Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended November 3, 2013 |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OF 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to . |

Commission File Number: 001-09232

VOLT INFORMATION SCIENCES, INC.

(Exact name of registrant as specified in its charter)

| New York | 13-5658129 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 1065 Avenue of Americas, New York, New York | 10018 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code:

(212) 704-2400

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| None | None |

Securities Registered Pursuant to Section 12(g) of the Act:

Common Stock, $.10 Par Value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer x | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

|

(Do not check if a smaller reporting company) |

||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes No x

As of April 26, 2013, there were 20,882,800 shares of common stock outstanding. The aggregate market value of the voting and non-voting common stock held by non-affiliates as of April 26, 2013 was $91,282,000, calculated by using the closing price of the common stock on such date on the over-the-counter market of $8.08.

As of January 24, 2014 there were 20,849,462 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Definitive Proxy Statement to be filed for its 2014 Annual Meeting of Shareholders are incorporated by reference into Part III of this report.

Table of Contents

VOLT INFORMATION SCIENCES, INC.

ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED NOVEMBER 3, 2013

Table of Contents

EXPLANATORY NOTE

Financial Reports for the Company’s 2013 Fiscal Year.

Volt Information Sciences, Inc. (the “Company” or “Volt”) previously restated its Consolidated Financial Statements for the fiscal year-ended November 2, 2008 (the “Restatement”). The Restatement corrected accounting errors related to recognition of revenue and related customer costs primarily in our Computer Systems and Staffing Services segments, employment taxes and benefits, intangible assets, timing and recording of various accruals and income taxes. The restated financial statements were included in an Annual Report on Form 10-K for 2008, 2009, and 2010, and the Company then filed an Annual Report on Form 10-K for 2011 and 2012. This Annual Report on Form 10-K (the “2013 Form 10-K”) contains the financial information for the Company’s fiscal year ended November 3, 2013 (the “2013 fiscal year”), as well as quarterly financial information for each of the first three quarters of the 2013 Fiscal Year.

Readers should be aware that this report differs from other annual reports. In addition to annual financial information for the 2013 fiscal year, the report is being filed in lieu of the Company filing separate Quarterly Reports on Form 10-Q for the first three quarters of the 2013 fiscal year.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this report are “forward-looking” statements within the meaning of that term in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and are made in reliance upon the protections provided by such acts for forward-looking statements. Forward-looking statements include statements that reflect the current views of our senior management with respect to our financial performance and future events of our business and industry in general. The terms “expect,” “intend,” “plan,” “believe,” “project,” “forecast,” “estimate,” “may,” “should,” “anticipate” and similar statements of a future or forward-looking nature identify forward-looking statements. Forward-looking statements address matters that involve risks and uncertainties. Accordingly, there are or will be important factors that could cause our actual results to differ materially from those indicated in these forward-looking statements. We believe that these factors include, but are not limited to, the following:

| • | the circumstances resulting in the restatement of our 2008 financial statements and the material weaknesses in our internal control over financial reporting and in our disclosure controls and procedures; |

| • | our ability to successfully regain a listing on a national securities exchange; |

| • | our ability to comply with the covenants in our credit agreements; |

| • | our Staffing Services segment is in a very competitive industry with few significant barriers to entry; |

| • | our project-related businesses are subject to project delays, unanticipated costs and cancellations; |

| • | many of our contracts either provide no minimum purchase requirements, are cancellable during the term or both; |

| • | our Computer Systems segment is highly dependent on our customers’ call volume and their acceptance of our OnDemand contact center technology platform; |

| • | we rely extensively on our information technology systems and are vulnerable to damage and interruption; |

| • | our business may be negatively affected if we are not able to keep pace with rapid changes in technology; |

1

Table of Contents

| • | the loss of any key customers would adversely impact our business; |

| • | we are dependent upon our key personnel and upon our ability to attract and retain technologically qualified personnel; |

| • | new and increased government regulation, employment costs or taxes could have a material adverse effect on our business, especially for our contingent staffing business; |

| • | the outcome of any future litigation or regulatory proceedings, including those related to the restatement of our consolidated financial statements; and |

| • | changes in general economic conditions. |

The foregoing factors should not be construed as exhaustive and should be read together with the other cautionary statements included in this report, including under the caption Risk Factors in Item 1A of this report. If one or more events related to these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may differ materially from what we anticipate. Readers should not place undue reliance on any forward-looking statements contained in this report, which speak only as of the date of this report. We undertake no obligation to update any forward-looking statements after the date of this report to conform such statements to actual results or to changes in our expectations.

2

Table of Contents

| ITEM | 1. BUSINESS |

Volt Information Sciences, Inc. (the “Company” or “Volt”) is an international provider of staffing services (traditional time and materials based as well as project based), contact center computer systems, information technology and telecommunications infrastructure services, and telephone directory publishing and printing in Uruguay. Our staffing services include a suite of workforce solutions that include providing contingent personnel, personnel recruitment services, and managed staffing services programs supporting primarily professional administration, technical, information technology and engineering positions. Our contact center computer systems provide the functionality for telecommunications company directory assistance services and for corporate and government call centers, operator services, and database management. Our information technology infrastructure services provide a single-source alternative to original equipment manufacturer and other independent IT service providers for server, storage, network and desktop IT hardware maintenance, data center and network monitoring and operations, and designing, deploying and supporting corporate technology upgrade and refresh programs, as well as design, engineering, construction, installation and maintenance of voice, data, video and utility infrastructure. The Company was incorporated in New York in 1957. Unless the context otherwise requires, throughout this report, the words “Volt,” “the Company,” “we,” “us” and “our” refer to Volt Information Sciences, Inc. and its consolidated subsidiaries.

Geographic Regions and Segments:

Volt operates 192 locations worldwide, with approximately 90% of its revenues generated in the United States where we have employees in all 50 U.S. states. Our principal non-U.S. markets include Canada, the United Kingdom, and Germany, with presence in most European countries and several Asian locations. Our global footprint enables us to deliver consistent quality to our enterprise customers that require an established international presence. For financial information concerning our domestic and international operations and segment reporting, see our Segment Disclosure footnote to our Consolidated Financial Statements included in this report.

We report our activities in three reportable segments: Staffing Services, Computer Systems and Other. Our operating segments have been determined in accordance with our internal management structure, which is based on operating activities. We evaluate business performance based upon several factors, using segment operating income as the primary financial measure. We believe operating income provides management and investors a measure to analyze operating performance of each business segment against historical and competitors’ data, although historical results, including operating income, may not be indicative of future results as operating income is highly contingent on many factors including the state of the economy, competitive conditions and customer preferences.

We allocate all costs to the operating segments except for certain corporate-wide general and administrative costs, intangible asset and goodwill impairment charges, and fees related to the restatement of our financial statements and associated investigations. These allocations are included in the calculation of each segment’s operating income. The following is a brief description of the reportable segments and the predominant source of their revenues, and each is discussed further in Management’s Discussion and Analysis of Financial Condition and Results of Operations in Item 7 of this report.

Staffing Services

The Staffing Services segment provides workforce management expertise to deliver staffing solutions including technology outsourcing services and solutions. Our staffing services are provided through approximately 160 locations in North America, Europe and Asia. We deliver a broad spectrum of contingent staffing, master staffing, vendor contracting and management, direct placement and other employment services. Our contingent employees are placed on assignment with our customers in a broad range of occupations including accounting, administrative, customer care, engineering, finance, human resources, information

3

Table of Contents

technology, life sciences, manufacturing and assembly, sales and marketing, technical communications and media, and warehousing and fulfillment. Our contingent staffing services are provided for varying periods of time to companies and other organizations (including government agencies) ranging from smaller retail accounts that may require ten or fewer contingent workers at a time to national accounts that require as many as several thousand contingent workers at one time. Our national accounts typically enter into longer term procurement agreements with us resulting in lower direct margins compared to our retail accounts.

Volt’s contingent staffing services enable customers to easily scale their workforce to meet changing business conditions, complete a specific project, secure the services of a specialist on an as-needed basis, substitute for regular employees during vacation or other temporary absences, staff high turnover positions, or meet seasonal peaks in workforce needs. When requested, we also provide Volt personnel at the customer’s location to coordinate and manage contingent workers. Many customers rely on Volt’s staffing services as a strategic element of their overall workforce, allowing them to more efficiently meet their fluctuating staffing requirements.

Contingent staff is recruited through proprietary internet recruiting sites, independent web-based job search companies, and social networking talent communities through which we build and maintain proprietary databases of candidates from which we can fill current and future customer needs. Contingent workers become Volt employees during the period of their assignment and we are responsible for the payment of wages, payroll taxes, workers’ compensation insurance, unemployment insurance and other benefits. Customers will sometimes hire Volt’s contingent workers as their own employees after a period of time, for which we may receive a fee.

We also provide recruitment and direct placement services of specialists in the information technology, engineering, technical, accounting, finance and administrative support disciplines. These services are primarily provided on a contingency basis with fees earned only if our clients ultimately hire the candidates.

Our staffing services include providing master vendor services under which we administer a customer’s entire contingent workforce program. Our responsibilities for these programs usually include subcontracting procurement of contingent workers from other qualified staffing providers if we are unable to fill a position. In most cases, we are only required to pay subcontractors after we receive payment from our customer.

Our managed service programs (“MSPs”) consist of managing the procurement and on-boarding of contingent workers and a broad range of specialized solutions that includes managing suppliers and providing sourcing and recruiting support, supplier performance measurement, consolidated customer billing, supplier payment, supplier optimization and analysis, and benchmarking of spend demographics and rates. The workforce placed on assignment through our MSPs is usually provided by third-party staffing providers (“associate vendors”) or through our own staffing services. In most cases, we are only required to pay associate vendors after we receive payment from our customer. We also act as a subcontractor or associate vendor to other national providers in their managed services programs.

Our MSPs are administered through the use of vendor management system software (“VMS”) utilizing either Volt’s proprietary systems or systems licensed from various other providers. Our proprietary VMS software, Consol and HRP, is also offered for licensing to non-MSP customers to support their contingent worker recruiting process. Our VMS technology enables sourcing of professional services, improvement of spending management, supplier management, time and expense processing and billing, and compliance with customer hiring policies.

Our technology outsourcing services and solutions provide flexible and scalable customer care call centers, video and online gaming industry quality assurance testing services, project-based staffing, and technology and consumer products industry development and integration activities, quality assurance testing, and customer care solutions including end-user and technical, sales and retention support. Project-based staffing includes project management and provides IT infrastructure outsourcing, data center management, enterprise technology implementation and integration and corporate helpdesk services.

4

Table of Contents

Computer Systems

Our Computer Systems segment provides information services, software, hosted OnDemand contact center service solutions and database services to customers worldwide. This includes design, integration and development of reliable and scalable directory assistance systems which we market to telephone companies and inter-exchange carriers. These services include traditional directory assistance (known in the United States as 411 service), enhanced directory assistance services such as reverse number lookup, weather, sports scores, and travel directions, and Short Message Services (“SMS”) messaging features and directory assistance automated services. We license systems to our customers and also provide an Application Service Provider (“ASP”) or “cloud” based model in which we host and manage the equipment.

Our OnDemand business delivers contact center and voice self-service solutions with Software as a Service (“SaaS”) performance and efficiency. OnDemand combines proprietary and third-party technology that enables distributed contact centers and deployment of home-based agents to enhance cost-effectiveness and flexibility in providing customer care. A unified framework of skills-based call routing, universal queue management, and multichannel support including phone, email, chat and social media enables organizations of all sizes with channel-of-choice communications and cloud-based value.

We leverage our directory assistance residential and business databases, including databases of the United States, Canada and some European countries to help customers improve their operations and marketing capabilities by providing database services, data processing, listing verification and online and offline data integration solutions (so called “big data”). We also aggregate data from third parties, including wireless and Voice over Internet Protocol (“VoIP”) networks, and make that information available on a real-time basis.

Other Segment

Our Other reportable segment consists of our information technology and telecommunications infrastructure businesses, as well as our Uruguay telephone directory publishing and printing business.

Our information technology infrastructure business provides customized, single-source, cost-effective IT service solutions to United States and multinational clients as an alternative to services offered by original equipment manufacturers and other independent IT services providers. We deliver our services across the United States and in major business centers globally, including hardware maintenance on all major brands of server, storage, network and desktop products, network and data center monitoring and operations services in large data center environments, and designing, deploying and supporting corporate technology upgrade and refresh programs including cloud strategies and Windows migration. We sell our services directly to corporate clients, with data center and network product providers, and through value added resellers. Our target markets include financial services, telecommunications and aerospace.

Our telecommunications infrastructure services business is an integrator of enterprise, campus and metropolitan security, voice and data systems for Fortune 500, critical infrastructure and telecommunications companies and government entities across the United States. We design, engineer, build, and maintain:

| • | Infrastructure services including fiber, copper, horizontal and backbone cabling, and EFIT&T; |

| • | Voice and Data networks including VoIP, PBX, TDM, and MAC; |

| • | Wireless systems including Wi-Fi, DAS, Mesh and PTP; and |

| • | Security systems including intrusion detection, behavioral analytics, video surveillance and perimeter detection. |

Our telephone directory publishing and printing business publishes telephone directories in Uruguay under contract with the Uruguayan telephone company, including printing of the white pages and the sale of yellow pages and web portal advertising. This business also operates a printing facility in Uruguay, which prints the Uruguay telephone directories, directories for other publishers in other countries, and commercial printing including books, magazines, periodicals and advertising material.

5

Table of Contents

Business Strategy

We believe that building upon our established brands and reinforcing our strong client relationships will position Volt to grow both profitability and shareholder value. Key elements of our strategy include:

Expand Margins and Reduce Operating Expenses

We are focused on increasing profitability through initiatives to expand margins and reduce operating expenses. We are pursuing these initiatives along with promoting a culture of disciplined execution to further expand our operating income:

| • | focus on core business offerings and on market sectors where we are profitable or that have long-term growth potential, and reduce or eliminate non-core, non-strategic business; |

| • | increase the percentage of our revenue represented by higher-margin business; |

| • | increase our market share in our key customers and target market sectors; |

| • | exit or reduce business levels in sectors or with customers where profitability or business terms are unfavorable; and |

| • | consolidate financial and other administrative and support functions, implement process standardization, and use productivity metrics to drive more cost-effective performance. |

We expect these initiatives to increase margins and reduce operating expenses as a percentage of margins, thus driving increased operating income.

Align Management Incentives with Corporate-Wide Objectives

We are changing management incentive structures corporate-wide to align with short and long term strategic objectives, profitability goals and efficiency measures. Variable management compensation is being redesigned from single-factor measurements to a set of entity and business unit targets along with specific department performance measures with achievement targets that reward accomplishment thresholds rather than incremental increases.

Retain, Recruit and Develop Talent Globally

We are focused on developing a workforce that has both exceptional technical capabilities and the leadership skills that are required to support future growth of the business, which will be achieved by developing new workforce capabilities and a committed, diverse executive team with the highest level of ethics and integrity.

Customers

The Company serves multinational, national and local clients with an emphasis on the technology, telecommunication and financial industries. The Company had no single customer that accounted for more than 10% of consolidated net revenue in the fiscal years 2013, 2012 and 2011. Our top 10 clients represented approximately 33%, 34% and 34% of our fiscal 2013, 2012 and 2011 revenue, respectively. The loss of one or more of these customers, unless the business is replaced, could have an adverse effect on our results of operations or cash flows.

For the fiscal years ended 2013, 2012 and 2011, 88.4%, 89.9% and 89.6% of our revenue, respectively, were from customers in the United States.

Competition

The markets for Volt’s staffing services are highly competitive. There are few barriers to entry, so new entrants frequently appear resulting in considerable market fragmentation. There are over 100 competitors with annual revenues over $300 million, some of whom are larger and have greater resources than we do. These large

6

Table of Contents

competitors collectively represent less than half of all staffing services revenues, and there are countless smaller companies competing in varying degrees at local levels. Our direct staffing competitors include Adecco, Randstad, Manpower, Allegis, Recruit, Hays, Kelly Services, USG People, Robert Half, Tempstaff and CDI Corp.

Our Computer Systems business is experiencing technology shifts in directory assistance. Consumers increasingly obtain information from alternative sources (primarily on-line sources using devices such as smartphones and computers) instead of traditional contact over telephone lines. Additionally, the change in how consumers obtain data is increasingly moving to on-line through numerous platforms including mobile devices where competitors face relatively fewer barriers to entry than in our traditional directory assistance services. Our specialized directory assistance technology and proprietary listings databases provide us with financial synergies in our directory assistance services, but because we do not have the same degree of synergies in other call center applications of our technology we face a broader range of competitors.

Our computer maintenance business competes with large system integration firms as well as other traditional hardware providers that are increasingly offering services to support their products. Many of our competitors are able to offer a wide range of global services, and some of our competitors benefit from significant brand recognition.

Our telecommunications infrastructure services business has competition from a wide range of contractors, many of which have greater resources and breadth of experience. Successfully competing in this market requires us to focus on those areas where we believe our expertise and capability is greater than our competitors and where we can deliver services with a cost structure that will permit us to achieve acceptable margins at acceptable risk levels.

In addition, we compete with numerous smaller local companies in the various geographic markets in which we operate. Companies in our industries compete on price, service quality, new capabilities and technologies, client attraction methods, and speed of completing assignments.

Research, Development and Engineering

We have project experience and expertise across multiple technologies and have made significant investments in research, development and engineering to keep abreast of the latest technology developments. The experience gained from particular projects and research, development and engineering efforts in each business we operate is utilized across all services in those businesses. As a result, we are able to react to customers’ needs quickly and efficiently. We believe that our ability to work with new technologies allows us to foster long-term relationships by having the skill set to continually address the evolving needs of both existing and new customers. The majority of research and development expenditures are incurred by the Computer Systems segment.

Intellectual Property

VOLT is the principal registered trademark for our brand in the United States. ARCTERN, A VOLT INFORMATION SCIENCES COMPANY, DATASERV, DIRECTDA, DIRECTORY ONE, DIRECTORY EXPRESS, FNCS & DESIGN, LSSI, LSSIDATA, MAINTECH, PARTNER WITH US, COMPETE WITH ANYBODY, PROCURESTAFF TECHNOLOGIES, PROCURESTAFF GETTING THE WORLD BACK TO BUSINESS & DESIGN, SMARTMATCH, TEAM WITH US. COMPETE WITH ANYBODY, VOLT DELTA, VOLT DELTA CONNECTING PEOPLE & INFORMATION, VOLTDELTA & DESIGN, and VOLTSOURCE are other registered trademarks in the United States. The Company also owns and uses common law trademarks and service marks.

We also own copyrights and patents and license technology from many providers. We rely on a combination of intellectual property rights in the United States and abroad to protect our brand and proprietary technology.

7

Table of Contents

Seasonality

Our Staffing Services segment’s revenue and operating income are typically lowest in our first fiscal quarter due to the Thanksgiving, Christmas and New Year holidays, customer facility closures during the holidays in some cases for up to two weeks, and closures caused by severe winter weather conditions. The demand for our staffing services typically increases during the third and fourth quarters of the fiscal year when customers increase the use of our administrative and industrial labor during the summer vacation period. Our second fiscal quarter typically has the lowest margins as most payroll tax contributions restart each year in January. Margins typically then increase in subsequent fiscal quarters as annual payroll tax contribution maximums are met, particularly for higher salaried employees.

Employees

As of November 3, 2013, Volt employed approximately 34,700 people, including approximately 30,600 who were on contingent staffing assignments for the Staffing Services segment. Those people on contingent staffing assignments are on our payroll for the length of their assignment.

We are focused on developing a workforce that has both exceptional technical capabilities and the leadership skills that are required to support our growth. Our strategy is to be a leader in the markets we serve which will be achieved by developing new workforce capabilities and a committed, diverse executive team with the highest level of ethics and integrity.

Some of our employees outside the United States have rights under agreements with local work councils. We believe that our relations with our employees are satisfactory. While claims and legal actions related to staffing matters arise on a routine basis, we believe they are inherent in maintaining a large contingent workforce.

Regulation

Some states in the United States and certain foreign countries license and regulate contingent staffing service firms and employment agencies. In connection with some foreign sales by certain segments, we are subject to export controls, including restrictions on the export of certain technologies. The sale of certain hardware and software by our Computer Systems segment in certain countries is permitted pursuant to a general export license. When we sell to countries designated by the United States as sensitive or develop products subject to restriction, sales would be subject to more restrictive export regulations. Compliance with applicable present federal, state and local environmental laws and regulations has not had, and we believe that compliance with those laws and regulations in the future will not have, a material effect on our competitive position, financial condition, results of operations or cash flows.

Access to Our Information

We electronically file our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports with the SEC. These and other SEC reports filed by us are available to the public at the SEC’s website at www.sec.gov and in the Investors & Governance section at our website at www.volt.com, as soon as reasonably practicable after filing with the SEC.

Copies of our Code of Business Conduct and Ethics and other significant corporate documents (our Corporate Governance Guidelines, Governance Committee Charter, Audit Committee Charter, Compensation Committee Charter, Executive Committee Charter, Financial Code of Ethics, Whistleblower Policy, Foreign Corrupt Practices Act Policy, Insider Trading Policy and Electronic Communication Policy) are also available in the Investors & Governance section at our website. Copies are also available without charge upon request to Volt Information Sciences, Inc., 1065 Avenue of the Americas, New York, NY 10018, Attention: Shareholder Relations, or by calling us at (212) 704-2400.

8

Table of Contents

Risk Factors

You should carefully consider the following risks along with the other information contained in this report. The following risks could materially adversely affect our business and, as a result, our financial condition, results of operations, and the market price of our common stock. Other risks and uncertainties not known to us or that we currently do not recognize as material also could materially adversely affect our business and, as a result, our financial condition, results of operations, cash flows, and the market price of our common stock.

Risks Related to the Restatement and Other Accounting Issues

The Restatement of our 2008 Financial Statements and related investigations and process and control remediation were time consuming and expensive and had, and could continue to have, a material adverse effect on our financial condition, results of operations or cash flows.

We devoted substantial resources to the completion of the Restatement of our 2008 Financial Statements and remediation of the process and internal control failures that precipitated the Restatement. As a result of these efforts, as of November 3, 2013, we have incurred approximately $147 million in fees and expenses, primarily for additional audit, financial, legal and related costs. We expect to continue to incur additional fees and expenses in connection with complying with applicable SEC reporting requirements and the operation of some of our processes and internal controls. These costs, as well as the substantial management time devoted to address these issues, had, and could continue to have, a material adverse effect on our financial condition, results of operations or cash flows.

Although we settled an investigation by the SEC, we may be the subject of litigation relating to the Restatement, which could adversely affect our business, results of operations or cash flows.

As previously reported, the Company was the subject of a non-public investigation by the SEC related to the Company’s accounting practices that led to the restatement of the Company’s 2008 financial statements. On January 10, 2013, the SEC filed a settled enforcement action against the Company in the United States District Court for the Southern District of New York.

Although the Company has settled this matter with the SEC, additional regulatory inquiries may also be commenced. In addition, we may in the future be subject to additional litigation, or other proceedings or actions arising in relation to the restatement of our historical financial statements or the accounting matters that were addressed in the SEC investigation or related matters. Litigation and any regulatory proceeding or action may be time consuming, expensive and distracting from the conduct of our business. In the event that there is an adverse ruling in any legal or regulatory proceeding or action, we may be required to make payments to third parties that could have a material adverse effect on our business, financial condition, results of operations or cash flows. Furthermore, regardless of the merits of any claim, legal proceedings may result in substantial legal expense and could also result in the diversion of time and attention by our management.

Our insurance coverage may not cover any costs and expenses related to this potential litigation. In addition, we indemnify our officers, directors and certain employees for certain events or occurrences while the employee, officer or director is, or was, serving at our request in such capacity, as permitted under New York law. We have paid and continue to pay legal counsel fees incurred by our present and former directors, officers and employees who are involved with the SEC inquiry, the Restatement, and related review by the Board of Directors. We currently hold insurance policies for the benefit of our current and former directors and officers, although our insurance coverage may not be sufficient in some or all of these matters. Furthermore, the insurers may seek to deny or limit coverage in some or all of these matters, in which case we may have to self-fund all or a substantial portion of our indemnification obligations.

9

Table of Contents

Our failure to timely comply with our reporting obligations under the Exchange Act may have an adverse effect on our ability to raise capital and compensate our employees.

As a result of our failure to comply timely with our reporting obligations under the Exchange Act, we are subject to a number of restrictions regarding the registration of our securities, including our common stock, under federal securities laws. Until such time as we have regained compliance with our reporting obligations under the Exchange Act for certain periods of time and meet certain other conditions, we will be unable to use shorter and less costly filings, including Registration Statements on Form S-3 and Form S-8. Being required to use the Registration Statement Form S-1 is likely to be more costly and time consuming. These restrictions reduce our access to capital markets and limit our ability to use equity-based awards as a way to reward and motivate certain of our employees, both of which may adversely affect our business.

Risks Relating to the Economy and our Industry

Our business is adversely affected by current economic and other business conditions.

The global economy continues to show the effects of a prolonged economic downturn and slow recovery characterized by high unemployment and decreased consumer and business spending. In the past our business has suffered during such downturns, and our business has similarly suffered during the recent downturn.

A weakened economy in which unemployment levels are relatively high may result in decreased demand for contingent and permanent personnel, which adversely impacts our Staffing Services segment. When economic activity slows, many of our customers reduce their use of contingent workers before undertaking layoffs of their own employees, resulting in decreased demand for contingent workers. Decreased demand and higher unemployment levels result in lower levels of pay rate increases and increased pressure on our markup of staffing service rates and direct margins and higher unemployment costs. Since employees are also reluctant to risk changing employers, there are fewer openings available and, therefore, reduced activity in permanent placements. In recent years, many of our customers have significantly reduced their workforce, including their use of contingent labor. The continuation of the current business climate is likely to continue to adversely affect our business.

In all of our business segments, we have experienced competition and pressure on price, margins and markups for renewals of customers’ contracts. There can be no assurance that we will be able to continue to compete in our business segments without impacting revenue or margins. Additionally, our efforts to manage costs in relation to our business volumes may not be successful, and the timing of these efforts and associated earnings charges may adversely affect our business.

Certain customers have also begun to contract for staffing services through managed service providers who assume all payment obligations on behalf of the end-customer to service suppliers such as Volt. These managed service providers may present greater credit risks than the end-customer and some of these managed service providers have in the past, and could in the future, default on their obligations to us, adversely impacting our business.

The contingent staffing industry is very competitive with few significant barriers to entry.

Our Staffing Services segment is in a very competitive industry with few significant barriers to entry. The worldwide contingent staffing industry is also highly fragmented. In the United States, approximately 100 competitors operate nationally and approximately 6,000 smaller companies compete in varying degrees at local levels. Some of our principal competitors in this segment are larger and have significantly more financial resources than we do. These competitors may be better able than we are to attract and retain qualified personnel, to offer more favorable pricing and terms, and otherwise attract and retain the business that we seek. In addition, some of the segment’s customers, generally larger companies, are mandated or otherwise motivated to utilize the services of small or minority-owned companies rather than publicly held corporations such as Volt, and have redirected substantial amounts of their staffing business to those companies. We also face the risk that certain of our current and prospective customers may decide to provide similar services internally.

10

Table of Contents

There has been a significant increase in the number of customers consolidating their staffing services purchases with a single provider or a small number of providers. This trend to consolidate purchases has, in some cases, made it more difficult for us to obtain or retain customers. Additionally, pricing pressures have intensified as customers have continued to competitively bid contracts. This trend is expected to continue for the foreseeable future. As a result, we cannot assure you that we will not encounter increased competition and lower margins in the future.

Risks Related to our Capital Structure and Finances

Our credit agreement contains restrictive covenants.

Our existing credit facilities include restrictive covenants which limit our ability to, among other things, change our lines of business and engage in certain consolidations, mergers, liquidations, or dissolutions. These covenants could limit our ability to react to market conditions or to otherwise engage in transactions beneficial to us.

Risks Related to our Particular Customers and the Projects on which We Work

Our project related businesses are subject to delays, unanticipated costs and cancellations that may result in unforeseen costs, reductions in revenues or the payment of liquidated damages.

In some of our contracts we guarantee certain results of a project, such as the substantial completion of a project by a scheduled date, performance testing levels, results and other performance requirements. Failure to meet those criteria could result in additional costs or penalties, including liquidated damages, which could exceed our projected profit. Many projects involve engineering, procurement and construction phases that may occur over extended time periods, sometimes over several years. We may encounter difficulties in design or engineering, delays in receiving designs or materials provided by our customers or third parties, delays in equipment and material delivery, schedule changes, delays from our customers’ failure to timely obtain rights required to perform or complete a project, weather-related delays and other factors, some of which are beyond our control, that could impact our ability to complete projects in accordance with the original delivery schedules. In addition, we often contract with subcontractors to assist us with our responsibilities, and any delay or poor performance by subcontractors may result in delays in the overall progress of projects or may cause us to incur additional costs, or both. Delays and additional costs may be substantial, we may not be able to recover any or all of these costs and our revenues and operating profits could be significantly reduced. We also may be required to invest significant working capital to fund cost overruns. Delays or cancellations also may impact our reputation or relationships with customers, adversely affecting our ability to secure new contracts.

At times, project contracts may require customers or other parties to provide the specifications, design, engineering information, equipment or materials to be used on a project. In some cases, the project schedule or the design, engineering information, equipment or materials may be deficient or delivered later than required by the project schedule. In addition, our customers may change or delay various elements of a project after commencement, resulting in additional direct or indirect costs.

Under these circumstances, we generally attempt to negotiate with the customer with respect to the amount of additional time required and the compensation to be paid to us. We may be unable to obtain, through negotiation, arbitration, mediation, litigation or otherwise, adequate amounts to compensate us for additional work or expense incurred by us due to customer change orders or failure by the customer to deliver items, such as engineering or design drawings, specifications or materials on time. Litigation, arbitration or mediation of claims for compensation may be lengthy and costly, and may not ultimately result in us receiving adequate compensation for these matters, which could adversely affect our results of operations or cash flows. Delays or cancellations also may impact our reputation or relationships with customers, adversely affecting our ability to secure new contracts.

Many of our contracts either provide no minimum purchase requirements, are cancellable during the term, or both.

In our Staffing Services segment most contracts are not sole source, and many of our contracts, even those with multi-year terms, provide no assurance of any minimum amount of revenue. Under many of these contracts

11

Table of Contents

we still must compete for each individual placement or project. In addition, many of our long-term contracts contain cancellation provisions under which the customer can cancel the contract at any time or on relatively short notice, even if we are not in default under the contract. Therefore, these contracts do not provide the assurances that typical long-term contracts often provide and are inherently uncertain with respect to the revenues and earnings we may recognize with respect to our customer contracts. Consequently, in all our business segments, if customers do not utilize our services under existing contracts or do not renew existing contracts, that could adversely affect our results of operations or cash flows.

Our Computer Systems segment is highly dependent on our customers’ call volume and their acceptance and adoption of our OnDemand product.

Revenues in our Computer Systems segment are highly dependent on the volume of directory assistance calls to our customers. The volume of such calls has declined, and will likely continue to decline, as consumers utilize free listings offered by alternative sources, including listings available on the internet, and from consolidation in the telecommunications industry which gives our customers greater negotiating power. Many of our contracts in this segment provide for us to be paid based on the volume of calls, while our costs of meeting the contractual service levels are largely fixed. Decreases in call volume that we are not able to offset with lowered costs could adversely affect our results of operations or cash flows. With the decline of call volume, revenues in our Computer Systems segment are increasingly dependent on our customers’ acceptance and adoption of our OnDemand product.

We rely extensively on our information technology systems and are vulnerable to damage and interruption.

We rely on our information technology systems and infrastructure to process transactions, summarize results, and manage our business, including maintaining client information. Failure to protect and maintain our data and information technology systems may cause outages or security breaches in our systems that could adversely affect our results of operations or cash flows, as well as our business reputation.

Our business may be negatively affected if we are not able to keep pace with rapid changes in technology.

We must obtain or produce products and systems, principally in the information technology environment, to satisfy customer requirements and to remain competitive. To do so, we must make significant investments to deploy, maintain and upgrade advanced computer software and purchase substantial amounts of computer equipment. These investments require significant capital, entail large technological obsolescence risk and require specialized talent to operate. There can be no assurance that in the future we will be able to foresee technological changes and to identify, develop and commercialize innovative and competitive products, systems and services in a timely and cost effective manner and to achieve customer acceptance of our products, systems and services in markets characterized by rapidly changing technology and frequent new product introductions.

The loss of any key customers could adversely impact our business.

Although we had no customer that represented over 10% of revenues in fiscal years 2012 or 2013, reductions, delays or cancellation of contracts with any of our key customers or the loss of one or more key customers could materially reduce our revenue and operating income. There is no assurance that our current customers will continue to do business with us or that contracts with existing customers will continue at current or historical levels.

We are dependent upon the quality of our personnel.

Our operations are dependent on the continued efforts of our senior management. In addition, we are dependent on the performance and productivity of our local managers and field personnel. Our ability to attract and retain business is significantly affected by local relationships and the quality of service rendered. The loss of high quality personnel and members of management with significant experience in our industry without replacement by similar quality and experience may cause a significant disruption to our business. Moreover, the loss of key local managers and field personnel could jeopardize existing client relationships with businesses that use our services based upon relationships with those managers and field personnel.

12

Table of Contents

We are dependent upon our ability to attract and retain technologically qualified personnel.

Our operations are dependent upon our ability to attract and retain technologically qualified personnel, particularly for temporary assignments to customers of our Staffing Services segment, as well as in the areas of research and development, implementation and upgrading of internal systems. The availability of such personnel is dependent upon a number of economic and demographic conditions. We may in the future find it difficult or more costly to hire such personnel in the face of competition from other companies.

In addition variations in the rate of unemployment and higher wages sought by contingent workers in certain technical fields that continue to experience labor shortages could affect our ability to meet our customers’ demands in these fields and adversely affect our results of operations.

Risks Related to Legal Compliance and Litigation

We are subject to employment–related and other claims and losses that could have a material adverse effect on our business.

Our Staffing Services segment employs or engages individuals on a contingent basis and places them in a customer’s workplace. Our ability to control the customer’s workplace is limited, and we risk incurring liability to our employees for injury (which can result in increased workers’ compensation costs) or other harm that they suffer at the customer’s workplace. In addition we may face claims related to violations of wage and hour regulations, discrimination, harassment, the employment of undocumented or unlicensed personnel; misconduct, negligence or professional malpractice by our employees, and claims relating to the misclassification of independent contractors, among others.

Additionally, we risk liability to our customers for the actions or inactions of our employees, including those individuals employed on a contingent basis, that may result in harm to our customers. Such actions may be the result of negligence or misconduct on the part of our employees, damage to customer facilities due to negligence, criminal activity and other similar claims. In some cases, we must indemnify our customers for certain acts of our employees, and certain customers have negotiated increases in the scope of such indemnification agreements. We also may incur fines, penalties and losses that are not covered by insurance or negative publicity with respect to these matters. There can be no assurance that the policies and procedures we have in place will be effective or that we will not experience losses as a result of these risks.

Improper disclosure of sensitive or confidential employee or client data, including personal data, could result in liability and harm our reputation.

Our business involves the use, storage and transmission of information about our full-time and contingent employees, clients and other individuals. This information may contain sensitive or confidential employee and client data, including personal data. Additionally, our employees may have access or exposure to customer data and systems, the misuse of which could result in legal liability. We and our third party service providers have established policies and procedures to help protect the security and privacy of this information. It is possible that our security controls over sensitive or confidential data and other practices we and our third party service providers follow may not prevent the improper access to or disclosure of such information. Such disclosure could harm our reputation and subject us to liability under our contracts and laws that protect sensitive or personal data and confidential information, resulting in increased costs or loss of revenue. Further, data privacy is subject to frequently changing rules and regulations, which sometimes conflict among jurisdictions and countries in which we provide services. Our failure to adhere to or successfully implement processes in response to changing regulatory requirements in this area could result in legal liability or impairment to our reputation in the marketplace.

The possession and use of personal information and data in conducting our business subjects us to legislative and regulatory burdens. We may be required to incur significant expenses to comply with mandatory privacy and security standards and protocols imposed by law, regulation, industry standards or contractual obligations.

13

Table of Contents

New and increased government regulation, employment costs or taxes could have a material adverse effect on our business, especially for our contingent staffing business.

Certain of our businesses are subject to licensing and regulation in some states and most foreign jurisdictions. There can be no assurance that we will continue to be able to comply with these requirements, or that the cost of compliance will not become material. Additionally, the jurisdictions in which we do or intend to do business may:

| • | create new or additional regulations that prohibit or restrict the types of services that we currently provide; |

| • | impose new or additional employment costs that we may not be able to be pass on to customers or that could cause customers to reduce their use of our services, especially in our Staffing Services segment, which could adversely impact our business; |

| • | require us to obtain additional licenses; or |

| • | increase taxes (especially payroll and other employment-related taxes) or enact new or different taxes payable by the providers or users of services such as those offered by us, thereby increasing our costs, some of which we may not be able to pass on to customers or that could cause customers to reduce their use of our services especially in our Staffing Services segment, which could adversely impact our results of operations or cash flows. |

In some of our foreign markets, new and proposed regulatory activity is imposing additional requirements and costs, and could cause changes in customers’ attitudes regarding the use of outsourcing and contingent personnel in general, which could have an adverse effect on our contingent staffing business.

Insurance has limits and exclusions and we retain risk.

Our insurance policies for various exposures including, but not limited to, general liability, auto liability, workers compensation and employer’s liability, directors’ and officers’ insurance, professional liability, employment practices, loss to real and personal property, business interruption, fiduciary and other management liability, are limited and the losses that we face may be not be covered, may be subject to high deductibles or may exceed the limits purchased.

Costs related to litigation could adversely impact our financial condition

We are involved in pending and threatened legal proceedings from time to time, the outcome of which is inherently uncertain and difficult to predict. It is uncertain at what point any of these or new matters may affect us, and there can be no assurance that our financial resources are sufficient to cover these matters in their entirety or any one of these matters. Therefore, there can be no assurance that these matters will not have an adverse effect on our financial condition, results of operations or cash flows.

Risks Related to Our Common Stock

Our common stock was delisted from the New York Stock Exchange and is not listed on any other national securities exchange which may negatively impact the trading price of our common stock and the levels of liquidity available to our stockholders.

Trading in the Company’s common stock on the New York Stock Exchange (“NYSE”) was suspended on January 26, 2011. The Company’s common stock was delisted from the NYSE on May 30, 2011. On January 27, 2011, the Company’s common stock began trading under the symbol “VISI” through the facilities of the OTC Markets Group, Inc.

The trading of our common stock on the OTC marketplace rather than the NYSE may negatively impact the trading price of our common stock and the levels of liquidity available to our stockholders. We can provide no assurance that we will be able to relist our common stock on a national securities exchange or that the stock will continue being traded on the OTC marketplace.

14

Table of Contents

Securities traded in the over-the-counter market generally have significantly less liquidity than securities traded on a national securities exchange due to factors such as the reduced number of investors that will consider investing in the securities, the reduced number of market makers in the securities, and the reduced number of securities analysts that follow such securities. As a result, holders of our common stock may find it difficult to resell their shares at prices quoted in the market or at all. The lack of liquidity in our common stock may also make it difficult for us to issue additional securities for financing or other purposes, or to otherwise arrange for any financing we may need in the future.

Our stock price could be volatile and, as a result, investors may not be able to resell their shares at or above the price they paid for them.

Our stock price has in the past, and could in the future, fluctuate as a result of a variety of factors, including the increased volatility of the over-the-counter markets and:

| • | our failure to meet the expectations of the investment community or our estimates of our future results of operations; |

| • | industry trends and the business success of our customers; |

| • | loss of one or more key customers; |

| • | strategic moves by our competitors, such as product or service announcements or acquisitions; |

| • | regulatory developments; |

| • | litigation; |

| • | general economic conditions; and |

| • | other domestic and international macroeconomic factors unrelated to our performance. |

The stock market has experienced, and may in the future experience, volatility that has often been unrelated to the operating performance of particular companies. These broad market fluctuations may also adversely affect the market price of our common stock.

Our principal shareholders own a significant percentage of our common stock and will be able to exercise significant influence over Volt. Their interests may differ from those of other shareholders.

As of December 31, 2013, our principal shareholders, who are related family members, controlled approximately 43% of our outstanding common stock. Accordingly, these shareholders, if they vote in the same manner, would effectively be able to control the composition of our board of directors and many other matters requiring shareholder approval and would continue to have significant influence over our affairs, and the interests of our principal shareholders may not align with those of our other shareholders.

Furthermore, the provisions of the New York Business Corporation Law, to which we are subject, requires the affirmative vote of the holders of two-thirds of all of our outstanding shares entitled to vote in order to adopt a plan of merger or consolidation between us and another entity and to approve a sale, lease, exchange or other disposition of all or substantially all of our assets not made in our usual and regular course of business. Accordingly, our principal shareholders, acting together, could prevent the approval of such transactions even if such transactions are in the best interests of our other shareholders.

New York law and our Articles of Incorporation and By-laws contain provisions that could make the takeover of Volt more difficult.

Certain provisions of New York law and our articles of incorporation and by-laws could have the effect of delaying or preventing a third party from acquiring Volt, even if a change in control would be beneficial to our shareholders. These provisions of our articles of incorporation and by-laws include:

| • | providing for a classified board of directors with directors having staggered, two-year terms; |

| • | permitting removal of directors only for cause; |

| • | providing that vacancies on the board of directors will be filled by the remaining directors then in office; and |

| • | requiring advance notice for shareholder proposals and director nominees. |

15

Table of Contents

In addition to the voting power of our principal shareholders discussed above, our board of directors could choose not to negotiate with a potential acquirer that it did not believe was in our strategic interests. If an acquirer is discouraged from offering to acquire Volt or prevented from successfully completing an acquisition by these or other measures, our shareholders could lose the opportunity to sell their shares at a more favorable price.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

Our corporate headquarters is located in approximately 18,700 square feet at 1065 Avenue of the Americas, New York, New York under a lease that expires in 2015. A summary of our principal owned and leased (those exceeding 20,000 square feet) that are currently in use is set forth below:

United States

| Location |

Business Segment/Purpose |

Own/Lease |

Lease Expiration | Approximate Square Feet |

||||||

| Orange, California |

Staffing Services and General and Administrative Offices | Own (1) | - | 200,000 | ||||||

| Redmond, Washington |

Staffing Services | Lease | 2015 | 77,000 | ||||||

| Rochester, New York |

Computer Systems | Lease | 2018 | 51,000 | ||||||

| San Antonio, Texas |

Staffing Services | Lease | 2019 | 71,000 | ||||||

| Wallington, New Jersey |

Other | Lease | 2015 | 32,000 | ||||||

| (1) | See Note 11 in our Consolidated Financial Statements for information regarding a term loan secured by a deed of trust on this property. We lease approximately 39,000 square feet of these premises to an unaffiliated third party with a term through October 31, 2015, with the tenant having two additional 60-month lease renewal options and certain rights of early termination. |

International

| Location |

Business Segment/Purpose |

Own/Lease |

Lease Expiration |

Approximate Square Feet |

||||||

| Montevideo, Uruguay |

Other | Own | - | 93,000 | ||||||

| Bangalore, India |

Other | Lease | Between 2014 and 2015 | 30,000 | ||||||

We lease space in approximately 135 other facilities worldwide, excluding month-to-month leases, each of which consists of less than 20,000 square feet. These leases expire at various times from 2014 until 2022.

At times we lease space to others in the buildings that we own or lease if we do not require the space for our own business. We believe that our facilities are adequate for our presently anticipated uses, and we are not dependent upon any individual leased premises.

For additional information pertaining to lease commitments, see our note on Commitments and Contingencies to our Consolidated Financial Statements included in this report.

SEC Civil Action

As previously reported, Volt was the subject of a non-public investigation by the SEC that we settled on January 18, 2013. Also arising from the investigation, the SEC filed a civil injunctive complaint on January 10, 2013, against Jack Egan, Volt’s former Chief Financial Officer, in the United States District Court for the Southern District of New York. The Commission alleges that Egan participated in a scheme in violation of the Securities Act and the Exchange Act to materially overstate revenue causing our net income for our fourth

16

Table of Contents

quarter and fiscal year ended October 28, 2007 to be materially overstated and to mislead our external auditors. The Commission seeks that Egan be permanently enjoined from further violations, be ordered to pay a civil money penalty, and be prohibited from acting as an officer or director of any public company.

Other Legal Proceedings

From time to time, the Company is subject to claims in legal proceedings arising in the ordinary course of its business, including those related to payroll related matters and various employment related matters. All litigation currently pending against the Company relates to matters that have arisen in the ordinary course of business and the Company believes that such matters will not have a material adverse effect on its consolidated financial condition, results of operations or cash flows.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

17

Table of Contents

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Until January 26, 2011, our common stock was listed on the NYSE under the symbol “VOL”. Since then it has traded in the over-the-counter market under the symbol “VISI”. The following table sets forth, for the periods indicated, the high and low sales prices or the high and low bid quotations for our common stock for the years ended November 3, 2013, October 28, 2012 and October 30, 2011. The over-the-counter market bid quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

| Fiscal Period | First Quarter | Second Quarter | Third Quarter | Fourth Quarter | ||||||||||||||

|

|

|

|||||||||||||||||

| 2013 |

High | $ | 7.81 | $ | 8.74 | $ | 8.10 | $ | 8.90 | |||||||||

| Low | $ | 6.20 | $ | 7.79 | $ | 6.65 | $ | 6.85 | ||||||||||

| 2012 |

High | $ | 7.00 | $ | 7.19 | $ | 7.35 | $ | 7.14 | |||||||||

| Low | $ | 5.45 | $ | 5.89 | $ | 6.57 | $ | 6.23 | ||||||||||

| 2011 |

High | $ | 9.49 | $ | 10.75 | $ | 10.80 | $ | 9.15 | |||||||||

| Low | $ | 5.92 | $ | 6.65 | $ | 9.10 | $ | 6.00 | ||||||||||

Cash dividends have not been paid for the five years ended November 3, 2013 and through the date of this report. One of our credit agreements contains a covenant that limits cash dividends, capital stock purchases and redemptions in any one fiscal year to 50% of our prior year’s consolidated net income, as defined. As the company reported a loss in fiscal 2013, there was no availability for cash dividends, capital stock purchases and redemptions under this covenant at November 3, 2013.

On January 24, 2014 there were approximately 282 holders of record of our common stock, exclusive of shareholders whose shares were held by brokerage firms, depositories and other institutional firms in “street name” for their customers.

Issuer Purchases of Equity Securities

On June 2, 2008, our Board of Directors authorized the repurchase of up to 1,500,000 shares of our common stock from time to time in open market or private transactions at management’s discretion, subject to market conditions and other factors. The timing and exact number of shares purchased will depend on market conditions and is subject to lender approval for purchases under the terms of our credit agreements.

Our purchases of our common stock from July 28, 2008 to November 3, 2013 were as follows:

| Period |

Total Number of Shares Purchased |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plan or Program |

Maximum Number of Shares that May Yet be Purchased Under Plan or Program |

||||||||||||

| July 28, 2008 - August 24, 2008 |

- | - | - | 1,500,000 | ||||||||||||

| August 25, 2008 - September 21, 2008 |

255,637 | $ | 10.84 | 255,637 | 1,244,363 | |||||||||||

| September 22, 2008 - November 2, 2008 |

903,098 | $ | 8.75 | 903,098 | 341,265 | |||||||||||

| June 28, 2009 - August 2, 2009 |

32,010 | $ | 7.08 | 32,010 | 309,255 | |||||||||||

|

|

|

|

|

|||||||||||||

| Total |

1,190,745 | 1,190,745 | ||||||||||||||

|

|

|

|

|

|||||||||||||

18

Table of Contents

Performance Information

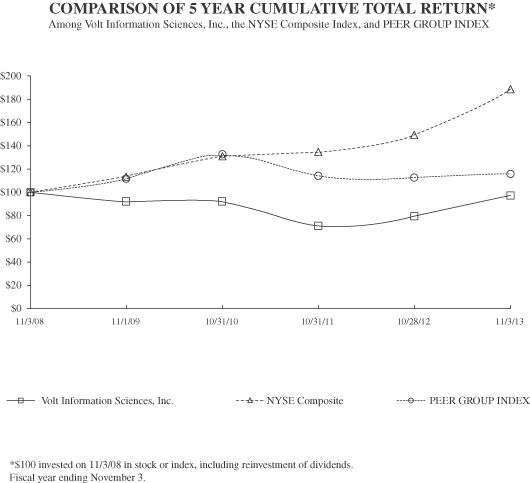

Shareholder Return Performance Graph

The Company’s Peer Group Index includes companies having market capitalizations that are within 5% of the market capitalization of the Company’s Common Stock at the end of the Company’s latest fiscal year-end (this peer group has been selected by the Company because the Company has operated in diverse business segments).

Other Events

We maintain a 401(k) retirement savings plan that is available to substantially all of our U.S. employees. The plan contains as an investment alternative an “Employer Stock Fund” that invests in our common stock and, until February 17, 2011, the plan allowed participants to allocate some or all of their account balances to interests in the Employer Stock Fund. In February 2011, we informed the participants in the 401(k) plan that they would no longer be allowed to allocate their account balance to the Employer Stock Fund because the Company had not been timely filing periodic reports with the Securities and Exchange Commission.

The Volt Information Sciences, Inc. common stock held in the Employer Stock Fund was not purchased from the Company; rather, the plan trustee accumulated the plan contributions that were directed to the Employer Stock Fund and purchased shares of our common stock in open market transactions. Nevertheless, because we sponsor the plan, we may be required to register certain transactions in the plan related to shares of our common stock, and we filed registration statements on Form S-8 with respect to shares offered and sold through the Employer Stock Fund.

19

Table of Contents

Purchases of shares for the Employer Stock Fund made from approximately September 15, 2009 through February 17, 2011 (the date as of which participants were no longer allowed to allocate their account balances to the Employer Stock Fund) occurred when we were not filing periodic reports with the Securities and Exchange Commission on a current basis. Consequently, our registration statements on Form S-8 may not have been available to cover these offers and sales to plan participants to the extent registration may have been required. During this period, the participants purchased through the Employer Stock Fund approximately 161,000 shares of our common stock.

20

Table of Contents

ITEM 6. SELECTED FINANCIAL DATA

The following selected financial data reflects the results of operations and balance sheet data for the fiscal years ended November 3, 2013, October 28, 2012, October 30, 2011, October 31, 2010 and November 1, 2009. The data below should be read in conjunction with, and is qualified by reference to, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and the Company’s Consolidated Financial Statements and notes thereto. The financial information presented may not be indicative of our future performance.

| For the years ended, (in thousands, except per share data) |

November 3, 2013 |

October 28, 2012 |

October 30, 2011 |

October 31, 2010 |

November 1, 2009 |

|||||||||||||||

| 53 weeks | 52 weeks | 52 weeks | 52 weeks | 52 weeks | ||||||||||||||||

| Revenue: | ||||||||||||||||||||

| Staffing services revenue |

$ | 1,899,723 | $ | 2,027,601 | $ | 1,957,905 | $ | 1,732,348 | $ | 1,717,255 | ||||||||||

| Other revenue |

191,214 | 218,526 | 280,204 | 224,064 | 246,754 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net revenue | 2,090,937 | 2,246,127 | 2,238,109 | 1,956,412 | 1,964,009 | |||||||||||||||

| Direct cost of staffing services revenue |

1,634,365 | 1,738,933 | 1,698,711 | 1,479,562 | 1,458,720 | |||||||||||||||

| Cost of other revenue | 160,199 | 163,853 | 166,211 | 178,268 | 230,031 | |||||||||||||||

| Selling, administrative and other operating costs | 294,034 | 310,847 | 302,882 | 294,564 | 288,404 | |||||||||||||||

| Amortization of purchased intangible assets | 1,369 | 1,382 | 1,347 | 1,434 | 1,435 | |||||||||||||||

| Restructuring costs | 4,726 | - | - | 3,149 | 10,739 | |||||||||||||||

| Gain on sale of building | - | (4,418) | - | - | - | |||||||||||||||

| Restatement and associated investigations | 24,828 | 42,906 | 49,193 | 29,158 | 924 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income (loss) | (28,584) | (7,376) | 19,765 | (29,723) | (26,244) | |||||||||||||||

| Other income (expense), net | (1,822) | (3,836) | (4,484) | (4,038) | (3,493) | |||||||||||||||

| Income tax provision (benefit) | 469 | 2,391 | (348) | 62,614 | (3,493) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) | $ | (30,875) | $ | (13,603) | $ | 15,629 | $ | (96,375) | $ | (26,244) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| PER SHARE DATA: |

||||||||||||||||||||

| Basic: |

||||||||||||||||||||

| Net income (loss) |

$ | (1.48) | $ | (0.65) | $ | 0.75 | $ | (4.63) | $ | (1.26) | ||||||||||

| Weighted average number of shares |

20,826 | 20,813 | 20,813 | 20,812 | 20,833 | |||||||||||||||

| Diluted: |

||||||||||||||||||||

| Net income (loss) |

$ | (1.48) | $ | (0.65) | $ | 0.75 | $ | (4.63) | $ | (1.26) | ||||||||||

| Weighted average number of shares |

20,826 | 20,813 | 20,896 | 20,812 | 20,833 | |||||||||||||||

| For the years ended, (in thousands) |

November 3, 2013 |

October 28, 2012 |

October 30, 2011 |

October 31, 2010 |

November 1, 2009 |

|||||||||||||||

| 53 weeks | 52 weeks | 52 weeks | 52 weeks | 52 weeks | ||||||||||||||||

| Cash and cash equivalents | $ | 11,114 | $ | 26,483 | $ | 44,567 | $ | 51,084 | $ | 118,765 | ||||||||||

| Working capital | 54,673 | 90,435 | 111,218 | 127,011 | 201,449 | |||||||||||||||

| Total assets | 500,312 | 557,572 | 579,479 | 599,124 | 658,343 | |||||||||||||||

| Long-term debt, current portion | 839 | 768 | 708 | 652 | 601 | |||||||||||||||

| Long-term debt, excluding current portion | 8,127 | 9,033 | 9,801 | 10,509 | 11,161 | |||||||||||||||

| Total stockholders’ equity | 110,241 | 143,117 | 156,663 | 140,137 | 237,285 | |||||||||||||||

| Note - Cash dividends were not paid during the above periods. |

|

|||||||||||||||||||

21

Table of Contents

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview

The demand for our services in all segments, both in the United States and internationally, is dependent upon general economic conditions. Our business suffers during economic downturns.