UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

| FORM 6-K |

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

March 28, 2024

Commission File Number 1-14712

ORANGE

(Translation of registrant’s name into English)

111 quai du Président Roosevelt

92130 Issy-les-Moulineaux, France

(Address of principal executive offices)

Indicate by check mark whether the Registrant files or will file

annual reports under cover Form 20-F or Form 40-F

| Form 20-F |

| Form 40- F |

|

Indicate by check mark if the Registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

| Yes |

| No |

|

Indicate by check mark if the Registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

| Yes |

| No |

|

Indicate by check mark whether the Registrant, by furnishing the

information contained in this Form, is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934

| Yes |

| No |

|

2023 Universal Registration Document

1. Presentation of the Group and its activities

1.2 Business model, market and strategy

1.7 Regulation of telecommunication activities

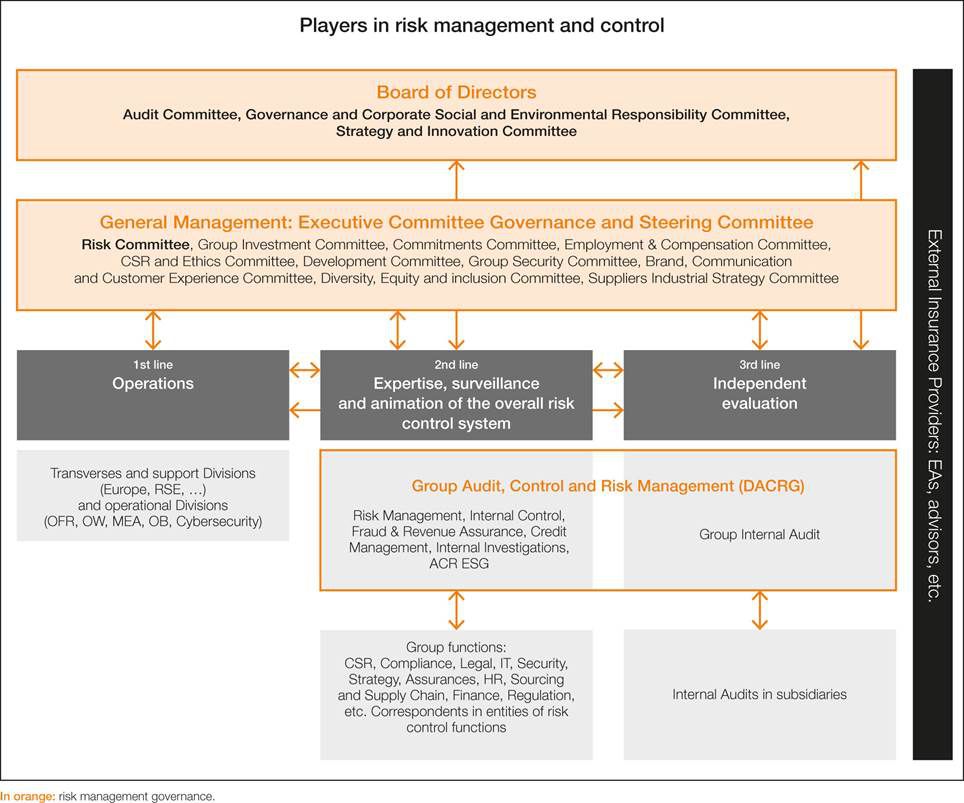

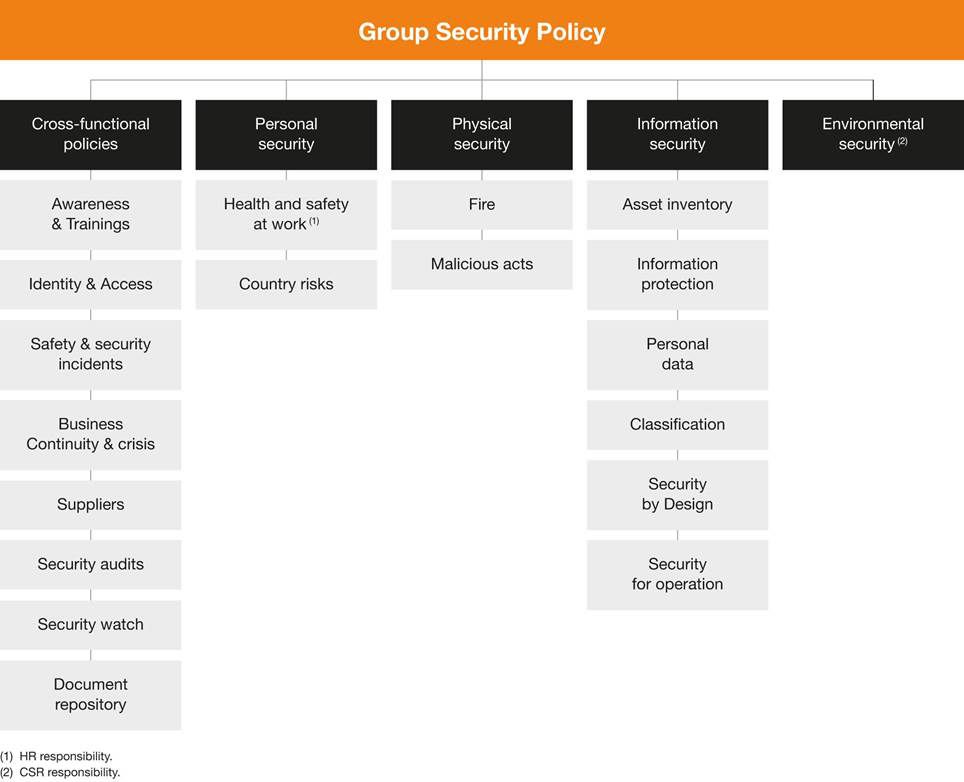

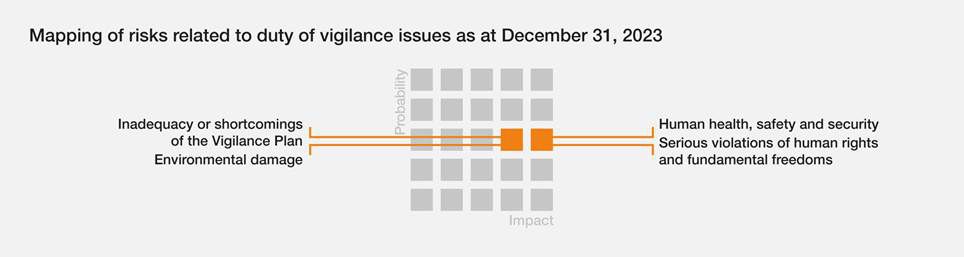

2. Risk factors and business control framework

2.2 Activity and risk management framework

3.1 Review of the Group’s financial position and results

3.3 Consolidated financial statements

3.4 Orange SA Statutory Financial Statements

4. Consolidated sustainability information

4.5 Independent third party report

5.1 Composition of management and supervisory bodies

5.2 Operation of the management and supervisory bodies

5.3 Reference to a Code of Corporate Governance

5.4 Compensation and benefits paid to Directors, Officers and Senior Management

6. Shareholder Base and Shareholders’ Meeting

6.3 Dividend distribution policy

6.4 Statutory information on shares and Shareholders’ Meetings

6.7 Statutory Auditors’ Reports on resolutions and related party agreements

2023 Universal Registration Document

including the Annual Financial Report

I hereby certify, that the information in this Universal Registration Document is, to the best of my knowledge, in accordance with the facts and makes no omission likely to affect its import.

I certify, to the best of my knowledge, that the financial statements have been prepared in accordance with applicable accounting standards and give a fair view of the assets, liabilities, financial position, and profit or loss of the Company and all the undertakings included in the consolidation, and that the Management Report, whose cross-reference table indicating its content is included in Section 7.3 of this Universal Registration Document, presents a fair review of the development and performance of the business and financial position of the Company and all undertakings included in the consolidation, and describes the main risks and uncertainties to which they are exposed.

Issy-les-Moulineaux, March 28, 2024

Chief Executive Officer

Christel Heydemann

|

The Universal Registration Document was filed on March 28, 2024, with the AMF as the competent authority under Regulation (EU) 2017-1129, without prior approval in accordance with Article 9 of said regulation. The Universal Registration Document can be used for the purpose of offering financial securities to the public or admitting financial securities for trading on a regulated market, if it is supplemented by an offering circular relating to the securities and, where applicable, a summary and all amendments made to the Universal Registration Document. The document thus supplemented is approved by the AMF in accordance with Regulation (EU) No. 2017-1129. |

This is a free translation into English of a report issued in French and it is provided solely for the convenience of English-speaking users. This report should be read in conjunction with and construed in accordance with French law and professional standards applicable in France.

Reports included in the Universal Registration Document

This Universal Registration Document includes:

− the Annual Financial Report, prepared pursuant to Article L. 451-1-2 of the French Monetary and Financial Code;

− the Management Report of the Board of Directors to the Shareholders’ Meeting, prepared pursuant to Articles L. 225-100 et seq. of the French Commercial Code;

− the Corporate Governance Report of the Board of Directors, prepared pursuant to Article L. 225-37 of the French Commercial Code.

Cross-reference tables between the information legally required in these reports and the content of this document are provided in Section 7.3 Cross-reference tables.

Information incorporated by reference

Pursuant to Article 19 of Regulation (EU) 2017-1129, the following information is incorporated by reference in this Universal Registration Document:

− the Consolidated Financial Statements, the annual financial statements and the corresponding audit reports, the analysis of the Group’s financial position and earnings as well as other information on the Company’s financial statements are provided on pages 89 to 302 of Registration Document D. 23-0180;

− the Consolidated Financial Statements, the annual financial statements and the corresponding audit reports, the analysis of the Group’s financial position and earnings as well as other information on the Company’s financial statements are provided on pages 82 to 294 of Registration Document D. 22-0222.

The references to websites contained in this document are provided for reference purposes only; the information contained on these websites is not incorporated by reference in this document.

Forward-looking statements

This document contains forward-looking statements, including in Sections 1.2 Business model, market and strategy, 1.4 Operating activities, 3.1 Review of the Group’s financial position and results (in particular in Sections 3.1.1 Overview) and 3.2.2 Financial objectives.

Although Orange believes these statements are based on reasonable assumptions, these forward-looking statements are subject to numerous risks and uncertainties and there can be no assurance that the anticipated events will occur or that the objectives set out will actually be achieved.

The important factors that could cause Orange’s actual results to differ materially from the objectives set out are described in Section 2.1 Risk factors. Other than required by law (in particular pursuant to Article 223-1 et seq. of the AMF General Regulations), Orange does not undertake any obligation to update forward-looking statements.

Documents available

Copies of the Universal Registration Document are available from Orange at its registered office.

This document, as well as Registration Documents No D. 22-0222 and D. 23-0180, some of whose information is incorporated by reference in this document, are also available on Orange’s website www.orange.com, under the heading Finance/Regulated information and on the AMF website: www.AMF-france.org.

Pursuant to Delegated Regulation (EU) No. 2019/815 of December 17, 2018, Orange’s Universal Registration Document is published in the European Single Electronic Format (xHTML). The Consolidated Financial Statements and their notes are subject to tags using the XBRL markup language specified in the annex to the regulation. This Universal Registration Document is a reproduction, translated in english, of the official version of the Universal Registration Document established in ESEF format in french, filed with the AMF on March 28, 2024 and available on the AMF website www.AMF-france.org. This reproduction is available on Orange’s website www.orange.com (https://www.orange.com/en/finance/investors/regulated-information).

All documents made available to shareholders under legal conditions can be viewed at Orange’s registered office, 111, quai du Président Roosevelt, 92130 Issy-les-Moulineaux, France.

In addition, Orange’s Bylaws are available on www.orange.com, under the heading Group/Documentation links to Governance.

Orange’s Consolidated Financial Statements for the last three fiscal years are also available on the www.orange.com website under the Finance/Results (www.orange.com/resultats-consolides) heading and at www.info-financiere.fr.

In this document, unless otherwise indicated, the terms the "Company" and "Orange SA" refer to Orange, société anonyme (French public limited company), and the terms "Orange," the "Group" and the "Orange Group" refer to the Company together with its consolidated subsidiaries.

1. Presentation of the Group and its activities

1.1.1 Group’s main footprint and key figures

1.1.2 Organizational structure

1.2 Business model, market and strategy

1.2.2 Key changes in the telecom services market

1.2.3 The Orange group strategy

1.4.6 International Carriers & Shared Services

1.4.7 Mobile Financial Services

1.5.2 National transmission and IP transport and control networks

1.5.4 Network Integration Factory

1.6.2 Intellectual Property and Licensing

1.7 Regulation of telecommunication activities

1.7.5 Other EU countries where the Orange group operates

1.7.6 Other non-EU countries where the Orange group operates

This chapter contains forward-looking statements about Orange, particularly in Sections 1.2 Business model, market and strategy and 1.4 Operating activities. These forward-looking statements are subject to numerous risks and uncertainties that could cause actual results to differ materially from the results anticipated in the forward-looking statements. The most significant risks are detailed in Section 2.1 Risk factors.

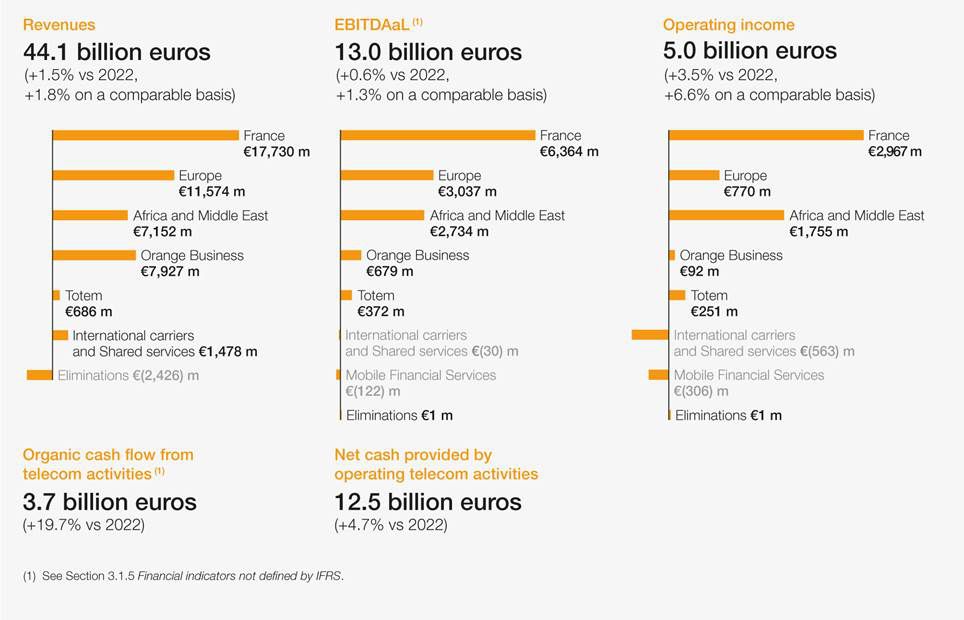

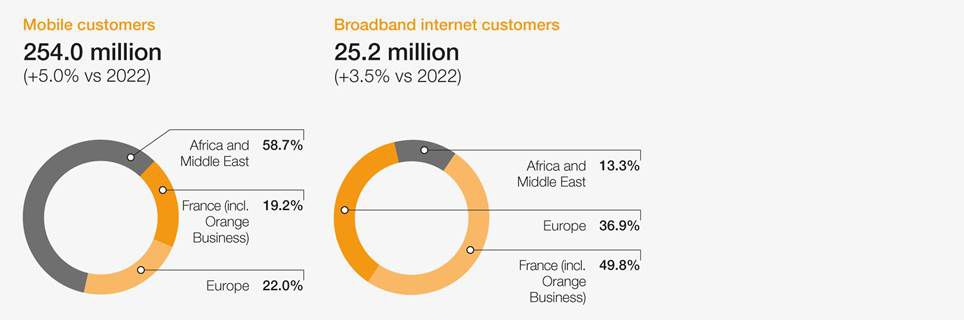

1.1 Overview

Orange is one of the world’s leading telecommunications operators with revenue of 44.1 billion euros in 2023 and 137,000 employees worldwide at December 31, 2023, including 73,000 in France. The Group has a total customer base of 298 million customers worldwide at December 31, 2023, including 254 million mobile customers and 25 million fixed broadband customers. The Group is present in 26 countries. Orange is also a leading provider of global IT and telecommunication services to multinational companies, under the brand Orange Business. In February 2023, the Group presented its strategic plan Lead the future, built on a new company model and guided by responsibility and efficiency. Lead the future capitalizes on network excellence to reinforce Orange’s leadership in service quality.

Orange SA has been listed since 1997 on Euronext Paris (symbol: ORA) and on the New York Stock Exchange (symbol: ORAN).

Orange’s purpose is to be the trusted partner that gives everyone the keys to a responsible digital world.

1.1.1 Group’s main footprint and key figures

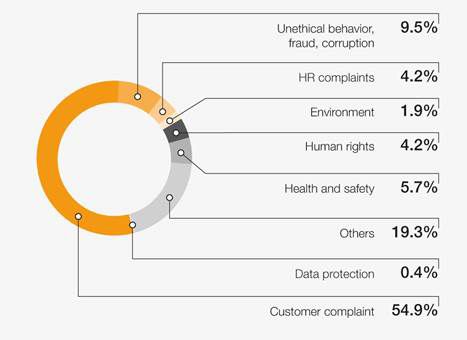

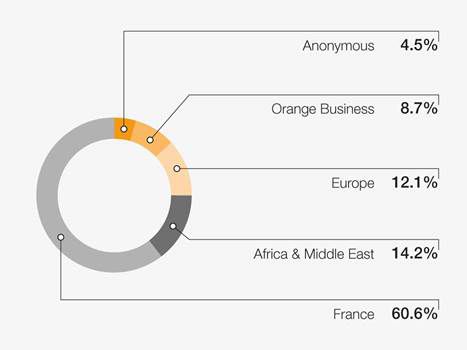

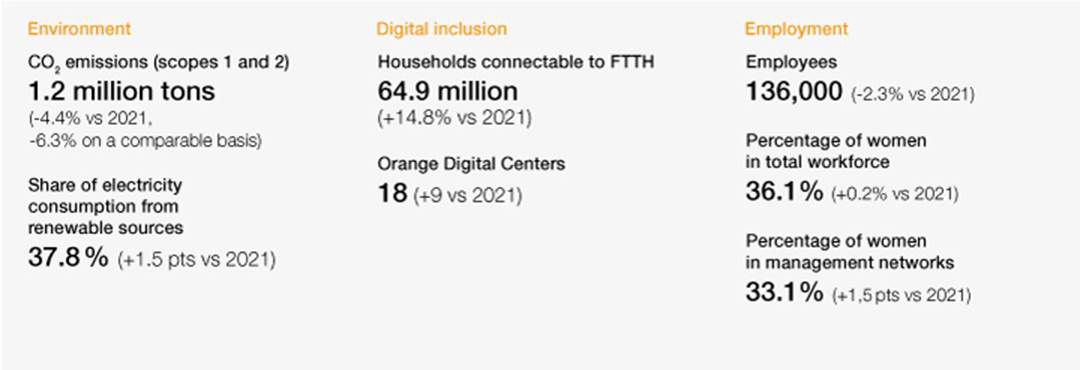

Financial performance

Clients

Non-Financial performance

1.1.2 Organizational structure

Orange SA is the parent company of the Orange group and also carries the bulk of the Group’s activities in France.

The list of the main consolidated entities of the Orange group at December 31, 2023 is provided in Note 20 to the Consolidated Financial Statements (Section 3.3).

The Group’s organizational structure is reflected in the composition of the Executive Committee (see Section 5.1.3).

| Geographical divisions - Orange France - Orange Europe (excluding France) - Orange Africa and Middle East (MEA) | Cross-cutting divisions - Orange Business - Orange Cyberdefense - Orange Wholesale (1) - Content - Mobile Financial Services | Cross-cutting functions - Communication - Corporate Social Responsibility - Finance, Performance and Development - General Secretariat - Human Resources - Strategy - Technology and Innovation |

(1) Created from April, 2023; brings together the Wholesale & International Networks and the Totem divisions.

1.1.3 History

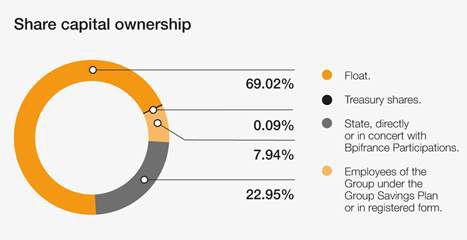

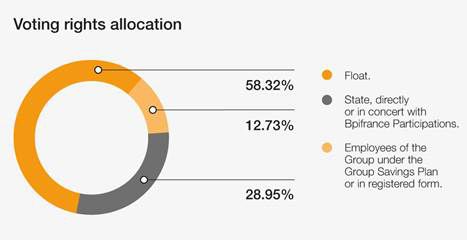

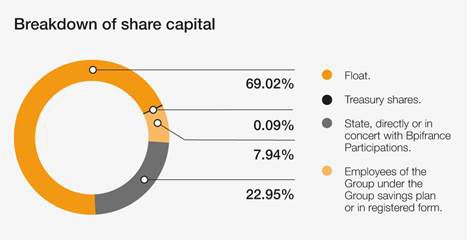

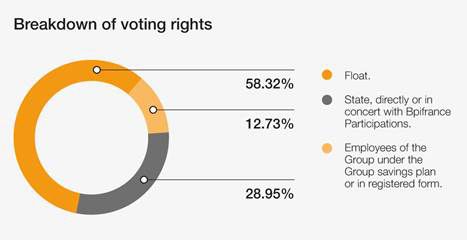

Orange is France’s incumbent telecommunications operator. The Group has its origins in the Ministry for Mail, Telegraphs and Telephone. It was renamed France Telecom in 1991 and became a société anonyme (limited company) on December 31, 1996. In October 1997, France Telecom shares were listed on the Paris and New York stock exchanges, allowing the French government the disposal of 25% of its shares to the public and Group employees. Subsequently, the public sector gradually reduced its holding to 53%. Between 2004 and 2008 the public sector sold a further 26% of the capital, and then again 4% in 2014 and 2015. On December 31, 2023, the French State retained 22.95% of the share capital, held either directly or jointly with Bpifrance Participations.

France Telecom’s area of activity and its regulatory and competitive environment have undergone significant changes since the 1990s. In a context of increased deregulation and competition, the Group has, over that period, undertaken several strategic investments, in particular the acquisition of the mobile operator Orange Plc and its brand created in 1994, and the acquisition of a controlling stake in Poland’s incumbent operator, Telekomunikacja Polska.

Since 2005, the Group has expanded strategically in Spain by acquiring the mobile operator Amena, then in 2015 the fixed-line operator Jazztel.

The Group is pursuing a policy of selective, value-creating acquisitions by concentrating on the markets in which it is already present. In the emerging markets of Africa and the Middle East where the Group is historically present (in particular Cameroon, Côte d’Ivoire, Guinea, Jordan, Mali and Senegal), this strategy was implemented through the acquisition of Mobinil in Egypt (2010) and of Méditel in Morocco (2015) and more recently by the acquisition of a number of African operators (in Liberia, Burkina Faso, Sierra Leone and the Democratic Republic of the Congo) (2016).

It also resulted in the joint venture with Deutsche Telekom that combined UK activities under the EE brand (2010) followed by the disposal of EE in 2016, as well as the disposal of Orange Switzerland (2012), Orange Dominicana (2014), Orange Armenia (2015) and Telkom Kenya (2016).

In Europe where Orange implements a convergence strategy, this policy resulted in the takeover of Telekom Romania Communications,in the strengthening of the majority shareholding in Orange Belgium (2021), in the takeover of the Belgian operator VOO (2023) and in the merger agreement signed on March 21, 2024 with the Romanian State defining the terms of the merger by absorption of Orange Romania Communications by Orange Romania, the Romanian State keeping a stake in the combined entity. In 2022, Orange and MásMóvil signed an agreement to consolidate their activities in Spain (excluding Totem Spain and MásMóvil Portugal) which was completed on March 26, 2024, after authorisation from the European Commission on February 20, 2024 and agreement of the Spanish Government on the control of foreign investments on March12, 2024. This merger, which combines the activities of Orange Espagne and MásMóvil, takes the form of a 50/50 joint venture jointly controlled by Orange and MásMóvil’s shareholders with equal governance rights in the combined entity, and results in its equity method (see section 3.2 Recent events and note 3.2 to the consolidated accounts).

As part of its corporate services and since the acquisition of Equant in 2000, Orange has been pursuing its strategy of becoming a global player in digital transformation and has accelerated its shift to services through a number of targeted acquisitions, notably in the fields of Cloud services and cybersecurity, such as those of Business & Decision and Basefarm (2018) and SecureLink and SecureData (2019), Expertime (2023), a service company specializing in Microsoft technologies, and the launch of Bleu, a future "Trusted Cloud" platform in a 50/50 joint venture with Capgemini and in partnership with Microsoft (2023-2024). In 2023, Enovacom, a health subsidiary of Orange Business and French leader in medical data interoperability, acquired NEHS Digital and Xperis, two French companies specializing in the development of solutions for healthcare professionals. (see Sections 1.3 Significant events and 3.1.1.3 Significant Events).

Orange aims to optimize, develop and enhance the value of its fixed and mobile infrastructure while retaining control of its strategic assets. In 2021, to support its development in fiber, the Group partnered with long-term investors to create two FiberCos in Europe. It also launched Totem, its European TowerCo, to pool its mobile towers in order to enhance their value and optimize their management.

In 2006, Orange became the Group’s main brand for Internet, television and mobile telephony services in the majority of countries where it operated. In 2013, the Company adopted the Orange name, offering the full range of its telephony services in France under the Orange brand. This policy continued with the gradual adoption of the Orange brand by most of the Group’s subsidiaries in Europe and Africa. Corporate services in the world are offered primarily under the Orange Business brand.

In February 2023, the Group presented its strategic plan Lead the future (see Section 1.2 Business model, market and strategy). In line with this plan that refocuses Orange on its core business, the Group announced at the end of June 2023 the opening of exclusive negotiations with BNP Paribas in order to define a referral partnership for the Orange Bank customer portfolio in France, develop financing solutions for mobile devices and discuss the terms of a takeover of Orange Bank’s business in Spain. At the end of these negotiation, Orange announced, at the end of February 2024, that it had selected BNP Paribas to offer a banking continuity solution for its customers (subject to eligibility conditions) in France and Spain. Orange and BNP Paribas signed a number of agreements in February 2024 in relation to this partnership, which is part of Orange’s wider intention to progressively withdraw Orange Bank from the retail banking market in France and Spain. In January 2024, the Group sold all of OCS and Orange Studio’s titles to the Canal+ Group (see Section 3.1.1.3 Significant Events).

1.2 Business model, market and strategy

1.2.1 Business model

1.2.1.1 "Integrated" business model

Orange, France’s incumbent telecoms operator, is a leading digital company globally. Guided by its purpose and its Lead the Future strategic plan, its business model integrates environmental, social and societal challenges to create sustainable value for all its stakeholders.

Rolling out and operating reliable, useful and resilient networks

For Orange, creating sustainable value means first and foremost making essential digital services accessible to as many people as possible. To achieve this, the Group rolls out and operates fixed and mobile networks for consumers in Europe and in Africa & Middle East, and for businesses, its networks are among the most extensive in the world. Orange invests in new technologies to ensure that all these networks are increasingly more efficient, secure and resilient. Lastly, the Group contributes to European and African digital sovereignty through its Data centers, and through its stake in 450,000 kilometers of submarine cables. Guided by its Net Zero Carbon 2040 target, Orange has been using artificial intelligence to optimize network maintenance and has stepped up the decommissioning of older infrastructure. The Group encourages the decarbonization of its value chain, promoting the circular economy and ecodesign for customer, network and IT equipment, and applies sustainability criteria in the selection of suppliers in its calls for tender. It implements measures combining energy efficiency, renewable energies and carbon sequestration. Committed to digital inclusion, it takes action to maximize geographical coverage and is rolling out 5G in a targeted manner Satellite technology allows its customers in remote areas to benefit from a very high-speed broadband connection. In Europe, Orange is the leader in the fiber optical roll-out and its two FiberCos support the development of fiber in rural areas. Its Totem subsidiary is now one of Europe’s leading TowerCos.

Marketing innovative and secure digital services

For Orange, creating sustainable value also means guaranteeing services and a trusted customer experience in the 26 countries in Europe and Africa & Middle East where the Group is present. To market offers that include accessible and inclusive services, Orange relies on the power of its brand, the network of its distribution channels, and its digital channels. Thanks to its experience as an infrastructure operator and the roll-out of very high-speed broadband, Orange meets the connectivity and innovative mobile service needs of its 298 million B2C, business and operator customers. It allows 34.1 million active Orange Money customers in Africa & Middle East to easily complete financial transactions.

To help businesses boost their financial performance and reduce their own environmental footprint, Orange offers innovative solutions (Cloud, trust Cloud (Cloud de confiance), artificial intelligence, data analysis, Internet of Things, Security Operations Centers (SOC), etc.) tailored to their sector. With 2,800 experts and 32 cyber threat detection centers, Orange Cyberdefense has emerged as a leading European provider of cybersecurity services.

Lastly, to contribute to the development of digital services and new ethical and responsible technologies, Orange experts and researchers work with an ecosystem of partners, companies, start-ups, and public and private laboratories in France and abroad, to build the networks of the future and guarantee its customers - both B2C and B2B - access to the tools and services of tomorrow with complete confidence.

1.2.1.2 Value creation model

For Orange, creating sustainable value means taking action with the aim of sharing this value with all its stakeholders. To this end, the Group develops its activities as a fixed and mobile infrastructure operator, and markets connectivity, financial, IT and cybersecurity services.

To encourage the personal and professional development of its employees, Orange anticipates career changes, ensures the development of skills, and implements a policy of talent management, diversity and equal opportunities.

To offer its customers better connectivity and to put digital technology at the service of businesses and regions, Orange upgrades its networks and supports the development of digital skills.

For its shareholders, the Group works to strengthen the company’s profitability and improve its financial value. It has adopted a sustainable financing charter to issue financing instruments indexed to sustainable performance targets (Orange Sustainability Financing Framework).

To help protect the environment, the Group supplements its Net Zero Carbon commitments by taking into account the impact of its activities on resources and biodiversity.

To promote respect for ethics and human rights and responsible purchasing, Orange applies exacting criteria throughout its value chain, and works closely with its ecosystem within the JAC [1].

To help build a society of trust, Orange leads initiatives to raise awareness of responsible digital use, to ensure that digital tools are used in a healthy, reasonable and secure manner. And to promote digital inclusion, the Group offers free training programs, in addition to supporting digital entrepreneurship.

| Assets |

| Value created |

| People 137,000 employees 97% of employees completed at least one training program 36.2% women in the workforce |

| People 85% of employees say they are proud to work at Orange 7.94% of shareholder base made up of employees and former employees 34.1% of women in management networks |

| Industrial assets Fiber: 71.7 m households connectable to FTTH worldwide, including 48.9 m rolled out by Orange in Europe and 4.1 m in Africa and the Middle East 4G coverage reaching an average of nearly 99% of the population in Orange’s 8 operating countries in Europe and 17 operating countries in Africa and the Middle East 5G available in 7 countries in Europe and 2 countries in Africa and the Middle East 450,000 km of submarine cables owned or co-owned |

| Industrial assets No.1 for mobile network quality in France for the 13th year running (Arcep) European leadership in fiber with 14.3 m customers and in convergence with 11.9 m customers 1.2 m fiber customers in Africa and the Middle East |

| Commercial assets 4,900 stores worldwide 32 cyber threat detection centers worldwide USD 18.4 bn: Orange’s brand value in 2023 (Brand Finance ranking) |

| Commercial assets 298 m individual customers, businesses, and operators 34.1 m active Orange Money customers 60% of Orange countries leaders or at parity in NPS (Net Promoter Score) |

| Intellectual assets €613 m dedicated to Research & Development 7 research chairs funded as part of Orange Innovation 59 start-ups in the Orange Ventures portfolio |

| Intellectual assets No.1 European telecom operator in intellectual property with over 10,500 patents, including more than 200 new patented inventions in 2023 Awarded the GEEIS-AI label for inclusive artificial intelligence |

| Financial assets €35.1 bn in equity 2.05x: controlled debt ratio €6.8 bn in eCAPEX |

| Financial assets €13.0 bn in EBITDAaL, 6,7%: ROCE (4) of telecom activities €3.7 bn in organic cash flow from telecom activities €2.9 bn in free cash flow all-in from telecom activities €0.85: net result per share (EPS (5)), €0.72: dividend per share (6) |

| Environmental assets A 2025 decarbonization trajectory based on the Science Based Targets initiative (SBTi) and a commitment to net zero carbon by 2040 30 of our 50 largest suppliers in terms of expenditure committed (1) to SBTi 20% of our total supplier score in IT&N (2) purchase decisions are based on CSR criteria |

| Environmental assets 37.4% reduction in CO2 emissions between 2015 and 2023 (scopes 1 & 2) (7) 25.4%: collection rate for used mobiles vs sold by Europe 2.9% of mobile devices sold by Europe are reconditioned (8) Nearly 1% of IT&N (2) equipment purchases made up of refurbished products |

| Social and societal assets Member of the JAC (3), to assess, develop, and control the implementation of CSR principles among suppliers 22 Orange Digital Centers 22 countries offering affordable features phones |

| Social and societal assets 890 corrective action plans carried out after CSR audits conducted under the JAC (3) 1.8 m beneficiaries of our free digital training programs since 2021 250,000 households equipped with individual solar kits in 12 countries |

Data as at 31 December 2023.

(1) Representing around 60% of total Group spending in scope 3 purchase categories.

(2) IT & Networks.

(3) Joint Alliance for CSR.

(4) Return on capital employed.

(5) Earnings per share.

(6) Subject to approval at the Shareholders Annual General Meeting (payable in 2024).

(7) On a comparable basis.

(8) Eight Orange countries in Europe.

1.2.1.3 Value sharing from telecom activities

1.2.1.4 Description of Orange’s value chain

In order to carry out its operations, Orange takes part in a set of activities that form its value chain, relying on two fundamental pillars of its integrated business model.

The first is the roll-out and maintenance of networks, with several stages being essential to the strength of the Group’s infrastructure:

− obtaining licenses from the regulatory authorities in each country: in particular, the operation of mobile networks involves participating in spectrum allocation procedures, which may be accompanied by specific obligations such as geographical coverage. Orange must report to the public authorities about these obligations throughout the period of validity of these authorizations and licenses. Then, depending on geographical location and market, Orange either operates its own fixed and mobile infrastructure, or uses the networks of third-party operators under the technical, financial and regulatory conditions that apply locally;

− the roll-out and maintenance of physical infrastructure networks, such as antennas, cables and switches, to guarantee extensive coverage and the best quality of service to meet customer expectations; the equipment required for these roll-outs, as well as the purchase of the devices needed to provide the service, are largely sourced from very large, globalized suppliers that are common to the various operators. Orange relies on its own workforce, employed in each of the countries where it operates, as well as entire workforce of companies acting locally on its behalf;

− the roll-out of software infrastructure via IT platforms that allow for proactive, real-time management of our networks, facilitating the control of physical infrastructure, customer service and data collection. Orange relies on its own solutions as well as those of international players, in compliance with the interoperability rules and standards developed by the international institutions to which Orange contributes.

The second pillar of our value chain focuses on marketing digital services. This stage is fundamental to maintaining our position as a major telecommunications player, and includes several key elements:

− product development: Orange must constantly innovate by developing new products and services to meet its customers’ needs. These offers can include mobile, fixed, Internet, television and Cloud services. Orange has its own research and development resources and favors an Open Innovation approach. Its experts and researchers work with an ecosystem of partners, companies, start-ups, and public and private laboratories in France and abroad;

− the sale and distribution of Orange services and Orange or partner equipment; Orange caters to all customers, with specific offers to meet the needs of businesses through a dedicated entity with a global scope of activity (Orange Business). For B2C, small business and professional customers, Orange has its own distribution channels, both physical (stores, technical sales specialists, etc.) and digital (call centers, website, apps), in every country where it operates. It also relies on indirect distribution channels ranging from large groups to independent retailers;

− after-sales service: after-sales service completes this value chain, resolving technical issues and providing continuity of service; after-sales service relies partially on Orange’s own resources and partially on a network of external service providers or subcontractors, whether global or local.

Recovery and end-of-life of products: Orange’s commitment to sustainability is reflected in its involvement in the recovery and recycling of products at end of life, thus helping to reduce the environmental impact of its activities. Product recovery relies on the Orange network, as well as partnerships with associations specializing in the social and solidarity economy. The recycling of customer equipment (mobile phones, set-top boxes, etc.) takes place through partnerships with specialized companies.

1.2.2 Key changes in the telecom services market

The telecoms services market as a whole is characterized by the following major trends. Specific market trends in the business segments are described in Section 1.4 Operating activities, while regulatory trends in national markets are described in Section 1.7 Regulation of telecommunication activities.

As the need for connectivity and digital services continues to grow worldwide, operators must transform themselves amidst a turbulent geopolitical, economic and regulatory environment marked by instability in conflict zones in Europe and Africa & Middle East, demographic variations and migration particularly affecting Africa & Middle East, climate disasters, the general economic slowdown due to the energy crisis and material shortages, inflation, intensifying competition between telecommunication operators and also with new non-telecommunication competitors, cyber threats, and changes in European regulations seeking to regulate markets in the face of security, sovereignty and sustainability issues.

Growth in usage and new customer expectations

The increased capacity of existing networks and the multiplicity of screens available (computers, smartphones, tablets, connected TVs, augmented reality glasses and headsets) are driving growth in usage. The development of 5G technology has prompted the emergence of new uses for businesses (optimization of production time, remote machine operation, predictive maintenance, etc.), and for B2C customers (connected devices, immersive videos, Web 3.0, Cloud gaming, etc.). Immersive technologies (metaverse), Web 3.0, and generative AI create the opportunity for new customer experiences. The rise in Internet traffic is driven by the increased digitization of essential services: education, health, finance, leisure, etc. The need for connectivity has become vital for individuals and businesses alike (teleworking, e-commerce, digitization of services, apps, etc.), with demand for digital services and content growing both in Europe and in Africa & Middle East, where the population is very young ("digital natives"). For businesses, better connectivity and services mean greater productivity and competitiveness. The need for coverage and continuity in the customer experience, as well as secure, on-demand connectivity (based on the number of users and their usage patterns), is growing. The digital transformation of companies exposes them to new cyber threats. Cybersecurity has become a need for individuals, businesses, and governments alike. More than ever, customers count on networks being reliable and resilient and on the protection of their personal data, highlighting the importance of a relationship of trust with their operator. To reduce inequalities in digital access, customers expect offers that are accessible to the most disadvantaged, as well as support for first-time users.

Network development

To face the increasingly steady growth of uses, operators must continue to invest in tomorrow’s very high-speed broadband (fiber, 5G, satellite), to increase their capacity and make them more efficient. This is made possible by the virtualization of network functions and automation, the emergence of "as a service" connectivity solutions that can be controlled and configured on demand, and the use of data and AI. As organizations are stepping up their digital transformation, app and data integration solutions are becoming critical elements for AI applications and roll-outs. Telecommunication operators are transforming their networks through an open platform approach and by integrating AI into their model. Digital technology is a growing challenge of sovereignty, leading economic players to implement sovereign telecommunication solutions through key technologies: Cloud & Edge, cybersecurity, satellite constellations (broadband connectivity solution resilient to climate and security disasters), AI. The growing digitization, complexity and interdependence of information systems are increasing the risk of cyber attacks, which are increasing in scale and intensity. Damage to property (following storms, floods, heat waves, cable theft, etc.) is multiplying, requiring immediate action to restore connectivity. Operators need to invest in the reliability of their networks and the resilience of their business processes in order to ensure business continuity. Storing a growing volume of data requires investment in Cloud infrastructure and datacenters.

In Europe, network investments are focused on very high-speed broadband access, with the development of fiber (supplemented by a satellite offer for remote areas), improved performance of 4G mobile networks and the roll-out of 5G. In Africa & Middle East, Internet access networks are developing primarily through the roll-out of 4G and 5G mobile networks, as well as fiber in targeted areas of large cities.

Transformation of the telecoms industry

Regulatory constraints (imposed rates, complex mergers, consolidation remedies) and competition (low cost, price wars) are still very intense in Europe. Competition is intensifying between telecommunication operators, as well as with disruptive new entrants like GAFAM [2] and other digital stakeholders (Starlink, start-ups and fintechs like Wave in Africa). More than 50% of network capacity in Europe is used by GAFAM1, which raises the question of fair value sharing. Smartphone manufacturers and digital service providers are challenging the operators’ ability to differentiate themselves. Over-The-Top (OTT) service providers are focusing on voice substitution in business to business (B2B) and in international wholesale. The major digital market players are also speeding up the development of their proprietary infrastructure by building new datacenters and international networks that they are promoting in the B2B and wholesale markets. At the same time, Chinese network and smartphone providers are increasingly being bypassed due to security and sovereignty risks.

Against this backdrop, the transformation of the telecoms industry is gathering pace.

For telecommunication operators, AI makes networks smarter and therefore more efficient. The emergence of generative AI represents a real revolution, as it can change professional practices by improving operational efficiency and the customer experience.

In terms of recruitment, there is high demand for multi-skilled and more software-development than physical-infrastructure-management oriented employees. To build team loyalty and to develop the digital skills required for the new technological revolution, operators are investing in employee training and seeking to increase their attractiveness.

Rising energy prices has put pressure on costs, while inflation has complicated the economic equation. To face the challenges of profitability, operators are seeking to raise rates, under both regulatory and competitive constraints. They have to decommission 2G, 3G and copper networks, and are seeking to pool and share their networks; some are even transferring all or part of their infrastructure to financial funds or infrastructure companies (TowerCos). "Coopetition" initiatives are on the rise, with alliances between telecommunications companies (APIs, Telco Cloud) and a growing number of RAN sharing projects (passive/active infrastructure). These have led to transformation and consolidation plans, particularly in Europe.

Working toward responsible digital technology

To reconcile growth in usage with the challenges of sustainability, operators have a role to play in guiding consumers toward more sustainable practices and transforming their ecosystems. They need to double down on their efforts to reach their Net Zero Carbon targets, limit the use of scarce resources, think strategically about access to critical materials (due to their limited availability and geopolitical risks), and preserve biodiversity. Levers for reducing greenhouse gas emissions include the use of energy-saving solutions, renewable energies and the development of the circular economy. The regulatory environment is becoming tougher, sustainable finance is shaping strategic guidelines, and CSR criteria are playing an increasingly important role in the choice of a supplier or product.

The digital sector also has a unique ability to help reduce CO2 emissions. Thanks to their network infrastructure and service platforms, operators are particularly well positioned to create solutions dedicated to better resource management (energy, rare metals, etc.) for businesses and governments. They also have a role to play from a social and societal standpoint: they have to make networks and practices accessible to everyone (people living in rural areas, people with disabilities, senior citizens, etc.), but also support their various audiences in adopting new technologies, developing trust by ensuring data protection and preventing social risks (harassment, dependency, etc.) that become more intense with innovations.

Changes in digital technology regulations

Against this backdrop of profound change, European regulations are evolving to support the digital transformation (see Section 1.7 Regulation of telecommunication activities).

The Digital Services Act (DSA) update to the e-Commerce Directive amends the obligations of intermediaries connecting consumers with goods, services and content to prevent illegal and harmful activities online, as well as the spread of misinformation. The DSA only provides for limited changes for electronic communications operators.

The Digital Market Act of September 14, 2022, applicable gradually from May 2, 2023, provides a framework for the economic activity of major digital platforms in the European Union, and should help establish fair relations between platforms and businesses. Telecommunication operators are outside the scope of the regulation.

The European Network and Information Security 2 (NIS 2) Directive, published in the Official Journal of the European Union in December 2022, succeeds the 2016 Directive by expanding it scope both in terms of sectors and entities covered, and by reinforcing sanctions. It also establishes CyCLONe, a network bringing together the French information systems security agency (Agence Nationale de Sécurité des Systèmes d’Information - ANSSI) and its European counterparts for coordinated responses in the event of a crisis. Member States must transpose these provisions into national law by October 2024.

The draft European Gigabit Infrastructure Act, which aims to improve the effectiveness of Directive 2014/61/EU to facilitate the roll-out of very high-speed broadband networks by reducing the associated costs and simplifying the administrative framework, was submitted in December 2023 and agreed upon on February 6, 2024. The provisional agreement, which has not yet been published, must still be submitted to the Council of the European Union and the European Parliament for formal adoption.

The Recommendation on Gigabit Connectivity was published on February 6, 2024. It updates two recommendations from 2010 and 2013, which dealt with the remedies that could be imposed on SMP operators (those with significant market power) during market analyses, particularly in the context of the transition from copper to fiber.

Lastly, on December 9, 2023, the Council of the European Union and the European Parliament reached a provisional agreement on AI legislation that harmonizes the rules on AI systems, ensuring that they are safe and respect the fundamental rights and values of the European Union. Once the final text of the law has been formally adopted by the Council of the European Union and the European Parliament, the AI legislation will come into force gradually until 3 years after its publication. In order to facilitate the transition to the new regulatory framework, the European Commission has launched the AI Pact, an initiative that aims to support implementation and invites AI developers to comply in advance with the main obligations of the AI legislation.

1.2.3 The Orange group strategy

Launched in February 2023, the strategic plan Lead the Future aims to generate value from the Group’s recognized excellence in its core business and to grow sustainably in Europe, Africa and the Middle East. Orange also intends to re-position its Enterprise activities in next generation connectivity solutions and accelerate in cybersecurity.

This plan was designed to project Orange into the future and capitalize on its unique strengths in the telecoms sector. The quality of its core assets combined with a solid financial position allow it to address the many structural and economic challenges facing the industry. The explosion of digital uses is accompanied by ever-increasing customer demands, notably in terms of resilience, making the telecoms sector essential for years to come.

Lead the Future aims to respond to these challenges and focus Orange on its core business. This ambitious and pragmatic plan aims to build on the Group’s strengths to create value. Orange, a pioneer in fiber, continues to deploy, innovate and invest in the best technologies to respond to its customers’ needs for reliability, security and resilience. In addition, Orange consolidates its strong position in cybersecurity and re-positions its B2B activities to better meet the expectations of its customers. Finally, this plan is expected to allow the Group to strengthen its position in Africa and the Middle East, a region of high growth.

Lead the Future is built on four pillars:

1. Capitalizing on Orange’s core business to reinforce excellence and quality of service;

2. Capitalizing on infrastructure in all the countries where the Group is active;

3. Transforming Orange Business to accelerate growth in the Enterprise segment and strengthen Orange’s position in cybersecurity;

4. Continuing to grow in Africa and the Middle East.

Accompanying the 2025 plan is a new company model.

Capitalizing on the core business to reinforce excellence and quality of service

Standing out for the quality of networks and service

The quality of Orange’s networks and the excellence of its customer service in Europe are widely recognized, as evidenced by the net promoter score (NPS). The power of the Orange brand, ranked the second most-valued telecoms brand in Europe in 2023, has thus been strengthened. As the leader in fiber optic deployment in Europe with nearly 48 million Fiber to the Home (FTTH) connections deployed by the Group by the end of 2023, Orange now has considerable technology assets. The excellence of the network, following significant investments, is expected to enable the Group to strengthen its leadership in terms of customer experience. Orange will continue to develop digital channels to seek to treat 70% of customer support requests in Europe by 2025 (compared with around 50% in 2022 and 66% in 2023).

Using Data and AI to offer customers a customized experience

Orange intends to develop its use of Data and AI to offer customers a customized and seamless experience across its digital and physical channels. The Group thus aims to continue to increase the share of digital technology in sales and in customer support. By leveraging AI, it intends to improve its ability to predict customer expectations, focusing on services that are secure (through network-integrated cybersecurity), transparent (offering customized, modular, seamless connectivity on-the-go) and "green" with, for example, repaired and refurbished devices.

Capitalizing on roll-out progress and leadership in networks

In addition to fiber, 5G and "4G Home" which are already widely available, Orange enhanced its satellite offer in 2023 by launching, in partnership with Eutelsat, a commercial offer in mainland France (see Section 1.5.1 Access networks).

In Spain, the combination with MásMóvil endows the created entity with the financial capacity and scale necessary to continue to invest and contribute to the development of competition through infrastructure, for the benefit of consumers and businesses.

Through this leadership in networks, customer satisfaction and enriched offers, Orange intends to improve average revenue per offer (ARPO) despite difficult macroeconomic conditions and intense competition.

The exceptional customer experience guided by the quality of its networks and of its digital interactions with customers has allowed the Group to implement its value-oriented strategy (a recent example of which is the targeted price increase) and convergence based on fiber and 5G networks. The consolidation of fixed and mobile services in Romania, Belgium and Spain will allow the Group’s convergent customer base, which reached 11.9 million at end-2023. Orange has set itself the target of becoming the leader - or on par - in customer satisfaction (NPS) in two-thirds (66%) of its geographical regions by 2025. In 2023, 60% of the branded Orange countries were NPS leaders or on par.

Lastly, with its sights firmly set on the usages of tomorrow, Lead the Future has capitalized on the expertise of researchers and other employees dedicated to innovation to build new services and applications such as Edge computing, virtualization of network operations, on-demand enterprise networks, the Wi-Fi of the future for the home, and services using generative AI.

Capitalizing on infrastructure in all the countries where the Group is active

Continuing the extension of very high-speed fixed and mobile broadband and increasing the value of Totem

The Group intends to continue to invest in the development of fixed and mobile networks within a responsible financial framework. To do so, Orange will continue to engage in strategic partnerships (radio access network (RAN) sharing and joint entities) to share financial costs and secure investments.

Across the fixed-line network, Orange continues to deploy, operate, and market fiber connections; by 2025, it plans to deploy five million additional fiber connections compared to 2022 in Europe, where peak investment has already been reached, and 2 million connections in Africa & Middle East. Across the mobile network, Orange has increased the value generated from its passive infrastructure by aiming to achieve, in 2026, a third-party operator hosting rate of 1.5 for pylons owned by Totem, the Group’s European TowerCo. Totem, a wholly owned Orange subsidiary, has all the strengths needed to be a key player in European consolidation.

The Group continues to modernize its fixed and mobile networks moving to very high-speed broadband with the decommissioning of the copper network in France and 2G and 3G networks in all its European countries by 2030. In Africa & Middle East, the Group’s entities own a portfolio of nearly 30,000 towers over which they have long-term control, and which represent significant potential for value enhancement in the coming years. Orange continues to roll out fixed and mobile networks (4G and 5G), to enable solid growth in its results and to support the African continent’s economic and social development.

Rolling out Network Integration Factories

Orange intends to enhance the value of its infrastructures through technology and strengthen the use of data and AI to put in place a new industrial model for the management of its network: more effective, more resilient, and higher performing. Group-wide Network Integration Factories will also accelerate the automation and virtualization of network operations. They will also make it possible to offer new on-demand network services operating in "Network-as-a-Service" mode (available via app programming interfaces), thus creating new business opportunities. Lastly, they will increase the resilience and security of networks thanks to considerably faster operations of network restoration, security updates or anomaly detection. This transformation is already contributing to optimizing capital and operating expenditure and reducing network electricity consumption by up to 20% (AI-assisted equipment standby, use of solar power at sites). (See Section 1.5.4 Network Integration Factory).

Transforming Orange Business to accelerate growth in the Enterprise segment and strengthen Orange’s position in cybersecurity

Positioning Orange Business as the leader for next generation connectivity solutions

The Internet, the Cloud and collaborative software have all revolutionized companies’ digital usage, for example through the shift away from fixed line telephony and private networks. These developments call into question the traditional B2B Telco operator model. With Lead the Future, Orange is profoundly transforming its model to adapt to the new realities of a market where the boundaries between networks and digital services are disappearing. Orange will therefore capitalize on its unique mastery of connectivity, security and resilience challenges.

Orange Business will position itself as the leader for next generation connectivity solutions. This ambition is rooted in its globally recognized expertise in secure and trusted connectivity solutions which provide the foundation for companies’ digital transformation. It will also rest on a re-focusing of the range of services it offers, the evolution of its company model and a far-reaching program of cost optimization. A large-scale employee training program supports this transformation.

This ambitious and demanding transformation plan is expected to enable Orange Business to return to growth in profitability (EBITDAaL) by 2025 at the latest.

Continuing the growth of Orange Cyberdefense to open up to new markets (B2C/micro-businesses)

In the cybersecurity sector, where the market is growing strongly, Orange has set itself the objective of becoming a European leader and is targeting revenues of 1.3 billion euros by 2025. Driven by the growing needs of both individuals and large businesses, the market is expected to experience double-digit growth over the coming years and the Group has already demonstrated its ability to outperform the market. With revenues of 1.1 billion euros at end-2023, an increase of 12.9% on a historical basis or 10.9% on a comparable basis, Orange Cyberdefense intends to continue with its organic growth and its strategy of targeted acquisitions, accelerate its push into the professional/ small- and medium-sized enterprise (SME) segment, and enter new markets such as business to consumer (B2C).

Continuing to grow in Africa and the Middle East

Maintaining growth in the Africa & Middle East region

The Africa and Middle East region has been a growth driver for the Group for many years and remains at the heart of its strategy. There is significant potential in this region, linked to strong demographics, the adoption of the Internet and increasing usage, the capture of which is made possible by the roll-out of networks and infrastructure. As the telecoms operator serving one in ten Africans, Orange intends to continue to invest in the deployment of its networks to further strengthen its position as a digital partner of reference in Africa and the Middle East. The Group has set the ambition of achieving average annual revenue growth above 7% between 2022 and 2025 as well as a significant increase in profitability over the same period.

Accelerating the transformation of Orange Money

On these solid foundations, the Group plans to accelerate the provision of services in the financial field (Orange Money, Orange Bank), content, energy, e-agriculture, health and B2B. Orange is thus accelerating the transformation of Orange Money toward a digital platform model that will offer other services in addition to transfers and payments. This will be offered to all consumers, whether or not they are Orange customers, across all the countries in which the Group is present. Following the success of its My Orange and Orange Money apps, Orange has launched its super-app Max it, which combines the telecommunications, financial services and e-commerce worlds, seeking to facilitate the everyday needs of its users. Developed by Orange teams in Africa for African customers, this new app was launched in 2023 in five countries. Since the end of 2022, Orange Money’s revenues has returned to growth, driven by the increase in its customer base to more than 34 million active users and by the volume of transactions made using Orange Money’s platforms, which exceeded 130 billion euros in value during the year.

Strengthening the Group’s foothold

Orange’s resilience in Africa & Middle East, fostered by the diversity of the countries in which it operates, its local ties and local management, demonstrates the Group’s ability to operate in complex geographical regions and deal with geopolitical and macroeconomic issues. A local partner in Africa and the Middle East through a dedicated subsidiary, Orange will continue to invest in infrastructure and work to promote digital inclusion across the African continent. In line with its digital inclusion policy - from the provision of offers at attractive prices to digital training - the Group will strengthen its local ties and its position as a multi-service operator, in particular by continuing to roll out its "Orange Digital Centers" and expanding Max it to the twelve other countries where Orange is present in Africa & Middle East.

A new company model guided by responsibility and efficiency

The Group’s environment is undergoing profound changes and Orange is therefore facing major challenges in terms of transformation. To overcome these challenges, Lead the Future will put in place a new company model guided by an ambitious policy of social and environmental responsibility.

Social and environmental responsibility

Environmental and social issues profoundly change the way Orange manages its activities. Its achievements are already recognized by high ESG scores. Orange now aims to transform itself and develop a more efficient and resilient company model. This sustainable transformation is underpinned by three major areas of commitment: Environment, Trust and Digital Inclusion.

In terms of the environment, the Group faces multiple challenges: climate emergencies as well as structural changes, such as access to natural resources, legislation and regulations, and society’s expectations. The long-term objective of being Net Zero Carbon in 2040 remains unchanged. The Group’s main source of energy consumption comes from networks and information system (85% of the Group’s energy consumption and 80% of its CO2 emissions across scopes 1 and 2 in 2023). In 2023, the Green ITN program saved nearly 1,150 GWh of electricity and 99 million liters of fuel. At a time when the fight against global warming is a major concern for everyone, the Group intends to be a driving force in the environmental transition and has continued its program to reduce CO2 emissions. At end-2023, Orange had already achieved its target (initially set for 2025) of reducing its scopes 1 and 2 carbon emissions by 30% compared with 2015, thanks to an increased share of renewable energies in its energy mix (notably through Power Purchase Agreements (PPAs) and efforts to use solar power at its sites). The next steps toward achieving the Group’s goal of being Net Zero Carbon in 2040 are to reduce scope 3 emissions by 14% in 2025 (compared to 2018), and to reduce emissions from all three scopes by 45% in 2030 (compared to 2020). Orange will also step up the roll-out of its European mobile device recycling program to reach 30% by 2025. The Group is also putting the eco-design of its products and services at the center of its decisions with the aim of reducing their environmental footprint from start to finish and promoting a circular economy in its processes and with its partners.

The Group’s second area of commitment is to work toward building a society of trust, to aim to become the leader in cybersecurity in Europe and a key player in digital trust. To achieve this, the Group intends to develop Orange Cyberdefense, reaffirm its policy of protecting customers’ personal data, promote the ethical use of AI and data (Code of Ethics, Positive AI initiative in France), raise awareness of responsible digital technology, and fight against cyberbullying. The Group has set itself the target of offering cybersecurity services in every country in which it operates in 2030.

Lastly, convinced that digital technology is a powerful tool for inclusion, the Group has made it its third area of commitment. Its promise of digital inclusion and empowerment focuses on three areas: access to networks and services; accessibility of offers; and the development of digital skills. It has set itself the target of reaching 2.5 million beneficiaries of free digital training programs between 2021 and 2025, and 6 million cumulatively by 2030.

Governance and social and environmental responsibility, which are at the heart of all the Group’s processes, are driven by the commitment of the Group’s management team, part of whose compensation is linked to non-financial performance indicators. Orange is also continuing to align its financing policy with its environmental, social and governance commitments by introducing sustainable financing indexed to environmental and/or social performance indicators.

A new company model

The success of Lead the Future is also linked to the development of the Group’s company model: simpler, faster, more efficient. People, organizational agility and the simplification of processes are at the heart of this transformation. The objective is to improve operational efficiency at Group level and accentuate its industrial approach geared towards excellence.

In a world of disruptive technologies, the Group is investing in training and has proactive skills management based on anticipating needs. The Group facilitates employee development toward new roles in data, Cloud Computing, cybersecurity and AI.

Lastly, the Group continues to closely manage its costs. Orange has set itself the target of saving an additional 600 million euros by 2025, on a cost base of around 12 billion euros after the integration of VOO in Belgium. Cost savings of 300 million euros by 2023 demonstrate that the Group is on track to meet its target in 2025.

Having reached a peak, Orange is aiming to reduce investments (eCAPEX) from 18% of revenues to around 15% from 2023 and for the duration of the plan. This reduction is particularly centered on France and Europe, where most of the investments in fiber have already been made. All the same, Orange will continue to invest to further strengthen its network leadership.

Within the framework of Lead the Future, the Group has set its financial ambitions for 2025. These ambitions are based on clear objectives for return on investment and long-term value creation, with a view to ROCE growth of 100 to 150 basis points by 2025 compared to end-2022, with an increase of 80 basis points in 2023. Orange intends to rigorously manage its asset portfolio, pursue its carefully considered strategy in respect of acquisitions and partnerships, and maintain self-discipline in terms of managing its debt and its balance sheet.

2025 financial objectives

Excluding ongoing or future acquisitions, the Group’s 2025 objectives include:

− low single digit growth in EBITDAaL (CAGR 2022-2025);

− discipline in eCAPEX;

− continued growth of organic cash flow from telecom activities to reach 4 billion euros in 2025;

− a ratio of net debt to EBITDAaL unchanged at 2x in the medium term;

− an increase in the ROCE in 2025 versus 2022.

In line with the solid growth in its organic cash flow, the Group expects to increase its dividend to 72 cents in respect of the 2023 fiscal year (payable in 2024), and to reach 75 cents in respect of the 2024 fiscal year (payable in 2025). This remains subject to the approval of the Shareholder Meeting.

For fiscal year 2025, in addition to the objectives presented at the Capital Markets Day, Orange has set a dividend floor of 0.75 euros per share.

The deconsolidation of Spain does not change the objectives of slight growth in EBITDAaL and discipline in eCAPEX. Organic cash flow, excluding Orange Espagne, will continue to grow by more than 300 million euros between 2023 [3] and 2025, reaching 3.3 billion euros in 2024 and 3.5 billion euros in 2025.

1.3 Significant events

Significant financial events, in particular changes in the asset portfolio, are presented in Chapter 3 Financial performance, in Sections 3.1.1.3 Significant events and 3.2 Recent events.

Governance

On March 24, 2023, Céline Fornaro was appointed by ministerial decree as a member of the Orange Board of Directors to represent the French government, replacing Stéphanie Besnier.

On May 23, 2023, the Orange Shareholders’ Meeting approved the appointment of two new directors: Momar Nguer, replacing Jean-Michel Severino, and Gilles Grapinet, replacing Bernard Ramanantsoa (see Section 5.1.1 Board of Directors).

In February 2023, Orange presented Lead the future, its new strategic plan which aims to generate value from the recognized excellence of its core business and to grow sustainably in Europe, Africa and the Middle East. Orange also confirms the repositioning of its Enterprise activities in next generation connectivity solutions and the acceleration in cybersecurity. Accompanying the plan is an ambitious new company model placing, at its heart, social and environmental responsibility and operational excellence. (see Section 1.2.3 The Orange group strategy).

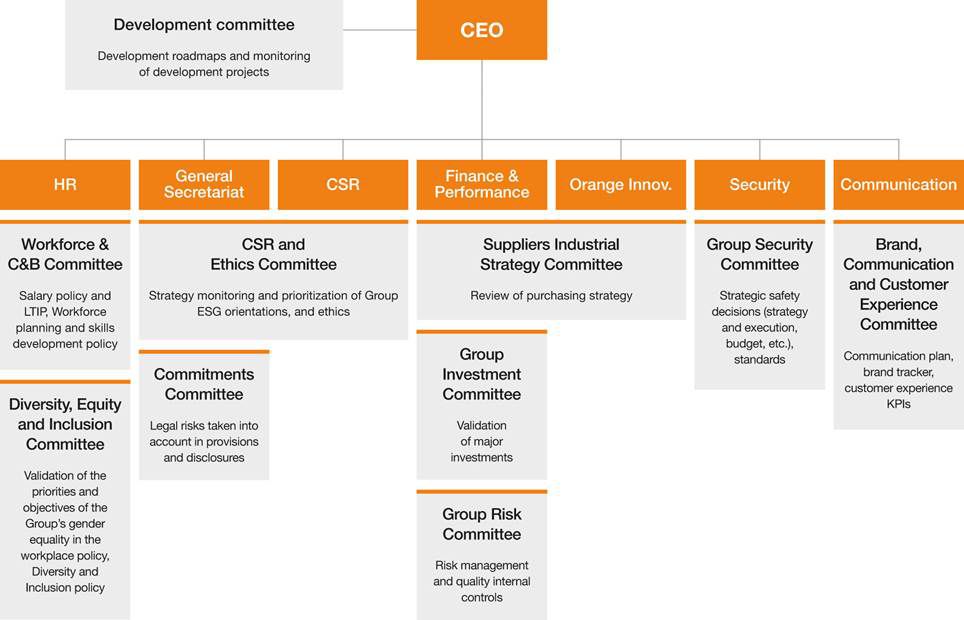

To accelerate the Group’s transformation and development, Christel Heydemann has made changes to part of her management team (see Section 5.1.3 Executive Committee). And as part of the implementation of the "New Company Model" project, which is the core of the Lead the Future strategy, the Group’s committee structure was reviewed with an eye to simplification and streamlining. The Group’s governance is now supported by 11 key committees. (See Section 5.2.2.3 Executive Committee and Group governance committees).

Capitalizing on the core business

Fixed-access networks

Partnership with Networth for the "All Fibre" offer

In March 2023 and in partnership with Networth, Orange Wholesale France (OWF) - the Orange entity dedicated to the telecommunication operator market in France - launched a complete voice over internet protocol (VoIP) telephony and fiber Internet connectivity offering called All Fibre. This offer is a turnkey solution for operators without a network or service platform operating in the professionals and very small businesses markets. It offers extensive national coverage and is simple, convenient, time-saving and cost-effective for telecommunication operators.

Launch of the new Livebox 7

In October 2023, Orange launched the XGS-PON-compatible Livebox 7, allowing all members of the same household to enjoy the best Orange Wi-Fi experience (gaming, video chat, ultra high-definition TV, etc.). Thanks to Wi-Fi 6E, several devices can be connected simultaneously on one of the three spectrum bands available, for an ultra-high-performance connection with improved latency. Livebox 7 is part of the eco-design approach recognized by Bureau Veritas’s "Footprint Progress" certification, a first for an Orange box in France. Bureau Veritas an internationally recognized certification body, focusing on the product’s life cycle. Livebox 7 is designed to be easily repairable, with a 100% recycled and recyclable shell, and offers a standby mode option to reduce energy consumption.

Widespread roll-out of fiber optic by 2025

In France, the roll-out of the FTTH network continued at a steady pace, and Orange consolidated its leadership with a total of 37.4 million households connectable to Orange fiber optic and 8.2 million customers at end-2023.

Orange and the French government announced on November 7, 2023 that they had reached a tentative new agreement on the widespread deployment of fiber optic by 2025. In the AMII (Appel à Manifestation d’Intention d’Investissement - call for expression of investment interest) zone, this new roll-out commitment will replace the 2022 milestone of the L. 33-13 commitments (i.e. the second milestone of the commitments made in 2018). This proposal is based on the following elements:

− by 2025, 1,120,000 premises in the entire AMII zone will be made connectable (which would represent 98.5% of connectable premises, including cases of blockage/refusal);

− by 2024, 140,000 premises within the perimeter of 55 inter-municipality cooperation zones with the lowest FTTH coverage.

Although this agreement is based on new commitments, it extends the deadline for Orange to meet its commitments. The agreement has been submitted to Arcep and the French government has accepted the commitments taken in Orange’s proposal by decision dated March 14, 2024.

In addition, a government order incorporating the terms of Orange’s commitment could be published following an advisory opinion from Arcep (Autorité de Régulation des Communications Electroniques, des Postes et de la Distribution de la Presse - the French Electronic Communications, Postal and Print Media Distribution Regulatory Authority), and may entail additional obligations.

The roll-out of FTTH networks is also continuing in Europe (excluding France), where Orange had more than 30.2 million households connected at end-2023 (including 16.8 million in Spain and 8.0 million in Poland) and 6.0 million customers (including 3.6 million in Spain and 1.3 million in Poland).

In Africa & Middle East, at end-2023, the Group had connected 4.1 million homes to FTTH in Morocco, Jordan, Côte d’Ivoire, Senegal, Mali, Burkina Faso, Egypt, the Democratic Republic of the Congo and Guinea. Orange has stepped up its fiber roll-out and had 1.2 million customers at end-December 2023.

2024 -2028 Framework for the regulation of fixed networks in France

On December 18, 2023 in France, Arcep published the framework for the regulation of fixed networks for the years 2024 to 2028, aimed in particular at defining the framework for unbundling and civil engineering access rates. On this occasion, Orange obtained an increase in its rates.

Mobile-access networks

Orange’s 5G is now marketed in a non-standalone (NSA) version (in other words based on a 5G spectrum but using a 4G core and an additional 4G anchor frequency band) in six countries in Europe (France, Luxembourg, Poland, Romania, Slovakia, Spain). It is initially being rolled out in urban areas where 4G is in high demand, and in areas with high levels of economic activity, as a complement to the other networks. In 2023, Spain and Belgium launched their 5G standalone (SA) network . The other four European countries that have already rolled out 5G NSA will commission 5G SA between 2024 and 2025.

In Africa & Middle East, Orange is pursuing a 4G roll-out strategy and is investing in all countries to upgrade and extend their access networks. The first 5G roll-outs took place in 2022, continued in 2023, and Orange is seeking to accelerate to cover almost the entire region by 2025.

In March 2023, Orange borrowed 500 million euros from the European Investment Bank (EIB) to help finance in France the rollout of its 5G mobile network and the reinforcement of its 4G mobile network capacity in rural areas. This financing is part of the roadmap of Orange’s new strategic plan, which aims, among other things, to capitalize on the Group’s infrastructure in order to consolidate Orange’s leading position in terms of quality of service and networks.

In October 2023, the results of Arcep’s annual survey on the quality of the mobile services of French telecoms operators confirmed for the thirteenth consecutive year that Orange remains the leader in voice, SMS and data, coming in first or tied for first in all 278 performance criteria measured. These results are a testament to the expertise and ongoing commitment of the teams to more efficient and more responsible networks.

Satellites

In March 2023, Orange announced that it had signed a distribution agreement with OneWeb (a low earth orbit satellite communications company) aimed at improving and expanding the Group’s global connectivity, particularly in rural and remote areas of Europe, Latin America and Africa. Thanks to this partnership, Orange will be able to offer telecommunication operators and businesses an enhanced connectivity offer incorporating OneWeb’s LEO (Low Earth Orbit) solution, making it possible to connect, with improved latency, hard-to-reach areas that could not be served until now. Other benefits of this partnership include increased resilience and geographical coverage of B2B and backhaul solutions in these remote areas.

In November 2023, Orange launched its Satellite offer, expanding its range of very high-speed broadband connectivity solutions to include satellite in its technological mix, in addition to fiber, ADSL, 4G Home and 5G Home. This new offer, marketed through Orange distribution channels, is operated by Nordnet, a Group subsidiary that has specialized in satellite Internet for 15 years. It is part of the French government’s Cohésion Numérique des Territoires (Digital Regional Cohesion) program, and meets the government’s objective of guaranteeing very high-speed broadband access for everyone by 2025. It relies on the Eutelsat Konnect VHTS satellite, designed by Thalès Alenia Space and launched in September 2022 by Ariane 5. This offer allows its most remotely located B2C and business customers to benefit from a very high-speed broadband experience (theoretically up to 200 Mbit/s downstream and 15 Mbit/s upstream) for the price of a fiber-optic offer.

In 2023, Orange was selected to participate in the IRIS [4] industrial consortium for the sovereign European satellite constellation project, which will contribute to the objectives of the European Union’s digital policy and Global Gateway strategy. The main objective is to provide European Union member states with guaranteed access to secure, sovereign connectivity services on a global scale, and to offer a commercial infrastructure that allows for seamless broadband connectivity.

Submarine cable

The Group continued to make substantial investments in international connectivity projects. In April 2023, Orange announced the roll-out of a new submarine cable linking Tunisia and France, co-financed by the European Commission as part of the "Connecting Europe Facility" (CEF) mechanism. The 1,050-kilometer cable is due to be commissioned at the end of 2025. Named Via Tunisia, this cable is part of the Medusa submarine cable system in the Mediterranean Sea. The entry into force of the construction contract for Via Tunisia was announced in July 2023.

In addition to the Dunant mega-submarine cable, which was commissioned in January 2021, the Amitié transatlantic submarine cable between New York and Europe, commissioned at the end of 2023, allows Orange to offer a unique, robust, ultra-low-latency transatlantic solution between the two continents. In France, Orange is in charge of operating and maintaining the system’s landing point, and also provides all Amitié cable partners with the terrestrial infrastructure required for its smooth operation, from the limit of French territorial waters to the new Equinix data center in Bordeaux. Orange also offers its wholesale and business customers connectivity from the United States to European hotspots thanks to the density of its European network, either in dark fiber or via its state-of-the-art WDM optical transport network, and in particular the main European hubs: Paris, Frankfurt, Madrid, Amsterdam, and London. The routes between Bordeaux and Marseille have been strengthened, to offer the most direct and efficient solution for connecting Africa & Middle East and Asia directly to the United States. From its design to its construction, the Amitié cable incorporates stringent environmental protection requirements. Lastly, by rolling out the latest optical fiber and transport technologies, the energy cost per megabit transported has been significantly reduced.

In September 2023 in La Seyne-sur-Mer, Orange Marine inaugurated the Sophie Germain, its new cable-laying ship. By investing in the construction of a state-of-the-art ship, Orange Marine is strengthening its position as a major player in submarine cable surveying, laying, repair and maintenance activities worldwide. Submarine cables play a major role in telecommunications, as they enable the transit of 99% of intercontinental telephone communications and data transfers. This investment is a testament to the Group’s determination to play a major role in long-distance network infrastructure, with guaranteed global connectivity as its compass. The ship’s modern, high-performance design and equipment allow it to operate more efficiently at sea and reduce its environmental footprint.

Capitalizing on infrastructure

In February 2023, Orange and Vodafone announced that they would cooperate to build and share an Open Radio Access Network (Open RAN) in rural areas of Europe where both operators have mobile networks. In mid-2023, Orange activated its first 4G (and soon 2G) Open RAN sites via a commercial network pilot in a rural area of Romania, sharing a network with Vodafone. This agreement, which is a first in Europe, demonstrates the two operators’ commitment to rolling out this technology for future mobile networks in Europe and also to supporting the European Commission’s goal of rolling out 5G to all populated areas by 2030. Thanks to this new operating model based on the integration of multi-provider equipment and software, Orange and Vodafone each benefit from greater agility when adding new radio sites or upgrading existing ones, while minimizing costs and energy consumption.

In April 2023, Totem, Orange’s European TowerCo, announced the roll-out of a next-generation 5G network within the Orange Vélodrome stadium in Marseille, to meet the expectations of the public, organizers and media for various sporting events. The four French telecommunication operators have been able to connect their equipment to the antenna infrastructure rolled out by Totem. Next-generation antennas have been developed for these locations with high mobile usage density, offering consistent high-quality network coverage and high energy efficiency.

Orange implemented its technological expertise and capacity for innovation to connect the planet to the Rugby World Cup 2023. Working hard for over two-and-a-half years, Orange teams provided all the connectivity required for the tournament, in particular through a secure very high-speed broadband image transport network (Broadcast Contribution Network), and offered immersive augmented reality experiences thanks to highly realistic 3D modeling. In order to minimize the environmental footprint of the network infrastructure rolled out for the competition, all installations will be reused for other events or left permanently. Precious metals from over 206,000 telephones were recycled to produce the nearly 1,500 recycled medals given to players.