| AURORA GOLD CORPORATION |

| FINANCIAL STATEMENTS (EXPRESSED IN U.S. DOLLARS) |

| QUARTERLY REPORT FOR THE PERIOD ENDED JUNE 30,2014 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

FOR THE QUARTERLY PERIOD ENDED JUNE 30, 2014

x QUARTERLY REPORT UNDER SECTION 13 0R 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

¨ TRANSITION REPORT UNDER SECTION 13 0R 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __ to __

Commission file number 000-24393

AURORA GOLD CORPORATION

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation or organization)

13-3945947

(I.R.S. Employer Identification No.)

Coresco AG, Level 3, Gotthardstrasse 20, 6300 Zug, Switzerland

(Address of principal executive offices)

+41 41 711 0281

(Issuer’s telephone number)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “accelerated filer”, “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Larger accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

¨ Yes x No

There were 53,588,990 shares of common stock outstanding on June 30, 2014.

Documents incorporated by reference: Refer to Exhibits

This quarterly report contains statements that plan for or anticipate the future and are not historical facts. In this Report these forward looking statements are generally identified by words such as “anticipate,” “plan,” “believe,” “expect,” “estimate,” and the like. Because forward-looking statements involve future risks and uncertainties, these are factors that could cause actual results to differ materially from the estimated results. These risks and uncertainties are detailed in this report. The Private Securities Litigation Reform Act of 1995, which provides a “safe harbor” for such statements, may not apply to this Report.

| AURORA GOLD CORPORATION |

| FINANCIAL STATEMENTS (EXPRESSED IN U.S. DOLLARS) |

| QUARTERLY REPORT FOR THE PERIOD ENDED JUNE 30,2014 |

| 2 | AURORA GOLD CORPORATION |

| AURORA GOLD CORPORATION |

| FINANCIAL STATEMENTS (EXPRESSED IN U.S. DOLLARS) |

| QUARTERLY REPORT FOR THE PERIOD ENDED JUNE 30,2014 |

Uncertainties Relating To Forward-Looking Statements

The information in this report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act (SEC) of 1934. These forward-looking statements involve risks and uncertainties, including statements regarding the Company’s capital needs, business strategy and expectations. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements.

In some cases, you can identify forward-looking statements by terminology such as “may”, “will”, “should”, “expect”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict”, “potential”, or “continue”, the negative of such terms or other comparable terminology. Actual events or results may differ materially. In evaluating these statements, you should consider various factors, including the risks outlined from time to time, in other reports the Company files with the Securities and Exchange Commission.

The information constitutes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The forward-looking statements in this form are subject to risks and uncertainties that could cause actual results to differ materially from the results expressed in or implied by the statements contained in this report. As a result, the identification and interpretation of data and other information and their use in developing and selecting assumptions from and among reasonable alternatives requires the exercise of judgment. To the extent that the assumed events do not occur, the outcome may vary substantially from anticipated or projected results, and accordingly, no opinion is expressed on the achievability of those forward-looking statements. No assurance can be given that any of the assumptions relating to the forward-looking statements specified in the following information are accurate.

All forward-looking statements are made as of the date of filing of this form and the Company disclaims any obligation to publicly update these statements, or disclose any difference between its actual results and those reflected in these statements. The Company may, from time to time, make oral forward-looking statements. The Company strongly advises that the above paragraphs and the risk factors described in this Report and in the Company’s other documents filed with the United States Securities and Exchange Commission should be read for a description of certain factors that could cause the actual results of the Company to materially differ from those in the oral forward-looking statements. The Company disclaims any intention or obligation to update or revise any oral or written forward-looking statements whether as a result of new information, future events or otherwise.

| 3 | AURORA GOLD CORPORATION |

| AURORA GOLD CORPORATION |

| FINANCIAL STATEMENTS (EXPRESSED IN U.S. DOLLARS) |

| QUARTERLY REPORT FOR THE PERIOD ENDED JUNE 30,2014 |

PART I – FINANCIAL INFORMATION

ITEM 1 – FINANCIAL STATEMENTS

| AURORA GOLD CORPORATION | 30 June | 31 December | ||||||

| Consolidated Balance Sheets | 2014 | 2013 | ||||||

| (An exploration stage enterprise) | (unaudited) | |||||||

| (Expressed in U.S. Dollars) | $ | $ | ||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash | 5,285 | 55,161 | ||||||

| Prepayments | - | 69,519 | ||||||

| Total current assets | 5,285 | 124,680 | ||||||

| Non current assets | ||||||||

| Vehicles and other equipment, net | 115,737 | 377,532 | ||||||

| Land Possession Rights | 53,323 | 53,323 | ||||||

| Total non current assets | 169,060 | 430,855 | ||||||

| Total assets | 174,345 | 555,535 | ||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIENCY) | ||||||||

| Current liabilities | ||||||||

| Accounts payable and accrued expenses | 301,914 | 185,267 | ||||||

| Accounts payable and accrued expenses - related party | 204,300 | 10,800 | ||||||

| Advances payable - related party | 62,000 | 32,000 | ||||||

| Total current liabilities | 568,214 | 228,067 | ||||||

| Stockholders’ Equity (Deficiency) | ||||||||

| Common stock with par value of $0.005 each | ||||||||

| Authorized: 300,000,000 (Dec 31, 2013: 300,000,000) | ||||||||

| Issued and outstanding: 51,188,990 (Dec 31, 2013: 49,828,942) | 252,906 | 249,146 | ||||||

| Additional paid-in capital | 27,380,229 | 27,211,349 | ||||||

| Accumulated other comprehensive income (loss) | (99,636 | ) | (126,564 | ) | ||||

| Accumulated deficit during the exploration stage | (27,927,368 | ) | (27,006,463 | ) | ||||

| Total stockholders’ equity (deficiency) | (393,869 | ) | 327,468 | |||||

| Total liabilities and stockholders’ equity (deficiency) | 174,345 | 555,535 | ||||||

The accompanying notes are an integral part of these interim consolidated financial statements.

| 4 | AURORA GOLD CORPORATION |

| AURORA GOLD CORPORATION |

| FINANCIAL STATEMENTS (EXPRESSED IN U.S. DOLLARS) |

| QUARTERLY REPORT FOR THE PERIOD ENDED JUNE 30,2014 |

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) UNAUDITED

| For the | For the | |||||||||||||||

| Three | Three | For the | For the | |||||||||||||

| Months | Months | Six Months | Six Months | |||||||||||||

| AURORA GOLD CORPORATION | Ended | Ended | Ended | Ended | ||||||||||||

| (An exploration stage enterprise) | 30 June | 30 June | 30 June | 30 June | ||||||||||||

| Consolidated Statements of Comprehensive Income (Loss) | 2014 | 2013 | 2014 | 2013 | ||||||||||||

| (Expressed in U.S. Dollars) | $ | $ | $ | $ | ||||||||||||

| Operating expenses | ||||||||||||||||

| Independent directors fees | 7,500 | 9,000 | 15,000 | 18,000 | ||||||||||||

| Professional fees - audit, legal, company secretary | 234,648 | 98,550 | 396,205 | 199,093 | ||||||||||||

| Investor relations, listing and filing fees | 74,515 | 22,112 | 80,329 | 164,537 | ||||||||||||

| Travel and accommodation | 920 | 23,459 | 920 | 109,704 | ||||||||||||

| Salaries, management and consulting fees | 91,229 | 119,000 | 185,229 | 213,123 | ||||||||||||

| Telecommunication costs | 11 | 1,773 | 11 | 1,773 | ||||||||||||

| Other general and administrative | 18,150 | 26,088 | 16,515 | 35,730 | ||||||||||||

| Total general and administration | 426,973 | 299,982 | 694,209 | 741,959 | ||||||||||||

| Depreciation and amortization | 802 | 7,315 | 7,574 | 13,465 | ||||||||||||

| Interest and bank charges | 627 | 2,572 | 2,186 | 4,251 | ||||||||||||

| Foreign exchange loss (gain) | (1,311 | ) | (2,823 | ) | (953 | ) | (2,303 | ) | ||||||||

| Exploration expenses | - | 447,499 | - | 757,301 | ||||||||||||

| 427,091 | 754,544 | 703,016 | 1,514,674 | |||||||||||||

| Other income (expense) | ||||||||||||||||

| Write-off of equipment | 217,889 | - | 217,889 | - | ||||||||||||

| Interest income | - | 1,347 | - | 2,141 | ||||||||||||

| 217,889 | 1,347 | 217,889 | 2,141 | |||||||||||||

| Net Loss | (644,980 | ) | (753,197 | ) | (920,905 | ) | (1,512,533 | ) | ||||||||

| Other comprehensive income (loss) | - | |||||||||||||||

| Foreign currency translation adjustments | 11,880 | (74,104 | ) | 26,928 | (78,788 | ) | ||||||||||

| Comprehensive income (loss) | (633,100 | ) | (827,301 | ) | (893,977 | ) | (1,591,321 | ) | ||||||||

| Net Loss Per Share – Basic and Diluted | (0.01 | ) | (0.02 | ) | (0.02 | ) | (0.03 | ) | ||||||||

| Weighted Average Shares Outstanding – Basic and Diluted | 53,215,649 | 49,828,942 | 51,726,296 | 49,828,942 | ||||||||||||

The accompanying notes are an integral part of these interim consolidated financial statements.

| 5 | AURORA GOLD CORPORATION |

| AURORA GOLD CORPORATION |

| FINANCIAL STATEMENTS (EXPRESSED IN U.S. DOLLARS) |

| QUARTERLY REPORT FOR THE PERIOD ENDED JUNE 30,2014 |

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

| For the | For the | |||||||

| Six Months | Six Months | |||||||

| AURORA GOLD CORPORATION | Ended | Ended | ||||||

| (An exploration stage enterprise) | 30 June | 30 June | ||||||

| Consolidated Statements of Cash Flows | 2014 | 2013 | ||||||

| (Expressed in U.S. Dollars) | $ | $ | ||||||

| Cash Flows From Operating Activities | ||||||||

| Net loss for the period | (920,905 | ) | (1,512,533 | ) | ||||

| Adjustments to reconcile net loss to cash used in operating activities | ||||||||

| Depreciation and amortization | 7,574 | 13,465 | ||||||

| Write-off of equipment | 217,889 | - | ||||||

| Change in operating assets and liabilities | ||||||||

| Decrease (increase) in receivables and other assets | - | - | ||||||

| (Increase) decrease in prepaid expenses and other assets | 69,519 | (97,324 | ) | |||||

| Increase (decrease) in accounts payable and accrued expenses (including related party) | 310,148 | 247 | ||||||

| Net Cash Used in Operating Activities | (315,775 | ) | (1,596,145 | ) | ||||

| Cash Flows From Investing Activities | ||||||||

| Purchase of equipment and land possession rights | (14,355 | ) | (274,279 | ) | ||||

| Net CashProvided by (used in) Investing Activities | (14,355 | ) | (274,279 | ) | ||||

| Cash Flows From Financing Activities | ||||||||

| Proceeds from common stock less issuance costs | 172,640 | - | ||||||

| Loan proceeds from related party | 30,000 | - | ||||||

| Net Cash Provided by Financing Activities | 202,640 | - | ||||||

| Effect of exchange rate changes on Cash and Cash Equivalents | 77,614 | (78,789 | ) | |||||

| (Decrease) Increase in Cash | (49,876 | ) | (1,949,213 | ) | ||||

| Cash at Beginning of Period | 55,161 | 3,963,836 | ||||||

| Cash at End of Period | 5,285 | 2,014,623 | ||||||

The accompanying notes are an integral part of these interim consolidated financial statements.

| 6 | AURORA GOLD CORPORATION |

| AURORA GOLD CORPORATION |

| FINANCIAL STATEMENTS (EXPRESSED IN U.S. DOLLARS) |

| QUARTERLY REPORT FOR THE PERIOD ENDED JUNE 30,2014 |

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY (DEFICIENCY) (UNAUDITED)

| Accumulated | ||||||||||||||||||||||||||||

| AURORA GOLD CORPORATION | Accumulated | Other | Total | |||||||||||||||||||||||||

| (An exploration stage enterprise) | Common | Additional | Advances for | (deficit) during | Comprehensive | Stockholders' | ||||||||||||||||||||||

| Consolidated Statements of Stockholders' Equity (Deficiency) | Stock | paid-in | Stock | Exploration | Income | Equity | ||||||||||||||||||||||

| Balance Sheets | Shares | Amount | capital | Subscriptions | Stage | (Loss) | (Deficiency) | |||||||||||||||||||||

| (Expressed in U.S. Dollars) | # | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||

| Balance, December 31, 2011 | 21,982,518 | 109,913 | 22,040,994 | 20,000 | (22,400,600 | ) | (70,525 | ) | (300,218 | ) | ||||||||||||||||||

| Issuance of common stock for settlement of indebtedness in March 2012 | 398,180 | 1,991 | 117,463 | 119,454 | ||||||||||||||||||||||||

| Issuance of common stock for cash in March 2012 - shares not issued until April 2012 | - | 17,513 | 17,513 | |||||||||||||||||||||||||

| Issuance of common stock for cash in April 2012 | 263,200 | 1,316 | 77,644 | 78,960 | ||||||||||||||||||||||||

| Issuance of common stock for settlement of indebtedness in April 2012 | 60,000 | 300 | 17,700 | 18,000 | ||||||||||||||||||||||||

| Issuance of common stock in April 2012 for Advances for Stock Subscriptions | 125,044 | 625 | 36,888 | (37,513 | ) | - | ||||||||||||||||||||||

| Stock option compensation expense | - | 55,660 | 55,660 | |||||||||||||||||||||||||

| Issuance of common stock for cash on October 5, 2012 | 27,000,000 | 135,000 | 4,865,000 | 5,000,000 | ||||||||||||||||||||||||

| Net (loss) for the period | - | (1,200,374 | ) | (1,200,374 | ) | |||||||||||||||||||||||

| Foreign currency translation adjustments | - | 63,323 | 63,323 | |||||||||||||||||||||||||

| Balance, December 31, 2012 | 49,828,942 | 249,146 | 27,211,349 | - | (23,600,974 | ) | (7,202 | ) | 3,852,319 | |||||||||||||||||||

| Net (loss) for the period | - | (3,405,489 | ) | (3,405,489 | ) | |||||||||||||||||||||||

| Foreign currency translation adjustments | - | (119,362 | ) | (119,362 | ) | |||||||||||||||||||||||

| Balance, December 31, 2013 | 49,828,942 | 249,146 | 27,211,349 | - | (27,006,463 | ) | (126,564 | ) | 327,468 | |||||||||||||||||||

| Issuance of common stock for cash on March 5, 2014 | 1,360,048 | 1,360 | 99,280 | 100,640 | ||||||||||||||||||||||||

| Net (loss) for the period | (275,925 | ) | (275,925 | ) | ||||||||||||||||||||||||

| Foreign currency translation adjustments | 15,048 | 15,048 | ||||||||||||||||||||||||||

| Balance, March 31, 2014 | 51,188,990 | 250,506 | 27,310,629 | - | (27,282,388 | ) | (111,516 | ) | 167,231 | |||||||||||||||||||

| Issuance of common stock for cash on April 15, 2014 | 2,400,048 | 2,400 | 69,600 | 72,000 | ||||||||||||||||||||||||

| Net (loss) for the period | - | (644,980 | ) | (644,980 | ) | |||||||||||||||||||||||

| Foreign currency translation adjustments | - | 11,880 | 11,880 | |||||||||||||||||||||||||

| Balance, June 30, 2014 | 53,589,038 | 252,906 | 27,380,228 | - | (27,927,368 | ) | (99,636 | ) | (393,869 | ) | ||||||||||||||||||

The accompanying notes are an integral part of these interim consolidated financial statements.

| 7 | AURORA GOLD CORPORATION |

| AURORA GOLD CORPORATION |

| FINANCIAL STATEMENTS (EXPRESSED IN U.S. DOLLARS) |

| QUARTERLY REPORT FOR THE PERIOD ENDED JUNE 30,2014 |

NOTES TO INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

| 1. | Organization, Business Strategy and Going Concern |

Organization

Aurora Gold Corporation ("the Company") was formed on October 10, 1995 under the laws of the State of Delaware and is in the business of location, acquisition, exploration and, if warranted, development of mineral properties. The Company’s focus is on the exploration and development of its exploration properties located in the Tapajos Gold Province, State of Pará, Brazil (refer to Note 3). The Company has not yet determined whether its properties contain mineral reserves that may be economically recoverable and has not generated any operating revenues to date.

The Company is a junior mineral exploration company and conducts principal and technical activities from Coresco AG, Level 3, Gotthardstrasse 20, 6300 Zug, Switzerland. The telephone number is (+41) 41 711 0281. These offices are provided to the Company on a month-to-month basis. The Company believes these offices are adequate for the business requirements during the next 12 months. The Company does not own any real property.

Business Strategy

The general business strategy is to acquire mineral properties either directly or through the acquisition of operating entities. The continued operations and the recoverability of minerals are dependent upon the existence of economically recoverable mineral reserves, confirmation of interest in the underlying properties and ability to obtain necessary financing to complete the development and future profitable production. Since 1996 the Company acquired and disposed of a number of properties. The Company has not been successful in any exploration efforts to establish reserves on any of the properties owned by or in which the Company holds an interest.

The Company currently has an interest in a strategic land package of four (4) properties covering 14,711 Hectares, none of which contain any reserves. The Company has no revenues, has sustained losses since inception and has been issued an opinion by the auditors expressing substantial doubt about the ability to continue as a going concern. The Company will not generate revenues even if any of its exploration programs indicate that a mineral deposit may exist on the properties. Accordingly, the Company will be dependent on future financings in order to maintain operations and continue exploration activities.

Going Concern

The Company has no revenues, and has sustained losses since inception. The Company will not generate revenues even if any of its exploration programs indicate that a mineral deposit may exist on the properties. Accordingly, the Company will be dependent on future financings in order to maintain operations and continue exploration activities.

These interim consolidated financial statements have been prepared in accordance with generally accepted accounting principles applicable to a going concern, which contemplates the realization of assets and the satisfaction of liabilities and commitments in the normal course of business. The general business strategy of the Company is to acquire mineral properties either directly or through the acquisition of operating entities. The Company has incurred recurring operating losses since inception, has not generated any operating revenues to date and during the six months ended June 30, 2014, operating activities used cash of $315,775 (June 30, 2013: $1,596,145). The Company requires additional funds to meet its obligations and maintain its operations.

These conditions raise substantial doubt about the Company's ability to continue as a going concern. Management's plans in this regard are to raise equity financing through private or public equity investment in order to support existing operations and expand its business. There is however no assurance that such additional funding will be available to the Company when required, or on terms acceptable to the Company. In the event that the Company cannot obtain additional funds, on a timely basis, or the operations do not generate sufficient cash flow, the Company may be forced to curtail development or cease activities. These interim consolidated financial statements do not include any adjustments that might result from this uncertainty.

| 8 | AURORA GOLD CORPORATION |

| AURORA GOLD CORPORATION |

| FINANCIAL STATEMENTS (EXPRESSED IN U.S. DOLLARS) |

| QUARTERLY REPORT FOR THE PERIOD ENDED JUNE 30,2014 |

| 1. | Organization, Business Strategy and Going Concern (Continued) |

The Company has no revenues, has sustained losses since inception, has been issued an opinion expressing substantial doubt about the ability to continue as a going concern by the auditors and relies upon the sale of securities to fund operations. The Company will not generate revenues even if any of exploration programs indicate that a mineral deposit may exist on the properties. Accordingly, the Company will be dependent on future financings in order to maintain operations and continue exploration activities.

The properties are in the exploration stage only and without a known body of mineral reserves. Development of the properties will follow only if satisfactory exploration results are obtained. Mineral exploration and development involves a high degree of risk and few properties that are explored are ultimately developed into producing mines. There is no assurance that the mineral exploration and development activities will result in any discoveries of commercially viable bodies of mineralization. The long-term profitability of the operations will be, in part, directly related to the cost and success of the exploration programs, which may be affected by a number of factors.

The Company has not been involved in any bankruptcy, receivership or similar proceedings.

| 2. | Summary of Significant Accounting Policies |

| (a) | Basis of Preparation |

The Company follows accounting standards set by the Financial Accounting Standards Board (FASB). The FASB sets accounting principles generally accepted (GAAP) in the United States that the Company follows to ensure they consistently report their financial condition, results of operations, and cash flows. References to GAAP issued by the FASB in these footnotes are to the FASB Accounting Standards Codification (ASC) or also referred to as Codification.

These consolidated financial statements have been prepared in accordance with GAAP and include the accounts of the Company and its wholly owned subsidiaries, Aurora Gold Mineração Ltda ("Aurora Gold Mineração") and AGC Resources LLC (“AGC”) (through to date of disposition of AGC, June 14, 2011). Collectively, they are referred to herein as "the Company". Significant inter-company accounts and transactions have been eliminated.

Certain information and footnote disclosures normally included in interim consolidated financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to such Securities and Exchange Commission (SEC) rules and regulations. The interim period consolidated financial statements should be read together with the audited consolidated financial statements and accompanying notes included in the Company’s audited consolidated financial statements for the year ended December 31, 2013. In the opinion of the management of the Company, the unaudited consolidated financial statements contained herein contain all adjustments (consisting of a normal recurring nature) necessary to present a fair statement of the results of the interim periods presented.

| (b) | Use of Estimates |

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates and assumptions.

| (c) | Cash Equivalents |

Cash equivalents comprise certain highly liquid instruments with a maturity date of three months or less when purchased. The Company has cash and cash equivalents of $5,285 as at June 30, 2014 ($55,161 as at December 31, 2013). Amounts paid for income taxes during the three and six months June 30, 2014 and 2013 were nil; and for interest paid nil respectively.

| 9 | AURORA GOLD CORPORATION |

| AURORA GOLD CORPORATION |

| FINANCIAL STATEMENTS (EXPRESSED IN U.S. DOLLARS) |

| QUARTERLY REPORT FOR THE PERIOD ENDED JUNE 30,2014 |

| 2. | Summary of Significant Accounting Policies (Continued) |

| (d) | Vehicles and Equipment and Land Possession Rights |

Vehicles and equipment are carried at cost (including development and preproduction costs, capitalized interest, other financing costs and all direct administrative support costs incurred during the construction period, net of cost recoveries and incidental revenues), less accumulated depletion and depreciation including write-downs. Following the construction period, interest, other financing costs and administrative costs are expensed as incurred. Buildings and equipment utilized directly in commercial mining activities are depreciated, following the commencement of commercial production, over their expected economic lives using either the unit-of-production method or the straight-line method. Depreciation is provided over the following useful lives:

| - | Vehicles | 5 years |

| - | Office equipment, furniture and fixtures | 2 to 10 years |

| - | Mining equipment | 10 years |

The Company reviews the carrying values of its vehicles and equipment whenever events or changes in circumstances indicate that their carrying values may not be recoverable. Impairment is considered to exist if total estimated future cash flows, or probability-weighted cash flows on an undiscounted basis, are less than the carrying value of the assets. An impairment loss is measured and recorded based on discounted estimated future cash flows associated with values beyond proven and probable reserves and resources. In estimating future cash flows, assets are grouped at the lowest level for which there is identifiable future cash flows that are largely independent of cash flows from other asset groups. Generally, in estimating future cash flows, all assets are grouped at a particular property for which there are identifiable cash flows.

All vehicles and equipment are located in Brazil.

Land possession rights consist of amounts paid for possession rights to land in Brazil. Such costs are capitalized as the payments provide us with certain ownership rights for a period of time.

| (e) | Mineral Property Reclamation Bonds and Other Related Refundable Costs |

Costs paid for the purchase of reclamation bonds and other related costs that are refundable are capitalized. If amounts paid are not to be refunded then they will be expensed when it is determined they will not be refunded.

| (f) | Mineral Properties and Exploration Expenses |

The Company accounts for its mineral properties on a cost basis whereby all direct costs, net of pre-production revenue, relative to the acquisition of the properties are capitalized. All sales and option proceeds received are first credited against the costs of the related property, with any excess credited to earnings. Once commercial production has commenced, the net costs of the applicable property will be charged to operations using the unit-of-production method based on estimated proven and probable recoverable reserves. The net costs related to abandoned properties are charged to operations.

Exploration costs are charged to operations as incurred until such time that proven reserves are discovered. From that time forward, the Company will capitalize all costs to the extent that future cash flow from mineral reserves equals or exceeds the costs deferred. The deferred costs will be amortized over the recoverable reserves when a property reaches commercial production. As at the reporting period ended, the Company does not have proven reserves. Exploration activities conducted jointly with others are reflected at the Company's proportionate interest in such activities.

| 10 | AURORA GOLD CORPORATION |

| AURORA GOLD CORPORATION |

| FINANCIAL STATEMENTS (EXPRESSED IN U.S. DOLLARS) |

| QUARTERLY REPORT FOR THE PERIOD ENDED JUNE 30,2014 |

| 2. | Summary of Significant Accounting Policies (Continued) |

The Company reviews the carrying values of its mineral properties on a regular basis by reference to the project economics including the timing of the exploration or development work, the program of works and the exploration results experienced by the Company and others. The review of the carrying value of any producing property will be made by reference to the estimated future operating results and net cash flows. When the carrying value of a property exceeds its estimated net recoverable amount, provision is made for the decline in value.

The recoverability of the amounts recorded for mineral properties is dependent on the confirmation of economically recoverable reserves, confirmation of the Company’s interest in the underlying mineral claims, the ability of the Company to obtain the necessary financing to successfully complete their development and the attainment of future profitable operations or proceeds from disposal.

Estimated costs related to site restoration programs during the commercial development stage of the property are accrued over the life of the project.

| (g) | Stock-Based Compensation |

The Company accounts for share-based payments under the fair value method of accounting for stock-based compensation consistent with GAAP. Under the fair value method, stock-based compensation cost is measured at the grant date based on the fair value of the award using the Black-Scholes option pricing model and is recognized to expense on a straight-line basis over the requisite service period, which is generally the vesting period. Where upon grant the options vest immediately the stock-based costs are expensed immediately.

| (h) | Interest Expense |

Interest expense for the periods ended June 30, 2014 and June 30, 2013 were nil.

| (i) | Foreign Currency Translation and Transactions |

The Company's reporting currency is the United States Dollar (USD). Aurora Gold Mineração Ltda is a foreign operation and its functional currency is the Brazilian Real (Real). Certain contractual obligations in these interim consolidated financial statements are stated in Brazilian Real’s. At the period ended June 30, 2014 the Brazilian Real exchange rate to the USD was $0.45340 to 1 Real (June 30, 2013: USD $0.44890 to 1 Real).

The Company translates foreign assets and liabilities of its subsidiaries, other than those denominated in USD, at the rate of exchange at the balance sheet date. Income and expenses of these subsidiaries are translated at the average rate of exchange throughout the reporting period. Gains or losses from these translations are reported as a separate component of other comprehensive income (loss) until all or a part of the investment in the subsidiaries is sold or liquidated. The translation adjustments do not recognize the effect of income tax because the Company expects to reinvest the amounts indefinitely in operations. Accumulated other comprehensive income (loss) consists entirely of foreign currency translation adjustments at June 30, 2014 and December 31, 2013.

Transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the local functional currency are included in foreign exchange (gain) loss in the consolidated statements of comprehensive income (loss).

| (j) | Concentration of Credit Risk |

Financial instruments that subject the Company to concentrations of credit risk consist primarily of cash and cash equivalents. The Company places its cash with high credit quality financial institutions in Brazil and Canada. The Company occasionally has cash deposits in excess of federally insured limits. The Company had funds deposited in banks beyond the insured limits as of June 30, 2014 and 2013 respectively. The Company has not experienced any losses related to these balances, and management believes the credit risk to be minimal.

| 11 | AURORA GOLD CORPORATION |

| AURORA GOLD CORPORATION |

| FINANCIAL STATEMENTS (EXPRESSED IN U.S. DOLLARS) |

| QUARTERLY REPORT FOR THE PERIOD ENDED JUNE 30,2014 |

| 2. | Summary of Significant Accounting Policies (Continued) |

| (k) | Fair Value of Financial Instruments and Risks |

Fair value estimates of financial instruments are made at a specific point in time, based on relevant information about financial markets and specific financial instruments. As these estimates are subjective in nature, involving uncertainties and matters of significant judgment, they cannot be determined with precision. Changes in assumptions can significantly affect estimated fair value.

Management is of the opinion that the Company is not exposed to significant interest or credit risks arising from these financial instruments. The Company operates outside of the United States of America (primarily in Brazil) and is exposed to foreign currency risk due to the fluctuation between the currency in which the Company operates in and the USD.

| (l) | Income Taxes |

The Company has adopted ASC 740, Accounting for Income Taxes, which requires the Company to recognize deferred tax liabilities and assets for the expected future tax consequences of events that have been recognized in the Company's financial statements or tax returns using the liability method. Under this method, deferred tax liabilities and assets are determined based on the differences between the financial statement carrying amounts and tax bases of assets and liabilities using enacted tax rates in effect in the years in which the differences are expected to reverse. In July 2006, the FASB issued an interpretation, which clarifies the accounting for uncertainty in income taxes recognized in a company’s financial statements in accordance with GAAP. This interpretation prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken in a tax return. It also provides guidance on derecognition, classification, interest and penalties, accounting in interim periods, disclosure and transition. Estimated interest and penalties related to recording uncertain tax positions when recorded are included as a component of income tax expense on the consolidated statement of operations. The Company has not recorded any liabilities for uncertain tax positions or any related interest and penalties. The Company’s tax returns are open to audit for the years ending December 31, 2010 to 2013.

| (m) | Basic and Diluted Net Income (Loss) Per Share |

Earnings (loss) per share is computed by dividing net income (loss) available to common stockholders by the weighted average number of common shares outstanding during the reporting period including common stock issued effective the date committed. Common stock issuable is considered outstanding as of the original approval date for the purposes of earnings per share computations. Diluted earnings (loss) per common share is computed by dividing net earnings (loss) by the sum of (a) the basic weighted average number of shares of common stock outstanding during the year and (b) additional shares that would have been issued and potentially dilutive securities. During the periods ended March 31, 2014 and 2013 the diluted earnings (loss) per share was equivalent to the basic earnings (loss) per share because all potentially dilutive securities were anti-dilutive due to the net losses incurred. Potentially dilutive securities consist of stock options and warrants outstanding at the end of the reporting period. Stock options outstanding as at June 30, 2014 were 1,930,000 (June 30, 2013: 9,650,000). Warrants outstanding as at June 30, 2014 totaled 3,760,000 at respective prices of of $0.15 for 2 years and $0.07 for 2 years (June 30, 2013: 1,930,000).

| (n) | Reverse Stock Split |

The Company has retroactively adjusted all share and per share information to reflect the reverse stock split, discussed in Note 5, in the consolidated financial statements and notes thereto, as well as throughout the rest of this Report for all periods presented.

| 12 | AURORA GOLD CORPORATION |

| AURORA GOLD CORPORATION |

| FINANCIAL STATEMENTS (EXPRESSED IN U.S. DOLLARS) |

| QUARTERLY REPORT FOR THE PERIOD ENDED JUNE 30,2014 |

| 2. | Summary of Significant Accounting Policies (Continued) |

| (o) | Interim Financial Statements |

In the opinion of management, the accompanying unaudited condensed financial statements contain all adjustments which include only normal recurring adjustments, necessary to present fairly the Company’s financial position, results of operations and cash flows for the periods shown. The results of operations for such periods are not necessarily indicative of the results expected for a full year or for any future period. The unaudited financial statements should be read in conjunction with the Company’s audited financial statements and notes for the year ended December 31, 2013, which are included in the Company’s Annual Report on Form 10-K.

| (p) | Recent Accounting Pronouncements |

At present, there are no other such pronouncements not yet effective that the Company expects will have a material impact on these interim consolidated financial statements.

| 13 | AURORA GOLD CORPORATION |

| AURORA GOLD CORPORATION |

| FINANCIAL STATEMENTS (EXPRESSED IN U.S. DOLLARS) |

| QUARTERLY REPORT FOR THE PERIOD ENDED JUNE 30,2014 |

| 3. | Mineral Properties and Exploration Expenses |

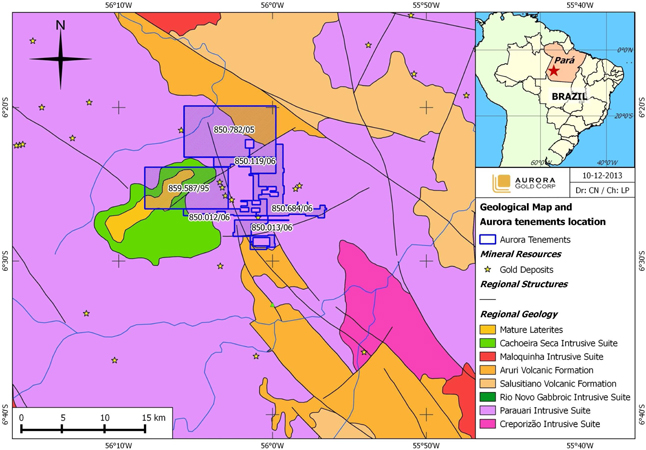

In Brazil, Aurora has four (4) properties with an approximate total of 14,711 ha within the Tapajos Gold Province. The Exploration licence areas are located in the vicinity of the Săo Domingos Township. The Company has conducted various degrees of exploration activities on the properties and ranked the mineralised occurrences in order of merit and may discontinue such activities and dispose of some of the rights to mineral exploration on parts of the property if further exploration work is not warranted. A summary of these properties approved by the Department of National Production Minerals (DNPM) is set out below.

| a) | DNPM Process 850.684/06 1,985.91 ha |

| b) | DNPM Process 850.782/05 6,656.20 ha |

| c) | DNPM Process 850.119/06 1,068.72 ha |

| d) | DNPM Process 859.587/95 5,000.00 ha |

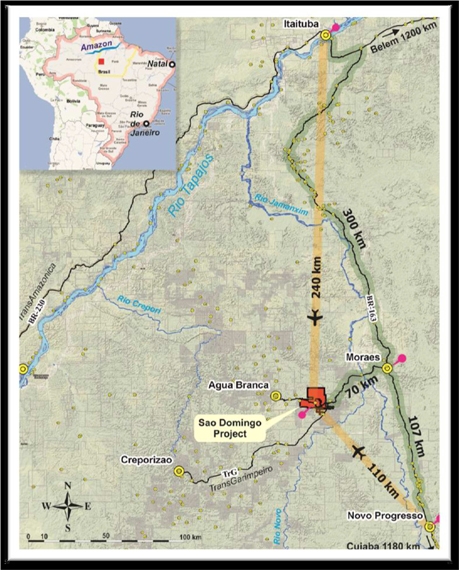

São Domingos Project in the Municipality of Itaituba, in the Tapajos gold province of the State of Para, Brazil.

| a) | DNPM Processes 850.684/06: 1,985.91 ha |

Aurora has good title over the mineral rights object of the DNPM Process No. 850.684/06, which is valid and in force, free and clear of any judicial and extrajudicial encumbrances and taxes. Aurora is the sole registered and beneficial holder of and owns and possesses good title to the referred mineral rights. On September 13, 2006 Aurora submitted to DNPM one Exploration Claim for gold covering an area of 4914.18 ha in the Municipality of Itaituba, State of Pará. According to the information obtained such claim was correctly prepared and the required documents are in place but the area will be reduced to 1,985.91 due to overlapping with third parties’ areas with priority rights. The Exploration Permit has not been granted yet. The above-mentioned area is not related to any payments or royalties to third parties since Aurora claimed them directly.

| b) | DNPM Processes 850.782/05: 6,656.20 ha |

Aurora has good title over the mineral rights object of the DNPM Process No. 850.782/05, which is valid and in force, free and clear of any judicial and extrajudicial encumbrances and taxes. On November 8, 2005 it was submitted to DNPM the Exploration Claim for gold in the Municipality of Itaituba, State of Pará. The Exploration Permit was granted on November 28, 2006 for a 3 (three) year period. The transfer to Aurora was approved on March 24, 2009 and on September 28, 2009 it was requested the renewal of the Exploration Permit. This area was reduced from 6,756 ha to 5,651.98 ha due to the overlapping with Garimpeira (alluvial) Mining properties held by Mr. Celio Paranhos. However the DNPM ́s general attorney in Brasilia agreed with Aurora’s legal thesis and nullified all applications filed by Mr. Paranhos (about to 1,900 applications). A new Exploration Permit rectifying the previous one was granted on August 20, 2010 for a 3 (three) year period, for an area of 6,656.20 hectares. An application has been lodged for the extension of the license and Aurora is awaiting the results of this. The renewal will be for a further 3 years and is expected to be granted in the near future. The Annual Fees per Hectare (TAHs) for the 1st and 2nd years of the extension period have been properly paid. The annual fee for the third year was paid in January 2013. No payments or royalties are due regarding the DNPM Process 850.782/05 since it was acquired through a permutation agreement with Altoro Mineração Ltda.

| 14 | AURORA GOLD CORPORATION |

| AURORA GOLD CORPORATION |

| FINANCIAL STATEMENTS (EXPRESSED IN U.S. DOLLARS) |

| QUARTERLY REPORT FOR THE PERIOD ENDED JUNE 30,2014 |

| 3. | Mineral Properties and Exploration Expenses (Continued) |

| c) | DNPM Process 850.119/06: 1,068.72 ha |

Direct access to the files of this Project at DNPM’s office were not sited, however analysis is based on the then current information provided on DNPM’s website. The exploration claim was submitted to DNPM on March 7, 2006, for gold covering an area of 1,068.72 ha, in the Municipality of Itaituba, State of Pará. Aurora has good title over the mineral rights object of the DNPM Process No. 850.119/06, which is valid and in force, free and clear of any judicial and extrajudicial encumbrances and taxes. Aurora is the sole registered and beneficial holder of and owns and possesses good title to the referred mineral rights. The Exploration Permit has not been granted yet. The above-mentioned area is not related to any payments or royalties to third parties since Aurora claimed them directly.

| d) | DNPM Process 859.587/95: 5,000 ha |

The tenement 859.587/95 is held by Aurora and is valid and in force, free and clear of any judicial and extrajudicial encumbrances and taxes. It is located at the Municipality of Itaituba, State of Pará. On November 27, 1995 it was submitted to DNPM the Exploration Claim for gold. The Exploration Permit was granted on September 15, 2006 for a 3 (three) years period covering an area of 5000 ha, and it was valid until September 15, 2009. On July 15, 2009 it was requested the renewal of the Exploration Permit, which was granted on June 14, 2012. The renewal is valid until June 14, 2015, when a Final Report must be submitted to DNPM with the results of the Exploration Activities. In order to have a Mining Permit granted, Aurora must present the Economic Exploitation Plan and the Mining Concession Request in one year from the approval of the Final Report.

| 4. | Advances Payable |

As at June 30, 2014 advances payable were $62,000 (June 30, 2013: $32,000), which is non-interest bearing and due on demand.

| 15 | AURORA GOLD CORPORATION |

| AURORA GOLD CORPORATION |

| FINANCIAL STATEMENTS (EXPRESSED IN U.S. DOLLARS) |

| QUARTERLY REPORT FOR THE PERIOD ENDED JUNE 30,2014 |

| 5. | Common Stock |

On March 5, 2014, Alltech Capital Limited subscribed for 1,360,000 shares at a price of $0.074 and received one warrant for each share valid for 2 years at a strike of $0.15 cents.

On August 15, 2013, an Information Statement was filed with the Securities and Exchange Commission and was mailed or otherwise furnished to the registered stockholders of Aurora in connection with the prior approval by the board of directors of Aurora, and receipt by the board of approval by written consent of the holders of a majority of Aurora’s outstanding shares of common stock, of a resolution to:

| - | Approve a consolidation of the issued and outstanding shares of common stock of Aurora, without correspondingly decreasing the number of authorized shares of common stock, on a five “old” shares for every one “new” share basis, which will result in a decrease of Aurora’s issued and outstanding share capital from 249,144,706 shares to approximately 49,828,942 shares of common stock, not including any rounding up of fractional shares to be issued on consolidation; |

| - | Approve a change of the par value of the shares of common stock of Aurora from a pre-consolidated par value of $0.001 per share to an amended par value of $0.005 per share; and |

| - | Amend Article Four of the Articles of Aurora as follows “FOURTH. The authorized capital stock of this Corporation shall consist of 300 Million (300,000,000) shares of common stock with a par value of $0.005 per share.” |

Section 228 of the Delaware General Corporation Law and the By-laws of Aurora provide that any action required or permitted to be taken at a meeting of the stockholders may be taken without a meeting if stockholders holding at least a majority of the voting power sign a written consent approving the action. On July 24, 2013, the board of directors of Aurora approved and recommended the Resolutions. Subsequently, the holders of a majority of the voting power signed and delivered to Aurora written consents representing at least 57.4% of the voting shares of common stock approving the Resolutions, in lieu of a meeting. Since the holders of the required majority of shares of common stock have approved the Resolutions, no other votes are required or necessary and no proxies are being solicited with this Information Statement. Aurora has obtained all necessary corporate approvals in connection with the Resolutions and your consent is not required and is not being solicited in connection with the approval of the Resolutions. The Information Statement was furnished solely for the purpose of informing stockholders in the manner required under the Securities Exchange Act of 1934 of these corporate actions before they take effect. The Resolutions will not become effective until (i) the date the Company receives confirmation from FINRA regarding the approval and effective date of the corporate action, or, (ii) such later date as approved by the board of directors, in its sole discretion. The Certificate of Amendment was filed with the Secretary of State of Delaware and became effective October 22, 2013,

On October 5, 2012, the Company, completed the sale of 27,000,000 shares of the Company’s common stock for a purchase price of $5,000,000, to Alltech Capital Limited pursuant to the terms of a subscription agreement entered into between the Company and the Alltech Capital Limited dated September 21, 2012. As a result of the sale of 27,000,000 shares of the Company’s common stock of approximately 54%, a change in control of the Company has occurred. As a condition to the closing of the transaction, the Company agreed to increase the size of its board of directors to five (5) members and to appoint two board members selected by the Investor. The board of directors appointed each of Messrs. Vladimir Bernshtein and Andrey Ratsko to serve as directors of the Company. Additionally, Mr. Bernshtein has been named as the Company’s Chief Business Development Director.

| 16 | AURORA GOLD CORPORATION |

| AURORA GOLD CORPORATION |

| FINANCIAL STATEMENTS (EXPRESSED IN U.S. DOLLARS) |

| QUARTERLY REPORT FOR THE PERIOD ENDED JUNE 30,2014 |

| 5. | Common Stock (Continued) |

In October 2011 the Company filed a Registration Statement on Form S-1 offering up to a maximum of 10,000,000 units of the Company's securities at an offering price of $0.50 per Unit in a direct public offering, without any involvement of underwriters or broker-dealers. Each Unit consists of one (1) share of common stock at a $0.005 par value per share and one (1) Stock Purchase Warrant. Each full Warrant entitles the holder to purchase one additional share of common stock at a price of $1.00 for a period of two years commencing November 1, 2011 through October 31, 2013. The Units will be sold by the Chief Executive Officer and Chief Financial Officer. A Notice of Effectiveness was issued April 25, 2012. The offer expired January 20, 2013. To date, no funds were obtained from this offering.

On April 16, 2012, the Company entered into subscription agreements for 263,200 shares of common stock at a purchase price of $0.30 per share for a gross aggregate price of $78,960. Pursuant to the subscription agreements, each of the Investors has represented that they are not a U.S. person; as such term is defined in Regulation S. In connection with the offering, the Company has agreed to pay a cash commission equal to 8% of all funds received or an aggregate of up $48,000 on the total maximum $600,000 subscription.

During April 2012, the Company entered into a debt settlement agreement for $18,000 in accounts payable which was settled for 60,000 shares of common stock at an issue price of $0.30 per share.

During March 2012, the Company entered into debt settlement agreements for advances received from a director of the Company and a company during fiscal 2011 as well as $14,454 of amounts in accounts payable and accrued expenses. $119,454 was settled for 398,180 shares of common stock at an issue price of $0.30 per share. As at March 31, 2012 advances on stock subscriptions were $37,513 and received during that quarter.

In March 2012, the Company entered into subscription agreements for 125,044 shares of common stock at a purchase price of $0.30 per share for a gross aggregate price of $37,513. Share certificates were not issued as at March 31, 2012 and they were treated as an Advance for Stock Subscriptions. The share certificates were issued in April 2012. Pursuant to the subscription agreements, each of the Investors has represented that they are not a U.S. person; as such term is defined in Regulation S. In connection with the offering, the Company has agreed to pay a cash commission equal to 8% of all funds received or an aggregate of up $48,000 on the total maximum $600,000 subscription that is being offered.

On December 20, 2011, the Company entered into subscription agreements for 1,600,000 shares of common stock at a purchase price of $0.20 per share for a gross aggregate price of $320,000. Attached to each unit of common stock is one (1) series A stock purchase warrant. Each full Series A warrant entitles the holder to purchase an additional share of the Company’s common stock at an exercise price of $0.40 per share for a period of eighteen months commencing on December 20, 2011 and expiring on June 20, 2013. Pursuant to the subscription agreements, each of the Investors has represented that they are not a U.S. person; as such term is defined in Regulation S. In connection with the offering, the Company has agreed to pay a cash commission equal to 8% of all funds received or an aggregate of up $25,600. The total amount of commission paid was $8,800. These warrants expired on June 20, 2013.

| 17 | AURORA GOLD CORPORATION |

| AURORA GOLD CORPORATION |

| FINANCIAL STATEMENTS (EXPRESSED IN U.S. DOLLARS) |

| QUARTERLY REPORT FOR THE PERIOD ENDED JUNE 30,2014 |

| 6. | Stock Options and Warrants |

In 2007, the Company's Board of Directors approved the 2007 Stock Option Plan (amended September 29, 2008) (“the Plan”) to offer an incentive to obtain services of key employees, directors and consultants of the Company. The Plan provides for the reservation for awards of an aggregate of 10% of the total shares of Common Stock outstanding from time to time. No Plan participant may receive stock options exercisable for more than 500,000 shares of Common Stock in any one calendar year. Under the Plan, the exercise price of an incentive stock option must be at least equal to 100% of the fair market value of the common stock on the date of grant (110% of fair market value in the case of options granted to employees who hold more than 10% of the Company's capital stock on the date of grant). The term of stock options granted under the Plan is not to exceed ten years and the stock options vest immediately upon granting.

The following is a summary of stock option activity and status at March 31, 2014:

| Options Outstanding and

Exercisable By Quarter | Stock Options # | Weighted Average Exercise Price $ | Remaining

Contractual Life (years) | Aggregate

Intrinsic value | ||||||||||||

| As at December 31, 2011 | 1,810,000 | 0.550 | 4.28 | 36,500 | ||||||||||||

| Forfeited during quarter | (40,000 | ) | 1.300 | - | - | |||||||||||

| Granted during quarter | 320,000 | 0.250 | - | - | ||||||||||||

| As at March, 31, 2012 | 2,090,000 | 0.450 | 4.21 | 42,000 | ||||||||||||

| Granted during quarter | 40,000 | 0.325 | - | - | ||||||||||||

| As at June, 30, 2012 | 2,130,000 | 0.485 | 3.97 | 34,125 | ||||||||||||

| Forfeited during quarter | (200,000 | ) | 1.300 | - | - | |||||||||||

| Granted during quarter | - | - | - | - | ||||||||||||

| As at September 30, 2012 | 1,930,000 | 0.400 | 3.74 | 52,500 | ||||||||||||

| Forfeited during quarter | - | - | - | - | ||||||||||||

| Granted during quarter | - | - | - | - | ||||||||||||

| As at December 31, 2012 | 1,930,000 | 0.400 | 3.51 | Nil | ||||||||||||

| Forfeited during quarter | - | - | - | - | ||||||||||||

| Granted during quarter | - | - | - | - | ||||||||||||

| As at March 31, 2013 | 1,930,000 | 0.400 | 3.28 | Nil | ||||||||||||

| Forfeited during quarter | - | - | - | - | ||||||||||||

| Granted during quarter | - | - | - | - | ||||||||||||

| As at June 30, 2013 | 1,930,000 | 0.400 | 3.06 | Nil | ||||||||||||

| Forfeited during quarter | - | - | - | - | ||||||||||||

| Granted during quarter | - | - | - | - | ||||||||||||

| As at September 30, 2013 | 1,930,000 | 0.400 | 2.83 | Nil | ||||||||||||

| Forfeited during quarter | - | - | - | - | ||||||||||||

| Granted during quarter | - | - | - | - | ||||||||||||

| As at December 31, 2013 | 1,930,000 | 0.400 | 2.60 | Nil | ||||||||||||

| Forfeited during quarter | - | - | - | - | ||||||||||||

| Granted during quarter | - | - | - | - | ||||||||||||

| As at March 31, 2014 | 1,930,000 | 0.400 | 2.38 | Nil | ||||||||||||

| Forfeited during quarter | - | - | - | - | ||||||||||||

| Granted during quarter | - | - | - | - | ||||||||||||

| As at June 30, 2014 | 1,930,000 | 0.400 | 2.15 | Nil | ||||||||||||

| 18 | AURORA GOLD CORPORATION |

| AURORA GOLD CORPORATION |

| FINANCIAL STATEMENTS (EXPRESSED IN U.S. DOLLARS) |

| QUARTERLY REPORT FOR THE PERIOD ENDED JUNE 30,2014 |

| 6. | Stock Options and Warrants (continued) |

The aggregate intrinsic value in the table above represents the total pre-tax intrinsic value for all “in-the-money” options (i.e. the difference between the Company’s closing stock price on the last trading day of the fiscal year and the exercise price, multiplied by the number of shares) that would have been received by the option holders had all option holders exercised their options as of each date presented.

The total fair value of options granted for the six months ended June 30, 2014 was nil (June 30, 2013: $nil) and expensed in full as options were vested in full on grant. The fair value of options are determined using the Black Scholes option pricing model that takes into account the exercise price, the expected life of the option, the share price at grant date and expected price volatility of the underlying share, the expected dividend yield and the risk free interest rate for the term of the option. Management determined 2.50 years to be the average expected likely life of the options and utilized the simplified method due to the fact that the Company has not had significant options granted to develop historical data to provide a reasonable basis to estimate option lives.

The total fair value of options granted for the three months ended September 30, 2013 was nil (September 30, 2012: $nil) and expensed in full as options were vested in full on grant. The fair value of options are determined using the Black Scholes option pricing model that takes into account the exercise price, the expected life of the option, the share price at grant date and expected price volatility of the underlying share, the expected dividend yield and the risk free interest rate for the term of the option. Management determined 2.50 years to be the average expected likely life of the options and utilized the simplified method due to the fact that the Company has not had significant options granted to develop historical data to provide a reasonable basis to estimate option lives.

The total fair value of options granted for the three months ended June 30, 2013 was nil (June 30, 2012: $11,979) and expensed in full as options were vested in full on grant. The fair value of options are determined using the Black Scholes option pricing model that takes into account the exercise price, the expected life of the option, the share price at grant date (April 10, 2012) and expected price volatility of the underlying share, the expected dividend yield (nil assumed) and the risk free interest rate (4.50% used) for the term of the option. Management determined 2.50 years to be the average expected likely life of the options and utilized the simplified method due to the fact that the Company has not had significant options granted to develop historical data to provide a reasonable basis to estimate option lives. Volatility rates were calculated at the grant date of each option tranche and rates of 161.04% respectively were used.

The total fair value of options granted for the period ended March 31, 2013 was nil (March 31, 2012: $43,681) and expensed in full as options were vested in full on grant. The fair value of options are determined using the Black Scholes option pricing model that takes into account the exercise price, the expected life of the option, the share price at grant date (January 13, 2012) and expected price volatility of the underlying share, the expected dividend yield (nil assumed) and the risk free interest rate (4.50% used) for the term of the option. Management determined 2.50 years to be the average expected likely life of the options and utilized the simplified method due to the fact that the Company has not had significant options granted to develop historical data to provide a reasonable basis to estimate option lives. Volatility rates were calculated at the grant date of each option tranche and rates of 120.89% were used.

As of June 30, 2014, there are 3,760,000 outstanding Warrants to purchase shares of common stock at respective prices of $0.15 for 2 years and $0.07 for 2 years (June 30, 2013: 1,930,000).

| 19 | AURORA GOLD CORPORATION |

| AURORA GOLD CORPORATION |

| FINANCIAL STATEMENTS (EXPRESSED IN U.S. DOLLARS) |

| QUARTERLY REPORT FOR THE PERIOD ENDED JUNE 30,2014 |

| 7. | Related Party Transactions |

Related party transactions not disclosed elsewhere in these interim consolidated financial statements include:

| a) | During the period ended June 30, 2014 consulting fees of $181,500 (June 30, 2013: $317,000) were incurred to directors and officers (or companies of the officers and directors other than Coresco which is disclosed below) of the Company. The transactions were recorded at the exchange amount, being the value established and agreed to by the related parties. |

| b) | Coresco (a company that the CEO and CFO are affiliated with) also charged for geophysical consulting activities and other exploration management fees for a total of $32,500 during the period ended June 30, 2014 (June 30, 2013: $63,000). |

| c) | Included in accounts payable and accrued expenses and advances payable (related parties) as at June 30, 2014 and December 31, 2013 were $258,800 and $42,800 respectively payable to officers and directors of the Company for consulting fees and various expenses incurred on behalf of the Company. |

| 8. | Non-Cash Investing and Financing Activities |

There were no non-cash investing and financings payments during the six months ended June 30, 2014 (June 30, 2013: nil).

| 9. | Subsequent events |

There are no subsequent events other than stated throughout this report.

| 20 | AURORA GOLD CORPORATION |

| AURORA GOLD CORPORATION |

| FINANCIAL STATEMENTS (EXPRESSED IN U.S. DOLLARS) |

| QUARTERLY REPORT FOR THE PERIOD ENDED JUNE 30,2014 |

ITEM 2 – MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis should be read in conjunction with the Financial Statements and Notes to the Financial Statements filed with this Report.

Uncertainties Relating To Forward-Looking Statements

This portion of the Quarterly Report provides management's discussion and analysis (MD&A) of the financial condition and results of operations to enable a reader to assess material changes in financial condition and results of operations as of and for the quarterly periods reported, in comparison to the corresponding prior-year period. This MD&A is intended to supplement and complement the unaudited interim consolidated financial statements and notes thereto, prepared in accordance with US GAAP, for the quarterly periods reported (collectively, the "Financial Statements"), which are included in this Quarterly Report. The reader is encouraged to review the Financial Statements in conjunction with your review of this MD&A. This MD&A should be read in conjunction with both the annual audited interim consolidated financial statements for the year ended and the related annual MD&A included in the Forms 10-K on file with the US Securities and Exchange Commission. Certain notes to the Financial Statements are specifically referred to in this MD&A and such notes are incorporated by reference herein. All dollar amounts in this MD&A are in US dollars, unless otherwise specified. For the purposes of preparing this MD&A, we consider the materiality of information. Information is considered material if: (i) such information results in, or would reasonably be expected to result in, a significant change in the market price or value of Aurora Gold Corporation's shares; or (ii) there is a substantial likelihood that a reasonable investor would consider it important in making an investment decision or if it would significantly alter the total mix of information available to investors. Materiality is evaluated by reference to all relevant circumstances, including potential market sensitivity. This document contains numerous forward-looking statements relating to our business. The United States Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for certain forward-looking statements. Operating, exploration and financial data, and other statements in this document are based on information we believe reasonable, but involve significant uncertainties as to future gold and silver prices, costs, ore grades, estimation of gold and silver reserves, mining and processing conditions, changes that could result from our future acquisition of new mining properties or businesses, the risks and hazards inherent in the mining business (including environmental hazards, industrial accidents, weather or geologically related conditions), regulatory and permitting matters, and risks inherent in the ownership and operation of, or investment in, mining properties or businesses in foreign countries. Actual results and timetables could vary significantly from the estimates presented. Readers are cautioned not to put undue reliance on forward-looking statements. We disclaim any intent or obligation to update publicly these forward-looking statements, whether as a result of new information, future events or otherwise.

Organization

Aurora Gold Corporation ("the Company" or “Aurora”) was formed on October 10, 1995 under the laws of the State of Delaware and is in the business of location, acquisition, exploration and, if warranted, development of mineral properties. The Company’s focus is on the exploration and development of its exploration properties located in the Tapajos Gold Province, State of Pará, Brazil (refer Notes). The Company has not yet determined whether its properties contain mineral reserves that may be economically recoverable and has not generated any operating revenues to date.

The Company is a junior mineral exploration company and conducts principal and technical activities from Coresco AG, Level 3, Gotthardstrasse 20, 6304 Zug, Switzerland. The telephone number is (+41) 41 711 0281. These offices are provided to the Company on a month-to-month basis. The Company believes these offices are adequate for the business requirements during the next 12 months. The Company does not own any real property.

| 21 | AURORA GOLD CORPORATION |

| AURORA GOLD CORPORATION |

| FINANCIAL STATEMENTS (EXPRESSED IN U.S. DOLLARS) |

| QUARTERLY REPORT FOR THE PERIOD ENDED JUNE 30,2014 |

Business Strategy

The general business strategy is to acquire mineral properties either directly or through the acquisition of operating entities. The continued operations and the recoverability of minerals are dependent upon the existence of economically recoverable mineral reserves, confirmation of interest in the underlying properties and ability to obtain necessary financing to complete the development and future profitable production. Since 1996 the Company acquired and disposed of a number of properties. The Company has not been successful in any exploration efforts to establish reserves on any of the properties owned by or in which the Company holds an interest.

The Company currently has an interest in a strategic land package of four (4) properties none of which contain any reserves. The Company has no revenues, has sustained losses since inception and has been issued an opinion by the auditors expressing substantial doubt about the ability to continue as a going concern. The Company will not generate revenues even if any of its exploration programs indicate that a mineral deposit may exist on the properties. Accordingly, the Company will be dependent on future financings in order to maintain operations and continue exploration activities.

Exploration and Development

Exploration Activities

The Company is a junior mineral exploration company and conducts principal and technical activities from Coresco AG, Level 3, Gotthardstrasse 20, 6300 Zug, Switzerland. The telephone number is +41 41 711 0281. These offices are provided to the Company on a month-to-month basis. The Company believes these offices are adequate for the business requirements during the next 12 months. The Company does not own any real property.

The strategic objectives of the Company are to concentrate efforts on existing operations where infrastructure already exists, properties presently being developed or in advanced stages of exploration that have potential for additional discoveries and grass-roots exploration opportunities. The Company is currently concentrating on property exploration activities in Brazil.

The properties are in the exploration stage only and without a known body of mineral reserves. Development of the properties will follow only if satisfactory exploration results are obtained. Mineral exploration and development involves a high degree of risk and few properties that are explored are ultimately developed into producing mines. There is no assurance that the mineral exploration and development activities will result in any discoveries of commercially viable bodies of mineralization. The long-term profitability of the operations will be, in part, directly related to the cost and success of the exploration programs, which may be affected by a number of factors.

Mineral exploration and development involves a high degree of risk and few properties that are explored are ultimately developed into producing mines. There is no assurance that planned production will result in a commercial success, as production is gold price and politically sensitive. Once production has commenced the Company is able to gauge the onward commercial viability of the project. There is no assurance that planned mineral exploration and development activities will result in any further discoveries of commercially viable bodies of mineralization. The long-term profitability of operations will be, in part, directly related to the cost and success of exploration programs, which may be affected by a number of factors.

During 2013 and the first fiscal two quarters of 2014, the Company has been evaluating property holdings in order to determine whether to implement exploration programs on existing properties or to acquire interests in new properties.

The Company currently has an interest in four (4) properties located in Tapajos gold province in Para State, Brazil, collectively called the Sao Domingo project. The Company has conducted exploration activities on the properties and have ranked the properties in order of merit and may discontinue such activities and dispose of some of the rights to mineral exploration on the properties if further exploration work is not warranted.

The geology of the Săo Domingos property is predominantly composed of paleo-proterozoic Parauari Granites that play host to a number of gold deposits in the Tapajos Basin. Typical Granites of the younger Maloquinha Intrusive Suite have been noticed in the vicinity of the Fofoca resource area, and basic rocks considered to be part of the mesoproterozoic Cachoeira Seca Intrusive Suite occur around the Esmeril target area. The Săo Domingos property was a previous large alluvial operation, and the property area covers numerous areas of workings. The Săo Domingos property lies in the Tapajos Province of Para State, Brazil It is situated approximately 250 km SE of Itaituba, the regional center. Small aircraft service Itaituba daily and on occasions flights can be sourced via Manaus. Access from Itaituba to site is by small aircraft or unsealed road of average to poor quality. The road is subject to seasonal closures and ‘wet’ season site access is granted via light aircraft utilizing the local airstrip.

| 22 | AURORA GOLD CORPORATION |

| AURORA GOLD CORPORATION |

| FINANCIAL STATEMENTS (EXPRESSED IN U.S. DOLLARS) |

| QUARTERLY REPORT FOR THE PERIOD ENDED JUNE 30,2014 |

Tenures from the Department of National Production Minerals (DNPM) are disclosed in the aforementioned notes to the financial statements.

The planned activity for 2014 year is as follows:

The following Plan of Operation contains forward-looking statements that involve risks and uncertainties, as described below. The actual results could differ materially from those anticipated in these forward-looking statements. During the next 12 months the Company may raise additional funds through equity offerings and/or debt borrowing to meet the general and administrative operating expenses and to conduct work on exploration properties. There is, of course, no assurance that the Company will be able to do so and the Company does not have any agreements or arrangements with respect to any such financing. The exploration properties have not commenced commercial production and the Company has no history of earnings or cash flow from operations. While the Company may attempt to generate additional working capital through the operation, development, sale or possible joint venture development of properties, there is no assurance that any such activity will generate funds that will be available for operations.

The Company has placed the project areas under care and maintenance whilst looking to raise the required finds to continue to explore the project areas. Subject to successful financing, the Company intends to concentrate exploration activities on the Brazilian Tapajos properties and examine data relating to the potential acquisition or joint venturing of additional mineral properties in either the exploration or development stage in other South American countries. Additional contractors and consultants may be hired on as and when the requirement occurs.

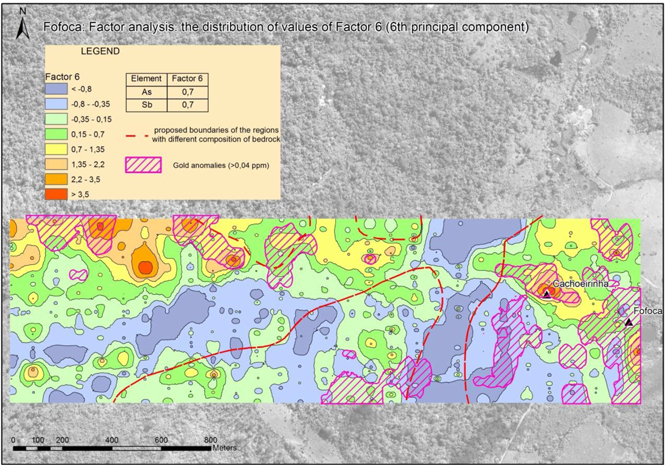

Any exploration work program for the Fiscal 2014 will focus on the Brazilian properties. The Company intends to follow up results from previous work on the Sao Domingo property, including the previous drilling and mapping over the Fofoca resource area. Follow up evaluation of the geophysical anomaly west of Fofoca is required to test any strike continuity of potential economic mineralization. The Toucano occurrence will be the focus of channel and auger sampling and will be the focus of an elluvial and oxide small scale production scenario. This is follow up detailed sampling was in response to the high grade gold results noted from the oxide insitu material mapped during the 2012 and 2013 exploration phases.

Two grids were cut through the Fofoca west extension area and the area encompassing the Toucano gold occurrence. These areas were systematically sampled and results showed numerous and extensive zones of anomalous gold mineralization. Assays were submitted for ICP Multi element analysis and results contoured onto plans for review. The results are being analysed for their patterns as related to classic deposit types for the region. The strong variance in the copper anomalism noted between the Toucano grid and the Fofoca grid will be reviewed in relation to the possible timing of mineralizing events at project scale and compared to similar styles within the Tapajos region. The dispersion of the elements has greatly aided the morphological understanding of the lithologies of the project area, and will assist the technical team in targeting subsurface follow up work during the 2014 season. Subsurface exploration will include trenching and follow up drilling at both the Fofoca resource area and the initial drill testing at the Toucano gold occurrence. The technical team is confident that the numerous gold occurrences on the Sao Domingo property will be related to each other and that important path finder elements and structures will lead to more drill targets. The anticipated results should delineate further areas for alluvial/elluvial mining and bulk sampling targets, as well as provide further resource ounces at Toucano to compliment the current and expected increased resources at Fofoca.

Aurora continued the project wide evaluation of tailings and alluvial/elluvial potential. Results showed that follow up test work is recommended and Aurora has an application in place for a trial mining license to carry out bulk sampling of recovery potentially economic material. Concurrently a technical team has been assembled to continue the evaluation of both the alluvial/elluvial potential and the geometry of the hard rock mineralization in preparation for subsurface test work.

Results of the follow up exploration during 2013 identified further primary and placer gold occurrences, which were subsequently sampled for gold and associated minerals; cartographic archival data was reviewed, and follow on exploration recommendations and budgets established.

Subject to receipt of financing, Aurora intends to execute a 3 Stage Exploration Plan:

| · | Stage 1. Total meters drilled will be a maximum of 1,000. Budget US$350,000 |

| · | Stage 2. Total meters drilled will be a maximum of 2,000. Budget US$700,000 |

| 23 | AURORA GOLD CORPORATION |

| AURORA GOLD CORPORATION |

| FINANCIAL STATEMENTS (EXPRESSED IN U.S. DOLLARS) |

| QUARTERLY REPORT FOR THE PERIOD ENDED JUNE 30,2014 |

| · | Stage 3. Combined with stage 2 and includes tenement wide Auger program to comply with the Department of National Petroleum Minerals (“DNPM”) resource determination. Budget US$1,000,000 |

Stage 1 program:

| · | Appraisal of grade and strike continuity to the North East and South West of the current garimpeiro workings at Toucano. |

| · | Test the mineralization below these workings. To date, the garimpeiros have worked the upper oxide component of the mineralised material which comprises of an altered stock work within Parauari granites. Silica and pyrite are common in the higher grade zones and has a distinctive greyer colouring giving some visual control on minerialization trends. |