Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 1-12981

AMETEK, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 14-1682544 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 1100 Cassatt Road P.O. Box 1764 Berwyn, Pennsylvania |

19312-1177 (Zip Code) | |

| (Address of principal executive offices) | ||

Registrant’s telephone number, including area code: (610) 647-2121

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $0.01 Par Value (voting) |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer þ | Accelerated filer ¨ |

Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

The aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $7.2 billion as of June 30, 2011, the last business day of the registrant’s most recently completed second fiscal quarter.

The number of shares of the registrant’s Common Stock outstanding as of January 31, 2012 was 160,491,092.

Documents Incorporated by Reference

Part III incorporates information by reference from the Proxy Statement for the Annual Meeting of Stockholders on May 1, 2012.

Table of Contents

2011 Form 10-K Annual Report

Table of Contents

1

Table of Contents

PART I

| Item 1. | Business |

General Development of Business

AMETEK, Inc. (“AMETEK” or the “Company”) is incorporated in Delaware. Its predecessor was originally incorporated in Delaware in 1930 under the name American Machine and Metals, Inc. The Company maintains its principal executive offices in suburban Philadelphia, Pennsylvania at 1100 Cassatt Road, Berwyn, Pennsylvania, 19312. AMETEK is a leading global manufacturer of electronic instruments and electromechanical devices with operations in North America, Europe, Asia and South America. The Company is listed on the New York Stock Exchange (symbol: AME). The common stock of AMETEK is a component of the S&P MidCap 400 and the Russell 1000 Indices.

Website Access to Information

The Company’s annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports filed or furnished pursuant to Section 13(a) of the Securities Exchange Act of 1934 are made available free of charge on the Company’s website at www.ametek.com (in the “Investors — Financial News and Information” section), as soon as reasonably practicable after such material is electronically filed with, or furnished to, the Securities and Exchange Commission. The Company has posted, free of charge, to the investor information portion of its website, its corporate governance guidelines, Board committee charters and codes of ethics. Such documents are also available in published form, free of charge, to any stockholder who requests them by writing to the Investor Relations Department at AMETEK, Inc., 1100 Cassatt Road, Berwyn, Pennsylvania, 19312.

Products and Services

The Company markets its products worldwide through two operating groups, the Electronic Instruments Group (“EIG”) and the Electromechanical Group (“EMG”). EIG builds monitoring, testing, calibration and display devices for the process, aerospace, industrial, power and medical markets. EMG produces highly engineered electromechanical connectors for hermetic (moisture-proof) applications, specialty metals for niche markets and brushless air-moving motors, blowers and heat exchangers. End markets include aerospace, defense, mass transit, medical, office products and other industrial markets. The Company continues to grow through strategic acquisitions focused on differentiated niche markets in instrumentation and electromechanical devices.

Competitive Strengths

Management believes that the Company has several significant competitive advantages that assist it in sustaining and enhancing its market positions. Its principal strengths include:

Significant Market Share. AMETEK maintains a significant share in many of its targeted niche markets because of its ability to produce and deliver high-quality products at competitive prices. In EIG, the Company maintains significant market positions in many niche segments within the process, aerospace, industrial and power instrumentation markets. In EMG, the Company maintains significant market positions in many niche segments including aerospace, defense, mass transit, medical, office products and air-moving motors for the floorcare market.

Technological and Development Capabilities. AMETEK believes it has certain technological advantages over its competitors that allow it to develop innovative products and maintain leading market positions. Historically, the Company has grown by extending its technical expertise into the manufacture of customized products for its customers, as well as through strategic acquisitions. EIG competes primarily on

2

Table of Contents

the basis of product innovation in several highly specialized instrumentation markets, including process measurement, aerospace, power, heavy-vehicle dashboard and medical instrumentation. EMG’s differentiated businesses focus on developing customized products for specialized applications in aerospace and defense, medical, business machines and other industrial applications. In its floorcare and specialty motor business, EMG focuses on low-cost design and manufacturing, while enhancing motor-blower performance through advances in power, efficiency, lighter weight and quieter operation.

Efficient and Low-Cost Manufacturing Operations. EMG has motor manufacturing plants in China, the Czech Republic, Mexico and Brazil to lower its costs and achieve strategic proximity to its customers, providing the opportunity to increase international sales and market share. Certain of the Company’s electronic instrument businesses have relocated manufacturing operations to low-cost locales. Furthermore, strategic acquisitions and joint ventures in Europe, North America and Asia have resulted in additional cost savings and synergies through the consolidation of operations, product lines and distribution channels, which benefits both operating groups.

Experienced Management Team. Another key component of AMETEK’s success is the strength of its management team and its commitment to the performance of the Company. AMETEK’s senior management has extensive experience, averaging approximately 26 years with the Company, and is financially committed to the Company’s success through Company-established stock ownership guidelines and equity incentive programs.

Business Strategy

AMETEK’s objectives are to increase the Company’s earnings and financial returns through a combination of operational and financial strategies. Those operational strategies include Operational Excellence, New Product Development, Global and Market Expansion and Strategic Acquisitions and Alliances programs designed to achieve double-digit annual percentage growth in earnings per share over the business cycle and a superior return on total capital. To support those operational objectives, financial initiatives have been, or may be, undertaken, including public and private debt or equity issuance, bank debt refinancing, local financing in certain foreign countries and share repurchases. AMETEK’s commitment to earnings growth is reflected in its continued implementation of cost-reduction programs designed to achieve the Company’s long-term best-cost objectives.

AMETEK’s Corporate Growth Plan consists of four key strategies:

Operational Excellence. Operational Excellence is AMETEK’s cornerstone strategy for improving profit margins and strengthening the Company’s competitive position across its businesses. Through its Operational Excellence strategy, the Company seeks to reduce production costs and improve its market positions. The strategy has played a key role in achieving synergies from newly acquired companies. AMETEK believes that Operational Excellence, which focuses on Six Sigma process improvements, global sourcing and lean manufacturing and also emphasizes team building and a participative management culture, has enabled the Company to improve operating efficiencies and product quality, increase customer satisfaction and yield higher cash flow from operations, while lowering operating and administrative costs and shortening manufacturing cycle times.

New Product Development. New products are essential to AMETEK’s long-term growth. As a result, AMETEK has consistently maintained its investment in new product development, and, in 2011, added to its highly differentiated product portfolio with a range of new products across each of its businesses. Its most recent product introductions include:

| • | CAMECA EX-300 metrology tool that utilizes a unique surface profiling technique developed specifically for advanced semiconductor fabrication; |

3

Table of Contents

| • | Pittman® high-performance slotless, brushless DC motors in autoclavable versions for medical instruments, dental drills and other compact medical devices; |

| • | SPECTROBLUE™ high-performance spectrometer with a robust design and simplified operation for high-accuracy analysis of metals and other materials; |

| • | GEMCO® 955 eBrik linear displacement transducer for accurate and reliable position sensing for a wide range of factory automation applications; |

| • | Talyrond 500 multi-functional metrology tool for roundness, roughness and surface finish analysis used in ultraprecision machining applications; |

| • | Eclipse II™ high-frequency industrial battery charging system that provides high-efficiency battery charging of fork lifts and other electric vehicles; |

| • | MINIFLASH™ Touch flash point tester that provides fast screening of diesel, other fuels and flammable liquids utilizing a user friendly touch-screen design; |

| • | Haydon Kerk® SRA04 Motorized ScrewRail linear actuator that combines a precision rolled lead screw with a compact stepper motor for a range of precision motion control applications; |

| • | Chatillon® digital force gauges that include a full-color display and Bluetooth connectivity for a host of automotive, biomedical, general manufacturing, military and pharmaceutical applications; |

| • | Arc Series robust thermal imaging cameras that provide accurate high-temperature thermal profiles for highly demanding industrial applications; |

| • | C110 Grade Pfinodal alloys made with proprietary powder metal technology and patented forging techniques for demanding industrial applications such as oil and gas exploration and production; and |

| • | Lloyd Instruments™ LS1 advanced materials tester used to determine the performance characteristics of plastics, packaging, medical devices, automotive electronics, textiles, rubber and pharmaceuticals among others. |

Global and Market Expansion. AMETEK’s largest presence outside the United States is in Europe, where it has operations in the United Kingdom, Germany, Denmark, Italy, the Czech Republic, Romania, France, Austria, Switzerland and the Netherlands. These operations provide design, engineering and manufacturing capability, product-line breadth, enhanced European distribution channels and low-cost production. AMETEK has a leading market position in European floorcare motors and a significant presence in many of its instrument businesses. It has grown sales in Latin America and Asia by building and expanding low-cost electric motor and instrument plants in Reynosa, Mexico and motor manufacturing plants near Sao Paulo, Brazil and in Shanghai, China. It also continues to achieve geographic expansion and market expansion in Asia through joint ventures in China, Taiwan and Japan and a direct sales and marketing presence in Singapore, Japan, China, Taiwan, Hong Kong, South Korea, India, the Middle East and Russia.

Strategic Acquisitions and Alliances. The Company continues to pursue strategic acquisitions, both domestically and internationally, to expand and strengthen its product lines, improve its market share positions and increase earnings through sales growth and operational efficiencies at the acquired businesses. Since the beginning of 2007, through December 31, 2011, the Company has completed 27 acquisitions with annualized sales totaling approximately $1 billion, including five acquisitions in 2011 (see “Recent Acquisitions”). Through these and prior acquisitions, the Company’s management team has gained

4

Table of Contents

considerable experience in successfully acquiring and integrating new businesses. The Company intends to continue to pursue this acquisition strategy.

2011 OVERVIEW

Operating Performance

In 2011, AMETEK achieved sales of $3.0 billion, an increase of 21% from 2010 and established records for net sales, operating income, operating income margins, net income, diluted earnings per share and operating cash flow. The Company achieved these results from strong internal growth in each of the Company’s two reportable segments, as well as contributions from recent acquisitions.

Financing

In September 2011, AMETEK completed a new five-year revolving credit facility with a total borrowing capacity of $700 million, which excludes an accordion feature that permits the Company to request up to an additional $200 million in revolving credit commitments at any time during the life of the revolving credit agreement under certain conditions. The new revolving credit facility replaced a $450 million total borrowing capacity revolving credit facility, which excluded a $100 million accordion feature, that was due to expire in June 2012. The new revolving credit facility provides the Company with additional financial flexibility to support its growth plans, including its successful acquisition strategy.

In the fourth quarter of 2011, the Company issued a 55 million Swiss franc ($59.0 million) 2.44% senior note due December 2021.

Recent Acquisitions

The Company spent $474.9 million in cash, net of cash acquired, for five business acquisitions in 2011.

In April 2011, the Company acquired Avicenna Technology, Inc. (“Avicenna”), a supplier of custom, fine-featured components used in the medical device industry. Avicenna is part of EMG.

In May 2011, the Company acquired Coining Holding Company (“Coining”), a leading supplier of custom-shaped metal preforms, microstampings and bonding wire solutions for interconnect applications in microelectronics packaging and assembly. Coining is part of EMG.

In October 2011, the Company acquired Reichert Technologies, a manufacturer of analytical instruments and diagnostic devices for the eye care market. Reichert Technologies is part of EIG.

In October 2011, the Company acquired EM Test (Switzerland) GmbH, a manufacturer of advanced monitoring, testing, calibrating and display instruments in the electrical immunity testing and emissions measurement market. EM Test is part of EIG.

In December 2011, the Company acquired Technical Manufacturing Corporation (“TMC”), a world leader in high-performance vibration isolation systems and optical test benches used to isolate highly sensitive instruments for the microelectronics, life sciences, photonics and ultra-precision manufacturing industries. TMC is part of EIG.

Financial Information About Reportable Segments, Foreign Operations and Export Sales

Information with respect to reportable segments and geographic areas is set forth in Note 16 to the Consolidated Financial Statements included in Part II, Item 8 of this Annual Report on Form 10-K.

5

Table of Contents

The Company’s international sales increased 24% to $1,501.1 million in 2011. The increase in international sales resulted from overall higher sales growth, driven by continued strong expansion into Asia, as well as growth in Europe, and includes the effect of foreign currency translation. The Company experienced increases in export sales of products manufactured in the United States, as well as increased sales from overseas operations. International sales represented 50.2% of consolidated net sales in 2011 compared with 49.0% in 2010.

Description of Business

The products and markets of each reportable segment are described below:

EIG

EIG is comprised of a group of differentiated businesses. EIG applies its specialized market focus and technology to manufacture instruments used for testing, monitoring, calibration and display for the process, aerospace, industrial and power markets. EIG’s growth is based on the four strategies outlined in AMETEK’s Corporate Growth Plan. EIG designs products that, in many instances, are significantly different from, or technologically better than, competing products. It has reduced costs by implementing operational improvements, achieving acquisition synergies, improving supply chain management, moving production to low-cost locales and reducing headcount. EIG is among the leaders in many of the specialized markets it serves, including aerospace engine sensors, heavy-vehicle instrument panels, analytical instrumentation, level measurement products, power instruments and pressure gauges. It has joint venture operations in China, Taiwan and Japan. EIG’s 2011 net sales to customers outside the United States were 56%.

At December 31, 2011, EIG employed approximately 6,100 people, of whom approximately 800 were covered by collective bargaining agreements. EIG had 56 operating facilities: 35 in the United States, seven in the United Kingdom, five in Germany, three in France, two in Switzerland and one each in Argentina, Austria, Canada and Denmark at December 31, 2011. EIG also shares operating facilities with EMG in China and Mexico.

Process and Analytical Instrumentation Markets and Products

Process and analytical measurement and analysis instruments represented 66% of EIG’s 2011 net sales. These include: oxygen, moisture, combustion and liquid analyzers; emission monitors; spectrometers; mechanical and electronic pressure sensors and transmitters; radiation measurement devices; level measurement devices; precision pumping systems; and force-measurement and materials testing instrumentation. EIG’s focus is on the process industries, including oil, gas and petrochemical refining, power generation, specialty gas production, water and waste treatment, natural gas distribution and semiconductor manufacturing. AMETEK’s analytical instruments are also used for precision measurement in a number of other applications including radiation detection for the U.S. Department of Homeland Security, materials analysis, nanotechnology research and other test and measurement applications.

TMC, acquired in December 2011, serves the leading manufacturers of life sciences, photonics and semiconductor equipment with a broad range of custom active piezoelectric vibration cancellation systems, based on their patented active piezo technology. TMC also supplies passive vibration cancellation systems, optical test tables, acoustic isolation hoods and magnetic isolation hoods. TMC is an excellent fit with the Company’s high-end analytical instruments businesses and further broadens AMETEK’s product offerings and expertise in ultra precision manufacturing.

Reichert Technologies, acquired in October 2011, is a leader and innovator in high-technology instruments used by ophthalmologists, optometrists, and opticians for vision correction and the screening and diagnosis of eye diseases such as glaucoma and macular degeneration. Reichert Technologies expands AMETEK’s business in the medical market.

6

Table of Contents

Atlas Material Testing Technology LLC (“Atlas”), acquired in November 2010, has products which include weather exposure test systems, corrosion-testing instruments, specialty lighting systems, and large-scale weathering test chambers. In addition, Atlas offers indoor laboratory and outdoor testing services, photovoltaic and solar testing and consulting. Atlas provides the Company with another growth platform in the materials testing equipment market and broadens AMETEK’s presence in the fast-growing photovoltaic testing market.

Power and Industrial Instrumentation Markets and Products

Power and industrial instrumentation markets represented 24% of EIG’s 2011 net sales.

AMETEK’s power businesses provide analytical instruments, uninterruptible power supply systems and programmable power supplies used in a wide variety of industrial settings.

EIG is a leader in the design and manufacture of power measurement and recording instrumentation used by the electric power and manufacturing industries. Those products include power transducers and meters, event and transient recorders, annunciators and alarm monitoring systems used to measure, monitor and record variables in the transmission and distribution of electric power.

EIG’s Solidstate Controls business designs and manufactures uninterruptible power supply systems for the process and power generation industries. EIG also manufactures sensor systems for land-based gas turbines and for boilers and burners used by the utility, petrochemical, process and marine industries worldwide.

EIG’s programmable power business is a leader in programmable AC and DC power sources and pursues growth opportunities in the highly attractive electronic test and measurement equipment market.

EM Test, acquired in October 2011, is a global leader in equipment used to perform electrical immunity and electromagnetic compatibility testing. EM Test manufactures a full line of conducted electromagnetic compatibility test equipment, including electrical fast transient generators, electrostatic discharge simulators, surge generators, waveform simulators and multifunctional generators. Its products are used in test applications by a wide range of industries to ensure that electronic and electrical products are not susceptible to external electromagnetic disturbances and do not generate electromagnetic disturbances that might affect other products or instruments.

Aerospace Instrumentation Markets and Products

Aerospace products represented 10% of EIG’s 2011 net sales. AMETEK’s aerospace products are designed to customer specifications and are manufactured to stringent operational and reliability requirements. Its aerospace business operates in specialized markets, where its products have a technological and/or cost advantage. Acquisitions have complemented and expanded EIG’s core sensor and transducer product line, used in a wide range of aerospace applications.

Aerospace products include: airborne data systems; turbine engine temperature measurement products; vibration-monitoring systems; indicators; displays; fuel and fluid measurement products; sensors; switches; cable harnesses; and transducers. EIG serves all segments of commercial aerospace, including helicopters, business jets, commuter aircraft and commercial airliners, as well as the military market.

Among its more significant competitive advantages are EIG’s 50-plus years of experience as an aerospace supplier and its long-standing customer relationships with global commercial aircraft Original Equipment Manufacturers (“OEMs”). Its customers are the leading producers of airframes and jet engines and other aerospace system integrators. It also serves the commercial aerospace aftermarket with spare part sales and repair and overhaul services.

7

Table of Contents

Customers

EIG is not dependent on any single customer such that the loss of that customer would have a material adverse effect on EIG’s operations. Approximately 9% of EIG’s 2011 net sales were made to its five largest customers.

EMG

EMG is among the leaders in many of the specialized markets it serves, including highly engineered motors, blowers, fans, heat exchangers, connectors, and other electromechanical products or systems for commercial and military aerospace applications, defense, medical equipment, business machines, computers and other power or industrial applications. In its floorcare and specialty motor business, the Company believes it is an industry leader in the development and production of high-speed, air-moving electric motors for OEMs of floorcare products and other specialty applications. EMG designs products that, in many instances, are significantly different from, or technologically better than, competing products. It has reduced costs by implementing operational improvements, achieving acquisition synergies, improving supply chain management, moving production to low-cost locales and reducing headcount. EMG’s 2011 net sales to customers outside the United States were 43%.

At December 31, 2011, EMG employed approximately 5,900 people, of whom approximately 1,300 were covered by collective bargaining agreements (including some that are covered by local unions). EMG had 58 operating facilities: 34 in the United States, nine in the United Kingdom, three in France, two each in China, Czech Republic, Italy and Mexico and one each in Brazil, Malaysia, Morocco and Taiwan at December 31, 2011.

Differentiated Businesses

Differentiated businesses account for an increasing proportion of EMG’s overall sales base. Differentiated businesses represented 82% of EMG’s net sales in 2011 and are comprised of the technical motors and systems businesses and the engineered materials, interconnects and packaging businesses.

Technical Motors and Systems Markets and Products

Technical motors and systems, representing 45% of EMG’s 2011 net sales, consist of brushless motors, blowers and pumps, as well as other electromechanical systems. These products are used in aerospace and defense, business machines, computer equipment, mass transit vehicles, medical equipment, power, and industrial applications.

EMG produces electronically commutated (brushless) motors, blowers and pumps that offer long life, reliability and near maintenance-free operation. These motor-blower systems and heat exchangers are used for thermal management and other applications on a wide variety of military and commercial aircraft and military ground vehicles, and are used increasingly in medical and other applications, in which their long life, and spark-free and reliable operation is very important. These motors provide cooling and ventilation for business machines, computers and mass transit vehicles.

Haydon Enterprises, acquired in July 2010, complements the Company’s highly differentiated technical motor business, which shares common markets, customers and distribution channels, and places AMETEK in a unique position as the premier industry provider of high-end linear and rotary motion control solutions.

EMG also serves the commercial and military aerospace third-party maintenance, repair and overhaul (“MRO”) market. These services are provided on a global basis with facilities in the United States, Europe and Singapore.

8

Table of Contents

Engineered Materials, Interconnects and Packaging Markets and Products

Engineered materials, interconnects and packaging products represented 37% of EMG’s 2011 net sales. AMETEK is an innovator and market leader in specialized metal powder, strip, wire and bonded products. It produces stainless steel and nickel clad alloys; stainless steel, cobalt and nickel alloy powders; metal strip; specialty shaped and electronic wire; and advanced metal matrix composites used in electronic thermal management. Its products are used in automotive, appliance, medical and surgical, aerospace, telecommunications, marine and general industrial applications. Its niche market focus is based upon proprietary manufacturing technology and strong customer relationships.

Coining, acquired in May 2011, is a global leader in custom-shaped preforms, microstampings and wire used for joining electronic circuitry, packaging microelectronics and providing thermal protection and electric conductivity for a wide range of electronic devices. Coining’s products are used in highly engineered applications for the RF/microwave, photonics, medical, aerospace and defense, and general electronics industries.

Avicenna, acquired in April 2011, provides the Company with additional expertise in producing fine-featured catheter and other medical components for leads, guide wires and custom medical assemblies. Avicenna complements the Company’s medical device market businesses and is an excellent fit with its Technical Services for Electronics (“TSE”) business.

TSE, acquired in June 2010, expands the Company’s position in the medical device market and is an excellent fit with the HCC Industries division, which manufactures highly engineered electronic interconnects and microelectronics packaging for sophisticated electronic applications.

The combination of Avicenna and TSE positions AMETEK as the only medical interconnects provider with integrated capabilities for the catheter, cardiac and neurostimulation markets.

Floorcare and Specialty Motor Markets and Products

Floorcare and specialty motor markets represented 18% of EMG’s 2011 net sales, where it sells air-moving electric motors to many of the world’s major floorcare OEMs, including vertically integrated OEMs that produce some of their own motors. EMG produces motor-blowers for a full range of floorcare products, ranging from hand-held, canister and upright vacuums to central vacuums for residential use. High-performance vacuum motors also are marketed for commercial and industrial applications.

The Company also manufactures a variety of specialty motors used in a wide range of products, such as household and personal care appliances; fitness equipment; electric materials handling vehicles; and sewing machines. Additionally, its products are used in outdoor power equipment, such as electric chain saws, leaf blowers, string trimmers and power washers.

EMG has been successful in directing a portion of its global floorcare marketing at vertically integrated vacuum cleaner manufacturers, who seek to outsource all or part of their motor production. By purchasing their motors from EMG, these customers are able to realize economic and operational advantages by reducing or discontinuing their own motor production and avoiding the capital investment required to keep their motor manufacturing current with changing technologies and market demands.

Customers

EMG is not dependent on any single customer such that the loss of that customer would have a material adverse effect on EMG’s operations. Approximately 9% of EMG’s 2011 net sales were made to its five largest customers.

9

Table of Contents

Marketing

The Company’s marketing efforts generally are organized and carried out at the division level. EIG makes significant use of distributors and sales representatives in marketing its products, as well as direct sales in some of its more technically sophisticated products. Within aerospace, its specialized customer base of aircraft and jet engine manufacturers is served primarily by direct sales engineers. Given the technical nature of many of its products, as well as its significant worldwide market share, EMG conducts much of its domestic and international marketing activities through a direct sales force and makes some use of sales representatives and distributors both in the United States and in other countries.

Competition

In general, most of the Company’s markets are highly competitive. The principal elements of competition for the Company’s products are product technology, distribution, quality, service and price.

In the markets served by EIG, the Company believes that it ranks among the leading U.S. producers of certain measuring and control instruments. It also is a leader in the U.S. heavy-vehicle instrumentation and power instrument markets and one of the leading instrument and sensor suppliers to the commercial aviation market. Competition remains strong and can intensify for certain EIG products, especially its pressure gauge and heavy-vehicle instrumentation products. Both of these businesses have several strong competitors. In the process and analytical instruments market, numerous companies in each specialized market compete on the basis of product quality, performance and innovation. The aerospace and power instrument businesses have a number of diversified competitors, which vary depending on the specific market niche.

EMG’s differentiated businesses have competition from a limited number of companies in each of their markets. Competition is generally based on product innovation, performance and price. There also is competition from alternative materials and processes. In its floorcare and specialty motor businesses, EMG has limited domestic competition in the U.S. floorcare market from independent manufacturers. Competition is strong from Asian motor manufacturers that serve both the U.S. and the European floorcare markets. Global vacuum motor production is continually being shifted to Asia where AMETEK has a smaller market position. There is potential competition from vertically integrated manufacturers of floorcare products that produce their own motor-blowers. Many of these manufacturers would also be potential EMG customers if they decided to outsource their motor production.

Backlog and Seasonal Variations of Business

The Company’s backlog of unfilled orders by business segment was as follows at December 31:

| 2011 | 2010 | 2009 | ||||||||||

| (In millions) | ||||||||||||

| Electronic Instruments |

$ | 437.5 | $ | 370.2 | $ | 284.3 | ||||||

| Electromechanical |

473.9 | 458.6 | 364.1 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 911.4 | $ | 828.8 | $ | 648.4 | ||||||

|

|

|

|

|

|

|

|||||||

The higher backlog at December 31, 2011 was due to higher order levels and the acquired backlog of 2011 acquisitions.

Of the total backlog of unfilled orders at December 31, 2011, approximately 88% is expected to be shipped by December 31, 2012. The Company believes that neither its business as a whole, nor either of its reportable segments, is subject to significant seasonal variations, although certain individual operations experience some seasonal variability.

10

Table of Contents

Availability of Raw Materials

The Company’s reportable segments obtain raw materials and supplies from a variety of sources and generally from more than one supplier. However, for EMG, certain items, including various base metals and certain steel components, are available only from a limited number of suppliers. The Company believes its sources and supplies of raw materials are adequate for its needs.

Research, Development and Engineering

The Company is committed to research, development and engineering activities that are designed to identify and develop potential new and improved products or enhance existing products. Research, development and engineering costs before customer reimbursement were $137.6 million, $112.1 million and $101.4 million in 2011, 2010 and 2009, respectively. Customer reimbursements in 2011, 2010 and 2009 were $6.1 million, $6.4 million and $5.5 million, respectively. These amounts included net Company-funded research and development expenses of $78.0 million, $56.8 million and $50.5 million in 2011, 2010 and 2009, respectively. All such expenditures were directed toward the development of new products and processes and the improvement of existing products and processes.

Environmental Matters

Information with respect to environmental matters is set forth in the section of Management’s Discussion and Analysis of Financial Condition and Results of Operations entitled “Environmental Matters” and in Note 14 to the Consolidated Financial Statements included in Part II, Item 8 of this Annual Report on Form 10-K.

Patents, Licenses and Trademarks

The Company owns numerous unexpired U.S. patents and foreign patents, including counterparts of its more important U.S. patents, in the major industrial countries of the world. The Company is a licensor or licensee under patent agreements of various types and its products are marketed under various registered and unregistered U.S. and foreign trademarks and trade names. However, the Company does not consider any single patent or trademark, or any group thereof, essential either to its business as a whole or to either of its business segments. The annual royalties received or paid under license agreements are not significant to either of its reportable segments or to the Company’s overall operations.

Employees

At December 31, 2011, the Company employed approximately 12,200 people in its EMG, EIG and corporate operations, of whom approximately 2,100 employees were covered by collective bargaining agreements. The Company has two collective bargaining agreements that will expire in 2012, which cover less than 100 employees. The Company expects no material adverse effects from the pending labor contract negotiations.

Working Capital Practices

The Company does not have extraordinary working capital requirements in either of its reportable segments. Customers generally are billed at normal trade terms, which may include extended payment provisions. Inventories are closely controlled and maintained at levels related to production cycles and are responsive to the normal delivery requirements of customers.

| Item 1A. | Risk Factors |

You should consider carefully the following risk factors and all other information contained in this Annual Report on Form 10-K and the documents we incorporate by reference in this Annual Report on Form 10-K. Any of the following risks could materially and adversely affect our business, financial condition, results of operations and cash flows.

11

Table of Contents

A prolonged downturn in the aerospace and defense, process instrumentation or electric motor markets could adversely affect our business.

Several of the industries in which we operate are cyclical in nature and therefore are affected by factors beyond our control. A prolonged downturn in the aerospace and defense, process instrumentation or electric motor markets could have an adverse effect on our business, financial condition and results of operations.

Our growth strategy includes strategic acquisitions. We may not be able to consummate future acquisitions or successfully integrate recent and future acquisitions.

A portion of our growth has been attributed to acquisitions of strategic businesses. Since the beginning of 2007, through December 31, 2011, we have completed 27 acquisitions. We plan to continue making strategic acquisitions to enhance our global market position and broaden our product offerings. Although we have been successful with our acquisition strategies in the past, our ability to successfully effectuate acquisitions will be dependent upon a number of factors, including:

| • | Our ability to identify acceptable acquisition candidates; |

| • | The impact of increased competition for acquisitions, which may increase acquisition costs and affect our ability to consummate acquisitions on favorable terms and may result in us assuming a greater portion of the seller’s liabilities; |

| • | Successfully integrating acquired businesses, including integrating the financial, technological and management processes, procedures and controls of the acquired businesses with those of our existing operations; |

| • | Adequate financing for acquisitions being available on terms acceptable to us; |

| • | U.S. and foreign competition laws and regulations affecting our ability to make certain acquisitions; |

| • | Unexpected losses of key employees, customers and suppliers of acquired businesses; |

| • | Mitigating assumed, contingent and unknown liabilities; and |

| • | Challenges in managing the increased scope, geographic diversity and complexity of our operations. |

The process of integrating acquired businesses into our existing operations may result in unforeseen operating difficulties and may require additional financial resources and attention from management that would otherwise be available for the ongoing development or expansion of our existing operations. Furthermore, even if successfully integrated, the acquired business may not achieve the results we expected or produce expected benefits in the time frame planned. Failure to continue with our acquisition strategy and the successful integration of acquired businesses could have a material adverse effect on our business, financial condition, results of operations and cash flows.

We may experience unanticipated start-up expenses and production delays in opening new facilities or product line transfers.

Certain of our businesses are relocating or have recently relocated manufacturing operations to low-cost locales. Unanticipated start-up expenses and production delays in opening new facilities or completing product line transfers, as well as possible underutilization of our existing facilities, could result in production inefficiencies, which would adversely affect our business and operations.

12

Table of Contents

Our substantial international sales and operations are subject to customary risks associated with international operations.

International sales for 2011 and 2010 represented 50.2% and 49.0% of our consolidated net sales, respectively. As a result of our growth strategy, we anticipate that the percentage of sales outside the United States will increase in the future. International operations are subject to the customary risks of operating in an international environment, including:

| • | Potential imposition of trade or foreign exchange restrictions; |

| • | Overlap of different tax structures; |

| • | Unexpected changes in regulatory requirements; |

| • | Changes in tariffs and trade barriers; |

| • | Fluctuations in foreign currency exchange rates, including changes in the relative value of currencies in the countries where we operate, subjecting us to exchange rate exposures; |

| • | Restrictions on currency repatriation; |

| • | General economic conditions; |

| • | Unstable political situations; |

| • | Nationalization of assets; and |

| • | Compliance with a wide variety of international and U.S. laws and regulatory requirements. |

Our international sales and operations may be adversely impacted by compliance with export laws.

We are required to comply with various import, export, export control and economic sanctions laws, which may affect our transactions with certain customers, business partners and other persons, including in certain cases dealings with or between our employees and subsidiaries. In certain circumstances, export control and economic sanctions regulations may prohibit the export of certain products, services and technologies and in other circumstances, we may be required to obtain an export license before exporting a controlled item. In addition, failure to comply with any of these regulations could result in civil and criminal, monetary and non-monetary penalties, disruptions to our business, limitations on our ability to import and export products and services and damage to our reputation.

Any inability to hire, train and retain a sufficient number of skilled officers and other employees could impede our ability to compete successfully.

If we cannot hire, train and retain a sufficient number of qualified employees, we may not be able to effectively integrate acquired businesses and realize anticipated results from those businesses, manage our expanding international operations and otherwise profitably grow our business. Even if we do hire and retain a sufficient number of employees, the expense necessary to attract and motivate these officers and employees may adversely affect our results of operations.

If we are unable to develop new products on a timely basis, it could adversely affect our business and prospects.

We believe that our future success depends, in part, on our ability to develop, on a timely basis, technologically advanced products that meet or exceed appropriate industry standards. Although we believe we have certain

13

Table of Contents

technological and other advantages over our competitors, maintaining such advantages will require us to continue investing in research and development and sales and marketing. There can be no assurance that we will have sufficient resources to make such investments, that we will be able to make the technological advances necessary to maintain such competitive advantages or that we can recover major research and development expenses. We are not currently aware of any emerging standards or new products which could render our existing products obsolete, although there can be no assurance that this will not occur or that we will be able to develop and successfully market new products.

A shortage of or price increases in our raw materials could increase our operating costs.

We have multiple sources of supply for our major raw material requirements and we are not dependent on any one supplier; however, certain items, including base metals and certain steel components, are available only from a limited number of suppliers and are subject to commodity market fluctuations. Shortages in raw materials or price increases therefore could affect the prices we charge, our operating costs and our competitive position, which could adversely affect our business, financial condition, results of operations and cash flows.

Certain environmental risks may cause us to be liable for costs associated with hazardous or toxic substance clean-up which may adversely affect our financial condition.

Our businesses, operations and facilities are subject to a number of federal, state, local and foreign environmental and occupational health and safety laws and regulations concerning, among other things, air emissions, discharges to waters and the use, manufacturing, generation, handling, storage, transportation and disposal of hazardous substances and wastes. Environmental risks are inherent in many of our manufacturing operations. Certain laws provide that a current or previous owner or operator of property may be liable for the costs of investigating, removing and remediating hazardous materials at such property, regardless of whether the owner or operator knew of, or was responsible for, the presence of such hazardous materials. In addition, the Comprehensive Environmental Response, Compensation and Liability Act generally imposes joint and several liability for clean-up costs, without regard to fault, on parties contributing hazardous substances to sites designated for clean-up under the Act. We have been named a potentially responsible party at several sites, which are the subject of government-mandated clean-ups. As the result of our ownership and operation of facilities that use, manufacture, store, handle and dispose of various hazardous materials, we may incur substantial costs for investigation, removal, remediation and capital expenditures related to compliance with environmental laws. While it is not possible to precisely quantify the potential financial impact of pending environmental matters, based on our experience to date, we believe that the outcome of these matters is not likely to have a material adverse effect on our financial position or future results of operations. In addition, new laws and regulations, new classification of hazardous materials, stricter enforcement of existing laws and regulations, the discovery of previously unknown contamination or the imposition of new clean-up requirements could require us to incur costs or become the basis for new or increased liabilities that could have a material adverse effect on our business, financial condition and results of operations. There can be no assurance that future environmental liabilities will not occur or that environmental damages due to prior or present practices will not result in future liabilities.

We are subject to numerous governmental regulations, which may be burdensome or lead to significant costs.

Our operations are subject to numerous federal, state, local and foreign governmental laws and regulations. In addition, existing laws and regulations may be revised or reinterpreted and new laws and regulations, including with respect to climate change, may be adopted or become applicable to us or customers for our products. We cannot predict the form any such new laws or regulations will take or the impact any of these laws and regulations will have on our business or operations.

We may be required to defend lawsuits or pay damages in connection with alleged or actual harm caused by our products.

We face an inherent business risk of exposure to product liability claims in the event that the use of our products is alleged to have resulted in harm to others or to property. For example, our operations expose us to

14

Table of Contents

potential liabilities for personal injury or death as a result of the failure of, for instance, an aircraft component that has been designed, manufactured or serviced by us. We may incur a significant liability if product liability lawsuits against us are successful. While we believe our current general liability and product liability insurance is adequate to protect us from future claims, we cannot assure that coverage will be adequate to cover all claims that may arise. Additionally, we may not be able to maintain insurance coverage in the future at an acceptable cost. Any liability not covered by insurance or for which third-party indemnification is not available could have a material adverse effect on our business, financial condition and results of operations.

We operate in highly competitive industries, which may adversely affect our results of operations or ability to expand our business.

Our markets are highly competitive. We compete, domestically and internationally, with individual producers, as well as with vertically integrated manufacturers, some of which have resources greater than we do. The principal elements of competition for our products are price, product technology, distribution, quality and service. EMG’s competition in specialty metal products stems from alternative materials and processes. In the markets served by EIG, although we believe EIG is a market leader, competition is strong and could intensify. In the pressure gauge, aerospace and heavy-vehicle markets served by EIG, a limited number of companies compete on the basis of product quality, performance and innovation. Our competitors may develop new or improve existing products that are superior to our products or may adapt more readily to new technologies or changing requirements of our customers. There can be no assurance that our business will not be adversely affected by increased competition in the markets in which it operates or that our products will be able to compete successfully with those of our competitors.

Restrictions contained in our revolving credit facility and other debt agreements may limit our ability to incur additional indebtedness.

Our existing revolving credit facility and other debt agreements contain restrictive covenants, including restrictions on our ability to incur indebtedness. These restrictions could limit our ability to effectuate future acquisitions or restrict our financial flexibility.

We are subject to possible insolvency of financial counterparties.

We engage in numerous financial transactions and contracts including insurance policies, letters of credit, credit facilities, financial derivatives and investment management agreements involving various counterparties. We are subject to the risk that one or more of these counterparties may become insolvent and, therefore, be unable to discharge its obligations under such contracts.

Our goodwill and other intangible assets represent a substantial amount of our total assets and the impairment of such substantial goodwill and intangible assets could have a negative impact on our financial condition and results of operations.

Our total assets include substantial amounts of intangible assets, primarily goodwill. At December 31, 2011, goodwill and other intangible assets, net of accumulated amortization, totaled $2,789.2 million or 65% of our total assets. The goodwill results from our acquisitions, representing the excess of cost over the fair value of the net tangible and other identifiable intangible assets we have acquired. At a minimum, we assess annually whether there has been impairment in the value of our intangible assets. If future operating performance at one or more of our business units were to fall significantly below current levels, we could record, under current applicable accounting rules, a non-cash charge to operating income for goodwill or other intangible asset impairment. Any determination requiring the impairment of a significant portion of goodwill or other intangible assets would negatively affect our financial condition and results of operations.

| Item 1B. | Unresolved Staff Comments |

None.

15

Table of Contents

| Item 2. | Properties |

At December 31, 2011, the Company had 114 operating facilities in 23 states and 16 foreign countries. Of these facilities, 55 are owned by the Company and 59 are leased. The properties owned by the Company consist of approximately 677 acres, of which approximately 4.3 million square feet are under roof. Under lease is a total of approximately 1.8 million square feet. The leases expire over a range of years from 2011 to 2082, with renewal options for varying terms contained in many of the leases. Production facilities in China, Taiwan and Japan provide the Company with additional production capacity through the Company’s investment in 50% or less owned joint ventures. The Company’s executive offices in Berwyn, Pennsylvania, occupy approximately 43,000 square feet under a lease that expires in September 2023.

The Company’s machinery and equipment, plants and offices are in satisfactory operating condition and are adequate for the uses to which they are put. The operating facilities of the Company by business segment were as follows at December 31, 2011:

| Number of Operating Facilities |

Square Feet Under Roof | |||||||||||||||

| Owned | Leased | Owned | Leased | |||||||||||||

| Electronic Instruments |

26 | 30 | 2,000,000 | 1,091,000 | ||||||||||||

| Electromechanical |

29 | 29 | 2,322,000 | 743,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

55 | 59 | 4,322,000 | 1,834,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Item 3. | Legal Proceedings |

Please refer to “Environmental Matters” in Management’s Discussion and Analysis of Financial Condition and Results of Operations and Note 14 to the Consolidated Financial Statements in this Annual Report on Form 10-K for information regarding certain litigation matters.

In addition to those litigation matters described above, the Company is, from time to time, subject to a variety of litigation and similar proceedings incidental to its business. These lawsuits may involve claims for damages arising out of the use of the Company’s products and services, personal injury, employment matters, tax matters, commercial disputes and intellectual property matters. The Company may also become subject to lawsuits as a result of past or future acquisitions. Based upon the Company’s experience, the Company does not believe that these proceedings and claims will have a material adverse effect on its results of operations, financial position or cash flows.

16

Table of Contents

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

The principal market on which the Company’s common stock is traded is the New York Stock Exchange and it is traded under the symbol “AME.” On January 31, 2012, there were approximately 2,200 holders of record of the Company’s common stock.

Market price and dividend information with respect to the Company’s common stock is set forth below. Future dividend payments by the Company will be dependent on future earnings, financial requirements, contractual provisions of debt agreements and other relevant factors.

Under its share repurchase program, the Company repurchased 1.7 million shares of common stock for $59.3 million in 2011 and 3.1 million shares of common stock for $78.6 million in 2010 primarily to offset the dilutive effect of shares granted as equity-based compensation.

The high and low sales prices of the Company’s common stock on the New York Stock Exchange composite tape and the quarterly dividends per share paid on the common stock were:

| First Quarter |

Second Quarter |

Third Quarter |

Fourth Quarter |

|||||||||||||

| 2011 |

||||||||||||||||

| Dividends paid per share |

$ | 0.06 | $ | 0.06 | $ | 0.06 | $ | 0.06 | ||||||||

| Common stock trading range: |

||||||||||||||||

| High |

$ | 44.83 | $ | 47.00 | $ | 46.59 | $ | 43.73 | ||||||||

| Low |

$ | 38.38 | $ | 40.38 | $ | 32.67 | $ | 30.87 | ||||||||

| 2010 |

||||||||||||||||

| Dividends paid per share |

$ | 0.04 | $ | 0.04 | $ | 0.04 | $ | 0.06 | ||||||||

| Common stock trading range: |

||||||||||||||||

| High |

$ | 27.89 | $ | 29.59 | $ | 32.41 | $ | 41.34 | ||||||||

| Low |

$ | 23.76 | $ | 25.33 | $ | 26.46 | $ | 31.55 | ||||||||

Issuer Purchases of Equity Securities

The following table reflects purchases of AMETEK, Inc. common stock by the Company during the three months ended December 31, 2011:

| Period |

Total Number of Shares Purchased(1) |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plan(1) |

Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plan |

||||||||||||

| October 1, 2011 to October 31, 2011 |

1,279,100 | $ | 33.58 | 1,279,100 | $ | 5,526,184 | ||||||||||

| November 1, 2011 to November 30, 2011 |

— | — | — | 105,526,184 | ||||||||||||

| December 1, 2011 to December 31, 2011 |

— | — | — | 105,526,184 | ||||||||||||

|

|

|

|

|

|||||||||||||

| Total |

1,279,100 | 33.58 | 1,279,100 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| (1) | Consists of the number of shares purchased pursuant to the Company’s Board of Directors $75 million authorization for the repurchase of its common stock announced on January 28, 2010. In November 2011, the Board of Directors approved an increase of $100 million in the authorization for the repurchase of the Company’s common stock. Such purchases may be affected from time to time in the open market or in private transactions, subject to market conditions and at management’s discretion. |

17

Table of Contents

Securities Authorized for Issuance Under Equity Compensation Plan Information

The following table sets forth information as of December 31, 2011 regarding all of the Company’s existing compensation plans pursuant to which equity securities are authorized for issuance to employees and nonemployee directors:

| Plan category |

Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) |

Weighted average exercise price of outstanding options, warrants and rights (b) |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) |

|||||||||

| Equity compensation plans approved by security holders |

5,466,439 | $ | 27.75 | 9,947,284 | ||||||||

| Equity compensation plans not approved by security holders |

— | — | — | |||||||||

|

|

|

|

|

|||||||||

| Total |

5,466,439 | $ | 27.75 | 9,947,284 | ||||||||

|

|

|

|

|

|

|

|||||||

18

Table of Contents

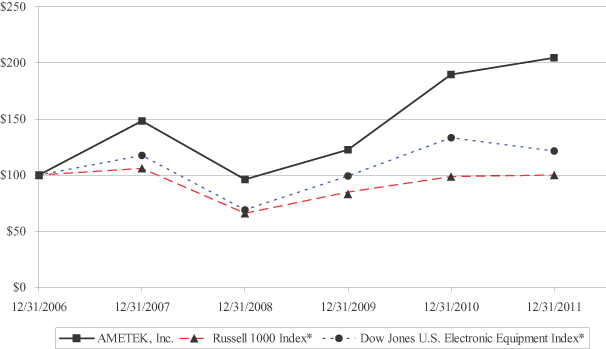

Stock Performance Graph

The following stock performance graph and related information shall not be deemed “soliciting material” or to be “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or Securities Exchange Act of 1934, each as amended, except to the extent that the Company specifically incorporates it by reference into such filing.

The following graph and accompanying table compare the cumulative total stockholder return for AMETEK, Inc. over the last five years ended December 31, 2011 with total returns for the same period for the Russell 1000 Index and the Dow Jones U.S. Electronic Equipment Index. The performance graph and table assume a $100 investment made on December 31, 2006 and reinvestment of all dividends. The stock performance shown on the graph below is based on historical data and is not necessarily indicative of future stock price performance.

COMPARISON OF FIVE-YEAR CUMULATIVE TOTAL RETURN

| December 31, | ||||||||||||||||||||||||

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | |||||||||||||||||||

| AMETEK, Inc. |

$ | 100.00 | $ | 148.01 | $ | 96.01 | $ | 122.40 | $ | 189.54 | $ | 204.50 | ||||||||||||

| Russell 1000 Index* |

100.00 | 105.77 | 66.01 | 84.77 | 98.42 | 99.90 | ||||||||||||||||||

| Dow Jones U.S. Electronic Equipment Index* |

100.00 | 117.34 | 68.89 | 99.05 | 133.21 | 121.36 | ||||||||||||||||||

| * | Includes AMETEK, Inc. |

19

Table of Contents

| Item 6. | Selected Financial Data |

The following financial information for the five years ended December 31, 2011, has been derived from the Company’s consolidated financial statements. This information should be read in conjunction with Management’s Discussion and Analysis of Financial Condition and Results of Operations and the consolidated financial statements and related notes thereto included elsewhere in this Annual Report on Form 10-K.

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

| (In millions, except per share amounts) | ||||||||||||||||||||

| Consolidated Operating Results (Year Ended December 31): |

||||||||||||||||||||

| Net sales |

$ | 2,989.9 | $ | 2,471.0 | $ | 2,098.4 | $ | 2,531.1 | $ | 2,136.9 | ||||||||||

| Operating income |

$ | 635.9 | $ | 482.2 | $ | 366.1 | $ | 432.7 | $ | 386.6 | ||||||||||

| Interest expense |

$ | (69.7 | ) | $ | (67.5 | ) | $ | (68.8 | ) | $ | (63.7 | ) | $ | (46.9 | ) | |||||

| Net income |

$ | 384.5 | $ | 283.9 | $ | 205.8 | $ | 247.0 | $ | 228.0 | ||||||||||

| Earnings per share: |

||||||||||||||||||||

| Basic |

$ | 2.40 | $ | 1.79 | $ | 1.28 | $ | 1.55 | $ | 1.44 | ||||||||||

| Diluted |

$ | 2.37 | $ | 1.76 | $ | 1.27 | $ | 1.53 | $ | 1.41 | ||||||||||

| Dividends declared and paid per share |

$ | 0.24 | $ | 0.18 | $ | 0.16 | $ | 0.16 | $ | 0.16 | ||||||||||

| Weighted average common shares outstanding: |

||||||||||||||||||||

| Basic |

160.3 | 159.1 | 160.2 | 159.2 | 158.7 | |||||||||||||||

| Diluted |

162.1 | 160.9 | 161.8 | 161.2 | 161.4 | |||||||||||||||

| Performance Measures and Other Data: |

||||||||||||||||||||

| Operating income — Return on net sales |

21.3 | % | 19.5 | % | 17.4 | % | 17.1 | % | 18.1 | % | ||||||||||

| — Return on average total assets |

15.6 | % | 13.6 | % | 11.6 | % | 14.9 | % | 15.9 | % | ||||||||||

| Net income — Return on average total capital(1) |

12.3 | % | 10.2 | % | 8.2 | % | 10.9 | % | 12.0 | % | ||||||||||

| — Return on average stockholders’ equity(1) |

20.1 | % | 17.0 | % | 14.4 | % | 19.5 | % | 20.7 | % | ||||||||||

| EBITDA(2) |

$ | 712.2 | $ | 545.9 | $ | 428.0 | $ | 489.4 | $ | 433.9 | ||||||||||

| Ratio of EBITDA to interest expense(2) |

10.2 | x | 8.2 | x | 6.3 | x | 7.7 | x | 9.3 | x | ||||||||||

| Depreciation and amortization |

$ | 86.5 | $ | 72.9 | $ | 65.5 | $ | 63.3 | $ | 52.7 | ||||||||||

| Capital expenditures |

$ | 50.8 | $ | 39.2 | $ | 33.1 | $ | 44.2 | $ | 37.6 | ||||||||||

| Cash provided by operating activities |

$ | 508.6 | $ | 423.0 | $ | 364.7 | $ | 247.3 | $ | 278.5 | ||||||||||

| Free cash flow(3) |

$ | 457.8 | $ | 383.8 | $ | 331.6 | $ | 203.1 | $ | 240.9 | ||||||||||

| Consolidated Financial Position (At December 31): |

||||||||||||||||||||

| Current assets |

$ | 1,059.1 | $ | 974.5 | $ | 969.4 | $ | 954.6 | $ | 952.2 | ||||||||||

| Current liabilities |

$ | 628.9 | $ | 550.9 | $ | 424.3 | $ | 447.5 | $ | 640.8 | ||||||||||

| Property, plant and equipment, net |

$ | 325.3 | $ | 318.1 | $ | 310.1 | $ | 307.9 | $ | 293.1 | ||||||||||

| Total assets |

$ | 4,319.5 | $ | 3,818.9 | $ | 3,246.0 | $ | 3,055.5 | $ | 2,745.7 | ||||||||||

| Long-term debt |

$ | 1,123.4 | $ | 1,071.4 | $ | 955.9 | $ | 1,093.2 | $ | 667.0 | ||||||||||

| Total debt |

$ | 1,263.9 | $ | 1,168.5 | $ | 1,041.7 | $ | 1,111.7 | $ | 903.0 | ||||||||||

| Stockholders’ equity(1) |

$ | 2,052.8 | $ | 1,775.2 | $ | 1,567.0 | $ | 1,287.8 | $ | 1,240.7 | ||||||||||

| Stockholders’ equity per share(1) |

$ | 12.80 | $ | 11.05 | $ | 9.68 | $ | 8.04 | $ | 7.70 | ||||||||||

| Total debt as a percentage of capitalization(1) |

38.1 | % | 39.7 | % | 39.9 | % | 46.3 | % | 42.1 | % | ||||||||||

| Net debt as a percentage of capitalization(1)(4) |

34.8 | % | 36.2 | % | 33.7 | % | 44.3 | % | 37.1 | % | ||||||||||

See Notes to Selected Financial Data on the following page.

20

Table of Contents

Notes to Selected Financial Data

| (1) | The adoption of provisions in Financial Accounting Standards Board Accounting Standards Codification Topic 740, Income Taxes as of January 1, 2007, resulted in a $5.9 million charge to the opening balance of stockholders’ equity. |

| (2) | EBITDA represents income before interest, income taxes, depreciation and amortization. EBITDA is presented because the Company is aware that it is used by rating agencies, securities analysts, investors and other parties in evaluating the Company. It should not be considered, however, as an alternative to operating income as an indicator of the Company’s operating performance or as an alternative to cash flows as a measure of the Company’s overall liquidity as presented in the Company’s consolidated financial statements. Furthermore, EBITDA measures shown for the Company may not be comparable to similarly titled measures used by other companies. The following table presents the reconciliation of net income reported in accordance with U.S. generally accepted accounting principles (“GAAP”) to EBITDA: |

| Year Ended December 31, | ||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

| (In millions) | ||||||||||||||||||||

| Net income |

$ | 384.5 | $ | 283.9 | $ | 205.8 | $ | 247.0 | $ | 228.0 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Add (deduct): |

||||||||||||||||||||

| Interest expense |

69.7 | 67.5 | 68.8 | 63.7 | 46.9 | |||||||||||||||

| Interest income |

(0.7 | ) | (0.7 | ) | (1.0 | ) | (3.9 | ) | (2.1 | ) | ||||||||||

| Income taxes |

172.2 | 122.3 | 88.9 | 119.3 | 108.4 | |||||||||||||||

| Depreciation |

48.9 | 45.4 | 42.2 | 45.8 | 42.3 | |||||||||||||||

| Amortization |

37.6 | 27.5 | 23.3 | 17.5 | 10.4 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total adjustments |

327.7 | 262.0 | 222.2 | 242.4 | 205.9 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA |

$ | 712.2 | $ | 545.9 | $ | 428.0 | $ | 489.4 | $ | 433.9 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (3) | Free cash flow represents cash flow from operating activities less capital expenditures. Free cash flow is presented because the Company is aware that it is used by rating agencies, securities analysts, investors and other parties in evaluating the Company. (Also see note 2 above). The following table presents the reconciliation of cash flow from operating activities reported in accordance with U.S. GAAP to free cash flow: |

| Year Ended December 31, | ||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

| (In millions) | ||||||||||||||||||||

| Cash provided by operating activities |

$ | 508.6 | $ | 423.0 | $ | 364.7 | $ | 247.3 | $ | 278.5 | ||||||||||

| Deduct: Capital expenditures |

(50.8 | ) | (39.2 | ) | (33.1 | ) | (44.2 | ) | (37.6 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Free cash flow |

$ | 457.8 | $ | 383.8 | $ | 331.6 | $ | 203.1 | $ | 240.9 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (4) | Net debt represents total debt minus cash and cash equivalents. Net debt is presented because the Company is aware that it is used by securities analysts, investors and other parties in evaluating the Company. (Also see note 2 above). The following table presents the reconciliation of total debt reported in accordance with U.S. GAAP to net debt: |

| December 31, | ||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

| (In millions) | ||||||||||||||||||||

| Total debt |

$ | 1,263.9 | $ | 1,168.5 | $ | 1,041.7 | $ | 1,111.7 | $ | 903.0 | ||||||||||

| Less: Cash and cash equivalents |

(170.4 | ) | (163.2 | ) | (246.4 | ) | (87.0 | ) | (170.1 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net debt |

1,093.5 | 1,005.3 | 795.3 | 1,024.7 | 732.9 | |||||||||||||||

| Stockholders’ equity |

2,052.8 | 1,775.2 | 1,567.0 | 1,287.8 | 1,240.7 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Capitalization (net debt plus stockholders’ equity) |

$ | 3,146.3 | $ | 2,780.5 | $ | 2,362.3 | $ | 2,312.5 | $ | 1,973.6 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net debt as a percentage of capitalization |

34.8 | % | 36.2 | % | 33.7 | % | 44.3 | % | 37.1 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

21

Table of Contents

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

This report includes forward-looking statements based on the Company’s current assumptions, expectations and projections about future events. When used in this report, the words “believes,” “anticipates,” “may,” “expect,” “intend,” “estimate,” “project” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such words. In this report, the Company discloses important factors that could cause actual results to differ materially from management’s expectations. For more information on these and other factors, see “Forward-Looking Information” herein.

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations should be read in conjunction with “Item 1A. Risk Factors,” “Item 6. Selected Financial Data” and the consolidated financial statements and related notes included elsewhere in this Annual Report on Form 10-K.

Business Overview

As a global business, AMETEK’s operations are affected by global, regional and industry economic factors. However, the Company’s strategic geographic and industry diversification, and its mix of products and services, have helped to limit the potential adverse impact of any unfavorable developments in any one industry or the economy of any single country on its consolidated operating results. In 2011, the Company established records for net sales, operating income, operating income margins, net income, diluted earnings per share and operating cash flow. The impact of contributions from recent acquisitions, combined with successful Operational Excellence initiatives, had a positive impact on 2011 results. The Company also benefited from its strategic initiatives under AMETEK’s four growth strategies: Operational Excellence, New Product Development, Global and Market Expansion and Strategic Acquisitions and Alliances. Highlights of 2011 were:

| • | In 2011, net sales were $3.0 billion, an increase of $518.9 million or 21.0% from 2010, on internal growth of approximately 16% in the Electronic Instruments Group (“EIG”) and 6% in the Electromechanical Group (“EMG”) excluding the effect of foreign currency translation, and contributions from the 2010 and 2011 acquisitions. |

| • | Net income for 2011 was $384.5 million, an increase of $100.6 million or 35.4% when compared with $283.9 million in 2010. |

| • | During 2011, the Company completed the following acquisitions: |

| • | In April 2011, the Company acquired Avicenna Technology, Inc. (“Avicenna”), a supplier of custom, fine-featured components used in the medical device industry. |

| • | In May 2011, the Company acquired Coining Holding Company (“Coining”), a leading supplier of custom-shaped metal preforms, microstampings and bonding wire solutions for interconnect applications in microelectronics packaging and assembly. |

| • | In October 2011, the Company acquired Reichert Technologies, a manufacturer of analytical instruments and diagnostic devices for the eye care market. |

| • | In October 2011, the Company acquired EM Test (Switzerland) GmbH, a manufacturer of advanced monitoring, testing, calibrating and display instruments in the electrical immunity testing and emissions measurement markets. |

| • | In December 2011, the Company acquired Technical Manufacturing Corporation (“TMC”), a world leader in high-performance vibration isolation systems and optical test benches used to isolate highly sensitive instruments for the microelectronics, life sciences, photonics and ultra-precision manufacturing industries. |

22

Table of Contents

| • | Higher earnings resulted in record cash flow provided by operating activities that totaled $508.6 million for 2011, a $85.6 million or 20.2% increase from 2010. |

| • | The Company continues to maintain a strong international sales presence. International sales, including U.S. export sales, were $1,501.1 million or 50.2% of net sales in 2011, compared with $1,211.3 million or 49.0% of net sales in 2010. |

| • | New orders for 2011 were $3,072.5 million, an increase of $421.2 million or 15.9% when compared with $2,651.3 million in 2010. As a result, the Company’s backlog of unfilled orders at December 31, 2011 was a year end record at $911.4 million. |

| • | The Company continued its emphasis on investment in research, development and engineering, spending $137.6 million in 2011 before customer reimbursement of $6.1 million. Sales from products introduced in the last three years were $595.2 million or 19.9% of net sales. |