Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 1-12981

AMETEK, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 14-1682544 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 1100 Cassatt Road Berwyn, Pennsylvania |

19312-1177 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (610) 647-2121

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $0.01 Par Value (voting) |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer þ |

Accelerated filer ¨ |

Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

The aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $13.3 billion as of June 30, 2015, the last business day of the registrant’s most recently completed second fiscal quarter.

The number of shares of the registrant’s Common Stock outstanding as of January 29, 2016 was 235,538,207.

Documents Incorporated by Reference

Part III incorporates information by reference from the Proxy Statement for the Annual Meeting of Stockholders on May 4, 2016.

Table of Contents

2015 Form 10-K Annual Report

Table of Contents

1

Table of Contents

PART I

| Item 1. | Business |

General Development of Business

AMETEK, Inc. (“AMETEK” or the “Company”) is incorporated in Delaware. Its predecessor was originally incorporated in Delaware in 1930 under the name American Machine and Metals, Inc. AMETEK is a leading global manufacturer of electronic instruments and electromechanical devices with operations in North America, Europe, Asia and South America. AMETEK maintains its principal executive offices in suburban Philadelphia at 1100 Cassatt Road, Berwyn, Pennsylvania, 19312. Listed on the New York Stock Exchange (symbol: AME), the common stock of AMETEK is a component of the Standard and Poor’s 500 and the Russell 1000 Indices.

Website Access to Information

AMETEK’s annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports filed or furnished pursuant to Section 13(a) of the Securities Exchange Act of 1934 are made available free of charge on the Company’s website at www.ametek.com in the “Investors — Financial News and Information” section as soon as reasonably practicable after such material is electronically filed with, or furnished to, the U.S. Securities and Exchange Commission. AMETEK has posted free of charge on the investor information portion of its website its corporate governance guidelines, Board committee charters and codes of ethics. Those documents also are available in published form free of charge to any stockholder who requests them by writing to the Investor Relations Department at AMETEK, Inc., 1100 Cassatt Road, Berwyn, Pennsylvania, 19312.

Products and Services

AMETEK’s products are marketed and sold worldwide through two operating groups: Electronic Instruments (“EIG”) and Electromechanical (“EMG”). Electronic Instruments is a leader in the design and manufacture of advanced instruments for the process, aerospace, power and industrial markets. Electromechanical is a differentiated supplier of electrical interconnects, precision motion control solutions, specialty metals, thermal management systems, and floor care and specialty motors. Its end markets include aerospace and defense, medical, factory automation, mass transit, petrochemical and other industrial markets.

Competitive Strengths

Management believes AMETEK has significant competitive advantages that help strengthen and sustain its market positions. Those advantages include:

Significant Market Share. AMETEK maintains significant market shares in a number of targeted niche markets through its ability to produce and deliver high-quality products at competitive prices. EIG has significant market positions in niche segments of the process, aerospace, power and industrial instrument markets. EMG holds significant positions in niche segments of the aerospace and defense, precision motion control, factory automation, robotics, medical and mass transit markets.

Technological and Development Capabilities. AMETEK believes it has certain technological advantages over its competitors that allow it to maintain its leading market positions. Historically, it has demonstrated an ability to develop innovative new products that anticipate customer needs and to bring them to market successfully. It has consistently added to its investment in research, development and engineering and improved its new product development efforts with the adoption of Design for Six Sigma and Value Analysis/Value Engineering methodologies. These have improved the pace and quality of product innovation and resulted in the introduction of a steady stream of new products across all of AMETEK’s lines of business.

2

Table of Contents

Efficient and Low-Cost Manufacturing Operations. Through its Operational Excellence initiatives, AMETEK has established a lean manufacturing platform for its businesses. In its effort to achieve best-cost manufacturing, AMETEK has relocated manufacturing and expanded plants in Brazil, China, the Czech Republic, Malaysia, Mexico, and Serbia. These plants offer proximity to customers and provide opportunities for increasing international sales. Acquisitions also have allowed AMETEK to reduce costs and achieve operating synergies by consolidating operations, product lines and distribution channels, benefitting both of AMETEK’s operating groups.

Experienced Management Team. Another component of AMETEK’s success is the strength of its management team and that team’s commitment to improving Company performance. AMETEK senior management has extensive industry experience and an average of approximately 24 years of AMETEK service. The management team is focused on achieving results, building stockholder value and continually growing AMETEK. Individual performance is tied to financial results through Company-established stock ownership guidelines and equity incentive programs.

Business Strategy

AMETEK is committed to achieving earnings growth through the successful implementation of a Corporate Growth Plan. The goal of that plan is double-digit annual percentage growth in earnings per share over the business cycle and a superior return on total capital. In addition, other financial initiatives have been or may be undertaken, including public and private debt or equity issuance, bank debt refinancing, local financing in certain foreign countries and share repurchases.

AMETEK’s Corporate Growth Plan consists of four key strategies:

Operational Excellence. Operational Excellence is AMETEK’s cornerstone strategy for improving profit margins and strengthening its competitive position across its businesses. Operational Excellence focuses on cost reductions, improvements in operating efficiencies and sustainable practices. It emphasizes team building and a participative management culture. AMETEK’s Operational Excellence strategies include lean manufacturing, global sourcing, Design for Six Sigma and Value Engineering/Value Analysis. Each plays an important role in improving efficiency, enhancing the pace and quality of innovation and cost reduction. Operational Excellence initiatives have yielded lower operating and administrative costs, shortened manufacturing cycle times, higher cash flow from operations and increased customer satisfaction. They also have played a key role in achieving synergies from newly acquired companies.

Strategic Acquisitions. Acquisitions are a key to achieving the goals of AMETEK’s Corporate Growth Plan. Since the beginning of 2011 through December 31, 2015, AMETEK has completed 22 acquisitions with annualized sales totaling approximately $1.3 billion, including two acquisitions in 2015 (see “Recent Acquisitions”). AMETEK targets companies that offer the right strategic, technical and cultural fit. It seeks to acquire businesses in adjacent markets with complementary products and technologies. It also looks for businesses that provide attractive growth opportunities, often in new and emerging markets. Through these and prior acquisitions, AMETEK’s management team has developed considerable skill in identifying, acquiring and integrating new businesses. As it has executed its acquisition strategy, AMETEK’s mix of businesses has shifted toward those that are more highly differentiated and, therefore, offer better opportunities for growth and profitability.

Global & Market Expansion. AMETEK has experienced dramatic growth outside the United States, reflecting an expanding international customer base and the attractive growth potential of its businesses in overseas markets. Its largest presence outside the United States is in Europe, where it has operations in the United Kingdom, Germany, France, Denmark, Italy, the Czech Republic, Serbia, Romania, Austria, Switzerland and the Netherlands. While Europe remains its largest overseas market, AMETEK has pursued growth opportunities worldwide, especially in key emerging markets. It has grown sales in Latin America

3

Table of Contents

and Asia by building, acquiring and expanding manufacturing facilities in Reynosa, Mexico; Sao Paulo, Brazil; Shanghai, China; and Penang, Malaysia. AMETEK also has expanded its sales and service capabilities in China and enhanced its sales presence and engineering capabilities in India. Elsewhere in Asia and in the Middle East, it has expanded sales, service and technical support. Recently acquired businesses have further added to AMETEK’s international presence. In recent years, AMETEK has acquired businesses with plants in Germany, Switzerland, the United Kingdom, Serbia and China, as well as acquired domestically located businesses that derive a substantial portion of their revenues from global markets.

New Products. New products are essential to AMETEK’s long-term growth. As a result, AMETEK has maintained a consistent investment in new product development and engineering. In 2015, AMETEK added to its highly differentiated product portfolio with a range of new products across many of its businesses. They included:

| • | Reichert Technologies’ Phoropoter VRx digital refraction system was designed to provide eye care professionals with the most-advanced, user friendly vision diagnosis instrument on the market; |

| • | ScanMaster turnkey 3-D scanning solution for automated quality control incorporates Creaform’s MetraSCAN 3D optical scanning system with advanced robotic tools from AGT Robotics; |

| • | Rotron’s lightweight, liquid-cooling heat exchanger is designed for extreme environments and customizable for a wide range of airborne and military applications; |

| • | Crystal Engineering’s HPC40 handheld pressure calibrator offers laboratory accuracy to an onsite, field usable calibration instrument; |

| • | Vision Research’s Miro LAB Series high-speed digital camera was designed specifically for use in industrial and laboratory applications; |

| • | Dunkermotoren’s BG95 brushless DC power package provides 1100 watts of continuous power to such demanding applications as battery-powered autonomous vehicles; |

| • | TMC’s STACIS III vibration cancellation systems designed to meet the needs of manufacturers and researchers working with highly vibration-sensitive instruments and devices; |

| • | Teseq’s NSG4060 testing system allows electrical and electronic device manufacturers to meet the latest electromagnetic immunity testing requirements; |

| • | Haydon Kerk’s Micro Series lead screws are customized for specialized medical applications such as insulin pumps; |

| • | Terra SAS™ standalone solar array simulator allows users to test the performance of photovoltaic micro-grid, energy storage and inverter applications; |

| • | Subsea Interconnect’s Elite Series high-pressure, high-temperature connectors are designed to operate reliably in the harsh environments found in deep water and downhole oil and gas applications; |

| • | Solidstate Controls’ DSE uninterruptible power supply system provides continuous, clean, regulated power for critical power and energy production; and |

| • | Zygo’s Nomad™ portable optical profiler employs advanced non-contact metrology technology to inspect large-scale optics and quality control for precision manufactured components. |

4

Table of Contents

2015 OVERVIEW

Operating Performance

In 2015, AMETEK achieved sales of $3,974.3 million, a decrease of 1.2% from 2014 and established records for operating income, operating income margins, net income and diluted earnings per share.

Financing

In August 2015, the Company obtained the third funding of $150 million under the third quarter of 2014 private placement agreement (the “2014 Private Placement”), consisting of $100 million in aggregate principal amount of 3.96% senior notes due August 2025 and $50 million in aggregate principal amount of 4.45% senior notes due August 2035. In June 2015, the Company obtained the second funding of $50 million in aggregate principal amount of 3.91% senior notes due June 2025 under the 2014 Private Placement. The first funding under the 2014 Private Placement occurred in September 2014 for $500 million, consisting of $300 million in aggregate principal amount of 3.73% senior notes due September 2024, $100 million in aggregate principal amount of 3.83% senior notes due September 2026 and $100 million in aggregate principal amount of 3.98% senior notes due September 2029. The 2014 Private Placement senior notes carry a weighted average interest rate of 3.88% and are subject to certain customary covenants, including financial covenants that, among other things, require the Company to maintain certain debt-to-EBITDA (earnings before interest, income taxes, depreciation and amortization) and interest coverage ratios. The proceeds from the third funding of the 2014 Private Placement were used to pay down senior notes that matured in the third quarter of 2015 described further below. The proceeds from the second funding of the 2014 Private Placement were used to pay down domestic borrowings under the Company’s revolving credit facility.

In the third quarter of 2015, the Company paid in full, at maturity, $90 million in aggregate principal amount of 6.59% private placement senior notes and a 50 million Euro ($56.4 million) 3.94% senior note.

In the fourth quarter of 2015, the Company paid in full, at maturity, $35 million in aggregate principal amount of 6.69% private placement senior notes.

Recent Acquisitions

AMETEK spent $356.5 million in cash, net of cash acquired, to acquire two businesses in 2015.

In May 2015, AMETEK acquired Global Tubes, a manufacturer of high-precision, small-diameter metal tubing. Global Tubes is part of EMG.

In July 2015, AMETEK acquired Surface Vision, formerly referred to as the Surface Inspection Systems Division of Cognex Corporation. Surface Vision develops and manufactures software-enabled vision systems used to inspect surfaces of continuously processed materials for flaws and defects. Surface Vision is part of EIG.

Financial Information About Reportable Segments, Foreign Operations and Export Sales

Information with respect to reportable segments and geographic areas is set forth in Note 15 to the Consolidated Financial Statements included in Part II, Item 8 of this Annual Report on Form 10-K.

AMETEK’s international sales decreased 6.4% to $2,054.7 million in 2015. International sales represented 51.7% of consolidated net sales in 2015 compared with 54.6% in 2014. The decrease in international sales was primarily driven by foreign currency translation headwinds and the competitive impacts of a stronger U.S. dollar.

5

Table of Contents

Description of Business

Described below are the products and markets of each reportable segment:

EIG

EIG is a leader in the design and manufacture of advanced instruments for the process, aerospace, power and industrial markets. Its growth is based on the four strategies outlined in AMETEK’s Corporate Growth Plan. In many instances, its products differ from or are technologically superior to its competitors’ products. It has achieved competitive advantage through continued investment in research, development and engineering to develop market-leading products that serve niche markets. It also has expanded its sales and service capabilities globally to serve its customers.

EIG is a leader in many of the specialized markets it serves. Products supplied to these markets include process control instruments for the oil and gas, petrochemical, pharmaceutical, semiconductor and factory automation industries. It provides a growing range of instruments to the laboratory equipment, ultraprecision manufacturing, medical, and test and measurement markets. It supplies the aerospace industry with aircraft and engine sensors, monitoring systems, power supplies, fuel and fluid measurement systems, and data acquisition systems. It is a leader in power quality monitoring and metering, uninterruptible power systems, programmable power equipment, electromagnetic compatibility (“EMC”) test equipment, sensors for gas turbines, and dashboard instruments for heavy trucks and other vehicles.

In 2015, 53% of EIG’s net sales was to customers outside the United States. At December 31, 2015, EIG employed approximately 8,100 people, of whom approximately 1,400 were covered by collective bargaining agreements. At December 31, 2015, EIG had 85 operating facilities: 52 in the United States, eight each in the United Kingdom and Germany, four in Canada, two each in China, France and Switzerland and one each in Argentina, Austria, Denmark, India, Japan, Mexico and Taiwan. EIG also shares operating facilities with EMG in Brazil, China and Mexico.

Process and Analytical Instrumentation Markets and Products

Process and analytical instrumentation sales represented 67% of EIG’s 2015 net sales. These sales include process analyzers, emission monitors, spectrometers, elemental and surface analysis instruments, level, pressure and temperature sensors and transmitters, radiation measurement devices, level measurement devices, precision pumping systems, materials- and force-testing instruments, and contact and non-contact metrology products. Among the industries it serves are oil, gas and petrochemical refining, power generation, pharmaceutical manufacturing, specialty gas production, water and waste treatment, natural gas distribution, and semiconductor manufacturing. Its instruments are used for precision measurement in a number of applications, including radiation detection, trace element and materials analysis, nanotechnology research, ultraprecise manufacturing, and test and measurement.

Acquired in July 2015, Surface Vision is a global leader in non-destructive process inspection. Surface Vision’s in-line image processing technology detects, classifies, filters and accurately maps specific defects over an entire surface area. End markets served include metals, paper, nonwovens, plastics and glass.

Acquired in August 2014, Amptek, Inc. provides x-ray detectors used in portable and laboratory instruments, electronics for nuclear and spaceflight instruments, and gamma-ray detectors for Homeland Security and nuclear emissions monitoring. It is a leader in x-ray fluorescence technology used to identify material composition in metal processing, environmental monitoring, petrochemical production, semiconductor manufacture, and research and development.

Acquired in June 2014, Zygo Corporation is a leader in non-contact metrology solutions, high-precision optics and optical assemblies used in a wide range of scientific, industrial, medical and bio-medical applications.

6

Table of Contents

Its products include high-precision topography and surface measurement instruments used in the manufacture of optical devices, medical implants, semiconductor wafers and precision machined components.

Acquired in May 2014, Luphos GmbH provides AMETEK with key non-contact metrology technology used to measure complex aspherical lenses and optical surfaces utilizing multi-wavelength laser interferometry metrology technology.

Power and Industrial Instrumentation Markets and Products

Power and industrial instrumentation sales represented 24% of EIG’s 2015 net sales. This business provides power monitoring and metering instruments, uninterruptible power supply systems and programmable power supplies used in a wide range of industrial settings. It is a leader in the design and manufacture of power measurement, quality monitoring and event recorders for use in power generation, transmission and distribution. It provides uninterruptible power supply systems, multifunction electric meters, annunciators, alarm monitoring systems and highly specialized communications equipment for smart grid applications. It also offers precision power supplies and power conditioning products and electrical immunity and EMC test equipment.

Acquired in February 2014, VTI Instruments (“VTI”) manufactures high-precision test and measurement instruments. It is a leader in highly engineered products used to deliver integrated solutions for critical test and measurement applications. VTI’s products include a wide range of signal conditioning and switching instruments, data acquisition solutions, and integrated test systems used in electrical and structural testing applications.

Acquired in January 2014, Teseq Group is a leader in test and measurement instruments used in EMC testing. It manufactures a broad line of conducted and radiated EMC compliance testing systems and radio-frequency amplifiers for a range of industries, including aerospace, automotive, consumer electronics, medical equipment, telecommunications and transportation.

Aerospace Instrumentation Markets and Products

Aerospace instrumentation sales represented 9% of EIG’s 2015 net sales. AMETEK’s aerospace products are designed to customer specifications and manufactured to stringent operational and reliability requirements. These products include airborne data systems, turbine engine temperature measurement products, vibration-monitoring systems, cockpit instruments and displays, fuel and fluid measurement products, sensors and switches. It serves all segments of the commercial and military aerospace market, including commercial airliners, business jets, regional aircraft and helicopters.

AMETEK operates in highly specialized aerospace market segments in which it has proven technological or manufacturing advantages versus its competition. Among its more significant competitive advantages is its 50-plus years’ experience as an aerospace supplier. It has long-standing relationships with the world’s leading commercial and military aircraft, jet engine and original equipment manufacturers (“OEMs”) and aerospace system integrators. AMETEK also provides the commercial aerospace aftermarket with spare part sales and repair and overhaul services.

Customers

EIG is not dependent on any single customer such that the loss of that customer would have a material adverse effect on EIG’s operations. Approximately 7% of EIG’s 2015 net sales was made to its five largest customers.

7

Table of Contents

EMG

EMG is a differentiated supplier of electrical interconnects, precision motion control solutions, specialty metals, thermal management systems, and floor care and technical motors. Differentiated businesses, those that compete on performance rather than price, account for an increasing proportion of EMG’s overall sales base. These businesses, which include EMG’s electrical interconnects, precision motion controls, technical motors and specialty metals, represented 87% of EMG’s net sales in 2015.

EMG is a leader in many of the niche markets in which it competes. Products supplied to these markets include its highly engineered electrical connectors and electronics packaging used in aerospace and defense, medical, and industrial applications, as well as its advanced technical motor and motion control products, which are used in a wide range of medical devices, office and business equipment, factory automation, robotics and other applications.

EMG supplies high-purity powdered metals, strip and foil, specialty clad metals and metal matrix composites. Its blowers and heat exchangers provide electronic cooling and environmental control for the aerospace and defense industries. Its motors are widely used in commercial appliances, fitness equipment, food and beverage machines, hydraulic pumps, industrial blowers and vacuum cleaners. Additionally, it operates a global network of aviation maintenance, repair and overhaul (“MRO”) facilities.

EMG designs and manufactures products that, in many instances, are significantly different from or technologically superior to competitors’ products. It has achieved competitive advantage through continued investment in research, development and engineering, cost reductions from operational improvements, acquisition synergies, improved supply chain management and production relocations to lower-cost locales.

In 2015, 50% of EMG’s net sales was to customers outside the United States. At December 31, 2015, EMG employed approximately 7,100 people, of whom approximately 2,100 were covered by collective bargaining agreements. At December 31, 2015, EMG had 63 operating facilities: 36 in the United States, nine in the United Kingdom, three each in China and France, two each in the Czech Republic, Germany, Italy and Mexico and one each in Brazil, Malaysia, Serbia and Taiwan.

Technical Motors and Systems Markets and Products

Technical motors and systems sales represented 52% of EMG’s 2015 net sales. Technical motors and systems consist of precision motion control solutions, brushless motors, blowers and pumps, heat exchangers and other electromechanical systems. These products are used in aerospace and defense, semiconductor equipment, computer equipment, mass transit, medical equipment and power industries among others.

EMG produces motor-blower systems and heat exchangers used in thermal management and other applications on a variety of military and commercial aircraft and military ground vehicles. In addition, EMG provides the commercial and military aerospace industry with third-party MRO services on a global basis with facilities in the United States, Europe and Asia.

Engineered Materials, Interconnects and Packaging Markets and Products

Engineered materials, interconnects and packaging sales represented 35% of EMG’s 2015 net sales. AMETEK is a leader in highly engineered electrical connectors and electronics packaging used to protect sensitive devices and mission-critical electronics. Its electrical connectors, terminals, headers and packaging are designed specifically for harsh environments and highly customized applications. In addition, AMETEK is an innovator and market leader in specialized metal powder, strip, wire and bonded products used in medical, aerospace and defense, telecommunications, automotive and general industrial applications.

8

Table of Contents

Acquired in May 2015, Global Tubes manufactures highly customized metal tubing from a wide variety of metals and alloys, including stainless steel, nickel, zirconium and titanium. Its products are used in highly engineered applications serving the aerospace, energy, power generation and medical markets.

Floor care and Specialty Motor Markets and Products

Floor care and specialty motor sales represented 13% of EMG’s 2015 net sales. Its motors and motor-blowers are used in a wide range of products, such as household, commercial and personal care appliances, fitness equipment, food and beverage machines, lawn and garden equipment, material handling equipment, hydraulic pumps, industrial blowers, vacuum cleaners, and other household and commercial floor care products.

Customers

EMG is not dependent on any single customer such that the loss of that customer would have a material adverse effect on EMG’s operations. Approximately 10% of EMG’s 2015 net sales was made to its five largest customers.

Marketing

AMETEK’s marketing efforts generally are organized and carried out at the business unit level. EIG makes use of distributors and sales representatives to market its products along with a direct sales force for its more technically sophisticated products. Within aerospace, the specialized customer base of aircraft and jet engine manufacturers is served primarily by direct sales engineers. Given the technical nature of many of its products, as well as its significant worldwide market share, EMG conducts much of its domestic and international marketing activities through a direct sales force and makes some use of sales representatives and distributors, both in the United States and in other countries.

Competition

In general, most of AMETEK’s markets are highly competitive with competition based on technology, performance, quality, service and price.

In EIG’s markets, AMETEK believes it ranks as a leader in certain analytical measuring and control instruments and in the U.S. heavy-vehicle and power instruments markets. It also is a major instrument and sensor supplier to commercial aviation. Competition is strong and may become intense for certain EIG products. In process and analytical instruments, numerous companies compete in each market on the basis of product quality, performance and innovation. In aerospace and power instruments, AMETEK competes with a number of diversified companies depending on the specific market segment.

EMG’s differentiated businesses compete with a limited number of companies in each of its markets. Competition is generally based on product innovation, performance and price. There also is competition from alternative materials and processes.

Availability of Raw Materials

AMETEK’s reportable segments obtain raw materials and supplies from a variety of sources and generally from more than one supplier. For EMG, however, certain items, including various base metals and certain steel components, are available from only a limited number of suppliers. AMETEK believes its sources and supplies of raw materials are adequate for its needs.

9

Table of Contents

Backlog and Seasonal Variations of Business

AMETEK’s backlog of unfilled orders by reportable segment was as follows at December 31:

| 2015 | 2014 | 2013 | ||||||||||

| (In millions) | ||||||||||||

| Electronic Instruments |

$ | 581.4 | $ | 623.2 | $ | 550.6 | ||||||

| Electromechanical |

566.4 | 574.1 | 589.4 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 1,147.8 | $ | 1,197.3 | $ | 1,140.0 | ||||||

|

|

|

|

|

|

|

|||||||

Of the total backlog of unfilled orders at December 31, 2015, approximately 88% is expected to be shipped by December 31, 2016. The Company believes that neither its business as a whole, nor either of its reportable segments, is subject to significant seasonal variations, although certain individual operations experience some seasonal variability.

Research, Development and Engineering

AMETEK is committed to, and has consistently invested in, research, development and engineering activities to design and develop new and improved products. Research, development and engineering costs before customer reimbursement were $200.8 million, $208.3 million and $178.7 million in 2015, 2014 and 2013, respectively. Customer reimbursements in 2015, 2014 and 2013 were $6.9 million, $8.9 million and $9.2 million, respectively. These amounts included net Company-funded research and development expenses of $116.3 million, $119.3 million and $93.9 million in 2015, 2014 and 2013, respectively. All such expenditures were directed toward the development of new products and processes and the improvement of existing products and processes.

Environmental Matters

Information with respect to environmental matters is set forth in the section of Management’s Discussion and Analysis of Financial Condition and Results of Operations entitled “Environmental Matters” and in Note 13 to the Consolidated Financial Statements included in Part II, Item 8 of this Annual Report on Form 10-K.

Patents, Licenses and Trademarks

AMETEK owns numerous unexpired U.S. and foreign patents, including counterparts of its more important U.S. patents, in the major industrial countries of the world. It is a licensor or licensee under patent agreements of various types, and its products are marketed under various registered and unregistered U.S. and foreign trademarks and trade names. AMETEK, however, does not consider any single patent or trademark, or any group of them, essential either to its business as a whole or to either one of its reportable segments. The annual royalties received or paid under license agreements are not significant to either of its reportable segments or to AMETEK’s overall operations.

Employees

At December 31, 2015, AMETEK employed approximately 15,400 people at its EIG, EMG and corporate operations, of whom approximately 3,500 employees were covered by collective bargaining agreements. AMETEK has four collective bargaining agreements that expire in 2016 that covers fewer than 400 employees. It expects no material adverse effects from the pending labor contract negotiations.

Working Capital Practices

AMETEK does not have extraordinary working capital requirements in either of its reportable segments. Its customers generally are billed at normal trade terms that may include extended payment provisions. Inventories are closely controlled and maintained at levels related to production cycles and normal delivery requirements of customers.

10

Table of Contents

| Item 1A. | Risk Factors |

You should consider carefully the following risk factors and all other information contained in this Annual Report on Form 10-K and the documents we incorporate by reference in this Annual Report on Form 10-K. Any of the following risks could materially and adversely affect our business, financial condition, results of operations and cash flows.

A downturn in the economy generally or in the markets we serve could adversely affect our business.

Several of the industries in which we operate are cyclical in nature and therefore are affected by factors beyond our control. A downturn in the U.S. or global economy, and, in particular, in the aerospace and defense, oil and gas, process instrumentation or power markets could have an adverse effect on our business, financial condition and results of operations.

Our growth strategy includes strategic acquisitions. We may not be able to consummate future acquisitions or successfully integrate recent and future acquisitions.

A portion of our growth has been attributed to acquisitions of strategic businesses. Since the beginning of 2011, through December 31, 2015, we have completed 22 acquisitions. We plan to continue making strategic acquisitions to enhance our global market position and broaden our product offerings. Although we have been successful with our acquisition strategy in the past, our ability to successfully effectuate acquisitions will be dependent upon a number of factors, including:

| • | Our ability to identify acceptable acquisition candidates; |

| • | The impact of increased competition for acquisitions, which may increase acquisition costs and affect our ability to consummate acquisitions on favorable terms and may result in us assuming a greater portion of the seller’s liabilities; |

| • | Successfully integrating acquired businesses, including integrating the financial, technological and management processes, procedures and controls of the acquired businesses with those of our existing operations; |

| • | Adequate financing for acquisitions being available on terms acceptable to us; |

| • | U.S. and foreign competition laws and regulations affecting our ability to make certain acquisitions; |

| • | Unexpected losses of key employees, customers and suppliers of acquired businesses; |

| • | Mitigating assumed, contingent and unknown liabilities; and |

| • | Challenges in managing the increased scope, geographic diversity and complexity of our operations. |

The process of integrating acquired businesses into our existing operations may result in unforeseen operating difficulties and may require additional financial resources and attention from management that would otherwise be available for the ongoing development or expansion of our existing operations. Furthermore, even if successfully integrated, the acquired business may not achieve the results we expected or produce expected benefits in the time frame planned. Failure to continue with our acquisition strategy and the successful integration of acquired businesses could have a material adverse effect on our business, financial condition, results of operations and cash flows.

11

Table of Contents

We may not properly execute, or realize anticipated cost savings or benefits from, our cost reduction initiatives.

Our success is partly dependent upon properly executing and realizing cost savings or other benefits from our ongoing production and procurement initiatives, including the relocation of manufacturing operations to low-cost locales. These initiatives are primarily designed to make the company more efficient, which is necessary in the company’s highly competitive industry. These initiatives are often complex, and a failure to implement them properly may, in addition to not meeting projected cost savings or benefits, adversely affect our business and operations.

Our substantial international sales and operations are subject to customary risks associated with international operations.

International sales for 2015 and 2014 represented 51.7% and 54.6% of our consolidated net sales, respectively. As a result of our growth strategy, we anticipate that the percentage of sales outside the United States will increase in the future. Approximately half of our international sales are of products manufactured outside the United States. We have manufacturing operations in 18 countries outside the United States, with significant operations in China, the Czech Republic and Mexico. A prolonged disruption of our ability to obtain a supply of goods from these countries could have a material adverse effect on our operations. International operations are subject to the customary risks of operating in an international environment, including:

| • | Potential imposition of trade or foreign exchange restrictions; |

| • | Overlap of different tax structures; |

| • | Unexpected changes in regulatory requirements; |

| • | Changes in tariffs and trade barriers; |

| • | The difficulty and/or costs of designing and implementing an effective control environment across diverse regions and employee bases; |

| • | Restrictions on currency repatriation; |

| • | General economic conditions; |

| • | Unstable political situations; |

| • | Nationalization of assets; and |

| • | Compliance with a wide variety of international and U.S. laws and regulatory requirements. |

Furthermore, fluctuations in foreign currency exchange rates, including changes in the relative value of currencies in the countries where we operate, subject us to exchange rate exposure and may adversely affect our financial statements. For example, increased strength in the U.S. dollar will increase the effective price of our products sold overseas, which may adversely affect sales or require us to lower our prices. In addition, our consolidated financial statements are presented in U.S. dollars, and we must translate our assets, liabilities, sales and expenses into U.S. dollars for external reporting purposes. As a result, changes in the value of the U.S. dollar due to fluctuations in currency exchange rates or currency exchange controls may materially and negatively affect the value of these items in our consolidated financial statements, even if their value has not changed in their local currency.

12

Table of Contents

Our international sales and operations may be adversely impacted by compliance with export laws.

We are required to comply with various import, export, export control and economic sanctions laws, which may affect our transactions with certain customers, business partners and other persons, including in certain cases dealings with or between our employees and subsidiaries. In certain circumstances, export control and economic sanctions regulations may prohibit the export of certain products, services and technologies and in other circumstances, we may be required to obtain an export license before exporting a controlled item. In addition, failure to comply with any of these regulations could result in civil and criminal, monetary and non-monetary penalties, disruptions to our business, limitations on our ability to import and export products and services and damage to our reputation.

Any inability to hire, train and retain a sufficient number of skilled officers and other employees could impede our ability to compete successfully.

If we cannot hire, train and retain a sufficient number of qualified employees, we may not be able to effectively integrate acquired businesses and realize anticipated results from those businesses, manage our expanding international operations and otherwise profitably grow our business. Even if we do hire and retain a sufficient number of employees, the expense necessary to attract and motivate these officers and employees may adversely affect our results of operations.

If we are unable to develop new products on a timely basis, it could adversely affect our business and prospects.

We believe that our future success depends, in part, on our ability to develop, on a timely basis, technologically advanced products that meet or exceed appropriate industry standards. Although we believe we have certain technological and other advantages over our competitors, maintaining such advantages will require us to continue investing in research and development and sales and marketing. There can be no assurance that we will have sufficient resources to make such investments, that we will be able to make the technological advances necessary to maintain such competitive advantages or that we can recover major research and development expenses. We are not currently aware of any emerging standards or new products which could render our existing products obsolete, although there can be no assurance that this will not occur or that we will be able to develop and successfully market new products.

Our technology is important to our success and our failure to protect this technology could put us at a competitive disadvantage.

Many of our products rely on proprietary technology; therefore we endeavor to protect our intellectual property rights through patents, copyrights, trade secrets, trademarks, confidentiality agreements and other contractual provisions. Despite our efforts to protect proprietary rights, unauthorized parties or competitors may copy or otherwise obtain and use our products or technology. In addition, our ability to protect and enforce our intellectual property rights may be limited in certain countries outside the U.S. Actions to enforce our rights may result in substantial costs and diversion of resources and we make no assurances that any such actions will be successful.

A shortage of, or price increases for, our raw materials could increase our operating costs.

While we manufacture certain parts and components used in our products, we require substantial amounts of raw materials and purchase some parts and components from suppliers. The availability and prices for raw materials, parts and components may be subject to curtailment or change due to, among other things, supplier’s allocation to other purchasers, interruptions in production by suppliers, changes in exchange rates and prevailing price levels. In addition, certain items, including base metals and certain steel components, are available only from a limited number of suppliers and are subject to commodity market fluctuations. Shortages in raw materials

13

Table of Contents

or price increases therefore could affect the prices we charge, our operating costs and our competitive position, which could adversely affect our business, financial condition, results of operations and cash flows.

Certain environmental risks may cause us to be liable for costs associated with hazardous or toxic substance clean-up which may adversely affect our financial condition.

Our businesses, operations and facilities are subject to a number of federal, state, local and foreign environmental and occupational health and safety laws and regulations concerning, among other things, air emissions, discharges to waters and the use, manufacturing, generation, handling, storage, transportation and disposal of hazardous substances and wastes. Environmental risks are inherent in many of our manufacturing operations. Certain laws provide that a current or previous owner or operator of property may be liable for the costs of investigating, removing and remediating hazardous materials at such property, regardless of whether the owner or operator knew of, or was responsible for, the presence of such hazardous materials. In addition, the Comprehensive Environmental Response, Compensation and Liability Act generally imposes joint and several liability for clean-up costs, without regard to fault, on parties contributing hazardous substances to sites designated for clean-up under the Act. We have been named a potentially responsible party at several sites, which are the subject of government-mandated clean-ups. As the result of our ownership and operation of facilities that use, manufacture, store, handle and dispose of various hazardous materials, we may incur substantial costs for investigation, removal, remediation and capital expenditures related to compliance with environmental laws. While it is not possible to precisely quantify the potential financial impact of pending environmental matters, based on our experience to date, we believe that the outcome of these matters is not likely to have a material adverse effect on our financial position or future results of operations. In addition, new laws and regulations, new classification of hazardous materials, stricter enforcement of existing laws and regulations, the discovery of previously unknown contamination or the imposition of new clean-up requirements could require us to incur costs or become the basis for new or increased liabilities that could have a material adverse effect on our business, financial condition and results of operations. There can be no assurance that future environmental liabilities will not occur or that environmental damages due to prior or present practices will not result in future liabilities.

We are subject to numerous governmental regulations, which may be burdensome or lead to significant costs.

Our operations are subject to numerous federal, state, local and foreign governmental laws and regulations. In addition, existing laws and regulations may be revised or reinterpreted and new laws and regulations, including with respect to climate change, may be adopted or become applicable to us or customers for our products. We cannot predict the form any such new laws or regulations will take or the impact any of these laws and regulations will have on our business or operations.

We may be required to defend lawsuits or pay damages in connection with alleged or actual harm caused by our products.

We face an inherent business risk of exposure to product liability claims in the event that the use of our products is alleged to have resulted in harm to others or to property. For example, our operations expose us to potential liabilities for personal injury or death as a result of the failure of, for instance, an aircraft component that has been designed, manufactured or serviced by us. We may incur a significant liability if product liability lawsuits against us are successful. While we believe our current general liability and product liability insurance is adequate to protect us from future claims, we cannot assure that coverage will be adequate to cover all claims that may arise. Additionally, we may not be able to maintain insurance coverage in the future at an acceptable cost. Any liability not covered by insurance or for which third-party indemnification is not available could have a material adverse effect on our business, financial condition and results of operations.

14

Table of Contents

We operate in highly competitive industries, which may adversely affect our results of operations or ability to expand our business.

Our markets are highly competitive. We compete, domestically and internationally, with individual producers, as well as with vertically integrated manufacturers, some of which have resources greater than we do. The principal elements of competition for our products are product technology, quality, service, distribution and price. EMG’s competition in specialty metal products stems from alternative materials and processes. In the markets served by EIG, although we believe EIG is a market leader, competition is strong and could intensify. In the aerospace and heavy-vehicle markets served by EIG, a limited number of companies compete on the basis of product quality, performance and innovation. Our competitors may develop new or improve existing products that are superior to our products or may adapt more readily to new technologies or changing requirements of our customers. There can be no assurance that our business will not be adversely affected by increased competition in the markets in which it operates or that our products will be able to compete successfully with those of our competitors.

Restrictions contained in our revolving credit facility and other debt agreements may limit our ability to incur additional indebtedness.

Our existing revolving credit facility and other debt agreements contain restrictive covenants, including restrictions on our ability to incur indebtedness. These restrictions could limit our ability to effectuate future acquisitions, limit our ability to pay dividends, limit our ability to make capital expenditures or restrict our financial flexibility. Our credit facility contains covenants requiring us to achieve certain financial and operating results and maintain compliance with specified financial ratios. Our ability to meet the financial covenants or requirements in our credit facility may be affected by events beyond our control, and we may not be able to satisfy such covenants and requirements. A breach of these covenants or our inability to comply with the financial ratios, tests or other restrictions contained in our facility could result in an event of default under this facility. Upon the occurrence of an event of default under our credit facility, and the expiration of any grace periods, the lenders could elect to declare all amounts outstanding under the facility, together with accrued interest, to be immediately due and payable. If this were to occur, our assets may not be sufficient to fully repay the amounts due under this facility or our other indebtedness.

Our business and financial performance may be adversely affected by information technology and other business disruptions.

Our facilities, supply chains, distribution systems and information technology systems may be impacted by natural or man-made disruptions, including information technology attacks or failures, threats to physical security, armed conflict, as well as damaging weather or other acts of nature, pandemics or other public health crises. For example, our information technology systems may be damaged, disrupted or shut down due to attacks by computer hackers, computer viruses, employee error or malfeasance, power outages, hardware failures, telecommunications or utility failures, or other unforeseen events, and in any such circumstances our disaster recovery planning may be ineffective or inadequate. A shutdown of, or inability to utilize, one or more of our facilities, our supply chain, our distribution system, or our information technology, telecommunications or other systems, could significantly disrupt our operations, delay production and shipments, damage customer relationships and our reputation, result in lost sales, result in the misappropriation or corruption of data, or result in legal exposure and large repair and replacement expenses.

Our goodwill and other intangible assets represent a substantial amount of our total assets and the impairment of such substantial goodwill and intangible assets could have a negative impact on our financial condition and results of operations.

Our total assets include substantial amounts of intangible assets, primarily goodwill. At December 31, 2015, goodwill and other intangible assets, net of accumulated amortization, totaled $4,379.6 million or 66% of our total assets. The goodwill results from our acquisitions, representing the excess of cost over the fair value of the

15

Table of Contents

net tangible and other identifiable intangible assets we have acquired. At a minimum, we assess annually whether there has been impairment in the value of our intangible assets. If future operating performance at one or more of our reporting units were to fall significantly below current levels, we could record, under current applicable accounting rules, a non-cash charge to operating income for goodwill or other intangible asset impairment. Any determination requiring the impairment of a significant portion of goodwill or other intangible assets would negatively affect our financial condition and results of operations.

| Item 1B. | Unresolved Staff Comments |

None.

| Item 2. | Properties |

At December 31, 2015, the Company had 148 operating facilities in 25 states and 18 foreign countries. Of these facilities, 59 are owned by the Company and 89 are leased. The properties owned by the Company consist of approximately 740 acres, of which approximately 5.2 million square feet are under roof. Under lease is a total of approximately 3.0 million square feet. The leases expire over a range of years from 2016 to 2082, with renewal options for varying terms contained in many of the leases. The Company’s executive offices in Berwyn, Pennsylvania, occupy approximately 43,000 square feet under a lease that expires in September 2023.

The Company’s machinery and equipment, plants and offices are in satisfactory operating condition and are adequate for the uses to which they are put. The operating facilities of the Company by reportable segment were as follows at December 31, 2015:

| Number

of Operating Facilities |

Square Feet Under Roof | |||||||||||||||

| Owned | Leased | Owned | Leased | |||||||||||||

| Electronic Instruments |

28 | 57 | 2,244,000 | 2,019,000 | ||||||||||||

| Electromechanical |

31 | 32 | 2,989,000 | 961,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

59 | 89 | 5,233,000 | 2,980,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Item 3. | Legal Proceedings |

Please refer to “Environmental Matters” in Management’s Discussion and Analysis of Financial Condition and Results of Operations and Note 13 to the Consolidated Financial Statements in this Annual Report on Form 10-K for information regarding certain litigation matters.

The Company is, from time to time, subject to a variety of litigation and similar proceedings incidental to its business. These lawsuits may involve claims for damages arising out of the use of the Company’s products and services, personal injury, employment matters, tax matters, commercial disputes and intellectual property matters. The Company may also become subject to lawsuits as a result of past or future acquisitions. Based upon the Company’s experience, the Company does not believe that these proceedings and claims will have a material adverse effect on its results of operations, financial position or cash flows.

16

Table of Contents

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

The principal market on which the Company’s common stock is traded is the New York Stock Exchange and it is traded under the symbol “AME.” On January 29, 2016, there were approximately 2,100 holders of record of the Company’s common stock.

Market price and dividend information with respect to the Company’s common stock is set forth below. Future dividend payments by the Company will be dependent on future earnings, financial requirements, contractual provisions of debt agreements and other relevant factors.

Under its share repurchase program, the Company repurchased approximately 7,978,000 shares of common stock for $435.4 million in 2015 and approximately 4,755,000 shares of common stock for $245.3 million in 2014.

The high and low sales prices of the Company’s common stock on the New York Stock Exchange composite tape and the quarterly dividends per share paid on the common stock were:

| First Quarter |

Second Quarter |

Third Quarter |

Fourth Quarter |

|||||||||||||

| 2015 |

||||||||||||||||

| Dividends paid per share |

$ | 0.09 | $ | 0.09 | $ | 0.09 | $ | 0.09 | ||||||||

| Common stock trading range: |

||||||||||||||||

| High |

$ | 54.00 | $ | 55.56 | $ | 57.67 | $ | 57.00 | ||||||||

| Low |

$ | 47.85 | $ | 51.23 | $ | 50.55 | $ | 50.97 | ||||||||

| 2014 |

||||||||||||||||

| Dividends paid per share |

$ | 0.06 | $ | 0.09 | $ | 0.09 | $ | 0.09 | ||||||||

| Common stock trading range: |

||||||||||||||||

| High |

$ | 54.40 | $ | 54.50 | $ | 53.49 | $ | 54.25 | ||||||||

| Low |

$ | 47.39 | $ | 49.50 | $ | 47.95 | $ | 45.12 | ||||||||

17

Table of Contents

Issuer Purchases of Equity Securities

The following table reflects purchases of AMETEK, Inc. common stock by the Company during the three months ended December 31, 2015:

| Period |

Total Number |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plan (2) |

Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plan |

||||||||||||

| October 1, 2015 to October 31, 2015 |

— | $ | — | — | $ | 90,609,705 | ||||||||||

| November 1, 2015 to November 30, 2015 |

82 | 56.48 | 82 | 440,605,074 | ||||||||||||

| December 1, 2015 to December 31, 2015 |

2,401,811 | 53.66 | 2,401,811 | 311,734,430 | ||||||||||||

|

|

|

|

|

|||||||||||||

| Total |

2,401,893 | 53.66 | 2,401,893 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| (1) | Includes 1,893 shares surrendered to the Company to satisfy tax withholding obligations in connection with employees’ share-based compensation awards. |

| (2) | Consists of the number of shares purchased pursuant to the Company’s Board of Directors $350 million authorization for the repurchase of its common stock announced both in April and November 2015. Such purchases may be effected from time to time in the open market or in private transactions, subject to market conditions and at management’s discretion. |

Securities Authorized for Issuance Under Equity Compensation Plan Information

The following table sets forth information as of December 31, 2015 regarding all of the Company’s existing compensation plans pursuant to which equity securities are authorized for issuance to employees and nonemployee directors:

| Plan category |

Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) |

Weighted average exercise price of outstanding options, warrants and rights (b) |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) |

|||||||||

| Equity compensation plans approved by security holders |

5,659,557 | $ | 39.49 | 9,308,860 | ||||||||

| Equity compensation plans not approved by security holders |

— | — | — | |||||||||

|

|

|

|

|

|||||||||

| Total |

5,659,557 | 39.49 | 9,308,860 | |||||||||

|

|

|

|

|

|

|

|||||||

18

Table of Contents

Stock Performance Graph

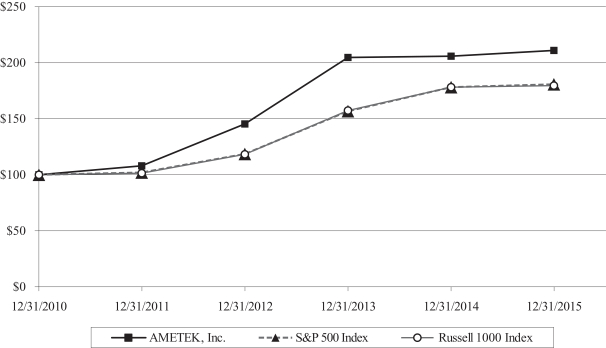

The following graph and accompanying table compare the cumulative total stockholder return for AMETEK over the last five years ended December 31, 2015 with total returns for the same period for the Standard and Poor’s (“S&P”) 500 Index and Russell 1000 Index. AMETEK’s stock price is a component of both indices. The performance graph and table assume a $100 investment made on December 31, 2010 and reinvestment of all dividends. The stock performance shown on the graph below is based on historical data and is not necessarily indicative of future stock price performance.

COMPARISON OF FIVE-YEAR CUMULATIVE TOTAL RETURN

| December 31, | ||||||||||||||||||||||||

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | |||||||||||||||||||

| AMETEK, Inc. |

$ | 100.00 | $ | 107.89 | $ | 145.34 | $ | 204.85 | $ | 205.98 | $ | 211.15 | ||||||||||||

| S&P 500 Index |

100.00 | 102.11 | 118.45 | 156.82 | 178.29 | 180.75 | ||||||||||||||||||

| Russell 1000 Index |

100.00 | 101.50 | 118.17 | 157.30 | 178.12 | 179.75 | ||||||||||||||||||

19

Table of Contents

| Item 6. | Selected Financial Data |

The following financial information for the five years ended December 31, 2015, has been derived from the Company’s consolidated financial statements. This information should be read in conjunction with Management’s Discussion and Analysis of Financial Condition and Results of Operations and the consolidated financial statements and related notes thereto included elsewhere in this Annual Report on Form 10-K.

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| (In millions, except per share amounts) | ||||||||||||||||||||

|

Consolidated Operating Results (Year Ended December 31): |

||||||||||||||||||||

| Net sales |

$ | 3,974.3 | $ | 4,022.0 | $ | 3,594.1 | $ | 3,334.2 | $ | 2,989.9 | ||||||||||

| Operating income |

$ | 907.7 | $ | 898.6 | $ | 815.1 | $ | 745.9 | $ | 635.9 | ||||||||||

| Interest expense |

$ | 91.8 | $ | 79.9 | $ | 73.6 | $ | 75.5 | $ | 69.7 | ||||||||||

| Net income |

$ | 590.9 | $ | 584.5 | $ | 517.0 | $ | 459.1 | $ | 384.5 | ||||||||||

| Earnings per share: |

||||||||||||||||||||

| Basic |

$ | 2.46 | $ | 2.39 | $ | 2.12 | $ | 1.90 | $ | 1.60 | ||||||||||

| Diluted |

$ | 2.45 | $ | 2.37 | $ | 2.10 | $ | 1.88 | $ | 1.58 | ||||||||||

| Dividends declared and paid per share |

$ | 0.36 | $ | 0.33 | $ | 0.24 | $ | 0.22 | $ | 0.16 | ||||||||||

| Weighted average common shares outstanding: |

||||||||||||||||||||

| Basic |

239.9 | 244.9 | 243.9 | 241.5 | 240.4 | |||||||||||||||

| Diluted |

241.6 | 247.1 | 246.1 | 244.0 | 243.2 | |||||||||||||||

| Performance Measures and Other Data: |

||||||||||||||||||||

| Operating income — Return on net sales |

22.8 | % | 22.3 | % | 22.7 | % | 22.4 | % | 21.3 | % | ||||||||||

|

— Return on average total assets |

13.9 | % | 14.6 | % | 14.7 | % | 15.7 | % | 15.6 | % | ||||||||||

| Net income — Return on average total capital |

11.6 | % | 12.3 | % | 12.1 | % | 12.6 | % | 12.3 | % | ||||||||||

|

— Return on average stockholders’ equity |

18.2 | % | 18.3 | % | 18.2 | % | 20.0 | % | 20.1 | % | ||||||||||

| EBITDA(1) |

$ | 1,046.9 | $ | 1,022.6 | $ | 916.3 | $ | 842.7 | $ | 712.2 | ||||||||||

| Ratio of EBITDA to interest expense(1) |

11.4 | x | 12.8 | x | 12.4 | x | 11.2 | x | 10.2 | x | ||||||||||

| Depreciation and amortization |

$ | 149.5 | $ | 138.6 | $ | 118.7 | $ | 105.5 | $ | 86.5 | ||||||||||

| Capital expenditures |

$ | 69.1 | $ | 71.3 | $ | 63.3 | $ | 57.4 | $ | 50.8 | ||||||||||

| Cash provided by operating activities |

$ | 672.5 | $ | 726.0 | $ | 660.7 | $ | 612.5 | $ | 508.6 | ||||||||||

| Free cash flow(2) |

$ | 603.4 | $ | 654.7 | $ | 597.4 | $ | 555.1 | $ | 457.8 | ||||||||||

| Consolidated Financial Position (At December 31): |

||||||||||||||||||||

| Current assets |

$ | 1,619.6 | $ | 1,578.6 | $ | 1,369.1 | $ | 1,164.7 | $ | 1,059.1 | ||||||||||

| Current liabilities |

$ | 1,025.2 | $ | 936.1 | $ | 874.5 | $ | 880.0 | $ | 628.9 | ||||||||||

| Property, plant and equipment, net |

$ | 484.5 | $ | 448.4 | $ | 402.8 | $ | 383.5 | $ | 325.3 | ||||||||||

| Total assets |

$ | 6,664.5 | $ | 6,421.0 | $ | 5,877.9 | $ | 5,190.1 | $ | 4,319.5 | ||||||||||

| Long-term debt |

$ | 1,556.0 | $ | 1,427.8 | $ | 1,141.8 | $ | 1,133.1 | $ | 1,123.4 | ||||||||||

| Total debt |

$ | 1,942.1 | $ | 1,714.0 | $ | 1,415.1 | $ | 1,453.8 | $ | 1,263.9 | ||||||||||

| Stockholders’ equity |

$ | 3,254.6 | $ | 3,239.6 | $ | 3,136.1 | $ | 2,535.2 | $ | 2,052.8 | ||||||||||

| Stockholders’ equity per share |

$ | 13.82 | $ | 13.42 | $ | 12.80 | $ | 10.42 | $ | 8.53 | ||||||||||

| Total debt as a percentage of capitalization |

37.4 | % | 34.6 | % | 31.1 | % | 36.4 | % | 38.1 | % | ||||||||||

| Net debt as a percentage of capitalization(3) |

32.4 | % | 29.2 | % | 26.3 | % | 33.8 | % | 34.8 | % | ||||||||||

See Notes to Selected Financial Data on the following page.

20

Table of Contents

Notes to Selected Financial Data

| (1) | EBITDA represents earnings before interest, income taxes, depreciation and amortization. EBITDA is presented because the Company is aware that it is used by rating agencies, securities analysts, investors and other parties in evaluating the Company. It should not be considered, however, as an alternative to operating income as an indicator of the Company’s operating performance or as an alternative to cash flows as a measure of the Company’s overall liquidity as presented in the Company’s consolidated financial statements. Furthermore, EBITDA measures shown for the Company may not be comparable to similarly titled measures used by other companies. The following table presents the reconciliation of net income reported in accordance with U.S. generally accepted accounting principles (“GAAP”) to EBITDA: |

| Year Ended December 31, | ||||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| (In millions) | ||||||||||||||||||||

| Net income |

$ | 590.9 | $ | 584.5 | $ | 517.0 | $ | 459.1 | $ | 384.5 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Add (deduct): |

||||||||||||||||||||

| Interest expense |

91.8 | 79.9 | 73.6 | 75.5 | 69.7 | |||||||||||||||

| Interest income |

(0.8 | ) | (0.8 | ) | (0.8 | ) | (0.7 | ) | (0.7 | ) | ||||||||||

| Income taxes |

215.5 | 220.4 | 207.8 | 203.3 | 172.2 | |||||||||||||||

| Depreciation |

68.7 | 63.7 | 57.2 | 53.7 | 48.9 | |||||||||||||||

| Amortization |

80.8 | 74.9 | 61.5 | 51.8 | 37.6 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total adjustments |

456.0 | 438.1 | 399.3 | 383.6 | 327.7 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA |

$ | 1,046.9 | $ | 1,022.6 | $ | 916.3 | $ | 842.7 | $ | 712.2 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (2) | Free cash flow represents cash flow from operating activities less capital expenditures. Free cash flow is presented because the Company is aware that it is used by rating agencies, securities analysts, investors and other parties in evaluating the Company. (Also see note 1 above). The following table presents the reconciliation of cash flow from operating activities reported in accordance with U.S. GAAP to free cash flow: |

| Year Ended December 31, | ||||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| (In millions) | ||||||||||||||||||||

| Cash provided by operating activities |

$ | 672.5 | $ | 726.0 | $ | 660.7 | $ | 612.5 | $ | 508.6 | ||||||||||

| Deduct: Capital expenditures |

(69.1 | ) | (71.3 | ) | (63.3 | ) | (57.4 | ) | (50.8 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Free cash flow |

$ | 603.4 | $ | 654.7 | $ | 597.4 | $ | 555.1 | $ | 457.8 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (3) | Net debt represents total debt minus cash and cash equivalents. Net debt is presented because the Company is aware that it is used by rating agencies, securities analysts, investors and other parties in evaluating the Company. (Also see note 1 above). The following table presents the reconciliation of total debt reported in accordance with U.S. GAAP to net debt: |

| December 31, | ||||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| (In millions) | ||||||||||||||||||||

| Total debt |

$ | 1,942.1 | $ | 1,714.0 | $ | 1,415.1 | $ | 1,453.8 | $ | 1,263.9 | ||||||||||

| Less: Cash and cash equivalents |

(381.0 | ) | (377.6 | ) | (295.2 | ) | (158.0 | ) | (170.4 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net debt |

1,561.1 | 1,336.4 | 1,119.9 | 1,295.8 | 1,093.5 | |||||||||||||||

| Stockholders’ equity |

3,254.6 | 3,239.6 | 3,136.1 | 2,535.2 | 2,052.8 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Capitalization (net debt plus stockholders’ equity) |

$ | 4,815.7 | $ | 4,576.0 | $ | 4,256.0 | $ | 3,831.0 | $ | 3,146.3 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net debt as a percentage of capitalization |

32.4 | % | 29.2 | % | 26.3 | % | 33.8 | % | 34.8 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

21

Table of Contents

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

This report includes forward-looking statements based on the Company’s current assumptions, expectations and projections about future events. When used in this report, the words “believes,” “anticipates,” “may,” “expect,” “intend,” “estimate,” “project” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such words. In this report, the Company discloses important factors that could cause actual results to differ materially from management’s expectations. For more information on these and other factors, see “Forward-Looking Information” herein.

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations should be read in conjunction with “Item 1A. Risk Factors,” “Item 6. Selected Financial Data” and the consolidated financial statements and related notes included elsewhere in this Annual Report on Form 10-K.

Business Overview

AMETEK’s operations are affected by global, regional and industry economic factors. However, the Company’s strategic geographic and industry diversification, and its mix of products and services, have helped to limit the potential adverse impact of any unfavorable developments in any one industry or the economy of any single country on its consolidated operating results. In 2015, the Company established records for operating income, operating income margins, net income and diluted earnings per share. Contributions from recent acquisitions, combined with successful Operational Excellence initiatives, had a positive impact on 2015 results. The Company also benefited from its strategic initiatives under AMETEK’s four key strategies: Operational Excellence, Strategic Acquisitions, Global & Market Expansion and New Products. Highlights of 2015 were:

| • | Operating income was $907.7 million or 22.8% of net sales for 2015, an increase of $9.1 million or 1.0%, compared with $898.6 million or 22.3% of net sales in 2014. |

| • | Net income for 2015 was $590.9 million, an increase of $6.4 million or 1.1%, compared with $584.5 million in 2014. |

| • | Diluted earnings per share for 2015 were $2.45, an increase of $0.08 or 3.4%, compared with $2.37 per diluted share in 2014. |

| • | During 2015, the Company recorded pre-tax realignment costs totaling $36.6 million. The realignment costs had the effect of reducing net income for 2015 by $24.7 million ($0.10 per diluted share). See below for further discussion. |

| • | During 2015, the Company spent $356.5 million in cash, net of cash acquired, to acquire two businesses: |

| • | In May 2015, AMETEK acquired Global Tubes, a manufacturer of high-precision, small-diameter metal tubing; and |

| • | In July 2015, AMETEK acquired Surface Vision, formerly referred to as the Surface Inspection Systems Division of Cognex Corporation. Surface Vision develops and manufactures software-enabled vision systems used to inspect surfaces of continuously processed materials for flaws and defects. |

| • | The Company continued its emphasis on investment in research, development and engineering, spending $200.8 million in 2015 before customer reimbursement of $6.9 million. Sales from products introduced in the past three years were $952.6 million or 24.0% of net sales. |

22

Table of Contents