Table of Contents

Exhibit a(1)(A)

Offer To Purchase For Cash

All Outstanding Shares of Common Stock

of

P.F. CHANG’S CHINA BISTRO, INC.

at

$51.50 NET PER SHARE

by

WOK ACQUISITION CORP.

an indirect wholly-owned subsidiary of

WOK PARENT LLC

THE OFFER AND WITHDRAWAL RIGHTS WILL EXPIRE AT 12:00 MIDNIGHT, NEW YORK CITY

TIME, ON JUNE 12, 2012, UNLESS THE OFFER IS EXTENDED.

Wok Acquisition Corp., a Delaware corporation (“Purchaser”) and an indirect wholly-owned subsidiary of Wok Parent LLC, a Delaware limited liability company (“Parent”), is offering to purchase all of the outstanding shares of common stock, par value $0.001 per share (the “Shares”), of P.F. Chang’s China Bistro, Inc., a Delaware corporation (“P.F. Chang’s”), at a purchase price of $51.50 per Share (the “Offer Price”), net to the seller in cash, without interest thereon and less any required withholding taxes, upon the terms and subject to the conditions set forth in this Offer to Purchase and in the related Letter of Transmittal (which, together with the Offer to Purchase, each as may be amended or supplemented from time to time, collectively constitute the “Offer”).

The Offer is being made pursuant to an Agreement and Plan of Merger, dated as of May 1, 2012 (as it may be amended from time to time, the “Merger Agreement”), by and among Parent, Purchaser and P.F. Chang’s. The Merger Agreement provides, among other things, that following the consummation of the Offer and subject to certain conditions, Purchaser will be merged with and into P.F. Chang’s (the “Merger”), with P.F. Chang’s continuing as the surviving corporation and becoming an indirect wholly-owned subsidiary of Parent. In the Merger, each Share issued and outstanding immediately prior to the effective time of the Merger (other than Shares held (i) by P.F. Chang’s, Parent, Purchaser or any subsidiary of P.F. Chang’s or Parent, including Purchaser, which Shares will be automatically cancelled and retired and will cease to exist without any consideration being paid in exchange for such Shares) or (ii) by stockholders who exercise appraisal rights under Delaware law with respect to such Shares) will be converted into the right to receive the Offer Price or any greater per Share price paid in the Offer, without interest thereon and less any required withholding taxes. Under no circumstances will interest be paid on the purchase price for the Shares, regardless of any extension of the Offer or any delay in making payment for the Shares.

The Offer is conditioned upon, among other things, (i) the satisfaction of the Minimum Condition, (ii) the Financing Proceeds Condition and (iii) the HSR Condition. The Minimum Condition requires that the number of Shares that has been validly tendered and not validly withdrawn prior to the expiration of the Offer, together with any Shares then owned, directly or indirectly, by Purchaser, Parent and its subsidiaries, collectively represent at least 83% of the Shares then outstanding. The Financing Proceeds Condition requires that Parent (either directly or through its subsidiaries) must have received the proceeds of the commitments from Wells Fargo Bank, National Association, WF Investment Holdings, LLC, Deutsche Bank Trust Company Americas, Deutsche Bank AG Cayman Islands Branch and Barclays Bank PLC as described in the amended and restated debt commitment letter, dated as of May 15, 2012 (as it may be amended from time to time, the “Debt Commitment Letter”) to provide an aggregate of $650.0 million in debt financing to Purchaser (or any alternative debt financing) and/or such financing sources will have confirmed to Parent or Purchaser that the debt financing (or any alternative debt financing) will be available in an amount sufficient to consummate the Offer and the Merger on the terms and conditions set forth in the Debt Commitment Letter (or new debt commitment letter for any alternative debt financing). The HSR Condition requires that any applicable waiting period applicable to the Offer under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, has expired or been terminated. The Offer also is subject to other conditions set forth in this Offer to Purchase. See Section 15 – “Certain Conditions of the Offer.”

The Board of Directors of P.F. Chang’s (i) approved the execution, delivery and performance of the Offer, the Merger and the Merger Agreement and the transactions contemplated by the Merger Agreement, (ii) determined that the terms of the Offer, the Merger, the Merger Agreement and the other transactions contemplated by the Merger Agreement were substantively and procedurally fair to and in the best interests of P.F. Chang’s and its stockholders, (iii) declared the Offer, the Merger and the Merger Agreement and the transactions contemplated by the Merger Agreement were advisable, (iv) recommended that the holders of Shares accept the Offer, tender their Shares to Purchaser pursuant to the Offer and, to the extent applicable, adopt the Merger Agreement and approve the Merger, (v) authorized and approved the top-up option (including the consideration to be paid upon exercise thereof) and the issuance of the top-up option shares thereunder, and (vi) authorized and approved the execution, delivery and effectiveness of the Merger Agreement and the other transactions contemplated thereby for purposes of Section 203 of the Delaware General Corporation Law.

A summary of the principal terms of the Offer appears on pages S-i through S-x. You should read this entire document carefully before deciding whether to tender your Shares in the Offer.

The Information Agent for the Offer is:

May 15, 2012

Table of Contents

IMPORTANT

If you wish to tender all or a portion of your Shares to Purchaser in the Offer, you should either (i) complete and sign the Letter of Transmittal (or a facsimile thereof) that accompanies this Offer to Purchase in accordance with the instructions in the Letter of Transmittal and mail or deliver the Letter of Transmittal and all other required documents to the Depositary (as defined in this Offer to Purchase) together with certificates representing the Shares tendered or follow the procedure for book-entry transfer set forth in Section 3 – “Procedures for Accepting the Offer and Tendering Shares” or (ii) request your broker, dealer, commercial bank, trust company or other nominee to effect the transaction for you. If your Shares are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, you must contact that institution in order to tender your Shares.

If you wish to tender Shares and cannot deliver certificates representing such Shares and all other required documents to the Depositary on or prior to the Expiration Date (as defined in this Offer to Purchase) or you cannot comply with the procedures for book-entry transfer on a timely basis, you may tender your Shares by following the guaranteed delivery procedures described in Section 3 – “Procedures for Accepting the Offer and Tendering Shares.”

Questions and requests for assistance should be directed to the Information Agent (as defined in this Offer to Purchase) at the address and telephone numbers set forth on the back cover of this Offer to Purchase. Additional copies of this Offer to Purchase, the related Letter of Transmittal, the related Notice of Guaranteed Delivery and other materials related to the Offer may also be obtained at our expense from the Information Agent. Additionally, copies of this Offer to Purchase, the related Letter of Transmittal, the related Notice of Guaranteed Delivery and any other material related to the Offer may be found at www.sec.gov. You may also contact your broker, dealer, commercial bank, trust company or other nominee for assistance.

This Offer to Purchase and the related Letter of Transmittal contain important information, and you should read both carefully and in their entirety before making a decision with respect to the Offer.

This transaction has not been approved or disapproved by the United States Securities and Exchange Commission (the “SEC”) or any state securities commission nor has the SEC or any state securities commission passed upon the fairness or merits of such transaction or upon the accuracy or adequacy of the information contained in this Offer to Purchase or the Letter of Transmittal. Any representation to the contrary is unlawful.

Table of Contents

i

Table of Contents

The information contained in this summary term sheet is a summary only and is not meant to be a substitute for the more detailed description and information contained in the Offer to Purchase, the Letter of Transmittal and the Notice of Guaranteed Delivery. You are urged to read carefully the Offer to Purchase, the Letter of Transmittal and the Notice of Guaranteed Delivery in their entirety. Parent and Purchaser have included cross-references in this summary term sheet to other sections of the Offer to Purchase where you will find more complete descriptions of the topics mentioned below. The information concerning P.F. Chang’s contained herein and elsewhere in the Offer to Purchase has been provided to Parent and Purchaser by P.F. Chang’s or has been taken from or is based upon publicly available documents or records of P.F. Chang’s on file with the SEC or other public sources at the time of the Offer. Parent and Purchaser have not independently verified the accuracy and completeness of such information. Parent and Purchaser have no knowledge that would indicate that any statements contained herein relating to P.F. Chang’s provided to Parent and Purchaser or taken from or based upon such documents and records filed with the SEC are untrue or incomplete in any material respect.

| Securities Sought | All of the issued and outstanding shares of common stock, par value $0.001 per share, of P.F. Chang’s China Bistro, Inc. See Section 1 – “Terms of the Offer.” | |

| Price Offered Per Share | $51.50 in cash, without interest thereon and less any required withholding taxes. See Section 1 – “Terms of the Offer.” | |

| Scheduled Expiration of Offer | 12:00 midnight, New York City time, at the end of June 12, 2012, unless the Offer is otherwise extended. See Section 1 – “Terms of the Offer.” | |

| Purchaser | Wok Acquisition Corp., a Delaware corporation and an indirect wholly-owned subsidiary of Wok Parent LLC, a Delaware limited liability company. See Section 1 – “Terms of the Offer.” | |

Who is offering to buy my securities?

We are Wok Acquisition Corp., a Delaware corporation, formed for the purpose of making this Offer. We are an indirect wholly-owned subsidiary of Wok Parent LLC, a Delaware limited liability company (“Parent”). Our sole shareholder, Wok Holdings Inc., a Delaware corporation, is a wholly-owned subsidiary of Parent. Parent is controlled by Centerbridge Capital Partners II, L.P. (“Centerbridge”), an affiliate of Centerbridge Partners, L.P., a private investment firm that focuses on private equity and credit investments.

Unless the context indicates otherwise, in this Offer to Purchase, we use the terms “us,” “we” and “our” to refer to Purchaser and, where appropriate, Parent. We use the term “Parent” to refer to Wok Parent LLC alone, the term “Purchaser” to refer to Wok Acquisition Corp. alone and the terms “P.F. Chang’s” or the “Company” to refer to P.F. Chang’s.

See the “Introduction” to this Offer to Purchase and Section 8 – “Certain Information Concerning Parent, Purchaser and Certain Related Persons.”

What are the classes and amounts of securities sought in the Offer?

We are offering to purchase all of the outstanding shares of common stock, par value $0.001 per share, of P.F. Chang’s on the terms and subject to the conditions set forth in this Offer to Purchase. In this Offer to Purchase we use the term “Offer” to refer to this offer and the term “Shares” to refer to shares of P.F. Chang’s common stock that are the subject of the Offer.

See the “Introduction” to this Offer to Purchase and Section 1 –“Terms of the Offer.”

S-i

Table of Contents

Why are you making the Offer?

We are making the Offer because we want to acquire control of, and ultimately the entire equity interest in, P.F. Chang’s. If the Offer is consummated, Parent intends immediately to have Purchaser consummate the Merger (as defined below) after the consummation of the Offer. Upon completion of the Merger, P.F. Chang’s would cease to be a publicly traded company and would become an indirect wholly-owned subsidiary of Parent.

How much are you offering to pay? What is the form of payment? Will I have to pay any fees or commissions?

We are offering to pay $51.50 per Share, in cash, without interest thereon and less any required withholding taxes. We refer to this amount as the “Offer Price.” If you are the record owner of your Shares and you directly tender your Shares to us in the Offer, you will not have to pay brokerage fees or similar expenses. If you own your Shares through a broker, banker or other nominee, and your broker tenders your Shares on your behalf, your broker, banker or other nominee may charge you a fee for doing so. You should consult your broker, banker or other nominee to determine whether any charges will apply.

See the “Introduction” to this Offer to Purchase.

Is there an agreement governing the Offer?

Yes. Parent, Purchaser and P.F. Chang’s have entered into an Agreement and Plan of Merger, dated as of May 1, 2012 (as it may be amended from time to time, the “Merger Agreement”). The Merger Agreement provides, among other things, for the terms and conditions of the Offer and the subsequent merger of Purchaser with and into P.F. Chang’s (the “Merger”).

See Section 11 – “The Merger Agreement; Other Agreements” and Section 15 – “Certain Conditions of the Offer.”

Do you have the financial resources to pay for all of the Shares that you are offering to purchase in the Offer?

Yes. We estimate that we will need approximately $1.1 billion to purchase all of the issued and outstanding Shares pursuant to the Offer and to consummate the Merger (which estimate includes payment in respect of outstanding in-the-money stock options, stock appreciation awards, restricted stock units, performance based restricted stock units, restricted cash units, stock appreciation rights, Shares issued or issuable pursuant to P.F. Chang’s 1998 Employee Stock Purchase Plan, as amended and restated effective November 1, 2009 (the “ESPP”) and Shares issued or issuable pursuant to outstanding dividend equivalents) and to pay related fees and expenses. Purchaser has received a commitment from Wells Fargo Bank, National Association, WF Investment Holdings, LLC, Deutsche Bank Trust Company Americas, Deutsche Bank AG Cayman Islands Branch and Barclays Bank PLC (collectively, the “Lenders”) to provide it with senior credit facilities in an aggregate amount of $350.0 million (“Senior Secured Facilities”), comprised of a $280.0 million term loan facility and a $70.0 million revolving credit facility. Additionally, Purchaser will either (i)(a) issue and sell senior unsecured notes (the “Senior Notes”) in a Rule 144A or other private placement on or prior to the closing of the Offer yielding at least $300.0 million in gross cash proceeds or (b) if and to the extent Purchaser does not, or is unable to, issue Senior Notes yielding at least $300.0 million in gross cash proceeds on or prior to the closing of the Offer, obtain up to $300.0 million, less the amount of Senior Notes, if any, issued on or prior to the closing of the Offer, in loans under a new senior unsecured bridge facility (the “Bridge Facility” and together with the Senior Secured Facilities, the “Credit Facilities”) or (ii) issue additional common equity, “qualified preferred” equity or other equity (such “qualified preferred” equity or other equity to be reasonably satisfactory to the lead arrangers) or a combination of the foregoing, in each case, in lieu thereof. Subject to certain conditions, the Credit Facilities will be available to Purchaser to finance the Offer and the Merger, repay or refinance certain existing indebtedness of P.F. Chang’s, pay related fees and expenses and, in the case of the revolving facility, to provide for funding of

S-ii

Table of Contents

P.F. Chang’s following the consummation of the Merger. Additionally, Parent has obtained an equity commitment of up to $580.0 million from Centerbridge and Centerbridge Capital Partners SBS II, L.P. Parent will contribute or otherwise advance to Purchaser the proceeds of the equity commitments, which, together with proceeds of the Credit Facilities and the proceeds from the Senior Notes, will be sufficient to pay the Offer Price for all Shares tendered in the Offer and all related fees and expenses. The equity and debt financing commitments are subject to certain conditions. In the event that we do not receive the proceeds of the debt financing commitments, we will not be obligated to purchase Shares in the Offer.

See Section 9 – “Source and Amount of Funds.”

If the Merger Agreement is terminated in the circumstance in which we do not receive the proceeds of the debt financing commitments, Purchaser may be obligated to pay P.F. Chang’s a termination fee of $67,436,400.

Is your financial condition relevant to my decision to tender my Shares in the Offer?

We do not think our or Parent’s financial condition is relevant to your decision whether to tender Shares and accept the Offer because:

| • | Parent and Purchaser were organized solely in connection with the Offer and the Merger and, prior to the Expiration Date, will not carry on any activities other than in connection with the Offer and the Merger and arranging the related financing; |

| • | the Offer is being made for all outstanding Shares solely for cash; |

| • | if Purchaser consummates the Offer, Purchaser will acquire all remaining Shares for the same cash price in the Merger; and |

| • | we have received equity and debt commitments in respect of funds sufficient to purchase all Shares tendered pursuant to the Offer. |

See Section 9 – “Source and Amount of Funds” and Section 11 – “The Merger Agreement; Other Agreements.”

How long do I have to decide whether to tender my Shares in the Offer?

You will have until the Expiration Date to tender your Shares in the Offer. The term “Expiration Date” means 12:00 midnight, New York City time, at the end of June 12, 2012, unless we, in accordance with the Merger Agreement, extend the period during which the Offer is open, in which event the term “Expiration Date” means the latest time and date at which the Offer, as so extended, expires. In addition, if pursuant to the Merger Agreement we decide to provide a subsequent offering period for the Offer as described below, you will have an additional opportunity to tender your Shares. We do not currently intend to provide a subsequent offering period, although we reserve the right to do so.

If you cannot deliver everything required to make a valid tender by the scheduled expiration of the Offer, you may still participate in the Offer by using the guaranteed delivery procedure that is described in Section 3 – “Procedures for Accepting the Offer and Tendering Shares” prior to the scheduled expiration of the Offer.

See Section 1 – “Terms of the Offer” and Section 3 – “Procedures for Accepting the Offer and Tendering Shares.”

S-iii

Table of Contents

Can the Offer be extended and under what circumstances?

Yes, the Offer can be extended and the Merger Agreement obligates us to extend the Offer for one or more periods, in increments of up to ten (10) business days (the precise length of which is in Parent’s sole discretion) if all of the conditions to the Offer are not satisfied or waived at the initial Expiration Date. The Merger Agreement also provides, however, that we are not required to extend the Offer beyond October 31, 2012 (the “Outside Date”) or, if earlier, the date that is five (5) business days following the Proxy Statement Clearance Date (as defined below). As defined in the Merger Agreement, the “Proxy Statement Clearance Date” means the later to occur of (i)(a) if the SEC has not informed P.F. Chang’s that it intends to review the preliminary proxy statement on Schedule 14A to be filed by P.F. Chang’s in connection with the adoption of the Merger Agreement (collectively, as amended or supplemented, the “Proxy Statement”) on or prior to the tenth (10th) calendar day following the filing of the preliminary Proxy Statement, the date of the day following such tenth (10th) calendar day or (b) if the SEC has informed P.F. Chang’s that it intends to review the Proxy Statement on or prior to the (10th) calendar day following the filing of the preliminary Proxy Statement, the date on which the SEC has, orally or in writing, confirmed that it has no further comments on the Proxy Statement and (ii) May 31, 2012 (such May 31, 2012 date, the “Go-Shop Period End Date”). We are also required by the terms of the Merger Agreement to extend the Offer to 12:00 midnight, New York City time, at the end of June 15, 2012, in the event that P.F. Chang’s has engaged in discussions or negotiations with a qualified bidder that has made a qualified acquisition proposal prior to the Go-Shop Period End Date.

See Section 11 – “The Merger Agreement; Other Agreements” for a discussion of the definitions relating to the “go-shop” period set forth in the Merger Agreement.

Finally, we are also required to extend the Offer beyond the initial Expiration Date for any period required by any rule, regulation, interpretation or position of the SEC or its staff or applicable law, in each case, applicable to the Offer.

If, after the payment for Shares accepted for payment pursuant to and subject to the conditions of the Offer (the “Offer Closing”), it is necessary to seek to obtain sufficient Shares so that we hold at least 90% of the Shares, we may, at our sole discretion, commence a subsequent offering period as contemplated by Rule 14d-11 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and one or more extensions thereof. A subsequent offering period is different from an extension of the Offer. During a subsequent offering period, you would not be able to withdraw any of the Shares that you had already tendered. You also would not be able to withdraw any of the Shares that you tender during the subsequent offering period.

See Section 1 – “Terms of the Offer” for more details on our obligation and ability to extend the Offer.

How will I be notified if the Offer is extended?

If we extend the Offer, we will inform Computershare Trust Company, N.A., which is the depositary for the Offer (the “Depositary”), of any extension and will issue a press release announcing the extension not later than 9:00 a.m., New York City time, on the next business day after the day on which the Offer was scheduled to expire.

See Section 1 – “Terms of the Offer.”

What are the most significant conditions to the Offer?

The Offer is conditioned upon, among other things:

| • | the number of Shares that has been validly tendered and not validly withdrawn prior to the expiration of the Offer, together with any Shares then owned, directly or indirectly, by Purchaser, Parent and its subsidiaries, collectively representing at least 83% of the Shares then outstanding (the “Minimum Condition”); |

S-iv

Table of Contents

| • | the expiration or termination of any applicable waiting period (and extensions thereof) under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Condition”); |

| • | the receipt of proceeds by Parent (either directly or through its subsidiaries) under the Debt Commitment Letter (as defined in the Merger Agreement) from Wells Fargo Bank, National Association, WF Investment Holdings, LLC, Deutsche Bank Trust Company Americas, Deutsche Bank AG Cayman Islands Branch and Barclays Bank PLC (collectively, the “Lenders”) (or the receipt of alternative debt financing), or the receipt of confirmation from the Lenders (or alternative debt financing sources) that the financing (or alternative debt financing) will be available in an amount sufficient to complete the Offer and the Merger (the “Financing Proceeds Condition”); |

| • | in the event that the issuance of Shares pursuant to the Top-Up Option (as defined below) of this Offer to Purchase is necessary to ensure that Parent and Purchaser collectively own at least 90% of the Shares outstanding (excluding from the calculation of the number of Shares Purchaser and Parent then own, but not from the calculation of then-outstanding Shares, the Shares tendered pursuant to guaranteed delivery procedures that have not yet been delivered in settlement or satisfaction of such guarantee) immediately after the completion of the Offer (the “Short-Form Threshold”), the Shares available to be issued to Purchaser upon exercise of the Top-Up Option, together with the Shares validly tendered in the Offer and not properly withdrawn, are sufficient for Purchaser to reach the Short-Form Threshold (the “Short-Form Threshold Condition”); and |

| • | No law or order, writ, injunction, judgment, decree or ruling in effect enjoining or otherwise preventing or prohibiting the making of the Offer or the consummation of the Merger or the Offer. |

The Offer also is subject to a number of other conditions set forth in this Offer to Purchase. We expressly reserve the right to waive any such conditions, but we cannot, without the prior written consent of P.F. Chang’s, (i) decrease the Offer Price, (ii) change the form of consideration payable in the Offer, (iii) reduce the number of Shares to be purchased in the Offer, (iv) amend or modify any of the conditions to the Offer in a manner that is adverse to the holders of Shares or impose conditions to the Offer that are different than or in addition to the conditions to the Offer, (v) amend, modify or waive the Minimum Condition, (vi) add to the conditions to the Offer or amend, modify or supplement any condition to the Offer in a manner that is or could reasonably be expected to be adverse to the holders of Shares in any respect, or (vii) extend or otherwise change any time period for the performance of any obligation of Purchaser or Parent (including the Expiration Date) in a manner other than pursuant to and in accordance with the Merger Agreement.

See Section 15 – “Certain Conditions of the Offer.”

How do I tender my Shares?

If you hold your Shares directly as the registered owner, you can (i) tender your Shares in the Offer by delivering the certificates representing your Shares, together with a completed and signed Letter of Transmittal and any other documents required by the Letter of Transmittal, to the Depositary, or (ii) follow the procedures for book-entry transfer set forth in Section 3 of the Offer to Purchase, not later than the Expiration Date. The Letter of Transmittal is enclosed with this Offer to Purchase.

If you hold your Shares in street name through a broker, dealer, commercial bank, trust company or other nominee, you must contact the institution that holds your Shares and give instructions that your Shares be tendered. You should contact the institution that holds your Shares for more details.

If you are unable to deliver everything that is required to tender your Shares to the Depositary by the Expiration Date, you may obtain a limited amount of additional time by having a broker, a bank or another

S-v

Table of Contents

fiduciary that is an eligible institution guarantee that the missing items will be received by the Depositary using the enclosed Notice of Guaranteed Delivery. To validly tender Shares in this manner, however, the Depositary must receive the missing items within the time period specified in the notice.

See Section 3 – “Procedures for Accepting the Offer and Tendering Shares.”

Until what time may I withdraw previously tendered Shares?

You may withdraw your previously tendered Shares at any time until the Expiration Date. In addition, if we have not accepted your Shares for payment by July 14, 2012, you may withdraw them at any time after that date until we accept your Shares for payment. This right to withdraw will not, however, apply to Shares tendered in any subsequent offering period, if one is provided. See Section 4 – “Withdrawal Rights.”

How do I withdraw previously tendered Shares?

To withdraw previously tendered Shares, you must deliver a written notice of withdrawal, or a facsimile of one, with the required information to the Depositary while you still have the right to withdraw Shares. If you tendered Shares by giving instructions to a broker, banker or other nominee, you must instruct the broker, banker or other nominee to arrange for the withdrawal of your Shares. See Section 4 – “Withdrawal Rights.”

What does the P.F. Chang’s Board of Directors think of the Offer?

The Board of Directors of P.F. Chang’s (the “P.F. Chang’s Board”) (i) approved the execution, delivery and performance of the Offer, the Merger and the Merger Agreement and the transactions contemplated by the Merger Agreement, (ii) determined that the terms of the Offer, the Merger, the Merger Agreement and the other transactions contemplated by the Merger Agreement were substantively and procedurally fair to and in the best interests of P.F. Chang’s and its stockholders, (iii) declared the Offer, the Merger and the Merger Agreement and the transactions contemplated by the Merger Agreement were advisable, (iv) recommended that the holders of Shares accept the Offer, tender their Shares to Purchaser pursuant to the Offer and, to the extent applicable, adopt the Merger Agreement and approve the Merger, (v) authorized and approved the Top-Up Option (as defined below) (including the consideration to be paid upon exercise thereof) and the issuance of Shares pursuant to the Top-Up-Option, and (vi) authorized and approved the execution, delivery and effectiveness of the Merger Agreement and the other transactions contemplated thereby for purposes of Section 203 of the Delaware General Corporation Law.

A more complete description of the reasons for the approval of the Offer and the Merger by the P.F. Chang’s Board is set forth in the Solicitation/Recommendation Statement on Schedule 14D-9 that is being mailed to you together with this Offer to Purchase.

If at least 83% of the Shares are tendered and accepted for payment, will P.F. Chang’s continue as a public company?

No. Following the purchase of Shares in the Offer, we expect to consummate the Merger. Once the Merger takes place, P.F. Chang’s will no longer be publicly owned.

See Section 13 – “Certain Effects of the Offer.”

If I decide not to tender, how will the Offer affect my Shares?

If the Offer is consummated and certain other conditions are satisfied, Purchaser will be merged with and into P.F. Chang’s and all of the then issued and outstanding Shares (other than Shares held (i) by P.F. Chang’s, Parent, Purchaser or any subsidiary of P.F. Chang’s or Parent, including Purchaser, which Shares will be automatically cancelled and retired and will cease to exist without any consideration being paid in exchange

S-vi

Table of Contents

for such Shares) or (ii) by stockholders who exercise appraisal rights under Delaware law with respect to such Shares) will be converted into the right to receive the Offer Price or any greater per Share price paid in the Offer, without interest thereon and less any required withholding taxes. If we accept and purchase Shares in the Offer, we will have sufficient voting power to approve the Merger without the affirmative vote of any other stockholder of P.F. Chang’s. It is also a condition to the Offer Closing that if Parent and Purchaser have not reached the Short-Form Threshold and therefore, the exercise of the Top-Up Option is necessary to ensure that Parent or Purchaser reaches the Short-Form Threshold immediately after the completion of the Offer, the Shares available to be issued to Purchaser upon exercise of the Top-Up Option, together with the Shares validly tendered in the Offer and not properly withdrawn, are sufficient for Purchaser to reach the Short-Form Threshold. As a result, if pursuant to the completion of the Offer or the exercise of the Top-Up Option we own in excess of 90% of the outstanding Shares, we will promptly effect the Merger after consummation of the Offer without any further action by the stockholders of P.F. Chang’s.

See Section 11 – “The Merger Agreement; Other Agreements.”

If the Merger is consummated, P.F. Chang’s stockholders who do not tender their Shares in the Offer will, unless they validly exercise appraisal rights (as described below) pursuant to the Merger, receive the same amount of cash per Share that they would have received had they tendered their Shares in the Offer. Therefore, if the Offer and the Merger are consummated, the only differences to you between tendering your Shares and not tendering your Shares in the Offer are that (i) you will be paid earlier if you tender your Shares in the Offer and (ii) appraisal rights will not be available to you if you tender Shares in the Offer but will be available to you in the Merger if you do not tender Shares in the Offer. See Section 17 – “Appraisal Rights.” However, if the Offer is consummated but the Merger is not consummated, the number of P.F. Chang’s stockholders and the number of Shares that are still in the hands of the public may be so small that there will no longer be an active public trading market (or, possibly, there may not be any public trading market) for the Shares. Also, as described below, P.F. Chang’s may cease making filings with the SEC or otherwise may not be required to comply with the rules relating to publicly held companies. As mentioned above, however, as a result of the Short-Form Threshold Condition to the Offer, we would have to waive that condition to the Offer in order to consummate the Offer and not proceed to consummate the Merger, which we do not intend, although we reserve the right to do so.

See the “Introduction” to this Offer to Purchase and Section 13 – “Certain Effects of the Offer.”

If you do not complete the Offer, will you nevertheless complete the Merger?

The Merger Agreement provides that, as promptly as reasonably practicable (and in any event within ten (10) business days) after the date of the Merger Agreement, P.F. Chang’s will prepare and file with the SEC a Proxy Statement in preliminary form.

If we do not complete the Offer and the Merger Agreement is not terminated, P.F. Chang’s has agreed to hold a meeting of its stockholders to consider and vote on the adoption of the Merger Agreement and will separately mail the Proxy Statement to holders of record of Shares as of the record date for the stockholder meeting. We are not asking you to take any action with respect to the Merger at this time.

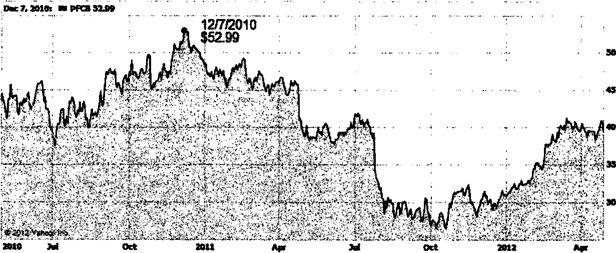

What is the market value of my Shares as of a recent date?

On April 30, 3012, the last full day of trading before the public announcement of the terms of the Offer and the Merger, the reported closing sales price of the Shares on the NASDAQ Global Select Market (“Nasdaq”) was $39.69 per Share. On May 14, 2012, the last full day of trading before the commencement of the Offer, the reported closing sales price of the Shares on Nasdaq was $51.27 per Share. The Offer represents a premium of approximately 30% over the average closing share price of P.F. Chang’s common stock over the April 30, 2012 closing stock price and premium of 0.4% over the May 14, 2012 stock price.

S-vii

Table of Contents

We encourage you to obtain a recent market quotation for Shares of P.F. Chang’s common stock in deciding whether to tender your Shares.

See Section 6 – “Price Range of Shares; Dividends.”

What is the “Top-Up Option” and when will it be exercised?

If Parent, Purchaser and any of their respective affiliates acquire at least 90% of the outstanding Shares, including through exercise of the Top-Up Option, Purchaser will complete the Merger through the “short-form” procedures available under Delaware law. P.F. Chang’s has granted to Purchaser an irrevocable right (the “Top-Up Option”), which Purchaser shall exercise immediately following consummation of the Offer, if necessary, to purchase from P.F. Chang’s the number of Shares that, when added to the Shares already owned by Parent or any of its subsidiaries following consummation of the Offer, constitutes at least 90% of the then outstanding Shares. It is also a condition to the Offer Closing that if Parent and Purchaser have not reached the Short-Form Threshold and therefore, the exercise of the Top-Up Option is necessary to ensure that Parent or Purchaser reaches the Short-Form Threshold immediately after the completion of the Offer, the Shares available to be issued to Purchaser upon exercise of the Top-Up Option, together with the Shares validly tendered in the Offer and not properly withdrawn, are sufficient for Purchaser to reach the Short-Form Threshold.

See Section 12 — “Purpose of the Offer; Plans for P.F. Chang’s” and Section 15 – “Certain Conditions of the Offer.”

Will I have appraisal rights in connection with the Offer?

No appraisal rights will be available to you in connection with the Offer. However, holders of Shares will be entitled to appraisal rights in connection with the Merger if they do not tender Shares in the Offer and do not vote in favor of the Merger, subject to and in accordance with Delaware law. Holders of Shares must properly perfect their right to seek appraisal under Delaware law in connection with the Merger in order to exercise appraisal rights.

See Section 17 – “Appraisal Rights.”

What will happen to my employee stock options in the Offer?

The Offer is made only for Shares and is not made for any employee stock options to purchase Shares that were granted under any P.F. Chang’s stock plan (“Options”).

Pursuant to the Merger Agreement, conditioned upon the occurrence of the effective time of the Merger (the “Effective Time”), all unvested and outstanding Options granted prior to calendar year 2012 (the “Pre-2012 Options”) will fully vest and become exercisable. To the extent not exercised prior to the Effective Time, then upon the Effective Time each Pre-2012 Option will be deemed to be exercised, cancelled and converted into the right to receive an amount in cash, without interest thereon and less any required withholding taxes, equal to the product of the excess, if any, of the Offer Price over the exercise price per Share previously subject to the Pre-2012 Option and the total number of Shares deemed to be issued upon the deemed exercise of such Pre-2012 Option; provided, however, that if the exercise price per Share of any such Pre-2012 Option is equal to or greater than the Offer Price, such Pre-2012 Option shall be cancelled and terminated without any cash payment being made in respect thereof.

Pursuant to the Merger Agreement, on May 14, 2012, the Compensation and Executive Development Committee of the P.F. Chang’s Board (the “Compensation Committee”) adopted resolutions providing that all Options granted in calendar year 2012 (the “2012 Options”) outstanding and unexercised immediately prior to the Effective Time will, in accordance with and pursuant to the terms of the P.F. Chang’s stock plans under which they were granted, be replaced at the Effective Time with a cash incentive program, which cash incentive program will be assumed by Purchaser and Parent at and as of the Effective Time, as set

S-viii

Table of Contents

forth in the Merger Agreement. Each 2012 Option shall be replaced with a right to receive an amount of cash, without interest thereon and less any required withholding taxes, equal to the product of the excess, if any, of the Offer Price over the exercise price per Share previously subject to the 2012 Option and the total number of Shares underlying such 2012 Option (determined in accordance with the terms of such 2012 Option).

See Section 11 – “The Merger Agreement; Other Agreements.”

What will happen to my stock appreciation rights in the Offer?

The Offer is made only for Shares and is not made for any stock appreciation rights that were granted under any P.F. Chang’s stock plan (“SARs”). Pursuant to the Merger Agreement, conditioned upon the occurrence of the Effective Time, all unvested and outstanding SARs will fully vest and become exercisable. To the extent not exercised prior to the Effective Time, then upon the Effective Time each SAR will be deemed to be exercised, cancelled and converted into the right to receive an amount in cash, without interest thereon and less any required withholding taxes, equal to the product of the excess, if any, of the Offer Price over the exercise price per Share previously represented by the SAR and the total number of Shares previously represented by such SAR; provided, however, that if the exercise price per Share previously represented by any such SAR is equal to or greater than the Offer Price, such SAR shall be cancelled and terminated without any cash payment being made in respect thereof. See Section 11 – “The Merger Agreement; Other Agreements.”

What will happen to my restricted stock units in the Offer?

The Offer is made only for Shares and is not made for any restricted stock units that were granted under any P.F. Chang’s stock plan (“RSUs”).

Pursuant to the Merger Agreement, conditioned upon the occurrence of the Effective Time, each RSU granted prior to calendar year 2012 (the “Pre-2012 RSUs”) that is outstanding immediately prior to the Effective Time will fully vest immediately prior to, and then will be cancelled at, the Effective Time in exchange for the right to receive an amount in cash, without interest thereon and less any required withholding taxes, equal to the product of the Offer Price and the number of Shares subject to such cancelled Pre-2012 RSU.

Pursuant to the Merger Agreement, on May 14, 2012, the Compensation Committee adopted resolutions providing that all RSUs granted in calendar year 2012 (the “2012 RSUs”) outstanding and unexercised immediately prior to the Effective Time will, in accordance with and pursuant to the terms of the P.F. Chang’s stock plans under which they were granted, be replaced at the Effective Time with a cash incentive program, which cash incentive program will be assumed by Purchaser and Parent at and as of the Effective Time, as set forth in the Merger Agreement. Each 2012 RSU shall be replaced with a right to receive an amount of cash, without interest thereon and less any required withholding taxes, equal to the product of the Offer Price and the number of Shares subject to such 2012 RSU (determined in accordance with the terms of such 2012 RSU).

See Section 11 – “The Merger Agreement; Other Agreements.”

What will happen to my performance based restricted stock in the Offer?

The Offer is made only for Shares and is not made for any performance-based restricted stock units that were granted under any P.F. Chang’s stock plan (“PBRSUs”). Pursuant to the Merger Agreement, on May 14, 2012, the Compensation Committee adopted resolutions providing that all PBRSUs outstanding and unexercised immediately prior to the Effective Time will, in accordance with and pursuant to the terms of the P.F. Chang’s stock plans under which they were granted, be replaced at the Effective Time with a cash incentive program, which cash incentive program will be assumed by Purchaser and Parent at and as of the Effective Time, as set forth in the Merger Agreement. Each PBRSU shall be replaced with a right to receive an amount of cash, without interest thereon and less any required withholding taxes, equal to the product of the Offer Price and the number of Shares subject to such PBRSU (determined in accordance with the terms of such PBRSU with the performance period ending as of the earlier of the Offer Closing and the closing of the Merger).

S-ix

Table of Contents

See Section 11 – “The Merger Agreement; Other Agreements.”

What will happen to my restricted cash units in the Offer?

The Offer is made only for Shares and is not made for any restricted cash units that were granted under any P.F. Chang’s stock plan (“RCUs”).

Pursuant to the Merger Agreement, conditioned upon the occurrence of the Effective Time, each RCU granted prior to calendar year 2012 (the “Pre-2012 RCUs”) that is outstanding immediately prior to the Effective Time will fully vest immediately prior to, and then will be cancelled at, the Effective Time in exchange for the right to receive an amount in cash, without interest thereon and less any required withholding taxes, equal to the product of the Offer Price and the number of cash units subject to such cancelled Pre-2012 RCU.

Pursuant to the Merger Agreement, on May 14, 2012, the Compensation Committee adopted resolutions providing that all RCUs granted in calendar year 2012 (the “2012 RCUs”) outstanding and unexercised immediately prior to the Effective Time will, in accordance with and pursuant to the terms of the P.F. Chang’s stock plans under which they were granted, be replaced at the Effective Time with a cash incentive program, which cash incentive program will be assumed by Purchaser and Parent at and as of the Effective Time, as set forth in the Merger Agreement. Each 2012 RCU shall be replaced with a right to receive an amount of cash, without interest thereon and less any required withholding taxes, equal to the product of the Offer Price and the number of cash units subject to such 2012 RCU (determined in accordance with the terms of such 2012 RCU).

See Section 11 – “The Merger Agreement; Other Agreements.”

What are the material United States federal income tax consequences of tendering Shares?

The receipt of cash in exchange for your Shares in the Offer or the Merger will be a taxable transaction for U.S. federal income tax purposes and may also be a taxable transaction under applicable state, local or foreign income or other tax laws. In general, for U.S. federal income tax purposes, assuming that you hold your Shares as a capital asset, you will recognize capital gain or loss in an amount equal to the difference between the amount of cash you receive and your adjusted tax basis in the Shares sold pursuant to the Offer or exchanged for cash pursuant to the Merger. This capital gain or loss will be long-term capital gain or loss if you have held the Shares for more than one (1) year as of the date of your sale or exchange of the Shares pursuant to the Offer or the Merger. Special rules will apply to you if you are not a U.S. person for U.S. federal income tax purposes. See Section 5 – “Certain United States Federal Income Tax Consequences” for a more detailed discussion of the tax treatment of the Offer. We urge you to consult with your own tax advisor as to the particular tax consequences to you of the Offer and the Merger.

Who should I call if I have questions about the Offer?

You may call Georgeson Inc. at (866) 300-8594 (Toll Free). Georgeson Inc. is acting as the Information Agent. See the back cover of this Offer to Purchase for additional contact information.

S-x

Table of Contents

To the Holders of Shares of

Common Stock of P.F. Chang’s:

We, Wok Acquisition Corp., a Delaware corporation (“Purchaser”) and an indirect wholly-owned subsidiary of Wok Parent LLC, a Delaware limited liability company (“Parent”), are offering to purchase all of the outstanding shares of common stock, par value $0.001 per share of P.F. Chang’s China Bistro, Inc. (the “Shares”), a Delaware corporation (“P.F. Chang’s” or the “Company”), at a purchase price of $51.50 per Share (the “Offer Price”), net to the seller in cash, without interest thereon and less any required withholding taxes, upon the terms and subject to the conditions set forth in this Offer to Purchase and in the related Letter of Transmittal (which, together with the Offer to Purchase, as each may be amended or supplemented from time to time, collectively constitute the “Offer”).

The Offer is being made pursuant to an Agreement and Plan of Merger, dated as of May 1, 2012 (as it may be amended from time to time, the “Merger Agreement”), by and among Parent, Purchaser and P.F. Chang’s. The Merger Agreement provides, among other things, that following the consummation of the Offer and subject to certain conditions, Purchaser will be merged with and into P.F. Chang’s (the “Merger”), with P.F. Chang’s continuing as the surviving corporation and will become an indirect wholly-owned subsidiary of Parent (the “Surviving Corporation”). In the Merger, each Share issued and outstanding immediately prior to the date and time of filing of the certificate of merger with the Office of the Secretary of State of the State of Delaware (the “Effective Time”) (other than Shares held (i) by P.F. Chang’s, Parent, Purchaser or any subsidiary of P.F. Chang’s or Parent, including Purchaser, which Shares will be automatically cancelled and retired and will cease to exist without any consideration being paid in exchange for such Shares or (ii) by holders of Shares who exercise appraisal rights under Delaware law with respect to such Shares) will be converted into the right to receive the Offer Price or any greater per Share price paid in the Offer, without interest thereon and less any required withholding taxes. The Merger Agreement is more fully described in Section 11 – “The Merger Agreement; Other Agreements,” which also contains a discussion of the treatment of stock options, restricted stock units, performance based restricted stock units, restricted cash units and Shares issued or issuable pursuant to P.F. Chang’s 1998 Employee Stock Purchase Plan, as amended and restated effective November 1, 2009 (the “ESPP”).

Tendering stockholders who are record owners of their Shares and who tender directly to the Depositary (as defined in Section 18 – “Fees and Expenses”) will not be obligated to pay brokerage fees or commissions or, except as otherwise provided in Instruction 6 of the Letter of Transmittal, stock transfer taxes with respect to the purchase of Shares by Purchaser pursuant to the Offer. Stockholders who hold their Shares through a broker, banker or other nominee should consult such institution as to whether it charges any service fees or commissions.

The Board of Directors of P.F. Chang’s (the “P.F. Chang’s Board”) (i) approved the execution, delivery and performance of the Offer, the Merger and the Merger Agreement and the transactions contemplated by the Merger Agreement, (ii) determined that the terms of the Offer, the Merger, the Merger Agreement and the other transactions contemplated by the Merger Agreement were substantively and procedurally fair to and in the best interests of P.F. Chang’s and its stockholders, (iii) declared the Offer, the Merger and the Merger Agreement and the transactions contemplated by the Merger Agreement were advisable, (iv) recommended that the holders of Shares accept the Offer, tender their Shares to Purchaser pursuant to the Offer and, to the extent applicable, adopt the Merger Agreement and approve the Merger, (v) authorized and approved the Top-Up Option (as defined below) (including the consideration to be paid upon exercise thereof) and the issuance of Shares pursuant to the Top-Up Option, and (vi) authorized and approved the execution, delivery and effectiveness of the Merger Agreement and the other transactions contemplated thereby for purposes of Section 203 of the Delaware General Corporation Law (as amended, the “DGCL”).

1

Table of Contents

A more complete description of the reasons of the P.F. Chang’s Board for authorizing and approving the Merger Agreement and the transactions contemplated thereby, including the Offer and the Merger, is set forth in P.F. Chang’s Solicitation/Recommendation Statement on Schedule 14D-9 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that is being furnished to stockholders in connection with the Offer (the “Schedule 14D-9”). Stockholders should carefully read the information set forth in the Schedule 14D-9, including the information set forth under the sub-headings “Background of the Merger” and “Recommendation of the Company’s Board of Directors; Reasons for the Merger.”

The Offer is conditioned upon, among other things, (i) the satisfaction of the Minimum Condition (as described below), (ii) the Financing Proceeds Condition (as described below) and (iii) the HSR Condition (as described below). The Minimum Condition requires that the number of Shares that has been validly tendered and not validly withdrawn prior to the expiration of the Offer which, together with any Shares then owned, directly or indirectly, by Purchaser, Parent and its subsidiaries, collectively represents at least 83% of the Shares then outstanding (the “Minimum Condition”). The Financing Proceeds Condition requires that Parent (either directly or through its subsidiaries) must have received the proceeds of the commitments from Wells Fargo Bank, National Association, WF Investment Holdings, LLC, Deutsche Bank Trust Company Americas, Deutsche Bank AG Cayman Islands Branch and Barclays Bank PLC (collectively the “Lenders”) to provide an aggregate of $650.0 million in debt financing to Purchaser (as it may be amended from time to time, the “debt financing”) (or any alternative debt financing) and/or the Lenders will have confirmed to Parent or Purchaser that the debt financing (or any alternative debt financing) will be available in an amount sufficient to consummate the Offer and the Merger (the “Financing Proceeds Condition”). The HSR Condition requires that any applicable waiting period applicable to the Offer under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”), has expired or been terminated (the “HSR Condition”). The term “Expiration Date” means 12:00 midnight, New York City time, at the end of June 12, 2012, unless Parent and Purchaser, in accordance with the Merger Agreement, extend the period during which the Offer is open, in which event the term “Expiration Date” means the latest time and date at which the Offer, as so extended, expires. The Offer is also subject to other conditions set forth in this Offer to Purchase. See Section 15 – “Certain Conditions of the Offer.”

Consummation of the Merger is conditioned upon, among other things, the adoption of the Merger Agreement by the requisite vote of holders of Shares, if required by Delaware law. Under Delaware law, the affirmative vote of a majority of the outstanding Shares is the only vote of any class or series of P.F. Chang’s capital stock that would be necessary to adopt the Merger Agreement at any required meeting of P.F. Chang’s stockholders. If we accept and purchase Shares in the Offer, we will have sufficient voting power to approve the Merger without the affirmative vote of any other stockholder of P.F. Chang’s. In addition, Section 253 of the DGCL provides that if a corporation owns at least 90% of the outstanding shares of each class of stock of a subsidiary corporation entitled to vote on a merger, the corporation holding such stock may merge such subsidiary into itself, or itself into such subsidiary, without any action or vote on the part of the board of directors or the stockholders of such other corporation.

This Offer to Purchase and the related Letter of Transmittal contain important information that should be read carefully in its entirety before any decision is made with respect to the Offer.

2

Table of Contents

| 1. | Terms of the Offer. |

Purchaser is offering to purchase all of the outstanding Shares of P.F. Chang’s at the Offer Price. According to P.F. Chang’s, as of May 4, 2012, there were (i) 21,283,548 Shares issued and outstanding, (ii) 1,238,857 Shares subject to issuance pursuant to outstanding stock options (of which 737,592 have an exercise price less than the Offer Price) and (iii) 44,500 outstanding restricted stock units.

Upon the terms and subject to the conditions of the Offer (including, if the Offer is extended or amended, the terms and conditions of such extension or amendment), we will accept for payment and promptly pay for all Shares validly tendered prior to the Expiration Date and not validly withdrawn as permitted under Section 4 – “Withdrawal Rights.”

The Offer is conditioned upon, among other things, the satisfaction of the Minimum Condition, the HSR Condition and the other conditions described in Section 15 – “Certain Conditions of the Offer.”

The Merger Agreement obligates us to extend the Offer for one or more periods, in increments of up to ten (10) business days (the precise length of which is in Parent’s sole discretion) if all of the conditions to the Offer are not satisfied or waived at the initial Expiration Date. The Merger Agreement also provides, however, that we are not required to extend the Offer beyond October 31, 2012 (the “Outside Date”) or, if earlier, the date that is five (5) business days following the Proxy Statement Clearance Date. As defined in the Merger Agreement, the “Proxy Statement Clearance Date” means the later to occur of (i)(a) if the SEC has not informed P.F. Chang’s that it intends to review the preliminary proxy statement on Schedule 14A to be filed by P.F. Chang’s in connection with the adoption of the Merger Agreement (collectively, as amended or supplemented, the “Proxy Statement”) on or prior to the tenth (10th) calendar day following the filing of the preliminary Proxy Statement, the date of the day following such tenth (10th) calendar day or (b) if the SEC has informed P.F. Chang’s that it intends to review the Proxy Statement on or prior to the (10th) calendar day following the filing of the preliminary Proxy Statement, the date on which the SEC has, orally or in writing, confirmed that it has no further comments on the Proxy Statement and (ii) May 31, 2012 (such May 31, 2012 date, the “Go-Shop Period End Date”). We are also required by the terms of the Merger Agreement to extend the Offer to 12:00 midnight, New York City time, at the end of June 15, 2012, in the event that P.F. Chang’s has engaged in discussions or negotiations with a qualified bidder that has made a Qualified Acquisition Proposal (as defined in Section 11 – “The Merger Agreement; Other Agreements”) prior to the Go-Shop Period End Date. Finally, we are also required to extend the Offer beyond the initial Expiration Date for any period required by any rule, regulation, interpretation or position of the SEC or its staff or applicable law, in each case, applicable to the Offer.

We have agreed in the Merger Agreement that, without the prior written consent of P.F. Chang’s, we will not (i) decrease the Offer Price, (ii) change the form of consideration payable in the Offer, (iii) reduce the number of Shares to be purchased in the Offer, (iv) amend or modify any of the Offer Conditions in a manner that is adverse to the holders of Shares or impose conditions to the Offer that are different than or in addition to the Offer Conditions, (v) amend, modify or waive the Minimum Condition, (vi) add to the Offer Conditions or amend, modify or supplement any Offer Condition in a manner that is or could reasonably be expected to be adverse to the holders of Shares in any respect, or (vii) extend or otherwise change any time period for the performance of any obligation of Purchaser or Parent (including the Expiration Date) in a manner other than pursuant to and in accordance with the Merger Agreement.

If we extend the Offer, are delayed in our acceptance for payment of or payment (whether before or after our acceptance for payment for Shares) for Shares or are unable to accept Shares for payment pursuant to the Offer for any reason, then, without prejudice to our rights under the Offer, the Depositary may retain tendered Shares on our behalf, and such Shares may not be withdrawn except to the extent that tendering stockholders are entitled to withdrawal rights as described in Section 4 – “Withdrawal Rights.” However, our ability to delay the payment for Shares that we have accepted for payment is limited by Rule 14e-1(c) under the Exchange Act, which requires us to pay the consideration offered or return the securities deposited by or on behalf of stockholders promptly after the termination or withdrawal of the Offer.

3

Table of Contents

Except as set forth above, and subject to the applicable rules and regulations of the SEC, we expressly reserve the right to waive any Offer Condition at any time and from time to time, to increase the Offer Price or to make any other changes in the terms and conditions of the Offer. Any extension, delay, termination or amendment of the Offer will be followed as promptly as practicable by public announcement thereof, and such announcement in the case of an extension will be made no later than 9:00 a.m., New York City time, on the next business day after the previously scheduled Expiration Date. Without limiting the manner in which we may choose to make any public announcement, we currently intend to make announcements regarding the Offer by issuing a press release and making any appropriate filing with the SEC.

If we make a material change in the terms of the Offer or the information concerning the Offer or if we waive a material condition of the Offer, we will disseminate additional tender offer materials and extend the Offer in each case, if and to the extent required by Rules 14d-4(d)(1), 14d-6(c) and 14e-1 under the Exchange Act. The minimum period during which the Offer must remain open following material changes in the terms of the Offer or information concerning the Offer, other than a change in price or a change in percentage of securities sought, will depend upon the facts and circumstances, including the relative materiality of the terms or information changes. In the SEC’s view, an offer should remain open for a minimum of five (5) business days from the date the material change is first published, sent or given to stockholders, and with respect to a change in price or a change in the percentage of securities sought, a minimum ten (10) business day period generally is required to allow for adequate dissemination to stockholders and investor response.

If, on or before the Expiration Date, we increase the consideration being paid for Shares accepted for payment in the Offer, such increased consideration will be paid to all stockholders whose Shares are purchased in the Offer, whether or not such Shares were tendered before the announcement of the increase in consideration.

We expressly reserve the right, in our sole discretion, subject to the terms and conditions of the Merger Agreement and the applicable rules and regulations of the SEC, not to accept for payment any Shares if, at the Expiration Date, any of the conditions to the Offer have not been satisfied or upon the occurrence of any of the events set forth in Section 15 – “Certain Conditions of the Offer.” Under certain circumstances, we may terminate the Merger Agreement and the Offer.

The Merger Agreement also provides that if, after the expiration of the Offer and acceptance of the Shares tendered and not properly withdrawn in the Offer, the number of Shares that have been validly tendered and not properly withdrawn pursuant to the Offer, together with any Shares then owned by Parent or any of its subsidiaries, is less than 90% of the outstanding Shares, Purchaser may, in its sole discretion, commence a subsequent offering period. A subsequent offering period, if included, will be an additional period of not less than three (3) business days and up to twenty (20) business days beginning on the next business day following the Expiration Date in accordance with Rule 14d-11 promulgated under the Exchange Act, during which any remaining stockholders may tender, but not withdraw, their Shares and receive the Offer Price. If we include a subsequent offering period, we will immediately accept and promptly pay for all Shares that were validly tendered during the initial offering period. During a subsequent offering period, tendering stockholders will not have withdrawal rights, and we will immediately accept and promptly pay for any Shares tendered during the subsequent offering period.

We do not currently intend to provide a subsequent offering period for the Offer, although we reserve the right to do so. If we elect to provide or extend any subsequent offering period, a public announcement of such determination will be made no later than 9:00 a.m., New York City time, on the next business day following the Expiration Date or date of termination of any prior subsequent offering period.

Under the Merger Agreement, if we do not acquire more than 90% of the outstanding Shares in the Offer after our acceptance of, and payment for Shares pursuant to the Offer, we have been granted an irrevocable option (the “Top-Up Option”), subject to certain limitations, to purchase from P.F. Chang’s an

4

Table of Contents

aggregate number of validly issued, fully paid and nonassessable Shares sufficient to cause Purchaser and Parent to own at least 90% of the Shares outstanding on a fully-diluted basis at a price per Share equal to the Offer Price. The Top-Up Option may not be exercised more than once and only upon the terms and subject to the conditions set forth in the Merger Agreement, and only for so long as the Merger Agreement has not been terminated pursuant to its terms. The Top-Up Option shall be deemed to have been exercised after the acceptance of Shares in the Offer if the acquisition of such additional Shares by Purchaser is necessary for Purchaser to reach the Short-Form Threshold (as defined in Section 11 – “The Merger Agreement; Other Agreements”).

P.F. Chang’s has provided us with its stockholder list and security position listings for the purpose of disseminating the Offer to holders of Shares. This Offer to Purchase and the related Letter of Transmittal, together with the Schedule 14D-9, will be mailed to record holders of Shares whose names appear on the stockholder list provided by P.F. Chang’s and will be furnished, for subsequent transmittal to beneficial owners of Shares, to brokers, dealers, commercial banks, trust companies and similar persons whose names, or the names of whose nominees, appear on the stockholder list or, if applicable, who are listed as participants in a clearing agency’s security position listing.

| 2. | Acceptance for Payment and Payment for Shares. |

Subject to the terms of the Offer and the Merger Agreement and the satisfaction or waiver of the Offer Conditions set forth in Section 15 – “Certain Conditions of the Offer,” we will accept for payment and pay for all Shares validly tendered and not validly withdrawn pursuant to the Offer as promptly as possible and in any event within three (3) business days after the Expiration Date (such time, the “Offer Closing”). If we commence a subsequent offering period in connection with the Offer, we will immediately accept for payment and promptly pay for all additional Shares as they are tendered during such subsequent offering period, subject to and in compliance with the requirements of Rule 14d-11(e) under the Exchange Act. Subject to compliance with Rule 14e-1(c) under the Exchange Act, we expressly reserve the right to delay payment for Shares in order to comply in whole or in part with any applicable law, including, without limitation, the HSR Act. See Section 16 – “Certain Legal Matters; Regulatory Approvals.”

In all cases, we will pay for Shares accepted for payment pursuant to the Offer only after timely receipt by the Depositary of (i) the certificates evidencing such Shares (the “Share Certificates”) or confirmation of a book-entry transfer of such Shares (a “Book-Entry Confirmation”) into the Depositary’s account at The Depository Trust Company (“DTC”) pursuant to the procedures set forth in Section 3 – “Procedures for Accepting the Offer and Tendering Shares,” (ii) the Letter of Transmittal (or a manually signed facsimile thereof), properly completed and duly executed, with any required signature guarantees or, in the case of a book-entry transfer, an Agent’s Message (as defined below) in lieu of the Letter of Transmittal and (iii) any other documents required by the Letter of Transmittal. Accordingly, tendering stockholders may be paid at different times depending upon when Share Certificates or Book-Entry Confirmations with respect to Shares are actually received by the Depositary.

The term “Agent’s Message” means a message, transmitted by DTC to and received by the Depositary and forming a part of a Book-Entry Confirmation, that states that DTC has received an express acknowledgment from the participant in DTC tendering the Shares that are the subject of such Book-Entry Confirmation, that such participant has received and agrees to be bound by the terms of the Letter of Transmittal and that Purchaser may enforce such agreement against such participant.

For purposes of the Offer, we will be deemed to have accepted for payment, and thereby purchased, Shares validly tendered and not validly withdrawn as, if and when we give oral or written notice to the Depositary of our acceptance for payment of such Shares pursuant to the Offer. Upon the terms and subject to the conditions of the Offer, payment for Shares accepted for payment pursuant to the Offer will be made by deposit of the Offer Price for such Shares with the Depositary, which will act as agent for tendering stockholders for the purpose of receiving payments from us and transmitting such payments to tendering stockholders whose Shares have been accepted for payment. If we extend the Offer, are delayed in our acceptance for payment of

5

Table of Contents

Shares or are unable to accept Shares for payment pursuant to the Offer for any reason, then, without prejudice to our rights under the Offer, the Depositary may retain tendered Shares on our behalf, and such Shares may not be withdrawn except to the extent that tendering stockholders are entitled to withdrawal rights as described in Section 4 – “Withdrawal Rights” and as otherwise required by Rule 14e-1(c) under the Exchange Act. Under no circumstances will we pay interest on the purchase price for Shares, regardless of any extension of the Offer or any delay in making such payment.

If any tendered Shares are not accepted for payment for any reason pursuant to the terms and conditions of the Offer, or if Share Certificates are submitted evidencing more Shares than are tendered, Share Certificates evidencing unpurchased Shares will be returned, without expense to the tendering stockholder (or, in the case of Shares tendered by book-entry transfer into the Depositary’s account at DTC pursuant to the procedure set forth in Section 3 – “Procedures for Accepting the Offer and Tendering Shares,” such Shares will be credited to an account maintained at DTC), as promptly as practicable following the expiration or termination of the Offer.

| 3. | Procedures for Accepting the Offer and Tendering Shares. |

Valid Tenders. In order for a stockholder to validly tender Shares pursuant to the Offer, either (i) the Letter of Transmittal (or a manually signed facsimile thereof), properly completed and duly executed, together with any required signature guarantees (or, in the case of a book-entry transfer, an Agent’s Message in lieu of the Letter of Transmittal) and any other documents required by the Letter of Transmittal must be received by the Depositary at one of its addresses set forth on the back cover of this Offer to Purchase and either (a) the Share Certificates evidencing tendered Shares must be received by the Depositary at such address or (b) such Shares must be tendered pursuant to the procedure for book-entry transfer described below under “Book-Entry Transfer” and a Book-Entry Confirmation must be received by the Depositary, in each case prior to the Expiration Date, or (ii) the tendering stockholder must comply with the guaranteed delivery procedures described below under “Guaranteed Delivery.”

Book-Entry Transfer. The Depositary will establish an account with respect to the Shares at DTC for purposes of the Offer within two (2) business days after the date of this Offer to Purchase. Any financial institution that is a participant in the system of DTC may make a book-entry delivery of Shares by causing DTC to transfer such Shares into the Depositary’s account at DTC in accordance with DTC’s procedures for such transfer. However, although delivery of Shares may be effected through book-entry transfer at DTC, either the Letter of Transmittal (or a manually signed facsimile thereof), properly completed and duly executed, together with any required signature guarantees, or an Agent’s Message in lieu of the Letter of Transmittal, and any other required documents, must, in any case, be received by the Depositary at one of its addresses set forth on the back cover of this Offer to Purchase prior to the Expiration Date, or the tendering stockholder must comply with the guaranteed delivery procedure described below under “Guaranteed Delivery.” Delivery of documents to DTC does not constitute delivery to the Depositary.

Signature Guarantees. No signature guarantee is required on the Letter of Transmittal (i) if the Letter of Transmittal is signed by the registered holder(s) (which term, for purposes of this Section 3, includes any participant in DTC’s systems whose name appears on a security position listing as the owner of the Shares) of the Shares tendered therewith, unless such holder has completed either the box entitled “Special Delivery Instructions” or the box entitled “Special Payment Instructions” on the Letter of Transmittal or (ii) if the Shares are tendered for the account of a financial institution (including most commercial banks, savings and loan associations and brokerage houses) that is a member in good standing in the Security Transfer Agents Medallion Program or any other “eligible guarantor institution,” as such term is defined in Rule 17Ad-15 of the Exchange Act (each an “Eligible Institution” and collectively “Eligible Institutions”). In all other cases, all signatures on a Letter of Transmittal must be guaranteed by an Eligible Institution. See Instruction 1 of the Letter of Transmittal. If a Share Certificate is registered in the name of a person or persons other than the signer of the Letter of Transmittal, or if payment is to be made or delivered to, or a Share Certificate not accepted for payment or not tendered is to be issued in, the name(s) of a person other than the registered holder(s), then the Share Certificate

6

Table of Contents

must be endorsed or accompanied by appropriate duly executed stock powers, in either case signed exactly as the name(s) of the registered holder(s) appear on the Share Certificate, with the signature(s) on such Share Certificate or stock powers guaranteed by an Eligible Institution as provided in the Letter of Transmittal. See Instructions 1 and 5 of the Letter of Transmittal.

Guaranteed Delivery. If a stockholder desires to tender Shares pursuant to the Offer and the Share Certificates evidencing such stockholder’s Shares are not immediately available or such stockholder cannot deliver the Share Certificates and all other required documents to the Depositary prior to the Expiration Date, or such stockholder cannot complete the procedure for delivery by book-entry transfer on a timely basis, such Shares may nevertheless be tendered, provided that all of the following conditions are satisfied:

| • | such tender is made by or through an Eligible Institution; |

| • | a properly completed and duly executed Notice of Guaranteed Delivery, substantially in the form made available by us, is received prior to the Expiration Date by the Depositary as provided below; and |

| • | the Share Certificates (or a Book-Entry Confirmation) evidencing all tendered Shares, in proper form for transfer, in each case together with the Letter of Transmittal (or a manually signed facsimile thereof), properly completed and duly executed, with any required signature guarantees (or, in the case of a book-entry transfer, an Agent’s Message), and any other documents required by the Letter of Transmittal are received by the Depositary within three (3) trading days after the date of execution of such Notice of Guaranteed Delivery. |

The Notice of Guaranteed Delivery may be transmitted by manually signed facsimile transmission or mailed to the Depositary and must include a guarantee by an Eligible Institution in the form set forth in the form of Notice of Guaranteed Delivery made available by Purchaser.

Notwithstanding any other provision of this Offer, payment for Shares accepted pursuant to the Offer will in all cases only be made after timely receipt by the Depositary of (i) certificates evidencing such Shares or a Book-Entry Confirmation of a book-entry transfer of such Shares into the Depositary’s account at DTC pursuant to the procedures set forth in this Section 3, (ii) the Letter of Transmittal (or a manually signed facsimile thereof), properly completed and duly executed, with any required signature guarantees or, in the case of a book-entry transfer, an Agent’s Message in lieu of the Letter of Transmittal and (iii) any other documents required by the Letter of Transmittal. Accordingly, tendering stockholders may be paid at different times depending upon when Share Certificates or Book-Entry Confirmations with respect to Shares are actually received by the Depositary.

The method of delivery of Shares, the Letter of Transmittal and all other required documents, including delivery through DTC, is at the option and risk of the tendering stockholder, and the delivery of all such documents will be deemed made only when actually received by the Depositary (including, in the case of a book-entry transfer, receipt of a Book-Entry Confirmation). If delivery is by mail, registered mail with return receipt requested, properly insured, is recommended. In all cases, sufficient time should be allowed to ensure timely delivery.