United States

Securities and Exchange Commission

Washington, D.C. 20549

Form 10-Q

For the quarterly period ended September 30, 2023

Or

For the transition period from _____ to _____

Commission File Number 1-13145

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||||||||||||||||||||||||||||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||||||||||||||||||||||||||||||||

| Registrant's telephone number, including area code: | ||||||||||||||||||||||||||||||||||||||||||||

Former name, former address and former fiscal year, if changed since last report: Not Applicable | ||||||||||||||||||||||||||||||||||||||||||||

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| ☑ | Accelerated filer | ☐ | ||||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ||||||||||||

| Emerging growth company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The number of shares outstanding of the registrant's common stock (par value $0.01) as of the close of business on October 30, 2023 was 47,572,944 .

Table of Contents

| Part I | ||||||||

| Item 1. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Part II | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 6. | ||||||||

2

Part I. Financial Information

Item 1. Financial Statements

JONES LANG LASALLE INCORPORATED

CONDENSED CONSOLIDATED BALANCE SHEETS

| (in millions, except share and per share data) | September 30, 2023 | December 31, 2022 | ||||||

| Assets | (unaudited) | |||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | |||||||

Trade receivables, net of allowance of $ | ||||||||

| Notes and other receivables | ||||||||

| Reimbursable receivables | ||||||||

| Warehouse receivables | ||||||||

Short-term contract assets, net of allowance of $ | ||||||||

| Prepaid and other | ||||||||

| Total current assets | ||||||||

Property and equipment, net of accumulated depreciation of $ | ||||||||

| Operating lease right-of-use assets | ||||||||

| Goodwill | ||||||||

Identified intangibles, net of accumulated amortization of $ | ||||||||

Investments, including $ | ||||||||

| Long-term receivables | ||||||||

| Deferred tax assets, net | ||||||||

| Deferred compensation plan | ||||||||

| Other | ||||||||

| Total assets | $ | |||||||

| Liabilities and Equity | ||||||||

| Current liabilities: | ||||||||

| Accounts payable and accrued liabilities | $ | |||||||

| Reimbursable payables | ||||||||

| Accrued compensation and benefits | ||||||||

| Short-term borrowings | ||||||||

| Short-term contract liabilities and deferred income | ||||||||

| Short-term acquisition-related obligations | ||||||||

| Warehouse facilities | ||||||||

| Short-term operating lease liabilities | ||||||||

| Other | ||||||||

| Total current liabilities | ||||||||

Credit facility, net of debt issuance costs of $ | ||||||||

Long-term debt, net of debt issuance costs of $ | ||||||||

| Deferred tax liabilities, net | ||||||||

| Deferred compensation | ||||||||

| Long-term acquisition-related obligations | ||||||||

| Long-term operating lease liabilities | ||||||||

| Other | ||||||||

| Total liabilities | ||||||||

| Redeemable noncontrolling interest | ||||||||

| Company shareholders' equity: | ||||||||

Common stock, $ | ||||||||

| Additional paid-in capital | ||||||||

| Retained earnings | ||||||||

Treasury stock, at cost, | ( | ( | ||||||

| Shares held in trust | ( | ( | ||||||

| Accumulated other comprehensive loss | ( | ( | ||||||

| Total Company shareholders’ equity | ||||||||

| Noncontrolling interest | ||||||||

| Total equity | ||||||||

| Total liabilities, redeemable noncontrolling interest and equity | $ | |||||||

3

JONES LANG LASALLE INCORPORATED

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

| (in millions, except share and per share data) (unaudited) | Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||

| Revenue | $ | $ | |||||||||||||||

| Operating expenses: | |||||||||||||||||

| Compensation and benefits | $ | $ | |||||||||||||||

| Operating, administrative and other | |||||||||||||||||

| Depreciation and amortization | |||||||||||||||||

| Restructuring and acquisition charges | |||||||||||||||||

| Total operating expenses | $ | $ | |||||||||||||||

| Operating income | $ | $ | |||||||||||||||

| Interest expense, net of interest income | |||||||||||||||||

| Equity (losses) earnings | ( | ( | |||||||||||||||

| Other income | |||||||||||||||||

| Income before income taxes and noncontrolling interest | |||||||||||||||||

| Income tax provision | |||||||||||||||||

| Net income | |||||||||||||||||

| Net (loss) income attributable to noncontrolling interest | ( | ( | |||||||||||||||

| Net income attributable to common shareholders | $ | $ | |||||||||||||||

| Basic earnings per common share | $ | $ | |||||||||||||||

| Basic weighted average shares outstanding (in 000's) | |||||||||||||||||

| Diluted earnings per common share | $ | $ | |||||||||||||||

| Diluted weighted average shares outstanding (in 000's) | |||||||||||||||||

| Net income attributable to common shareholders | $ | $ | |||||||||||||||

| Change in pension liabilities, net of tax | ( | ||||||||||||||||

| Foreign currency translation adjustments | ( | ( | ( | ( | |||||||||||||

| Comprehensive (loss) income attributable to common shareholders | $ | ( | $ | ||||||||||||||

See accompanying notes to Condensed Consolidated Financial Statements.

4

JONES LANG LASALLE INCORPORATED

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2023 AND 2022

| Company Shareholders' Equity | ||||||||||||||||||||||||||||||||

| Common Stock | Additional | Shares | ||||||||||||||||||||||||||||||

| (in millions, except share and per share data) (unaudited) | Shares Outstanding | Amount | Paid-In | Retained | Held in | Treasury | Total | |||||||||||||||||||||||||

| Capital | Earnings | Trust | Stock | AOCI(1) | NCI(2) | Equity | ||||||||||||||||||||||||||

| December 31, 2022 | $ | ( | ( | ( | $ | |||||||||||||||||||||||||||

| Net (loss) income | — | — | — | ( | — | — | — | ( | ||||||||||||||||||||||||

| Shares issued under stock-based compensation programs | — | ( | ( | — | — | — | ||||||||||||||||||||||||||

| Shares repurchased for payment of taxes on stock-based compensation | ( | — | — | — | ( | — | — | ( | ||||||||||||||||||||||||

| Amortization of stock-based compensation | — | — | — | — | — | — | — | |||||||||||||||||||||||||

| Foreign currency translation adjustments | — | — | — | — | — | — | — | |||||||||||||||||||||||||

| Decrease in amounts attributable to noncontrolling interest | — | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||

| March 31, 2023 | $ | ( | ( | ( | $ | |||||||||||||||||||||||||||

Net income(3) | — | — | — | — | — | — | ||||||||||||||||||||||||||

| Shares issued under stock-based compensation programs | — | ( | ( | — | — | — | ||||||||||||||||||||||||||

| Shares repurchased for payment of taxes on stock-based compensation | ( | — | — | — | — | — | — | |||||||||||||||||||||||||

| Amortization of stock-based compensation | — | — | — | — | — | — | — | |||||||||||||||||||||||||

| Shares held in trust | — | — | — | — | ( | — | — | — | ( | |||||||||||||||||||||||

| Repurchase of common stock | ( | — | — | — | — | ( | — | — | ( | |||||||||||||||||||||||

| Change in pension liabilities, net of tax | — | — | — | — | — | — | ( | — | ( | |||||||||||||||||||||||

| Foreign currency translation adjustments | — | — | — | — | — | — | — | |||||||||||||||||||||||||

| Decrease in amounts attributable to noncontrolling interest | — | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||

| June 30, 2023 | $ | ( | ( | ( | $ | |||||||||||||||||||||||||||

Net income (loss)(3) | — | — | — | — | — | — | ( | |||||||||||||||||||||||||

| Shares issued under stock-based compensation programs | — | ( | ( | — | — | — | ( | |||||||||||||||||||||||||

| Shares repurchased for payment of taxes on stock-based compensation | ( | — | — | — | — | ( | — | — | ( | |||||||||||||||||||||||

| Amortization of stock-based compensation | — | — | — | — | — | — | — | |||||||||||||||||||||||||

| Shares held in trust | — | — | — | — | — | — | — | |||||||||||||||||||||||||

| Repurchase of common stock | ( | — | — | — | — | ( | — | — | ( | |||||||||||||||||||||||

| Foreign currency translation adjustments | — | — | — | — | — | — | ( | — | ( | |||||||||||||||||||||||

| Decrease in amounts attributable to noncontrolling interest | — | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||

| September 30, 2023 | $ | ( | ( | ( | $ | |||||||||||||||||||||||||||

(1) AOCI: Accumulated other comprehensive income (loss)

(2) NCI: Noncontrolling interest

(3) Excludes net (loss) income attributable to redeemable noncontrolling interest of $(0.3 ) million and $0.1 million for the three months ended September 30, 2023 and June 30, 2023.

5

JONES LANG LASALLE INCORPORATED

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY (CONTINUED)

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2023 AND 2022

| Company Shareholders' Equity | ||||||||||||||||||||||||||||||||

| Common Stock | Additional | Shares | ||||||||||||||||||||||||||||||

| (in millions, except share and per share data) (unaudited) | Shares Outstanding | Amount | Paid-In | Retained | Held in | Treasury | Total | |||||||||||||||||||||||||

| Capital | Earnings | Trust | Stock | AOCI(1) | NCI(2) | Equity | ||||||||||||||||||||||||||

| December 31, 2021 | $ | ( | ( | ( | $ | |||||||||||||||||||||||||||

Net income (loss) | — | — | — | — | — | — | ( | |||||||||||||||||||||||||

| Shares issued under stock-based compensation programs | — | ( | — | — | — | — | ||||||||||||||||||||||||||

| Shares repurchased for payment of taxes on stock-based compensation | ( | — | ( | — | — | ( | — | — | ( | |||||||||||||||||||||||

| Amortization of stock-based compensation | — | — | — | — | — | — | — | |||||||||||||||||||||||||

| Shares held in trust | — | — | — | — | — | — | — | |||||||||||||||||||||||||

| Repurchase of common stock | ( | — | — | — | — | ( | — | — | ( | |||||||||||||||||||||||

| Foreign currency translation adjustments | — | — | — | — | — | — | ( | — | ( | |||||||||||||||||||||||

| Increase in amounts attributable to noncontrolling interest | — | — | — | — | — | — | — | |||||||||||||||||||||||||

| March 31, 2022 | $ | ( | ( | ( | $ | |||||||||||||||||||||||||||

Net income(3) | — | — | — | — | — | — | ||||||||||||||||||||||||||

| Shares issued under stock-based compensation programs | — | ( | ( | — | — | — | ||||||||||||||||||||||||||

| Shares repurchased for payment of taxes on stock-based compensation | ( | — | ( | — | — | ( | — | — | ( | |||||||||||||||||||||||

| Amortization of stock-based compensation | — | — | — | — | — | — | — | |||||||||||||||||||||||||

| Repurchase of common stock | ( | — | — | — | — | ( | — | — | ( | |||||||||||||||||||||||

| Foreign currency translation adjustments | — | — | — | — | — | — | ( | — | ( | |||||||||||||||||||||||

| Decrease in amounts attributable to noncontrolling interest | — | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||

| June 30, 2022 | $ | ( | ( | ( | $ | |||||||||||||||||||||||||||

Net income (loss)(3) | — | — | — | — | — | — | ( | |||||||||||||||||||||||||

| Shares issued under stock-based compensation programs | — | ( | — | — | — | |||||||||||||||||||||||||||

| Shares repurchased for payment of taxes on stock-based compensation | ( | — | ( | — | — | ( | — | — | ( | |||||||||||||||||||||||

| Amortization of stock-based compensation | — | — | — | — | — | — | — | |||||||||||||||||||||||||

| Repurchase of common stock | ( | — | — | — | — | ( | — | — | ( | |||||||||||||||||||||||

| Foreign currency translation adjustments | — | — | — | — | — | — | ( | — | ( | |||||||||||||||||||||||

| Decrease in amounts attributable to noncontrolling interest | — | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||

| September 30, 2022 | $ | ( | ( | ( | $ | |||||||||||||||||||||||||||

(1) AOCI: Accumulated other comprehensive income (loss)

(2) NCI: Noncontrolling interest

(3) Excludes net loss attributable to redeemable noncontrolling interest of $0.1

See accompanying notes to Condensed Consolidated Financial Statements.

6

JONES LANG LASALLE INCORPORATED

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

See accompanying notes to Condensed Consolidated Financial Statements.

| Nine Months Ended September 30, | ||||||||

| (in millions) (unaudited) | 2023 | 2022 | ||||||

| Cash flows from operating activities: | ||||||||

| Net income | $ | |||||||

| Reconciliation of net income to net cash used in operating activities: | ||||||||

| Depreciation and amortization | ||||||||

| Equity losses (earnings) | ( | |||||||

| Net loss (gain) on dispositions | ( | |||||||

| Distributions of earnings from investments | ||||||||

| Provision for loss on receivables and other assets | ||||||||

| Amortization of stock-based compensation | ||||||||

| Net non-cash mortgage servicing rights and mortgage banking derivative activity | ( | |||||||

| Accretion of interest and amortization of debt issuance costs | ||||||||

| Other, net | ||||||||

| Change in: | ||||||||

| Receivables | ( | |||||||

| Reimbursable receivables and reimbursable payables | ( | ( | ||||||

| Prepaid expenses and other assets | ( | ( | ||||||

| Deferred tax assets, net | ( | |||||||

| Accounts payable and accrued liabilities | ( | ( | ||||||

| Accrued compensation | ( | ( | ||||||

| Net cash used in operating activities | ( | ( | ||||||

| Cash flows from investing activities: | ||||||||

| Net capital additions – property and equipment | ( | ( | ||||||

| Net investment asset activity (less than wholly-owned) | ||||||||

| Business acquisitions, net of cash acquired | ( | ( | ||||||

| Capital contributions to investments | ( | ( | ||||||

| Distributions of capital from investments | ||||||||

| Other, net | ( | ( | ||||||

| Net cash used in investing activities | ( | ( | ||||||

| Cash flows from financing activities: | ||||||||

| Proceeds from borrowings under credit facility | ||||||||

| Repayments of borrowings under credit facility | ( | ( | ||||||

| Repayment of senior notes | ( | |||||||

| Net (repayments of) proceeds from short-term borrowings | ( | |||||||

| Payments of deferred business acquisition obligations and earn-outs | ( | ( | ||||||

| Repurchase of common stock | ( | ( | ||||||

| Noncontrolling interest distributions, net | ( | ( | ||||||

| Other, net | ( | ( | ||||||

| Net cash provided by financing activities | ||||||||

| Effect of currency exchange rate changes on cash, cash equivalents and restricted cash | ( | ( | ||||||

| Net change in cash, cash equivalents and restricted cash | ( | ( | ||||||

| Cash, cash equivalents and restricted cash, beginning of the period | ||||||||

| Cash, cash equivalents and restricted cash, end of the period | $ | |||||||

| Supplemental disclosure of cash flow information: | ||||||||

| Restricted cash, beginning of period | $ | |||||||

| Restricted cash, end of period | ||||||||

| Cash paid during the period for: | ||||||||

| Interest | $ | |||||||

| Income taxes, net of refunds | ||||||||

| Operating leases | ||||||||

| Non-cash activities: | ||||||||

| Business acquisitions (including contingent consideration) | $ | |||||||

| Non-cash consideration received for disposition | ||||||||

| Deferred business acquisition obligations | ||||||||

7

JONES LANG LASALLE INCORPORATED

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

1.INTERIM INFORMATION

Readers of this quarterly report should refer to the audited financial statements of Jones Lang LaSalle Incorporated ("JLL," which may also be referred to as "the Company," "we," "us" or "our") for the year ended December 31, 2022, which are included in our 2022 Annual Report on Form 10-K, filed with the United States Securities and Exchange Commission ("SEC") and also available on our website (www.jll.com), since we have omitted from this quarterly report certain footnote disclosures which would substantially duplicate those contained in such audited financial statements. You should also refer to the "Summary of Critical Accounting Policies and Estimates" section within Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations and to Note 2, Summary of Significant Accounting Policies, in the Notes to Consolidated Financial Statements in our 2022 Annual Report on Form 10-K for further discussion of our significant accounting policies and estimates.

Our Condensed Consolidated Financial Statements as of September 30, 2023, and for the periods ended September 30, 2023 and 2022, are unaudited. In the opinion of management, we have included all adjustments (consisting solely of normal recurring adjustments) necessary for a fair presentation of the Condensed Consolidated Financial Statements for these interim periods.

Historically, our quarterly revenue and profits have tended to increase from quarter to quarter as the year progresses. This is the result of a general focus in the real estate industry on completing transactions by calendar year end, while certain expenses are recognized evenly throughout the year. Growth in our Property Management and Workplace Management businesses as well as other annuity-based services has, to an extent, lessened the seasonality in our revenue and profits during the past several years. Within our Markets Advisory and Capital Markets segments, revenue from transaction-based activities is driven by the size and timing of our clients' transactions and can fluctuate significantly from period to period. Our LaSalle Investment Management ("LaSalle") segment generally earns investment-generated performance fees on clients' real estate investment returns when assets are sold, the timing of which is geared toward the benefit of our clients, as well as co-investment equity gains and losses, primarily dependent on underlying valuations.

A significant portion of our compensation and benefits expense is from incentive compensation plans, which we generally accrue throughout the year based on progress toward annual performance targets. This process can result in significant fluctuations in quarterly compensation and benefits expense from period to period. Non-variable operating expenses, which we recognize when incurred during the year, are relatively constant on a quarterly basis.

We provide for the effects of income taxes on interim financial statements based on our estimate of the effective tax rate for the full year, which we base on forecasted income by country and expected enacted tax rates. As required, we adjust for the impact of discrete items in the quarters in which they occur. Changes in the geographic mix of income can impact our estimated effective tax rate.

As a result of the items mentioned above, the results for the periods ended September 30 are not fully indicative of what our results will be for the full fiscal year.

8

2.NEW ACCOUNTING STANDARDS

3.REVENUE RECOGNITION

Capital Markets revenue excluded from the scope of Accounting Standards Codification Topic 606, Revenue from Contracts with Customers ("ASC Topic 606")

Our mortgage banking and servicing operations, comprised of (i) all Loan Servicing revenue and (ii) activities related to mortgage servicing rights ("MSR" or "MSRs") and loan origination fees (included in Investment Sales, Debt/Equity Advisory and Other), are not considered revenue from contracts with customers, and accordingly are excluded from the scope of ASC Topic 606. Such out-of-scope revenue is presented below.

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||

| (in millions) | 2023 | 2022 | 2023 | 2022 | |||||||||||||

| Revenue excluded from scope of ASC Topic 606 | $ | $ | |||||||||||||||

Contract assets and liabilities

Our contract assets, net of allowance, are included in Short-term contract assets and Other assets and our contract liabilities are included in Short-term contract liabilities and deferred income on our Condensed Consolidated Balance Sheets. The majority of contract liabilities are recognized as revenue within 90 days. Such contract assets and liabilities are presented below.

| (in millions) | September 30, 2023 | December 31, 2022 | ||||||

| Contract assets, gross | $ | |||||||

| Contract asset allowance | ( | ( | ||||||

| Contract assets, net | $ | |||||||

| Contract liabilities | $ | |||||||

Remaining performance obligations

Remaining performance obligations represent the aggregate transaction price for contracts where our performance obligations have not yet been satisfied. As of September 30, 2023, the aggregate amount of transaction price allocated to remaining performance obligations represented less than 5 % of our total revenue. In accordance with ASC Topic 606, excluded from the aforementioned remaining performance obligations are (i) amounts attributable to contracts expected to be completed within 12 months and (ii) variable consideration for services performed as a series of daily performance obligations, such as facilities management, property management and LaSalle contracts. A significant portion of our customer contracts, which are not expected to be fulfilled within 12 months, are represented by the contracts within these businesses.

9

4. BUSINESS SEGMENTS

We manage and report our operations as five global business segments:

(1) Markets Advisory,

(2) Capital Markets,

(3) Work Dynamics,

(4) JLL Technologies and

(5) LaSalle.

Markets Advisory offers a wide range of real estate services, including agency leasing and tenant representation, property management, advisory and consulting services. Capital Markets service offerings include investment sales, debt and equity advisory, value and risk advisory, and loan servicing. Our Work Dynamics business provides a broad suite of integrated services to occupiers of real estate, including facility and project management, as well as portfolio and other services. Our JLL Technologies segment offers software products, solutions and services, while LaSalle provides investment management services on a global basis to institutional investors and high-net-worth individuals.

We allocate all indirect expenses to our segments, other than interest and income taxes, as nearly all expenses incurred benefit one or more of the segments. Allocated expenses primarily consist of corporate functional costs across the globe, which we allocate to the business segments using an expense-specific driver-based methodology.

Adjusted EBITDA does not include (i) Restructuring and acquisition charges, (ii) gain/loss on disposal, (iii) interest on employee loans, net of forgiveness, (iv) net non-cash MSR and mortgage banking derivative activity, (v) Interest expense, net of interest income, (vi) Income tax provision and (vii) Depreciation and amortization, which are otherwise included in Net income on the Condensed Consolidated Statements of Comprehensive Income.

The Chief Operating Decision Maker ("CODM") of JLL measures and evaluates the segment results based on Adjusted EBITDA for purposes of making decisions about allocating resources and assessing performance. Our CODM is not provided with total asset information by segment and accordingly does not measure or allocate resources based on total assets information. Therefore, we have not disclosed asset information by segment.

10

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||

| (in millions) | 2023 | 2022 | 2023 | 2022 | ||||||||||

| Markets Advisory | ||||||||||||||

| Leasing | $ | $ | ||||||||||||

| Property Management | ||||||||||||||

| Advisory, Consulting and Other | ||||||||||||||

| Revenue | $ | $ | ||||||||||||

Depreciation and amortization(1) | $ | $ | ||||||||||||

| Equity earnings (losses) | $ | ( | $ | |||||||||||

| Adjusted EBITDA | $ | $ | ||||||||||||

| Capital Markets | ||||||||||||||

| Investment Sales, Debt/Equity Advisory and Other | $ | $ | ||||||||||||

| Value and Risk Advisory | ||||||||||||||

| Loan Servicing | ||||||||||||||

| Revenue | $ | $ | ||||||||||||

| Depreciation and amortization | $ | $ | ||||||||||||

| Equity earnings | $ | $ | ||||||||||||

| Adjusted EBITDA | $ | $ | ||||||||||||

| Work Dynamics | ||||||||||||||

| Workplace Management | $ | $ | ||||||||||||

| Project Management | ||||||||||||||

| Portfolio Services and Other | ||||||||||||||

| Revenue | $ | $ | ||||||||||||

| Depreciation and amortization | $ | $ | ||||||||||||

| Equity earnings | $ | $ | ||||||||||||

| Adjusted EBITDA | $ | $ | ||||||||||||

| JLL Technologies | ||||||||||||||

| Revenue | $ | $ | ||||||||||||

| Depreciation and amortization | $ | $ | ||||||||||||

| Equity (losses) earnings | $ | ( | $ | ( | ||||||||||

| Adjusted EBITDA | $ | ( | ( | $ | ( | ( | ||||||||

| LaSalle | ||||||||||||||

| Advisory fees | $ | $ | ||||||||||||

| Transaction fees and other | ||||||||||||||

| Incentive fees | ||||||||||||||

| Revenue | $ | $ | ||||||||||||

| Depreciation and amortization | $ | $ | ||||||||||||

| Equity (losses) earnings | $ | ( | ( | $ | ( | |||||||||

| Adjusted EBITDA | $ | $ | ||||||||||||

11

The following table is a reconciliation of Adjusted EBITDA to Net income attributable to common shareholders.

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||

| (in millions) | 2023 | 2022 | 2023 | 2022 | ||||||||||

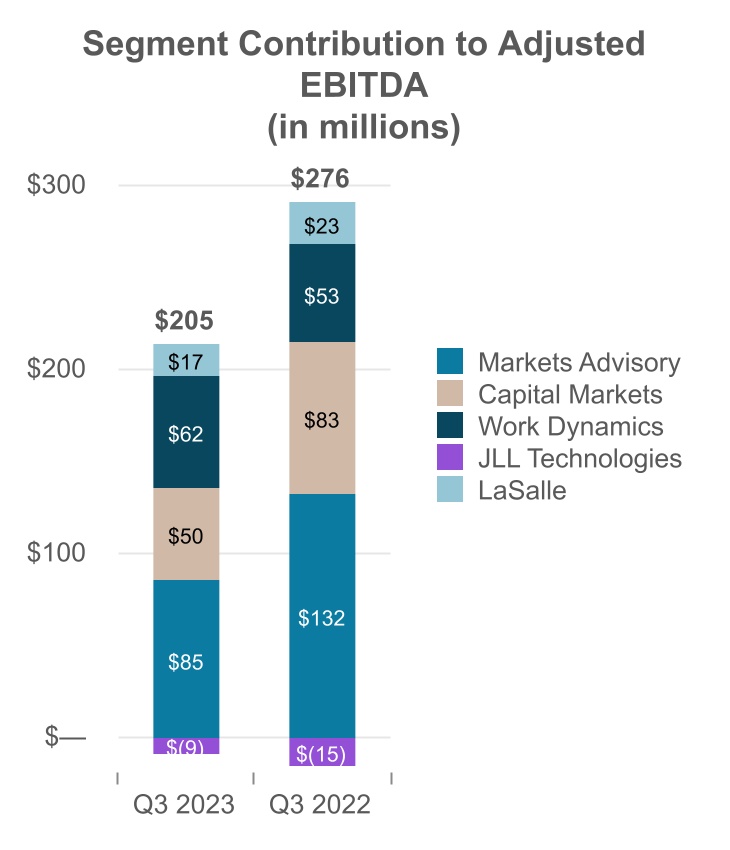

| Adjusted EBITDA - Markets Advisory | $ | $ | ||||||||||||

| Adjusted EBITDA - Capital Markets | ||||||||||||||

| Adjusted EBITDA - Work Dynamics | ||||||||||||||

| Adjusted EBITDA - JLL Technologies | ( | ( | ( | ( | ||||||||||

| Adjusted EBITDA - LaSalle | ||||||||||||||

| Adjusted EBITDA - Consolidated | $ | $ | ||||||||||||

| Adjustments: | ||||||||||||||

| Restructuring and acquisition charges | $ | ( | ( | $ | ( | ( | ||||||||

| Net gain (loss) on disposition | ( | ( | ||||||||||||

| Interest on employee loans, net of forgiveness | ||||||||||||||

| Net non-cash MSR and mortgage banking derivative activity | ( | ( | ||||||||||||

| Interest expense, net of interest income | ( | ( | ( | ( | ||||||||||

| Income tax provision | ( | ( | ( | ( | ||||||||||

Depreciation and amortization(1) | ( | ( | ( | ( | ||||||||||

| Net income attributable to common shareholders | $ | $ | ||||||||||||

(1) This adjustment excludes the noncontrolling interest portion of amortization of acquisition-related intangibles which is not attributable to common shareholders.

5.BUSINESS COMBINATIONS, GOODWILL AND OTHER INTANGIBLE ASSETS

2023 Business Combinations Activity

During the nine months ended September 30, 2023, we completed one strategic acquisition. This strategic acquisition is presented below.

| Acquired Company | Quarter of Acquisition | Country | Primary Segment | ||||||||

| Kensington Capital Advisors (KCA) | Q2 | United States | Capital Markets | ||||||||

Aggregate terms of our acquisition included: (1) cash paid at closing of $13.6 million and (2) prior 50.0% ownership previously accounted for as an equity method investment which had a fair value of $10.0 million.

A preliminary allocation of purchase consideration resulted in goodwill of $18.7 million, identifiable intangibles of $2.1 million and other net assets (acquired assets less assumed liabilities) of $2.8 million. As of September 30, 2023, we have not completed our analysis to assign fair values to all of the identifiable intangible and tangible assets acquired and, therefore, we may further refine the purchase price allocations for this acquisition during the open measurement period.

During the nine months ended September 30, 2023, we paid $22.8 million for deferred business acquisition and earn-out obligations for acquisitions completed in prior years.

2022 Business Combinations Activity

During the nine months ended September 30, 2022, we completed no strategic acquisitions.

12

Earn-Out Payments

| ($ in millions) | September 30, 2023 | December 31, 2022 | |||||||||

| Number of acquisitions with earn-out payments subject to the achievement of certain performance criteria | |||||||||||

| Maximum earn-out payments (undiscounted) | $ | ||||||||||

Short-term earn-out liabilities (fair value)(1) | |||||||||||

Long-term earn-out liabilities (fair value)(1) | |||||||||||

(1) Included in Short-term and Long-term acquisition-related obligations on the Condensed Consolidated Balance Sheets.

Assuming the achievement of the applicable performance criteria, we anticipate making these earn-out payments over the next five years. Refer to Note 8, Fair Value Measurements, and Note 11, Restructuring and Acquisition Charges, for additional discussion of our earn-out liabilities.

Goodwill and Other Intangible Assets

Goodwill and unamortized intangibles as of September 30, 2023 consisted of: (1) goodwill of $4,541.8 million, (2) identifiable intangibles of $803.2 million amortized over their remaining finite useful lives and (3) $47.8 million of identifiable intangibles with indefinite useful lives that are not amortized. Notable portions of our goodwill and unamortized intangibles are denominated in currencies other than the U.S. dollar, which means a portion of the movements in the reported book value of these balances is attributable to movements in foreign currency exchange rates.

The following table details, by reporting segment, movements in goodwill.

| (in millions) | Markets Advisory | Capital Markets | Work Dynamics | JLL Technologies | LaSalle | Consolidated | |||||||||||||||||

| Balance as of December 31, 2022 | $ | $ | |||||||||||||||||||||

| Additions, net of adjustments | |||||||||||||||||||||||

| Dispositions | ( | ( | ( | ||||||||||||||||||||

| Impact of exchange rate movements | ( | ( | ( | ( | ( | ||||||||||||||||||

| Balance as of September 30, 2023 | $ | $ | |||||||||||||||||||||

| (in millions) | Markets Advisory | Capital Markets | Work Dynamics | JLL Technologies | LaSalle | Consolidated | |||||||||||||||||

| Balance as of January 1, 2022 | $ | $ | |||||||||||||||||||||

| Additions, net of adjustments | |||||||||||||||||||||||

| Impact of exchange rate movements | ( | ( | ( | ( | ( | ( | |||||||||||||||||

| Balance as of September 30, 2022 | $ | $ | |||||||||||||||||||||

13

The following tables detail, by intangible type, movements in the gross carrying amount and accumulated amortization of our identifiable intangibles.

| (in millions) | MSRs | Other Intangibles | Consolidated | |||||||||||

| Gross Carrying Amount | ||||||||||||||

| Balance as of December 31, 2022 | $ | $ | ||||||||||||

Additions, net of adjustments(1) | ||||||||||||||

| Adjustment for fully amortized intangibles | ( | ( | ( | |||||||||||

| Impact of exchange rate movements | ( | ( | ||||||||||||

| Balance as of September 30, 2023 | $ | $ | ||||||||||||

| Accumulated Amortization | ||||||||||||||

| Balance as of December 31, 2022 | $ | ( | ( | $ | ( | |||||||||

Amortization, net(2) | ( | ( | ( | |||||||||||

| Adjustment for fully amortized intangibles | ||||||||||||||

| Impact of exchange rate movements | ||||||||||||||

| Balance as of September 30, 2023 | $ | ( | ( | $ | ( | |||||||||

| Net book value as of September 30, 2023 | $ | $ | ||||||||||||

(1) Included in this amount for MSRs was $8.4 million relating to prepayments/write-offs due to prepayments of the underlying obligation for which we assumed, acquired or retained the servicing rights.

(2) Amortization of MSRs is included in Revenue within the Condensed Consolidated Statements of Comprehensive Income.

| (in millions) | MSRs | Other Intangibles | Total | |||||||||||

| Gross Carrying Amount | ||||||||||||||

| Balance as of December 31, 2021 | $ | $ | ||||||||||||

Additions, net of adjustments(1) | ||||||||||||||

| Adjustment for fully amortized intangibles | ( | ( | ( | |||||||||||

| Impact of exchange rate movements | ( | ( | ||||||||||||

| Balance as of September 30, 2022 | $ | $ | ||||||||||||

| Accumulated Amortization | ||||||||||||||

| Balance as of December 31, 2021 | $ | ( | ( | $ | ( | |||||||||

Amortization, net(2) | ( | ( | ( | |||||||||||

| Adjustment for fully amortized intangibles | ||||||||||||||

| Impact of exchange rate movements | ||||||||||||||

| Balance as of September 30, 2022 | $ | ( | ( | $ | ( | |||||||||

| Net book value as of September 30, 2022 | $ | $ | ||||||||||||

(1) Included in this amount for MSRs was $22.5 million relating to prepayments/write-offs due to prepayments of the underlying obligation for which we assumed, acquired or retained the servicing rights.

(2) Amortization of MSRs is included in Revenue within the Condensed Consolidated Statements of Comprehensive Income.

14

6.INVESTMENTS

Summarized investment balances as of September 30, 2023 and December 31, 2022 are presented in the following table.

| (in millions) | September 30, 2023 | December 31, 2022 | |||||||||

| JLL Technologies investments | $ | ||||||||||

| LaSalle co-investments | |||||||||||

| Other investments | |||||||||||

| Total | $ | ||||||||||

Our JLL Technologies investments are, generally, investments in early to mid-stage proptech companies as well as proptech funds, while our LaSalle co-investments are, primarily, direct investments in 49 separate property or commingled funds, where we co-invest alongside our clients and for which we also have an advisory agreement.

We have maximum potential unfunded commitments to direct investments or investment vehicles of $361.9 million and $14.2 million as of September 30, 2023 for our LaSalle Investment Management business and JLL Technologies, respectively. Of the $361.9 million related to LaSalle, while we remain contractually obligated, we do not expect a call on the $60.3 million relating to a specific investment since the underlying fund moved into its liquidation phase in January 2020.

We evaluate our less-than-wholly-owned investments to determine whether the underlying entities are classified as variable interest entities ("VIEs"); we assess each identified VIE to determine whether we are the primary beneficiary. In prior periods, we determined we were the primary beneficiary of certain VIEs and, accordingly, we consolidated such entities. In December of 2022, as a result of a reconsideration event, we concluded we were no longer the primary beneficiary of these VIEs and, therefore, no longer consolidate these VIEs.

Summarized financial information for our consolidated VIEs is presented in the following table. As a result of the reconsideration event described above, there were no consolidated VIE balances as of September 30, 2023 and December 31, 2022; net income was consolidated up to the reconsideration date.

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||

| (in millions) | 2023 | 2022 | 2023 | 2022 | |||||||||||||

| Revenue | $ | $ | |||||||||||||||

| Operating and other expenses | ( | ( | |||||||||||||||

Net gains on sale of investments(1) | |||||||||||||||||

| Net (loss) income | $ | ( | $ | ||||||||||||||

(1) The gain was included in Other income on the Condensed Consolidated Statements of Comprehensive Income.

We allocated the net (loss) income of the consolidated VIEs to the noncontrolling interest holders as Net (loss) income attributable to noncontrolling interest in our Condensed Consolidated Statements of Comprehensive Income.

Impairment

There were no significant other-than-temporary impairment charges on investments for the nine months ended September 30, 2023 and 2022.

15

Fair Value

We report a majority of our investments at fair value. For such investments, we increase or decrease our investment each reporting period by the change in the fair value and we report these fair value adjustments in our Condensed Consolidated Statements of Comprehensive Income within Equity (losses) earnings. The table below shows the movement in our investments reported at fair value.

| (in millions) | 2023 | 2022 | ||||||

| Fair value investments as of January 1, | $ | |||||||

Investments(1) | ||||||||

| Distributions | ( | ( | ||||||

| Change in fair value, net | ( | |||||||

| Foreign currency translation adjustments, net | ( | ( | ||||||

| Fair value investments as of September 30, | $ | |||||||

(1) In 2023, $66.9 million in Notes receivable matured and (inclusive of accrued interest) converted to equity.

See Note 8, Fair Value Measurements, for additional discussion of our investments reported at fair value.

16

7.STOCK-BASED COMPENSATION

Stock Unit Awards

Restricted stock unit ("RSU") and performance stock unit ("PSU") awards activity is presented in the following tables.

| RSU Shares (in 000's) | PSU Shares (in 000's) | Total Shares (in 000's) | Weighted Average Grant Date Fair Value | Weighted Average Remaining Contractual Life (in years) | |||||||||||||||||||

Unvested as of June 30, 2023 | $ | ||||||||||||||||||||||

| Granted | |||||||||||||||||||||||

| Vested | ( | ( | |||||||||||||||||||||

| Forfeited | ( | ( | ( | ||||||||||||||||||||

Unvested as of September 30, 2023 | $ | ||||||||||||||||||||||

Unvested as of June 30, 2022 | $ | ||||||||||||||||||||||

| Granted | |||||||||||||||||||||||

| Vested | ( | ( | |||||||||||||||||||||

| Forfeited | ( | ( | ( | ||||||||||||||||||||

Unvested as of September 30, 2022 | $ | ||||||||||||||||||||||

| RSU Shares (in 000's) | PSU Shares (in 000's) | Total Shares (in 000's) | Weighted Average Grant Date Fair Value | Weighted Average Remaining Contractual Life (in years) | |||||||||||||||||||

Unvested as of December 31, 2022 | $ | ||||||||||||||||||||||

| Granted | |||||||||||||||||||||||

| Vested | ( | ( | ( | ||||||||||||||||||||

| Forfeited | ( | ( | ( | ||||||||||||||||||||

Unvested as of September 30, 2023 | $ | ||||||||||||||||||||||

Unvested as of December 31, 2021 | $ | ||||||||||||||||||||||

| Granted | |||||||||||||||||||||||

| Vested | ( | ( | ( | ||||||||||||||||||||

| Forfeited | ( | ( | ( | ||||||||||||||||||||

Unvested as of September 30, 2022 | $ | ||||||||||||||||||||||

As of September 30, 2023, we had $99.4 million of unamortized deferred compensation related to unvested RSUs and PSUs, which we anticipate recognizing over varying periods into 2027.

For the three and nine months ended September 30, 2023, we recorded $13.5 million of stock-based compensation expense reversal associated with the expected achievement against performance measures of certain PSU awards.

17

8.FAIR VALUE MEASUREMENTS

We measure certain assets and liabilities in accordance with ASC Topic 820, Fair Value Measurements and Disclosures, which defines fair value as the price that would be received for an asset, or paid to transfer a liability, in an orderly transaction between market participants on the measurement date. In addition, it establishes a framework for measuring fair value according to the following three-tier fair value hierarchy:

•Level 1 - Quoted prices for identical assets or liabilities in active markets accessible as of the measurement date;

•Level 2 - Inputs, other than quoted prices in active markets, that are observable either directly or indirectly; and

•Level 3 - Unobservable inputs in which there is little or no market data, which require the reporting entity to develop its own assumptions.

Financial Instruments

Our financial instruments include Cash and cash equivalents, Trade receivables, Notes and other receivables, Reimbursable receivables, Warehouse receivables, restricted cash, contract assets, Accounts payable, Reimbursable payables, Short-term borrowings, contract liabilities, Warehouse facilities, Credit facility, Long-term debt and foreign currency forward contracts. The carrying amounts of Cash and cash equivalents, Trade receivables, Notes and other receivables, Reimbursable receivables, restricted cash, contract assets, Accounts payable, Reimbursable payables, contract liabilities and the Warehouse facilities approximate their estimated fair values due to the short-term nature of these instruments. The carrying values of our Credit facility and Short-term borrowings approximate their estimated fair values given the variable interest rate terms and market spreads.

We estimated the fair value of our Long-term debt using dealer quotes that are Level 2 inputs in the fair value hierarchy. The fair value and carrying value of our debt are presented in the following table.

| (in millions) | September 30, 2023 | December 31, 2022 | |||||||||

| Long-term debt, fair value | $ | ||||||||||

| Long-term debt, carrying value, net of debt issuance costs | |||||||||||

Investments at Fair Value - Net Asset Value ("NAV")

We report a significant portion of our investments at fair value. For such investments, we increase or decrease our investment each reporting period by the change in the fair value, and we report these fair value adjustments in our Condensed Consolidated Statements of Comprehensive Income within Equity (losses) earnings.

For a subset of our investments reported at fair value, we estimate the fair value using the NAV per share (or its equivalent) our investees provide. Critical inputs to NAV estimates included valuations of the underlying real estate assets and borrowings, which incorporate investment-specific assumptions such as discount rates, capitalization rates, rental and expense growth rates, and asset-specific market borrowing rates. We did not consider any adjustments to NAV estimates provided by investees, including adjustments for any restrictions to the transferability of ownership interests embedded within investment agreements to which we are a party, to be necessary based upon (i) our understanding of the methodology utilized and inputs incorporated to estimate NAV at the investee level, (ii) consideration of market demand for the specific types of real estate assets held by each venture and (iii) contemplation of real estate and capital markets conditions in the localities in which these ventures operate. As of September 30, 2023 and December 31, 2022, investments at fair value using NAV were $307.8 million and $284.6 million, respectively. As these investments are not required to be classified in the fair value hierarchy, they have been excluded from the following table.

18

Recurring Fair Value Measurements

The following table categorizes by level in the fair value hierarchy the estimated fair value of our assets and liabilities measured at fair value on a recurring basis.

| September 30, 2023 | December 31, 2022 | ||||||||||||||||||||||

| (in millions) | Level 1 | Level 2 | Level 3 | Level 1 | Level 2 | Level 3 | |||||||||||||||||

| Assets | |||||||||||||||||||||||

| Investments - fair value | $ | ||||||||||||||||||||||

| Foreign currency forward contracts receivable | |||||||||||||||||||||||

| Warehouse receivables | |||||||||||||||||||||||

| Deferred compensation plan assets | |||||||||||||||||||||||

| Mortgage banking derivative assets | |||||||||||||||||||||||

| Total assets at fair value | $ | ||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||

| Foreign currency forward contracts payable | $ | ||||||||||||||||||||||

| Deferred compensation plan liabilities | |||||||||||||||||||||||

| Earn-out liabilities | |||||||||||||||||||||||

| Mortgage banking derivative liabilities | |||||||||||||||||||||||

| Total liabilities at fair value | $ | ||||||||||||||||||||||

Investments

We classify one investment as Level 1 in the fair value hierarchy as a quoted price is readily available. We increase or decrease our investment each reporting period by the change in the fair value of the investment. We report the fair value adjustments in our Condensed Consolidated Statements of Comprehensive Income within Equity (losses) earnings.

Investments classified as Level 3 in the fair value hierarchy represent investments in early to mid-stage non-public entities where we elected the fair value option. To the extent there are changes in fair value, we recognize such changes through Equity (losses) earnings. Such changes are generally the result of pricing in subsequent funding rounds, changes in business strategy or performance updates from the investee. For most of our investments, the carrying value was deemed to approximate fair value due to the proximity of the investment date, or date of most recent financing raise, to the balance sheet date, as well as consideration of investee-level performance updates.

Foreign Currency Forward Contracts

We regularly use foreign currency forward contracts to manage our currency exchange rate risk related to intercompany lending and cash management practices. We determine the fair values of these contracts based on current market rates. The inputs for these valuations are Level 2 inputs in the fair value hierarchy. The following table details the gross notional value and net basis of these contracts.

| (in billions) | September 30, 2023 | December 31, 2022 | |||||||||

| Foreign currency forward contracts, gross notional value | $ | ||||||||||

| Foreign currency forward contracts, net basis | |||||||||||

19

We record the asset and liability positions for our foreign currency forward contracts based on the net payable or net receivable position with the financial institutions from which we purchase these contracts. The outstanding balances of these contracts are presented in the following table.

| (in millions) | September 30, 2023 | December 31, 2022 | |||||||||

| Net asset, receivable positions | $ | ||||||||||

| Net asset, payable positions | ( | ( | |||||||||

| Foreign currency forward contracts receivable | $ | ||||||||||

| Net liability, receivable positions | $ | ( | ( | ||||||||

| Net liability, payable positions | |||||||||||

| Foreign currency forward contracts payable | $ | ||||||||||

Warehouse Receivables

As of September 30, 2023 and December 31, 2022, all of our Warehouse receivables were under commitment to be purchased by government-sponsored enterprises ("GSEs") or by a qualifying investor as part of a U.S. government or GSE mortgage-backed security program.

Deferred Compensation

We maintain a deferred compensation plan for certain of our U.S. employees that allows them to defer portions of their compensation. We recorded this plan on our Condensed Consolidated Balance Sheet as Deferred compensation plan assets, long-term deferred compensation plan liabilities, included in Deferred compensation, and as a reduction of equity, Shares held in trust. The components of the plan are presented in the following table.

| (in millions) | September 30, 2023 | December 31, 2022 | |||||||||

| Deferred compensation plan assets | $ | ||||||||||

| Long-term deferred compensation plan liabilities | |||||||||||

| Shares held in trust | |||||||||||

Earn-Out Liabilities

We classify our Earn-out liabilities within Level 3 in the fair value hierarchy because the inputs we use to develop the estimated fair value include unobservable inputs. See Note 5, Business Combinations, Goodwill and Other Intangible Assets, for additional discussion of our Earn-out liabilities.

Mortgage Banking Derivatives

Both our interest rate lock commitments to prospective borrowers and forward sale contracts with prospective investors are undesignated derivatives and considered Level 3 valuations due to significant unobservable inputs related to counterparty credit risk. An increase in counterparty credit risk assumptions would result in a lower fair value measurement.

20

The tables below present a reconciliation for assets and liabilities measured at fair value on a recurring basis using significant unobservable inputs (Level 3).

| (in millions) | Balance as of June 30, 2023 | Net change in fair value | Foreign CTA(1) | Purchases / Additions | Settlements | Transfers in(2) | Balance as of September 30, 2023 | |||||||||||||||||||

| Investments | $ | ( | ( | $ | ||||||||||||||||||||||

| Mortgage banking derivative assets and liabilities, net | ( | |||||||||||||||||||||||||

| Earn-out liabilities | ( | ( | ||||||||||||||||||||||||

| (in millions) | Balance as of June 30, 2022 | Net change in fair value | Foreign CTA(1) | Purchases / Additions | Settlements | Transfers out | Balance as of September 30, 2022 | |||||||||||||||||||

| Investments | $ | ( | $ | |||||||||||||||||||||||

| Mortgage banking derivative assets and liabilities, net | ( | |||||||||||||||||||||||||

| Earn-out liabilities | ( | ( | ( | |||||||||||||||||||||||

| (in millions) | Balance as of December 31, 2022 | Net change in fair value | Foreign CTA(1) | Purchases / Additions | Settlements | Transfers in(2) | Balance as of September 30, 2023 | |||||||||||||||||||

| Investments | $ | ( | $ | |||||||||||||||||||||||

| Mortgage banking derivative assets and liabilities, net | ( | |||||||||||||||||||||||||

| Earn-out liabilities | ( | ( | ||||||||||||||||||||||||

| (in millions) | Balance as of December 31, 2021 | Net change in fair value | Foreign CTA(1) | Purchases / Additions | Settlements | Transfers out | Balance as of September 30, 2022 | |||||||||||||||||||

| Investments | $ | ( | $ | |||||||||||||||||||||||

| Mortgage banking derivative assets and liabilities, net | ( | |||||||||||||||||||||||||

| Earn-out liabilities | ( | ( | ||||||||||||||||||||||||

(1) CTA: Currency translation adjustments

(2) Notes receivable (inclusive of accrued interest) converted to equity upon maturity and was classified as a Level 3 investment immediately.

Net change in fair value, included in the tables above, is reported in Net income as follows.

| Category of Assets/Liabilities using Unobservable Inputs | Condensed Consolidated Statements of Comprehensive Income Account Caption | ||||

| Earn-out liabilities (Short-term and Long-term) | Restructuring and acquisition charges | ||||

| Investments | Equity (losses) earnings | ||||

| Other current assets - Mortgage banking derivative assets | Revenue | ||||

| Other current liabilities - Mortgage banking derivative liabilities | Revenue | ||||

21

Non-Recurring Fair Value Measurements

We review our investments, except those investments otherwise reported at fair value, on a quarterly basis, or as otherwise deemed necessary, for indications of whether we may be unable to recover the carrying value of our investments and whether such investments are other than temporarily impaired. When the carrying amount of the investment is in excess of the estimated future undiscounted cash flows, we use a discounted cash flow approach or other acceptable method to determine the fair value of the investment in computing the amount of the impairment. Our determination of fair value primarily relies on Level 3 inputs. We did not recognize any significant investment-level impairment losses during either of the nine months ended September 30, 2023 or 2022. See Note 6, Investments, for additional information, including information related to impairment charges recorded at the investee level.

9.DEBT

Debt is composed of the following obligations.

| ($ in millions) | September 30, 2023 | December 31, 2022 | ||||||

| Local overdraft facilities | $ | |||||||

| Other short-term borrowings | ||||||||

| Short-term borrowings | $ | |||||||

Credit facility, net of debt issuance costs of $ | ||||||||

Long-term senior notes, | ||||||||

Long-term senior notes, | ||||||||

| Total debt | $ | |||||||

Credit Facilities

We have a $3.35 billion unsecured revolving credit facility (the "Facility") that matures on April 14, 2026. Pricing on the Facility ranges from Adjusted Term Secured Overnight Financing Rate ("SOFR") plus 0.875% to 1.35% , with pricing as of September 30, 2023 at Adjusted Term SOFR plus 0.98 %. In addition to outstanding borrowings under the Facility presented in the above table, we had outstanding letters of credit under the Facility of $0.4 million as of both September 30, 2023 and December 31, 2022.

In addition, we have an uncommitted credit agreement (the "Uncommitted Facility"), which allows for discretionary short-term liquidity of up to $400.0 million. Interest and fees are set at the time of utilization and calculated on a 360-day basis. Between quarter-end dates, we intend to use the proceeds to reduce indebtedness under the Facility at a lower interest rate. As such, the Uncommitted Facility had no outstanding balance as of both September 30, 2023 and December 31, 2022.

The following table provides additional information on our Facility and Uncommitted Facility, collectively.

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||

| ($ in millions) | 2023 | 2022 | 2023 | 2022 | ||||||||||

| Average outstanding borrowings | $ | $ | ||||||||||||

| Average effective interest rate | % | % | % | % | ||||||||||

We will continue to use the Facility for, but not limited to, business acquisitions, working capital needs (including payment of accrued incentive compensation), co-investment activities, share repurchases and capital expenditures.

Short-Term and Long-Term Debt

In addition to our credit facilities, we have the capacity to borrow up to an additional $52.9 million under local overdraft facilities. Amounts outstanding are presented in the debt table above.

As of September 30, 2023, our issuer and senior unsecured ratings are investment grade: Baa1 from Moody’s Investors Service, Inc. and BBB+ from Standard & Poor’s Ratings Services.

22

Covenants

Our Facility and senior notes are subject to customary financial and other covenants, including cash interest coverage ratios and leverage ratios, as well as event of default conditions. We remained in compliance with all covenants as of September 30, 2023.

Warehouse Facilities

| September 30, 2023 | December 31, 2022 | ||||||||||||||||

| ($ in millions) | Outstanding Balance | Maximum Capacity | Outstanding Balance | Maximum Capacity | |||||||||||||

| Warehouse facilities: | |||||||||||||||||

| $ | |||||||||||||||||

Fannie Mae ASAP(5) program, | n/a | n/a | |||||||||||||||

| Gross warehouse facilities | |||||||||||||||||

| Debt issuance costs | ( | n/a | ( | n/a | |||||||||||||

| Total warehouse facilities | $ | ||||||||||||||||

(1) Bloomberg Short-Term Bank Yield Index rate ("BSBY")

(2) In the third quarter of 2023, JLL extended the Warehouse facility; previously, the facility had a maturity date of September 18, 2023.

(3) In the third quarter of 2023, JLL extended the Warehouse facility; previously, the facility had a maturity date of September 15, 2023.

(4) In the third quarter of 2023, JLL extended the Warehouse facility; previously, the facility had a maturity date of July 28, 2023.

(5) As Soon As Pooled ("ASAP") funding program.

We have lines of credit established for the sole purpose of funding our Warehouse receivables. These lines of credit exist with financial institutions and are secured by the related warehouse receivables. Pursuant to these facilities, we are required to comply with certain financial covenants regarding (i) minimum net worth, (ii) minimum servicing-related loans and (iii) minimum adjusted leverage ratios. We remained in compliance with all covenants under our facilities as of September 30, 2023.

23

10.COMMITMENTS AND CONTINGENCIES

We are a defendant in various litigation matters arising in the ordinary course of business, some of which involve claims for damages that are substantial in amount.

Professional Indemnity Insurance

In order to better manage our global insurance program and support our risk management efforts, we supplement our traditional insurance coverage for certain types of claims by using a wholly-owned captive insurance company. The level of risk retained by our captive insurance company, with respect to professional indemnity claims, is up to $10.0 million per claim, inclusive of the deductible. We contract third-party insurance companies to provide coverage of risk in excess of this amount. When a potential loss event occurs, we estimate the ultimate cost of the claim and accrue the amount in Other current and long-term liabilities on our Condensed Consolidated Balance Sheets when probable and estimable. In addition, we have established receivables from third-party insurance providers for claim amounts in excess of the risk retained by our captive insurance company. As of September 30, 2023 and December 31, 2022, these receivables were $2.2 million and $22.5 million, respectively, and are included in Notes and other receivables on our Condensed Consolidated Balance Sheets.

The following table shows the professional indemnity accrual activity and related payments.

| (in millions) | |||||

| December 31, 2022 | $ | ||||

| New claims | |||||

| Prior year claims adjustments (including foreign currency changes) | |||||

| Claims paid | ( | ||||

| September 30, 2023 | $ | ||||

| December 31, 2021 | $ | ||||

| New claims | |||||

| Prior year claims adjustments (including foreign currency changes) | ( | ||||

| Claims paid | ( | ||||

| September 30, 2022 | $ | ||||

Delegated Underwriting and Servicing ("DUS") Program Loan Loss-Sharing

As a participant in the DUS program, we retain a portion of the risk of loss for loans that are originated and sold under the DUS program. Net losses on defaulted loans are shared with Fannie Mae based upon established loss-sharing ratios. Generally, we share approximately one-third of incurred losses, subject to a cap of 20% of the principal balance of the mortgage at origination. As of September 30, 2023 and December 31, 2022, we had loans, funded and sold, subject to such loss-sharing arrangements with an aggregate unpaid principal balance of $20.5 billion and $18.3 billion, respectively.

For all DUS program loans with loss-sharing obligations, we record a non-contingent liability equal to the estimated fair value of the guarantee obligations undertaken upon sale of the loan, which reduces our gain on sale of the loan. Subsequently, this liability is amortized over the estimated life of the loan and recognized as Revenue on the Condensed Consolidated Statements of Comprehensive Income. As of September 30, 2023 and December 31, 2022, the loss-sharing guarantee obligations were $31.1 million and $29.0 million, respectively, and are included in Other liabilities on our Condensed Consolidated Balance Sheets. There were no loan losses incurred during the nine months ended September 30, 2023 and 2022.

24

11.RESTRUCTURING AND ACQUISITION CHARGES

Restructuring and acquisition charges include cash and non-cash expenses. Cash-based charges primarily consist of (i) severance and employment-related charges, including those related to external service providers, incurred in conjunction with a structural business shift, which can be represented by a notable change in headcount, change in leadership, or transformation of business processes, (ii) acquisition, transaction and integration-related charges and (iii) other restructuring including lease exit charges. Non-cash charges include (i) stock-based compensation expense for retention awards issued in conjunction with prior-period acquisitions and (ii) fair value adjustments to earn-out liabilities relating to prior-period acquisition activity. Restructuring and acquisition charges are presented in the table below.

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||

| (in millions) | 2023 | 2022 | 2023 | 2022 | |||||||||||||

| Severance and other employment-related charges | $ | $ | |||||||||||||||

| Restructuring, pre-acquisition and post-acquisition charges | |||||||||||||||||

Stock-based compensation expense for post-acquisition retention awards(1) | ( | ||||||||||||||||

| Fair value adjustments to earn-out liabilities | ( | ( | |||||||||||||||

| Restructuring and acquisition charges | $ | $ | |||||||||||||||

(1) Includes the impact of shares forfeited during the third quarter.

We expect nearly all expenses related to (i) severance and other employment-related charges and (ii) restructuring, pre-acquisition and post-acquisition charges as of September 30, 2023 will be paid during the next twelve months.

25

12. ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS) BY COMPONENT

The tables below present the changes in Accumulated other comprehensive income (loss) ("AOCI") by component.

| (in millions) | Pension and postretirement benefit | Cumulative foreign currency translation adjustment | Total | |||||||||||

| Balance as of June 30, 2023 | $ | ( | ( | $ | ( | |||||||||

| Other comprehensive loss before reclassification | ( | ( | ||||||||||||

Amounts reclassified from AOCI after tax expense of $ -, $ - and $ - | ||||||||||||||

| Other comprehensive loss after tax expense of $ - , $ - and $ - | ( | ( | ||||||||||||

| Balance as of September 30, 2023 | $ | ( | ( | $ | ( | |||||||||

| (in millions) | Pension and postretirement benefit | Cumulative foreign currency translation adjustment | Total | |||||||||||

| Balance as of June 30, 2022 | $ | ( | ( | $ | ( | |||||||||

| Other comprehensive loss before reclassification | ( | ( | ||||||||||||

| Amounts reclassified from AOCI after tax expense of $ - , $ - and $ - | ||||||||||||||

| Other comprehensive loss after tax expense of $ - , $ - and $ - | ( | ( | ||||||||||||

| Balance as of September 30, 2022 | $ | ( | ( | $ | ( | |||||||||

| (in millions) | Pension and postretirement benefit | Cumulative foreign currency translation adjustment | Total | |||||||||||

| Balance as of December 31, 2022 | $ | ( | ( | $ | ( | |||||||||

| Other comprehensive loss before reclassification | ( | ( | ( | |||||||||||

| Amounts reclassified from AOCI after tax expense of $ - , $ - and $ - | ||||||||||||||

| Other comprehensive loss after tax expense of $ - , $ - and $ - | ( | ( | ( | |||||||||||

| Balance as of September 30, 2023 | $ | ( | ( | $ | ( | |||||||||

| (in millions) | Pension and postretirement benefit | Cumulative foreign currency translation adjustment | Total | |||||||||||

| Balance as of December 31, 2021 | $ | ( | ( | $ | ( | |||||||||

| Other comprehensive loss before reclassification | ( | ( | ||||||||||||

| Amounts reclassified from AOCI after tax expense of $ - , $ - and $ - | ||||||||||||||

| Other comprehensive loss after tax expense of $ - , $ - and $ - | ( | ( | ||||||||||||

| Balance as of September 30, 2022 | $ | ( | ( | $ | ( | |||||||||

For pension and postretirement benefits, we report amounts reclassified from Accumulated other comprehensive income (loss) in Other income within the Condensed Consolidated Statements of Comprehensive Income.

26

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis should be read in conjunction with the Condensed Consolidated Financial Statements, including the notes thereto, for the three and nine months ended September 30, 2023, and our audited Consolidated Financial Statements, including the notes thereto, for the fiscal year ended December 31, 2022, which are included in our 2022 Annual Report on Form 10-K, filed with the SEC and also available on our website (www.jll.com). You should also refer to Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations contained in our 2022 Annual Report on Form 10-K.

The following discussion and analysis contains certain forward-looking statements generally identified by the words anticipates, believes, estimates, expects, forecasts, plans, intends and other similar expressions. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause JLL's actual results, performance, achievements, plans and objectives to be materially different from any future results, performance, achievements, plans and objectives expressed or implied by such forward-looking statements. See the Cautionary Note Regarding Forward-Looking Statements included within this section for further information.

We present our quarterly Management's Discussion and Analysis in the following sections:

(1)A summary of our critical accounting policies and estimates;

(2)Certain items affecting the comparability of results and certain market and other risks we face;

(3)The results of our operations, first on a consolidated basis and then for each of our business segments; and

(4)Liquidity and capital resources.

SUMMARY OF CRITICAL ACCOUNTING POLICIES AND ESTIMATES

An understanding of our accounting policies is necessary for a complete analysis of our results, financial position, liquidity and trends. See Note 2, Summary of Significant Accounting Policies, of the Notes to Consolidated Financial Statements in our 2022 Annual Report on Form 10-K for a complete summary of our significant accounting policies.

The preparation of our financial statements requires management to make certain critical accounting estimates and judgments that impact (1) the stated amount of assets and liabilities, (2) disclosure of contingent assets and liabilities at the date of the financial statements and (3) the reported amount of revenue and expenses during the reporting periods. These accounting estimates are based on management's judgment. We consider them to be critical because of their significance to the financial statements and the possibility that future events may differ from current judgments or that the use of different assumptions could result in materially different estimates. We review these estimates on a periodic basis to ensure reasonableness. Although actual amounts likely differ from such estimated amounts, we believe such differences are not likely to be material.

A discussion of our critical accounting policies and estimates used in the preparation of our Condensed Consolidated Financial Statements included in Part I, Item 1 of this Quarterly Report on Form 10-Q can be found in Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations of our Annual Report on Form 10-K for the year ended December 31, 2022. There have been no material changes to these critical accounting policies and estimates during the nine months ended September 30, 2023.

ITEMS AFFECTING COMPARABILITY

Macroeconomic Conditions

Our results of operations and the variability of these results are significantly influenced by (i) macroeconomic trends, (ii) the geopolitical environment, (iii) the global and regional real estate markets and (iv) the financial and credit markets. These macroeconomic and other conditions have had, and we expect will continue to have, a significant impact on the variability of our results of operations.

27

Acquisitions and Dispositions

The timing of acquisitions and dispositions may impact the comparability of our results on a year-over-year basis. Our results include incremental revenues and expenses following the completion date of an acquisition. Relating to dispositions, comparable results will include the revenues and expenses of recent dispositions and results may also include gains (losses) on the disposition. In addition, there is generally an initial adverse impact on net income from an acquisition as a result of pre-acquisition due diligence expenditures, transaction/deal costs and post-acquisition integration costs, such as fees from third-party advisors engaged to assist with onboarding and process alignment, retention and severance expense, early lease termination costs and other integration expenses. For dispositions, we may also incur such incremental costs during the disposition process and these costs could have an adverse impact on net income.

Equity Earnings and Incentive Fees

Equity earnings may vary substantially from period to period for a variety of reasons, including as a result of (i) valuation increases (decreases) on investments reported at fair value, (ii) gains (losses) on asset dispositions and (iii) impairment charges. The timing of recognition of these items may impact comparability between quarters, in any one year, or compared with a prior year.

LaSalle, our investment management business, is in part compensated through incentive fees where performance of underlying funds' investments exceeds agreed-to return hurdles. Depending upon performance, disposition activity and the contractual timing of measurement periods with clients, these fees can be significant and may vary substantially from period to period.

The comparability of these items can be seen in Note 4, Business Segments, of the Notes to Condensed Consolidated Financial Statements and is discussed further in Segment Operating Results included herein.

Foreign Currency

We conduct business using a variety of currencies, but we report our results in U.S. dollars. As a result, the volatility of currencies against the U.S. dollar may positively or negatively impact our results. This volatility can make it more difficult to perform period-to-period comparisons of the reported U.S. dollar results of operations, because such results may indicate a growth or decline rate that might not have been consistent with the real underlying growth or decline rates in the local operations. Consequently, we provide information about the impact of foreign currencies in the period-to-period comparisons of the reported results of operations in our discussion and analysis of financial condition in the Results of Operations section below.

Transaction-Based Revenue

Transaction-based fees, which are impacted by the size and timing of our clients' transactions, from real estate investment banking, capital markets activities and other services within our segments, increase the variability of the revenue we earn. The timing and the magnitude of these fees can vary significantly from year to year and quarter to quarter, and from region to region.

Seasonality

Historically, our quarterly revenue and profits have tended to increase from quarter to quarter as the year progresses. This is a result of a general focus in the real estate industry on completing or documenting transactions by calendar year end and the fact that certain expenses are constant through the year. In addition, this seasonality excludes the recognition of investment-generated performance fees as well as realized and unrealized co-investment equity earnings and losses (the timing of each of these can fluctuate based on a variety of factors). Generally, we recognize incentive fees when assets are sold, the timing of which is geared toward the benefit of our clients. In addition, co-investment equity gains and losses are primarily dependent on valuations of underlying investments, the direction and magnitude of changes to such valuations fluctuate based on a variety of factors. Non-variable operating expenses, which we treat as expenses when incurred during the year, are relatively constant on a quarterly basis.

A significant portion of our Compensation and benefits expense is from incentive compensation plans, which we generally accrue throughout the year based on progress toward annual performance targets. This quarterly estimation can result in significant fluctuations in quarterly Compensation and benefits expense from period to period. Consequently, the results for the periods ended September 30, 2023 and 2022 are not fully indicative of the results we expect to realize for the full fiscal year.

28

RESULTS OF OPERATIONS

Definitions

•Assets under management data for LaSalle is reported on a one-quarter lag.

•MENA: Middle East & North Africa

•n.m.: not meaningful, represented by a percentage change of greater than 1,000% or a change in margin of greater than 10,000 basis points ("bps"), favorable or unfavorable.

Consolidated Operating Results

| Three Months Ended September 30, | Change in | % Change in Local Currency | |||||||||||||||

| ($ in millions) | 2023 | 2022 | U.S. dollars | ||||||||||||||

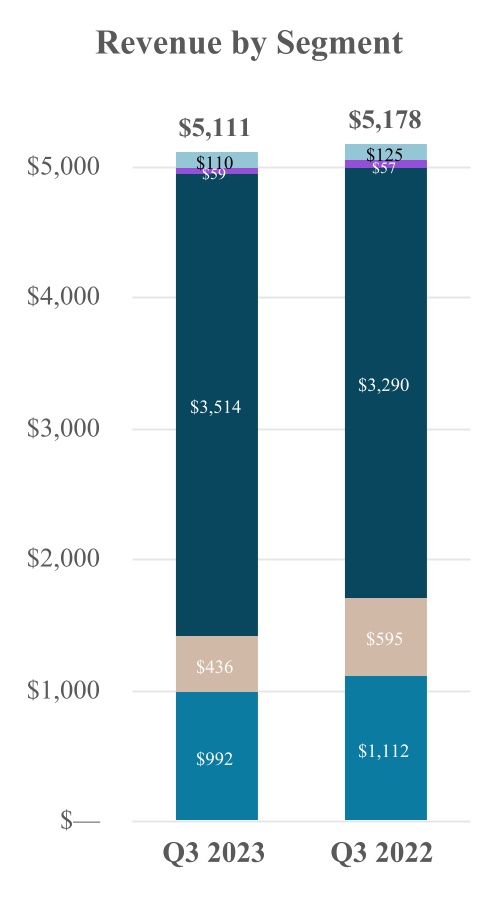

| Markets Advisory | $ | 992.4 | 1,111.5 | (119.1) | (11) | % | (11) | % | |||||||||

| Capital Markets | 435.8 | 595.2 | (159.4) | (27) | (28) | ||||||||||||

| Work Dynamics | 3,514.2 | 3,289.8 | 224.4 | 7 | 6 | ||||||||||||

| JLL Technologies | 58.9 | 56.5 | 2.4 | 4 | 4 | ||||||||||||

| LaSalle | 110.1 | 124.5 | (14.4) | (12) | (13) | ||||||||||||

| Revenue | $ | 5,111.4 | 5,177.5 | (66.1) | (1) | % | (2) | % | |||||||||

| Gross contract costs | (3,327.1) | (3,123.7) | (203.4) | 7 | 6 | ||||||||||||

| Net non-cash MSR and mortgage banking derivative activity | 7.1 | (5.2) | 12.3 | (237) | (236) | ||||||||||||

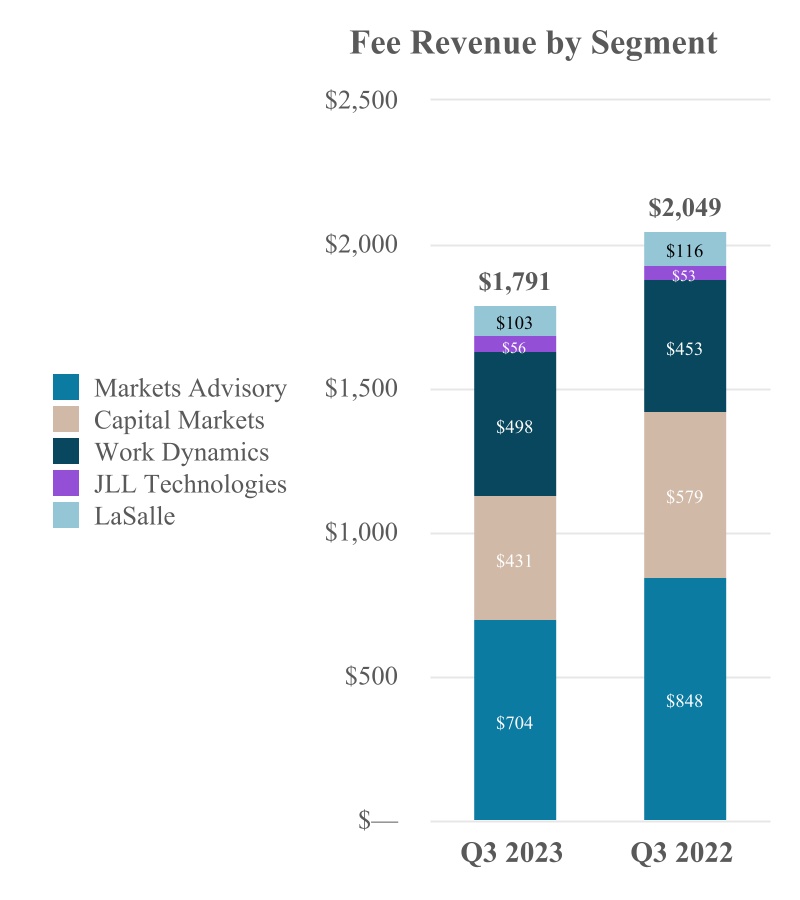

| Fee revenue | $ | 1,791.4 | 2,048.6 | (257.2) | (13) | % | (13) | % | |||||||||

| Markets Advisory | 704.0 | 847.9 | (143.9) | (17) | (17) | ||||||||||||

| Capital Markets | 431.4 | 579.1 | (147.7) | (26) | (27) | ||||||||||||

| Work Dynamics | 497.7 | 452.9 | 44.8 | 10 | 9 | ||||||||||||

| JLL Technologies | 55.6 | 52.7 | 2.9 | 6 | 5 | ||||||||||||

| LaSalle | 102.7 | 116.0 | (13.3) | (11) | (13) | ||||||||||||

| Compensation and benefits, excluding gross contract costs | $ | 1,299.8 | 1,472.4 | (172.6) | (12) | % | (13) | % | |||||||||

| Operating, administrative and other expenses, excluding gross contract costs | 274.7 | 302.1 | (27.4) | (9) | (12) | ||||||||||||

| Depreciation and amortization | 59.1 | 55.7 | 3.4 | 6 | 5 | ||||||||||||

| Restructuring and acquisition charges | 31.6 | 21.0 | 10.6 | 50 | 46 | ||||||||||||

| Total fee-based operating expenses | 1,665.2 | 1,851.2 | (186.0) | (10) | (11) | ||||||||||||

| Gross contract costs | 3,327.1 | 3,123.7 | 203.4 | 7 | 6 | ||||||||||||

| Total operating expenses | $ | 4,992.3 | 4,974.9 | 17.4 | — | % | (1) | % | |||||||||

| Operating income | $ | 119.1 | 202.6 | (83.5) | (41) | % | (39) | % | |||||||||

| Equity (losses) earnings | $ | (11.2) | 0.5 | (11.7) | n.m. | n.m. | |||||||||||

| Adjusted EBITDA | $ | 205.2 | 276.2 | (71.0) | (26) | % | (23) | % | |||||||||

| Net income margin attributable to common shareholders (USD basis) | 1.2 | % | 2.7 | % | (150) bps | n/a | |||||||||||

| Adjusted EBITDA margin (local currency basis) | 12.0 | % | 13.5 | % | (200) bps | (150) bps | |||||||||||

| Adjusted EBITDA margin (USD basis) | 11.5 | % | |||||||||||||||

29

Consolidated Operating Results (continued)