|

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

(IRS employer identification no.)

|

|

Title of each class

|

Trading symbol

|

Name of exchange on which registered

|

|

|

|

|

|

|

☒

|

Accelerated filer

|

☐

|

|||

|

Non-accelerated filer

|

☐

|

Smaller reporting company

|

|

|||

|

Emerging growth company

|

|

|

Consolidated Financial Statements

|

|

| • |

MOSFETs: Infineon, ON Semiconductor, Renesas, STMicroelectronics, Toshiba.

|

| • |

Diodes: Diodes Inc., Nexperia, ON Semiconductor, Rohm, STMicroelectronics.

|

| • |

Optoelectronic Components: Broadcom, ON Semiconductor, Renesas, Toshiba.

|

| • |

Resistors: Bourns, KOA, Murata, Panasonic, Rohm, TDK-EPCOS, Yageo.

|

| • |

Inductors: Bourns, Cyntec, Murata, Panasonic, Taiyo Yuden, TDK-EPCOS, Yageo.

|

| • |

Capacitors: Kyocera, Murata, Nichicon, Panasonic, Taiyo Yuden, TDK-EPCOS, Yageo.

|

|

United States

|

2,300 |

|||

|

People’s Republic of China

|

7,600 |

|||

|

Germany

|

2,300 |

|||

|

Israel

|

2,400 |

|||

|

Taiwan

|

2,000 |

|||

|

Czech Republic

|

1,200 |

|||

|

India

|

1,100 |

|||

|

Other Europe

|

1,600 |

|||

|

Other Americas

|

1,400 |

|||

|

Other Asia

|

2,000 |

|||

|

Total

|

23,900

|

| • |

Corporate Governance Principles

|

| • |

Code of Business Conduct and Ethics

|

| • |

Code of Ethics for Financial Officers

|

| • |

Audit Committee Charter

|

| • |

Nominating and Corporate Governance Committee Charter

|

| • |

Compensation Committee Charter

|

| • |

Executive Stock Ownership Guidelines

|

| • |

Director Stock Ownership Guidelines

|

| • |

Clawback Policy

|

| • |

Hedging-Pledging Policy

|

| • |

Nominating and Corporate Governance Committee Policy Regarding Qualifications of Directors

|

| • |

Related Party Transactions Policy

|

| • |

Ethics Helpline

|

|

•

|

Adverse impact on our customers and supply channels;

|

|

•

|

Decrease in sales, product demand and pricing and unfavorable economic and market conditions;

|

|

•

|

Increased costs, including higher shipping costs due to reduced shipping capacity;

|

|

•

|

Restrictions on our manufacturing, support operations or workforce, or similar limitations for our customers, vendors, and suppliers, that could limit our

ability to meet customer demand;

|

|

•

|

Potential increased credit risk if customers, distributors, and resellers are unable to pay us, or must delay paying their obligations to us;

|

|

•

|

Restrictions or disruptions of transportation, such as reduced availability of air transport, port closures, and increased border controls or closures could

result in delays;

|

|

•

|

Impact on our workforce/employees due to the spread of the virus and any shelter-in-place orders; and

|

|

•

|

Cybersecurity risks as a result of extended periods of remote work arrangements.

|

|

•

|

the provision that our Class B common stock is generally entitled to ten votes per share, while our common stock is entitled to one vote per share, enabling the

holders of our Class B common stock to effectively control the outcome of substantially all matters submitted to a vote of our stockholders, including the election of directors and change of control transactions;

|

|

•

|

the provision establishing a classified board of directors with three-year staggered terms and the provision that a director may be removed only for cause, each

of which could delay the ability of stockholders to change the membership of a majority of our board of directors;

|

|

•

|

the ability of our board of directors to issue shares of preferred stock and to determine the price and other terms of those shares, including preferences and

voting rights, without stockholder approval, which could be used to significantly dilute the ownership of a hostile acquirer;

|

|

•

|

the right of our board of directors to elect a director to fill a vacancy created by the expansion of our board of directors or the resignation, death or removal

of a director, which prevents stockholders from being able to fill vacancies on our board of directors;

|

|

•

|

the requirement that a special meeting of stockholders may be called only by the directors or by any officer instructed by the directors to call the meeting,

which could delay the ability of our stockholders to force consideration of a proposal or to take action, including the removal of directors; and

|

|

•

|

the ability of our board of directors, by majority vote, to amend the bylaws, which may allow our board of directors to take additional actions to prevent an

unsolicited takeover and inhibit the ability of an acquirer to amend the bylaws to facilitate an unsolicited takeover attempt.

|

| • |

overall economic and business conditions;

|

| • |

competitive factors in the industries in which we conduct our business;

|

| • |

changes in governmental regulation;

|

| • |

changes in tax requirements, including tax rate changes, new tax laws, and revised tax law interpretations;

|

| • |

changes in GAAP or interpretations of GAAP by governmental agencies and self-regulatory groups;

|

| • |

interest rate fluctuations, foreign currency rate fluctuations, and other capital market conditions; and

|

| • |

economic and political conditions in international markets, including governmental changes and restrictions on the ability to transfer capital across borders.

|

|

Owned Locations

|

Business Segment

|

Approx. Available Space

(Square Feet)

|

|

|

United States

|

|||

|

Columbus, NE

|

Resistors

|

201,000

|

|

|

Bennington, VT

|

Capacitors

|

64,000

|

|

|

Yankton, SD

|

Inductors

|

60,000

|

|

|

Warwick, RI

|

Resistors

|

56,000

|

|

|

Niagara Falls, NY

|

Resistors

|

34,000

|

|

|

Marshall, MN

|

Inductors

|

22,000

|

|

|

Non-U.S.

|

|||

|

Vocklabruck, Austria

|

Diodes

|

100,000

|

|

|

People's Republic of China

|

|||

|

Tianjin

|

Diodes

|

397,000

|

|

|

Shanghai

|

Diodes

|

195,000

|

|

|

Xi'an

|

MOSFETs and Diodes

|

133,000

|

|

|

Czech Republic

|

|||

|

Blatna

|

Resistors and Capacitors

|

276,000

|

|

|

Dolni Rychnov

|

Resistors and Capacitors

|

183,000

|

|

|

Prachatice

|

Capacitors

|

92,000

|

|

|

Volary

|

Resistors

|

35,000

|

|

|

France

|

|||

|

Nice

|

Resistors

|

221,000

|

|

|

Chateau Gontier

|

Resistors

|

82,000

|

|

|

Hyeres

|

Resistors

|

59,000

|

|

|

Germany

|

|||

|

Selb

|

Resistors and Capacitors

|

472,000

|

|

|

Heide

|

Resistors

|

264,000

|

|

|

Landshut

|

Capacitors

|

75,000

|

|

|

Fichtelberg

|

Resistors

|

36,000

|

|

|

Budapest, Hungary

|

Diodes

|

101,000

|

|

|

Loni, India

|

Resistors and Capacitors

|

405,000

|

|

|

Israel

|

|||

|

Dimona

|

Resistors and Capacitors

|

404,000

|

|

|

Migdal Ha'Emek

|

Capacitors

|

288,000

|

|

|

Be'er Sheva

|

Resistors, Inductors and Capacitors

|

276,000

|

|

|

Turin, Italy

|

Diodes

|

102,000

|

|

|

Miharu, Japan

|

Capacitors

|

165,000

|

|

|

Melaka, Malaysia

|

Optoelectronic Components

|

156,000

|

|

|

Juarez, Mexico

|

Resistors

|

75,000

|

|

|

Famalicao, Portugal

|

Capacitors

|

222,000

|

|

|

Republic of China (Taiwan)

|

|||

|

Taipei

|

Diodes

|

366,000

|

|

|

Kaohsiung

|

MOSFETs

|

105,000

|

|

Leased Locations

|

Business Segment

|

Approx. Available Space

(Square Feet)

|

|

|

United States

|

|||

|

Attleboro, MA

|

Resistors

|

100,000 | |

|

Columbus, NE

|

Resistors

|

87,000

|

|

|

Ontario, CA

|

Resistors

|

38,000

|

|

|

Dover, NH

|

Inductors

|

35,000

|

|

| East Windsor, CT | Resistors | 30,000 | |

|

Hollis, NH

|

Resistors

|

25,000

|

|

|

Fremont, CA

|

Resistors

|

18,000

|

|

| Glendale, WI |

Resistors |

14,000 | |

| Montevideo, MN |

Inductors |

11,000 |

|

|

Duluth, MN

|

Inductors

|

10,000

|

|

|

Non-U.S.

|

|||

|

Klagenfurt, Austria

|

Capacitors

|

150,000

|

|

|

People’s Republic of China

|

|||

|

Danshui

|

Capacitors, Inductors, and Resistors

|

446,000

|

|

|

Shanghai

|

MOSFETs

|

300,000

|

|

|

Shatian

|

Capacitors and Resistors

|

218,000

|

|

|

Zhuhai

|

Inductors

|

179,000

|

|

|

Long Xi

|

Resistors

|

36,000

|

|

|

Prestice, Czech Republic

|

Capacitors

|

15,000

|

|

|

Santo Domingo, Dominican Republic

|

Inductors

|

44,000

|

|

|

Germany

|

|||

|

Itzehoe

|

MOSFETs

|

217,000

|

|

|

Heilbronn

|

Diodes and Optoelectronic Components

|

163,000

|

|

|

Selb

|

Capacitors

|

47,000

|

|

|

Mumbai, India

|

Diodes

|

34,000

|

|

|

Mexico

|

|||

| Juarez |

Resistors |

314,000 | |

|

Durango

|

Inductors

|

134,000

|

|

|

Mexicali

|

Resistors

|

15,000

|

|

|

Manila, Philippines

|

Optoelectronic Components

|

149,000

|

|

|

Kaohsiung, Republic of China (Taiwan)

|

Diodes

|

130,000

|

|

Name

|

Age

|

Positions Held

|

|

|

Marc Zandman*

|

61

|

Executive Chairman of the Board, Chief Business Development Officer, and President, Vishay Israel Ltd.

|

|

|

Joel Smejkal*

|

56

|

Chief Executive Officer, President, and Director

|

|

|

Lori Lipcaman

|

65

|

Executive Vice President and Chief Financial Officer

|

|

| Jeff Webster |

52 |

Executive Vice President - Chief Operating Officer |

|

|

Roy Shoshani

|

49

|

Executive Vice President - Chief Technical Officer

|

|

|

Peter Henrici

|

67

|

Executive Vice President - Corporate Development

|

|

|

Andreas Randebrock

|

58

|

Executive Vice President Global Human Resources

|

|

Common stock price range

|

Dividends declared

|

|||||||||||||||||||||||

|

2022

|

2021

|

per share

|

||||||||||||||||||||||

|

High

|

Low

|

High

|

Low

|

2022

|

2021

|

|||||||||||||||||||

|

Fourth quarter

|

$

|

23.39

|

$

|

17.63

|

$

|

22.65

|

$

|

19.00

|

$

|

0.100

|

$

|

0.100

|

||||||||||||

|

Third quarter

|

$

|

21.58

|

$

|

16.73

|

$

|

22.93

|

$

|

19.67

|

$

|

0.100

|

$

|

0.095

|

||||||||||||

|

Second quarter

|

$

|

20.91

|

$

|

17.13

|

$

|

26.50

|

$

|

21.09

|

$

|

0.100

|

$

|

0.095

|

||||||||||||

|

First quarter

|

$

|

22.71

|

$

|

17.58

|

$

|

25.26

|

$

|

20.56

|

$

|

0.100

|

$

|

0.095

|

||||||||||||

|

Period

|

Total Number of Shares Purchased

|

Average Price Paid per Share (including commission)

|

Total Number of Shares Purchased as Part of Publicly Announced Program

|

Total Dollar Amount Purchased Under the Program

|

Maximum Number of Shares that May Yet Be Purchased Under the Program

|

|||||||||||||||

|

October 2 - October 29

|

472,324

|

$

|

19.34

|

472,324

|

$

|

9,134,132

|

4,549,338

|

|||||||||||||

|

October 30 - November 26

|

385,274

|

21.82

|

385,274

|

8,406,284

|

4,164,064

|

|||||||||||||||

|

November 27 - December 31

|

491,371

|

21.90

|

491,371

|

10,760,263

|

3,672,693

|

|||||||||||||||

|

Total

|

1,348,969

|

$

|

20.98

|

1,348,969

|

$

|

28,300,679

|

3,672,693

|

|||||||||||||

|

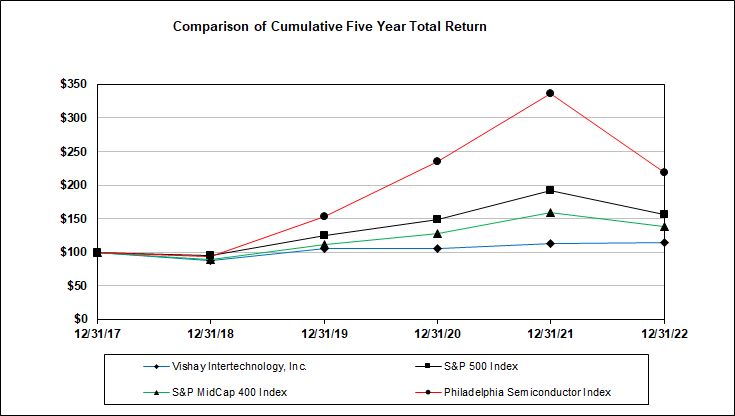

Base

|

Years Ending December 31,

|

||||||||||

|

Period

|

|||||||||||

|

Company Name / Index

|

2017

|

2018

|

2019

|

2020

|

2021

|

2022

|

|||||

|

Vishay Intertechnology, Inc.

|

100

|

88.11

|

106.31 |

105.76 |

113.65 |

114.41 |

|||||

|

S&P 500 Index

|

100

|

95.62 |

125.72 |

148.85 |

191.58 |

156.88 |

|||||

|

S&P MidCap 400 Index

|

100

|

88.92 |

112.21 |

127.54 |

159.12 |

138.34 |

|||||

|

Philadelphia Semiconductor Index

|

100

|

93.95 |

153.39 |

235.71 |

336.71 |

219.26 |

|||||

|

Years ended December 31,

|

||||||||||||

|

2022

|

2021

|

2020

|

||||||||||

|

GAAP net earnings attributable to Vishay stockholders

|

$

|

428,810

|

$

|

297,970

|

$

|

122,923

|

||||||

|

Reconciling items affecting gross profit:

|

||||||||||||

|

Impact of COVID-19 pandemic

|

6,661

|

-

|

4,563

|

|||||||||

|

Other reconciling items affecting operating income:

|

||||||||||||

|

Impact of COVID-19 pandemic

|

546

|

-

|

(1,451

|

)

|

||||||||

|

Restructuring and severance costs

|

-

|

-

|

743

|

|||||||||

|

Reconciling items affecting other income (expense):

|

||||||||||||

|

Loss on early extinguishment of debt

|

-

|

-

|

8,073

|

|||||||||

|

Reconciling items affecting tax expense (benefit):

|

||||||||||||

| Effects of changes in uncertain tax positions |

$ | (5,941 | ) | $ | - | $ | 3,751 | |||||

| Effects of changes in valuation allowances |

(33,669 | ) | (5,714 | ) | - | |||||||

|

Effect of change in indefinite reversal assertion

|

59,642 |

-

|

-

|

|||||||||

|

Change in tax laws and regulations

|

-

|

45,040

|

-

|

|||||||||

|

Change in deferred taxes due to early extinguishment of debt

|

-

|

-

|

(1,563

|

)

|

||||||||

| Effects of cash repatriation program | - | - | (190 | ) | ||||||||

|

Tax effects of pre-tax items above

|

(1,802

|

)

|

-

|

(2,799

|

)

|

|||||||

|

Adjusted net earnings

|

$

|

454,247

|

$

|

337,296

|

$

|

134,050

|

||||||

|

Adjusted weighted average diluted shares outstanding

|

143,915

|

145,495

|

145,228

|

|||||||||

|

Adjusted earnings per diluted share

|

$

|

3.16

|

$

|

2.32

|

$

|

0.92

|

||||||

|

Years ended December 31,

|

||||||||||||

| 2022 | 2021 | 2020 | ||||||||||

|

MOSFETS

|

$ | 274,498 |

$

|

189,959

|

$ | 114,236 | ||||||

|

Diodes

|

198,105 | 168,365 | 90,004 | |||||||||

|

Optoelectronic Components

|

102,787 | 100,737 | 66,502 | |||||||||

|

Resistors

|

262,072 | 215,853 | 153,214 | |||||||||

|

Inductors

|

104,349 | 107,358 | 92,500 | |||||||||

|

Capacitors

|

123,839 | 105,641 | 70,010 | |||||||||

|

Unallocated gross profit (loss)

|

(6,661 | ) | - | (4,563 | ) | |||||||

|

Gross profit

|

$ | 1,058,989 |

$

|

887,913

|

$ | 581,903 | ||||||

|

Years ended December 31,

|

||||||||||||

|

2022

|

2021

|

2020

|

||||||||||

|

Net cash provided by continuing operating activities

|

$

|

484,288

|

$

|

457,104

|

$

|

314,938

|

||||||

|

Proceeds from sale of property and equipment

|

1,198

|

1,317

|

403

|

|||||||||

|

Less: Capital expenditures

|

(325,308

|

)

|

(218,372

|

)

|

(123,599

|

)

|

||||||

|

Free cash

|

$

|

160,178

|

$

|

240,049

|

$

|

191,742

|

||||||

|

4th Quarter

2021

|

1st Quarter

2022

|

2nd Quarter

2022

|

3rd Quarter

2022

|

4th Quarter

2022

|

||||||||||||||||

|

Net revenues

|

$

|

843,072

|

$

|

853,793

|

$

|

863,512

|

$

|

924,798

|

$

|

$ 855,298

|

||||||||||

|

Gross profit margin (1)

|

27.3

|

%

|

30.3

|

%

|

30.3

|

%

|

31.3

|

%

|

29.1

|

%

|

||||||||||

|

Operating margin (2)

|

14.4

|

%

|

17.1

|

%

|

17.5

|

%

|

19.8

|

%

|

15.8

|

%

|

||||||||||

|

End-of-period backlog

|

$

|

2,306,500

|

$

|

2,416,700

|

$

|

2,425,200

|

$

|

2,261,400

|

$

|

2,292,700

|

||||||||||

|

Book-to-bill ratio

|

1.09

|

1.14

|

1.07

|

0.88

|

0.94

|

|||||||||||||||

|

Inventory turnover

|

4.5

|

4.2

|

3.8

|

4.1

|

3.9

|

|||||||||||||||

|

Change in ASP vs. prior quarter

|

1.3

|

%

|

2.4

|

%

|

2.9

|

%

|

0.0

|

%

|

0.6

|

%

|

||||||||||

|

4th Quarter

2021

|

1st Quarter

2022

|

2nd Quarter

2022

|

3rd Quarter

2022

|

4th Quarter

2022

|

||||||||||||||||

|

MOSFETs

|

||||||||||||||||||||

|

Net revenues

|

$

|

171,339

|

$

|

172,674

|

$

|

158,395

|

$

|

225,186

|

$

|

206,005

|

||||||||||

|

Book-to-bill ratio

|

1.01

|

1.28

|

1.14

|

0.78

|

1.15

|

|||||||||||||||

|

Gross profit margin

|

30.1

|

%

|

34.0

|

%

|

35.0

|

%

|

36.9

|

%

|

37.5

|

%

|

||||||||||

|

Segment operating margin

|

23.5

|

%

|

28.1

|

%

|

28.2

|

%

|

31.9

|

%

|

30.9

|

%

|

||||||||||

|

Diodes

|

||||||||||||||||||||

|

Net revenues

|

$

|

192,117

|

$

|

182,334

|

$

|

192,083

|

$

|

209,012

|

$

|

181,791

|

||||||||||

|

Book-to-bill ratio

|

1.10

|

1.16

|

1.10

|

0.79

|

0.88

|

|||||||||||||||

|

Gross profit margin

|

23.7

|

%

|

25.1

|

%

|

27.8

|

%

|

27.0

|

%

|

23.4

|

%

|

||||||||||

|

Segment operating margin

|

20.6

|

%

|

22.2

|

%

|

25.3

|

%

|

24.6

|

%

|

19.9

|

%

|

||||||||||

|

Optoelectronic Components

|

||||||||||||||||||||

|

Net revenues

|

$

|

78,398

|

$

|

81,016

|

$

|

77,936

|

$

|

73,447

|

$

|

63,985

|

||||||||||

|

Book-to-bill ratio

|

1.22

|

0.78

|

0.86

|

0.57

|

0.78

|

|||||||||||||||

|

Gross profit margin

|

34.2

|

%

|

40.0

|

%

|

33.9

|

%

|

35.3

|

%

|

28.1

|

%

|

||||||||||

|

Segment operating margin

|

27.2

|

%

|

34.8

|

%

|

28.7

|

%

|

30.0

|

%

|

20.1

|

%

|

||||||||||

|

Resistors

|

||||||||||||||||||||

|

Net revenues

|

$

|

190,041

|

$

|

207,032

|

$

|

213,176

|

$

|

207,437

|

$

|

205,161

|

||||||||||

|

Book-to-bill ratio

|

1.14

|

1.24

|

1.05

|

1.08

|

0.85

|

|||||||||||||||

|

Gross profit margin

|

28.5

|

%

|

31.4

|

%

|

33.1

|

%

|

33.0

|

%

|

28.3

|

%

|

||||||||||

|

Segment operating margin

|

25.6

|

%

|

28.1

|

%

|

29.9

|

%

|

29.7

|

%

|

25.3

|

%

|

||||||||||

|

Inductors

|

||||||||||||||||||||

|

Net revenues

|

$

|

81,825

|

$

|

82,777

|

$

|

89,608

|

$

|

83,503

|

$

|

75,198

|

||||||||||

|

Book-to-bill ratio

|

1.13

|

1.14

|

0.97

|

1.02

|

0.83

|

|||||||||||||||

|

Gross profit margin

|

29.4

|

%

|

30.0

|

%

|

33.1

|

%

|

30.8

|

%

|

32.1

|

%

|

||||||||||

|

Segment operating margin

|

26.4

|

%

|

26.8

|

%

|

30.0

|

%

|

27.0

|

%

|

28.9

|

%

|

||||||||||

|

Capacitors

|

||||||||||||||||||||

|

Net revenues

|

$

|

129,352

|

$

|

127,960

|

$

|

132,314

|

$

|

126,213

|

$

|

123,158

|

||||||||||

|

Book-to-bill ratio

|

1.04

|

1.02

|

1.17

|

0.95

|

0.99

|

|||||||||||||||

|

Gross profit margin

|

21.6

|

%

|

25.2

|

%

|

24.5

|

%

|

23.7

|

%

|

23.7

|

%

|

||||||||||

|

Segment operating margin

|

17.7

|

%

|

21.4

|

%

|

20.9

|

%

|

20.1

|

%

|

19.9

|

%

|

||||||||||

| Year ended |

||||

| December 31, 2022 | ||||

|

Dividends paid to stockholders

|

$ | 57,187 | ||

|

Stock repurchases

|

82,972 | |||

|

Total

|

$ | 140,159 | ||

|

Benefit

obligation

|

Plan assets

|

Funded

position

|

Informally

funded assets

|

Net position

|

Unrecognized

actuarial

items

|

|||||||||||||||||||

|

U.S. non-qualified pension plans

|

$

|

37,221

|

$

|

-

|

$

|

(37,221

|

)

|

$

|

21,638

|

$

|

(15,583

|

)

|

$

|

69

|

||||||||||

|

German pension plans

|

125,377

|

-

|

(125,377

|

)

|

3,677

|

(121,700

|

)

|

12,500

|

||||||||||||||||

|

Taiwanese pension plans

|

47,210

|

39,461

|

(7,749

|

)

|

-

|

(7,749

|

)

|

4,000

|

||||||||||||||||

|

Other pension plans

|

30,954

|

26,159

|

(4,795

|

)

|

-

|

(4,795

|

)

|

(108

|

)

|

|||||||||||||||

|

OPEB plans

|

11,043

|

-

|

(11,043

|

)

|

-

|

(11,043

|

)

|

(1,288

|

)

|

|||||||||||||||

|

Other retirement obligations

|

10,560

|

-

|

(10,560

|

)

|

-

|

(10,560

|

)

|

-

|

||||||||||||||||

|

$

|

262,365

|

$

|

65,620

|

$

|

(196,745

|

)

|

$

|

25,315

|

$

|

(171,430

|

)

|

$

|

15,173

|

|||||||||||

|

Years ended December 31,

|

||||||||||||

|

2022

|

2021

|

2020

|

||||||||||

|

Costs of products sold

|

69.7

|

%

|

72.6

|

%

|

76.7

|

%

|

||||||

|

Gross profit

|

30.3

|

%

|

27.4

|

%

|

23.3

|

%

|

||||||

|

Selling, general, and administrative expenses

|

12.7

|

%

|

13.0

|

%

|

14.8

|

%

|

||||||

|

Operating income

|

17.6

|

%

|

14.4

|

%

|

8.4

|

%

|

||||||

|

Income before taxes and noncontrolling interest

|

17.0

|

%

|

13.4

|

%

|

6.3

|

%

|

||||||

|

Net earnings attributable to Vishay stockholders

|

12.3

|

%

|

9.2

|

%

|

4.9

|

%

|

||||||

|

________

|

||||||||||||

|

Effective tax rate

|

27.5

|

%

|

31.2

|

%

|

21.8

|

%

|

||||||

|

2022

|

2021

|

2020

|

||||||||||

|

Net revenues

|

$

|

3,497,401

|

$

|

3,240,487

|

$

|

2,501,898

|

||||||

|

Change versus prior year

|

$

|

256,914

|

$

|

738,589

|

||||||||

|

Percentage change versus prior year

|

7.9

|

%

|

29.5

|

%

|

||||||||

|

2022 vs. 2021

|

2021 vs. 2020

|

|||||||

|

Change attributable to:

|

||||||||

|

Increase in volume

|

4.3

|

%

|

25.5

|

%

|

||||

|

Increase in average selling prices

|

7.2

|

%

|

1.0

|

%

|

||||

|

Foreign currency effects

|

(4.0

|

)%

|

1.4

|

%

|

||||

|

Acquisitions

|

0.4

|

%

|

0.7

|

%

|

||||

|

Other

|

0.0

|

%

|

0.9

|

%

|

||||

|

Net change

|

7.9

|

%

|

29.5

|

%

|

||||

|

Years ended December 31,

|

||||||||||||

|

2022

|

2021

|

2020

|

||||||||||

|

Net revenues

|

$

|

762,260

|

$

|

667,998

|

$

|

501,380

|

||||||

|

Change versus comparable prior year period

|

$

|

94,262

|

$

|

166,618

|

||||||||

|

Percentage change versus comparable prior year period

|

14.1

|

%

|

33.2

|

%

|

||||||||

|

2022 vs. 2021

|

2021 vs. 2020

|

|||||||

|

Change attributable to:

|

||||||||

|

Increase in volume

|

4.1

|

%

|

33.1

|

%

|

||||

|

Change in average selling prices

|

11.8

|

%

|

(0.3

|

)%

|

||||

|

Foreign currency effects

|

(2.4

|

)%

|

0.6

|

%

|

||||

| Acquisition |

0.1 | % | 0.0 | % | ||||

|

Other

|

0.5

|

%

|

(0.2

|

)%

|

||||

|

Net change

|

14.1

|

%

|

33.2

|

%

|

||||

|

Years ended December 31,

|

||||||||||||

|

2022

|

2021

|

2020

|

||||||||||

|

Gross profit margin

|

36.0 | % | 28.4 | % | 22.8 | % | ||||||

| Segment operating margin |

30.0 | % | 22.3 | % | 15.3 | % | ||||||

|

Years ended December 31,

|

||||||||||||

|

2022

|

2021

|

2020

|

||||||||||

|

Net revenues

|

$

|

765,220

|

$

|

709,416

|

$

|

502,548

|

||||||

|

Change versus comparable prior year period

|

$

|

55,804

|

$

|

206,868

|

||||||||

|

Percentage change versus comparable prior year period

|

7.9

|

%

|

41.2

|

%

|

||||||||

|

2022 vs. 2021

|

2021 vs. 2020

|

|||||||

|

Change attributable to:

|

||||||||

|

Increase in volume

|

1.8

|

%

|

34.2

|

%

|

||||

|

Increase in average selling prices

|

9.7

|

%

|

2.9

|

%

|

||||

|

Foreign currency effects

|

(3.7

|

)%

|

1.2

|

%

|

||||

|

Other

|

0.1

|

%

|

2.9

|

%

|

||||

|

Net change

|

7.9

|

%

|

41.2

|

%

|

||||

|

Years ended December 31,

|

||||||||||||

|

2022

|

2021

|

2020

|

||||||||||

|

Gross profit margin

|

25.9

|

%

|

23.7

|

%

|

17.9

|

%

|

||||||

| Segment operating margin |

23.1 | % | 20.6 | % | 13.9 | % | ||||||

|

Years ended December 31,

|

||||||||||||

|

2022

|

2021

|

2020

|

||||||||||

|

Net revenues

|

$

|

296,384

|

$

|

302,714

|

$

|

236,616

|

||||||

|

Change versus comparable prior year period

|

$

|

(6,330

|

)

|

$

|

66,098

|

|||||||

|

Percentage change versus comparable prior year period

|

(2.1

|

)%

|

27.9

|

%

|

||||||||

|

2022 vs. 2021

|

2021 vs. 2020

|

|||||||

|

Change attributable to:

|

||||||||

|

Change in volume

|

(3.6

|

)%

|

22.2

|

%

|

||||

|

Increase in average selling prices

|

6.7

|

%

|

2.7

|

%

|

||||

|

Foreign currency effects

|

(4.7

|

)%

|

1.7

|

%

|

||||

|

Other

|

(0.5

|

)%

|

1.3

|

%

|

||||

|

Net change

|

(2.1

|

)%

|

27.9

|

%

|

||||

|

Years ended December 31,

|

||||||||||||

|

2022

|

2021

|

2020

|

||||||||||

|

Gross profit margin

|

34.7

|

%

|

33.3

|

%

|

28.1

|

%

|

||||||

| Segment operating margin |

28.8 | % | 27.2 | % | 21.3 | % | ||||||

|

Years ended December 31,

|

||||||||||||

|

2022

|

2021

|

2020

|

||||||||||

|

Net revenues

|

$

|

832,806

|

$

|

752,554

|

$

|

606,183

|

||||||

|

Change versus comparable prior year period

|

$

|

80,252

|

$

|

146,371

|

||||||||

|

Percentage change versus comparable prior year period

|

10.7

|

%

|

24.1

|

%

|

||||||||

|

2022 vs. 2021

|

2021 vs. 2020

|

|||||||

|

Change attributable to:

|

||||||||

|

Increase in volume

|

10.4

|

%

|

18.2

|

%

|

||||

|

Increase in average selling prices

|

4.6

|

%

|

0.3

|

%

|

||||

|

Foreign currency effects

|

(5.6

|

)%

|

2.0

|

%

|

||||

|

Acquisitions

|

1.5

|

%

|

3.0

|

%

|

||||

|

Other

|

(0.2

|

)%

|

0.6

|

%

|

||||

|

Net change

|

10.7

|

%

|

24.1

|

%

|

||||

|

Years ended December 31,

|

||||||||||||

|

2022

|

2021

|

2020

|

||||||||||

|

Gross profit margin

|

31.5

|

%

|

28.7

|

%

|

25.3

|

%

|

||||||

| Segment operating margin |

28.2 | % | 25.4 | % | 21.6 | % | ||||||

|

Years ended December 31,

|

||||||||||||

|

2022

|

2021

|

2020

|

||||||||||

|

Net revenues

|

$

|

331,086

|

$

|

335,638

|

$

|

293,629

|

||||||

|

Change versus comparable prior year period

|

$

|

(4,552

|

)

|

$

|

42,009

|

|||||||

|

Percentage change versus comparable prior year period

|

(1.4

|

)%

|

14.3

|

%

|

||||||||

|

2022 vs. 2021

|

2021 vs. 2020

|

|||||||

|

Change attributable to:

|

||||||||

|

Change in volume

|

(0.8

|

)%

|

15.4

|

%

|

||||

|

Change in average selling prices

|

1.2

|

%

|

(1.3

|

)%

|

||||

|

Foreign currency effects

|

(1.8

|

)%

|

0.6

|

%

|

||||

|

Other

|

0.0

|

%

|

(0.4

|

)%

|

||||

|

Net change

|

(1.4

|

)%

|

14.3

|

%

|

||||

|

Years ended December 31,

|

||||||||||||

|

2022

|

2021

|

2020

|

||||||||||

|

Gross profit margin

|

31.5

|

%

|

32.0

|

%

|

31.5

|

%

|

||||||

| Segment operating margin |

28.2 | % | 29.0 | % | 28.1 | % | ||||||

|

Years ended December 31,

|

||||||||||||

|

2022

|

2021

|

2020

|

||||||||||

|

Net revenues

|

$

|

509,645

|

$

|

472,167

|

$

|

361,542

|

||||||

|

Change versus comparable prior year period

|

$

|

37,478

|

$

|

110,625

|

||||||||

|

Percentage change versus comparable prior year period

|

7.9

|

%

|

30.6

|

%

|

||||||||

|

2022 vs. 2021

|

2021 vs. 2020

|

|||||||

|

Change attributable to:

|

||||||||

|

Increase in volume

|

8.0

|

%

|

25.0

|

%

|

||||

|

Increase in average selling prices

|

5.6

|

%

|

1.8

|

%

|

||||

|

Foreign currency effects

|

(5.5

|

)%

|

2.0

|

%

|

||||

|

Other

|

(0.2

|

)%

|

1.8

|

%

|

||||

|

Net change

|

7.9

|

%

|

30.6

|

%

|

||||

|

Years ended December 31,

|

||||||||||||

|

2022

|

2021

|

2020

|

||||||||||

|

Gross profit margin

|

24.3

|

%

|

22.4

|

%

|

19.4

|

%

|

||||||

| Segment operating margin |

20.6 | % | 18.1 | % | 14.0 | % | ||||||

|

Years ended December 31,

|

||||||||||||

|

2022

|

2021

|

2020

|

||||||||||

|

Total SG&A expenses

|

$

|

443,503

|

$

|

420,111

|

$

|

371,450

|

||||||

|

as a percentage of sales

|

12.7

|

%

|

13.0

|

%

|

14.8

|

%

|

||||||

|

Years ended December 31,

|

||||||||||||

|

2022

|

2021

|

Change

|

||||||||||

|

Foreign exchange gain (loss)

|

$

|

5,690

|

$

|

(2,692

|

)

|

$

|

8,382

|

|||||

|

Interest income

|

7,560

|

1,269

|

6,291

|

|||||||||

|

Other components of net periodic pension expense

|

(11,090

|

)

|

(13,206

|

)

|

2,116

|

|||||||

|

Investment income (loss)

|

(6,812

|

)

|

(1,036

|

)

|

(5,776

|

)

|

||||||

|

Other

|

(200

|

)

|

11

|

(211

|

)

|

|||||||

|

$

|

(4,852

|

)

|

$

|

(15,654

|

)

|

$

|

10,802

|

|||||

|

Years ended December 31,

|

||||||||||||

|

2021

|

2020

|

Change

|

||||||||||

|

Foreign exchange gain (loss)

|

$

|

(2,692

|

)

|

$

|

(4,095

|

)

|

$

|

1,403

|

||||

|

Interest income

|

1,269

|

3,709

|

(2,440

|

)

|

||||||||

|

Other components of net periodic pension expense

|

(13,206

|

)

|

(13,613

|

)

|

407

|

|||||||

|

Investment income (loss)

|

(1,036

|

)

|

2,271

|

(3,307

|

)

|

|||||||

|

Other

|

11

|

(26

|

)

|

37

|

||||||||

|

$

|

(15,654

|

)

|

$

|

(11,754

|

)

|

$

|

(3,900

|

)

|

||||

|

December 31,

2022

|

December 31,

2021

|

|||||||

|

Credit Facility

|

$

|

42,000

|

$

|

-

|

||||

|

Convertible senior notes, due 2025

|

465,344

|

465,344

|

||||||

|

Deferred financing costs

|

(6,407

|

)

|

(9,678

|

)

|

||||

|

Total debt

|

500,937

|

455,666

|

||||||

|

Cash and cash equivalents

|

610,825

|

774,108

|

||||||

|

Short-term investments

|

305,272

|

146,743

|

||||||

|

Net cash and short-term investments (debt)

|

$

|

415,160

|

$

|

465,185

|

||||

|

Payments due by period

|

||||||||||||||||||||||||||||

|

Total

|

2023

|

2024

|

2025

|

2026

|

2027

|

Thereafter

|

||||||||||||||||||||||

|

Long-term debt

|

$

|

507,344

|

$

|

-

|

$

|

42,000

|

$

|

465,344

|

$

|

-

|

$

|

-

|

$

|

-

|

||||||||||||||

|

Interest payments on long-term debt

|

31,773

|

14,688

|

12,286

|

4,799

|

-

|

-

|

-

|

|||||||||||||||||||||

|

Operating leases

|

171,147

|

25,067

|

22,891

|

19,687

|

16,989

|

15,766

|

70,747

|

|||||||||||||||||||||

|

Letters of credit

|

939

|

-

|

939

|

-

|

-

|

-

|

-

|

|||||||||||||||||||||

|

Expected pension and postretirement plan funding

|

195,885

|

25,269

|

18,701

|

19,792

|

26,285

|

19,986

|

85,852

|

|||||||||||||||||||||

|

Estimated costs to complete construction in progress

|

162,000

|

157,300

|

4,700

|

-

|

-

|

-

|

-

|

|||||||||||||||||||||

| Estimated costs to complete MOSFETs wafer fab |

329,500 | 38,400 | 175,700 | 115,400 | - | - | - | |||||||||||||||||||||

|

TCJA transition tax

|

110,680

|

27,670

|

36,893

|

46,117

|

-

|

-

|

-

|

|||||||||||||||||||||

|

Uncertain tax positions

|

19,525

|

1,542

|

-

|

-

|

-

|

-

|

17,983

|

|||||||||||||||||||||

|

Purchase commitments

|

63,360

|

48,073

|

15,287

|

-

|

-

|

-

|

-

|

|||||||||||||||||||||

|

Other long-term liabilities

|

74,547

|

-

|

-

|

-

|

-

|

-

|

74,547

|

|||||||||||||||||||||

|

Total contractual cash obligations

|

$ | 1,666,700 | 338,009 | 329,397 | 671,139 |

$

|

43,274

|

$

|

35,752

|

$

|

249,129

|

|||||||||||||||||

| 1. |

Financial Statements

|

| 2. |

Financial Statement Schedules

|

| 3. |

Exhibits

|

| 3.4 |

Second Amendment to Amended and Restated Bylaws. Incorporated by reference to

Exhibit 3.1 to our Current Report on Form 8-K, filed on February 21, 2023. |

|

| 10.3†** | ||

|

101**

|

Interactive Data File (Annual Report on Form 10-K, for the year ended December 31, 2022, furnished in iXBRL (Inline eXtensible Business Reporting Language)).

|

|

|

104**

|

Cover Page Interactive Data File (formatted as Inline eXtensible Business Reporting Language and contained in Exhibit 101)

|

|

By:

|

/s/ Joel Smejkal

|

|

|

Joel Smejkal

|

||

|

President and Chief Executive Officer

|

||

|

February 22, 2023

|

|

Signature

|

Title

|

Date

|

|

Principal Executive Officer:

|

||

|

/s/ Joel Smejkal

|

President, Chief Executive Officer,

|

February 22, 2023

|

|

Joel Smejkal

|

and Director

|

|

|

Principal Financial and Accounting Officer:

|

||

|

/s/ Lori Lipcaman

|

Executive Vice President and Chief

|

February 22, 2023

|

|

Lori Lipcaman

|

Financial Officer

|

|

|

Board of Directors:

|

||

|

/s/ Marc Zandman

|

Executive Chairman of

|

February 22, 2023

|

|

Marc Zandman

|

the Board of Directors

|

|

|

/s/ Renee B. Booth

|

Director

|

February 22, 2023

|

|

Dr. Renee B. Booth

|

||

|

/s/ Michael J. Cody

|

Director

|

February 22, 2023

|

|

Michael J. Cody

|

||

|

/s/ Michiko Kurahashi

|

Director

|

February 22, 2023

|

|

Dr. Michiko Kurahashi

|

||

|

/s/ Abraham Ludomirski

|

Director

|

February 22, 2023

|

|

Dr. Abraham Ludomirski

|

||

|

/s/ Ziv Shoshani

|

Director

|

February 22, 2023

|

|

Ziv Shoshani

|

||

|

/s/ Timothy V. Talbert

|

Director

|

February 22, 2023

|

|

Timothy V. Talbert

|

||

|

/s/ Jeffrey H. Vanneste

|

Director

|

February 22, 2023

|

|

Jeffrey H. Vanneste

|

||

|

/s/ Ruta Zandman

|

Director

|

February 22, 2023

|

|

Ruta Zandman

|

||

|

/s/ Raanan Zilberman

|

Director

|

February 22, 2023

|

|

Raanan Zilberman

|

|

Report of Independent Registered Public Accounting Firm (PCAOB ID:)

|

|

|

Audited Consolidated Financial Statements

|

|

|

Sales Returns and Allowances Accruals

|

||

|

Description of the Matter

|

At December 31, 2022, the Company’s liability for sales returns and allowances was $47 million. As discussed in Note 1 of the consolidated

financial statements, the Company recognizes the estimated variable consideration to be received as revenue from contracts with customers and recognizes a related accrued liability for estimated future credits that will be issued to its

customers, primarily distributors, for product returns, scrap allowance, “stock, ship and debit”, and price protection programs with those customers.

Auditing management’s sales returns and allowances accruals specifically related to the scrap allowance and “stock, ship and debit” programs involved a high degree of subjectivity due to the significant judgment required in evaluating

management’s estimates of future credits that will be issued to customers for sales that were recognized during the period. In particular, the estimates were sensitive to significant assumptions such as the amount of future credits that are

expected to be provided to the customers.

|

|

|

How We Addressed the Matter in Our Audit

|

We obtained an understanding, evaluated the design and tested the operating effectiveness of controls over the Company’s sales returns and

allowances review process for the scrap allowance and “stock, ship and debit” programs. For example, we tested controls over management’s review of the significant assumptions described above.

To test the estimated sales returns and allowances accruals for the scrap allowance and “stock, ship and debit” programs, we

performed audit procedures that included, among others, assessing methodologies and testing the significant assumptions discussed above and the completeness and accuracy of the underlying data used by the Company in its analyses. We

inspected contracts with customers in evaluating whether the assumptions used by management agreed with the terms and conditions of the contracts. In addition, we compared the significant assumptions used by management to actual historical

credit experience. We also assessed the historical accuracy of management’s estimates and performed sensitivity analyses of significant assumptions to evaluate the changes in the accruals that would result from changes in the significant

assumptions.

|

|

|

|

December 31,

2022

|

December 31,

2021

|

||||||

|

|

||||||||

|

Assets

|

||||||||

|

Current assets:

|

||||||||

|

Cash and cash equivalents

|

$ |

$

|

|

|||||

|

|

||||||||

|

Short-term investments

|

|

|

||||||

|

|

||||||||

|

Accounts receivable, net of allowances for credit losses of $

|

|

|

||||||

|

|

||||||||

|

Inventories:

|

||||||||

|

Finished goods

|

|

|

||||||

|

Work in process

|

|

|

||||||

|

Raw materials

|

|

|

||||||

|

Total inventories

|

|

|

||||||

|

|

||||||||

|

Prepaid expenses and other current assets

|

|

|

||||||

|

Total current assets

|

|

|

||||||

|

|

||||||||

|

Property and equipment, at cost:

|

||||||||

|

Land

|

|

|

||||||

|

Buildings and improvements

|

|

|

||||||

|

Machinery and equipment

|

|

|

||||||

|

Construction in progress

|

|

|

||||||

|

Allowance for depreciation

|

(

|

)

|

(

|

)

|

||||

|

Property and equipment, net

|

|

|

||||||

|

|

||||||||

|

Right of use assets

|

|

|||||||

|

Deferred income taxes

|

|

|||||||

|

Goodwill

|

|

|||||||

|

|

||||||||

|

Other intangible assets, net

|

|

|

||||||

|

|

||||||||

|

Other assets

|

|

|||||||

|

Total assets

|

$

|

|

$

|

|

||||

|

December 31,

2022

|

December 31,

2021

|

|||||||

|

Liabilities and equity

|

||||||||

|

Current liabilities:

|

||||||||

|

Trade accounts payable

|

$

|

|

$

|

|

||||

|

Payroll and related expenses

|

|

|

||||||

|

Lease liabilities

|

|

|

||||||

|

Other accrued expenses

|

|

|

||||||

|

Income taxes

|

|

|

||||||

|

Total current liabilities

|

|

|

||||||

|

|

||||||||

|

Long-term debt, less current portion

|

|

|

||||||

|

U.S. transition tax payable

|

|

|

||||||

|

Deferred income taxes

|

|

|

||||||

|

Long-term lease liabilities

|

|

|

||||||

|

Other liabilities

|

|

|

||||||

|

Accrued pension and other postretirement costs

|

|

|

||||||

|

Total liabilities

|

|

|

||||||

|

|

||||||||

|

Commitments and contingencies

|

||||||||

|

|

||||||||

|

Stockholders' equity:

|

||||||||

|

Preferred stock, par value $

|

|

|

||||||

|

Common stock, par value $

|

|

|

||||||

|

Class B convertible common stock, par value $

|

|

|

||||||

|

Capital in excess of par value

|

|

|

||||||

|

Retained earnings

|

|

|

||||||

| Treasury stock (at cost): |

( |

) | ||||||

|

Accumulated other comprehensive income (loss)

|

(

|

)

|

(

|

)

|

||||

|

Total Vishay stockholders' equity

|

|

|

||||||

|

Noncontrolling interests

|

|

|

||||||

|

Total equity

|

|

|

||||||

|

Total liabilities and equity

|

$

|

|

$

|

|

||||

|

Years ended December 31,

|

||||||||||||

|

2022

|

2021

|

2020

|

||||||||||

|

Net revenues

|

$

|

|

$

|

|

$

|

|

||||||

|

Costs of products sold

|

|

|

|

|||||||||

|

Gross profit

|

|

|

|

|||||||||

|

Selling, general, and administrative expenses

|

|

|

|

|||||||||

|

Restructuring and severance costs

|

|

|

|

|||||||||

|

Operating income

|

|

|

|

|||||||||

|

Other income (expense):

|

||||||||||||

|

Interest expense

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Other

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Loss on early extinguishment of debt

|

|

|

(

|

)

|

||||||||

|

Total other income (expense)

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Income before taxes

|

|

|

|

|||||||||

|

Income tax expense

|

|

|

|

|||||||||

|

Net earnings

|

|

|

|

|||||||||

|

Less: net earnings attributable to noncontrolling interests

|

|

|

|

|||||||||

|

Net earnings attributable to Vishay stockholders

|

$

|

|

$

|

|

$

|

|

||||||

|

Basic earnings per share attributable to Vishay stockholders:

|

$

|

|

$

|

|

$

|

|

||||||

|

Diluted earnings per share attributable to Vishay stockholders:

|

$

|

|

$

|

|

$

|

|

||||||

|

Weighted average shares outstanding - basic

|

|

|

|

|||||||||

|

Weighted average shares outstanding - diluted

|

|

|

|

|||||||||

|

Cash dividends per share

|

$

|

|

$

|

|

$

|

|

||||||

|

Years ended December 31,

|

||||||||||||

|

2022

|

2021

|

2020

|

||||||||||

|

Net earnings

|

$

|

|

$

|

|

$

|

|

||||||

|

Other comprehensive income (loss), net of tax

|

||||||||||||

|

Pension and other post-retirement actuarial items

|

|

|

(

|

)

|

||||||||

|

Foreign currency translation adjustment

|

(

|

)

|

(

|

)

|

|

|||||||

|

Other comprehensive income (loss)

|

|

(

|

)

|

|

||||||||

|

Comprehensive income

|

|

|

|

|||||||||

|

Less: comprehensive income attributable to noncontrolling interests

|

|

|

|

|||||||||

|

Comprehensive income attributable to Vishay stockholders

|

$

|

|

$

|

|

$

|

|

||||||

|

Years ended December 31,

|

||||||||||||

|

2022

|

2021

|

2020

|

||||||||||

|

Operating activities

|

||||||||||||

|

Net earnings

|

$

|

|

$

|

|

$

|

|

||||||

|

Adjustments to reconcile net earnings to net cash provided by operating activities:

|

||||||||||||

|

Depreciation and amortization

|

|

|

|

|||||||||

|

(Gain) loss on disposal of property and equipment

|

(

|

)

|

(

|

)

|

|

|||||||

|

Accretion of interest on convertible debt instruments

|

|

|

|

|||||||||

|

Inventory write-offs for obsolescence

|

|

|

|

|||||||||

|

Pensions and other postretirement benefits, net of contributions

|

(

|

)

|

|

|

||||||||

|

Loss on early extinguishment of debt

|

|

|

|

|||||||||

|

Deferred income taxes

|

|

|

(

|

)

|

||||||||

|

Other operating activities

|

|

|

|

|||||||||

|

Change in U.S. transition tax liability

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Change in repatriation tax liability

|

(

|

)

|

|

(

|

)

|

|||||||

|

Net change in operating assets and liabilities, net of effects of businesses acquired

|

(

|

)

|

(

|

)

|

|

|||||||

|

Net cash provided by operating activities

|

|

|

|

|||||||||

|

Investing activities

|

||||||||||||

|

Capital expenditures

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Proceeds from sale of property and equipment

|

|

|

|

|||||||||

|

Purchase of businesses, net of cash acquired

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Purchase of short-term investments

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Maturity of short-term investments

|

|

|

|

|||||||||

|

Other investing activities

|

(

|

)

|

|

(

|

)

|

|||||||

|

Net cash used in investing activities

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Financing activities

|

||||||||||||

| Net proceeds on revolving credit facility |

||||||||||||

|

Repurchase of convertible debt instruments

|

|

(

|

)

|

(

|

)

|

|||||||

|

Dividends paid to common stockholders

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Dividends paid to Class B common stockholders

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Net changes in short-term borrowings

|

|

|

(

|

)

|

||||||||

| Repurchase of common stock held in treasury |

( |

) | ||||||||||

|

Distributions to noncontrolling interests

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Cash withholding taxes paid when shares withheld for vested equity awards

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Net cash used in financing activities

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Effect of exchange rate changes on cash and cash equivalents

|

(

|

)

|

(

|

)

|

|

|||||||

|

Net increase (decrease) in cash and cash equivalents

|

( |

) |

|

(

|

)

|

|||||||

|

Cash and cash equivalents at beginning of year

|

|

|

|

|||||||||

|

Cash and cash equivalents at end of year

|

$

|

|

$

|

|

$

|

|

||||||

|

Common

Stock

|

Class B

Convertible

Common

Stock

|

Capital in

Excess of Par

Value

|

Retained

Earnings

(Accumulated

Deficit)

|

Treasury Stock |

Accumulated

Other

Comprehensive

Income (Loss)

|

Total Vishay

Stockholders'

Equity

|

Noncontrolling

Interests

|

Total Equity

|

||||||||||||||||||||||||||||

|

Balance at December 31, 2019

|

$

|

|

$

|

|

$

|

|

$

|

|

$ |

$

|

(

|

)

|

$

|

|

$

|

|

$

|

|

||||||||||||||||||

|

Cumulative effect of accounting change for adoption of ASU 2016-13

|

|

|

|

(

|

)

|

|

(

|

)

|

|

(

|

)

|

|||||||||||||||||||||||||

|

Net earnings

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

Other comprehensive income

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

Distributions to noncontrolling interests

|

|

|

|

( |

) | ( |

) | |||||||||||||||||||||||||||||

|

Conversion of Class B shares (

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

Temporary equity reclassifications

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

Issuance of stock and related tax withholdings for vested restricted stock units (

|

|

|

(

|

)

|

|

|

(

|

)

|

|

(

|

)

|

|||||||||||||||||||||||||

|

Dividends declared ($

|

|

|

|

(

|

)

|

|

(

|

)

|

|

(

|

)

|

|||||||||||||||||||||||||

|

Stock compensation expense

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

Repurchase of convertible debt instruments

|

|

|

(

|

)

|

|

|

(

|

)

|

|

(

|

)

|

|||||||||||||||||||||||||

|

Balance at December 31, 2020

|

$

|

|

$

|

|

$

|

|

$

|

|

$ |

$

|

|

$

|

|

$

|

|

$

|

|

|||||||||||||||||||

|

Cumulative effect of accounting change for adoption of ASU 2020-06

|

|

|

(

|

)

|

|

|

(

|

)

|

|

(

|

)

|

|||||||||||||||||||||||||

|

Net earnings

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

Other comprehensive income (loss)

|

|

|

|

|

(

|

)

|

(

|

)

|

|

(

|

)

|

|||||||||||||||||||||||||

|

Distributions to noncontrolling interests

|

|

|

|

|

|

|

(

|

)

|

(

|

)

|

||||||||||||||||||||||||||

|

Issuance of stock and related tax withholdings for vested restricted stock units (

|

|

|

(

|

)

|

|

|

(

|

)

|

|

(

|

)

|

|||||||||||||||||||||||||

|

Dividends declared ($

|

|

|

|

(

|

)

|

|

(

|

)

|

|

(

|

)

|

|||||||||||||||||||||||||

|

Stock compensation expense

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

Balance at December 31, 2021

|

$

|

|

$

|

|

$

|

|

$

|

|

$ |

$

|

(

|

)

|

$

|

|

$

|

|

$

|

|

||||||||||||||||||

|

Net earnings

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|