PROSPECTUS

Investor and Service Class

November 30, 2023

|

|

INVESTOR CLASS |

SERVICE CLASS |

|

Access Flex Bear High Yield

ProFundSM

|

AFBIX |

AFBSX |

|

Access Flex High Yield

ProFundSM

|

FYAIX |

FYASX |

|

Banks UltraSector ProFund |

BKPIX |

BKPSX |

|

Bear ProFund |

BRPIX |

BRPSX |

|

Biotechnology UltraSector

ProFund |

BIPIX |

BIPSX |

|

Bull ProFund |

BLPIX |

BLPSX |

|

Communication Services

UltraSector ProFund |

WCPIX |

WCPSX |

|

Consumer Discretionary

UltraSector ProFund |

CYPIX |

CYPSX |

|

Consumer Staples

UltraSector ProFund |

CNPIX |

CNPSX |

|

Energy UltraSector ProFund |

ENPIX |

ENPSX |

|

Europe 30 ProFund |

UEPIX |

UEPSX |

|

Falling U.S. Dollar ProFund |

FDPIX |

FDPSX |

|

Financials UltraSector

ProFund |

FNPIX |

FNPSX |

|

Health Care UltraSector

ProFund |

HCPIX |

HCPSX |

|

Industrials UltraSector

ProFund |

IDPIX |

IDPSX |

|

Internet UltraSector ProFund |

INPIX |

INPSX |

|

Large-Cap Growth ProFund |

LGPIX |

LGPSX |

|

Large-Cap Value ProFund |

LVPIX |

LVPSX |

|

Materials UltraSector

ProFund |

BMPIX |

BMPSX |

|

Mid-Cap Growth ProFund |

MGPIX |

MGPSX |

|

Mid-Cap ProFund |

MDPIX |

MDPSX |

|

Mid-Cap Value ProFund |

MLPIX |

MLPSX |

|

Nasdaq-100 ProFund |

OTPIX |

OTPSX |

|

Oil & Gas Equipment &

Services UltraSector

ProFund |

OEPIX |

OEPSX |

|

Pharmaceuticals UltraSector

ProFund |

PHPIX |

PHPSX |

|

Precious Metals UltraSector

ProFund |

PMPIX |

PMPSX |

|

Real Estate UltraSector

ProFund |

REPIX |

REPSX |

|

Rising Rates Opportunity

ProFund |

RRPIX |

RRPSX |

|

Rising Rates Opportunity 10

ProFund |

RTPIX |

RTPSX |

|

|

INVESTOR CLASS |

SERVICE CLASS |

|

Rising U.S. Dollar ProFund |

RDPIX |

RDPSX |

|

Semiconductor UltraSector

ProFund |

SMPIX |

SMPSX |

|

Short Energy ProFund |

SNPIX |

SNPSX |

|

Short Nasdaq-100 ProFund |

SOPIX |

SOPSX |

|

Short Precious Metals

ProFund |

SPPIX |

SPPSX |

|

Short Real Estate ProFund |

SRPIX |

SRPSX |

|

Short Small-Cap ProFund |

SHPIX |

SHPSX |

|

Small-Cap Growth ProFund |

SGPIX |

SGPSX |

|

Small-Cap ProFund |

SLPIX |

SLPSX |

|

Small-Cap Value ProFund |

SVPIX |

SVPSX |

|

Technology UltraSector

ProFund |

TEPIX |

TEPSX |

|

UltraBear ProFund |

URPIX |

URPSX |

|

UltraBull ProFund |

ULPIX |

ULPSX |

|

UltraChina ProFund |

UGPIX |

UGPSX |

|

UltraDow 30 ProFund |

UDPIX |

UDPSX |

|

UltraEmerging Markets

ProFund |

UUPIX |

UUPSX |

|

UltraInternational ProFund |

UNPIX |

UNPSX |

|

UltraJapan ProFund |

UJPIX |

UJPSX |

|

UltraLatin America ProFund |

UBPIX |

UBPSX |

|

UltraMid-Cap ProFund |

UMPIX |

UMPSX |

|

UltraNasdaq-100 ProFund |

UOPIX |

UOPSX |

|

UltraShort China ProFund |

UHPIX |

UHPSX |

|

UltraShort Dow 30 ProFund |

UWPIX |

UWPSX |

|

UltraShort Emerging Markets

ProFund |

UVPIX |

UVPSX |

|

UltraShort International

ProFund |

UXPIX |

UXPSX |

|

UltraShort Japan ProFund |

UKPIX |

UKPSX |

|

UltraShort Latin America

ProFund |

UFPIX |

UFPSX |

|

UltraShort Mid-Cap ProFund |

UIPIX |

UIPSX |

|

UltraShort Nasdaq-100

ProFund |

USPIX |

USPSX |

|

UltraShort Small-Cap

ProFund |

UCPIX |

UCPSX |

|

UltraSmall-Cap ProFund |

UAPIX |

UAPSX |

|

U.S. Government Plus

ProFund |

GVPIX |

GVPSX |

|

Utilities UltraSector ProFund |

UTPIX |

UTPSX |

Neither the Securities and Exchange Commission, the Commodity Futures Trading Commission, nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

Table of Contents

|

3 |

|

|

4 |

|

|

8 |

|

|

12 |

|

|

18 |

|

|

23 |

|

|

28 |

|

|

32 |

|

|

37 |

|

|

42 |

|

|

48 |

|

|

53 |

|

|

57 |

|

|

61 |

|

|

67 |

|

|

73 |

|

|

78 |

|

|

84 |

|

|

88 |

|

|

92 |

|

|

97 |

|

|

101 |

|

|

105 |

|

|

109 |

|

|

113 |

|

|

119 |

|

|

124 |

|

|

130 |

|

|

136 |

|

|

141 |

|

|

146 |

|

|

151 |

|

|

156 |

|

|

162 |

|

|

167 |

|

|

173 |

|

179 |

|

|

185 |

|

|

189 |

|

|

193 |

|

|

197 |

|

|

203 |

|

|

208 |

|

|

213 |

|

|

219 |

|

|

224 |

|

|

230 |

|

|

236 |

|

|

242 |

|

|

248 |

|

|

253 |

|

|

258 |

|

|

264 |

|

|

269 |

|

|

275 |

|

|

281 |

|

|

287 |

|

|

293 |

|

|

298 |

|

|

303 |

|

|

308 |

|

|

314 |

|

|

319 |

|

|

324 |

|

|

352 |

|

|

353 |

|

|

356 |

|

|

357 |

|

|

361 |

|

|

372 |

4 :: Access Flex Bear High Yield ProFund :: TICKERS :: Investor Class AFBIX :: Service Class AFBSX

Wire Fee $10

|

| ||

|

|

Investor

Class |

Service

Class |

|

Investment Advisory Fees |

|

|

|

Distribution and Service (12b-1) Fees |

|

|

|

Other Expenses |

|

|

|

Total Annual Fund Operating Expenses

Before Fee Waivers and Expense

Reimbursements |

|

|

|

Fee Waivers/Reimbursements1 |

- |

- |

|

Total Annual Fund Operating Expenses

After Fee Waivers and Expense

Reimbursements |

|

|

1

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Investor Class |

$ |

$ |

$ |

$ |

|

Service Class |

$ |

$ |

$ |

$ |

FUND NUMBERS :: Investor Class 111 :: Service Class 141 :: Access Flex Bear High Yield ProFund :: 5

6 :: Access Flex Bear High Yield ProFund :: TICKERS :: Investor Class AFBIX :: Service Class AFBSX

Please see “Investment Objectives, Principal Investment Strategies and Related Risks” in the Fund’s Prospectus for additional details.

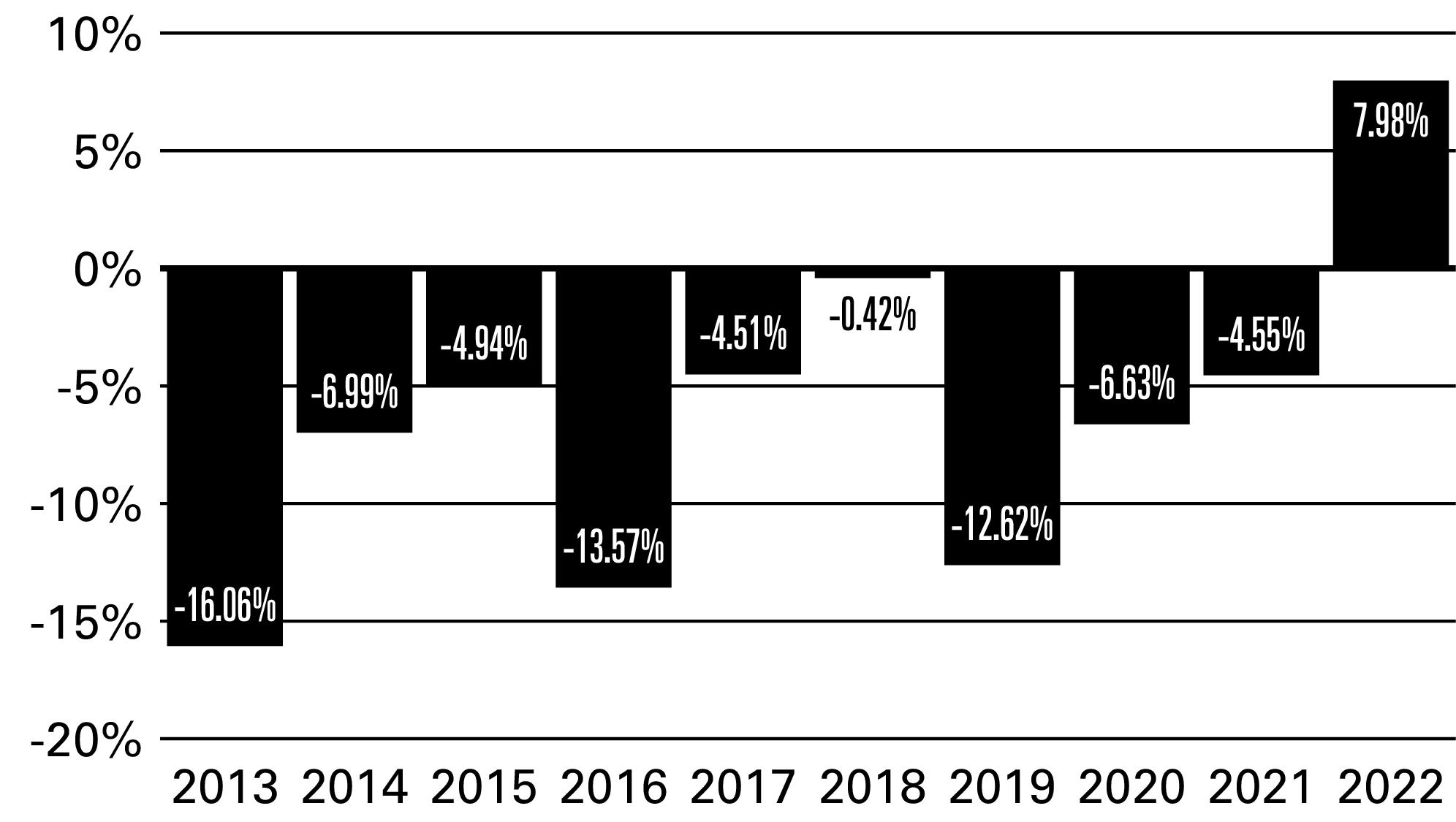

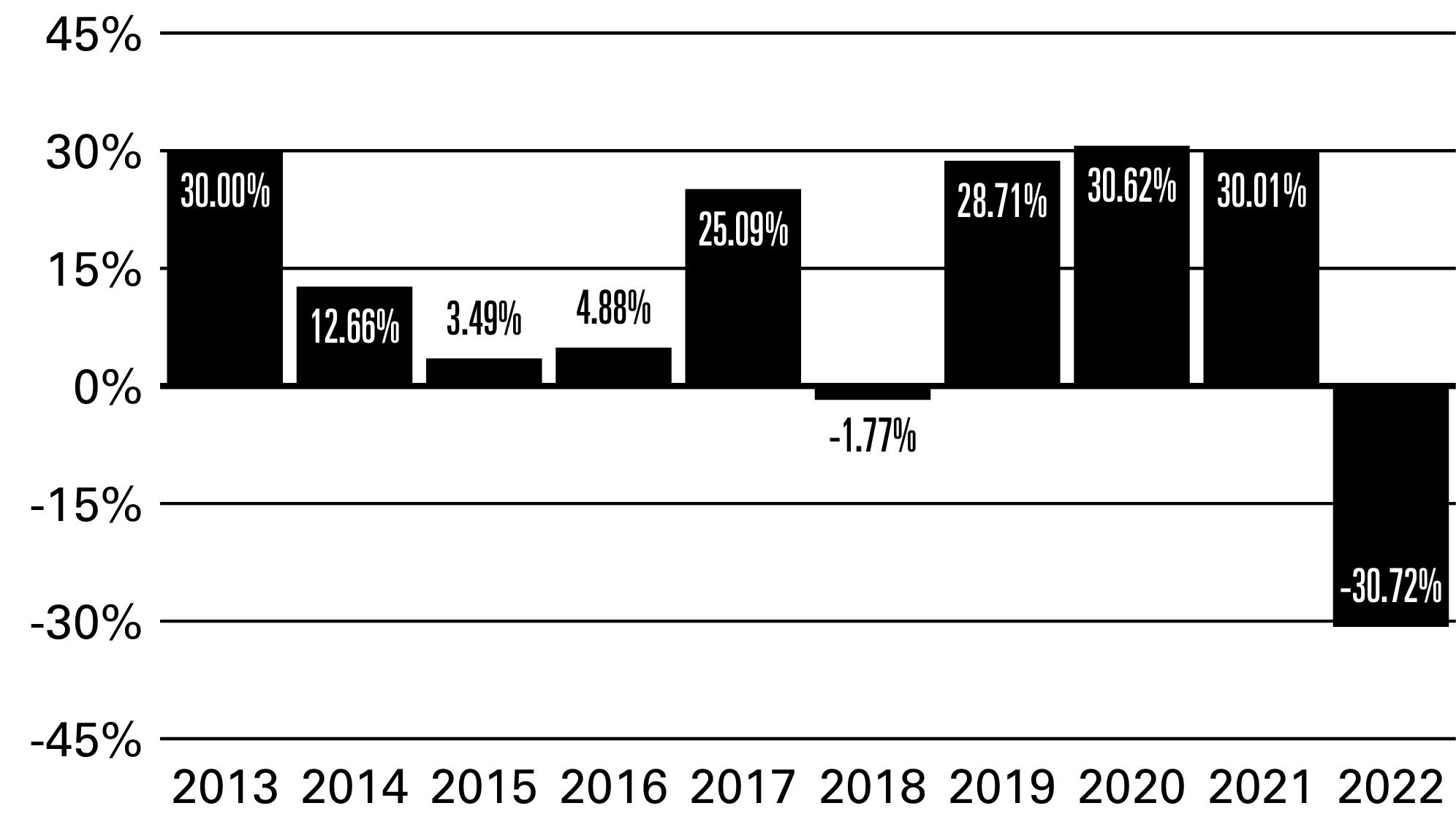

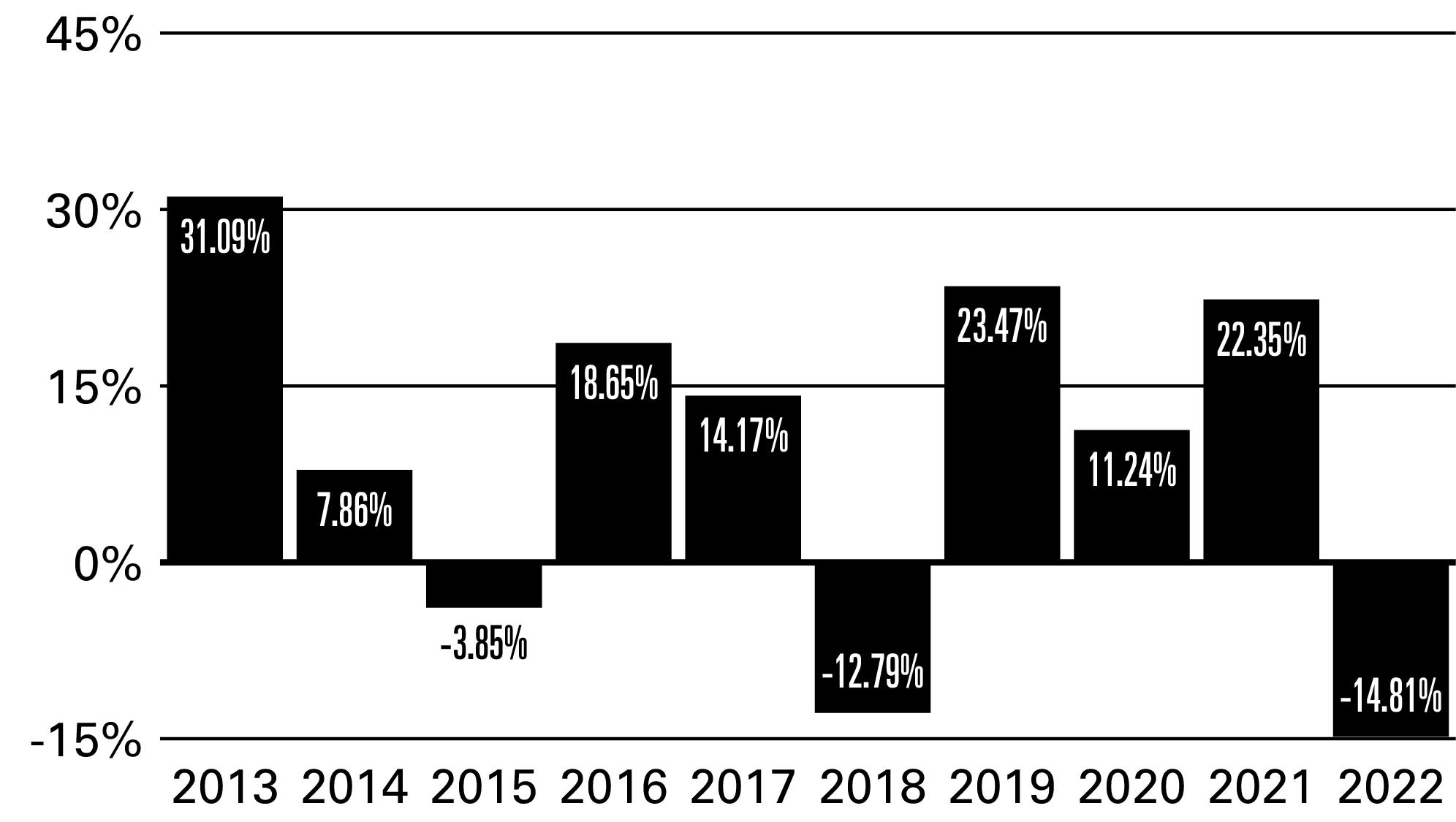

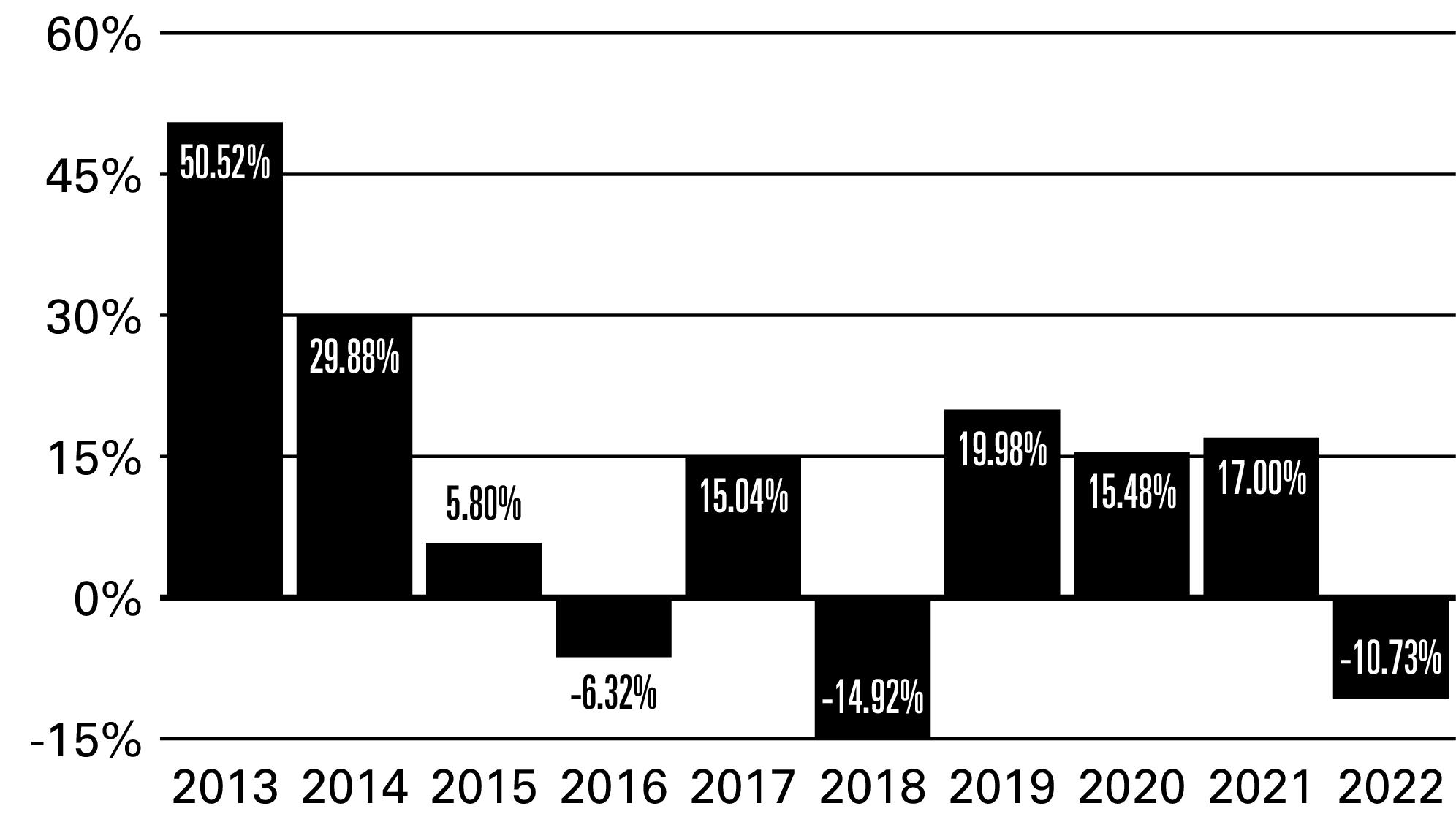

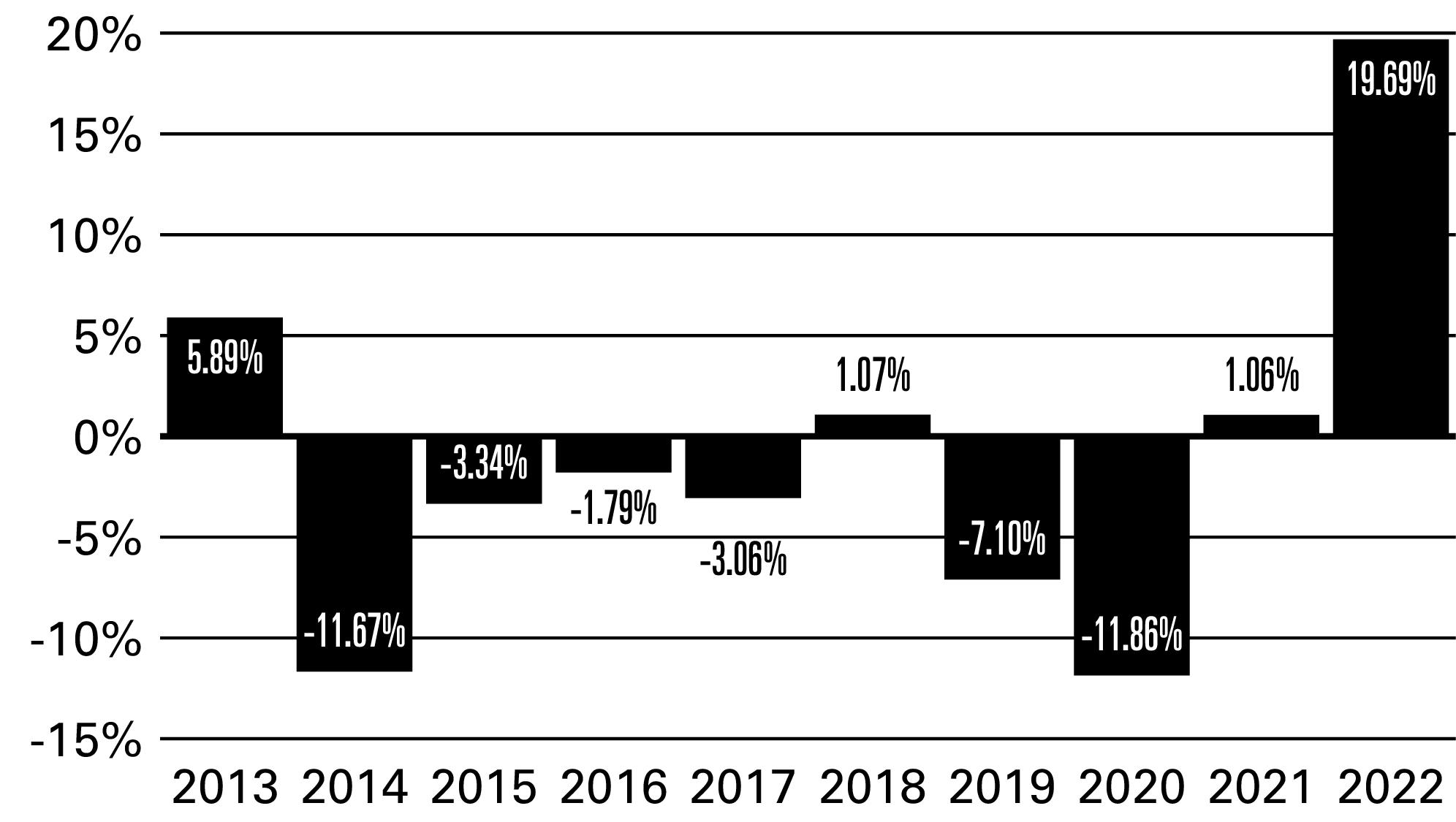

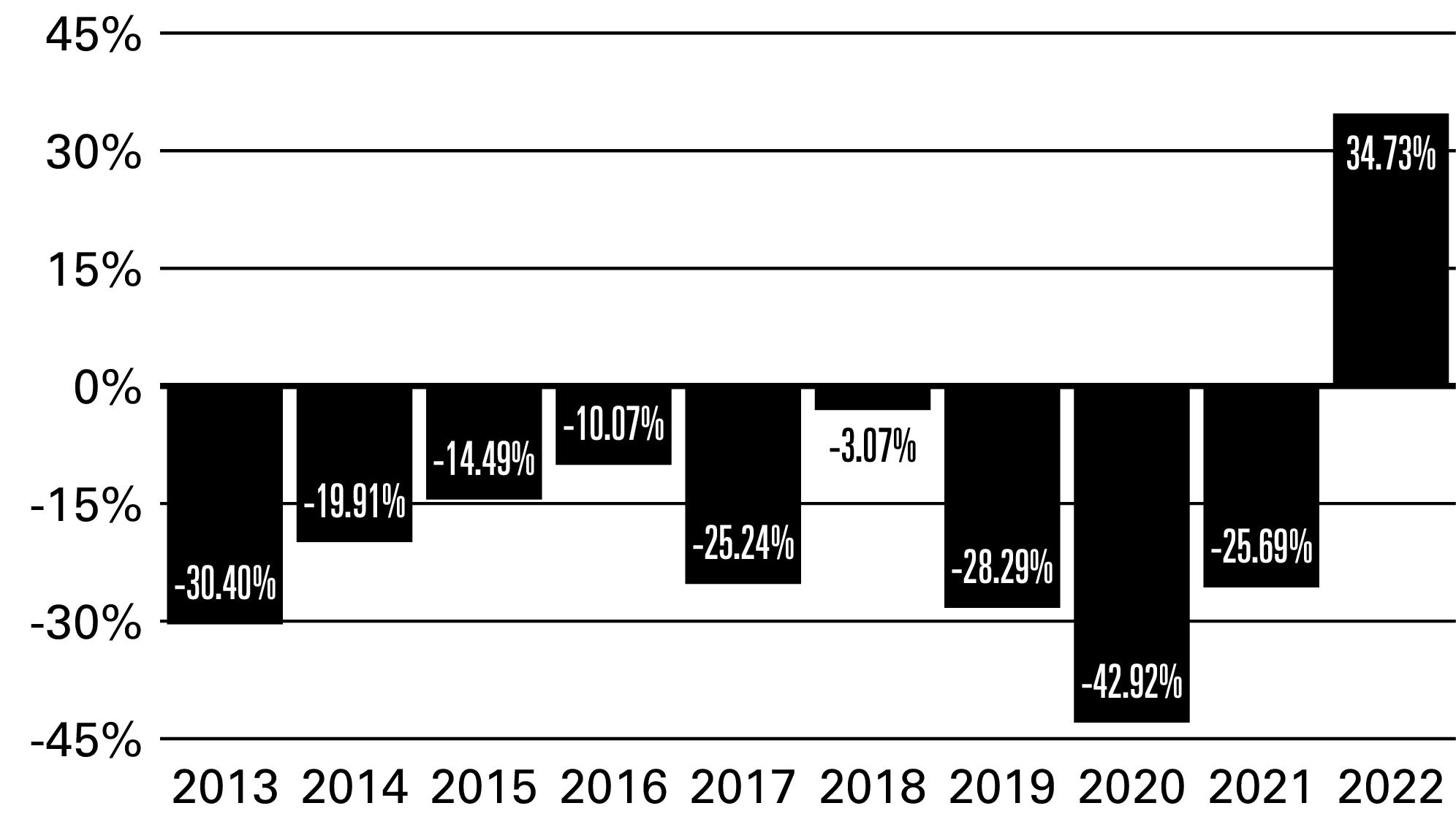

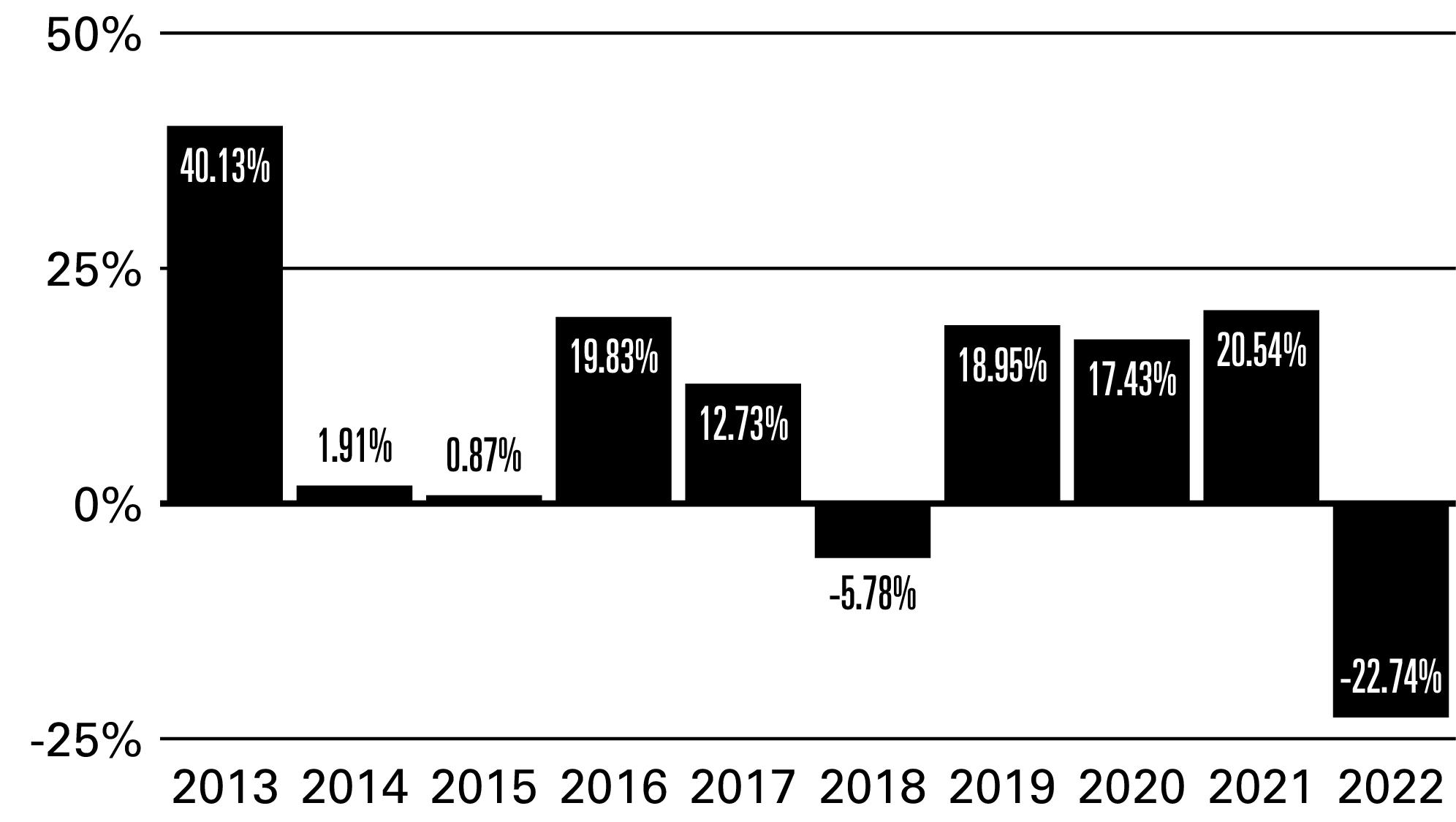

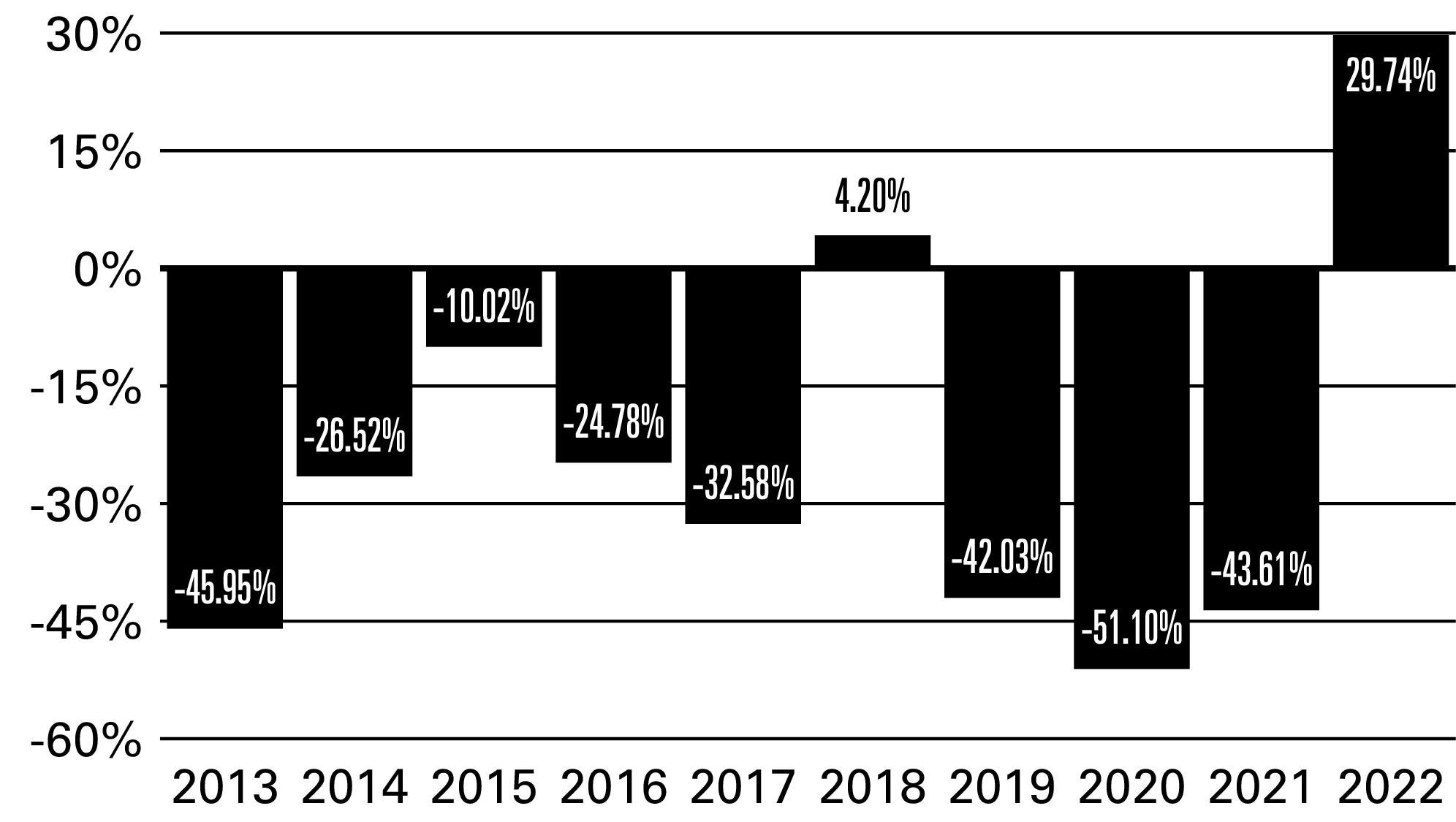

The Fund is the successor to the Access Flex Bear High Yield Fund, a series of Access One Trust (the “Predecessor Fund”), a mutual fund with identical investment objectives, policies, and restrictions, as a result of the reorganization of the Predecessor Fund into the Fund on April 23, 2021 (the “Reorganization

FUND NUMBERS :: Investor Class 111 :: Service Class 141 :: Access Flex Bear High Yield ProFund :: 7

Date”). The performance in the bar chart and table for the periods prior to the Reorganization Date is that of the Predecessor Fund.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One

Year |

Five

Years |

Ten

Years |

Inception

Date |

|

Investor Class Shares |

|

|

|

|

|

– Before Taxes |

|

- |

- |

|

|

– After Taxes on Distributions |

|

- |

- |

|

|

– After Taxes on Distributions

and Sale of Shares |

|

- |

- |

|

|

Service Class Shares |

|

- |

- |

|

|

Markit iBoxx $ Liquid High

Yield Index1 |

- |

|

|

|

1

Management

The Fund is advised by ProFund Advisors. Alexander Ilyasov, Senior Portfolio Manager, and James Linneman, Portfolio Manager, have jointly and primarily managed the Fund since April 2019 and March 2022, respectively.

Purchase and Sale of Fund Shares

The minimum initial investment amounts for all classes, which may be waived at the discretion of the Fund, are:

•$5,000 for accounts that list a financial professional.

•$15,000 for self-directed accounts.

You may purchase, redeem or exchange Fund shares on any day which the New York Stock Exchange is open for business. Depending on where your account is held, you may redeem your shares by contacting your financial professional or the Fund by mail, telephone, wire transfer or on-line (www.profunds.com).

Tax Information

The Fund’s distributions generally are taxable, and will be taxed as ordinary income, qualified dividend income or capital gains, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account. You may be taxed later upon withdrawal of monies from such tax-advantaged arrangements. The Fund intends to distribute income, if any, and capital gains, if any, at least annually.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a financial intermediary, such as a broker-dealer or investment adviser, the Fund and its distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

8 :: Access Flex High Yield ProFund :: TICKERS :: Investor Class FYAIX :: Service Class FYASX

Wire Fee $10

|

| ||

|

|

Investor

Class |

Service

Class |

|

Investment Advisory Fees |

|

|

|

Distribution and Service (12b-1) Fees |

|

|

|

Other Expenses |

|

|

|

Total Annual Fund Operating Expenses1 |

|

|

1

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Investor Class |

$ |

$ |

$ |

$ |

|

Service Class |

$ |

$ |

$ |

$ |

The Fund is actively managed and seeks to achieve returns that are not directly correlated to any particular fixed income index. The Fund invests primarily in financial instruments that ProFund Advisors believes, in combination, should provide investment results that correspond generally to the high yield market. The Fund uses the Markit iBoxx $ Liquid High Yield Index as a performance benchmark only, and does not seek to track its performance.

FUND NUMBERS :: Investor Class 110 :: Service Class 140 :: Access Flex High Yield ProFund :: 9

10 :: Access Flex High Yield ProFund :: TICKERS :: Investor Class FYAIX :: Service Class FYASX

Please see “Investment Objectives, Principal Investment Strategies and Related Risks” in the Fund’s Prospectus for additional details.

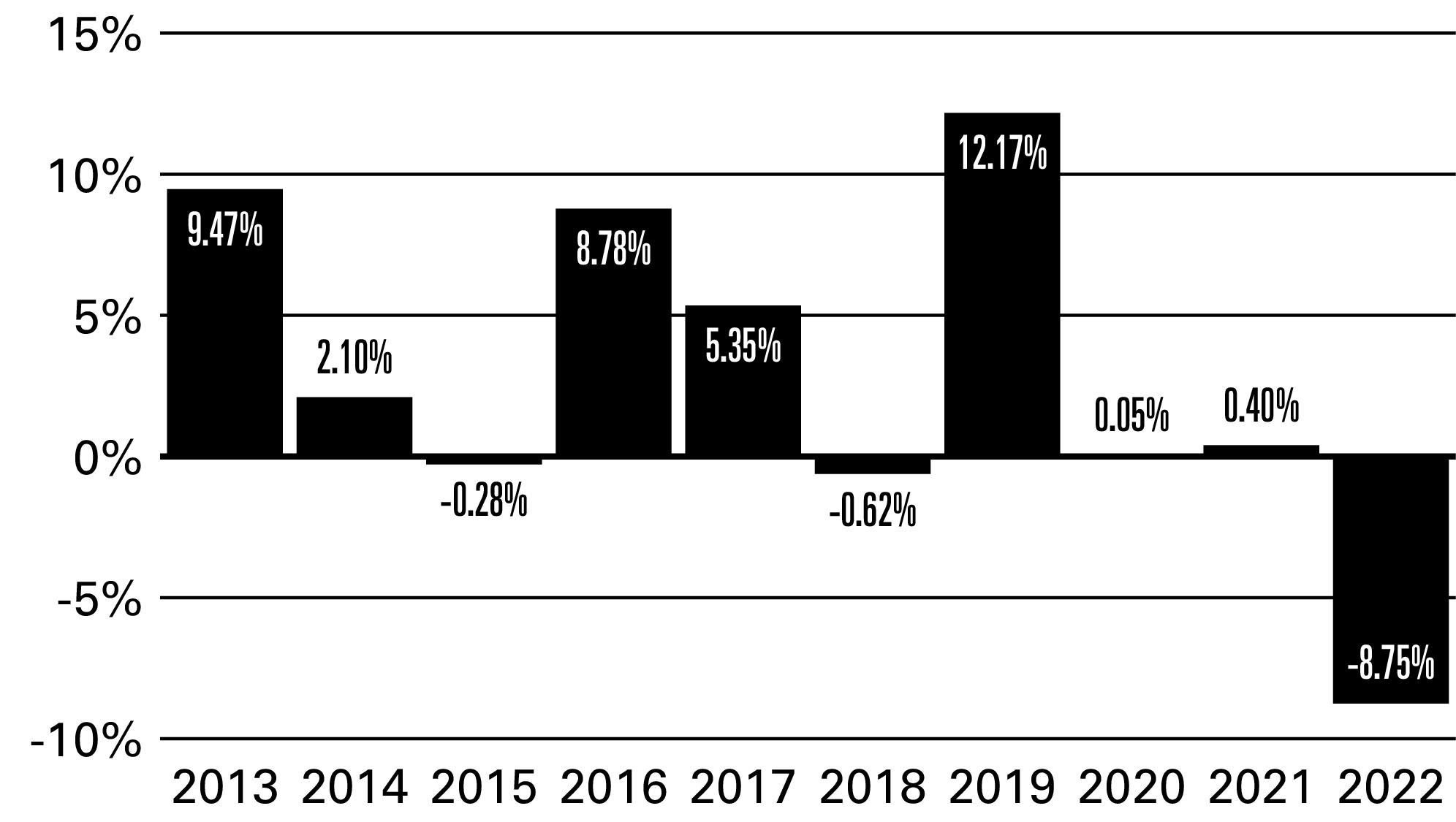

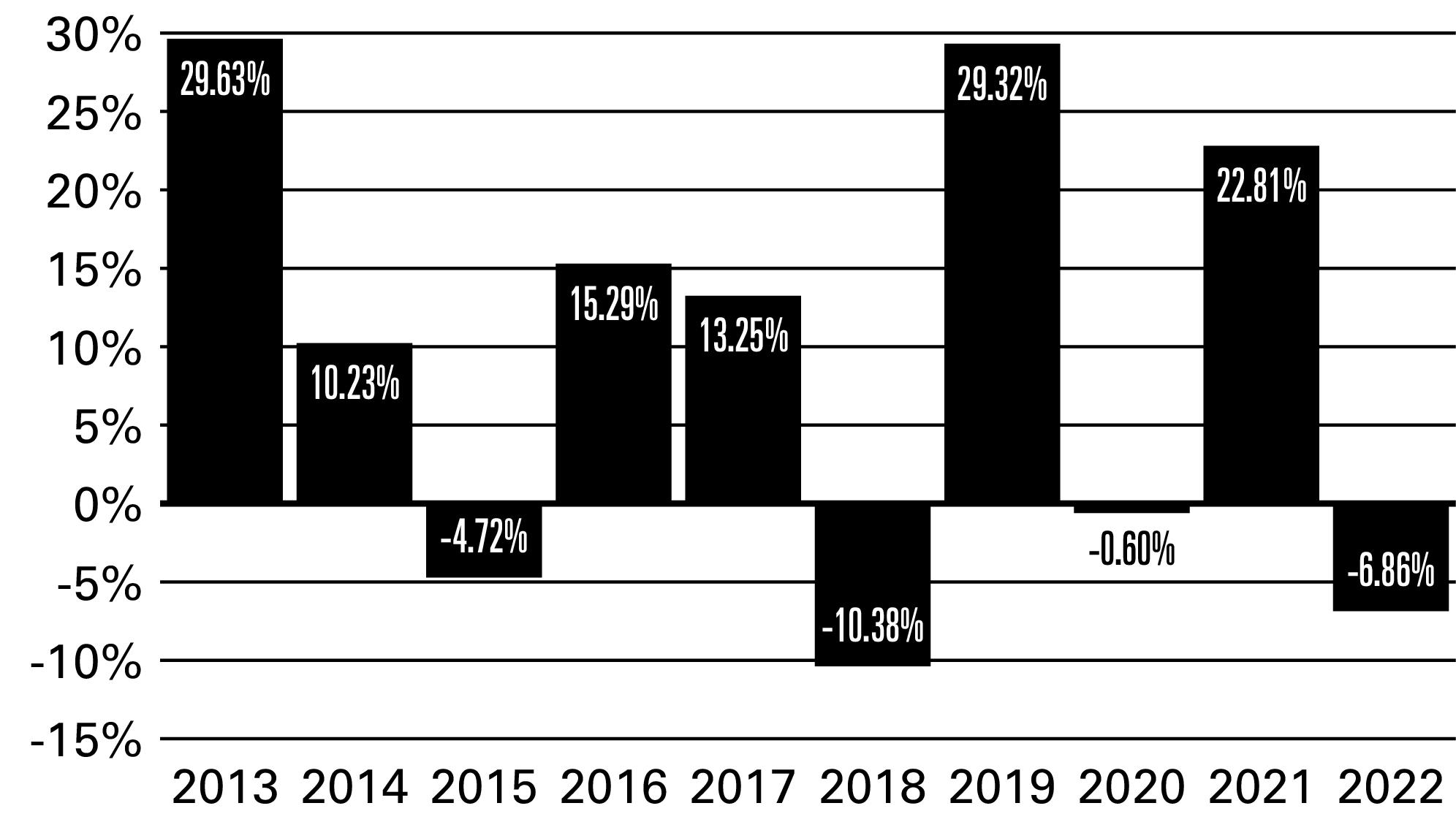

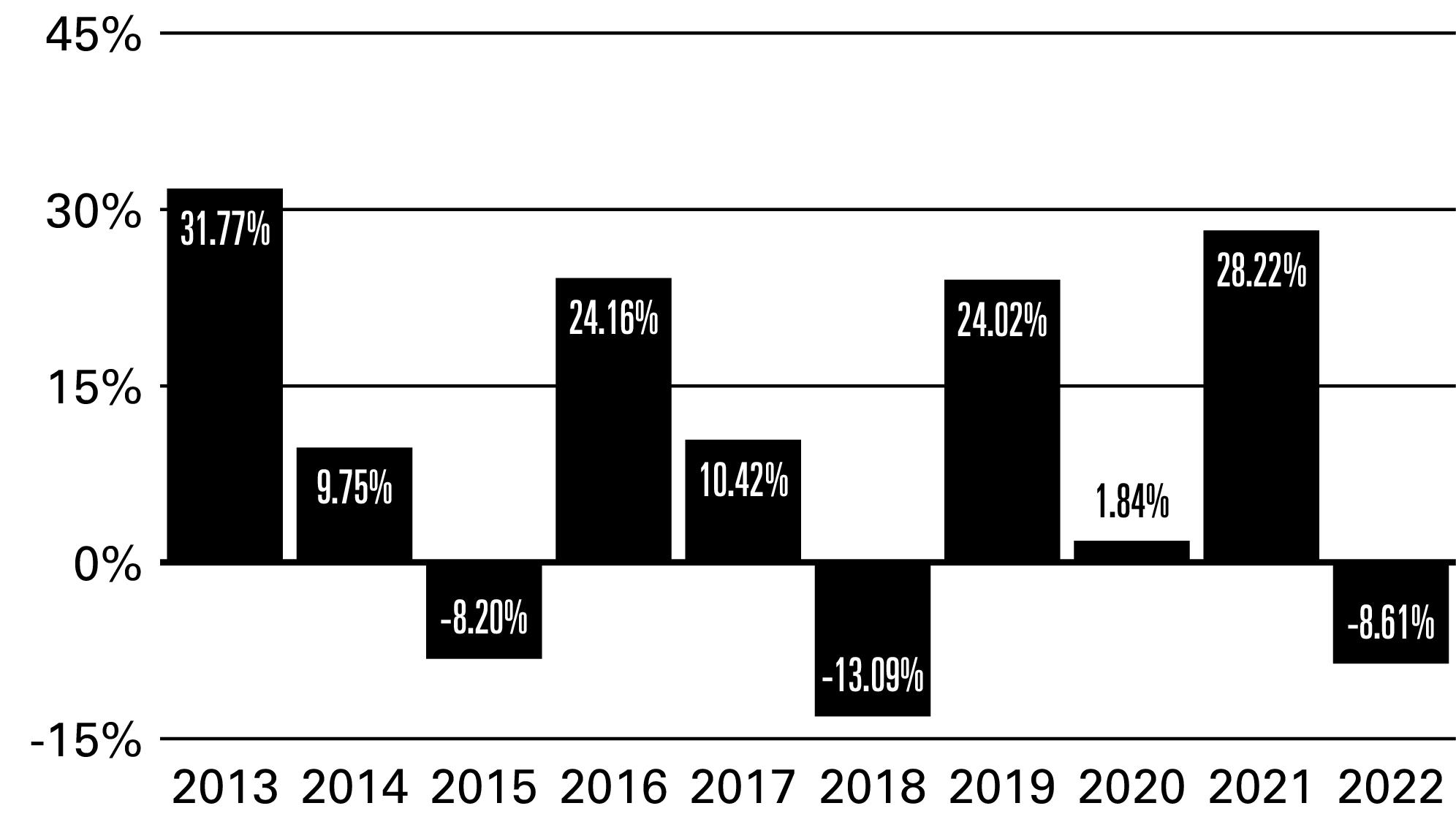

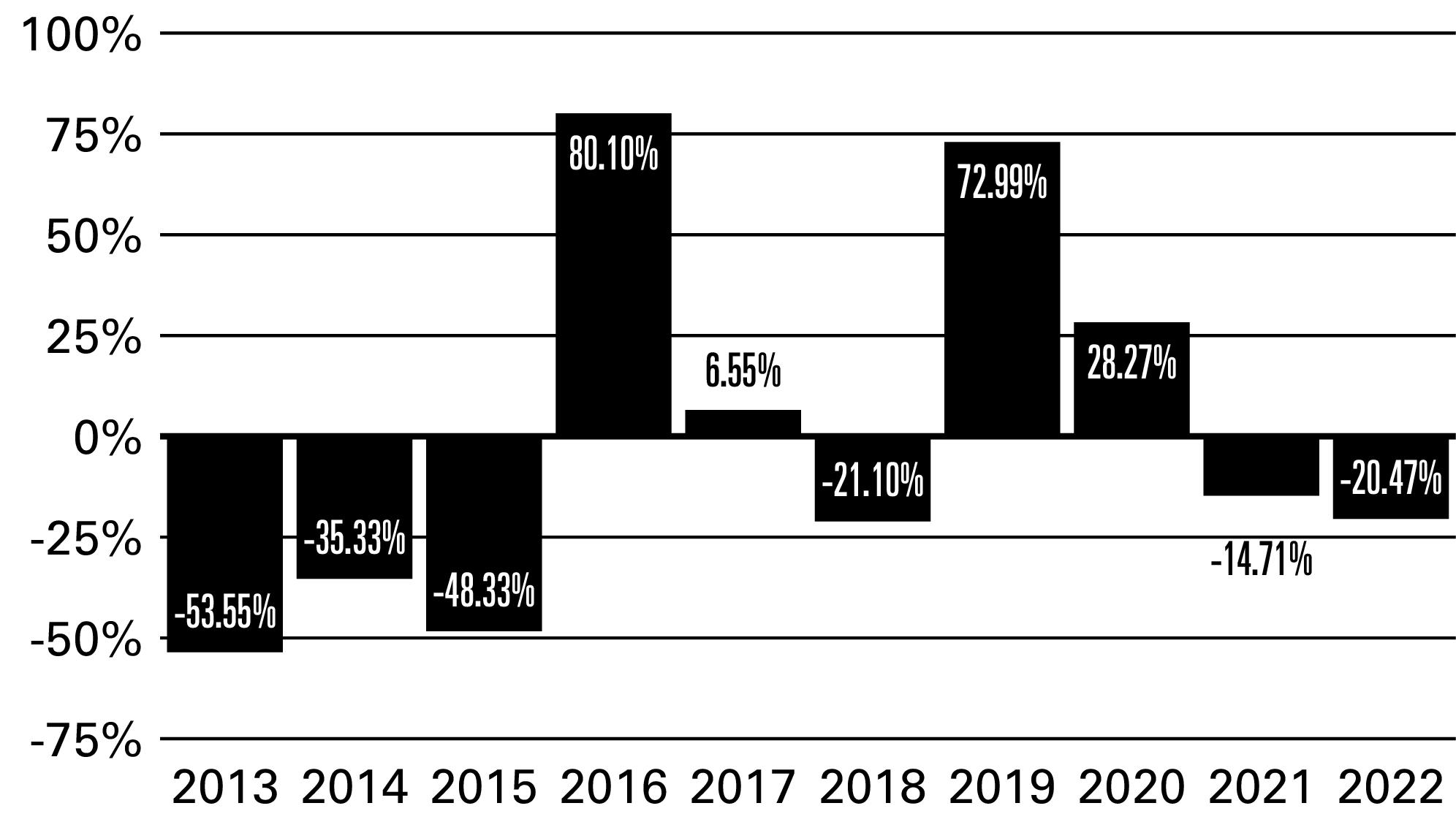

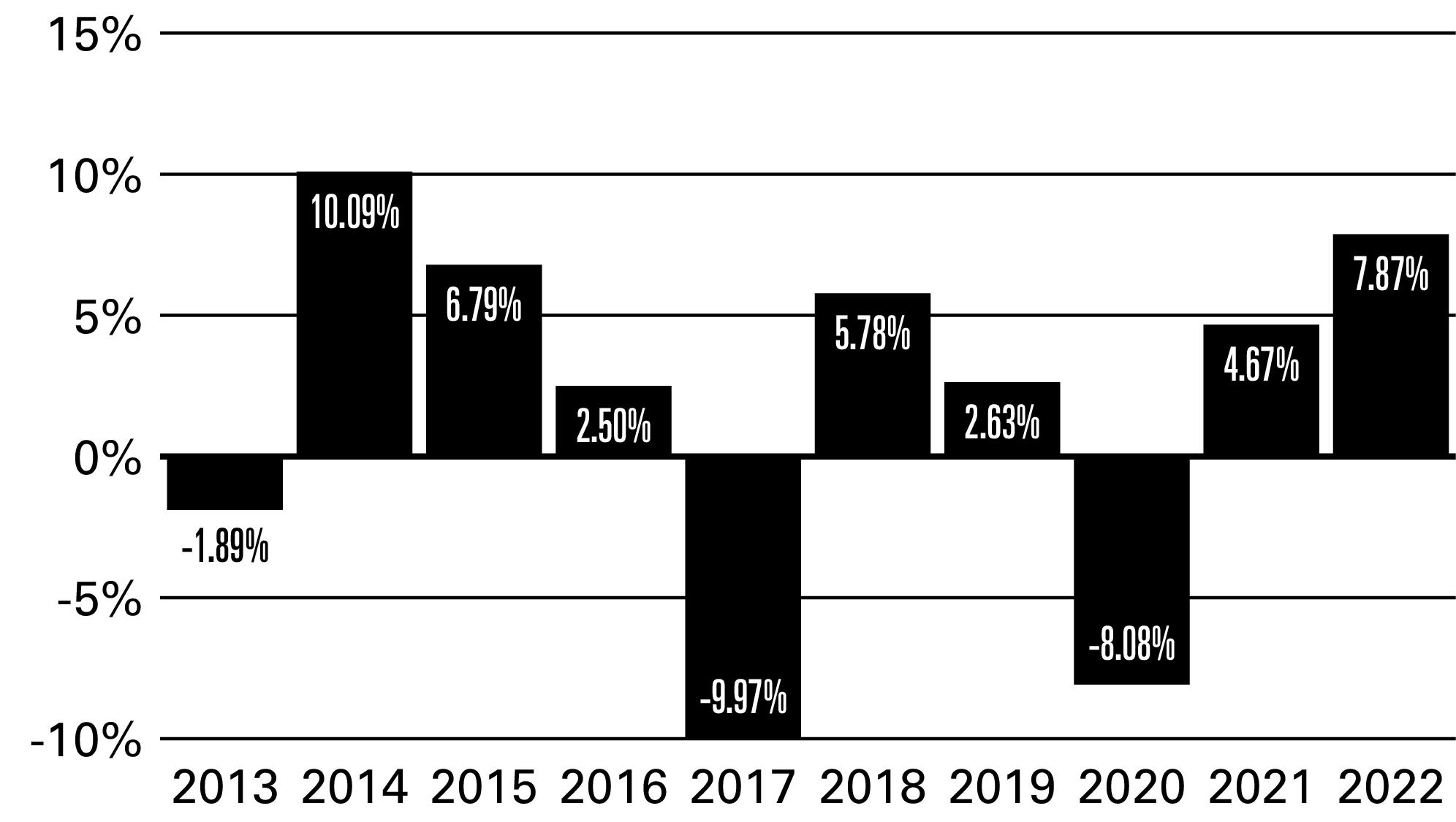

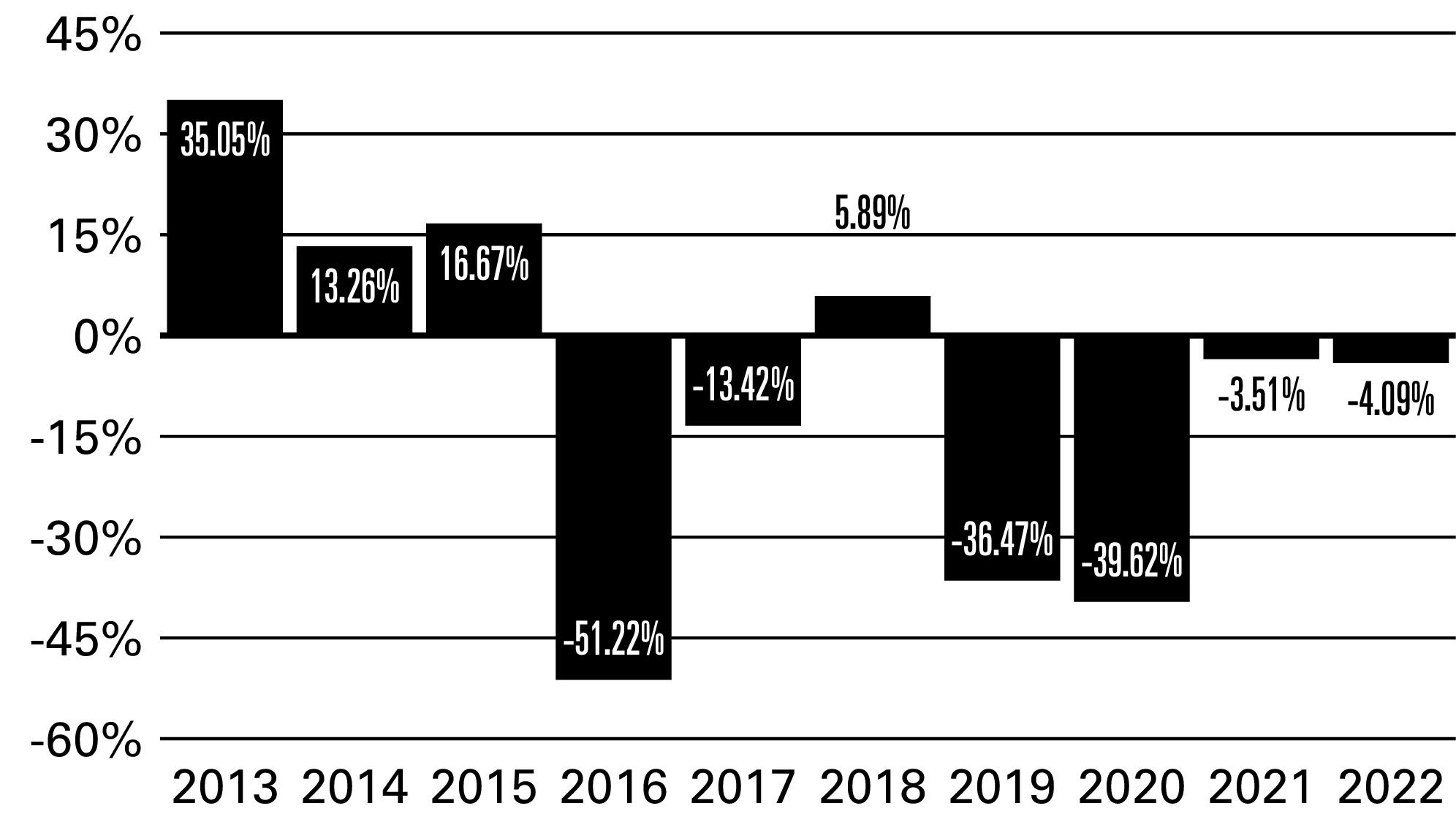

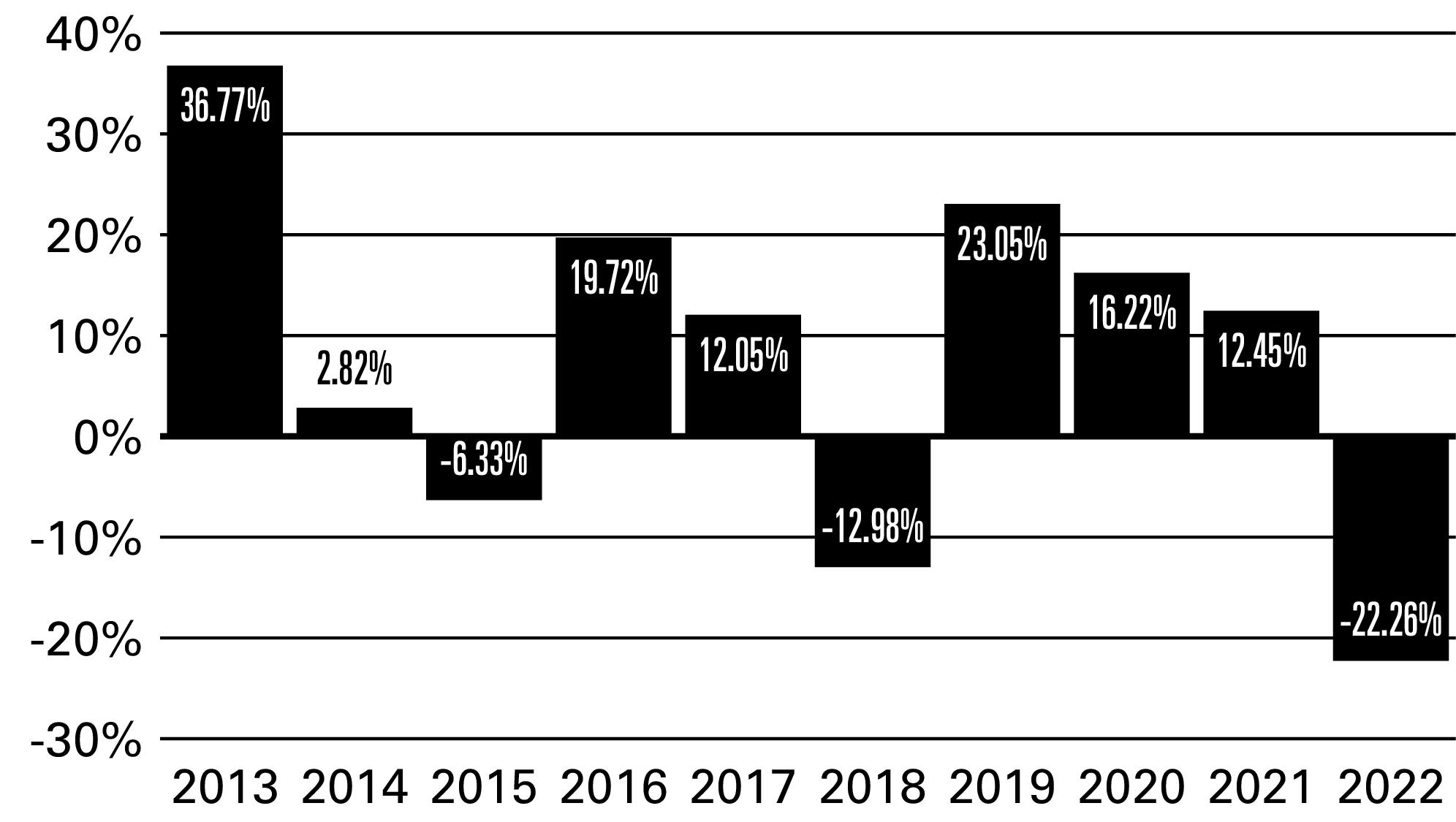

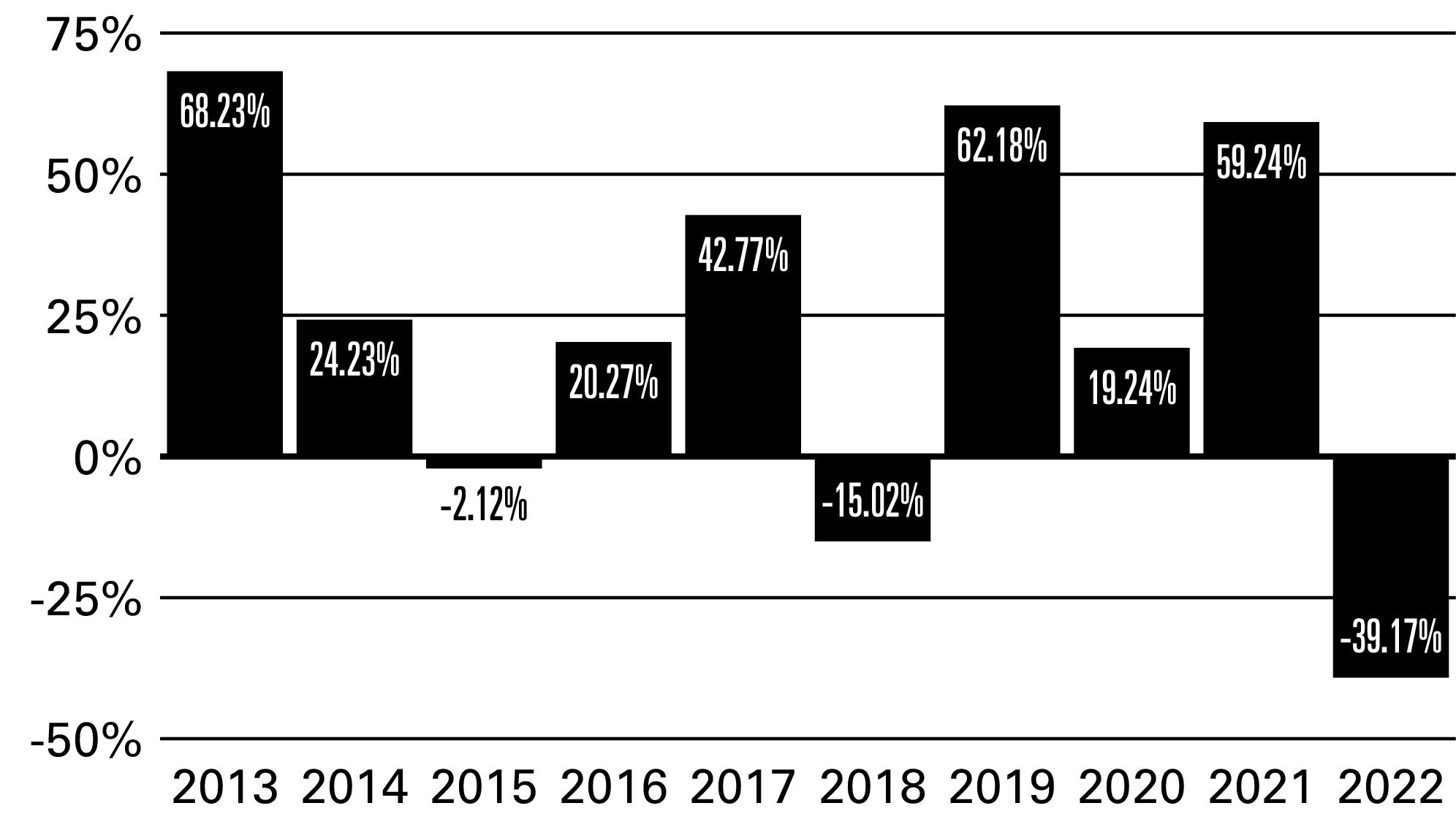

The Fund is the successor to the Access Flex High Yield Fund, a series of Access One Trust (the “Predecessor Fund”), a mutual fund with identical investment objectives, policies, and restrictions, as a result of the reorganization of the Predecessor Fund into the Fund on April 23, 2021 (the “Reorganization Date”). The performance in the bar chart and table for the periods prior to the Reorganization Date is that of the Predecessor Fund.

FUND NUMBERS :: Investor Class 110 :: Service Class 140 :: Access Flex High Yield ProFund :: 11

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One

Year |

Five

Years |

Ten

Years |

Inception

Date |

|

Investor Class Shares |

|

|

|

|

|

– Before Taxes |

- |

|

|

|

|

– After Taxes on Distributions |

- |

- |

|

|

|

– After Taxes on Distributions

and Sale of Shares |

- |

- |

|

|

|

Service Class Shares |

- |

- |

|

|

|

Markit iBoxx $ Liquid High

Yield Index1 |

- |

|

|

|

1

Management

The Fund is advised by ProFund Advisors. Alexander Ilyasov, Senior Portfolio Manager, and James Linneman, Portfolio Manager, have jointly and primarily managed the Fund since April 2019 and March 2022, respectively.

Purchase and Sale of Fund Shares

The minimum initial investment amounts for all classes, which may be waived at the discretion of the Fund, are:

•$5,000 for accounts that list a financial professional.

•$15,000 for self-directed accounts.

You may purchase, redeem or exchange Fund shares on any day which the New York Stock Exchange is open for business. Depending on where your account is held, you may redeem your shares by contacting your financial professional or the Fund by mail, telephone, wire transfer or on-line (www.profunds.com).

Tax Information

The Fund’s distributions generally are taxable, and will be taxed as ordinary income, qualified dividend income or capital gains, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account. You may be taxed later upon withdrawal of monies from such tax-advantaged arrangements. The Fund intends to distribute income, if any, quarterly, and capital gains, if any, at least annually.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a financial intermediary, such as a broker-dealer or investment adviser, the Fund and its distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

12 :: Banks UltraSector ProFund :: TICKERS :: Investor Class BKPIX :: Service Class BKPSX

Wire Fee $10

|

| ||

|

|

Investor

Class |

Service

Class |

|

Investment Advisory Fees |

|

|

|

Distribution and Service (12b-1) Fees |

|

|

|

Other Expenses |

|

|

|

Total Annual Fund Operating Expenses

Before Fee Waivers and Expense

Reimbursements |

|

|

|

Fee Waivers/Reimbursements1 |

- |

- |

|

Total Annual Fund Operating Expenses

After Fee Waivers and Expense

Reimbursements |

|

|

1

FUND NUMBERS :: Investor Class 059 :: Service Class 089 :: Banks UltraSector ProFund :: 13

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Investor Class |

$ |

$ |

$ |

$ |

|

Service Class |

$ |

$ |

$ |

$ |

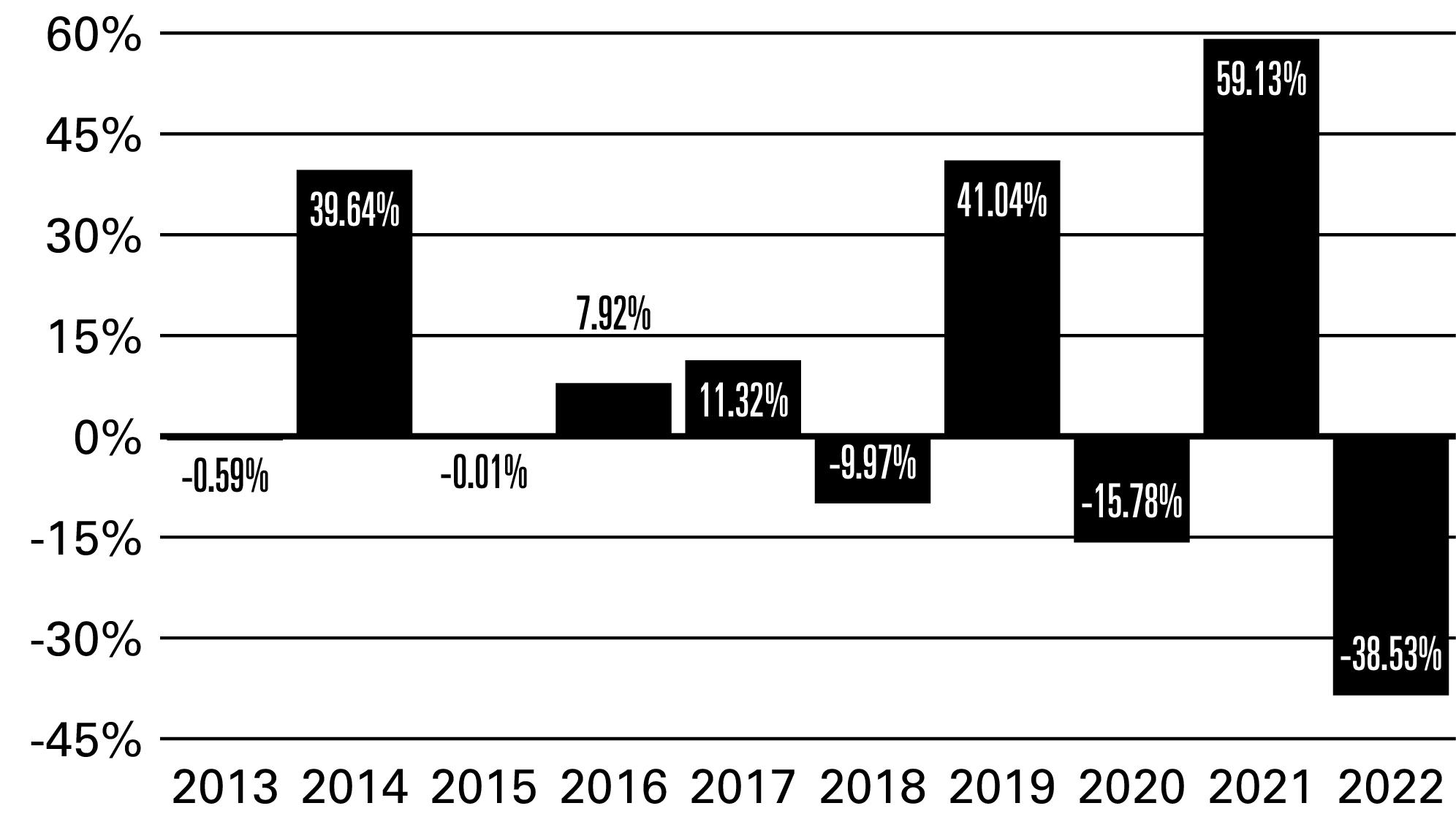

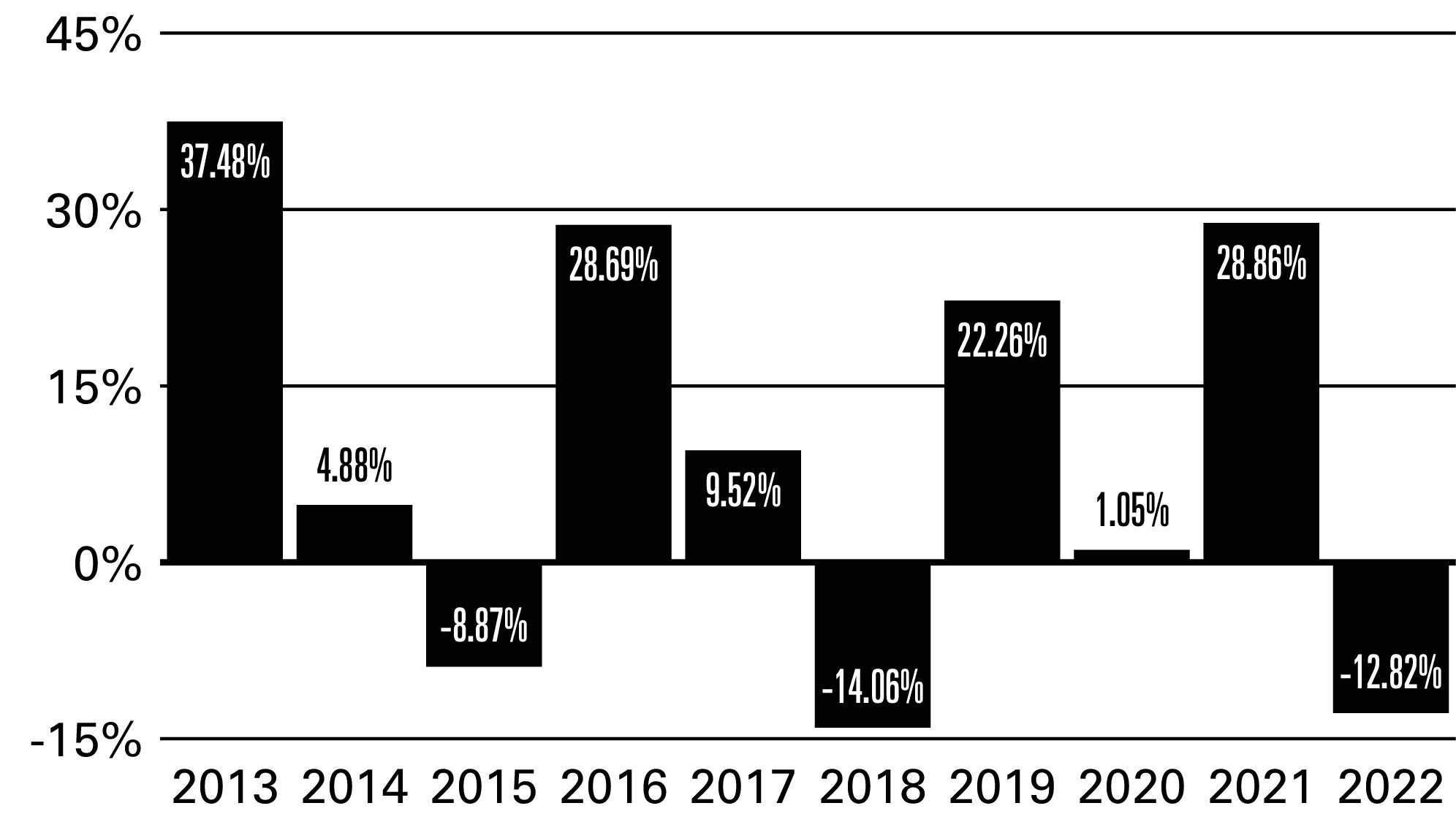

14 :: Banks UltraSector ProFund :: TICKERS :: Investor Class BKPIX :: Service Class BKPSX

|

| ||||||

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FUND NUMBERS :: Investor Class 059 :: Service Class 089 :: Banks UltraSector ProFund :: 15

16 :: Banks UltraSector ProFund :: TICKERS :: Investor Class BKPIX :: Service Class BKPSX

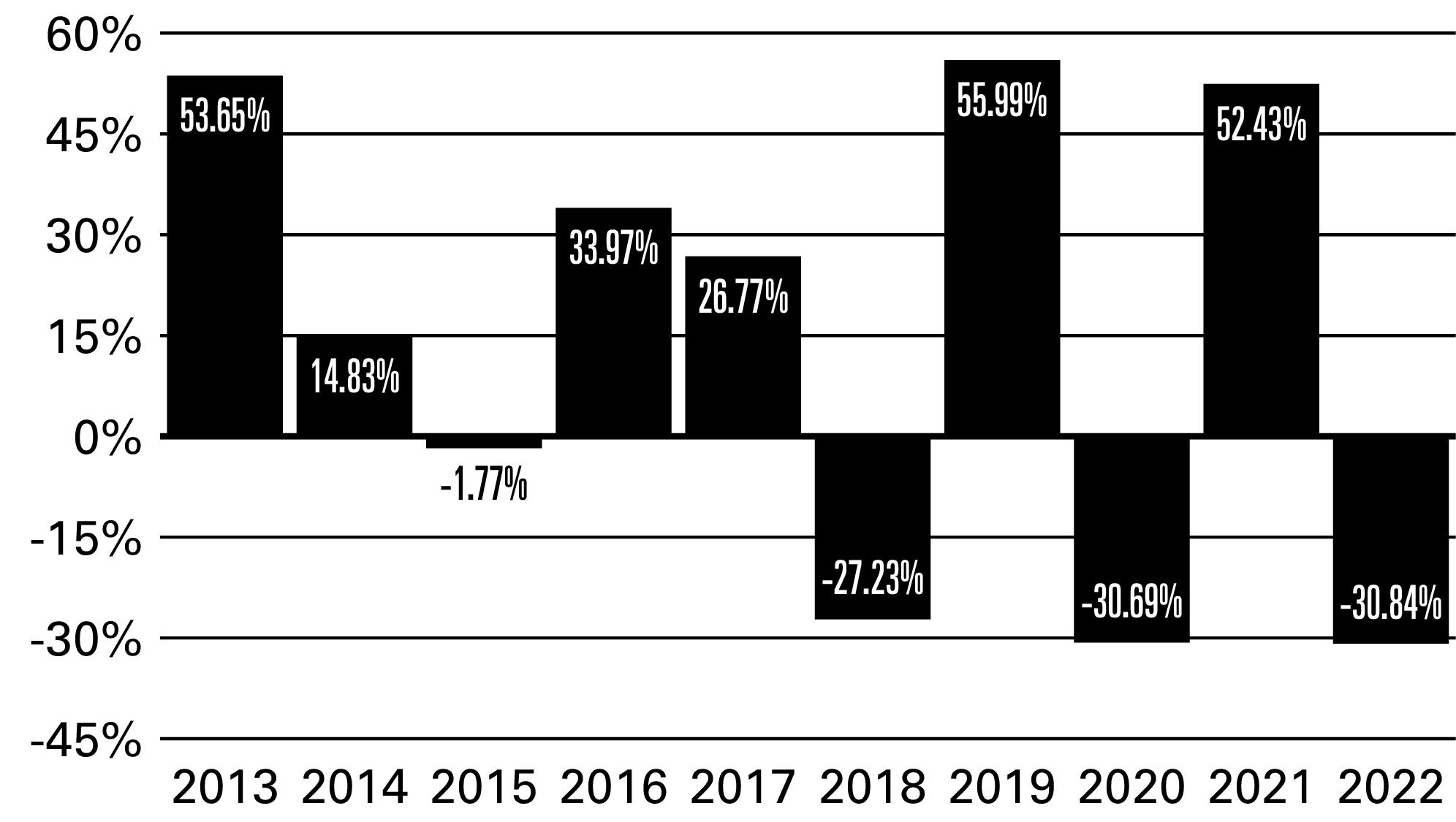

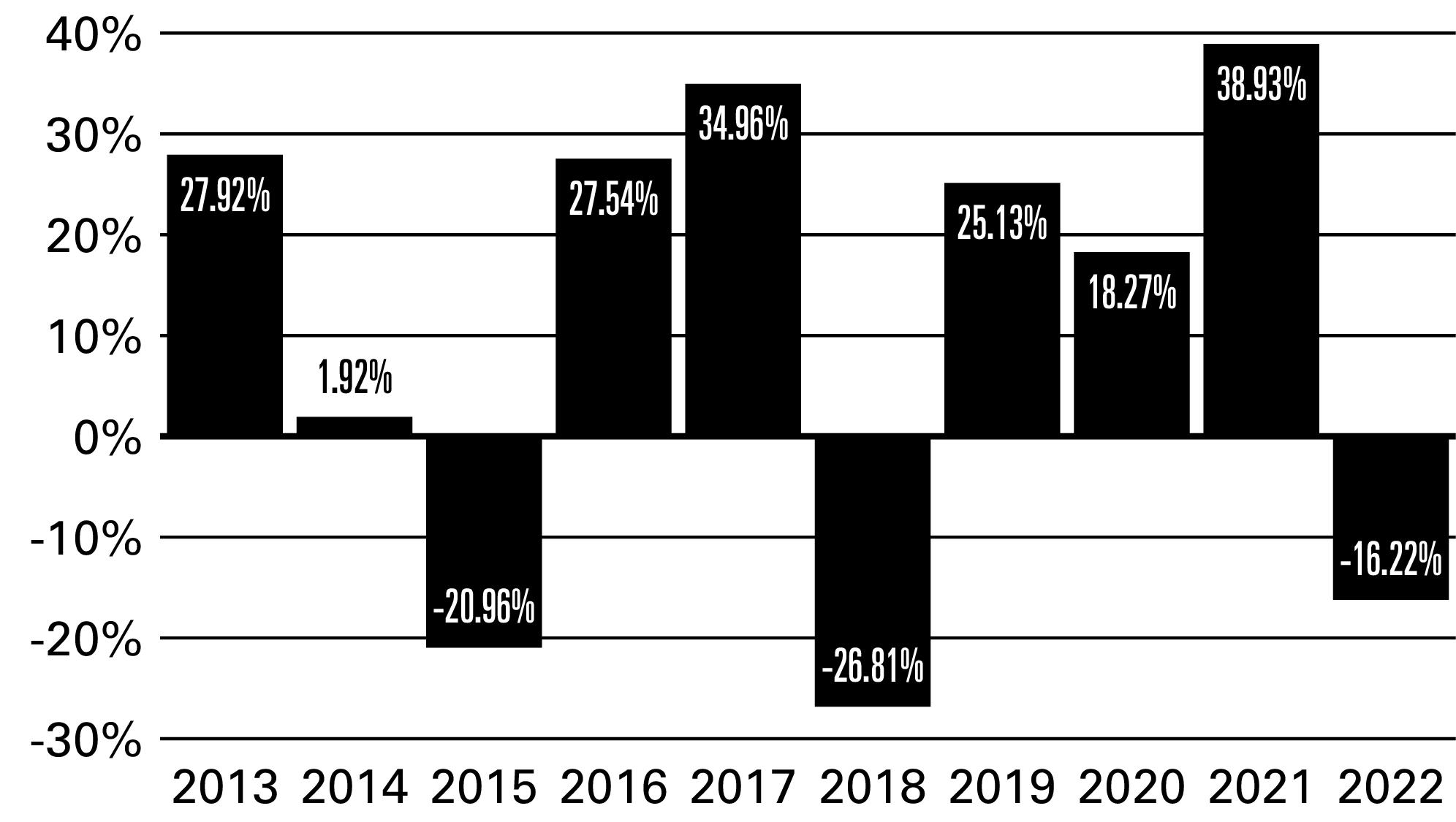

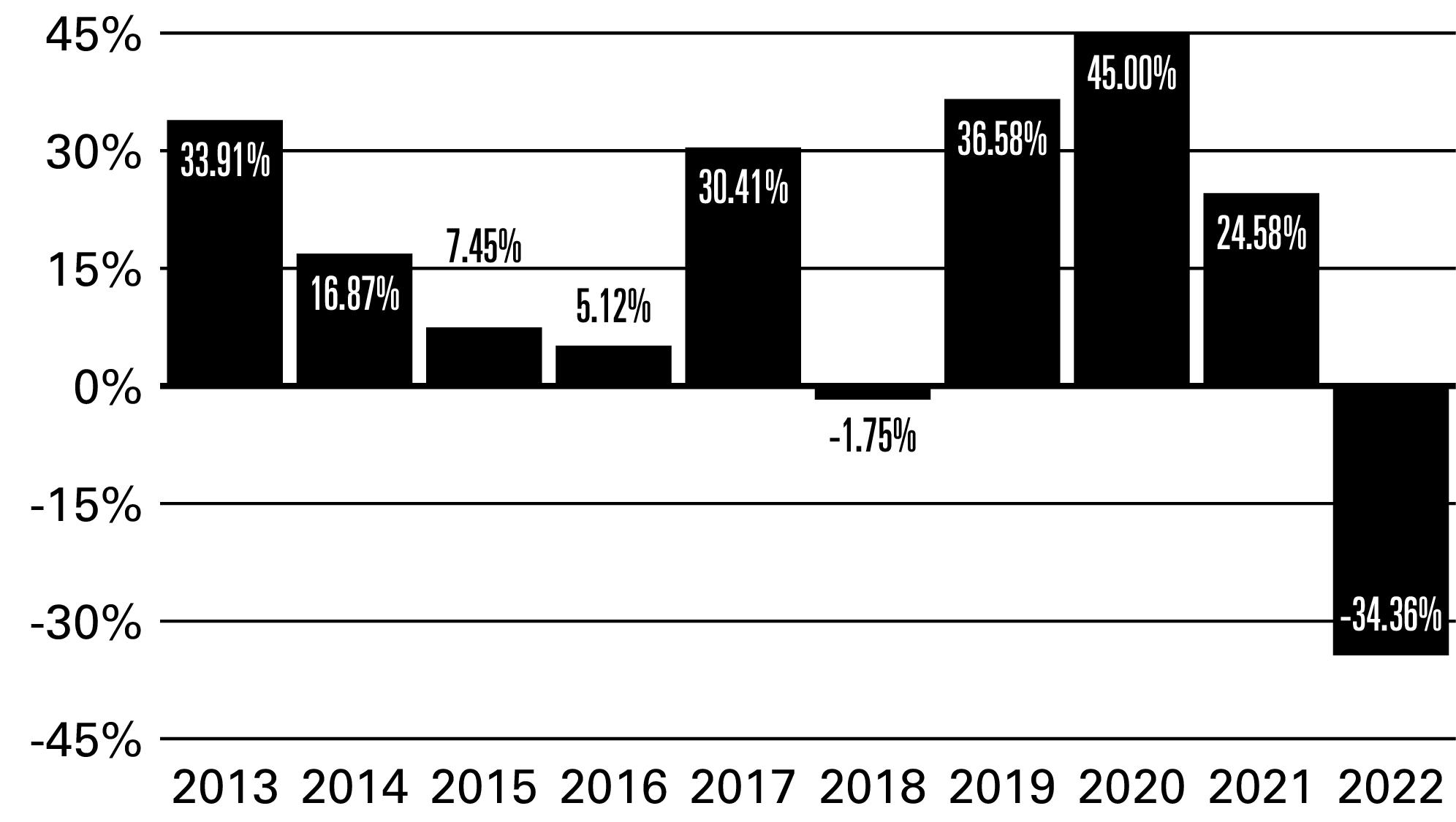

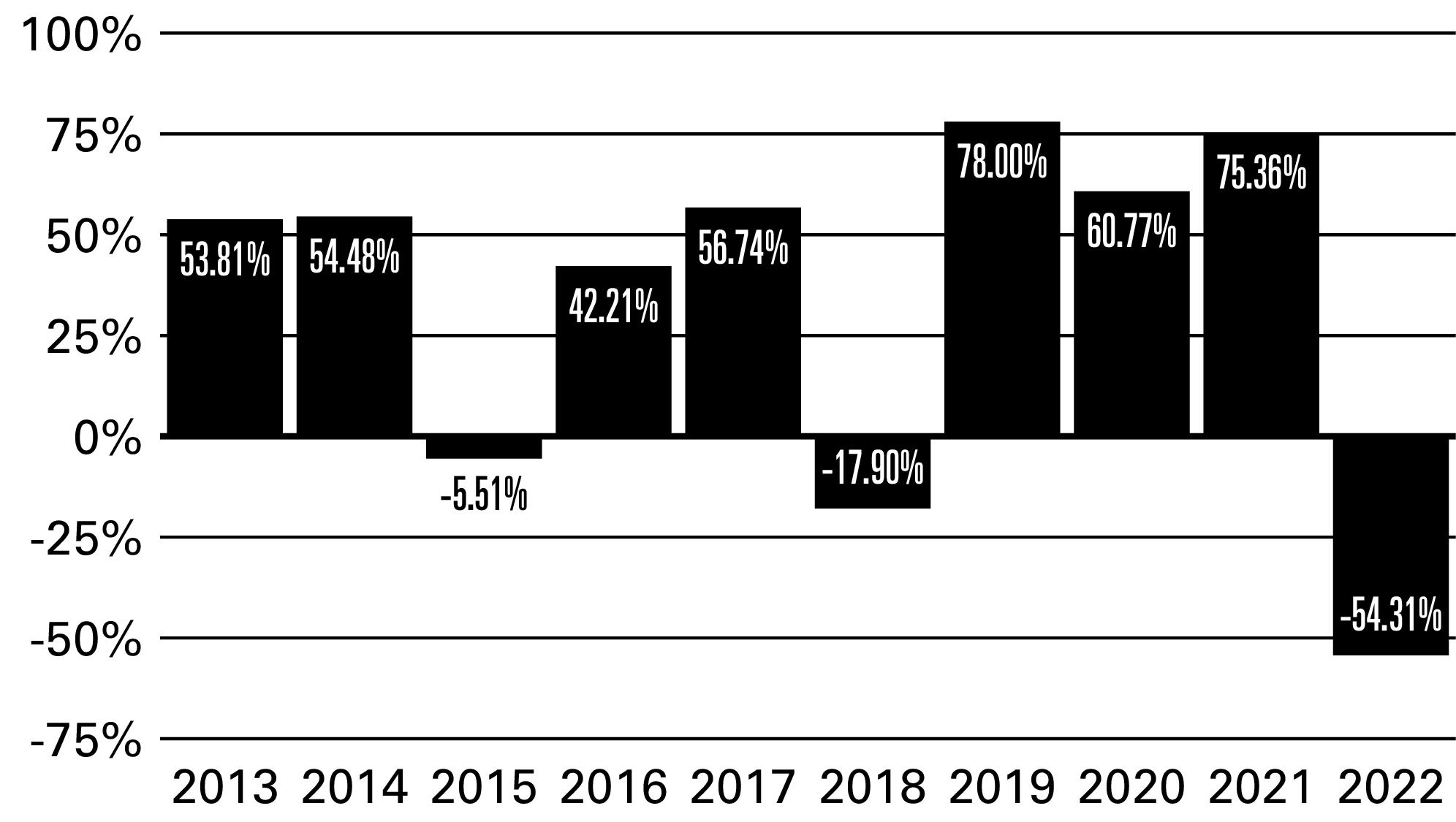

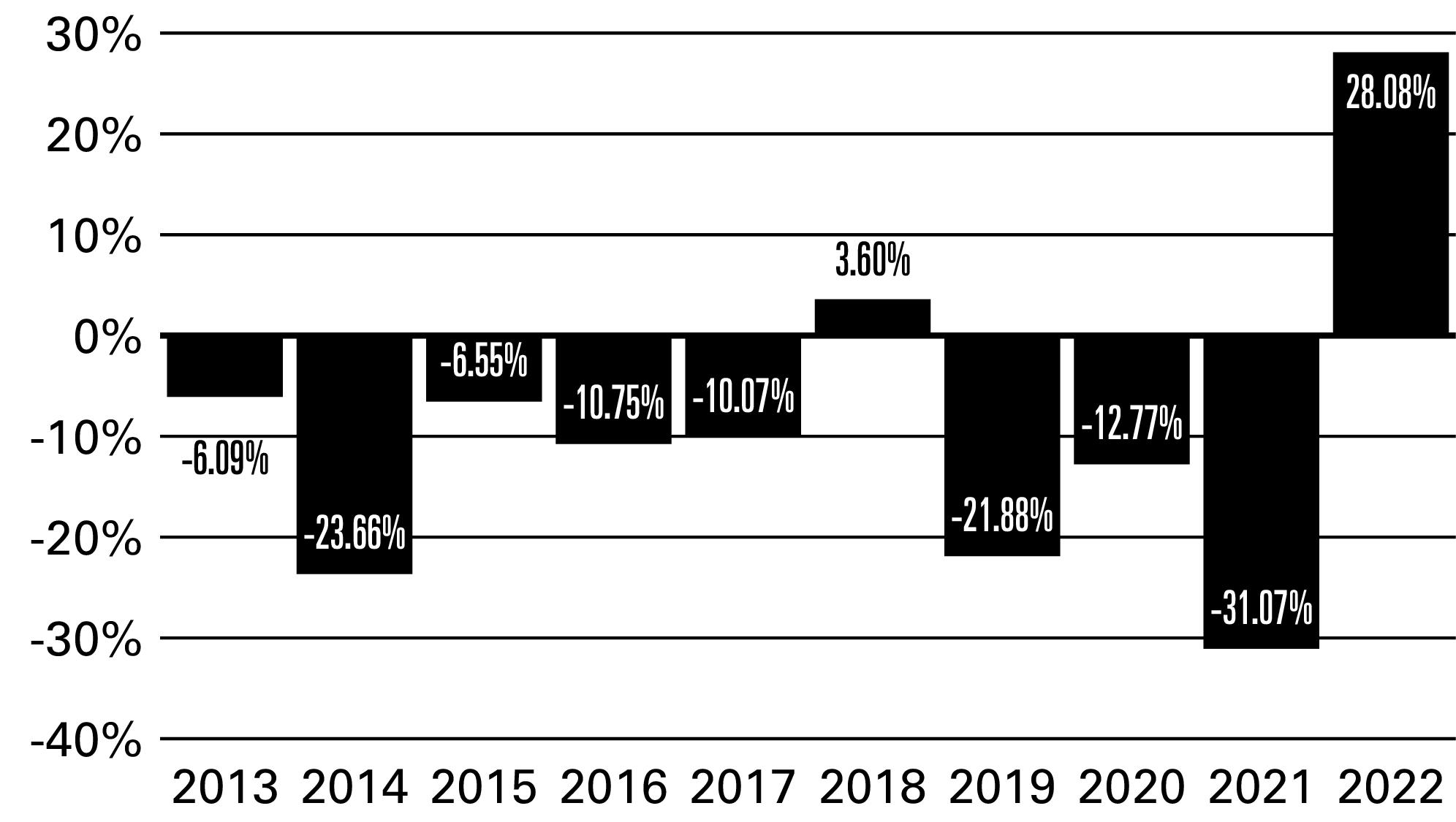

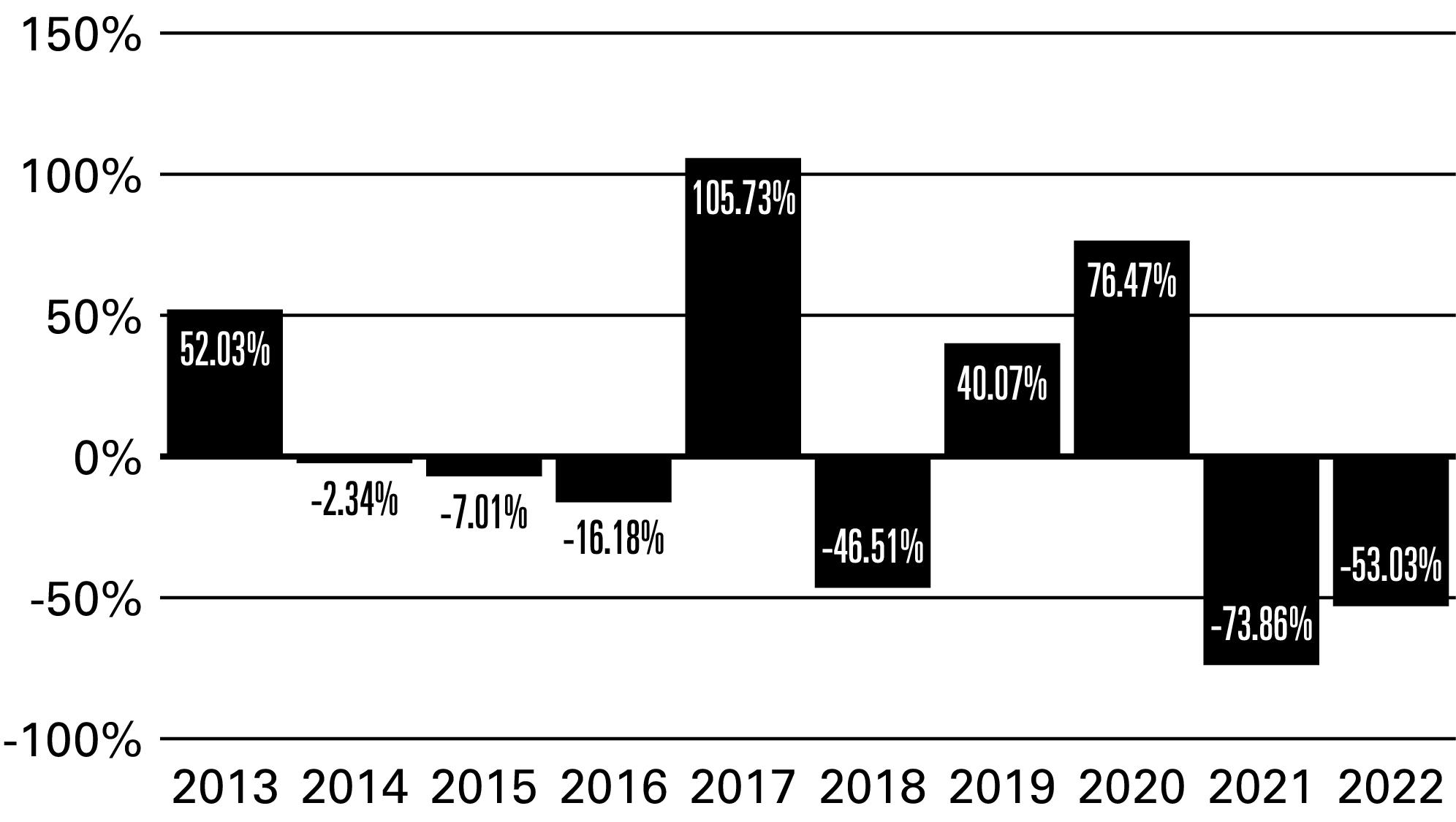

Please see “Investment Objectives, Principal Investment Strategies and Related Risks” in the Fund’s Prospectus for additional details.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One

Year |

Five

Years |

Ten

Years |

Inception

Date |

|

Investor Class Shares |

|

|

|

|

|

– Before Taxes |

- |

- |

|

|

|

– After Taxes on Distributions |

- |

- |

|

|

|

– After Taxes on Distributions

and Sale of Shares |

- |

- |

|

|

|

Service Class Shares |

- |

- |

|

|

|

S&P Banks Select Industry

Index1 |

- |

|

|

|

|

Dow Jones U.S. BanksSM

Index1,2 |

- |

|

|

|

|

S&P 500®1 |

- |

|

|

|

1

2

Management

The Fund is advised by ProFund Advisors. Michael Neches, Senior Portfolio Manager, and Tarak Davé, Portfolio Manager, have

FUND NUMBERS :: Investor Class 059 :: Service Class 089 :: Banks UltraSector ProFund :: 17

jointly and primarily managed the Fund since October 2013 and April 2018, respectively.

Purchase and Sale of Fund Shares

The minimum initial investment amounts for all classes, which may be waived at the discretion of the Fund, are:

•$5,000 for accounts that list a financial professional.

•$15,000 for self-directed accounts.

You may purchase, redeem or exchange Fund shares on any day which the New York Stock Exchange is open for business. Depending on where your account is held, you may redeem your shares by contacting your financial professional or the Fund by mail, telephone, wire transfer or on-line (www.profunds.com).

Tax Information

The Fund’s distributions generally are taxable, and will be taxed as ordinary income, qualified dividend income or capital gains,

unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account. You may be taxed later upon withdrawal of monies from such tax-advantaged arrangements. The Fund intends to distribute income, if any, and capital gains, if any, at least annually.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a financial intermediary, such as a broker-dealer or investment adviser, the Fund and its distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

18 :: Bear ProFund :: TICKERS :: Investor Class BRPIX :: Service Class BRPSX

Wire Fee $10

|

| ||

|

|

Investor

Class |

Service

Class |

|

Investment Advisory Fees |

|

|

|

Distribution and Service (12b-1) Fees |

|

|

|

Other Expenses |

|

|

|

Total Annual Fund Operating Expenses

Before Fee Waivers and Expense

Reimbursements |

|

|

|

Fee Waivers/Reimbursements1 |

- |

- |

|

Total Annual Fund Operating Expenses

After Fee Waivers and Expense

Reimbursements |

|

|

1

FUND NUMBERS :: Investor Class 006 :: Service Class 026 :: Bear ProFund :: 19

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Investor Class |

$ |

$ |

$ |

$ |

|

Service Class |

$ |

$ |

$ |

$ |

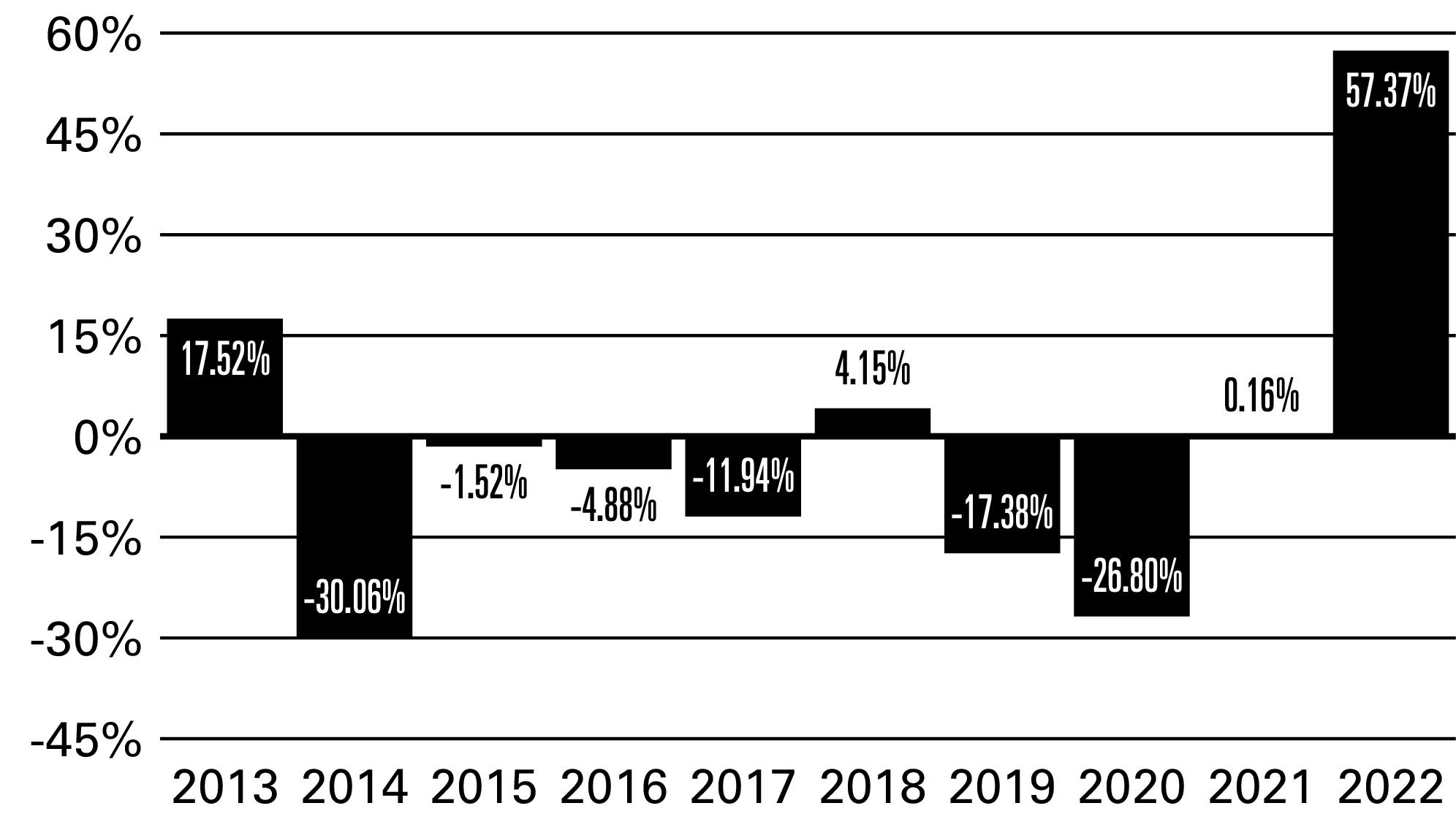

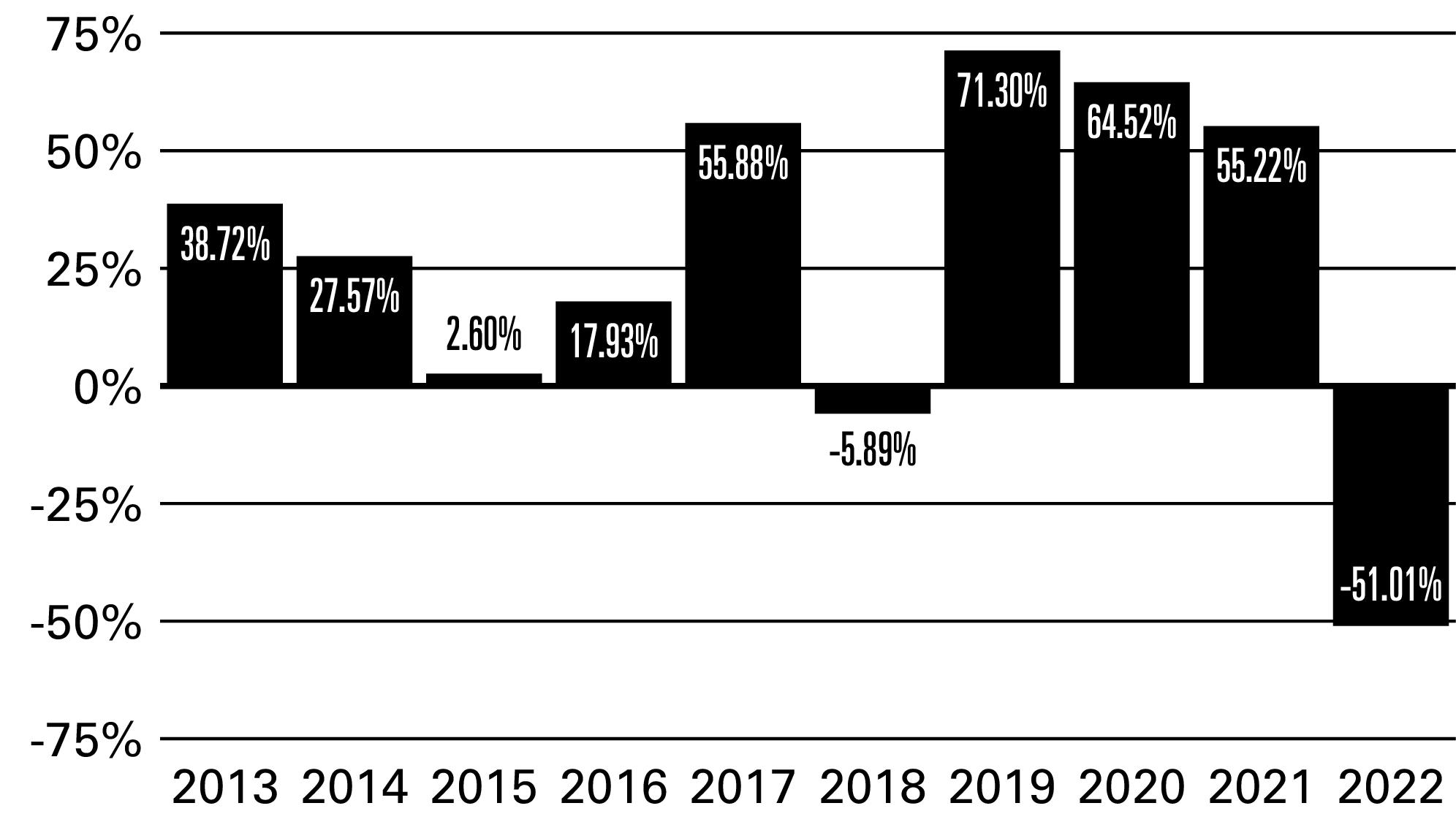

20 :: Bear ProFund :: TICKERS :: Investor Class BRPIX :: Service Class BRPSX

|

| ||||||

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FUND NUMBERS :: Investor Class 006 :: Service Class 026 :: Bear ProFund :: 21

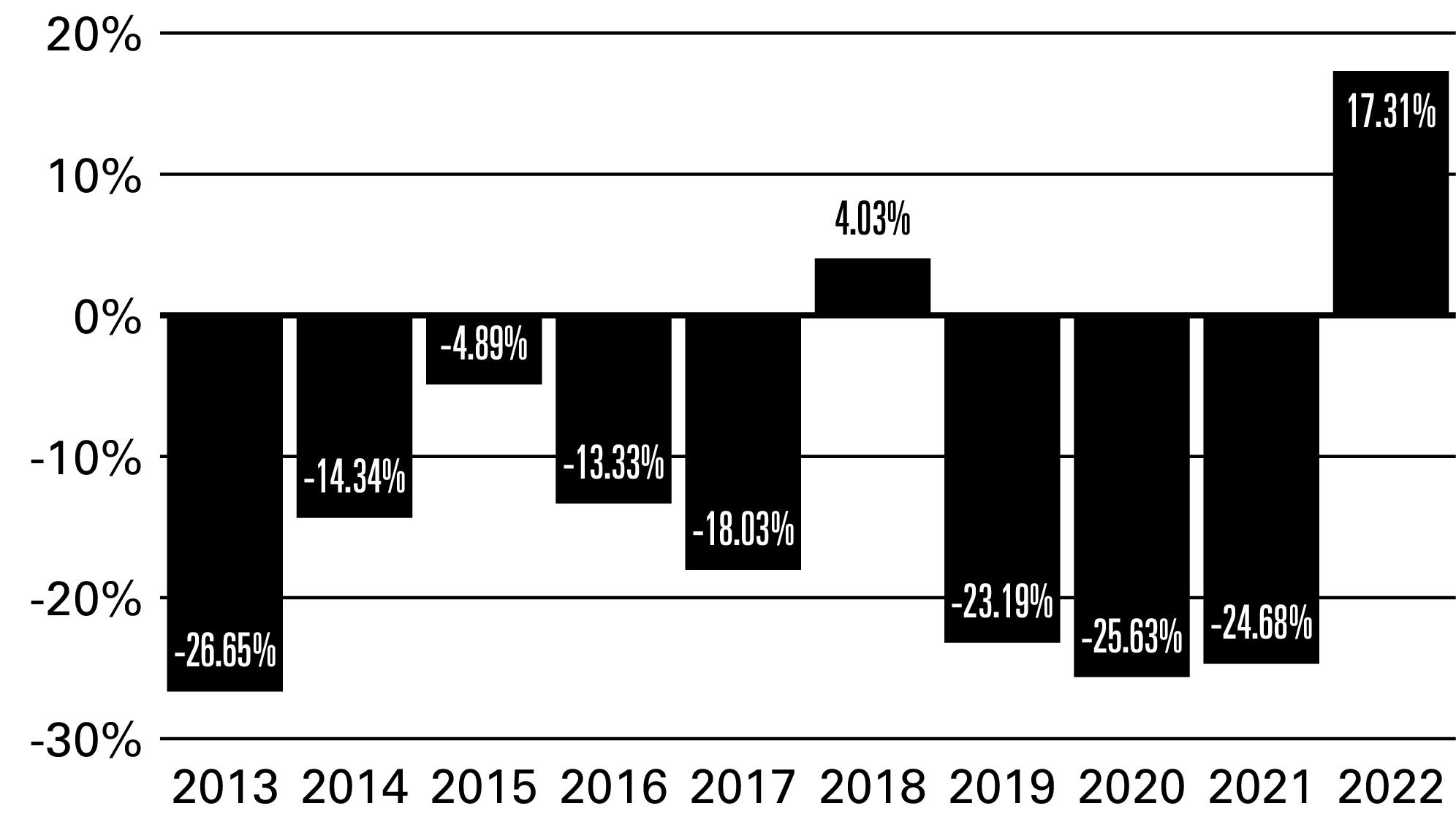

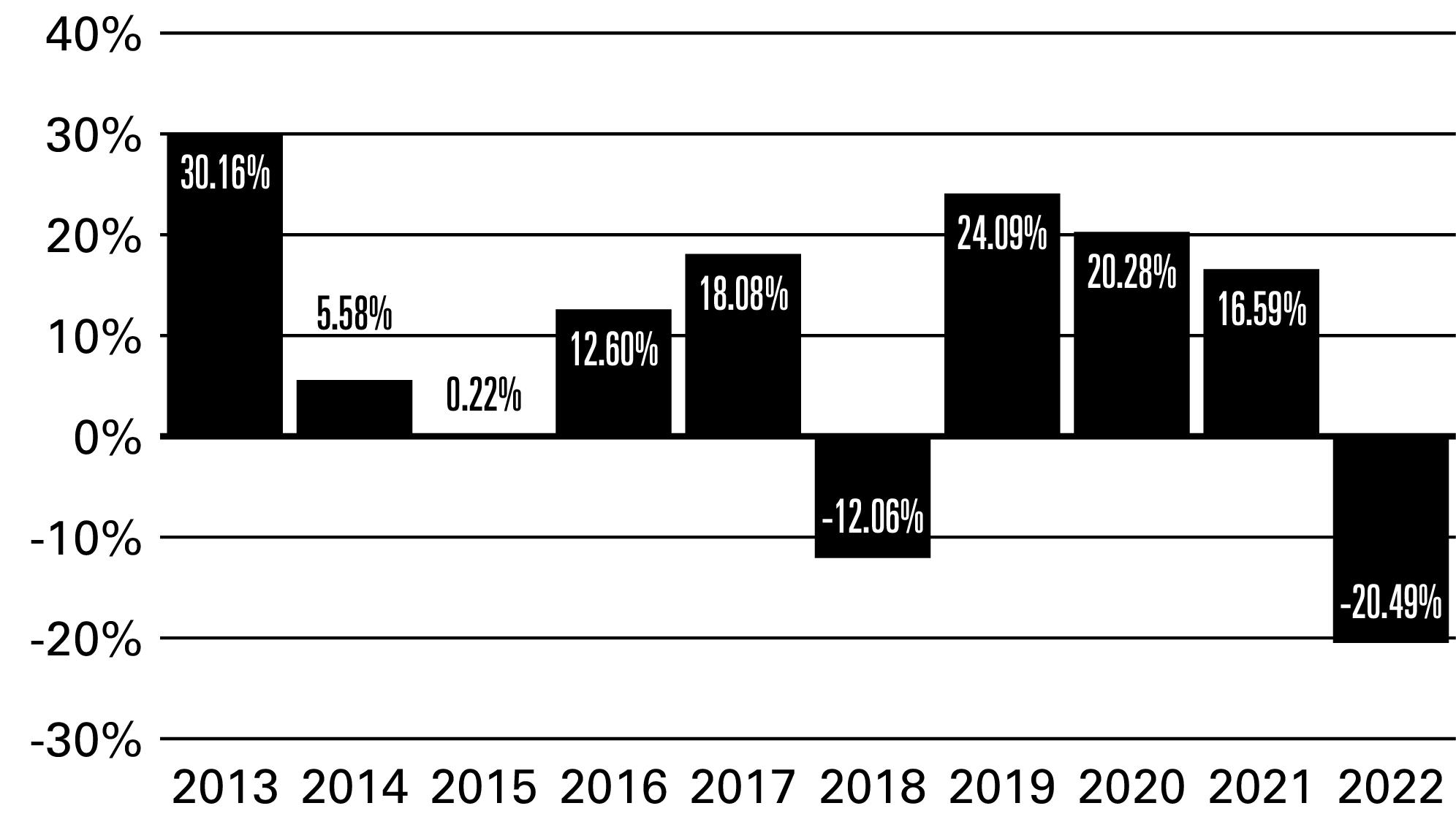

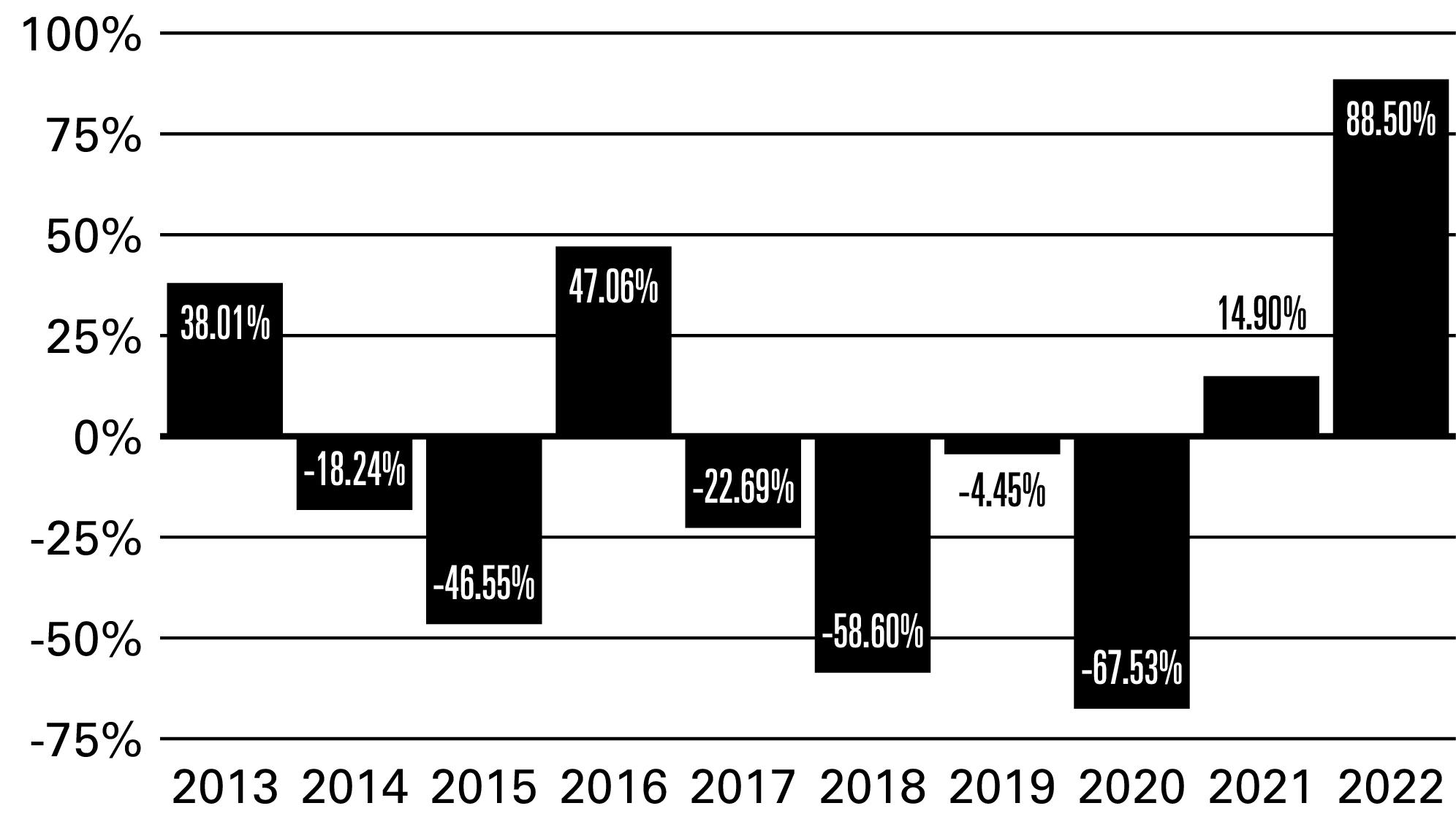

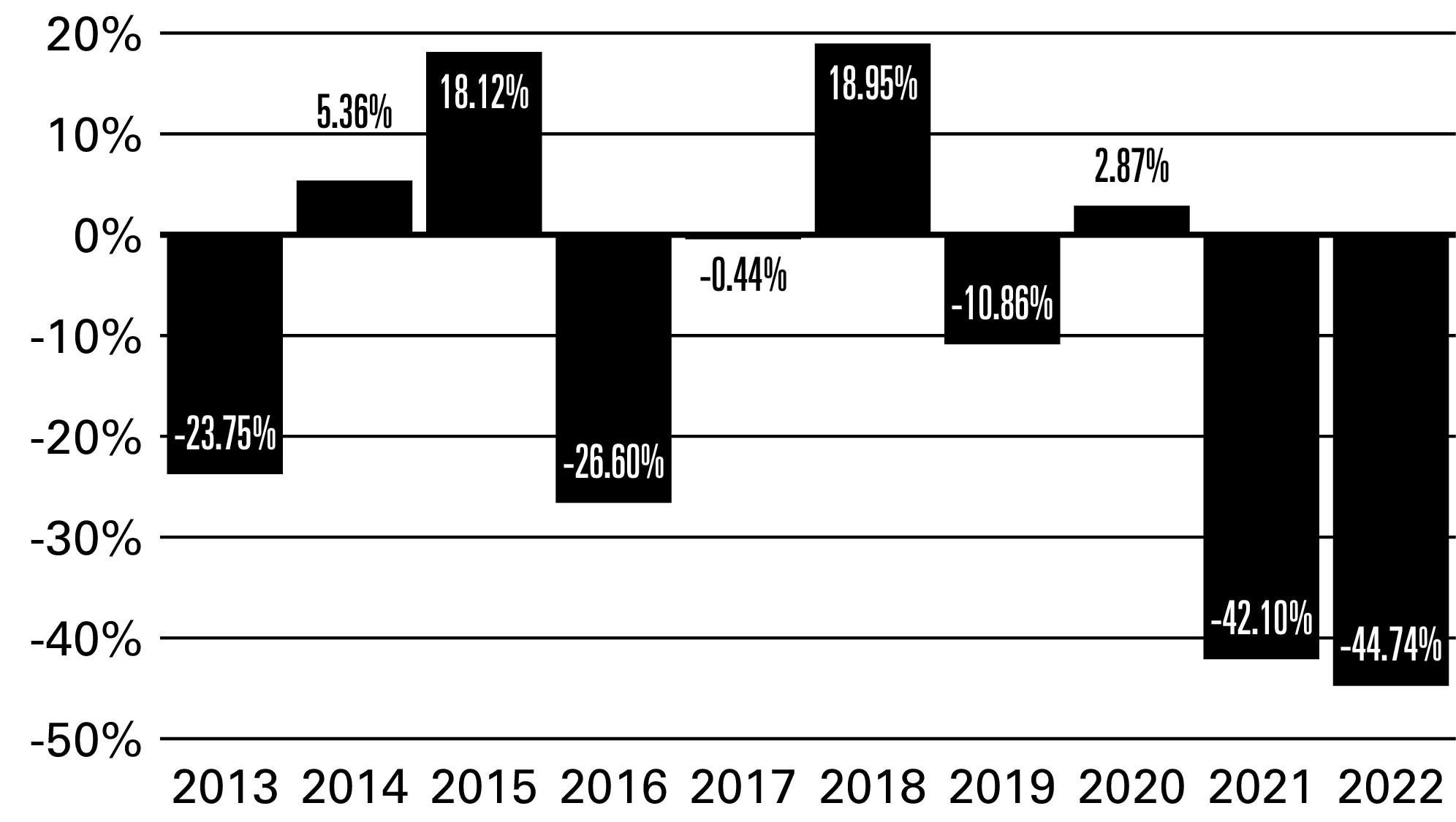

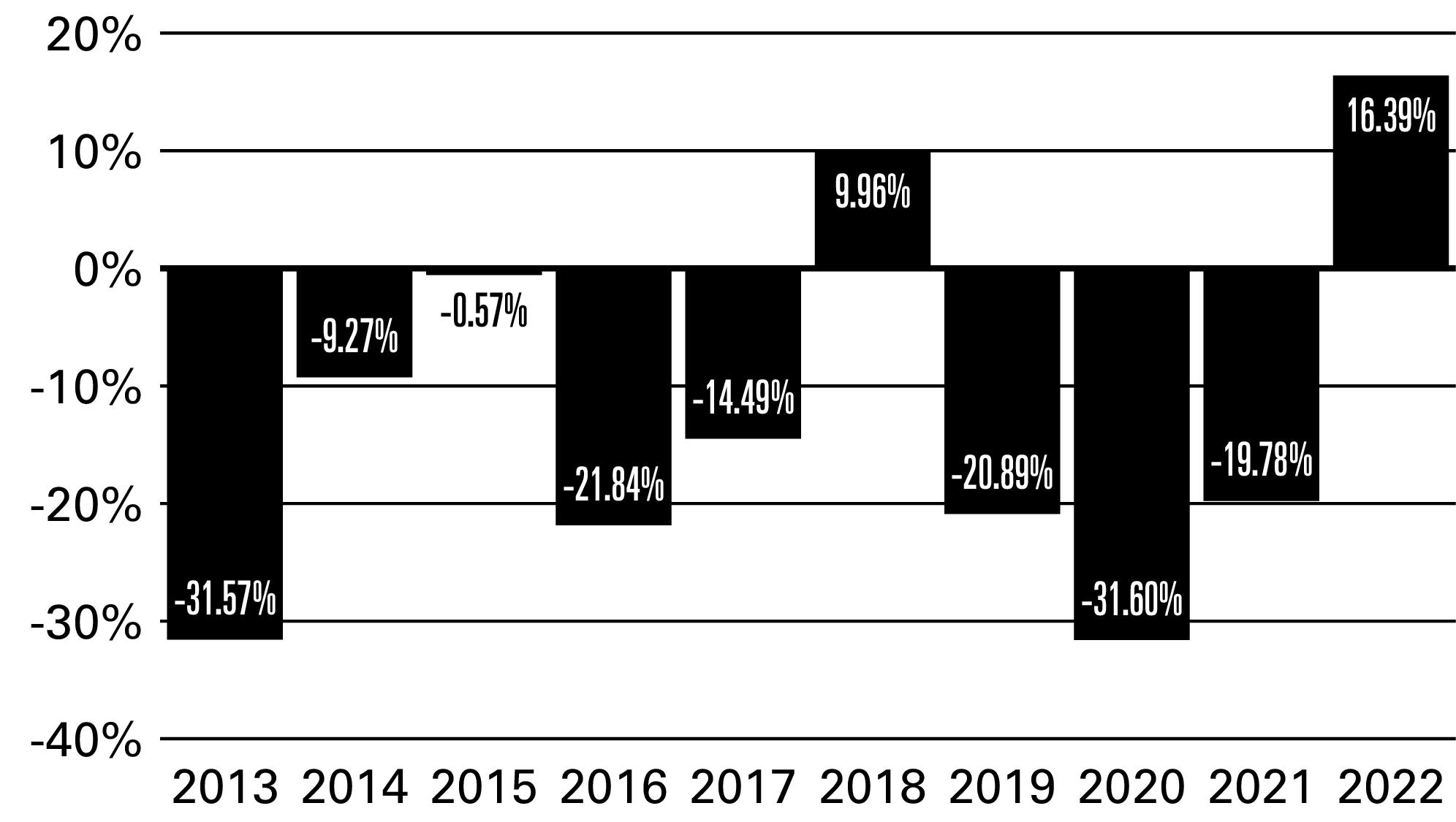

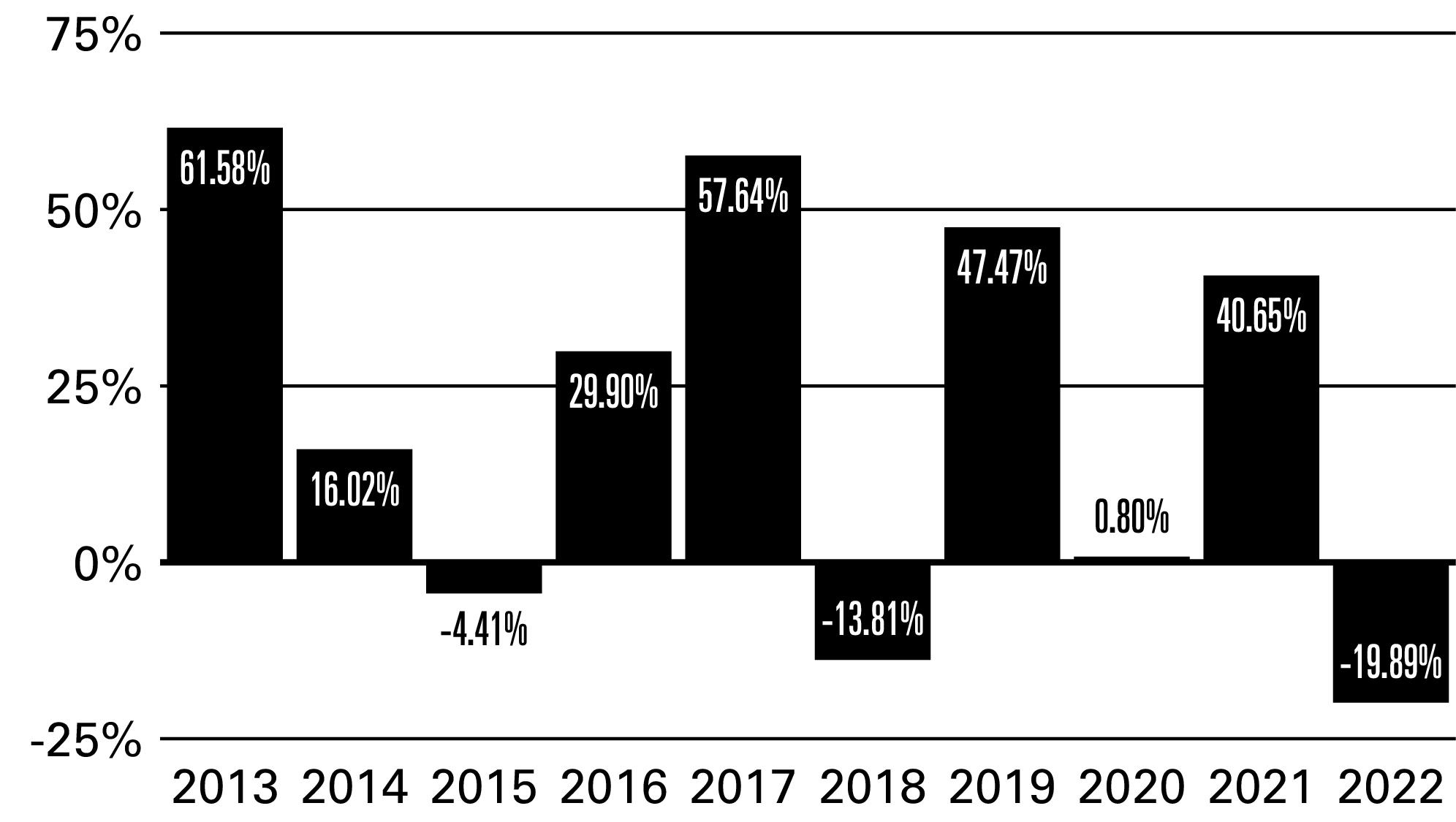

Please see “Investment Objectives, Principal Investment Strategies and Related Risks” in the Fund’s Prospectus for additional details.

22 :: Bear ProFund :: TICKERS :: Investor Class BRPIX :: Service Class BRPSX

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One

Year |

Five

Years |

Ten

Years |

Inception

Date |

|

Investor Class Shares |

|

|

|

|

|

– Before Taxes |

|

- |

- |

|

|

– After Taxes on

Distributions |

|

- |

- |

|

|

– After Taxes on

Distributions and Sale of

Shares |

|

- |

- |

|

|

Service Class Shares |

|

- |

- |

|

|

S&P 500®1 |

- |

|

|

|

1

Management

The Fund is advised by ProFund Advisors. Michael Neches, Senior Portfolio Manager, and Devin Sullivan, Portfolio Manager, have jointly and primarily managed the Fund since October 2013 and April 2018, respectively.

Purchase and Sale of Fund Shares

The minimum initial investment amounts for all classes, which may be waived at the discretion of the Fund, are:

•$5,000 for accounts that list a financial professional.

•$15,000 for self-directed accounts.

You may purchase, redeem or exchange Fund shares on any day which the New York Stock Exchange is open for business. Depending on where your account is held, you may redeem your shares by contacting your financial professional or the Fund by mail, telephone, wire transfer or on-line (www.profunds.com).

Tax Information

The Fund’s distributions generally are taxable, and will be taxed as ordinary income, qualified dividend income or capital gains, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account. You may be taxed later upon withdrawal of monies from such tax-advantaged arrangements. The Fund intends to distribute income, if any, and capital gains, if any, at least annually.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a financial intermediary, such as a broker-dealer or investment adviser, the Fund and its distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

FUND NUMBERS :: Investor Class 043 :: Service Class 073 :: Biotechnology UltraSector ProFund :: 23

Wire Fee $10

|

| ||

|

|

Investor

Class |

Service

Class |

|

Investment Advisory Fees |

|

|

|

Distribution and Service (12b-1) Fees |

|

|

|

Other Expenses |

|

|

|

Total Annual Fund Operating Expenses1 |

|

|

1

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Investor Class |

$ |

$ |

$ |

$ |

|

Service Class |

$ |

$ |

$ |

$ |

24 :: Biotechnology UltraSector ProFund :: TICKERS :: Investor Class BIPIX :: Service Class BIPSX

FUND NUMBERS :: Investor Class 043 :: Service Class 073 :: Biotechnology UltraSector ProFund :: 25

|

| ||||||

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26 :: Biotechnology UltraSector ProFund :: TICKERS :: Investor Class BIPIX :: Service Class BIPSX

Please see “Investment Objectives, Principal Investment Strategies and Related Risks” in the Fund’s Prospectus for additional details.

FUND NUMBERS :: Investor Class 043 :: Service Class 073 :: Biotechnology UltraSector ProFund :: 27

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One

Year |

Five

Years |

Ten

Years |

Inception

Date |

|

Investor Class Shares |

|

|

|

|

|

– Before Taxes |

- |

|

|

|

|

– After Taxes on Distributions |

- |

|

|

|

|

– After Taxes on Distributions

and Sale of Shares |

- |

|

|

|

|

Service Class Shares |

- |

|

|

|

|

S&P Biotechnology Select

Industry Index1 |

- |

- |

|

|

|

Dow Jones

U.S. BiotechnologySM Index1,2 |

- |

|

|

|

|

S&P 500®1 |

- |

|

|

|

1

2

Management

The Fund is advised by ProFund Advisors. Michael Neches, Senior Portfolio Manager, and Tarak Davé, Portfolio Manager, have jointly and primarily managed the Fund since October 2013 and April 2018, respectively.

Purchase and Sale of Fund Shares

The minimum initial investment amounts for all classes, which may be waived at the discretion of the Fund, are:

•$5,000 for accounts that list a financial professional.

•$15,000 for self-directed accounts.

You may purchase, redeem or exchange Fund shares on any day which the New York Stock Exchange is open for business. Depending on where your account is held, you may redeem your shares by contacting your financial professional or the Fund by mail, telephone, wire transfer or on-line (www.profunds.com).

Tax Information

The Fund’s distributions generally are taxable, and will be taxed as ordinary income, qualified dividend income or capital gains, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account. You may be taxed later upon withdrawal of monies from such tax-advantaged arrangements. The Fund intends to distribute income, if any, and capital gains, if any, at least annually.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a financial intermediary, such as a broker-dealer or investment adviser, the Fund and its distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

28 :: Bull ProFund :: TICKERS :: Investor Class BLPIX :: Service Class BLPSX

Wire Fee $10

|

| ||

|

|

Investor

Class |

Service

Class |

|

Investment Advisory Fees |

|

|

|

Distribution and Service (12b-1) Fees |

|

|

|

Other Expenses |

|

|

|

Total Annual Fund Operating Expenses1 |

|

|

1

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Investor Class |

$ |

$ |

$ |

$ |

|

Service Class |

$ |

$ |

$ |

$ |

FUND NUMBERS :: Investor Class 004 :: Service Class 024 :: Bull ProFund :: 29

30 :: Bull ProFund :: TICKERS :: Investor Class BLPIX :: Service Class BLPSX

Please see “Investment Objectives, Principal Investment Strategies and Related Risks” in the Fund’s Prospectus for additional details.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One

Year |

Five

Years |

Ten

Years |

Inception

Date |

|

Investor Class Shares |

|

|

|

|

|

– Before Taxes |

- |

|

|

|

|

– After Taxes on Distributions |

- |

|

|

|

|

– After Taxes on Distributions

and Sale of Shares |

- |

|

|

|

|

Service Class Shares |

- |

|

|

|

|

S&P 500®1 |

- |

|

|

|

1

Management

The Fund is advised by ProFund Advisors. Michael Neches, Senior Portfolio Manager, and Devin Sullivan, Portfolio Manager, have jointly and primarily managed the Fund since October 2013 and April 2018, respectively.

Purchase and Sale of Fund Shares

The minimum initial investment amounts for all classes, which may be waived at the discretion of the Fund, are:

•$5,000 for accounts that list a financial professional.

•$15,000 for self-directed accounts.

FUND NUMBERS :: Investor Class 004 :: Service Class 024 :: Bull ProFund :: 31

You may purchase, redeem or exchange Fund shares on any day which the New York Stock Exchange is open for business. Depending on where your account is held, you may redeem your shares by contacting your financial professional or the Fund by mail, telephone, wire transfer or on-line (www.profunds.com).

Tax Information

The Fund’s distributions generally are taxable, and will be taxed as ordinary income, qualified dividend income or capital gains, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account. You may be taxed later upon withdrawal of monies from such tax-advantaged arrangements. The Fund intends to distribute income, if any, and capital gains, if any, at least annually.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a financial intermediary, such as a broker-dealer or investment adviser, the Fund and its distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

32 :: Communication Services UltraSector ProFund :: TICKERS :: Investor Class WCPIX :: Service Class WCPSX

Wire Fee $10

|

| ||

|

|

Investor

Class |

Service

Class |

|

Investment Advisory Fees |

|

|

|

Distribution and Service (12b-1) Fees |

|

|

|

Other Expenses |

|

|

|

Total Annual Fund Operating Expenses

Before Fee Waivers and Expense

Reimbursements |

|

|

|

Fee Waivers/Reimbursements1 |

- |

- |

|

Total Annual Fund Operating Expenses

After Fee Waivers and Expense

Reimbursements |

|

|

1

FUND NUMBERS :: Investor Class 053 :: Service Class 083 :: Communication Services UltraSector ProFund :: 33

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Investor Class |

$ |

$ |

$ |

$ |

|

Service Class |

$ |

$ |

$ |

$ |

34 :: Communication Services UltraSector ProFund :: TICKERS :: Investor Class WCPIX :: Service Class WCPSX

|

| ||||||

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FUND NUMBERS :: Investor Class 053 :: Service Class 083 :: Communication Services UltraSector ProFund :: 35

Please see “Investment Objectives, Principal Investment Strategies and Related Risks” in the Fund’s Prospectus for additional details.

36 :: Communication Services UltraSector ProFund :: TICKERS :: Investor Class WCPIX :: Service Class WCPSX

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One

Year |

Five

Years |

Ten

Years |

Inception

Date |

|

Investor Class Shares |

|

|

|

|

|

– Before Taxes |

- |

|

|

|

|

– After Taxes on Distributions |

- |

|

|

|

|

– After Taxes on Distributions

and Sale of Shares |

- |

|

|

|

|

Service Class Shares |

- |

|

|

|

|

S&P Communication Services

Select Sector Index1 |

- |

|

|

|

|

S&P 500®1 |

- |

|

|

|

1

Management

The Fund is advised by ProFund Advisors. Michael Neches, Senior Portfolio Manager, and Tarak Davé, Portfolio Manager, have jointly and primarily managed the Fund since October 2013 and April 2018, respectively.

Purchase and Sale of Fund Shares

The minimum initial investment amounts for all classes, which may be waived at the discretion of the Fund, are:

•$5,000 for accounts that list a financial professional.

•$15,000 for self-directed accounts.

You may purchase, redeem or exchange Fund shares on any day which the New York Stock Exchange is open for business. Depending on where your account is held, you may redeem your shares by contacting your financial professional or the Fund by mail, telephone, wire transfer or on-line (www.profunds.com).

Tax Information

The Fund’s distributions generally are taxable, and will be taxed as ordinary income, qualified dividend income or capital gains, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account. You may be taxed later upon withdrawal of monies from such tax-advantaged arrangements. The Fund intends to distribute income, if any, and capital gains, if any, at least annually.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a financial intermediary, such as a broker-dealer or investment adviser, the Fund and its distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

FUND NUMBERS :: Investor Class 051 :: Service Class 081 :: Consumer Discretionary UltraSector ProFund :: 37

Wire Fee $10

|

| ||

|

|

Investor

Class |

Service

Class |

|

Investment Advisory Fees |

|

|

|

Distribution and Service (12b-1) Fees |

|

|

|

Other Expenses |

|

|

|

Total Annual Fund Operating Expenses1 |

|

|

1

38 :: Consumer Discretionary UltraSector ProFund :: TICKERS :: Investor Class CYPIX :: Service Class CYPSX

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Investor Class |

$ |

$ |

$ |

$ |

|

Service Class |

$ |

$ |

$ |

$ |

FUND NUMBERS :: Investor Class 051 :: Service Class 081 :: Consumer Discretionary UltraSector ProFund :: 39

|

| ||||||

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40 :: Consumer Discretionary UltraSector ProFund :: TICKERS :: Investor Class CYPIX :: Service Class CYPSX

Please see “Investment Objectives, Principal Investment Strategies and Related Risks” in the Fund’s Prospectus for additional details.

FUND NUMBERS :: Investor Class 051 :: Service Class 081 :: Consumer Discretionary UltraSector ProFund :: 41

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One

Year |

Five

Years |

Ten

Years |

Inception

Date |

|

Investor Class Shares |

|

|

|

|

|

– Before Taxes |

- |

|

|

|

|

– After Taxes on Distributions |

- |

|

|

|

|

– After Taxes on Distributions

and Sale of Shares |

- |

|

|

|

|

Service Class Shares |

- |

|

|

|

|

S&P Consumer Discretionary

Select Sector Index1 |

- |

|

|

|

|

Dow Jones U.S. Consumer

ServicesSM Index1,2 |

- |

|

|

|

|

S&P 500®1 |

- |

|

|

|

1

2

Management

The Fund is advised by ProFund Advisors. Michael Neches, Senior Portfolio Manager, and Tarak Davé, Portfolio Manager, have jointly and primarily managed the Fund since October 2013 and April 2018, respectively.

Purchase and Sale of Fund Shares

The minimum initial investment amounts for all classes, which may be waived at the discretion of the Fund, are:

•$5,000 for accounts that list a financial professional.

•$15,000 for self-directed accounts.

You may purchase, redeem or exchange Fund shares on any day which the New York Stock Exchange is open for business. Depending on where your account is held, you may redeem your shares by contacting your financial professional or the Fund by mail, telephone, wire transfer or on-line (www.profunds.com).

Tax Information

The Fund’s distributions generally are taxable, and will be taxed as ordinary income, qualified dividend income or capital gains, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account. You may be taxed later upon withdrawal of monies from such tax-advantaged arrangements. The Fund intends to distribute income, if any, and capital gains, if any, at least annually.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a financial intermediary, such as a broker-dealer or investment adviser, the Fund and its distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

42 :: Consumer Staples UltraSector ProFund :: TICKERS :: Investor Class CNPIX :: Service Class CNPSX

Wire Fee $10

|

| ||

|

|

Investor

Class |

Service

Class |

|

Investment Advisory Fees |

|

|

|

Distribution and Service (12b-1) Fees |

|

|

|

Other Expenses |

|

|

|

Total Annual Fund Operating Expenses

Before Fee Waivers and Expense

Reimbursements |

|

|

|

Fee Waivers/Reimbursements1 |

- |

- |

|

Total Annual Fund Operating Expenses

After Fee Waivers and Expense

Reimbursements |

|

|

1

FUND NUMBERS :: Investor Class 044 :: Service Class 074 :: Consumer Staples UltraSector ProFund :: 43

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Investor Class |

$ |

$ |

$ |

$ |

|

Service Class |

$ |

$ |

$ |

$ |

44 :: Consumer Staples UltraSector ProFund :: TICKERS :: Investor Class CNPIX :: Service Class CNPSX

|

| ||||||

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FUND NUMBERS :: Investor Class 044 :: Service Class 074 :: Consumer Staples UltraSector ProFund :: 45

46 :: Consumer Staples UltraSector ProFund :: TICKERS :: Investor Class CNPIX :: Service Class CNPSX

Please see “Investment Objectives, Principal Investment Strategies and Related Risks” in the Fund’s Prospectus for additional details.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One

Year |

Five

Years |

Ten

Years |

Inception

Date |

|

Investor Class Shares |

|

|

|

|

|

– Before Taxes |

- |

|

|

|

|

– After Taxes on Distributions |

- |

|

|

|

|

– After Taxes on Distributions

and Sale of Shares |

- |

|

|

|

|

Service Class Shares |

- |

|

|

|

|

S&P Consumer Staples Select

Sector Index1 |

- |

|

|

|

|

Dow Jones U.S. Consumer

GoodsSM Index1,2 |

- |

|

|

|

|

S&P 500®1 |

- |

|

|

|

1

2

FUND NUMBERS :: Investor Class 044 :: Service Class 074 :: Consumer Staples UltraSector ProFund :: 47

Management

The Fund is advised by ProFund Advisors. Michael Neches, Senior Portfolio Manager, and Tarak Davé, Portfolio Manager, have jointly and primarily managed the Fund since October 2013 and April 2018, respectively.

Purchase and Sale of Fund Shares

The minimum initial investment amounts for all classes, which may be waived at the discretion of the Fund, are:

•$5,000 for accounts that list a financial professional.

•$15,000 for self-directed accounts.

You may purchase, redeem or exchange Fund shares on any day which the New York Stock Exchange is open for business. Depending on where your account is held, you may redeem your shares by contacting your financial professional or the Fund by mail, telephone, wire transfer or on-line (www.profunds.com).

Tax Information

The Fund’s distributions generally are taxable, and will be taxed as ordinary income, qualified dividend income or capital gains,

unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account. You may be taxed later upon withdrawal of monies from such tax-advantaged arrangements. The Fund intends to distribute income, if any, and capital gains, if any, at least annually.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a financial intermediary, such as a broker-dealer or investment adviser, the Fund and its distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

48 :: Energy UltraSector ProFund :: TICKERS :: Investor Class ENPIX :: Service Class ENPSX

Wire Fee $10

|

| ||

|

|

Investor

Class |

Service

Class |

|

Investment Advisory Fees |

|

|

|

Distribution and Service (12b-1) Fees |

|

|

|

Other Expenses |

|

|

|

Total Annual Fund Operating Expenses1 |

|

|

1

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Investor Class |

$ |

$ |

$ |

$ |

|

Service Class |

$ |

$ |

$ |

$ |

FUND NUMBERS :: Investor Class 046 :: Service Class 076 :: Energy UltraSector ProFund :: 49

50 :: Energy UltraSector ProFund :: TICKERS :: Investor Class ENPIX :: Service Class ENPSX

|

| ||||||

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FUND NUMBERS :: Investor Class 046 :: Service Class 076 :: Energy UltraSector ProFund :: 51

52 :: Energy UltraSector ProFund :: TICKERS :: Investor Class ENPIX :: Service Class ENPSX

Please see “Investment Objectives, Principal Investment Strategies and Related Risks” in the Fund’s Prospectus for additional details.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One

Year |

Five

Years |

Ten

Years |

Inception

Date |

|

Investor Class Shares |

|

|

|

|

|

– Before Taxes |

|

|

|

|

|

– After Taxes on Distributions |

|

|

|

|

|

– After Taxes on Distributions

and Sale of Shares |

|

|

|

|

|

Service Class Shares |

|

|

|

|

|

S&P Energy Select Sector

Index1 |

|

|

|

|

|

Dow Jones U.S. Oil & GasSM

Index1,2 |

|

|

|

|

|

S&P 500®1 |

- |

|

|

|

1

2

Management

The Fund is advised by ProFund Advisors. Michael Neches, Senior Portfolio Manager, and Tarak Davé, Portfolio Manager, have jointly and primarily managed the Fund since October 2013 and April 2018, respectively.

Purchase and Sale of Fund Shares

The minimum initial investment amounts for all classes, which may be waived at the discretion of the Fund, are:

•$5,000 for accounts that list a financial professional.

•$15,000 for self-directed accounts.

You may purchase, redeem or exchange Fund shares on any day which the New York Stock Exchange is open for business. Depending on where your account is held, you may redeem your shares by contacting your financial professional or the Fund by mail, telephone, wire transfer or on-line (www.profunds.com).

Tax Information

The Fund’s distributions generally are taxable, and will be taxed as ordinary income, qualified dividend income or capital gains, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account. You may be taxed later upon withdrawal of monies from such tax-advantaged arrangements. The Fund intends to distribute income, if any, and capital gains, if any, at least annually.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a financial intermediary, such as a broker-dealer or investment adviser, the Fund and its distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

FUND NUMBERS :: Investor Class 002 :: Service Class 022 :: Europe 30 ProFund :: 53

Wire Fee $10

|

| ||

|

|

Investor

Class |

Service

Class |

|

Investment Advisory Fees |

|

|

|

Distribution and Service (12b-1) Fees |

|

|

|

Other Expenses |

|

|

|

Total Annual Fund Operating Expenses

Before Fee Waivers and Expense

Reimbursements |

|

|

|

Fee Waivers/Reimbursements1 |

- |

- |

|

Total Annual Fund Operating Expenses

After Fee Waivers and Expense

Reimbursements |

|

|

1

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Investor Class |

$ |

$ |

$ |

$ |

|

Service Class |

$ |

$ |

$ |

$ |

54 :: Europe 30 ProFund :: TICKERS :: Investor Class UEPIX :: Service Class UEPSX

FUND NUMBERS :: Investor Class 002 :: Service Class 022 :: Europe 30 ProFund :: 55

Please see “Investment Objectives, Principal Investment Strategies and Related Risks” in the Fund’s Prospectus for additional details.

56 :: Europe 30 ProFund :: TICKERS :: Investor Class UEPIX :: Service Class UEPSX

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One

Year |

Five

Years |

Ten

Years |

Inception

Date |

|

Investor Class Shares |

|

|

|

|

|

– Before Taxes |

- |

|

|

|

|

– After Taxes on Distributions |

- |

|

|

|

|

– After Taxes on Distributions and

Sale of Shares |

- |

|

|

|

|

Service Class Shares |

- |

|

|

|

|

ProFunds Europe 30® Index1 |

- |

- |

|

|

|

STOXX Europe 50® Index2 |

- |

|

|

|

1

2

Management

The Fund is advised by ProFund Advisors. Alexander Ilyasov, Senior Portfolio Manager, and Eric Silverthorne, Portfolio Manager, have jointly and primarily managed the Fund since August 2020 and March 2023, respectively.

Purchase and Sale of Fund Shares

The minimum initial investment amounts for all classes, which may be waived at the discretion of the Fund, are:

•$5,000 for accounts that list a financial professional.

•$15,000 for self-directed accounts.

You may purchase, redeem or exchange Fund shares on any day which the New York Stock Exchange is open for business. Depending on where your account is held, you may redeem your shares by contacting your financial professional or the Fund by mail, telephone, wire transfer or on-line (www.profunds.com).

Tax Information

The Fund’s distributions generally are taxable, and will be taxed as ordinary income, qualified dividend income or capital gains, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account. You may be taxed later upon withdrawal of monies from such tax-advantaged arrangements. The Fund intends to distribute income, if any, and capital gains, if any, at least annually.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a financial intermediary, such as a broker-dealer or investment adviser, the Fund and its distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

FUND NUMBERS :: Investor Class 113 :: Service Class 143 :: Falling U.S. Dollar ProFund :: 57

Wire Fee $10

|

| ||

|

|

Investor

Class |

Service

Class |

|

Investment Advisory Fees |

|

|

|

Distribution and Service (12b-1) Fees |

|

|

|

Other Expenses1 |

|

|

|

Total Annual Fund Operating Expenses

Before Fee Waivers and Expense

Reimbursements |

|

|

|

Fee Waivers/Reimbursements2 |

- |

- |

|

Total Annual Fund Operating Expenses

After Fee Waivers and Expense

Reimbursements |

|

|

1

2

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Investor Class |

$ |

$ |

$ |

$ |

|

Service Class |

$ |

$ |

$ |

$ |

58 :: Falling U.S. Dollar ProFund :: TICKERS :: Investor Class FDPIX :: Service Class FDPSX

FUND NUMBERS :: Investor Class 113 :: Service Class 143 :: Falling U.S. Dollar ProFund :: 59

Please see “Investment Objectives, Principal Investment Strategies and Related Risks” in the Fund’s Prospectus for additional details.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One

Year |

Five

Years |

Ten

Years |

Inception

Date |

|

Investor Class Shares |

|

|

|

|

|

– Before Taxes |

- |

- |

- |

|

|

– After Taxes on Distributions |

- |

- |

- |

|

|

– After Taxes on Distributions

and Sale of Shares |

- |

- |

- |

|

|

Service Class Shares |

- |

- |

- |

|

|

ICE® U.S. Dollar Index1 |

|

|

|

|

|

S&P 500®2 |

- |

|

|

|

1

2

Management

The Fund is advised by ProFund Advisors. Alexander Ilyasov, Senior Portfolio Manager, and James Linneman, Portfolio Manager, have jointly and primarily managed the Fund since April 2019 and March 2022, respectively.

Purchase and Sale of Fund Shares

The minimum initial investment amounts for all classes, which may be waived at the discretion of the Fund, are:

•$5,000 for accounts that list a financial professional.

•$15,000 for self-directed accounts.

You may purchase, redeem or exchange Fund shares on any day which the New York Stock Exchange is open for business. Depending on where your account is held, you may redeem your

60 :: Falling U.S. Dollar ProFund :: TICKERS :: Investor Class FDPIX :: Service Class FDPSX

shares by contacting your financial professional or the Fund by mail, telephone, wire transfer or on-line (www.profunds.com).

Tax Information

The Fund’s distributions generally are taxable, and will be taxed as ordinary income, qualified dividend income or capital gains, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account. You may be taxed later upon withdrawal of monies from such tax-advantaged arrangements. The Fund intends to distribute income, if any, and capital gains, if any, at least annually.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a financial intermediary, such as a broker-dealer or investment adviser, the Fund and its distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

FUND NUMBERS :: Investor Class 048 :: Service Class 078 :: Financials UltraSector ProFund :: 61

Wire Fee $10

|

| ||

|

|

Investor

Class |

Service

Class |

|

Investment Advisory Fees |

|

|

|

Distribution and Service (12b-1) Fees |

|

|

|

Other Expenses |

|

|

|

Total Annual Fund Operating Expenses

Before Fee Waivers and Expense

Reimbursements |

|

|

|

Fee Waivers/Reimbursements1 |

- |

- |

|

Total Annual Fund Operating Expenses

After Fee Waivers and Expense

Reimbursements |

|

|

1

62 :: Financials UltraSector ProFund :: TICKERS :: Investor Class FNPIX :: Service Class FNPSX

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Investor Class |

$ |

$ |

$ |

$ |

|

Service Class |

$ |

$ |

$ |

$ |

FUND NUMBERS :: Investor Class 048 :: Service Class 078 :: Financials UltraSector ProFund :: 63

|

| ||||||

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

64 :: Financials UltraSector ProFund :: TICKERS :: Investor Class FNPIX :: Service Class FNPSX

FUND NUMBERS :: Investor Class 048 :: Service Class 078 :: Financials UltraSector ProFund :: 65

Please see “Investment Objectives, Principal Investment Strategies and Related Risks” in the Fund’s Prospectus for additional details.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One

Year |

Five

Years |

Ten

Years |

Inception

Date |

|

Investor Class Shares |

|

|

|

|

|

– Before Taxes |

- |

|

|

|

|

– After Taxes on Distributions |

- |

|

|

|

|

– After Taxes on Distributions

and Sale of Shares |

- |

|

|

|

|

Service Class Shares |

- |

|

|

|

|

S&P Financial Select Sector

Index1 |

- |

|

|

|

|

Dow Jones U.S. FinancialsSM

Index1,2 |

- |

|

|

|

|

S&P 500®1 |

- |

|

|

|

1

2

66 :: Financials UltraSector ProFund :: TICKERS :: Investor Class FNPIX :: Service Class FNPSX

Management

The Fund is advised by ProFund Advisors. Michael Neches, Senior Portfolio Manager, and Tarak Davé, Portfolio Manager, have jointly and primarily managed the Fund since October 2013 and April 2018, respectively.

Purchase and Sale of Fund Shares

The minimum initial investment amounts for all classes, which may be waived at the discretion of the Fund, are:

•$5,000 for accounts that list a financial professional.

•$15,000 for self-directed accounts.

You may purchase, redeem or exchange Fund shares on any day which the New York Stock Exchange is open for business. Depending on where your account is held, you may redeem your shares by contacting your financial professional or the Fund by mail, telephone, wire transfer or on-line (www.profunds.com).

Tax Information

The Fund’s distributions generally are taxable, and will be taxed as ordinary income, qualified dividend income or capital gains,

unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account. You may be taxed later upon withdrawal of monies from such tax-advantaged arrangements. The Fund intends to distribute income, if any, and capital gains, if any, at least annually.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a financial intermediary, such as a broker-dealer or investment adviser, the Fund and its distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

FUND NUMBERS :: Investor Class 049 :: Service Class 079 :: Health Care UltraSector ProFund :: 67

Wire Fee $10

|

| ||

|

|

Investor

Class |

Service

Class |

|

Investment Advisory Fees |

|

|

|

Distribution and Service (12b-1) Fees |

|

|

|

Other Expenses |

|

|

|

Total Annual Fund Operating Expenses1 |

|

|

1

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Investor Class |

$ |

$ |

$ |

$ |

|

Service Class |

$ |

$ |

$ |

$ |

68 :: Health Care UltraSector ProFund :: TICKERS :: Investor Class HCPIX :: Service Class HCPSX

FUND NUMBERS :: Investor Class 049 :: Service Class 079 :: Health Care UltraSector ProFund :: 69

|

| ||||||

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

70 :: Health Care UltraSector ProFund :: TICKERS :: Investor Class HCPIX :: Service Class HCPSX

FUND NUMBERS :: Investor Class 049 :: Service Class 079 :: Health Care UltraSector ProFund :: 71

Please see “Investment Objectives, Principal Investment Strategies and Related Risks” in the Fund’s Prospectus for additional details.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One

Year |

Five

Years |

Ten

Years |

Inception

Date |

|

Investor Class Shares |

|

|

|

|

|

– Before Taxes |

- |

|

|

|

|

– After Taxes on Distributions |

- |

|

|

|

|

– After Taxes on Distributions

and Sale of Shares |

- |

|

|

|

|

Service Class Shares |

- |

|

|

|

|

S&P Health Care Select

Sector Index1 |

- |

|

|

|

|

Dow Jones U.S. Health

CareSM Index1,2 |

- |

|

|

|

|

S&P 500®1 |

- |

|

|

|

1

2

72 :: Health Care UltraSector ProFund :: TICKERS :: Investor Class HCPIX :: Service Class HCPSX

Management

The Fund is advised by ProFund Advisors. Michael Neches, Senior Portfolio Manager, and Tarak Davé, Portfolio Manager, have jointly and primarily managed the Fund since October 2013 and April 2018, respectively.

Purchase and Sale of Fund Shares

The minimum initial investment amounts for all classes, which may be waived at the discretion of the Fund, are:

•$5,000 for accounts that list a financial professional.

•$15,000 for self-directed accounts.

You may purchase, redeem or exchange Fund shares on any day which the New York Stock Exchange is open for business. Depending on where your account is held, you may redeem your shares by contacting your financial professional or the Fund by mail, telephone, wire transfer or on-line (www.profunds.com).

Tax Information

The Fund’s distributions generally are taxable, and will be taxed as ordinary income, qualified dividend income or capital gains,

unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account. You may be taxed later upon withdrawal of monies from such tax-advantaged arrangements. The Fund intends to distribute income, if any, and capital gains, if any, at least annually.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a financial intermediary, such as a broker-dealer or investment adviser, the Fund and its distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

FUND NUMBERS :: Investor Class 056 :: Service Class 086 :: Industrials UltraSector ProFund :: 73

Wire Fee $10

|

| ||

|

|

Investor

Class |

Service

Class |

|

Investment Advisory Fees |

|

|

|

Distribution and Service (12b-1) Fees |

|

|

|

Other Expenses |

|

|

|

Total Annual Fund Operating Expenses

Before Fee Waivers and Expense

Reimbursements |

|

|

|

Fee Waivers/Reimbursements1 |

- |

- |

|

Total Annual Fund Operating Expenses

After Fee Waivers and Expense

Reimbursements |

|

|

1

74 :: Industrials UltraSector ProFund :: TICKERS :: Investor Class IDPIX :: Service Class IDPSX

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Investor Class |

$ |

$ |

$ |

$ |

|

Service Class |

$ |

$ |

$ |

$ |

FUND NUMBERS :: Investor Class 056 :: Service Class 086 :: Industrials UltraSector ProFund :: 75

|

| ||||||

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

76 :: Industrials UltraSector ProFund :: TICKERS :: Investor Class IDPIX :: Service Class IDPSX

Please see “Investment Objectives, Principal Investment Strategies and Related Risks” in the Fund’s Prospectus for additional details.

FUND NUMBERS :: Investor Class 056 :: Service Class 086 :: Industrials UltraSector ProFund :: 77

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One

Year |

Five

Years |

Ten

Years |

Inception

Date |

|

Investor Class Shares |

|

|

|

|

|

– Before Taxes |

- |

|

|

|

|

– After Taxes on Distributions |

- |

|

|

|

|

– After Taxes on Distributions

and Sale of Shares |

- |

|

|

|

|

Service Class Shares |

- |

|

|

|

|

S&P Industrials Select Sector

Index1 |

- |

|

|

|

|

Dow Jones U.S. IndustrialsSM

Index1,2 |

- |

|

|

|

|

S&P 500®1 |

- |

|

|

|

1

2

Management

The Fund is advised by ProFund Advisors. Michael Neches, Senior Portfolio Manager, and Tarak Davé, Portfolio Manager, have jointly and primarily managed the Fund since October 2013 and April 2018, respectively.

Purchase and Sale of Fund Shares

The minimum initial investment amounts for all classes, which may be waived at the discretion of the Fund, are:

•$5,000 for accounts that list a financial professional.

•$15,000 for self-directed accounts.