2014 | $ | 3,446 | August 15, 2014 | ||||||

| October 20, 2014 | $ | 0.17 | November 3, 2014 | $ | 3,445 | November 14, 2014 | ||||||

| January 20, 2015 | $ | 0.17 | February 3, 2015 | $ | 3,445 | February 13, 2015 | ||||||

| May 4, 2015 | $ | 0.18 | May 1, 2015 | $ | 3,647 | May 22, 2015 | ||||||

| July 20, 2015 | $ | 0.18 | August 3, 2015 | $ | 3,660 | August 14, 2015 | ||||||

| October 19, 2015 | $ | 0.18 | November 2, 2015 | $ | 3,660 | November 13, 2015 | ||||||

| January 25, 2016 | $ | 0.18 | February 8, 2016 | $ | 3,659 | February 19, 2016 | ||||||

On May 9, 2016, the Company’s Board of Directors declared an increased quarterly dividend of $0.19 per share on its common stock. The $3.9 million dividend will be paid on May 27, 2016, to shareholders of record at the close of business on May 20 2016. The Company intends to continue to pay regular quarterly dividends; however the declaration and payment of future dividends is discretionary and will be subject to a determination by the Board of Directors each quarter following its review of the Company’s financial performance.

Issuer Purchases of Equity Securities

On November 8, 2006, the Company’s Board of Directors approved a share repurchase plan of up to $20.0 million. On October 31, 2008, November 1, 2010, and August 1, 2011, the Company’s Board of Directors approved an increase under the share repurchase plan, each for an additional $20.0 million. The repurchase plan is intended to be implemented through purchases made from time to time in either the open market or through private transactions at the Company’s discretion, subject to market conditions and other factors, in accordance with Securities and Exchange Commission requirements.

| 11 |

There can be no assurances as to the precise number of shares that will be repurchased under the share repurchase plan, and the Company may discontinue the share repurchase plan at any time subject to compliance with applicable regulatory requirements. Shares purchased pursuant to the share repurchase plan will either be cancelled or held in the Company’s treasury. During fiscal 2016 and fiscal 2015 the Company did not repurchase any shares, and as of March 31, 2016, the Company had approximately $10.2 million remaining under the Company’s share repurchase plan. Since the inception of the share repurchase plan, approximately 5.6 million shares have been repurchased under the plan for approximately $69.8 million, averaging approximately $12.54 per share.

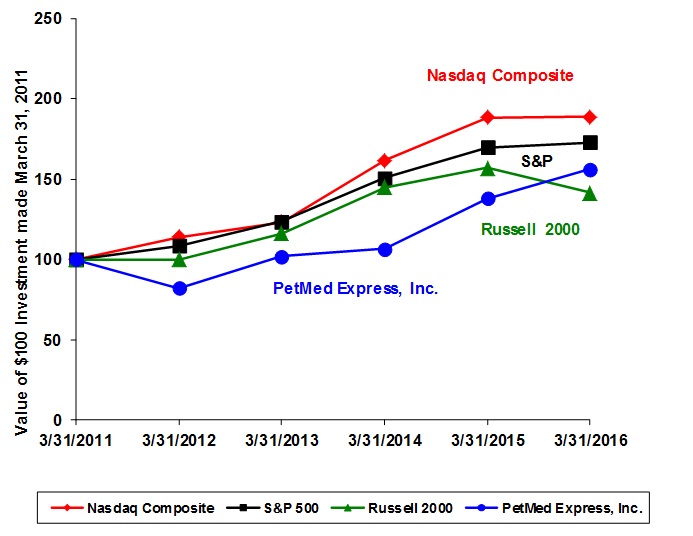

Performance Graph

Set forth below is a line graph comparing the five year cumulative performance of our Common Stock with the Standard & Poor’s Composite-500 Stock Index (the “S&P 500”), the Nasdaq Composite, and the Russell 2000, from March 31, 2011 to March 31, 2016. The graph assumes that $100 was invested on March 31, 2011 in each of our Common Stock, the S&P 500, the Nasdaq Composite, and the Russell 2000. Because we have historically paid dividends on a quarterly basis, the graph assumes that dividends were reinvested. The performance graph and related information below shall not be deemed “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or Securities Exchange Act of 1934, each as amended, except to the extent that we specifically incorporate it by reference into such filing.

Performance graph data:

| Fiscal Year Ended March 31, | ||||||||||||||||||||||||

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |||||||||||||||||||

| Nasdaq Composite | 100.00 | 114.03 | 123.04 | 161.72 | 188.56 | 188.62 | ||||||||||||||||||

| S&P 500 | 100.00 | 108.54 | 123.69 | 150.73 | 169.92 | 172.95 | ||||||||||||||||||

| Russell 2000 | 100.00 | 99.82 | 116.09 | 145.00 | 156.90 | 141.59 | ||||||||||||||||||

| PetMed Express, Inc. | 100.00 | 81.87 | 101.86 | 106.68 | 138.04 | 156.27 | ||||||||||||||||||

| 12 |

Securities Authorized for Issuance under Equity Compensation Plans

The following table sets forth securities authorized for issuance under equity compensation plans, including individual compensation arrangements, by us under our 2006 Amended and Restated Employee Equity Compensation Restricted Stock Plan, Amended and Restated 2006 Outside Director Equity Compensation Restricted Stock Plan, and 2015 Outside Director Equity Compensation Restricted Stock Plan as of March 31, 2016:

EQUITY COMPENSATION PLAN INFORMATION

(In thousands, except for per share amounts)

| Number of securities | Number of securities | |||||||||||

| to be issued upon | Weighted average | remaining available | ||||||||||

| exercise of outstanding | exercise price of | for future issuance | ||||||||||

| options, warrants | outstanding options, | under equity | ||||||||||

| Plan category | and rights | warrants and rights | compensation plans | |||||||||

| 2006 Employee Restricted Stock Plan | 928 | - | 515 | |||||||||

| 2006 Director Restricted Stock Plan | 272 | - | 305 | |||||||||

| 2015 Director Restricted Stock Plan | - | - | 400 | |||||||||

| Total | 1,200 | 1,220 | ||||||||||

| 13 |

ITEM 6. SELECTED FINANCIAL DATA

The following selected financial data should be read together with "Management's Discussion and Analysis of Financial Condition and Results of Operations," the Consolidated Financial Statements and notes thereto, and other financial information included elsewhere in this Annual Report on Form 10-K. The Consolidated Statements of Income data set forth below for the fiscal years ended March 31, 2016, 2015, and 2014 and the Consolidated Balance Sheet data as of March 31, 2016 and 2015 have been derived from our audited Consolidated Financial Statements which are included elsewhere in this Annual Report on Form 10-K. The Consolidated Statements of Income data set forth below for the fiscal years ended March 31, 2013 and 2012 and the Consolidated Balance Sheet data as of March 31, 2014, 2013 and 2012 have been derived from our audited Consolidated Financial Statements which are not included in this Annual Report on Form 10-K.

CONSOLIDATED STATEMENTS OF INCOME DATA

(In thousands, except for per share amounts)

| Fiscal Year Ended March 31, | ||||||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||

| Sales | $ | 234,684 | $ | 229,395 | $ | 233,391 | $ | 227,829 | $ | 238,250 | ||||||||||

| Cost of sales | 158,388 | 153,125 | 155,774 | 150,708 | 158,085 | |||||||||||||||

| Gross profit | 76,296 | 76,270 | 77,617 | 77,121 | 80,165 | |||||||||||||||

| Operating expenses | 43,908 | 48,657 | 49,399 | 50,116 | 54,143 | |||||||||||||||

| Net income | 20,567 | 17,453 | 17,972 | 17,165 | 16,659 | |||||||||||||||

| Net income per common share: | ||||||||||||||||||||

| Basic | 1.02 | 0.87 | 0.90 | 0.86 | 0.81 | |||||||||||||||

| Diluted | 1.02 | 0.87 | 0.90 | 0.86 | 0.80 | |||||||||||||||

| Weighted average number of common shares outstanding: | ||||||||||||||||||||

| Basic | 20,124 | 20,015 | 19,901 | 19,926 | 20,613 | |||||||||||||||

| Diluted | 20,254 | 20,136 | 20,043 | 20,049 | 20,708 | |||||||||||||||

| Cash dividends declared per common share | 0.720 | 0.680 | 0.660 | 1.600 | 0.525 | |||||||||||||||

CONSOLIDATED BALANCE SHEET DATA

(In thousands)

| March 31, | ||||||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||

| Working capital | $ | 60,543 | $ | 72,166 | $ | 66,116 | $ | 59,760 | $ | 78,216 | ||||||||||

| Total assets | 90,279 | 82,852 | 78,375 | 73,179 | 91,064 | |||||||||||||||

| Total liabilities | 7,084 | 7,417 | 8,158 | 9,165 | 9,883 | |||||||||||||||

| Shareholders' equity | 83,195 | 75,435 | 70,217 | 64,014 | 81,181 | |||||||||||||||

NON FINANCIAL DATA (UNAUDITED)

(In thousands)

| March 31, | ||||||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||

| New customers acquired | 489 | 529 | 597 | 630 | 722 | |||||||||||||||

| Total accumulated customers (1) | 9,075 | 8,586 | 8,057 | 7,460 | 6,830 | |||||||||||||||

(1) includes both active and inactive customers

| 14 |

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Executive Summary

PetMed Express was incorporated in the state of Florida in January 1996. The Company’s common stock is traded on the NASDAQ Global Select Market under the symbol “PETS.” The Company began selling pet medications and other pet health products in September 1996. In March 2010 the Company started offering for sale additional pet supplies on its website, and these items are drop shipped to customers by third party vendors. Presently, the Company’s product line includes approximately 3,000 SKUs of the most popular pet medications, health products, and supplies for dogs and cats.

The Company markets its products through national television, online, and direct mail/print advertising campaigns which aim to increase the recognition of the “1-800-PetMeds” brand name, and “PetMeds” family of trademarks, increase traffic on its website at www.1800petmeds.com, acquire new customers, and maximize repeat purchases. Approximately 81% of all sales were generated via the Internet in fiscal 2016, compared to 80% in fiscal 2015. The Company’s sales consist of products sold mainly to retail consumers. The twelve-month average purchase was approximately $81 and $77 per order for the fiscal years ended March 31, 2016 and 2015, respectively.

Critical Accounting Policies

Our discussion and analysis of our financial condition and the results of our operations are based upon our Consolidated Financial Statements and the data used to prepare them. The Company’s Consolidated Financial Statements have been prepared in accordance with accounting principles generally accepted in the United States of America. On an ongoing basis we re-evaluate our judgments and estimates including those related to product returns, bad debts, inventories, and income taxes. We base our estimates and judgments on our historical experience, knowledge of current conditions, and our beliefs of what could occur in the future considering available information. Actual results may differ from these estimates under different assumptions or conditions. Our estimates are guided by observing the following critical accounting policies.

Revenue recognition

The Company generates revenue by selling pet medication products and pet supplies primarily to retail consumers. The Company’s policy is to recognize revenue from product sales upon shipment, when the rights of ownership and risk of loss have passed to the customer. Outbound shipping and handling fees are included in sales and are billed upon shipment. Shipping expenses are included in cost of sales. The majority of the Company’s sales are paid by credit cards and the Company usually receives the cash settlement in two to three banking days. Credit card sales minimize accounts receivable balances relative to sales. The Company maintains an allowance for doubtful accounts for losses that the Company estimates will arise from customers’ inability to make required payments, arising from either credit card charge-backs or insufficient funds checks. The Company determines its estimates of the uncollectibility of accounts receivable by analyzing historical bad debts and current economic trends. The allowance for doubtful accounts was approximately $13,000 at March 31, 2016, compared to $8,000 at March 31, 2015.

Valuation of inventory

Inventories consist of prescription and non-prescription pet medications and pet supplies that are available for sale and are priced at the lower of cost or market value using a weighted average cost method. The Company writes down its inventory for estimated obsolescence. The inventory reserve was approximately $64,000 and $63,000 as of March 31, 2016 and 2015, respectively.

Advertising

The Company's advertising expense consists primarily of television advertising, Internet marketing, and direct mail/print advertising. Television advertising costs are expensed as the advertisements are televised. Internet costs are expensed in the month incurred and direct mail/print advertising costs are expensed when the related catalogs, brochures, and postcards are produced, distributed, or superseded.

| 15 |

Accounting for income taxes

The Company accounts for income taxes under the provisions of ASC Topic 740, (“Accounting for Income Taxes”), which generally requires the recognition of deferred tax assets and liabilities for the expected future tax benefits or consequences of events that have been included in the Consolidated Financial Statements or tax returns. Under this method, deferred tax assets and liabilities are determined based on differences between the financial reporting carrying values and the tax bases of assets and liabilities, and are measured by applying enacted tax rates and laws for the taxable years in which those differences are expected to reverse.

Results of Operations

The following should be read in conjunction with the Company’s Consolidated Financial Statements and the related notes thereto included elsewhere herein. The following table sets forth, as a percentage of sales, certain operating data appearing in the Company’s Consolidated Statements of Comprehensive Income:

| Fiscal Year Ended March 31, | ||||||||||||

| 2016 | 2015 | 2014 | ||||||||||

| Sales | 100.0 | % | 100.0 | % | 100.0 | % | ||||||

| Cost of sales | 67.5 | 66.8 | 66.7 | |||||||||

| Gross profit | 32.5 | 33.2 | 33.3 | |||||||||

| Operating expenses: | ||||||||||||

| General and administrative | 9.1 | 9.2 | 9.2 | |||||||||

| Advertising | 9.3 | 11.0 | 11.6 | |||||||||

| Discontinued project costs | - | 0.7 | - | |||||||||

| Depreciation | 0.3 | 0.3 | 0.4 | |||||||||

| Total operating expenses | 18.7 | 21.2 | 21.2 | |||||||||

| Income from operations | 13.8 | 12.0 | 12.1 | |||||||||

| Total other income | 0.1 | 0.1 | 0.1 | |||||||||

| Income before provision for income taxes | 13.9 | 12.1 | 12.2 | |||||||||

| Provision for income taxes | 5.1 | 4.5 | 4.5 | |||||||||

| Net income | 8.8 | % | 7.6 | % | 7.7 | % | ||||||

Fiscal 2016 Compared to Fiscal 2015

Sales

Sales increased by approximately $5.3 million, or 2.3%, to approximately $234.7 million for the fiscal year ended March 31, 2016, from approximately $229.4 million for the fiscal year ended March 31, 2015. The increase in sales for the fiscal year ended March 31, 2016 was primarily due to increased reorder sales, offset by a slight decrease in new order sales. The Company acquired approximately 489,000 new customers for the year ended March 31, 2016, compared to approximately 529,000 new customers for the same period the prior year.

| 16 |

The following chart illustrates sales by various sales classifications:

| Sales (In thousands) | 2016 | % | 2015 | % | $ Variance | % Variance | ||||||||||||||||||

| Reorder Sales | $ | 195,569 | 83.3 | % | $ | 189,685 | 82.7 | % | $ | 5,884 | 3.1 | % | ||||||||||||

| New Order Sales | $ | 39,115 | 16.7 | % | $ | 39,710 | 17.3 | % | $ | (595 | ) | -1.5 | % | |||||||||||

| Total Net Sales | $ | 234,684 | 100.0 | % | $ | 229,395 | 100.0 | % | $ | 5,289 | 2.3 | % | ||||||||||||

| Internet Sales | $ | 190,781 | 81.3 | % | $ | 184,078 | 80.2 | % | $ | 6,703 | 3.6 | % | ||||||||||||

| Contact Center Sales | $ | 43,903 | 18.7 | % | $ | 45,317 | 19.8 | % | $ | (1,414 | ) | -3.1 | % | |||||||||||

| Total Net Sales | $ | 234,684 | 100.0 | % | $ | 229,395 | 100.0 | % | $ | 5,289 | 2.3 | % | ||||||||||||

Going forward sales may be adversely affected due to increased competition and consumers giving more consideration to price. No guarantees can be made that sales will grow in the future. The majority of our product sales are affected by the seasons, due to the seasonality of mainly heartworm, and flea and tick medications. For the quarters ended June 30, September 30, December 31, and March 31 of fiscal 2016, the Company’s sales were approximately 30%, 24%, 22%, and 24%, respectively. For the quarters ended June 30, September 30, December 31, and March 31 of fiscal 2015, the Company’s sales were approximately 32%, 25%, 21%, and 22%, respectively.

Cost of sales

Cost of sales increased by $5.3 million, or 3.4% to $158.4 million for the fiscal year ended March 31, 2016, from $153.1 million for the fiscal year ended March 31, 2015. The increase in cost of sales in fiscal 2016 is directly related to the increase in sales during the fiscal year. As a percentage of sales, cost of sales was 67.5% in fiscal 2016, as compared to 66.8% in fiscal 2015. The cost of sales percentage increase can be mainly attributed to an increase in product costs on certain brands and additional discounts given to customers to increase sales during the fiscal year.

Gross profit

Gross profit was $76.3 million for both of the fiscal years ended March 31, 2016 and 2015. Gross profit as a percentage of sales for fiscal 2016 was 32.5% compared to 33.2%, for fiscal 2015. The gross profit percentage decrease in fiscal 2016 can be mainly attributed to an increase in product costs on certain brands and additional discounts given to customers to increase sales during the fiscal year.

General and administrative expenses

General and administrative expenses increased by $200,000, or 1.0%, to $21.3 million for the fiscal year ended March 31, 2016 from $21.1 million for the fiscal year ended March 31, 2015. The increase in general and administrative expenses for the fiscal year ended March 31, 2016 was primarily due to the following: a $165,000 increase in bad debt expenses relating to increased credit card chargebacks in the period; a $139,000 increase in property expenses; and a $135,000 increase in bank service fees due to increased sales. Offsetting the increase was a $62,000 decrease in payroll expenses; a $53,000 decrease due to a one-time charge relating to state/county sales tax which was not collected on behalf of our customers in fiscal 2015; a $53,000 decrease in licenses and fees; a $39,000 decrease in insurance expenses; and a $32,000 net decrease in other expenses which included telephone, travel, and office expenses. General and administrative expenses as a percentage of sales were 9.1% for the fiscal year ended March 31, 2016, compared to 9.2% for the fiscal year ended March 31, and 2015, respectively. The decrease in general and administrative expenses as a percentage of sales was primarily due to an increase to sales for fiscal 2016.

Advertising expenses

Advertising expenses decreased by approximately $3.4 million to approximately $21.8 million for the year ended March 31, 2016, from approximately $25.2 million for the year ended March 31, 2015. The decrease in advertising expenses for fiscal 2016 can be attributed to a reduction in television advertising spending. The advertising costs of acquiring a new customer, defined as total advertising costs divided by new customers acquired, was $45 for the fiscal year ended March 31, 2016, compared to $48 for the fiscal year ended March 31, 2015. The decrease in customer acquisition costs for fiscal 2016 can be attributed to increased response to our advertising.

| 17 |

Advertising cost of acquiring a new customer can be impacted by the advertising environment, the effectiveness of our advertising creative, increased advertising spending, and price competition. Historically, the advertising environment fluctuates due to supply and demand. A more favorable advertising environment may positively impact future new order sales, whereas a less favorable advertising environment may negatively impact future new order sales.

As a percentage of sales, advertising expense was 9.3% and 11.0% for the fiscal years ended March 31, 2016 and 2015, respectively. The decrease in advertising expense as a percentage of total sales for the fiscal year ended March 31, 2016 can be attributed to a reduction in television advertising spending. The Company currently anticipates advertising as a percentage of sales to be approximately 9% for fiscal 2017. However, the advertising percentage will fluctuate quarter to quarter due to seasonality and advertising availability. For the fiscal year ended March 31, 2016, quarterly advertising expenses as a percentage of sales ranged between 7% and 11%.

Discontinued project costs

During the quarter ended September 30, 2014 the Company discontinued an information technology project related to a new software platform, which was intended to be put into service and capitalized during fiscal 2015. The Company expensed a one-time project charge of $1.7 million in the September 2014 quarter. The net after tax impact of this one-time charge was $1.1 million, or $0.05 diluted per share. The Company does not expect any additional future expenditures relating to the discontinued project. There was no financial impact related to the discontinued project during the fiscal year ended March 31, 2016.

Depreciation

Depreciation increased by approximately $110,000, to approximately $770,000 for the year ended March 31, 2016, from approximately $660,000 for the year ended March 31, 2015. This increase to depreciation for the fiscal year ended March 31, 2016 can be attributed to an increase in new property and equipment additions.

Other income

Other income decreased slightly, to approximately $179,000 for the year ended March 31, 2016 from approximately $185,000 for the year ended March 31, 2015. Other income mainly consists of interest income and rental income. Other income may increase in fiscal 2017 due to increased rental revenue and interest income may decrease in the future as the Company utilizes its cash balances on its share repurchase plan, with approximately $10.2 million remaining as of March 31, 2016, on any quarterly dividend payment, or on its operating activities.

Provision for income taxes

For the fiscal years ended March 31, 2016 and 2015, the Company recorded an income tax provision for approximately $12.0 million and $10.3 million, respectively. The increase to the income tax provision for fiscal 2016 is related to an increase to operating income for the period due to a reduction in operating expenses. The increase to the income tax provision is also related to the one-time discontinued project charge of $1.7 million which was recognized in fiscal 2015, the net after tax impact of this one-time charge was $1.1 million, which reduced the income tax provision by approximately $600,000. The effective tax rate for the fiscal years ended March 31, 2016 and 2015 were 36.8% and 37.2%, respectively. The effective tax rate decrease for the fiscal year ended March 31, 2016, can be attributed to a one-time benefit related to a fiscal 2016 income tax over-accrual, which was recognized in the quarter ended December 31, 2015, compared to a one-time charge related to a fiscal 2015 income tax under-accrual, which was recognized in the quarter ended December 31, 2014. The Company estimates its effective tax rate will be approximately 37.0% for fiscal 2017.

Net income

Net income increased by approximately $3.1 million, or 17.8%, to approximately $20.6 million for the fiscal year ended March 31, 2016 from approximately $17.5 million for the fiscal year ended March 31, 2015. The increase was primarily due to a reduction in operating expenses during fiscal 2016 and the recognition of a one-time project charge of $1.7 million recognized in fiscal 2015. The net after tax impact of this one-time charge was $1.1 million.

| 18 |

Fiscal 2015 Compared to Fiscal 2014

Sales

Sales decreased by approximately $4.0 million, or 1.7%, to approximately $229.4 million for the fiscal year ended March 31, 2015, from approximately $233.4 million for the fiscal year ended March 31, 2014. The decrease in sales for the fiscal year ended March 31, 2015 was primarily due to decreased new order and reorder sales. Fiscal 2015 sales were negatively impacted primarily by the weakness in demand for flea and tick topical pet medications. The Company acquired approximately 529,000 new customers for the year ended March 31, 2015, compared to approximately 597,000 new customers for the same period the prior year.

The following chart illustrates sales by various sales classifications:

| Sales (In thousands) | 2015 | % | 2014 | % | $ Variance | % Variance | ||||||||||||||||||

| Reorder Sales | $ | 189,685 | 82.7 | % | $ | 191,205 | 81.9 | % | $ | (1,520 | ) | -0.8 | % | |||||||||||

| New Order Sales | $ | 39,710 | 17.3 | % | $ | 42,186 | 18.1 | % | $ | (2,476 | ) | -5.9 | % | |||||||||||

| Total Net Sales | $ | 229,395 | 100.0 | % | $ | 233,391 | 100.0 | % | $ | (3,996 | ) | -1.7 | % | |||||||||||

| Internet Sales | $ | 184,078 | 80.2 | % | $ | 184,356 | 79.0 | % | $ | (278 | ) | -0.2 | % | |||||||||||

| Contact Center Sales | $ | 45,317 | 19.8 | % | $ | 49,035 | 21.0 | % | $ | (3,718 | ) | -7.6 | % | |||||||||||

| Total Net Sales | $ | 229,395 | 100.0 | % | $ | 233,391 | 100.0 | % | $ | (3,996 | ) | -1.7 | % | |||||||||||

Going forward sales may continue to be adversely affected due to increased competition and consumers giving more consideration to price. The majority of our product sales were affected by the seasons, due to the seasonality of mainly heartworm, and flea and tick medications. For the quarters ended June 30, September 30, December 31, and March 31 of fiscal 2015, the Company’s sales were approximately 32%, 25%, 21%, and 22%, respectively. For the quarters ended June 30, September 30, December 31, and March 31 of fiscal 2014, the Company’s sales were approximately 32%, 26%, 21%, and 21%, respectively.

Cost of sales

Cost of sales decreased by $2.7 million, or 1.7%, to $153.1 million for the fiscal year ended March 31, 2015, from $155.8 million for the fiscal year ended March 31, 2014. The decrease in cost of sales is directly related to a reduction in sales. As a percentage of sales, cost of sales was 66.8% in fiscal 2015, as compared to 66.7% in fiscal 2014. The cost of sales percentage increase can be mainly attributed to a slight increase in product costs.

Gross profit

Gross profit decreased by $1.3 million, or 1.7%, to $76.3 million for the fiscal year ended March 31, 2015, from $77.6 million for the fiscal year ended March 31, 2014. Gross profit as a percentage of sales for fiscal 2015 was 33.2% compared to 33.3%, for fiscal 2014. The gross profit percentage decrease can be mainly attributed to a slight increase in product costs.

General and administrative expenses