UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For 6 February, 2019

Commission File Number 1-14642

ING Groep N.V.

Bijlmerplein 888

1102 MG Amsterdam

The Netherlands

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T rule 101(b)(7): ☐

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b).

This Report contains a copy of the following:

The Press Release issued on 6 February, 2019

Investor enquiries T: +31 (0)20 576 6396 E: investor.relations@ing.com Press enquiries T: +31 (0)20 576 5000 E: media.relations@ing.com Investor conference call 6 February 2019 at 9:00 am CET +31 (0)20 531 5821 (NL) +44 203 365 3209 (UK) +1 866 349 6092 (US) Live audio webc ast at www.ing.com Media conference 6 February 2019 at 11:00 am CET Bijlmerplein 888, Amsterdam Or via +31 (0)20 531 5871 (NL) or +44 203 365 3210 (UK) (listen - only) Live audio webc ast at www.ing.com Corporate Communications Amsterdam, 6 February 2019 ING posts 2018 net result of €4,703 million; 4Q18 net result of €1,273 million ING continued to achieve strong commercial momentum • Retail customer base grew to 38.4 million in 4Q18, and primary customer relationships grew by 300,000 to reach 12.5 million • Net core lending increased by €3.2 billion in 4Q18; net customer deposit inflow amounted to €7.7 billion ING 4Q18 underlying pre - tax result of €1,692 million; full - year 2018 underlying pre - tax result up 4.5% on 2017 • Results reflect continued business growth at resilient margins, higher net commission and fee income, and lower risk costs • Full - year underlying ROE rose to 11.2% and fully loaded CET1 ratio is strong at 14.5%; FY2018 dividend of €0.68 per share CEO statement “This past year has been filled with both achievements to be proud of and challenges to overcome and learn from,” said Ralph Hamers, CEO of ING Group. “Following the settlement we reached with Dutch authorities in September 2018, we are continuing our know your customer (KYC) enhancement programme, emphasising regulatory compliance as the key priority. The organisation continues to work hard on enhancing our customer due diligence files and on a number of structural solutions to bring our anti - money laundering activities to a sustainably better level. We’re committed to conducting our business with integrity, and regulatory compliance remains the priority for 2019 and beyond. “At the same time, we’ve maintained the focus on our customers by continuing to create innovative products and services while transforming internally so we can provide customers with a differentiating and efficient banking experience. As we work to accelerate the pace of innovation, fintech fund ING Ventures made several investments. We invested in multibank platform Cobase, for example, which makes it easier and more efficient for international corporate clients to work with multiple banks. We also invested, together with UniCredit, in Axyon AI, an Italian company that helps banks offer better and faster advice to their clients by using artificial intelligence to identify investors most likely to participate in a syndicated loan, for example. “We continued to attract new customers. Our global customer base grew by one million customers over the year to reach 38.4 million, and the number of primary customers increased 9.9% to 12.5 million. Our most recent net promoter scores among customers rank us first in six of our 13 retail markets. Our customer focus is also reflected in our strong commercial results in 2018. Net growth in core lending amounted to €36.6 billion, while net growth in customer deposits was €19.3 billion. ING’s full - year underlying pre - tax result rose 4.5% to €7,524 million, reflecting continued business growth at resilient interest margins, despite heightened competition in some of our markets; higher net commission and fee income; and somewhat lower risk costs. ING’s full - year underlying return on equity increased from 2017 to 11.2% and the fully loaded CET1 ratio came in strong at 14.5%. We propose a full - year 2018 cash dividend of €0.68 per share, comprising the interim dividend of €0.24 paid in August 2018 and a final dividend of €0.44 per share. “Fourth - quarter underlying operating expenses fell 1.9% year - on - year, but they rose 11.3% from the third quarter, mainly due to higher regulatory costs related to the Dutch banking tax. We stepped up our cost - saving measures, resulting in a four - quarter rolling average cost - to - income ratio of 54.8%. We see a need for further cost discipline as we expect lower lending growth in Wholesale Banking, possible increases in regulatory expenses as well as due to the fact that Financial Markets profitability continues to be challenging. “As we take steps to build a sustainable future for our company and our customers, we’ve achieved a milestone in our ambition to steer our €600 billion loan book towards the well - below two - degree goal of the Paris Agreement. I’m proud that four major global banks have already joined us in our pledge – together, we have a combined loan book of €2.4 trillion. We believe that banks have a vital role to play in scaling, accelerating and financing the transition towards a low - carbon economy. Together, we are stronger. Supporting this transition, ING successfully issued the largest ever green bond transaction certified under the Climate Bonds Standard, and the largest ever from a European bank. The bonds will fund a green loan portfolio of new and existing loans in renewable energy and green buildings. “We’ve started 2019 with total dedication to our regulatory and compliance commitments, while always rememberingwho we’re here for – our customers. Empowering them to stay a step ahead in life and in business remains our guidingpurpose.” Press release

2 ING Press Release 4Q2018 Business Highlights Table of contents Share Information Business Highlights Consolidated Results Retail Banking Wholesale Banking Corporate Line Consolidated Balance Sheet Risk Management Capital, Liquidity and Funding Economic Environment Appendix 2 3 4 9 13 16 17 19 20 22 23 4Q2017 1Q2018 2Q2018 3Q2018 4Q2018 Shares (in millions, end of period) Total number of shares 3,885 .8 3,888 .0 3,891 .5 3,891 .6 3,891 .7 - Treasury shares 0.9 0.9 1.7 0.9 1.1 - Shares outstanding 3,884 .8 3,887 .1 3,889 .9 3,890 .7 3,890 .6 Average number of shares 3,884 .6 3,885 .0 3,889 .7 3,890 .1 3,890 .8 Share price (in euros) End of period 15 .33 13 .70 12 .33 11 .18 9.41 High 15 .98 16 .66 14 .45 13 .10 11 .39 Low 15 .00 13 .41 12 .28 10 .89 9.19 Net result per share (in euros) 0.26 0.32 0.37 0.20 0.33 Shareholders' equity per share (end of period in euros) 12 .97 12 .91 12 .85 12 .59 13 .09 Dividend per share (in euros) 0.43 - 0.24 - 0.44 Price/earnings ratio 1) 12 .1 10 .7 9.5 9.8 7.8 Price/book ratio 1.18 1.06 0.96 0.89 0.72 Share information 1) Four - quarter rolling average Market capitalisation (in € billion) 75 50 25 0 31 Dec. 2017 31 Mar. 2018 30 Jun. 2018 30 Sep. 2018 31 Dec. 2018 American Depositary Receipts (ADRs) For questions related to the ING ADR programme, please visit J.P. Morgan Depositary Receipts Services at www.adr.com, or contact: * only if any dividend is paid All dates are provisional Listing information The ordinary shares of ING Group are listed on the exchanges of Amsterdam, Brussels and New York (NYSE). Broker/Institutional investors please contact : J.P. Morgan Chase Bank, N.A. Depositary Receipts Group 383 Madison Avenue, Floor 11 New York, NY 10179 In the US : ( 866 ) JPM - ADRS Outside the US : + 1 866 576 - 2377 ADR shareholders can contact J.P. Morgan Transfer Agent Service Center: J.P. Morgan Chase Bank, N.A. P.O. Box 64504 St. Paul, MN 55164 - 0504 In the US: +1 800 990 1135 Outside the US: +1 651 453 2128 Email: jpmorgan.adr@eq - us.com Tickers (Bloomberg, Reuters) Security codes (ISIN, SEDOL1) NL0011821202, BZ57390 Euronext Amsterdam INGA NA, INGA.AS and Brussels New York Stock Exchange ING US, ING.N US4568371037, 2452643 Shareholders or holders of ADRs can request a hard copy of ING’s audited financial statements, free of charge, at www.ing.com/publications.htm Relative share price performance 1 January 2017 to 31 December 2018 130 120 110 100 90 80 70 60 1 Jan. 2017 1 Apr. 2017 1 Jul. 2017 1 Oct. 2017 1 Jan. 2018 1 Apr. 2018 1 Jul. 2018 1 Oct. 2018 31 Dec. 2018 ING Stoxx Europe 600 Banks Euro Stoxx 50 Euro Stoxx Banks Financial calendar Share Information 60 53 48 43 37 Listings Stock exchanges Publication 2018 ING Group Annual Report: Thursday, 7 March 2019 ING Investor Day: Monday, 25 March 2019 2019 Annual General Meeting: Tuesday, 23 April 2019 Ex - date for final dividend 2018 (Euronext Amsterdam)*: Thursday, 25 April 2019 Record date for final dividend 2018 entitlement (NYSE)*: Friday, 26 April 2019 Record date for final dividend 2018 entitlement (Euronext Amsterdam)*: Friday, 26 April 2019 Payment date final dividend 2018 (Euronext Amsterdam)*: Thursday, 2 May 2019 Publication results 1Q2019: Thursday, 2 May 2019 Payment date final dividend 2018 (NYSE)*: Thursday, 9 May 2019 Publication results 2Q2019: Thursday, 1 August 2019 Ex - date for interim dividend 2019 (Euronext Amsterdam)*: Monday, 5 August 2019 Record date for interim dividend 2019 entitlement (Euronext Amsterdam)*: Tuesday, 6 August 2019 Record date for interim dividend 2019 entitlement (NYSE)*: Monday, 12 August 2019 Payment date interim dividend 2019 (Euronext Amsterdam)*: Monday, 12 August 2019 Payment date interim dividend 2019 (NYSE)*: Monday, 19 August 2019 Publication results 3Q2019: Thursday, 31 October 2019

ING Press Release 4Q2018 3 Business Highlights ING posted strong commercial results in the fourth quarter and for the full year 2018. Our global customer base grew by one million customers to reach 38.4 million over the year, and the number of primary customers rose by 1.1 million to 12.5 million. Our most recent net promoter scores, based on direct feedback from our customers, rank us first in six of our 13 retail markets. Here are some highlights that show how we are empowering these customers to stay a step ahead in life and in business. Innovation Innovation is at the core of how we offer customers a differentiating experience. This is partly achieved by entering into partnerships and making strategic investments, such as with our fintech fund ING Ventures. We’ve invested in Cobase, a multibank platform that helps international customers manage multiple bank accounts. We also invested, together with UniCredit, in Axyon AI, an Italian company that helps banks offer better and faster advice to their clients by using artificial intelligence to identify investors most likely to participate in a syndicated loan, for example. In Spain, we expanded our partnership with Europe’s largest department store, El Corte Inglés, to roll out our mobile payments app Twyp in its supermarkets. This helps us take akey step forward in our objective to make Twyp available to as many people as possible. Customers of any bank can now make payments and withdrawals using Twyp at 8,000 points of sale, doubling the app’s reach within a year. In Australia, ING launched Everyday Round Up for HomeLoans, an extension of the digital savings tool Everyday Round Up. It helps customers pay down their ING home loan as they spend by rounding up loose change from their card purchases to the nearest $1 or $5, with the extra amount automatically shifted to help pay down their mortgage. It’s one more way ING is helping customers reach their goals by integrating their finances with their digital life. We introduced a mobile - only retail platform in the Philippines, which uses the ING Mobile Banking app as its only business channel. This proof - of - concept of our TouchPoint Architecture (TPA) was soft - launched in December after being built within nine months. Components will be available for use in our Retail businesses worldwide in further support of our goal to build a cross - border Retail platform. Increasing efficiency We’ve taken important steps in our programmes meant to strengthen our position in our Challenger markets by increasing efficiency. In the Czech Republic, for example, we migrated over 400,000 customers to a new Retail banking platform that offers a better customer experience across all channels. This is a milestone in our plan to create one advanced Retail banking platform to serve some seven million customers in the Czech Republic, Spain, Italy, France and later Austria . And in Germany, we completed the update of our IT systems, designed to create a go - to financial platform offering our own and third - party services . In the Netherlands, we’ve joined with ABN AMRO, Rabobank and Geldservice Nederland to launch shared ATMs under the brand Geldmaat. The ATMs will look similar and work in the same way. This partnership will lower costs as we stay focused on digitalising our customers, as well as making sure an efficient, bank - independent network of ATMs remains so that cash is easily accessible to our customers. After the migration, the Geldmaat ATMs will have replaced all of the banks’ existing ATMs in the Netherlands. Sustainable milestones ING has also made progress as we steer our €600 billion loan book towards the well - below two - degree goal of the Paris Agreement. Four banks have joined our pledge: BBVA, BNP Paribas, Société Générale and Standard Chartered. Together, we have a combined loan book of €2.4 trillion. This is a milestone, as we believe that banks have an important role to play in financing, scaling and accelerating the transition toward a low - carbon economy. ING successfully issued a 12 - year €1.5 billion and a 7 - year $1.25 billion green bond, the largest ever green bond transaction certified under the Climate Bonds Standard and the largest ever by a European bank. It will fund a green loan portfolio of new and existing loans in the categories renewable energy and green buildings. We are a leading bank in structuring green bonds for our clients and are pleased with our own, second, green bond transaction. It was named SRI Bond of the year at the prestigious 2018 IFR Awards. We also continue to advise clients on their sustainable projects. For example, we acted as financial advisor on the Jawa 1 integrated gas - to - power project in Indonesia. This project is an efficient and cleaner way to significantly add capacity to the power grid, especially in emerging markets. Not only was this Indonesia’s first gas - to - power project, it was also the first project - finance - based gas - to - power project in Asia. Know your customer Following the settlement we reached with Dutch authorities in September 2018, we are continuing taking a number of specific measures to strengthen our management of compliance risks and address the root causes. These measures are being implemented as part of a bank - wide, global know your customer (KYC) enhancement programme. The programme is aimed at enhancing our processes, tooling, monitoring, governance and mindset. More details on the setup of the KYC enhancement programme will be published in our Annual Report in March.

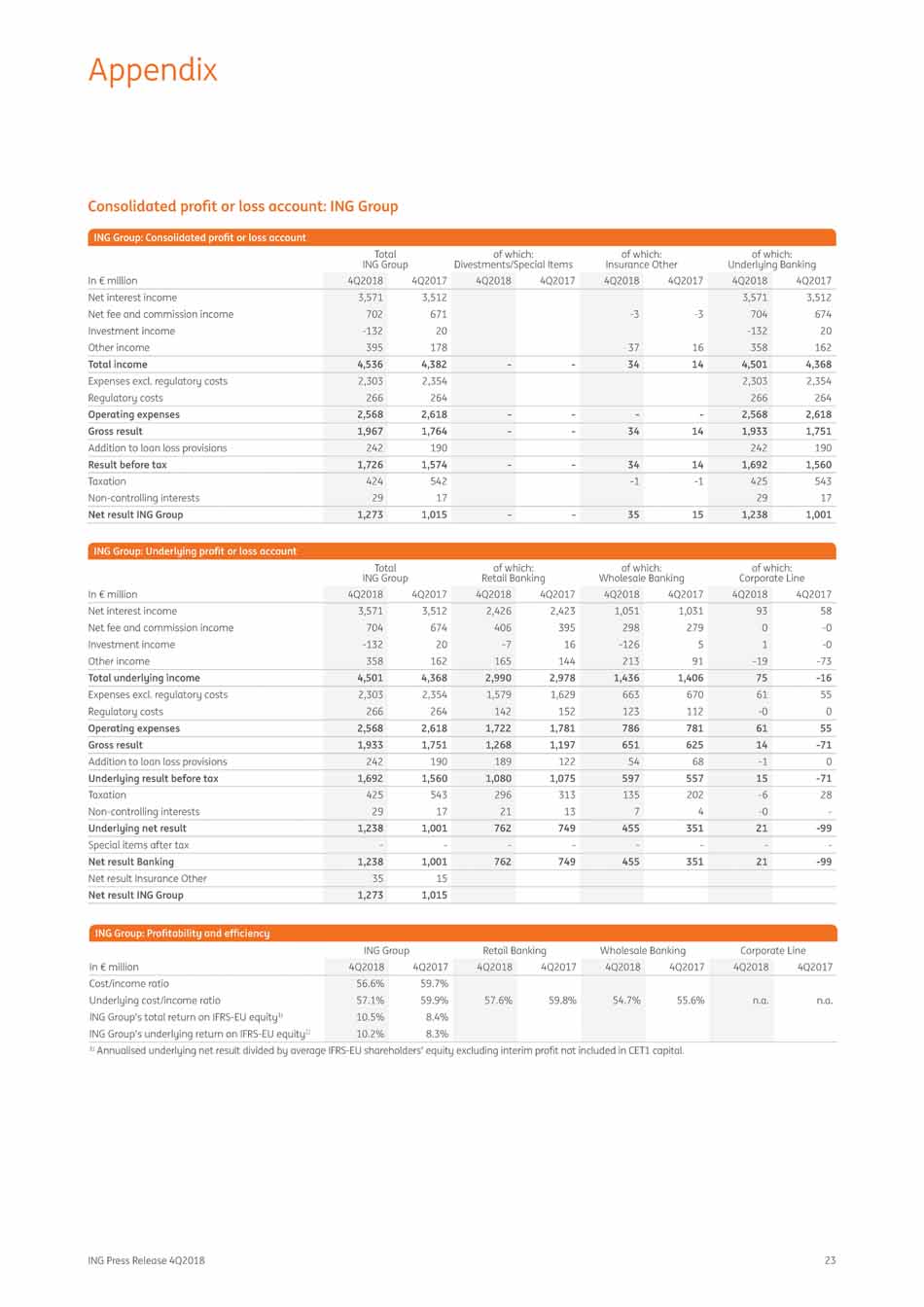

4 ING Press Release 4Q2018 Consolidated Results 1) Regulatory costs represent bank taxes and contributions to the deposit guarantee schemes (‘DGS’) and the (European) single resolution fund (‘SRF’). 2) The amount presented in 'Addition to loan loss provisions' (which is equivalent to risk costs) includes write - offs and recoveries on loans and receivables not included in the stock of provision for loan losses. 3) Capital ratios, customer lending/deposits, Stage 3 ratio, Stage 3 provision - coverage ratio and risk - weighted assets of FY2017 sh ow key figures as at 1 January 2018 and include the impact of applying IFRS 9. 4) Interim profit not included in CET1 capital in FY18 amounting to €1,712 million (FY17: €1,670 million, and 9M18: €1,577 million). 5) Annualised underlying net result divided by average IFRS - EU shareholders' equity excluding interim profit not included in CET1 capital. Note: Underlying figures are non - GAAP measures. These are derived from figures according to IFRS - EU by excluding the impact from special items and Insurance Other. See the Appendix for a reconciliation between GAAP and non - GAAP figures. 4Q2018 4Q2017 C h a n ge 3Q2018 C h a n ge FY2018 FY2017 C h a n ge C ro o f n it so o l r id lo a s t s ed (in re € su m lt i s ll Net interest income 3,571 3,512 1.7% 3,500 2.0% 13,916 13,714 1.5% Net fee and commission income 704 674 4.5% 720 - 2.2% 2,803 2,714 3.3% Investment income - 132 20 - 760.0% 89 - 248.3% 60 194 - 69 .1% Other income 358 162 121.0% 337 6.2% 1,309 1,083 20 .9% Total underlying income 4,501 4,368 3.0% 4,646 - 3.1% 18,088 17,704 2.2% Staff expenses 1,351 1,336 1.1% 1,346 0.4% 5,420 5,202 4.2% Regulatory costs 1) 266 264 0.8% 91 192.3% 947 901 5.1% Other expenses 952 1,018 - 6.5% 870 9.4% 3,540 3,726 - 5.0% Underlying operating expenses 2,568 2,618 - 1.9% 2,307 11.3% 9,907 9,829 0.8% Gross result 1,933 1,751 10.4% 2,339 - 17.4% 8,180 7,875 3.9% Addition to loan loss provisions 2) 242 190 27 .4% 215 12 .6% 656 676 - 3.0% Underlying result before tax 1,692 1,560 8.5% 2,124 - 20.3% 7,524 7,199 4.5% Taxation 425 543 - 21 .7% 582 - 27 .0% 2,028 2,160 - 6.1% Non - controlling interests 29 17 70 .6% 28 3.6% 108 82 31 .7% Underlying net result 1,238 1,001 23.7% 1,515 - 18.3% 5,389 4,957 8.7% Special items after tax 0 0 - 775 - 775 0 Net result from Banking 1,238 1,001 23.7% 740 67.3% 4,614 4,957 - 6.9% Net result Insurance Other 35 15 133.3% 36 - 2.8% 90 - 52 Net result ING Group 1,273 1,015 25.4% 776 64.0% 4,703 4,905 - 4.1% Net result per share (in €) 0.33 0.26 0.20 1.21 1.26 Capital ratios (end of period) 3) ING Group shareholders' equity (in € billion) 49 .0 4.0% 50 .9 49 .4 3.2% ING Group common equity Tier 1 ratio fully loaded 4) 14 .0% 14 .5% 14 .5% ING Group common equity Tier 1 ratio phased in 14 .0% 14 .5% 14 .5% Customer lending/deposits (end of period, in € billion) 3) Residential mortgages 284.9 1.0% 287.7 278.6 3.3% Other customer lending 318.8 - 3.1% 309.0 292.1 5.8% Customer deposits 552.0 0.7% 555.8 539.9 2.9% Profitability and efficiency Underlying interest margin 1.56% 1.58% 1.52% 1.53% 1.54% Underlying cost/income ratio 57 .1% 59 .9% 49 .7% 54 .8% 55 .5% Underlying return on equity based on IFRS - EU equity 5) 10 .2% 8.3% 12 .7% 11 .2% 10 .2% Employees (internal FTEs, end of period) 52,519 0.6% 52,855 51,815 2.0% Four - quarter rolling average key figures Underlying interest margin 1.53% 1.54% 1.53% Underlying cost/income ratio 54 .8% 55 .5% 55 .5% Underlying return on equity based on IFRS - EU equity 5) 11 .2% 10 .2% 10 .7% Risk 31 25 Stage 3 ratio (end of period) 3) 1.6% 1.5% 1.8% Stage 3 provision - coverage ratio (end of period) 3) 34 .0% 30 .6% 34 .6% Underlying risk costs in bps of average RWA 27 21 22 Risk - weighted assets (end of period, in € billion) 3) 316.3 - 0.9% 314.1 311.2 0.9%

ING Press Release 4Q2018 5 Consolidated Results ING posted strong commercial results in 2018. They were primarily driven by continued business growth at resilient interest margins, higher net commission and fee income, and slightly lower risk costs. The full - year 2018 net result was €4,703 million and includes the impact of the €775 million settlement agreement with the Dutch authorities, which was recorded as a special item in the third quarter of 2018. Commercial performance was robust in 2018, as further evidenced by a net growth in primary customers of 1.1 million. At comparable exchange rates and excluding Bank Treasury and the run - off portfolios, net core lending growth was €36.6 billion, or 6.4%. The net growth in customer deposits was €19.3 billion. Risk costs declined slightly to 21 basis points of average risk - weighted assets. ING Group’s fully loaded CET1 ratio was 14.5% at year - end 2018. The underlying net result, defined as net result excluding special items and Insurance Other, rose 8.7% to €5,389 million in 2018; this was mainly supported by higher income and a lower effective tax rate. The underlying pre - tax result rose 4.5% compared with 2017, and the underlying cost/income ratio improved by 0.7 percentage point to 54.8%. ING’s underlying return on IFRS - EU equity rose to 11.2% in 2018 from 10.2% in 2017. ING’s fourth - quarter 2018 net result was €1,273 million, up from €1,015 million in the fourth quarter of 2017 and €776 million in the previous quarter, which included the aforementioned settlement agreement. Year - on - year, the underlying net result rose by €237 million to €1,238 million. Commercial momentum continued in the fourth quarter of 2018 as the number of primary clients grew by 300,000 to 12.5 million. ING recorded €3.2 billion of net core lending growth in the fourth quarter of 2018. Underlying results The fourth - quarter 2018 underlying result before tax of €1,692 million was mainly attributable to strong net interest income (supported by resilient margins), solid net fee and commission income, and a higher profit from our stake in TMB, while risk costs remained well below ING’s through - the - cycle average. The pre - tax result was negatively affected by higher expenses, mainly due to the annual Dutch bank tax, which was fully recorded in the fourth quarter. Compared with the fourth quarter of 2017, the underlying result before tax rose 8.5%. Sequentially, the underlying result before tax fell 20.3%. This was mainly caused by higher expenses, lower Bank Treasury - related income and the annual Bank of Beijing dividend, which was recorded in the third quarter of 2018. Total underlying income Total underlying income rose 3.0% to €4,501 million compared with the fourth quarter of 2017. The increase mainly reflects business growth in Retail Challengers & Growth Markets and in the Wholesale Banking lending activities, as well as an improvement of the result in the Corporate Line. These drivers more than outpaced negative currency impacts, notably the depreciation of the Turkish lira against the euro, and lower income in Retail Benelux. Financial Markets revenues remained low and ended just slightly above last year’s level. Compared with the third quarter of 2018, which included a €83 million annual dividend from Bank of Beijing, total underlying income declined by €145 million. The remaining decrease was primarily due to lower Bank Treasury - related income (especially in Retail Netherlands and Retail Germany) and lower revenues from Financial Markets and Corporate Investments within Wholesale Banking. Total customer lending declined by €7.0 billion in the fourth quarter of 2018 to €596.7 billion, primarily caused by Bank Treasury (which reported a €9.7 billion decrease) and the run - off portfolios of WUB and Lease (a €2.2 billion decline). Excluding these items and adjusted for currency impacts, net growth in ING’s core lending book was €3.2 billion. Residential mortgages increased by €3.5 billion due to growth in most countries, including the Netherlands. Other net core lending declined by €0.2 billion. This was mainly attributable to Wholesale Banking, which reported a decline of €1.5 billion; this decline was predominantly in Trade & Commodity Finance, among others as a consequence of a drop in oil prices. In Retail Banking, other net core lending grew by €1.2 billion, primarily in Retail Belgium. ING’s total net growth in core lending in 2018 was €36.6 billion (or +6.4%) versus €26.9 billion in 2017. Customer deposits increased by €3.8 billion to €555.8 billion in the fourth quarter of 2018. Excluding a decline in Bank Treasury and adjusted for currency impacts, net customer deposits in Retail and Wholesale Banking grew by €7.7billion. Retail Banking generated a net inflow of €9.2 billion, driven by strong growth in Germany and in the Other Challengers & Growth Markets. In the Benelux, there was limited growth in the Netherlands, while Belgium reported a small net outflow. Net customer deposits in Wholesale Banking decreased by €1.6 billion. On a full - year basis, total net customer deposit growth (excluding currency impacts and Bank Treasury) was €19.3 billion in 2018, slightly higher than the €19.0 billion of net growth in 2017. Underlying net interest income increased to €3,571 million from €3,512 million in the fourth quarter of 2017, despite a

6 ING Press Release 4Q2018 Consolidated Results €60 million decline in the volatile interest results of Financial Markets. The increase was driven by higher interest resultson customer lending, due to volume growth in both mortgages and other customer lending whereas the overall lending margin remained stable compared with a year ago despite heightened competition in some of our markets. The interest results on customer deposits declined slightly compared with the fourth quarter of 2017. This was caused by lower interest margins on both savings and current accounts, partly offset by the impact of higher volumes in current accounts. Compared with the third quarter of 2018, total net interest income increased by €71 million, or 2.0%. The increase was mainly caused by €82 million of higher interest results in Financial Markets (with an offset in other income). A slight increase in the interest result on customer lending was offset by an almost equal decline on customer deposits. Net interest income (in € million) and net interest margin (in %) in the balance sheet from loans and receivables to assets held for sale. The remaining €9 million loss mainly reflects negative realised results on debt and equity securities. Compared with the third quarter of 2018, investment income fell by €221 million. This decline was mainly caused by the aforementioned loss on the Italian lease run - off portfolio, whereas the previous quarter included the €83 million annual dividend from Bank of Beijing. Other income rose to €358 million from €162 million in the year - ago quarter. The increase was supported by a €101 million gain on an equity - linked bond transaction in Belgium and an approximately €50 million higher contribution from our stake in TMB, which was mainly driven by one - offs. Excluding both items, other income rose by €45 million, due to an increase in Financial Markets revenues, which was only partly offset by lower Bank Treasury - related other income. On a sequential basis, other income increased by €21 million as the positive impact from the aforementioned items in the 3,750 3,500 3,250 3,000 2,750 4 Q 201 7 1 Q 201 8 2 Q 201 8 3 Q 201 8 4Q201 8 1 . 7 1 . 6 1 . 5 1 . 4 1 . 3 fourth quarter was largely offset by strong declines in Bank Treasury - related other income and in Financial Markets. Net interest income Net interest margin Operating expenses Underlying operating expenses decreased 1.9% year - on - year to €2,568 million, but they rose 11.3% compared with the third quarter of 2018. Regulatory costs in the fourth quarter of 2018 totalled €266 million and were almost on par with the year - ago quarter. However, they were significantly higher than the € 91 million of regulatory costs in the previous quarter due to the fact that the annual Dutch bank tax was recorded in the final quarter of theyear . Operating expenses (in € million) and cost/income ratio (in %) 264 98 266 ING’s fourth - quarter 2018 net interest margin rose to 1.56% compared with 1.52% in the third quarter of 2018. The higher, volatile interest results in Financial Markets led to an increase of four basis points and almost fully explain the quarter - on - quarter increase, whereas the lower average balance sheet added another one basis point. The interest margin on customer lending remained stable, while the interest margin on customer deposits declined due to a lower margin on savings. 55 .5% 56 .1% 55 .7 % 55 .5% 62 . 5 60 . 0 57 . 5 54 . 8 % 2,750 2,500 2,250 2,000 1,750 1,500 2,354 2,19 2,24 2,21 2,303 55.0 52 . 5 50.0 Net fee and commission income rose to €704 million from €674 million one year ago. In Retail Banking, net fee and commission income increased by €11 million, mainly due to higher fee income in the Netherlands and Germany, while fees declined in Turkey and Belgium among others. Total fee income in Wholesale Banking rose by €19 million, supported by higher fee income in Industry Lending and the inclusion of Payvision as from the second quarter of 2018. Compared with the third quarter of 2018, which included €27 million of income related to Global Capital Markets activities that had been recorded under ‘other income’ in the first half of 2018, net fee and commission income fell by €16 million. Excluding this adjustment in Financial Markets fees, net fee and commission income was €11 million higher, predominantly due to higher fee income in Industry Lending. Investment income dropped to € - 132 million from €20 million in the fourth quarter of 2017, primarily due to a €123 million recorded loss related to the intended sale of an Italian lease run - off portfolio. The sale process triggered a reclassification 3 Q 201 8 4 Q 2 0 1 8 4 Q 201 7 1 Q 201 8 2 Q 201 8 Regulatory costs Expenses excluding regulatory costs C/I ratio (4 - quarter rolling average) Expenses excluding regulatory costs declined by €51 million, or 2.2%, compared with a year ago to €2,303 million. Decreases were mainly recorded in Retail Netherlands, which included additional restructuring costs in the fourth quarter of 2017, and in the Retail Challengers & Growth Markets, which were supported by foreign currency movements. Expenses in Wholesale Banking were slightly lower than a year ago, mainly due to lower additions to legal provisions and strict cost management, and despite the inclusion of Payvision. In the Corporate Line, expenses were slightly higher due to increased shareholder expenses and higher costs for innovation initiatives and strategic projects, which in turn were partly offset by a higher VAT refund. Compared with the third quarter of 2018, expenses excluding 3,404 3,441 3,512 3,500 1.52% 1 .51% 1 .52% 3,571 1.56% .58 % 493 91

ING Press Release 4Q2018 7 Consolidated Results regulatory costs rose by €87 million, or 3.9%. This increase was primarily visible in Retail Netherlands (mainly due to higher staff costs), Retail Other Challengers & Growth Markets (primarily due to additional investments in strategic projects) and Wholesale Banking (due to impairments and additional pension charges), and was also caused by higher expenses for compliance and the KYC enhancement programme. Expenses in the Corporate Line also increased, mainly due to the aforementioned reasons, whereas the previous quarter included a reimbursement from reinsurance and settlement costs related to previous ING Group entities. ING’s fourth - quarter 2018 underlying cost/income ratio was 57.1% compared with 59.9% in the year - ago quarter and 49.7% in the previous quarter. On a full - year basis, which eliminates the seasonality of regulatory costs, the underlying cost/income ratio improved to 54.8% from 55.5% in 2017. The total number of internal staff increased by 336 FTEs in the fourth quarter to 52,855 FTEs at year - end 2018. This was due to FTE increases in the Netherlands and in most of the Challengers & Growth Markets countries. These increases were partly offset by declines primarily in Belgium and Romania. Addition to loan loss provisions ING recorded €242 million of net additions to loan loss provisions in the fourth quarter of 2018 compared with €190 million in the year - ago quarter and €215 million in the third quarter of 2018. As from 2018, risk costs are reported in accordance with IFRS 9 and are therefore not fully comparable with those reported in previous years when IAS 39 accounting standards were applied. Compared with the third quarter of 2018, risk costs in Retail Banking increased, whereas Wholesale Banking reported a decline. Overall, the macroeconomic outlook has deteriorated somewhat but it remained robust in both Europe and the US. In Turkey, the macroeconomic environment has deteriorated more rapidly, impacting IFRS 9 riskcosts. Addition to loan loss provisions (in € million) Risk costs in the Retail Challengers & Growth Markets were €107 million, up from €90 million in the fourth quarter of 2017 and €82 million in the previous quarter. Fourth - quarter 2018 risk costs were recorded mainly in Turkey, Spain and Poland, while Germany recorded a net release due to a review of the consumer lending portfolio. Wholesale Banking recorded €54 million of risk costs in the fourth quarter of 2018 compared with €68 million in the year - ago quarter and €108 million in the previous quarter. Fourth - quarter 2018 risk costs were predominantly in individual Stage 3 provisions and mainly attributable to a few larger clients in the Americas and Italy. ING’s Stage 3 ratio, which represents Stage 3 credit - impaired outstandings as a percentage of total credit outstandings, improved to 1.5% at year - end 2018 compared with 1.6% at the end of 30 September 2018 and 1.8% as of 1 January 2018. Total fourth - quarter 2018 risk costs were 31 basis points of average risk - weighted assets (RWA) versus 25 basis points in the fourth quarter of 2017 and 27 basis points in the third quarter of 2018. Although higher than in the previous quarters, risk costs remained well below ING’s through - the - cycle average of 40 - 45 basis points. For the full - year 2018, risk costs were 21 basis points of average risk - weighted assets, which is just below last year's level. Underlying result before tax ING’s fourth - quarter 2018 underlying result before tax was €1,692 million, up 8.5% from one year ago as higher income and lower expenses more than compensated for an increase in risk costs . Quarter - on - quarter, the underlying result before tax fell 20 . 3 % , partly due to the Dutch bank tax and the annual Bank of Beijing dividend received in the previous quarter . Underlying result before tax (in € million) 300 200 100 0 190 85 11 115 15 215 27 242 60 40 20 0 2,500 2,000 1,500 1,000 500 0 4 Q 201 7 1 Q 201 8 2 Q 201 8 3 Q 201 8 4 Q 2 0 1 8 3 Q 201 8 4 Q 2 0 1 8 4Q2017 1Q2018 2Q2018 Addition to loan loss provisions Risk costs in bps of average RWA (annualised) Retail Netherlands recorded € 41 million of risk costs in the fourth quarter of 2018 , primarily caused by a more prudent approach for part of the Dutch mortgage portfolio . Risk costs were € 5 million in the year - ago quarter, and the third quarter of 2018 showed a net release from loan loss provisions of €21 million. In Retail Belgium, risk costs were €40 million, largely related to business lending. This was higher than the €27 million in the same quarter of last year, but lower than the € 46 million in the third quarter of 2018 . 2,022 2,124 1,560 1,686 1,692 25 31

8 ING Press Release 4Q2018 Segment Reporting: Retail Banking Underlying net result ING’s underlying net result was €1,238 million. This is 23.7% higher than the €1,001 million recorded in the fourth quarter of 2017, but down 18.3% from €1,515 million in the third quarter of 2018. The effective underlying tax rate was 25.1% compared with 27.4% in the previous quarter and 34.8% in the fourth quarter of 2017. The relatively high tax charge in the fourth quarter of 2017 was mainly due to the impact of the corporate tax reforms in the US and Belgium, which resulted in a one - off tax charge related to a reduction in deferred tax assets. Return on equity (in %) 15 . 0 12 . 5 10 . 0 7 . 5 4Q2017 1Q2018 2Q2018 3Q2018 4Q2018 Underlying return on IFRS - EU equity (quarter) Underlying return on IFRS - EU equity (4 - quarter rolling average) In the fourth quarter of 2018, ING’s underlying return on average IFRS - EU equity was 10.2% compared with 8.3% reported over the fourth quarter of 2017 and 12.7% over the third quarter of 2018. Over the full year of 2018, the underlying return on ING Group’s average IFRS - EU equity increased to 11.2% in 2018 from 10.2% in 2017. ING’s underlying return on equity is calculated using IFRS - EU shareholders' equity after excluding 'interim profit not included in CET1 capital'. As at 31 December 2018, interim profit not included in CET1 capital amounted to €1,712 million, and is already reserved for future dividend payments. Net result ING’s fourth - quarter 2018 net result amounted to €1,273 million compared with €1,015 million in the fourth quarter of 2017 and €776 million in the third quarter of 2018. The net result also includes the net result from special itemsand Insurance Other. There were no special items excluded from the underlying results in the fourth quarter of 2018, nor in the year - ago quarter. In the third quarter of 2018, a special item of € - 775 million was recorded following the settlement agreement with the Dutch authorities on regulatory issues. In the fourth quarter of 2018, ING recorded a €35 million net result from Insurance Other. This result reflects the profit made on the termination of the warrant agreement between NN Group and ING in November 2018, for which NN Group has paid a total consideration of €76 million. With this transaction, ING no longer holds any warrants related to its previous Insurance activities. In the fourth quarter of 2017, the net result on warrants (which at that time still included the result from warrants on Voya shares) was €15 million. The last remaining warrants on Voya shares were sold in March 2018 . In the third quarter of 2018 , a net profit of € 36 million was recorded on the warrants on NN Group shares due to a positive change in valuation . ING’s net result per share was €0.33 in the fourth quarter of 2018 based on an average number of shares outstanding of 3,891 million during the quarter. ING’s full - year 2018 net result was €4,703 million, or €1.21 per share. ING’s total return on average IFRS - EU equity excluding 'interim profit not included in CET1 capital' was 10.5% in the fourth quarter of 2018; the total full - year 2018 return was 9.8%. Dividend In line with our financial ambitions, ING is committed to maintaining a CET1 ratio of around 13.5%, taking into account potential RWA inflation from regulatory developments on the current CET1 ratio. This is well above the prevailing fully loaded requirement, currently set at 11.8%, and implies a management buffer of 170 basis points (including Pillar 2 Guidance). ING aims to pay a progressive dividend. The Board proposes to pay a total 2018 dividend of €2.6 billion, or €0.68 per ordinary share, subject to the approval of shareholders at the Annual General Meeting in April 2019. Taking into account the interim dividend of €0.24 per ordinary share that was paid in August 2018, the final 2018 proposed dividend amounts to €0.44 per ordinary share and will be paid in cash shortly after the Annual General Meeting. Consolidated Results 11 .2 10.2 12 .7 12 .0 10 .0 8.3 10 .7 10 .4 10 .3 10 .2

ING Press Release 4Q2018 9 Segment Reporting: Retail Banking 1) Key figures based on underlying figures 2) Underlying after - tax return divided by average equity based on 12.0% CET1 ratio (annualised). Retail Benelux Retail Netherlands Retail Netherlands posted an underlying fourth - quarter 2018 result before tax of €456 million, down 11.6% versus the year - ago quarter. The decrease was mainly attributable to lower net interest income, reflecting lower margins on savings and current accounts, as well as higher risk costs due to a more prudent approach for part of the mortgage portfolio. Underlying expenses decreased 5.9%, mainly due to lower regulatory costs and lower redundancy and restructuring costs. Sequentially, the underlying result before tax declined by €191 million, or 29.5%. This was due to €58 million of lower income (mainly attributable to lower Bank Treasury - related results), €71 million of higher expenses (mainly regulatory costs due to the annual Dutch bank tax and increased staff expenses), and €62 million of higher risk costs after a release in the third quarter of 2018. The return on equity, based on a 12% common equity Tier 1 ratio, was 24.6% for the quarter and 30.6% for the full - year 2018. Underlying result before tax - Retail Netherlands (in € million) 800 600 400 200 0 4Q2017 1Q2018 2Q2018 3Q2018 4Q20 1 8 676 647 563 516 456 “I am pleased to say that we reached further milestones in our Unite programme during the fourth quarter of 2018, most notably the launch of our new cross - border IT organisation. The shared platform we are building and the accompanying operational model will streamline our operations, thereby facilitating faster interactions and better service for customers in Belgium and the Netherlands. “We saw good commercial performance in the Netherlands in 2018, especially in light of the persistently low interest rate environment and in the context of our ongoing transformation. Cost control remained a focal point, which is evident by lower expenses compared with the prior year, while we are continuously working to improve our KYC processes and risk mindset. “In Belgium, we completed the installation of our new sales and servicing model. With this new approach personal advice has become more accessible in the branches while, together with the service provided by our Customer Loyalty Teams, customers will be enabled to process simple banking transactions effortlessly and efficiently via their preferred channel.” Roland Boekhout , Member Management Board Banking, Head of Market Leaders Retail Benelux: Consolidated profit or loss account Retail Benelux Netherlands Belgium In € million 4Q2018 4Q2017 4Q2018 4Q2017 4Q2018 4Q2017 Profit or loss Net interest income 1,323 1,359 858 908 465 451 Net fee and commission income 247 238 166 152 81 86 Investment income - 2 2 - 2 0 0 2 Other income 85 124 54 76 32 48 Total underlying income 1,653 1,723 1,076 1,136 577 587 Expenses excl. regulatory costs 875 900 524 550 351 350 Regulatory costs 64 75 55 65 9 10 Operating expenses 939 975 579 615 360 360 Gross result 714 748 497 521 217 227 Addition to loan loss provisions 81 32 41 5 40 27 Underlying result before tax 633 716 456 516 177 200 Profitability and efficiency 1) Cost/income ratio 56 .8% 56 .6% 53 .8% 54 .1% 62 .4% 61 .3% Return on equity based on 12.0% common equity Tier 1 2) 17 .9% 19 .2% 24 .6% 26 .2% 9.8% 9.6% Employees (internal FTEs, end of period) 16,888 17,276 8,862 8,811 8,026 8,464 Risk 1) Risk costs in bps of average RWA 38 15 36 4 42 30 Risk - weighted assets (end of period, in € billion) 84 .9 83 .4 45 .8 48 .2 39 .1 35 .1 4Q2018 3Q2018 4Q2018 3Q2018 4Q2018 3Q2018 Customer lending/deposits (end of period, in € billion) Residential mortgages 149.2 149.2 111.4 111.3 37 .9 37 .9 Other customer lending 84 .1 88 .2 34 .7 40 .3 49 .5 48 .0 Customer deposits 229.3 230.9 143.8 145.4 85 .5 85 .6

10 ING Press Release 4Q2018 Segment Reporting: Retail Banking Total underlying income declined 5.3% year - on - year to €1,076 million. This was mainly caused by a decrease in net interest income, reflecting lower margins on savings and current accounts, as well as lower Bank Treasury - related income. These factors were only partly compensated by higher margins on mortgages and an increase in net fee and commission income. On a sequential basis, total underlying income fell 5.1%. The decline was caused by lower income from Bank Treasury and from savings and current accounts, partly offset by higher margins on mortgages. Net core lending (excluding declines in Bank Treasury and the WUB run - off portfolio) grew by €0.4 billion in the fourth quarter of 2018, of which €0.3 billion was in residential mortgages. Overall, total customer lending decreased by €5.5 billion in the fourth quarter to €146.0 billion; of this decline, €5.7 billion was attributable to Bank Treasury. Net customer deposits (excluding Bank Treasury) grew by €0.3 billion, reflecting €1.5 billion of net inflow in current accounts, which was largely offset by €1.2 billion of outflow in savings and deposits, mainly due to seasonality. Underlying operating expenses decreased by € 36 million, or 5 . 9 % , from a year ago . Excluding a € 10 million decline in regulatory costs, expenses were 4 . 7 % lower . This was mainly due to lower redundancy and restructuring costs and the benefits from our ongoing cost - savings programmes, which more than offset the impact of higher salaries and an increase in external staff costs. Sequentially, expenses were €71 million higher, of which €34 million was caused by higher regulatory costs due to the booking of the annual Dutch bank tax as well as higher DGS costs in the fourth quarter. Excluding regulatory costs, expenses rose by €37 million from the third quarter of 2018. This was mainly due to higher staff expenses related to transformation and KYC enhancement programme. Fourth - quarter 2018 risk costs were €41 million, or 36 basis points of average risk - weighted assets, compared with €5 million in the year - ago quarter and a €21 million net release in the third quarter of 2018. The higher risk costs were almost entirely related to a more prudent approach for part of the mortgage portfolio. Risk - weighted assets decreased by €1.3 billion in the fourth quarter of 2018 to €45.8 billion, mainly reflecting positive risk migration. Retail Belgium Retail Belgium, including Luxembourg, posted a fourth - quarter 2018 underlying result before tax of €177 million, down 11.5% from €200 million in the year - ago quarter. Total income decreased 1.7% compared with the fourth quarter of 2017, while expenses were broadly stable and risk costs increased, mainly related to business lending. On a sequential basis, the underlying result before tax declined 5.3%, mainly reflecting higher regulatory costs and a small decline in underlying income, which were slightly offset by lower risk costs. The return on equity, based on a 12% common equity Tier 1 ratio, was 9.8% for the quarter and 8.8% for the full - year 2018. Underlying result before tax - Retail Belgium (in € million) 400 300 200 100 0 4Q2017 1Q2018 2Q2018 3Q2018 4Q20 1 8 Total underlying income declined by €10 million to €577 million compared with €587 million in the fourth quarter of 2017, which was negatively impacted by a €17 million shift of payment - related income from Retail Banking to Wholesale Banking. The decline year - on - year mainly reflected lower interest results on savings and current accounts, and lower income from investment and financial markets products. Sequentially, total underlying income decreased by €3 million, primarily due to lower fee income on investment products due to increased equity markets volatility. Customer lending increased by €1.5 billion in the fourth quarter of 2018 to €87.3 billion. Net core lending (which excludes Bank Treasury) also grew by €1.5 billion and consisted of a €0.3 billion increase in mortgages and a €1.2 billion increase in other customer lending. Net customer deposits (excluding Bank Treasury) showed a net outflow of €0.1 billion in the quarter, reflecting a small decline in current accounts, while savings and deposit balances remained stable. Total customer deposits at the end of the fourth quarter of 2018 stood at €85.5 billion. Underlying operating expenses remained in line with the year - ago quarter at €360 million. Compared with the third quarter of 2018, expenses rose by €13 milllion, mainly due to €10 milllion of higher regulatory expenses related to the allocation of the annual Dutch bank tax, which was booked in the fourth quarter of 2018. The remaining increase in expenses was caused by one - off items. Fourth - quarter 2018 risk costs were €40 million, or 42 basis points of average risk - weighted assets, compared with €27 million in the year - ago quarter and €46 million in the previous quarter. The higher amount of risk costs versus last year was almost entirely attributable to business lending. Risk - weighted assets increased by €0.9 billion in the fourth quarter of 2018 to €39.1 billion. The increase mainly reflects an increase in lending volumes as well as model updates. 200 211 187 177 21

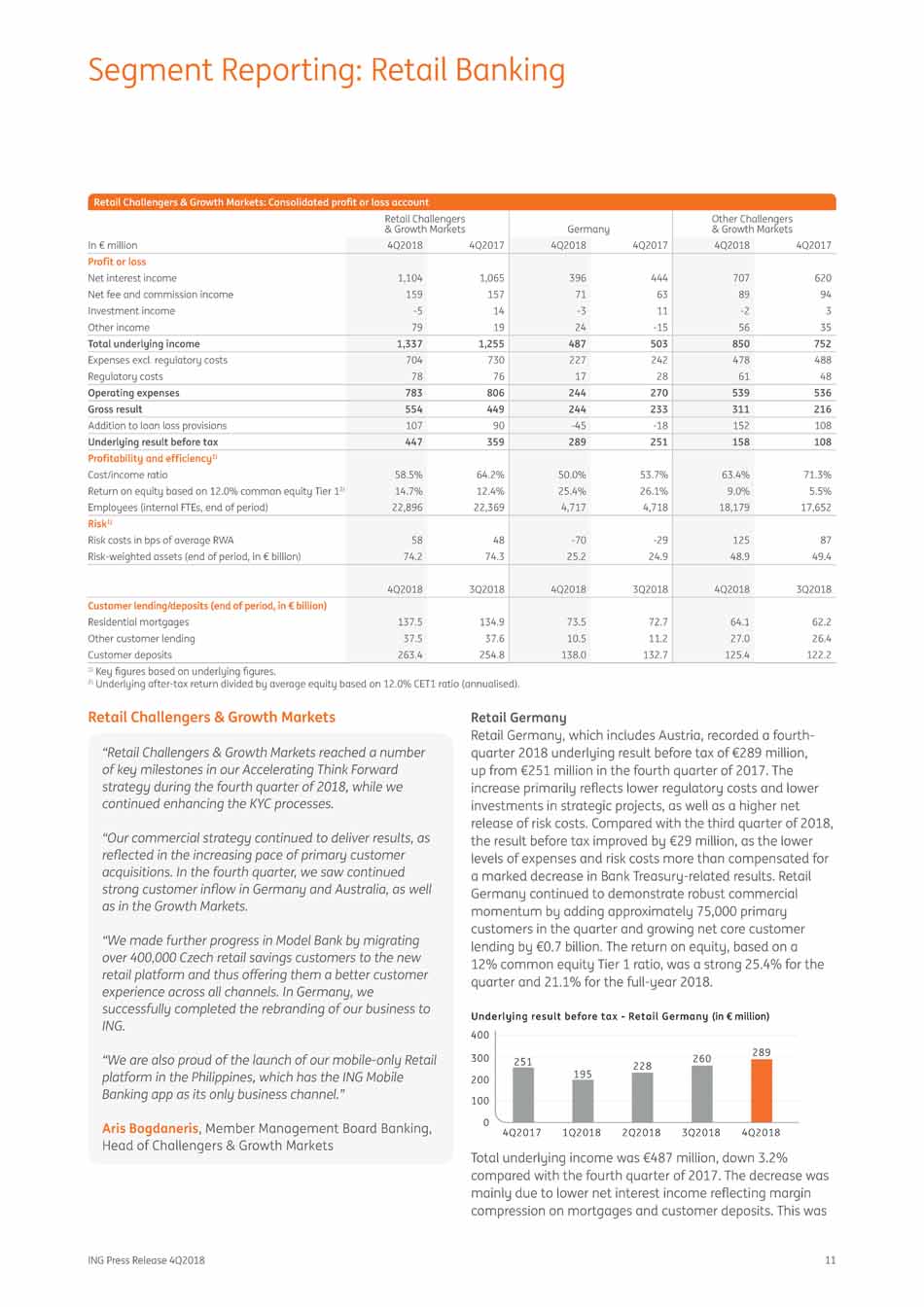

ING Press Release 4Q2018 11 Segment Reporting: Retail Banking 1) Key figures based on underlying figures. 2) Underlying after - tax return divided by average equity based on 12.0% CET1 ratio (annualised). Retail Challengers & Growth Markets Retail Germany Retail Germany, which includes Austria, recorded a fourth - quarter 2018 underlying result before tax of €289 million, up from €251 million in the fourth quarter of 2017. The increase primarily reflects lower regulatory costs and lower investments in strategic projects, as well as a higher net release of risk costs. Compared with the third quarter of 2018, the result before tax improved by €29 million, as the lower levels of expenses and risk costs more than compensated for a marked decrease in Bank Treasury - related results. Retail Germany continued to demonstrate robust commercial momentum by adding approximately 75,000 primary customers in the quarter and growing net core customer lending by €0.7 billion. The return on equity, based on a 12% common equity Tier 1 ratio, was a strong 25.4% for the quarter and 21.1% for the full - year 2018. Underlying result before tax - Retail Germany (in € million) 400 300 200 100 0 4Q201 7 1Q201 8 2Q201 8 3Q201 8 4Q20 1 8 Total underlying income was €487 million, down 3.2% compared with the fourth quarter of 2017. The decrease was mainly due to lower net interest income reflecting margin compression on mortgages and customer deposits. This was 289 228 195 260 251 “Retail Challengers & Growth Markets reached a number of key milestones in our Accelerating Think Forward strategy during the fourth quarter of 2018, while we continued enhancing the KYC processes. “Our commercial strategy continued to deliver results, as reflected in the increasing pace of primary customer acquisitions. In the fourth quarter, we saw continued strong customer inflow in Germany and Australia, as well as in the Growth Markets. “We made further progress in Model Bank by migrating over 400,000 Czech retail savings customers to the new retail platform and thus offering them a better customer experience across all channels. In Germany, we successfully completed the rebranding of our business to ING. “We are also proud of the launch of our mobile - only Retail platform in the Philippines, which has the ING Mobile Banking app as its only business channel.” Aris Bogdaneris , Member Management Board Banking, Head of Challengers & Growth Markets Retail Challengers & Growth Markets: Consolidated profit or loss acco R u e n t t ail Challengers & Growth Markets 4Q2018 Germany Other Challengers & Growth Markets In € million 4Q2017 4Q2018 4Q2017 4Q2018 4Q2017 Profit or loss Net interest income 1,104 1,065 396 444 707 620 Net fee and commission income 159 157 71 63 89 94 Investment income - 5 14 - 3 11 - 2 3 Other income 79 19 24 - 15 56 35 Total underlying income 1,337 1,255 487 503 850 752 Expenses excl. regulatory costs 704 730 227 242 478 488 Regulatory costs 78 76 17 28 61 48 Operating expenses 783 806 244 270 539 536 Gross result 554 449 244 233 311 216 Addition to loan loss provisions 107 90 - 45 - 18 152 108 Underlying result before tax 447 359 289 251 158 108 Profitability and efficiency 1) Cost/income ratio 58 .5% 64 .2% 50 .0% 53 .7% 63 .4% 71 .3% Return on equity based on 12.0% common equity Tier 1 2) 14 .7% 12 .4% 25 .4% 26 .1% 9.0% 5.5% Employees (internal FTEs, end of period) 22,896 22,369 4,717 4,718 18,179 17,652 Risk 1) Risk costs in bps of average RWA 58 48 - 70 - 29 125 87 Risk - weighted assets (end of period, in € billion) 74 .2 74 .3 25 .2 24 .9 48 .9 49 .4 4Q2018 3Q2018 4Q2018 3Q2018 4Q2018 3Q2018 Customer lending/deposits (end of period, in € billion) Residential mortgages 137.5 134.9 73 .5 72 .7 64 .1 62 .2 Other customer lending 37 .5 37 .6 10 .5 11 .2 27 .0 26 .4 Customer deposits 263.4 254.8 138.0 132.7 125.4 122.2

12 ING Press Release 4Q2018 Segment Reporting: Wholesale Banking partly caused by a promotional client savings rate offered in the fourth quarter of 2018 and lower Bank - Treasury related Underlying result before tax - Retail Other Challengers & Growth Markets (in € million) 400 related performance recorded in the third - quarter 2018 results. Total customer lending grew by €0.1 billion in the fourth quarter of 2018 to €84.0 billion. Net core lending, which excludes Bank Treasury products, rose by €0.7 billion and was fully attributable to residential mortgages. Customer deposits increased by €5.3 billion to €138.0 billion. Excluding Bank Treasury customer deposits, they increased by €6.0 billion, mainly driven by the aforementioned promotional savings campaign in the fourth quarter of 2018. Operating expenses decreased by €26 million to €244 million from €270 million in the fourth quarter of 2017. The decrease was mainly caused by lower regulatory expenses, lower staff - related expenses and lower investments in strategic projects. Compared with the third quarter of 2018, operating expenses decreased by €15 million, mainly due to a higher restructuring provision recorded in that quarter. Risk costs in the fourth quarter of 2018 were a €45 million net release from loan loss provisions and included a release of €52 million reflecting a review of the consumer lending portfolio. This compares with an €18 million net release in the year - ago quarter (which included a €22 million release, reflecting model updates for consumer lending and overdrafts), and a €5 million net addition in the third quarter of 2018. Risk - weighted assets decreased by €0.8 billion in the fourth quarter of 2018 to €25.2 billion, as lending - volume growth was more than offset by positive risk migration and a synthetic securitisation transaction for German mortgages. Retail Other Challengers & Growth Markets The underlying result before tax of the Retail Other Challengers & Growth Markets increased to €158 million from €108 million in the fourth quarter of 2017. The increase was mainly driven by strong net interest income growth in most countries, consistent with higher lending volumes and a higher contribution from our stake in TMB, which was only partly offset by higher risk costs. Compared with the third quarter of 2018, the underlying result before tax declined by €155 million, as the previous period included the €83 million annual dividend received from Bank of Beijing. Excluding this dividend, the decrease was due to the seasonal increase in regulatory expenses and higher risk costs caused by model updates and negative risk migration in Turkey. The return on equity, based on a 12% common equity Tier 1 ratio, decreased to 9.0% in the fourth quarter of 2018. For the full - year 2018, the return on equity was 12.4% versus 10.8% in 2017. 0 4Q201 7 1Q201 8 2Q201 8 3Q201 8 4Q20 1 8 Total underlying income increased to €850 million, which is an improvement of €98 million compared with the fourth quarter of 2017. This increase was driven by continued strong commercial results across most countries, reflecting customer growth and higher volumes, and a higher contribution from ING Bank’s 25% stake in TMB, which was mainly driven by one - offs . Compared with the third quarter of 2018 , underlying income was € 33 million lower, mainly due to the annual Bank of Beijing dividend that was recorded in the thirdquarter . However, net interest income increased sequentially by €34 million, reflecting sustained growth in lending and customer deposit volumes and an improved total interest margin. Customer lending increased by €2.4 billion to €91.0 billion at the end of the fourth quarter of 2018. Excluding currency impacts (mainly the strengthening of the Turkish lira) and Bank Treasury, net core lending grew by €2.0 billion, of which €2.1 billion was in mortgages. Other customer lending declined by €0.1 billion. The net core lending growth was mainly generated in Australia, Spain and Poland, whereas Turkey reported a decline. Customer deposits increased by €3.3 billion to €125.4 billion. Net customer deposits (excluding currency impacts and Bank Treasury) grew by €3.1 billion, mainly driven by net inflows in Poland, Australia and Spain. Operating expenses remained almost flat year - on - year, increasing by only €3 million to €539 million in the fourth quarter of 2018. Compared with the third quarter of 2018, operating expenses increased by €46 million due to higher seasonal regulatory expenses and additional investments in strategic projects. Risk costs amounted to €152 million, up by €44 million year - on - year and €75 million higher than in the third quarter of 2018. The increase compared to the previous quarter was predominantly due to model updates in Spain and Romania, as well as negative risk migration under IFRS 9 in Turkey. Fourth - quarter 2018 risk costs were 125 basis points of average risk - weighted assets compared with 63 basis points in the previous quarter. Risk - weighted assets increased by €0.5 billion in the fourth quarter of 2018 to €48.9 billion, mainly driven by lending growth and a model update in Australia, partly offset by lower RWA for the Asian stakes. Segment Reporting: Retail Banking 313 158 108 215 245 income. These factors were only partly offset by higher fee income on mortgages and current accounts. Compared 300 with the third quarter of 2018, total income declined by €38 200 million, mainly due to a significantly higher Bank Treasury - 100

ING Press Release 4Q2018 13 Segment Reporting: Wholesale Banking In € million Total Wholesale Banking 4Q2018 4Q2017 Industry Lending 4Q2018 4Q2017 General Lending & Transaction Services 4Q2018 4Q2017 Profit or loss Net interest income Net fee and commission income Investment income Other income excl. CVA/DVA 1,051 298 - 126 228 1,031 279 5 125 627 163 1 107 550 145 4 19 317 110 0 16 288 104 0 31 112 32 0 68 172 34 - 1 21 897 719 444 423 Underlying income excl. CVA/DVA CVA/DVA 1) Total underlying income 1,452 - 16 1,436 1,441 - 34 1,406 212 - 16 196 227 - 34 192 897 167 719 177 444 221 423 207 Expenses excl. regulatory costs Regulatory costs Operating expenses 663 123 786 670 112 781 35 202 32 208 33 254 23 231 220 47 266 242 50 292 Gross result 651 625 695 511 189 192 - 70 - 100 Addition to loan loss provisions 54 68 43 36 2 4 2 - 1 Underlying result before tax 597 557 651 474 187 188 - 73 - 99 Profitability and efficiency 2) 21 - 3 1 54 73 73 44 7 51 22 29 - 7 54 .7% 10 .1% 55.6% 7.9% 22 .5% 21 .1% 29 .0% 15 .7% 57.3% 8.9% 54.6% 9.6% 135.9% - 8.7% 152.0% - 6.2 % 69 .8% - 22.4% 13,067 12,167 Cost/income ratio Return on equity based on 12.0% common equity Tier 1 3) Employees (internal FTEs, end of period) Risk 1) Risk costs in bps of average RWA Risk - weighted assets (end of period, in € billion) 14 152.4 18 149.4 24 72 .2 21 69 .3 2 51 .6 3 48 .0 5 20 .3 - 1 23 . 2 128 9.0 Customer lending/deposits 4Q2018 3Q2018 4Q2018 3Q2018 4Q2018 3Q2018 4Q2018 3Q 2 0 1 8 3Q2018 (end of period, in € billion) Residential mortgages Other customer lending Customer deposits 0.9 187.0 63.1 0.8 192.6 66.2 0.0 124.7 1.2 0.0 126.1 2.0 0.0 57.7 50.8 0.0 57.2 50.7 0.0 1.5 4.3 0.0 1.4 5.0 1) As from 2018 only CVA/DVA on derivatives, as DVA on notes directly impacts equity under IFRS 9. 2) Key figures based on underlying figures. 3) Underlying after - tax return divided by average equity based on 12.0% CET1 ratio (annualised). 4) Return on equity of ING's total Financial Markets activities (including Retail Banking) was - 4.3% in 4Q2018 and - 2.0% in 4Q2017. 0.8 8.0 8.4 Wholesale Banking The underlying result before tax of Wholesale Banking rose by €40 million, or 7.2%, to €597 million from €557 million in the fourth quarter of 2017. The increase mainly reflects higher income in Industry Lending (including a €101 million gain on a bond transaction) and General Lending & Transaction Services, as well as lower performance - related expenses and strict cost management, and a lower net addition to loan loss provisions. This was partly offset by increased regulatory costs and a €123 million recorded loss related to theintended sale of an Italian lease run - off portfolio. Sequentially, the result before tax declined by €123 million, or 17.1%. Excluding the impact of the aforementioned one - off items, the decline was mainly due to the inclusion of the annual Dutch bank tax and lower results in Financial Markets in the fourth quarter of 2018. Net core lending (excluding currency impacts, Bank Treasury and the lease run - off portfolios) decreased by €1.5 billion in the fourth quarter of 2018, predominantly in Industry Lending due to a decline in Trade & Commodity Finance. The return on equity, based on a 12 % common equity Tier 1 ratio, was 10 . 1 % in the fourth quarter of 2018 . The full - year 2018 return on equity rose to 11 . 4 % from 10 . 9 % in 2017 . Wholesale Banking: Consolidated profit or loss account “We continued to convert Wholesale Banking into a more client - oriented organisation that offers a consistent experience across borders, with ongoing work on compliance programmes and KYC enhancement. “Despite the difficult financial markets the whole industry faced, 2018 was a very successful year wherein we were able to assist our clients with our in - depth sector expertise. “On customer experience, we are confident that our investments this quarter in Cobase and Axyon AI will make banking easier and faster for our clients. “Furthermore, we are excited that our sustainability initiative, the Terra approach, is gaining momentum in the industry as a portfolio measurement standard. Not only will it help in steering towards the well - below two - degree goal to help combat climate change, it also presents a business opportunity in assisting our clients with advice and financing to make the investments necessary for their sectors to transform.” Isabel Fernandez , Member Management Board Banking, Head of Wholesale Banking Financial Markets 4) Bank Treasury & Other 4Q2018 4Q 2 0 1 7 4Q2018 4Q2017 - 4 - 7 - 126 38 - 100 - 100 56 8 64 - 164 6 - 169 n . a . - 35 .6% 28 8.3 4Q2018 0 . 9 3 . 1 6 . 8

14 ING Press Release 4Q2018 Segment Reporting: Wholesale Banking Underlying result before tax - Wholesale Banking (in € million) 1,00 0 800 600 400 200 0 4Q201 7 1Q201 8 2Q201 8 3Q201 8 4Q20 1 8 Total underlying income rose by €30 million, or 2.1%, from the fourth quarter of 2017. This was mainly due to higher income in Industry Lending and GL&TS, which compensated for lower results in Bank Treasury & Other. In addition, Industry Lending benefited from a €101 million gain on an equity - linked bond transaction in Belgium, which was more than offset by a €123 million loss on the intended sale of an Italian lease run - off portfolio reported under Bank Treasury & Other. On a sequential basis, total income was 3.0% lower, mainly on the back of lower results in Financial Markets. Net interest income increased 1.9% year - on - year, driven by resilient margins and volume growth in Industry Lending and GL&TS. Compared with the third quarter of 2018, net interest income rose 7.9%, primarily reflecting higher interest income in Financial Markets (with an offset in other income). Net fee and commission income increased 6.8% year - on - year, mainly driven by higher Industry Lending fees from increased deal activity, and the inclusion of Payvision under GL&TS. Sequentially, net fee and commission income decreased 3.9%, mainly due to lower commission income in Financial Markets, as the third quarter of 2018 included a reclassification of Global Capital Markets income that had been recorded under ‘other income’ in the first half of 2018 . When adjusted for this reclassification, commission income rose 5 . 3 % , driven by better results in Industry Lending . Investment income dropped by €131 million year - on - year and by €129 million sequentially. The decline versus both comparable quarters was mainly due to the aforementioned loss on the intended sale of an Italian lease run - off portfolio. Total other income including credit valuation and debt valuation adjustments (CVA/DVA) was €213 million, up from €91 million in the fourth quarter of 2017. This increase was mainly due to the aforementioned gain on an equity - linked bond transaction. Other income was broadly in line with the previous quarter, as the third quarter of 2018 included a gain on the sale of an equity stake in Corporate Investments and higher other income in Financial Markets. Operating expenses rose by €5 million, or 0.6%, year - on - year to €786 million. The small increase was fully attributable to a higher contribution to the annual Dutch bank tax. Expenses excluding regulatory costs fell by €7 million, mainly reflecting lower performance - related expenses and strict cost management, and despite the inclusion of Payvision. The fourth quarter of 2018 furthermore included impairments on a real estate run - off portfolio and a one - off pension expense in the UK as well as higher expenses for change initiatives, while the year - ago quarter included a one - off legal provision. Sequentially, expenses excluding regulatory costs rose by €20 million, mainly due to the aforementioned reasons. Fourth - quarter 2018 risk costs amounted to €54 million, or 14 basis points of average risk - weighted assets, down from €68 million in the fourth quarter of 2017 and €108 million in the previous quarter. In the fourth quarter of 2018, risk - weighted assets decreased by €1.6 billion to €152.4 billion due to positive risk migration and lower lending volume, partly offset by currency impacts. Industry Lending Underlying result before tax - Industry Lending (in € million) 800 600 400 200 0 4Q2017 1Q2018 2Q2018 3Q2018 4Q2018 Industry Lending posted an underlying result before tax of €651 million, up 37.3% from the fourth quarter of 2017. The increase was driven by a €101 million gain on an equity - linked bond transaction in Belgium and higher income consistent with volume growth, while risk costs were slightly higher. Quarter - on - quarter, the result before tax was up 27.9% due to the aforementioned increase in income, which in turn was partly offset by the inclusion of the annual Dutch bank tax in this quarter. Net core lending declined by €2.0 billion in the fourth quarter of 2018 as overall commercial portfolio growth was offset by lower volumes in Trade & Commodity Finance, among others due to a drop in oil prices. Income increased 24.8% year - on - year, driven by the aforementioned gain on a bond transaction in Belgium. Excluding this bond transaction, income rose 10.7%, reflecting volume growth and higher commission income supported by higher deal activity. Sequentially, income excluding the bond transaction increased 7.1%. The increase was driven by overall volume growth and higher commission income, and interest margins also improved slightly. Expenses were 2.9% lower than in the fourth quarter of 2017, mainly due to strict cost management which led to lower personnel expenses. Sequentially, expenses increased by €22 million due to €35 million of regulatory costs recorded in the fourth quarter, partially compensated by the abovementioned cost control. Risk costs amounted to €43 million and primarily included some larger files in the Americas and Italy. Risk costs rose by €7 million from the year - ago quarter, which included some larger files in the Benelux. Sequentially, risk costs decreased by €11 million. 702 736 720 557 597 651 509 488 443 474

ING Press Release 4Q2018 15 Segment Reporting: Wholesale Banking General Lending & Transaction Services Underlying result before tax - General Lending & Transaction Services (in € million) 300 200 100 0 4Q201 7 1Q201 8 2Q201 8 3Q201 8 4Q20 1 8 GL&TS posted an underlying result before tax of €187 million, almost flat compared with the year - ago quarter as an increase in income and slightly lower risk costs were fully offset by higher expenses. Sequentially, the pre - tax result rose 15.4%. This increase was mainly due to higher income and lower risk costs, and was achieved despite seasonally higher regulatory costs. Income rose 5.0% year - on - year, mainly attributable to General Lending and the inclusion of Payvision, while Payments & Cash Management income was lower as the year - ago quarter included a €17 million transfer of international payment income from Retail Banking to Wholesale Banking in Belgium. Higher income in General Lending was mainly driven by strong net interest income stemming from portfolio growth. Compared with the previous quarter, income increased 4 . 5 % , mainly due to higher interest and commission income in General Lending, as well as higher income in Bank Mendes Gans and Securities Services . Net core lending grew by € 0 . 3 billion in the fourth quarter of 2018 . Operating expenses increased 10.0% year - on - year, due to the inclusion of Payvision and higher regulatory costs. Sequentially, expenses increased by €42 million, of which €31 million is explained by higher regulatory costs. Excluding regulatory costs, expenses were up 5.2%, mainly due to payment innovation initiatives and higher project costs. Risk costs were € 2 million compared with € 4 million in the fourth quarter of 2017 . Risk costs were significantly lower than the € 52 million recorded in the third quarter of 2018 , which included some larger files in General Lending . Financial Markets Underlying result before tax - Financial Markets (in € million) 150 75 18 22 0 quarter of 2017 and € - 6 million in the previous quarter. Income excluding CVA/DVA impacts fell 6.2% compared with the fourth quarter of 2017. The decline was mainly caused by lower revenues in the Fixed Income and CorporateFinance businesses, which were impacted by lower client activity and challenging global market conditions. Compared with the third quarter of 2018, income excluding CVA/DVA fell 5.4%, mainly due to lower revenues in the Fixed Income business. Operational expenses decreased 8.9% year - on - year, largely due to the temporarily elevated cost levels in the fourth quarter of 2017 related to the consolidation of most of the trading activities in London. Excluding regulatory costs, expenses decreased 9.1%, mainly due to lower performance - related expenses and strict cost management. Compared with the previous quarter, expenses rose by €40 million due to €46 million of higher regulatory costs. Excluding regulatory costs, expenses decreased 2.2%. Bank Treasury & Other Underlying result before tax - Bank Treasury & Other (in € million) 100 0 - 100 - 200 - 300 4Q201 7 1Q201 8 2Q201 8 3Q201 8 4Q20 1 8 Bank Treasury & Other recorded an underlying result before tax of € - 169 million versus € - 7 million in the fourth quarter of 2017 and € 56 million in the previous quarter . Income fell to € - 100 million from €73 million a year ago, mainly due to a €123 million loss on the intended sale of an Italian lease run - off portfolio and lower Bank Treasury income. The latter was mainly related to lower hedge ineffectiveness results. Sequentially, total income fell by €195 million, mainly attributable to the aforementioned loss on the Italian lease run - off portfolio. Furthermore, the third quarter of 2018 included positive revaluations on derivatives used for hedging purposes in Bank Treasury, as well as a gain on the sale of an equity stake in Corporate Investments. - 75 - 150 - 73 - 99 4Q201 7 1Q201 8 2Q201 8 3Q201 8 4Q20 1 8 Operating expenses rose by €13 million year - on - year and by €28 million compared with the previous quarter. The fourth quarter of 2018 included impairments on a real estate run - off portfolio and a one - off pension charge in the UK, whereas the year - ago quarter included a one - off legal provision. The quarter - on - quarter increase was mainly caused by the aforementioned items. Financial Markets posted an underlying result before tax of € - 73 million compared with € - 99 million in the fourth quarter of 2017 and € - 7 million in the third quarter of 2018. The fourth - quarter 2018 result included € - 16 million of CVA/DVA impacts against € - 34 million of CVA/DVA impacts in the fourth Risk costs amounted to €6 million for the quarter, down from €29 million in the fourth quarter of 2017, but up from €3 million in the third quarter of 2018. The decline versus the fourth quarter of 2017 was mainly related to risk costs on the Italian lease run - off portfolio booked in that quarter. 188 189 213 187 162 - 169 - 7 52 14 56 - 7

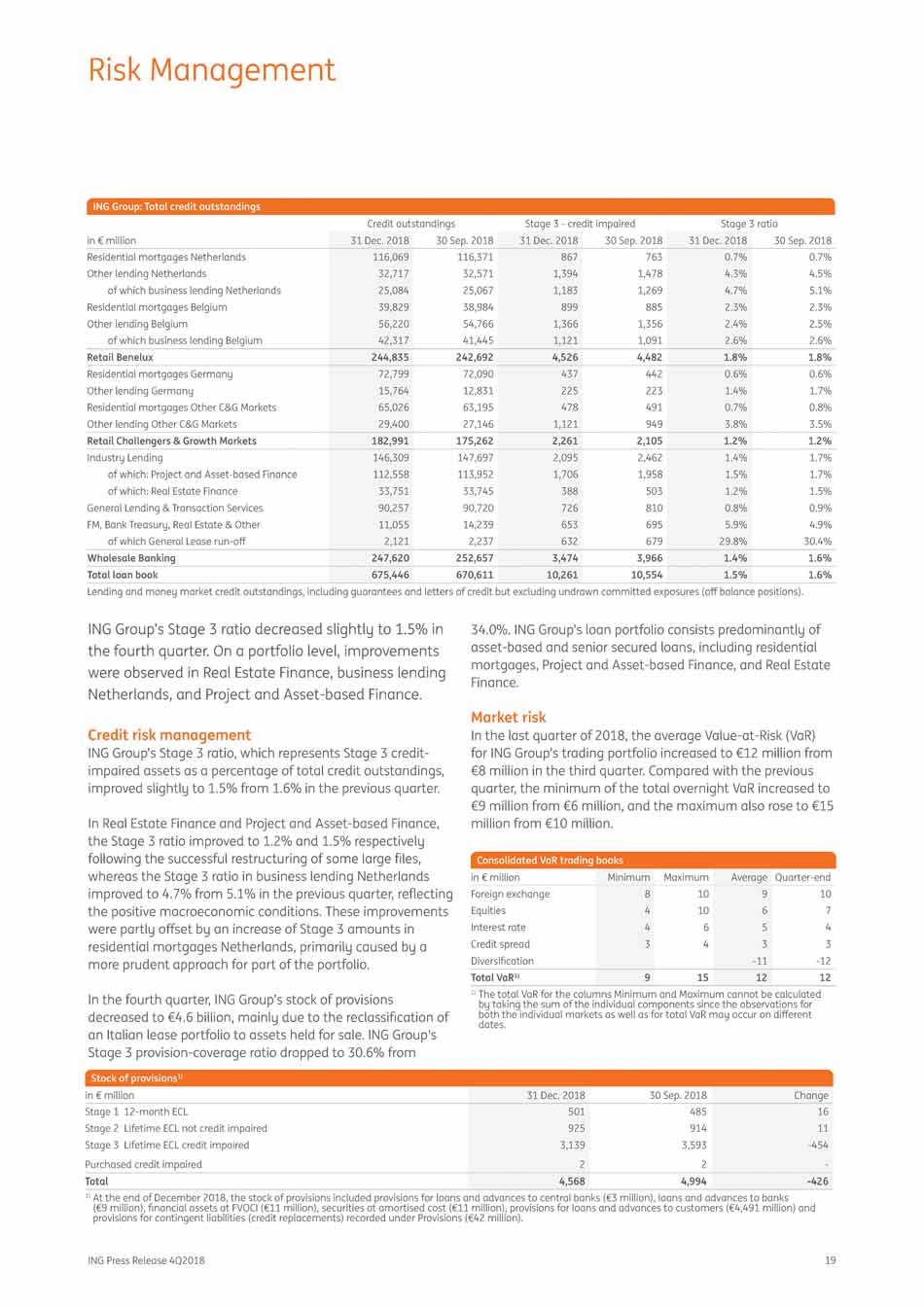

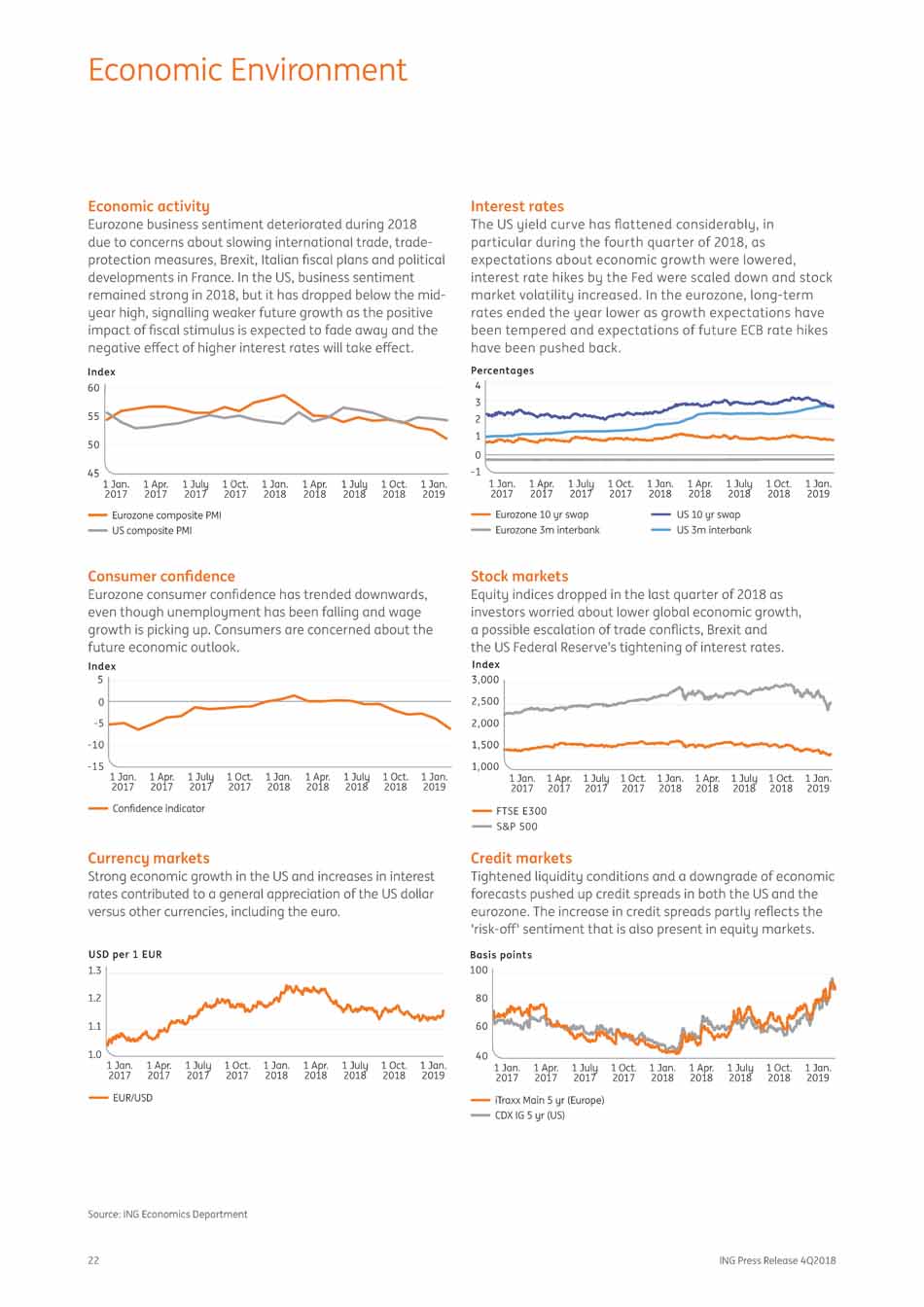

16 ING Press Release 4Q2018 CoSegmentnsolidatReported Balanceing: CoSrhpeoertate Line Banking In € million 4Q2018 4Q2017 Profit or loss Net interest income 93 58 Net fee and commission income 0 0 Investment income 1 0 Other income - 19 - 73 Total underlying income 75 - 16 Expenses excl. regulatory costs 61 55 Regulatory costs 0 0 Operating expenses 61 55 Gross result 14 - 71 Addition to loan loss provisions - 1 0 Underlying result before tax 15 - 71 of which: Income on capital surplus - 7 20 Foreign currency exchange ratio hedging 140 80 Other Capital Management 4 - 27 Capital Management 137 72 Bank Treasury - 66 - 95 Other Corporate Line - 56 - 49 Corporate Line posted an underlying result before taxof €15 million in the fourth quarter of 2018 compared with € - 71 million in the fourth quarter of 2017. Underlying income improved to €75 million from € - 16 million one year ago. This was primarily due to higher income from foreign currency exchange ratio hedging and Bank Treasury results, which were only partly offset by lower income on capital surplus. The fourth quarter of 2017 also included a negative revaluation result. Operating expenses increased by €6 million compared with the same quarter of 2017, mainly due to higher shareholders expenses, which were only partly offset by a higher value - added tax (VAT) refund. Furthermore, the fourth quarter of 2017 included a provision for reinsurance and settlement costs related to previous ING Group entities. The underlying result before tax in the third quarter of 2018 was € - 3 million. The Capital Management - related result was €137 million in the fourth quarter of 2018 compared with €72 million in the same quarter of 2017. The income on capital surplus was € - 7 million in the fourth quarter of 2018 versus €20 million one year ago, mainly due to a lower result on capital investments and higher solvency costs. The foreign currency exchange ratio hedging result was €140 million in the fourth quarter of 2018 versus €80 million in the fourth quarter of last year. The €60 million increase was mainly due to a higher capital charge received from non - eurozone entities. The result of Other Capital Management amounted to €4 million in the fourth quarter of 2018 versus € - 27 million in the same quarter of 2017. The €31 million improvement was mainly due to a negative revaluation result on a prepayment swap for externally sold securitised mortgages in the fourth quarter of 2017. Bank Treasury - related results mostly include the isolated legacy costs (mainly negative interest results) caused by the replacement of short - term funding with long - term funding during 2012 and 2013. The fourth - quarter 2018 result improved to € - 66 million from € - 95 million one year ago, mainly due to positive hedge ineffectiveness and run - off in the legacy portfolio. The Other Corporate Line result, which includes items such as shareholder expenses and unallocated income and other expenses, decreased to € - 56 million from € - 49 million one year ago. The decline reflects higher shareholder expenses, which were partly offset by a higher VATrefund and a higher contribution from ING Group’s 4.9% stake in TMB (the latter supported by one - offs). Corporate Line: Consolidated profit or loss account Segment Reporting: Corporate Line