(1) The following document contains certain pages and sections of the 2015 Registration Document which are being incorporated by reference into the 2015 Annual Report on Form 20-F of Orange. Where information within a subsection has been deleted, such deletion is indicated with a notation that such information has been redacted.

1.1 Overview

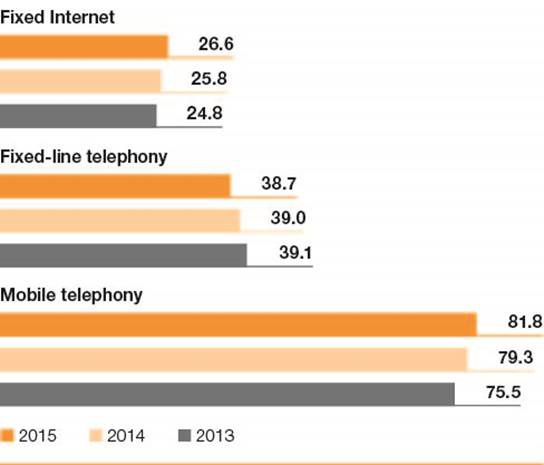

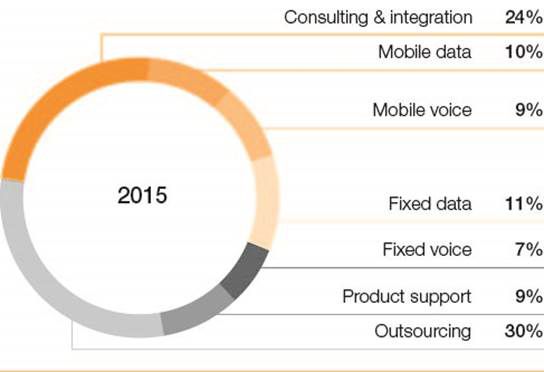

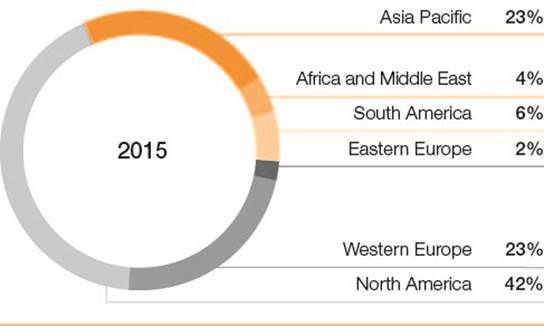

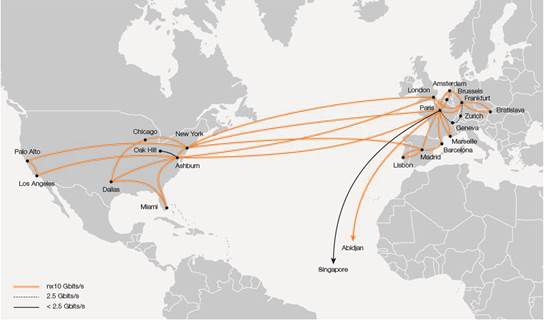

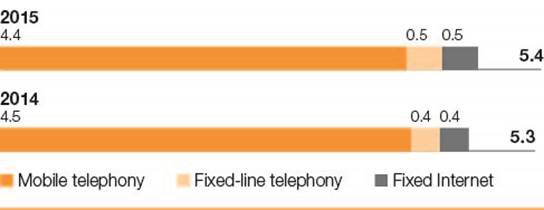

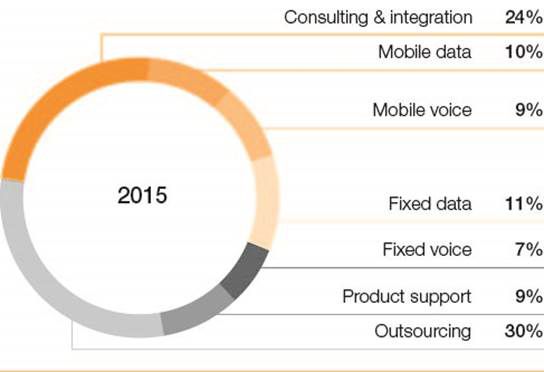

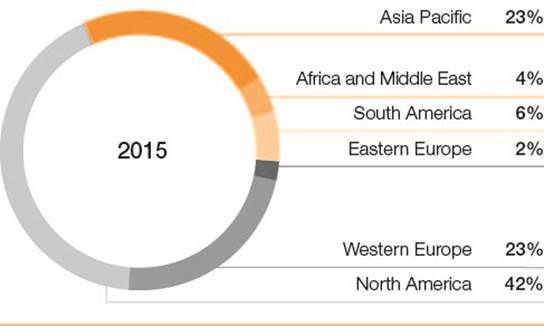

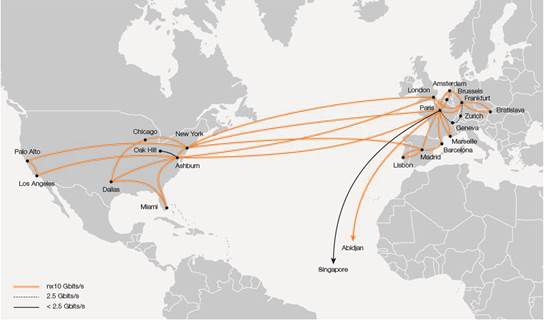

Orange is one of the world’s leading telecommunications operators with revenues of 40 billion euros and 156,000 employees worldwide (including 97 000 in France) at December 31, 2015. With operations in 28 countries, the Group served 263 million customers at December 31, 2015, including 201 million mobile customers and 18 million fixed broadband customers. Orange is also a leading provider of telecommunication services to multinational companies, under the brand Orange Business Services. In March 2015, the Group presented its new strategic plan, Essentials2020, which focuses on its customers’ expectations to ensure that they experience the best of the digital world and the power of its high speed broadband networks.

Orange has been listed since 1997 on Euronext Paris (symbol: ORA) and on the New York Stock Exchange (symbol: ORAN).

History

Orange, formerly France Telecom, is France’s incumbent telecommunications operator. The Group has its origins in the Ministry for Mail, Telegraphs and Telephone, later to become the General Directorate of Telecommunications, which in 1990 was accorded the status of independent public entity and, on January 1, 1991, renamed France Telecom. On December 31, 1996, France Telecom became a Société Anonyme (limited company) with the French State as its sole shareholder. In October 1997, France Telecom shares were listed on the Paris and New York stock exchanges allowing the French government the disposal of 25% of its shares to the public and Group employees. Subsequently, the public sector gradually reduced its holding to 53%. The law of December 31, 2003 authorized the transfer of the Company to the private sector and between 2004 and 2008 the public sector sold a further 26% of the capital, and then again 4% in 2014 and 2015. At December 31, 2015, the French State retained 23,04% of the share capital, held either directly or jointly with Bpifrance.

Since the 1990s, France Telecom’s area of activity and its regulatory and competitive environment have undergone significant changes. In a context of increased deregulation and competition, between 1999 and 2002, the Group pursued a strategy of developing new services and accelerated its international growth with a number of strategic investments. These included, in particular, acquiring mobile operator Orange and the Orange brand, which had been created in 1994, and taking a stake in Poland’s incumbent operator, Telekomunikacja Polska (renamed Orange Polska in 2013). Most of these investments could not be financed by share issues and therefore the Group’s debt substantially increased during this period.

At the end of 2002, France Telecom started a large-scale refinancing plan for its debt to reinforce its balance sheet, as well as an operational improvements program, the success of which has allowed the Group to develop a global integrated-operator strategy by anticipating changes in the telecommunications industry.

In 2005, France Telecom acquired 80% of Spanish mobile operator Amena, whose activities were then regrouped with the Group’s fixed-line and Internet operations in Spain into a single entity under the Orange brand. In 2008 and 2009, the Group acquired almost all the remaining capital of Orange Espagne.

In parallel, the Group streamlined its asset portfolio by selling off non-strategic subsidiaries and holdings.

In 2006, Orange became the single brand of the Group for Internet, television and mobile services in most countries where the Group operates, and Orange Business Services the brand for services offered to businesses throughout the world.

Since 2007, Orange has pursued a selective policy for the development and management of its activities, mainly focused on emerging markets (in particular Africa and the Middle East), while attempting to grasp opportunities for consolidation in markets where the Group was already present. In 2010 this strategy notably led the Group to raise its stake in Egyptian operator ECMS (Mobinil) from 36% to 94% (and to 99% in February 2015). It also resulted in the joint venture with Deutsche Telekom that combined UK business under the EE brand on April 1, 2010, as well as in the 2012 disposal of Orange Suisse.

This policy continued in 2014 with the disposal of Orange Dominicana, in 2015 with the acquisition of Jazztel in Spain and the consolidation of Médi Telecom in Morocco and finally in early 2016 with the disposal of the Group’s stake in EE and the signing of agreements to acquire several operators in Africa.

From July 1, 2013, the Company adopted the corporate name Orange.

For more information on Orange’s strategy, see Section 2.3 Orange’s Group strategy.

Business in 2015

Revenues (in euros) Mobiles customers Broadband Internet Customers

(1) The EE customer base in the UK is 50% consolidated in the Orange customer base.

ORANGE / 2015 REGISTRATION DOCUMENT - 4

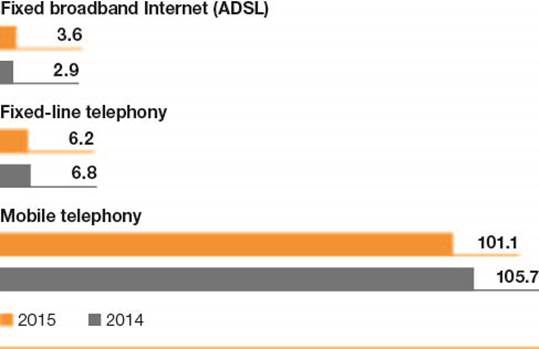

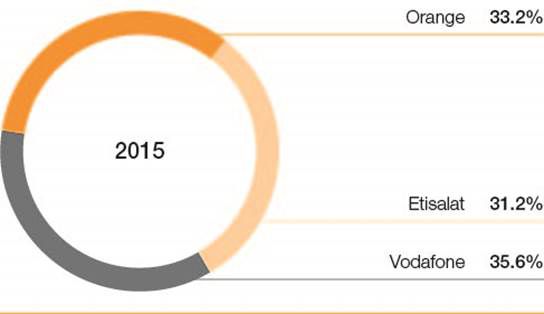

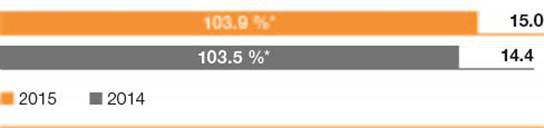

At the end of 2015, the Orange group grew its worldwide customer base by 7.7% year-on-year, adding 18.8 million new customers to 262.9 million, including 201.2 million mobile customers (excluding MVNOs) (up 8.5%) and 18.1 million broadband customers (up 13.1%).

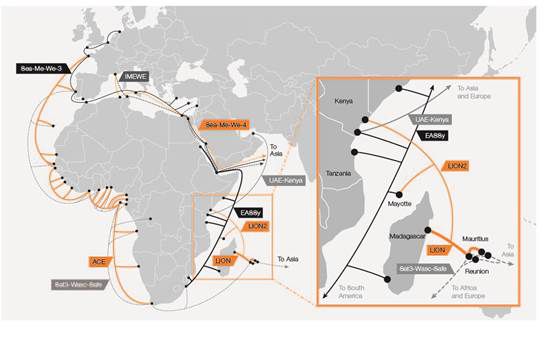

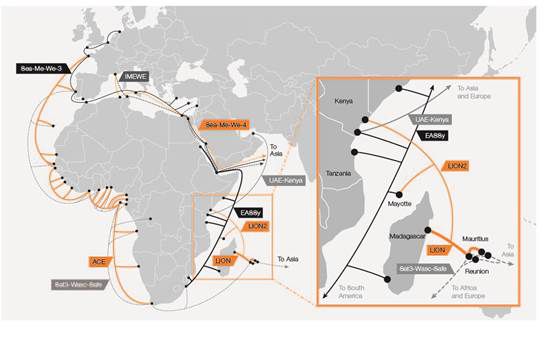

This increase reflects the continued strength of growth in mobile services in Africa and the Middle East, where numbers rose 13% to 110.2 million customers at December 31, 2015 (12.7 million new mobile customers). In Africa, the Orange Money application had 16.4 million customers, compared with 12.6 million in 2014.

In France, mobile contract customers, which accounted for 85% of the mobile customer base at December 31, 2015 (24 million customers), increased by almost 10%. In the Europe zone (excluding the UK), mobile contracts (31.4 million customers at December 31, 2015) also rose (+12.2% year-on-year), in particular in Spain, Poland and Romania, representing 62.4% of the mobile customer base at December 31, 2015.

2015 saw the continued development of 4G high-speed mobile broadband with a total of almost 18 million customers in Europe at December 31, 2015 (i.e. 2.3 times more than a year earlier), including 8 million in France, 5.1 million in Spain, 2 million in Poland and 1 million in Belgium. 4G has also been rolled out in Europe in Romania, Slovakia and Moldova. In Africa and the Middle East, 4G has been deployed in Botswana, Jordan, Morocco, Mauritius, Cameroon and Guinea-Bissau.

Fixed-line broadband had 18.1 million customers at December 31, 2015, up 13.1% year-on-year. Fixed-line broadband subscribers included 1.882 million fiber subscribers at December 31, 2015, of which 960,000 in France and 809,000 in Spain.

Revenues for the Orange group were 40.236 billion euros in 2015, almost unchanged on a comparable basis. Excluding the impact of regulatory measures, they rose 0.3% after falling 1.6% in 2014.

CAPEX was 6.486 billion euros in 2015, up 9.3% compared to the previous year on a comparable basis, in line with the Essentials2020 plan. Investments in fiber rose sharply (+55% year-on-year on a comparable basis) and the Group’s investment strategy also targets an improved customer experience, with in particular the extension of 4G mobile coverage and the modernization of the distribution network.

Group footprint in 2015

ORANGE / 2015 REGISTRATION DOCUMENT - 5

1.3 Organizational chart

The chart below shows the main operating subsidiaries and investments of Orange SA as of December 31, 2015 (the complete list is available on the Group’s website (the complete list is available on the Group’s website (www.orange.com under the heading About/Global-footprint)). The holding percentages shown for each entity are the percentage of interest along with the percentage of control when these differ:

(1) Company operating under the Orange brand.

(2) Orange controls the Strategy Committee, which makes recommendations to the Board of Directors.

(3) See Note 2.2 to the consolidated financial statements.

ORANGE / 2015 REGISTRATION DOCUMENT - 7

This chapter contains forward-looking statements, particularly in Section 2.3 Orange’s group strategy. These forward-looking statements are subject to numerous risks and uncertainties that could cause actual results to differ materially from the results anticipated in the forward-looking statements. The most significant risks are detailed in Section 2.4 Risk factors. Please also consult the information under the heading Forward-looking information at the start of this document.

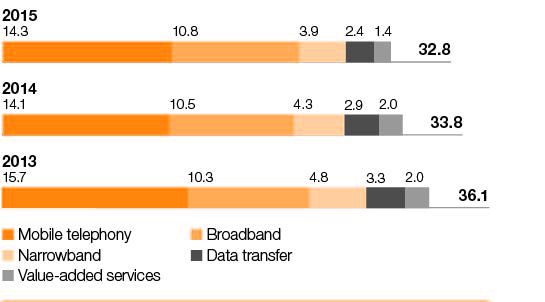

2.1 The world Information and Communication Technologies market

2015 was marked by continued global growth in the information and communication technologies segment (ICT), which includes mainly the sectors of computing, audiovisual, multimedia, Internet and telecommunications. After the recovery recorded in 2013, and then in 2014, growth in ICT revenues continued to accelerate in 2015 to +4.8% (+0.4 percentage points compared to 2014), and totaled 3,913 billion euros.

The ICT market remains an essential component of economic growth, and represents an important source of value creation through the distribution of new services and new uses. Among these are, in particular, growth areas developed by Orange: the Cloud, Big Data and the Internet of Things.

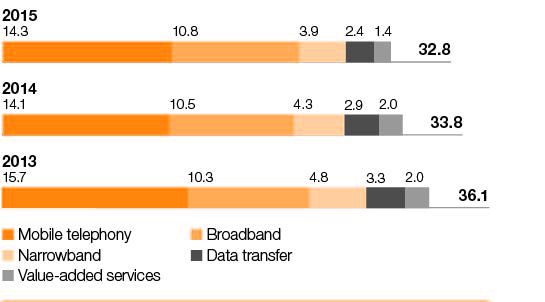

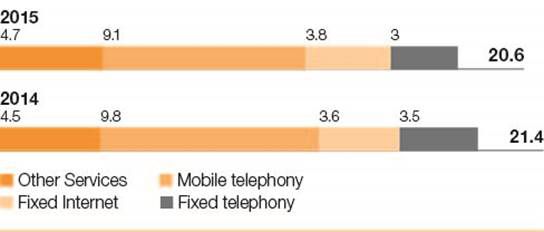

Revenues of telecom services, which amounted to 1,164 billion euros at the end of 2015, continued to grow by +2.1%, albeit at a slower rhythm than that of all ICT services (+4.8%)

Market growth by region

Figure 1: Geographical breakdown of global ICT revenues (in billions of euros)

Source: Idate.

ORANGE / 2015 REGISTRATION DOCUMENT - 10

The ICT market grew in 2015 at different speeds depending on the geographical area. Growth accelerated in emerging countries, in particular in Africa and the Middle East. Emerging countries, which represent 30% of the world market, contributed more than 50% of global growth (source: Idate).

Figure 2: 2015/2014 Growth rate by region

Source: Idate and FMI.

Europe

In 2015, revenues of European telecom services stabilized (-0.2%) compared to 2014, after four years of shrinkage from 2010 to 2014 (-1.2% in 2014 and -3.4% in 2013). Europe remains the least dynamic region in the world in terms of growth, and its weight in the world market now only represents 24%, behind Asia Pacific and North America (source: Idate).

Moreover, operators (including cable operators) continue to face competition from Over the top (OTT) players that generally offer communication services to users for free (being remunerated by advertising).

USA

In 2015, the growth in the ICT market was down slightly, from 4.6% to 4.3%, in a context of stable US GDP growth. The region improved its performance in the ICT market, despite a downturn in growth in telecom services, and more noticeably in networking equipment. Indeed, the United States is coming out of a strong growth phase led by the renewal of its mobile networks. The rollout of LTE led to significant investments and an increase in the operators’ revenues (source: Idate). In 2015, revenues from telecom services reached 298 billion euros, up by 1.8%, representing 26% of the world market.

Africa and the Middle East

In 2015, the growth of the ICT market remained high at 6.7%, despite a downturn in economic growth of 2.8% on the continent (compared with 3.5% in 2014). The potential of this region in which the Orange group is very present remains strong, both in terms of equipment and access infrastructure. Telecom services that represent 43% of the ICT market are up by 5.1%, higher than that of the world market overall, but slowing down compared to 2014. Revenues of telecom services totaled 103 billion euros, for a 9% share of the world market, the weakest compared to the other regions in the world.

South America

In spite of the advanced maturity of services, the opening to market competition created a strong dynamic of development of equipments and uses. The growth of the ICT market fell slightly compared to 2014, but was higher than 5%. Telecom services represent nearly 36% of the ICT market with sustained growth in 2015 (+3.1%).

Revenues of telecom services reached 112 billion euros, representing 10% of the world market.

Asia Pacific

This region, that includes both advanced economies and emerging countries, recorded a high growth in the ICT market (+6.6%), valued at 1,196 billion euros. Economically, the region also posted high GDP growth, especially in China (+6.8%). Revenues of telecom services that reached 373 billion euros in 2015, a growth of 2.9%, represent 32% of the world market, the largest share of all regions worldwide. In this region, telecom services represent almost one third of the revenues of the ICT, in spite of a 1.5 percentage point slowdown in 2015 compared to 2014.

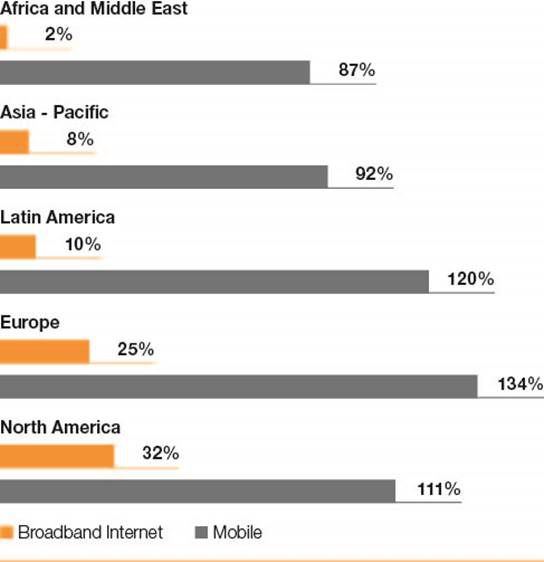

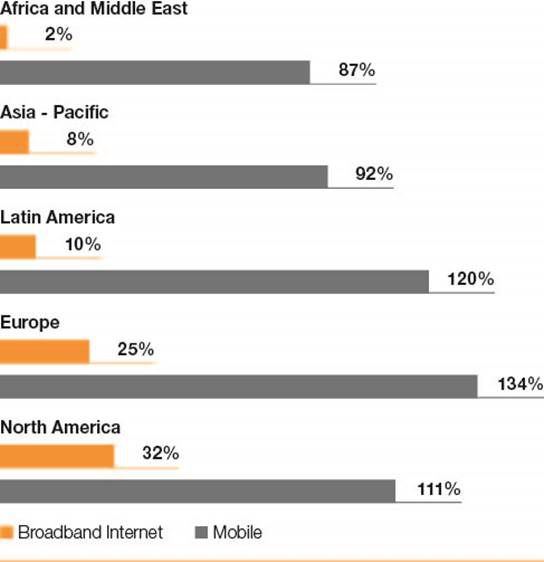

Figure 3: Mobile and fixed broadband Internet penetration rate by geographic region in 2015 (in % of the population)

Source: Idate.

ORANGE / 2015 REGISTRATION DOCUMENT - 11

Key trends and changes

Convergence of services and market consolidation

The growth in mobile access with the 4G development and the high penetration of smartphones and M2M throughout the world constitutes a major component of the momentum of the telecommunication sector. Convergence is also a major trend, particularly in Europe, since it allows operators with both fixed and mobile network infrastructures to capture and keep their customers through a household-based approach, faced by the competition from fixed-line only or mobile only operators. This convergence results in the development of so-called “quadruplay” offers (voice, Internet, television, mobile). Convergence is also illustrated by the growing use of WiFi in mobile networks. On their side, the cable operators also include WiFi in their offers to counter telecom operators’ quadruplay offers.

One can simultaneously observe a movement toward consolidation of players, both in Europe and the USA, linked to this convergence of networks and services, as well as the necessity of acquiring a larger size whereas the pressure on prices is stronger and infrastructure investments are indispensable.

In Europe, a series of mergers between fixed-line and mobile operators have occurred since 2014, such as the acquisition of the fixed-line operator Kabel Deutschland by Vodafone in Germany, the acquisition of SFR and Virgin Mobile in France and Portugal Telecom in Portugal by Altice, the purchase of Groupo Corporativo by Vodafone in Spain and the purchase of Base by Telenet in Belgium. The acquisition of EE by BT in the United Kingdom and Jazztel by Orange in Spain follows the same logic of alliances between fixed and mobile activities.

Moreover, since 2013 consolidation transactions have reduced the number of mobile operators in Austria, Germany, Ireland, Italy and in the UK from four to three.

Cable has also been at the center of many transactions over the past few years with Liberty Global, which took control of Virgin Media in the United Kingdom and Ziggo in the Netherlands, the merger of Comcast with Time Warner cable and the entry of Altice into the United States with the acquisition of two cable operators in 2015: Suddenlink Communications and Cablevision.

Development of networks and growth of telecommunications uses worldwide

In Africa and the Middle East, Internet access networks are developing mainly via the deployment of 3G and 4G mobile networks, whereas in Europe investments in networks are concentrated in high capacity broadband access, with the development of fixed-line offers on fiber referred to as FTTH (Fiber-to-the-Home) and the deployment of 4G mobile networks. In parallel, operators are developing their networks to make them more agile and simpler to manage (with “virtualization”) and more open (with API).

Uses are exploding under the combined effect of the deployment of new networks, the increase in the capacities of existing networks and the growth in the penetration rate of more and more sophisticated mobile handsets (smartphones). The explosion in uses is mainly driven by video, and by the increase in the number of screens (computers, smartphones, tablets, readers, connected TVs, connected watches).

New expectations of consumers and businesses

For the consumer, digital technologies continue to permeate all areas of daily life: family, home, wellness, entertainment, work and money. Indeed, more and more of these areas are being affected by connected objects, such as domotics (home automation), automobile, health, energy and wellness, and are likely to be integrated in all industries and services over time. Some forecasts indicate for example about 25 billion connected objects in 2020 (source: GSMA Understanding the Internet of Things, July 2014). In this area, the development of technologies such as LoRa (long range bi-directional low power network) should have a major impact on the growth of this market.

For the most part, B2B applications of the Internet of Things are being developed within companies (for example, for the optimization of internal logistic processes). The big players of the Internet generate revenue by monetizing data obtained via connected objects (collected and analyzed thanks to Big Data techniques). In this context, consumers have strong expectations on the quality and reliability of the communication networks, but also on the protection of their personal data and on having a relationship of trust with their operator.

Digitalization (IoT, Big Data) allows companies to improve their performance by knowing their customers better and by improving the management of their industrial processes. Therefore they also express the need to be assisted in this double aspect of their transformation process.

Evolution of operators’ model and revenues

Connectivity services will continue to make up the largest part of telecommunications operators’ revenues in the next few years. Nevertheless, other sources of revenues will reside in the ability to monetize new services related to changes in their networks and services platforms, to applications suppliers, residential and business customers. These are in particular:

- new models of access to IT (Information Technology) platforms through API (Application Programming Interfaces) that will strengthen the independence of users to implement personalized services themselves;

- innovative technologies such as data analysis (Big Data), Internet of Things (IoT) or M2M (Machine to Machine);

- mobile financial services in 3 areas: money transfers, payments and mobile banking;

- a secure management of data and transactions by operators.

The rise of the collaborative economy

The digital revolution has allowed collaborative models to emerge in the economic sphere where sharing and using take precedence over property. These models are based on direct relationships between individuals who can exchange services thanks to the development of digital networking platforms (accessible over the Internet, mobile phones or tablets). This market, representing $15 billion today, will reach $335 billion by 2025, according to estimates by the auditing and consulting firm PwC. The biggest players (Airbnb, Uber, Blablacar, etc.) who focus on the management of these platforms with minimum investment, reap significant revenue. These models are extremely disruptive. They enter into direct competition with well-established companies (hotel industry, transportation, finance, distribution) that have to bear the costs associated with the production of goods and services. They also pose challenges to traditional ways of organizing labor and social security (associated with salaried employees), and are outside the established framework of corporate taxation. Whereas traditional players will have to adapt themselves by integrating consumers and users into their business processes, the collaborative models will also have to evolve in order to overcome obstacles to their development.

ORANGE / 2015 REGISTRATION DOCUMENT - 12

2.2 Regulations

2.2.1 European Union

The regulatory environment of the electronic communications sector within the member states of the European Union in which the Orange Group operates conforms to a requirement of harmonization arising from the obligation for National Regulatory Authorities to implement at a national level the regulatory framework defined at the level of the European Union, even if the regulatory environment is marked by certain discrepancies.

This common regulatory framework is presented below with a detailed description for each major country in which the Orange Group operates[1].

2.2.1.1 Legal and regulatory framework

The general EU legal framework for electronic communications consists of five main directives deriving from the 2002 Telecom Package:

- Framework Directive 2002/21/EC of March 7, 2002, on a common regulatory framework for electronic communications networks and services;

- Authorization Directive 2002/20/EC of March 7, 2002, on the authorization of electronic communications networks and services;

- Access Directive 2002/19/EC of March 7, 2002, on access to, and interconnection of, electronic communications networks and associated facilities;

- Universal Service Directive 2002/22/EC of March 7, 2002, on universal service and users’ rights relating to electronic communications networks and services;

- Directive on Privacy and electronic communications 2002/58/EC of July 12, 2002, concerning the processing of personal data and the protection of privacy in the electronic communications sector.

All five directives were reviewed in 2009[2] with changes fully transposed by EU member states, and were subsequently placed under the oversight of the Body of European Regulators for Electronic Communications, (BEREC)[3].

The European Commission is expected to present a new framework directive in 2016.

On October 9, 2014, the European Commission approved a new recommendation (2014/710/EC) identifying four relevant product and service markets susceptible to ex ante regulation compared to seven in its previous recommendation made in 2007:

- M 1: wholesale call termination on individual public telephone networks provided at a fixed location;

- M 2: wholesale voice call termination on individual mobile networks;

- M 3:

a) wholesale local access provided at a fixed location, and

b) wholesale central access provided at a fixed location for mass-market products;

- M 4: wholesale high-quality access provided at a fixed location.

This regulatory framework has been fleshed out with a number of additional texts.

Roaming

Regulation No. 531/2012, adopted on June 13, 2012 by the European Parliament and Council, on roaming on public mobile communications networks within the Union (Roaming III):

- introduces, for the wholesale market, a regulated right of access to European roaming services for MVNOs and resellers;

- extends the sliding cap on roaming rates to the retail data market;

- introduces, as of July 1, 2014, two structural changes to increase competition in the retail market by separating domestic services and international roaming services;

- expands, for customers using their cell phones outside the EU, pricing transparency requirements and bill shock prevention measures for European operators.

ORANGE / 2015 REGISTRATION DOCUMENT - 13

Roaming III regulation

|

Price caps

(euros VAT excl.) | |

July 1, 2011 |

July 1, 2012 |

July 1, 2013 |

July 1, 2014 |

July 1, 2017 |

July 1, 2022 |

|

Voice |

Sent (retail) |

0.35 |

0.29 |

0.24 |

0.19 |

Withdrawal (1) |

|

Received (retail) |

0.11 |

0.08 |

0.07 |

0.05 |

Withdrawal (1) |

|

Wholesale |

0.18 |

0.14 |

0.10 |

0.05 |

0.05 |

Withdrawal (1) |

|

SMS |

Sent (retail) |

0.11 |

0.09 |

0.08 |

0.06 |

Withdrawal (1) |

|

Received (retail) |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

Withdrawal (1) |

|

Wholesale |

0.04 |

0.03 |

0.02 |

0.02 |

0.02 |

Withdrawal (1) |

|

Data |

Retail | |

0.70 |

0.45 |

0.20 |

Withdrawal (1) |

|

Wholesale |

0.50 |

0.25 |

0.15 |

0.05 |

0.05 |

Withdrawal (1) |

| | | | | | | | |

Voice: price per minute excl. VAT/SMS: price by SMS excl. VAT/data: price per MB excl. VAT.

(1) Withdrawal subject to EC review in 2016.

Source: Orange, based on data in EU regulation No. 531/2012.

The European single market for telecommunications was adopted by the European institutions and published on November 26, 2015. One of its main aims was to amend the Roaming III regulations that would ban surcharging for roaming within the EU by June 2017 (see Section 2.2.1.2).

Call termination rates

On May 7, 2009, the European Commission adopted a recommendation regulating fixed-line and mobile call termination rates in the EU (2009/396/EC).

The Commission recommends that national authorities should apply the following principles:

- symmetry in each country between the various operators’ fixed voice call termination rates and also between their mobile call termination rates, with the option of allowing a four-year transitional asymmetry on fixed or mobile call termination rates to benefit a new entrant;

- call termination rates geared towards the avoidable cost of this service for an efficient operator (i.e. about 1 euro cent per minute for voice MTRs and a lower rate for voice FTRs).

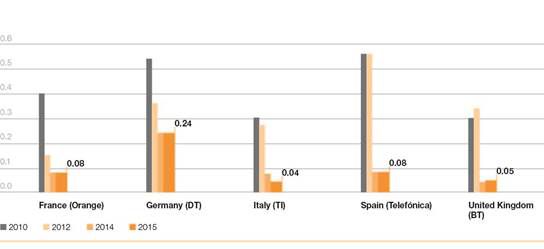

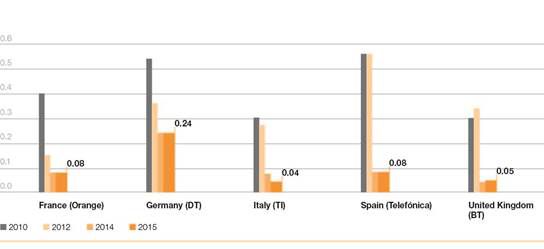

Change in mobile voice call termination rates (in euro cents per minute)

|

2013 |

2014 |

2015 |

|

Quarter |

1 |

2 |

3 |

4 |

1 |

2 |

3 |

4 |

1 |

2 |

3 |

4 |

|

Orange France |

0.8 |

0.78 |

|

Orange UK/EE |

2.066 |

1.168 |

1.16 |

1.16 |

|

Orange Espagne |

3.16 |

2.76 |

1.09 |

|

Orange Polska |

1.97 |

1.03 |

|

Mobistar |

1.08 |

|

Orange Romania |

3.07 |

0.96 |

|

Orange Slovensko |

3.18 |

1.23 |

| | | | | | | | | | | | | | | | |

Source: Cullen International December 2015.

Figures are December tariffs at local level-Exchange rates used in this table are the latest month average rate of the period.

Change in fixed voice call termination rates (in euro cents per minute) (1)

Source: Cullen International - December 2015.

Exchange rates used in this table are the latest month average rate of the period

(1) Methodology for fixed-line call termination benchmarking: Average price per minute (in euro cents): at local level, i.e. at the lowest interconnection point (the equivalent the of ICAA in France); during “peak” minutes only (as off-peak periods are not consistent from one operator to another).

ORANGE / 2015 REGISTRATION DOCUMENT - 14

Access to fixed-line infrastructure

Recommendation “on non-discrimination obligations and consistent costing methodologies to promote competition and enhance the broadband investment environment”

The recommendation adopted by the European Commission on September 12, 2013, seeks to:

- strengthen rules on non-discrimination to provide equivalent access on new networks, publication of performance indicators and the application of technical replicability tests;

- to stabilize prices, at constant currency, for use of the copper network around the current average access price within the EU (8 to 10 euros at current rates excluding tax); and

- to allow greater flexibility in determining high speed broadband wholesale prices to the extent that National Regulatory Authorities are allowed not to impose a cost-orientation obligation when strengthened non discrimination rules are in place and competition between platforms (copper, cable, mobile) is effective.

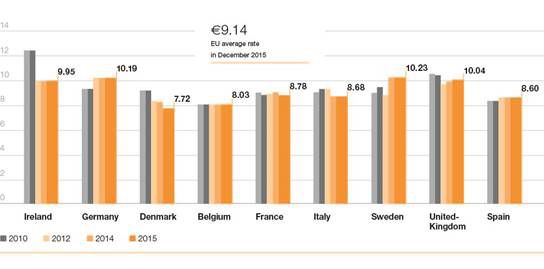

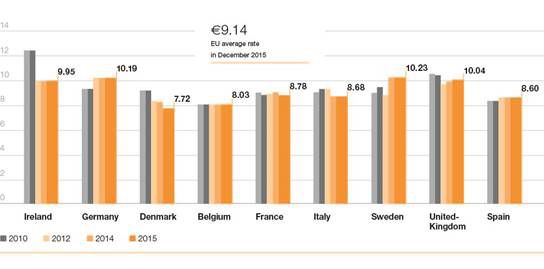

Full unbundling - European benchmark data (recurrent monthly charge excluding commissioning costs)

Source: Cullen International - December 2015. Exchange rates used in this table are the latest month average rate of the period

2.2.1.2 Significant events in 2015 and the start of 2016

|

Regulation on the European Single Market for Electronic Communications |

|

October 2015 |

Adoption by the European Parliament of the regulation |

|

Protecting Personal Data |

|

February 2016 |

Adoption by the European Parliament of a General Data Protection Regulation |

|

“Privacy Shield” agreement |

|

Framework Review |

|

September 2015 |

Consultation on the framework review |

European single market for telecommunications

The European Parliament adopted the European single market for telecommunications on October 27, 2015. This covers:

- the end of roaming charges and international call premiums for intra-European calls: representing a consensus on the political objective among the institutions and the telecommunications industry, the text takes into account the serious technical difficulties that must be resolved in order to ensure that this key measure for Europe does not have concrete negative consequences on the price of domestic mobile services or on investments in the networks. In November 2015 the European Commission launched a public consultation on how to resolve these technical difficulties.

Under this regulation, a transitional period starting on April 30, 2016, allows, for all price plans, intra-European roaming calls to be charged at the domestic price, plus a maximum surcharge corresponding to the regulated wholesale price caps currently applicable. The cost of incoming roaming calls is capped at the weighted average call termination rates regulated in Europe (1.14 euro cents). A “RLAH[4] + surcharge” model is allowed for all pricing plans.

After this transition period, roaming charges and international call premiums for intra-European calls must be stopped according to technical terms that have yet to be defined;

- net neutrality: BEREC is responsible for creating the guidelines for the establishment of rules applicable throughout Europe to preserve the open Internet, which will be applied in each country under the responsibility of local regulators by May 2016.

ORANGE / 2015 REGISTRATION DOCUMENT - 15

Review of the “Telecom Package” framework

The European Commission launched a consultation in September 2015 to review the “Telecom Package” regulatory framework. In response, Orange affirms the need to reorient the objectives of the framework towards economic development and investment, to limit and to simplify access obligations to fixed-line networks, to impose spectrum allocation rules that promote economic efficiency, to modernize consumer protections, to rethink the instruments allowing access to the Internet for all and to adopt a truly harmonized regulation in Europe. The European Commission is expected to present a new framework directive in 2016.

Protecting Personal Data

A general directive (1995/46/EC) encompasses the processing of personal data in the European Union. This directive must be updated in early 2016, following an agreement between the European Commission, the European Parliament and the European Council concluded on December 15, 2015. The new rules harmonize with one another within the EU and strengthen the rights on data protection and the control of existing personal data; they will apply from 2018. The Privacy and electronic communications directive, specific to the electronic communications sector (2002/58/EC), will also be updated in order to remain consistent with the inter-sector directive.

Following the ECJ’s invalidation of Decision 2000/520/EC, known as “Safe Harbour”, the European Commission and the US authorities published a new framework for transatlantic data exchange on February 29, 2016. Known as EU-US Privacy Shield, the agreement is intended to ensure that the personal data of European citizens enjoys the same protections they do in Europe when they are processed in the United States.

2.2.2 France

2.2.2.1 Legal and regulatory framework

Legal framework

The electronic communications sector is primarily governed by the French Postal and Electronic Communications Code (CPCE) as well as legal provisions relating to e-commerce, the information society, consumer protection and personal data protection.

The French government transposed the European Telecom Package, as amended in 2009, into national law via the Ministerial Order of August 24, 2011 and the Decree of March 12, 2012, implementing regulations.

The audiovisual communication services produced or distributed by the Orange group come under the specific regulations governing this sector and are managed by the amended law of September 30, 1986[5].

Regulatory Authorities

The Postal and Electronic Communications Regulatory Authority (the Arcep) is an independent administrative body created by the law of July 26, 1996 and acts as French regulator for these sectors nationwide. The Arcep’S main missions in electronic communications are to set regulations (general or specific obligations) for operators within its jurisdiction. It has powers to sanction non-compliant operators and can rule on disputes between operators over technical and pricing conditions for network access and interconnection. The Arcep also allocates spectrum and numbering resources. Finally, it determines the size of contributions to fund the universal service obligation and oversees the mechanisms for delivering this funding.

The French Competition Authority is an independent government authority responsible for ensuring open market competition and compliance with public economic policy. It has jurisdiction over all business segments, including the electronic communications sector. It has sanction powers for anti-competitive practices, as well as consultative powers. It also specializes in overseeing mergers and acquisitions.

The ANFr (Agence nationale des fréquences - French national agency for frequencies) is responsible for planning, managing and controlling the usage of radio frequencies and for coordinating the establishment of certain radio transmission facilities. The frequency spectrum is covered by 11 controlling authorities: government ministries, Arcep and the French Broadcasting Authority (CSA). The Arcep and the CSA are in turn responsible for allotting to users the frequencies they control.

The CSA is an independent administrative body created by the law of January 17, 1989, tasked with protecting freedom of audiovisual communication by means of any electronic communications technology as regards radio and television in accordance with the Law of September 30, 1986. In July, 2013 the CSA was partly reformed and a Commission for the modernization of audiovisual broadcasting is to be created and given responsibility for the radio spectrum.

ORANGE / 2015 REGISTRATION DOCUMENT - 16

2.2.2.2 Regulation of mobile telephony

Main blocks assigned in the mobile services spectrum

(700 MHz, 800 MHz, 900 MHz, 1,800 MHz, 2.1 GHz and 2.6 GHz)

|

700 MHz |

- Authorizations were given to Orange and Free in December 2015 for 10 MHz each, and to Bouygues Telecom and SFR for 5 MHz each for a period of 20 years |

|

800 MHz |

- Authorizations were given to Bouygues Telecom, Orange and SFR in January 2012 for 10 MHz each for a period of 20 years

- Free Mobile has roaming access rights on the SFR network in the “priority development zone” (ZDP), covering the least populous areas of the country (18% of the population and just under two thirds of mainland France) |

|

900 MHz |

- 2G and 3G operators were authorized to refarm the 900 MHz band for 3G in February 2008

- 2 x 5 MHz were sold back to Free Mobile by Orange France and SFR on January 1, 2013 for high-density areas, and by Bouygues Telecom in July 2011 for the remaining parts of the country |

|

1,800 MHz |

- Bouygues Telecom has been authorized to refarm the 1,800 MHz band for 4G from October 2013, after handing back some spectrum

- Orange and SFR have been authorized to refarm the 1,800 MHz band for 4G from May 2016, or earlier if they so desire, after handing back some spectrum

- Authorization was given to Free in December 2014 for 5 MHz duplex; Free may request the allocation of the 10 MHz handed back by Orange and SFR |

|

2.1 GHz |

- Free Mobile was awarded the fourth 3G license, with a 2.1 GHz channel, in January 2010

- SFR and Orange France were each awarded two other channels in May 2010 |

|

2.6 GHz |

- Authorizations were given to Orange France and Free Mobile in October 2011 for 20 MHz each, and to Bouygues Telecom and SFR for 15 MHz each |

Deployment obligations of 3G operators in continental France

To date, Arcep has considered that the operators have respected their 3G deployment obligations in continental France in regard to the schedules specified in their authorizations.

At the end of December 2015, Orange’s 3G coverage was 99.3% of the population and 92.6% of the country.

Deployment obligations of 4G operators in continental France

|

(as a % of the population) |

01/17/2017 |

10/11/2019 |

01/17/2022 |

10/11/2023 |

01/17/2024 |

01/17/2027 |

End-2030 |

|

Regional rail network

(coverage in each region) | | | | | |

60%

(700 mHz) |

80%

(700 MHz) |

|

Regional rail network (national coverage) | |

60%

(700 mHz) | | | |

80%

(700 MHz) |

90%

(700 MHz) |

|

Priority highways | | | | | | |

100%

(700 MHz) |

|

Town centers in the “white area” program (1% of the population and 3,300 town centers) | | | | | |

100%

(700 MHz) | |

|

Inside priority deployment area (18% of population and 63% of territory) |

40%

(800 MHz) |

90%

(800 MHz)

50%

(700 MHz) | | | |

92%

(700 MHz) |

97.7%

(700 MHz) |

|

In each county (département) | | | | |

90%

(800 MHz) |

95%

(800 MHz) |

95%

(700 MHz) |

|

Throughout the metropolitan territory | |

60%

(2.6 GHz) | |

75%

(2.6 GHz) |

98%

(800 MHz) |

99.6%

(800 MHz) 98%

(700 mHz)

(700 MHz) |

99.6%

(700 mHz) |

Source: Arcep.

At the end of December 2015, Orange’s 4G coverage was 79.6% of the population and 32.8% of the country.

ORANGE / 2015 REGISTRATION DOCUMENT - 17

Analysis of the wholesale mobile call termination markets (4th round)

Mobile voice call termination

On December 9, 2014, Arcep issued decision No. 2014-1485 concerning analysis of the wholesale fixed-line or mobile call termination markets for 2014-2017. It set the following price ceilings for mobile voice call termination:

|

(cent€/min) |

Market analysis -

1st round |

Market analysis - 2nd round |

Market analysis - 3rd round |

Market analysis - 4th round |

|

1st price cap |

2nd price cap (decision Dec. 2008) (1) |

(March 2011 and July 2012 decisions) |

(December 2014 decision) |

|

2005 |

2006 |

2007 |

Jan. 08 - Jun. 09 |

Jul. 09

- Jun. 10 |

Jul. 10 - Dec.10 |

Jan. 11

- Jun. 11 |

Jul. 11 - Dec. 11 |

Jan. 12 - Jun. 12 |

Jul. 12 (2) - Dec. 12 |

Jan. 13

- Jun. 13 |

Jul. 13 - Dec. 13 |

Jan. 14

- Dec. 14 |

Jan. 15 - Dec. 15 |

Jan. 16 - Dec. 16 |

Jan. 17 - Dec. 17 |

|

Orange France |

12.50 |

9.50 |

7.50 |

6.50 |

4.50 |

3.00 |

3.00 |

2.00 |

1.50 |

1.00 |

0.80 |

0.80 |

0.80 |

0.78 |

0.76 |

0.74 |

|

SFR |

12.50 |

9.50 |

7.50 |

6.50 |

4.50 |

3.00 |

3.00 |

2.00 |

1.50 |

1.00 |

0.80 |

0.80 |

0.80 |

0.78 |

0.76 |

0.74 |

|

Bouygues Télécom |

14.79 |

11.24 |

9.24 |

8.50 |

6.00 |

3.40 |

3.40 |

2.00 |

1.50 |

1.00 |

0.80 |

0.80 |

0.80 |

0.78 |

0.76 |

0.74 |

|

Free Mobile, full MVNO (2) | | | | | | | | |

2.40 |

1.6 (3) |

1.1 (3) |

0.80 |

0.80 |

0.78 |

0.76 |

0.74 |

|

Asymmetry |

18 % |

18 % |

23 % |

31 % |

33 % |

13 % |

13 % |

0 % |

0 % |

60 % |

38 % |

0 % |

0 % |

0 % |

0 % |

0 % |

(1) For Bouygues Telecom, decision 2010-0211 of February 18, 2010 setting the rate for 2nd half 2010 at €3.40 cents.

(2) For Free Mobile and full MVNO's Lycamobile and Oméa Telecom, decision of July 27, 2012 with effect as of August 1, 2012 - maximum price for 1st half 2012.

(3) Excluding BNP.

SMS TR

On January 29, 2015, the Arcep put the SMS call termination market, previously regulated, under surveillance.

Significant events in 2015 and the start of 2016

|

Spectrum |

|

July 2015 |

Orange and SFR have been authorized to use the 1,800 MHz band for 4G from May 2016 after handing back some spectrum |

|

September 2015 |

Allocation of 5 MHz duplex of 1,800 MHz spectrum to Free Mobile |

|

December 2015 |

Allocation of 30 MHz duplex of 700 MHz spectrum to Orange, Free Mobile, SFR and Bouygues Telecom |

|

January 2016 |

Overseas territories: launch of an allocation process for the 800 MHz and 2.6 GHz spectrum not yet allocated, and the spectrum still available in 900 MHz, 1,800 MHz and 2.1 GHz |

|

Mobile coverage |

|

August 2015 |

Provisions for improved coverage under the Macron law giving broader powers to Arcep on the matter |

|

May 2015 |

Inter-operator agreement on the coverage of white areas |

Spectrum

Digital dividend - 700 MHz Band

On January 8, 2015 the Prime Minister’s Order on reallocating the 700 MHz band to the Arcep (2*30 MHz) for high-capacity mobile uses was published in the French Official Journal. It allocated the 703-733 MHz and 758-788 MHz bands to the Arcep, initially jointly with the CSA as from December 1, 2015 and exclusively from July 1, 2019.

On December 9, 2015, following a spectrum allocation auction, Arcep granted authorizations to use the spectrum in the 700 MHz band as follows: Orange and Free received two blocks of 5 MHz duplex each, Bouygues and SFR one block of 5 MHz duplex each. In total, the government will receive €2,799 million, including €933 million from Orange, for the allocation of this spectrum, between 2015 and 2018.

1,800 MHz

In July 2015, the Arcep authorized Orange and SFR to use the 1,800 MHz band for 4G from May 25, 2016 after handing back some spectrum. Orange and SFR keep 20 MHz in the band; Free may request the allocation of the 10 MHz handed back.

In September 2015, Arcep granted 5 MHz to Free Mobile in the 1,800 MHz band, as per decision of December 16, 2014: this allocation is part of the 15 MHz duplex reserved for Free Mobile in the target allocation plan for the 1,800 MHz band by May 2016. These 5 MHz duplex are technology neutral.

Allocation of spectrum in overseas territories

The call for applications for the allocation of 800 MHz, 900 MHz, 1.8 GHz, 2.1 GHz and 2.6 GHz frequencies in the overseas territories (in Guadeloupe, Guyana, La Réunion, Martinique, Mayotte, Saint-Martin and Saint-Barthélemy) was launched by the government on January 29, 2016, in order to provide the operators with the means necessary to deploy 4G and continue developing their 3G networks. The allocations distributed by beauty contest procedure are scheduled for 2016.

Mobile coverage

As part of the Macron Act of August 6, 2015, measures have been taken to improve mobile telephony coverage, which must cover all non-covered town centers by the end of 2016. This involves finalizing the White Zones 2G program and supplementing it with the coverage of 268 additional town centers, which may be deployed in 3G. Moreover, the current shared 3G program, “3G RAN Sharing”, should be finalized by mid-2017. Beyond the town centers, some areas of economic interest which are not currently covered may be the subject of a request to the concerned territorial authority for financial aid from the government at a local bureau, which the government will organize.

These measures have been incorporated in the agreement signed on February 24, 2016, between the four mobile operators in the presence of the Ministry of the Economy and Arcep. They are accompanied by the withdrawal of the public telephony component of the universal service.

ORANGE / 2015 REGISTRATION DOCUMENT - 18

2.2.2.3 Regulation of fixed-line telephony, broadband and superfast broadband Internet

Since July 2008, except for retail offers for fixed telephony under universal service, all of Orange’s regulatory obligations concerning retail fixed-line telephony (access and communication) on the consumer and business markets have been lifted. Ex ante regulation of Orange’s fixed-line services relates to retail offers under the universal service and wholesale offers that are regulated to ensure effective competition in the retail markets (call origination and termination, wholesale line rental, unbundling, access to ducts and poles, bitstream and capacity services).

Orange’s obligations regarding cost accounting and accounting separation in the fixed-line business

The Arcep’S decision No. 06-1007 of December 7, 2006 sets forth Orange’s obligations as to cost accounting and accounting separation in the wholesale and retail businesses. When retail activities make use of wholesale network services that are subject to accounting separation, these resources are recognized in regulatory accounts at the wholesale offers price. These obligations were first implemented in 2007 in respect of FY2006 ; they were deemed compliant by the Arcep and were renewed every year since then with the same outcome.

Analysis of the relevant markets for fixed broadband and high-speed fixed broadband, fixed-line telephony and fixed-line voice call termination (4th round)

Analysis of the fixed broadband and high-speed fixed broadband markets mid-2014 to mid-2017

On June 26, 2014, the Arcep issued three analysis decisions on the fixed broadband and high-speed fixed broadband markets for mid-2014 to mid-2017:

- decision No. 2014-0733 concerning analysis of the relevant wholesale market for access to the physical network infrastructure that composed the local loop (market 4);

- decision No. 2014-0734 concerning analysis of the relevant wholesale market within France for broadband and high-capacity broadband (market 5);

- decision No. 2014-0735 concerning analysis of the relevant wholesale market for capacity services (market 6).

The scopes for these three decisions were defined to comply with changes made by the European Commission recommendation of October 9, 2014 on the relevant markets subject to ex ante regulation, in order to make a distinction between wholesale “generalist” offers aimed at the consumer and wholesale offers targeting business needs. In this enterprise segment, Arcep decision No. 2014-0735 lift the pricing obligations on Orange (copper and fiber) in some competitive geographical areas from January 1, 2015.

Analysis of relevant fixed-line telephony markets in 2014-2017

On September 30, 2014 the Arcep issued decision No. 2014-1102 on analysis of the relevant markets for fixed-line telephony in 2014-2017. It prolonged the obligation imposed on Orange to provide wholesale line rental (WLR) at cost-based prices. The decision introduced a gradual relaxation of the pricing obligations imposed on Orange for straight carrier selection offers. Finally, the decision lifts the asymmetrical regulation imposed on Orange in the call origination market for calls to value-added service (VAS) numbers, instead relying exclusively on the symmetrical framework established by Arcep decision No. 2007-0213.

Analysis of the wholesale markets for fixed-line voice call termination in 2014-2017: cut in call termination prices

On December 9, 2014, Arcep issued decision No. 2014-1485 concerning analysis of the wholesale fixed-line or mobile call termination markets for 2014-2017. It set the following price ceilings for fixed-line call termination:

|

Caps (in euro cents/min) |

Call termination rates |

Variation |

|

January 1, 2013 |

0.08 |

(46.6)% |

|

January 1, 2015 |

0.079 |

(1.25)% |

|

January 1, 2016 |

0.078 |

(1.26)% |

|

January 1, 2017 |

0.077 |

(1.28)% |

Regulation of fixed-line electronic communications service offers

Rate changes for wholesale offers subject to cost orientation (unbundling, analog and digital Wholesale Line Rental, and call origination)

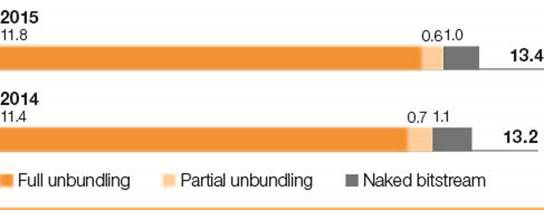

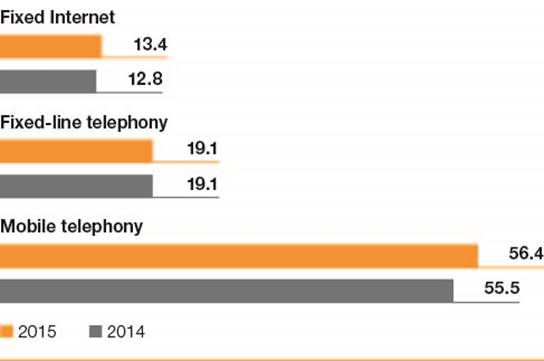

In respect of 2015, Orange published a new increase in the prices for full unbundling and a rise in bitstream access prices. The unbundling prices were EBITDA, before restructuring costs, brand royalties and management during the year in order to respect Orange’s cost orientation obligation.

2016 rates approved by the Arcep in February 2016:

| |

2014 rates |

2015 rates |

2016 rates |

|

Unbundling |

Total |

€9.02 |

€9.05 € (1) |

€9.10 |

|

Partial |

€1.64 |

€1.77 |

€1.77 |

|

Wholesale line rental |

Analog WLR |

€12.19 |

€12.32 |

€12.32 |

|

Digital WLR |

€18.35 |

€18.57 |

€18.57 |

|

Bitstream |

DSL access |

€4.39 |

€4.79 |

€4.79 |

|

Naked DSL access |

€12.41 |

€12.53 |

€12.63 |

(1) Rate adjusted to €8.78 from August 1, 2015.

ORANGE / 2015 REGISTRATION DOCUMENT - 19

Regulation of fiber optic networks

Regulatory framework governing very high-capacity broadband wholesale offers:

- asymmetric regulation of access to civil engineering infrastructure which allows alternative operators to deploy their horizontal networks on Orange’s infrastructure: non-discriminatory access at a rate that reflects costs;

- principle that the terminating segment of FTTH networks are mutualized between operators;

- symmetrical regulation of access to the terminating segment of FTTH networks including outside high-density areas: same obligations to offer passive access to the terminating segment of FTTH networks on reasonable and non-discriminatory terms apply to all operators cabling buildings anywhere in France. This access must be made available from a sharing point in a reasonable location (Arcep decision No. 2009-1106 of December 22, 2009, see also decision no. 2010-1312 of December 14, 2010). Charges must be reasonable and compatible with the principles of efficiency, relevance, objectivity and non discrimination.

National Digital Agency

On February 4, 2015, the decree creating a service with national authority was published in the French Official Journal: the National Digital Agency, which takes over three responsibilities: steering and implementation of the “France Superfast Broadband Program”, coordinating and leading the various initiatives of French Tech, overseeing the dissemination of digital tools and the development of their use. It has to coordinate with several other institutions, including the Caisse des dépôts, BPI France, the National Digital Council, the Arcep and other state services involved in digital development.

The France Superfast Broadband Program aims to have 100% of the French population eligible for very high capacity broadband by 2022, with an interim target of covering half the population and companies by 2017. FTTH is seen as the main way of achieving this, although other technologies are also expected to contribute (higher speed on copper as a transitional solution, satellite, LTE). A total 20 billion euros of private and public investment is estimated to be needed to meet the 2022 target. This breaks down into three parts:

- one third of investment by private operators who expect to use their own capital to deliver FTTH to 57% of French homes by 2022;

- the remaining 43% of homes will be covered by the other two-thirds of investment, to be financed through networks managed by local public authorities (RIP):

- for more than half of these homes, it has been decided to provide FTTH coverage financed partly by public subsidy with the rest provided by private operators,

- the remainder relates to coverage of the more rural zones by complementary solutions (higher speed on copper, satellite, etc.) jointly financed by the state and local authorities.

Significant events in 2015 and the start of 2016

|

Roll out of fiber optic networks and switch off of the copper network |

|

February 2015 |

Delivery of the Champsaur report on the conditions and timing of the copper network closure |

|

August 2015 |

Arcep’s decision on the technical and operational processes for sharing high-capacity fiber optic broadband infrastructure |

|

December 2015 |

Arcep’s decision on the guidelines relating to the FTTH prices of networks managed by local public authorities (RIP) |

|

Arcep’s recommendation on the implementation of the completeness obligation of the fiber optic rollouts outside high-density areas |

|

Reform of value-added services (VAS) pricing |

|

October 2015 |

Entry into force of the VAS pricing reform on October 1, 2015 |

|

Miscellaneous |

|

July 2015 |

Arcep’s decision in dispute resolution on our LFO offers and all-usage hosting |

|

January 2016 |

Arcep strategic review |

|

February 2016 |

Decision on wholesale rates for fixed-line access 2016/2017 |

Rollout of fiber optic networks and switch off of the copper network

The Macron Act of August 6, 2015, establishes new provisions concerning FTTH, including the establishment of an ex ante rate regulation mechanism for FTTH offers for network managed by public local authorities (RIP). In this context, Arcep is responsible for specifying the rate conditions that the network managed by public local authorities (RIP) must meet in order to comply with the EC guidelines regarding state aids to NGAs and with Arcep regulations regarding FTTH. In its decision dated December 7, 2015, Arcep recommends that the rates practiced in the network managed by public local authorities (RIP) be close to those in the privately organized area, taking as reference for the co-financing the rates equal to those charged by Orange in the AMII[6] area and lower for per line rental. Moreover, Arcep reiterates the need for rate consistency between the different offers, and in particular that bitstream rates must be higher than passive leasing. Finally, Arcep proposes to allow a transitional arrangement during the introductory period of the network managed by public local authorities (RIP) with discounted rates during the network’s first years.

On August 7, 2015, Arcep adopted its decision on the technical and operational processes for sharing high-capacity fiber optic broadband infrastructure. The main purpose of this decision is to harmonize the practices of the different operators outside high-density areas. The operators are obliged to roll out the network in the immediate vicinity of all houses located in an area behind a sharing point within five years after its launch. The obligation of completeness of the fiber optic rollouts outside of high-density areas was clarified in December 2015 by a recommendation that tends to alleviate this constraint in the case of an isolated housing area, while precisely defining the technical and economic conditions.

Moreover, the French Competition Authority noted, on July 30, 2015, the lifting of the clause prohibiting Orange from deploying its FTTH network in 208 towns in the AMII area making up part of the area granted to Numericable SFR (i.e. about 900 k lines).

ORANGE / 2015 REGISTRATION DOCUMENT - 20

In parallel, a report (the Champsaur report) aiming to clarify the conditions and the schedule of the copper network closure was delivered to the government on February 19, 2015. This report rules out a closure of the copper network imposed by the public authorities, because only Orange is responsible for making such a decision. It notably includes the creation of “fibered zones” which the government would designate under certain conditions (whole zone served by FTTH networks, network engineering compliant with regulations, etc.) triggering measures to incentivize customers to migrate from copper to fiber.

Reform of value-added services pricing

In March 2014, the Arcep published a recommendation on the wholesale VAS interconnection market with a particular focus on the relationship between originating and recipient operators, as part of the implementation of the VAS pricing reform (decision No. 2012-0856).

On June 10, 2014, Arcep issued decision No. 2014-0661, postponing the entry into force of VAS market reform until October 1, 2015 (initially scheduled for January 1, 2015). This was to allow VAS publishers and recipient operators adequate visibility to conduct their commercial negotiations.

The VAS reform redefines pricing methods applied to calls to short and special numbers (beginning with 08) which allow users to access weather forecasts and distance sales services, for instance, as well as government services. The reform (i) creates a uniform pricing model for the retail services market irrespective of whether the originating call is from fixed-line or mobile network, known as “C+S” for its two components: the price of the call (C) equal to the price of the local call and service (S) defined by the provider and (ii) makes calls which are currently free when calling from a fixed line also free when calling from a mobile number.

Dispute resolution on our LFO offers and all-usage hosting

On April 1, Free submitted a request for dispute resolution to Arcep, asking to use the NRA and LFO hosting offer without extra charge for the routing of its mobile traffic from antennas connected by fiber optics, despite the fact that we offer a commercial package to this effect. Arcep issued its decision on July 30, 2015, in which it imposed on Orange a cost-oriented hosting service for the equipment that permits the routing of mobile traffic, and to allow the routing of the traffic stemming from mobile sites connected by fiber optics on the LFO without extra charge. Orange has appealed this decision based on the second point before the Paris Court of Appeal.

Wholesale rates on fixed-line access 2016/2017

Wholesale rates on fixed-line access 2016/2017: by its decision No. 2016-0206, dated February 16, 2016, on the price framework for copper local loop access for 2016 and 2017, Arcep proposes to increase the full unbundling contract from €9.05 per month to €9.10 per month in 2016, and then to €9.45 per month in 2017, to lower the service access fee from €56 to €50 and the termination fee from €20 to €15 and to lower the price of the SAV+ service (increasing the reliability of a line performing worse than the theoretical values) from €135 to €105.

By its decision No. 2016-0208, dated February 16, 2016, on the price framework of wholesale access to fixed-line telephony services and the associated call origination, for 2016 and 2017, it proposes to stabilize the prices of wholesale line rental and an annual increase of 10% of the call origination.

In addition, by its decision No. 2016-0207 dated February 16, 2016, on the price framework of the offer for generalist activated access to DSL delivered within France by Orange, for the years 2016 and 2017, Arcep proposes to maintain the current prices for collecting and accessing non-naked bitstream and a slight increase in access prices for naked bitstream.

Arcep strategic review

On January 19, 2016, the Arcep published the conclusions of its strategic review, in which it makes public its new regulatory priorities: promoting investment in infrastructures and innovation, ensuring connectivity in all geographies and preserving an open Internet.

2.2.3 Spain

2.2.3.1 Legal and regulatory system

Legal framework

The 2002 European Telecom Package was transposed into Spanish law by the general Telecommunications Act (law No. 32/2003 of November 3, 2003), Royal Decree No. 2296/2004 of December 10, 2004 on the electronic communications markets, network access and numbering, and Royal Decree No. 424/2005 of April 15, 2005 on the supply of electronic communications services, universal service obligations and user rights.

The 2009 Telecom Package was transposed into Spanish law by Royal Decree No. 726/2011 on universal service provision in May 2011 and Royal Decree No. 13/2012 of March 31, 2012.

The telecommunications sector is also covered by law No. 15/2007 of July 3, 2007 relating to the implementation of competition rules.

Law No. 34/2002 of July 11, 2002 relating to the information society and electronic commerce specifies the obligations and limits of responsibility applicable to service providers in the information society.

The regulatory framework applicable to data protection in Spain is based around law No. 15/1999 of December 13, 1999, relating to personal data protection and order No. 999/1999 relating to security measures. In the field of intellectual property rights protection, law No. 23/2006 of July 7, 2006 amends law No. 1/1996 of April 12, 1996 and transposes European directive 2001/29/EC relating to the harmonization of certain aspects of copyright and related rights in the information society.

Regulatory Authorities

Since October 2013, the regulators for all the various sectors of the economy, including telecommunications, have been brought together under a new cross-industry entity, the National Commission for Markets and Competition (Comisión Nacional de los Mercados y la Competencia), set up by law No. 3/2013 of June 4, 2013, which also has responsibility for competition issues.

As a result the telecom industry is overseen by both the new multi-industry regulator and Setsi as follows:

- Setsi handles authorizations, spectrum allocations, telephone numbering, universal service cost approvals, quality of service, and disputes between consumers and non-dominant operators;

- the CNMC conducts market analysis and handles disputes involving operators with significant market power.

ORANGE / 2015 REGISTRATION DOCUMENT - 21

2.2.3.2 Regulation of mobile telephony

Mobile voice call termination rates

Following a consultation on the wholesale mobile call termination market (market 7), the CMT issued a decision on May 10, 2012 proposing a gradual decrease of mobile call termination caps, reaching rate symmetry in July 2013. The adopted caps are as follows:

|

(in euro cents/minute) |

04/16/2012-

10/15/2012 |

10/16/2012-

02/29/2013 |

03/01/2013-

06/30/2013 |

From July

2013 |

|

Movistar, Vodafone, and Orange |

3.42 |

3.16 |

2.76 |

1.09 |

|

Yoigo |

4.07 |

3.36 |

2.86 |

1.09 |

Spectrum

In May 2011, the Spanish authorities allocated a 5 MHz duplex block in the 900 MHz spectrum to Orange Espagne. The license, granted under the principle of technological neutrality, is valid until December 2030.

In July 2011, the Spanish authorities auctioned the 800 MHz, 900 MHz and 2.6 GHz frequency bands. The 800 MHz licenses, awarded in 2011, only become available from 2015. The same is true for the 900 MHz block allotted to Telefónica.

In July 2013, Orange Espagne ‘s license for the 900 MHz band was extended from 2025 to 2030 and its 1,800 MHz license from 2023 to 2030.

Following these allocations, the Spanish spectrum is distributed as follows (national licenses):

|

800 MHz |

900 MHz |

1,800 MHz | |

2.1 GHz | |

2.6 GHz |

| | | |

FDD |

TDD |

FDD |

TDD |

|

Orange |

2*10 MHz |

2*10 MHz |

2*20 MHz |

2*15 MHz |

5 MHz |

2*20 MHz |

10 MHz |

|

Vodafone |

2*10 MHz |

2*10 MHz |

2*20 MHz |

2*15 MHz |

5 MHz |

2*20 MHz |

20 MHz |

|

Telefónica |

2*10 MHz |

2*10 MHz |

2*20 MHz |

2*15 MHz |

5 MHz |

2*20 MHz | |

|

Yoigo | | |

2*15 MHz |

2*15 MHz |

5 MHz | | |

The schedule of the allocation of 700 MHz spectrum for telecom operators has not yet been announced.

Significant events in 2015 and the start of 2016

|

March 2015 |

Start date of 800 MHz licenses for operators |

|

January 2016 |

Proposal to increase the spectrum cap per telecom operator |

Start date of 800 MHz licenses for telecom operators in March 2015

On September 24, 2014 the government approved by Royal Decree 805/2014 the technical specifications that would allow the handover of digital TV spectrum in the 800 MHz band to mobile telephony use. These licenses, awarded following the 2011 auction process to three operators, Telefónica Móviles, Vodafone and Orange, came into force in March 2015.

Spectrum cap per operator

The total spectrum cap is currently set by the CNMC to 185 MHz per operator. In the context of the future regional auctions in the 2.6 GHz band and the auctions in the 3.5 GHz band, which should be held at the end of the first quarter of 2016, the CNMC proposes to increase this cap.

2.2.3.3 Regulation of fixed-line telephony, broadband and superfast broadband Internet

Wholesale broadband markets (markets 4 and 5/2007)

By its decisions of July 18, 2013, revising the rates for access to Telefónica’s local loop, of January 30, 2014, revising the rates of the wholesale services GigADSL, ADSL IP and NEBA and July 23, 2015, revising the rates for the traffic component of the NEBA offer, the CNMC confirmed the following rates:

|

Rates |

|

Unbundling offer (since September 2013) | |

|

Full unbundling |

€8.60 |

|

Partial Unbundling |

€1.30 |

|

Bitstream Offers | |

|

Neba FTTH |

€19.93 |

|

Neba DSL |

€6.48 |

|

Naked DSL premium |

€8.60 |

|

Aggregation offer (per Mbit/s) |

€7.98 |

|

GigADSL and IP-ADSL (regional offer) at 10 Mbits/s |

€10.20 |

|

IP-ADSL (national offer) at 10 Mbits/s |

€13.60 |

Since April 2014, the GigADSL and ADSL IP offers, replaced by NEBA, which will cease to be regulated in areas of Spain where NEBA is available.

ORANGE / 2015 REGISTRATION DOCUMENT - 22

Significant events in 2015 and the start of 2016

|

Replicability of triple play bundles |

|

April 2015 |

Authorization of Telefónica’s takeover of DTS under certain conditions |

|

Orange’s bid for Jazztel |

|

May 2015 |

Authorization by the European Commission of Orange’s takeover of Jazztel under certain conditions |

|

Wholesale broadband market |

|

November 2015 |

Closure of the first copper distribution frames in view of the transition to a very high-capacity fixed broadband network |

|

February 2016 |

Adoption of the third round of analysis of the markets 3a and 3b/2014 and 4/2014 imposing geographical remedies |

Replicability of triple play bundles

The CNMC, in its formation Competition Authority, conditioned its approval of Telefónica’s acquisition of DTS in Resolution C/0612/14 of April 22, 2015, on (1) an offer to access exclusive content under economic conditions of replicability, including for offers coupled with Internet access, as well as on (2) the provision of a wholesale access offer to Telefónica’s Internet network at data rates sufficient to offer competitive IPTV services. Telefónica took on these commitments for a period of five years, renewable for 3 additional years.

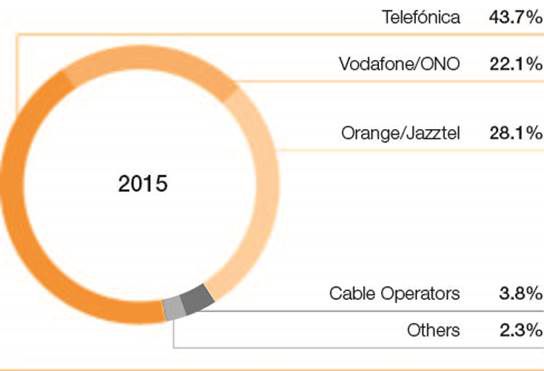

Orange’s bid for Jazztel

The European Commission approved Orange’s proposed acquisition of Jazztel PLC on May 19, 2015, under the EU Merger Regulation. This authorization is subject to Orange’s complete implementation of a number of commitments that will ensure effective competition in the markets for access to fixed-line Internet services after the acquisition.

In order to remedy the problems identified by the Commission, Orange presented the following commitments:

- for fiber optics: Orange has committed to sell an independent Fiber To The Home (FTTH) network which covers between 700,000 and 800,000 housing units, which approximates the size of the current Orange FTTH network in Spain. This high speed broadband network serves 13 municipalities in five of the largest cities in Spain: Madrid, Barcelona, Valencia, Seville and Malaga;

- for copper: Orange has committed to granting to the purchaser of the FTTH network a wholesale access to Jazztel’s national ADSL network for period of up to 8 years. The commitment is valid for an unlimited number of subscribers and will allow the purchaser to position itself immediately as a competitor in 78% of Spain territory.

The buyer of the fiber optic network by the MVNO MasMóvil, was approved by the European Commission on October 16, 2015.

Wholesale broadband markets: Third round of the analysis of markets 3a and 3b/2014 and 4/2014

The CNMC has adopted its third cycle of the analysis of the markets 3a and 3b/2014 and 4/2014 on February 25, 2016. It has decided:

for market 3a :

- to retain the copper network unbundling obligations introduced in the previous 2009 market analysis and to retain access to Telefónica civil engineering infrastructure;

- to not impose ex ante asymmetrical obligations on Telefónica for the fiber network, in 66 cities considered effectively competitive, representing 35% of the Spanish population, given that a virtual unbundled local access (VULA) offer must be made available for the rest of Spain;

for market 3b:

- to remove progressively the obligations for ex ante regulation of copper networks in parts of Spain declared to be competitive, and covering 58% of currently installed broadband lines; and, in the rest of Spain determined to be non competitive, to retain Telefónica’s network access obligations, with a NEBA-copper offer with no bandwidth cap and charged on a cost-based basis;

- and to retain the ex ante obligations with a bitstream offer on the fiber network for part of Spain declared non competitive, this obligation being temporary for the part declared competitive.

And for market 4 :

- to retain, throughout Spain, Telefónica’s NEBA-business offer obligation, charged on a cost-based basis for copper, meeting the economic replicability test for fiber.

Decommissioning of the copper network

The CNMC approved Telefónica’s first requests to decommission two distribution frames in its copper network in October 2014. The distribution frames in question are small exchanges with no unbundling or equipment collocation. Under the terms of the regulator’s decision on the analysis of the wholesale network infrastructure, market 4/2007, issued in 2009 and supplemented by the CNMC’s decision of October 2014, Telefónica is obliged to continue offering the option of unbundling for five years after filing a request to decommission an exchange with the CNMC. This period falls to just one year if there are no unbundled operators. The first copper distribution frames were closed end-November 2015.

ORANGE / 2015 REGISTRATION DOCUMENT - 23

2.2.4 Poland

2.2.4.1 Legal and regulatory system

Legal framework

Orange Polska’s businesses are governed by the law of July 16, 2004 on telecommunications, transposing the 2002 European Telecom Package concerning electronic communications into Polish law, and by the law of February 16, 2007 concerning competition and consumer protection. The law of December 2012, transposing EU directives issued in 2009, came into force on January 21, 2013.

The law of May 7, 2010, on developing telecommunication networks and services, provides access to telecommunications and other technical infrastructures funded by public funds.

As regards e-commerce, the law of July 18, 2002 that governs provision of electronic services transposes European Directive 2000/31/EC concerning electronic commerce and defines electronic service supplier obligations.

The applicable framework concerning personal data protection is defined by the law of August 29, 1997 concerning personal data protection, as amended in 2002. The 2004 Telecommunications Act also defines certain rules applicable to personal data protection and storage[7].

Regulatory Authorities

The Ministry of Digitization, created in November 2015, is responsible for telecommunications.

The Office of Electronic Communications (UKE) is responsible, in particular, for telecommunications regulation and frequency management, as well as certain functions related to broadcasting services.

The Office of Competition and Consumer Protection (Uokik) is responsible for the application of competition law, merger control and consumer protection.

Digital Poland

The government’s action plan to meet the targets of its digital strategy in Poland was passed in January 2014. The plan is budgeted at 2,665 million euros and aims to ensure that all households have at least 30 Mbps Internet access by 2020. Nearly half the funds are earmarked for broadband network construction projects. The Polish government will contribute 409.4 million euros.

2.2.4.2 Regulation of mobile telephony

Mobile call termination rates

The UKE published seven decisions on December 14, 2012, ruling that Orange Polska, T-Mobile, Polkomtel, P4, CenterNet, Mobyland and Aero2 each had a dominant position in the mobile call termination market for the mobile numbers open to interconnection on their network (market analysis -3rd round). It also set symmetrical mobile voice call termination rates for all operators from January 1, 2013, and termination rates based on pure long run incremental costs as from July 1, 2013.

|

Date |

from July 1, 2013

(pure LRIC) |

|

zlotys/min |

0.0429 |

|

Euro cents/min |

1.00 |

Exchange rate as at 12/31/2015: 1 PLN = 0.234 euros

Spectrum

In 2011, the UKE issued three decisions that introduce technological neutrality in the 900 MHz, 1,800 MHz, and 2,100 MHz frequency bands.

In July 2013, the UKE published a consultation on whether to assign 700 MHz spectrum to electronic communications. No decision on this has yet been announced.

Spectrum awarded is distributed as follows:

|

800 MHz (1) |

900 MHz |

1,800 MHz | |

2.1 GHz |

2.6 GHz |

| | | | | | |

|

Orange (PTK) |

10 MHz duplex |

7 MHz duplex |

10 MHz duplex |

15 MHz duplex |

5 MHz |

15 MHz duplex |

|

Era (T-Mobile) |

5 MHz duplex |

9 MHz duplex |

20 MHz duplex |

15 MHz duplex |

5 MHz |

15 MHz duplex |

|

Plus (Polkomtel) | |

9 MHz duplex |

10 MHz duplex |

15 MHz duplex |

5 MHz |

20 MHz duplex |

|

Play (P4) |

5 MHz duplex |

5 MHz duplex |

15 MHz duplex |

15 MHz duplex |

5 MHz |

20 MHz duplex |

|

Aero2 | |

5 MHz duplex |

10 MHz duplex | | |

50 MHz |

|

Mobyland | | |

10 MHz duplex | | | |

|

Centernet | | |

10 MHz duplex | | | |

|

Sferia |

5 MHz duplex | | | | | |

(1) A block of 5 MHz duplex in the 800 MHz band was allocated to NetNet as part of the 2015 auction, but this operator refused the allocation and these 5 MHz are currently being reallocated.

ORANGE / 2015 REGISTRATION DOCUMENT - 24

Significant events in 2015 and the start of 2016

|

Spectrum in the 800 MHz and 2.6 GHz band |

|

October 2015 |

Spectrum allocation after the auction |

Allocation of 800 MHz and 2.6 GHz spectrum

At the end of an auction process, five blocks of 5 MHz duplex in the 800 MHz band and 14 blocks of 5 MHz duplex in the 2.6 GHz band were allocated for a period of 15 years. Orange was allocated 10 MHz duplex in the 800 MHz band and 15 MHz duplex in the 2.6 GHz band for a total of PLN 3,168 million.

The licenses in the 800 MHz band include coverage obligations in the white areas at the town level, leading to coverage of 62% of the Polish population in 4 years.

2.2.4.3 Regulation of fixed-line telephony, broadband and superfast broadband Internet

All of Orange Polska’s regulatory obligations concerning retail fixed-line telephony (access and communication) on the consumer and business markets have been lifted. Ex ante regulation of Orange Polska’s fixed-line services, for the areas defined as non-competitive, relates to wholesale offers that are regulated to ensure effective competition in the retail markets (call origination and termination, wholesale line rental, unbundling, bitstream).

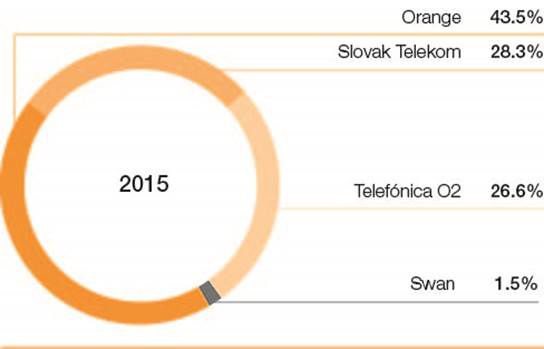

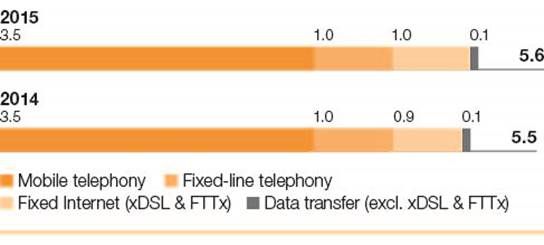

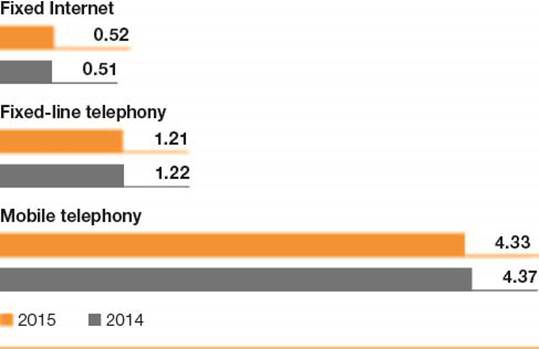

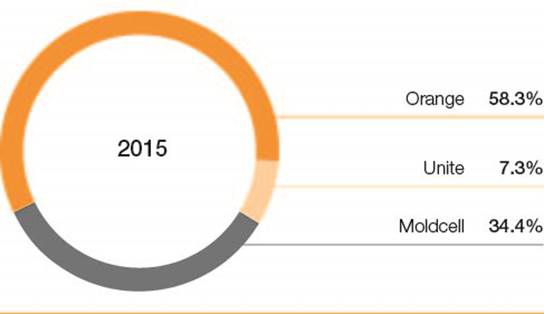

Orange Polska’s obligations regarding cost accounting and accounting separation in the fixed-line business