WILLKIE FARR & GALLAGHER LLP

787 Seventh Avenue

New York, New York 10019

November 23, 2009

Mail Stop 3010

VIA EDGAR AND FEDEX

Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington D.C. 20549

|

|

Attn: Mr. Tom Kluck |

Branch Chief

|

Re: |

Westport JWH Futures Fund L.P. |

(f/k/a Smith Barney Westport Futures Fund L.P.)(the “Partnership”)

Form 10-K for the fiscal year ended December 31, 2008 filed on March 31, 2009

Form 10-Q for the quarter ended March 31, 2009 filed on May 15, 2009

Form 10-Q for the quarter ended June 30, 2009 filed on August 14, 2009

File No. 000-24111__________________________________________________

Ladies and Gentlemen:

On behalf of this firm’s client, Ceres Managed Futures LLC (f/k/a Citigroup Managed Futures LLC), the general partner of the Partnership (the “General Partner”), I am submitting this letter in response to the Securities and Exchange Commission (the “Commission”) staff’s (the “Staff”) comment letter dated September 17, 2009 (the “Letter”) to Mr. Jerry Pascucci, President and Director of the General Partner, to the Partnership’s Form 10-K for the fiscal year ended December 31, 2008 that was filed with the Commission on March 31, 2009 (the “2008 Form 10-K”) and the Partnership’s Forms 10-Q for the quarters ended March 31, 2009 and June 30, 2009 that were filed with the Commission on May 15, 2009 and August 14, 2009, respectively. The following responses are numbered to correspond to the numbering of the Letter. For your convenience, the Staff’s comments are indicated in italics, followed by the General Partner’s response. Page numbers refer to page numbers in the 2008 Form 10-K.

Mr. Tom Kluck

November 23, 2009

Page 2

Form 10-K for the fiscal year ended December 31, 2008

Item 1. Business

General

|

1. |

Please provide us with more details about the trading activities and focus of your advisor as this information appears to be important in understanding your operations. Please tell whether your trading system is discretionary or systematic and whether there have been any changes in your trading system over the past year. To the extent that you utilize additional advisors other than John W. Henry & Company, Inc., please expand your disclosure to identify each such trading advisor and provide similar disclosure regarding their trading activities and focus. Please confirm that you will provide similar disclosure in your future filings. |

As indicated on page 2 of the 2008 Form 10-K, John W. Henry Company, Inc. (“JWH”®), on behalf of the Partnership, engages in trading of futures, forwards, swaps and options contracts on commodities primarily on United States commodity exchanges and foreign commodity exchanges. JWH is the Partnership’s sole trading advisor. JWH trades a portion of the Partnership’s assets directly, in accordance with the JWH Diversified Plus program, through a managed account in the name of the Partnership. JWH also trades a portion of the Partnership’s assets indirectly, in accordance with the JWH GlobalAnalytics® program, through a managed account in the name of JWH Master Fund LLC. The General Partner is the managing member of the master fund and maintains ultimate control over the assets in the Partnership’s and the master fund’s managed accounts.

For a detailed description of the trading activities and focus of JWH, please see the Overview section of “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” on pages 19 to 20 of the 2008 Form 10-K. In order to avoid repeating information contained elsewhere in the Form 10-K, the General Partner has determined to provide, as appropriate, a cross-reference in the Business section to the pages on which the description of the trading activities and focus of JWH is disclosed.

As indicated on page 20 of the 2008 Form 10-K, JWH’s individual investment programs are based on systematic (a/k/a technical) analysis. The General Partner has determined to clarify this disclosure in future filings, as appropriate.

Pursuant to the management agreement with JWH, JWH is permitted to make non-material changes to its trading programs without seeking the approval of the General Partner. JWH, however, is required to notify the General Partner of any material change in the trading system or methodology prior to implementing such change with respect to the Partnership or the master fund. The General Partner is not aware of any material changes to the trading programs over the past year. To the extent that there are any material changes to the trading strategy of JWH, the General Partner has determined to include disclosure of such changes in future filings as appropriate.

|

2. |

Please tell us the allocation by sector of total partnership assets as of the end of the fiscal year. We note that your MD&A disclosure includes the allocation to each trading advisor, but the overall mix of assets in your portfolio is not clear. Confirm that you will include similar disclosure in future filings. |

Mr. Tom Kluck

November 23, 2009

Page 3

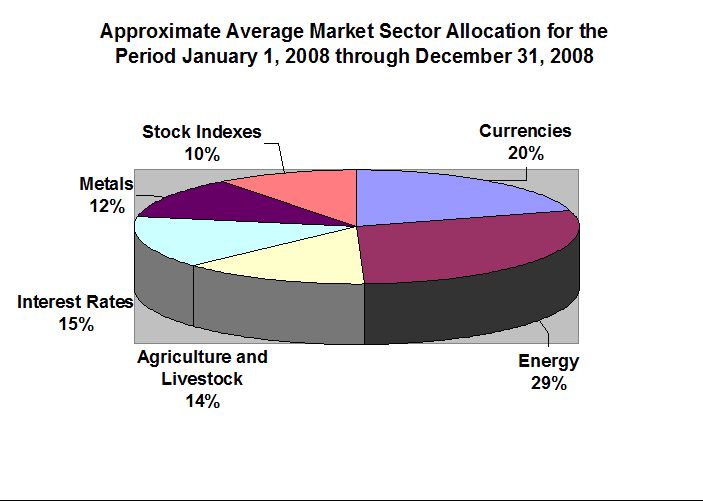

As explained above in response to Staff comment number one, JWH is the Partnership’s sole trading advisor. The assets of the Partnership are not traded by any other trading advisor. The approximate average allocation by commodity market sector of total Partnership assets for the period January 1, 2008 through December 31, 2008 is represented in the chart attached as Appendix A. The General Partner has determined to include similar disclosure in future filings as appropriate.

Regulatory Matters, page 5

|

3. |

In future filings, please expand your disclosure to describe in greater detail the regulatory provisions applicable to your business. Please discuss any position limits that the CFTC imposes on related agricultural products and those that may be imposed on energy commodities. Also discuss any imposed position limits by the exchanges that are separate from the CFTC. In addition, please include any related risk factors in the risk factors section. Please tell us how you intend to comply. |

The activities of the Partnership and the General Partner are affected by a number of statutes, rules and regulations, including, but not limited to, those discussed below.

Prior to February 1, 1998, limited partnership interests in the Partnership (“Units”) were registered under, offered and sold pursuant to the Securities Act of 1933, as amended (the “Securities Act”). Currently, the Partnership is offering Units pursuant to a private offering exempt from registration under Section 4(2) of the Securities Act and Regulation D promulgated thereunder. The Partnership is also registered under the Securities Exchange Act of 1934, as amended (the “1934 Act”).

The business of the Partnership is affected by the Commodity Exchange Act (the “CEA”). The CEA does not regulate the Partnership itself, except to the extent that the CEA would regulate the activities of any trader in the commodity futures markets. Instead, the CEA regulates the activities of the General Partner as the commodity pool operator of the Partnership. The General Partner is registered with the Commodity Futures Trading Commission (the “CFTC”) as a commodity pool operator. The CEA requires a registered commodity pool operator, such as the General Partner, to comply with various disclosure, recordkeeping and reporting requirements with respect to the commodity pools it operates. Generally, the General Partner may not solicit funds for a pool, such as the Partnership, without first delivering to the prospective investor an offering document that contains the disclosures enumerated in CFTC Rule 4.24 and that has been reviewed by the National Futures Association. The General Partner must maintain copies of various documents prepared in connection with the pool and must deliver to investors an annual report certified by an independent public accountant as well as monthly statements of the pool’s performance. Pursuant to CFTC Rule 4.22(h), each such annual report and monthly statement must contain an oath or affirmation made by a representative duly authorized to bind the General Partner that, to the best of the knowledge and belief of the individual making the oath or affirmation, the information contained in the document is accurate and complete. In future filings, the General Partner has determined to include disclosure with respect to the regulatory provisions applicable to the Partnership and the General Partner as necessary.

The CFTC and U.S. exchanges have established speculative position limits on the maximum net long or net short position that any person or group of persons acting together, may hold or control in particular commodities. The position limits established by the CFTC apply to grains, soybeans and

Mr. Tom Kluck

November 23, 2009

Page 4

cotton. For all other commodity contracts, including energy commodities, in accordance with the CEA, U.S. exchanges have established position limits or position accountability levels. The CFTC has adopted rules with respect to the treatment of positions held by a commodity pool, such as the Partnership, for purposes of determining compliance with speculative position limits. Generally, CFTC rules require that positions held by all accounts owned or controlled by a trading advisor to the Partnership and its principals be aggregated with the positions of the Partnership established by the trading advisor for purposes of calculating the trading advisor’s compliance with the limits. Depending upon the number and types of futures contracts managed in both the Partnership’s account and the other accounts controlled directly or indirectly by the trading advisor to the Partnership, position limits may limit the ability of the trading advisor to establish particular positions in certain commodities for the Partnership or may require the liquidation of positions. If new regulations were to further limit the number of positions in a particular commodity that could be controlled by a trading advisor, such regulations could negatively impact the operations and profitability of the Partnership.

The General Partner has determined to include in future filings, as appropriate, a risk factor similar to the following risk factor pertaining to the risk that position limits could impact the operations and profitability of the Partnership.

Speculative position and trading limits may reduce profitability. The CFTC and U.S. exchanges have established speculative position limits on the maximum net long or net short positions which any person may hold or control in particular futures and options on futures. The trading instructions of the advisor may have to be modified, and positions held by the Partnership may have to be liquidated in order to avoid exceeding these limits. Such modification or liquidation could adversely affect the operations and profitability of the Partnership by increasing transaction costs to liquidate positions and foregoing potential profits.

A similar risk factor is included in the document delivered to prospective investors prior to their admission to the Partnership.

Item 1A. Risk Factors, page 6

|

4. |

We note your disclosure that pending legislation could limit trading by speculators in futures markets and that other potentially adverse regulatory initiatives could develop suddenly and without notice. Please provide us with a more specific description of any current or proposed limits and discuss how such limits would impact your trading strategy. Confirm that you will provide similar disclosure in future filings. |

The General Partner respectfully declines to provide a detailed description of the potential consequences of each legislative proposal since to do so would be largely speculative. The following table sets forth certain of the legislation proposed in the 2009 legislative Congressional session and by other governmental agencies, which, if enacted, could impact the Partnership’s trading strategy.

Mr. Tom Kluck

November 23, 2009

Page 5

PROPOSED LEGISLATION

|

S. 221 |

A bill to amend the CEA to require energy commodities to be traded only on regulated markets, and for other purposes |

1/13/09 |

|

|||

|

S. 272 H.R. 977 |

Derivatives Markets Transparency & Accountability Act of 2009 |

1/15/09 2/11/09 |

|

|||

|

S. 298 |

Financial Markets Commission Act of 2009 |

1/22/09 |

|

|||

|

H.R. 768 |

Commission on Financial Crisis Accountability Act of 2009 |

1/28/09 |

|

|||

|

H.R. 711 |

Hedge Fund Adviser Registration Act of 2009 |

1/27/09 |

|

|||

|

S. 344 |

Hedge Fund Transparency Act |

1/29/09 |

|

|||

|

H.R. 885 S. 1354 |

Improved Financial Commodity Markets Oversight and Accountability Act |

2/4/09 6/25/09 |

|

|||

|

S. 447 |

Prevent Excessive Speculation Act |

2/13/09 |

|

|||

|

H.R. 1068 |

Let Wall Street Pay for Wall Street’s Bailout Act of 2009 |

2/13/09 |

|

|||

|

S. 664 H.R. 1754 |

Financial System Stabilization and Reform Act of 2009 |

3/23/09 3/26/09 |

|

|||

|

S. 672 |

Natural Gas and Electricity Review and Enforcement Act |

3/24/09 |

|

|||

|

H.R. 1748 |

Fight Fraud Act of 2009 |

3/26/09 |

|

|||

|

S. 807 |

SMART Energy Act |

4/02/09 |

|

|||

|

H.R. 1880 |

National Insurance Consumer Protection Act |

4/02/09 |

|

|||

|

H.R. 2448 |

Prevent Unfair Manipulation of Prices Act of 2009 |

5/14/09 |

|

|||

|

S. 961 |

Authorizing the Regulation of Swaps Act |

5/4/09 |

|

|||

|

S. 1225 H.R. 2869 |

Energy Market Manipulation Prevention Act |

6/10/09 6/15/09 |

|

|||

|

S. 1276 |

Private Fund Transparency Act of 2009 |

6/16/09 |

|

|||

|

H.R. 3145 |

Credit Default Swap Prohibition Act of 2009 |

7/9/09 |

|

|||

|

|

Treas. Reg. |

Over-the-Counter Derivatives Markets Act |

8/11/09 |

|||

|

|

|

Discussion Draft submitted by Collin Peterson, Chairman, House Agriculture Committee |

10/9/09 |

|||

|

|

H.R. 3795 |

To enact the Over-the-Counter Derivatives Markets Act of 2009 |

10/13/09 |

|||

|

|

|

Financial Stability Improvement Act of 2009 |

|

|||

|

|

|

Discussion Draft submitted by Barney Frank, Chairman, House Financial Services Committee |

10/27/09 |

|||

|

|

|

Restoring American Financial Stability Act of 2009 |

|

|||

|

|

|

Discussion Draft submitted by Christopher Dodd, Chairman, Senate Banking Committee |

11/10/09 |

|||

The General Partner is monitoring the status of these and other proposals. To the extent that any of the proposals impact speculative position limits, JWH has represented to the Partnership in its management agreement that if its trading recommendations are altered because of the application of position limits, it will not modify its trading instructions with respect to the Partnership’s or the master fund’s managed accounts in such a manner as to affect the Partnership substantially disproportionately as compared with other accounts advised by JWH.

Mr. Tom Kluck

November 23, 2009

Page 6

As an example of the uncertainty surrounding legislative proposals, the Energy Markets Emergency Act of 2008, proposed in June 2008, passed the House with bipartisan support but failed to emerge from committee in the Senate and expired at the end of the legislative session. This proposal also exemplifies the difficulty of forecasting the likely impact of certain legislative proposals. In sum, the proposal directed the CFTC to “utilize all its authority, including its emergency powers, to curb immediately the role of excessive speculation in any contract market within the jurisdiction and control of the [CFTC], on or through which energy futures or swaps are traded, and to eliminate excessive speculation, price distortion, sudden or unreasonable fluctuations or unwarranted changes in prices, or other unlawful activity that is causing major market disturbances that prevent the market from accurately reflecting the forces of supply and demand for energy commodities.”1

The General Partner has determined to include in future filings, as appropriate, a revised risk factor similar to the following risk factor pertaining to the risk that regulatory developments could impact the operations and profitability of the Partnership.

Regulatory changes could restrict the Partnership’s operations. Regulatory changes could adversely affect the Partnership by restricting its markets or activities, limiting its trading and/or increasing the taxes to which investors are subject. The General Partner is not aware of any definitive regulatory developments that might adversely affect the Partnership; however, since June 2008, several bills have been proposed in the U.S. Congress in response to record energy and agricultural prices and the financial crisis. Some of the pending legislation, if enacted, could impact the manner in which swap contracts are traded and/or settled and limit trading by speculators (such as the Partnership) in futures and over-the-counter markets. Certain of the proposals would authorize the CFTC and the Commission to regulate swap transactions. Other potentially adverse regulatory initiatives could develop suddenly and without notice.

The expanded disclosure more closely tracks the disclosure in the document delivered to prospective investors prior to their admission to the Partnership. The General Partner will continue to monitor legislative developments and believes that its approach is appropriate given the wide variety of consequences that could stem from enactment of any particular proposal and the difficulty of assessing which proposals are likely to be enacted.

For the foregoing reasons, therefore, the General Partner respectfully declines to provide a detailed description of the potential consequences of each legislative proposal.

The General Partner notes that none of the recent regulatory developments pertaining to long-only exchange-traded commodity pools has had any impact on the Partnership’s trading strategy. The CFTC recently revoked exemptions from certain agricultural position limits that were granted to a

_________________________

|

1 |

H.R. 6377 110th Cong. (2nd Sess. 2008); S. 3205 110th Cong. (2nd Sess. 2008). |

Mr. Tom Kluck

November 23, 2009

Page 7

commodity pool with an index strategy. The Partnership is neither long-only nor exchange-traded and does not operate under any such exemptions.

Item 6. Selected Financial Data, page 18

|

5. |

Please tell us net asset value on a per unit basis as of the end of each period presented. Confirm that you will provide similar disclosure in future filings. |

As disclosed on page 23 of the 2008 Form 10-K, the net asset value per unit as of each of December 31, 2008, December 31, 2007, December 31, 2006 and December 31, 2005 was $1,822.83, $956.81, $1,035.48 and $1,262.39, respectively. The net asset value per unit for the year ended December 31, 2004 was $1,635.67. The General Partner has determined to include in the Selected Financial Data table of future filings, as appropriate, the net asset value per unit as of the end of each period presented.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

General

|

6. |

Please tell us, if known, the sector allocation by percentage for each of the trading advisor funds where you have invested as of the end of the last fiscal year. Tell us what consideration you have given to including this information in your filing. |

As indicated above in response to Staff comment number one, JWH is the sole trading advisor to the Partnership. The assets of the Partnership are not traded by any other trading advisor. The assets of the Partnership are not “invested” in “trading advisor funds.” Whether traded directly or through the master fund, they are maintained in segregated customer brokerage accounts at the Partnership’s commodity broker and are always under the control of the General Partner.

As indicated above in response to Staff comment number one, JWH trades a portion of the Partnership’s assets directly and a portion of the Partnership’s assets indirectly through the master fund. To facilitate its allocation to JWH, the General Partner has established managed accounts in the Partnership’s and the master fund’s name at the Partnership’s and the master fund’s commodity broker and has granted limited authority to JWH to make trading decisions with respect such managed accounts. The General Partner serves as the managing member of the master fund.

The average allocation by commodity market sector for the period January 1, 2008 through December 31, 2008 for the master fund and for the assets traded directly by JWH is set forth in the tables attached as Appendix B. The General Partner has determined to include similar disclosure in future filings as appropriate.

Liquidity, page 20

|

7. |

Please tell us whether you have been subject to margin calls. If so, quantify the amount of such margin calls in your most recent three fiscal years and confirm that you will provide similar disclosure, if material, in your future filings. |

Mr. Tom Kluck

November 23, 2009

Page 8

The Partnership has never been subject to a margin call. The General Partner does not expect the Partnership to be subject to margin calls in the future based on current margin requirements and the amount of cash held by the Partnership directly and through the master fund.

In the context of commodity futures trading, “margin” refers to the good faith deposit required for a customer to maintain its futures contract positions. An amount equal to the required margin must at all times be on deposit with the customer’s commodity broker. A margin call is issued when a customer’s amount on deposit is less than the margin requirement. Commodity pools, such as the Partnership (and the master fund), often have on deposit with their commodity broker amounts far in excess of their required margin.

As noted on page 3 of the 2008 Form 10-K, substantially all of the Partnership’s assets are deposited in segregated accounts at the Partnership’s and the master fund’s commodity broker. The amount of cash on deposit in such accounts has, since inception, far exceeded the margin required to maintain the Partnership’s (and the master fund’s) futures contract positions. From January 1, 2008 through December 31, 2008, the Partnership’s average margin to equity ratio (i.e., the percentage of assets on deposit required for margin) was approximately 12.6%. The foregoing margin to equity ratio takes into account positions and cash held in the Partnership’s name, as well as the allocable value of the positions and cash held on behalf of the Partnership in the name of the master fund (the “Margin to Equity Ratio”).

The General Partner has determined to disclose the Partnership’s average Margin to Equity Ratio in future filings as appropriate. In the unlikely event that margin requirements exceed the Partnership’s amounts on deposit and the Partnership or the master fund receives a margin call, the General Partner will disclose the amount of such margin call in future filings as appropriate.

Capital Resources, page 22

|

8. |

Please explain how redemptions are funded. Clarify how the Partnership obtains the cash needed for redemption payments and, to the extent the Partnership liquidates positions to fund redemptions, please explain how the General Partner decides which positions to liquidate. Confirm that you will provide similar disclosure in future filings. |

Limited partners are permitted to redeem Units on a monthly basis. Generally, the Partnership uses its cash holdings to fund redemptions. The Partnership has, to date, always had sufficient cash available to fund redemptions. The General Partner expects to continue to have sufficient cash available to fund redemptions. As explained above in response to Staff comment number seven, only a portion of the Partnership’s (and the master fund’s) assets deposited in segregated brokerage accounts at the commodity broker is required for margin.

If the Partnership’s assets are reduced due to redemptions or otherwise, JWH may decide to liquidate positions in accordance with its strategy. Absent extraordinary circumstances, the General Partner would not interfere with JWH’s decision as to which positions to liquidate.

For the foregoing reasons, the General Partner believes that its disclosure concerning redemptions is sufficient. As indicated above, however, in response to Staff comment number seven,

Mr. Tom Kluck

November 23, 2009

Page 9

the General Partner has determined to disclose the Margin to Equity Ratio in future filings as appropriate.

Results of Operations, page 23

|

9. |

Please provide us with a discussion of the fees accrued and paid during the disclosed periods. Similar disclosure should be provided in future filings. |

As disclosed on page F-7 of the 2008 Form 10-K, the Partnership is subject to the following fees: brokerage commissions, management fees, incentive fees, professional fees and other expenses. The General Partner has determined to disclose in future filings, as appropriate, a description of the fees to which the Partnership is subject similar to the description attached as Appendix C.

|

10. |

To the extent that changes in net asset value reflect material changes in interest income, please describe to us the impact and reasons for changes in your interest income. |

As disclosed on page 18 of the 2008 Form 10-K, interest income for the year ended December 31, 2008 decreased $1,985,407, as compared to the corresponding period in 2007. To the extent a decrease in interest earned by the Partnership represents a decrease in Partnership capital, such decrease would necessarily impact the net asset value of the Partnership. In the disclosure document delivered to prospective investors prior to their admission to the Partnership, the General Partner explains that interest income is paid at a U.S. Treasury bill rate determined by the commodity broker and, therefore, will fluctuate from year to year due to changes in interest rates. The General Partner has determined to include in future filings, as appropriate, disclosure describing the changes in interest income.

|

11. |

We note that you have disclosed net trading gain through investments in the Funds on an aggregate basis. Please tell us the net trading gain realized from each Fund separately and tell us what consideration you have given to including this information in the Results of Operations disclosure. |

As noted above in response to Staff comment number one, JWH is the Partnership’s sole trading advisor. The General Partner wishes to make clear that the assets of the Partnership are not “invested” in “Funds” controlled by the trading advisor. As indicated above in response to Staff comment number one, the General Partner allocates the assets of the Partnership to JWH by contributing a portion of the assets of the Partnership to the master fund, with respect to which the General Partner has granted JWH limited authority to make trading decisions. The remaining assets are contributed to a managed account in the name of the Partnership over which JWH has been granted limited authority to make trading decisions.

The net trading gain realized from total Partnership assets is disclosed on page 23 of the 2008 Form 10-K. This figure reflects the gain realized on assets traded directly by JWH as well as the assets traded through the master fund. The net trading gain realized from assets traded directly is disclosed on page F-17 of the 2008 Form 10-K. The net trading gain realized from the assets of the master fund is disclosed on page F-26 of the 2008 Form 10-K. This figure reflects the gain realized on assets of entities other than the Partnership. In future filings, in order to avoid repeating information contained

Mr. Tom Kluck

November 23, 2009

Page 10

elsewhere in the Form 10-K, the General Partner has determined to provide, as appropriate, a cross-reference in the Results of Operation section to the pages on which the net trading gain realized from (i) total Partnership assets, (ii) master fund assets and (iii) assets traded directly are each disclosed.

Item 10. Directors, Executive Officers and Corporate Governance

|

12. |

In future filings, please revise to provide Item 401 disclosure for the executive officers and directors of your General Partner. Refer to the definitions of “director” and “executive officer” in Rule 405 of the Securities Act. In addition, please revise Item 12 to disclose the shares beneficially owned by these individuals, as required by Item 403 of Regulation S-K. Please tell us how you intend to comply. |

As explained on page 32 of the 2008 Form 10-K, the Partnership has no officers or directors. Items 401 and 403 of Regulation S-K pertain to the directors and executive officers of the registrant (i.e., the Partnership). The information requested with respect to the General Partner’s officers and directors, therefore, is not required disclosure under those rules. Limited partners receive such information, nonetheless, because the disclosure document delivered to prospective investors prior to their admission to the Partnership includes biographical information relating to the General Partner’s principals, as required by CFTC rules. The General Partner has determined to include in future filings, as appropriate, disclosure that includes (i) the biographical information of the General Partner’s directors and (ii) the beneficial ownership of such individuals, if any. Further, as of December 31, 2008, none of the executive officers and directors of the General Partner owned units in the Partnership.

Item 15. Exhibits, Financial Statement Schedules

|

13. |

We note that you incorporate exhibits by reference by indicating that the documents were “previously filed.” In future filings, please specifically identify the prior filing or submission in accordance with Item 10(d) of Regulation S-K. Please also supplementally provide us with this information for all material contracts that are included as exhibits to this Form 10-K. |

The exhibit list attached as Appendix D contains the requested reference information for each document incorporated by reference to a prior filing or submission. The General Partner has determined to include this information in future filings as appropriate.

Signatures, page 35

|

14. |

Please confirm that Jennifer Magro is also your principal accounting officer or controller. |

The General Partner confirms that Jennifer Magro is its principal accounting officer.

Forms 10-Q for the quarters ended March 31, 2009 and June 30, 2009

Exhibits 31.1 and 31.2

|

15. |

The required certifications must be in the exact form prescribed and the wording of the required certifications may not be changed in any respect. We note, in paragraph 4(d), you omitted the parenthetical: “(The registrant’s fourth fiscal quarter in the case of an annual |

Mr. Tom Kluck

November 23, 2009

Page 11

report).” In future filings please ensure that the certifications are in the exact form currently set forth in Item 601(b)(31) of Regulation S-K.

The referenced parenthetical was inadvertently omitted from the certifications included as Exhibits 31.1 and 31.2 of the Forms 10-Q for the quarters ended March 31, 2009 and June 30, 2009. The General Partner confirms that in future filings it will include these certifications in the exact form set forth in Item 601(b)(31) of Regulation S-K.

* * * *

A copy of the Partnership’s “Tandy” letter is included with the filing. Should you have any questions, please do not hesitate to contact the undersigned at (212) 728-8727 or James Hannigan of this office at (212) 728-8117.

Very truly yours,

/s/ Rita M. Molesworth

Rita M. Molesworth

|

cc: |

Jennifer Magro |

Gabriel Acri

Lisa Eskenazi

James Hannigan

APPENDIX A

APPENDIX B

Average Allocation by Commodity Market Sector

for the Period January 1, 2008 through December 31, 2008

|

John W. Henry & Company, Inc. |

|

JWH Master Fund LLC |

||

|

Currencies |

16.45% |

|

Currencies |

20.63% |

|

Energy |

24.90% |

|

Energy |

22.48% |

|

Grains |

12.72% |

|

Grains |

5.63% |

|

Interest Rates Non-U.S. |

13.07% |

|

Interest Rates Non-U.S. |

9.66% |

|

Interest Rates U.S. |

8.05% |

|

Interest Rates U.S. |

5.94% |

|

Metals |

9.74% |

|

Livestock |

1.34% |

|

Softs |

7.62% |

|

Metals |

11.23% |

|

Stock Index |

7.45% |

|

Softs |

7.54% |

|

|

|

|

Stock Index |

15.54% |

APPENDIX C

Brokerage commissions are calculated as a percentage of the Partnership’s adjusted net asset value on the last day of each month and are affected by trading performance, additions and redemptions. Accordingly, they must be compared in relation to the fluctuations in the monthly net asset values. Brokerage commissions and fees for the year ended December 31, 2008 decreased $321,103 as compared to the corresponding period in 2007. The decrease is due to lower average net assets in 2008 as compared to 2007. Brokerage commissions and fees for the year ended December 31, 2007 decreased $3,193,632 as compared to the corresponding period in 2006. The decrease is due to a decrease in net assets in 2007 as compared to 2006.

Management fees are calculated as a percentage of the Partnership’s adjusted net asset value as of the end of each month and are affected by trading performance, additions and redemptions. Management fees for the year ended December 31, 2008 decreased $106,981 as compared to the corresponding period in 2007. The decrease is due to lower average net assets in 2008 as compared to 2007. Management fees for the year ended December 31, 2007 decreased $1,103,994 as compared to the corresponding period in 2007. The decrease is due to a decrease in net assets in 2007 as compared to 2006.

Incentive fees paid quarterly are based on the new trading profits generated by JWH as defined in the management agreement between the Partnership, the General Partner and JWH. Trading performance for the years ended December 31, 2008, 2007 and 2006 resulted in incentive fees of $1,950,387, $0 and $0, respectively.

The Partnership pays professional fees, which generally include legal and accounting expenses. Professional fees for the years ended December 31, 2008, 2007 and 2006 were $262,526, $205,446 and $129,655, respectively.

The Partnership pays other expenses, which generally include filing, reporting and data processing fees. Other expenses for the years ended December 31, 2008, 2007 and 2006 were $32,029, $66,931 and $33,740, respectively.

APPENDIX D

Item 15. Exhibits and Financial Statement Schedules.

(a) (1) Financial Statements:

Statements of Financial Condition at December 31, 2008 and 2007.

Schedules of Investments at December 31, 2008 and 2007.

Statements of Income and Expenses for the years ended December 31, 2008, 2007 and 2006.

Statements of Changes in Partners’ Capital for the years ended December 31, 2008, 2007 and 2006.

Notes to Financial Statements.

(2) Exhibits:

|

|

3.1 |

Limited Partnership Agreement (filed as Exhibit A to the Registration Statement on Form S-1 filed on April 10, 1997 and incorporated herein by reference). |

|

|

3.2 |

Certificate of Limited Partnership of the Partnership as filed in the office of the Secretary of State of the State of New York (filed as Exhibit 3.2 to the Registration Statement on Form S-1 filed on April 10, 1997 and incorporated herein by reference). |

|

|

10.1 |

Customer Agreement between the Partnership and Salomon Smith Barney Inc. (filed as Exhibit 10.1 to the Registration Statement on Form S-1 filed on April 10, 1997 and incorporated herein by reference). |

|

|

10.2 |

Subscription Agreement (filed as Exhibit B to the Registration Statement on Form S-1 filed on April 10, 1997 and incorporated herein by reference). |

|

|

10.3 |

Escrow Instructions relating to escrow of subscription funds (filed as Exhibit 10.3 to the Registration Statement on Form S-1 filed on April 10, 1997 and incorporated herein by reference). |

|

|

10.4 |

Management Agreement among the Partnership, the General Partner and John W. Henry & Company Inc. (filed as Exhibit 10.5 to the Registration Statement on Form S-1 filed on June 22, 1998 and incorporated herein by reference). |

|

|

10.5 |

Letter extending the Management Agreement between the General Partner and John W. Henry & Company, Inc. for 1999 (filed as Exhibit 99.A4 to the Form 10-K filed on March 29, 2000 and incorporated herein by reference). |

|

|

10.6 |

Letter extending the Management Agreement between the General Partner and John W. Henry & Company, Inc. for 2000 (filed as Exhibit 99.A4 to the Form 10-K filed on March 29, 2001 and incorporated herein by reference). |

|

|

10.7 |

Letter extending the Management Agreement between the General Partner and John W. Henry & Company, Inc. for 2001 (filed as Exhibit 10 to the Form 10-K filed on March 28, 2002 and incorporated herein by reference). |

|

|

10.8 |

Letter extending the Management Agreement between the General Partner and John W. Henry & Company, Inc. for 2002 (filed as Exhibit 10 to the Form 10-K filed on March 27, 2003 and incorporated herein by reference). |

|

|

10.9 |

Letter extending the Management Agreement between the General Partner and John W. Henry & Company, Inc. for 2003 (filed as Exhibit 32.2 to the Form 10-K filed on March 15, 2004 and incorporated herein by reference). |

|

|

10.10 |

Letter extending the Management Agreement between the General Partner and John W. Henry & Company, Inc. for 2004 (filed as Exhibit 10.10 to the Form 10-K filed on March 16, 2005 and incorporated herein by reference). |

|

|

10.11 |

Letter extending the Management Agreement between the General Partner and John W. Henry & Company, Inc. for 2005 (filed as Exhibit 10.11 to the Form 10-K filed on March 29, 2006 and incorporated herein by reference). |

|

|

10.12 |

Letter extending the Management Agreement between the General Partner and John W. Henry & Company, Inc. for 2006 (filed as Exhibit 10.12 to the Form 10-K filed on March 30, 2007 and incorporated herein by reference). |

|

|

10.13 |

Letter extending the Management Agreement between the General Partner and John W. Henry & Company, Inc. for 2007 (filed as Exhibit 10.13 to the Form 10-K filed on March 28, 2008 and incorporated herein by reference). |

|

|

10.14 |

Letter extending the Management Agreement between the General Partner and John W. Henry & Company, Inc. for 2008 (filed as Exhibit 10.14 to the Form 10-K filed on March 31, 2009 and incorporated herein by reference). |

23.1 Consent from KPMG LLP dated March 26, 2009 (filed as Exhibit 23.1 to the Form 10-K filed on March 31, 2009 and incorporated herein by reference).

Exhibit 31.1 — Rule 13a-14(a)/15d-14(a) Certification (Certification of President and Director)

Exhibit 31.2 — Rule 13a-14(a)/15d-14(a) Certification (Certification of Chief Financial Officer and Director)

Exhibit 32.1 — Section 1350 Certification (Certification of President and Director)

Exhibit 32.2 — Section 1350 Certification (Certification of Chief Financial Officer and Director)