Exhibit 15.1

Excerpt containing the pages and sections of the 2020 Universal Registration Document that are incorporated by reference into the 2020 Annual Report on Form 20-F(1)

(1) The following document contains certain pages and sections of the Orange 2020 Universal Registration Document which are being incorporated by reference into the 2020 Annual Report on Form 20-F of Orange. Where information within a subsection has been deleted, such deletion is indicated with a notation that such information has been redacted.

[REDACTED SECTION: CERTAIN TEXT HAS BEEN REDACTED]

1.1 Overview

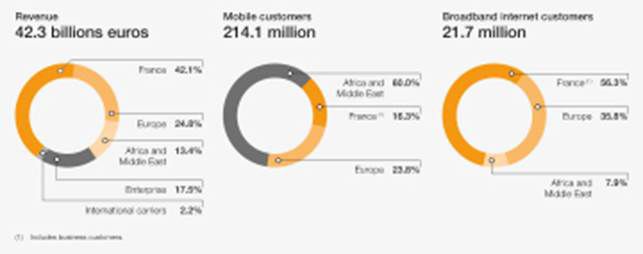

Orange is one of the world’s leading telecommunications operators with revenue of 42.3 billion euros in 2020 and 142,000 employees worldwide at December 31, 2020, including 82,000 in France. The Group has a total customer base of 259 million customers worldwide at December 31, 2020, including 214 million mobile customers and 22 million fixed broadband customers. The Group is present in 26 countries. Orange is also a leading provider of global IT and telecommunication services to multinational companies, under the brand Orange Business Services. In December 2019, the Group presented its new "Engage 2025" strategic plan, which, guided by social and environmental accountability, aims to reinvent its operator model. Whilst accelerating in growth areas and placing data and AI at the heart of its innovation model, the Group will be an attractive and responsible employer, adapted to emerging professions.

Orange SA has been listed since 1997 on Euronext Paris (symbol: ORA) and on the New York Stock Exchange (symbol: ORAN).

1.1.1 Company identification

Company name: Orange

Place and registration number:

Paris Trade and Companies Register (Registre du commerce et des sociétés) 380 129 866 APE (principal activity) code: 6110Z

Legal Entity Identifier (LEI): 969500MCOONR8990S771

Date of incorporation and term:

Orange SA was incorporated as a French société anonyme (a public limited company under French law) on December 31, 1996 for a 99-year term. Barring early liquidation or extension, the Company will expire on December 31, 2095.

Registered office:

78, rue Olivier de Serres, 75015 Paris, France

From May 18, 2021: 111, quai du Président Roosevelt in Issy-les-Moulineaux (92130), subject to ratification of the transfer of the registered office by the Shareholders’ Meeting of May 18, 2021.

Telephone: + 33 (0)1 44 44 22 22

Website: www.orange.com

Legal form and legislation applicable:

Orange is governed by French corporate law subject to specific laws governing the Company, notably Act 90/568 of July 2, 1990 on the organization of public postal services and France Telecom, as amended.

The regulations applicable to Orange as a result of its operations are described in Section 1.7 Regulation of activities.

Purpose: "As a trusted partner, Orange gives everyone the keys to a responsible digital world".

The purpose of Orange, included in Article 2 Corporate scope and Purpose of the By-laws, is part of the Strategic Plan, Engage 2025, which is guided by exemplary social and environmental conduct. See Chapter 4 Non-financial performance, Section Orange’s Purpose.

Corporate scope:

The Company’s corporate scope, in France and abroad, specifically pursuant to the French Postal & Electronic Communications Code, shall be:

− to provide all electronic communication services in internal and international relations;

− to carry out activities related to public service and, in particular, to provide, where applicable, a universal telecommunications service and other mandatory services;

− to establish, develop and operate all electronic communications networks open to the public necessary for providing said services and to interconnect the same with other French and foreign networks open to the public;

− to provide all other services, facilities, handset equipment, electronic communications networks, and to establish and operate all networks distributing audiovisual services, and especially radio, television and multimedia broadcasting services;

− to set up, acquire, rent or manage all real-estate or other assets and businesses, to lease, install and operate all structures, businesses, factories and workshops related to any of the purposes defined above;

− to obtain, acquire, operate or transfer all processes and patents related to any of the purposes defined above;

− to participate directly or indirectly in all transactions that may be related to any of the purposes defined above, through the creation of new companies or enterprises, the contribution, subscription or purchase of securities or corporate rights, acquisitions of interests, mergers, partnerships, or by any other means;

− and more generally, all industrial, commercial and financial transactions, or transactions involving movable or fixed assets, that may be related directly or indirectly, in whole or in part, to any of the aforementioned corporate purposes, or to any similar or related purposes, or to any and all purposes that may enhance or develop the Company’s business.

1.1.2 Group’s main footprint and key figures

1.1.3 Organizational structure

Orange SA is the parent company of the Orange group and also carries the bulk of the Group’s activities in France.

The list of the main consolidated entities of the Orange group at December 31, 2020 is provided in Note 20 to the consolidated financial statements (Section 3.3).

The Group’s organizational structure is reflected in the composition of the Executive Committee (see Section 5.1.3).

|

Geographical divisions • France • Europe • Africa and Middle East |

Cross-cutting divisions • Orange Business Services • Mobile Financial Services • Wholesale and International Networks • Cyberdefense • Orange Content |

Cross-cutting functions • Finance, Performance and Development • Human Resources and Group transformation • Technology and Innovation • General Secretariat • Strategy • Communication, Brand, and Commitment • CSR, Diversity and Solidarity |

1.1.4 History

Orange, formerly France Telecom, is France’s incumbent telecommunications operator. The Group has its origins in the Ministry for Mail, Telegraphs and Telephone, later to become the General Directorate of Telecommunications, which in 1990 was accorded the status of independent public entity and, on January 1, 1991, renamed France Telecom. On December 31, 1996, France Telecom became a société anonyme (limited company). In October 1997, France Telecom shares were listed on the Paris and New York stock exchanges, allowing the French government the disposal of 25% of its shares to the public and Group employees. Subsequently, the public sector gradually reduced its holding to 53%. The law of December 31, 2003 authorized the transfer of the Company to the private sector and between 2004 and 2008 the public sector sold a further 26% of the capital, and then again 4% in 2014 and 2015. On December 31, 2020, the French State retained 22.95% of the share capital, held either directly or jointly with Bpifrance Participations.

France Telecom’s area of activity and its regulatory and competitive environment have undergone significant changes since the 1990s. In a context of increased deregulation and competition, the Group has, over that period, undertaken several strategic investments, in particular the acquisition of the mobile operator Orange Plc and its brand created in 1994, and the acquisition of a controlling stake in Poland’s incumbent operator, Telekomunikacja Polska.

Since 2005, the Group has expanded strategically in Spain by acquiring the mobile operator Amena, then in 2015 the fixed-line operator Jazztel.

Over the last fifteen years, the Group has pursued a policy of selective, value-creating acquisitions by concentrating on the markets in which it is already present. Mainly targeting the emerging markets of Africa and the Middle East where the Group is historically present (in particular Cameroon, Côte d’Ivoire, Guinea, Jordan, Mali and Senegal), this strategy was implemented through the acquisition of Mobinil in Egypt (2010) and of Méditel in Morocco (2015) and more recently by the acquisition of a number of African operators (in Liberia, Burkina Faso, Sierra Leone and the Democratic Republic of the Congo) (2016).

It also resulted in the joint venture with Deutsche Telekom that combined UK activities under the EE brand (2010) followed by the disposal of EE in 2016, as well as the disposal of Orange Suisse (2012), Orange Dominicana (2014), Orange Armenia (2015) and Telkom Kenya (2016).

As part of its corporate services and since the acquisition of Equant in 2000, Orange has been pursuing its strategy of becoming a global player in digital transformation and has accelerated its shift to services through a number of targeted acquisitions, notably in the fields of cyber security and Cloud services, such as those of Business & Decision and Basefarm in 2018 and SecureLink and SecureData in 2019.

Business diversification is one of the major pillars of Orange’s strategy. The acquisition of Groupama Banque, now Orange Bank, in 2016, which launched its new banking offer in November 2017, illustrates the goal of diversifying into the mobile financial services sector.

In 2006, Orange became the Group’s main brand for Internet, television and mobile telephony services in the majority of countries where it operated, most importantly France and Spain. In 2013, the Company adopted the Orange name, offering the full range of its telephony services in France under the Orange brand. This policy continued with the adoption of the Orange brand by Telekomunikacja Polska in 2013, by Mobinil in Egypt, Mobistar in Belgium and Méditel in Morocco in 2016, and by several of the Group’s subsidiaries in Africa in 2017. Corporate services in the world are offered primarily under the brand Orange Business Services.

In December 2019, the Group presented its new strategic plan, Engage 2025, which looks to reinvent its operator model, guided by exemplary social and environmental conduct. For more information on Orange’s strategic plan and its business model, see Section 1.2 Market, strategy and business model.

1.2 Market, strategy and business model

1.2.1 The global digital services market

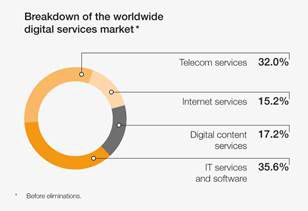

The digital services market is a subsector of the broader Information and Communication Technologies (ICT) sector. It combines IT services and software, telecom services, digital content TV and video services, and Internet services. However, it does not include network equipment or telecommunication devices [1]. The digital services market offers significant sources of value creation through the spread of new services and new uses. It has been a vital component of the economy since the start of the health crisis. Digital technology has become essential to maintaining economic activity and social ties (widespread use of telework during periods of lockdown, maintenance of essential services, entertainment, etc.).

In 2020, the global digital services market amounted to 3,630 billion euros. The Covid-19 pandemic had a significant impact on market trends, leaving it down 0.8% over the year (instead of the 5.4% growth projected in p-Covid forecasts). The impact varied greatly from one sector to another. The IT services market, for instance, experienced a sharp drop of 4.8% (compared with projected growth of 7.2% before the pandemic), whereas the impact was close to zero on revenues from telecom services, which remained more or less flat (+0.6%) at 1,161 billion euros. The numbers were more mixed for Internet services (+4.7%) and content services (+0.7%), where strong pressure on advertising revenues was offset by huge demand for entertainment services and e-commerce [2]. For a presentation of the global business services market, see Section 1.4.5 Enterprise.

Source: IDATE DigiWorld 2021.

Market growth by region [3]

In 2020, North America (excluding Mexico) remained the world’s leading region in the digital services market with 35.1% of global market revenues, ahead of Asia-Pacific, which is catching up at 32.5%, driven by its economic and industrial development. Europe is losing ground, with 23% of the global market, while Africa and the Middle East (4.7%) and Latin America (4.8%) together account for nearly 10%. In Africa and the Middle East, digital market growth is estimated at 2.3% in 2020 (compared with 5.3% in p-Covid-19 estimates).

The impact of the Covid-19 pandemic has varied from one region to another. Europe, and even more so North America, have been badly affected, with differences of 7.3 and 8.2 percentage points respectively between p-Covid forecasts for 2020 and the current IDATE projections, whereas Asia-Pacific lost only 3.3 points between the two measures - probably reflecting an earlier recovery, particularly in China. In Africa and the Middle East, the gap is limited to 3 points - and just under 2 points in the region’s telecom markets only.

With Africa projected to account for 25% of the world’s population in 2050, up from 17% in 2020, the potential of the Africa and Middle East region, where the Orange group has a broad footprint, is huge.

According to the GSMA report, The Mobile Economy, Sub-Saharan Africa 2020, the Covid-19 pandemic has demonstrated the importance of a strong and inclusive digital economy, supported by universal access to a fast and reliable Internet network and a range of digital services, for individuals and businesses alike. And with nearly 800 million people in the region still not connected to the mobile Internet, bridging the digital divide has never been more pressing. The report states that 45% of the population in Sub-Saharan Africa had subscribed to mobile services by the end of 2019. That percentage is expected to reach 50% by 2025. In absolute terms, the number of subscribers is set to reach 500 million in 2021 and the number of mobile connections 1 billion in 2024, with a penetration rate of 50% of the population by 2025. Africa thus remains a region of strong growth in connectivity and digital services [4].

Key social and environmental trends for 2025

At the demographic level, a dramatic increase in the African population is expected in the coming years as large numbers of young people will reach adult age.

With the increase in the number of extreme weather and climatic events, the immediate impacts of climate change have become more tangible. The tech industry, which consumes a great amount of data, is directly concerned: the boom in data could account for nearly 20% of global electricity consumption by 2025 (source: ICT Footprint EU, European Framework Initiative for Energy & Environmental Efficiency in the ICT Sector). However, digital technology is also a tool for the energy transition, because it provides other sectors with innovative solutions to reduce their environmental impact (mobility, industry, agriculture, housing, energy). In the years to 2025, major technological developments (AI, Data, Cloud, 5G, etc.) are poised to transform all business sectors, affecting professions across the board and laying down new skills and expertise challenges to businesses.

Key changes in telecom services

Network development and growth in telecommunication uses worldwide

While Internet access networks are expanding mainly through the rollout of mobile 4G networks in Africa and the Middle East, network investments in Europe are focused on very high-speed broadband access, with the development of fiber in the fixed-line segment, improved performance of 4G mobile networks and commercial launches of 5G. At the same time, operators are constantly upgrading their networks in a bid to make them more agile and easier to manage (through the virtualization of network functions and automation), and to optimize their value through pooling.

Constraints related to the pandemic (lockdown measures, widespread telework, heightened need for cybersecurity) have greatly accelerated the take-up of new uses accessible via a multiplicity of screens (computers, smartphones, tablets, connected TV), thanks to the resilience and increased capacity of existing networks and the penetration of smartphones. Lastly, the development of 5G technology has prompted the emergence of new use cases, both for companies, for which 5G is already a real breakthrough (optimization of production times, remote control of machines, predictive maintenance, etc.), and for the general public (immersive videos, Cloud gaming).

Consumer and company expectations

The health crisis and global lockdown have turned connectivity into a vital need. More than simply providing services for daily life, the Internet is now essential for individuals to work, eat, look after themselves and maintain social ties, and for companies to ensure their survival or growth, by accelerating their digitization (telework, e-commerce, etc.). With the expansion of telework, business customers now see cybersecurity as a vital means of addressing the shifting types of attacks and phishing maneuvers. The need for cybersecurity is now critical for people, companies and governments. Gartner sees the cybersecurity market representing 186 billion US dollars in 2024 (source: Gartner - Forecast: Information Security and Risk Management Worldwide, July 2020).

More than ever, customers expect quality coverage and continuous network reliability everywhere, but also the protection of their personal data based on a relationship of trust with their operator. On top of those expectations, society is increasingly demanding greater transparency from companies, more commitment in respect of major environmental and social issues, and a greater presence in the regions and other areas.

Transformation of the telecom industry

Against this new backdrop, the transformation of the telecom industry has gathered pace. OTT players have continued to gain ground, and are more than ever leveraging the digital services they offer in the B2C and B2B markets. They have become increasingly important, particularly in communication services for companies (telework), e-commerce and entertainment. Moreover, the major digital players are speeding up the development of their own infrastructure by building new Data centers and international networks that they are promoting in the B2B and wholesale markets.

At the same time, European operators need to continue to invest massively in the networks of the future to meet ever-growing demand for connectivity, against the backdrop of intense competition and heightened regulatory requirements. This imposes significant financial constraints on the entire industry, leading operators to make structuring decisions in their choice of telecom infrastructure. To better capitalize on them, operators will have to further pool or share their networks, and even sell part or all of their infrastructure to financial funds and/or infrastructure companies.

1.2.2 The Orange group strategy

The Engage 2025 strategic plan, which combines growth and responsibility, is based on an environmental and social commitment and four ambitions:

1. Reinventing Orange’s operator model;

2. Accelerating in growth areas;

3. Placing data and AI at the heart of the innovation model;

4. Co-creating a future-facing company.

In this plan for 2025, launched in December 2019, Orange has for the first time made the clear and committed choice to place its social responsibility at the heart of its strategic vision. With Engage 2025, the Group aims to play its part in building a more sustainable and inclusive world by focusing its CSR initiatives on two main areas: the fight against global warming and digital exclusion.

A strong commitment guided by social and environmental responsibility

The Group has adopted a business model that is committed and accountable to its employees, its customers and society as a whole. And it is giving itself the resources to finance its environmental and social plans with the completion of an inaugural 500 million euro sustainable bond issue in September 2020 and the announcement that some of the 2.2 billion euros in funding received in December will be used to ramp up a number of projects including the rollout of Orange Digital Centers and the financing of carbon sinks (see Section 1.3 Significant events).

Commitment to inclusion

The Covid-19 pandemic has confirmed the pressing need for this commitment, as the economic crisis is likely to exacerbate inequalities in access to digital technology. In addition to its ambitions for the digital coverage of regional areas, Orange trains and supports the digitally excluded so that everybody can reap the benefits of the digital revolution. The Group has thus opened its first three Orange Digital Centers to promote more inclusive digital uses. Since June 15, 2020, Orange Polska has been holding free webinars on the digital world for the elderly with the Senior Economy Institute in Poland. After gigas solidarios in Spain, and the coup de pouce offer in France, a new offer for low-income households, Tarifa social, was launched in Spain in September. 2020 also saw Orange join forces with Google to launch the Orange Sanza Touch, the most affordable advanced Android 4G smartphone on the market, thereby improving access to the mobile Internet in Africa.

Environmental commitment

In response to the challenge of climate change, the Group has set itself the goal of bringing forward the GSMA objectives by 10 years, reaching Net Zero Carbon by 2040, despite the surge in network data, which has been compounded by the health crisis. To that end, the Group is making unprecedented efforts to improve energy efficiency, increase the use of renewable energies and adopt circular economy principles. In July 2020, Orange signed its first renewable electricity purchase agreement in France with Boralex Europe, the leading independent French producer of onshore wind (see Section 1.3 Significant events). In September, with its "re" program in France, the Group undertook to recycle, return and recondition mobile phones. Lastly, Orange Polska has launched a pilot project to monitor air quality in schools, completed the Warsaw Data Hub, a new data center built to demanding safety standards and equipped with the latest technologies and sustainable solutions, and installed two wind farms near Poznań to supply itself with clean energy. Since 2015, the Group has reduced its CO2 emissions by 12%.

[REDACTED SECTION: CERTAIN TEXT HAS BEEN REDACTED]

Four bold ambitions to tackle a changing ecosystem

Reinventing its operator model by capitalizing on its leading position in networks

Despite the effects of an unprecedented health and economic crisis, Orange has begun rolling out its Engage 2025 strategic plan, demonstrating the robustness of its networks and its resilience in all of its markets. During the crisis, society’s increasing digitization allowed Orange customers to continue to work, play, train, learn and stay in touch, highlighting the value of the Group’s networks. At the end of 2020, Orange’s mobile network was ranked by Arcep as the best in mainland France for the tenth consecutive year, and the best in rural areas in France (see Section 1.3 Significant events).

In 2020, the Group stepped up the rollout of its fixed and mobile broadband networks, benefiting from joint funding of the fiber network in France driven by a health environment making the quality of connectivity more essential than ever. Whether through its own infrastructure or the use of third-party networks, Orange aims to be able to offer its FTTH packages to more than 65 million households in Europe by 2023, thereby entrenching its leadership in fiber in Europe. See Section 1.3 Significant events.

In November, Orange acquired 54% of Telekom Romania Communications, Romania’s second-largest fixed-line operator, a major step towards becoming the leading convergent player in that country (see Section 1.3 Significant events).

Faster digital development for regional communities

The Group continues to improve mobile coverage in France: in 2020, for instance, thousands of kilometers of motorway and 100% of the metro networks in Paris, Toulouse, Rennes and Lyon were covered by 4G. The agreement signed with Eutelsat in July (see Section 1.3 Significant events) also makes it possible to provide very high-speed satellite broadband throughout France, even in the most remote areas. The creation of Orange Concessions in January 2021 (see below) gives the Group the means to continue to expand fiber networks in rural areas by winning new public initiative networks or by taking part in market consolidation. With the aim of holding more than 4.5 million FTTH connections by 2025, Orange Concessions will be the leading operator of fiber networks in rural areas.

At the same time, Orange is constantly improving the quality of connectivity in homes (Homelan) through advances in boxes and WiFi, and helping customers optimize their home network. The Group now offers new services: around the connected home via a partnership in France with Somfy, world leader in the automation of home and building openings and closures, as well as in content. Partnering with Amazon, it launched the Prime Video app on Orange TV in September. Its contribution to the digitization and renewal of TV media was marked by the November 2020 launch with France TV Publicité of the first segmented (or addressed) TV campaigns in France via Orange set-top boxes. A great technological achievement, this allows the personalization of advertising messages in compliance with personal data regulations.

In mobiles, the Group has embraced 5G, which represents a turning point in the history of telecoms. After Romania, the Group launched its 5G offers in Poland, Spain and then France, where it acquired the largest block of spectrum in October 2020 and rolled out its 5G network in Marseille, Toulouse, Nice, Strasbourg and Le Mans in December (160 municipalities by the end of 2020). The technical performance of 5G will allow the emergence of countless use cases. For the general public, the immersive and personalized videos displayed at the French Open in September foreshadow what can be expected at similar events in the future. For companies, 5G is an accelerator of digital transformation, helping optimize production times, facilitating remote machine control and promoting predictive maintenance. In France, the Group is testing the industrial uses of 5G on two factory of the future projects with Schneider Electric (Eure) and Lacroix Group (Maine-et-Loire). On the Orange Industry 4.0 Campus in the port of Antwerp (Belgium), it is testing network slicing (prioritizing certain parts of the network to cover critical uses or specific needs). For more information on 5G, see Section 1.6.1 Research and innovation.

Lastly, the Group is intensifying its investments to develop national and international networks and extract value from them on the wholesale market. In July, Orange Wholesale France was the first wholesale operator in France to offer the eSIM (see Section 1.3 Significant events). In July, the Group also launched the Montblanc Summit 2+ cellular watch, a pioneer in eSIM connectivity with Wear OS by Google.

In Africa, Orange has invested in facilitating access to connectivity for operators and companies by supporting the "One Africa Network" project and building a new secure international backbone linking eight West African countries. Lastly, Orange is the majority investor in more than 40 submarine cables. In February 2020, it joined forces with a Telefónica subsidiary to extend the terrestrial links of Google’s Dunant transatlantic cable; in May, it partnered with international and African players on 2Africa, the innovative submarine cable linking 23 countries in Africa, the Middle East and Europe. It also launched the Urbano Monti, its new vessel dedicated to laying submarine cables. The Group is also helping improve access to quality content delivery services in Africa by providing its CDN content delivery solution (which replaces satellite broadcasting) to Côte Ouest Audiovisuel, a leading content provider in West Africa. See Section 1.3 Significant events.

Monetization of the networks and execution of the infrastructure strategy

To develop its networks while keeping a rein on its investments, Orange is reinventing its business model. Acknowledging the transformation of the telecom industry in Europe, Orange is entrenching its leadership in more open and better valued infrastructure, while retaining control of its strategic assets. For its FTTH infrastructure, Orange continues to invest in its own infrastructure, in order to fulfill its commitments outside of very densely populated areas (especially in France), while working with partners to pursue industrial efforts in certain areas. The Group has thus launched the projects needed to set up FiberCos in rural areas in both France and Poland. In France, the Group took a step forward in the development of its infrastructure in January 2021 by partnering with long-term investors Banque des Territoires (Caisse des dépôts), CNP Assurances and EDF Invest to create Orange Concessions (see above and Section 1.3 Significant events - Optimization, development et valorization of infrastructure).

In addition, co-financing of fiber optic networks in France by other operators is expected to continue in the coming years. It is clearly a means of making investments profitable.

Orange can now seize potential opportunities to develop or consolidate its positions in this market. It anticipates the signing of agreements in the first half of 2021, with a view to creating dedicated structures that will be up and running in both France and Poland in 2021.

To optimize the rollout of its mobile infrastructure, particularly in 5G, in terms of pace, coverage and financial capacity, Orange plans to rely on RAN-sharing agreements, while maintaining areas of differentiation, in keeping with the agreements already existing in Poland and Romania, and those signed in 2019 in Spain and Belgium.

At the same time, to better understand and extract value from the 40,000 towers of its own mobile network in Europe, the Group has launched its European TowerCo plans. In February 2021, Orange took a major step forward in its Engage 2025 strategic plan with the creation of its European TowerCo TOTEM, which will initially operate around 25,500 sites in France and Spain. See section 1.3 Significant events - Optimization, development and valorization of infrastructure.

Accelerating its development in three growth areas: Africa and the Middle East, B2B services and financial services

Making Orange the benchmark digital operator in Africa and the Middle East

Orange has considerably expanded its activities in Africa and the Middle East, where its operations go back more than 20 years: the Africa and Middle East region has more than doubled its contribution to the Group’s revenue in 10 years. In January 2020, Orange set up the new headquarters of its subsidiary Orange Middle East and Africa in Morocco, thereby confirming its commitment to Africa, with the aim of becoming the benchmark digital operator in Africa and the Middle East. The Group’s target for the 2020-2023 period is average annual revenue growth (CAGR) of approximately 5% across the region.

It aims to achieve that target by virtue of growth in mobile data driven by the increase in the smartphone penetration rate and the rollout of 4G. At the end of 2020, the 4G network covered 33 million customers, an increase of 39% over the year, out of a total of 128 million mobile customers. In 2020, Orange will thus have rolled out 4G in almost all countries, using RAN-sharing agreements and innovative technologies (lighter masts for example) to extend its coverage in rural areas. At the same time, the Group is pursuing its multi-service strategy, with the development of content, e-health and energy offers. The aim is for these services to account for 20% of regional revenue by 2025. In September, it launched Orange Campus Africa, the new African e-learning platform. That was followed in November by a partnership with Greenlight Planet, the largest provider of prepaid energy services, to provide customers with clean energy solutions in several African countries.

Financial services in the MEA region

Confirming the Group’s ranking as a major player in mobile money in Africa and the Middle East, Orange Money was rolled out in Jordan (where 70% of the population is unbanked) in January 2020, and then Morocco in March. In May 2020, two new money transfer corridors via Orange Money were opened from France to Burkina Faso and Morocco, after Côte d’Ivoire, Guinea, Madagascar and Mali.

In addition, the Group partnered with NSIA, a leading bank and insurance company in Africa and the Middle East, to launch Orange Bank Africa in Abidjan (Côte d’Ivoire) in July 2020 (see Section 1.3 Significant events). New for Orange in Africa, the banking activity is part of the Group’s multi-service operator strategy, and confirms its determination to facilitate access to financial services and strengthen the financial inclusion of populations in West Africa, offering customers a fully digital credit and savings offer.

In financial services, Orange Money’s goal is to generate approximately 900 million euros in revenue by 2023 and at the same time to continue developing content, e-health and energy offers. The Group plans to achieve average annual revenue growth (CAGR) of around 5% across the region between 2020 and 2023.

Accelerating the development of IT services for B2B customers and scaling up cybersecurity

During the Covid crisis, digital technology in general and Orange’s networks in particular helped ensure the continuity of economic life by supporting initiatives by companies and public authorities. The crisis has also opened up opportunities stemming from the acceleration of the digital transformation of companies, in line with Orange’s B2B strategy of opening up to IT businesses and services. It focuses on four categories of services related to our legacy business as an operator (Cloud services, cybersecurity, digital and data, smart mobility), as well as four priority sectors, namely health, industry, automotive and smart cities. In 2020, IT services accounted for more than 39% of Orange Business Services revenue.

Faced with unprecedented demand since March 2020, Orange is helping VSEs and SMEs with the development of new digital solutions for e-commerce and the digitization of strategic business processes. In October, Orange Business Services merged its activities into a Health division within its Enovacom subsidiary. In November, Orange Business Services signed a strategic global partnership agreement with Amazon Web Services to help companies accelerate their digital transformation and leverage the benefits of the Cloud to adapt more quickly to market developments and user needs. KDDI, a Japanese telecommunication services provider, has chosen Orange Business Services to equip more than 1 million vehicles in 63 countries and regions in Europe with connected device services. Orange Business Services ranked among the leaders in the March 2020 edition of the Gartner Institute’s Magic Quadrant for Global Network Services for its more flexible SD-WAN customer projects, and its smart end-to-end multi-cloud, multi-service and multi-access networks.

Cybersecurity is a fast-growing sector. Its new organization (which includes the acquisitions of SecureLink and Secure Data in 2019) under the Orange Cyberdefense (OCD) brand has seen the Group provide assistance to some 50 French healthcare establishments, which were a prime target of cybercriminals when the health crisis peaked between March and June 2020. It has also supported its business customers in the face of the increase in the number of cyberattacks and phishing maneuvers. The spread of telework has made cybersecurity a core concern for most companies, prompting the shift to a fresh approach. The Group aims to exceed 1 billion euros in revenue and to be the European leader in this area in 2023.

The Group’s target is that more than half of its revenue in the Enterprise segment comes from new connectivity services (SD-WAN, 5G) and IT services in 2023.

Continuing its expansion in financial services across its footprint

The Engage 2025 strategic plan underscores Orange’s determination to accelerate its growth in financial services. The pertinence of its growth path is backed up by the push towards digitization across all sectors on the back of the health crisis.

The Group aims to capitalize on the success of Orange Bank in European countries, and of Orange Money in Africa where demand in countries with limited banking access is very strong. Orange Bank now extends out of France and into Spain, highlighting the strategy of expanding into other European countries. In order to support this phase of development, the Group is looking for a new banking partner to possibly replace Groupama: a partner who shares its ambitions, contributes to the industrial project, and is likely to provide its expertise and possibly its assets.

The Group’s multi-service diversification around payments, credit and insurance is underway. The July 2020 acquisition of Orange Courtage made Orange Bank an insurance broker. With BNP Paribas Cardif, it now offers insurance covering smartphones, tablets and connected devices. In November 2019, Orange Bank partnered with Wirecard to offer a practical mobile payment solution with Google Pay for all Android users in France. To mark its third anniversary, Orange Bank launched an innovative offer for families, featuring new-generation cards for the secure and autonomous management of children’s pocket money. Orange Bank has also gained a foothold in the VSE/SME market with the acquisition of Anytime, a neobank dedicated to the needs of professionals, companies and associations. Lastly, in Romania, Orange Money has launched its currency transfer service to all types of accounts in Romania or internationally.

Orange Bank aims to break even in Europe towards the end of 2023, with nearly 5 million customers and around 400 million euros in net banking income. Orange Bank Africa aims to have nearly 10 million customers by 2023, with NBI of about 100 million euros.

Crossing a new milestone in its digital transformation by placing AI and data at the heart of its innovation model

The Covid crisis has demonstrated Orange’s ability to move very quickly on the digitization of certain processes and to step up the pace of its transformation. By combining digital resources and human interaction, the Group uses new technologies to offer a simple, expert and responsible customer experience. It is based on digital acceleration (chatbots, robotic process automation) combined with the redesign of stores as Smart Stores, essential for customer proximity. Orange aims to increase the share of the digital channel in its day-to-day relationship with its customers, and to reduce the number of contacts with call centers in Europe by 55% by 2023. In December 2020, Orange Polska became the first entity to receive Customer Operations Performance Center (COPC) "Operational Excellence" certification for the improvement of its operational efficiency and quality of service. In May, the Orange Fixbox, which allows our Tunisian customers to benefit from unlimited Internet access at home, was voted 2020 Product of the Year in the "Broadband Internet" category. Building on more streamlined customer journeys and better customer insight, the Group is aiming to have nine out of ten customers recommend Orange in all its countries by 2025. It also hopes to double the number of users of the My Orange app by 2023, bringing the number of users to nearly 50 million.

In 2020, research and innovation activities were reorganized on three pillars: guaranteeing the quality and availability of networks and services, shedding light on developments in the digital world and the Group’s vision, and creating value by prioritizing innovation choices as close as possible to its markets. Orange has accordingly revisited the development strategy for Djingo, its voice interface, by stopping the marketing of the speaker in an overly crowded market. At the same time, the Group plans to use the embedded voice recognition technology to develop new services in the world of the connected home. In July 2020, Orange and Google Cloud announced a strategic co-innovation partnership to accelerate Orange’s IT and digital transformation and develop new Cloud services, particularly in edge computing (i.e. services located as close as possible to customers’ processing needs).

In addition, in 2021, Orange strengthened its innovation in the digital ecosystem and venture capital investment by creating Orange Ventures, a new investment firm with a budget of 350 million euros that ranks as one of the ten largest corporate venture capital funds in Europe. Orange has partnered with Sanofi, Capgemini and Generali to create a unique e-health ecosystem in Europe to accelerate the development of practical solutions for patients. The Group is also teaming up with the national cybersecurity agency, Atos, Thales and Capgemini, and plans to join the Cyber Campus project initiated by the President of the French Republic to bring together the main national and international players in the field, which is scheduled to open in October 2021.

Smarter networks and improved operational efficiency

The Group uses AI and Data to optimize the rollout of new mobile and fiber sites, and to facilitate the maintenance of its networks, back office and internal processes, thereby reducing costs and improving quality of service.

To harness the full potential of new technologies, Orange keeps a close eye on the digital ecosystem, giving its venture capital entity the capacity to invest in the future champions of the digital economy in Europe, Africa and the Middle East. In December 2019, Orange Ventures invested in InterCloud, a leader in Cloud application interconnection, to support its European leadership in Cloud interconnection, then in native Cloud service provider Weaveworks to help drive the take-up of its GitOps solution in B2B and telecom markets. As global telecom operators prepare to deliver 5G applications and services reliably and on a large scale, GitOps is facilitating the shift to native Cloud Computing. Orange Digital Ventures Africa has launched the MEA Seed Challenge, a new seed investment activity aiming to fund 100 start-ups by 2025 in Cameroon, Côte d’Ivoire, Egypt, Jordan, Morocco, Senegal and Tunisia. In February, it invested in Ethiopian-based start-up EdTech Gebeya, a pan-African marketplace for the training and placement of African developers to help solve the tech talent shortage, and Youverify, a Lagos (Nigeria) start-up that automates identity verification for financial and telecommunication players.

Creating a future-facing company

Thanks to its size and the diversity of its business lines, the Group gives its employees the possibility of improving their skills to keep up with and anticipate market developments, in line with its "digital and caring" employer promise. To achieve the Group’s ambition to be more international, more B2B-oriented and at the cutting edge of new technologies by 2025, Orange has invested more than 1.5 billion euros in a skills enhancement program open to all employees and enhanced the company’s attractiveness for new talent while ensuring the social and human consistency of its projects.

Meeting the skills challenge

The context of the health crisis makes new digital skills more necessary than ever. Their list includes technological expertise, practice and use of data, artificial intelligence (AI) and cybersecurity, plus a broad range of soft skills. The Group plans to use Orange Campus, which has become a networked school for all employees, to train 20,000 employees in network virtualization, artificial intelligence, data, Cloud Computing, coding and cybersecurity. New forms of cooperation, methods and working environments are offered to Orange managers to foster cross-cutting approaches, promote empowerment and cultivate a sense of service. In October, Orange opened its own Apprentice Training Center. Lastly, the Group supports the Grande École du Numérique, which has trained nearly 28,000 people in the digital professions in France.

Ranking among the most attractive employers

In February 2020, Orange featured in the Top Employers Global 2020 rankings for the fifth consecutive year. This certification recognizes the best human resources practices worldwide. The Group is also certified HappyTrainees, a label which rewards the quality and interest of the tasks assigned to interns and work-study students.

The Group’s challenge is reinforced by the scarcity of tech profiles on the job market. In September, Orange launched a recruitment campaign in nine countries under the slogan "At Orange you can", focusing on the diversity of its jobs and career paths, and on reconciling employees’ personal and professional aspirations.

Supporting everyone in a sustainable and responsible transformation

Against a backdrop of upheaval in everyday life due to the health crisis, which is prompting us to rethink the meaning of the collective approach and teamwork, as well as the role of telework, the Group is implementing internal initiatives to better support the transformation and ensure a better quality of life at work, and is committed to a more inclusive society.

The policy and initiatives dating back many years to promote gender equality in the workplace have made Orange a benchmark in this area. Women account for 36% of the Group’s overall workforce, and 31% of the network of managers and senior executives are women. In both France and Poland, Orange promotes access to scientific and technical jobs for women, including in cybersecurity with the Cercle des Femmes de la Cybersecurité (Cefcys). The Group is involved with the Women’s Forum on digital tools for economic development in the MEA region. Lastly, Orange was the first company to receive the GEEIS-AI (Gender Equality European & International Standard-Artificial Intelligence) label, created by the Arborus Endowment Fund, confirming its commitment to Artificial Intelligence designed and developed both responsibly and inclusively. In France, Orange employs more than 4,800 people with disabilities, who are supported when they join the company and in ensuring the accessibility of their work environment by more than 120 correspondents.

A growth ambition accompanied by an operational efficiency program

To secure the achievement of its objectives, Orange has launched the Scale-Up operational efficiency program, undertaking to achieve net savings of 1 billion euros by 2023 on an indirect cost base at end-2019 of nearly 14 billion euros in telecom activities excluding high revenue growth areas (MEA and IS/IT services at OBS) at the end of 2019. This commitment is based on a combination of targeted initiatives and various measures focused on the levers of digitization, simplification and pooling:

− the transformation plans undertaken by all relevant Group entities, and in particular the support functions, since 2019;

− targeted cross-functional initiatives, such as:

- the optimization of the real estate master plan,

- the digitization of the customer relationship with the rollout of robotic process automation (RPA) at Group level,

- the automation of network management and maintenance,

- smart spend for the optimization of certain expenses, including a plan to rein in energy costs, which is a real challenge for the future.

[REDACTED SECTION: CERTAIN TEXT HAS BEEN REDACTED]

1.3 Significant events

In June 2020, Stéphane Richard, Chairman and CEO of Orange, announced the reorganization of the Group’s Executive Committee in order to accelerate the implementation of Engage 2025, the Group’s new strategic plan. This reorganization has been effective since September 1, 2020 (see Section 5.1 Composition of management and supervisory bodies).

Impacts of the Covid-19 pandemic on the Group’s activities and financial position

The Covid-19 pandemic that affected France and the rest of the world in 2020 had an impact on the Group’s activities and financial position, as well as its employees, suppliers, subcontractors, customers and all its stakeholders. Against this backdrop, Orange’s priorities were, and still are, to ensure the safety of its employees and to support its customers by providing telecommunication services, which have become more essential than ever. At the start of the pandemic, the Group swiftly put in place a number of actions to adapt to the crisis situation, ensure business continuity and reduce the risks posed by the pandemic. In particular, Orange focused its actions on:

− business continuity. In countries that have been severely affected by the pandemic, Orange had to, and must continue, as a provider of essential business services, to ensure the continuity of its electronic communications services, in particular its critical activities. In accordance with government requirements, Orange has implemented, particularly in France, a business continuity plan and then a business recovery plan essentially covering network and information system supervision and operation teams, security teams, technical support, data center employees and field-work teams. Neither Orange SA nor most of its subsidiaries in France and worldwide have made use of the special furlough schemes in place during the health crisis.

Moreover, the Group enhanced the capacity of its networks and put in place supervision and security measures to cope with the additional load caused by the increase in traffic linked to the crisis and the potential increase in cyberattacks. The quality and resilience of Orange’s networks absorbed the sharp growth in traffic and usage. The combination of fiber, 4G and fixed service-based WiFi networks proved effective in allowing the Group’s customers to receive a reliable, efficient service, thus demonstrating the relevance of Orange’s strategy concerning large-scale investment in high-quality fixed and mobile broadband networks;

− health and human safety. Orange puts the health and safety of its employees first. A coordinator was appointed to report directly to the Chairman and Chief Executive Officer on global developments. Local correspondents were also appointed in the Group’s different geographical regions. Orange’s activity in the various countries was adapted to comply with the health guidance issued by each government, while ensuring business continuity. Teleworking was widely adopted throughout the Group (around 100,000 employees during the first lockdown), all locations combined. Orange also encouraged shielding measures as early as possible in its instructions to employees and provided suitable personal protective equipment and hygiene supplies;

− the launch of specific actions to show solidarity with customers, health workers, teaching professionals and public authorities, and heightened internal and external communication.

The consequences of the Covid-19 pandemic on the Group’s business and financial position are not easily quantifiable, as these effects are difficult to separate from other development factors (see Note 3 to the Consolidated Financial Statements). However, in 2020, the main effects of the Covid-19 pandemic were as follows:

− on the Group’s revenue:

- a widespread and significant decline in revenues from international roaming (customers and visitors), in all countries and particularly for B2B services, due to travel restrictions and border closures,

- a sharp fall in equipment sales (B2C and B2B customers), mainly in France and in Europe, due to the closure of Orange stores during the lockdown in spring 2020 and the lower footfall due to mobility restrictions,

- lower-than-expected growth in revenues from fixed services to carriers, due to the slowdown in the construction of public initiative networks marketed, rolled out and operated by Orange in France, despite the partial catch-up in the second half of 2020,

- a slowdown in the B2B services activity, with a decline in revenues from IT & integration services in the second and third quarters of 2020 and, on an ancillary basis, of some data services (satellite TV broadcasting) not offset by the growth of some voice services (audioconferencing), and

- a general decline in sales activity, due in particular to the closure of Orange stores, and in some countries, to a restriction on portability and a ban on advertising campaigns, partially offset by lower churn rates overall;

− on the operating expenses [REDACTED SECTION: CERTAIN TEXT HAS BEEN REDACTED]:

- an increase of 144 million euros in impairments and losses on trade receivables (see Notes 5.3 and 6.2 to the Consolidated Financial Statements), of which 129 million euros related to telecom activities (mainly in France and Spain and for B2B services) and 15 million euros related to Orange Bank. It should be noted that the Covid-19 health crisis has resulted in the provision of economic support measures for companies and individuals in a number of countries. Such measures have helped to partially reduce the risk of non-recovery of trade receivables at December 31, 2020, but reduce visibility as to the magnitude of the expected deterioration of the economic environment (including the risk of corporate default),

- an increase in external purchases (mainly other external purchases) primarily related to (i) the costs of health measures for 72 million euros, (ii) the additional costs of support measures for some network service providers in France (in order to maintain the activity and offset a portion of their fixed costs) for 19 million euros (see also the effects of the Covid-19 pandemic on investments below), and (iii) donations and philanthropic activities for 9 million euros,

- a 10 million euro increase in labor expenses with the payment to some employees of specific bonuses in connection with the health crisis, including bonuses for committed employees who continued working on site (internal or external to Orange), and

- conversely, (i) a significant decline in commercial expenses and equipment costs, with the decrease in purchases of handsets and other products sold, the fall in advertising and promotion expenses, and lower distribution commission caused by the downturn in sales activity, and (ii) a reduction in overheads, mainly due to travel savings and the cancellation of various events.

In fiscal year 2020, an amount of 253 million euros was recognized for the main specific additional costs generated by management of the Covid-19 health crisis (see Note 3 to the Consolidated Financial Statements).

− on the Group’s investments:

- a significant inflection in investments in the first half of 2020 due to the slowdown in fixed (FTTH) and mobile network rollout during lockdown periods. This continued after each lockdown had been lifted owing to the measures and restrictions imposed by the health crisis and the shutdown of several economic sectors. However, in view of the Group’s initial forecasts, some of the delays in rollout were made up for in the second half of 2020, particularly in France (see Investments in networks below),

- a delay in some structural projects for the Group, such as Orange Concessions, which aims to (i) consolidate the FTTH connections of public initiative networks (PIN) belonging to local authorities in France and for which Orange is the concession holder, and (ii) take advantage of potential development or consolidation opportunities in this market (see below and section 3.1.2.5.3 Investment projects),

- the recognition of additional costs related to support measures for some network providers in France for 24 million euros (see also the effects of the Covid-19 pandemic on external purchases above), and

- modifications or temporary delays in the 5G licensing process, particularly in France, Spain and Poland;

[REDACTED SECTION: CERTAIN TEXT HAS BEEN REDACTED]

− on cash flow and financial debt management:

In 2020, the Covid-19 health crisis had no impact on the risk management policy relating to financial instruments. The Group therefore continued to put in place and manage hedging instruments in order to limit its exposure to operational and financial interest rate and foreign exchange risks. Existing cash flow hedges, in particular, were not affected by the crisis. In addition, the Group maintained a diversified financing policy (see Notes 13.5 and 13.6 to the Consolidated Financial Statements). The financing transactions carried out in 2020 are part of the Orange group’s active refinancing policy, aimed at the prudent and forward-looking management of its liquidity by optimizing the cost of its resources and maintaining a high level of cash. As of December 31, 2020, the liquidity position of the telecom activities amounted to 17,243 million euros (see Note 14.3 to the Consolidated Financial Statements).

− on the value of the Group’s goodwill and fixed assets:

At December 31, 2020, the Group reviewed the key assumptions used to determine the recoverable amounts of cash-generating units (CGUs). Those assumptions include the impact of the Covid-19 pandemic on discount rates and perpetual growth rates, as well as on business plan trajectories. As a result of this work, the Group did not recognize any impairment losses at December 31, 2020 (see Note 8 to the Consolidated Financial Statements).

− on the Orange dividend:

Due to the uncertainties generated by the Covid-19 health crisis, the Orange Shareholders’ Meeting of May 19, 2020 decided, on the proposal of the Board of Directors, to distribute a dividend for the 2019 fiscal year of 0.50 euros per share, instead of the previously announced 0.70 euros per share. In view of the interim dividend of 0.30 euros per share paid in December 2019, the balance of the cash dividend paid in June 2020 was 0.20 euros per share (see Note 15.3 to the Consolidated Financial Statements and section 6.3 Dividend distribution policy).

Beyond the health crisis, the Group launched a plan to prioritize digital inclusion, with the aim of continual improvement in networks and acceleration of digitalization. Fixed and mobile networks, network access sharing agreements and optimized network management, which were already part of Orange’s core strategy, are and remain major priorities for the Group. Moreover, Orange is keen to help accelerate the digitalization of its customers and to focus on the house/home with more relevant strategic choices. In addition, the Group’s objective is to prioritize its future sales activity, secure its supply chains and, as much as possible, catch up on delivery and production delays.

Settlement of a tax dispute in France in respect of fiscal years 2005-2006 and use of the funds received

On November 13, 2020, the French Conseil d’État found in favor of Orange SA in a tax dispute in France in respect of fiscal years 2005-2006. This decision terminated the proceedings and allowed Orange to recover the sums paid in July 2013, i.e. a total amount of 2,246 million euros (including 646 million euros in interest). This amount was recognized as tax income in the Consolidated Financial Statements for fiscal year 2020 (see Note 11.2 to the Consolidated Financial Statements).

Regarding the use of these funds, the Board of Directors, at its meeting on December 2, 2020, looked favorably on the following projects:

− accelerating the Group’s main areas of development to enhance its value creation:

- by using nearly a quarter of the amount received to strengthen the Group’s leadership in French and international networks for the benefit of its customers, as well as projects linked to the environmental transition,

- by allocating a quarter of the amount received to support the Group’s operational transformation, in particular to improve agility and performance, and

- by launching a conditional voluntary public tender offer for Orange Belgium (see Changes in asset portfolio below);

− making an additional dividend payment to shareholders of 20 euro cents per share (subject to the approval of the Shareholders’ Meeting of May 18, 2021);

− encouraging employee shareholding through an offer reserved for employees of around 30 million shares, the aim being that employees will eventually hold 10% of the capital of Orange SA;

− allocating a portion of the funds to the Group’s social commitments to reach Net Zero Carbon by 2040 and to digital equality; and

− using any residual balance to reduce the Group’s net financial debt.

Investments in networks

Fixed access networks

The Covid-19 health crisis marked a significant inflection in the rollout of FTTH networks in the first half of 2020. However, the Group accelerated the rollout of its very high-speed fixed broadband networks in 2020. Despite the health crisis, the Group will have succeeded in rolling out more fiber optic connections in 2020 than in 2019, providing an additional 9.0 million FTTH connectable households year-on-year (compared to 7.2 million in the previous year). At December 31, 2020, Orange thus had 47.2 million FTTH connectable households worldwide (and a total of 48.3 million households connectable to very high-speed broadband), up 23.4% year-on-year. This included 22.9 million in France, 14.9 million in Spain and 7.8 million in Other European countries. Whether through its own infrastructure or the use of third-party networks, in late 2019 Orange announced its aim to be able to offer its FTTH packages to more than 65 million households in Europe by 2023, to assert its leadership position in Europe in fiber.

In France, in late 2020, Orange was awarded the public service contract for the very high-speed network in Haute-Saône in the context of public initiative networks (PIN). This will enable 100% of Haute-Saône department to have fiber optic broadband by 2023. At the end of 2020, Orange was working with 23 public initiative networks as network operator, under various models, and had passed the symbolic milestone of one million connectable units across all PINs operated by Orange. Through Orange Concessions, the Group’s ambition is to provide more than 4.5 million households and businesses with fiber optic connections (FTTH) within the public initiative networks operated by Orange by 2025 (see Infrastructure optimization, development and enhancement below).

In Spain, in the case of fixed access networks providing very high-speed broadband Internet access (fiber and other very high-speed technologies), Orange wants to accelerate its rollout and has now set itself the target of connecting 18 million households to very high-speed broadband by the end of 2023 (through several channels, including its own infrastructure).

Mobile access networks

Licenses and 5G networks

Orange acquired new 5G licenses (see section 1.7 Regulation) and launched its first offers in several countries in 2020.

In France, following the auction process for 3.5 GHz frequencies in October 2020, Orange has the highest number of 5G frequencies of any carrier, with 90 MHz of spectrum. Orange has thus strengthened its number one position with the largest portfolio of frequencies in the French market (257 MHz of frequencies in total, with 90 MHz of 3.5 GHz plus 2 X 83.5 MHz in other bands, from August 2021). The acquisition of these frequencies is an essential industrial investment that will maintain and strengthen the position acquired by Orange as a leader in mobile networks and consolidate, with the rollout of a 5G network using these frequencies, its number one position for the benefit of its B2C and B2B customers (see also Digital transformation of business customers below). The total cost of the 90 MHz acquired by Orange was 875 million euros, including 854 million euros in fixed fees (with payment spread over four to 15 years, depending on the block) and 21 million euros in spectrum refarming costs relating to the allocation of new frequencies to carriers (see Notes 9.4 and 16.1 to the Consolidated Financial Statements).

After Romania at the end of 2019, Poland in July 2020 and Spain in September 2020, Orange launched its 5G network in France on December 3, 2020. At the end of 2020, nearly 160 municipalities had 5G coverage. Faced with the sharp increase in data usage in 2020, Orange has chosen to initially cover areas that already have high demand to reduce the risk of network saturation. 5G-compatible plans have been offered to B2C and B2B customers in France since October 8, 2020.

In Slovakia, Orange also acquired 5G licenses in 2020 for the planned launch of offers in 2021.

Other mobile networks

In 2020, the Group continued its efforts to roll out the 4G network. At the end of 2020, nearly 100% of its mobile sites in France offered 4G coverage.

The quality of the mobile network is a priority for Orange. The results of the annual survey by Arcep (the French electronic communications and postal regulator) on the quality of mobile services of French telecom operators, released in December 2020, confirmed for the tenth year running that Orange has the best mobile network in mainland France. Orange is ranked first or joint first for voice, SMS and mobile Internet on 244 of the 266 criteria measured. More specifically, Orange ranks first or joint first on 51 of the 57 criteria measured in rural areas and offers the best all-uses Internet speed in rural areas. In addition, with regard to the Covid-19 health crisis, which has increased the need for connectivity and seen a sharp increase in teleworking, Orange offers the best indoor quality for mobile Internet and voice calls (first or joint first on 66 of the 71 criteria measured). In mobile Internet, Orange is first or joint first when it comes to Internet speeds for sending and receiving files. Lastly, Orange is also ranked first or joint first on all 90 criteria concerning transport, video streaming, web browsing excluding transport, and file transfers.

In February 2020, Orange and Free signed an amendment extending until December 31, 2022 the termination period for Free Mobile’s national roaming on Orange’s 2G and 3G networks. Arcep approved this amendment in October 2020.

Transmission networks

In February 2020, Orange joined forces with Telxius (a subsidiary of Telefónica) on the terrestrial backhaul extensions of Google’s "Dunant" transatlantic cable. This 6,600 km cable has three times the data transfer capacity of previous generation cables. Orange and Telxius will offer and operate co-location services in their respective cable landing stations located on either side of the Atlantic Ocean. This agreement strengthens the Group’s connectivity capabilities for its international customers in Europe and America and its international positioning in the wholesale market. The Dunant cable was commissioned in 2020 for wholesale and B2B customers.

In addition, in January 2021, Orange announced the signing of a partnership agreement for the new generation AMITIE cable, which should link the United States to France and enter service in early 2022. With fiber pairs on two new generation ultra-high-speed cable systems, Orange will serve the B2C, wholesale and B2B markets in Europe and America with a single low-latency global France - US connectivity solution offering performance and redundancy.

In May 2020, Orange also announced its participation in the 2Africa project. Led by an international consortium, the project should enable a 37,000 km submarine cable to be laid around the coast of Africa to improve Internet access on the African continent and in the Middle East. The cable is due to be commissioned in 2023 or 2024.

Orange is thus continuing to invest heavily in global connectivity projects to guarantee and constantly improve the quality of service of its global network with more than 40 submarine cables worldwide. Orange’s global network, which serves its customers all over the world, connects more than 300 points of presence via 45,000 km of fiber in Europe, the United States, Africa and Asia.

Satellite transmission

In July 2020, Orange announced the purchase from Eutelsat Communications of all available capacity on the Eutelsat Konnect satellite to cover the whole of France. All Orange B2C customers, including those living in the most isolated areas, have therefore been able to benefit from very high-speed fixed broadband via satellite since January 2021. This agreement is directly in line with the Broadband/Very High-Speed Broadband France Plan adopted by the government with the aim of rolling out broadband services of at least 30 megabytes/second over the whole of France by 2022. The service is distributed by Orange’s Nordnet subsidiary, the leading French distributor of satellite Internet services since 2008.

In December 2020, Orange was selected by the European Commission to be part, along with satellite manufacturers and operators, of a consortium to study the design, development and launch of an independent European space communications system to strengthen Europe’s digital sovereignty.

Infrastructure optimization, development and enhancement (FiberCos - TowerCos)

FiberCo in France (Orange Concessions) and Poland

Orange has moved forward in its plans to share future fiber network rollouts with its partners via FiberCos.

In France, in January 2021 Orange announced that it had signed an exclusive agreement with a consortium of long-term investors including La Banque des Territoires (Caisse des dépôts), CNP Assurances and EDF Invest for the sale of 50% of the capital and joint control of Orange Concessions. Orange Concessions will allow Orange to continue the rollout of fiber in rural areas of France while sharing the investment effort, in line with the ambitions of the strategic plan Engage 2025. With 23 public initiative networks (PIN) representing nearly 4.5 million FTTH connections created or to be created by December 31, 2020, Orange Concessions will be the leading operator in France for Fiber To The Home (FTTH), deployed and operated on behalf of local authorities. Orange would have a future call option enabling it to take control of and consolidate Orange Concessions. The agreement values Orange Concessions at 2.675 billion euros. Subject to the approval of the relevant antitrust authorities and all stakeholders, the transaction is expected to be completed in the second half of 2021 (see Notes 4.3 and 19 to the Consolidated Financial Statements).

In Poland, the Group plans to sign an agreement in the first half of 2021 to establish a special purpose entity due to be operational in 2021.

Creation of the European TowerCo Totem

In terms of plans to upgrade its European mobile network, in February 2021 Orange announced the creation of Totem, a European TowerCo intended to create value (i) by operating first-class passive infrastructure assets, (ii) by focusing on revenue growth and optimization of operational efficiency, and (iii) by fostering both organic and inorganic growth.

Totem will have a portfolio of assets with proven operational excellence. It will have all the skills and functions needed to create sustainable value to make the TowerCo a leader in the growing European telecommunication tower market. Initially, it will operate a portfolio of premium towers comprising around 25,500 sites in France and Spain, the two largest countries where Orange is present. After France and Spain, the Group will study the possibility of integrating Orange’s other European passive infrastructure assets that could create value for the TowerCo. Based on this scope and under the terms of the Master Service Agreement (MSA) signed with Orange, in 2020 Totem would have generated revenue in excess of 500 million euros[REDACTED SECTION: CERTAIN TEXT HAS BEEN REDACTED], around two thirds of which from assets in France.

One of Totem’s core priorities will be organic growth. The TowerCo will benefit from significant opportunities to develop its hosting activities across its entire portfolio. In addition, the TowerCo will host and roll out new sites for Orange and other network operators.

Totem also intends to seize opportunities for inorganic growth in Europe. To support this development ambition, Orange will be able to use the flexibility of the new company’s capital structure, whether in terms of equity issuance or debt financing. Orange wants to retain control of the TowerCo to benefit from the significant source of sustainable value creation that it offers the Group.

Totem will be led by a fully independent and dedicated management team. The team will be appointed in the first half of 2021 with a view to the TowerCo becoming operational by the end of 2021.

Acceleration in growth areas

Africa & Middle East

In early January 2020, Orange inaugurated the new headquarters of its subsidiary Orange Middle East and Africa in Casablanca, Morocco. A major player in the Africa region for more than 20 years, Orange hopes to become the preferred multiservice operator for the people. To be successful, Orange must develop its new services in Africa, getting closer to its customers so that it can fulfil their needs and adapt to the local market.

In addition, in November 2020 Orange announced the entry into service and commercial launch of Djoliba, the first pan-African backbone. This infrastructure is based on a terrestrial fiber optic network of more than 10,000 km, coupled with 10,000 km of submarine cables offering secure very high-speed international connectivity from West Africa. The network will cover eight countries (Burkina Faso, Côte d’Ivoire, Ghana, Guinea, Liberia, Mali, Nigeria and Senegal). With Djoliba, Orange is catering for the needs of businesses and telecom players in West Africa, serving a potential 330 million inhabitants.

In January 2021, Orange announced a partnership with Côte Ouest Audiovisuel which will distribute its TV and OTT (Over-The-Top) content in West Africa via Media Delivery Boost, Orange’s CDN (Content Delivery Network) content delivery solution. This solution ensures quality, speed and reliability in content delivery without the need for satellites as used previously.

Mobile Finance Services

In Europe, in July 2020 Orange Bank announced that it had expanded its services and reached a new milestone in its cross-selling policy with Orange by integrating into its business the subsidiary Orange Courtage, which notably offered insurance for mobile devices to 549,000 B2C customers at December 31, 2020. This integration allows Orange Bank to become an insurance broker. In November 2020, Orange Bank also launched new value offers in France (including the Premium Pack for families) and new bank cards to celebrate its third anniversary. Lastly, in January 2021 Orange Bank announced the acquisition of Anytime, a neobank specializing in business banking. This acquisition will allow Orange to offer its millions of business customers financial support and digital management tools. At December 31, 2020, Orange Bank had nearly 1.2 million customers in France and Spain (this number includes customers of all products sold by Orange Bank: accounts, loans and mobile insurance).

In Africa, the Orange strategy in mobile financial services seeks to offer solutions accessible to as many people as possible, regardless of their income or where they live. In July 2020, Orange and NSIA, a leader in bancassurance, announced the launch of Orange Bank Africa’s sales activities in Abidjan, Côte d’Ivoire. Orange Bank Africa offers, through the Orange Money channel, a savings and micro-credit solution that allows users to borrow instantly using their mobile device. Orange Bank Africa plans to expand into Senegal, Mali and Burkina Faso. The goal of Orange Bank Africa is to become the leading player for financial inclusion in West Africa. The successful launch of Orange Bank Africa enabled it to acquire 356,000 customers by the end of December 2020 with its pico-credit and savings offers via Orange Money.

In March 2020, Orange also announced the launch of Orange Money in Morocco. This service enables Moroccans to use their telephones to make payments and transfer money, thereby facilitating trade. The Orange Money service is now available in all countries in Africa & Middle East. Moreover, since May 2020, Orange Money customers have been able to transfer money from France to Morocco or Burkina Faso, in real time and securely, directly through an Orange Money account. At December 31, 2020, Orange Money had more than 49 million customers, including 22 million active customers using the service each month, in 16 countries (excluding associates and joint ventures).

Wholesale services

In July 2020, Orange Wholesale France, the first wholesale operator to launch an e-SIM offer in France for its light mobile virtual network operator (MVNO) customers, signed a partnership agreement with Prixtel. Prixtel has thus become the first French MVNO to be able to offer its customers the option of downloading their digital SIM card (e-SIM) to their smartphones. Orange is thus capitalizing on its network and its capacity for innovation to offer the best wholesale service on the French market by supporting operators in the digitalization of the customer experience.

In January 2021, Orange announced a partnership with Côte Ouest Audiovisuel which will distribute its TV and OTT (Over-The-Top) content in West Africa via Media Delivery Boost (MDB), Orange’s CDN (Content Delivery Network) content delivery solution. This solution ensures quality, speed and reliability in content delivery without the need for satellites as used previously. For Orange, the development of CDN is a strategic opportunity for revenue growth, particularly in Africa where the operator already manages the largest network of this type on the continent, enabling audiovisual content to be delivered to 10 countries.

Digital transformation of business customers