UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________________________________

FORM

| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

||

| OR | ||

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended |

||

| OR | ||

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

||

| OR | ||

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission

File Number

_______________________________________________________________________

(Exact Name of Registrant as Specified in its Charter)

BRAZILIAN

DISTRIBUTION COMPANY

(Translation of Registrant’s name into English)

THE

FEDERATIVE REPUBLIC OF BRAZIL

(Jurisdiction of incorporation or organization)

_______________________________________________________________________

Phone:

(Address of principal executive offices)

_______________________________________________________________________

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Shares, without par value | - | New York Stock Exchange* |

|

|

|

|

_______________________________________________________________________

*Not for trading purposes, but only in connection with the listing on the New York Stock Exchange of American Depositary Shares representing

those Common Shares.

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the period covered by the annual report:

As

of December 31, 2022, the registrant had outstanding common shares, no par value per share

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the

Securities Act.

¨ Yes x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

¨ Yes x

Note—Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

¨ Yes x

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ¨

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b)

of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that

prepared

or issued its audit report

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ¨ | Other ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

¨ Yes x

TABLE OF CONTENTS

Page

i

ii

INTRODUCTION

All references in this annual report to (i) “CBD,” “we,” “us,” “our,” “Company” and “Pão de Açúcar Group” are references to Companhia Brasileira de Distribuição and its consolidated subsidiaries, unless the context requires otherwise; (ii) the “Brazilian government” are references to the federal government of the Federative Republic of Brazil, or Brazil; (iii) “common shares” are references to our authorized and outstanding common shares (ações ordinárias), without par value; and (iv) “preferred shares” are references to our formerly issued preferred shares, all of which were converted into common shares on February 28, 2020. For more information on the conversion of our preferred shares into common shares, see “Item 9. The Offer and Listing—9A. Offer and Listing Details.” All references to “ADSs” are to American Depositary Shares, each representing one common share, without par value. The ADSs are evidenced by American Depositary Receipts, or ADRs, issued by J.P. Morgan Chase Bank N.A., the depositary bank for the ADSs. All references to “real,” “reais” or “R$” are to the Brazilian real, the official currency of Brazil. All references to “US$,” “dollars” or “U.S. dollars” are to United States dollars. All references to “€” or “euro” are to the currency introduced at the start of the third stage of the European economic and monetary union pursuant to the treaty establishing the European Community, as amended.

Presentation of Financial and Other Data

Financial Data

We have prepared our consolidated financial statements included in this annual report in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or the IASB.

Our consolidated financial statements are presented in Brazilian reais. The rate used to translate the U.S. dollars amounts as of December 31, 2022 was R$5.2177 to US$1.00, which was the commercial selling rate of U.S. dollars in effect as of December 31, 2022, as reported by the Central Bank of Brazil, or the Central Bank. The U.S. dollar equivalent information presented in this annual report are solely for the convenience of investors and should not be construed as implying that the real amounts represent, or could have been or could be converted into, U.S. dollars at that rate or at any other rate.

Other Data

In this annual report:

| · | some of the financial data reflects the effect of rounding; |

| · | the term “audited consolidated financial statements” refers to our audited consolidated financial statements prepared in accordance with IFRS, as issued by the IASB, as of December 31, 2022 and 2021 and for the years ended December 31, 2022, 2021 and 2020, together with the corresponding reports of our independent registered public accounting firms, included elsewhere in this annual report; |

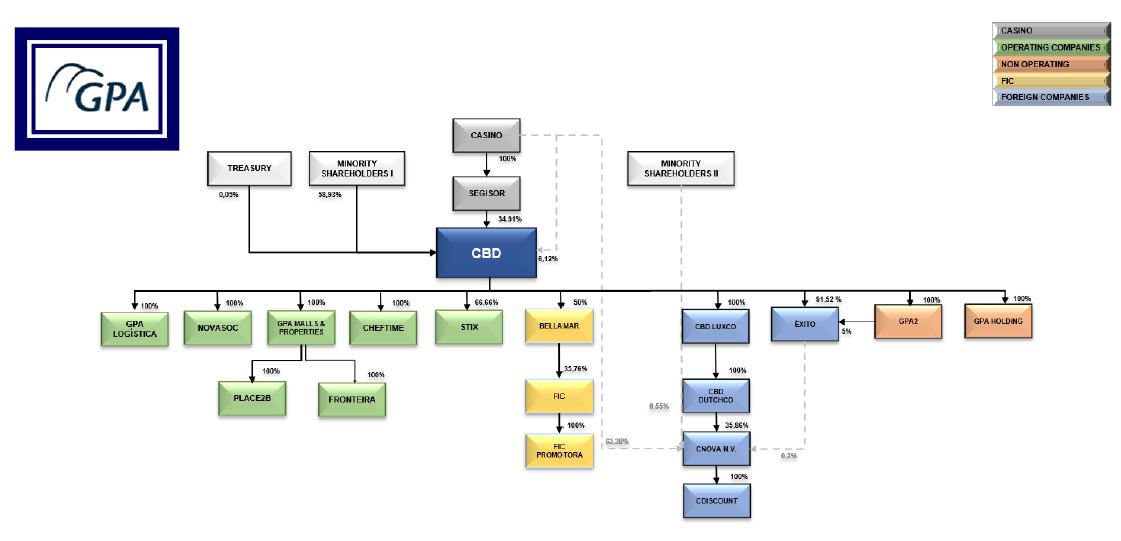

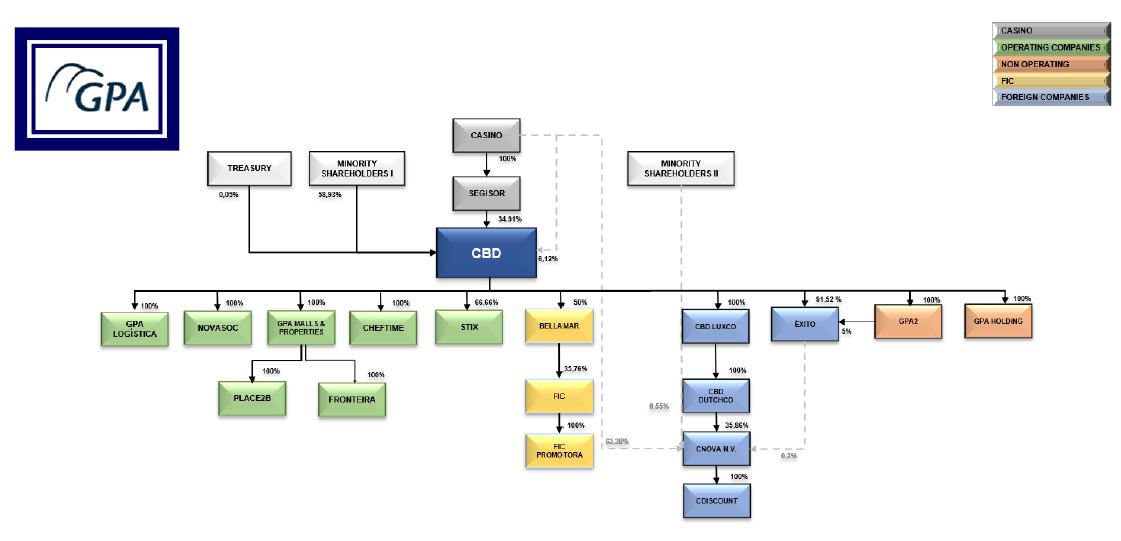

| · | the term “Casino” refers to Casino, Guichard-Perrachon S.A., a French corporation (société anonyme). Casino is our indirect controlling shareholder. It is ultimately controlled by Mr. Jean-Charles Naouri, the chairman of our board of directors. For more information on our direct and indirect shareholders, see “Item 7. Major Shareholders and Related Party Transactions––7A. Major Shareholders;” |

| · | the term “Casino Group” refers to Casino and Casino’s subsidiaries, including Rallye S.A., or Rallye, and Euris S.A.S., or Euris, Wilkes Participações S.A., Segisor S.A., King LLC, Geant International B.V. and Helicco Participações Ltda., which are ultimately controlled by Mr. Jean-Charles Naouri; |

| · | the term “Cnova” refers to CNova N.V., a Dutch corporation, and, where appropriate, its subsidiaries. Cnova was one of our consolidated subsidiaries until October 31, 2016 and, starting on November 1, 2016, we began recording our investment in Cnova according to the equity pick-up accounting method. For more information on our investment in Cnova, see “Item 4. Information on the Company—4A. History and Development of the Company—Changes in Our Business—Corporate Reorganization of E-commerce Operating Segment;” |

| · | the term “Cnova Brazil” refers to Cnova Comércio Eletrônico S.A., a Brazilian corporation (sociedade anônima), which until October 31, 2016 was a wholly-owned subsidiary of Cnova and operated and |

| 1 |

owned the Brazilian non-food e-commerce businesses of CBD and Via, as defined below. Following the completion of the Cnova corporate reorganization on October 31, 2016, Cnova Brazil became a wholly-owned subsidiary of Via. For more information on the Cnova reorganization, see “Item 4. Information on the Company—4A. History and Development of the Company—Corporate Reorganization of E-commerce Operating Segment;”

| · | “Éxito” are to Almacenes Éxito S.A., a Colombian corporation, one of our subsidiaries; |

| · | “Grupo Éxito” are to Éxito and its consolidated subsidiaries. As of December 31, 2022, we have reported Grupo Éxito’s results of operations as discontinued operations. For more information on Grupo Éxito’s discontinued operations and its consequences on our audited consolidated financial statements, see Explanatory Note on “Item 4. Information on the Company—Item 4A. History and Development of the Company—Changes in our Business—Discontinued Operations for the Year Ended December 31, 2022—Grupo Éxito” and notes 1.2 and 33(a) to our audited consolidated financial statements as of and for the year ended December 31, 2022; |

| · | “FIC” are to Financeira Itaú CBD S.A. Crédito, Financiamento e Investimento, a Brazilian financial services company; |

| · | the term “GHG emissions” refers to greenshouse gas emissions; |

| · | the term “private label” refers to our own branded products, including Qualitá, Taeq, Cheftime, Casino, Club des Sommeliers, Fábrica 1959, Confraria, Finlandek and Nous; |

| · | the term “same-store-sales” refers to sales made in stores open for at least 12 consecutive months and that did not close nor remain closed for a period of seven or more consecutive days; |

| · | the term “Sendas” refers to Sendas Distribuidora S.A., a Brazilian corporation (sociedade anônima) and, where appropriate, its subsidiaries. Sendas was one of our subsidiaries until December 31, 2020 and it operated in the cash and carry business under the banner Assaí. The spin-off and separation of Sendas from CBD was completed on December 31, 2020. For more information on the spin-off and separation of Sendas, see “Item 4. Information on the Company—4A. History and Development of the Company—Changes in Our Business—Spin-off of Cash and Carry Operating Segment;” |

| · | the term “Sendas Spin-Off” refers to our separation from Sendas through the distribution of substantially all of the issued and outstanding Sendas common shares to holders of CBD common shares, on a pro rata basis for no consideration. For more information on the Sendas Spin-Off, see “Item 4. Information on the Company—4A. History and Development of the Company—Changes in Our Business—Spin-Off of Cash and Carry Operating Segment;” |

| · | the term “Stix” refers to Stix Fidelidade e Inteligência S.A., a Brazilian corporation (sociedade anônima), focused on loyalty programs, in which we hold 66.7% of the capital stock and Raia Drogasil S.A., or RD, a pharmacy retailer in Brazil, holds the remaining 33.3% of the capital stock; and |

| · | the term “Via” refers to Via S.A., a Brazilian corporation (sociedade anônima) and, where appropriate, its subsidiaries. Via was one of our subsidiaries until June 2019 and it operated in the home appliances business under the banners Ponto Frio and Casas Bahia. On June 14, 2019, we consummated the sale of all equity interest we held in Via. For more information on the sale of the operations of Via, see “Item 4. Information on the Company—4A. History and Development of the Company—Changes in Our Business—Sale of Home Appliances Operating Segment.” |

None of the information available on our website or on websites referred to in this annual report is incorporated by reference into this annual report.

FORWARD-LOOKING STATEMENTS

This annual report includes forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, principally in “Item 3. Key Information—3D. Risk Factors,” “Item 4. Information on the Company—4B. Business Overview” and “Item 5. Operating and Financial Review and Prospects.” We have based these forward-looking statements largely on our current expectations and projections about future

| 2 |

events and financial trends affecting our business. These forward-looking statements are subject to risks, uncertainties and assumptions including, among other things:

| · | global economic and political conditions as well as geopolitical instability, including the military conflict between Russia and Ukraine and the potential outbreaks of transmissible diseases around the world, and their impacts on the global economy and consumer spending patterns (including, but not limited to, unemployment rates, interest rates, monetary policies and inflation rates in Brazil); |

| · | political instability relating to the election of the new president of Brazil, who took office in January 2023, and uncertainties relating to the monetary, fiscal and social security policies that will be adopted by the new government and the political turmoil that started after the election results, with demonstrations and strikes; |

| · | government interventions that affect the economy, incentive policies, tariffs and taxation, regulatory restrictions, as well as environmental regulations in Brazil; |

| · | changes in Brazil’s socioeconomic, political and business environment, including changes in inflation rates, interest rates, exchange rates, unemployment rates, population growth, consumer confidence and capital and financial markets liquidity; |

| · | our ability to sustain or improve our performance; |

| · | competition in the Brazilian retail industry in the sectors in which we operate; |

| · | adverse legal or regulatory disputes or proceedings; |

| · | our ability to implement our strategy, including our digital transformation initiatives; |

| · | credit and other risks of lending and investment activities; |

| · | our ability to expand our operations outside of our existing markets; |

| · | hedge risks; and |

| · | other risk factors as set forth under “Item 3. Key Information—3D. Risk Factors.” |

The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect” and similar words are intended to identify forward-looking statements. We undertake no obligation to update publicly or revise any forward-looking statements because of new information, future events or otherwise. In light of these risks and uncertainties, the forward-looking information, events and circumstances discussed in this annual report might not occur. Our actual results and performance could differ substantially from those anticipated in our forward-looking statements.

EXPLANATORY NOTE

Éxito Segregation Transaction

In February 2023, our shareholders approved the segregation of Grupo Éxito’s operations in Colombia, Argentina and Uruguay, from our business. The segregation of Grupo Éxito is expected to unlock value to our shareholders by enhancing the market value of the Company and Éxito separately, and will be achieved through a capital reduction of the Company in the amount of R$7,133.4 million, with the delivery to our shareholders of approximately 83% of the common shares issued by Éxito, which are owned by the Company, or the Éxito Segregation Transaction.

Éxito’s common shares will be delivered: (a) in the form of sponsored Brazilian Depositary Receipts Level II, or Éxito BDRs, admitted to trading in the B3, to holders of our common shares who do not have their investment in the Company registered as a direct investment under the terms of Law No. 4,131, dated September 3, 1962, as amended, or Law No. 4,131 CBD shareholders; and (b) in the form of American Depositary Receipts Level II, or Éxito ADSs, admitted to trading on the New York Stock Exchange, or NYSE, which are expected to begin trading in the NYSE on the third quarter of 2023, to (i) holders of our ADSs and (ii) to Law No. 4,131 CBD

| 3 |

shareholders who chose to receive Éxito ADSs. The amount of Éxito common shares to be delivered to our shareholders and ADR holders through Éxito BDRs or Éxito ADSs, are set out below:

| · | One Éxito BDR will be delivered to holders of our common shares who are not Law No. 4,131 CBD shareholders for each common share of the Company held by each of them on a date to be determined in due course. Each Éxito BDR will represent four Éxito common shares; |

| · | One Éxito ADS will be delivered to our ADS holders for every two ADSs of the Company held by each of them on a date to be determined in due course. Each Éxito ADS will represent eight Éxito common shares; and |

| · | One Éxito ADS will be delivered to our Law No. 4,131 CBD shareholders who chose to receive Éxito ADSs for every two common shares of the Company held by each of them on a date to be determined in due course. |

Following the completion of the Éxito Segregation Transaction, which is expected to occur in the third quarter of 2023, the Company will retain a minority stake of approximately 13% of Éxito’s common shares and Casino will retain a voting stake, directly and indirectly, of approximately 47% of Éxito.

As of the date of this annual report, we have fulfilled the main requirements for the Éxito Segregation Transaction. Thus, in accordance with IFRS 5, we report the net result of Grupo Éxito for the year ended December 31, 2022, after taxes, in one single line item in the statement of income and the balances of assets and liabilities are presented as held for sale or distribution and discontinued operations, or the Grupo Éxito Discontinued Operations. Furthermore, in accordance with IFRS 5, for comparative purposes, the statement of income and the explanatory notes related to our income for the years ended December 31, 2021 and 2020 were restated to account for the effects of the Éxito Segregation Transaction and the Extra Hiper Discontinued Operations (as defined below) in our audited consolidated financial statements.

For more information on the effects of the Éxito Segregation Transaction on our consolidated financial statements, see notes 1.2 and 33(a) to our audited consolidated financial statements.

Extra Hiper Discontinued Operations

In line with our strategy of focusing on the premium supermarket and proximity store segments, we decided to discontinue our hypermarket business, operated under the Extra Hiper banner, or the Extra Hiper Discontinued Operations. As part of that goal, in late 2021, the boards of directors of CBD and Sendas approved the conversion of a number of Extra Hiper stores operated by us and located in several states of Brazil into cash and carry stores to be operated by Sendas through the sale of certain assets, or the Extra Hiper Asset Sale.

The Extra Hiper Asset Sale consisted of (i) the transfer of commercial rights of 66 Extra Hiper stores to Sendas for R$3.9 billion to be paid by Sendas to CBD in installments and (ii) the sale of 17 Extra Hiper real estate properties stores to Barzel Properties, a Brazilian real estate investment fund, or Barzel, for R$1.2 billion. The 17 real estate properties were subsequently leased by Barzel to Sendas for a period of 25 years, renewable for the same term.

In August 2022, as part of the Extra Hiper Asset Sale, after the transfer of commercial rights of 61 stores to Sendas, we assigned certain receivables related to those stores to financial institutions, for approximately R$2 billion. The receivables consisted of R$1.2 billion maturing in 2023 and R$700 million maturing in January 2024, adjusted by the CDI rate, plus 1.2% per year. The cost of the receivables assignment was R$2.4 million, which we recorded in the line item “financial income (expenses), net” of our income statement. In the end of 2022, after the transfer of commercial rights of five additional stores to Sendas, we assigned the remaining receivables related to those stores to financial institutions. As of December 31, 2022, Sendas had paid all the amount due to CBD relating to the transfer of commercial rights of 66 Extra Hiper stores to Sendas.

Out of our remaining 37 Extra Hiper stores that were not part of the Extra Hiper Asset Sale, 23 stores were converted into Pão de Açúcar or Mercado Extra stores, 11 stores were closed or sold to other third parties and three stores remain under analysis for possible closure. As of the date of this annual report, we no longer operate under the Extra Hiper banner.

| 4 |

In accordance with IFRS 5, we report the net result of the sale of our hypermarket business as of and for the year ended December 31, 2022, after taxes, in one single line item in the statement of income and the balances of assets and liabilities of our hypermarket business are presented as held for sale and discontinued operations, or the Extra Hiper Discontinued Operations. Furthermore, in accordance with IFRS 5, for comparative purposes, the statement of income and the explanatory notes related to our income for the years ended December 31, 2021 and 2020 were restated to account for the effects of the Éxito Segregation Transaction and the Extra Hiper Discontinued Operations in our audited consolidated financial statements.

For the year ended December 31, 2022, the Company recorded proceeds related to the Extra Hiper Asset Sale in the amount of R$3.9 billion, in addition to asset write-offs in the amount of R$1.0 billion and expenses of R$1.3 billion. The net result of the Extra Hiper Asset Sale, in the amount of R$1.5 billion, was recorded in our result of discontinued operations. As of December 31, 2022, we had received all amounts expected to be received under the Extra Hiper Asset Sale.

For more information on the effects of the Extra Hiper Discontinued Operations on our consolidated financial statements, see notes 1.1 and 33(b) to our audited consolidated financial statements.

PART I

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| ITEM 3. | KEY INFORMATION |

3A. Reserved

3B. Capitalization and Indebtedness

Not applicable.

3C. Reasons for the Offer and Use of Proceeds

Not applicable.

3D. Risk Factors

An investment in the ADSs or our common shares involves a high degree of risk. You should carefully consider the risks and uncertainties described below and the other information in this annual report before making an investment decision. The risks described below are those that we currently believe may materially affect us. Our business, financial condition and results of operations could be materially and adversely affected by any of these risks. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. This annual report also contains forward-looking statements that involve risks and uncertainties. See “Forward-Looking Statements.” The trading price of the ADSs and our common shares could decline due to any of these risks or other factors, and you may lose all or part of your investment. Our actual results could differ materially and adversely from those anticipated in these forward-looking statements as a result of certain factors, including the risks facing our Company described below and elsewhere in this annual report.

For purposes of this Item 3D. Risk Factors, when we state that a risk, uncertainty or problem may, could or will have an “adverse effect” on us or “adversely affect” us, we mean that the risk, uncertainty or problem could have an adverse effect on our business, financial condition, results of operations, cash flow, liquidity, prospects, reputation and/or the trading price of our common shares and ADSs, except as otherwise indicated. You should view similar expressions in this Item 3D. Risk Factors as having similar meanings.

| 5 |

Risks Relating to Brazil

The Brazilian government has exercised, and continues to exercise, significant influence over the Brazilian economy. Brazilian political and economic conditions may adversely affect us and the trading price of the ADSs and our common shares.

The Brazilian government has frequently intervened in the Brazilian economy and has occasionally made significant changes to monetary, credit, tariff, tax and other policies and regulations. The Brazilian government’s actions to control inflation have often involved, among other measures, increases and decreases in interest rates, changes in tax and social security policies, price controls, currency exchange and remittance controls, devaluations, capital controls and limits on imports. Our business, financial condition, results of operations and the trading price of our ADSs and common shares may be adversely affected by changes in Brazilian policy or regulations at the federal, state or municipal level involving or affecting various factors, such as:

| · | economic, political and social instability; |

| · | increases in the unemployment rate; |

| · | interest rates and monetary policies (such as restrictive consumption measures that could affect the income of the population and government measures that may affect the levels of investment and employment in Brazil); |

| · | significant increases in inflation or strong deflation in prices; |

| · | expansion or contraction of the Brazilian economy, as measured by gross domestic product, or GDP, growth rates; |

| · | currency fluctuations; |

| · | import and export controls; |

| · | exchange controls and restrictions on remittances abroad (such as those that were imposed in 1989 and early 1990s); |

| · | modifications to laws and regulations according to political, social and economic interests; |

| · | efforts to reform labor, tax and social security policies and regulation (including the increase of taxes, both generally and on dividends); |

| · | energy and water shortages and rationing; |

| · | liquidity of domestic capital and lending markets; |

| · | public health, including as a result of epidemics and pandemics, such as the COVID-19 pandemic; and |

| · | other political, diplomatic, social and economic developments in or affecting Brazil. |

Uncertainty over whether the Brazilian government will implement changes in policy or regulation affecting these or other factors in the future may contribute to economic uncertainty in Brazil and to heightened volatility in the Brazilian securities markets and securities issued abroad by Brazilian companies. These uncertainties and other future developments in the Brazilian economy may adversely affect our business activities, and consequently our results of operations, and may also adversely affect the trading price of the ADSs and our common shares.

Political instability has adversely affected and may continue to adversely affect our business, results of operations and the trading price of the ADSs and our common shares.

The Brazilian economy has been and continues to be affected by political events in Brazil, which have also affected the confidence of investors and the public in general, adversely affecting the performance of the Brazilian economy and increasing the volatility of securities issued by Brazilian companies, including the trading price of the ADSs and our common shares.

| 6 |

Brazilian markets have experienced heightened volatility due to uncertainties from investigations related to allegations of money laundering, corruption and misconduct by government officials and legal entities and individuals from the private sector carried out by the Brazilian Federal Police and the Office of the Brazilian Federal Prosecutor. These investigations have adversely affected the Brazilian economy and political environment. We have no control over and cannot predict developments in these investigations nor whether future investigations or allegations will result in further political and economic instability, which could adversely affect the trading price of securities issued by Brazilian companies, including ours.

In October 2022, Brazil held elections for President, senators, federal legislators, state governors, state legislators and former President Luiz Inácio Lula da Silva was elected, representing distinctly opposing political ideologies as compared to those of the previous president Jair Bolsonaro. Political bipolarization between the left and right wings tends to enhance political instability, which could adversely affect the economy and therefore us.

The president of Brazil has the power to determine policies and issue governmental acts related to the Brazilian economy that affect the operations and financial performance of companies, including us. We cannot predict which policies the newly elected president will adopt or if these policies or changes in current policies may have an adverse effect on us or the Brazilian economy.

Uncertainty regarding political developments and the policies the Brazilian federal government may adopt or alter may have material adverse effects on the macroeconomic environment in Brazil, as well as on the operations and financial performance of businesses operating in Brazil, including ours. These uncertainties may heighten the volatility of the Brazilian securities market, including in relation to our ADSs and our common shares.

Brazilian government efforts to combat inflation may hinder the growth of the Brazilian economy and could harm us and the trading price of the ADSs and our common shares.

Historically, Brazil has experienced high inflation rates. Inflation and certain actions taken by the Brazilian government to curb it, including the increase of the SELIC rate, the basic interest rate in the Brazilian banking system, established by the Central Bank, together with the speculation about governmental measures to be adopted, have materially and adversely affected the Brazilian economy and contributed to economic uncertainty in Brazil, heightening volatility in the Brazilian capital markets and adversely affecting us. Brazil’s annual inflation, as measured by the general price index (Índice Geral de Preços – Mercado), or IGP-M index, was 5.5% in 2022, 17.1% in 2021 and 23.1% in 2020. Brazil’s Broad Consumer Price Index (Índice Nacional de Preços ao Consumidor Amplo), or the IPCA, recorded inflation of 5.8%, 10.1% and 4.5% in 2022, 2021 and 2020, respectively, according to IBGE. As of December 31, 2022, 2021 and 2020, the SELIC rate was 13.75%, 9.25% and 2.00%, respectively. The Monetary Policy Committee (Comitê de Política Monetária), or COPOM, has adjusted the official interest rates in situations of economic uncertainty to meet the economic goals established by the Brazilian government. As of August 2, 2023, the COPOM decreased the official interest rates to 13.25%. As of the date of this annual report, the official interest rate in Brazil is 13.25%.

Inflationary pressures may hinder our ability to access foreign financial markets or lead to government policies to combat inflation that could harm us or adversely affect the trading price of the ADSs and our common shares. In addition, we may not be able to adjust the prices we charge our customers to offset the effects of inflation on our cost structure.

Brazilian government measures to combat inflation that result in an increase in interest rates may have an adverse effect on us, as our indebtedness is indexed to the interbank deposit certificate (Certificados de Depósito Interbancário), or CDI, rate. An increase in interest rates may affect not only the cost of new loans, but also the cost of our current indebtedness, increasing our financial expenses. This increase, in turn, may adversely affect our cash availability and ability to meet our financial obligations. In addition, tight monetary policies with high interest rates have restricted and may restrict Brazil’s growth and the availability of credit, which adversely affects our customers’ purchasing power and consequently our net operating revenue.

Conversely, more lenient government and Central Bank policies and interest rate decreases have triggered and may trigger increases in inflation, and, consequently, growth volatility and the need for sudden and significant interest rate increases, which could negatively affect our business and increase our financial expenses. Furthermore, interest rate decreases may affect our ability to maintain interest margins we charge on installment sales, which could have a negative effect on our net operating revenue.

| 7 |

Exchange rate volatility may adversely affect the Brazilian economy and us.

The real has historically experienced frequent and substantial variations in relation to the U.S. dollar and other foreign currencies. In 2020, the real depreciated against the U.S. dollar in comparison to 2019, reaching R$5.1967 per US$1.00 as of December 31, 2020. In 2021, the real further depreciated against the U.S. dollar in comparison to December 31, 2020, reaching R$5.5805 per US$1.00 as of December 31, 2021. In 2022, the real gained value against the U.S. dollar and, as of December 31, 2022, the U.S. dollar selling rate was R$5.2177 per US$1.00. As of August 15, 2023, the real-U.S. dollar exchange rate was R$4.9812 per U.S. dollar.

The real may substantially depreciate or appreciate against the U.S. dollar in the future. Depreciation of the real against the U.S. dollar could create inflationary pressures in Brazil and cause increases in interest rates, which negatively affects the growth of the Brazilian economy as a whole, curtails access to foreign financial markets and may prompt government intervention, including recessionary governmental policies. Depreciation of the real against the U.S. dollar has also, including in the context of an economic slowdown, led to decreased consumer spending, deflationary pressures and reduced growth of the economy as a whole. Depreciation would also reduce the U.S. dollar value of distributions and dividends and the U.S. dollar equivalent of the trading price of the ADSs and our common shares. As a result, we may be materially and adversely affected by real/U.S. dollar exchange rate variations.

Any further downgrading of Brazil’s credit rating may adversely affect the trading price of the ADSs and our common shares.

Credit ratings affect investors’ perceptions of risk and, as a result, the yields required on indebtedness issuances in the financial markets. Rating agencies regularly evaluate Brazil and its sovereign ratings, taking into account a number of factors, including macroeconomic trends, fiscal and budgetary conditions, indebtedness and the prospect of change in these factors. Downgrades in Brazil’s credit rating can lead to downgrades in our credit rating and increase the cost of our indebtedness as investors may require a higher rate of return to compensate a perception of increased risk.

In January 2018, Standard & Poor’s downgraded Brazil’s credit rating to BB- with a stable outlook, which it changed to positive in December 2019 and back to stable in April 2020. In June 2021, and in June 2022, Standard & Poor’s reaffirmed its rating. In June 2023, Standard & Poor’s adjusted its outlook to positive. In February 2018, Fitch downgraded Brazil’s credit rating to BB- with a stable outlook, which it affirmed in May 2019. In May 2020, Fitch adjusted its outlook to negative, which it reaffirmed in May 2021 and July 2022. In June 2023, Fitch upgraded Brazil’s credit rating to BB with a stable outlook. Since April 2018, Moody’s has maintained Brazil’s credit rating at Ba2 with a stable outlook.

We cannot assure you that rating agencies will maintain Brazil’s sovereign credit ratings. Any further downgrade of Brazil’s credit rating could heighten investors’ perception of risk and, as a result, increase the cost of debt issuances and adversely affect the trading price of our securities.

Developments and the perception of risk in other countries may adversely affect the trading price of Brazilian securities, including the ADSs and our common shares.

The market value of securities of Brazilian issuers is affected to varying degrees by economic and market conditions in other countries, including developed countries such as the United States and certain European and emerging market countries.

Investors’ reactions to developments in other countries may adversely affect the market value of securities of Brazilian issuers, including the ADSs and our common shares. Any financial crisis or significant developments, such as increase in interest rates in other countries, especially the United States, may decrease global liquidity and the interest of investors in securities of Brazilian issuers, adversely affecting the ADSs and our common shares. Moreover, geopolitical conflicts, such as the military conflict between Russia and Ukraine, have had and may continue to have an adverse effect on global capital markets and investors’ interest in securities issued by companies operating in emerging markets, which could have a negative impact on the trading price of the ADSs and our common shares.

| 8 |

The outbreak of communicable diseases around the world has led and may continue to lead to higher volatility in the global capital markets, adversely affecting the trading price of ADSs and our common shares.

The COVID-19 pandemic and governmental responses thereto had a severe impact on global and Brazilian macro-economic and financial conditions, including the disruption of supply chains and the closures or interruptions of many businesses, leading to losses of revenues, increased unemployment and economic stagnation and contraction. The COVID-19 pandemic also resulted in materially increased volatility in both Brazilian and international financial markets and economic indicators, including exchange rates, interest rates and credit spreads.

In Brazil, the stock market experienced automatic suspensions, known as “circuit-breakers,” as a result of significant volatility in stock trading caused by investors’ reactions to the uncertainty related to the COVID-19 pandemic in the global economy and recessionary effect on the Brazilian economy. The B3 dropped 36.9% from January 1, 2020, to March 31, 2020, following the downfall of international equity markets. The trading piece of our common shares was also adversely affected.

Measures taken by governmental authorities worldwide, including Brazil, to stabilize markets and support economic growth in the case of an outbreak of an epidemic or pandemic may not be sufficient to control volatility or to prevent serious and prolonged reductions in economic activity. These measures may have adverse macroeconomic effects and negatively influence the behavior of the consumer market and the population in general.

The effects of an outbreak of an epidemic or pandemic on our business will depend on, among other factors, the ultimate geographic spread of the disease, the duration of the outbreak and the extent and overall economic effects of the governmental response to it. In addition, the effects of the outbreak may exacerbate the effects of the other risk factors disclosed in this section of this annual report, including the effects on the price and performance of our common shares and ADSs.

Risks Relating to our Industry and Us

We face significant competition and pressure to adapt to changing consumer habits and preferences, which may adversely affect our market share and net income.

We operate mainly in the Brazilian food retail industry, which is highly competitive. We compete with other retailers based on price, product mix, store location and layout and services. Consumer habits are constantly changing, and we may not be able to anticipate and quickly respond to these changes. We face intense competition from other store formats and sub-segments within the food retail industry, especially the cash-and-carry sector, which has in recent years imposed significant competitive pressure on our stores. We also face competition from small and regional retailers, mainly in the retail segment, and especially from those that operate in the informal segment of the Brazilian economy. In addition, in our markets, particularly in the São Paulo and Rio de Janeiro metropolitan areas, we compete in the Brazilian retail sector with a number of large multinational retail food, general merchandise and cash and carry chains, as well as local supermarkets and independent grocery stores. Acquisitions or consolidations within the industry may also increase competition and adversely affect our market share and net income.

If we are unable to compete successfully in our target markets (including adapting our store format mix or layout, identifying locations and opening stores in preferred areas, and quickly adjusting our product mix or prices under each of our banners and segments) or otherwise adjust to changing consumer habits and preferences, such as online shopping, including through mobile devices, we may lose market share, which would adversely affect our financial condition and results of operations.

Our traditional supermarkets and retail stores face increasing competition from internet sales, which may negatively affect sales of traditional channels, and our digital transformation strategy might not be an effective response to this emerging competition.

In recent years, traditional supermarkets and retail stores sales in Brazil have increased sales of food and clothing products over the internet. We expect this trend to continue as more traditional retailers enter into the online retail field or expand their existing infrastructure related to internet sales. For example, in recent years, Amazon has been expanding its operations in Brazil. Growth in the internet retail business of our competitors would likely harm not only our retail operations but also our internet retail operations. Internet retailers are able

| 9 |

to sell directly to consumers, reducing the importance of traditional distribution channels such as supermarkets and retail stores. Certain internet food retailers have significantly lower operating costs than traditional supermarkets because they do not rely on an expensive network of retail points of sale or a large workforce. As a result, internet food retailers are able to offer their products at lower costs than we do and, in certain cases, are able to bypass retailing intermediaries and deliver particularly high-quality and fresh products to consumers. We believe that our customers are increasingly using the internet to shop electronically for food and other retail goods, and that this trend is likely to continue.

Additionally, technology employed in retail food sales evolves constantly as part of a modern digital culture. We may not be able to adapt to these changes quickly enough to meet our customers’ demands and preferences, as well as standards of the industry in which we operate.

We have a digital transformation strategy, but we cannot provide any assurance that our strategy will be successful in meeting customer demands or maintaining our market share in light of our competitors’ internet retail businesses. If internet sales in Brazil continue to grow, consumers’ reliance on traditional distribution channels such as our supermarkets and retail stores could be materially diminished, which could have a material adverse effect on our financial condition and results of operations.

The Brazilian food retail industry is sensitive to decreases in consumer purchasing power and unfavorable economic cycles.

Historically, the Brazilian food retail industry has experienced periods of economic slowdown that led to declines in consumer spending. The success of operations in the food retail sector depends on various factors related to consumer spending and consumer income, including general business conditions, interest rates, inflation, consumer credit availability, taxation, consumer confidence in future economic conditions, employment and salary levels. Reductions in credit availability in Brazil, as well as more stringent credit policies adopted by us and credit card companies may negatively affect our sales. Unfavorable economic conditions in Brazil, or unfavorable economic conditions worldwide reflected in the Brazilian economy, may significantly reduce consumer spending and available income, particularly for lower income classes, who have less access to credit than higher income classes, more limited debt refinancing conditions and more susceptibility to be affected by increases in the unemployment rate. These conditions may have a material adverse effect on our financial condition and results of operation.

These factors are compounded as Brazil continues to slowly recover from a recession following the COVID-19 pandemic, with only meager GDP. Brazil’s GDP growth rates were 2.9% in 2022, 4.6% in 2021, (4.1)% in 2020. Negative developments in the Brazilian economy may affect its growth rate and, consequently, the sales of our products, which may adversely affect the trading price of our ADSs and common shares.

Because the Brazilian retail industry is usually perceived as essentially growth-oriented, we are dependent on the growth rate of the urban population and on the income levels of the Brazilian population. Any decrease or slowdown in these metrics may adversely affect our sales and our results of operations.

We cannot guarantee that our service providers or suppliers do not engage in irregular practices.

We engage in the ordinary course of business in commercial transactions with a significant number of service providers and suppliers. While we have policies and procedures in place to know the essential facts related to the operations of the service providers and suppliers with whom we enter into agreements, we cannot guarantee that they will not have issues, such as illegal working and improper safety conditions, environmental and sustainability matters, among other issues, nor that they will not engage in irregular practices. If our service providers or suppliers have issues related to those conditions or matters or engage in irregular practices, our reputation may be harmed and we could be subject to market scrutiny or legal proceedings, which may adversely affect the trading price of the ADSs and our common shares. In addition, our customers’ perception of our products may be adversely affected, causing a reduction in sales and in our results of operations.

Restrictions of credit availability to consumers in Brazil and Brazilian government rules and interventions affecting financial operations may adversely affect our sales volumes and operations, and we are exposed to risks related to customer financing and loans.

Sales in installments are an important component of the results of operations for Brazilian non-food retailers. The increase in the unemployment rate combined with relatively high interest rates have resulted in an

| 10 |

increased restriction of credit availability to consumers in Brazil. The unemployment rate in the country reached 9.3% in 2022 compared to 11.1% in 2021 and 13.9% in 2020.

Our sales volumes, particularly for non-food products, and, consequently, our results of operations may be adversely affected if the credit availability to consumers is reduced, or if the Brazilian government restricts the granting of credit to consumers.

Additionally, through FIC, we extend credit to customers in Brazil. FIC is our partnership with Itaú Unibanco Holding S.A., or Itaú Unibanco, one of the largest financial institutions in Brazil. FIC exclusively offers credit cards, financial services and insurance coverage at our stores. For more information on FIC, see “Item 4. Information on the Company—4B. Business Overview—Operations—Financial Services.”

FIC is subject to the risks usually associated with providing financing services, including the risk of default on the payment of principal and interest and any mismatch of cost and maturity of our funding in relation to the cost and maturity of financing to customers, which could have a material adverse effect on us.

Furthermore, FIC is a financial institution regulated by the Central Bank and is, therefore, subject to extensive regulation. The regulatory framework of the Brazilian financial system is continuously changing. Existing laws and regulations may be amended, and their application or interpretation may also change, and new laws and regulations may be adopted. FIC and, therefore, we, may be adversely affected by regulatory changes, including those related to:

· minimum capital requirements;

· requirements for investment in fixed capital;

· credit limits and other credit restrictions;

· accounting requirements;

· intervention, liquidation and/or temporary special management systems; and

· interest rates.

Brazilian government rules and intervention may adversely affect our operations and profitability more than those of a competitor without financial operations.

We are increasingly dependent on credit card sales. Any changes in the policies of merchant acquirers may adversely affect us.

We are increasingly dependent on credit card sales. Sales to customers using credit cards accounted for 44.6%, 47.0% and 47.2% of our consolidated net operating revenue in 2022, 2021 and 2020, respectively. In order to offer credit card sales to our customers, we depend on the policies of merchant acquirers, including fees charged by these companies. Any change in the policies of merchant acquirers, including, for example, their merchant discount rate, may adversely affect us.

In addition, a portion of our sales is paid in installments offered by merchant acquirers. As a result, we depend on those merchant acquirers to be able to continue offering credit cards as a payment option to our customers. Any change in the policies of acquirers regarding installment payments and credit may adversely affect us.

Our business depends on strong brands. We may not be able to maintain and enhance our brands, or we may receive unfavorable customer complaints or negative publicity, which could adversely affect our brands.

We believe that our Pão de Açúcar, Extra and Compre Bem banners contribute significantly to the success of our business. We also believe that maintaining and enhancing those brands is critical to expanding our base of customers, which depends largely on our ability to continue to create the best customer experience, based on our competitive pricing and our large assortment of products.

| 11 |

Customer complaints or negative publicity about our product offerings or services could harm our reputation and diminish consumer confidence in us. A reduction in the strength of our brands and reputation could adversely affect our business, financial condition and operating results.

Contingent obligations for the benefit of unrelated parties may cause a material adverse effect on our business and result of operations.

On June 14, 2019, we completed the sale of all of our equity interest in Via and Via ceased to be a consolidated subsidiary. Since then, we do not control Via nor have exercised influence over its management or operations, and, as a result, Via has no longer been our related party. However, certain transactions, previously existing between the Company and Via, when Via was part of the Pão de Açúcar Group, remained in effect, including guarantees we have granted for certain obligations of Via. While the vast majority of the guarantees have been terminated, we and Via are under discussions with respect to allegedly outstanding obligations under certain agreements. In the event of non-compliance by Via of these obligations, including as a result of non-payment, our business and results of operations may be adversely and materially affected. For more information on these transactions, see “Item 4. Information on the Company—4A. History and Development of the Company—Sale of Home Appliances Operating Segment.”

We may not be able to protect our intellectual property rights.

Our business strategy depends significantly on our ability to protect our brands and to defend our intellectual property rights, including trademarks, patents, domain names, trade secrets and know-how. We have been granted numerous trademark registrations covering our brands and products and have filed, and expect to continue to file, trademark and patent applications seeking to protect newly developed brands and products. We cannot assure that trademark and patent registrations will be issued with respect to any of our applications. There is also a risk that we could inadvertently fail to renew a trademark or patent on a timely basis or that our competitors will challenge, invalidate or circumvent any existing or future trademarks and patents issued to, or licensed by, us. Although we have put in place appropriate actions to protect our portfolio of intellectual property rights (including trademark registration and domain names), we cannot assure that the steps we have taken will be sufficient or that third parties will not infringe upon or misappropriate our proprietary rights. Any failure in our ability to protect our proprietary rights against infringement or misappropriation could adversely affect our business, results of operations, cash flows or financial condition, and, in particular, our ability to carry out our business and implement our business strategy.

Our sales depend on the effectiveness of our advertisement and marketing campaigns, which may adversely affect our revenues and profitability.

To promote increased traffic of customers and attract them to our stores, we dedicate substantial resources to our advertisement and marketing campaigns. Our revenues and profitability depend on our ability to, among other things, identify our target consumers and decide on the marketing message and communication method to reach them most effectively. If we do not conceive, plan or execute our advertisement and marketing activities in order to successfully and efficiently increase revenues and market share, our profitability and financial position may be adversely affected.

We may not be able to renew or maintain our stores’ lease agreements on acceptable terms, or at all, and we may be unable to obtain or renew the operational licenses of our stores or distribution centers in a timely manner.

Most of our stores are leased. The strategic location of our stores is key to the development of our business strategy and, as a result, we may be adversely affected in the event that a significant number of our lease agreements is terminated and we fail to renew these lease agreements on acceptable terms, or at all. In addition, in accordance with applicable law, landlords may increase rent periodically, usually every three years. A significant increase in the rent of our leased properties may adversely affect our financial position and results of operations.

Our stores and distribution centers are also subject to certain operational licenses. Our inability to obtain or renew these operational licenses may result in the imposition of fines and, as the case may be, in the closing of stores or distribution centers. Given that smooth and uninterrupted operations in our stores and distribution centers are a critical factor for the success of our business strategy, we may be negatively affected in the case of their closing as a result of our inability to obtain or renew the necessary operational licenses.

| 12 |

Our product distribution is dependent on a limited number of distribution centers and we depend on the Brazilian transportation systems and infrastructure to deliver our products, and any disruption at one of our distribution centers or delay related to transportation and infrastructure could adversely affect our supply needs and our ability to distribute products to our stores and customers.

Approximately 65% of our products are distributed through our 10 distribution centers and warehouses located in the Southeastern, Midwestern and Northeastern regions of Brazil. The transportation system and infrastructure in Brazil are underdeveloped and need significant investment to work efficiently and to meet our business needs.

Any significant interruption or reduction in the use or operation of transportation infrastructure in the cities where our distribution centers are located or in operations at one of our distribution centers, as a result of natural disasters, fire, accidents, systemic failures, strikes or other unexpected causes, may delay or affect our ability to distribute products to our stores and customers and may decrease our sales, which may have a material adverse effect on us. Our growth strategy includes the opening of new stores which may require the opening of new distribution centers or the expansion of the existing ones to supply and meet the demand of additional stores. Our operations may be negatively affected if we are not able to open new distribution centers or expand our existing distribution centers to meet the supply needs of these new stores.

Factors associated with climate change could adversely affect us.

The long-term effects of global climate change present both physical risks, such as extreme weather conditions or rising sea levels, and transition risks, such as regulatory or technology changes, which are expected to be widespread and unpredictable.

Many of our operations are in locations that may be affected by the physical risks of climate change. Weather conditions, natural disasters, and other catastrophic events, such as tropical storms, floods, fires and droughts, in areas where we or our suppliers operate, or depend upon for continued operations, could adversely affect the availability and cost of commodities, including utilities, and certain products within our supply chain, affect consumer purchasing power, and reduce consumer demand. We also face the risk of losses incurred as a result of physical damage to stores or warehouses, loss or spoilage of inventory and business interruption caused by such events, all of which could adversely affect us.

We use natural gas, diesel fuel, gasoline and electricity in our operations, all of which could face increased regulation and cost increases as a result of climate change or other environmental concerns. Transitioning to alternative energy sources, such as renewable electricity or electric vehicles, could result in higher costs. Regulations limiting greenhouse gas emissions and energy inputs are expected to increase in coming years, which may increase our costs associated with compliance, tracking, reporting, and sourcing. We also sell fuel at our gas stations, the demand for which could be impacted by concerns about climate change and increased regulations. Furthermore, any failure to achieve our goals with respect to reducing our impact on the environment, or perception of a failure to act responsibly with respect to the environment, could adversely affect our reputation and results of operations. These events and their impacts could adversely affect us.

We rely on information technologies and systems to operate our business and any disruption to these systems may adversely affect our business. Moreover, failure to protect our database from violations and breaches could have an adverse effect on us.

We heavily rely on the accuracy, availability and security of our information technology systems, including systems used for websites and apps, data analytics, customer service, supplier connectivity, communications, fraud detection, enterprise resource planning, inventory management, warehouse management and administration. Disruptions to these systems, caused by obsolescence, natural disasters, energy interruptions, failures in telecommunication, technical failures, human input errors or intentional acts, such as hacker attacks, could affect the availability of our services and prevent or inhibit the ability of consumers to complete purchases on our stores, websites and apps. Problems with the reliability of our systems could prevent us from recording and earning revenue, result in loss of customers, harm our reputation and adversely affect our business.

In addition, we, like all business organizations in the digital world, have been subject to a broad range of cyber threats, including attacks, with varying levels of sophistication. These cyber threats may undermine the confidentiality, availability and integrity of our systems and database, including our customers’, suppliers’ and employees’ confidential, classified or personal information.

| 13 |

We maintain what we believe to be reasonable and adequate technical security controls, policy enforcement mechanisms, monitoring systems and management oversight to address these threats. While these measures are designed to prevent, detect and respond to unauthorized activity in our systems, certain types of attacks, including cyberattacks, may occur.

Moreover, we maintain a database of information about our suppliers, employees and customers, which mainly includes, but is not limited to, data collected when customers sign up for our loyalty programs. If we experience a breach in our security procedures that affect the integrity of our database, including unauthorized access to any personal information of our customers, we may be subject to legal proceedings that could result in damages, fines and harm to our reputation.

Some of our suppliers and service providers have significant access to confidential and strategic data collected by our systems, including confidential information regarding our customers. Any unauthorized access to, or release or violation of our systems and data or those of our customers, suppliers or service providers could disrupt our operations, particularly our digital retail operations, cause information losses and cause us to incur significant costs, including the cost of retrieving lost information, which could have a material adverse effect on our business and reputation.

We are subject to risks associated with non-compliance with the applicable data protection laws.

The processing of personal data in Brazil is regulated by Law No. 13,709/2018 (Lei Geral de Proteção de Dados), or the Brazilian General Data Protection Law, which became effective as of September 18, 2020. The Brazilian General Data Protection Law established a new legal framework for the treatment of personal data, which set forth rules relating to, among other subjects: (i) the rights of personal data owners; (ii) the legal basis applicable to personal data protection; (iii) the requirements to obtain consent to use personal data; (iv) the obligations and requirements related to security incidents involving personal data, (v) personal data leaks and transfers; and (vi) the creation of the Brazilian Data Protection Authority (Autoridade Nacional de Proteção de Dados).

If we fail to comply with the Brazilian General Data Protection Law, we may be subject to penalties, such as: (i) notifications; (ii) obligations to disclose the infraction; (iii) temporary blockage or deletion of personal data to which the infraction relates from our database; (iv) partial or total suspension to operate the database to which the infringement relates for a maximum period of six months; (v) partial or total prohibition to exercise activities related to data processing; and (vi) fines in amounts corresponding to up to 2% of our revenue or the revenues of our group or financial conglomerate in Brazil for the previous fiscal year, excluding taxes, limited to an aggregate amount of R$50.0 million per infraction. In addition, we may be held responsible for pecuniary, non-pecuniary, individual, or collective damages caused by us and jointly and severally liable in case these damages are caused by our subsidiaries, due to non-compliance with the obligations set forth in the Brazilian General Data Protection Law and in other sparse and sectoral legislation on data protection in effect in Brazil.

Accordingly, failures by us and our subsidiaries to comply with the Brazilian General Data Protection Law may result in penalties and damages which could have a material adverse effect on our business and reputation.

Our controlling shareholder has the ability to direct our businesses and affairs.

According to Brazilian Law No. 6,404, dated December 15, 1976, as amended, or Brazilian corporate law, our controlling shareholder, the Casino Group, has the power to (i) appoint the majority of the members of our board of directors, who, in turn, appoint our executive officers; and (ii) determine the outcome of the vast majority of actions requiring shareholder approval. Our controlling shareholders’ interests and business decisions may prevail over our other shareholders or holders of ADSs.

Unfavorable decisions in legal and administrative proceedings could have a material adverse effect on us.

We are party to legal and administrative proceedings related to civil, regulatory, tax and labor matters. We cannot assure you that these legal proceedings will be decided in our favor. We have made provisions for proceedings in which the chance of loss has been classified as probable by our external legal advisors, management and our audit committee. Our provisions may not be sufficient to cover the total liabilities arising from unfavorable decisions in legal or administrative proceedings. If all or a significant number of these proceedings have an outcome unfavorable to us, our business, financial condition and results of operations may

| 14 |

be materially and adversely affected. In addition to provisions recorded on our financial statements and the cost of legal fees associated with the proceedings, we may be required to post bonds in connection with the proceedings, which may adversely affect our financial condition. See “Item 8. Financial Information—8A. Consolidated Statements and Other Financial Information—Legal Proceedings” and note 21 to our audited consolidated financial statements, for a description of our material litigation contingencies.

We may be unable to attract or retain key personnel.

In order to support and develop our operations, we must attract and retain personnel with specific skills and knowledge. We face various challenges inherent to the management of a large number of employees over a wide geographical area. Key personnel may leave us for a variety of reasons and the impact of these departures is difficult to predict, which may hinder the implementation of our strategic plans and adversely affect our results of operations.

We could be materially adversely affected by violations of the Brazilian Anti-Corruption Law, U.S. Foreign Corrupt Practices Act, the Sapin II Law and similar anti-corruption laws.

Law No. 12,846, of August 1, 2013, or the Brazilian Anti-Corruption Law, introduced the concept of strict liability for legal entities involved in harmful acts against the public administration, subjecting the perpetrator to both administrative and civil penalties. Similar to the Foreign Corrupt Practices Act of the United States, to which we are also subject, the Brazilian Anti-Corruption Law considers that an effective implementation of a compliance program may be used to mitigate the administrative penalties to be applied as a consequence of a harmful act against the public administration.

Additionally, French Law No. 1,691, of December 2016, or the Sapin II Law, relates to transparency, preventing corruption and the modernization of economic activity, and determines that companies must establish an anti-corruption program to identify and mitigate corruption risks. Under the Sapin II Law, among others, any legal entity or individual may be held criminally liable for offering a donation, gift or reward with the intent to induce a foreign public official to abuse their position or influence to obtain an undue advantage. The Sapin II Law is applicable to companies belonging to a group whose parent company is headquartered in France and whose workforce includes at least 500 employees worldwide. As such, the Sapin II Law applies to us. The key anti-corruption provisions of the Sapin II Law have been in force since June 1, 2017.

Failure to comply with anti-corruption laws to which we are subject or any investigations of misconduct, or enforcement actions could subject us to fines, loss of operating licenses, and reputational harm as well as other penalties, including individual arrests, which may materially and adversely affect us, our reputation, and the trading price of the ADSs and our common shares.

Some categories of products that we sell are principally acquired from a few suppliers and over-concentration could disrupt the availability of these products.

Some categories of products that we sell are principally acquired from a few suppliers. If any supplier is not able to supply the products in the quantity and at the frequency that we normally acquire them, and we are not able to replace the supplier on acceptable terms or at all, we may be unable to maintain our usual level of sales in the affected category of product, which may have a material adverse effect on our business and operations and, consequently, on our results of operations.

We may be held responsible for consumer incidents involving adverse reactions after consumption of products sold by us.

Products sold in our stores may cause consumers to suffer adverse reactions. Incidents involving these products may have a material adverse effect on our operations, financial condition, results of operations and reputation. Legal or administrative proceedings related to these incidents may be initiated against us, with allegations, among others, that our products were defective, damaged, adulterated, contaminated, do not contain the properties advertised or do not contain adequate information about possible side effects or interactions with other chemical substances. Any actual or possible health risk associated with these products, including negative publicity related to these risks, may lead to a loss of confidence among our customers regarding the safety, efficacy and quality of the products sold in our stores, especially our private label products. Any allegation of this nature made against our brands or products sold in our stores may have a material adverse effect on our operations, financial condition, results of operations and reputation.

| 15 |

We are subject to environmental laws and regulations and any non-compliance may adversely affect our financial condition and results of operations.

We are subject to a number of federal, state and municipal laws and regulations relating to the preservation and protection of the environment, especially in relation to our gas stations. Among other obligations, these laws and regulations establish environmental licensing requirements and standards for the release of effluents, gaseous emissions, management of solid waste and protected areas. We incur expenses for the prevention, control, reduction or elimination of releases into the air, ground and water at our gas stations, as well as in the disposal and handling of wastes at our stores and distribution centers. Any failure to comply with those laws and regulations may subject us to significant administrative and criminal sanctions, such as fines and shutdown of business and operations, in addition to the obligation to remediate or indemnify others for the damages caused. We cannot ensure that these laws and regulations will not become stricter. If they do, we may be required to increase, perhaps significantly, our capital expenditures and costs to comply with these environmental laws and regulations. Sanctions for non-compliance with environmental laws and regulations and unforeseen environmental investments could materially and adversely affect our financial condition and results of operations.

Risks Relating to the ADSs and Our Common Shares

ADS holders may find it difficult to exercise voting rights at our shareholders’ meetings.

ADS holders may only exercise their voting rights in accordance with the deposit agreement governing the ADRs. Holders of ADSs face practical limitations in exercising their voting rights because of the additional steps involved in our communications with ADS holders. For example, we are required to publish a notice of our shareholders’ meetings in specified newspapers in Brazil. Holders of our common shares are able to exercise their voting rights by attending a shareholders’ meeting in person or virtually (whenever the shareholders’ meeting is held under a partial or 100% digital format), by means of the distance voting form (boletim de voto a distância) or by voting by proxy. By contrast, ADS holders will receive notice of a shareholders’ meeting by mail from the depositary bank for the ADSs if we give notice to the depositary requesting it to do so. To exercise their voting rights, ADS holders must instruct the depositary on a timely basis. This voting process necessarily takes longer for ADS holders than for holders of our common shares. If the depositary fails to receive timely voting instructions for all or part of the ADSs, the depositary will assume that those ADS holders are instructing it to give a discretionary proxy to a person designated by us to vote their ADSs, to the extent permitted by NYSE rules.

ADS holders also may not receive the voting materials in time to instruct the depositary to vote our common shares underlying the ADSs. In addition, the depositary and its agents are not responsible for failing to carry out voting instructions of the ADS holders or for the manner of carrying out those voting instructions. Accordingly, ADS holders may not be able to exercise voting rights, and they have little, if any, recourse if the common shares underlying the ADSs are not voted as requested.

If you exchange the ADSs for common shares, as a result of Brazilian regulations you may risk losing the ability to remit foreign currency abroad.

As an ADS holder, you benefit from the electronic certificate of foreign capital registration obtained by Itaú Corretora de Valores S.A., or the Custodian, for our common shares underlying the ADSs in Brazil, which permits the Custodian to convert dividends and other distributions with respect to the common shares into non-Brazilian currency and remit the proceeds abroad. If you surrender your ADSs and withdraw common shares, you will be entitled to continue to rely on the Custodian’s electronic certificate of foreign capital registration for only five business days from the date of withdrawal. Thereafter, upon the disposition of or distributions relating to the common shares, you will not be able to remit abroad non-Brazilian currency unless you obtain your own electronic certificate of foreign capital registration or you qualify under Brazilian foreign investment regulations that entitle some foreign investors to buy and sell common shares on Brazilian stock exchanges without obtaining separate electronic certificates of foreign capital registration. If you do not qualify under the foreign investment regulations, you will generally be subject to less favorable tax treatment of dividends and distributions on, and the proceeds from any sale of, our common shares.

If you attempt to obtain your own electronic certificate of foreign capital registration, you may incur expenses or suffer delays in the application process, which could delay your ability to receive dividends or distributions relating to our common shares or the return of your capital in a timely manner. The depositary’s electronic certificate of foreign capital registration may also be adversely affected by future legislative changes. See “Item 10. Additional Information—10D. Exchange Controls.”

| 16 |

You might be unable to exercise preemptive rights with respect to the common shares underlying the ADSs.