UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q /A

(Amendment No. 1)

(Mark One)

|

x

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period ended June 30, 2011

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE EXCHANGE ACT OF 1934

|

For the transition period from _ _ _ _ _ _ _ _ _ _ to _ _ _ _ _ _ _ _ _ _

Commission file number 0-24393

AURORA GOLD CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware

|

13-3945947

|

|

|

(State or other jurisdiction of incorporation or

|

(IRS Employer Identification No.)

|

|

|

organization)

|

|

C/- Coresco AG, Level 3, Gotthardstrasse 20, Zug

|

6304 Switzerland

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

+41 7887-96966

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the issuer (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

YES x NO ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer ¨ (do not check if a smaller reporting company)

Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES ¨ NO x

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PRECEDING FIVE YEARS

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15 (d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by court.

YES ¨ NO ¨

APPLICABLE ONLY TO CORPORATE ISSUERS

Indicate the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: 89,153,868 shares of Common Stock were outstanding as of August 22, 2011.

AURORA GOLD CORPORATION

Explanatory Note

The purpose of this Amendment No. 1 to Aurora Gold Corporation’s Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2011, filed with the Securities and Exchange Commission on August 22, 2011 (the “Form 10-Q”), is solely to furnish Exhibit 101 to the Form 10-Q in accordance with Rule 405 of Regulation S-T. Exhibit 101 to this report provides the consolidated financial statements and related notes from the Form 10-Q formatted in XBRL (eXtensible Business Reporting Language).

No other changes have been made to the Form 10-Q. This Amendment No. 1 to the Form 10-Q speaks as of the original filing date of the Form 10-Q, does not reflect events that may have occurred subsequent to the original filing date, and does not modify or update in any way disclosures made in the original Form 10-Q.

This quarterly report contains statements that plan for or anticipate the future and are not historical facts. In this Report these forward looking statements are generally identified by words such as “anticipate,” “plan,” “believe,” “expect,” “estimate,” and the like. Because forward looking statements involve future risks and uncertainties, these are factors that could cause actual results to differ materially from the estimated results. These risks and uncertainties are detailed in Part 1 – Financial Information - Item 1. “Financial Statements” and Item 2. “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

The Private Securities Litigation Reform Act of 1995, which provides a “safe harbor” for such statements, may not apply to this Report.

INDEX

|

PART 1 – FINANCIAL INFORMATION

|

|||

|

Item 1.

|

Financial Statements

|

||

|

Consolidated Balance Sheets June 30, 2011 (unaudited) and December 31, 2010

|

3

|

||

|

Consolidated Statements of Operations (unaudited) Three and Six months ended June 30, 2011 and 2010; and for the period from October 10, 1995 (Inception) to June 30, 2011

|

4

|

||

|

Consolidated Statements of Cash Flows (unaudited) Six months ended June 30, 2011 and 2010 and for the period from October 10, 1995 (Inception) to June 30, 2011

|

5

|

||

|

Notes to Consolidated Financial Statements (unaudited)

|

6

|

||

|

Item 2.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

11

|

|

|

Item 3.

|

Quantitative and Qualitative Disclosures About Market Risk

|

25

|

|

|

Item 4.

|

Controls and Procedures

|

25

|

|

|

PART II – OTHER INFORMATION

|

|||

|

Item 1.

|

Legal Proceedings

|

26

|

|

|

Item 1A.

|

Risk Factors

|

26

|

|

|

Item 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

26

|

|

|

Item 3.

|

Defaults Upon Senior Securities

|

26

|

|

|

Item 4.

|

Submission of Matters to a Vote of Security Holders

|

27

|

|

|

Item 5.

|

Other Information

|

27

|

|

|

Item 6.

|

Exhibits

|

27

|

|

|

SIGNATURES

|

30

|

||

2

PART I Financial Information

(An exploration stage enterprise)

|

Consolidated Balance Sheets

|

||||||||

|

June 30, 2011 and December 31, 2010

|

||||||||

|

(Expressed in U.S. Dollars)

|

June 30

|

December 31

|

||||||

|

(Unaudited)

|

2011

|

2010

|

||||||

|

ASSETS

|

||||||||

|

Current assets

|

||||||||

|

Cash

|

$ | 38,913 | $ | 579,191 | ||||

|

Prepaid expenses and other assets

|

33,548 | 20,154 | ||||||

|

Total current assets

|

72,461 | 599,345 | ||||||

|

Mineral property reclamation bonds

|

245,221 | 325,221 | ||||||

|

Buildings and equipment, net

|

86,255 | 849,445 | ||||||

|

Participating interest in mineral property

|

- | 1,758,685 | ||||||

|

Total assets

|

$ | 403,937 | $ | 3,532,696 | ||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIENCY)

|

||||||||

|

Current liabilities

|

||||||||

|

Accounts payable and accrued expenses

|

$ | 346,363 | $ | 354,755 | ||||

|

Accounts payable and accrued expenses - related parties

|

18,581 | 17,264 | ||||||

|

Advances payable

|

212,100 | - | ||||||

|

Total current liabilities

|

577,044 | 372,019 | ||||||

|

Stockholders' Equity (Deficiency)

|

||||||||

|

Common stock

|

||||||||

|

Authorized:

|

||||||||

|

300,000,000 common shares, (December 31, 2010 - 300,000,000)

|

||||||||

|

with par value $0.001 each

|

||||||||

|

Issued and outstanding:

|

||||||||

|

89,153,868 (December 31, 2010 - 88,703,868) common shares

|

89,154 | 88,704 | ||||||

|

Additional paid-in capital

|

20,937,842 | 20,938,292 | ||||||

|

Accumulated deficit during the exploration stage

|

(21,108,965 | ) | (17,773,262 | ) | ||||

|

Accumulated other comprehensive income (loss)

|

(91,138 | ) | (93,057 | ) | ||||

|

Stockholders' equity (deficiency)

|

(173,107 | ) | 3,160,677 | |||||

|

Total liabilities and stockholders' equity (deficiency)

|

$ | 403,937 | $ | 3,532,696 | ||||

The accompanying notes are an integral part of these consolidated financial statements

3

|

AURORA GOLD CORPORATION

|

||||||||||||||||||||

|

(An exploration stage enterprise)

|

||||||||||||||||||||

|

Cumulative

|

||||||||||||||||||||

|

Consolidated Statements of Operations

|

October 10

|

Three months

|

Three months

|

Six months

|

Six months

|

|||||||||||||||

|

(Expressed in U.S. Dollars)

|

1995 (inception)

|

Ended

|

Ended

|

Ended

|

Ended

|

|||||||||||||||

|

(Unaudited)

|

to June 30

|

June 30

|

June 30

|

June 30

|

June 30

|

|||||||||||||||

|

2011

|

2011

|

2010

|

2011

|

2010

|

||||||||||||||||

|

Expenses

|

||||||||||||||||||||

|

Administrative and general

|

$ | 1,871,414 | $ | 30,417 | $ | 113,711 | $ | 85,155 | $ | 169,500 | ||||||||||

|

Depreciation and amortization

|

132,692 | 10,362 | 3,620 | 15,463 | 7,244 | |||||||||||||||

|

Imputed interest on loan payable - related party

|

1,560 | - | - | - | - | |||||||||||||||

|

Interest and bank charges

|

391,469 | 2,329 | (3,201 | ) | 5,079 | 17,279 | ||||||||||||||

|

Foreign exchange loss (gain)

|

(9,518 | ) | 3,594 | 1,034 | 4,188 | 2,734 | ||||||||||||||

|

Professional fees - accounting and legal

|

1,730,890 | 128,021 | 181,437 | 163,979 | 330,125 | |||||||||||||||

|

Property search and negotiation

|

479,695 | - | - | - | - | |||||||||||||||

|

Salaries, management and consulting fees

|

3,113,547 | 195,291 | 93,756 | 311,300 | 170,939 | |||||||||||||||

| 7,711,749 | 370,014 | 390,357 | 585,164 | 697,821 | ||||||||||||||||

|

Exploration expenses

|

9,661,975 | 68,698 | 150,059 | 238,249 | 232,720 | |||||||||||||||

|

Write-off of mineral property costs

|

172,981 | - | - | - | - | |||||||||||||||

| 17,546,705 | 438,712 | 540,416 | 823,413 | 930,541 | ||||||||||||||||

|

Other income (loss)

|

||||||||||||||||||||

|

Gain (loss) on disposition of subsidiary

|

(2,295,816 | ) | (2,512,290 | ) | - | (2,512,290 | ) | - | ||||||||||||

|

Interest income

|

22,353 | - | - | - | - | |||||||||||||||

|

Gain on sale of rights to the Matupa agreement, net of expenses of $138,065

|

80,237 | - | - | - | - | |||||||||||||||

|

Loss on investments

|

(37,971 | ) | - | - | - | - | ||||||||||||||

|

Loss on spun-off operations

|

(316,598 | ) | - | - | - | - | ||||||||||||||

|

Loss on debt extinguishment

|

(1,014,465 | ) | - | - | - | - | ||||||||||||||

| (3,562,260 | ) | (2,512,290 | ) | - | (2,512,290 | ) | - | |||||||||||||

|

Net loss for the period

|

$ | (21,108,965 | ) | $ | (2,951,002 | ) | $ | (540,416 | ) | $ | (3,335,703 | ) | $ | (930,541 | ) | |||||

|

Loss per share

|

||||||||||||||||||||

|

- basic and diluted

|

$ | (0.03 | ) | $ | (0.01 | ) | $ | (0.04 | ) | $ | (0.01 | ) | ||||||||

|

Weighted average number of common shares outstanding

|

||||||||||||||||||||

|

- basic and diluted

|

88,855,553 | 80,072,968 | 88,778,868 | 74,240,745 | ||||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements

4

|

AURORA GOLD CORPORATION

|

Cumulative

|

|||||||||||

|

(An exploration stage enterprise)

|

October 10

|

Six months

|

Six months

|

|||||||||

|

Consolidated Statements of Cash Flows

|

1995 (inception)

|

Ended

|

Ended

|

|||||||||

|

(Expressed in U.S. Dollars)

|

to June 30

|

June 30

|

June 30

|

|||||||||

|

(Unaudited)

|

2011

|

2011

|

2010

|

|||||||||

|

Cash flows from operating activities

|

||||||||||||

|

Net loss for the period

|

$ | (21,108,965 | ) | $ | (3,335,703 | ) | $ | (930,541 | ) | |||

|

Adjustments to reconcile net loss to

|

||||||||||||

|

net cash used in operating activities:

|

||||||||||||

|

- depreciation and amortization

|

132,692 | 15,463 | 7,244 | |||||||||

|

- stock compensation expense on stock option grants

|

1,174,795 | - | - | |||||||||

|

- expenses satisfied with issuance of common stock

|

958,800 | - | - | |||||||||

|

- expenses satisfied with transfer of marketable securities

|

33,903 | - | - | |||||||||

|

- imputed interest on loan payable - related party

|

1,560 | - | - | |||||||||

|

- write-off of mineral property costs

|

172,981 | - | - | |||||||||

|

- adjustment for spin-off of subsidiaries

|

316,498 | - | - | |||||||||

|

- loss on disposition of subsidiary

|

2,512,290 | 2,512,290 | - | |||||||||

|

- realized loss on investments

|

37,971 | - | - | |||||||||

|

- gain on sale of rights to Matupa agreement, net of expenses

|

(80,237 | ) | - | - | ||||||||

|

- realized loss on debt extinguishment

|

1,014,465 | - | - | |||||||||

|

- foreign exchange (gain) loss related to notes payable

|

(24,534 | ) | - | - | ||||||||

|

Changes in assets and liabilities:

|

||||||||||||

|

- (increase) in receivables

|

(206,978 | ) | - | - | ||||||||

|

- (increase) decrease in prepaid expenses and other assets

|

(51,869 | ) | (11,066 | ) | (15,917 | ) | ||||||

|

- increase (decrease) in accounts payable

|

- | |||||||||||

|

and accrued expenses (including related party)

|

1,036,741 | (14,967 | ) | (37,595 | ) | |||||||

|

Net cash provided by (used in) operating activities

|

(14,079,887 | ) | (833,983 | ) | (976,809 | ) | ||||||

|

Cash flows from investing activities

|

||||||||||||

|

Purchase of equipment

|

(205,348 | ) | - | - | ||||||||

|

Proceeds on disposal of equipment

|

16,761 | - | - | |||||||||

|

Purchases (reimbursements) of Mineral Property Reclamation Bonds

|

(245,221 | ) | 80,000 | - | ||||||||

|

Proceeds from disposition of marketable securities

|

32,850 | - | - | |||||||||

|

Acquisition of mineral property costs

|

(672,981 | ) | - | (500,000 | ) | |||||||

|

Payment for incorporation cost

|

(11,511 | ) | - | - | ||||||||

|

Net cash used in investing activities

|

(1,085,450 | ) | 80,000 | (500,000 | ) | |||||||

|

Cash flows from financing activities

|

||||||||||||

|

Proceeds from common stock less issuance costs

|

13,537,339 | - | 3,895,000 | |||||||||

|

Loan proceeds from related party

|

289,000 | - | - | |||||||||

|

Net proceeds from (payments on) convertible notes and loans

|

969,252 | - | (250,000 | ) | ||||||||

|

Net proceeds from (payments on) advances payable

|

212,100 | 212,100 | (50,000 | ) | ||||||||

|

Net proceeds from (payments on) advances payable -related party

|

- | - | (50,000 | ) | ||||||||

|

Net cash provided by financing activities

|

15,007,691 | 212,100 | 3,545,000 | |||||||||

|

Effect of exchange rate changes on cash

|

196,559 | 1,605 | (1,964 | ) | ||||||||

|

Increase (decrease) in cash

|

38,913 | (540,278 | ) | 2,066,227 | ||||||||

|

Cash, beginning of year

|

- | 579,191 | 556,957 | |||||||||

|

Cash, end of period

|

$ | 38,913 | $ | 38,913 | $ | 2,623,184 | ||||||

The accompanying notes are an integral part of these consolidated financial statements

5

Notes to Consolidated Financial Statements (Unaudited)

|

1.

|

Nature of Business and Going Concern

|

Aurora Gold Corporation ("the Company") was formed on October 10, 1995 under the laws of the State of Delaware and is in the business of location, acquisition, exploration and, if warranted, development of mineral properties. The Company’s focus is on the exploration and development of its exploration properties located in the Tapajos Gold Province, State of Pará, Brazil. The Company has not yet determined whether its properties contain mineral reserves that may be economically recoverable and has not generated any operating revenues to date.

These interim consolidated financial statements have been prepared in accordance with generally accepted accounting principles applicable to a going concern which contemplates the realization of assets and the satisfaction of liabilities and commitments in the normal course of business. The general business strategy of the Company is to acquire mineral properties either directly or through the acquisition of operating entities. The Company has incurred recurring operating losses since inception, has not generated any operating revenues to date and used cash of $833,983 from operating activities in 2011 through June 30. The Company requires additional funds to meet its obligations and maintain its operations. These conditions raise substantial doubt about the Company's ability to continue as a going concern. Management's plans in this regard are to raise equity financing through private or public equity investment in order to support existing operations and expand its business. There is no assurance that such additional funds will be available to the Company when required or on terms acceptable to the Company. In the event that we cannot obtain additional funds, on a timely basis or our operations do not generate sufficient cash flow, we may be forced to curtail our development or cease our activities.These consolidated financial statements do not include any adjustments that might result from this uncertainty.

|

2.

|

Significant Accounting Policies

|

|

|

(a)

|

Principles of Accounting

|

The Company follows accounting standards set by the Financial Accounting Standards Board, referred to as the “FASB”. The FASB sets accounting principles generally accepted in the United States (“GAAP”) that the Company follows to ensure they consistently report their financial condition, results of operations, and cash flows. References to GAAP issued by the FASB in these footnotes are to the FASB Accounting Standards Codification, referred to as Codification or “ASC”.

These consolidated financial statements have been prepared in accordance with GAAP and include the accounts of the Company and its wholly-owned subsidiaries, Aurora Gold Mineração Ltda ("Aurora Gold Mineracao") and AGC Resources LLC (“AGC”) (through date of disposition of AGC, June 14, 2011. See note 4). Collectively, they are referred to herein as "the Company". Significant inter-company accounts and transactions have been eliminated. Aurora Gold Mineração was incorporated on October 27, 2005. AGC was formed as a Limited Liability company on April 21, 2010 under the law of Colorado USA to hold the assets purchased from Global Minerals Ltd as discussed in Note 3.

Certain information and footnote disclosures normally included in consolidated financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to such SEC rules and regulations. The interim period consolidated financial statements should be read together with the audited consolidated financial statements and accompanying notes included in the Company’s audited consolidated financial statements for the year ended December 31, 2010. In the opinion of management of the Company, the unaudited consolidated financial statements contained herein contain all adjustments (consisting of a normal recurring nature) necessary to present a fair statement of the results of the interim periods presented.

In preparing the accompanying consolidated financial statements, the Company has evaluated information about subsequent events that became available to them through the date the financial statements were issued. This information relates to events, transactions or changes in circumstances that would require us to adjust the amounts reported in the financial statements or to disclose information about those events, transactions or changes in circumstances.

6

|

2.

|

Significant Accounting Policies (continued)

|

|

(b)

|

Accounting Estimates

|

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates and assumptions.

|

(c)

|

Comprehensive income (loss)

|

The Company has adopted ASC 220, Reporting Comprehensive Income, which establishes standards for reporting and display of comprehensive income, its components and accumulated balances. Comprehensive income comprises equity except those resulting from investments by owners and distributions to owners. Comprehensive income (loss) is as follows for the three and six months ended June 30, 2011 and 2010:

|

Three Months Ended

|

Six Months Ended

|

|||||||||||||||

|

Components of comprehensive income (loss)

|

June 30

|

June 30

|

June 30

|

June 30

|

||||||||||||

|

2011

|

2010

|

2011

|

2010

|

|||||||||||||

|

$

|

$

|

$

|

$

|

|||||||||||||

|

Net (loss) for the period

|

(2,951,002 | ) | (540,416 | ) | (3,335,703 | ) | (930,541 | ) | ||||||||

|

Foreign currency translation adjustments

|

1,499 | 617 | 1,919 | 7,011 | ||||||||||||

|

Total comprehensive (loss)

|

(2,949,503 | ) | (539,799 | ) | (3,333,784 | ) | (923,530 | ) | ||||||||

Accumulated other comprehensive income consists entirely of foreign currency translation adjustments at June 30, 2011 and December 31, 2010.

|

(d)

|

Earnings (Loss) Per Share

|

Earnings (loss) per share is computed by dividing net income or loss available to common stockholders by the weighted average number of common shares outstanding during the year including common stock issued effective the date committed. Common stock issuable is considered outstanding as of the original approval date for the purposes of earnings per share computations. Diluted loss per common share is computed by dividing net loss by the sum of (a) the basic weighted average number of shares of common stock outstanding during the period and (b) additional shares that would have been issued and potentially dilutive securities and is equivalent to basic loss per share for the six months ended June 30, 2011 and 2010 because potentially dilutive securities were anti-dilutive due to the net losses incurred in each period. Potentially dilutive securities outstanding consist of 1,700,000 stock options in 2011 (2010 – 2,300,000).

|

|

(e)

|

Fair Value of Financial Instruments

|

Fair value estimates of financial instruments are made at a specific point in time, based on relevant information about financial markets and specific financial instruments. As these estimates are subjective in nature, involving uncertainties and matters of significant judgment, they cannot be determined with precision. Changes in assumptions can significantly affect estimated fair value.

The carrying value of cash, accounts payable and accrued expenses, accounts payable and accrued expenses – related parties, and advances payable approximate their fair value because of the short-term nature of these instruments.

7

|

2.

|

Significant Accounting Policies (continued)

|

|

|

(f)

|

Recent Accounting Pronouncements

|

In June 2011, the Financial Accounting Standards Board issued Accounting Standards Update ("ASU") No. 2011-05, Comprehensive Income or ASU 2011-05. The guidance in ASU 2011-05 revises the manner in which entities present comprehensive income in their financial statements. An entity is required to report the components of comprehensive income in either one or two consecutive financial statements:

|

|

·

|

A single, continuous statement must present the components of net income and total net income, the components of other comprehensive income and total other comprehensive income, and a total for comprehensive income.

|

|

|

·

|

In a two-statement approach, an entity must present the components of net income and total net income in the first statement. That statement must be immediately followed by a financial statement that presents the components of other comprehensive income, a total for other comprehensive income, and a total for comprehensive income.

|

ASU 2011-05 does not change the items that must be reported in other comprehensive income. The amendments in ASU 2011-05 are effective for fiscal years beginning after December 15, 2011. The Company does not believe the adoption of ASU 2011-05 will have a material impact on the presentation of information in its financial statements.

|

3.

|

Joint Venture Agreements

|

|

|

(a)

|

Samba Minerals Limited

|

In May 2008, the Company signed an agreement with Samba Minerals Limited (“Samba”), which was subsequently amended in August 2008, whereby Samba can earn up to an 80% participating interest in the São João and/or the Commandante Araras projects by funding exploration expenditures on each of the projects to completion of a feasibility study on each property. The Company is currently negotiating with Samba a Supplement and Amendment to the Farm-in Agreement amending the terms of the agreement. The properties are located in the Municipality of Itaituba, State of Pará, Brazil. Upon completion of a feasibility study on either property, the Company will immediately transfer an 80% participation interest in the relevant property to Samba and enter into a formal joint venture agreement to govern the development and production of minerals from the property. Samba can terminate its participation in either of the projects by providing the Company 30 days notice in writing. Upon withdrawal from its participation in either property, Samba would forfeit to the Company all of its rights in relation to the projects and would be free of any and all payment commitments yet to be due. Samba will be the manager of the São João and the Commandante Araras projects. The Company has also granted Samba a right of first refusal to acquire an interest in, or enter into a joint venture or farm-in agreement on the Company’s São Domingos and Bigode (since dropped) projects.

Samba did not exercise the right of first refusal and the term of the first right of refusal expired on August 1, 2010. Feasibility studies have not been completed as of June 30, 2011, and thus no joint venture has been formed as of that date.

|

(b)

|

Front Range Gold Property Joint Venture

|

On June 15, 2010, pursuant to the Asset Purchase Agreement between Global Minerals Ltd. (“GML”) and Mount Royale Ventures, LLC (“MRV”), as Sellers, and the Company and AGC Resources LLC, the Company’s wholly-owned subsidiary(“AGC”), as Buyers, AGC acquired 50% interest in the Front Range Gold Project joint venture (“JV”), and title to the Gold Hill Mill, and became a joint venture partner with Gold Reef Mining Company, Mi Vida Enterprises, Inc., Gold Hill Mines, Inc. and Southern Cross Prospecting Company (“Property Owners”).

8

|

3.

|

Joint Venture Agreements (continued)

|

|

(b)

|

Front Range Gold Property Joint Venture (continued)

|

On March 10, 2011, Mi Vida Enterprises, Inc., Gold Hill Mines, Inc. and Southern Cross Prospecting Company intervened in a preexisting lawsuit commenced by MRV against Gold Reef Mining Company in Boulder County District Court (the “Action”). Among other things, they have alleged that GML was in material default of the JV agreement prior to the assignment by GML of its rights in the JV to AGC in June of 2010, that GML wrongfully assigned its rights in the JV without permission of the Property Owners, and have asked the court to declare the JV terminated. The Property Owners also alleged that the transfer of title to the Gold Hill Mill was subject to a right of first refusal in favor of Gold Hill Mines, Inc., and that MRV conveyed its title to the Gold Hill Mill to AGC without giving proper notice to Gold Hill Mines Inc. and in violation of a right of first refusal in favor of Gold Hill Mines, Inc., and requested the court to enter an order granting Gold Hill Mines Inc. an option to purchase the Gold Hill Mill for $10,000, the amount set in the right of first refusal.

A court decision in favor of the Property Owners may have a material adverse affect on the Company’s ability to collect the purchase price, plus royalty from the sale of AGC to Devtec Management Ltd. since an unfavorable court decision may result in AGC losing its 50% interest in the JV as well as its interest in and to the Gold Hill Mill.

|

4.

|

Sale of AGC Resources LLC

|

On June 14, 2011, the Company, entered into an Asset Purchase Agreement with Devtec Management Ltd. (“Devtec”), pursuant to which the Company sold its subsidiary, AGC, which owns certain properties in Boulder, Colorado (see note 3(b) for a discussion of the specific assets purchased by AGC in June 2010), to Devtec for a total of $2 million, plus royalty. Under the terms of the agreement, Devtec will pay the Company $1 million upon production of the cumulative total of 1,000 ounces of gold and/or silver, and a further $1 million on the six month anniversary of the payment of the first $ 1 million. Additionally, Devtec will pay the Company a 5% royalty from the start of production.

The Company is unable to reasonably estimate the amount of minerals the properties will produce, if any, and thus there is uncertainty as to whether the purchase price will be collected. Further, the collection of any purchase price is also contingent on the outcome of the court case described in note 3(b). Given these factors, collection of the purchase price is not considered reasonably possible at the time of these consolidated financial statements given the current uncertain status of exploration work on the Boulder ,Colorado properties and the uncertainties of the related legal action and thus no purchase price has been recorded as of June 30, 2011. Therefore, the Company is recognizing a loss on the sale of its subsidiary of $2,512,290 for the three and six months ended June 30, 2011, which represents the net book value of the assets transferred to Devtec on June 14, 2011 (no liabilities were assumed by Devtec) as follows:

|

Buildings and equipment

|

$ | 753,605 | ||

|

Participating interest in mineral property

|

1,758,685 | |||

| $ | 2,512,290 |

|

5.

|

Advances Payable

|

The Company has advances payable with an individual and a company totaling $212,100 at June 30, 2011. The advances are non-interest bearing, due on demand and are unsecured.

9

|

6.

|

Common Stock

|

In April 2010, the Company completed a private placement of 12,983,335 common shares, which were authorized for issuance at $0.30 per share for net cash proceeds of $3,895,000. Of the $3,895,000 in proceeds, $1,350,000 was received during the first quarter of 2010 prior to completion of formal signed private placement agreements, which occurred in April 2010. The shares were physically issued in April 2010 to individuals and companies who reside outside the United States of America. A finders’ fee of 1,126,111 common shares were authorized in connection with the private placement. The shares were issued in September 2010 to an individual and a company who reside outside the United States of America. When the shares for the finders’ fee were issued, there was no impact on the total Stockholders’ equity or results of operations.

In March 2011, the Company filed a Post-Effective Amendment to its Registration Statement on Form S-1 filed on December 21, 2010 offering up to a maximum of 10,000,000 units of the Company's securities at an offering price of $0.30 per Unit in a direct public offering, without any involvement of underwriters or broker-dealers. Each Unit consists of:

|

|

(i)

|

one (1) share of our common stock, $0.001 par value per share; and,

|

|

|

(ii)

|

one (1) Series A Stock Purchase Warrant.

|

Each full Series A Warrant entitles the holder to purchase one additional share of our common stock at a price of $0.40 for a period of one year commencing on April 1, 2011 through March 31, 2012.

In April 2011, as an incentive to assist with future private placements, the Company authorized the payment of a non cash finders fee of 450,000 shares of common stock of the Company in connection with the private placement completed in April 2010. The shares were issued in May 2011. The issuance of these shares had no net effect on total shareholders' equity or results of operations as they related to fees associated with issuance of shares.

|

7.

|

Stock Options

|

In 2007, the Company's Board of Directors approved the 2007 Stock Option Plan (“the Plan”) to offer an incentive to obtain services of key employees, directors and consultants of the Company. The Plan provides for the reservation for awards of an aggregate of 10% of the total shares of Common Stock outstanding from time to time. No Plan participant may receive stock options exercisable for more than 2,500,000 shares of Common Stock in any one calendar year. Under the Plan, the exercise price of an incentive stock option must be at least equal to 100% of the fair market value of the common stock on the date of grant (110% of fair market value in the case of options granted to employees who hold more than 10% of the Company's capital stock on the date of grant). The term of stock options granted under the Plan is not to exceed ten years and the stock options vest immediately upon granting.

The following is a summary of stock option activity for the six month period ended June 30, 2011 and the status of stock options outstanding and exercisable at June 30, 2011:

|

Remaining

|

Aggregate

|

|||||||||||||||

|

Contractual

|

Intrinsic

|

|||||||||||||||

|

Exercise

|

Life (yrs) at

|

value at

|

||||||||||||||

|

Shares

|

price

|

30-Jun-11

|

30-Jun-11

|

|||||||||||||

| 1,700,000 | $ | 0.26 | - | $ | - | |||||||||||

|

Granted

|

- | - | - | - | ||||||||||||

|

Forfeited

|

- | - | - | - | ||||||||||||

|

Outstanding and exercisable at June 30, 2011

|

1,700,000 | $ | 0.26 | 1.10 | $ | - | ||||||||||

10

|

7.

|

Stock Options (continued)

|

The aggregate intrinsic value in the table above represents the total pretax intrinsic value for all “in-the-money” options (i.e., the difference between the Company’s closing stock price on June 30, 2011 and the exercise price, multiplied by the number of shares) that would have been received by the option holders had all option holders exercised their options on June 30, 2011.

|

8.

|

Related Party Transactions

|

Related party transactions not disclosed elsewhere in these consolidated financial statements include:

|

|

a.

|

During the three and six month periods ended June 30, 2011, consulting fees of $71,706 (2010 - $91,279) and $155,983 (2010 - $153,881), respectively were incurred to directors and officers of the Company. The transactions were recorded at the exchange amount, being the value established and agreed to by the related parties.

|

|

|

b.

|

Included in accounts payable and accrued expenses - related parties at June 30, 2011 is $18,581 (December 31, 2010 - $17,264) payable to an officer/director and another director of the Company for consulting fees and various expenses incurred on behalf of the Company.

|

|

9.

|

Non-cash Investing and Financing Activities

|

In April 2011, as an incentive to assist with future private placements, the Company authorized the payment of a non cash finders fee of 450,000 shares of common stock of the Company in connection with the private placement completed in April 2010. The shares were issued in May 2011. The issuance of these shares had no net effect on total shareholders' equity or results of operations as they related to fees associated with issuance of shares.

In June 2010, pursuant to an Asset Purchase Agreement, the Company issued 5 million shares of its common stock, which were authorized for issuance at $0.40 per share for the acquisition of assets further discussed in Note 3, and acquired Global Minerals Ltd. 50% participating interest in the joint venture agreement dated December 18, 2002 between Consolidated Global Minerals Ltd. and the property owners of the Front Range Gold JV property.

|

Item 2.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

(A)

|

General

|

This portion of the Quarterly Report provides management's discussion and analysis of the financial condition and results of operations to enable a reader to assess material changes in financial condition and results of operations as of and for the six month period ended June 30, 2011, in comparison to the corresponding prior-year period. This MD&A is intended to supplement and complement the unaudited consolidated financial statements and notes thereto, prepared in accordance with US GAAP, for the three and six month periods ended June 30, 2011 and 2010 (collectively, the "Financial Statements"), which are included in this Quarterly Report. The reader is encouraged to review the Financial Statements in conjunction with your review of this MD&A. This MD&A should be read in conjunction with both the annual audited consolidated financial statements for the year ended December 31, 2010 and the related annual MD&A included in the December 31, 2010 Form 10-K on file with the US Securities and Exchange Commission. Certain notes to the Financial Statements are specifically referred to in this MD&A and such notes are incorporated by reference herein. All dollar amounts in this MD&A are in US dollars, unless otherwise specified.

For the purposes of preparing this MD&A, we consider the materiality of information. Information is considered material if: (i) such information results in, or would reasonably be expected to result in, a significant change in the market price or value of Aurora Gold Corporation's shares; or (ii) there is a substantial likelihood that a reasonable investor would consider it important in making an investment decision or if it would significantly alter the total mix of information available to investors. Materiality is evaluated by reference to all relevant circumstances, including potential market sensitivity.

11

This document contains numerous forward-looking statements relating to our business. The United States Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for certain forward-looking statements. Operating, exploration and financial data, and other statements in this document are based on information we believe reasonable, but involve significant uncertainties as to future gold and silver prices, costs, ore grades, estimation of gold and silver reserves, mining and processing conditions, changes that could result from our future acquisition of new mining properties or businesses, the risks and hazards inherent in the mining business (including environmental hazards, industrial accidents, weather or geologically related conditions), regulatory and permitting matters, and risks inherent in the ownership and operation of, or investment in, mining properties or businesses in foreign countries. Actual results and timetables could vary significantly from the estimates presented. Readers are cautioned not to put undue reliance on forward-looking statements. We disclaim any intent or obligation to update publicly these forward-looking statements, whether as a result of new information, future events or otherwise.

|

|

(B)

|

Significant developments during the six month period ended June 30, 2011 and Subsequent Events to August 22, 2011

|

We are a mineral exploration company engaged in the exploration of base, precious metals and industrial minerals worldwide. We were incorporated under the laws of the State of Delaware on October 10, 1995, under the name "Chefs Acquisition Corp."

We have no revenues, have sustained losses since inception, have been issued a going concern opinion by our auditors and rely upon the sale of our securities to fund operations. We will not generate revenues even if any of our exploration programs indicate that a mineral deposit may exist on our properties. Accordingly, we will be dependent on future financings in order to maintain our operations and continue our exploration activities.

During 2011 through August 15, 2011 we have been evaluating our property holdings in order to determine whether to implement exploration programs on our existing properties or to acquire interests in new properties.

For the six month periods ended June 30, 2011 and 2010 we recorded exploration expenses of $238,249 compared to $232,720, respectively.

On June 15, 2010, pursuant to the Asset Purchase Agreement between Global Minerals Ltd. (“GML”) and Mount Royale Ventures, LLC (“MRV”), as Sellers, and the Company and AGC Resources LLC, the Company’s wholly-owned subsidiary(“AGC”), as Buyers, AGC acquired 50% interest in the Front Range Gold Project joint venture (“JV”), and title to the Gold Hill Mill, and became a joint venture partner with Gold Reef Mining Company, Mi Vida Enterprises, Inc., Gold Hill Mines, Inc. and Southern Cross Prospecting Company (“Property Owners”).

On March 10, 2011, Mi Vida Enterprises, Inc., Gold Hill Mines, Inc. and Southern Cross Prospecting Company intervened in a preexisting lawsuit commenced by MRV against Gold Reef Mining Company in Boulder County District Court (the “Action”). Among other things, they have alleged that GML was in material default of the JV agreement prior to the assignment by GML of its rights in the JV to AGC in June of 2010, that GML wrongfully assigned its rights in the JV without permission of the Property Owners, and have asked the court to declare the JV terminated. The Property Owners also alleged that the transfer of title to the Gold Hill Mill was subject to a right of first refusal in favor of Gold Hill Mines, Inc., and that MRV conveyed its title to the Gold Hill Mill to AGC without giving proper notice to Gold Hill Mines Inc. and in violation of a right of first refusal in favor of Gold Hill Mines, Inc., and requested the court to enter an order granting Gold Hill Mines Inc. an option to purchase the Gold Hill Mill for $10,000, the amount set in the right of first refusal.

A court decision in favor of the Property Owners may have a material adverse affect on the Company’s ability to collect the purchase price, plus royalty from the sale of AGC to Devtec Management Ltd. since an unfavorable court decision may result in AGC losing its 50% interest in the JV as well as its interest in and to the Gold Hill Mill.

12

On June 14, 2011, the Company, entered into an Asset Purchase Agreement with Devtec Management Ltd. (“Devtec”), pursuant to which the Company sold its subsidiary, AGC Resources LLC, which owns certain properties in Boulder, Colorado, to Devtec for a total of $2 million, plus royalty. Devtec will pay the Company $1 million upon production of the cumulative total of 1,000 ounces of gold and/or silver, and a further $1 million on the six month anniversary of the payment of the first One Million Dollars. Additionally, Devtec will pay Aurora a 5% royalty from the start of production.

|

(C)

|

Exploration and Development

|

Exploration Activities

We conduct our activities from our principal and technical office located at, C/- Coresco AG, Level 3, Gotthardstrasse 20, Zug, 6304 Switzerland. The telephone number is (+41) 7887-96966. We believe that these offices are adequate for our purposes and operations. These offices are provided to us on a month to month basis. We believe that these offices are adequate for our purposes. We do not own any real property or significant assets. Management believes that this space will meet our needs for the next 12 months.

Our strategy is to concentrate our efforts on: (i) existing operations where an infrastructure already exists; (ii) properties presently being developed and/or in advanced stages of exploration which have potential for additional discoveries; and (iii) grass-roots exploration opportunities.

We are currently concentrating our property exploration activities in Brazil and USA. We are also examining data relating to the potential acquisition of other exploration properties in Latin America, South America.

Our properties are in the exploration stage only and are without a known body of mineral reserves. Development of the properties will follow only if satisfactory exploration results are obtained. Mineral exploration and development involves a high degree of risk and few properties that are explored are ultimately developed into producing mines. There is no assurance that our mineral exploration and development activities will result in any discoveries of commercially viable bodies of mineralization. The long-term profitability of our operations will be, in part, directly related to the cost and success of our exploration programs, which may be affected by a number of factors.

Mining Properties

Our properties are located in the Tapajos Region of Brazil. In Brazil we have calculated a body of mineralized material to Guide 7 standards calculated in accordance with the Australasian Joint Ore Reserves Committee (the “JORC”) code for reporting of Mineral Resources and Ore Reserves (the “JORC Code”). The JORC resource is currently estimated at 130,000 ounces at 2.0 g/t calculated on a 0.5 g/t cut off.. This mineralized material is located on our Săo Domingos property. The rest of our Brazil properties are in the preliminary exploration stage and do not contain any known bodies of ore.

Our strategy is to concentrate our efforts on: (i) existing operations where an infrastructure already exists; (ii) properties presently being developed and/or in advanced stages of exploration which have potential for additional discoveries; and (iii) grass-roots exploration opportunities. We are currently concentrating our property exploration activities in Brazil. We are also examining data relating to the potential acquisition of other exploration properties in Latin America, South America.

Mineral exploration and development involves a high degree of risk and few properties that are explored are ultimately developed into producing mines. There is no assurance that our planned production will result in a commercial success, as production is gold price and politically sensitive. Once production has commenced we will be able to gauge the onward commercial viability of the project. There is no assurance that our planned mineral exploration and development activities will result in any further discoveries of commercially viable bodies of mineralization. The long-term profitability of our operations will be, in part, directly related to the cost and success of our exploration programs, which may be affected by a number of factors.

13

We currently have an interest in three (3) projects located in Tapajos gold province in Para State, Brazil and one (1) property located in British Columbia, Canada. We have conducted exploration activities on all our projects and have ranked the projects in order of merit and may discontinue such activities and dispose of some of the properties if further exploration work is not warranted.

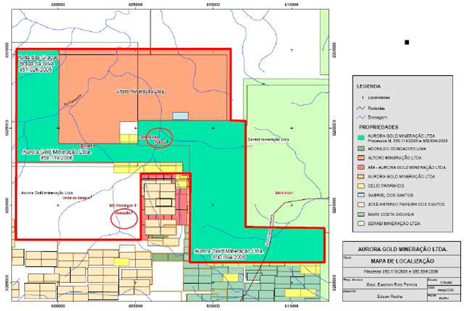

Figure 1. Brazil, South America-property locality guide

Properties

Brazil

Săo Domingos

Location and access

The Săo Domingos property lies in the Tapajos Province of Para State, Brazil It is situated approximately 250 km SE of Itaituba, the regional centre, and includes an area of over 33,033.44 ha. Small aircraft service Itaituba daily and on this occasion flights were sourced via Manaus. Access from Itaituba to site is by small aircraft or unsealed road of average to poor quality. The road is subject to seasonal closures and as the visit was at the end of the ‘wet’ season site access was granted via light aircraft utilizing the local airstrip.

Tenure

a) The project covers an area of 33,000 hectare DNPM Process 850.684/06:

Aurora has good title over the mineral rights object of the DNPM Process No. 850.684/06, which is valid and in force, free and clear of any judicial and extrajudicial encumbrances and taxes. Aurora is the sole registered and beneficial holder of and owns and possesses good title to the referred mineral rights. On September 13th 2006 Aurora submitted to DNPM one Exploration Claim for gold covering an area of 4914,18 ha in the Municipality of Itaituba, State of Pará. According to information obtained such claim was correctly prepared and the required documents are in place.

The above mentioned area is not related to any payments or royalties to third parties since they were claimed by Aurora directly.

14

b) DNPM Process 850.782/05:

Aurora has good title over the mineral rights object of the DNPM Process Nos 850.782/05, which is valid and in force, free and clear of any judicial and extrajudicial encumbrances and taxes. On November 8th 2005 it was submitted to DNPM the Exploration Claim for gold in the Municipality of Itaituba, State of Pará. The Exploration Permit was granted on November 28th 2006 for a 3 (three) years period. The transfer to Aurora was approved on March 24th 2009 and on September 28th 2009 it was requested the renewal of the Exploration Permit but it hasn’t been analyzed by the DNPM yet.

This area was reduced from 6.756 ha to 5.651,98 ha due to the overlapping with Garimpeira (alluvial) Mining properties held by Mr. Celio Paranhos. However the DNPM´s general attorney in Brasilia agreed with Aurora’s legal thesis and nullified all applications filed by Mr. Paranhos (about to 1.900 applications).

The files are in Brasilia where a new area control survey is being done after which the tenement 850.782/2005 shall return to its original size, except for a small 100 ha area held by third parties with priority rights.

No payments or royalties are due regarding the DNPM Process 850.782/05 since it was acquired through a permutation agreement with Altoro Mineração Ltda.

c) DNPM Process 850.400/07:

Aurora has good title over the mineral rights object of the DNPM Process Nos 850.400/07, which is valid and in force, free and clear of any judicial and extrajudicial encumbrances and taxes. It is located at the Municipality of Itaituba and Trairão, State of Pará. On June 8th 2007 it was submitted to DNPM the Exploration Claim for gold. The Exploration Permit was granted on July 09th 2008 for a 3 (three) years period covering an area of 9832,26 ha, and it is valid until July 09th 2011 and is renewable for three additional years (the Company has applied for a renewal of the Exploration Permit).

The above mentioned area is not related to any payments or royalties to third parties since they were claimed by Aurora directly.

d) DNPM Processes 850.012/06 and 850.013/06:

The tenements are held by Mr. Airton Mesquita Cardoso and were submitted to DNPM on January 19, 2006. The tenements and are located at Itaituba, state of Pará and are valid and in force, free and clear of any judicial and extrajudicial encumbrances and taxes, but the area was blocked since it is inside of a Garimpeira Reserve.

The transfer to Aurora will be submitted after the Exploration Permit is granted.

There are no payments or royalties related to the tenements according to the agreement entered into with the previous owner.

e) DNPM Process 850.119/06:

Aurora has good title over the mineral rights object of the DNPM Process No. 850.119/06, which is valid and in force, free and clear of any judicial and extrajudicial encumbrances and taxes. Aurora is the sole registered and beneficial holder of and owns and possesses good title to the referred mineral rights. On March 7, 2006, Aurora submitted to DNPM one Exploration Claim for gold covering an area of 3531 ha in the Municipality of Itaituba, State of Pará. According to information obtained such claim was correctly prepared and the required documents are in place.

The above mentioned area is not related to any payments or royalties to third parties since they were claimed by Aurora directly.

15

f) DNPM Process 859.587/95:

The tenement, which is held by Vera Lucia Lopes, is valid and in force, and is free and clear of any judicial and extrajudicial encumbrances and taxes. It is located at the Municipality of Itaituba, State of Pará. On November 27, 1995, it was submitted to DNPM the Exploration Claim for gold. The Exploration Permit was granted on September 15, 2006, for a three year period covering an area of 5000 ha, and it was valid until September 15, 2009. On July 15, 2009, it was requested the renewal of the Exploration Permit but it hasn’t been analyzed by the DNPM yet. The transfer to Aurora was submitted on November 23, 2006, but it hasn’t been approved yet.

There are no payments or royalties related to the tenements since all payments due under the terms of the agreement entered into with the previous owner have been already made.

Geology

The geology of the Săo Domingos property is predominantly composed of paleo-proterozoic Parauari Granites that play host to a number of gold deposits in the Tapajos Basin. Typical Granites of the younger Maloquinha Intrusive Suite have been noticed in the vicinity of Molly Gold Target, and basic rocks considered to be part of the mesoproterozoic Cachoeira Seca Intrusive Suite occur around the Esmeril target area.

The Săo Domingos property was a previous large alluvial operation, and the property area covers numerous areas of workings.

Săo Joăo – Samba Minerals farm in agreement

In May 2008 we signed an agreement with Samba Minerals Limited (“Samba”), which was subsequently amended in August 2008, whereby Samba can earn up to an 80% participating interest in the Săo Joăo project by funding exploration expenditures to completion of a feasibility study on the property. Upon completion of a feasibility study, we will immediately transfer an 80% participation interest in the property to Samba and enter into a formal joint venture agreement to govern the development and production of minerals from the property. Samba can terminate its participation by providing us 30 days notice in writing. Upon withdrawal from its participation, Samba would forfeit to us all of its rights in relation to the project and would be free of any and all payment commitments yet to be due. Samba will be the manager of the Săo Joăo project. A feasibility study has not been completed as of August 22, 2011 and thus no joint venture has been formed as of that date.

16

Location and access

The Săo Joăo property is located in the central portion of the Southern Tapajos basin and is accessed by light aircraft from the regional centre of Itaituba. Access is also possible by unsealed roads linking up to the Transgarimpeiro highway and by a purpose cut heavy vehicle access track linking Sao Joao to the exploration centre at the primary project at Sao Domingo.

Tenure - Săo Joăo Project - DNPM Processes 851.533/94 to 851.592/94 inclusive:

The company has good title over the mineral rights which were granted in 1994 and 2005 by the Brazilian National department of Mineral Production DNPM - Departamento Nacional de Produçăo Mineral, as DNPM Process numbers 851.533/94 to 851.592/94 and which are valid and in force, free and clear of any judicial and extrajudicial encumbrances and taxes. The Săo Joăo mineral rights are located at the Municipality of Itaituba, State of Pará, and are registered in the name of the previous holder since an Exploration Permit has not yet been granted. The Săo Joăo mineral rights comprise 60 Applications for Alluvial Mine of 50 hectares each which was presented to DNPM on May 16, 1994. On August 30, 2006 the previous holder of the Applications applied for the conversion of the Applications to Exploration Permits. When the conversion request is approved by the Authorities, the previous holder will be granted the Exploration Permit for an area of 3000 ha. The assignment of the Săo Joăo mineral rights to Aurora can only be done after the approval of the Applications and the actual granting of an Exploration Permit to the previous Holder.

Option Agreement

The Săo Joăo Option Agreement dated January 20, 2006 and amendments dated June 2, 2008 and December 2, 2008, allows us to perform geological surveys and assessment work necessary to ascertain the existence of possible mineral deposits which may be economically mined and to earn a 100% interest in the Săo Joăo property mineral rights. Under the terms of the Option Agreement and amendments, a total amount of USD $1,435,000 (one million four hundred and thirty five thousand dollars) is due by Aurora for the acquisition of the Săo Joăo mineral rights. The total option agreement payments for the mineral rights are structured as follows: April 12, 2006 – USD $20,000 (paid); September 12, 2006 – USD $25,000 (paid); September 12, 2007 – USD $60,000 (paid); June 25, 2008 - $100,000 (paid by Samba Minerals Limited as part of the agreement with them as discussed in the Săo Joăo – Samba Minerals farm in agreement above); December 5, 2008 – USD $40.000 (paid by Samba Minerals Limited as part of the agreement with them as discussed in the Săo Joăo – Samba Minerals farm in agreement above); January 15, 2009 – USD $30,000 (paid by Samba Minerals Limited as part of the agreement with them as discussed in the Săo Joăo – Samba Minerals farm in agreement above); February 15, 2009 – USD $30,000 (paid by Samba Minerals Limited as part of the agreement with them as discussed in the Săo Joăo – Samba Minerals farm in agreement above); April 30, 2009 to March 30, 2011 – USD $8,333.33 per month (April 30, 2009 to June 30, 2011 paid by Samba Minerals Limited as part of the agreement with them as discussed in the Săo Joăo – Samba Minerals farm in agreement above); July 30, 2011 – USD $950,000 (has not been paid as of August 22, 2011). The vendor will have a 1.5% Net Smelter Royalty. The Royalty payment can be purchased at any time upon written notice to the vendor and payment in Reals (Brazilian currency) of the equivalent of USD $1,000,000. The option agreement can be terminated at any time upon written notice to the vendor and we will be free of any and all payment commitments yet to be due.

Geology

The prime targets for the Săo Joăo property are located around and on the intersection of regional NW and NNW faults within the Pararui Intrusive Suite and this area has been the focus of large-scale alluvial workings. The Pararui Intrusive Suite has proven to host the vast majority of gold deposits elsewhere within the Tapajos Gold Province. We conducted a rock chip program over an area currently being excavated for gold in quartz systems via shallow underground workings. The sample results have demonstrated that the quartz vein systems are highly mineralized and considered continuous for at least 200m. We are confident that the quartz vein systems are much more extensive and are currently planning to increase the sample density of rock and soil sampling over, and adjacent to, the current workings to locate further mineralized vein systems, and to drill test their depth extensions in the near future.

Previous mining activity over a number of years focused on the alluvial deposits within its many tributaries, and has now progressed to include the saprolite host rock and out cropping quartz veins.

17

Comandante Araras - Samba Minerals farm in agreement

In May 2008 we signed an agreement with Samba, which was subsequently amended in August 2008, whereby Samba can earn up to an 80% participating interest in the Comandante Araras projects by funding exploration expenditures to completion of a feasibility study on the property. Upon completion of a feasibility study, we will immediately transfer an 80% participation interest to Samba and enter into a formal joint venture agreement to govern the development and production of minerals from the property. Samba can terminate its participation by providing us 30 days notice in writing. Upon withdrawal from its participation, Samba would forfeit to us all of its rights in relation to the project and would be free of any and all payment commitments yet to be due. Samba will be the manager of the Comandante Araras project. A feasibility study has not been completed as of August 22, 2011 and thus no joint venture has been formed as of that date.

Location and access

The Comandante Araras property is located in the central portion of the Southern Tapajos basin and is accessed by light aircraft from the regional centre of Itaituba. The project adjoins the Săo Joăo project to the south east. Access is also possible by unsealed roads linking up to the Transgarimpeiro highway and by a purpose cut heavy vehicle access track linking Săo Joăo to the exploration centre at the primary project at Sao Domingo.

Tenure - Comandante Araras Project - DNPM Processes 853.785/93 to 853.839/93 inclusive:

We have good title over the mineral rights which were granted by the Brazilian Department of Mines (Departamento Nacional de Produçăo Mineral – “DNPM”) as DNPM Process numbers 853.785/93 to 853.839/93 and which are valid and in force, free and clear of any judicial and extrajudicial encumbrances and taxes. The Comandante Araras mineral rights are located at the Municipality of Itaituba, State of Pará, and are registered in the name of the previous holder since an Exploration Permit has not yet been granted. The Comandante Arara mineral rights comprise 55 Applications for Alluvial Mine of 50 hectares each and the Applications for the rights were presented to DNPM on October 5, 1993. The conversion to Exploration Permits has not been applied for yet. The assignment of the Comandante Araras mineral rights to Aurora can only be done after the approval for the conversion of the Applications and the actual granting of an Exploration Permit to the previous Holder.

Option Agreement

The Comandante Araras Option Agreement dated July 2, 2007, and amendments dated June 2, 2008, November 10, 2008, and September 18, 2009, allows us to perform geological surveys and assessment work necessary to ascertain the existence of possible mineral deposits which may be economically mined and to earn a 100% interest in the Comandante Araras property mineral rights via structured cash payments. The total option agreement payments for the mineral rights are structured as follows: November 1, 2006 R$20,000 (paid); November 15, 2006 – R$40,000 (paid); December 15, 2006 R$40,000 (paid); May 18, 2007 - R$15,000 (paid); May 29, 2007 – R$50,000 (paid); June 25, 2008 – USD $80,000 (paid by Samba Minerals Limited as part of the agreement with them as discussed in the Comandante Araras - Samba Minerals farm in agreement above); November 30, 2008 – USD $20,000 or 100,000 shares of Samba Minerals Limited at a deemed issue price of $0.20 per Samba share (paid by Samba Minerals Limited as part of the agreement with them as discussed in the Comandante Araras - Samba Minerals farm in agreement above); November 30, 2008 – 400,000 shares of Samba Minerals Limited at a deemed issue price of $0.20 per Samba share (to be issued by Samba when the Exploration Permit is granted and transferred to Aurora). The vendor will have a 1.5% Net Smelter Royalty. The Royalty payment can be purchased at any time upon written notice to the vendor and payment in Reals (Brazilian currency) of the equivalent of USD $1,000,000. The option agreement can be terminated at any time upon written notice to the vendor and we will be free of any and all payment commitments yet to be due.

Geology

The geology of the Comandante Araras property is dominated by two regional faults in the Parauari granite that strike North west in the northern half of the property and South east in the southern part of the property. The project was selected based on the potential trends of mineralization striking towards Comandante Araras from the Săo Joăo project.

18

British Columbia, Canada

Kumealon

Location and access

In February 1999, we acquired, by staking, a high grade limestone property three (3) square kilometers (741 acres) located on the north shore of Kumealon Inlet, 54 kilometers south-southeast of Prince Rupert, British Columbia, Canada.

This property is highlighted by consistence of purity and whiteness of the limestone zone outcropping along the southwest shore of Kumealon Lagoon. The zone is comprised mostly of white, recrystallized, fine to course grained limestone, striking 150 degrees and can be traced for at least 1200 meters. The zone is estimated to have an average stratigraphic thickness of 180 meters. Chip samples taken across the zone averaged 55.06% CaO, 2.11% insolubles and 43.51% ignition loss. This property has no known reserves.

We have conducted only preliminary exploration activities on these properties. None of the foregoing properties contain any known reserves.

Three and six months ended June 30, 2011 (Fiscal 2011) versus three and six months ended June 30, 2010 (Fiscal 2010)

Revenues-The Company has yet to generate any revenues or establish any history of profitable operations. For the three and six month periods ended June 30, 2011, we recorded a net loss of $2,951,002 (fiscal 2010 net loss - $540,416), and $3,335,703 (fiscal 2010 net loss - $930,541) respectively, or $(0.03) [fiscal 2010 – $(0.01)] and $(0.04) [fiscal 2010 – $(0.01)] per share.

Expenses – Our general and administrative expenses consist primarily of personnel costs, legal costs, investor relations costs, stock based compensation costs, accounting costs and other professional and administrative costs. For the three and six months ended June 30, 2011 we recorded General and Administrative expenses of $370,014 (fiscal 2010 - $390,357) and $585,164 (fiscal 2010 - $697,821). Administrative costs were lower in fiscal 2011 as a result of cut backs in administrative expenses. For the three and six month periods this amount includes, professional fees - accounting $46,349 (fiscal 2010 - $103,678) and $67,602 (fiscal 2010 - $151,057) respectively, and legal $81,672 (fiscal 2010 - $77,759) and $96,377 (fiscal 2010 - $179,068) . The majority of the legal costs incurred during fiscal 2010 relate to the Global Asset Purchase Agreement.

Exploration expenditures – Exploration expenses are charged to operations as they are incurred. For the three and six months ended June 30, 2011 we recorded exploration expenses of $68,698 (fiscal 2010 - $150,059) and $238,249 (fiscal 2010 - $232,720) respectively. The following is a breakdown of the exploration expenses by property: Colorado, $65,334 (2010 – $137,454) and $216,774 (2010 - $137,454) respectively; Brazil $3,364 (2010 – $12,605) and $18,894 (2010 - $92,911) respectively; and Canada, Kumealon property $Nil (2009 - $Nil) and $2,581 (2010 - $2,355) respectively.

Depreciation expense – Depreciation expenses charged to operations for six months ended June 30, 2011 were $15,463 (fiscal 2010 - $7,244) respectively.

Sale of AGC - On June 14, 2011, the Company, entered into an Asset Purchase Agreement with Devtec Management Ltd. (“Devtec”), pursuant to which the Company sold its subsidiary, AGC, which owns certain properties in Boulder, Colorado (see note 3(b) for a discussion of the specific assets purchased by AGC in June 2010), to Devtec for a total of $2 million, plus royalty. Under the terms of the agreement, Devtec will pay the Company $1 million upon production of the cumulative total of 1,000 ounces of gold and/or silver, and a further $1 million on the six month anniversary of the payment of the first $ 1 million. Additionally, Devtec will pay the Company a 5% royalty from the start of production.

19

The Company is unable to reasonably estimate the amount of minerals the properties will produce, if any, and thus there is uncertainty as to whether the purchase price will be collected. Further, the collection of any purchase price is also contingent on the outcome of the court case described in note 3(b). Given these factors, collection of the purchase price is not considered reasonably possible at the time of these consolidated financial statements given the current uncertain status of exploration work on the Boulder ,Colorado properties and the uncertainties of the related legal action and thus no purchase price has been recorded as of June 30, 2011. Therefore, the Company is recognizing a loss on the sale of its subsidiary of $2,512,290 for the three and six months ended June 30, 2011, which represents the net book value of the assets transferred to Devtec on June 14, 2011 (no liabilities were assumed by Devtec) as follows:

|

Buildings and equipment

|

$ | 753,605 | ||

|

Participating interest in mineral property

|

1,758,685 | |||

| $ | 2,512,290 |

Capital Resources and Liquidity

June 30, 2011 versus December 31, 2010:

Recent developments in capital markets have restricted access to debt and equity financing for many companies. The Company's exploration properties are in the exploration stage, have not commenced commercial production and consequently the Company has no history of earnings or cash flow from its operations. As a result, the Company is reviewing its 2011 exploration and capital spending requirements in light of the current and anticipated, global economic environment.

The Company currently finances its activities primarily by the private placement of securities. There is no assurance that equity funding will be accessible to the Company at the times and in the amounts required to fund the Company’s activities. There are many conditions beyond the Company’s control which have a direct bearing on the level of investor interest in the purchase of Company securities. The Company may also attempt to generate additional working capital through the operation, development, sale or possible joint venture development of its properties, however, there is no assurance that any such activity will generate funds that will be available for operations. Debt financing has been used to fund the Company’s property acquisitions and exploration activities, however the Company has no current plans to use debt financing. The Company does not have “standby” credit facilities, or off-balance sheet arrangements and it does not use hedges or other financial derivatives. The Company has no agreements or understandings with any person as to additional financing.

At June 30, 2011, we had cash of $38,913 (December 31, 2010 - $579,191) and working capital deficiency of $504,583 (working capital at December 31, 2010 – $227,326). Total liabilities as of June 30, 2011 were $577,044 (December 31, 2010 - $372,019).

During the period January 1 to December 31, 2010, we received cash of $3,895,000 from a private placement of 12,983,335 common shares at $0.30 per share, paid non cash finder’s fees of 1,126,111 shares in connection with the private placement, issued 685,900 shares in settlement of indebtedness and payment of expenses amounting to $205,770 and paid a non cash finder’s fee of 500,000 shares in connection with a property acquisition valued at $0.30 per share. In April 2011, as an incentive to assist with future private placements, the Company authorized the payment of a non cash finders fee of 450,000 shares of common stock of the Company in connection with the private placement completed in April 2010. The shares were issued in May 2011. All shares issued were to individuals and companies who reside outside the United States of America. The issuance of the shares was exempt from the registration requirements of Securities Act by virtue of Section 4(2) thereof as well as the exemption from registration requirements afforded by Regulation S.

20

In June 2010, pursuant to an Asset Purchase Agreement, the Company issued 5 million shares of its common stock, which had a market value of $0.40 per share, paid $600,000 in cash, of which $100,000 was paid in November 2009 on signing the Letter Agreement, and acquired: (i) Global Minerals Ltd. 50% participating interest in the joint venture agreement dated December 18, 2002 between Consolidated Global Minerals Ltd. and the property owners of the Front Range Gold JV property; (ii) the personal property assets of Mount Royale Ventures, LLC., which include a permitted mill, permitted to 70,000 tons per year, and the associated mining equipment; and, (iii) a 50% equity interest in the Black Cloud Mine Claim Group tenements, located within the Front Range Gold property. The issuance of the shares was exempt from the registration requirements of Securities Act by virtue of Section 4(2) thereof as well as the exemption from registration requirements afforded by Regulation S.

Our general business strategy is to acquire mineral properties either directly or through the acquisition of operating entities. Our consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America and applicable to a going concern which contemplates the realization of assets and the satisfaction of liabilities and commitments in the normal course of business. As discussed in note 1 to the consolidated financial statements, we have incurred recurring operating losses since inception, have not generated any operating revenues to date and used cash of $833,983 from operating activities in 2011 through June 30. We require additional funds to meet our obligations and maintain our operations. We do not have sufficient working capital to (i) pay our administrative and general operating expenses through December 31, 2011 and (ii) to conduct our preliminary exploration programs. Without cash flow from operations, we may need to obtain additional funds (presumably through equity offerings and/or debt borrowing) in order, if warranted, to implement additional exploration programs on our properties. While we may attempt to generate additional working capital through the operation, development, sale or possible joint venture development of our properties, there is no assurance that any such activity will generate funds that will be available for operations. Failure to obtain such additional financing may result in a reduction of our interest in certain properties or an actual foreclosure of our interest. We have no agreements or understandings with any person as to such additional financing.