UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

Form 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

For the fiscal year ended December 31, 2019

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

Commission file number: 1-13105

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

(Address of principal executive offices) | (Zip code) |

Registrant’s telephone number, including area code: (314 ) 994-2700

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

☒ | Accelerated filer | ☐ | |

Non-accelerated filer | ☐ | Smaller reporting company | |

Emerging growth company | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting stock held by non-affiliates of the registrant (excluding outstanding shares beneficially owned by directors, officers, other affiliates and treasury shares) as of June 30, 2019 was approximately $1.5 billion.

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☒ No ☐

At January 31, 2020 there were 15,131,573 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement to be filed with the Securities and Exchange Commission in connection with the 2020 annual stockholders’ meeting are incorporated by reference into Part III of this Form 10-K.

TABLE OF CONTENTS

Page | ||

3 |

If you are not familiar with any of the mining terms used in this report, we have provided explanations of many of them under the caption “Glossary of Selected Mining Terms” on page 31 of this report. Unless the context otherwise requires, all references in this report to “Arch,” “we,” “us,” or “our” are to Arch Coal, Inc. and its subsidiaries.

CAUTIONARY STATEMENTS REGARDING FORWARD‑LOOKING INFORMATION

This report contains forward‑looking statements, within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, such as our expected future business and financial performance, and are intended to come within the safe harbor protections provided by those sections. The words “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “predicts,” “projects,” “seeks,” “should,” “will” or other comparable words and phrases identify forward‑looking statements, which speak only as of the date of this report. Forward‑looking statements by their nature address matters that are, to different degrees, uncertain. Actual results may vary significantly from those anticipated due to many factors, including:

• | changes in the demand for our coal, by the electric generation and steel industries; |

• | geologic conditions, weather and other inherent risks of coal mining that are beyond our control; |

• | competition, both within our industry and with producers of competing energy sources, including the effects from any current or future legislation or regulations designed to support, promote or mandate renewable energy sources; |

• | excess production and production capacity; |

• | our ability to acquire or develop coal reserves in an economically feasible manner; |

• | our ability to fund substantial capital expenditures; |

• | inaccuracies in our estimates of our coal reserves; |

• | availability and price of mining and other industrial supplies; |

• | disruptions in the supply of coal from third parties; |

• | availability of skilled employees and other workforce factors; |

• | our ability to collect payments from our customers; |

• | defects in title or the loss of a leasehold interest; |

• | railroad, barge, truck, ocean vessel and other transportation performance and costs; |

• | our ability to successfully integrate the operations that we acquire; |

• | our ability to secure new coal supply arrangements or to renew existing coal supply arrangements; |

• | our relationships with, and other conditions affecting our customers; |

• | the loss of, or significant reduction in, purchases by our largest customers; |

• | our ability to service our outstanding indebtedness; |

• | our ability to comply with the restrictions imposed by our Term Loan Debt Facility, Securitization Facility or Inventory Facility (each as defined below), other financing arrangements or any subsequent financing or credit facilities; |

• | the availability and cost of surety bonds; |

4 |

• | our ability to manage the market and other risks associated with certain trading and other asset optimization strategies; |

• | risks due to our international operations; |

• | cyber-attacks or other security breaches that disrupt our operations, or that result in the unauthorized release of proprietary or confidential information; |

• | the loss of key personnel or the failure to attract additional qualified personnel; |

• | our ability to pay dividends or repurchase shares of our common stock in accordance with our announced intent or at all; |

• | the effects of foreign and domestic trade policies, actions or disputes on the level of trade among the countries and regions in which we operate, the competitiveness of our exports, or our ability to export; |

• | terrorist attacks, military action or war; |

• | our ability to obtain and renew various permits; |

• | existing and future legislation and regulations affecting both our coal mining operations and our customers’ coal usage, governmental policies and taxes, including those aimed at reducing emissions of elements such as mercury, sulfur dioxides, nitrogen oxides, particulate matter or greenhouse gases; |

• | the accuracy of our estimates of reclamation and other mine closure obligations; |

• | the existence of hazardous substances or other environmental contamination on property owned or used by us; |

• | existing and future litigation based on the alleged effects of climate change; |

• | our ability to complete the proposed joint venture transaction with Peabody Energy (“Peabody”) in a timely manner, including obtaining regulatory approvals and satisfying other closing conditions; |

• | our ability to achieve the expected synergies from the joint venture; |

• | our ability to successfully integrate the operations of certain mines in the joint venture; and |

• | other factors, including those discussed in “Legal Proceedings”, set forth in Item 3 of this report and “Risk Factors,” set forth in Item 1A of this report. |

All forward‑looking statements in this report, as well as all other written and oral forward‑looking statements attributable to us or persons acting on our behalf, are expressly qualified in their entirety by the cautionary statements contained in this section and elsewhere in this report. These factors are not necessarily all of the important factors that could affect us. These risks and uncertainties, as well as other risks of which we are not aware or which we currently do not believe to be material, may cause our actual future results to be materially different than those expressed in our forward‑looking statements. These forward‑looking statements speak only as of the date on which such statements were made, and we do not undertake to update our forward‑looking statements, whether as a result of new information, future events or otherwise, except as may be required by the federal securities laws.

5 |

PART I

ITEM 1. BUSINESS

Introduction

We are one of the world’s largest coal producers. For the year ended December 31, 2019, we sold approximately 90 million tons of coal, including approximately 0.5 million tons of coal we purchased from third parties. We sell substantially all of our coal to power plants, steel mills and industrial facilities. At December 31, 2019, we operated 8 active mines located in each of the major coal-producing regions of the United States. The locations of our mines and access to export facilities enable us to ship coal worldwide. We incorporate by reference the information about the geographical breakdown of our coal sales for the respective periods covered within this Form 10-K contained in Note 23 to the Consolidated Financial Statements.

Our History

We were organized in Delaware in 1969 as Arch Mineral Corporation. In July 1997, we merged with Ashland Coal, Inc., a subsidiary of Ashland Inc. that was formed in 1975. As a result of the merger, we became one of the largest producers of low‑sulfur coal in the eastern United States.

In June 1998, we expanded into the western United States when we acquired the coal assets of Atlantic Richfield Company. This acquisition included the Black Thunder and Coal Creek mines in the Powder River Basin of Wyoming, the West Elk mine in Colorado and a 65% interest in Canyon Fuel Company, which operated three mines in Utah. In October 1998, we acquired a leasehold interest in the Thundercloud reserve, a 412‑million‑ton federal reserve tract adjacent to the Black Thunder mine.

In July 2004, we acquired the remaining 35% interest in Canyon Fuel Company. In August 2004, we acquired Triton Coal Company’s North Rochelle mine adjacent to our Black Thunder operation. In September 2004, we acquired a leasehold interest in the Little Thunder reserve, a 719‑million‑ton federal reserve tract adjacent to the Black Thunder mine.

In December 2005, we sold the stock of Hobet Mining, Inc., Apogee Coal Company and Catenary Coal Company and their four associated mining complexes (Hobet 21, Arch of West Virginia, Samples and Campbells Creek) and approximately 455 million tons of coal reserves in Central Appalachia to Magnum Coal Company, which was subsequently acquired by Patriot Coal Corporation.

In October 2009, we acquired Rio Tinto’s Jacobs Ranch mine complex in the Powder River Basin of Wyoming, which included 345 million tons of low‑cost, low‑sulfur coal reserves, and integrated it into the Black Thunder mine.

In June 2011, we acquired International Coal Group, Inc., which owned and operated mines primarily in the Appalachian Region of the United States.

In August 2013, we sold the equity interests of Canyon Fuel Company, LLC (“Canyon Fuel”), which owned and operated our Utah operations.

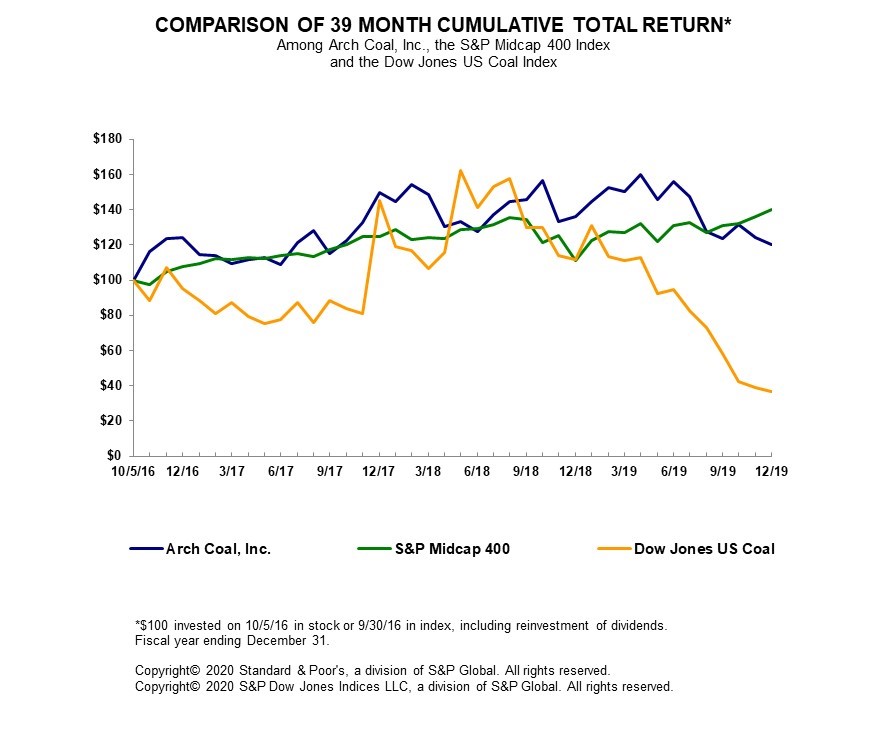

In January 2016, Arch and substantially all of its wholly owned domestic subsidiaries (the “Filing Subsidiaries” and, together with Arch, the “Debtors”) filed voluntary petitions for reorganization (collectively, the “Bankruptcy Petitions”) under Chapter 11 of Title 11 of the U.S. Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the Eastern District of Missouri (the “Court”). The Debtor’s Chapter 11 Cases (collectively, the “Chapter 11 Cases”) were jointly administered under the caption In re Arch Coal, Inc., et al., Case No. 16-40120 (lead case). During the bankruptcy proceedings, each Debtor operated its business as a “debtor in possession” under the jurisdiction of the Court and in accordance with the applicable provisions of the Bankruptcy Code and the orders of the Court.

In September 2016, the Bankruptcy Court entered an order, Docket No. 1324, confirming the Debtors’ Fourth Amended Joint Plan of Reorganization under Chapter 11 of the Bankruptcy Code (the “Plan”).

In October 2016, Arch Coal emerged from Chapter 11 and the Plan became effective on such date (the “Effective Date”).

6 |

For additional information, see Note 3, “Emergence from Bankruptcy,” to our Consolidated Financial Statements included within this Form 10-K.

In June 2019, Arch Coal entered into a definitive implementation agreement (the “Implementation Agreement”) with Peabody Energy Corporation (“Peabody”), to establish a joint venture that will combine the respective Powder River Basin and Colorado mining operations of Arch Coal and Peabody. Pursuant to the terms of the Implementation Agreement, Arch Coal will hold a 33.5% economic interest, and Peabody will hold a 66.5% economic interest in the joint venture. At the closing of the joint venture transaction, certain of the respective subsidiaries of Arch Coal and Peabody will enter into an Amended and Restated Limited Liability Company Agreement (the “LLC Agreement”). Under the terms of the LLC Agreement, the governance of the joint venture will be overseen by the joint venture’s board of managers, which will initially be comprised of three representatives appointed by Peabody and two representatives appointed by Arch. Decisions of the board of managers will be determined by a majority vote subject to certain specified matters set forth in the LLC Agreement that will require a supermajority vote. Peabody, or one of its affiliates, will initially be appointed as the operator of the joint venture and will manage the day-to-day operations of the joint venture, subject to the supervision of the joint venture’s board of managers.

Formation of the joint venture is subject to customary closing conditions, including the termination or expiration of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, the receipt of certain other required regulatory approvals and the absence of injunctions or other legal restraints preventing the formation of the joint venture. Formation of the joint venture does not require approval of the respective stockholders of either Arch or Peabody.

Coal Characteristics

End users generally characterize coal as thermal coal or metallurgical coal. Heat value, sulfur, ash, moisture content, and volatility, in the case of metallurgical coal, are important variables in the marketing and transportation of coal. These characteristics help producers determine the best end use of a particular type of coal. The following is a description of these general coal characteristics:

Heat Value. In general, the carbon content of coal supplies most of its heating value, but other factors also influence the amount of energy it contains per unit of weight. The heat value of coal is commonly measured in Btus. Coal is generally classified into four categories, lignite, subbituminous, bituminous and anthracite, reflecting the progressive response of individual deposits of coal to increasing heat and pressure. Anthracite is coal with the highest carbon content and, therefore, the highest heat value, nearing 15,000 Btus per pound. Bituminous coal, used primarily to generate electricity and to make coke for the steel industry, has a heat value ranging between 10,500 and 15,500 Btus per pound. Subbituminous coal ranges from 8,300 to 13,000 Btus per pound and is generally used for electric power generation. Lignite coal is a geologically young coal which has the lowest carbon content and a heat value ranging between 4,000 and 8,300 Btus per pound.

Sulfur Content. Federal and state environmental regulations, including regulations that limit the amount of sulfur dioxide that may be emitted as a result of combustion, have affected and may continue to affect the demand for certain types of coal. The sulfur content of coal can vary from seam to seam and within a single seam. The chemical composition and concentration of sulfur in coal affects the amount of sulfur dioxide produced in combustion. Coal‑fueled power plants can comply with sulfur dioxide emission regulations by burning coal with low sulfur content, blending coals with various sulfur contents, purchasing emission allowances on the open market and/or using sulfur dioxide emission reduction technology.

Ash. Ash is the inorganic residue remaining after the combustion of coal. As with sulfur, ash content varies from seam to seam. Ash content is an important characteristic of coal because it impacts boiler performance and electric generating plants must handle and dispose of ash following combustion. The composition of the ash, including the proportion of sodium oxide and fusion temperature, is also an important characteristic of coal, as it helps to determine the suitability of the coal to end users. The absence of ash is also important to the process by which metallurgical coal is transformed into coke for use in steel production.

Moisture. Moisture content of coal varies by the type of coal, the region where it is mined and the location of the coal within a seam. In general, high moisture content decreases the heat value and increases the weight of the coal, thereby making it more expensive to transport. Moisture content in coal, on an as‑sold basis, can range from approximately 2% to over 30% of the coal’s weight.

Other. Users of metallurgical coal measure certain other characteristics, including fluidity, swelling capacity and volatility to assess the strength of coke produced from a given coal or the amount of coke that certain types of coal will yield. These characteristics may be important elements in determining the value of the metallurgical coal we produce and market.

7 |

The Coal Industry

Background. Coal is mined globally using various methods of surface and underground recovery. Coal is used primarily for the generation of electric power and steel production but is also used for chemical, food and cement processing. Coal is traded globally and can be transported to demand centers by ocean-going vessels, rail, barge, truck or conveyor belt.

Total world coal production increased around 3.3% to approximately 7.8 billion metric tons in 2019 according to preliminary data from the International Energy Agency (IEA). China is the largest producer of coal in the world, producing over 3.6 billion metric tons in 2019 according to the Chinese National Bureau of Statistics. The United States and India follow China with total coal production of over 600 million metric tons each in 2019 based on preliminary data.

The primary nations that are supplying coal to the global power and steel markets are Australia and Indonesia, as well as Russia, the United States, Canada, Colombia and South Africa.

We produce coal used for electric power generation (thermal) and coal used in the production of steel (metallurgical). All of our thermal coal production occurs in the United States at mines located in Wyoming, Colorado and Illinois. All of our metallurgical coal is produced at operations in West Virginia. Heat value and sulfur content are the most important variables in the economic marketing and transportation of thermal coal. Carbon content, the composition of the non-carbon volatiles and other chemical constituents are critical characteristics for metallurgical coal.

Much of our coal is sold at the mine where title and risk of loss transfer to the customer as coal is loaded into the railcar or truck. Customers are generally responsible for transportation - typically using third party carriers. There are, however, some agreements where we retain responsibility for the coal during delivery to the customer site or intermediate terminal. Our international coal usually changes title and risk of loss as coal is loaded on an ocean vessel. Normally we contract for transportation services from the mine to the ocean loading port. On rare occasion, we retain title to the coal to the ocean delivery port.

We seek to establish long-term relationships with customers through exemplary customer service while operating safe and environmentally responsible mines. In 2019, we shipped to 31 states and 16 countries. During the year, we supplied coal to 84 domestic and 33 foreign customers. In 2019, approximately 92% of our coal sales volume was sold as a thermal product with the remaining 8% as metallurgical. However, due to the significantly higher selling price of our metallurgical coal, our metallurgical segment contributed 43% of our sales revenue in 2019.

Coal was used to produce approximately 24% of the electric power generated in the U.S. in 2019 based on preliminary data from the Energy Information Administration (EIA.) The coal we produced fueled approximately 3.4% of the electricity produced in the U.S. in 2019. We also exported 5% of our thermal coal production to customers outside the U.S. in 2019.

We rank among the largest metallurgical coal producers in the U.S. Based on internal estimates, we produced around 9% of total U.S. metallurgical coal in 2019. Our metallurgical coal was sold to 3 domestic customers and shipped to 16 international destinations in 2019.

We operate in a very competitive environment. We compete with domestic and international coal producers, traders or brokers as well as producers of other energy sources including natural gas, renewables and nuclear, as well as other non-coal based forms of steel production. We compete using price, coal quality, transportation, optionality, customer administration, reputation and reliability.

Coal demand and coal prices are tied to coal consumption patterns which are influenced by many uncontrollable factors. For power generation, the price of coal is affected by the relative supply and demand of competitive coal, transportation, availability and price of other non-coal forms of power production (particularly, natural gas but also renewables), regulatory limits on using coal, taxes, the weather and economic conditions. For metallurgical coal, the price of coal is affected by the supply, demand and price of competitive coal, transportation, the price of steel, demand for steel, as well as regulations, taxes and economic conditions.

We have an experienced and knowledgeable sales and marketing group. This group is dedicated to meeting customer needs, coordinating transportation, providing accounting services and managing risk.

U.S. Coal Production. The United States is among the top three largest coal producers in the world, exceeded only by China and roughly equivalent to India based on preliminary data. According to the EIA, there are over 250 billion short tons of

8 |

recoverable coal in the United States. The U.S. Department of Energy estimates that current domestic recoverable coal reserves could supply enough electricity to satisfy domestic demand for over 300 years.

Coal is mined from coal basins throughout the United States, with the major production centers located in the western United States, the Appalachian region and the Interior. According to the EIA and Mine Safety and Health Administration (MSHA), U.S. coal production decreased by an estimated 51 million tons in 2019, to around 705 million tons.

The EIA subdivides United States coal production into three major areas: Western, Appalachia and Interior.

The Western area includes the Powder River Basin and the Western Bituminous region. According to the EIA, coal produced in the western United States decreased from an estimated 418 million short tons in 2018 to 381 million short tons in 2019. The Powder River Basin is located in northeastern Wyoming and southeastern Montana and is the largest producing region in the United States. Coal from this region is sub-bituminous coal with low sulfur content ranging from 0.2% to 0.9% and heating values ranging from 8,300 to 9,500 Btu. Powder River Basin coal generally has a lower heat content than other regions and is produced from thick seams using surface recovery methods. The Western Bituminous region includes Colorado, Utah and southern Wyoming. Coal from this region typically has low sulfur content ranging from 0.4% to 0.8% and heating values ranging from 10,000 to 12,200 Btu. Western bituminous coal has certain quality characteristics, especially its higher heat content and low sulfur, that make this a desirable coal for domestic and international power producers.

The Appalachia region is divided into north, central and southern regions. According to the EIA, coal produced in the Appalachian region decreased from 201 million short tons in 2018 to 193 million short tons in 2019. Appalachian coal is located near the prolific eastern shale-gas producing regions. Central Appalachian thermal coal is disadvantaged for power generation because of the depletion of economically attractive reserves, increasing costs of production and permitting issues. However, virtually all U.S. metallurgical coal is produced in Appalachia and the relative scarcity and high-quality of this coal allows for a pricing premium over thermal coal. Appalachia, while still a major producer of thermal coal, is undergoing a shift towards heavier reliance on metallurgical coal production for both domestic and international use. This is especially the case in Central Appalachia.

Northern Appalachia includes Pennsylvania, Northern West Virginia, Ohio and Maryland. Coal from this region generally has a high heat value ranging from 10,300 to 13,500 Btu and a sulfur content ranging from 0.8% to 4.0%. Central Appalachia includes Southern West Virginia, Virginia, Kentucky and Northern Tennessee. Coal mined from this region generally has a high heat value ranging from 11,400 to 13,200 Btu and low sulfur content ranging from 0.2% to 2.0%. Southern Appalachia primarily covers Alabama and generally has a heat content ranging from 11,300 to 12,300 Btu and a sulfur content ranging from 0.7% to 3.0%. Southern Appalachia mines are primarily focused on metallurgical markets.

The Interior region includes the Illinois Basin and Gulf Lignite production in Texas and Louisiana, and a small producing area in Kansas, Oklahoma, Missouri and Arkansas. The Illinois Basin is the largest producing region in the Interior and consists of Illinois, Indiana and western Kentucky. According to the EIA, coal produced in the Interior region decreased from 137 million short tons in 2018 to approximately 131 million short tons in 2019. Coal from the Illinois Basin generally has a heat value ranging from 10,100 to 12,600 Btu and has a sulfur content ranging from 1.0% to 4.3%. Despite its high sulfur content, coal from the Illinois Basin can generally be used by electric power generation facilities that have installed emissions control devices, such as scrubbers.

Coal Mining Methods

The geological characteristics of our coal reserves largely determine the coal mining method we employ. We use two primary methods of mining coal: surface mining and underground mining.

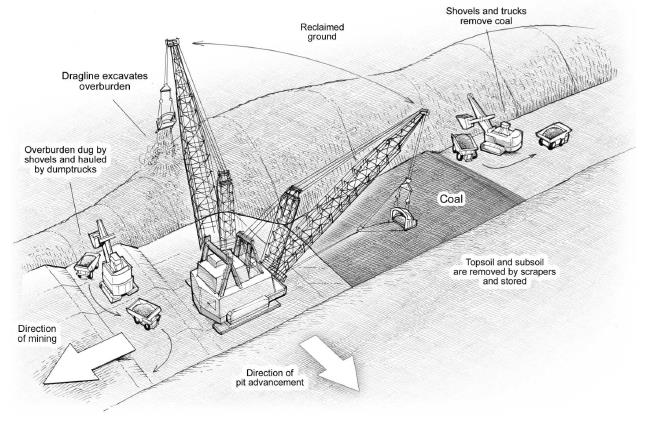

Surface Mining. We use surface mining when coal is found close to the surface. We have included the identity and location of our surface mining operations below under “Our Mining Operations-General.” The majority of the thermal coal we produce comes from surface mining operations.

Surface mining involves removing the topsoil then drilling and blasting the overburden (earth and rock covering the coal) with explosives. We then remove the overburden with heavy earth‑moving equipment, such as draglines, power shovels, excavators and loaders. Once exposed, we drill, fracture and systematically remove the coal using haul trucks or conveyors to transport the coal to a preparation plant or to a loadout facility. We reclaim disturbed areas as part of our normal mining activities. After final coal removal, we use draglines, power shovels, excavators or loaders to backfill the remaining pits with the overburden removed at the beginning of the process. Once we have replaced the overburden and topsoil, we reestablish

9 |

vegetation and plant life into the natural habitat and make other improvements that have local community and environmental benefits.

The following diagram illustrates a typical dragline surface mining operation:

10 |

Underground Mining. We use underground mining methods when coal is located deep beneath the surface. We have included the identity and location of our underground mining operations below under “Our Mining Operations-General.”

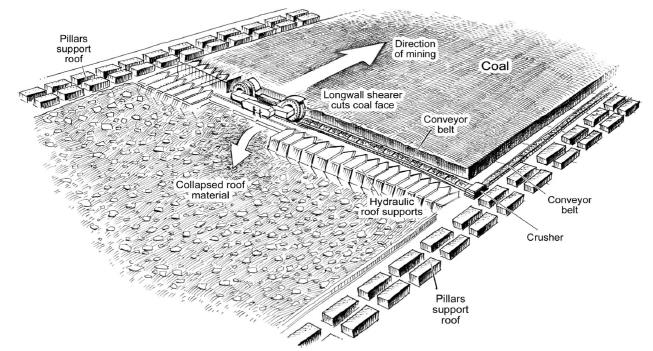

Our underground mines are typically operated using one or both of two different mining techniques: longwall mining and room‑and‑pillar mining.

Longwall Mining. Longwall mining involves using a mechanical shearer to extract coal from long rectangular blocks of medium to thick seams. Ultimate seam recovery using longwall mining techniques can exceed 75%. In longwall mining, continuous miners are used to develop access to these long rectangular coal blocks. Hydraulically powered supports temporarily hold up the roof of the mine while a rotating drum mechanically advances across the face of the coal seam, cutting the coal from the face. Chain conveyors then move the loosened coal to an underground mine conveyor system for delivery to the surface. Once coal is extracted from an area, the roof is allowed to collapse in a controlled fashion. The following diagram illustrates a typical underground mining operation using longwall mining techniques:

Room‑and‑Pillar Mining. Room‑and‑pillar mining is effective for small blocks of thin coal seams. In room‑and‑pillar mining, a network of rooms is cut into the coal seam, leaving a series of pillars of coal to support the roof of the mine. Continuous miners are used to cut the coal and shuttle cars are used to transport the coal to a conveyor belt for further transportation to the surface. The pillars generated as part of this mining method can constitute up to 40% of the total coal in a seam. Higher seam recovery rates can be achieved if retreat mining is used. In retreat mining, coal is mined from the pillars as workers retreat. As retreat mining occurs, the roof is allowed to collapse in a controlled fashion.

11 |

The following diagram illustrates our typical underground mining operation using room‑and‑pillar mining techniques:

Coal Preparation and Blending. We crush the coal mined from our Powder River Basin mining complexes and ship it directly from our mines to the customer. Typically, no additional preparation is required for a saleable product. Coal extracted from some of our underground mining operations contains impurities, such as rock, shale and clay occupying a wide range of particle sizes. All of our mining operations in the Appalachia region use a coal preparation plant located near the mine or connected to the mine by a conveyor. These coal preparation plants allow us to treat the coal we extract from those mines to ensure a consistent quality and to enhance its suitability for particular end‑users. In addition, depending on coal quality and customer requirements, we may blend coal mined from different locations, including coal produced by third parties, in order to achieve a more suitable product.

The treatments we employ at our preparation plants depend on the size of the raw coal. For coarse material, the separation process relies on the difference in the density between coal and waste rock and, for the very fine fractions, the separation process relies on the difference in surface chemical properties between coal and the waste minerals. To remove impurities, we crush raw coal and classify it into various sizes. For the largest size fractions, we use dense media vessel separation techniques in which we float coal in a tank containing a liquid of a pre‑determined specific gravity. Since coal is lighter than its impurities, it floats, and we can separate it from rock and shale. We treat intermediate sized particles with dense medium cyclones, in which a liquid is spun at high speeds to separate coal from rock. Fine coal is treated in spirals, in which the differences in density between coal and rock allow them, when suspended in water, to be separated. Ultra fine coal is recovered in column flotation cells utilizing the differences in surface chemistry between coal and rock. By injecting stable air bubbles through a suspension of ultra-fine coal and rock, the coal particles adhere to the bubbles and rise to the surface of the column where they are removed. To minimize the moisture content in coal, we process most coal sizes through centrifuges. A centrifuge spins coal very quickly, causing water accompanying the coal to separate.

For more information about the locations of our preparation plants, you should see the section entitled “Our Mining Operations.”

12 |

Our Mining Operations

General. At December 31, 2019, we operated 8 active mines in the United States. Our reportable business segments are based on two distinct lines of business, metallurgical coal and thermal coal, and may include a number of mine complexes. We manage our coal sales by market, not by individual mining complex. Geology, coal transportation routes to customers, and regulatory environments also have a significant impact on our marketing and operations management. Our mining operations are evaluated based on Adjusted EBITDA, per-ton cash operating costs (defined as including all mining costs except depreciation, depletion, amortization, accretion on asset retirements obligations, and pass-through transportation expenses), and on other non-financial measures, such as safety and environmental performance. Adjusted EBITDA is defined as net income attributable to the Company before the effect of net interest expense, income taxes, depreciation, depletion and amortization, the amortization of sales contracts, and the accretion on asset retirement obligations. Adjusted EBITDA may also be adjusted for items that may not reflect the trend of future results by excluding transactions that are not indicative of our core operating performance. We use Adjusted EBITDA to measure the operating performance of our segments and allocate resources to our segments. Adjusted EBITDA is not a measure of financial performance in accordance with generally accepted accounting principles, and items excluded from Adjusted EBITDA are significant in understanding and assessing our financial condition. Therefore, Adjusted EBITDA should not be considered in isolation, nor as an alternative to net income, income from operations, cash flows from operations or as a measure of our profitability, liquidity or performance under generally accepted accounting principles. Furthermore, analogous measures are used by industry analysts to evaluate the Company’s operating performance. Investors should be aware that our presentation of Adjusted EBITDA may not be comparable to similarly titled measures used by other companies. Our reportable segments are the Powder River Basin (PRB) segment containing our primary thermal operations in Wyoming; the Metallurgical (MET) segment, containing our metallurgical operations in West Virginia and the Other Thermal segment containing our supplementary thermal operations in Colorado and Illinois. For additional information about the operating results of each of our segments for the years ended December 31, 2019, 2018, and 2017, see Note 26, “Segment Information” to our Consolidated Financial Statements.

In December of 2019 we sold our Coal-Mac operation, Coal-Mac LLC, which had been part of our Other Thermal segment, to Condor Holdings LLC. For further information on the sale of Coal-Mac LLC to Condor Holdings LLC, please see Note 5 to the Consolidated Financial Statements, “Divestitures.”

In general, we have developed our mining complexes and preparation plants at strategic locations in close proximity to rail or barge shipping facilities. Coal is transported from our mining complexes to customers by means of railroads, trucks, barge lines, and ocean‑going vessels from terminal facilities. We currently own or lease under long‑term arrangements all of the equipment utilized in our mining operations. We employ sophisticated preventative maintenance and rebuild programs and upgrade our equipment to ensure that it is productive, well-maintained and cost-competitive.

13 |

The following table provides a summary of information regarding our active mining complexes as of December 31, 2019, including the total sales associated with these complexes for the years ended December 31, 2019, 2018, and 2017 and the total assigned reserves associated with these complexes at December 31, 2019. The amount disclosed below for the total cost of property, plant and equipment of each mining complex does not include the costs of the coal reserves that we have assigned to an individual complex.

Tons Sold (1) | |||||||||||||||

Mining Complex | Mines | Mining Equipment | Railroad | 2017 | 2018 | 2019 | Total Cost of Property, Plant and Equipment at December 31, 2019 | Total Assigned Recoverable Reserves | |||||||

($ millions) | (Million tons) | ||||||||||||||

Powder River Basin: | |||||||||||||||

Black Thunder | S | D, S | UP/BN | 70.5 | 71.1 | 72.0 | $ | 299.4 | 747.7 | ||||||

Coal Creek | S | D, S | UP/BN | 9.0 | 8.0 | 2.6 | 44.5 | 92.2 | |||||||

Metallurgical: | |||||||||||||||

Mountain Laurel | U | CM | CSX | 1.5 | 1.9 | 1.4 | 32.6 | 21.4 | |||||||

Beckley | U | CM | CSX | 1.0 | 1.0 | 1.0 | 63.5 | 25.5 | |||||||

Leer South/Sentinel | U | CM | CSX | 1.5 | 1.2 | 1.1 | 197.5 | 43.2 | |||||||

Leer | U | LW, CM | CSX | 3.2 | 3.5 | 4.1 | 252.9 | 48.3 | |||||||

Other Thermal: | |||||||||||||||

West Elk | U | LW, CM | UP | 4.9 | 4.8 | 4.1 | 49.9 | 50.5 | |||||||

Viper | U | CM | — | 1.7 | 1.8 | 1.5 | 35.3 | 40.4 | |||||||

Totals | 93.3 | 93.3 | 87.8 | $ | 975.6 | 1,069.2 | |||||||||

S = Surface mine | D = Dragline | UP = Union Pacific Railroad |

U = Underground mine | S = Shovel/truck | CSX = CSX Transportation |

LW = Longwall | BN = Burlington Northern‑Santa Fe Railway | |

CM = Continuous miner | ||

(1) | Tons of coal we purchased from third parties that were not processed through our loadout facilities are not included in the amounts shown in the table above. |

14 |

Powder River Basin

Black Thunder. Black Thunder is a surface mining complex located on approximately 35,400 acres in Campbell County, Wyoming. The Black Thunder complex extracts thermal coal from the Upper Wyodak and Main Wyodak seams.

We control a significant portion of the coal reserves through federal and state leases. The Black Thunder mining complex had approximately 747.7 million tons of proven and probable reserves at December 31, 2019.

The Black Thunder mining complex currently consists of four active pit areas and two active loadout facilities. We ship all of the coal raw to our customers via the Burlington Northern Santa Fe and Union Pacific railroads. We do not process the coal mined at this complex. Each of the loadout facilities can load a 15,000‑ton train in less than two hours.

Coal Creek. Coal Creek is a surface mining complex located on approximately 7,400 acres in Campbell County, Wyoming. The Coal Creek mining complex extracts thermal coal from the Wyodak‑R1 and Wyodak‑R3 seams.

We control a significant portion of the coal reserves through federal and state leases. The Coal Creek mining complex had approximately 92.2 million tons of proven and probable reserves at December 31, 2019.

The Coal Creek complex currently consists of one active pit area and a loadout facility. We ship all of the coal raw to our customers via the Burlington Northern Santa Fe and Union Pacific railroads. We do not process the coal mined at this complex. The loadout facility can load a 15,000‑ton train in less than three hours.

Metallurgical

Mountain Laurel. Mountain Laurel is an underground mining complex located on approximately 38,200 acres in Logan County and Boone County, West Virginia. Underground mining operations at the Mountain Laurel mining complex extracts High-vol B metallurgical coal from the Cedar Grove and Alma seams, and we are currently developing access to further High-vol B reserves in the 2 Gas seam. Including the 2 Gas seam, the Mountain Laurel mining complex has approximately 21.4 million tons of proven and probable reserves at December 31, 2019.

We process all of the coal through a 1,400‑ton‑per‑hour preparation plant before shipping the coal to our customers via the CSX railroad. The loadout facility can load a 15,000‑ton train in less than four hours.

Beckley. The Beckley mining complex is located on approximately 19,700 acres in Raleigh County, West Virginia. Beckley is extracting high quality, low‑volatile metallurgical coal in the Pocahontas No. 3 seam. The Beckley mining complex had approximately 25.5 million tons of proven and probable reserves at December 31, 2019.

Coal is belted from the mine to a 600‑ton‑per‑hour preparation plant before shipping the coal via the CSX railroad. The loadout facility can load a 10,000‑ton train in less than four hours.

Leer South/Sentinel. The Leer South/Sentinel mining complex consists of the existing Sentinel underground mine in the Clarion seam, the Leer South longwall operation being developed in the Lower Kittanning seam, a preparation plant and a loadout facility located on approximately 26,000 acres in Barbour County, West Virginia. Plant and coal handling facilities are being upgraded to handle longwall volumes and will include a 1,600 ton-per-hour preparation plant located near the mine, as well as a loadout facility served by the CSX railroad and connected to the plant by a 4,000 ton-per-hour conveyor system. The loadout facility will be capable of loading a 15,000 ton unit train in less than four hours.

Coal quality is primarily High-vol A metallurgical coal similar to our Leer Complex. The Leer South/Sentinel mining complex had approximately 43.2 million tons of proven and probable reserves at December 31, 2019. Full production will not be realized until the longwall is placed into service in the second half of 2021. A significant portion of the reserves at Leer South are owned rather than leased from third parties.

Leer. The Leer Complex, located in Taylor County, West Virginia, includes approximately 48.3 million tons of coal reserves as of December 31, 2019 and has primarily High-vol A metallurgical quality coal in the Lower Kittanning seam, and is part of approximately 92,600 acres that is considered our Tygart Valley area. Substantially all of the reserves at Leer are owned rather than leased from third parties.

All the production is processed through a 1,400 ton‑per‑hour preparation plant and loaded on the CSX railroad. A 15,000‑ton train can be loaded in less than four hours.

15 |

Other Thermal

West Elk. West Elk is an underground mining complex located on approximately 18,500 acres in Gunnison County, Colorado. The West Elk mining complex extracts thermal coal from the E seam.

We control a significant portion of the coal reserves through federal and state leases. The West Elk mining complex had approximately 50.5 million tons of proven and probable reserves at December 31, 2019.

The West Elk complex currently consists of a longwall, continuous miner sections and a loadout facility. We ship most of the coal raw to our customers via the Union Pacific railroad. The loadout facility can load an 11,000‑ton train in less than three hours.

Viper. The Viper mining complex consists of one underground coal mine and a preparation plant located on approximately 40,200 acres in central Illinois near the city of Springfield. Mining operations extract thermal coal from the Illinois No. 5 seam, also referred to as the Springfield seam. All coal is processed through an 800 ton‑per‑hour preparation plant and shipped to customers by on‑highway trucks.

We control a significant portion of the coal reserves through private leases. As of December 31, 2019, we had approximately 40.4 million tons of proven and probable reserves.

Sales, Marketing and Trading

Overview. Coal prices are influenced by a number of factors and can vary materially by region. The price of coal within a region is influenced by general marketplace conditions, the supply and price of alternative fuels to coal (such as natural gas and renewables), production costs, coal quality, transportation costs involved in moving coal from the mine to the point of use and mine operating costs. For example, in thermal coal markets, higher heat and lower ash content generally result in higher prices, and higher sulfur and higher ash content generally result in lower prices within a given geographic region. In metallurgical coal markets, chemical properties within the coal determine price differences.

The cost of coal at the mine is also influenced by geologic characteristics such as seam thickness, overburden ratios and depth of underground reserves. It is generally less expensive to mine coal seams that are thick and located close to the surface than to mine thin underground seams. Within a particular geographic region, underground mining, which is the primary mining method we use in certain of our Appalachian mines, is generally more expensive than surface mining, which is the mining method we use in the Powder River Basin. This is the case because of the higher capital costs, including costs for construction of extensive ventilation systems, and higher per unit labor costs due to lower productivity associated with underground mining.

Our sales, marketing and trading functions are principally based in St. Louis, Missouri and consist of sales and trading, transportation and distribution, quality control and contract administration personnel as well as revenue management. We also have sales representatives in our Singapore and London offices. In addition to selling coal produced from our mining complexes, from time to time we purchase and sell coal mined by others, some of which we blend with coal produced from our mines. We focus on meeting the needs and specifications of our customers rather than just selling our coal production.

Customers. The Company markets its thermal and metallurgical coal to steel producers, domestic and foreign power generators, and other industrial facilities. For the year ended December 31, 2019, we derived approximately 21% of our total coal revenues from sales to our three largest customers, ArcelorMittal, T S Global Procurement Company Pte. and Southern Company and approximately 47% of our total coal revenues from sales to our 10 largest customers.

In 2019, we sold coal to domestic customers located in 31 different states. The locations of our mines enable us to ship coal to most of the major coal-fueled power plants in the United States.

In addition, in 2019 we exported coal to Europe, Asia, Central and South America and Africa. Exports to seaborne countries were $1.0 billion, $1.1 billion and $0.7 billion for the years ended December 31, 2019, 2018 and 2017, respectively. As of December 31, 2019 and 2018, trade receivables related to metallurgical‑quality coal sales totaled $98.6 million and $126.5 million, respectively, or 59% and 63% of total trade receivables, respectively. We do not have foreign currency exposure for our international sales as all sales are denominated and settled in U.S. dollars.

16 |

The Company’s seaborne revenues by coal shipment destination for the year ended December 31, 2019, were as follows:

(In thousands) | |||

Europe | $ | 537,117 | |

Asia | 322,029 | ||

Central and South America | 82,476 | ||

Africa | 18,698 | ||

Total | $ | 960,320 | |

Long-Term Coal Supply Arrangements

As is customary in the coal industry, we enter into fixed price, fixed volume long-term supply contracts, the terms of which are sometimes more than one year, with many of our customers. Multiple year contracts usually have specific and possibly different volume and pricing arrangements for each year of the contract. Long-term contracts allow customers to secure a supply for their future needs and provide us with greater predictability of sales volume and sales prices. In 2019, we sold approximately 56% of our coal under long-term supply arrangements. The majority of our supply contracts include a fixed price for the term of the agreement or a pre-determined escalation in price for each year. Some of our long-term supply agreements may include a variable pricing system. While most of our sales contracts are for terms of one to five years, some are as short as one month. At December 31, 2019, the average volume‑weighted remaining term of our long-term contracts for metallurgical and thermal coal was approximately 2.7 years, with remaining terms ranging from one to four years. At December 31, 2019, remaining tons under long-term supply agreements, including those subject to price re-opener or extension provisions, were approximately 129 million tons.

We typically sell coal to North American customers under long‑term arrangements through a “request‑for‑proposal” process. The terms of our coal sales agreements are dictated by general marketplace conditions, the availability and price of alternative fuels, the quality of the coal we have available to sell, our mine operations (including operating costs), the length of contract, as well as negotiations with customers. Consequently, the terms of these contracts may vary to some extent by customer, including base price adjustment features, price re‑opener terms, coal quality requirements, quantity parameters, permitted sources of supply, future regulatory changes, extension options, force majeure, termination, damages and assignment provisions. Our long‑term supply contracts typically contain provisions to adjust the base price due to new statutes, ordinances or regulations. We typically sell our metallurgical coal to non-North American customers based on various indices or agreements to mutually negotiate the price. These agreements generally are for one year and can reset pricing with each shipment. Additionally, some of our contracts contain provisions that allow for the recovery of costs affected by modifications or changes in the interpretations or application of any applicable statute by local, state or federal government authorities. These provisions only apply to the base price of coal contained in these supply contracts. In some circumstances, a significant adjustment in base price can lead to termination of the contract.

Certain of our contracts contain index provisions that change the price based on changes in market based indices or changes in economic indices or both. Certain of our contracts contain price re‑opener provisions that may allow a party to commence a renegotiation of the contract price at a pre‑determined time. Price re‑opener provisions may automatically set a new price based on prevailing market price or, in some instances, require us to negotiate a new price, sometimes within a specified range of prices. In a limited number of agreements, if the parties do not agree on a new price, either party has an option to suspend the agreement for the pricing period not agreed to. In addition, certain of our contracts contain clauses that may allow customers to terminate the contract in the event of certain changes in environmental laws and regulations that impact their operations.

Coal quality and volumes are stipulated in coal sales agreements. In most cases, the annual pricing and volume obligations are fixed, although in some cases the volume specified may vary depending on the customer consumption requirements. Most of our coal sales agreements contain provisions requiring us to deliver coal within certain ranges for specific coal characteristics such as heat content (for thermal coal contracts), volatile matter (for metallurgical coal contracts), and for both types of contracts, sulfur, ash and moisture content. Failure to meet these specifications can result in economic penalties, suspension or cancellation of shipments or termination of the contracts.

Our coal sales agreements also typically contain force majeure provisions allowing temporary suspension of performance by us or our customers, during the duration of events beyond the control of the affected party, including events such as strikes, adverse mining conditions, mine closures or serious transportation problems that affect us or unanticipated plant

17 |

outages that may affect the buyer. Our contracts also generally provide that in the event a force majeure circumstance exceeds a certain time period, the unaffected party may have the option to terminate the purchase or sale in whole or in part. Some contracts stipulate that this tonnage can be made up by mutual agreement or at the discretion of the buyer. Agreements between our customers and the railroads servicing our mines may also contain force majeure provisions.

In most of our thermal coal contracts, we have a right of substitution (unilateral or subject to counterparty approval), allowing us to provide coal from different mines, including third‑party mines, as long as the replacement coal meets quality specifications and will be sold at the same equivalent delivered cost.

In some of our coal supply contracts, we agree to indemnify or reimburse our customers for damage to their or their rail carrier’s equipment while on our property, which results from our or our agents’ negligence, and for damage to our customer’s equipment due to non‑coal materials being included with our coal while on our property.

Trading. In addition to marketing and selling coal to customers through traditional coal supply arrangements, we seek to optimize our coal production and leverage our knowledge of the coal industry through a variety of other marketing, trading and asset optimization strategies. From time to time, we may employ strategies to use coal and coal‑related commodities and contracts for those commodities in order to manage and hedge volumes and/or prices associated with our coal sales or purchase commitments, reduce our exposure to the volatility of market prices or augment the value of our portfolio of traditional assets. These strategies may include physical coal contracts, as well as a variety of forward, futures or options contracts, swap agreements or other financial instruments, in coal or other commodities such as natural gas.

We maintain a system of complementary processes and controls designed to monitor and manage our exposure to market and other risks that may arise as a consequence of these strategies. These processes and controls seek to preserve our ability to profit from certain marketing, trading and asset optimization strategies while mitigating our exposure to potential losses. You should see Item 7A, entitled “Quantitative and Qualitative Disclosures About Market Risk” for more information about the market risks associated with these strategies at December 31, 2019.

Transportation. We ship our coal to domestic customers by means of railcars, barges, or trucks, or a combination of these means of transportation. We generally sell coal used for domestic consumption free on board (f.o.b.) at the mine or nearest loading facility. Our domestic customers normally bear the costs of transporting coal by rail, barge or truck.

Historically, most domestic electricity generators have arranged long‑term shipping contracts with rail, trucking or barge companies to assure stable delivery costs. Transportation can be a large component of a purchaser’s total cost. Although the purchaser pays the freight, transportation costs still are important to coal mining companies because the purchaser may choose a supplier largely based on cost of transportation. Transportation costs borne by the customer vary greatly based on each customer’s proximity to the mine and our proximity to the loadout facilities. Trucks and overland conveyors haul coal over shorter distances, while barges, Great Lake carriers and ocean vessels move coal to export markets and domestic markets requiring shipment over the Great Lakes and several river systems.

Most coal mines are served by a single rail company, but much of the Powder River Basin is served by two rail carriers: the Burlington Northern‑Santa Fe railroad and the Union Pacific railroad. We generally transport coal produced at our Appalachian mining complexes via the CSX railroad. Besides rail deliveries, some customers in the eastern United States rely on a river barge system.

We generally sell coal to international customers at export terminals, and we are usually responsible for the cost of transporting coal to the export terminals. We transport our coal to Atlantic coast terminals, Pacific cost terminals or terminals along the Gulf of Mexico for transportation to international customers. Our international customers are generally responsible for paying the cost of ocean freight. We may also sell coal to international customers delivered to an unloading facility at the destination country.

We own a 35% interest in Dominion Terminal Associates, a partnership that operates a ground storage‑to‑vessel coal transloading facility in Newport News, Virginia. The facility has a rated throughput capacity of 20 million tons of coal per year and ground storage capacity of approximately 1.7 million tons. The facility primarily serves international customers, as well as domestic coal users located along the Atlantic coast of the United States. From time-to-time, we may lease a portion of our port capacity to third parties.

18 |

Competition

The coal industry is intensely competitive. The most important factors on which we compete are coal quality, delivered costs to the customer and reliability of supply. In thermal coal, another important factor is the cost competitiveness of our coal relative to alternative fuels. Our principal domestic coal-producing competitors include Blackhawk Mining LLC; Contura Energy; Coronado Coal LLC; Corsa Coal Corp.; Eagle Specialty Materials LLC; Navajo Transitional Energy Company, LLC; Peabody Energy Corp.; Ramaco Resources and Warrior Met Coal, Inc. Some of these coal producers are larger than we are and have greater financial resources and larger reserve bases than we do. We also compete directly with a number of smaller producers in each of the geographic regions in which we operate, as well as companies that produce coal from one or more foreign countries, such as Australia, Colombia, Indonesia and South Africa. In thermal coal, our principal competitor is natural gas and other alternative fuels.

Specifically, coal competes directly with other fuels, such as natural gas, nuclear energy, hydropower, wind, solar and petroleum, for steam and electrical power generation. Costs and other factors relating to these alternative fuels, such as safety and environmental considerations, as well as tax incentives and various mandates, affect the overall demand for coal as a fuel and the price we can charge for the coal.

Suppliers

Principal supplies used in our business include petroleum‑based fuels, explosives, tires, steel and other raw materials as well as spare parts and other consumables used in the mining process. We use third‑party suppliers for a significant portion of our equipment rebuilds and repairs, drilling services and construction. We use sole source suppliers for certain parts of our business such as explosives and fuel, and preferred suppliers for other parts of our business such as original equipment suppliers, dragline and shovel parts and related services. We believe adequate substitute suppliers are available. For more information about our suppliers, you should see Item 1A, “Risk Factors-Increases in the costs of mining and other industrial supplies, including steel‑based supplies, diesel fuel and rubber tires, or the inability to obtain a sufficient quantity of those supplies, could negatively affect our operating costs or disrupt or delay our production.”

Environmental and Other Regulatory Matters

Federal, state and local authorities regulate the U.S. coal mining industry with respect to matters such as employee health and safety and the environment, including the protection of air quality, water quality, wetlands, special status species of plants and animals, land uses, cultural and historic properties and other environmental resources identified during the permitting process. Reclamation is required during production and after mining has been completed. Materials used and generated by mining operations must also be managed according to applicable regulations and law. These laws have, and will continue to have, a significant effect on our production costs and our competitive position.

We endeavor to conduct our mining operations in compliance with applicable federal, state and local laws and regulations. However, due in part to the extensive, comprehensive and changing regulatory requirements, violations during mining operations occur from time to time. We cannot assure you that we have been or will be at all times in complete compliance with such laws and regulations. Expenditures we incur to maintain compliance with all applicable federal and state laws have been and are expected to continue to be significant. Federal and state mining laws and regulations require us to obtain surety bonds to guarantee performance or payment of certain long‑term obligations, including mine closure and reclamation costs, federal and state workers’ compensation benefits, coal leases and other miscellaneous obligations. Compliance with these laws has substantially increased the cost of coal mining for domestic coal producers.

Future laws, regulations or orders, as well as future interpretations and more rigorous enforcement of existing laws, regulations or orders, may require substantial increases in equipment and operating costs and delays, interruptions or a termination of operations, the extent to which we cannot predict. Future laws, regulations or orders may also cause coal to become a less attractive fuel source, thereby reducing coal’s share of the market for fuels and other energy sources used to generate electricity. As a result, future laws, regulations or orders may adversely affect our mining operations, cost structure or our customers’ demand for coal.

The following is a summary of the various federal and state environmental and similar regulations that have a material impact on our business:

Mining Permits and Approvals. Numerous governmental permits or approvals are required for mining operations. When we apply for these permits and approvals, we may be required to prepare and present to federal, state or local authorities data pertaining to the effect or impact that any proposed production or processing of coal may have upon the environment. For

19 |

example, in order to obtain a federal coal lease, an environmental impact statement must be prepared to assist the BLM in determining the potential environmental impact of lease issuance, including any collateral effects from the mining, transportation and burning of coal, which may in some cases include a review of impacts on climate change. The authorization, permitting and implementation requirements imposed by federal, state and local authorities may be costly and time consuming and may delay commencement or continuation of mining operations. In the states where we operate, the applicable laws and regulations also provide that a mining permit or modification can be delayed, refused or revoked if officers, directors, shareholders with specified interests or certain other affiliated entities with specified interests in the applicant or permittee have, or are affiliated with another entity that has, outstanding permit violations. Thus, past or ongoing violations of applicable laws and regulations could provide a basis to revoke existing permits and to deny the issuance of additional permits.

In order to obtain mining permits and approvals from federal and state regulatory authorities, mine operators must submit a reclamation plan for restoring, upon the completion of mining operations, the mined property to its prior condition or other authorized use. Typically, we submit the necessary permit applications several months or even years before we plan to begin mining a new area. Some of our required permits are becoming increasingly more difficult and expensive to obtain, and the application review processes are taking longer to complete and becoming increasingly subject to challenge, even after a permit has been issued.

Under some circumstances, substantial fines and penalties, including revocation or suspension of mining permits, may be imposed under the laws described above. Monetary sanctions and, in severe circumstances, criminal sanctions may be imposed for failure to comply with these laws.

Surface Mining Control and Reclamation Act. The Surface Mining Control and Reclamation Act, which we refer to as SMCRA, establishes mining, environmental protection, reclamation and closure standards for all aspects of surface mining as well as many aspects of underground mining. Mining operators must obtain SMCRA permits and permit renewals from the Office of Surface Mining, which we refer to as OSM, or from the applicable state agency if the state agency has obtained regulatory primacy. A state agency may achieve primacy if the state regulatory agency develops a mining regulatory program that is no less stringent than the federal mining regulatory program under SMCRA. All states in which we conduct mining operations have achieved primacy and issue permits in lieu of OSM.

SMCRA permit provisions include a complex set of requirements which include, among other things, coal prospecting; mine plan development; topsoil or growth medium removal and replacement; selective handling of overburden materials; mine pit backfilling and grading; disposal of excess spoil; protection of the hydrologic balance; subsidence control for underground mines; surface runoff and drainage control; establishment of suitable post mining land uses; and revegetation. We begin the process of preparing a mining permit application by collecting baseline data to adequately characterize the pre‑mining environmental conditions of the permit area. This work is typically conducted by third‑party consultants with specialized expertise and includes surveys and/or assessments of the following: cultural and historical resources; geology; soils; vegetation; aquatic organisms; wildlife; potential for threatened, endangered or other special status species; surface and ground water hydrology; climatology; riverine and riparian habitat; and wetlands. The geologic data and information derived from the other surveys and/or assessments are used to develop the mining and reclamation plans presented in the permit application. The mining and reclamation plans address the provisions and performance standards of the state’s equivalent SMCRA regulatory program, and are also used to support applications for other authorizations and/or permits required to conduct coal mining activities. Also included in the permit application is information used for documenting surface and mineral ownership, variance requests, access roads, bonding information, mining methods, mining phases, other agreements that may relate to coal, other minerals, oil and gas rights, water rights, permitted areas, and ownership and control information required to determine compliance with OSM’s Applicant Violator System, including the mining and compliance history of officers, directors and principal owners of the entity.

Once a permit application is prepared and submitted to the regulatory agency, it goes through an administrative completeness review and a thorough technical review. Also, before a SMCRA permit is issued, a mine operator must submit a bond or otherwise secure the performance of all reclamation obligations. After the application is submitted, a public notice or advertisement of the proposed permit is required to be given, which begins a notice period that is followed by a public comment period before a permit can be issued. It is not uncommon for a SMCRA mine permit application to take over a year to prepare, depending on the size and complexity of the mine, and anywhere from six months to two years or even longer for the permit to be issued. The variability in time frame required to prepare the application and issue the permit can be attributed primarily to the various regulatory authorities’ discretion in the handling of comments and objections relating to the project received from the general public and other agencies. Also, it is not uncommon for a permit to be delayed as a result of litigation related to the specific permit or another related company’s permit.

20 |

In addition to the bond requirement for an active or proposed permit, the Abandoned Mine Land Fund, which was created by SMCRA, requires that a fee be paid on all coal produced. The proceeds of the fee are used to restore mines closed or abandoned prior to SMCRA’s adoption in 1977, as well as fund other state and federal initiatives. The current fee is $0.28 per ton of coal produced from surface mines and $0.12 per ton of coal produced from underground mines. In 2019, we recorded $22.9 million of expense related to these reclamation fees.

Surety Bonds. Mine operators are often required by federal and/or state laws, including SMCRA, to assure, usually through the use of surety bonds, payment of certain long‑term obligations including mine closure or reclamation costs, federal and state workers’ compensation costs, coal leases and other miscellaneous obligations. Although surety bonds are usually noncancelable during their term, many of these bonds are renewable on an annual basis and collateral requirements may change.

The costs of these bonds have widely fluctuated in recent years while the market terms of surety bonds have generally hardened for mine operators. These changes in the terms of the bonds have been accompanied at times by a decrease in the number of companies willing to issue surety bonds. As of December 31, 2019, we posted an aggregate of approximately $528.9 million in surety bonds for reclamation purposes. In addition, we had approximately $156.5 million of surety bonds, cash and letters of credit outstanding at December 31, 2019 to secure workers’ compensation, coal lease and other obligations.

For additional information, please see “Failure to obtain or renew surety bonds on acceptable terms could affect our ability to secure reclamation and coal lease obligations and, therefore, our ability to mine or lease coal which could have a material, adverse effect on our business and results of operations,” contained in Item 1A, “Risk Factors—Risk Related to Our Operations,” for a discussion of certain risks associated with our surety bonds.

Mine Safety and Health. Stringent safety and health standards have been imposed by federal legislation since Congress adopted the Mine Safety and Health Act of 1969. The Mine Safety and Health Act of 1977 significantly expanded the enforcement of safety and health standards and imposed comprehensive safety and health standards on all aspects of mining operations. In addition to federal regulatory programs, all of the states in which we operate also have programs aimed at improving mine safety and health. Collectively, federal and state safety and health regulation in the coal mining industry is among the most comprehensive and pervasive systems for the protection of employee health and safety affecting any segment of U.S. industry.

Under the Black Lung Benefits Revenue Act of 1977 and the Black Lung Benefits Reform Act of 1977, each coal mine operator must secure payment of federal black lung benefits to claimants who are current and former employees and to a trust fund for the payment of benefits and medical expenses to claimants who last worked in the coal industry prior to July 1, 1973. The trust fund is funded by an excise tax on production of up to $1.10 per ton for coal mined in underground operations and up to $0.55 per ton for coal mined in surface operations. These amounts may not exceed 4.4% of the gross sales price. This excise tax does not apply to coal shipped outside the United States. In 2019, we recorded $20.0 million of expense related to this excise tax.

Clean Air Act. The federal Clean Air Act and similar state and local laws that regulate air emissions affect coal mining directly and indirectly. Direct impacts on coal mining and processing operations include Clean Air Act permitting requirements and emissions control requirements. These include emissions of ozone precursors and particulate matter which may include controlling fugitive dust. The Clean Air Act also indirectly affects coal mining operations, for example, by extensively regulating the emissions of fine particulate matter measuring 2.5 micrometers in diameter or smaller, sulfur dioxide, nitrogen oxides, mercury and other compounds emitted by coal‑fueled power plants and industrial boilers, which are the largest end‑users of our coal. Already stringent regulation of emissions further tightened throughout the Obama Administration, such as the Mercury and Air Toxics Standard (MATS), finalized in 2011 and discussed in more detail below. In addition, the U.S. Environmental Protection Agency, which we refer to as the EPA, has issued regulations with respect to other emissions, such as greenhouse gases (GHG’s), from new, modified, reconstructed and existing electric generating units, including coal-fired plants. Other GHG regulations apply to industrial boilers (see discussion of Climate Change, below). Although the Trump Administration has proposed repealing or loosening a number of these regulations as described below, it is unclear the degree to which these proposals will take effect, or to what extent they will survive into future Administrations. Collectively, regulations of air emissions, as well as uncertainty regarding the future course of regulation could eventually reduce the demand for coal.

Clean Air Act requirements that may directly or indirectly affect our operations include the following:

• | Acid Rain. Title IV of the Clean Air Act, promulgated in 1990, imposed a two‑phase reduction of sulfur dioxide emissions by electric utilities. Phase II became effective in 2000 and applies to all coal‑fueled power plants with a capacity of more than 25‑megawatts. Generally, the affected power plants have sought to comply with these |

21 |

requirements by switching to lower sulfur fuels, installing pollution control devices, reducing electricity generating levels or purchasing or trading sulfur dioxide emissions allowances. Although we cannot accurately predict the future effect of this Clean Air Act provision on our operations, we believe that implementation of Phase II has been factored into the pricing of the coal market.

• | Particulate Matter. The Clean Air Act requires the EPA to set national ambient air quality standards, which we refer to as NAAQS, for certain pollutants associated with the combustion of coal, including sulfur dioxide, particulate matter, nitrogen oxides and ozone. Areas that are not in compliance with these standards, referred to as non‑attainment areas, must take steps to reduce emissions levels. For example, NAAQS currently exist for particulate matter measuring 10 micrometers in diameter or smaller (PM10) and for fine particulate matter measuring 2.5 micrometers in diameter or smaller (PM2.5), and the EPA revised the PM2.5 NAAQS on December 14, 2012, making it more stringent. The states were required to make recommendations on nonattainment designations for the new NAAQS in late 2013. The EPA issued final designations for most areas of the country in 2012 and made some revisions in 2015. Individual states must now identify the sources of emissions and develop emission reduction plans. These plans may be state‑specific or regional in scope. Under the Clean Air Act, individual states have up to 12 years from the date of designation to secure emissions reductions from sources contributing to the problem. Future regulation and enforcement of the new PM2.5 standard, as well as future revisions of PM standards, will affect many power plants, especially coal‑fueled power plants, and all plants in non‑attainment areas. |