UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

ý |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material under §240.14a-12 |

|

| Arch Coal, Inc. | ||||

|

(Name of Registrant as Specified In Its Charter) |

||||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

Payment of Filing Fee (Check the appropriate box): |

||||

ý |

No fee required. |

|||

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

o |

Fee paid previously with preliminary materials. |

|||

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(1) |

Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

|

STEVEN F. LEER Chairman and Chief Executive Officer |

March 16, 2012

Dear fellow stockholder:

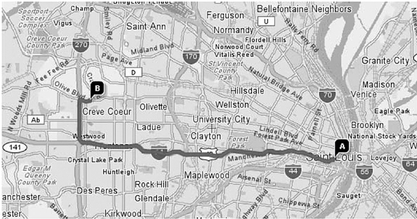

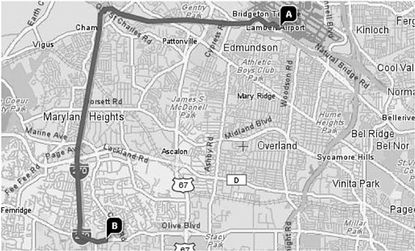

You are cordially invited to attend our annual meeting of stockholders on Thursday, April 26, 2012. We will hold the meeting at 10:00 a.m., Central Time, in the lower level auditorium at our headquarters located at CityPlace One, One CityPlace Drive, St. Louis, Missouri 63141. You can find maps with directions to our headquarters near the back of the proxy statement that accompanies this letter.

In connection with the annual meeting, we have enclosed a notice of the meeting, a proxy statement and a proxy card. We have also enclosed a copy of our annual report for 2011 which contains detailed information about us and our operating and financial performance.

I hope that you will be able to attend the meeting, but I know that not every stockholder will be able to do so. Whether or not you plan to attend, I encourage you to vote your shares. You may vote by telephone or via the Internet, or complete, sign and return the enclosed proxy card in the postage-prepaid envelope, also enclosed. The prompt execution of your proxy will be greatly appreciated.

| Sincerely, | ||

STEVEN F. LEER Chairman of the Board and Chief Executive Officer |

ARCH COAL, INC.

1 CityPlace Drive,

Suite 300 St. Louis, Missouri 63141

t: (314) 994-2700

One CityPlace Drive, Suite 300

St. Louis, Missouri 63141

March 16, 2012

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held April 26, 2012

The annual meeting of stockholders (the "Annual Meeting") of Arch Coal, Inc. will be held in the lower level auditorium at our headquarters located at CityPlace One, One CityPlace Drive, St. Louis, Missouri 63141 on Thursday, April 26, 2012 at 10:00 a.m., Central Time, for the following purposes:

- (1)

- To

elect the five nominees for director named in the attached proxy statement;

- (2)

- To

ratify the appointment of Ernst & Young LLP, independent registered public accounting firm, as our independent auditors for the year ending

December 31, 2012;

- (3)

- To

vote on an advisory resolution to approve executive compensation;

- (4)

- To

consider one stockholder proposal described in the accompanying proxy statement, if properly presented at the Annual Meeting; and

- (5)

- To transact any other business that may properly come before the Annual Meeting or any adjournment(s) or postponement(s) thereof.

The close of business on March 1, 2012 has been fixed as the record date for the determination of stockholders entitled to receive notice of and to vote at the Annual Meeting or any adjournment(s) or postponement(s) thereof. This Notice, the proxy statement and the form of proxy/voting instruction card are first being sent or made available to stockholders on or about March 16, 2012.

An admittance card or other proof of ownership is required to attend the Annual Meeting. If you are a stockholder of record, please retain the admission card printed on the enclosed proxy card for this purpose. If your shares are held by a bank, broker or other nominee, you will have to request that such person in whose name the shares are held to provide you with evidence of your beneficial ownership, such as a current broker's statement.

| By Order of the Board of Directors | ||

|

||

| ROBERT G. JONES | ||

Senior Vice President-Law, General Counsel and Secretary |

YOUR VOTE IS IMPORTANT

YOU ARE URGED TO VOTE YOUR SHARES VIA THE INTERNET, BY TOLL-FREE TELEPHONE NUMBER OR BY SIGNING, DATING AND PROMPTLY RETURNING YOUR PROXY CARD IN

THE ENCLOSED ENVELOPE.

PROXY STATEMENT

TABLE OF CONTENTS

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

When and Where is the 2012 Annual Meeting of Stockholders Being Held?

The 2012 annual meeting of stockholders (the "Annual Meeting") of Arch Coal, Inc., a Delaware corporation ("Arch" or the "Company"), will be held on Thursday, April 26, 2012. The Annual Meeting will be held at 10:00 a.m., Central Time, in the lower level auditorium at our headquarters located at CityPlace One, One CityPlace Drive, St. Louis, Missouri 63141. You can find maps with directions to our headquarters under "Directions to the Annual Meeting" in this proxy statement.

Who May Vote at the Annual Meeting?

Stockholders of the Company at the close of business on March 1, 2012, the record date for the Annual Meeting, are entitled to receive notice of and to vote at the Annual Meeting or any adjournments or postponements of the Annual Meeting. On the record date, Arch had 212,075,792 shares of common stock outstanding.

Who Can Attend the Annual Meeting?

All Arch stockholders on the record date are invited to attend the Annual Meeting. Each stockholder planning to attend the Annual Meeting will be asked to present valid photo identification, such as a driver's license or passport. In addition, each stockholder must present his or her admission ticket, which is a portion of the enclosed proxy card. Please tear off the ticket at the perforation. If your shares are not registered in your name and you would like to attend the Annual Meeting, please ask the broker, trust, bank or other nominee in whose name the shares are held to provide you with evidence of your beneficial ownership, such as a current broker's statement.

No cameras, camcorders, videotaping equipment, other recording devices or large packages will be permitted in the Annual Meeting. Photographs may be taken by Arch employees or independent contractors at the Annual Meeting, and those photographs may be used by Arch. By attending the Annual Meeting, you will be agreeing to Arch's use of those photographs and waive any claim or rights with respect to those photographs and their use.

What Items Will Be Voted On at the Annual Meeting?

Stockholders will vote on four items at the Annual Meeting:

Management Proposals:

- •

- The election of five director nominees to the board of directors (the "Board") of the Company (Proposal No. 1);

- •

- Ratification of the appointment of Ernst & Young LLP, independent registered public accounting firm, as our

independent auditors for the year ending December 31, 2012 (Proposal No. 2);

- •

- To vote on an advisory resolution to approve executive compensation (Proposal No. 3); and

1

Stockholder Proposal:

- •

- One stockholder proposal (Proposal No. 4).

What Are the Board's Voting Recommendations?

The Board recommends you vote your shares:

Management Proposals:

- •

- "FOR" each of the director nominees to the

Board (Proposal No. 1);

- •

- "FOR" the ratification of the appointment of

Ernst & Young LLP, independent registered public accounting firm, as our independent auditors for the year ending December 31, 2012 (Proposal No. 2);

- •

- "FOR" the advisory resolution to approve executive compensation (Proposal No. 3); and

Stockholder Proposal:

- •

- "AGAINST" the stockholder proposal (Proposal No. 4).

If your shares are registered in the name of a nominee, including your broker or bank, follow the instructions provided by your nominee to vote your shares. In most instances, you will be able to vote over the telephone, via the Internet, or by mail. If your shares are registered in your name:

You may vote in person at the Annual Meeting. You can find maps with directions to our headquarters under "Directions to the Annual Meeting" in this proxy statement.

You may vote by telephone. You can vote by calling the toll-free telephone number on your proxy card. Telephone voting is available 24 hours a day, 7 days a week, until 11:59 p.m., Eastern Time, on the day before the Annual Meeting. If you vote by telephone, you do not need to return your proxy card.

You may vote via the Internet. The website for Internet voting is on your proxy card. Internet voting is available 24 hours a day, 7 days a week, until 11:59 p.m., Eastern Time, on the day before the Annual Meeting. If you vote via the Internet, you do not need to return your proxy card.

You may vote by mail. If you choose to vote by mail, simply mark your proxy card, date and sign it, and return it in the postage-paid envelope provided.

Can I Change My Vote Once I Vote By Telephone, Mail or Via the Internet?

Yes. You have the right to change or revoke your proxy (1) at any time before the Annual Meeting by (a) notifying Robert G. Jones, Arch's Secretary, in writing, or (b) returning a later-dated proxy card; or (2) by voting in person at the Annual Meeting.

2

You have one vote for each share of our common stock that you owned at the close of business on the record date. These shares include:

- •

- Shares registered directly in your name with our transfer agent, for which you are considered the "stockholder of record;"

- •

- Shares held for you as the beneficial owner through a broker, bank, or other nominee in "street name;" and

- •

- Shares credited to your account in our employee thrift plan.

How Do I Vote My Shares in the Dividend Reinvestment Plan or the Direct Stock Purchase Plan?

If you participate in our dividend reinvestment plan or our direct stock purchase plan, your proxy will also serve as an instruction to vote the whole shares you hold under those plans in the manner indicated on the proxy. If your proxy is not received, the shares you hold in those plans will not be voted.

How Do I Vote My Shares Held in the Employee Thrift Plan?

If you are both a registered stockholder and a participant in our employee thrift plan, you will receive a single proxy card that covers shares of our common stock credited to your plan account as well as shares of record registered in exactly the same name. Accordingly, your proxy card also serves as a voting instruction for the trustee of the plan. If your plan account is not carried in exactly the same name as your shares of record, you will receive separate proxy cards for individual and plan holdings. If you own shares through this plan and you do not return your proxy by April 16, 2012, the trustee will vote your shares in the same proportion as the shares that are voted by the other participants in the plan. The trustee will also vote unallocated shares of our common stock held in the plan in direct proportion to the voting of allocated shares in the plan for which voting instructions have been received unless doing so would be inconsistent with the trustee's duties.

Yes. Voting tabulations are confidential except in extremely limited circumstances. Such limited circumstances include contested solicitation of proxies, when disclosure is required by law, to defend a claim against us or to assert a claim by us and when a stockholder's written comments appear on a proxy or other voting material.

What Happens If I Do Not Give Specific Voting Instructions?

Stockholders of Record. If you are a stockholder of record and you either indicate when voting that you wish to vote as recommended by the Board or you sign and return a proxy card without giving specific voting instructions on any one or more matters, the proxy holders will vote your shares in the manner recommended by the Board on all such matters presented in this proxy statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting. See the section entitled "Other Matters" below.

3

Beneficial Owners of Shares Held in Street Name. If you are a beneficial owner of shares held in street name and you do not provide the organization that holds your shares with specific voting instructions, under the rules of applicable national securities exchanges, the organization that holds your shares may generally vote on routine matters but cannot vote on non-routine matters. If the organization that holds your shares does not receive specific instructions from you on how to vote your shares on a non-routine matter, such organization will inform the inspector of election that it does not have the authority to vote on this matter with respect to your shares. This is generally referred to as a "broker non-vote."

Which Ballot Measures Are Considered "Routine" or "Non-Routine"?

The ratification of the appointment of Ernst & Young LLP, independent registered public accounting firm, as our independent auditors for the year ending December 31, 2012 (Proposal No. 2) is a matter considered routine under applicable rules. A broker or other nominee may generally vote on routine matters, and therefore no broker non-votes are expected to exist in connection with Proposal No. 2.

The election of directors (Proposal No. 1), the advisory resolution to approve executive compensation (Proposal No. 3), and the stockholder proposal (Proposal No. 4) are matters considered non-routine under applicable rules. A broker or other nominee cannot vote without instructions on non-routine matters, and therefore there may be broker non-votes on Proposals No. 1, No. 3 and No. 4.

What Is the Voting Requirement to Approve Each of the Proposals?

For Proposal No. 1, the five nominees receiving the highest number of affirmative votes of the shares entitled to be voted for them will be elected as directors to serve until their terms expire and until their successors are duly elected and qualified. Abstentions are not counted for the purpose of the election of directors, and broker non-votes will have no effect on the voting results.

Approval of Proposals No. 2, No. 3 and No. 4 requires the affirmative vote of a majority of the shares present or represented by proxy and voting at the Annual Meeting. Abstentions and broker non-votes will have no effect on the voting results with respect to these matters.

What "Quorum" Is Required for the Annual Meeting?

In order to have a valid stockholder vote, a quorum must exist at the Annual Meeting. For the Company, a quorum exists when stockholders holding a majority of the outstanding shares of common stock are present or represented at a meeting. For these purposes, shares that are present or represented by proxy at the Annual Meeting will be counted toward a quorum, regardless of whether the holder of the shares or proxy fails to vote on a particular matter or whether a broker with discretionary voting authority fails to exercise such authority with respect to any particular matter.

Where Can I Find the Voting Results?

We intend to announce preliminary voting results at the Annual Meeting. We will publish the final results in a Current Report on Form 8-K, which we expect to file within four business days after the Annual Meeting is held. You can obtain a copy of the Form 8-K by logging on to our website at archcoal.com, by calling the Securities and Exchange Commission (SEC) at 800-SEC-0330 for the location of the nearest public reference room, or through the EDGAR system at sec.gov. Information on our website does not constitute part of this proxy statement.

4

DIRECTORS AND CORPORATE GOVERNANCE PRACTICES

Arch is dedicated to being a market-driven global leader in the coal industry and to creating superior long-term stockholder value. It is our policy to conduct our business with integrity and an unrelenting passion for providing the best value to our customers. All of our corporate governance materials, including the Corporate Governance Guidelines, our Code of Business Conduct and our board committee charters, are published under "Corporate Governance" in the Investors section of our website at archcoal.com. Information on our website does not constitute part of this proxy statement. The Board regularly reviews these materials, Delaware law, the rules and listing standards of the New York Stock Exchange and SEC regulations, as well as best practices suggested by recognized governance authorities, and modifies the materials as warranted.

Our certificate of incorporation and bylaws provide for a Board that is divided into three classes as equal in size as possible. The classes have three-year terms, and the term of one class expires each year in rotation at that year's annual meeting. The size of the Board can be changed by a two-thirds vote of its members. There are currently 14 members of the Board:

| James R. Boyd | Steven F. Leer | |

| John W. Eaves | George C. Morris III | |

| David D. Freudenthal | A. Michael Perry | |

| Patricia Fry Godley | Robert G. Potter | |

| Douglas H. Hunt | Theodore D. Sands | |

| Brian J. Jennings | Wesley M. Taylor | |

| J. Thomas Jones | Peter I. Wold |

The Board met ten times during 2011. Each current director attended at least 75% of the aggregate of all of the meetings of the Board and committees on which he or she served and attended the Company's 2011 annual stockholders meeting. Under the Company's Corporate Governance Guidelines, each director is expected to spend the time needed and meet as frequently as necessary to properly perform their duties and responsibilities, including attending annual and special meetings of the stockholders, the Board and committees of which he or she is a member.

Corporate Governance Guidelines and Code of Business Conduct

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines, which sets forth a framework within which the Board, assisted by its committees, directs the affairs of the Company. These Guidelines address, among other items, the composition and functions of the Board, director independence, stock ownership by and compensation of directors, and director qualification standards.

5

Code of Conduct

The Company has adopted the Code of Business Conduct, which is applicable to all employees of the Company, including the principal executive officer, the principal financial officer and the principal accounting officer, as well as all directors of the Company.

The Corporate Governance Guidelines and the Code of Business Conduct are available on the Company's website under the "Corporate Governance" heading in the "Investors" section at archcoal.com and in print to any stockholder who requests them from the Company's Secretary. We intend to post amendments to or waivers from (to the extent applicable to one of our directors or executive officers) the Code of Business Conduct at the same location on our website. Information on our website does not constitute part of this proxy statement.

It is the Board's objective to have a substantial number of directors who are independent. The Corporate Governance Guidelines incorporates the criteria established by the New York Stock Exchange to assist the Board in determining whether a director is independent. The Board has determined, in its judgment, that all but two members, Steven F. Leer and John W. Eaves, each of whom are executive officers, meet the New York Stock Exchange standards for independence. The independent members of the Board meet regularly without any members of management present. These sessions are normally held following or in conjunction with regular Board meetings. Mr. James R. Boyd, chairman of the Nominating and Corporate Governance Committee and lead director, serves as the presiding director during executive sessions of the Board.

All members of our Audit, Nominating and Corporate Governance and Personnel and Compensation Committees must be independent directors in accordance with our corporate governance guidelines. Members of the Audit Committee must also satisfy a separate SEC independence requirement, which provides that they may not accept, directly or indirectly, any consulting, advisory or other compensatory fee from us or any of our subsidiaries other than their directors' compensation.

Mr. Leer has served as both the chairman of our Board and our chief executive officer since being appointed as chairman in April 2006. Mr. Boyd served as the chairman of our Board from 1998 until April 2006 and has served as our lead director since stepping down as the chairman. The responsibilities of the lead independent director include consulting with the chairman of the Board regarding agendas for Board meetings and presiding over meetings of the Board during executive sessions of the independent directors.

The Board has no fixed policy with respect to the separation of the offices of chairman and chief executive officer. Instead, the Board retains the discretion to make this determination on a case-by-case basis from time to time as it deems to be in the best interest of the Company and our stockholders at any given time. In weighing the structure of the chairman's role, the Board believes that the current Board leadership structure has been appropriate because it recognizes that the Company has benefitted from one person

6

speaking for and leading the Company and the Board in order to promote unified leadership and direction, particularly given Mr. Leer's long history with the Company. In addition, the Board believes that Mr. Leer has served effectively as a liaison between the Board and management by serving the Company in both capacities. In addition to retaining a strong lead independent director, the Company's governance structure provides effective oversight of the Board through the following:

- •

- all but two members of our Board are independent;

- •

- the Board has established and follows robust Corporate Governance

Guidelines, which are routinely reviewed by the Board and are publicly available on our website;

- •

- our Nominating and Corporate Governance Committee, Personnel and Compensation Committee and Audit Committee are all

composed solely of independent directors; and

- •

- our independent directors meet regularly in scheduled executive sessions.

As has been previously disclosed, Mr. Leer intends to retire from his position as chief executive officer of the Company after the Annual Meeting, while continuing to serve on the Board. The Board will make a determination on the chairman role of the Board at the Board meetings that coincide with the Annual Meeting and will implement the leadership structure that it determines to be in the best interest of the Company and our stockholders at that time.

The entire Board is responsible for oversight of the company's risk management processes. Our Vice President of Enterprise Risk Management oversees risk management efforts, provides periodic reports to the Board's Audit Committee and provides reports to our Board at least once per year. In addition, the Board and its standing committees periodically request supplemental information or reports as they deem appropriate.

Director Qualifications, Diversity and Biographies

The Corporate Governance Guidelines provide that our Nominating and Corporate Governance Committee and Board will nominate candidates for our board of directors who possess the following principal qualities: strength of character, an inquiring and independent mind, practical wisdom, and mature judgment. In addition to these qualities, the selection criteria for nomination include recognized achievement, an ability to contribute to some aspect of our business, and the willingness to make the commitment of time and effort required of a director.

As described in more detail below, our Board believes that each of our directors meets such criteria and has attributes and experience that make him or her well qualified to serve. While we do not have a formal diversity policy, in order to find the most valuable talent available to meet these criteria, our Board generally considers candidates diverse in geographic origin, gender, ethnic background, and professional experience (private, public, and non-profit), pursuant to our Corporate Governance Guidelines. Our goal is to include members with the skills and characteristics that, taken together, will assure a strong Board.

7

Our directors have diverse backgrounds and provide experience and expertise in a number of critical areas. The Nominating and Corporate Governance Committee considers the particular experience, attributes, reputation and qualifications of directors standing for re-election and potential nominees for election, as well as the needs of our Board as a whole and its individual committees. In nominating candidates for election by our stockholders, both the Nominating and Corporate Governance Committee and the Board act pursuant to these guidelines. Both the Nominating and Corporate Governance Committee and the Board assess the effectiveness of corporate governance policies, including with respect to diversity, through completion of an annual evaluation process.

The Nominating and Corporate Governance Committee has identified nine areas of expertise that are particularly relevant to service on the Board and has identified the directors whose key areas of expertise qualify them for each of the listed categories. The categories identified by the Nominating and Corporate Governance Committee are:

CEO/Senior Management — Experience working as a chief executive officer or senior officer of a major public or private company or non-profit entity.

Energy — Extensive knowledge and experience in the energy industry, either as a senior executive of an energy company, as a senior executive of a customer of an energy company or through legal or regulatory experience on energy matters.

Environmental and Safety — A thorough understanding of safety and environmental issues and energy industry regulations.

Finance and Accounting — Senior executive-level experience in financial accounting and reporting, auditing, corporate finance and/or internal controls.

Governance/Board — Prior or current experience as a board member of a major organization (private, public or non-profit).

Government Relations — Experience in or a strong understanding of the workings of government and public policy on a local, state and national level.

Human Resources and Compensation — Senior executive-level experience or membership on a board compensation committee with an extensive understanding of compensation programs, particularly compensation programs for executive-level employees and incentive based compensation programs.

Marketing — Senior executive-level experience in marketing combined with a strong working knowledge of our markets, customers and strategy.

Strategic Planning — Senior executive-level experience in strategic planning for a major public, private or non-profit entity.

8

The following is a list of our directors, their ages as of March 1, 2012, their occupation during the last five years and certain other biographical information, including the areas of expertise where each director or nominee is most skilled:

CLASS III DIRECTORS WHO ARE UP FOR ELECTION AT THE ANNUAL MEETING

Director

|

Areas of Expertise

|

Occupation and Other Information

|

||

|---|---|---|---|---|

| Governor David D. Freudenthal Age 61 Director since 2011 |

CEO/Senior Management Energy Governance/Board Government Relations Strategic Planning |

Since June 2011, Governor Freudenthal has been Senior Counsel with the law firm of Crowell & Moring, LLC. Governor Freudenthal served as the Governor of Wyoming from 2003 until January 2011. Prior to his service as governor, he served as U.S. Attorney for the District of Wyoming. Governor Freudenthal currently serves as an Adjunct Professor at the University of Wyoming. | ||

Governor Freudenthal contributes to the mix of experience and qualifications the Board seeks to maintain primarily through his experience as Governor for the State of Wyoming. This experience has provided Governor Freudenthal with a significant understanding of the regulatory and governmental issues facing the Company in our daily operations. |

9

Director

|

Areas of Expertise

|

Occupation and Other Information

|

||

|---|---|---|---|---|

| Patricia F. Godley Age 63 Director since 2004 |

Energy Environmental and Safety Governance/Board Government Relations Human Resources and Compensation Strategic Planning |

Since 1998, Ms. Godley has been a partner with the law firm of Van Ness Feldman, practicing in the areas of economic and environmental regulation of electric utilities and natural gas companies. Ms. Godley is also a director of the United States Energy Association. | ||

Ms. Godley contributes to the mix of experience and qualifications the Board seeks to maintain primarily through her work as an attorney in the areas of economic and environmental regulations. This experience has provided Ms. Godley with an in-depth knowledge of the ever changing regulatory environment that the Company faces, and dealing with governmental agencies in this regulatory environment. From her work in this area, she also has an extensive background in the energy industry and the environmental issues facing the Company. |

10

Director

|

Areas of Expertise

|

Occupation and Other Information

|

||

|---|---|---|---|---|

| Wesley M. Taylor Age 69 Director since 2005 |

CEO/Senior Management Energy Environmental and Safety Governance/Board Government Relations Human Resources and Compensation Marketing Strategic Planning |

Mr. Taylor was President of TXU Generation, a company engaged in electricity infrastructure ownership and management. Mr. Taylor served at TXU for 38 years prior to his retirement in 2004. Mr. Taylor also serves on the board of directors of FirstEnergy Corporation. | ||

Mr. Taylor contributes to the mix of experience and qualifications the Board seeks to maintain primarily through his experience with TXU Generation, as well as his service as a member of the board of directors of FirstEnergy Corporation. Mr. Taylor's experience has provided him with a strong background in the energy industry. In addition, as President of TXU Generation, Mr. Taylor brings to our Board the experience of guiding a company in all aspects of its day-to-day operations. |

11

Director

|

Areas of Expertise

|

Occupation and Other Information

|

||

|---|---|---|---|---|

| Peter I. Wold Age 64 Director since 2010 |

CEO/Senior Management Energy Environmental and Safety Finance and Accounting Governance/Board Government Relations Strategic Planning |

Mr. Wold is President and co-owner of Wold Oil Properties, Inc., an oil and gas exploration and production company. He is also Vice President of American Talc Company, a corporation that mines and processes talc in Western Texas. He presently chairs the Wyoming Enhanced Oil Recovery Commission and is a director of the Oppenheimer Funds, Inc. New York Board. Mr. Wold has also served in the Wyoming House of Representatives and as a director of the Denver Branch of the Kansas City Federal Reserve Bank. | ||

Mr. Wold contributes to the mix of experience and qualifications the Board seeks to maintain primarily through his experience as President of Wold Oil Properties, Inc., as well as his positions with Oppenheimer Funds, Inc. and the Kansas City Federal Reserve Bank. This experience has provided Mr. Wold with a deep understanding of the financial hurdles and constraints companies face in today's economy. In addition, as head of an energy company, Mr. Wold has a strong understanding of the environmental and other regulatory issues the Company faces, particularly in the West. |

12

CLASS II DIRECTORS WHO ARE UP FOR ELECTION AT THE ANNUAL MEETING AND

WHOSE TERM EXPIRES AT THE 2014 ANNUAL MEETING

Director

|

Areas of Expertise

|

Occupation and Other Information

|

||

|---|---|---|---|---|

| George C. Morris III Age 56 Director since 2012 |

CEO/Senior Management Energy Finance and Accounting Governance/Board Strategic Planning |

Since March 2009, Mr. Morris has served as President of Morris Energy Advisors, Inc. From December 2006 until his retirement in March 2009, Mr. Morris served as a managing director at Merrill Lynch & Co. Prior to 2006, Mr. Morris served as a managing director of investment banking at Petrie Parkman & Co. until its acquisition by Merrill Lynch & Co. in 2006, and also previously served as a managing director of investment banking at Simmons & Company International, as a director of investment banking at Merrill Lynch & Co. and as a director of investment banking at The First Boston Corporation. Mr. Morris also serves on the board of directors of Calumet GP, LLC, the general partner of Calumet Specialty Products Partners, L.P. | ||

Mr. Morris contributes to the mix of experience and qualifications the Board seeks to maintain primarily through his experience and roles with a variety of investment companies, including his most recent role as a managing director at Merrill Lynch & Co. His experience in advising clients of investment companies provides Mr. Morris with a strong understanding of the financial hurdles public companies face, including the various financing avenues available for a company. In addition, his board member experience adds additional valuable management and oversight knowledge to our Board. |

13

THE FOLLOWING CLASSES OF DIRECTORS ARE NOT UP FOR ELECTION AT THE

ANNUAL MEETING

CLASS I DIRECTORS WHOSE TERM EXPIRES AT THE 2013 ANNUAL MEETING

Director

|

Areas of Expertise

|

Occupation and Other Information

|

||

|---|---|---|---|---|

| Brian J. Jennings Age 51 Director since 2006 |

CEO/Senior Management Energy Finance and Accounting Human Resources and Compensation Strategic Planning |

Since February 2009, Mr. Jennings has been President and Chief Executive Officer of Rise Energy Partners, L.P. From February 2007 to June 2008, Mr. Jennings served as Chief Financial Officer of Energy Transfer Partners GP, L.P., the general partner of Energy Transfer Partners, L.P., a publicly-traded partnership owning and operating intrastate and interstate natural gas pipelines. From 2004 to 2006, Mr. Jennings served as Senior Vice President-Corporate Finance and Development and Chief Financial Officer of Devon Energy Corporation. | ||

Mr. Jennings contributes to the mix of experience and qualifications the Board seeks to maintain through his experience as a senior officer in a variety of energy companies, with particular focus on financial and accounting oversight. With his experience, Mr. Jennings brings to the Board a strong understanding of the financial and accounting issues the Company faces in our industry. We believe that this experience allows Mr. Jennings to efficiently and effectively chair our Audit Committee. |

14

Director

|

Areas of Expertise

|

Occupation and Other Information

|

||

|---|---|---|---|---|

Steven F. Leer Age 59 Director since 1992 |

CEO/Senior Management Energy Environmental and Safety Finance and Accounting Governance/Board Government Relations Marketing Human Resources and Compensation Strategic Planning |

Mr. Leer has been our Chief Executive Officer since 1992. From 1992 to 2006, Mr. Leer also served as our President. In 2006, Mr. Leer became Chairman of the board of directors. Mr. Leer also serves on the boards of the Norfolk Southern Corporation, USG Corp., the Business Roundtable, the University of the Pacific, Washington University and is past chairman of the Coal Industry Advisory Board. Mr. Leer is past chairman and continues to serve on the boards of the Center for Energy and Economic Development, the National Coal Council and the National Mining Association. |

||

Mr. Leer contributes to the mix of experience and qualifications the Board seeks to maintain primarily through his position as Chief Executive Officer and Chairman of the Company. As Chief Executive Officer and Chairman, Mr. Leer has in-depth knowledge of all aspects of the Company's business and close working relationships with all of the Company's senior executives. |

15

Director

|

Areas of Expertise

|

Occupation and Other Information

|

||

|---|---|---|---|---|

| Robert G. Potter Age 72 Director since 2001 |

CEO/Senior Management Environmental and Safety Finance and Accounting Governance/Board Marketing Human Resources and Compensation Strategic Planning |

Mr. Potter was Chairman and Chief Executive Officer of Solutia, Inc. from 1997 until his retirement in 1999. He is also an investor in several private companies and has served as a member of the board of directors for six other companies. | ||

Mr. Potter contributes to the mix of experience and qualifications the Board seeks to maintain primarily through his roles with Solutia, Inc. As a former Chairman and Chief Executive Officer of Solutia, Inc., Mr. Potter has the experience overseeing the operations of a large public company. This experience has provided him with a strong understanding of the long-term planning requirements for a large public company, as well as an in-depth knowledge of the corporate governance required for a public company. |

16

Director

|

Areas of Expertise

|

Occupation and Other Information

|

||

|---|---|---|---|---|

| Theodore D. Sands Age 66 Director since 1999 |

Energy Finance and Accounting Governance/Board Human Resources and Compensation Strategic Planning |

Since 1999, Mr. Sands has served as President of HAAS Capital, LLC, a private consulting and investment company. Mr. Sands served as Managing Director, Investment Banking for the Global Metals/Mining Group of Merrill Lynch & Co. from 1982 until 1999. Mr. Sands has also served as a member of the board of directors for several other companies. | ||

Mr. Sands contributes to the mix of experience and qualifications the Board seeks to maintain primarily through his role at Merrill Lynch and as the head of a private investment company. In leading an investment company in today's economy, Mr. Sands has a strong understanding of the financial hurdles public companies face, as well as an in-depth knowledge of the various financing avenues available for a company. In addition, his past experience as a board member for several other companies adds valuable prior oversight experience to our existing board of directors. |

17

CLASS II DIRECTORS WHOSE TERM EXPIRES AT THE 2014 ANNUAL MEETING

Director

|

Areas of Expertise

|

Occupation and Other Information

|

||

|---|---|---|---|---|

| James R. Boyd Age 65 Director since 1990 |

CEO/Senior Management Energy Environmental and Safety Finance and Accounting Governance/Board Marketing Human Resources and Compensation Strategic Planning |

Mr. Boyd served as chairman of the board of directors from 1998 to 2006, when he was appointed our lead director. Mr. Boyd served as Senior Vice President and Group Operating Officer of Ashland Inc. from 1989 until his retirement in 2002. Mr. Boyd also serves on the board of directors of Halliburton Inc. | ||

Mr. Boyd contributes to the mix of experience and qualifications the Board seeks to maintain primarily through his years of experience in senior management at Ashland Inc. and his other public company board experience. At Ashland Inc., Mr. Boyd was a senior executive, charged with oversight of key aspects of the company's daily operations. In addition, his experience serving on the board of Halliburton Inc. brings additional insight over the management of large public companies. As a result of this experience, Mr. Boyd brings to our Board in-depth knowledge of the energy industry, corporate governance and company oversight, an extensive understanding of our markets and customers, and a strong understanding of finance and executive management. |

18

Director

|

Areas of Expertise

|

Occupation and Other Information

|

||

|---|---|---|---|---|

| John W. Eaves Age 54 Director since 2006 |

CEO/Senior Management Energy Environmental and Safety Governance/Board Government Relations Marketing Human Resources and Compensation Strategic Planning |

Mr. Eaves has been our President and Chief Operating Officer since 2006. From 2002 to 2006, Mr. Eaves served as our Executive Vice President and Chief Operating Officer. Mr. Eaves also serves on the board of directors of COALOGIX. | ||

Mr. Eaves contributes to the mix of experience and qualifications the Board seeks to maintain primarily through his position as President and Chief Operating Officer of the Company. As President and Chief Operating Officer, and as a result of the experience he has gained during his tenure with the Company, Mr. Eaves has intimate knowledge of all aspects of the Company's business and close working relationships with all of the Company's senior executives. In addition, as Chief Operating Officer, Mr. Eaves has an extensive understanding of the Company's industry and customer base. |

19

Director

|

Areas of Expertise

|

Occupation and Other Information

|

||

|---|---|---|---|---|

| Douglas H. Hunt Age 59 Director since 1995 |

CEO/Senior Management Energy Environmental and Safety Human Resources and Compensation Strategic Planning |

Since 1995, Mr. Hunt has served as Director of Acquisitions of Petro-Hunt, LLC, a private oil and gas exploration and production company. Mr. Hunt contributes to the mix of experience and qualifications the Board seeks to maintain primarily through his long-time position as a senior officer for Petro-Hunt, LLC. As Director of Acquisitions of Petro-Hunt, LLC, Mr. Hunt has significant experience as a senior officer in the energy industry and in the strategic planning of companies as they look to grow their business. |

||

J. Thomas Jones Age 62 Director since 2010 |

CEO/Senior Management Governance/Board Government Relations Human Resources and Compensation Strategic Planning |

Mr. Jones has been Chief Executive Officer of West Virginia United Health System located in Fairmont, West Virginia since 2002. From 2000 to 2002, Mr. Jones served as Chief Executive Officer of Genesis Hospital System in Huntington, West Virginia. Mr. Jones is also a director of Premier, Inc. and Health Partners Network. |

||

Mr. Jones contributes to the mix of experience and qualifications the Board seeks to maintain primarily through his services as Chief Executive Officer of health systems in the State of West Virginia. Being in charge of companies in a heavily regulated industry, Mr. Jones brings the valuable experience of assisting a company navigate through an ever changing regulatory background. In addition, as a senior officer, Mr. Jones brings strong experience in handling key financial decisions for the long-term benefit of a company. |

20

Director

|

Areas of Expertise

|

Occupation and Other Information

|

||

|---|---|---|---|---|

| A. Michael Perry Age 75 Director since 1998 |

CEO/Senior Management Energy Finance and Accounting Governance/Board Government Relations Strategic Planning |

Mr. Perry served as Chairman of Bank One, West Virginia, N.A. from 1993 and as its Chief Executive Officer from 1983 until his retirement in 2001. Mr. Perry also serves on the board of directors of Champion Industries, Inc. | ||

Mr. Perry contributes to the mix of experience and qualifications the Board seeks to maintain primarily through his service with Bank One, West Virginia, N.A., together with his membership on other boards. As a result of this experience, Mr. Perry brings to the Board a strong finance and accounting background, and has experience in handling, as a senior executive in charge of a financial institution and as a board member of other companies, the long-term strategic planning of a corporation. |

The Board has the following five committees: Nominating and Corporate Governance, Finance, Personnel and Compensation, Audit and Energy and Environmental Policy. The table below contains information concerning the membership of each of the committees as of December 31, 2011, and the number of times the Board and each committee met during 2011. Each director attended at least 75% of the total number of meetings of the Board and of the committees on which he or she serves. In addition, all directors attended last year's annual meeting.

21

| |

Board of Directors(1) |

Nominating and Corporate Governance |

Finance | Personnel and Compensation |

Audit | Energy and Environmental Policy |

||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Mr. Boyd |

M | C | M | |||||||||

Mr. Eaves |

M | M | M | |||||||||

Gov. Freudenthal |

M | M | M | |||||||||

Ms. Godley |

M | M | M | C | ||||||||

Mr. Hunt |

M | M | M | |||||||||

Mr. Jennings |

M | M | C | |||||||||

Mr. Jones |

M | M | M | |||||||||

Mr. Leer |

C | M | ||||||||||

Mr. Perry |

M | M | M | |||||||||

Mr. Potter |

M | M | C | |||||||||

Mr. Sands |

M | C | M | M | ||||||||

Mr. Taylor |

M | VC | M | |||||||||

Mr. Wold |

M | M | M | M | ||||||||

Number of 2011 meetings |

10 | 9 | 7 | 6 | 7 | 5 |

C Chair VC Vice Chair M Member

- (1)

- Mr. Morris is not included in the above table because he was elected to the Board in March 2012. In addition to being a member of the Board, he currently serves on the Audit and Finance Committees.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is responsible for the following items:

- •

- identifying individuals qualified to become directors and recommending candidates for membership on the Board and its

committees, as described under the heading "Nomination Process for Election of Directors";

- •

- developing and recommending the corporate governance guidelines to the Board;

- •

- reviewing and recommending compensation of non-employee directors; and

- •

- reviewing the effectiveness of board governance, including overseeing an annual assessment of the performance of the Board and each of its committees.

The Board has determined, in its judgment, that the Nominating and Corporate Governance Committee is composed entirely of independent directors as defined in the New York Stock Exchange listing standards and operates under a written charter adopted by the board of directors, a copy of which is published under "Corporate Governance" in the Investors section of our website at archcoal.com.

22

Finance Committee

The Finance Committee reviews and approves fiscal policies relating to our financial structure, including our debt, cash and risk management policies. The Finance Committee also reviews and recommends to the Board appropriate action with respect to significant financial matters, including dividends on our capital stock, major capital expenditures and acquisitions, and funding policies of our employee benefit plans.

Personnel and Compensation Committee

The Personnel and Compensation Committee is responsible for the following items:

- •

- reviewing and recommending to the board of directors the design of and associated payments related to the compensation

programs for our named executive officers and other key personnel;

- •

- reviewing and recommending to the board of directors the participation of executives and other key management employees in

the various compensation plans; and

- •

- monitoring our succession planning and management development practices.

The Board has determined, in its judgment, that the Personnel and Compensation Committee is composed entirely of independent directors as defined in the New York Stock Exchange listing standards and operates under a written charter adopted by the entire board of directors, a copy of which is published under "Corporate Governance" in the Investors section of our website at archcoal.com. The report of the Personnel and Compensation Committee can be found under "Personnel and Compensation Committee Report" in this proxy statement.

Audit Committee

The Audit Committee is responsible for the following items:

- •

- monitoring the integrity of our consolidated financial statements, internal accounting, financial controls, disclosure

controls and financial reporting processes;

- •

- confirming the qualifications and independence of our independent registered public accounting firm;

- •

- evaluating the performance of our internal audit function and our independent registered public accounting firm; and

- •

- reviewing our compliance with legal and regulatory requirements.

The Audit Committee is directly responsible for the appointment, compensation and oversight of the work of our independent registered public accounting firm. The Board has determined, in its judgment, that the Audit Committee is composed entirely of independent directors in compliance with the New York Stock Exchange listing standards and Rule 10A-3 of the Securities Exchange Act of 1934. The Audit Committee operates under a written charter adopted by the Board, a copy of which is published under "Corporate Governance" in the Investors section of our website at archcoal.com.

23

The Board has also determined, in its judgment, that Mr. Jennings is an "audit committee financial expert" and that each member of the Audit Committee is "financially literate." Our corporate governance guidelines do not currently restrict the number of audit committees of public companies on which members of our Audit Committee may serve. The Board has determined that none of the members of the Audit Committee currently serves on the audit committees of more than three public companies. The report of the Audit Committee can be found under "Audit Committee Report" in this proxy statement.

Energy and Environmental Policy Committee

The Energy and Environmental Policy Committee reviews, assesses and provides advice to the Board on current and emerging energy and environmental policy trends and developments that affect or could affect us. In addition, the Energy and Environmental Policy Committee makes recommendations concerning whether, and to what extent, we should become involved in current and emerging energy and environmental policy issues.

Director Retirement/Resignation Policies

Our Board has a policy requiring members to resign from their position on the Board effective at the Company's annual meeting immediately following a member's 72nd birthday. Vacancies on the Board may be filled by a majority of the remaining directors. A director elected to fill a vacancy, or a new directorship created by an increase in the size of the Board, serves for the remainder of the full term of the class of directors in which the vacancy or newly created directorship occurred. Two of the Company's directors, Mr. Perry and Mr. Potter, have offered their resignations under this policy, but the Board has requested that they continue their service on the Board, and each has agreed, for an additional period of time not to extend past the 2013 annual meeting of stockholders.

The Corporate Governance Guidelines requires any nominee for director in an uncontested election who receives a greater number of votes "withheld" from his or her election than votes "for" such election to offer his or her resignation to the Board. In the event a resignation is tendered, the Nominating and Corporate Governance Committee and the Board will evaluate the best interests of the Company and its stockholders and make a determination on the action to be taken with respect to such offered resignation, which may include (i) accepting the resignation, (ii) maintaining the director but addressing the underlying cause of the withheld votes, (iii) resolving that the director will not be re-nominated in the future for election, or (iv) rejecting the resignation. Following a determination by the Board, the Company will disclose the Board's decision in a filing with the Securities and Exchange Commission, a press release, or other broadly disseminated means of communication. Each nominee for election at the Annual Meeting has agreed to follow this policy as set forth in the Corporate Governance Guidelines.

Our code of conduct reflects our policy that all of our employees, including the named executive officers, and directors must avoid any activity that creates, or may create, a conflict of interest that might interfere with the proper performance of their duties or that might be hostile, adverse or competitive with

24

our business. In addition, each of our directors and executive officers is encouraged to notify our Board when confronted with any situation that may be perceived as a conflict of interest, even if the person does not believe that the situation would violate our Code of Business Conduct or Corporate Governance Guidelines. The Board will then determine, after consultation with counsel, whether a conflict of interest exists. Directors who have a material personal interest in a particular issue may not vote on any matters with respect to that issue.

Compensation Committee Interlocks and Insider Participation

The identities of the directors who served on the Personnel and Compensation Committee during 2011 are set forth under the report of the Personnel and Compensation Committee under "Personnel and Compensation Committee Report" in this proxy statement. None of the directors who served on the Personnel and Compensation Committee during 2011 has been an officer or employee of Arch. None of our executives has served on the Board or compensation committee of any other entity that has or has had one or more executives serving as a member of our Board or compensation committee.

Nomination Process for Election of Directors

The Nominating and Corporate Governance Committee has responsibility for assessing the need for new directors to address specific requirements or to fill a vacancy. The committee initiates a search for a new candidate seeking input from our chairman and from other directors. The committee may retain an executive search firm to identify potential candidates. All candidates must meet the requirements specified in our Corporate Governance Guidelines. Candidates who meet those requirements and otherwise qualify for membership on our Board are identified, and the committee initiates contact with preferred candidates. The committee regularly reports to the Board on the progress of the committee's efforts. The committee meets to consider and approve final candidates who are then presented to the Board for consideration and approval. Our chairman or the chairman of the Nominating and Corporate Governance Committee may extend an invitation to join the Board.

Stockholder recommendations should be submitted in writing to Robert G. Jones, our secretary, and should include information regarding nominees required under our bylaws. Individuals recommended by stockholders will receive the same consideration received by individuals identified to the Nominating and Corporate Governance Committee through other means.

Communicating with the Board of Directors

Our Board has established procedures intended to facilitate stockholder communication directly with the Board, the non-employee directors or the Audit Committee. Such communications may be confidential or anonymous, and may be reported by phone to our confidential hotline at 866-519-1881 or by writing to the individual directors or group in care of Arch Coal, Inc., One CityPlace Drive, Suite 300, St. Louis, Missouri 63141, Attention: Senior Vice President-Law, General Counsel and Secretary. All such communications are promptly communicated to the lead director, the chairman of the Audit Committee or our Director of Internal Audit, as appropriate.

25

ELECTION OF DIRECTORS

(PROPOSAL NO. 1)

A total of five directors are up for election at the Annual Meeting. The terms of four directors (Messrs. Freudenthal, Taylor and Wold and Ms. Godley) will expire at the Annual Meeting. Our Board has nominated each of those individuals for re-election for a three-year term that will expire in 2015. In addition, as part of the Board's succession planning process and upon the recommendation of the Nominating and Corporate Governance Committee, Mr. Morris was appointed to the Board in March 2012. It is our Board's policy to have each member of the Board that is appointed outside the normal annual stockholder meeting process to come up for election at the annual meeting immediately after such member is appointed to the Board. As a result, Mr. Morris has been nominated for election as a Class II Director, and if elected will serve a term that will expire at the 2014 annual meeting.

The Board is not aware that any nominee will be unwilling or unable to serve as a director. All nominees have consented to be named in the proxy statement and to serve if elected. If, however, a nominee is unavailable for election, your proxy authorizes us to vote for a replacement nominee if the Board names one. As an alternative, the Board may reduce the number of directors to be elected at the Annual Meeting.

The Board recommends a vote "FOR" each nominee.

26

RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

(PROPOSAL NO. 2)

Ernst & Young LLP was our independent registered public accounting firm for 2011. The Audit Committee has appointed Ernst & Young LLP as our independent registered public accounting firm for 2012. The Audit Committee and the Board are requesting that stockholders ratify this appointment. In the event the stockholders do not ratify the selection of Ernst & Young LLP, the Audit Committee will reconsider its selection. Even if the selection is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the fiscal year if the Audit Committee believes such a change would be in our best interests and the best interests of our stockholders.

Representatives of Ernst & Young LLP are expected to be present at the Annual Meeting and to respond to questions.

The following table sets forth the fees accrued or paid to Ernst & Young LLP, the Company's independent registered public accounting firm, for the years ended December 31, 2011 and December 31, 2010:

| |

Fee | ||||||

|---|---|---|---|---|---|---|---|

Service

|

2011 | 2010 | |||||

Audit(1) |

$ | 2,399,372 | $ | 1,527,231 | |||

Audit-Related(2) |

46,500 | — | |||||

Tax(3) |

151,136 | — | |||||

All Other(4) |

— | 65,989 | |||||

- (1)

- Audit

services performed by Ernst & Young LLP in 2011 and 2010 included the annual financial statement audit (including required quarterly reviews)

and other procedures performed by Ernst & Young LLP to form an opinion on our consolidated financial statements and to issue their consent to include their audit opinion in registration

statements we filed with the SEC. Audit services in 2011 and 2010 also included the deliverance of comfort letters by Ernst & Young LLP in connection with the issuance of common stock and

senior notes in offerings in June 2011 and the issuance of senior notes in an offering completed in September 2010.

- (2)

- Audit-related

fees in 2011 relate to due diligence procedures performed by Ernst & Young LLP in connection with potential business acquisitions.

- (3)

- Fees

for tax services and related expenses in 2011 related to tax advice and tax planning services performed by Ernst & Young LLP.

- (4)

- All other services performed by Ernst & Young LLP in 2010 include process review and assessment services.

The Audit Committee has adopted an audit and non-audit services pre-approval policy that requires the committee, or the chairman of the committee, to pre-approve services to be provided by our independent registered public accounting firm. The Audit Committee will consider whether the services to be provided by the independent registered public accounting firm are prohibited by the SEC's rules on auditor

27

independence and whether the independent registered public accounting firm is best positioned to provide the most effective and efficient service. The Audit Committee is mindful of the relationship between fees for audit and non-audit services in deciding whether to pre-approve such services. The Audit Committee has delegated to the chairman of the committee pre-approval authority between committee meetings, and the chairman must report any pre-approval decisions to the committee at the next regularly scheduled committee meeting. All non-audit services performed by Ernst & Young LLP in 2011 and 2010 were pre-approved in accordance with the procedures established by the Audit Committee.

The Board recommends a vote "FOR" Proposal No. 2.

28

ADVISORY RESOLUTION TO APPROVE EXECUTIVE COMPENSATION

(PROPOSAL NO. 3)

Based on the voting results for the proposal considered by our stockholders at the 2011 annual meeting of stockholders regarding the frequency of stockholder votes on executive compensation, and the consideration of these results by the Board, the Board has adopted a policy to hold an annual advisory vote on executive compensation until the next required vote on the frequency of such advisory votes. We are required to hold such frequency votes at least every six years. We are seeking advisory stockholder approval of the compensation of named executive officers as disclosed in the section of this proxy statement entitled "Executive Compensation." Stockholders are being asked to vote on the following advisory resolution:

"RESOLVED, that the stockholders advise that they approve the compensation of the Company's named executive officers, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission (which disclosure includes the Compensation Discussion and Analysis, the compensation tables, and any related material)."

The compensation of our named executive officers (NEOs) is designed to tie a substantial percentage of a NEO's compensation to the attainment of financial and other performance measures that, the Board believes, promote the creation of long-term stockholder value and position the Company for long-term success. As described more fully in the Compensation Discussion and Analysis (CD&A), the total mix of compensation that the Company offers its NEOs is designed to enable the Company to attract and maintain top talent while, at the same time, creating a close relationship between performance and compensation. The Personnel and Compensation Committee and the Board believe that the design of the program, and as a result the compensation awarded to NEOs under the current program, fulfills this objective.

Stockholders are urged to read the CD&A section of this Proxy Statement, which discusses in detail how our compensation policies and procedures implement our compensation philosophy.

Although the vote on this Proxy Item No. 3 is non-binding, the Board will review the voting results in connection with its ongoing evaluation of the Company's compensation program. The final decision on the compensation and benefits of our NEOs remains with the Board.

The Board recommends a vote "FOR" the following resolution at the Annual Meeting:

"RESOLVED, that the stockholders advise that they approve the compensation of the Company's named executive officers, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission (which disclosure includes the Compensation Discussion and Analysis, the compensation tables, and any related material)."

29

STOCKHOLDER PROPOSAL

(PROXY ITEM NO. 4)

Our Company has received notice of the intention of stockholders to present the following proposal for voting at the Annual Meeting. The text of the stockholder proposal and supporting statements appear exactly as received, other than minor formatting changes, by our Company unless otherwise noted. All statements contained in a stockholder proposal and supporting statement are the sole responsibility of the proponent of that stockholder proposal. Our Company will provide the names, addresses and shareholdings (to our knowledge) of the proponents of the stockholder proposal upon oral or written request made to the Secretary of the Company.

Our Board recommends that you vote "AGAINST" this proposal for the reasons set forth below.

WHEREAS: In its 2009-2010 Corporate Social Responsibility Report, Arch Coal stated that "[i]n 2009 and 2010, Arch delivered its best environmental compliance years on record." and that it "adhere[s] to the requirements of the Clean Water Act ... at all levels of our operations." However, Arch recently incurred considerable legal liability and economic loss due to water pollution associated with its Appalachian mining, including mountaintop mining.

In 2011, Arch agreed to pay $6 million to settle suits brought by the U.S. Environmental Protection Agency (EPA) and the states of West Virginia and Kentucky, and by conservation organizations, for water pollution violations at several of Arch's Appalachian mines. The violations included selenium discharges over twice the allowable limits and discharges of aluminum and total suspended solids at concentrations over 20 times above allowable limits. In late 2010, International Coal Group (ICG), Inc., recently acquired by Arch, agreed to pay a total of $752,450 to settle two cases alleging water pollution violations at Appalachian surface mines.

In January 2011, EPA vetoed the Clean Water Act permit for Arch's 2,300-acre Spruce No. 1 Mine in West Virginia because the mountaintop mining would bury 6.6 miles of high-quality headwater streams, causing "unacceptable adverse effects on wildlife."

Mountaintop mining, which involves depositing rock and soil in valleys, frequently burying streams, "causes permanent loss of ecosystems that play critical roles in ecological processes such as nutrient cycling and production of organic matter for downstream food webs." (Science 327:148, 2010). Streams affected by mountaintop mining contain pollutants in concentrations dangerous to fish, birds, and humans. Mountaintop mining increases the frequency and intensity of flooding and the amount of runoff.

Mountaintop mining communities have increased rates of birth defects, cardiovascular disease mortality, and self-reported cancer, as well as an overall reduction in health-related quality of life.

Having recognized the significant environmental concerns and increasing regulatory scrutiny associated with mountaintop mining, several major U.S. and European banks have decided to cease financing companies whose primary coal extractions method is mountaintop mining.

30

- •

- Total water withdrawal by source.

- •

- Water sources significantly affected by withdrawal of water.

- •

- Percentage and total volume of water recycled and reused.

- •

- Total water discharge by quality and destination.

- •

- Total weight of waste by type and disposal method.

- •

- Identity, size, protected status, and biodiversity value of water bodies and related habitats significantly affected by the reporting organization's discharges of water and runoff.

In its 2009-2010 Corporate Social Responsibility Report, Arch Coal used Global Reporting Initiative (GRI) guidelines to report its environmental impacts. However, the information Arch presented was partial and not verified by GRI.

Resolved: Shareholders request a report, prepared at reasonable cost within six months after the 2012 annual meeting, omitting confidential information, on the company's efforts to reduce environmental and health hazards associated with its Appalachian mining operations, and how those efforts may reduce legal, reputational and other risks to the company's finances. The report should include complete, detailed information for these GRI performance indicators:

ARCH'S STATEMENT IN OPPOSITION TO PROXY ITEM NO. 4

While Arch recognizes the importance of environmental issues such as the ones raised in the proposal and the public interest in environmental matters associated with coal companies in general, the Board believes that it would be inappropriate for Arch to engage in the requested study at this time for a variety of reasons, including those set forth below.

Preparing the Requested Report Would Be Overly Burdensome and an Inefficient Use of Company Resources

The stockholder proposal requests a report on the Company's efforts to reduce environmental and health hazards associated with its Appalachian mining operations, specifically addressing certain GRI performance indicators related to water usage and water and waste disposal. The primary reason the proponents are requesting additional reporting is certain surface mining activity in the Appalachian region. Particularly, the proponents cite the recent veto by the Environmental Protection Agency ("EPA") of the Clean Water Act Section 404 permit for our 2,300-acre Spruce No. 1 Mine in West Virginia, as well as make statements regarding communities located around mountaintop removal mines.

We believe that the requested additional reporting would be overly burdensome and would represent an inefficient use of the Company's resources. Out of 46 mines in Arch's 23 active mining complexes, only 13 mines, located in seven of the mining complexes, are Appalachian surface mining operations, and none of them are mountaintop mining operations as that term is defined in the Surface Mining Control and Reclamation Act ("SMCRA") and regulations promulgated pursuant to SMCRA.

31

Furthermore, a majority of the information that the proponents are requesting, namely information related to water withdrawal and use, is not applicable in surface mining operations. In surface mining operations, water is typically not withdrawn from streams or used in the mining process. Water is encountered through natural precipitation events, but it is simply collected and discharged to streams in a manner that prevents sedimentation.

In addition, the mine that the proponents specifically mention in their proposal, the proposed 2,300-acre Spruce No. 1 Mine in West Virginia, is not currently in operation because of the EPA's unprecedented action. The EPA and the public as a whole had significant input during the approval process for the Spruce permit, and, notwithstanding this high level of collaboration during the approval process, the EPA subsequently vetoed the permit after it had already been issued. The Spruce permit was one of the most scrutinized and fully considered permits in West Virginia's history, and the 13-year permitting process included the preparation of a full environmental impact statement, the only permit in the eastern coal fields to ever undergo such a review. While we continue to pursue our legal actions against the EPA in this matter, as we have indicated previously, we do not believe that the EPA's veto of this permit currently has a material impact on the operation of our business.

The Board and our management believe that they are in the best position to determine how Company resources should be deployed toward addressing these matters. The engagement of a third party to undertake the requested report, when it is based on a type of mining operation that is not utilized by a majority of our mining complexes, and at mines located in a limited geographic area, is overly burdensome on the Company and would significantly increase administrative costs and divert Company resources from our more relevant and meaningful health and environmental concerns, as determined by those closest to and most knowledgeable about our business. Further, preparing a report covering the requested information would require analysis of day-to-day management decisions, strategies and plans implemented at various local levels which, individually, often are not material to Arch on a consolidated basis.

Existing Public Disclosures Address Environmental and Health Hazards Associated with Our Business, Including Our Appalachian Mining Operations

As a natural resource company, we take seriously our commitment to environmental stewardship and social responsibility to our stakeholders, including the communities in which we operate. Our commitment to the environment is described under our "Environment" tab on our website, archcoal.com, and is further expanded upon in our 2009-2010 Corporate Social Responsibility Report, published in September 2011, which stockholders can view on our website or obtain a copy in print form by sending a written request to our Company's Secretary. In this report, we outline the increased Company-wide water, oil and metal recycling, as well as discuss efforts underway to reduce airborne emissions, advance technology to address global greenhouse gas emissions, and protect and enhance water resources. As we state in the Corporate Social Responsibility Report, "Our charge is to carefully balance economic progress and social responsibility. That's why we go beyond supplying affordable and increasingly clean energy to people around the world... By respecting the environment, we strive to be good neighbors."

32

In addition, in our Form 10-K for the fiscal year ended December 31, 2011, under the "Environmental and Other Regulatory Matters" heading, we outline the steps we must take to ensure compliance with various water, air and other environmental regulations. As we describe in the Form 10-K, during the permitting process for each mining operation, there are public notice and comment periods, whereby the general public is able to review and provide input on the mining operations related to such permits. In fact, as described above, the Spruce permit mentioned by the proponent had a 13-year permitting process, and included a full environmental impact statement.

Finally, under the Clean Water Act and corresponding state regulations, we are already required to report specific water discharge information. This information is collected by each state and is made available to the public by each state. In addition, the EPA has recently begun compiling this information and has created a publicly available, searchable database, the Discharge Monitoring Report (DMR) Pollutant Loading Tool located at http://cfpub.epa.gov/dmr/ez_search.cfm, where anyone can view water discharge information from the Company's operations.

As a result, in accordance with applicable laws and regulations, we already include material information about the environmental impact of our operations in our public filings with the SEC and the EPA and in our public reports to other applicable federal, state and local agencies. Requiring us to provide information at an even greater level of detail regarding a separate limited subset of our mining operations would result in our stockholders receiving a report that necessarily would be lengthy given the scope of the information requested in the stockholder proposal, while all information material to Arch on a consolidated basis already appears in our publicly available reports pursuant to applicable laws and regulations.

Arch Has Demonstrated a Strong Commitment to Environmental Issues at the Highest Levels of Its Management

Across a variety of materials published by Arch, including in our Corporate Social Responsibility Report, our website, our most recent Form 10-K, and other materials, we emphasize our strong focus on achieving "A Perfect Zero." This means zero environmental violations and zero safety incidents across all of our operations and regions, the ultimate standard to which our management and Board holds each subsidiary operation.