PROSPECTUS

Investor and Service Class

November 30, 2022

|

|

INVESTOR CLASS |

SERVICE CLASS |

|

Access Flex Bear High Yield

ProFundSM

|

AFBIX |

AFBSX |

|

Access Flex High Yield

ProFundSM

|

FYAIX |

FYASX |

|

Banks UltraSector ProFund |

BKPIX |

BKPSX |

|

Basic Materials UltraSector

ProFund |

BMPIX |

BMPSX |

|

Bear ProFund |

BRPIX |

BRPSX |

|

Biotechnology UltraSector

ProFund |

BIPIX |

BIPSX |

|

Bull ProFund |

BLPIX |

BLPSX |

|

Communication Services

UltraSector ProFund |

WCPIX |

WCPSX |

|

Consumer Goods UltraSector

ProFund |

CNPIX |

CNPSX |

|

Consumer Services

UltraSector ProFund |

CYPIX |

CYPSX |

|

Europe 30 ProFund |

UEPIX |

UEPSX |

|

Falling U.S. Dollar ProFund |

FDPIX |

FDPSX |

|

Financials UltraSector

ProFund |

FNPIX |

FNPSX |

|

Health Care UltraSector

ProFund |

HCPIX |

HCPSX |

|

Industrials UltraSector

ProFund |

IDPIX |

IDPSX |

|

Internet UltraSector ProFund |

INPIX |

INPSX |

|

Large-Cap Growth ProFund |

LGPIX |

LGPSX |

|

Large-Cap Value ProFund |

LVPIX |

LVPSX |

|

Mid-Cap Growth ProFund |

MGPIX |

MGPSX |

|

Mid-Cap ProFund |

MDPIX |

MDPSX |

|

Mid-Cap Value ProFund |

MLPIX |

MLPSX |

|

Nasdaq-100 ProFund |

OTPIX |

OTPSX |

|

Oil & Gas UltraSector

ProFund |

ENPIX |

ENPSX |

|

Oil Equipment & Services

UltraSector ProFund |

OEPIX |

OEPSX |

|

Pharmaceuticals UltraSector

ProFund |

PHPIX |

PHPSX |

|

Precious Metals UltraSector

ProFund |

PMPIX |

PMPSX |

|

Real Estate UltraSector

ProFund |

REPIX |

REPSX |

|

Rising Rates Opportunity

ProFund |

RRPIX |

RRPSX |

|

Rising Rates Opportunity 10

ProFund |

RTPIX |

RTPSX |

|

|

INVESTOR CLASS |

SERVICE CLASS |

|

Rising U.S. Dollar ProFund |

RDPIX |

RDPSX |

|

Semiconductor UltraSector

ProFund |

SMPIX |

SMPSX |

|

Short Nasdaq-100 ProFund |

SOPIX |

SOPSX |

|

Short Oil & Gas ProFund |

SNPIX |

SNPSX |

|

Short Precious Metals

ProFund |

SPPIX |

SPPSX |

|

Short Real Estate ProFund |

SRPIX |

SRPSX |

|

Short Small-Cap ProFund |

SHPIX |

SHPSX |

|

Small-Cap Growth ProFund |

SGPIX |

SGPSX |

|

Small-Cap ProFund |

SLPIX |

SLPSX |

|

Small-Cap Value ProFund |

SVPIX |

SVPSX |

|

Technology UltraSector

ProFund |

TEPIX |

TEPSX |

|

Telecommunications

UltraSector ProFund |

TCPIX |

TCPSX |

|

UltraBear ProFund |

URPIX |

URPSX |

|

UltraBull ProFund |

ULPIX |

ULPSX |

|

UltraChina ProFund |

UGPIX |

UGPSX |

|

UltraDow 30 ProFund |

UDPIX |

UDPSX |

|

UltraEmerging Markets

ProFund |

UUPIX |

UUPSX |

|

UltraInternational ProFund |

UNPIX |

UNPSX |

|

UltraJapan ProFund |

UJPIX |

UJPSX |

|

UltraLatin America ProFund |

UBPIX |

UBPSX |

|

UltraMid-Cap ProFund |

UMPIX |

UMPSX |

|

UltraNasdaq-100 ProFund |

UOPIX |

UOPSX |

|

UltraShort China ProFund |

UHPIX |

UHPSX |

|

UltraShort Dow 30 ProFund |

UWPIX |

UWPSX |

|

UltraShort Emerging Markets

ProFund |

UVPIX |

UVPSX |

|

UltraShort International

ProFund |

UXPIX |

UXPSX |

|

UltraShort Japan ProFund |

UKPIX |

UKPSX |

|

UltraShort Latin America

ProFund |

UFPIX |

UFPSX |

|

UltraShort Mid-Cap ProFund |

UIPIX |

UIPSX |

|

UltraShort Nasdaq-100

ProFund |

USPIX |

USPSX |

|

UltraShort Small-Cap

ProFund |

UCPIX |

UCPSX |

|

UltraSmall-Cap ProFund |

UAPIX |

UAPSX |

|

U.S. Government Plus

ProFund |

GVPIX |

GVPSX |

|

Utilities UltraSector ProFund |

UTPIX |

UTPSX |

Neither the Securities and Exchange Commission, the Commodity Futures Trading Commission, nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

Table of Contents

|

3 |

|

|

4 |

|

|

10 |

|

|

15 |

|

|

22 |

|

|

30 |

|

|

38 |

|

|

45 |

|

|

50 |

|

|

58 |

|

|

66 |

|

|

73 |

|

|

79 |

|

|

84 |

|

|

92 |

|

|

99 |

|

|

107 |

|

|

115 |

|

|

120 |

|

|

125 |

|

|

130 |

|

|

135 |

|

|

140 |

|

|

145 |

|

|

152 |

|

|

160 |

|

|

168 |

|

|

176 |

|

|

183 |

|

|

190 |

|

|

197 |

|

|

204 |

|

|

211 |

|

|

219 |

|

|

227 |

|

|

235 |

|

243 |

|

|

251 |

|

|

256 |

|

|

262 |

|

|

267 |

|

|

275 |

|

|

282 |

|

|

290 |

|

|

297 |

|

|

306 |

|

|

314 |

|

|

323 |

|

|

331 |

|

|

340 |

|

|

349 |

|

|

356 |

|

|

363 |

|

|

372 |

|

|

380 |

|

|

390 |

|

|

399 |

|

|

408 |

|

|

417 |

|

|

425 |

|

|

433 |

|

|

441 |

|

|

449 |

|

|

456 |

|

|

463 |

|

|

489 |

|

|

490 |

|

|

493 |

|

|

494 |

|

|

498 |

|

|

509 |

4 :: Access Flex Bear High Yield ProFund :: TICKERS :: Investor Class AFBIX :: Service Class AFBSX

Wire Fee $10

|

| ||

|

|

Investor

Class |

Service

Class |

|

Investment Advisory Fees |

|

|

|

Distribution and Service (12b-1) Fees |

|

|

|

Other Expenses |

|

|

|

Total Annual Fund Operating Expenses

Before Fee Waivers and Expense

Reimbursements |

|

|

|

Fee Waivers/Reimbursements1 |

- |

- |

|

Total Annual Fund Operating Expenses

After Fee Waivers and Expense

Reimbursements |

|

|

1

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Investor Class |

$ |

$ |

$ |

$ |

|

Service Class |

$ |

$ |

$ |

$ |

•Derivatives — The Fund invests in derivatives, which are financial instruments whose value is derived from the value of an underlying asset or assets, such as stocks, bonds, funds (including exchange-traded funds (“ETFs”)), currencies,

FUND NUMBERS :: Investor Class 111 :: Service Class 141 :: Access Flex Bear High Yield ProFund :: 5

interest rates or indexes. The Fund invests in derivatives as a substitute for directly shorting debt instruments in order to gain inverse exposure to the high yield market. These derivatives principally include:

The Fund seeks to maintain inverse exposure to the high yield market regardless of market conditions and without taking defensive positions in cash or other instruments in anticipation of periods favorable for the high yield market (which would generally be adverse market conditions for this Fund). There is no assurance that the Fund will achieve its investment objective.

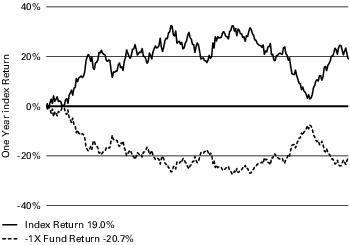

The Fund presents different risks than other types of funds in that it seeks inverse or “short” exposure. This means the Fund should generally lose value as the high yield market (i.e., U.S. corporate high yield debt market) is rallying (gaining value). Conversely, it should generally increase in value as the high yield market is falling (losing value). An investor in the Fund could potentially lose the full principal value of their investment.

6 :: Access Flex Bear High Yield ProFund :: TICKERS :: Investor Class AFBIX :: Service Class AFBSX

•Credit Default Swaps (CDS) Risk — The Fund will normally be a net buyer of credit protection on North American high yield debt issuers through index-based CDS. Upon the occurrence of a credit event, the counterparty to the Fund will have an obligation to pay the full notional value of a defaulted reference entity less recovery value. Recovery values for CDS are generally determined via an auction process to determine the final price for a given reference entity. Although the Fund intends, as practicable, to obtain initial exposure primarily through centrally cleared CDS, an active market may not exist for any of the CDS in which the Fund invests or in the reference entities subject to the CDS. As a result, the Fund’s ability to maximize returns or minimize losses on such CDS may be impaired. Other risks of CDS include difficulty in valuation due to the lack of pricing transparency and the risk that changes in the value of the CDS do not reflect changes in the credit quality of the underlying reference entities or may otherwise perform differently than expected given market conditions.

•Inverse Risk — Investors will lose money when the high yield market gains value — a result that is the opposite from traditional high yield mutual funds.

FUND NUMBERS :: Investor Class 111 :: Service Class 141 :: Access Flex Bear High Yield ProFund :: 7

8 :: Access Flex Bear High Yield ProFund :: TICKERS :: Investor Class AFBIX :: Service Class AFBSX

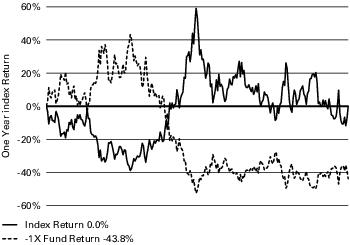

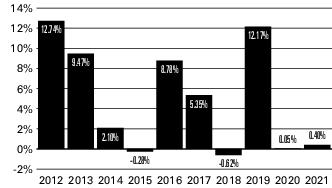

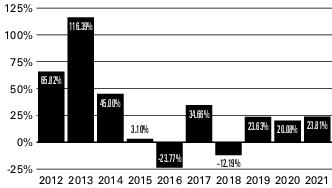

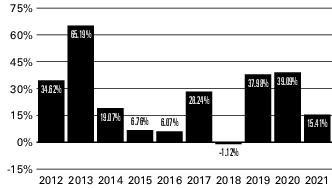

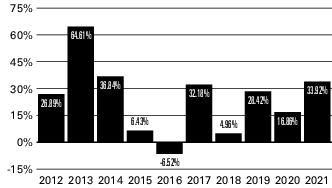

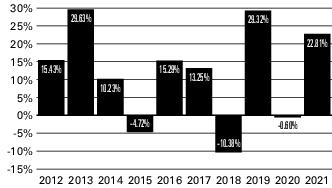

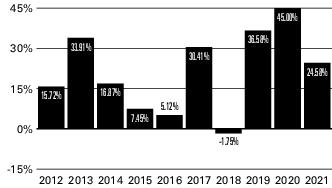

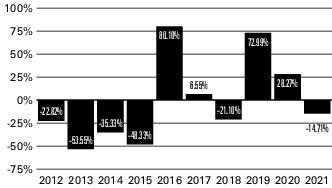

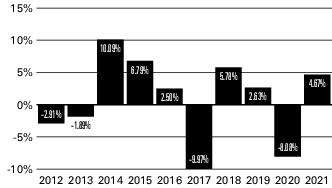

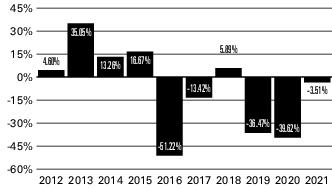

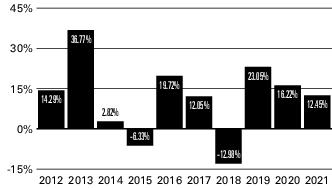

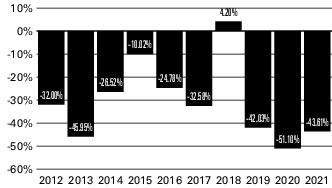

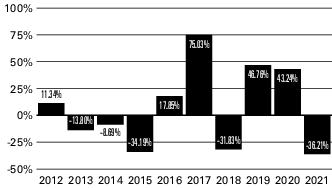

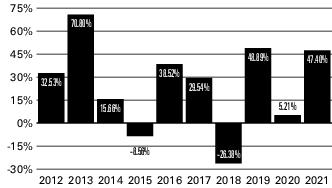

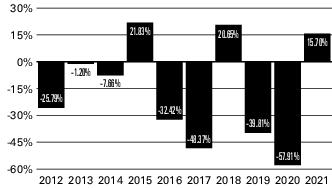

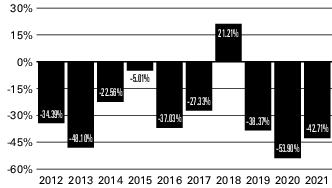

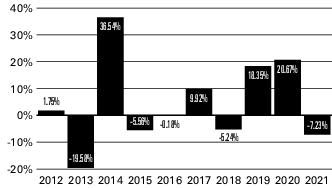

The Fund is the successor to the Access Flex Bear High Yield Fund, a series of Access One Trust (the “Predecessor Fund”), a mutual fund with identical investment objectives, policies, and restrictions, as a result of the reorganization of the Predecessor Fund into the Fund on April 23, 2021 (the “Reorganization Date”). The performance in the bar chart and table for the periods prior to the Reorganization Date is that of the Predecessor Fund.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One

Year |

Five

Years |

Ten

Years |

Inception

Date |

|

Investor Class Shares |

|

|

|

|

|

– Before Taxes |

- |

- |

- |

|

|

– After Taxes on Distributions |

- |

- |

- |

|

|

– After Taxes on Distributions

and Sale of Shares |

- |

- |

- |

|

|

Service Class Shares |

- |

- |

- |

|

|

Markit iBoxx $ Liquid High Yield

Index1 |

|

|

|

|

1

FUND NUMBERS :: Investor Class 111 :: Service Class 141 :: Access Flex Bear High Yield ProFund :: 9

Management

The Fund is advised by ProFund Advisors. Alexander Ilyasov, Senior Portfolio Manager, and James Linneman, Portfolio Manager, have jointly and primarily managed the Fund since April 2019 and March 2022, respectively.

Purchase and Sale of Fund Shares

The minimum initial investment amounts for all classes, which may be waived at the discretion of the Fund, are:

•$5,000 for accounts that list a financial professional.

•$15,000 for self-directed accounts.

You may purchase, redeem or exchange Fund shares on any day which the New York Stock Exchange is open for business. Depending on where your account is held, you may redeem your

shares by contacting your financial professional or the Fund by mail, telephone, wire transfer or on-line (www.profunds.com).

Tax Information

The Fund’s distributions generally are taxable, and will be taxed as ordinary income, qualified dividend income or capital gains, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account. You may be taxed later upon withdrawal of monies from such tax-advantaged arrangements. The Fund intends to distribute income, if any, and capital gains, if any, at least annually.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a financial intermediary, such as a broker-dealer or investment adviser, the Fund and its distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

10 :: Access Flex High Yield ProFund :: TICKERS :: Investor Class FYAIX :: Service Class FYASX

Wire Fee $10

|

| ||

|

|

Investor

Class |

Service

Class |

|

Investment Advisory Fees |

|

|

|

Distribution and Service (12b-1) Fees |

|

|

|

Other Expenses |

|

|

|

Recoupment1 |

|

|

|

Other Operating Expenses |

|

|

|

Total Annual Fund Operating Expenses2 |

|

|

1

2

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Investor Class |

$ |

$ |

$ |

$ |

|

Service Class |

$ |

$ |

$ |

$ |

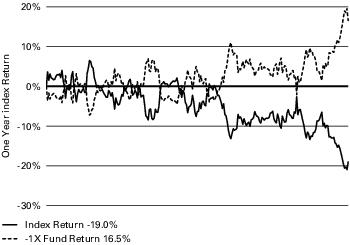

The Fund is actively managed and seeks to achieve returns that are not directly correlated to any particular fixed income index. The Fund invests primarily in financial instruments that ProFund Advisors believes, in combination, should provide investment results that correspond generally to the high yield market. The Fund uses the Markit iBoxx $ Liquid High Yield Index as a performance benchmark only, and does not seek to track its performance.

FUND NUMBERS :: Investor Class 110 :: Service Class 140 :: Access Flex High Yield ProFund :: 11

12 :: Access Flex High Yield ProFund :: TICKERS :: Investor Class FYAIX :: Service Class FYASX

FUND NUMBERS :: Investor Class 110 :: Service Class 140 :: Access Flex High Yield ProFund :: 13

14 :: Access Flex High Yield ProFund :: TICKERS :: Investor Class FYAIX :: Service Class FYASX

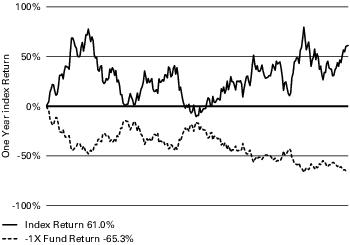

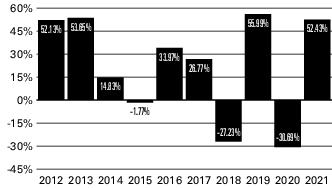

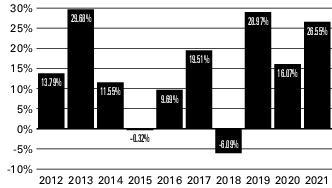

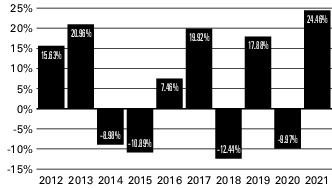

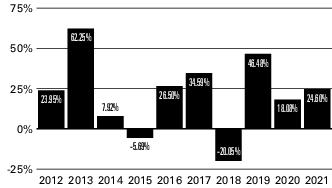

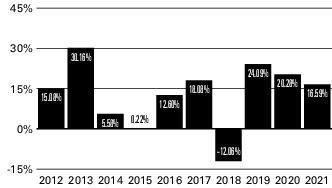

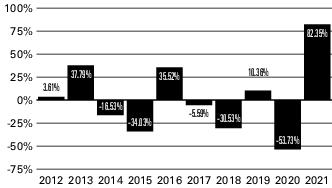

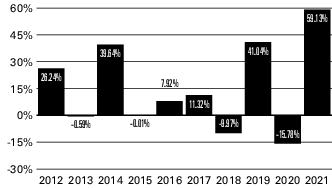

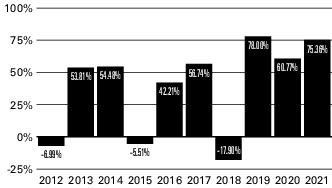

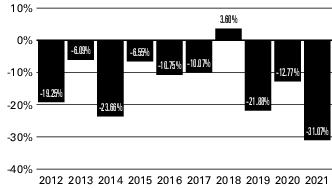

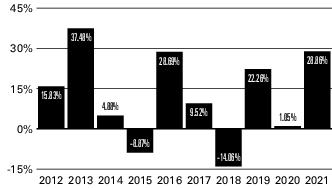

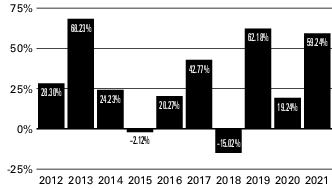

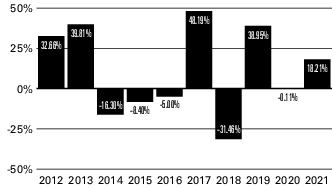

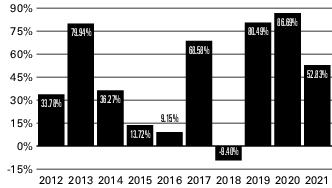

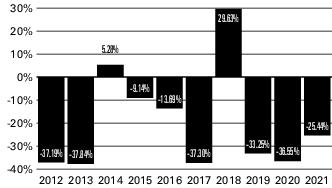

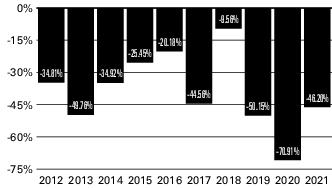

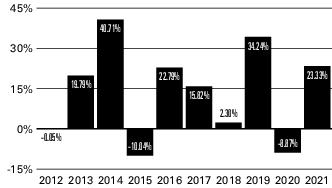

The Fund is the successor to the Access Flex High Yield Fund, a series of Access One Trust (the “Predecessor Fund”), a mutual fund with identical investment objectives, policies, and restrictions, as a result of the reorganization of the Predecessor Fund into the Fund on April 23, 2021 (the “Reorganization Date”). The performance in the bar chart and table for the periods prior to the Reorganization Date is that of the Predecessor Fund.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One

Year |

Five

Years |

Ten

Years |

Inception

Date |

|

Investor Class Shares |

|

|

|

|

|

– Before Taxes |

|

|

|

|

|

– After Taxes on Distributions |

- |

|

|

|

|

– After Taxes on Distributions

and Sale of Shares |

|

|

|

|

|

Service Class Shares |

- |

|

|

|

|

Markit iBoxx $ Liquid High Yield

Index1 |

|

|

|

|

1

Management

The Fund is advised by ProFund Advisors. Alexander Ilyasov, Senior Portfolio Manager, and James Linneman, Portfolio Manager, have jointly and primarily managed the Fund since April 2019 and March 2022, respectively.

Purchase and Sale of Fund Shares

The minimum initial investment amounts for all classes, which may be waived at the discretion of the Fund, are:

•$5,000 for accounts that list a financial professional.

•$15,000 for self-directed accounts.

You may purchase, redeem or exchange Fund shares on any day which the New York Stock Exchange is open for business. Depending on where your account is held, you may redeem your shares by contacting your financial professional or the Fund by mail, telephone, wire transfer or on-line (www.profunds.com).

Tax Information

The Fund’s distributions generally are taxable, and will be taxed as ordinary income, qualified dividend income or capital gains, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account. You may be taxed later upon withdrawal of monies from such tax-advantaged arrangements. The Fund intends to distribute income, if any, quarterly, and capital gains, if any, at least annually.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a financial intermediary, such as a broker-dealer or investment adviser, the Fund and its distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

FUND NUMBERS :: Investor Class 059 :: Service Class 089 :: Banks UltraSector ProFund :: 15

Wire Fee $10

|

| ||

|

|

Investor

Class |

Service

Class |

|

Investment Advisory Fees |

|

|

|

Distribution and Service (12b-1) Fees |

|

|

|

Other Expenses |

|

|

|

Total Annual Fund Operating Expenses1 |

|

|

1

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Investor Class |

$ |

$ |

$ |

$ |

|

Service Class |

$ |

$ |

$ |

$ |

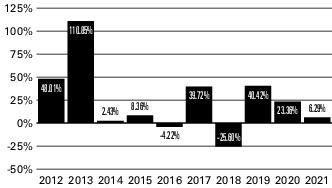

16 :: Banks UltraSector ProFund :: TICKERS :: Investor Class BKPIX :: Service Class BKPSX

FUND NUMBERS :: Investor Class 059 :: Service Class 089 :: Banks UltraSector ProFund :: 17

18 :: Banks UltraSector ProFund :: TICKERS :: Investor Class BKPIX :: Service Class BKPSX

|

| ||||||

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FUND NUMBERS :: Investor Class 059 :: Service Class 089 :: Banks UltraSector ProFund :: 19

20 :: Banks UltraSector ProFund :: TICKERS :: Investor Class BKPIX :: Service Class BKPSX

FUND NUMBERS :: Investor Class 059 :: Service Class 089 :: Banks UltraSector ProFund :: 21

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One

Year |

Five

Years |

Ten

Years |

Inception

Date |

|

Investor Class Shares |

|

|

|

|

|

– Before Taxes |

|

|

|

|

|

– After Taxes on Distributions |

|

|

|

|

|

– After Taxes on Distributions

and Sale of Shares |

|

|

|

|

|

Service Class Shares |

|

|

|

|

|

S&P 500®1 |

|

|

|

|

|

Dow Jones U.S. BanksSM

Index1 |

|

|

|

|

1

Management

The Fund is advised by ProFund Advisors. Michael Neches, Senior Portfolio Manager, and Tarak Davé, Portfolio Manager, have jointly and primarily managed the Fund since October 2013 and April 2018, respectively.

Purchase and Sale of Fund Shares

The minimum initial investment amounts for all classes, which may be waived at the discretion of the Fund, are:

•$5,000 for accounts that list a financial professional.

•$15,000 for self-directed accounts.

You may purchase, redeem or exchange Fund shares on any day which the New York Stock Exchange is open for business. Depending on where your account is held, you may redeem your shares by contacting your financial professional or the Fund by mail, telephone, wire transfer or on-line (www.profunds.com).

Tax Information

The Fund’s distributions generally are taxable, and will be taxed as ordinary income, qualified dividend income or capital gains, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account. You may be taxed later upon withdrawal of monies from such tax-advantaged arrangements. The Fund intends to distribute income, if any, and capital gains, if any, at least annually.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a financial intermediary, such as a broker-dealer or investment adviser, the Fund and its distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

22 :: Basic Materials UltraSector ProFund :: TICKERS :: Investor Class BMPIX :: Service Class BMPSX

Wire Fee $10

|

| ||

|

|

Investor

Class |

Service

Class |

|

Investment Advisory Fees |

|

|

|

Distribution and Service (12b-1) Fees |

|

|

|

Other Expenses |

|

|

|

Recoupment1 |

|

|

|

Other Operating Expenses |

|

|

|

Total Annual Fund Operating Expenses

Before Fee Waivers and Expense

Reimbursements |

|

|

|

Fee Waivers/Reimbursements2 |

- |

- |

|

Total Annual Fund Operating Expenses

After Fee Waivers and Expense

Reimbursements |

|

|

1

2

FUND NUMBERS :: Investor Class 042 :: Service Class 072 :: Basic Materials UltraSector ProFund :: 23

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Investor Class |

$ |

$ |

$ |

$ |

|

Service Class |

$ |

$ |

$ |

$ |

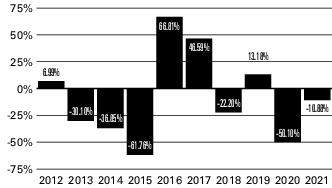

24 :: Basic Materials UltraSector ProFund :: TICKERS :: Investor Class BMPIX :: Service Class BMPSX

FUND NUMBERS :: Investor Class 042 :: Service Class 072 :: Basic Materials UltraSector ProFund :: 25

|

| ||||||

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26 :: Basic Materials UltraSector ProFund :: TICKERS :: Investor Class BMPIX :: Service Class BMPSX

FUND NUMBERS :: Investor Class 042 :: Service Class 072 :: Basic Materials UltraSector ProFund :: 27

28 :: Basic Materials UltraSector ProFund :: TICKERS :: Investor Class BMPIX :: Service Class BMPSX

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One

Year |

Five

Years |

Ten

Years |

Inception

Date |

|

Investor Class Shares |

|

|

|

|

|

– Before Taxes |

|

|

|

|

|

– After Taxes on Distributions |

|

|

|

|

|

– After Taxes on Distributions

and Sale of Shares |

|

|

|

|

|

Service Class Shares |

|

|

|

|

|

S&P 500®1 |

|

|

|

|

|

Dow Jones U.S. Basic

MaterialsSM Index1 |

|

|

|

|

1

Management

The Fund is advised by ProFund Advisors. Michael Neches, Senior Portfolio Manager, and Tarak Davé, Portfolio Manager, have jointly and primarily managed the Fund since October 2013 and April 2018, respectively.

Purchase and Sale of Fund Shares

The minimum initial investment amounts for all classes, which may be waived at the discretion of the Fund, are:

•$5,000 for accounts that list a financial professional.

•$15,000 for self-directed accounts.

You may purchase, redeem or exchange Fund shares on any day which the New York Stock Exchange is open for business. Depending on where your account is held, you may redeem your shares by contacting your financial professional or the Fund by mail, telephone, wire transfer or on-line (www.profunds.com).

FUND NUMBERS :: Investor Class 042 :: Service Class 072 :: Basic Materials UltraSector ProFund :: 29

Tax Information

The Fund’s distributions generally are taxable, and will be taxed as ordinary income, qualified dividend income or capital gains, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account. You may be taxed later upon withdrawal of monies from such tax-advantaged arrangements. The Fund intends to distribute income, if any, and capital gains, if any, at least annually.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a financial intermediary, such as a broker-dealer or investment adviser, the Fund and its

distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

30 :: Bear ProFund :: TICKERS :: Investor Class BRPIX :: Service Class BRPSX

Wire Fee $10

|

| ||

|

|

Investor

Class |

Service

Class |

|

Investment Advisory Fees |

|

|

|

Distribution and Service (12b-1) Fees |

|

|

|

Other Expenses |

|

|

|

Total Annual Fund Operating Expenses1 |

|

|

1

FUND NUMBERS :: Investor Class 006 :: Service Class 026 :: Bear ProFund :: 31

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Investor Class |

$ |

$ |

$ |

$ |

|

Service Class |

$ |

$ |

$ |

$ |

32 :: Bear ProFund :: TICKERS :: Investor Class BRPIX :: Service Class BRPSX

FUND NUMBERS :: Investor Class 006 :: Service Class 026 :: Bear ProFund :: 33

|

| ||||||

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34 :: Bear ProFund :: TICKERS :: Investor Class BRPIX :: Service Class BRPSX

FUND NUMBERS :: Investor Class 006 :: Service Class 026 :: Bear ProFund :: 35

36 :: Bear ProFund :: TICKERS :: Investor Class BRPIX :: Service Class BRPSX

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One

Year |

Five

Years |

Ten

Years |

Inception

Date |

|

Investor Class Shares |

|

|

|

|

|

– Before Taxes |

- |

- |

- |

|

|

– After Taxes on

Distributions |

- |

- |

- |

|

|

– After Taxes on

Distributions and Sale of

Shares |

- |

- |

- |

|

|

Service Class Shares |

- |

- |

- |

|

|

S&P 500®1 |

|

|

|

|

1

Management

The Fund is advised by ProFund Advisors. Michael Neches, Senior Portfolio Manager, and Devin Sullivan, Portfolio Manager, have jointly and primarily managed the Fund since October 2013 and April 2018, respectively.

Purchase and Sale of Fund Shares

The minimum initial investment amounts for all classes, which may be waived at the discretion of the Fund, are:

•$5,000 for accounts that list a financial professional.

•$15,000 for self-directed accounts.

You may purchase, redeem or exchange Fund shares on any day which the New York Stock Exchange is open for business. Depending on where your account is held, you may redeem your shares by contacting your financial professional or the Fund by mail, telephone, wire transfer or on-line (www.profunds.com).

FUND NUMBERS :: Investor Class 006 :: Service Class 026 :: Bear ProFund :: 37

Tax Information

The Fund’s distributions generally are taxable, and will be taxed as ordinary income, qualified dividend income or capital gains, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account. You may be taxed later upon withdrawal of monies from such tax-advantaged arrangements. The Fund intends to distribute income, if any, and capital gains, if any, at least annually.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a financial intermediary, such as a broker-dealer or investment adviser, the Fund and its

distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

38 :: Biotechnology UltraSector ProFund :: TICKERS :: Investor Class BIPIX :: Service Class BIPSX

Wire Fee $10

|

| ||

|

|

Investor

Class |

Service

Class |

|

Investment Advisory Fees |

|

|

|

Distribution and Service (12b-1) Fees |

|

|

|

Other Expenses |

|

|

|

Total Annual Fund Operating Expenses1 |

|

|

1

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Investor Class |

$ |

$ |

$ |

$ |

|

Service Class |

$ |

$ |

$ |

$ |

FUND NUMBERS :: Investor Class 043 :: Service Class 073 :: Biotechnology UltraSector ProFund :: 39

40 :: Biotechnology UltraSector ProFund :: TICKERS :: Investor Class BIPIX :: Service Class BIPSX

FUND NUMBERS :: Investor Class 043 :: Service Class 073 :: Biotechnology UltraSector ProFund :: 41

|

| ||||||

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

42 :: Biotechnology UltraSector ProFund :: TICKERS :: Investor Class BIPIX :: Service Class BIPSX

FUND NUMBERS :: Investor Class 043 :: Service Class 073 :: Biotechnology UltraSector ProFund :: 43

44 :: Biotechnology UltraSector ProFund :: TICKERS :: Investor Class BIPIX :: Service Class BIPSX

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One

Year |

Five

Years |

Ten

Years |

Inception

Date |

|

Investor Class Shares |

|

|

|

|

|

– Before Taxes |

|

|

|

|

|

– After Taxes on Distributions |

|

|

|

|

|

– After Taxes on Distributions

and Sale of Shares |

|

|

|

|

|

Service Class Shares |

|

|

|

|

|

S&P 500®1 |

|

|

|

|

|

Dow Jones

U.S. BiotechnologySM Index1 |

|

|

|

|

1

Management

The Fund is advised by ProFund Advisors. Michael Neches, Senior Portfolio Manager, and Tarak Davé, Portfolio Manager, have jointly and primarily managed the Fund since October 2013 and April 2018, respectively.

Purchase and Sale of Fund Shares

The minimum initial investment amounts for all classes, which may be waived at the discretion of the Fund, are:

•$5,000 for accounts that list a financial professional.

•$15,000 for self-directed accounts.

You may purchase, redeem or exchange Fund shares on any day which the New York Stock Exchange is open for business. Depending on where your account is held, you may redeem your shares by contacting your financial professional or the Fund by mail, telephone, wire transfer or on-line (www.profunds.com).

Tax Information

The Fund’s distributions generally are taxable, and will be taxed as ordinary income, qualified dividend income or capital gains, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account. You may be taxed later upon withdrawal of monies from such tax-advantaged arrangements. The Fund intends to distribute income, if any, and capital gains, if any, at least annually.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a financial intermediary, such as a broker-dealer or investment adviser, the Fund and its distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

FUND NUMBERS :: Investor Class 004 :: Service Class 024 :: Bull ProFund :: 45

Wire Fee $10

|

| ||

|

|

Investor

Class |

Service

Class |

|

Investment Advisory Fees |

|

|

|

Distribution and Service (12b-1) Fees |

|

|

|

Other Expenses |

|

|

|

Total Annual Fund Operating Expenses1 |

|

|

1

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Investor Class |

$ |

$ |

$ |

$ |

|

Service Class |

$ |

$ |

$ |

$ |

46 :: Bull ProFund :: TICKERS :: Investor Class BLPIX :: Service Class BLPSX

FUND NUMBERS :: Investor Class 004 :: Service Class 024 :: Bull ProFund :: 47

48 :: Bull ProFund :: TICKERS :: Investor Class BLPIX :: Service Class BLPSX

FUND NUMBERS :: Investor Class 004 :: Service Class 024 :: Bull ProFund :: 49

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One

Year |

Five

Years |

Ten

Years |

Inception

Date |

|

Investor Class Shares |

|

|

|

|

|

– Before Taxes |

|

|

|

|

|

– After Taxes on Distributions |

|

|

|

|

|

– After Taxes on Distributions

and Sale of Shares |

|

|

|

|

|

Service Class Shares |

|

|

|

|

|

S&P 500®1 |

|

|

|

|

1

Management

The Fund is advised by ProFund Advisors. Michael Neches, Senior Portfolio Manager, and Devin Sullivan, Portfolio Manager, have jointly and primarily managed the Fund since October 2013 and April 2018, respectively.

Purchase and Sale of Fund Shares

The minimum initial investment amounts for all classes, which may be waived at the discretion of the Fund, are:

•$5,000 for accounts that list a financial professional.

•$15,000 for self-directed accounts.

You may purchase, redeem or exchange Fund shares on any day which the New York Stock Exchange is open for business. Depending on where your account is held, you may redeem your shares by contacting your financial professional or the Fund by mail, telephone, wire transfer or on-line (www.profunds.com).

Tax Information

The Fund’s distributions generally are taxable, and will be taxed as ordinary income, qualified dividend income or capital gains, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account. You may be taxed later upon withdrawal of monies from such tax-advantaged arrangements. The Fund intends to distribute income, if any, and capital gains, if any, at least annually.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a financial intermediary, such as a broker-dealer or investment adviser, the Fund and its distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

50 :: Communication Services UltraSector ProFund :: TICKERS :: Investor Class WCPIX :: Service Class WCPSX

Wire Fee $10

|

| ||

|

|

Investor

Class |

Service

Class |

|

Investment Advisory Fees |

|

|

|

Distribution and Service (12b-1) Fees |

|

|

|

Other Expenses |

|

|

|

Recoupment1 |

|

|

|

Other Operating Expenses |

|

|

|

Total Annual Fund Operating Expenses

Before Fee Waivers and Expense

Reimbursements |

|

|

|

Fee Waivers/Reimbursements2 |

- |

- |

|

Total Annual Fund Operating Expenses

After Fee Waivers and Expense

Reimbursements |

|

|

1

2

FUND NUMBERS :: Investor Class 053 :: Service Class 083 :: Communication Services UltraSector ProFund :: 51

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Investor Class |

$ |

$ |

$ |

$ |

|

Service Class |

$ |

$ |

$ |

$ |

52 :: Communication Services UltraSector ProFund :: TICKERS :: Investor Class WCPIX :: Service Class WCPSX

FUND NUMBERS :: Investor Class 053 :: Service Class 083 :: Communication Services UltraSector ProFund :: 53

|

| ||||||

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

54 :: Communication Services UltraSector ProFund :: TICKERS :: Investor Class WCPIX :: Service Class WCPSX

FUND NUMBERS :: Investor Class 053 :: Service Class 083 :: Communication Services UltraSector ProFund :: 55

56 :: Communication Services UltraSector ProFund :: TICKERS :: Investor Class WCPIX :: Service Class WCPSX

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One

Year |

Five

Years |

Ten

Years |

Inception

Date |

|

Investor Class Shares |

|

|

|

|

|

– Before Taxes |

|

|

|

|

|

– After Taxes on Distributions |

|

|

|

|

|

– After Taxes on Distributions

and Sale of Shares |

|

|

|

|

|

Service Class Shares |

|

|

|

|

|

S&P 500®1 |

|

|

|

|

|

S&P Communication Services

Select Sector® Index1 |

|

|

|

|

1

FUND NUMBERS :: Investor Class 053 :: Service Class 083 :: Communication Services UltraSector ProFund :: 57

Management

The Fund is advised by ProFund Advisors. Michael Neches, Senior Portfolio Manager, and Tarak Davé, Portfolio Manager, have jointly and primarily managed the Fund since October 2013 and April 2018, respectively.

Purchase and Sale of Fund Shares

The minimum initial investment amounts for all classes, which may be waived at the discretion of the Fund, are:

•$5,000 for accounts that list a financial professional.

•$15,000 for self-directed accounts.

You may purchase, redeem or exchange Fund shares on any day which the New York Stock Exchange is open for business. Depending on where your account is held, you may redeem your shares by contacting your financial professional or the Fund by mail, telephone, wire transfer or on-line (www.profunds.com).

Tax Information

The Fund’s distributions generally are taxable, and will be taxed as ordinary income, qualified dividend income or capital gains, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account. You may be taxed later upon withdrawal of monies from such tax-advantaged arrangements. The Fund intends to distribute income, if any, and capital gains, if any, at least annually.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a financial intermediary, such as a broker-dealer or investment adviser, the Fund and its distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

58 :: Consumer Goods UltraSector ProFund :: TICKERS :: Investor Class CNPIX :: Service Class CNPSX

Wire Fee $10

|

| ||

|

|

Investor

Class |

Service

Class |

|

Investment Advisory Fees |

|

|

|

Distribution and Service (12b-1) Fees |

|

|

|

Other Expenses |

|

|

|

Total Annual Fund Operating Expenses

Before Fee Waivers and Expense

Reimbursements |

|

|

|

Fee Waivers/Reimbursements1

|

- |

- |

|

Total Annual Fund Operating Expenses

After Fee Waivers and Expense

Reimbursements |

|

|

1

FUND NUMBERS :: Investor Class 044 :: Service Class 074 :: Consumer Goods UltraSector ProFund :: 59

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Investor Class |

$ |

$ |

$ |

$ |

|

Service Class |

$ |

$ |

$ |

$ |

60 :: Consumer Goods UltraSector ProFund :: TICKERS :: Investor Class CNPIX :: Service Class CNPSX

FUND NUMBERS :: Investor Class 044 :: Service Class 074 :: Consumer Goods UltraSector ProFund :: 61

|

| ||||||

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

62 :: Consumer Goods UltraSector ProFund :: TICKERS :: Investor Class CNPIX :: Service Class CNPSX

FUND NUMBERS :: Investor Class 044 :: Service Class 074 :: Consumer Goods UltraSector ProFund :: 63

64 :: Consumer Goods UltraSector ProFund :: TICKERS :: Investor Class CNPIX :: Service Class CNPSX

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One

Year |

Five

Years |

Ten

Years |

Inception

Date |

|

Investor Class Shares |

|

|

|

|

|

– Before Taxes |

|

|

|

|

|

– After Taxes on Distributions |

|

|

|

|

|

– After Taxes on Distributions

and Sale of Shares |

|

|

|

|

|

Service Class Shares |

|

|

|

|

|

S&P 500®1 |

|

|

|

|

|

Dow Jones U.S. Consumer

GoodsSM Index1 |

|

|

|

|

1

Management

The Fund is advised by ProFund Advisors. Michael Neches, Senior Portfolio Manager, and Tarak Davé, Portfolio Manager, have jointly and primarily managed the Fund since October 2013 and April 2018, respectively.

FUND NUMBERS :: Investor Class 044 :: Service Class 074 :: Consumer Goods UltraSector ProFund :: 65

Purchase and Sale of Fund Shares

The minimum initial investment amounts for all classes, which may be waived at the discretion of the Fund, are:

•$5,000 for accounts that list a financial professional.

•$15,000 for self-directed accounts.

You may purchase, redeem or exchange Fund shares on any day which the New York Stock Exchange is open for business. Depending on where your account is held, you may redeem your shares by contacting your financial professional or the Fund by mail, telephone, wire transfer or on-line (www.profunds.com).

Tax Information

The Fund’s distributions generally are taxable, and will be taxed as ordinary income, qualified dividend income or capital gains, unless you are investing through a tax-advantaged arrangement,

such as a 401(k) plan or an individual retirement account. You may be taxed later upon withdrawal of monies from such tax-advantaged arrangements. The Fund intends to distribute income, if any, and capital gains, if any, at least annually.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a financial intermediary, such as a broker-dealer or investment adviser, the Fund and its distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

66 :: Consumer Services UltraSector ProFund :: TICKERS :: Investor Class CYPIX :: Service Class CYPSX

Wire Fee $10

|

| ||

|

|

Investor

Class |

Service

Class |

|

Investment Advisory Fees |

|

|

|

Distribution and Service (12b-1) Fees |

|

|

|

Other Expenses |

|

|

|

Total Annual Fund Operating Expenses1 |

|

|

1

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Investor Class |

$ |

$ |

$ |

$ |

|

Service Class |

$ |

$ |

$ |

$ |

FUND NUMBERS :: Investor Class 051 :: Service Class 081 :: Consumer Services UltraSector ProFund :: 67

68 :: Consumer Services UltraSector ProFund :: TICKERS :: Investor Class CYPIX :: Service Class CYPSX

FUND NUMBERS :: Investor Class 051 :: Service Class 081 :: Consumer Services UltraSector ProFund :: 69

|

| ||||||

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

70 :: Consumer Services UltraSector ProFund :: TICKERS :: Investor Class CYPIX :: Service Class CYPSX

FUND NUMBERS :: Investor Class 051 :: Service Class 081 :: Consumer Services UltraSector ProFund :: 71

72 :: Consumer Services UltraSector ProFund :: TICKERS :: Investor Class CYPIX :: Service Class CYPSX

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One

Year |

Five

Years |

Ten

Years |

Inception

Date |

|

Investor Class Shares |

|

|

|

|

|

– Before Taxes |

|

|

|

|

|

– After Taxes on Distributions |

|

|

|

|

|

– After Taxes on Distributions

and Sale of Shares |

|

|

|

|

|

Service Class Shares |

|

|

|

|

|

S&P 500®1 |

|

|

|

|

|

Dow Jones U.S. Consumer

ServicesSM Index1 |

|

|

|

|

1

Management

The Fund is advised by ProFund Advisors. Michael Neches, Senior Portfolio Manager, and Tarak Davé, Portfolio Manager, have jointly and primarily managed the Fund since October 2013 and April 2018, respectively.

Purchase and Sale of Fund Shares

The minimum initial investment amounts for all classes, which may be waived at the discretion of the Fund, are:

•$5,000 for accounts that list a financial professional.

•$15,000 for self-directed accounts.

You may purchase, redeem or exchange Fund shares on any day which the New York Stock Exchange is open for business. Depending on where your account is held, you may redeem your shares by contacting your financial professional or the Fund by mail, telephone, wire transfer or on-line (www.profunds.com).

Tax Information

The Fund’s distributions generally are taxable, and will be taxed as ordinary income, qualified dividend income or capital gains, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account. You may be taxed later upon withdrawal of monies from such tax-advantaged arrangements. The Fund intends to distribute income, if any, and capital gains, if any, at least annually.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a financial intermediary, such as a broker-dealer or investment adviser, the Fund and its distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

FUND NUMBERS :: Investor Class 002 :: Service Class 022 :: Europe 30 ProFund :: 73

Wire Fee $10

|

| ||

|

|

Investor

Class |

Service

Class |

|

Investment Advisory Fees |

|

|

|

Distribution and Service (12b-1) Fees |

|

|

|

Other Expenses |

|

|

|

Total Annual Fund Operating Expenses

Before Fee Waivers and Expense

Reimbursements |

|

|

|

Fee Waivers/Reimbursements1 |

- |

- |

|

Total Annual Fund Operating Expenses

After Fee Waivers and Expense

Reimbursements |

|

|

1

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Investor Class |

$ |

$ |

$ |

$ |

|

Service Class |

$ |

$ |

$ |

$ |

74 :: Europe 30 ProFund :: TICKERS :: Investor Class UEPIX :: Service Class UEPSX

FUND NUMBERS :: Investor Class 002 :: Service Class 022 :: Europe 30 ProFund :: 75

76 :: Europe 30 ProFund :: TICKERS :: Investor Class UEPIX :: Service Class UEPSX

FUND NUMBERS :: Investor Class 002 :: Service Class 022 :: Europe 30 ProFund :: 77

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One

Year |

Five

Years |

Ten

Years |

Inception

Date |

|

Investor Class Shares |

|

|

|

|

|

– Before Taxes |

|

|

|

|

|

– After Taxes on Distributions |

|

|

|

|

|

– After Taxes on Distributions and

Sale of Shares |

|

|

|

|

|

Service Class Shares |

|

|

|

|

|

STOXX Europe 50® Index1 |

|

|

|

|

|

ProFunds Europe 30® Index2 |

|

|

|

|

1

2

Management

The Fund is advised by ProFund Advisors. Alexander Ilyasov, Senior Portfolio Manager, and Scott Hanson, Portfolio Manager, have jointly and primarily managed the Fund since August 2020 and August 2016, respectively.

Purchase and Sale of Fund Shares

The minimum initial investment amounts for all classes, which may be waived at the discretion of the Fund, are:

•$5,000 for accounts that list a financial professional.

•$15,000 for self-directed accounts.

You may purchase, redeem or exchange Fund shares on any day which the New York Stock Exchange is open for business. Depending on where your account is held, you may redeem your shares by contacting your financial professional or the Fund by mail, telephone, wire transfer or on-line (www.profunds.com).

78 :: Europe 30 ProFund :: TICKERS :: Investor Class UEPIX :: Service Class UEPSX

Tax Information

The Fund’s distributions generally are taxable, and will be taxed as ordinary income, qualified dividend income or capital gains, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account. You may be taxed later upon withdrawal of monies from such tax-advantaged arrangements. The Fund intends to distribute income, if any, and capital gains, if any, at least annually.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a financial intermediary, such as a broker-dealer or investment adviser, the Fund and its

distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

FUND NUMBERS :: Investor Class 113 :: Service Class 143 :: Falling U.S. Dollar ProFund :: 79

Wire Fee $10

|

| ||

|

|

Investor

Class |

Service

Class |

|

Investment Advisory Fees |

|

|

|

Distribution and Service (12b-1) Fees |

|

|

|

Other Expenses |

|

|

|

Total Annual Fund Operating Expenses

Before Fee Waivers and Expense

Reimbursements |

|

|

|

Fee Waivers/Reimbursements1 |

- |

- |

|

Total Annual Fund Operating Expenses

After Fee Waivers and Expense

Reimbursements |

|

|

1

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Investor Class |

$ |

$ |

$ |

$ |

|

Service Class |

$ |

$ |

$ |

$ |

80 :: Falling U.S. Dollar ProFund :: TICKERS :: Investor Class FDPIX :: Service Class FDPSX

FUND NUMBERS :: Investor Class 113 :: Service Class 143 :: Falling U.S. Dollar ProFund :: 81

82 :: Falling U.S. Dollar ProFund :: TICKERS :: Investor Class FDPIX :: Service Class FDPSX

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One

Year |

Five

Years |

Ten

Years |

Inception

Date |

|

Investor Class Shares |

|

|

|

|

|

– Before Taxes |

- |

- |

- |

|

|

– After Taxes on Distributions |

- |

- |

- |

|

|

– After Taxes on Distributions

and Sale of Shares |

- |

- |

- |

|

|

Service Class Shares |

- |

- |

- |

|

|

S&P 500®1 |

|

|

|

|

|

ICE® U.S. Dollar Index®2 |

|

- |

|

|

1

2

FUND NUMBERS :: Investor Class 113 :: Service Class 143 :: Falling U.S. Dollar ProFund :: 83

Management

The Fund is advised by ProFund Advisors. Alexander Ilyasov, Senior Portfolio Manager, and James Linneman, Portfolio Manager, have jointly and primarily managed the Fund since April 2019 and March 2022, respectively.

Purchase and Sale of Fund Shares

The minimum initial investment amounts for all classes, which may be waived at the discretion of the Fund, are:

•$5,000 for accounts that list a financial professional.

•$15,000 for self-directed accounts.

You may purchase, redeem or exchange Fund shares on any day which the New York Stock Exchange is open for business. Depending on where your account is held, you may redeem your shares by contacting your financial professional or the Fund by mail, telephone, wire transfer or on-line (www.profunds.com).

Tax Information

The Fund’s distributions generally are taxable, and will be taxed as ordinary income, qualified dividend income or capital gains, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account. You may be taxed later upon withdrawal of monies from such tax-advantaged arrangements. The Fund intends to distribute income, if any, and capital gains, if any, at least annually.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a financial intermediary, such as a broker-dealer or investment adviser, the Fund and its distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

84 :: Financials UltraSector ProFund :: TICKERS :: Investor Class FNPIX :: Service Class FNPSX

Wire Fee $10

|

| ||

|

|

Investor

Class |

Service

Class |

|

Investment Advisory Fees |

|

|

|

Distribution and Service (12b-1) Fees |

|

|

|

Other Expenses |

|

|

|

Total Annual Fund Operating Expenses1 |

|

|

1

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Investor Class |

$ |

$ |

$ |

$ |

|

Service Class |

$ |

$ |

$ |

$ |

FUND NUMBERS :: Investor Class 048 :: Service Class 078 :: Financials UltraSector ProFund :: 85

86 :: Financials UltraSector ProFund :: TICKERS :: Investor Class FNPIX :: Service Class FNPSX

FUND NUMBERS :: Investor Class 048 :: Service Class 078 :: Financials UltraSector ProFund :: 87

|

| ||||||

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

88 :: Financials UltraSector ProFund :: TICKERS :: Investor Class FNPIX :: Service Class FNPSX

FUND NUMBERS :: Investor Class 048 :: Service Class 078 :: Financials UltraSector ProFund :: 89

90 :: Financials UltraSector ProFund :: TICKERS :: Investor Class FNPIX :: Service Class FNPSX

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One

Year |

Five

Years |

Ten

Years |

Inception

Date |

|

Investor Class Shares |

|

|

|

|

|

– Before Taxes |

|

|

|

|

|

– After Taxes on Distributions |

|

|

|

|

|

– After Taxes on Distributions

and Sale of Shares |

|

|

|

|

|

Service Class Shares |

|

|

|

|

|

S&P 500®1 |

|

|

|

|

|

Dow Jones U.S. FinancialsSM

Index1 |

|

|

|

|

1

FUND NUMBERS :: Investor Class 048 :: Service Class 078 :: Financials UltraSector ProFund :: 91

Management

The Fund is advised by ProFund Advisors. Michael Neches, Senior Portfolio Manager, and Tarak Davé, Portfolio Manager, have jointly and primarily managed the Fund since October 2013 and April 2018, respectively.

Purchase and Sale of Fund Shares

The minimum initial investment amounts for all classes, which may be waived at the discretion of the Fund, are:

•$5,000 for accounts that list a financial professional.

•$15,000 for self-directed accounts.

You may purchase, redeem or exchange Fund shares on any day which the New York Stock Exchange is open for business.

Depending on where your account is held, you may redeem your shares by contacting your financial professional or the Fund by mail, telephone, wire transfer or on-line (www.profunds.com).

Tax Information

The Fund’s distributions generally are taxable, and will be taxed as ordinary income, qualified dividend income or capital gains, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account. You may be taxed later upon withdrawal of monies from such tax-advantaged arrangements. The Fund intends to distribute income, if any, and capital gains, if any, at least annually.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a financial intermediary, such as a broker-dealer or investment adviser, the Fund and its distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

92 :: Health Care UltraSector ProFund :: TICKERS :: Investor Class HCPIX :: Service Class HCPSX

Wire Fee $10

|

| ||

|

|

Investor

Class |

Service

Class |

|

Investment Advisory Fees |

|

|

|

Distribution and Service (12b-1) Fees |

|

|

|

Other Expenses |

|

|

|

Total Annual Fund Operating Expenses1 |

|

|

1

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Investor Class |

$ |

$ |

$ |

$ |

|

Service Class |

$ |

$ |

$ |

$ |

FUND NUMBERS :: Investor Class 049 :: Service Class 079 :: Health Care UltraSector ProFund :: 93

94 :: Health Care UltraSector ProFund :: TICKERS :: Investor Class HCPIX :: Service Class HCPSX

FUND NUMBERS :: Investor Class 049 :: Service Class 079 :: Health Care UltraSector ProFund :: 95

|

| ||||||

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

96 :: Health Care UltraSector ProFund :: TICKERS :: Investor Class HCPIX :: Service Class HCPSX

FUND NUMBERS :: Investor Class 049 :: Service Class 079 :: Health Care UltraSector ProFund :: 97

98 :: Health Care UltraSector ProFund :: TICKERS :: Investor Class HCPIX :: Service Class HCPSX

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One

Year |

Five

Years |

Ten

Years |

Inception

Date |

|

Investor Class Shares |

|

|

|

|

|

– Before Taxes |

|

|

|

|

|

– After Taxes on Distributions |

|

|

|

|

|

– After Taxes on Distributions

and Sale of Shares |

|

|

|

|

|

Service Class Shares |

|

|

|

|

|

S&P 500®1 |

|

|

|

|

|

Dow Jones U.S. Health CareSM

Index1 |

|

|

|

|

1

Management

The Fund is advised by ProFund Advisors. Michael Neches, Senior Portfolio Manager, and Tarak Davé, Portfolio Manager, have jointly and primarily managed the Fund since October 2013 and April 2018, respectively.

Purchase and Sale of Fund Shares

The minimum initial investment amounts for all classes, which may be waived at the discretion of the Fund, are:

•$5,000 for accounts that list a financial professional.

•$15,000 for self-directed accounts.

You may purchase, redeem or exchange Fund shares on any day which the New York Stock Exchange is open for business. Depending on where your account is held, you may redeem your shares by contacting your financial professional or the Fund by mail, telephone, wire transfer or on-line (www.profunds.com).

Tax Information

The Fund’s distributions generally are taxable, and will be taxed as ordinary income, qualified dividend income or capital gains, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account. You may be taxed later upon withdrawal of monies from such tax-advantaged arrangements. The Fund intends to distribute income, if any, and capital gains, if any, at least annually.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a financial intermediary, such as a broker-dealer or investment adviser, the Fund and its distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

FUND NUMBERS :: Investor Class 056 :: Service Class 086 :: Industrials UltraSector ProFund :: 99

Wire Fee $10

|

| ||

|

|

Investor

Class |

Service

Class |

|

Investment Advisory Fees |

|

|

|

Distribution and Service (12b-1) Fees |

|

|

|

Other Expenses |

|

|

|

Recoupment1 |

|

|

|

Other Operating Expenses |

|

|

|

Total Annual Fund Operating Expenses

Before Fee Waivers and Expense

Reimbursements |

|

|

|

Fee Waivers/Reimbursements2 |

- |

- |

|

Total Annual Fund Operating Expenses

After Fee Waivers and Expense

Reimbursements |

|

|

1

2

100 :: Industrials UltraSector ProFund :: TICKERS :: Investor Class IDPIX :: Service Class IDPSX

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Investor Class |

$ |

$ |

$ |

$ |

|

Service Class |

$ |

$ |

$ |

$ |

FUND NUMBERS :: Investor Class 056 :: Service Class 086 :: Industrials UltraSector ProFund :: 101

102 :: Industrials UltraSector ProFund :: TICKERS :: Investor Class IDPIX :: Service Class IDPSX

|

| ||||||

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|