FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of May, 2022

Brazilian

Distribution Company

(Translation of Registrant’s Name Into English)

Av. Brigadeiro Luiz Antonio,

3142 São Paulo, SP 01402-901

Brazil

(Address of Principal Executive Offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F)

Form 20-F X Form 40-F

(Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule

101 (b) (1)):

Yes ___ No X

(Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule

101 (b) (7)):

Yes ___ No X

(Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes ___ No X

| FREE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) |

| ITR – Interim Financial Information – March 31,2022 – COMPANHIA BRASILEIRA DE DISTRIBUIÇÃO |

Independent Auditor’s review report on quarterly information

To the Shareholders and Board of Directors of

Companhia Brasileira de Distribuição

Introduction

We have reviewed the accompanying individual and consolidated interim financial information of Companhia Brasileira de Distribuição (“Company”), included in the Interim Financial Information Form - ITR, for the quarter ended March 31, 2022, which comprises the balance sheet as of March 31, 2022 and the related statements of profit and loss and comprehensive income for the three-month periods then ended, and changes in equity and cash flows for the three-month period then ended, including the explanatory notes.

Management is responsible for the preparation of the individual and consolidated interim financial information in accordance with technical pronouncement CPC 21 (R1) - Interim Financial Reporting and international standard IAS 34 - Interim Financial Reporting, issued by the International Accounting Standards Board (IASB), as well as for the presentation of such information in accordance with the standards issued by the Brazilian Securities Commission (CVM), applicable to the preparation of Interim Financial Information (ITR). Our responsibility is to express a conclusion on this interim financial information based on our review.

Scope of review

We conducted our review in accordance with Brazilian and international standards on review of interim financial information (NBC TR 2410 and ISRE 2410 - Review of Interim Financial Information Performed by the Independent Auditor of the Entity, respectively). A review of interim financial information consists of making inquiries, primarily of persons responsible for financial and accounting matters, and applying analytical and other review procedures. A review is substantially less in scope than an audit conducted in accordance with the standards on auditing and, consequently, does not enable us to obtain assurance that we would become aware of all significant matters that might be identified in an audit. Accordingly, we do not express an audit opinion.

Conclusion on the individual and consolidated interim financial information

Based on our review, nothing has come to our attention that causes us to believe that the accompanying individual and consolidated interim financial information included in the ITR referred to above is not prepared, in all material respects, in accordance with technical pronouncement CPC 21 (R1) and international standard IAS 34 applicable to the preparation of Interim Financial Information - ITR and presented in accordance with the standards issued by the CVM.

| 2 |

Companhia Brasileira de Distribuição

FREE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) ITR – Interim Financial Information – March 31,2021 – COMPANHIA BRASILEIRA DE DISTRIBUIÇÃO |  |

Other matters

Statements of value added

The aforementioned interim financial information includes the individual and consolidated statements of value added (DVA) for the three-month period ended March 31, 2022, prepared under the responsibility of the Company’s Management and presented as supplementary information for the purposes of international standard IAS 34. These statements have been subject to review procedures performed in conjunction with the review of the ITR to determine whether they are reconciled with the interim financial information and the accounting records, as applicable, and if their form and content are in accordance with the criteria defined in technical pronouncement CPC 09 - Statement of Value Added. Based on our review, nothing has come to our attention that causes us to believe that these statements of value added were not prepared, in all material respects, in accordance with the criteria set out in CPC 09 and consistently with respect to the individual and consolidated interim financial information taken as a whole.

The accompanying interim financial information has been translated into English for the convenience of readers outside Brazil.

São Paulo, May 4, 2022

| DELOITTE TOUCHE TOHMATSU | Eduardo Franco Tenório |

| Auditores Independentes Ltda. | Engagement Partner |

| 3 |

Companhia Brasileira de Distribuição

FREE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) ITR – Interim Financial Information – March 31,2021 – COMPANHIA BRASILEIRA DE DISTRIBUIÇÃO |  |

| Company Information | |

| Capital Composition | 5 |

| Individual Interim Financial Information | |

| Balance Sheet – Assets | 6 |

| Balance Sheet – Liabilities | 7 |

| Statement of Operations | 8 |

| Statement of Comprehensive Income | 9 |

| Statement of Cash Flows | 10 |

| Statement of Changes in Shareholders’ Equity | |

| 1/1/2022 to 3/31/2022 | 11 |

| 1/1/2021 to 3/31/2021 | 12 |

| Statement of Value Added | 13 |

| Consolidated Interim Financial Information | |

| Balance Sheet – Assets | 14 |

| Balance Sheet – Liabilities | 15 |

| Statement of Operations | 17 |

| Statement of Comprehensive Income | 18 |

| Statement of Cash Flows | 19 |

| Statement of Changes in Shareholders’ Equity | |

| 1/1/2022 to 3/31/2022 | 20 |

| 1/1/2021 to 3/31/2021 | 21 |

| Statement of Value Added | 22 |

| Comments on the Company`s Performance | 23 |

| Notes to the Interim Financial Information | 44 |

| 4 |

Companhia Brasileira de Distribuição

FREE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) ITR – Interim Financial Information – March 31,2021 – COMPANHIA BRASILEIRA DE DISTRIBUIÇÃO |  |

|

Number of Shares (thousand) |

Current Quarter 3/31/2022 |

|

| Share Capital | ||

| Common | 269,395 | |

| Preferred | 0 | |

| Total | 269,395 | |

| Treasury Shares | ||

| Common | 160 | |

| Preferred | 0 | |

| Total | 160 |

| 5 |

Companhia Brasileira de Distribuição

FREE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) ITR – Interim Financial Information – March 31,2021 – COMPANHIA BRASILEIRA DE DISTRIBUIÇÃO |  |

| Individual Interim Financial Information / Balance Sheet – Assets | |||

| R$ (in thousands) | |||

| Code | Description | Current Quarter 03/31/2022 |

Previous Year 12/31/2021 |

| 1 | Total Assets | 31,575,000 | 33,646,000 |

| 1.01 | Current Assets | 8,053,000 | 9,650,000 |

| 1.01.01 | Cash and Cash Equivalents | 2,043,000 | 4,662,000 |

| 1.01.03 | Accounts Receivable | 404,000 | 428,000 |

| 1.01.03.01 | Trade Receivables | 319,000 | 330,000 |

| 1.01.03.02 | Other Receivables | 85,000 | 98,000 |

| 1.01.04 | Inventories | 1,952,000 | 2,232,000 |

| 1.01.06 | Recoverable Taxes | 1,365,000 | 1,048,000 |

| 1.01.08 | Other Current Assets | 2,289,000 | 1,280,000 |

| 1.01.08.01 | Assets Held for Sale | 255,000 | 1,153,000 |

| 1.01.08.03 | Other | 2,034,000 | 127,000 |

| 1.01.08.03.02 | Dividends Receivable | 17,000 | 16,000 |

| 1.01.08.03.03 | Credits with Other Related Parties – Short Term | 1,794,000 | 0 |

| 1.01.08.03.04 | Others assets | 223,000 | 111,000 |

| 1.02 | Noncurrent Assets | 23,552,000 | 23,996,000 |

| 1.02.01 | Long-term Assets | 5,521,000 | 4,935,000 |

| 1.02.01.04 | Accounts Receivable | 465,000 | 491,000 |

| 1.02.01.04.01 | Trade Receivables | 3,000 | 1,000 |

| 1.02.01.04.02 | Other Accounts Receivable | 462,000 | 490,000 |

| 1.02.01.07 | Deferred Taxes | 433,000 | 550,000 |

| 1.02.01.09 | Credits with Related Parties | 1,815,000 | 692,000 |

| 1.02.01.10 | Other Noncurrent Assets | 2,808,000 | 3,202,000 |

| 1.02.01.10.04 | Recoverable Taxes | 2,002,000 | 2,399,000 |

| 1.02.01.10.05 | Restricted deposits for legal proceedings | 719,000 | 717,000 |

| 1.02.01.10.06 | Financial Instruments - Fair Value Hegde | 1,000 | 1,000 |

| 1.02.01.10.07 | Other Noncurrent Assets | 86,000 | 85,000 |

| 1.02.02 | Investments | 9,981,000 | 11,059,000 |

| 1.02.02.01 | Investments | 9,981,000 | 11,059,000 |

| 1.02.02.01.02 | Investments in Subsidiaries | 9,981,000 | 11,059,000 |

| 1.02.03 | Property and Equipment, Net | 6,081,000 | 6,067,000 |

| 1.02.03.01 | Property and Equipment in Use | 3,273,000 | 3,331,000 |

| 1.02.03.02 | Leased Properties Right-of-use | 2,808,000 | 2,736,000 |

| 1.02.04 | Intangible Assets, net | 1,939,000 | 1,935,000 |

| 1.02.04.01 | Intangible Assets | 1,939,000 | 1,935,000 |

| 1.02.04.01.02 | Intangible Assets | 1,513,000 | 1,494,000 |

| 1.02.04.01.03 | Intangible Right-of-use | 426,000 | 441,000 |

| 6 |

Companhia Brasileira de Distribuição

FREE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) ITR – Interim Financial Information – March 31,2021 – COMPANHIA BRASILEIRA DE DISTRIBUIÇÃO |  |

Individual Interim Financial Information / Balance Sheet – Liabilities

| R$ (in thousands) | |||

| Code | Description | Current Quarter 03/31/2022 |

Previous Year 12/31/2021 |

| 2 | Total Liabilities | 31,575,000 | 33,646,000 |

| 2.01 | Current Liabilities | 5,775,000 | 7,541,000 |

| 2.01.01 | Payroll and Related Taxes | 313,000 | 394,000 |

| 2.01.02 | Trade payables, net | 2,165,000 | 3,651,000 |

| 2.01.03 | Taxes and Contributions Payable | 506,000 | 278,000 |

| 2.01.04 | Borrowings and Financing | 1,284,000 | 1,243,000 |

| 2.01.05 | Other Liabilities | 1,507,000 | 1,913,000 |

| 2.01.05.01 | Payables to Related Parties | 333,000 | 388,000 |

| 2.01.05.02 | Other | 1,174,000 | 1,525,000 |

| 2.01.05.02.01 | Dividends and interest on own capital | 81,000 | 81,000 |

| 2.01.05.02.07 | Pass-through to Third Parties | 0 | 2,000 |

| 2.01.05.02.08 | Financing Related to Acquisition of Assets | 68,000 | 84,000 |

| 2.01.05.02.09 | Deferred Revenue | 42,000 | 44,000 |

| 2.01.05.02.12 | Other Accounts Payable | 446,000 | 768,000 |

| 2.01.05.02.17 | Lease Liability | 537,000 | 546,000 |

| 2.01.07 | Liabilities related to assets held for sale | 0 | 62,000 |

| 2.01.07.01 | Liabilities on Non-current Assets for Sale | 0 | 62,000 |

| 2.02 | Noncurrent Liabilities | 11,517,000 | 12,456,000 |

| 2.02.01 | Borrowings and Financing | 5,626,000 | 6,563,000 |

| 2.02.02 | Other Liabilities | 4,476,000 | 4,513,000 |

| 2.02.02.01 | Liabilities with related parties | 90,000 | 96,000 |

| 2.02.02.01.04 | Debts with Others Related Parties | 90,000 | 96,000 |

| 2.02.02.02 | Others | 4,386,000 | 4,417,000 |

| 2.02.02.02.03 | Taxes payable in installments | 125,000 | 148,000 |

| 2.02.02.02.07 | Other Noncurrent Liabilities | 209,000 | 231,000 |

| 2.02.02.02.08 | Provision for Losses on Investments | 658,000 | 703,000 |

| 2.02.02.02.09 | Lease Liability | 3,394,000 | 3,335,000 |

| 2.02.04 | Provisions | 1,353,000 | 1,315,000 |

| 2.02.06 | Deferred Revenue | 62,000 | 65,000 |

| 2.03 | Shareholders’ Equity | 14,283,000 | 13,649,000 |

| 2.03.01 | Share Capital | 5,859,000 | 5,859,000 |

| 2.03.02 | Capital Reserves | 297,000 | 291,000 |

| 2.03.02.04 | Stock Option | 295,000 | 289,000 |

| 2.03.02.07 | Capital Reserve | 2,000 | 2,000 |

| 2.03.04 | Earnings Reserve | 7,146,000 | 6,925,000 |

| 2.03.04.01 | Legal Reserve | 705,000 | 705,000 |

| 2.03.04.05 | Retention of Profits Reserve | 230,000 | 233,000 |

| 2.03.04.07 | Tax Incentive Reserve | 2,578,000 | 2,349,000 |

| 2.03.04.10 | Expansion Reserve | 2,414,000 | 2,575,000 |

| 2.03.04.12 | Transactions with non-controlling interests | 1,369,000 | 1,213,000 |

| 2.03.04.14 | Settlement of Equity Instrument | -150,000 | -150,000 |

| 2.03.05 | Retained Earnings/ Accumulated Losses | 1,317,000 | 0 |

| 2.03.08 | Other comprehensive income | -336,000 | 574,000 |

| 7 |

Companhia Brasileira de Distribuição

FREE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) ITR – Interim Financial Information – March 31,2021 – COMPANHIA BRASILEIRA DE DISTRIBUIÇÃO |  |

Individual Interim Financial Information / Statement of Operations

R$ (in thousands)

| Code | Description | Year to date current period 03/01/2022 to 03/31/2022 |

Year to date previous period 03/01/2021 to 03/31/2021 |

| 3.01 | Net operating revenue | 3,613,000 | 3,677,000 |

| 3.02 | Cost of sales | -2,632,000 | -2,667,000 |

| 3.03 | Gross Profit | 981,000 | 1,010,000 |

| 3.04 | Operating Income/Expenses | -967,000 | -901,000 |

| 3.04.01 | Selling Expenses | -580,000 | -547,000 |

| 3.04.02 | General and administrative expenses | -134,000 | -160,000 |

| 3.04.05 | Other Operating Expenses | -231,000 | -239,000 |

| 3.04.05.01 | Depreciation and Amortization | -213,000 | -201,000 |

| 3.04.05.03 | Other operating expenses, net | -18,000 | -38,000 |

| 3.04.06 | Share of Profit of associates | -22,000 | 45,000 |

| 3.05 | Profit from operations before net financial expenses | 14,000 | 109,000 |

| 3.06 | Net Financial expenses | -234,000 | -133,000 |

| 3.07 | Income (loss) before income tax and social contribution | -220,000 | -24,000 |

| 3.08 | Income tax and social contribution | 109,000 | 127,000 |

| 3.08.01 | Current | -272,000 | -2,000 |

| 3.08.02 | Deferred | 381,000 | 129,000 |

| 3.09 | Net Income from continued operations | -111,000 | 103,000 |

| 3.10 | Net Income (loss) from discontinued operations | 1,510,000 | 10,000 |

| 3.10.01 | Net Income (loss) from Discontinued Operations | 1,510,000 | 10,000 |

| 3.11 | Net Income for the period | 1,399,000 | 113,000 |

| 3.99 | Earnings per Share | ||

| 3.99.01 | Basic Earnings per Share | ||

| 3.99.01.01 | ON | 5.19649 | 0.42147 |

| 3.99.02 | Dilutet Earnings per Share | ||

| 3.99.02.01 | ON | 5.19002 | 0.42049 |

| 8 |

Companhia Brasileira de Distribuição

FREE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) ITR – Interim Financial Information – March 31,2021 – COMPANHIA BRASILEIRA DE DISTRIBUIÇÃO |  |

Individual Interim Financial Information / Statement of Comprehensive Income

R$ (in thousands)

| Code | Description | Year to date current period 03/01/2022 to 03/31/2022 |

Year to date previous period 03/01/2021 to 03/31/2021 |

| 4.01 | Net income for the Period | 1,399,000 | 113,000 |

| 4.02 | Other Comprehensive Income | -910,000 | 161,000 |

| 4.02.02 | Foreign Currency Translation | -916,000 | 164,000 |

| 4.02.04 | Fair Value of Trade Receivables | -1,000 | -2,000 |

| 4.02.05 | Cash Flow Hedge | 5,000 | 1,000 |

| 4.02.06 | Income Tax Related to Other Comprehensive Income | 2,000 | -2,000 |

| 4.03 | Total Comprehensive Income for the Period | 489,000 | 274,000 |

| 9 |

Companhia Brasileira de Distribuição

FREE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) ITR – Interim Financial Information – March 31,2021 – COMPANHIA BRASILEIRA DE DISTRIBUIÇÃO |  |

Individual Interim Financial Information / Statement of Cash Flows - Indirect Method

| R$ (in thousands) | |||

| Code | Description | Year to date current period 03/01/2022 to 03/31/2022 |

Year to date previous period 03/01/2021 to 03/31/2021 |

| 6.01 | Net Cash Operating Activities | -1,931,000 | -1,573,000 |

| 6.01.01 | Cash Provided by the Operations | -639,000 | 460,000 |

| 6.01.01.01 | Net Income for the Period | 1,399,000 | 113,000 |

| 6.01.01.02 | Deferred Income Tax and Social Contribution (Note 19.3) | 117,000 | -125,000 |

| 6.01.01.03 | Gain (Losses) on Disposal of Property and equipments | -2,766,000 | -4,000 |

| 6.01.01.04 | Depreciation/Amortization | 263,000 | 310,000 |

| 6.01.01.05 | Interest and Inflation Adjustments | 337,000 | 208,000 |

| 6.01.01.07 | Share of Profit (Loss) of Subsidiaries and Associates (Note 12) | 22,000 | -45,000 |

| 6.01.01.08 | Provision for Risks | 44,000 | 4,000 |

| 6.01.01.10 | Share-based Payment | 6,000 | 7,000 |

| 6.01.01.11 | Allowance for Doubtful Accounts (Note 7.2 anda 8.1) | 3,000 | 3,000 |

| 6.01.01.13 | Allowance for obsolescence and damages (Note 9.1) | -32,000 | -13,000 |

| 6.01.01.15 | Deferred Revenue | -3,000 | 2,000 |

| 6.01.01.16 | Loss or gain on lease liabilities (Note 21.2) | -30,000 | 0 |

| 6.01.01.18 | Gain in disposal of subsidiaries | 1,000 | 0 |

| 6.01.02 | Changes in Assets and Liabilities | -1,292,000 | -2,033,000 |

| 6.01.02.01 | Accounts Receivable | 7,000 | -32,000 |

| 6.01.02.02 | Inventories | 312,000 | -106,000 |

| 6.01.02.03 | Recoverable Taxes | 97,000 | -201,000 |

| 6.01.02.04 | Other Assets | -80,000 | -135,000 |

| 6.01.02.05 | Related Parties | -116,000 | -34,000 |

| 6.01.02.06 | Restricted Deposits for Legal Proceeding | -7,000 | -29,000 |

| 6.01.02.07 | Trade Payables | -1,486,000 | -1,590,000 |

| 6.01.02.08 | Payroll and Related Taxes | -81,000 | -29,000 |

| 6.01.02.09 | Taxes and Social Contributions Payable | 189,000 | -29,000 |

| 6.01.02.10 | Payments of provision for risk | -39,000 | -18,000 |

| 6.01.02.11 | Deferred Revenue | -2,000 | 13,000 |

| 6.01.02.12 | Other Payables | -344,000 | 157,000 |

| 6.01.02.15 | Received Dividends and Interest on own capital | 258,000 | 0 |

| 6.02 | Net Cash of Investing Activities | 688,000 | -173,000 |

| 6.02.02 | Acquisition of Property and Equipment (Note 14.1) | -198,000 | -140,000 |

| 6.02.03 | Increase in Intangible Assets (Note 15.2) | -36,000 | -44,000 |

| 6.02.04 | Sales of Property and Equipment | 922,000 | 11,000 |

| 6.03 | Net Cash of Financing Activities | -1,376,000 | -804,000 |

| 6.03.03 | Payments of Borrowings and Financing (Note 16.2) | -1,092,000 | -515,000 |

| 6.03.07 | Acquisition of companies | -3,000 | 0 |

| 6.03.09 | Payment of lease liability | -281,000 | -289,000 |

| 6.05 | Increase (Decrease) in Cash and Cash Equivalents | -2,619,000 | -2,550,000 |

| 6.05.01 | Cash and Cash Equivalents at the Beginning of the Period | 4,662,000 | 4,905,000 |

| 6.05.02 | Cash and Cash Equivalents at the End of the Period | 2,043,000 | 2,355,000 |

| 10 |

Companhia Brasileira de Distribuição

FREE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) ITR – Interim Financial Information – March 31,2021 – COMPANHIA BRASILEIRA DE DISTRIBUIÇÃO |  |

Individual Interim Financial Information / Statement of Changes in Shareholders' Equity 01/01/2022 to 03/31/2022

| R$ (in thousands) | |||||||

| Code | Description | Share Capital |

Capital Reserves, Options Granted and Treasury Shares |

Earnings Reserve |

Retained Earnings/ Accumulated Losses | Other comprehensive income | Shareholders' Equity |

| 5.01 | Opening balance | 5,859,000 | 291,000 | 6,925,000 | 0 | 574,000 | 13,649,000 |

| 5.03 | Adjusted opening balance | 5,859,000 | 291,000 | 6,925,000 | 0 | 574,000 | 13,649,000 |

| 5.04 | Capital Transactions with Shareholders | 0 | 6,000 | 139,000 | 0 | 0 | 145,000 |

| 5.04.03 | Share based expenses | 0 | 6,000 | 0 | 0 | 0 | 6,000 |

| 5.04.07 | Interest on own Capital | 0 | 0 | -14,000 | 0 | 0 | -14,000 |

| 5.04.11 | Hyperinflationary economy effect | 0 | 0 | 156,000 | 0 | 0 | 156,000 |

| 5.04.16 | Others | 0 | 0 | -3,000 | 0 | 0 | -3,000 |

| 5.05 | Total Comprehensive Income | 0 | 0 | 0 | 1,399,000 | -910,000 | 489,000 |

| 5.05.01 | Net Income for the Period | 0 | 0 | 0 | 1,399,000 | 0 | 1,399,000 |

| 5.05.02 | Other Comprehensive Income | 0 | 0 | 0 | 0 | -910,000 | -910,000 |

| 5.05.02.04 | Foreign currency translation | 0 | 0 | 0 | 0 | -916,000 | -916,000 |

| 5.05.02.07 | Fair value of trade receivables | 0 | 0 | 0 | 0 | -1,000 | -1,000 |

| 5.05.02.08 | Cash Flow Hedge | 0 | 0 | 0 | 0 | 5,000 | 5,000 |

| 5.05.02.09 | Income taxes related to other comprehensive income | 0 | 0 | 0 | 0 | 2,000 | 2,000 |

| 5.06 | Internal Changes of Shareholders’ Equity | 0 | 0 | 82,000 | -82,000 | 0 | 0 |

| 5.06.01 | Reserves Constitution | 0 | 0 | 82,000 | -82,000 | 0 | 0 |

| 5.07 | Closing Balance | 5,859,000 | 297,000 | 7,146,000 | 1,317,000 | -336,000 | 14,283,000 |

| 11 |

Companhia Brasileira de Distribuição

FREE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) ITR – Interim Financial Information – March 31,2021 – COMPANHIA BRASILEIRA DE DISTRIBUIÇÃO |  |

Individual Interim Financial Information / Statement of Changes in Shareholders' Equity 01/01/2021 to 03/31/2021

| R$ (in thousands) | |||||||

| Code | Description | Share Capital |

Capital Reserves, Options Granted and Treasury Shares |

Earnings Reserve |

Retained Earnings/ Accumulated Losses | Other comprehensive Income | Shareholders' Equity |

| 5.01 | Opening balance | 5,434,000 | 479,000 | 6,090,000 | 0 | 1,692,000 | 13,695,000 |

| 5.03 | Adjusted opening balance | 5,434,000 | 479,000 | 6,090,000 | 0 | 1,692,000 | 13,695,000 |

| 5.04 | Capital Transactions with Shareholders | 216,000 | -209,000 | 35,000 | -3,000 | 0 | 39,000 |

| 5.04.03 | Share based expenses | 0 | 7,000 | 0 | 0 | 0 | 7,000 |

| 5.04.07 | Interest on own Capital | 0 | 0 | -69,000 | 0 | 0 | -69,000 |

| 5.04.11 | Hyperinflationary economy effect | 0 | 0 | 104,000 | 0 | 0 | 104,000 |

| 5.04.14 | Capital Reduction | 216,000 | -216,000 | 0 | 0 | 0 | 0 |

| 5.04.16 | Others | 0 | 0 | 0 | -3,000 | 0 | -3,000 |

| 5.05 | Total Comprehensive Income | 0 | 0 | 0 | 129,000 | 145,000 | 274,000 |

| 5.05.01 | Net Income for the Period | 0 | 0 | 0 | 113,000 | 0 | 113,000 |

| 5.05.02 | Other Comprehensive Income | 0 | 0 | 0 | 16,000 | 145,000 | 161,000 |

| 5.05.02.04 | Foreign currency translation | 0 | 0 | 0 | 16,000 | 148,000 | 164,000 |

| 5.05.02.07 | Fair value of trade receivables | 0 | 0 | 0 | 0 | -2,000 | -2,000 |

| 5.05.02.08 | Cash Flow Hedge | 0 | 0 | 0 | 0 | 1,000 | 1,000 |

| 5.05.02.09 | Income taxes related to other comprehensive income | 0 | 0 | 0 | 0 | -2,000 | -2,000 |

| 5.07 | Closing Balance | 5,650,000 | 270,000 | 6,125,000 | 126,000 | 1,837,000 | 14,008,000 |

| 12 |

Companhia Brasileira de Distribuição

FREE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) ITR – Interim Financial Information – March 31,2021 – COMPANHIA BRASILEIRA DE DISTRIBUIÇÃO |  |

Individual Interim Financial Information / Statement of Value Added

| R$ (in thousands) | |||

| Code | Description | Year to date current period 03/01/2022 to 03/31/2022 |

Year to date previous period 03/01/2021 to 03/31/2021 |

| 7.01 | Revenues | 3,924,000 | 3,961,000 |

| 7.01.01 | Sales of Goods, Products and Services | 3,875,000 | 3,945,000 |

| 7.01.02 | Other Revenues | 50,000 | 18,000 |

| 7.01.04 | Allowance for/Reversal of Doubtful Accounts | -1,000 | -2,000 |

| 7.02 | Products Acquired from Third Parties | -3,070,000 | -3,061,000 |

| 7.02.01 | Costs of Products, Goods and Services Sold | -2,508,000 | -2,572,000 |

| 7.02.02 | Materials, Energy, Outsourced Services and Other | -562,000 | -489,000 |

| 7.03 | Gross Value Added | 854,000 | 900,000 |

| 7.04 | Retention | -231,000 | -225,000 |

| 7.04.01 | Depreciation and Amortization | -231,000 | -225,000 |

| 7.05 | Net Value Added Produced | 623,000 | 675,000 |

| 7.06 | Value Added Received in Transfer | 1,599,000 | 84,000 |

| 7.06.01 | Share of Profit of Subsidiaries and Associates | -22,000 | 45,000 |

| 7.06.02 | Financial Revenue | 111,000 | 29,000 |

| 7.06.03 | Other | 1,510,000 | 10,000 |

| 7.07 | Total Value Added to Distribute | 2,222,000 | 759,000 |

| 7.08 | Distribution of Value Added | 2,222,000 | 759,000 |

| 7.08.01 | Personnel | 464,000 | 415,000 |

| 7.08.01.01 | Direct Compensation | 314,000 | 296,000 |

| 7.08.01.02 | Benefits | 73,000 | 68,000 |

| 7.08.01.03 | Government Severance Indemnity Fund for Employees (FGTS) | 98,000 | 38,000 |

| 7.08.01.04 | Other | -21,000 | 13,000 |

| 7.08.02 | Taxes, Fees and Contributions | 0 | 60,000 |

| 7.08.02.01 | Federal | -101,000 | -13,000 |

| 7.08.02.02 | State | 59,000 | 50,000 |

| 7.08.02.03 | Municipal | 42,000 | 23,000 |

| 7.08.03 | Value Distributed to Providers of Capital | 359,000 | 171,000 |

| 7.08.03.01 | Interest | 351,000 | 167,000 |

| 7.08.03.02 | Rentals | 8,000 | 4,000 |

| 7.08.04 | Value Distributed to Shareholders | 1,399,000 | 113,000 |

| 7.08.04.01 | Interest on shareholders' equity | 14,000 | 69,000 |

| 7.08.04.03 | Retained Earnings/ Accumulated Losses for the Period | 1,385,000 | 44,000 |

| 13 |

Companhia Brasileira de Distribuição

FREE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) ITR – Interim Financial Information – March 31,2021 – COMPANHIA BRASILEIRA DE DISTRIBUIÇÃO |  |

Consolidated Interim Financial Information /Balance Sheet - Assets

| R$ (in thousands) | |||

| Code | Description | Current Quarter 03/31/2022 |

Previous Year 12/31/2021 |

| 1 | Total Assets | 44,758,000 | 49,443,000 |

| 1.01 | Current Assets | 14,035,000 | 17,872,000 |

| 1.01.01 | Cash and Cash Equivalents | 3,610,000 | 8,274,000 |

| 1.01.03 | Accounts Receivable | 1,031,000 | 1,125,000 |

| 1.01.03.01 | Trade Receivables | 756,000 | 831,000 |

| 1.01.03.02 | Other Receivables | 275,000 | 294,000 |

| 1.01.04 | Inventories | 4,882,000 | 5,257,000 |

| 1.01.06 | Recoverable Taxes | 2,084,000 | 1,743,000 |

| 1.01.08 | Other Current Assets | 634,000 | 1,473,000 |

| 1.01.08.01 | Non-Current Assets for Sale | 286,000 | 1,187,000 |

| 1.01.08.03 | Other | 348,000 | 286,000 |

| 1.01.08.03.01 | Financial Instruments - Derivatives | 10,000 | 19,000 |

| 1.01.08.03.02 | Dividends Receivable | 16,000 | 16,000 |

| 1.01.08.03.03 | Credits with Related Parties - Short Term | 1,794,000 | 0 |

| 1.01.08.03.04 | Others assets | 322,000 | 251,000 |

| 1.02 | Noncurrent Assets | 30,723,000 | 31,571,000 |

| 1.02.01 | Long-term Assets | 5,559,000 | 4,966,000 |

| 1.02.01.04 | Accounts Receivable | 543,000 | 559,000 |

| 1.02.01.04.01 | Trade Receivables | 3,000 | 1,000 |

| 1.02.01.04.02 | Other Accounts Receivable | 540,000 | 558,000 |

| 1.02.01.07 | Deferred Taxes | 465,000 | 581,000 |

| 1.02.01.09 | Credits with Related Parties | 1,631,000 | 517,000 |

| 1.02.01.10 | Other Noncurrent Assets | 2,920,000 | 3,309,000 |

| 1.02.01.10.04 | Recoverable Taxes | 2,039,000 | 2,410,000 |

| 1.02.01.10.05 | Restricted deposits for legal proceedings | 733,000 | 731,000 |

| 1.02.01.10.06 | Financial Instruments - Fair Value Hegde | 6,000 | 6,000 |

| 1.02.01.10.07 | Other Noncurrent Assets | 142,000 | 162,000 |

| 1.02.02 | Investments | 4,176,000 | 4,508,000 |

| 1.02.02.01 | Investments | 1,232,000 | 1,254,000 |

| 1.02.02.02 | Investment properties | 2,944,000 | 3,254,000 |

| 1.02.03 | Property and Equipment, Net | 15,543,000 | 16,344,000 |

| 1.02.03.01 | Property and Equipment in Use | 10,785,000 | 11,573,000 |

| 1.02.03.02 | Leased Properties Right-of-use | 4,758,000 | 4,771,000 |

| 1.02.04 | Intangible Assets, net | 5,445,000 | 5,753,000 |

| 1.02.04.01 | Intangible Assets | 5,445,000 | 5,753,000 |

| 1.02.04.01.02 | Intangible Assets | 5,018,000 | 5,312,000 |

| 1.02.04.01.03 | Intangible Right-of-use | 427,000 | 441,000 |

| 14 |

Companhia Brasileira de Distribuição

FREE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) ITR – Interim Financial Information – March 31,2021 – COMPANHIA BRASILEIRA DE DISTRIBUIÇÃO |  |

Consolidated Interim Financial Information / Balance Sheet - Liabilities

| R$ (in thousands) | |||

| Code | Description | Current Quarter 03/31/2022 |

Previous Year 12/31/2021 |

| 2 | Total Liabilities | 44,758,000 | 49,443,000 |

| 2.01 | Current Liabilities | 12,672,000 | 16,550,000 |

| 2.01.01 | Payroll and Related Taxes | 630,000 | 808,000 |

| 2.01.02 | Trade payables, net | 6,487,000 | 10,078,000 |

| 2.01.03 | Taxes and Contributions Payable | 815,000 | 580,000 |

| 2.01.04 | Borrowings and Financing | 1,801,000 | 1,470,000 |

| 2.01.05 | Other Liabilities | 2,939,000 | 3,552,000 |

| 2.01.05.01 | Payables to Related Parties | 306,000 | 371,000 |

| 2.01.05.02 | Other | 2,633,000 | 3,181,000 |

| 2.01.05.02.01 | Dividends and interest on own capital | 90,000 | 112,000 |

| 2.01.05.02.07 | Pass-through to Third Parties | 32,000 | 15,000 |

| 2.01.05.02.08 | Financing Related to Acquisition of Assets | 128,000 | 182,000 |

| 2.01.05.02.09 | Deferred Revenue | 249,000 | 383,000 |

| 2.01.05.02.11 | Other Payables | 661,000 | 701,000 |

| 2.01.05.02.12 | Lease liability | 597,000 | 893,000 |

| 2.01.05.02.17 | Lease Liability | 876,000 | 895,000 |

| 2.01.07 | Liabilities related to assets held for sale | 0 | 62,000 |

| 2.01.07.01 | Liabilities on Non-current Assets for Sale | 0 | 62,000 |

| 2.02 | Noncurrent Liabilities | 15,285,000 | 16,513,000 |

| 2.02.01 | Borrowings and Financing | 6,533,000 | 7,582,000 |

| 2.02.02 | Other Liabilities | 6,356,000 | 6,489,000 |

| 2.02.02.01 | Liabilities with related parties | 90,000 | 96,000 |

| 2.02.02.01.04 | Debts with Others Related Parties | 90,000 | 96,000 |

| 2.02.02.02 | Others | 6,266,000 | 6,393,000 |

| 2.02.02.02.03 | Taxes payable in installments | 130,000 | 153,000 |

| 2.02.02.02.05 | Financing Related to Acquisition of Assets | 66,000 | 68,000 |

| 2.02.02.02.07 | Other Noncurrent Liabilities | 235,000 | 260,000 |

| 2.02.02.02.08 | Provision for Losses on Investments | 641,000 | 689,000 |

| 2.02.02.02.09 | Other Payable Accounts | 5,194,000 | 5,223,000 |

| 2.02.03 | Deferred taxes | 862,000 | 935,000 |

| 2.02.04 | Provisions | 1,472,000 | 1,442,000 |

| 2.02.04.01 | Tax, Social Security, Labor and Civil Provisions | 1,472,000 | 1,442,000 |

| 2.02.06 | Profits and Revenues to be Appropriated | 62,000 | 65,000 |

| 2.03 | Shareholders’ Equity | 16,801,000 | 16,380,000 |

| 2.03.01 | Share Capital | 5,859,000 | 5,859,000 |

| 2.03.02 | Capital Reserves | 297,000 | 291,000 |

| 2.03.02.04 | Stock Option | 295,000 | 289,000 |

| 2.03.02.07 | Capital Reserve | 2,000 | 2,000 |

| 2.03.04 | Earnings Reserve | 7,146,000 | 6,925,000 |

| 2.03.04.01 | Legal Reserve | 705,000 | 705,000 |

| 2.03.04.05 | Retention of Profits Reserve | 230,000 | 233,000 |

| 2.03.04.07 | Tax Incentive Reserve | 2,578,000 | 2,349,000 |

| 2.03.04.10 | Expansion Reserve | 2,414,000 | 2,575,000 |

| 2.03.04.12 | Transactions with non-controlling interests | 1,369,000 | 1,213,000 |

| 2.03.04.14 | Settlement of Equity Instrument | -150,000 | -150,000 |

| 2.03.05 | Retained Earnings/ Accumulated Losses | 1,317,000 | 0 |

| 2.03.08 | Other comprehensive income | -336,000 | 574,000 |

| 2.03.09 | Non-Controlling interests | 2,518,000 | 2,731,000 |

| 15 |

Companhia Brasileira de Distribuição

FREE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) ITR – Interim Financial Information – March 31,2021 – COMPANHIA BRASILEIRA DE DISTRIBUIÇÃO |  |

Consolidated Interim Financial Information / Statement of Operations

| R$ (in thousands) | |||

| Code | Description | Year to date current period 01/01/2022 to 03/31/2022 |

Year to date previous period 01/01/2021 to 03/31/2021 |

| 3.01 | Net operating revenue | 10,069,000 | 9,843,000 |

| 3.02 | Cost of sales | -7,461,000 | -7,231,000 |

| 3.03 | Gross Profit | 2,608,000 | 2,612,000 |

| 3.04 | Operating Income/Expenses | -2,432,000 | -2,385,000 |

| 3.04.01 | Selling Expenses | -1,494,000 | -1,444,000 |

| 3.04.02 | General and administrative expenses | -420,000 | -464,000 |

| 3.04.05 | Other Operating Expenses | -432,000 | -463,000 |

| 3.04.05.01 | Depreciation and Amortization | -409,000 | -408,000 |

| 3.04.05.03 | Other operating expenses, net | -23,000 | -55,000 |

| 3.04.06 | Share of Profit of associates | -86,000 | -14,000 |

| 3.05 | Profit from operations before net financial expenses | 176,000 | 227,000 |

| 3.06 | Net Financial expenses | -303,000 | -206,000 |

| 3.07 | Income (loss) before income tax and social contribution | -127,000 | 21,000 |

| 3.08 | Income tax and social contribution | 42,000 | 96,000 |

| 3.08.01 | Current | -300,000 | -22,000 |

| 3.08.02 | Deferred | 342,000 | 118,000 |

| 3.09 | Net Income from continued operations | -85,000 | 117,000 |

| 3.10 | Net Income (loss) from discontinued operations | 1,510,000 | 10,000 |

| 3.10.01 | Net Income (loss) from Discontinued Operations | 1,510,000 | 10,000 |

| 3.11 | Net Income for the period | 1,425,000 | 127,000 |

| 3.11.01 | Attributable to Controlling Shareholders - continued operations | 1,399,000 | 113,000 |

| 3.11.02 | Attributable to Non-controlling Shareholders - discontinued operations | 26,000 | 14,000 |

| 3.99 | Earnings per Share | ||

| 3.99.01 | Basic Earnings per Share | ||

| 3.99.01.01 | ON | 5.19649 | 0.42147 |

| 3.99.02 | Diluted Earnings per Share | 5.19002 | 0.42049 |

| 3.99.02.01 | ON | ||

| 16 |

Companhia Brasileira de Distribuição

FREE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) ITR – Interim Financial Information – March 31,2021 – COMPANHIA BRASILEIRA DE DISTRIBUIÇÃO |  |

Consolidated Interim Financial Information / Statement of Comprehensive Income

R$ (in thousands)

| Code | Description | Year to date current period 01/01/2022 to 03/31/2022 |

Year to date previous period 01/01/2021 to 03/31/2021 |

| 4.01 | Net income for the Period | 1,425,000 | 127,000 |

| 4.02 | Other Comprehensive Income | -1,137,000 | 226,000 |

| 4.02.02 | Foreign Currency Translation | -1,142,000 | 230,000 |

| 4.02.04 | Fair Value of Trade Receivables | -1,000 | -2,000 |

| 4.02.05 | Cash Flow Hedge | 4,000 | 0 |

| 4.02.06 | Income Tax Related to Other Comprehensive Income | 2,000 | -2,000 |

| 4.03 | Total Comprehensive Income for the Period | 288,000 | 353,000 |

| 4.03.01 | Attributable to Controlling Shareholders | 489,000 | 274,000 |

| 4.03.02 | Attributable to Non-Controlling Shareholders | -201,000 | 79,000 |

| 17 |

Companhia Brasileira de Distribuição

FREE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) ITR – Interim Financial Information – March 31,2021 – COMPANHIA BRASILEIRA DE DISTRIBUIÇÃO |  |

Consolidated Interim Financial Information / Statement of Cash Flows - Indirect Method

| R$ (in thousands) | |||

| Code | Description | Year to date current period 03/01/2022 to 03/31/2022 |

Year to date previous period 03/01/2021 to 03/31/2021 |

| 6.01 | Net Cash Operating Activities | -3,821,000 | -3,498,000 |

| 6.01.01 | Cash Provided by the Operations | -283,000 | 750,000 |

| 6.01.01.01 | Net Income for the Period | 1,425,000 | 127,000 |

| 6.01.01.02 | Deferred Income Tax and Social Contribution (Note 19.3) | 156,000 | -114,000 |

| 6.01.01.03 | Gain (Losses) on Disposal of Property and equipments | -2,753,000 | 32,000 |

| 6.01.01.04 | Depreciation/Amortization | 488,000 | 548,000 |

| 6.01.01.05 | Interest and Inflation Adjustments | 427,000 | 246,000 |

| 6.01.01.07 | Share of Profit (Loss) of Subsidiaries and Associates (Note 12.2) | 86,000 | 14,000 |

| 6.01.01.08 | Provision for Risks | 48,000 | 3,000 |

| 6.01.01.09 | Provision for Write-off and impairment | -4,000 | 0 |

| 6.01.01.10 | Share-based Payment | 6,000 | 7,000 |

| 6.01.01.11 | Allowance for Doubtful Accounts (Note 7.1 anda 8.1) | 14,000 | 18,000 |

| 6.01.01.13 | Allowance for obsolescence and damages (Note 9.1) | -32,000 | -19,000 |

| 6.01.01.15 | Deferred Revenue | -106,000 | -91,000 |

| 6.01.01.16 | Loss or gain on lease liabilities (Note 21.2) | -39,000 | -21,000 |

| 6.01.01.18 | Gain in disposal of subsidiaries | 1,000 | 0 |

| 6.01.02 | Changes in Assets and Liabilities | -3,538,000 | -4,248,000 |

| 6.01.02.01 | Accounts Receivable | 21,000 | 51,000 |

| 6.01.02.02 | Inventories | 151,000 | -151,000 |

| 6.01.02.03 | Recoverable Taxes | -8,000 | -343,000 |

| 6.01.02.04 | Other Assets | -60,000 | -99,000 |

| 6.01.02.05 | Related Parties | -146,000 | -48,000 |

| 6.01.02.06 | Restricted Deposits for Legal Proceeding | -8,000 | -29,000 |

| 6.01.02.07 | Trade Payables | -3,170,000 | -3,766,000 |

| 6.01.02.08 | Payroll and Related Taxes | -148,000 | -95,000 |

| 6.01.02.09 | Taxes and Social Contributions Payable | 299,000 | 168,000 |

| 6.01.02.10 | Payments of provision for risk | -44,000 | -24,000 |

| 6.01.02.11 | Deferred Revenue | -15,000 | 47,000 |

| 6.01.02.12 | Other Payables | -312,000 | 158,000 |

| 6.01.02.13 | Income Tax and Social contribution,paid | -98,000 | -117,000 |

| 6.02 | Net Cash of Investing Activities | 591,000 | -413,000 |

| 6.02.02 | Acquisition of Property and Equipment (Note 14.1) | -281,000 | -270,000 |

| 6.02.03 | Increase in Intangible Assets (Note 15.2) | -45,000 | -61,000 |

| 6.02.04 | Sales of Property and Equipment | 924,000 | 11,000 |

| 6.02.09 | Acquisition of Investment Propery (Note 13) | -7,000 | -93,000 |

| 6.03 | Net Cash of Financing Activities | -1,253,000 | -974,000 |

| 6.03.02 | Proceeds from Borrowings and Financing (Note 16.2) | 328,000 | 1,015,000 |

| 6.03.03 | Payments of Borrowings and Financing (Note 16.2) | -1,143,000 | -1,528,000 |

| 6.03.05 | Payment of Dividends | -35,000 | -36,000 |

| 6.03.06 | Transactions with Non-controlling Interest | 0 | 7,000 |

| 6.03.07 | Acquisition of companies | -3,000 | 0 |

| 6.03.08 | Transactions with Non-controlling Interest | 0 | -2,000 |

| 6.03.09 | Payment of lease liability | -400,000 | -430,000 |

| 6.04 | Exchange rate changes in cash and cash equivalents | -181,000 | 65,000 |

| 6.05 | Increase (Decrease) in Cash and Cash Equivalents | -4,664,000 | -4,820,000 |

| 6.05.01 | Cash and Cash Equivalents at the Beginning of the Period | 8,274,000 | 8,711,000 |

| 6.05.02 | Cash and Cash Equivalents at the End of the Period | 3,610,000 | 3,891,000 |

| 18 |

Companhia Brasileira de Distribuição

FREE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) ITR – Interim Financial Information – March 31,2021 – COMPANHIA BRASILEIRA DE DISTRIBUIÇÃO |  |

Consolidated Interim Financial Information / Statement of Changes in Shareholders' Equity 01/01/2022 to 03/31/2022

| R$ (in thousands) 1000 | |||||||||

| Code | Description | Share Capital |

Capital Reserves, Options Granted and Treasury Shares |

Earnings Reserves |

Retained Earnings/ Accumulated Losses | Other comprehensive Income | Shareholders' Equity |

Non-Controlling Interest |

Consolidated Shareholders' Equity |

| 5.01 | Opening balance | 5,859,000 | 291,000 | 6,925,000 | 0 | 574,000 | 13,649,000 | 2,731,000 | 16,380,000 |

| 5.03 | Adjusted opening balance | 5,859,000 | 291,000 | 6,925,000 | 0 | 574,000 | 13,649,000 | 2,731,000 | 16,380,000 |

| 5.04 | Capital Transactions with Shareholders | 0 | 6,000 | 139,000 | 0 | 0 | 145,000 | -12,000 | 133,000 |

| 5.04.03 | Share based expenses | 0 | 6,000 | 0 | 0 | 0 | 6,000 | 0 | 6,000 |

| 5.04.07 | Interest on own Capital | 0 | 0 | -14,000 | 0 | 0 | -14,000 | 0 | -14,000 |

| 5.04.11 | Hyperinflationary economy effect | 0 | 0 | 156,000 | 0 | 0 | 156,000 | 5,000 | 161,000 |

| 5.04.14 | Capital Reduction | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 5.04.15 | Dividends declared to non-controlling interests | 0 | 0 | 0 | 0 | 0 | 0 | -17,000 | -17,000 |

| 5.04.16 | Others | 0 | 0 | -3,000 | 0 | 0 | -3,000 | 0 | -3,000 |

| 5.05 | Total Comprehensive Income | 0 | 0 | 0 | 1,399,000 | -910,000 | 489,000 | -201,000 | 288,000 |

| 5.05.01 | Net Income for the Period | 0 | 0 | 0 | 1,399,000 | 0 | 1,399,000 | 26,000 | 1,425,000 |

| 5.05.02 | Other Comprehensive Income | 0 | 0 | 0 | 0 | -910,000 | -910,000 | -227,000 | -1,137,000 |

| 5.05.02.04 | Foreign currency translation | 0 | 0 | 0 | 0 | -916,000 | -916,000 | -226,000 | -1,142,000 |

| 5.05.02.07 | Fair value of trade receivables | 0 | 0 | 0 | 0 | -1,000 | -1,000 | 0 | -1,000 |

| 5.05.02.08 | Cash Flow Hedge | 0 | 0 | 0 | 0 | 5,000 | 5,000 | -1,000 | 4,000 |

| 5.05.02.09 | Income taxes related to other comprehensive income | 0 | 0 | 0 | 0 | 2,000 | 2,000 | 0 | 2,000 |

| 5.06 | Internal Changes of Shareholders’ Equity | 0 | 0 | 82,000 | -82,000 | 0 | 0 | 0 | 0 |

| 5.06.01 | Reserves Constitution | 0 | 0 | 82,000 | -82,000 | 0 | 0 | 0 | 0 |

| 5.07 | Closing Balance | 5,859,000 | 297,000 | 7,146,000 | 1,317,000 | -336,000 | 14,283,000 | 2,518,000 | 16,801,000 |

| 19 |

Companhia Brasileira de Distribuição

FREE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) ITR – Interim Financial Information – March 31,2021 – COMPANHIA BRASILEIRA DE DISTRIBUIÇÃO |  |

Consolidated Interim Financial Information / Statement of Changes in Shareholders' Equity 01/01/2021 to 03/31/2021

| R$ (in thousands) | |||||||||

| Code | Description | Share Capital |

Capital Reserves, Options Granted and Treasury Shares |

Earnings Reserves |

Retained Earnings/ Accumulated Losses | Other comprehensive Income | Shareholders' Equity |

Non-Controlling Interest |

Consolidated Shareholders' Equity |

| 5.01 | Opening balance | 5,434,000 | 479,000 | 6,090,000 | 0 | 1,692,000 | 13,695,000 | 3,112,000 | 16,807,000 |

| 5.03 | Adjusted opening balance | 5,434,000 | 479,000 | 6,090,000 | 0 | 1,692,000 | 13,695,000 | 3,112,000 | 16,807,000 |

| 5.04 | Capital Transactions with Shareholders | 216,000 | -209,000 | 35,000 | -3,000 | 0 | 39,000 | -15,000 | 24,000 |

| 5.04.03 | Share based expenses | 0 | 7,000 | 0 | 0 | 0 | 7,000 | 0 | 7,000 |

| 5.04.07 | Interest on own Capital | 0 | 0 | -69,000 | 0 | 0 | -69,000 | 0 | -69,000 |

| 5.04.11 | Hyperinflationary economy effect | 0 | 0 | 104,000 | 0 | 0 | 104,000 | 11,000 | 115,000 |

| 5.04.14 | Capital Reduction | 216,000 | -216,000 | 0 | 0 | 0 | 0 | 0 | 0 |

| 5.04.15 | Dividends declared to non-controlling interests | 0 | 0 | 0 | 0 | 0 | 0 | -28,000 | -28,000 |

| 5.04.16 | Others | 0 | 0 | 0 | -3,000 | 0 | -3,000 | 2,000 | -1,000 |

| 5.05 | Total Comprehensive Income | 0 | 0 | 0 | 129,000 | 145,000 | 274,000 | 79,000 | 353,000 |

| 5.05.01 | Net Income for the Period | 0 | 0 | 0 | 113,000 | 0 | 113,000 | 14,000 | 127,000 |

| 5.05.02 | Other Comprehensive Income | 0 | 0 | 0 | 16,000 | 145,000 | 161,000 | 65,000 | 226,000 |

| 5.05.02.04 | Foreign currency translation | 0 | 0 | 0 | 16,000 | 148,000 | 164,000 | 66,000 | 230,000 |

| 5.05.02.07 | Fair value of trade receivables | 0 | 0 | 0 | 0 | -2,000 | -2,000 | 0 | -2,000 |

| 5.05.02.08 | Cash Flow Hedge | 0 | 0 | 0 | 0 | 1,000 | 1,000 | -1,000 | 0 |

| 5.05.02.09 | Income taxes related to other comprehensive income | 0 | 0 | 0 | 0 | -2,000 | -2,000 | 0 | -2,000 |

| 5.07 | Closing Balance | 5,650,000 | 270,000 | 6,125,000 | 126,000 | 1,837,000 | 14,008,000 | 3,176,000 | 17,184,000 |

| 20 |

Companhia Brasileira de Distribuição

FREE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) ITR – Interim Financial Information – March 31,2021 – COMPANHIA BRASILEIRA DE DISTRIBUIÇÃO |  |

Consolidated Interim Financial Information / Statement of Value Added

| R$ (in thousands) | |||

| Code | Description | Year to date current period 01/01/2022 to 03/31/2022 |

Year to date previous period 01/01/2021 to 03/31/2021 |

| 7.01 | Revenues | 11,155,000 | 10,850,000 |

| 7.01.01 | Sales of Goods, Products and Services | 11,105,000 | 10,836,000 |

| 7.01.02 | Other Revenues | 55,000 | 21,000 |

| 7.01.04 | Allowance for/Reversal of Doubtful Accounts | -5,000 | -7,000 |

| 7.02 | Products Acquired from Third Parties | -8,319,000 | -8,024,000 |

| 7.02.01 | Costs of Products, Goods and Services Sold | -7,117,000 | -6,913,000 |

| 7.02.02 | Materials, Energy, Outsourced Services and Other | -1,202,000 | -1,111,000 |

| 7.03 | Gross Value Added | 2,836,000 | 2,826,000 |

| 7.04 | Retention | -455,000 | -463,000 |

| 7.04.01 | Depreciation and Amortization | -455,000 | -463,000 |

| 7.05 | Net Value Added Produced | 2,381,000 | 2,363,000 |

| 7.06 | Value Added Received in Transfer | 1,597,000 | 79,000 |

| 7.06.01 | Share of Profit of Subsidiaries and Associates | -86,000 | -14,000 |

| 7.06.02 | Financial Revenue | 173,000 | 83,000 |

| 7.06.03 | Other | 1,510,000 | 10,000 |

| 7.07 | Total Value Added to Distribute | 3,978,000 | 2,442,000 |

| 7.08 | Distribution of Value Added | 3,978,000 | 2,442,000 |

| 7.08.01 | Personnel | 1,041,000 | 1,019,000 |

| 7.08.01.01 | Direct Compensation | 827,000 | 840,000 |

| 7.08.01.02 | Benefits | 130,000 | 123,000 |

| 7.08.01.03 | Government Severance Indemnity Fund for Employees (FGTS) | 100,000 | 41,000 |

| 7.08.01.04 | Other | -16,000 | 15,000 |

| 7.08.01.04.01 | Profit (cost) sharing | -16,000 | 15,000 |

| 7.08.02 | Taxes, Fees and Contributions | 1,019,000 | 1,000,000 |

| 7.08.02.01 | Federal | 151,000 | 208,000 |

| 7.08.02.02 | State | 783,000 | 729,000 |

| 7.08.02.03 | Municipal | 85,000 | 63,000 |

| 7.08.03 | Value Distributed to Providers of Capital | 493,000 | 296,000 |

| 7.08.03.01 | Interest | 484,000 | 292,000 |

| 7.08.03.02 | Rentals | 9,000 | 4,000 |

| 7.08.04 | Value Distributed to Shareholders | 1,425,000 | 127,000 |

| 7.08.04.01 | Interest on shareholders' equity | 14,000 | 69,000 |

| 7.08.04.03 | Retained Earnings/ Accumulated Losses for the Period | 1,385,000 | 44,000 |

| 7.08.04.04 | Noncontrolling Interest in Retained Earnings | 26,000 | 14,000 |

| 22 |

| 23 |

EARNINGS

|

RELEASE 1Q22

São Paulo, May 4th, 2022 GPA [B3: PCAR3; NYSE: CBD] announces its results for the first quarter of 2022 (1Q22). In consequence of discontinuing hypermarket operations, as disclosed in the material fact or/notice to the market of October 14 and December 16, 2021, February 24 and April 13, 2022, Extra hypermarket operations will be deemed discontinued operations. Hence, net sales as well as the other result items were retrospectively adjusted, as established by IFRS 5/CPC31, approved by CVM Resolution No. 598/09 – Noncurrent assets held for sale and discontinued operations. The comments below concern the result from continuing operations. Comparisons are with the same period in 2021, unless stated otherwise. The results include the effects of IFRS 16/CPC 06 (R2), unless stated otherwise. |

|

Resilient Consolidated Result for the period

| · | Total consolidated gross revenue from continuing operations reached R$11.1 billion in 1Q22, an 11.2% increase in the same-store concept vs. 1Q21; |

| · | Consolidated Adjusted EBITDA totaled R$655 million in 1Q22 with a Consolidated Adjusted EBITDA Margin of 6.5%, a 110 bps decrease vs. 1Q21; |

| · | The Consolidated Net Profit of Controlling Shareholders reached R$1,399 million. As released on April 4, 2022, we completed, in 1Q22, the assignment of rights to exploit more than 40 commercial points to Assaí, reaching 86% of the transaction scope, and thus the net profit from discontinued activities was R$1,510 million for the period; |

| · | The cash position at the end of the quarter was R$3.6 billion, 2.0x times the Company’s short-term debt. |

Double-digit growth internationally

| · | Grupo Éxito recorded strong double-digit growth in same-store sales at 20.8% vs. 1Q21 (in constant currency), growing in the 3 countries in which it operates, which is mainly due to increase in store traffic and economy reopening with the resumption of tourism. Omnichannel sales represented 9.4% of total sales of 1Q22; |

| · | Grupo Éxito reached an Adjusted EBITDA Margin of 7.0% in 1Q22, a decrease of 120 bps compared to 1Q21, which refers to lower nonrecurrent real estate development and trading fees in 1Q22 vs. 1Q21. |

New GPA Brazil transition quarter

| · | The gross revenue from sales of the New GPA Brazil (excluding gas stations) amounted to R$3.8 billion in 1Q22, in line with 1Q21, which was affected by a punctual stockout effect, due to a period of adjustment in the logistics network after the closing of the hypermarkets. In 1Q22, total online sales penetration was 9.9%; |

| · | At GPA Brazil, the Adjusted EBITDA margin (pro forma) was 8.2% in 1Q22, which was mainly affected by the lower dilution of the fixed costs. With a greater focus on more profitable formats and our expansion and conversion plan, we expect a dilution of the fixed costs in the next quarters and, as a consequence, an evolution on our profitability margin. |

| 24 |

|

GPA Consolidated

Transition quarter regarding operations in Brazil and maintenance of strong resumption of Grupo Éxito

| R$ million, except when indicated | GPA Consolidated(1) | ||

| 1Q22 | 1Q21 | Δ | |

| Gross Revenue | 11,105 | 10,836 | 2.5% |

| Net Revenue | 10,069 | 9,844 | 2.3% |

| Gross Profit | 2,608 | 2,613 | -0.2% |

| Gross Margin | 25.9% | 26.5% | -60 bps |

| Selling, General and Administrative Expenses | (1,914) | (1,907) | 0.4% |

| % of Net Revenue | 19.0% | 19.4% | -40 bps |

| Other Operating Revenue (Expenses) | (23) | (54) | -58.3% |

| Adjusted EBITDA(2) | 655 | 745 | -12.2% |

| Adjusted EBITDA Margin(2) | 6.5% | 7.6% | -110 bps |

| Net Income Controlling Shareholders - Continued Operations | (111) | 103 | -208.2% |

| Net Margin Controlling Shareholders - Continued Operations | -1.1% | 1.0% | -210 bps |

| Net Income Controlling Shareholders - Discontinued Operations(3) | 1,510 | 10 | n.d. |

| Net Income Controlling Shareholders Consolidated | 1,399 | 112 | n.d. |

(1) The consolidated considers profit and loss of the operations of GPA Brazil, the operations of Grupo Éxito (Colombia, Uruguay, and Argentina), other businesses (Stix Fidelidade, Cheftime, and James Delivery), and the result of the equity income of CDiscount

(2) Operating income before interest, taxes, depreciation and amortization. Adjusted for Other Operating Revenue (Expenses)

(3) Includes the result of hypermarket operations

Message from the CEO

We started the first quarter of the year in a situation of transition for business in Brazil, with the closing process of hypermarket-format stores, which requires restructuring and resizing of the entire business. At Grupo Éxito, we see a resumption of traffic in stores, with the economy reopening and the resumption of tourism, which gave rise to strong growth, as has happened in the previous quarters.

Our consolidated gross revenue increased 11.2% in the same-store sales concept in 1Q, driven especially by the results of Éxito in the three countries in which it operates. In Brazil, despite the challenges of the macro scenario, with high pressure due to inflation and the deterioration in the population’s income, we recorded gross revenue in line with the 1Q21.

The new cycle that has started in GPA Brazil enables us to put into practice an important expansion plan, which provides for the opening of 200 new stores by 2024. This quarter, we have opened two new stores - one Minuto Pão de Açúcar and one Pão de Açúcar Fresh. There are 25 units being converted from hypermarkets into Pão de Açúcar or Mercado Extra, and approximately 40 Pão de Açúcar stores are in the process of revitalization, with opening expected over the next few months. Our food e-commerce business remains an important way of growing and we will continue to strengthen it, supported by an open collaborative platform, as part of a multichannel strategy. In Colombian Carulla, omnichannel sales share reached an incredible 17%, a benchmark for the sector.

Lastly, we have started the second quarter confident of the strategy defined, focused on our strategic priorities, to “do the basics well” and resume our business strengths in Brazil, maintaining the constant growth of Grupo Éxito. We have simplified our structure, resized the Company and now we look to the future, focused on delivering results sustainably.

Marcelo Pimentel

GPA’s CEO

Disclaimer: Statements contained in this release regarding the Company's business outlook, projections of operating/financial profit and loss, the Company's growth potential, and related to market and macroeconomic estimates constitute mere forecasts and were based on the beliefs, intentions, and expectations of the Management regarding the future of the Company. Those estimates are highly dependent on changes in the market, the general economic performance of Brazil, the industry, and international markets and, therefore, are subject to change.

| 25 |

|

Sales Performance

GPA Brazil

Challenging quarter for New GPA transformation

| GROSS REVENUE | 1Q22/1Q21 | ||

| (R$ million) | Selling | % Total Stores | Same Store Sales(4) |

| Pão de Açúcar | 1,870 | -1.5% | 0.1% |

| Mercado Extra / Compre Bem | 1,337 | 0.5% | 0.6% |

| Proximity | 564 | 7.5% | 5.5% |

| Other businesses(1) | 37 | -31.5% | n.d. |

| New GPA Brazil ex Gas Stations | 3,808 | 0.0% | 1.0% |

| Gas Stations | 363 | -18.0% | -16.7% |

| New GPA Brazil | 4,171 | -1.8% | -0.9% |

| Extra Hiper | 533 | -80.9% | n.d. |

| Drugstores | 2 | -95.8% | n.d. |

| Other Discontinued Business(2) | 18 | -58.3% | n.d. |

| GPA Brazil(3) | 4,724 | -33.8% | -0.9% |

(1) Revenue mainly from lease of commercial centers

(2) Revenue mainly from lease of commercial centers of discontinued operations

(3) GPA Brazil does not include the results of Stix Fidelidade, Cheftime, and James Delivery

(4) To reflect the calendar effect, 110 bps were reduced in 1Q22

Second consecutive quarter with positive same-store sale in the New GPA

Total sales of New GPA Brazil reached R$4.2 billion in 1Q22 and, excluding service stations, we reached R$3.8 billion. We ended the first quarter of 2022 with a similar trend to the 4Q of 2021, with positive same-store sales excluding gas stations, despite the impact on stockouts due to logistical adjustments, necessary after the closing of the hypermarket stores (closing of 4 DCs and area reduction in another 4 DCs), and impact on the focus of the operation also generated by the hyper stores’ transaction.

In this first quarter, we had a negative impact on gas station sales, as most of them are in closed store areas for conversion to cash and carry. This tends to be reverted with the opening of the new stores.

Sales from premium formats corresponded to almost 50% of the total gross sales

GPA Brazil’s transition period marked by the exit of the hypermarket format

GPA Brazil is going through a transition period, which began in October 2021 with the announcement of the discontinuation of hypermarket and drugstore stores and should last until the end of the second quarter. During that period, we closed all stores of these formats, adjusted our logistics network, we are working on adapting our principal place of business and IT platforms, and are mainly focused on 5 points of action in our banners, to continue feeding

| 26 |

|

dreams and lives with excellence: i) OSA (on-shelf availability), always to meet our customers’ needs; ii) NPS to continually improve our services; iii) Assortment, providing premium and regional products; iv) Conversion, focus on the conversion of stores after the closing of hypermarkets; and v) Expansion, the opening of stores according to the plan announced in 2021.

Temporary impact on stockouts due to adjustment in the logistics network

In the Pão de Açúcar banner, we presented a slight, but important growth, with market share gain in the premium segment. This result gives us confidence that the strategy outlined proves to be a winner. We had a very high unique effect on stockouts, explained by the adjustment in the logistics network due to the exit from hypermarkets. This network adequacy has already been overcome and at the beginning of April, we are already at pre-transaction levels. Another negative impact on the banner was the difficulty in importing in the last 2 months, mainly due to the lack of containers. As a result, the participation of some products in important categories is suffering from stockouts.

In the 1Q, we had two Pão de Açúcar stores reopened to the G7 concept, Indaiatuba and Piracicaba. These two stores are performing in two-digit perishables categories above unrenovated stores and 36 reopenings are planned for Q2. We also started the conversion of 15 hypermarket stores to this banner, with a reopening expected between the 2nd and 3rd quarters. In the assortment review journey, in order to better meet the demand of our customers, we added approximately 500 SKUs in the last few months and we could reach up to 1.000 additional SKUs, which may also replace low-performance assortments in some stores.

Focus on regional assortment for mainstream banners

For Mercado Extra, besides the impacts of logistical adjustments, the banner was impacted in the quarter by the rains in the mountainous region of Rio de Janeiro. At Compre Bem, sales performance was affected by the strong base, but with an improvement in the banner's profitability.

We continue to accelerate the integration of the banners into the e-commerce operation and focus on serving perishables and regionalized assortment. In this quarter, we started the conversion of 9 hypermarket stores to the Mercado Extra format.

On April 29, 2022, we announced a proposal to incorporate the Compre Bem banner, with the purpose of maximizing synergies among mainstream banners.

Constant growth in Proximity format sales

In the Proximity format, during the first quarter of 2022, we opened a new Minuto Pão de Açúcar store and another store in the new Pão de Açúcar Fresh format – a model focused on purchasing fresh products and allowing us to occupy the space between Minuto Pão de Açúcar and the traditional Pão de Açúcar.

Even with a difficult comparison basis, we had a 5.5% growth in same-store sales for this banner, mainly driven by the resumption of flow in transit stores, with people returning to the offices.

|

Temporary impact of CDs changes on the e-commerce operation

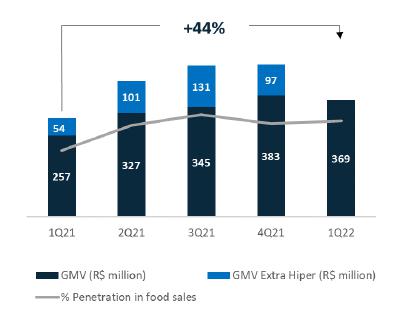

In e-commerce, our GMV was R$369 million in 1Q22, 19% higher than in the same period in 2021. If we exclude sales from hypermarkets in 1Q21, the growth was 44%.

Compared to 4Q21, excluding sales from hypermarkets in e-commerce, our GMV decreased by 4%, mainly explained by the impacts of logistical adjustments and reduced promotions. |

| 27 |

|

We are implementing several initiatives to strengthen our digital strategy, including:

| § | Improving our competitiveness: resumption of promotions in specific categories such as wine, beers, personal care, pet shop, and others; |

| § | Attracting new sales: implementation of logistics hubs in places where we no longer have brick and mortar stores such as Salvador, Belo Horizonte, and Curitiba. These hubs will serve our customers of Pão de Açúcar and Clube Extra, in addition to all our e-commerce partners; |

| § | Operating improvement: in logistics and IT, with the automation of service via WhatsApp and the OMS tool. |

Private-label brands with quality products at the best value for money

Our private-label brands have the purpose of offering quality products at the best value for money, in all operation segments (day-to-day, healthy, superior quality, gourmet etc.) seeking higher profitability, exclusivity and differentiation for the group’s banners. With an increasing demand in Brazil, Qualitá, Taeq, Cheftime, Casíno, Club des Sommeliers and Finlandek brands closed the 1Q22 representing 21.52% of GPA Brazil’s sales.

| 28 |

|

GRUPO ÉXITO

Solid performance in Colombia and improved sales benefited from omnichannel and economic reopening

| GROSS REVENUE | 1Q22/1Q21 | |||

| (R$ million) | Selling | % Total Stores | % Total Stores Constant Currency | Same Store Sales(1) Constant Currency |

| Grupo Éxito | 6,916 | 5.2% | 20.3% | 20.8% |

| Colombia | 5,215 | 3.9% | 19.5% | 20.2% |

| Uruguay | 1,215 | 5.9% | 11.1% | 11.8% |

| Argentina | 486 | 20.2% | 66.3% | 62.7% |

(1) Same-store concept performance considering growth at constant exchange rates. To reflect the calendar effect, in 1Q22, -30 bps was added in Grupo Éxito (-20 bps in Colombia, -70 bps in Uruguay, and -70 bps in Argentina)

Grupo Éxito posted a solid sales performance in 1Q22, as was already shown in previous quarters. Gross revenue totaled R$6.9 billion in the quarter, with same-store growth of 20.8% vs 1Q21 and due to the valuation of the Brazilian real vs the Colombian peso, total store growth was 5.2% YoY.

COLOMBIA

Strong growth in the quarter, despite the challenging macroeconomic environment. Inflation in the last 12 months in the country was 8.5% and, in 1Q22, we had a growth in total sales volume at constant exchange rates above inflation. In same-store sales, growth was 20.2% versus the same period of the previous year. Let us emphasize the Carulla format (similar to the Pão de Açúcar format), with a significant 17% share in omnichannel sales. This result supports the winning strategy of investments in innovative concepts (Éxito Wow and Carulla Fresh Market) and the important performance of omnichannel in Éxito.

URUGUAY

The macroeconomic context in Uruguay has significantly improved with the resumption of tourism in the country since the end of 2021. Moreover, the country has a more favorable consumption scenario and lower inflation rates. As a result, same-store sales grew 11.8% in the quarter.

ARGENTINA

Sales growth above inflation in the quarter is a reflection of the good performance of commercial centers, increased in-store traffic (due to the reduction of sanitary restrictions related to Covid-19), and consolidation of the real estate business in the country, with the opening of malls and leisure spaces.

For further information on the results of Grupo Éxito, please find below the link to the released earnings: https://www.grupoexito.com.co/en/financial-information

| 29 |

|

Financial Performance

GPA BRAZIL

In the first quarter of 2022, we have two views for GPA Brazil’s result, for a better analysis of our businesses: the accounting view and the pro-forma view. In applying IFRS5/CPC 31 “Noncurrent Assets Held for Sale and Discontinued Operations”, certain expenses recorded in the Gross Profit, Selling, General and Administrative Expenses cannot be reclassified to net profit of the discontinued operations in accounting since they are only partially related to discontinued operations. Hence, this proration was made for “pro-forma” purposes only and must cease as the expenses reach their new recurring level.

| R$ million, except when indicated | GPA Brazil(1) | ||

| 1Q22 | 1Q21 | Δ | |

| Gross Revenue | 4,171 | 4,249 | -1.8% |

| Net Revenue | 3,893 | 3,965 | -1.8% |

| Gross Profit | 1,035 | 1,064 | -2.7% |

| Gross Margin | 26.6% | 26.8% | -20 bps |

| Selling, General, and Administrative Expenses | (761) | (755) | 0.8% |

| % of Net Revenue | 19.6% | 19.0% | 60 bps |

| Equity Income | 8 | 15 | -47.1% |

| Adjusted EBITDA(2) | 299 | 348 | -13.9% |

| Adjusted EBITDA Margin(2) | 7.7% | 8.8% | -110 bps |

(1) GPA Brazil does not include results from other businesses (Stix Fidelidade, Cheftime, and James Delivery)

(2) Earnings before interest, taxes, depreciation, and amortization. Adjusted for Other Operating Revenue (Expenses)

GPA BRAZIL – PRO-FORMA

| R$ million, except when indicated | GPA Brazil – Pro-Forma(1) | ||

| 1Q22 | 1Q21 | Δ | |

| Gross Revenue | 4,171 | 4,249 | -1.8% |

| Net Revenue | 3,893 | 3,965 | -1.8% |

| Gross Profit | 1,052 | 1,062 | -0.9% |

| Gross Margin | 27.0% | 26.8% | 20 bps |

| Selling, General, and Administrative Expenses | (759) | (735) | 3.2% |

| % of Net Revenue | 19.5% | 18.5% | 100 bps |

| Equity Income | 8 | 15 | -47.1% |

| Adjusted EBITDA(2) | 321 | 368 | -12.8% |

| Adjusted EBITDA Margin(2) | 8.2% | 9.3% | -110 bps |

(1) GPA Brazil does not include results from other businesses (Stix Fidelidade, Cheftime, and James Delivery)

(2) Earnings before interest, taxes, depreciation, and amortization. Adjusted for Other Operating Revenue (Expenses)

The Gross Profit of GPA Brazil totaled R$1.1 billion in the first quarter and 27.0% margin, 20 bps better when compared to 1Q21, a result that was achieved controlling promotions in a high-inflation scenario.

The Selling, General and Administrative Expenses totaled R$759 million in the quarter. It is worth noting that nominal growth was 3.2%, significantly below the inflation for the period, which was 11.3% (12-month IPCA). This was possible because of the initiatives for controlling costs, mainly, freight, expenses with personnel (productivity

| 30 |

|

improvement) and marketing reduction. In 1Q22 SG&A represented 19.5% of Net Revenue – an increase of 100 bps vs 1Q21.

The Equity Income totaled R$8 million in 1Q22, negatively affected by the increase in the allowance for doubtful accounts in the FIC, due to a macroeconomic environment with higher default levels.

|

As a result of the effects mentioned, GPA Brazil’s Adjusted EBITDA was R$321 million (-12.8% YoY) and Adjusted EBITDA Margin was 8.2%, with a reduction of 110 bps vs. 1Q21. With a greater focus on more profitable formats and our expansion and conversion plan, we expect a dilution of the fixed costs in the first quarters and, as a consequence, an evolution on our profitability margin. |

| 31 |

|

GRUPO ÉXITO

| R$ million, except when indicated | Grupo Éxito | ||

| 1Q22 | 1Q21 | Δ | |

| Gross Revenue | 6,916 | 6,571 | 5.2% |

| Net Revenue | 6,159 | 5,866 | 5.0% |

| Gross Profit | 1,556 | 1,539 | 1.1% |

| Gross Margin | 25.3% | 26.2% | -90 bps |

| Selling, General, and Administrative Expenses | (1,131) | (1,105) | 2.3% |

| % of Net Revenue | 18.4% | 18.8% | -40 bps |

| Equity Income | (24) | 20 | -219.9% |

| Adjusted EBITDA(1) | 430 | 484 | -11.1% |

| Adjusted EBITDA Margin(1) | 7.0% | 8.2% | -120 bps |

(1) Profit before interest, taxes, depreciation, and amortization. Adjusted for Other Operating Revenue (Expenses)

The Gross Profit of Grupo Éxito in 1Q22 totaled R$1.6 billion (+1.1% YoY) with 25.3% margin, a reduction of 90 bps vs. 1Q21 which refers to lower nonrecurrent real estate development and trading fees in 1Q22 vs. 1Q21.

The Selling, General and Administrative Expenses totaled R$1.1 billion in the 1Q22, an increase below the growth in sales, with a dilution of 40 bps to 18.4% of the net revenue.

Equity Income totaled a loss of R$24 million in 1Q22, which reflects the result of the 50% interest held in Puntos Colombia and in Tuya finance (both joint ventures with Bancolombia), due to a higher level of allowance for doubtful accounts.

The Adjusted EBITDA in 1Q22 totaled R$430 million, a reduction of 11.1% compared to 1Q21. The Adjusted EBITDA Margin reduced 120 bps compared to the same period of the previous year, reaching 7.0%, due to the impacts mentioned above.

In the shopping mall operation, the largest operator in Colombia, Viva Malls, reached an EBITDA margin of 35.9% in 1Q21, corresponding to 11.9% of the Consolidated EBITDA in Colombia in local currency. |

|

| 32 |

|

OTHER OPERATING REVENUE (EXPENSES)

In the quarter, Other Revenue (Expenses) reached R$23 million. The result is mainly related to labor contingencies, expenses with restructuring and property and equipment assets.

FINANCIAL RESULT

| FINANCIAL RESULT | Consolidated | ||

| (R$ Million) | 1Q22 | 1Q21 | Δ |

| Financial Revenue | 127 | 40 | 219.3% |

| Financial Expenses | (312) | (129) | 142.4% |

| Cost of Debt | (210) | (62) | 240.0% |

| Cost of Receivables Discount | (12) | (0) | n.d. |

| Other financial expenses | (79) | (66) | 19.6% |

| Net exchange variation | (11) | (1) | n.d. |

| Net Financial Revenue (Expenses) | (186) | (89) | 108.2% |

| % of Net Revenue | -1.8% | -0.9% | -90 bps |

| Interest on lease liabilities | (118) | (116) | 1.8% |

| Net Financial Revenue (Expenses) - Post IFRS 16 | (304) | (205) | 47.9% |

| % of Net Revenue - Post IFRS 16 | -3.0% | -2.1% | -90 bps |

GPA Consolidated's net financial result totaled an expense of R$304 million in the quarter, representing 3.0% of net revenue. Excluding interest on lease liabilities, it reached R$186 million in the quarter, equivalent to 1.8% of net revenue.

The main changes in the financial results in the quarter were:

| · | Financial revenue: the increase to R$127 million in 1Q22 (vs. R$40 million in 1Q21), reflects: |

| ○ | Higher cash profitability due to the increase in interest rates for the period; |

| ○ | R$71 million, related to the adjustment for inflation for Extra Hiper assignment. |

| · | Financial expenses (including the cost of receivables discount): reached R$312 million in 1Q22 vs. R$129 million in 1Q21, due to a higher debt cost, as a consequence of the CDI increase for the period. In the receivable discount item, the amount for 2021 was allocated to discontinued operations, since most was derived from Hypermarket operations. |

NET PROFIT - DISCONTINUED OPERATIONS

As informed on April 4, 2022, we completed the assignment of rights to exploit more than 40 commercial points to Assaí, and adding to the 20 assigned in the 4Q 2021, we ended 1Q22 with 60 assigned points, 86% of total. Hence, the net profit in the quarter from discontinued activities was R$1,510 million, where:

| · | R$3.7 billion revenue from the sale of the 40 goodwill and transfer of 11 real estate properties; |

| · | R$954 million from write-off of assets; |

| · | R$494 million from project expenses, where: |

| o | R$136 million refer to the dismissal of employees; |

| o | R$94 million termination of agreements; |

| o | R$264 million other expenses related to the transaction (transaction-related costs, inventories, write-off of other balance sheet accounts related to stores and decommissioning); |

| · | R$229 million from expenses related to the operating result mainly of assigned stores and stores under conversion; |

| · | R$498 million from income tax expenses. |

| 33 |

|

NET DEBT

| INDEBTEDNESS | Consolidated | |

| (R$ Million) | 03/31/2022 | 03/31/2021 |

| Short-Term Debt | (1,791) | (2,974) |

| Loans and Financing | (706) | (366) |

| Debentures | (1,085) | (2,608) |

| Long-Term Debt | (6,527) | (5,760) |

| Loans and Financing | (3,973) | (4,259) |

| Debentures | (2,554) | (1,501) |

| Total Gross Debt | (8,318) | (8,734) |

| Cash and Financial investments | 3.610 | 3.891 |

| Net Debt | (4,708) | (4,843) |

| Adjusted EBITDA(1) | 2,230 | 2,798 |

| On balance Credit Card Receivables not discounted | 77 | 126 |

| Net Debt incl. Credit Card Receivables not discounted | (4,631) | (4,717) |

| Net Debt incl. Credit Card Receivables not discounted / | -2.1x | -1.7x |

| Adjusted EBITDA(1) | ||

(1) Adjusted EBITDA pre-IFRS 16, accumulated in the last 12 months

Net debt including the balance of unearned receivables reached R$-4.6 billion in consolidated GPA at the end of the quarter, stable regarding 1Q21. GPA maintains a low ratio of Net Debt/Adjusted EBITDA at -2.1x.

In the last 12 months, the group generated an operating cash flow of R$1.7 billion in the scope of continued activities. As to the discontinued scope, Extra Hiper stores and Drugstores, presented a positive variance of R$0.8 billion.

Evolution of the Pro-Forma net debt (R$ million)

| 34 |

|

INVESTMENTS

| (R$ Million) | Consolidated | ||

| 1Q22 | 1Q21 | Δ | |

| New Stores and Land Acquisition | 16 | 13 | 23.1% |

| Store Renovations, Conversions and Maintenance | 118 | 97 | 21.8% |

| IT, Digital and Logistics | 105 | 81 | 29.5% |

| Total Investments GPA Brazil | 239 | 191 | 25.1% |

| Total Investments Grupo Éxito | 87 | 140 | -38.2% |

| Total Investments Consolidated | 326 | 331 | -1.7% |

Capex totaled R$326 million in 1Q22, of which R$239 million in Brazil and R$87 million in Grupo Éxito. In Brazil, our focus remains on adjusting the Pão de Açúcar banner portfolio for our latest G7 model, in addition to continuous IT investments in our digital platform that provides new technologies. In Grupo Éxito, approximately 78% in local currency was allocated to expansion, innovation, omnichannel and digital transformation activities in the period, and the remaining portion to maintenance and support of operational structures, IT and logistics.

| 35 |

|

ESG AT GPA

Agenda with and for society and the environment

GPA BRAZIL

With our sustainability strategy and GPA’s activity pillars, the following are the highlights for 1Q22:

| · | Social impact and promotion of opportunities: |

We started the year with another group of students benefited by Prosperar, grant program (didactic materials, housing, transportation and food allowances) for young students that pass university entrance exams, but have no socio-economic capacity to bear the university costs. Since it began, Prosperar Program has supported 84 students in public management and business management courses at Fundação Getúlio Vargas (FGV) and Social Sciences and Consumption Sciences at Escola Superior de Propaganda e Marketing (ESPM). Currently, of those assisted by the program, 53% are women and 47% are Black.

| · | Fight against climate change: |

In addition to the initiatives to reduce scope 1 and 2 emissions (the company's own and indirect emissions from electricity purchased by the company), we provide options for our clients to have more sustainable attitudes, such as Pão de Açúcar-Unilever Recycling Stations, a partnership with Unilever since 2001. Currently, 101 stores have Recycling Stations to dispose of recyclable materials such as paper, glass, metal, cooking oil and plastic. In 1Q22, we reached more than 5.5 tons of recyclable materials collected, on average, per station each month. Since the beginning of the Program, more than 129 thousand tons have been collected in partnership with 24 recyclable material collector association and partner companies.

| · | Promotion of diversity and inclusion: |

We continue progressing on gender equity, contributing to speed up development of our female employees, increasing their presence in leadership positions (today 36% of leadership positions are held by women – managing positions and above). In the last 3 years, we have trained more than 700 women in different positions (managers, coordinators, advisors, and analysts) with our women leadership development programs, and, in 2022, we will open 500 places, and will also have a specific class with 70 places for the Development Program totally focused on Black women.

| · | Integrated management and transparency: |